SECOND QUARTER: Fiscal Year 2024 0 Second Quarter Fiscal Year 2024 Exhibit 99.1

SECOND QUARTER: Fiscal Year 2024 1 FOREWORD John Ratigan, Interim CEO Fellow Shareholders, Let me begin with a quick note of introduction: while I’m new to the role of Comtech’s CEO, I’m not new to Comtech, our strategy, our markets, our vendors, or our customers, and I’m not new to being a CEO. Before Comtech, I served as CEO and President of iDirect Government for 20 years, a company delivering secure satellite-based voice, video and data applications with anytime and anywhere connectivity in the air, at sea and on land. At iDirect Government, I led the team that built a business from the ground up to over $100 million in annual revenue, and led the acquisition of GlowLink Communications. I have been involved in network technologies and satellite communications for the majority of my career, and I know what it takes to both lead and grow a business. And while I joined as Comtech’s Chief Corporate Development Officer last fall, my roots here run deeper: I spent ten years at EF Data Corp. prior to its acquisition by Comtech in July 2000. It's fair to say a lot has changed at Comtech since then, and that’s exactly why I chose to return. As Chief Corporate Development Officer, I have already spent months travelling to visit our sites, and working closely with leaders across all our businesses, focused on the shared goal of growing our organization in every way. I look forward to continuing that in my new role. I also believe that as CEO, it’s best practice to be direct with the people you have made commitments to, including customers, employees, partners, and certainly you – Comtech’s valued shareholders. As it relates to this quarter, I understand that foremost in most people’s minds is our refinancing. Please know that it is and will remain my single highest priority until it is complete. ____________________ While I’m new to the role of Comtech’s CEO, I’m not new to Comtech, our strategy, our markets, our vendors, or our customers, and I’m not new to being a CEO. Our refinancing is and will remain my single highest priority until it is complete.

SECOND QUARTER: Fiscal Year 2024 2 Throughout the quarter, the team has been working hard to strengthen our balance sheet. Here’s where we are right now: First, in January, two of our largest shareholders, White Hat Capital and Magnetar, made an additional $45 million strategic investment in Comtech. Both know the Company very well: following an initial investment of $100 million in October 2021, White Hat’s Co-Founder Mark Quinlan joined our Board of Directors and has since been active in helping promote and accelerate our One Comtech transformation – something he’s now doing as our newly appointed Board Chair. The continued support of Mark Quinlan, White Hat, and Magnetar – particularly given their deep understanding of our company, our markets, and our strategic vision – is not only appreciated, but also further validation of the underlying strength and long-term potential of our business. Second, we have been engaging with potential lenders to refinance our existing credit facility, and have advanced into what we believe are productive negotiations. We expect to replace our existing credit facility, and look forward to sharing more details once we have finalized our important work here. Our Second Quarter Results Our financial results this quarter in part reflect the temporary uncertainties created by the refinancing overhang. At the same time, they also reflect the ongoing benefits of implementing the One Comtech transformation that began 18 months ago. I will review our financial results in detail later in this letter, but the headline numbers are as follows: • Consolidated net sales increased slightly year-over-year to $134.2 million, compared to $133.7 million in the second quarter of fiscal 2023. This represents a sequential decline from $151.9 million in the first quarter of fiscal 2024. • Gross margin was 32.2%, compared to 31.5% in our first quarter of fiscal 2024 and 34.3% in our second quarter of fiscal 2023. ____________________ The continued support of Mark Quinlan, White Hat, and Magnetar – particularly given their deep understanding of our company, our markets, and our strategic vision – is not only appreciated, but also further validation of the underlying strength and long-term potential of our business.

SECOND QUARTER: Fiscal Year 2024 3 • Our Adjusted EBITDA* was $15.1 million (11.3% margin), as compared to $18.4 million (12.1% margin) in the first quarter of fiscal 2024 and $11.3 million (8.5% margin), in the second quarter of fiscal 2023. As a reminder, this is the first quarter we are reporting after completing the sale of the Power Systems Technology (PST) product line in early November 2023. Also, our second quarter fiscal 2024 results, primarily in our Satellite and Space Communications segment, reflect order delays and supply chain constraints largely stemming from the refinancing overhang. Our Terrestrial & Wireless Networks segment remained strong, with 12% sequential growth and 4% growth compared to our second quarter of fiscal 2023, as the team continued to perform on NG-911 contracts, such as with the State of Ohio. Despite net sales coming in roughly flat year-over-year, our Adjusted EBITDA grew 33% over the same time period, achieving an 11.3% Adjusted EBITDA margin. This overall increase in bottom line performance reflects the operational improvements we have made through the One Comtech lean initiatives over the past year. As we look forward, I believe we will win back any ground lost during our second quarter. Overall demand for our solutions remains healthy as the Comtech team continues to secure key wins for our business, with backlog approximating $680 million. One other financial data point to consider, which I believe is an important indicator of our business trajectory: Comtech’s operating income. As noted in our first quarter fiscal 2024 investor letter, operating income reflects Comtech’s ability to generate profit from our core business activities and underscores the extent to which our business operations and processes are improving. This quarter, we reported GAAP operating income of $3.0 million, compared to $2.1 million in our first quarter of fiscal 2024 and a GAAP operating loss of $0.8 million in the second quarter of fiscal 2023. Our second quarter performance resulted in yet another sequential improvement in our trailing twelve month GAAP operating income. While the second quarter benefited from a $2.2 million estimated gain on the PST product line divestiture, I believe this ongoing positive trend largely reflects the benefit of our One Comtech lean initiatives. *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q ____________________ Despite net sales coming in roughly flat year-over-year, our Adjusted EBITDA grew 33% over the same time period, achieving an 11.3% Adjusted EBITDA margin.

SECOND QUARTER: Fiscal Year 2024 4 Other Recent Key Developments The team at Comtech continues to deliver key wins for our business: Global Field Service Representative (“GFSR”) contract In the first quarter of fiscal 2024, we were awarded a large, multi-year Global Field Service Representative (“GFSR”) contract by the U.S. Army. In November 2023, the incumbent protested the award, which resulted in a stop work order. In January 2024, the protest was dismissed in our favor and the stop work order was lifted. The incumbent has protested the award again, resulting in another stop work order. This contract has a total potential value of $544.0 million and is expected to start contributing significantly to our net sales in the latter part of fiscal 2024 and beyond, assuming a timely resolution of the protest in our favor. NG-911 services: Washington State In the second quarter of fiscal 2024, our Terrestrial and Wireless Networks segment extended critical NG-911 services for the State of Washington. Comtech has had a longstanding partnership with the State of Washington since 2016 to deploy one of the most robust and advanced NG-911 systems in the United States. This extension is valued at $48.0 million over the next five years, with the option to extend further through 2034. Accelerated Growth Service ("AGS") program Also, we recently announced that our Canadian subsidiary was invited by Innovation Canada, a sector of Innovation, Science and Economic Development Canada, to join a select group of companies participating in the Accelerated Growth Service ("AGS") program. The AGS program offers support to a number of high-growth, high- potential, qualifying businesses across Canada. As part of the program, we will gain access to key government services such as financing and export opportunities. The AGS program will also provide us with a personalized team of government experts to support our growth plans and help identify new government programs that could help us capture near- and long-term business opportunities.

SECOND QUARTER: Fiscal Year 2024 5 The Road Ahead Roughly 18 months ago, Comtech embarked on a journey to drive meaningful growth with improved profitability. It involved the execution of the most significant transformation in Comtech’s history. Accordingly, we have devoted significant focus to ensuring that Comtech has not only the right people and processes in place, but that our business operations rest upon a solid foundation that includes: ● An innovative culture; ● Technology leadership; ● An intense focus on the customer; and ● A steadily improving balance sheet. We have done, and will continue to put in, the hard work necessary to build a bigger, stronger, higher-performing business. We have demonstrated we can win business. Our operational improvements continue to support and benefit our financial performance. We continue to attract exceptional talent to Comtech and add to our high-quality management team. I’m excited to have the opportunity to lead this company forward at this moment in time. ____________________ Roughly 18 months ago, Comtech embarked on a journey to drive meaningful growth with improved profitability. We have done, and will continue to put in, the hard work necessary to build a bigger, stronger, higher- performing business.

SECOND QUARTER: Fiscal Year 2024 6 $134.2 M Net Sales 32.2% Gross Profit Margin FISCAL Q2 2024 CONSOLIDATED RESULTS $15.1 M Adjusted EBITDA* *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q $3.0 M GAAP Operating Income $141.8 M Net Bookings

SECOND QUARTER: Fiscal Year 2024 8 SATELLITE & SPACE COMMUNICATIONS Our Satellite and Space Communications segment designs, builds and supports a variety of sophisticated communications solutions that meet or exceed the highest standards for performance and quality by businesses and governments worldwide. It has three product areas: Satellite Modem and Amplifier Technologies, Troposcatter and SATCOM Solutions, and Space Components and Antennas. $78.6 M Net Sales $1.9 M GAAP Operating Income $67.6 M Net Bookings $7.1 M Adjusted EBITDA* *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q

SECOND QUARTER: Fiscal Year 2024 9 SATELLITE & SPACE COMMUNICATIONS Operating income in Q2 fiscal 2024 was $1.9 million or 2.4% of related segment net sales, compared to operating income of $3.3 million or 4.1% in Q2 fiscal 2023. Q2 fiscal 2024 Adjusted EBITDA was $7.1 million, a decrease from the $8.2 million of Adjusted EBITDA reported in Q2 fiscal 2023. The decreases in our Satellite and Space Communications segment's operating income, as well as Adjusted EBITDA, both in dollars and as a percentage of related segment net sales, was driven primarily by a decrease in related segment net sales and gross profit percentage. Satellite and Space Communications net sales were $78.6 million for the quarter, a decrease of $1.8 million as compared to Q2 fiscal 2023. Segment net sales primarily reflect higher net sales of our troposcatter and SATCOM solutions to U.S. government end customers (including progress toward delivering next-generation troposcatter terminals to both the U.S. Marine Corps and U.S. Army), more than offset by lower net sales resulting from the PST divestiture on November 7, 2023 and of satellite ground station solutions (including our X/Y steerable antennas). Net bookings in the Satellite and Space Communications segment totaled $67.6 million for the quarter. Key bookings include over $7.0 million of funded orders from two foreign militaries, who are evaluating our next generation Modular Transportable Transmission System ("MTTS") troposcatter solutions. *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q $137.5 $77.5 $85.5 $137.1 $67.6 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Satellite & Space Communications Net Bookings (millions) $80.4 $82.2 $94.2 $102.4 $78.6 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Satellite & Space Communications Net Sales (millions) 10.2% 7.7% 13.3% 14.8% 9.0% Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Satellite & Space Communications Adjusted EBITDA* Margin

SECOND QUARTER: Fiscal Year 2024 10 TERRESTRIAL & WIRELESS NETWORKS Our Terrestrial and Wireless Networks segment is a leading provider of the hardware, software, and solutions critical to the global 5G network infrastructure market, as well as for applications and services requiring the specific location of a mobile user's geospatial position. It is organized into three service areas: next generation 911 and call delivery, Solacom call handling solutions, and trusted location and messaging solutions. $55.6 M Net Sales $13.7 M Adjusted EBITDA* $74.2 M Net Bookings $8.1 M GAAP Operating Income *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q

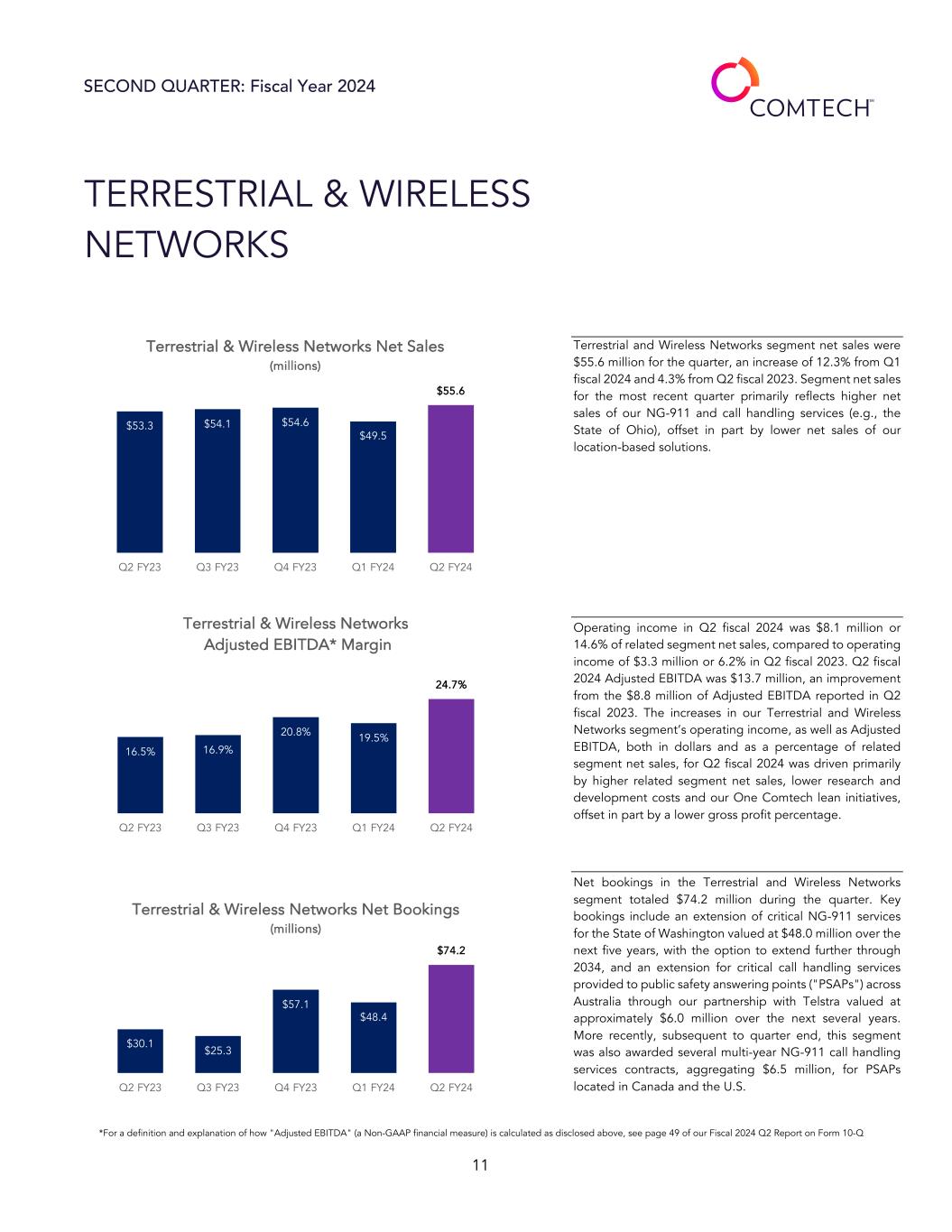

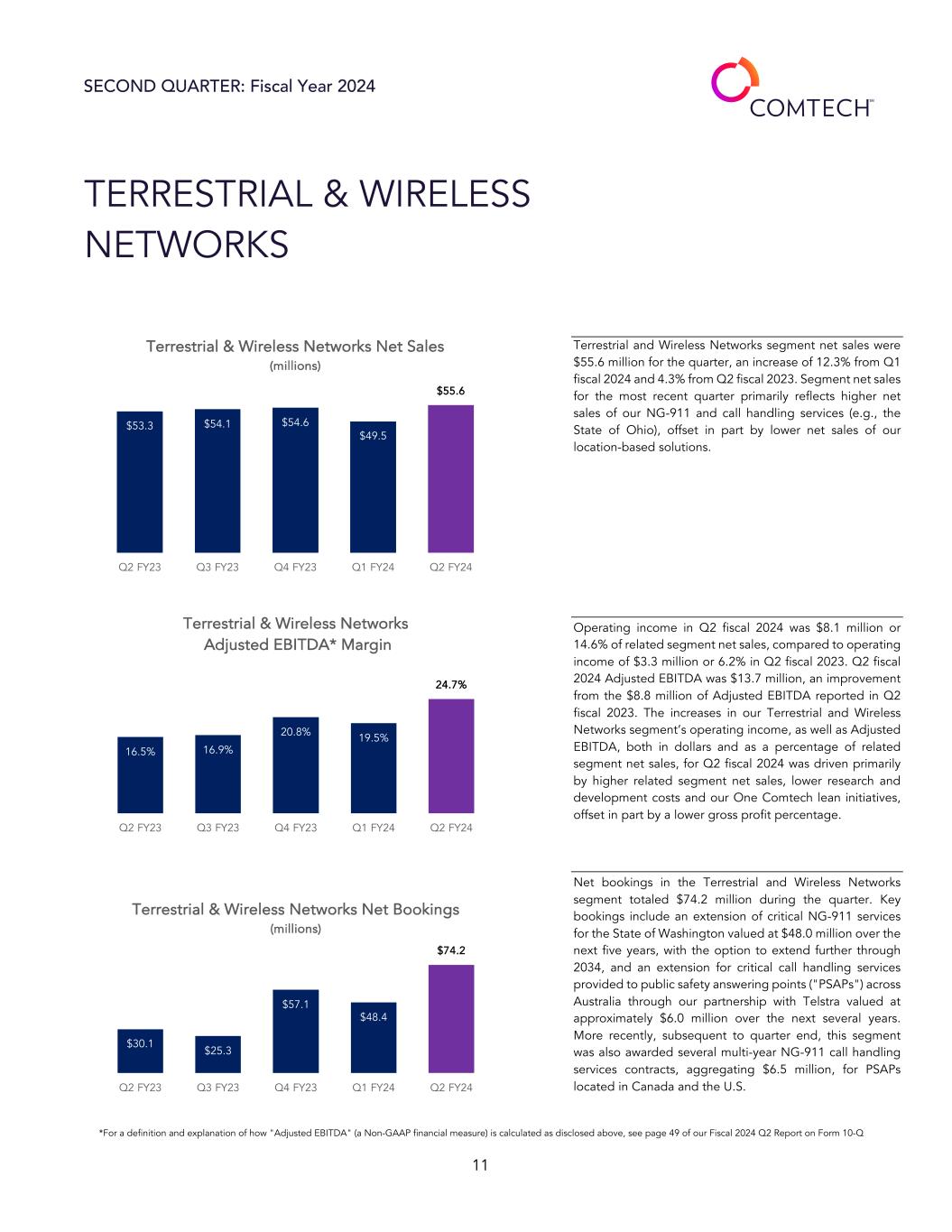

SECOND QUARTER: Fiscal Year 2024 11 TERRESTRIAL & WIRELESS NETWORKS Net bookings in the Terrestrial and Wireless Networks segment totaled $74.2 million during the quarter. Key bookings include an extension of critical NG-911 services for the State of Washington valued at $48.0 million over the next five years, with the option to extend further through 2034, and an extension for critical call handling services provided to public safety answering points ("PSAPs") across Australia through our partnership with Telstra valued at approximately $6.0 million over the next several years. More recently, subsequent to quarter end, this segment was also awarded several multi-year NG-911 call handling services contracts, aggregating $6.5 million, for PSAPs located in Canada and the U.S. Terrestrial and Wireless Networks segment net sales were $55.6 million for the quarter, an increase of 12.3% from Q1 fiscal 2024 and 4.3% from Q2 fiscal 2023. Segment net sales for the most recent quarter primarily reflects higher net sales of our NG-911 and call handling services (e.g., the State of Ohio), offset in part by lower net sales of our location-based solutions. Operating income in Q2 fiscal 2024 was $8.1 million or 14.6% of related segment net sales, compared to operating income of $3.3 million or 6.2% in Q2 fiscal 2023. Q2 fiscal 2024 Adjusted EBITDA was $13.7 million, an improvement from the $8.8 million of Adjusted EBITDA reported in Q2 fiscal 2023. The increases in our Terrestrial and Wireless Networks segment’s operating income, as well as Adjusted EBITDA, both in dollars and as a percentage of related segment net sales, for Q2 fiscal 2024 was driven primarily by higher related segment net sales, lower research and development costs and our One Comtech lean initiatives, offset in part by a lower gross profit percentage. *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q $53.3 $54.1 $54.6 $49.5 $55.6 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Terrestrial & Wireless Networks Net Sales (millions) 16.5% 16.9% 20.8% 19.5% 24.7% Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Terrestrial & Wireless Networks Adjusted EBITDA* Margin $30.1 $25.3 $57.1 $48.4 $74.2 Q2 FY23 Q3 FY23 Q4 FY23 Q1 FY24 Q2 FY24 Terrestrial & Wireless Networks Net Bookings (millions)

SECOND QUARTER: Fiscal Year 2024 12 OUTLOOK: As I wrote earlier, we are encouraged by the progress we have made through our One Comtech transformation. We continue to implement many important lean initiatives and process improvement activities anticipated to drive sustainable, profitable growth in our business. Several of these actions have already contributed to our improved financial performance, affording us the opportunity to report our third consecutive fiscal quarter of positive GAAP operating income since fiscal 2021. As we enter the third quarter of fiscal 2024, as described in more detail in our Q2 FY24 Form 10-Q, business conditions continue to be challenging, and the operating environment is largely unpredictable. Nevertheless, despite these business conditions and resulting challenges and although we anticipate some variability from time to time as we move through our One Comtech transformational change, we are targeting net sales and Adjusted EBITDA* for fiscal year 2024 to be better than fiscal 2023. *For a definition and explanation of how "Adjusted EBITDA" (a Non-GAAP financial measure) is calculated as disclosed above, see page 49 of our Fiscal 2024 Q2 Report on Form 10-Q ____________________ We are encouraged by the progress we have made through our One Comtech transformation. We are targeting net sales and Adjusted EBITDA* for fiscal year 2024 to be better than fiscal 2023.

SECOND QUARTER: Fiscal Year 2024 13 UPDATE & REVIEW: KEY BUSINESS INITIATIVES Comtech continues to win business thanks to our combination of industry-leading services and solutions, and the recognized expertise and dedication of our people. Highlights of key business initiatives and wins over the past several months include: In the second quarter of fiscal 2024, our Satellite and Space Communications segment was awarded over $7.0 million of funded orders from two foreign militaries, who are purchasing initial units to evaluate our next generation Modular Transportable Transmission System ("MTTS") troposcatter solutions. We believe that these two new international customers could lead to larger scale troposcatter opportunities in the future. We extended critical call handling services provided to public safety answering points ("PSAPs") throughout Australia. These services, valued at approximately $6.0 million over the next several years, support Australia's "000" (911 equivalent) emergency communications. We were recently awarded several multi-year NG-911 call handling services contracts, aggregating $6.5 million, for PSAPs located in Canada and the U.S. Earlier this year, under the guidance of Comtech’s Chief Technology Officer, Anirban Chakraborty, we formally launched the WAVE Consortium, whose mission is to transform the satellite industry toward a fully interoperable ecosystem by using intelligent, open, and virtualized networks by providing standardized architectures and specifications. With a board comprising senior leaders and technical experts from Alignment, Comtech, Amazon, Microsoft, SES Space & Defense, Reticulate Micro, Intelsat, U.S. Air Force Research Lab, the Department of Defense, iDirect Government, and The Space Crowd, and chaired by Anirban himself, WAVE will enable the acceleration of innovation in network services and operations.

SECOND QUARTER: Fiscal Year 2024 14 Finally, in March 2024, in order to continue to streamline our operations and improve efficiency, we decided to relocate our corporate headquarters to our 146,000 square foot facility in Chandler, Arizona. With an ability to support several of our largest and key commercial and defense customers, our engineering and manufacturing facility in Chandler, Arizona – which also includes a customer experience center – was a logical choice for becoming our newest headquarters. This will afford Comtech’s employees, across multiple disciplines and businesses, the opportunity to spend time both formally and informally with one another, which we believe will continue to support and amplify our One Comtech transformation. IN CLOSING As I said, I take seriously my commitment to Comtech and our customers, employees, partners, and investors. You can expect me to be direct in my communications and clear about my priorities. Our top priority right now is strengthening our balance sheet. We completed the first step toward this objective with the strategic growth investment announced in January, and we are working diligently to refinance our credit facility in the near term. When I rejoined Comtech, I was enthusiastic about the opportunities that lay ahead for the Company. That remains the case today, and I am proud to lead this talented organization. We have end markets that are changing and growing, the best people and products in the industry, and, in our growing sales and visible revenues, a vote of confidence and appreciation from our customers that Comtech is the right partner to help them navigate a challenging technology landscape. Thank you, John ____________________ We have end markets that are changing and growing, the best people and products in the industry, and, in our growing sales and visible revenues, a vote of confidence and appreciation from our customers.

SECOND QUARTER: Fiscal Year 2024 15 Everything we are doing is being done to put our company on a durable growth trajectory that I believe will create and deliver value for years to come. Thank you, as ever, for your support and confidence. Ken Appendix & Additional Information Q2: FY 2024

Conference Call Information We have scheduled an investor conference call for 5:00 PM (ET) on Monday, March 18, 2024. Investors and the public are invited to access a live webcast of the conference call from the Investor Relations section of the Comtech website at www.comtech.com. Alternatively, investors can access the conference call by dialing (800) 225-9448 (domestic), or (203) 518-9708 (international) and using the conference I.D. "Comtech." A replay of the conference call will also be available by dialing (888) 566-0825 (domestic), or (402) 220-0427 (international) through Monday, April 1, 2024. About Comtech Comtech Telecommunications Corp. is a leading global technology company providing terrestrial and wireless network solutions, next-generation 9-1-1 emergency services, satellite and space communications technologies, and cloud native capabilities to commercial and government customers around the world. Our unique culture of innovation and employee empowerment unleashes a relentless passion for customer success. With multiple facilities located in technology corridors throughout the United States and around the world, Comtech leverages our global presence, technology leadership, and decades of experience to create the world’s most innovative communications solutions. For more information, please visit www.comtech.com. Comtech Investor Relations Maria Ceriello (631) 962-7102 investors@comtech.com Appendix: – Cautionary Statement Regarding Forward-Looking Statements – Condensed Consolidated Statements of Operations (Unaudited) – Condensed Consolidated Balance Sheets (Unaudited) – Use of Non-GAAP Financial Measures Cautionary Statement Regarding Forward-Looking Statements Certain information in this shareholder letter contains forward-looking statements, including but not limited to, information relating to our future performance and financial condition, plans to address our ability to continue as a going concern, plans and objectives of our management and our assumptions regarding such future performance, financial condition, and plans and objectives that involve certain significant known and unknown risks and uncertainties and other factors not under our control which may cause our actual results, future performance and financial condition, and achievement of our plans and objectives of our management to be materially different from the results, performance or other expectations implied by these forward-looking statements. These factors include, among other things: our ability to access capital and liquidity so that we are able to continue as a going concern; our ability to successfully implement changes in our executive leadership; the possibility that the expected synergies and benefits from acquisitions and or restructuring activities will not be fully realized, or will not be realized within the anticipated time periods; the risk that the acquired businesses will not be integrated successfully; the possibility of disruption from acquisitions or dispositions, making it more difficult to maintain business and operational relationships or retain key personnel; the risk that we will be unsuccessful in implementing our "One Comtech" transformation and integration of individual businesses into two segments; the risk that we will be unsuccessful in implementing a tactical shift in our Satellite and Space Communications segment away from bidding on large commodity service contracts and toward pursuing contracts for our niche products and solutions with higher margins; the nature and timing of our receipt of, and our performance on, new or existing orders that can cause significant fluctuations in net sales and operating results; the timing and funding of government contracts; adjustments to gross profits on long-term contracts; risks associated with international sales; rapid technological change; evolving industry standards; new product announcements and enhancements; changing customer demands and or procurement strategies; changes in prevailing economic and political conditions, including as a result of Russia's military incursion into Ukraine, the Israel-Hamas war and escalating attacks in the Red Sea region; changes in the price of oil in global markets; changes in prevailing interest rates and foreign currency exchange rates; risks associated with our legal proceedings, customer claims for indemnification, and other similar matters; risks associated with our obligations under our Credit Facility and our ability to refinance our Credit Facility; risks associated with our large contracts; risks associated with supply chain disruptions; and other factors described in this and our other filings with the Securities and Exchange Commission ("SEC"). 16

COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES Consolidated Statements of Operations (Unaudited) (Unaudited) Three months ended January 31, Six months ended January 31, 2024 2023 2024 2023 Net sales $ 134,225,000 133,725,000 $ 286,136,000 264,864,000 Cost of sales 91,027,000 87,801,000 195,056,000 172,137,000 Gross profit 43,198,000 45,924,000 91,080,000 92,727,000 Expenses: Selling, general and administrative 30,307,000 28,915,000 63,002,000 58,252,000 Research and development 6,843,000 12,441,000 14,655,000 25,192,000 Amortization of intangibles 5,288,000 5,349,000 10,577,000 10,698,000 Gain on business divestiture, net (2,213,000) — (2,213,000) — CEO transition costs — — — 9,090,000 40,225,000 46,705,000 86,021,000 103,232,000 Operating income (loss) 2,973,000 (781,000) 5,059,000 (10,505,000) Other expenses (income): Interest expense 5,265,000 3,791,000 10,197,000 6,026,000 Interest (income) and other 902,000 455,000 837,000 200,000 Loss before benefit from income taxes (3,194,000) (5,027,000) (5,975,000) (16,731,000) Provision for (benefit from) income taxes 7,364,000 (222,000) 6,020,000 (830,000) Net loss $ (10,558,000) (4,805,000) $ (11,995,000) (15,901,000) Loss on extinguishment of convertible preferred stock (13,640,000) — (13,640,000) — Adjustments to reflect redemption value of convertible preferred stock: Convertible preferred stock issuance costs (4,273,000) — (4,273,000) — Dividend on convertible preferred stock (2,061,000) (1,737,000) (3,884,000) (3,447,000) Net loss attributable to common stockholders $ (30,532,000) (6,542,000) $ (33,792,000) (19,348,000) Net loss per common share: Basic $ (1.07) (0.23) $ (1.18) (0.69) Diluted $ (1.07) (0.23) $ (1.18) (0.69) Weighted average number of common shares outstanding – basic 28,662,000 27,954,000 28,704,000 27,892,000 Weighted average number of common and common equivalent shares outstanding – diluted 28,662,000 27,954,000 28,704,000 27,892,000 17

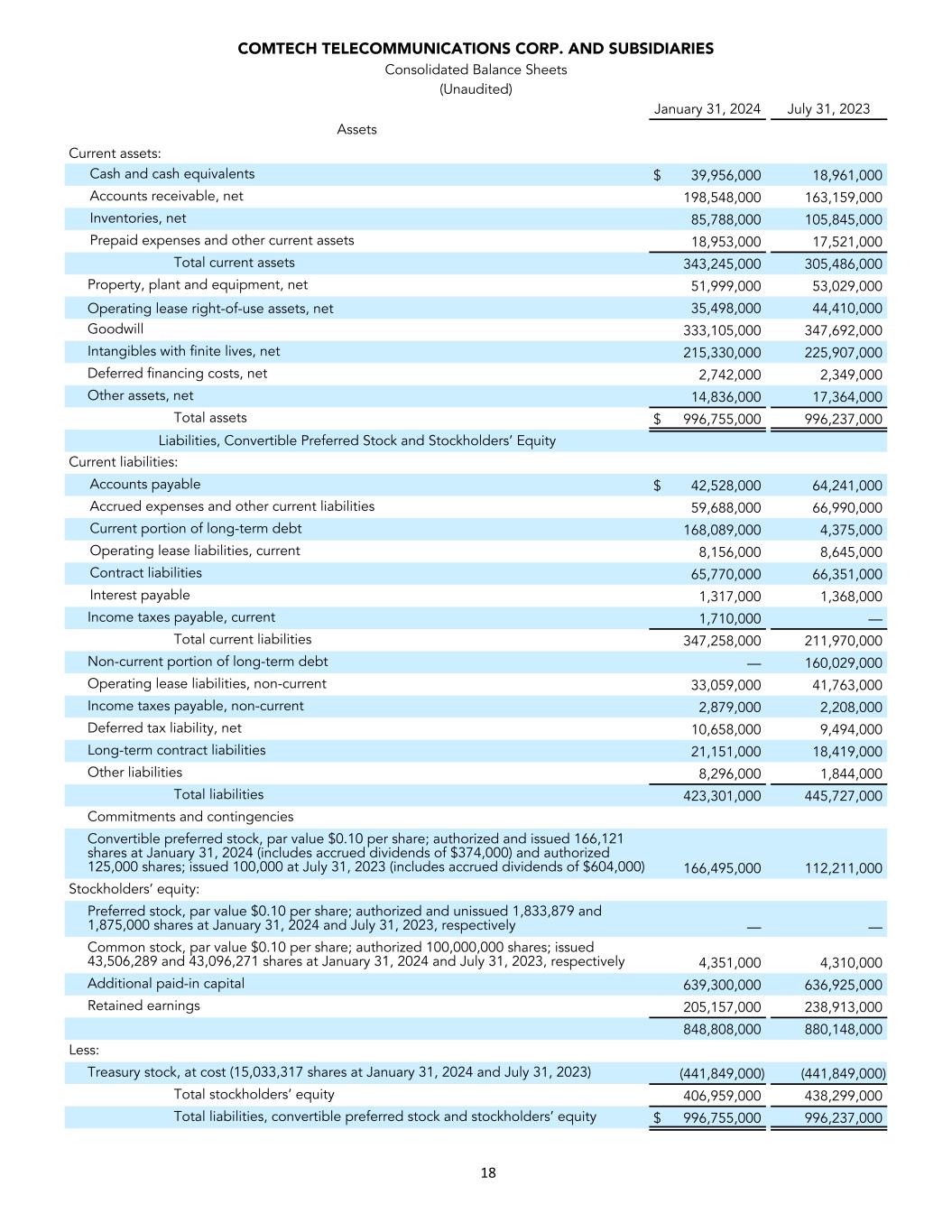

COMTECH TELECOMMUNICATIONS CORP. AND SUBSIDIARIES Consolidated Balance Sheets (Unaudited) Assets Current assets: Cash and cash equivalents $ 39,956,000 18,961,000 Accounts receivable, net 198,548,000 163,159,000 Inventories, net 85,788,000 105,845,000 Prepaid expenses and other current assets 18,953,000 17,521,000 Total current assets 343,245,000 305,486,000 Property, plant and equipment, net 51,999,000 53,029,000 Operating lease right-of-use assets, net 35,498,000 44,410,000 Goodwill 333,105,000 347,692,000 Intangibles with finite lives, net 215,330,000 225,907,000 Deferred financing costs, net 2,742,000 2,349,000 Other assets, net 14,836,000 17,364,000 Total assets $ 996,755,000 996,237,000 Liabilities, Convertible Preferred Stock and Stockholders’ Equity Current liabilities: Accounts payable $ 42,528,000 64,241,000 Accrued expenses and other current liabilities 59,688,000 66,990,000 Current portion of long-term debt 168,089,000 4,375,000 Operating lease liabilities, current 8,156,000 8,645,000 Contract liabilities 65,770,000 66,351,000 Interest payable 1,317,000 1,368,000 Income taxes payable, current 1,710,000 — Total current liabilities 347,258,000 211,970,000 Non-current portion of long-term debt — 160,029,000 Operating lease liabilities, non-current 33,059,000 41,763,000 Income taxes payable, non-current 2,879,000 2,208,000 Deferred tax liability, net 10,658,000 9,494,000 Long-term contract liabilities 21,151,000 18,419,000 Other liabilities 8,296,000 1,844,000 Total liabilities 423,301,000 445,727,000 Commitments and contingencies Convertible preferred stock, par value $0.10 per share; authorized and issued 166,121 shares at January 31, 2024 (includes accrued dividends of $374,000) and authorized 125,000 shares; issued 100,000 at July 31, 2023 (includes accrued dividends of $604,000) 166,495,000 112,211,000 Stockholders’ equity: Preferred stock, par value $0.10 per share; authorized and unissued 1,833,879 and 1,875,000 shares at January 31, 2024 and July 31, 2023, respectively — — Common stock, par value $0.10 per share; authorized 100,000,000 shares; issued 43,506,289 and 43,096,271 shares at January 31, 2024 and July 31, 2023, respectively 4,351,000 4,310,000 Additional paid-in capital 639,300,000 636,925,000 Retained earnings 205,157,000 238,913,000 848,808,000 880,148,000 Less: Treasury stock, at cost (15,033,317 shares at January 31, 2024 and July 31, 2023) (441,849,000) (441,849,000) Total stockholders’ equity 406,959,000 438,299,000 Total liabilities, convertible preferred stock and stockholders’ equity $ 996,755,000 996,237,000 January 31, 2024 July 31, 2023 18

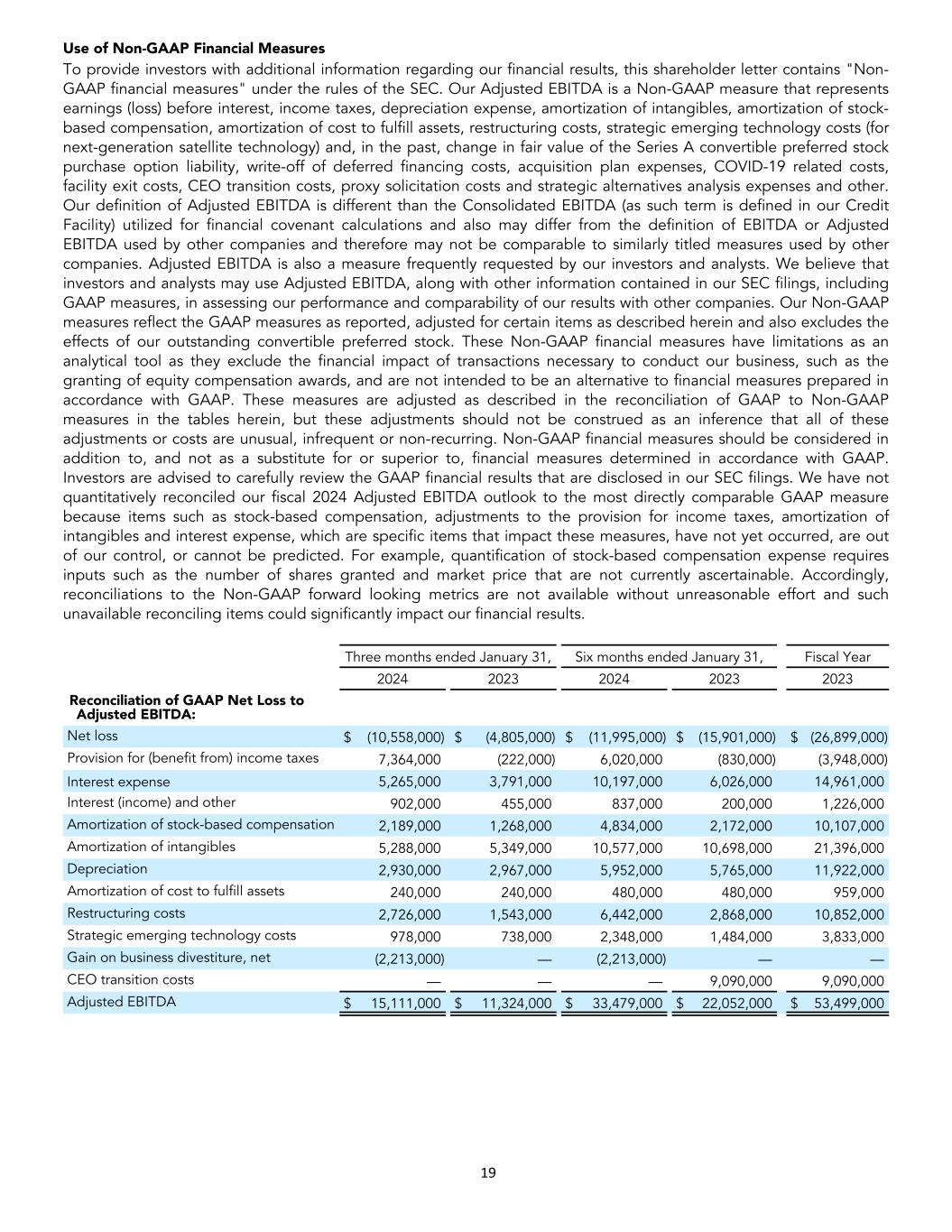

Use of Non-GAAP Financial Measures To provide investors with additional information regarding our financial results, this shareholder letter contains "Non- GAAP financial measures" under the rules of the SEC. Our Adjusted EBITDA is a Non-GAAP measure that represents earnings (loss) before interest, income taxes, depreciation expense, amortization of intangibles, amortization of stock- based compensation, amortization of cost to fulfill assets, restructuring costs, strategic emerging technology costs (for next-generation satellite technology) and, in the past, change in fair value of the Series A convertible preferred stock purchase option liability, write-off of deferred financing costs, acquisition plan expenses, COVID-19 related costs, facility exit costs, CEO transition costs, proxy solicitation costs and strategic alternatives analysis expenses and other. Our definition of Adjusted EBITDA is different than the Consolidated EBITDA (as such term is defined in our Credit Facility) utilized for financial covenant calculations and also may differ from the definition of EBITDA or Adjusted EBITDA used by other companies and therefore may not be comparable to similarly titled measures used by other companies. Adjusted EBITDA is also a measure frequently requested by our investors and analysts. We believe that investors and analysts may use Adjusted EBITDA, along with other information contained in our SEC filings, including GAAP measures, in assessing our performance and comparability of our results with other companies. Our Non-GAAP measures reflect the GAAP measures as reported, adjusted for certain items as described herein and also excludes the effects of our outstanding convertible preferred stock. These Non-GAAP financial measures have limitations as an analytical tool as they exclude the financial impact of transactions necessary to conduct our business, such as the granting of equity compensation awards, and are not intended to be an alternative to financial measures prepared in accordance with GAAP. These measures are adjusted as described in the reconciliation of GAAP to Non-GAAP measures in the tables herein, but these adjustments should not be construed as an inference that all of these adjustments or costs are unusual, infrequent or non-recurring. Non-GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, financial measures determined in accordance with GAAP. Investors are advised to carefully review the GAAP financial results that are disclosed in our SEC filings. We have not quantitatively reconciled our fiscal 2024 Adjusted EBITDA outlook to the most directly comparable GAAP measure because items such as stock-based compensation, adjustments to the provision for income taxes, amortization of intangibles and interest expense, which are specific items that impact these measures, have not yet occurred, are out of our control, or cannot be predicted. For example, quantification of stock-based compensation expense requires inputs such as the number of shares granted and market price that are not currently ascertainable. Accordingly, reconciliations to the Non-GAAP forward looking metrics are not available without unreasonable effort and such unavailable reconciling items could significantly impact our financial results. Three months ended January 31, Six months ended January 31, Fiscal Year 2024 2023 2024 2023 2023 Reconciliation of GAAP Net Loss to Adjusted EBITDA: Net loss $ (10,558,000) $ (4,805,000) $ (11,995,000) $ (15,901,000) $ (26,899,000) Provision for (benefit from) income taxes 7,364,000 (222,000) 6,020,000 (830,000) (3,948,000) Interest expense 5,265,000 3,791,000 10,197,000 6,026,000 14,961,000 Interest (income) and other 902,000 455,000 837,000 200,000 1,226,000 Amortization of stock-based compensation 2,189,000 1,268,000 4,834,000 2,172,000 10,107,000 Amortization of intangibles 5,288,000 5,349,000 10,577,000 10,698,000 21,396,000 Depreciation 2,930,000 2,967,000 5,952,000 5,765,000 11,922,000 Amortization of cost to fulfill assets 240,000 240,000 480,000 480,000 959,000 Restructuring costs 2,726,000 1,543,000 6,442,000 2,868,000 10,852,000 Strategic emerging technology costs 978,000 738,000 2,348,000 1,484,000 3,833,000 Gain on business divestiture, net (2,213,000) — (2,213,000) — — CEO transition costs — — — 9,090,000 9,090,000 Adjusted EBITDA $ 15,111,000 $ 11,324,000 $ 33,479,000 $ 22,052,000 $ 53,499,000 19

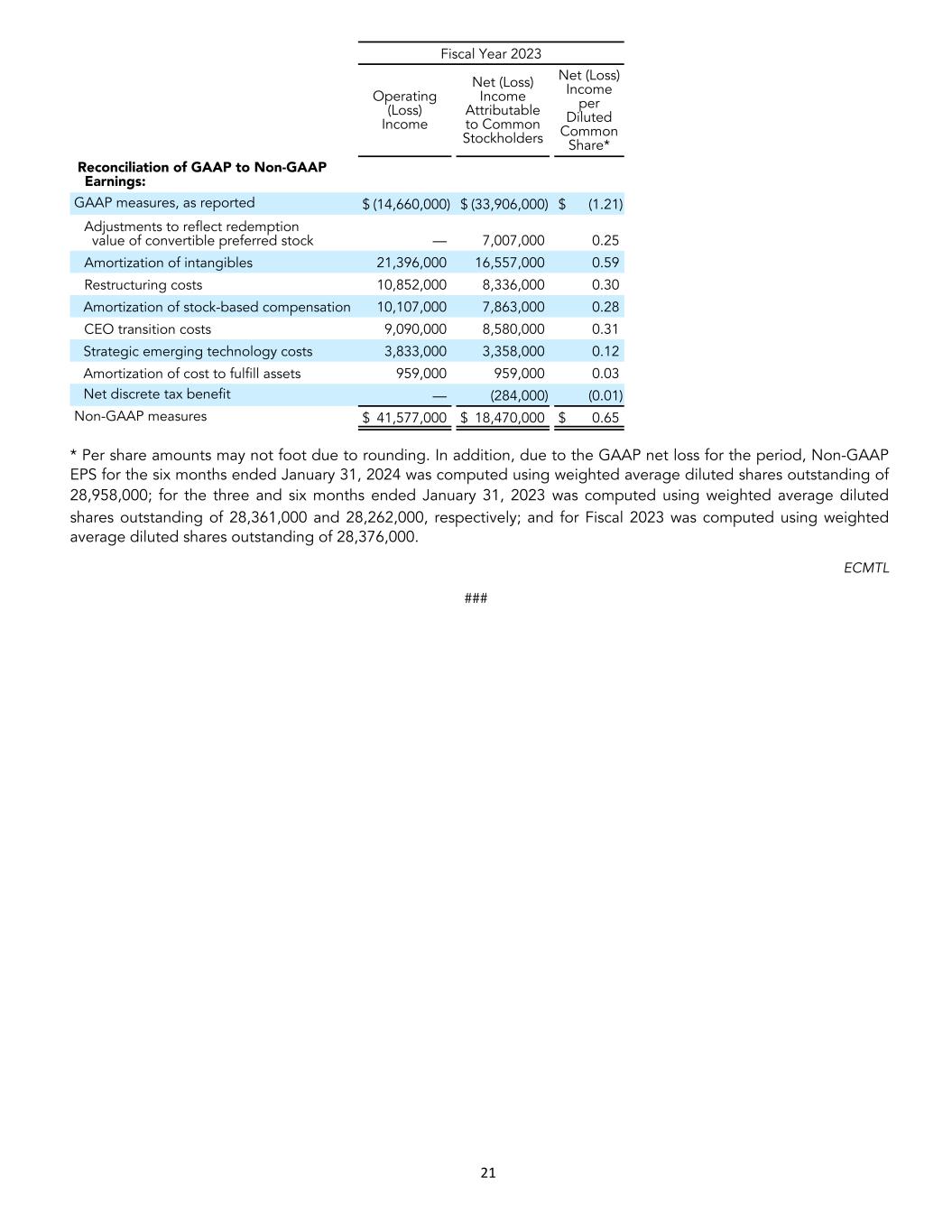

Reconciliations of our GAAP consolidated operating income (loss), net loss attributable to common stockholders and net loss per diluted common share to the corresponding Non-GAAP measures are shown in the tables below. Non- GAAP net (loss) income attributable to common stockholders and Non-GAAP net (loss) income per diluted common share reflect Non-GAAP provisions for income taxes based on year-to-date results, as adjusted for the Non-GAAP reconciling items included in the tables below. We evaluate our Non-GAAP effective income tax rate on an ongoing basis, and it can change from time to time. Our Non-GAAP effective income tax rate can differ materially from our GAAP effective income tax rate. January 31, 2024 Three months ended Six months ended Operating Income Net Loss Attributable to Common Stockholders Net Loss per Diluted Common Share* Operating Income Net (Loss) Income Attributable to Common Stockholders Net (Loss) Income per Diluted Common Share* Reconciliation of GAAP to Non-GAAP Earnings: GAAP measures, as reported $ 2,973,000 $ (30,532,000) $ 0$ (1.07) $ 5,059,000 $ (33,792,000) $ (1.18) Loss on extinguishment of convertible preferred stock — 13,640,000 0.48 — 13,640,000 0.48 Adjustments to reflect redemption value of convertible preferred stock — 6,334,000 0.22 — 8,157,000 0.29 Amortization of intangibles 5,288,000 4,097,000 0.14 10,577,000 8,194,000 0.28 Restructuring costs 2,726,000 2,092,000 0.07 6,442,000 4,953,000 0.17 Amortization of stock-based compensation 2,189,000 1,705,000 0.06 4,834,000 3,760,000 0.13 Strategic emerging technology costs 978,000 753,000 0.03 2,348,000 1,808,000 0.06 Amortization of cost to fulfill assets 240,000 240,000 0.01 480,000 480,000 0.02 Gain on sale of business divestiture, net (2,213,000) (2,870,000) (0.10) (2,213,000) (1,447,000) (0.05) Net discrete tax expense — 371,000 0.01 — 996,000 0.03 Non-GAAP measures $ 12,181,000 $ (4,170,000) $ (0.15) $ 27,527,000 $ 6,749,000 $ 0.23 January 31, 2023 Three months ended Six months ended Operating (Loss) Income Net (Loss) Income Attributable to Common Stockholders Net (Loss) Income per Diluted Common Share* Operating (Loss) Income Net (Loss) Income Attributable to Common Stockholders Net (Loss) Income per Diluted Common Share* Reconciliation of GAAP to Non-GAAP Earnings: GAAP measures, as reported $ (781,000) $ (6,542,000) $ (0.23) $ (10,505,000) $ (19,348,000) $ (0.69) Adjustments to reflect redemption value of convertible preferred stock — 1,737,000 0.06 — 3,447,000 0.12 Amortization of intangibles 5,349,000 4,147,000 0.15 10,698,000 8,294,000 0.30 Restructuring costs 1,543,000 1,188,000 0.04 2,868,000 2,208,000 0.08 Amortization of stock-based compensation 1,268,000 975,000 0.03 2,172,000 1,694,000 0.06 Strategic emerging technology costs 738,000 654,000 0.02 1,484,000 1,273,000 0.05 Amortization of cost to fulfill assets 240,000 240,000 0.01 480,000 480,000 0.02 CEO transition costs — — — 9,090,000 8,580,000 0.31 Net discrete tax expense — 122,000 — — 521,000 0.02 Non-GAAP measures $ 8,357,000 $ 2,521,000 $ 0.09 $ 16,287,000 $ 7,149,000 $ 0.25 20

Fiscal Year 2023 Operating (Loss) Income Net (Loss) Income Attributable to Common Stockholders Net (Loss) Income per Diluted Common Share* Reconciliation of GAAP to Non-GAAP Earnings: GAAP measures, as reported $ (14,660,000) $ (33,906,000) $ (1.21) Adjustments to reflect redemption value of convertible preferred stock — 7,007,000 0.25 Amortization of intangibles 21,396,000 16,557,000 0.59 Restructuring costs 10,852,000 8,336,000 0.30 Amortization of stock-based compensation 10,107,000 7,863,000 0.28 CEO transition costs 9,090,000 8,580,000 0.31 Strategic emerging technology costs 3,833,000 3,358,000 0.12 Amortization of cost to fulfill assets 959,000 959,000 0.03 Net discrete tax benefit — (284,000) (0.01) Non-GAAP measures $ 41,577,000 $ 18,470,000 $ 0.65 * Per share amounts may not foot due to rounding. In addition, due to the GAAP net loss for the period, Non-GAAP EPS for the six months ended January 31, 2024 was computed using weighted average diluted shares outstanding of 28,958,000; for the three and six months ended January 31, 2023 was computed using weighted average diluted shares outstanding of 28,361,000 and 28,262,000, respectively; and for Fiscal 2023 was computed using weighted average diluted shares outstanding of 28,376,000. ECMTL ### 21