e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Transformation ACCELERATED INVESTOR PRESENTATION | February 2021 IT Solutions to Fast-Track Digital Transformation Exhibit 99.1

Forward-Looking Statements This presentation contains certain forward-looking statements concerning the Company’s current expectations as to future growth and should be read in conjunction with the Company’s disclosures in its reports that are filed from time to time with the Securities and Exchange Commission. These statements are based upon a review of industry reports, current business conditions in the areas where the Company provides services, the availability of qualified professional staff, and other factors that involve risk and uncertainty. As such, actual results may differ materially in response to a change in such factors.

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 A Compelling Investment Opportunity Attractive profile—Rapidly improving profitability, adaptable delivery models, and growing portfolio of repeatable digital transformation (DT) solutions Massive near-term market opportunity—Megatrends and market disruption are accelerating the demand for DT solutions Deep and diverse domain expertise—Limited industry concentration with global clients across numerous verticals Blue-chip customer base—Global industry leaders rely on CTG to enable their businesses to effectively compete Experienced senior management team—Proven change agents and new DT solutions leadership

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Powered by Client-Centric Solutions CTG is a catalyst for DT, helping IT and business leaders accelerate their digital momentum and achieve their desired outcomes. Industry Leading Digital & Technology Talent Breakthrough DT Offerings Innovative Tools & Methodologies Global Delivery Network Industry Experience

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Supported by Leading Technology Partners Trusted by Global Industry Leaders

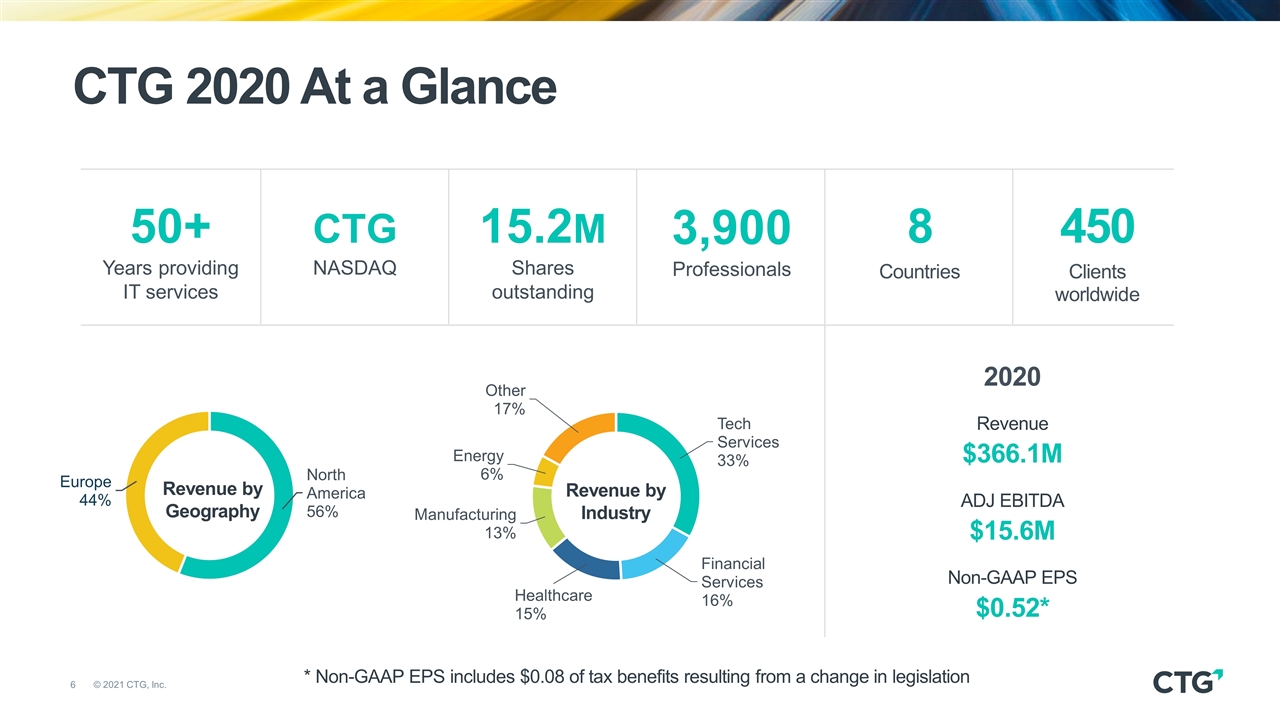

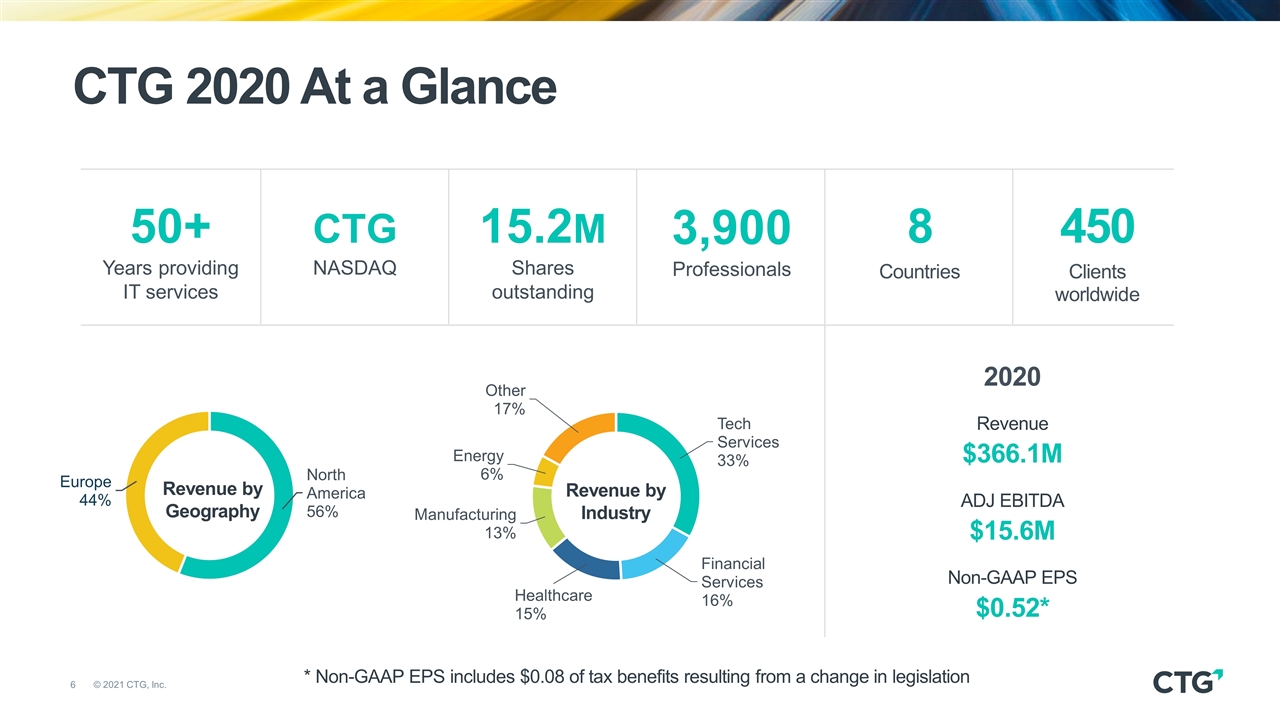

450 Clients worldwide 3,900 Professionals 15.2M Shares outstanding CTG 2020 At a Glance CTG NASDAQ Revenue by Industry Revenue by Geography 8 Countries 2020 Revenue $366.1M ADJ EBITDA $15.6M Non-GAAP EPS $0.52* 50+ Years providing IT services * Non-GAAP EPS includes $0.08 of tax benefits resulting from a change in legislation

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Market Opportunity Demand Is Growing. The Pace Is Faster. The Stakes Are Higher.

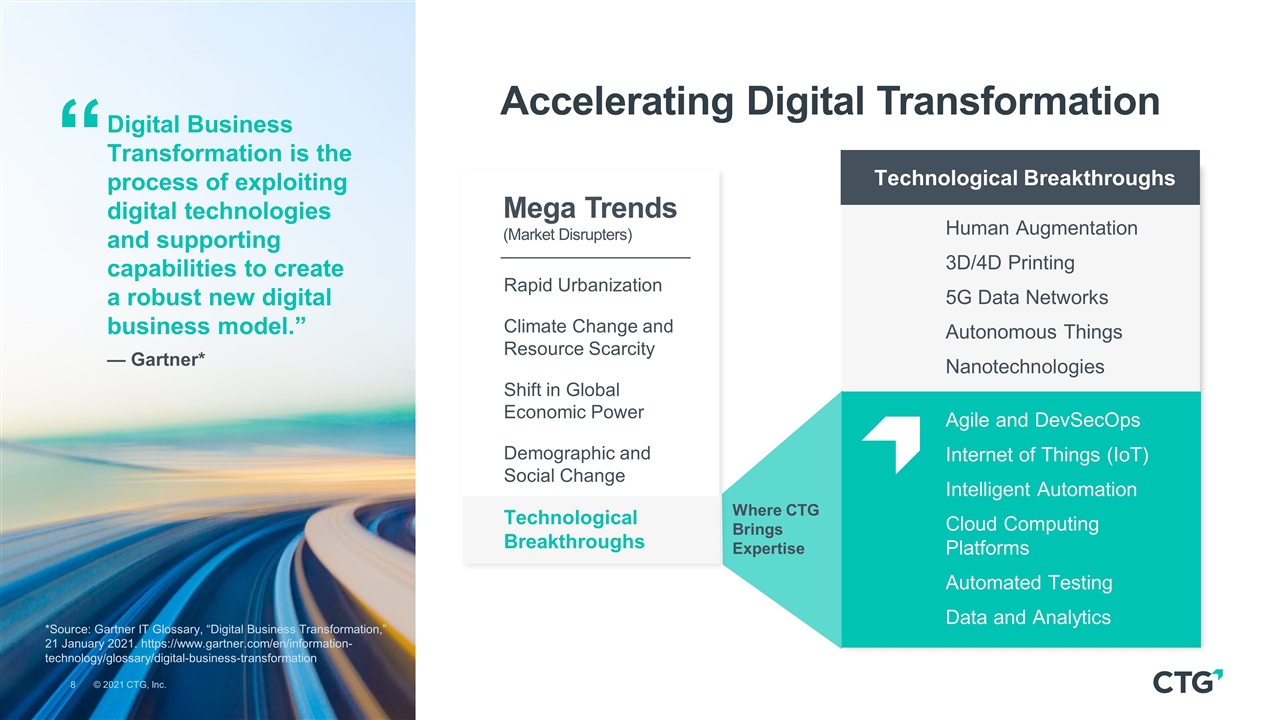

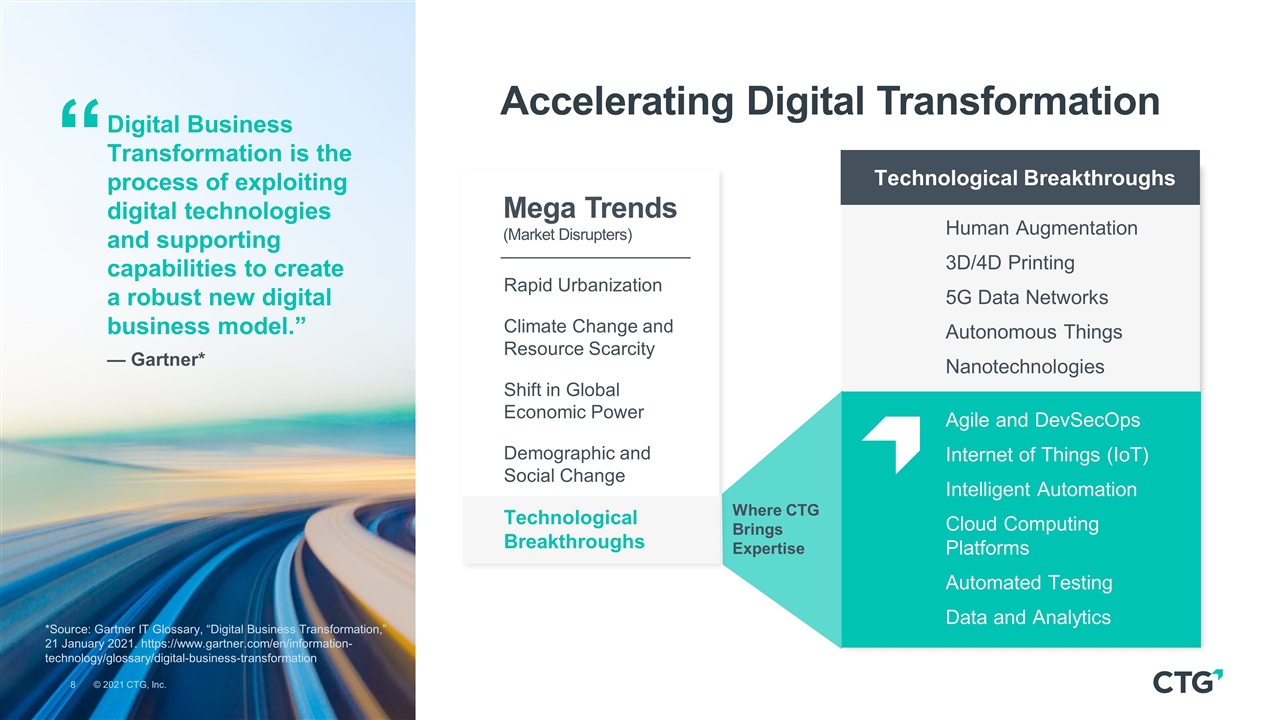

Digital Business Transformation is the process of exploiting digital technologies and supporting capabilities to create a robust new digital business model.” — Gartner* “ *Source: Gartner IT Glossary, “Digital Business Transformation,” 21 January 2021. https://www.gartner.com/en/information-technology/glossary/digital-business-transformation Accelerating Digital Transformation Mega Trends (Market Disrupters) Human Augmentation 3D/4D Printing 5G Data Networks Autonomous Things Nanotechnologies Agile and DevSecOps Internet of Things (IoT) Intelligent Automation Cloud Computing Platforms Automated Testing Data and Analytics Technological Breakthroughs Rapid Urbanization Climate Change and Resource Scarcity Shift in Global Economic Power Demographic and Social Change Technological Breakthroughs Where CTG Brings Expertise

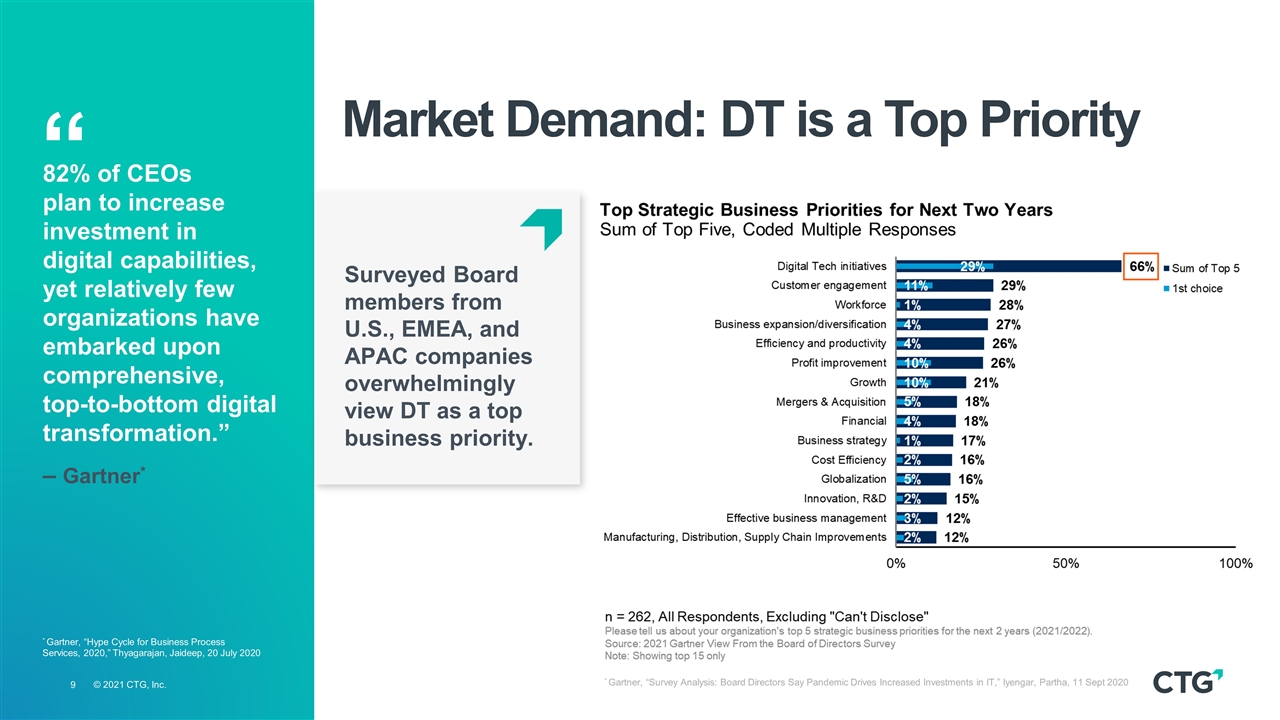

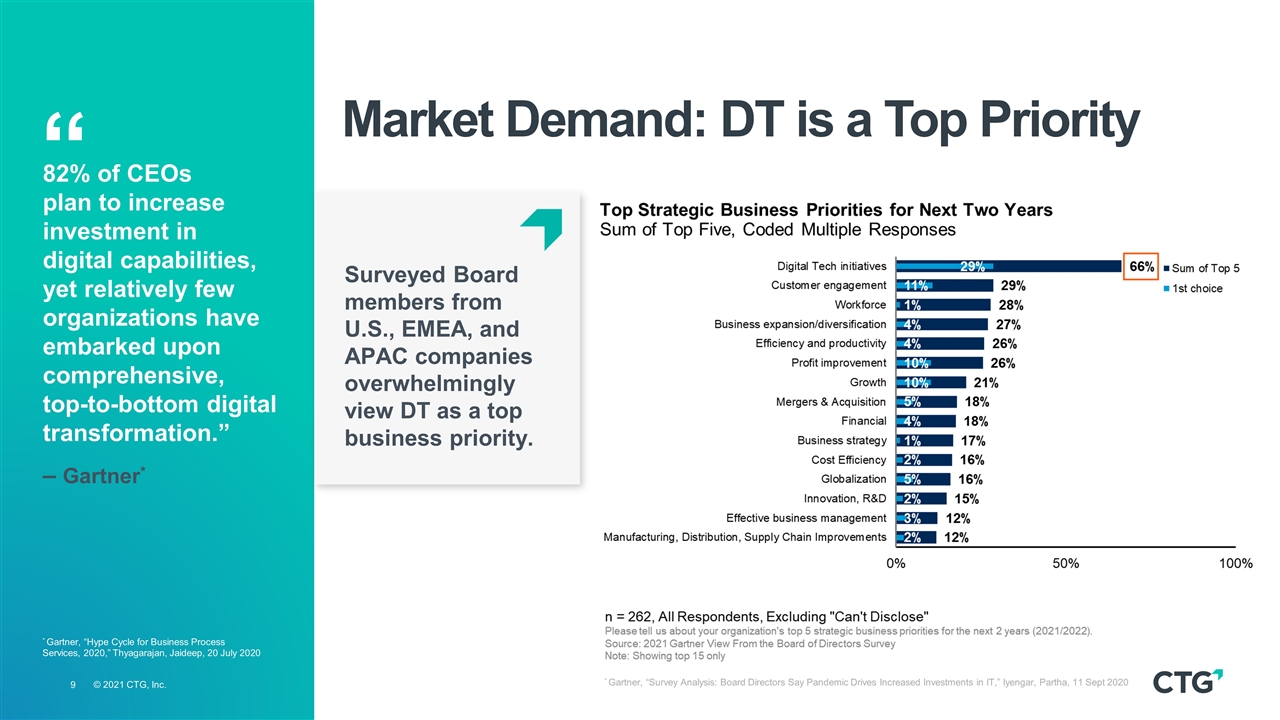

Market Demand: DT is a Top Priority 82% of CEOs plan to increase investment in digital capabilities, yet relatively few organizations have embarked upon comprehensive, top-to-bottom digital transformation.” – Gartner* Surveyed Board members from U.S., EMEA, and APAC companies overwhelmingly view DT as a top business priority. * Gartner, “Survey Analysis: Board Directors Say Pandemic Drives Increased Investments in IT,” Iyengar, Partha, 11 Sept 2020 “ * Gartner, “Hype Cycle for Business Process Services, 2020,” Thyagarajan, Jaideep, 20 July 2020

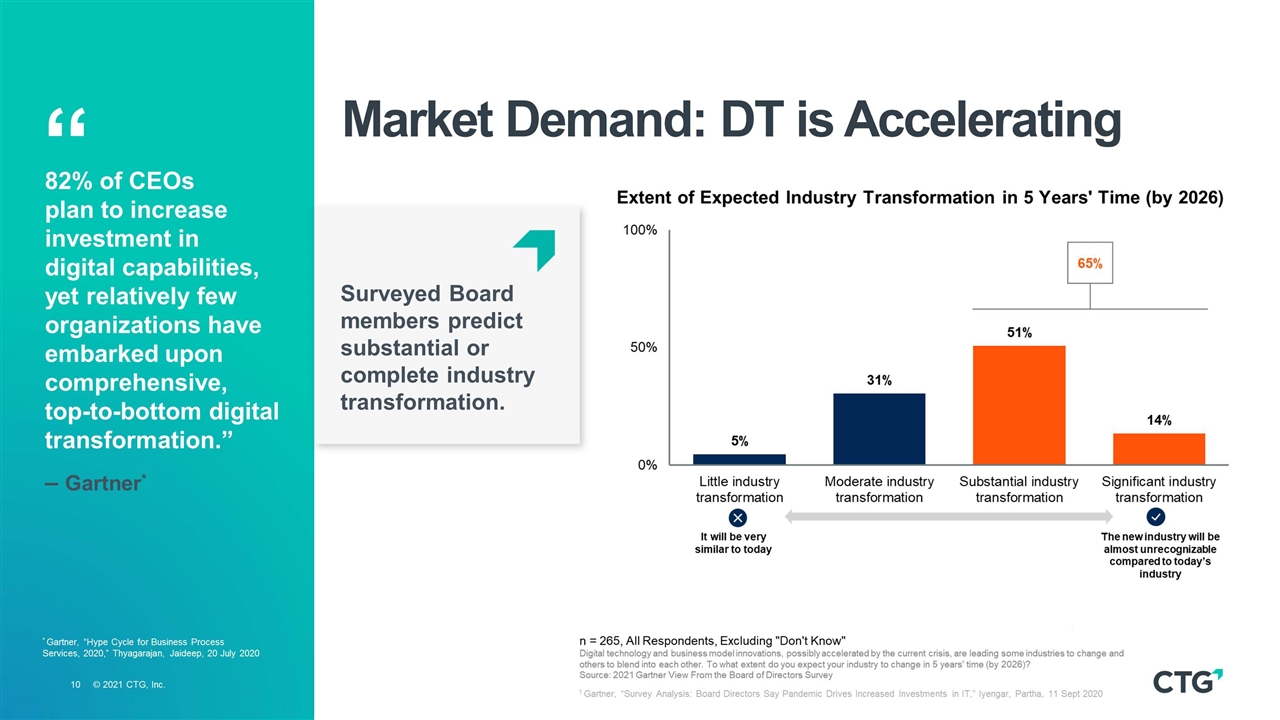

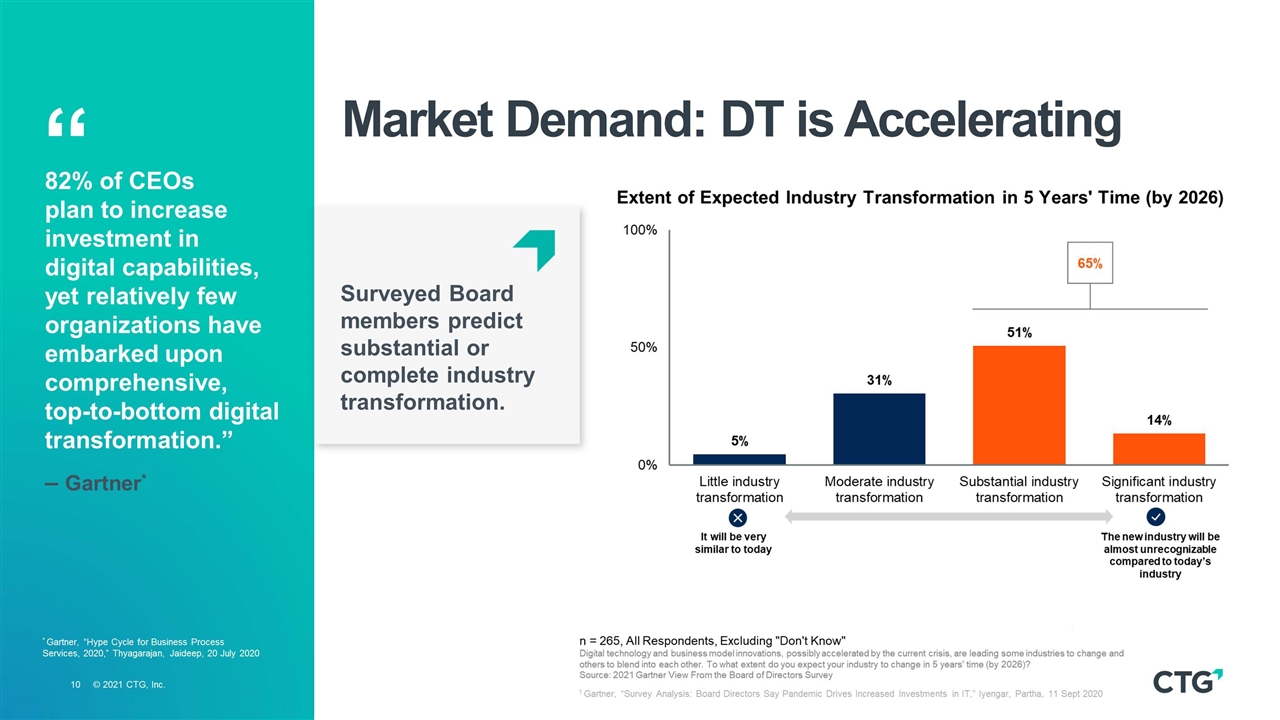

Market Demand: DT is Accelerating 82% of CEOs plan to increase investment in digital capabilities, yet relatively few organizations have embarked upon comprehensive, top-to-bottom digital transformation.” – Gartner* 1 Gartner, “Survey Analysis: Board Directors Say Pandemic Drives Increased Investments in IT,” Iyengar, Partha, 11 Sept 2020 “ * Gartner, “Hype Cycle for Business Process Services, 2020,” Thyagarajan, Jaideep, 20 July 2020 Surveyed Board members predict substantial or complete industry transformation.

The Pace Is Faster. The Stakes Are Higher. “Through 2024, organizations need to adapt to a post-COVID world involving permanently higher adoption of remote work and digital touchpoints that will drive a significant acceleration in their business transformation plans. …Even in an economic downturn, 52% of organizations said they would increase speed of digital business initiatives.” – Gartner Growing demand for CTG’s solutions and global delivery model Increasing client focus on DT and emerging technologies Greater need for the trust and speed for which CTG is known Source Reports: “Forecast Analysis: Digital Business Consulting Services, Worldwide”; Gartner, “Hype Cycle for Business Process Services, 2020,” Thyagarajan, Jaideep, 20 July 2020

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 CTG Strategy Vision: Be a Catalyst for DT Momentum and Success

Accelerating CTG's Transformation Industry Leading Digital and Technology Talent Breakthrough DT Solutions Innovative Tools and Methodologies Global Delivery Network Industry Expertise Strategic Acquisitions Where we are investing to expand our DT portfolio

Industry Leading Digital and Technology Talent Olivier Saucin Vice President, Global Solutions AI, RPA, Cloud, ITIL Pieter Vanhaecke Global Director, Testing Software Testing (Automated, Crowd, Performance), Digital Transformation, SAFe, DevOps, Agile Rick Cruz Director, Application and Information Solutions Enterprise Architecture, DT Programs, App Development, User Experience, Workflow Automation, MS365/SharePoint Phaedra Divras Director, Infrastructure, Support, and Operations AWS and Microsoft Cloud Technologies, DevOps, Digital Workplace Brett Hunt Managing Director, Solutions AI, Data Analytics, Cloud Applications, IoT Systems, Networked Delivery Centers Tanya Johnson Managing Director, Testing Software Testing (Automated, Crowd), Clinical Education, Medical Device Rollout, Go-Live Support Jochen Gyssels Director, Application and Information Solutions App Development, MS365, DevOps, Agile, Process Automation, Cloud Fabienne Lens Director, Regulatory Compliance GDPR, GxP, ISO, Customer Engagement/Service

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Breakthrough Digital Transformation Portfolio Business Process Technology Operations Transformation Solutions Digital Accelerators Agile and DevSecOps Cloud Automated Testing IoT Business Outcomes Business Performance Data-Driven Decisions Continuous Innovation Customer Experience Data and Analytics Intelligent Automation Adaptable IT services and solutions accelerating project momentum—60+ engagements 2019–2020

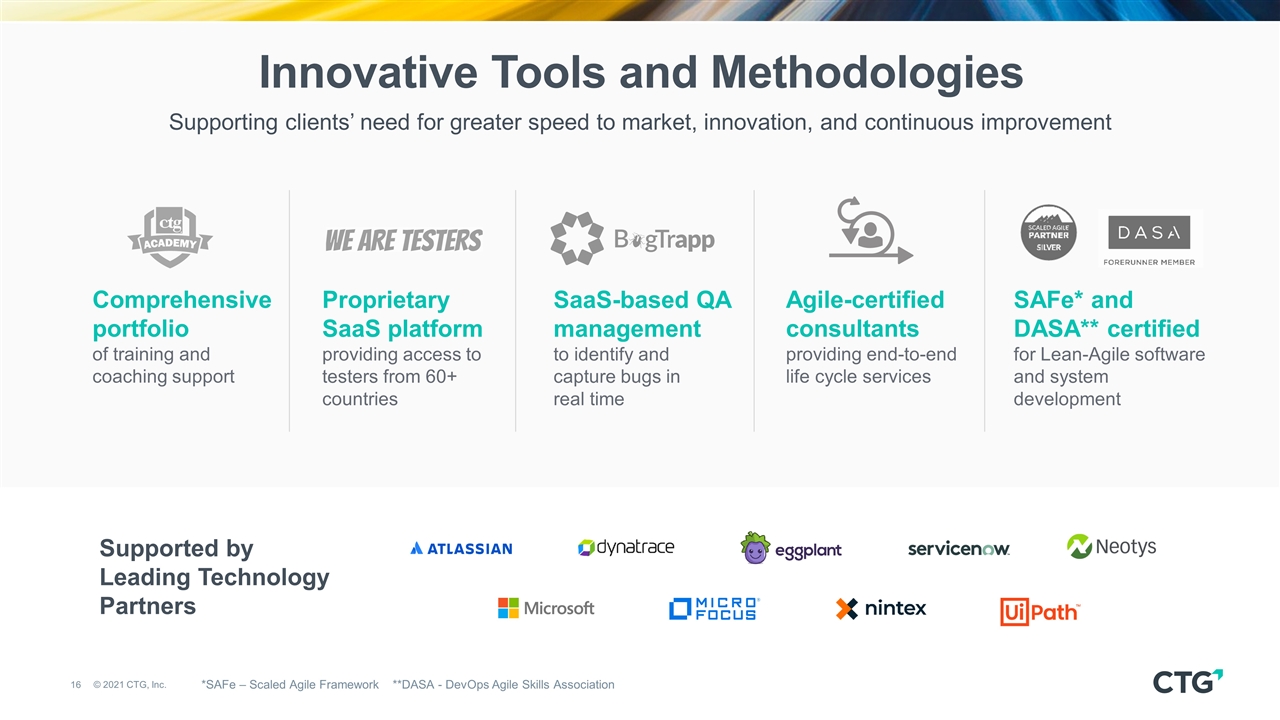

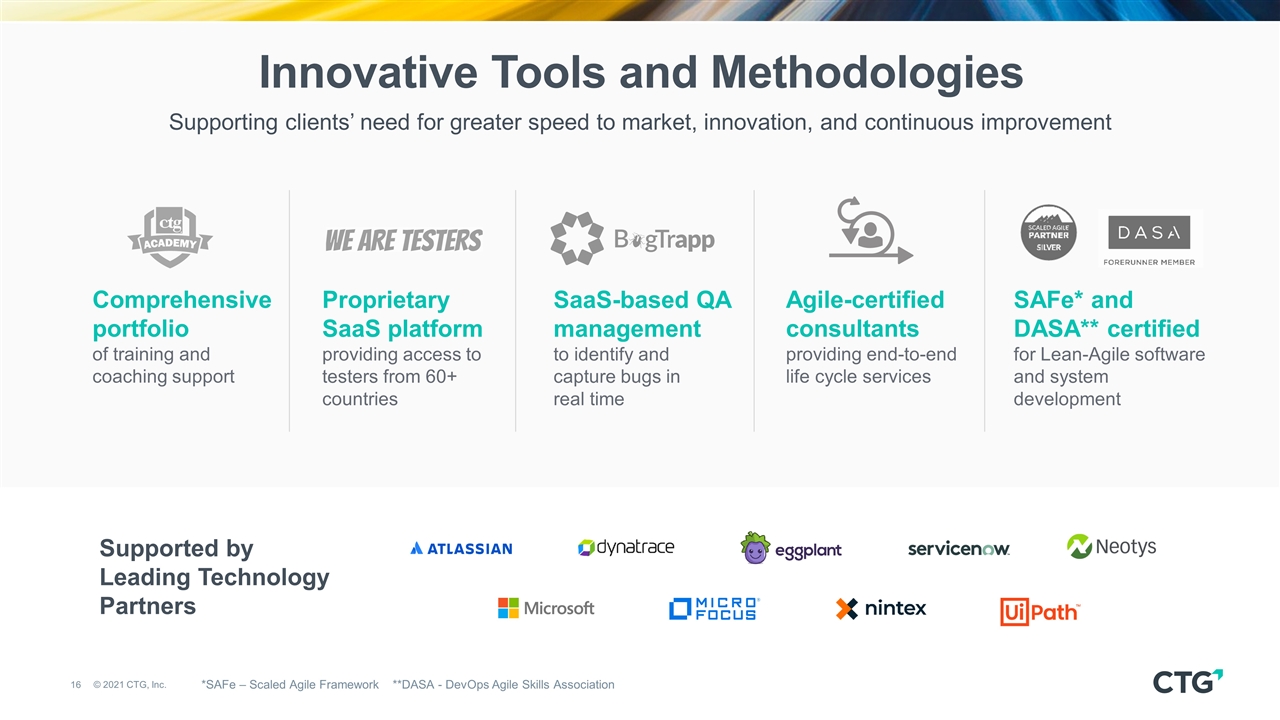

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Innovative Tools and Methodologies Supported by Leading Technology Partners Supporting clients’ need for greater speed to market, innovation, and continuous improvement Comprehensive portfolio of training and coaching support Proprietary SaaS platform providing access to testers from 60+ countries SaaS-based QA management to identify and capture bugs in real time SAFe* and DASA** certified for Lean-Agile software and system development Agile-certified consultants providing end-to-end life cycle services *SAFe – Scaled Agile Framework **DASA - DevOps Agile Skills Association

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Global Delivery Network Connectivity optimizes global platform to create adaptable solutions and minimize delivery costs 24x7 Delivery “Follow-the-Sun” Support Access to Best Talent Globally Enables Project Rigor and Quality Support in 7 Languages Global Delivery Center Nearshore/Offshore Onshore 3,900 Global Professionals Bogotá Melbourne Montreal Marseille Brussels Hyderabad Luxembourg

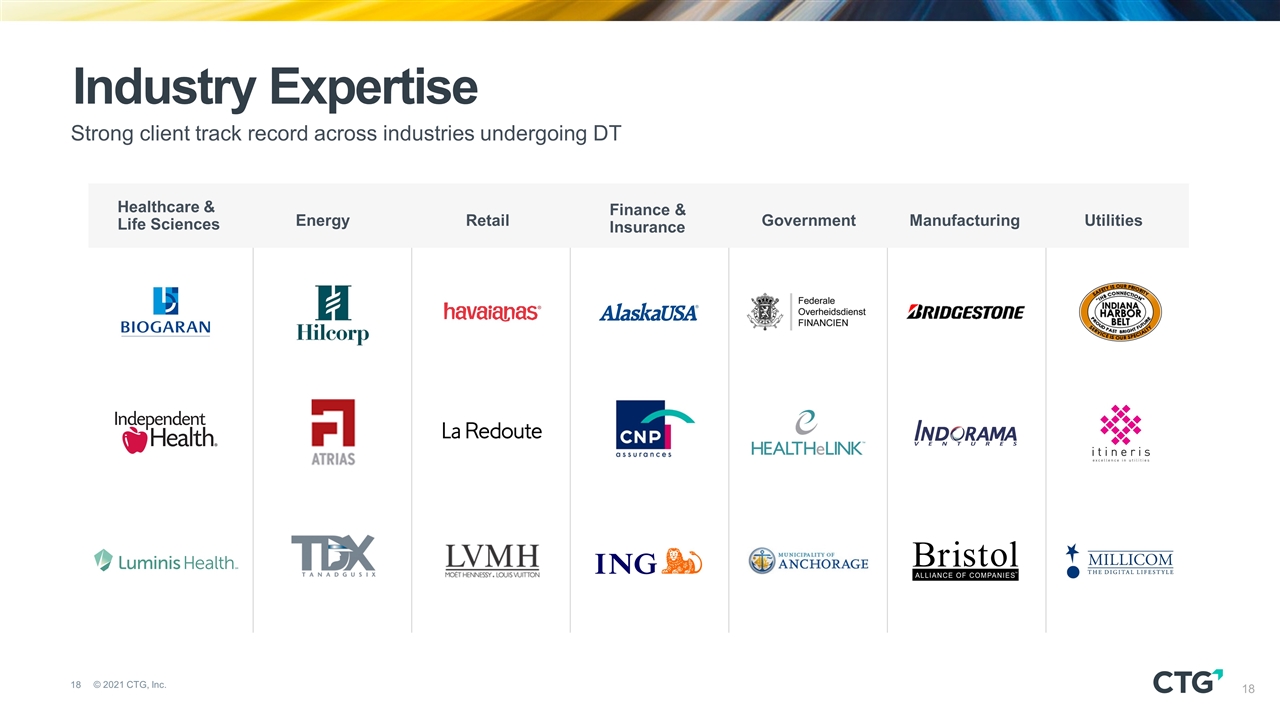

Healthcare & Life Sciences Energy Manufacturing Finance & Insurance Utilities Retail Government Industry Expertise Strong client track record across industries undergoing DT

Recent DT investments through strategic M&A Future Acquisition Criteria Established, accretive organizations Accelerates our DT strategy Primarily North American-focused Highly synergistic solutions or personnel Proven Ability to Acquire and Integrate Region Acquisition Vertical DT Services Financial Services Telecom Healthcare Government Financial Services Retail Technology Financial Services Data Analytics Software Dev. Systems Integration Software Dev., Cloud Services Crowdtesting Quality Assurance 2018 2019 2020 Strategic Acquisitions Canada France Europe Luxembourg Europe France

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Financial Highlights

CTG Q4 2020 Highlights $0.14 Non-GAAP EPS 4.8% EBITDA Margin $2.5M Free Cash Flow $101.3M Revenue $4.9M Adjusted EBITDA $32.9M Cash Net of Debt Non-GAAP EPS Growth Q4 2017 Q4 2020 Q4 2017 Q4 2020 Adjusted EBITDA (millions) Q4 2017 Q4 2020 Non-GAAP Operating Income (millions)

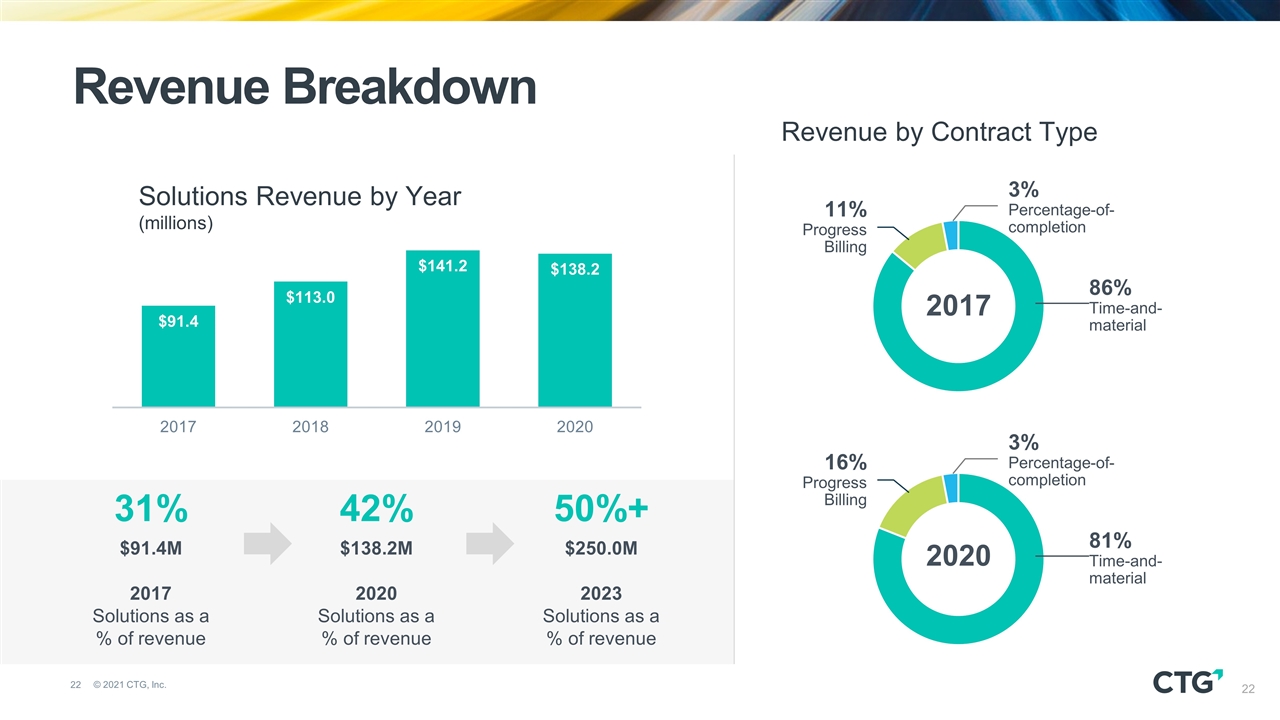

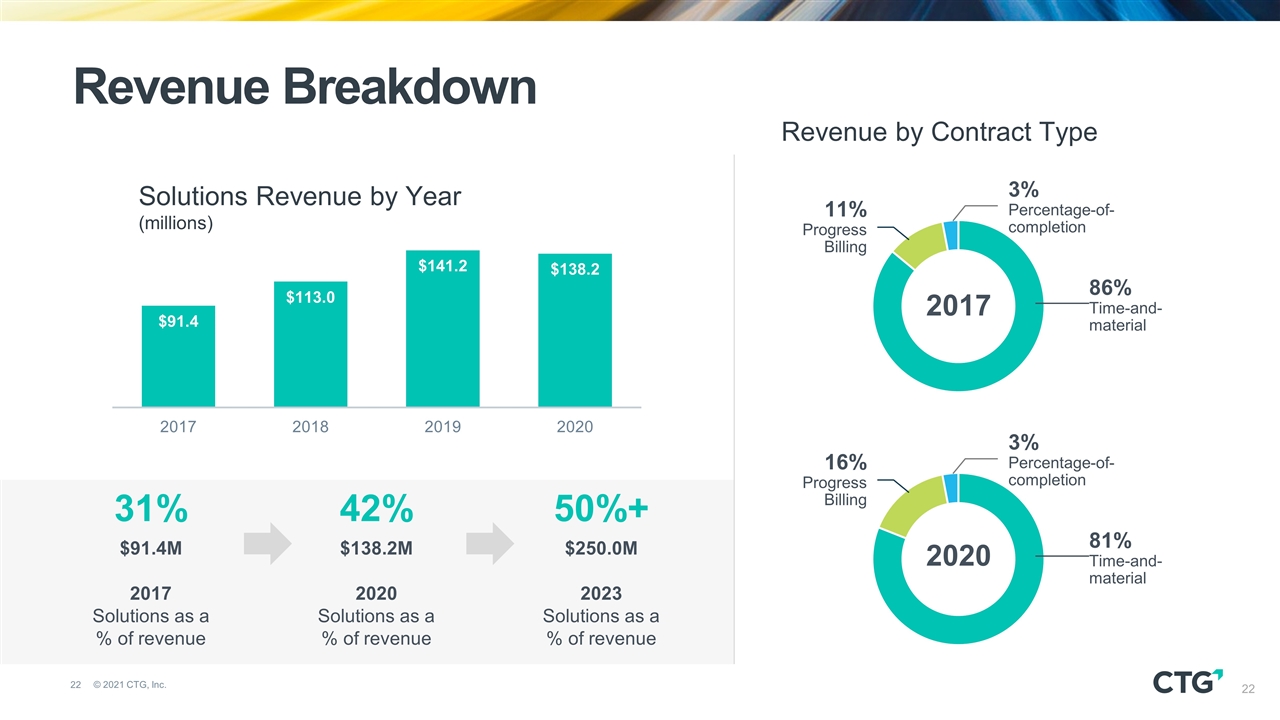

42% $138.2M 2020 Solutions as a % of revenue 31% $91.4M 2017 Solutions as a % of revenue Revenue by Contract Type 11% Progress Billing 86% Time-and-material 2017 3% Percentage-of-completion 50%+ $250.0M 2023 Solutions as a % of revenue Revenue Breakdown Solutions Revenue by Year (millions) 16% Progress Billing 81% Time-and-material 2020 3% Percentage-of-completion

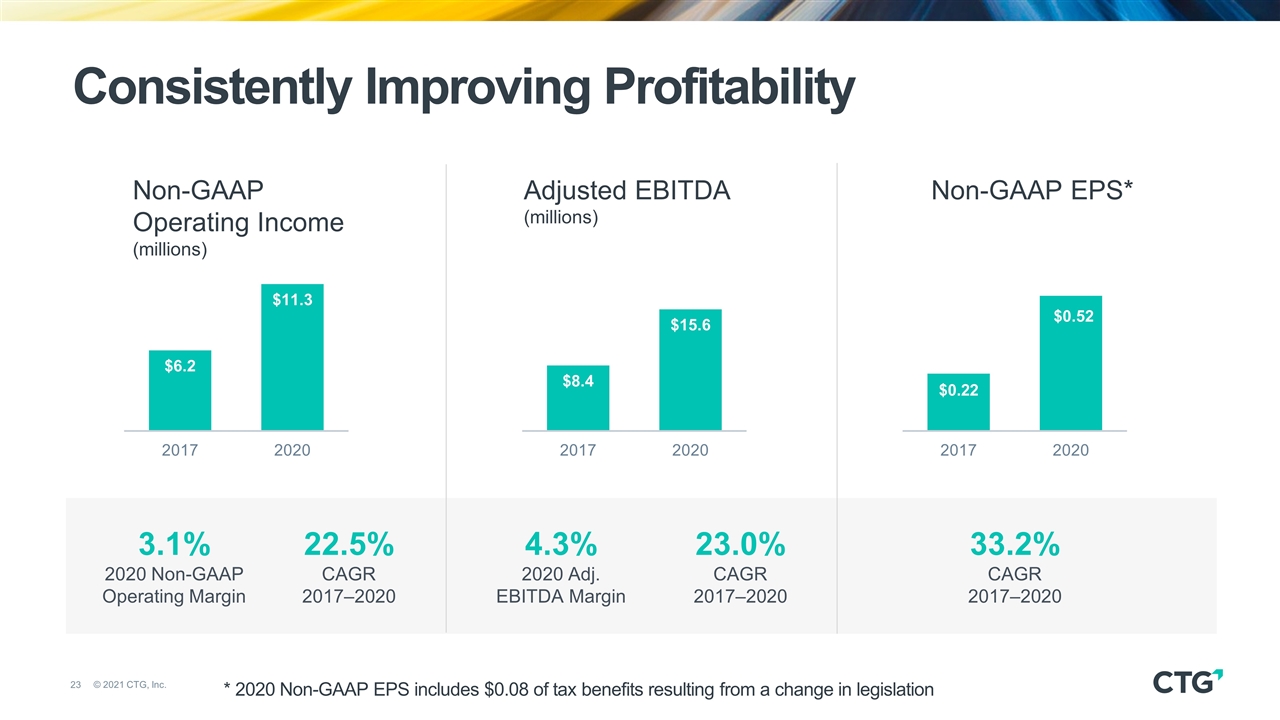

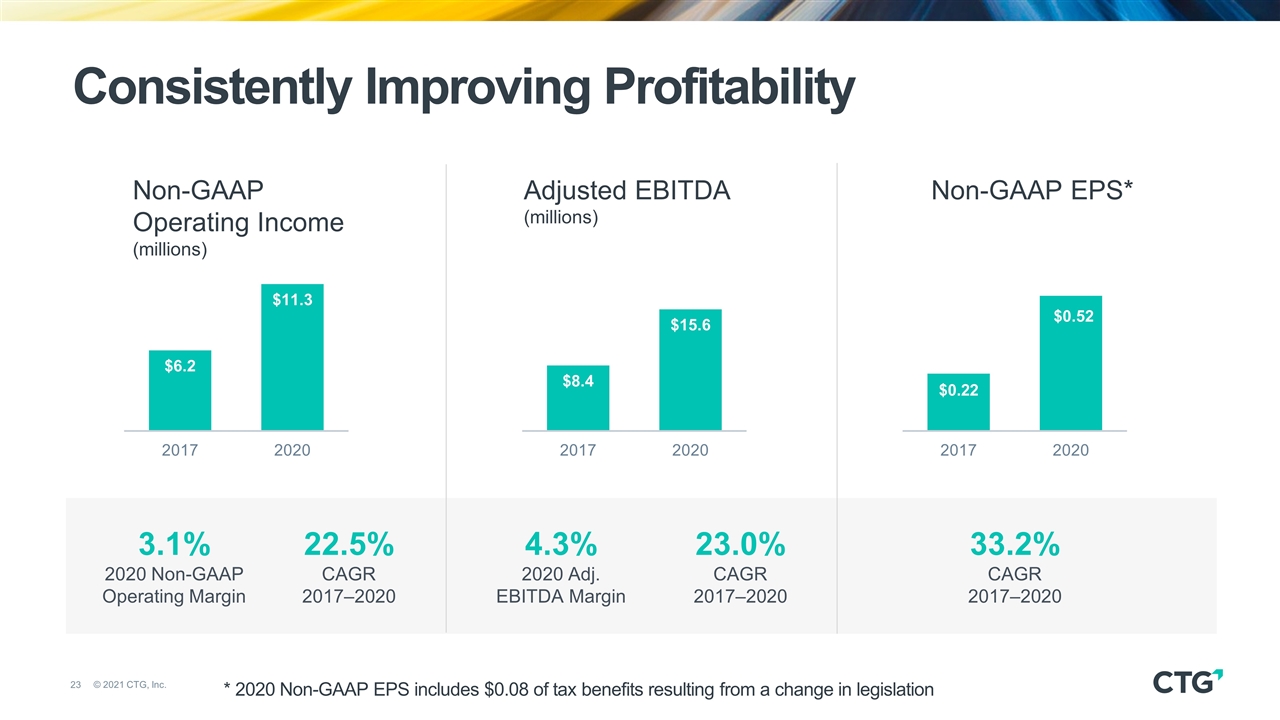

Consistently Improving Profitability Non-GAAP Operating Income (millions) Adjusted EBITDA (millions) Non-GAAP EPS* 3.1% 2020 Non-GAAP Operating Margin 22.5% CAGR 2017–2020 4.3% 2020 Adj. EBITDA Margin 23.0% CAGR 2017–2020 33.2% CAGR 2017–2020 * 2020 Non-GAAP EPS includes $0.08 of tax benefits resulting from a change in legislation

2023 Vision CTG is a leading provider of DT services, helping IT and business leaders accelerate their digital momentum and achieve their desired outcomes. 50+ % 20 % of our overall business is solutions-based of our solutions delivered from Global Delivery Network Solutions revenue EBITDA $35M $250M+

e7d195523061f1c0205959036996ad55c215b892a7aac5c0B9ADEF7896FB48F2EF97163A2DE1401E1875DEDC438B7864AD24CA23553DBBBD975DAF4CAD4A2592689FFB6CEE59FFA55B2702D0E5EE29CDA434CDE87C66DAD0FD8205252696877ADA88AE38FC398BD2CB8C716F0122FEA29EC10133FA025D2CF9019FE6F0700FDF43595715D022B1E7731FF5AD9B394AA0 Appendices

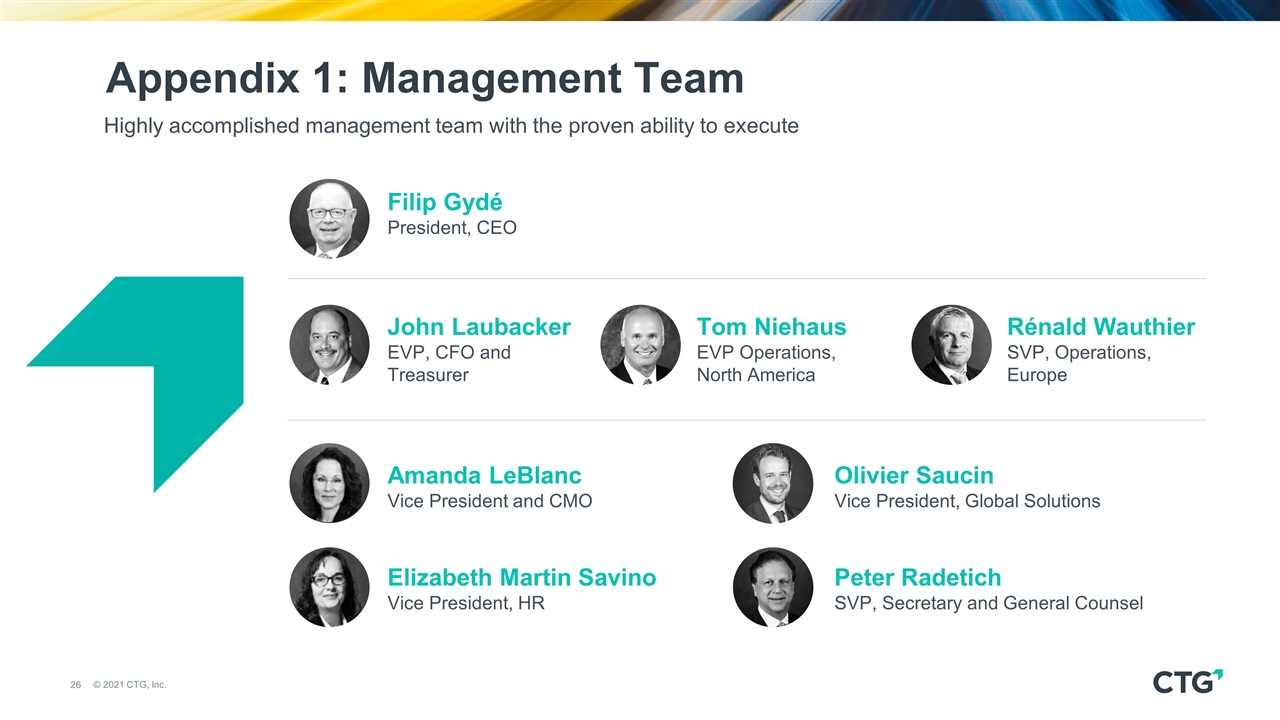

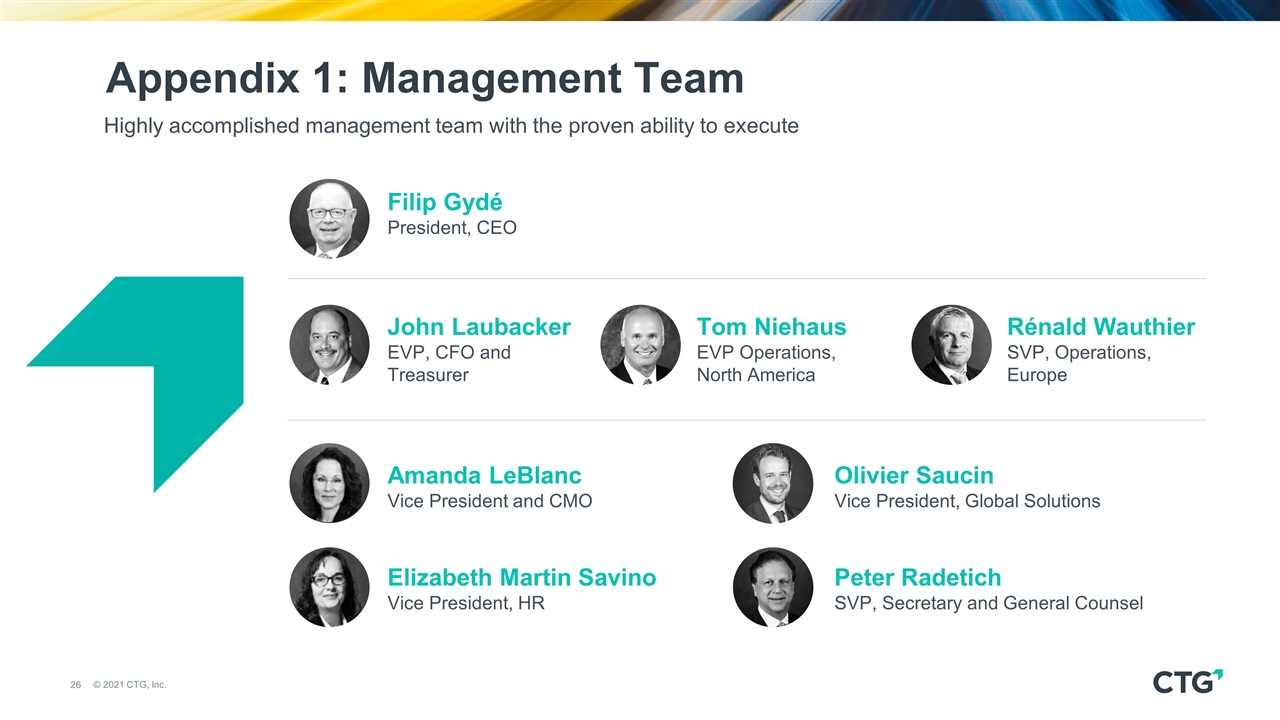

Appendix 1: Management Team Olivier Saucin Vice President, Global Solutions John Laubacker EVP, CFO and Treasurer Amanda LeBlanc Vice President and CMO Elizabeth Martin Savino Vice President, HR Peter Radetich SVP, Secretary and General Counsel Rénald Wauthier SVP, Operations, Europe Tom Niehaus EVP Operations, North America Filip Gydé President, CEO Highly accomplished management team with the proven ability to execute

Appendix 2: Board of Directors Daniel J. Sullivan Chairman of the Board, Director since 2002 Former CEO, FedEx Ground (1998-2007) Board Member: Schneider National, Medical University of South Carolina Foundation (emeritus director) David H. Klein Director since 2012 President, Klein Solutions Group (Healthcare Payer/Provider Guidance) Special Advisor: University of Rochester (UR) Medical Center Filip Gydé Director since 2019 President, CEO, and Member of the Board (effective March 2, 2019) Began CTG career in 1987; named MD, Belgium, 1996, and MD, Luxembourg, 1999 Valerie Rahmani Director since 2015 Former General Manager, IBM and CEO, Damballa (Cybersecurity) Board Member: London Stock Exchange, RenaissanceRe, Entrust, Rungway James R. Helvey II Director since 2015 Founding Partner, Cassia Capital Partners Board Member: Coca-Cola Bottling, Verger Capital Management, Piedmont Federal Savings Bank Raj Rajgopal Director since 2020 Former President of Virtusa Corporation, and various leadership roles at Capgemini Board Observer: Wevo Corporation (provider of AI and machine learning-based digital marketing platform) Owen J. Sullivan Director since 2017 COO, NCR Corporation Board Member: Marquette University, Medical College of Wisconsin, Johnson Financial Group Committed to maintaining a highly diverse and qualified Board Experienced Board with global business, digital technology and finance leaders Corporate Governance Highlights Independent Board Chair 6 of 7 Independent Directors Diverse Board in Terms of Gender, Race, Experience, Skills and Tenure Majority Voting for Directors Active Board Oversight Modified Board Compensation in 2021 to 40% Cash / 60% Stock for base compensation

Appendix 3: Committed to Ongoing Board Refreshment Recently appointed director with digital experience following extensive search process Nominating and Corporate Governance Committee engaged a leading search firm to identify new independent director As a result of this search, the Board appointed Raj Rajgopal as an independent director in December 2020 Until Dan Sullivan, current chairman, steps down from the board at the 2021 Annual Meeting as a result of reaching CTG’s mandatory retirement age, the Company will temporarily have seven directors Raj Rajgopal Seasoned industry executive with extensive experience implementing digital strategies and driving transformative growth Previously served as President of Virtusa Corporation and led the company’s transformation to becoming a leading consulting, digital solutions and IT services organization Held various leadership roles in both the U.S. and the U.K. at Capgemini Currently serves as a Board Observer for Wevo Corporation

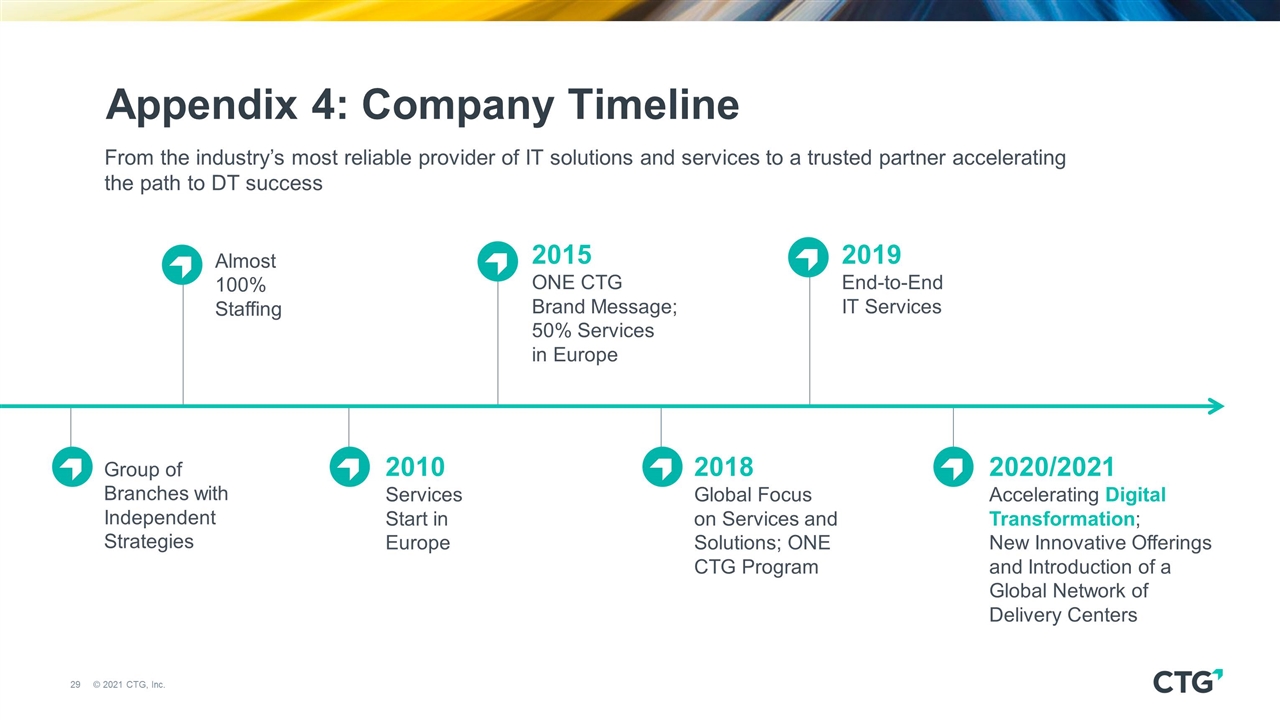

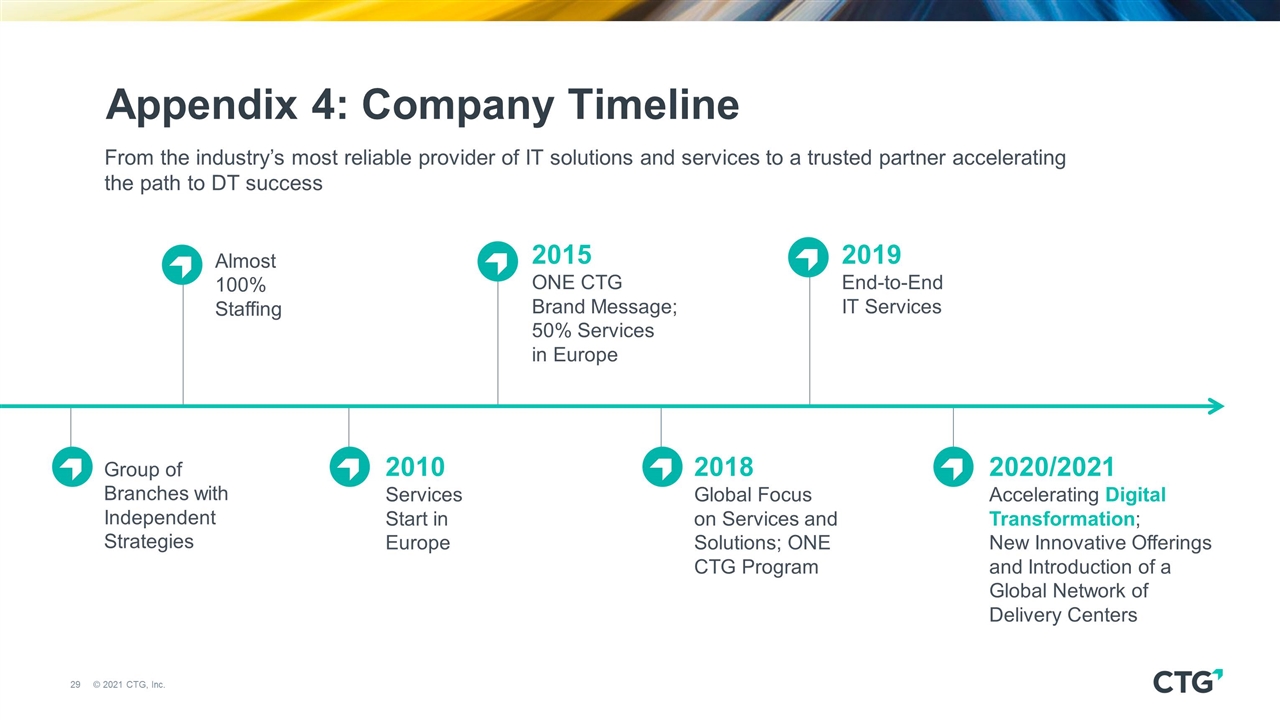

Appendix 4: Company Timeline From the industry’s most reliable provider of IT solutions and services to a trusted partner accelerating the path to DT success Almost 100% Staffing Group of Branches with Independent Strategies 2010 Services Start in Europe 2015 ONE CTG Brand Message; 50% Services in Europe 2018 Global Focus on Services and Solutions; ONE CTG Program 2019 End-to-End IT Services 2020/2021 Accelerating Digital Transformation; New Innovative Offerings and Introduction of a Global Network of Delivery Centers

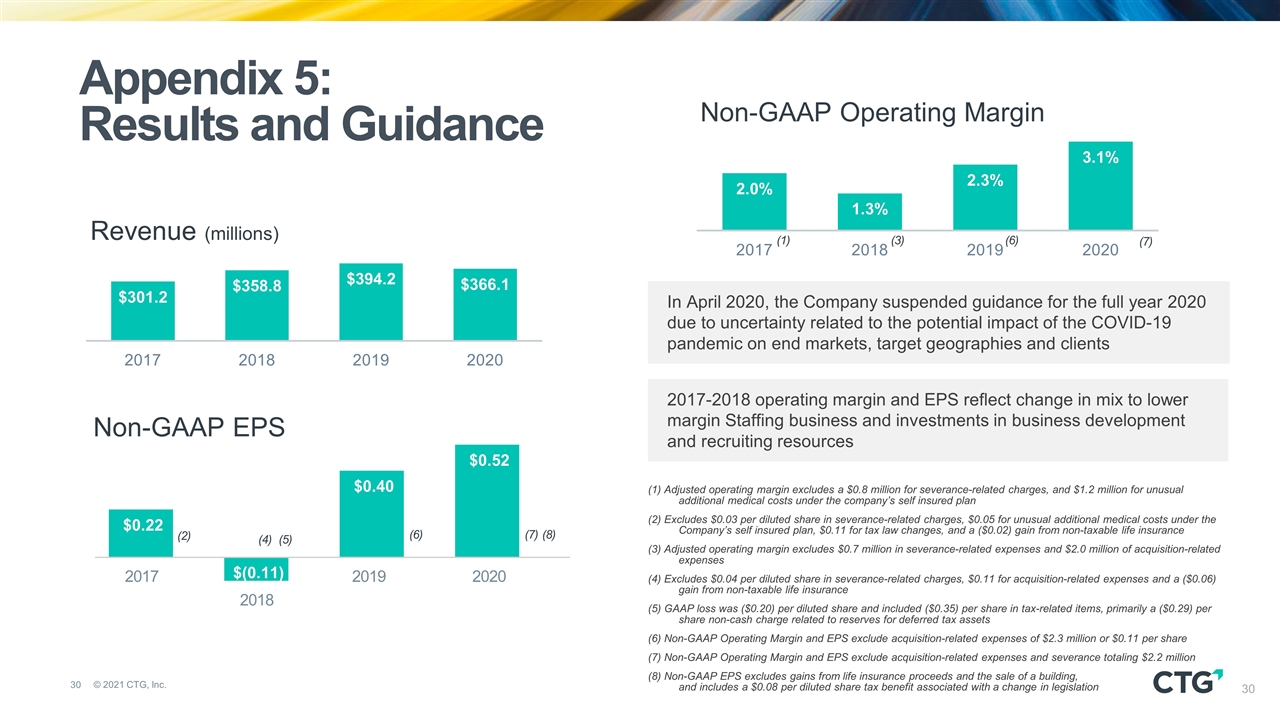

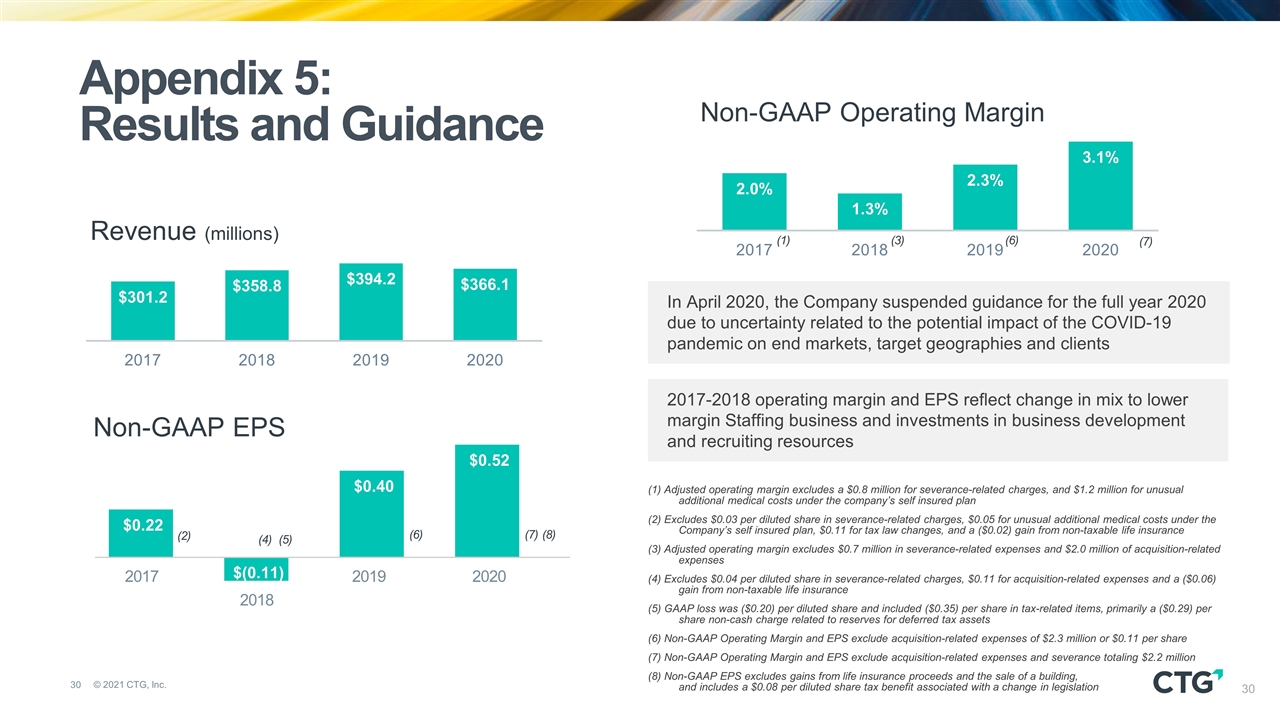

Appendix 5: Results and Guidance Revenue (millions) Non-GAAP EPS 2017 2018 2019 2020 (2) (4) (5) (6) (7) (8) (1) Adjusted operating margin excludes a $0.8 million for severance-related charges, and $1.2 million for unusual additional medical costs under the company’s self insured plan (2) Excludes $0.03 per diluted share in severance-related charges, $0.05 for unusual additional medical costs under the Company’s self insured plan, $0.11 for tax law changes, and a ($0.02) gain from non-taxable life insurance (3) Adjusted operating margin excludes $0.7 million in severance-related expenses and $2.0 million of acquisition-related expenses (4) Excludes $0.04 per diluted share in severance-related charges, $0.11 for acquisition-related expenses and a ($0.06) gain from non-taxable life insurance (5) GAAP loss was ($0.20) per diluted share and included ($0.35) per share in tax-related items, primarily a ($0.29) per share non-cash charge related to reserves for deferred tax assets (6) Non-GAAP Operating Margin and EPS exclude acquisition-related expenses of $2.3 million or $0.11 per share (7) Non-GAAP Operating Margin and EPS exclude acquisition-related expenses and severance totaling $2.2 million (8) Non-GAAP EPS excludes gains from life insurance proceeds and the sale of a building, and includes a $0.08 per diluted share tax benefit associated with a change in legislation 2017-2018 operating margin and EPS reflect change in mix to lower margin Staffing business and investments in business development and recruiting resources In April 2020, the Company suspended guidance for the full year 2020 due to uncertainty related to the potential impact of the COVID-19 pandemic on end markets, target geographies and clients Non-GAAP Operating Margin (1) (3) (6) (7)

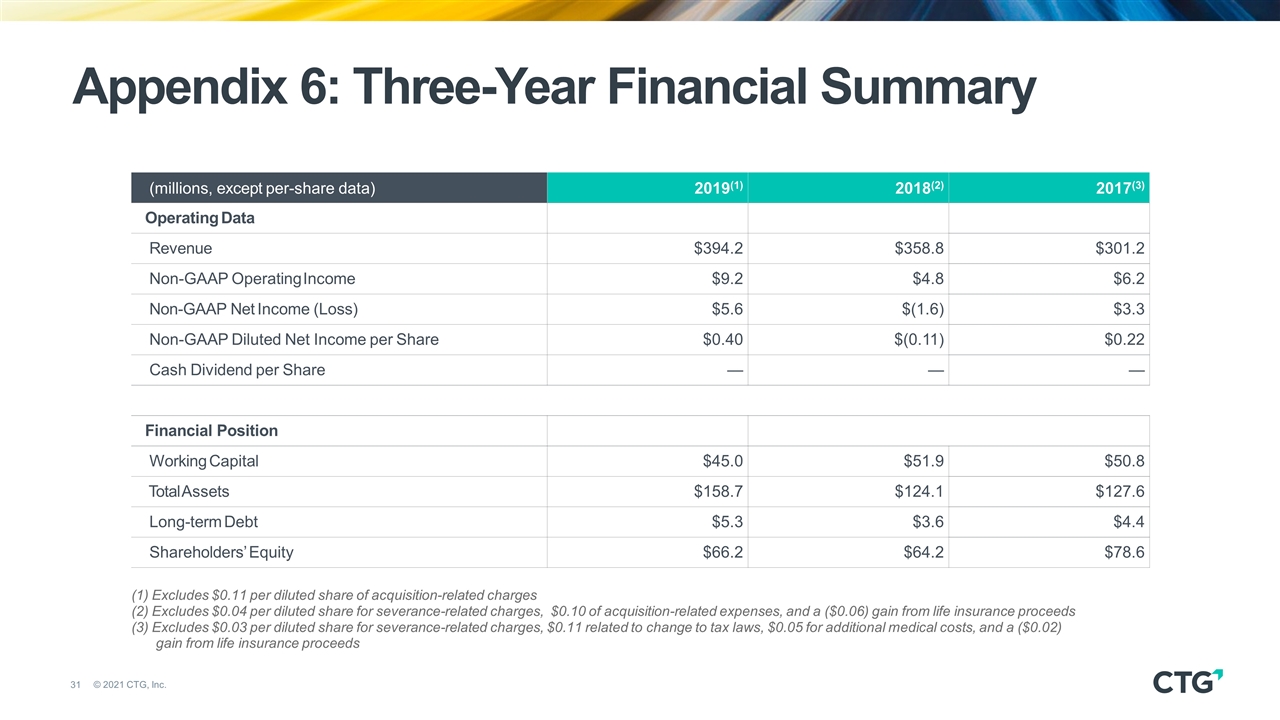

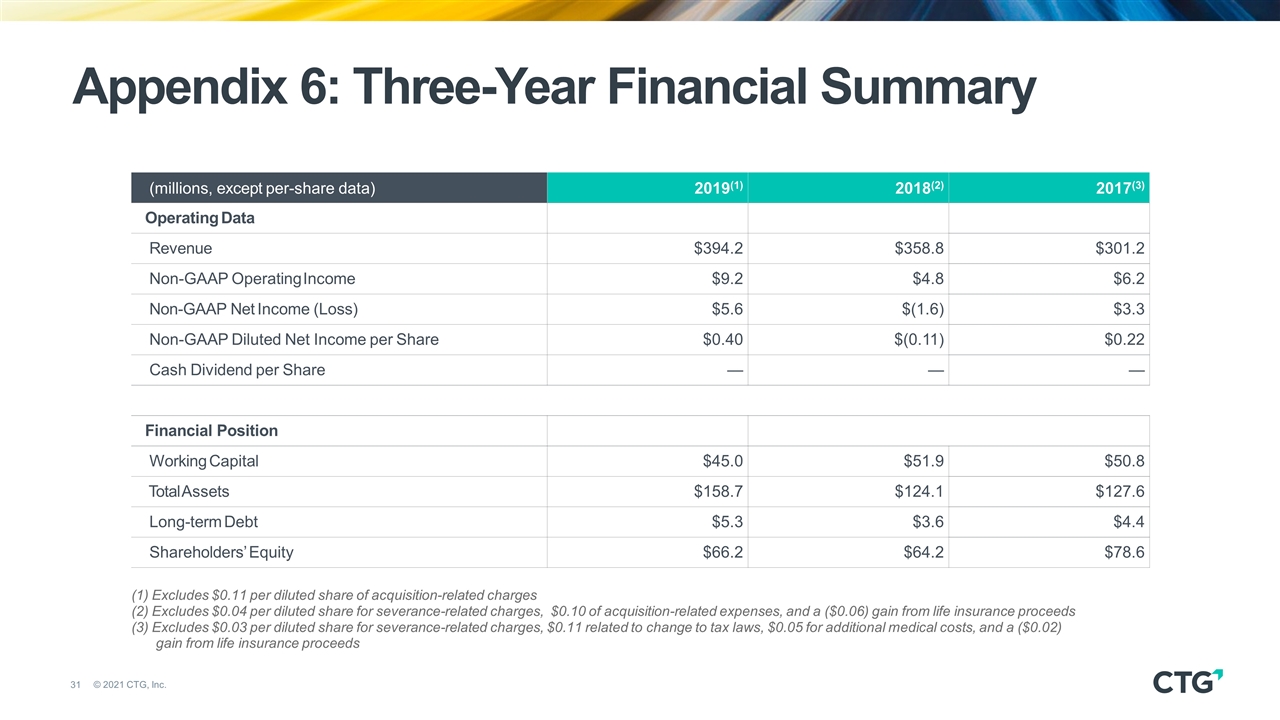

Appendix 6: Three-Year Financial Summary (millions, except per-share data) 2019(1) 2018(2) 2017(3) Operating Data Revenue $394.2 $358.8 $301.2 Non-GAAP Operating Income $9.2 $4.8 $6.2 Non-GAAP Net Income (Loss) $5.6 $(1.6) $3.3 Non-GAAP Diluted Net Income per Share $0.40 $(0.11) $0.22 Cash Dividend per Share — — — Financial Position Working Capital $45.0 $51.9 $50.8 Total Assets $158.7 $124.1 $127.6 Long-term Debt $5.3 $3.6 $4.4 Shareholders’ Equity $66.2 $64.2 $78.6 (1) Excludes $0.11 per diluted share of acquisition-related charges (2) Excludes $0.04 per diluted share for severance-related charges, $0.10 of acquisition-related expenses, and a ($0.06) gain from life insurance proceeds (3) Excludes $0.03 per diluted share for severance-related charges, $0.11 related to change to tax laws, $0.05 for additional medical costs, and a ($0.02) gain from life insurance proceeds

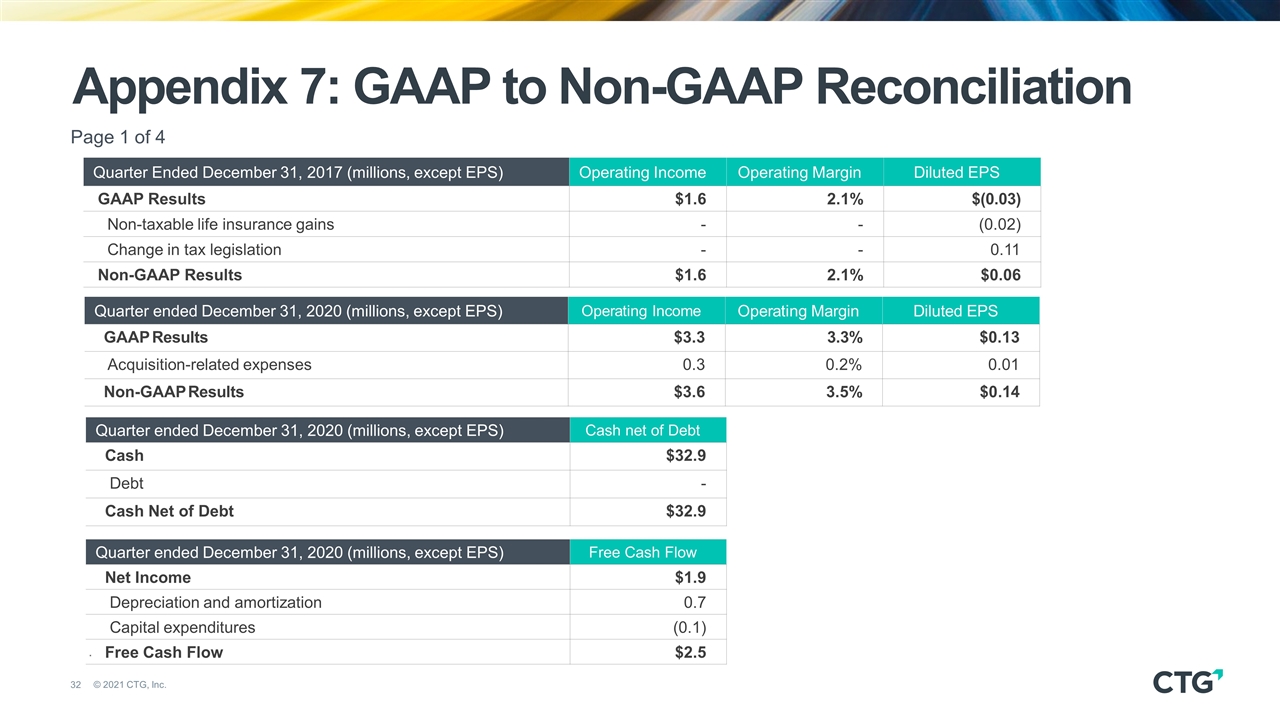

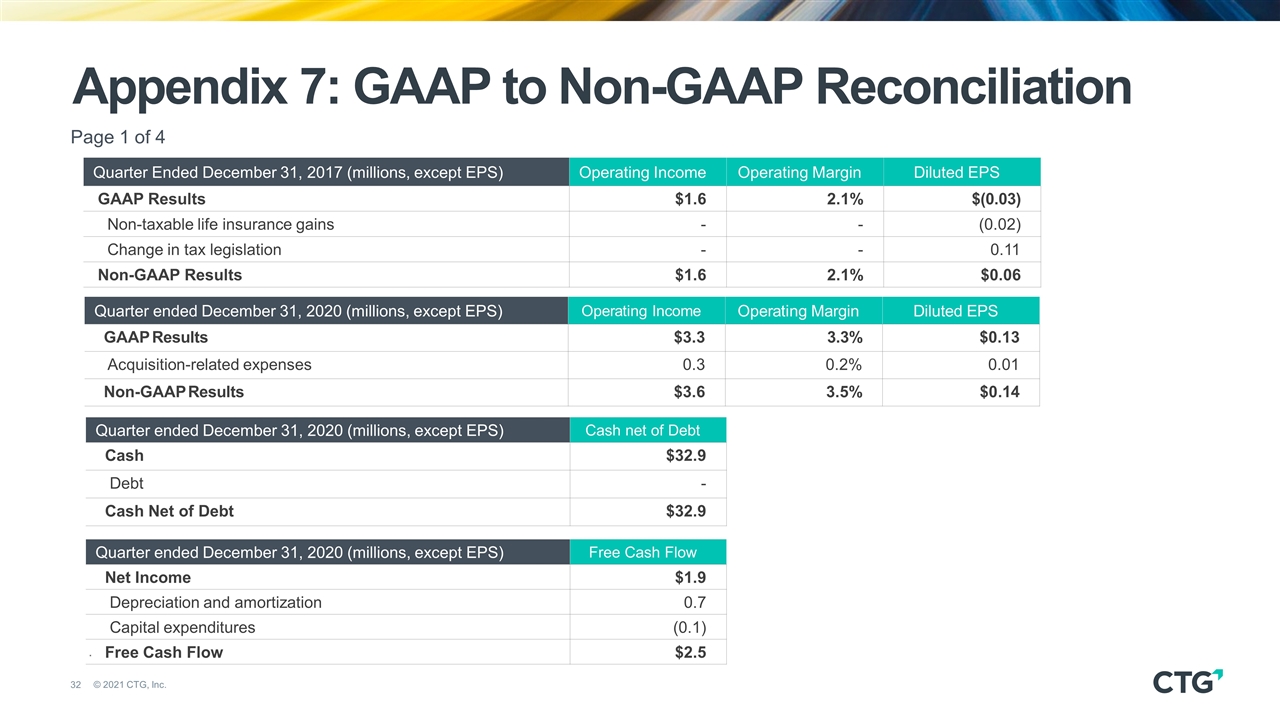

Page 1 of 4 Quarter Ended December 31, 2017 (millions, except EPS) Operating Income Operating Margin Diluted EPS GAAP Results $1.6 2.1% $(0.03) Non-taxable life insurance gains - - (0.02) Change in tax legislation - - 0.11 Non-GAAP Results $1.6 2.1% $0.06 . Appendix 7: GAAP to Non-GAAP Reconciliation Quarter ended December 31, 2020 (millions, except EPS) Operating Income Operating Margin Diluted EPS GAAP Results $3.3 3.3% $0.13 Acquisition-related expenses 0.3 0.2% 0.01 Non-GAAP Results $3.6 3.5% $0.14 Quarter ended December 31, 2020 (millions, except EPS) Cash net of Debt Cash $32.9 Debt - Cash Net of Debt $32.9 Quarter ended December 31, 2020 (millions, except EPS) Free Cash Flow Net Income $1.9 Depreciation and amortization 0.7 Capital expenditures (0.1) Free Cash Flow $2.5

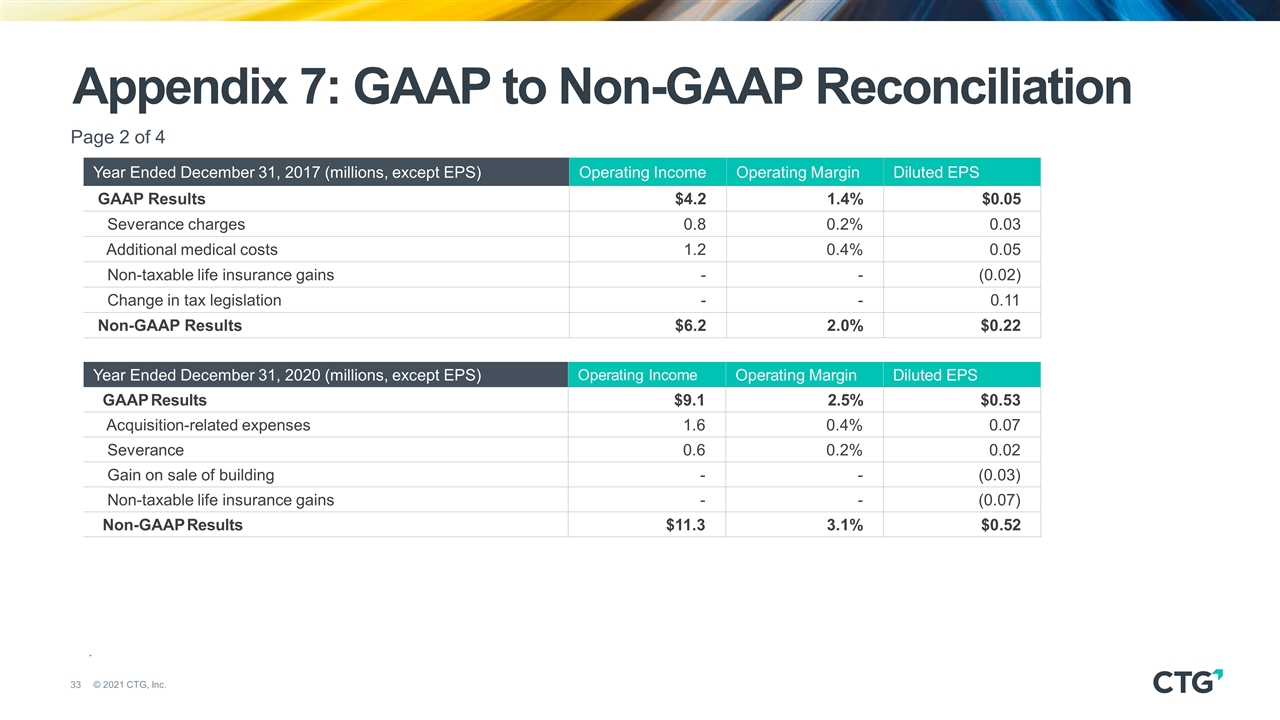

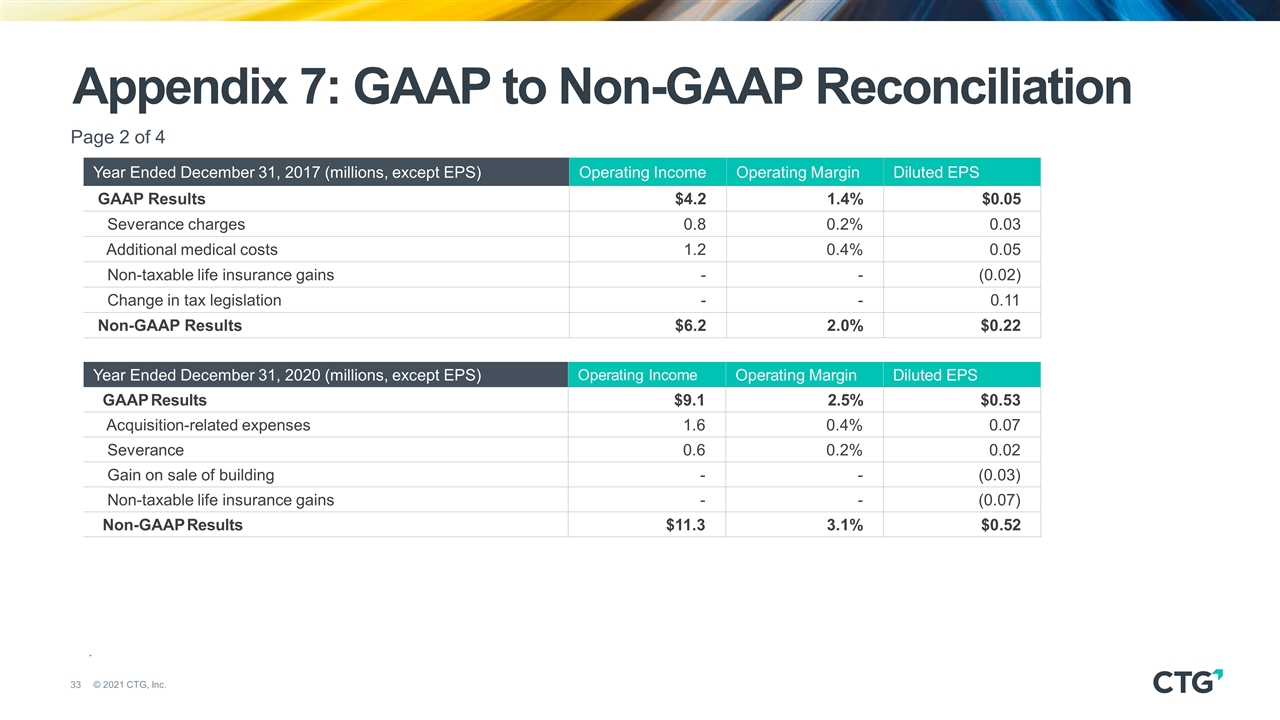

Page 2 of 4 Year Ended December 31, 2017 (millions, except EPS) Operating Income Operating Margin Diluted EPS GAAP Results $4.2 1.4% $0.05 Severance charges 0.8 0.2% 0.03 Additional medical costs 1.2 0.4% 0.05 Non-taxable life insurance gains - - (0.02) Change in tax legislation - - 0.11 Non-GAAP Results $6.2 2.0% $0.22 . Appendix 7: GAAP to Non-GAAP Reconciliation Year Ended December 31, 2020 (millions, except EPS) Operating Income Operating Margin Diluted EPS GAAP Results $9.1 2.5% $0.53 Acquisition-related expenses 1.6 0.4% 0.07 Severance 0.6 0.2% 0.02 Gain on sale of building - - (0.03) Non-taxable life insurance gains - - (0.07) Non-GAAP Results $11.3 3.1% $0.52

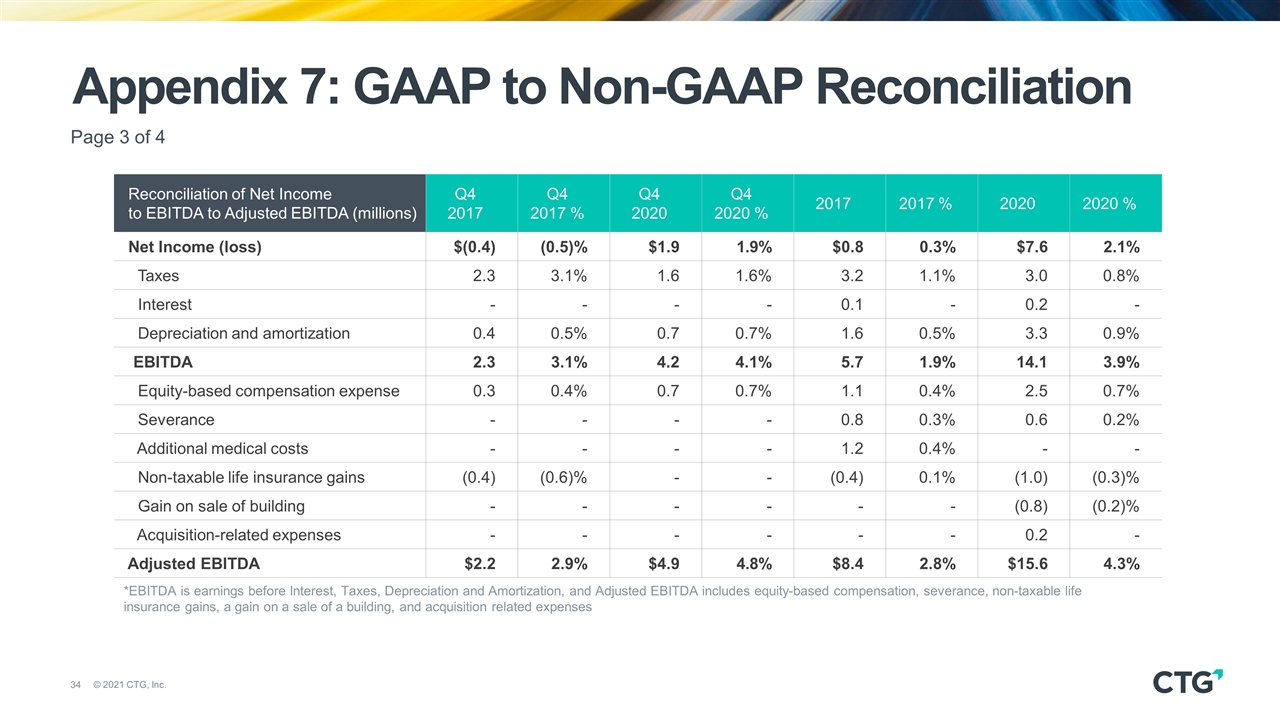

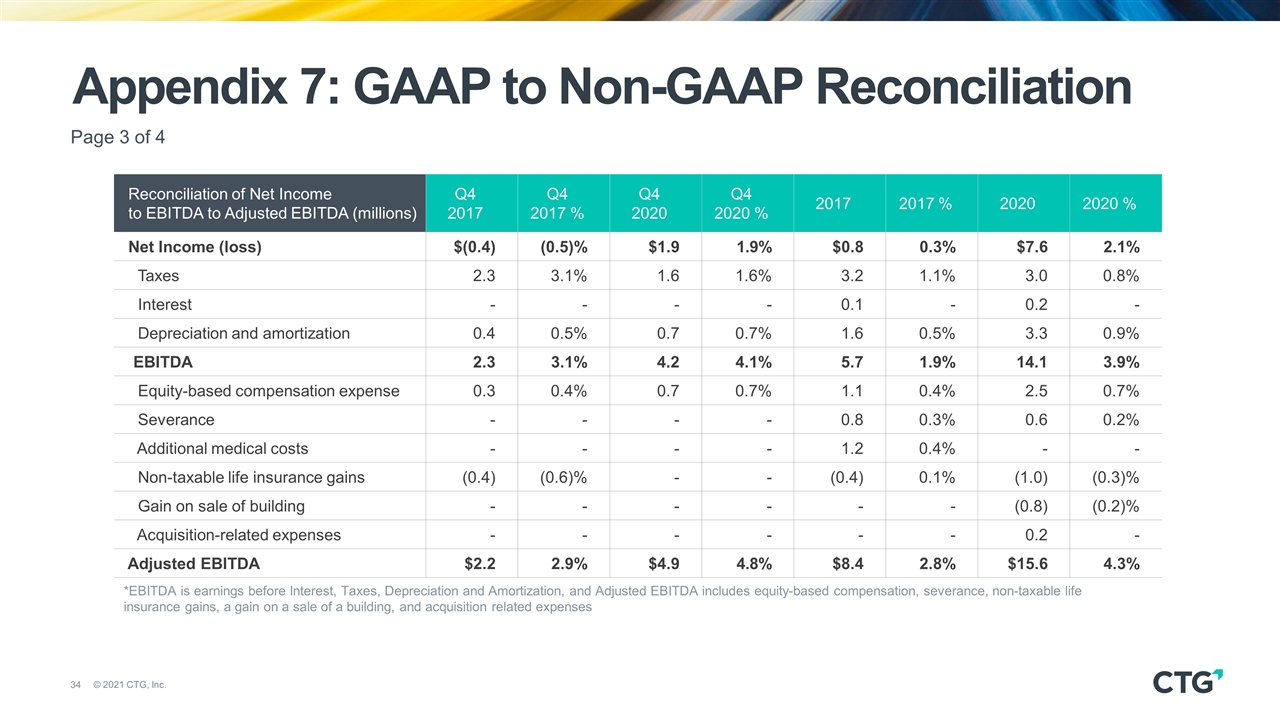

Page 3 of 4 Reconciliation of Net Income to EBITDA to Adjusted EBITDA (millions) Q4 2017 Q4 2017 % Q4 2020 Q4 2020 % 2017 2017 % 2020 2020 % Net Income (loss) $(0.4) (0.5)% $1.9 1.9% $0.8 0.3% $7.6 2.1% Taxes 2.3 3.1% 1.6 1.6% 3.2 1.1% 3.0 0.8% Interest - - - - 0.1 - 0.2 - Depreciation and amortization 0.4 0.5% 0.7 0.7% 1.6 0.5% 3.3 0.9% EBITDA 2.3 3.1% 4.2 4.1% 5.7 1.9% 14.1 3.9% Equity-based compensation expense 0.3 0.4% 0.7 0.7% 1.1 0.4% 2.5 0.7% Severance - - - - 0.8 0.3% 0.6 0.2% Additional medical costs - - - - 1.2 0.4% - - Non-taxable life insurance gains (0.4) (0.6)% - - (0.4) 0.1% (1.0) (0.3)% Gain on sale of building - - - - - - (0.8) (0.2)% Acquisition-related expenses - - - - - - 0.2 - Adjusted EBITDA $2.2 2.9% $4.9 4.8% $8.4 2.8% $15.6 4.3% *EBITDA is earnings before Interest, Taxes, Depreciation and Amortization, and Adjusted EBITDA includes equity-based compensation, severance, non-taxable life insurance gains, a gain on a sale of a building, and acquisition related expenses Appendix 7: GAAP to Non-GAAP Reconciliation

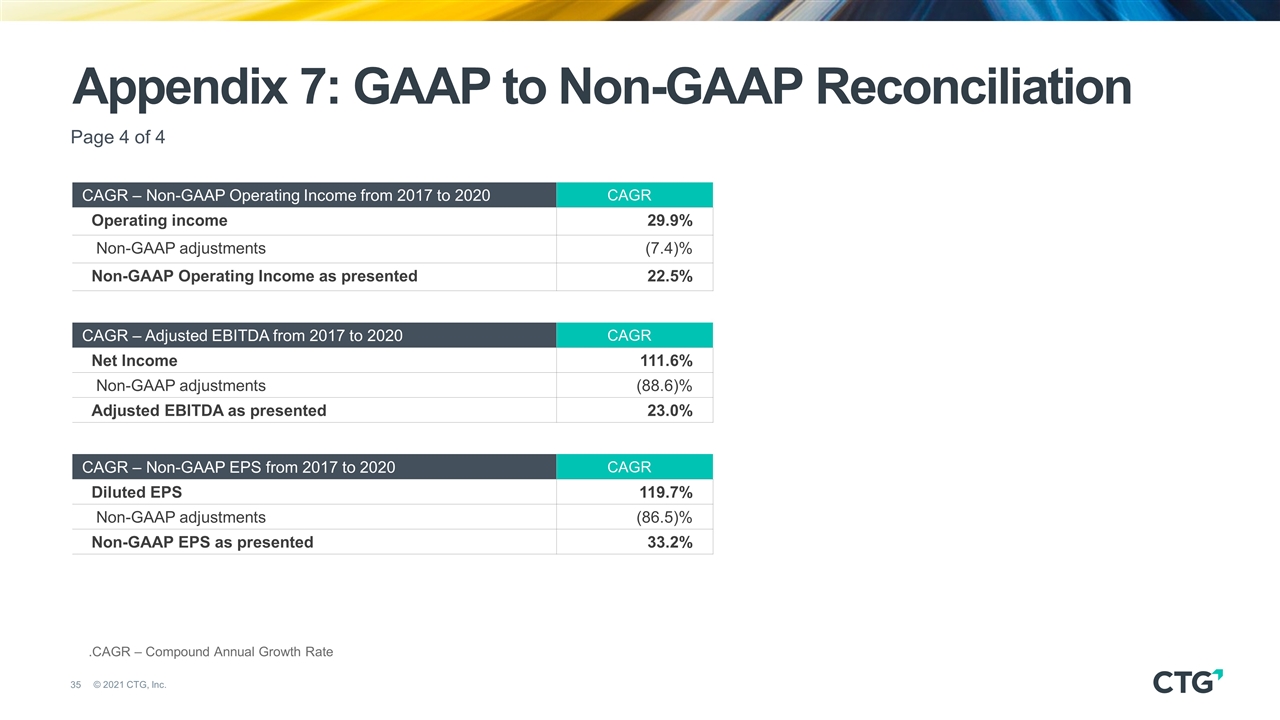

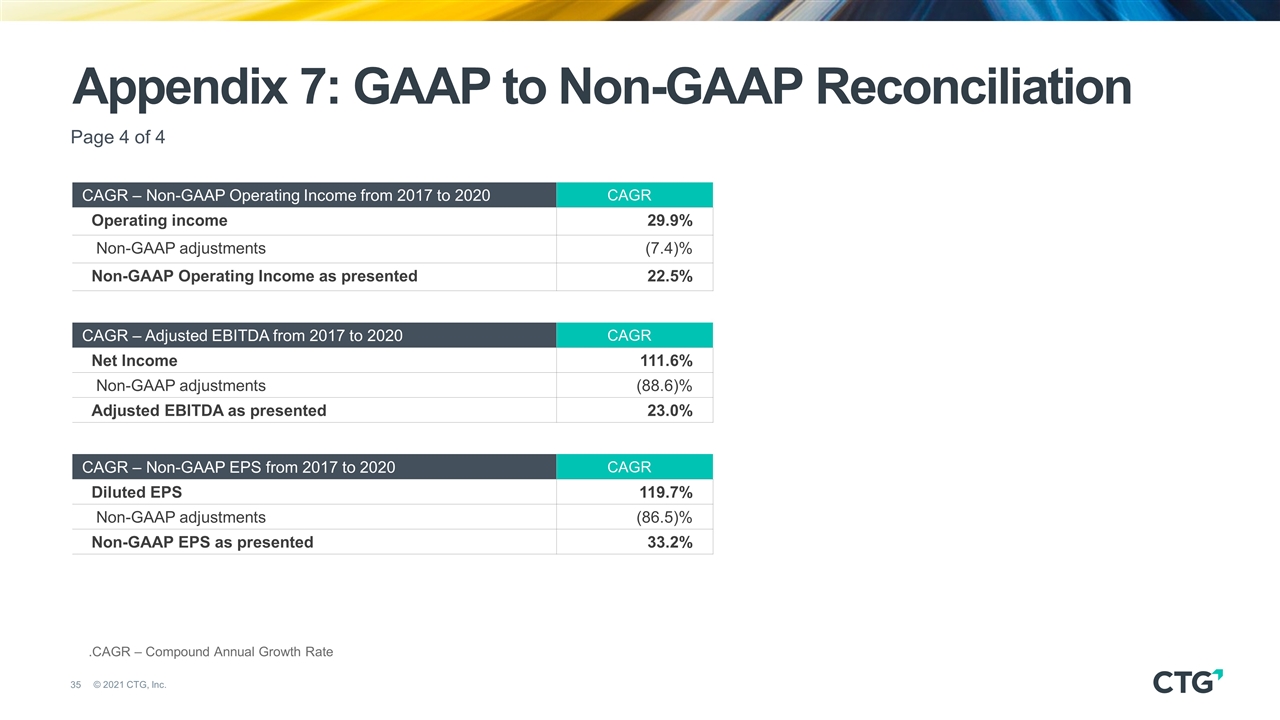

Page 4 of 4 .CAGR – Compound Annual Growth Rate Appendix 7: GAAP to Non-GAAP Reconciliation CAGR – Non-GAAP Operating Income from 2017 to 2020 CAGR Operating income 29.9% Non-GAAP adjustments (7.4)% Non-GAAP Operating Income as presented 22.5% CAGR – Adjusted EBITDA from 2017 to 2020 CAGR Net Income 111.6% Non-GAAP adjustments (88.6)% Adjusted EBITDA as presented 23.0% CAGR – Non-GAAP EPS from 2017 to 2020 CAGR Diluted EPS 119.7% Non-GAAP adjustments (86.5)% Non-GAAP EPS as presented 33.2%

Thank You! John M. Laubacker Executive Vice President, Chief Financial Officer and Treasurer +1 716 887 7368 info@ctg.com • http://investors.ctg.com Published by Computer Task Group, Inc. The information in this presentation is proprietary. In no event shall all or any portion of this presentation be disclosed or disseminated without the express written permission of CTG. The CTG logo is a registered trademark of CTG. © 2021 Computer Task Group, Inc. All Rights Reserved. Investor Presentation | February 2021