We currently have a backlog of orders, mostly under contracts that the customer may modify or terminate. Almost all of the contracts in our backlog are subject to cancellation at the convenience of the customer or for default in the event that we are unable to perform under the contract. We cannot assure you that our backlog will result in net sales.

We record a provision for excess and obsolete inventory based on historical and future usage trends and other factors including the consideration of the amount of backlog we have on hand at any particular point in time. If our backlog is canceled or modified, our estimates of future product demand may prove to be inaccurate, in which case we may have understated the provision required for excess and obsolete inventory. In the future, if we determine that our inventory is overvalued, we will be required to recognize such costs in our financial statements at the time of such determination. Any such charges could be material to our results of operations and financial condition.

Our dependence on component availability, government furnished equipment, subcontractor availability and performance and key suppliers, including the core manufacturing expertise of our high-volume technology manufacturing center located in Tempe, Arizona, may adversely affect us.

None of our business segments generally maintain a substantial inventory of components and subsystems. Although we obtain certain components and subsystems from a single source or a limited number of sources, we believe that most components and subsystems are available from alternative suppliers and subcontractors. A significant interruption in the delivery of such items, however, could have a material adverse impact on our business, results of operations and financial condition.

In recent years, we have increased the company-wide dependency on our high-volume technology manufacturing center located in Tempe, Arizona, which is part of our telecommunications transmission segment. In fiscal 2007, 2006 and 2005, intersegment sales by the telecommunications transmission segment to the mobile data communications segment were $78.3 million, $55.7 million and $19.5 million, respectively. Intersegment sales in fiscal 2007, 2006 and 2005 by the telecommunications transmission segment to the RF microwave amplifiers segment were $6.5 million, $7.5 million and $8.6 million, respectively. If a natural disaster or other business interruption occurred, we do not have immediate access to other manufacturing facilities, and as a result, our business would suffer. In addition, if our high-volume technology manufacturing center is unable to produce sufficient product or maintain quality, it could have a material adverse impact on all three of our business segments, our results of operations and our financial condition.

Throughout fiscal 2007, the U.S. government experienced delays in the receipt of certain components that are ultimately provided to us for incorporation into our satellite transceivers that we ship to the U.S. government. If we do not receive these government furnished components in a timely manner, we could experience delays in fulfilling orders from our customers.

Contract cost growth on our fixed price contracts and other contracts that cannot be justified as an increase in contract value due from customers exposes us to reduced profitability and the potential loss of future business and other risks.

Almost all of our products and services are sold under fixed price contracts. This means that we bear the risk of unanticipated technological, manufacturing, supply or other problems, price increases or other increases in the cost of performance. Operating margin is adversely affected when contract costs that cannot be billed to the customer are incurred. This cost growth can occur if initial estimates used for calculating the contract price were incorrect, or if estimates to complete increase. The cost estimation process requires significant judgment and expertise. Reasons for cost growth may include unavailability and productivity of labor, the nature and complexity of the work to be performed, the effect of change orders, the availability of materials, the effect of any delays in performance, availability and timing of funding from the customer, natural disasters, and the inability to recover any claims included in the estimates to complete. A significant change in an estimate on one or more programs could have a material impact on our business, results of operations and financial condition.

Adverse regulatory changes could impair our ability to sell products.

Our products are incorporated into wireless communications systems that must comply with various U.S. government regulations, including those of the FCC, as well as international laws and regulations. Regulatory changes, including changes in the allocation and availability of frequency spectrum, and in the military standards and specifications that define the current satellite networking environment, could materially harm our business by (i) restricting development efforts by us and our customers, (ii) making our current products less attractive or obsolete, or (iii) increasing the opportunity for additional competition.

Changes in, or our failure to comply with, applicable laws and regulations could materially harm our business. In addition, the increasing demand for wireless communications has exerted pressure on regulatory bodies worldwide to adopt new standards and reassign bandwidth for these products and services. The reduced number of available frequencies for other products and services and the time delays inherent in the government approval process of new products and services have caused and may continue to cause our customers to cancel, postpone or reschedule their installation of communications systems including their satellite, over-the-horizon microwave, or terrestrial line-of-sight microwave communication systems. This, in turn, could have a material adverse effect on our sales of products to our customers.

The EU has adopted two directives to facilitate the recycling of electrical and electronic equipment sold in the EU. The first of these is the Waste from Electrical and Electronic Equipment directive, which directs EU member states to enact laws, regulations, and administrative provisions to ensure that producers of electrical and electronic equipment are financially responsible for the collection, recycling, treatment, and environmentally sound disposal of

16

certain products placed on the market after August 13, 2005, and from products in use prior to that date that are being replaced. The EU has also adopted the Restriction on the Use of Certain Hazardous Substances in Electrical and Electronic Equipment (“RoHS”) directive. The RoHS directive restricts the use of lead, mercury, and certain other substances in electrical and electronic products placed on the market in the EU after July 1, 2006.

Similar laws and regulations have been or may be enacted in other regions, including in the U.S., China and Japan. Other environmental regulations may require us to reengineer our products to utilize components that are more environmentally compatible, and such reengineering and component substitution may result in additional costs to us. There can be no assurance that such existing or future laws will not have a material adverse effect on our business.

Acquisitions and strategic investments may divert our resources and management attention; results may fall short of expectations.

We intend to continue pursuing selected acquisitions of and investments in businesses, technologies and product lines as a key component of our growth strategy. Any future acquisition or investment may result in the use of significant amounts of cash, potentially dilutive issuances of equity securities, incurrence of debt and amortization expenses or in process research and development charges related to intangible assets. Acquisitions involve numerous risks, including:

| | |

| • | difficulties in the integration and assimilation of the operations, technologies, products and personnel of an acquired business; |

| | |

| • | diversion of management’s attention from other business concerns; |

| | |

| • | increased expenses associated with the acquisition; and |

| | |

| • | loss of key employees or customers of any acquired business. |

We cannot assure you that our acquisitions will be successful and will not adversely affect our business, results of operations or financial condition.

We have investments in recorded goodwill as a result of prior acquisitions, and changes in future business conditions could cause these investments to become impaired, requiring substantial write-downs that would reduce our operating income.

Goodwill recorded on our balance sheet as of July 31, 2007 was $24.4 million. We evaluate the recoverability of recorded goodwill amounts annually, or when evidence of potential impairment exists. The annual impairment test is based on several factors requiring judgment. Changes in our operating performance or business conditions, in general, could result in an impairment of goodwill which could be material to our results of operations.

The loss of key technical or management personnel could adversely affect our business.

Our success depends on the continued contributions of key technical management personnel, including the key corporate and operating unit management at each of our subsidiaries. Many of our key personnel, particularly the key engineers of our subsidiaries, would be difficult to replace, and are not subject to employment or noncompetition agreements. Our growth and future success will depend in large part upon our ability to attract and retain highly qualified engineering, sales and marketing personnel. Competition for such personnel from other companies, academic institutions, government entities and other organizations is intense. Although we believe that we have been successful to date in recruiting and keeping key personnel, we may not be successful in attracting and retaining the personnel we will need to continue to grow and operate profitably. Also, the management skills that have been appropriate for us in the past may not continue to be appropriate if we continue to grow and diversify.

Our business and operating results may be negatively impacted if we are unable to continue to manage growth of our businesses.

Certain of our businesses have experienced periods of rapid growth that have placed, and may continue to place, significant demands on our managerial, operational and financial resources. In order to manage this growth, we must continue to improve and expand our management, operational and financial systems and controls. We also need to continue to recruit and retain personnel and train and manage our employee base. We must carefully manage research and development capabilities and production and inventory levels to meet product demand, new product introductions and product and technology transitions. If we are not able to timely and effectively manage our growth and maintain the quality standards required by our existing and potential customers, we could experience a material adverse impact on our business, results of operations and financial condition.

17

Our markets are highly competitive.

The markets for our products are highly competitive. We cannot assure you that we will be able to successfully compete or that our competitors will not develop new technologies and products that are more effective than our own. We expect the DoD’s increased use of commercial off-the-shelf products and components in military equipment will encourage new competitors to enter the market. Also, although the implementation of advanced telecommunications services is in its early stages in many developing countries, we believe competition may intensify as businesses and foreign governments realize the market potential of telecommunications services. Many of our competitors have financial, technical, marketing, sales and distribution resources greater than ours.

Protection of our intellectual property is limited; we are subject to the risk of third party claims of infringement.

Our businesses rely in large part upon our proprietary scientific and engineering “know-how” and production techniques. Historically, patents have not been an important part of our protection of our intellectual property rights. We rely upon the laws of unfair competition, restrictions in licensing agreements and confidentiality agreements to protect our intellectual property. We limit access to and distribution of our proprietary information. These efforts allow us to rely upon the knowledge and experience of our management and technical personnel to market our existing products and to develop new products. The departure of any of our key management and technical personnel, the breach of their confidentiality and non-disclosure obligations to us or the failure to achieve our intellectual property objectives may have a material adverse impact on our business, results of operations and financial condition.

Our ability to compete successfully and achieve future revenue growth will depend, in part, on our ability to protect our proprietary technology and operate without infringing upon the rights of others. We may fail to do so. In addition, the laws of certain countries in which our products are or may be sold may not protect our products and intellectual property rights to the same extent as the laws of the U.S.

We believe that we own or have licensed all intellectual property rights necessary for the operation of our businesses as currently contemplated. If the technology we use is found to infringe on protected technology, we could be required to change our business practices, license the protected technology, and/or pay damages or other compensation to the infringed party. If we are unable to license protected technology that we use in our business or if we are required to change our business practices, we could be prohibited from making and selling our products or providing certain telecommunications services.

Our operations are subject to environmental laws and regulations and we may be subject to environmental liabilities.

We engage in manufacturing and are subject to a variety of local, state and federal governmental regulations relating to the storage, discharge, handling, emission, generation, manufacture and disposal of toxic or other hazardous substances used to manufacture our products, such as the fabrication of fiberglass antennas by our Comtech Antenna Systems, Inc. subsidiary. We are also subject to the RoHS directive which restricts the use of lead, mercury and other substances in electrical and electronic products. The failure to comply with current or future environmental requirements could result in the imposition of substantial fines, suspension of production, alteration of our manufacturing processes or cessation of operations that could have a material adverse impact on our business, results of operations and financial condition.

In addition, the handling, treatment or disposal of hazardous substances by us or our predecessors may have resulted or could in the future result in contamination requiring investigation or remediation, or leading to other liabilities, any of which could have a material adverse impact on our business, results of operations and financial condition.

Our fiscal 2004 Federal income tax return is being audited by the Internal Revenue Service, other returns may be selected for audit and a resulting tax assessment or settlement could have a material adverse impact on our results of operations and financial position.

We are subject to income taxes in both the U.S. and certain foreign jurisdictions, including Canada. Significant judgment is required in determining the provision for income taxes. Although we believe our tax estimates are reasonable, the final determination of tax examinations and any related litigation could be materially different than what is reflected in historical income tax provisions and accruals.

18

In fiscal 2006, we were informed by the Internal Revenue Service that our Federal income tax return for the fiscal year ended July 31, 2004 was selected for a general tax audit. The audit is ongoing and additional income tax returns for other fiscal years may be examined. If the outcome of the audit differs materially from our original income tax provisions, it could have a material impact on our results of operations and financial condition.

Recently enacted securities laws and regulations are increasing our costs.

The Sarbanes-Oxley Act of 2002 required changes in some of our corporate governance, public disclosure and compliance practices. For example, the SEC has promulgated new rules on a variety of subjects. In addition, the NASDAQ Stock Market LLC (“NASDAQ”) has revised its requirements for companies, such as us, that are listed on the NASDAQ. These changes are increasing our legal and financial compliance costs including making it more difficult and more expensive for us to obtain director and officer liability insurance or maintain our current liability coverage. We believe that these new laws and regulations could make it more difficult for us to attract and retain qualified members of our Board of Directors, particularly to serve on our audit committee, and qualified executive officers.

We are subject to the ongoing internal control provisions of Section 404 of the Sarbanes-Oxley Act of 2002. Identification of material weaknesses in internal controls, if identified, could indicate a lack of proper controls to generate accurate financial statements.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 and related SEC rules, we are required to furnish a report of management’s assessment of the effectiveness of our internal controls as part of our Annual Report on Form 10-K. Our independent registered accountants are required to attest to and report on management’s assessment, as well as provide a separate opinion. To issue our report, we document our internal control design and the testing processes that support our evaluation and conclusion, and then we test and evaluate the results. There can be no assurance, however, that we will be able to remediate material weaknesses, if any, that may be identified in future periods, or maintain all of the controls necessary for continued compliance. There likewise can be no assurance that we will be able to retain sufficient skilled finance and accounting personnel, especially in light of the increased demand for such personnel among publicly traded companies.

Changes in financial accounting standards related to stock-based awards are expected to continue to have a significant effect on our reported results.

In fiscal 2006, we adopted Statement of Financial Accounting Standards No. 123(R), “Share-Based Payment,” a revised standard that requires that we record compensation expense in the statement of operations for employee and director stock-based awards using a fair value method. The adoption of the new standard had a significant effect on our reported earnings, and could adversely impact our ability to provide accurate guidance on our future reported financial results due to the variability of the factors used to estimate the value of stock-based awards. As a result, the ongoing application of this standard could impact the future value of our common stock and may result in greater stock price volatility.

In addition, since our inception, we have used stock-based awards as a fundamental component of our employee compensation packages. We believe that stock-based awards directly motivate our employees to maximize long-term stockholder value and, through the use of long-term vesting, encourage employees to remain with us. To the extent that this accounting standard makes it less attractive to grant stock-based awards to employees, we may incur increased compensation costs, change our equity compensation strategy or find it difficult to attract, retain and motivate employees, each of which could have a material adverse impact on our business, results of operations and financial condition.

We face risks from the uncertainty of prevailing political conditions.

Current global political conditions are uncertain. Because the accuracy of our budgeting and forecasting process relies on stable political conditions, the prevailing political environment renders estimates of future income and expenses even more difficult than usual to formulate. The future direction of the political environment could have a material adverse impact on our business, results of operations and financial condition.

Terrorist attacks and threats, and government responses thereto, and threats of war elsewhere may negatively impact all aspects of our operations, revenues, costs and stock price.

Terrorist attacks, the U.S. government’s and other governments’ responses thereto, and threats of war could adversely impact our business, results of operations and financial condition. Any escalation in these events or similar or future events may disrupt our operations or those of our customers and may affect the availability of

19

materials needed to manufacture our products or the means to transport those materials to manufacturing facilities and finished products to customers. In addition, these could have an adverse impact on the U.S. and world economy in general.

Provisions in our corporate documents, stockholder rights plan, and Delaware law could delay or prevent a change in control of Comtech.

We have taken a number of actions that could have the effect of discouraging, delaying or preventing a merger or acquisition involving Comtech that our stockholders may consider favorable. For example, we have a classified board and the employment contract of our chief executive officer provides for a substantial payment in the event of a change of control of Comtech. We also adopted a stockholder rights plan that could cause substantial dilution to a stockholder, and substantially increase the cost paid by a stockholder, who attempts to acquire us on terms not approved by our Board of Directors. These provisions could prevent us from being acquired. In addition, our certificate of incorporation grants our Board of Directors the authority to fix the rights, preferences and privileges of and issue up to 2,000,000 shares of preferred stock without stockholder action. Although we have no present intention to issue shares of preferred stock, such an issuance of any class or series of our preferred stock could have rights which would adversely affect the voting power of the common stock or which could delay, defer, or prevent a change in control of Comtech. In addition, we are subject to the provisions of Section 203 of the Delaware General Corporation Law, an anti-takeover law. In general, this statute provides that except in certain limited circumstances a corporation shall not engage in any “business combination” with an “interested stockholder” for a period of three years after the date of the transaction in which the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination” includes mergers, asset sales and other transactions resulting in a financial benefit to the interested stockholder. Subject to certain exceptions, for purposes of Section 203 of the Delaware General Corporation Law, an “interested stockholder” is a person who, together with affiliates, owns, or within three years did own, 15% or more of the corporation’s voting stock. This provision could have the effect of delaying or preventing a change in control of Comtech.

Our debt service obligations may adversely affect our cash flow.

The higher level of indebtedness resulting from the issuance of our 2.0% convertible senior notes increases the risk that we may default on our debt obligations. We cannot assure you that we will be able to generate sufficient cash flow to pay the interest on our debt or that future working capital, borrowings or equity financing will be available to pay or refinance such debt.

| | |

The level of our indebtedness, among other things, could: |

| | |

| • | make it difficult for us to make payments on our debt; |

| | |

| • | make it difficult for us to obtain any necessary financing in the future for working capital, acquisitions, capital expenditures, debt service requirements or other purposes; |

| | |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; and |

| | |

| • | make us more vulnerable in the event of a downturn in our business. |

Our stock price is volatile.

The stock market in general, and the stock prices of technology-based companies in particular, have experienced extreme volatility that often has been unrelated to the operating performance of any specific public company. The market price of our common stock has fluctuated significantly in the past and is likely to fluctuate significantly in the future as well. Factors that could have a significant impact on the market price of our stock are described throughout the Risk Factors section and include:

| | |

| • | strategic transactions, such as acquisitions and divestures; |

|

| • | future announcements concerning us or our competitors; |

|

| • | receipt or non-receipt of substantial orders for products and services; |

|

| • | quality deficiencies in services or products; |

|

| • | results of technological innovations; |

|

| • | new commercial products; |

|

| • | changes in recommendations of securities analysts; |

|

| • | government regulations; |

20

| | |

|

| • | proprietary rights or product or patent litigation; |

|

| • | changes in economic conditions generally, particularly in the telecommunications sector; |

|

| • | changes in securities market conditions, generally; |

|

| • | energy blackouts; |

|

| • | acts of terrorism or war; |

|

| • | inflation or deflation; and |

|

| • | rumors or allegations regarding our financial disclosures or practices. |

Shortfalls in our sales or earnings in any given period relative to the levels expected by securities analysts could immediately, significantly and adversely affect the trading price of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our corporate headquarters are located in an office building complex in Melville, New York. The lease, which is for 9,600 square feet, provides for our use of the premises for seven years through July 2013.

Our RF microwave amplifiers segment is primarily located in a 46,000 square foot engineering and manufacturing facility on more than two acres of land in Melville, New York. We lease this facility from a partnership controlled by our Chairman, Chief Executive Officer and President. The lease, as amended, provides for our use of the premises as they now exist for a term of ten years through December 2011. We have a right of first refusal in the event of a sale of the facility. The base annual rent under the lease is subject to customary adjustments.

Although primarily used for our satellite earth station product lines which are part of the telecommunications transmission segment, all three of our business segments utilize our four high-volume technology manufacturing facilities located in Tempe, Arizona. These manufacturing facilities comprising 146,000 square feet utilize state-of-the-art design and production techniques, including analog, digital and RF microwave production, hardware assembly and full service engineering. The leases for these facilities expire in fiscal 2011 and in each lease we have the option to extend the term of the lease for an additional five-year period.

Our telecommunications transmission segment leases an additional twelve facilities, six of which are located in the U.S. The U.S. facilities (excluding our Tempe, Arizona facility) aggregate 126,000 square feet and are primarily utilized for manufacturing, engineering, and general office use. Our telecommunications transmission segment also operates six small offices in China, India, North Africa, Thailand, the United Kingdom and Canada that are primarily utilized for customer support, engineering and sales.

Our mobile data communications segment operates in a leased 31,000 square foot facility located in Germantown, Maryland. Our lease expires in fiscal 2008. We have signed a letter of intent to renew the lease and expect to finalize the terms of the lease in the near future.

The terms for all of our leased facilities are generally for multi-year periods and we believe that we will be able to renew these leases or find comparable facilities elsewhere.

ITEM 3. LEGAL PROCEEDINGS

Hurricane-Related Proceedings

During fiscal 2005, two of our leased facilities located in Florida experienced hurricane damage to both leasehold improvements and personal property. As of July 31, 2007, we have completed all restoration efforts relating to the hurricane damage and have recorded a $0.8 million insurance recovery receivable and accrued a total of $2.2 million for hurricane related costs. Despite a written agreement with the general contractor that we believe limits our liability for the cost of the repairs to the amount of insurance proceeds ultimately received from our insurance company, a dispute has arisen with the general contractor and a certain subcontractor over the subcontractor’s demand for payment directly from us (by virtue of a purported assignment of rights and other grounds) in an amount exceeding the insurance proceeds by $0.8 million, plus late charges, interest, fees, costs and certain treble damages. As a result of this dispute, we deposited approximately $1.4 million, representing the balance of the insurance proceeds received, in our attorneys’ trust account and filed a complaint for declaratory judgment in the 9th Judicial Circuit Court for Orange County, Florida. The general contractor and the subcontractor have filed separate and

21

independent actions against us and our insurance company, all of which have now been consolidated under our original action. The Court has postponed the trial date several times and has not scheduled a new trial date. We have also filed a cross-claim against our insurance company asserting that the insurer is responsible for whatever liability, if any, we are ultimately adjudged to have to the general contractor or the subcontractor. However, to the extent that insurance recoveries are inadequate, we might be required to fund the shortfall. All parties have held and are currently engaged in mediation and settlement discussions. However, to date, no agreements have been reached. We do not expect that the outcome of this matter will have a material adverse effect on our consolidated financial position.

Other Legal Proceedings

In March 2007, a lawsuit was brought against us in the Federal District Court for the Western District of Texas by a company that claims that it was a consultant and a reseller of certain of our products and that it is owed damages for alleged lost profits, as well as punitive damages, costs and attorney’s fees. We believe that we have substantial legal and factual defenses to the plaintiff’s allegations and we intend to vigorously defend ourselves in this matter. We do not expect that the ultimate outcome of this matter will have a material adverse effect on our consolidated financial position.

We are party to certain other legal actions, which arise in the normal course of business. Although the ultimate outcome of litigation is difficult to accurately predict, we believe that the outcome of these actions will not have a material adverse effect on our consolidated financial position or results of operations.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to our stockholders during the fourth quarter of the fiscal year ended July 31, 2007.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

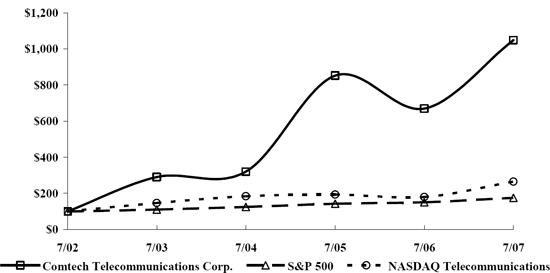

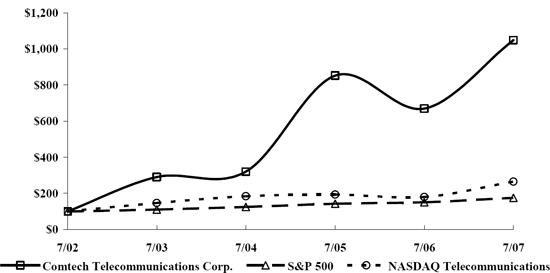

Stock Performance Graph and Cumulative Total Return

The graph below compares the cumulative total stockholder return on our common stock with the cumulative total return on the S&P’s 500 Index and the NASDAQ Telecommunications Index for each of the last five fiscal years ended July 31, assuming an investment of $100 at the beginning of such period and the reinvestment of any dividends. The comparisons in the graphs below are based upon historical data and are not indicative of, nor intended to forecast, future performance of our common stock.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Comtech Telecommunications Corp., The S&P 500 Index

And The NASDAQ Telecommunications Index

| | |

| * $100 invested on 7/31/02 in stock or index-including reinvestment of dividends. Fiscal year ending July 31. |

| | |

| Copyright © 2007, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm |

22

Our common stock trades on the NASDAQ Stock Market LLC (“NASDAQ”) under the symbol “CMTL.” The following table shows the quarterly range of the high and low sale prices for our common stock as reported by the NASDAQ. Such prices do not include retail markups, markdowns or commissions.

| | | | | | | |

| | Common Stock | |

| |

| |

| | High | | Low | |

| |

| |

| |

Fiscal Year Ended July 31, 2006 | | | | | | | |

First Quarter | | $ | 43.36 | | $ | 30.60 | |

Second Quarter | | | 45.65 | | | 29.42 | |

Third Quarter | | | 33.44 | | | 27.40 | |

Fourth Quarter | | | 33.80 | | | 25.67 | |

| | | | | | | |

Fiscal Year Ended July 31, 2007 | | | | | | | |

First Quarter | | | 36.96 | | | 26.88 | |

Second Quarter | | | 39.86 | | | 33.56 | |

Third Quarter | | | 40.23 | | | 33.21 | |

Fourth Quarter | | | 48.94 | | | 37.93 | |

Dividends

We have never paid cash dividends on our common stock. Although we currently expect to use earnings and cash on hand to finance the development and expansion of our businesses, our Board of Directors reviews our dividend policy periodically. The payment of dividends in the future will depend upon our earnings, capital requirements, financial condition and other factors considered relevant by our Board of Directors.

Recent Sales of Unregistered Securities

None.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during fiscal 2007.

Approximate Number of Equity Security Holders

As of September 11, 2007, there were approximately 782 holders of our common stock. Such number of record owners was determined from our shareholder records and does not include beneficial owners of our common stock held in the name of various security holders, dealers and clearing agencies.

23

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following table shows selected historical consolidated financial data for our Company. During the fiscal quarter ended January 31, 2005, the Company adopted Emerging Issues Task Force (“EITF”) Issue No. 04-8, “The Effect of Contingently Convertible Instruments on Diluted Earnings Per Share.” The Company has restated, for comparative purposes, the historical share and per share data, including earnings per share (“EPS”), to reflect the impact of the assumed conversion of the Company’s 2.0% convertible senior notes in calculating diluted EPS. No restatement of EPS for periods prior to fiscal 2004 was required since the convertible senior notes were not outstanding during these periods. In addition, effective August 1, 2005, we adopted the provisions of SFAS No. 123(R), “Share-Based Payment” using the modified prospective method and, as a result, periods prior to August 1, 2005 do not reflect the recognition of stock-based compensation expense.

All share and per share amounts have also been adjusted to reflect the three-for-two stock splits of the Company’s common shares that occurred in April 2005 and July 2003. Detailed historical financial information is included in the audited consolidated financial statements for fiscal 2007, 2006 and 2005.

| | | | | | | | | | | | | | | | |

| |

| |

| | Fiscal Years Ended July 31,

(In thousands, except per share amounts) | |

| |

| |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Consolidated Statement of

Operations Data: | | | | | | | | | | | | | | | | |

Net sales | | $ | 445,684 | | | 391,511 | | | 307,890 | | | 223,390 | | | 174,035 | |

Cost of sales | | | 252,389 | | | 232,210 | | | 180,524 | | | 135,858 | | | 114,317 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Gross profit | | | 193,295 | | | 159,301 | | | 127,366 | | | 87,532 | | | 59,718 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 73,312 | | | 67,071 | | | 51,819 | | | 36,016 | | | 28,045 | |

Research and development | | | 32,469 | | | 25,834 | | | 21,155 | | | 15,907 | | | 12,828 | |

In-process research and development | | | — | | | — | | | — | | | 940 | | | — | |

Amortization of intangibles | | | 2,592 | | | 2,465 | | | 2,328 | | | 2,067 | | | 2,039 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | 108,373 | | | 95,370 | | | 75,302 | | | 54,930 | | | 42,912 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Operating income | | | 84,922 | | | 63,931 | | | 52,064 | | | 32,602 | | | 16,806 | |

| | | | | | | | | | | | | | | | |

Other expenses (income): | | | | | | | | | | | | | | | | |

Interest expense | | | 2,731 | | | 2,687 | | | 2,679 | | | 1,425 | | | 2,803 | |

Interest income and other | | | (14,208 | ) | | (9,243 | ) | | (4,072 | ) | | (921 | ) | | (275 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Income before provision for income taxes | | | 96,399 | | | 70,487 | | | 53,457 | | | 32,098 | | | 14,278 | |

| | | | | | | | | | | | | | | | |

Provision for income taxes | | | 31,186 | | | 25,218 | | | 16,802 | | | 10,271 | | | 4,569 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Net income | | $ | 65,213 | | | 45,269 | | | 36,655 | | | 21,827 | | | 9,709 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Net income per share: | | | | | | | | | | | | | | | | |

Basic | | $ | 2.81 | | | 1.99 | | | 1.69 | | | 1.03 | | | 0.57 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Diluted | | $ | 2.42 | | | 1.72 | | | 1.42 | | | 0.92 | | | 0.53 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Weighted average number of common shares outstanding - basic | | | 23,178 | | | 22,753 | | | 21,673 | | | 21,178 | | | 17,168 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | | | | |

Weighted average number of common and common equivalent shares outstanding assuming dilution – diluted | | | 27,603 | | | 27,324 | | | 27,064 | | | 24,781 | | | 18,290 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

24

| | | | | | | | | | | | | | | | |

| |

|

|

| | Fiscal Years Ended July 31,

(In thousands) | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Other Consolidated Operating Data: | | | | | | | | | | | | | | | | |

Backlog at period-end | | $ | 129,044 | | | 186,007 | | | 153,314 | | | 83,549 | | | 100,142 | |

New orders | | | 388,721 | | | 424,204 | | | 377,655 | | | 206,797 | | | 230,056 | |

Research and development expenditures - internal and customer funded | | | 36,639 | | | 30,243 | | | 24,156 | | | 21,656 | | | 16,504 | |

| | | | | | | | | | | | | | | | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | As of July 31,

(In thousands) | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | |

Total assets | | $ | 556,342 | | | 455,266 | | | 382,403 | | | 306,390 | | | 164,250 | |

Working capital | | | 397,083 | | | 308,986 | | | 254,690 | | | 201,218 | | | 74,801 | |

Convertible senior notes | | | 105,000 | | | 105,000 | | | 105,000 | | | 105,000 | | | — | |

Other long-term obligations | | | 108 | | | 243 | | | 396 | | | 158 | | | 393 | |

Stockholders’ equity | | | 345,768 | | | 254,242 | | | 196,629 | | | 142,398 | | | 117,568 | |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We design, develop, produce and market innovative products, systems and services for advanced communications solutions. We believe many of our solutions play a vital role in providing or enhancing communication capabilities when terrestrial communications infrastructure is unavailable or ineffective.

We conduct our business through three complementary segments: telecommunications transmission, mobile data communications and RF microwave amplifiers. We sell our products to a diverse customer base in the global commercial and government communications markets. We believe we are a leader in the market segments that we serve.

Our telecommunications transmission segment, which is currently our largest business segment, provides sophisticated equipment and systems that are used to enhance satellite transmission efficiency and that enable wireless communications in environments where terrestrial communications are unavailable, inefficient or too expensive. Our mobile data communications segment, currently our fastest growing segment, provides customers with an integrated solution, including mobile satellite transceivers and satellite network support, to enable global satellite-based communications when mobile, real-time, secure transmission is required for applications including logistics, support and battlefield command and control. Our RF microwave amplifiers segment designs, manufactures and markets solid-state, high-power, broadband RF microwave amplifier products.

A substantial portion of our sales may be derived from a limited number of relatively large customer contracts, such as our Movement Tracking System (“MTS”) contract with the U.S. Army and our U.S. Army’s Force XXI Battle Command, Brigade and Below command and control systems (also known as Blue Force Tracking (“BFT”)) contract, for which the timing of revenues cannot be predicted. Quarterly and period-to-period sales and operating results may be significantly affected by one or more of such contracts. In addition, our gross profit is affected by a variety of factors, including the mix of products, systems and services sold, production efficiencies, estimates of warranty expense, price competition and general economic conditions. Our gross profit may also be affected by the impact of any cumulative adjustments to contracts that are accounted for under the percentage-of-completion method. Our contracts with the U.S. government can be terminated at any time and orders are subject to unpredictable funding, deployment and technology decisions by the U.S. government. Some of these contracts, such as the MTS and BFT contracts, are indefinite delivery/indefinite quantity (“IDIQ”) contracts, and as such, the U.S. Army is not obligated to purchase any equipment or services under the contracts. Accordingly, we can experience significant fluctuations in sales and operating results from quarter-to-quarter and period-to-period comparisons may not be indicative of a trend or future performance.

25

Revenue from the sale of our products is generally recognized when the earnings process is complete, upon shipment or customer acceptance. Revenue from contracts relating to the design, development or manufacture of complex electronic equipment to a buyer’s specification or to provide services relating to the performance of such contracts is generally recognized using the percentage-of-completion method. Revenue from contracts that contain multiple elements that are not accounted for under the percentage-of-completion method are generally accounted for in accordance with Emerging Issues Task Force (“EITF”) Issue No. 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables.” Revenue from these contracts is allocated to each respective element based on each element’s relative fair value and is recognized when the respective revenue recognition criteria for each element are met.

Recent Acquisitions

In February 2005, we acquired certain assets and assumed certain liabilities of Tolt Technologies, Inc. (“Tolt”) for an aggregate purchase price of $3.7 million, including transaction costs of $0.2 million. In fiscal 2006, we significantly de-emphasized stand-alone sales of Tolt’s turnkey employee mobility solutions, and are focusing our efforts on selling commercial satellite-based mobile data applications. This operation was combined with our existing business in 2006 and is part of our mobile data communications segment.

In August 2006, we acquired certain assets and assumed certain liabilities of Insite Consulting, Inc. (“Insite”), a logistics application software company, for $3.2 million, including transaction costs of $0.3 million. Insite has developed the geoOps™ Enterprise Location Monitoring System, a software-based solution that allows customers to integrate legacy data systems with near-real time logistics and operational data systems. This operation was combined with our existing business and is part of our mobile data communications segment.

In February 2007, we acquired certain assets and assumed certain liabilities of Digicast Networks, Inc. (“Digicast”), a manufacturer of digital video broadcasting equipment, for $1.0 million. This operation was combined with our existing business and is part of the telecommunications transmission segment.

Critical Accounting Policies

We consider certain accounting policies to be critical due to the estimation process involved in each.

Revenue Recognition on Long-Term Contracts. Revenues and related costs from long-term contracts relating to the design, development or manufacture of complex electronic equipment to a buyer’s specification or to provide services relating to the performance of such contracts are recognized in accordance with AICPA Statement of Position 81-1, “Accounting for Performance of Construction-Type and Certain Production-Type Contracts” (“SOP 81-1”). We primarily apply the percentage-of-completion method and generally recognize revenue based on the relationship of total costs incurred to total projected costs, or, alternatively, based on output measures, such as units delivered. Profits expected to be realized on such contracts are based on total estimated sales for the contract compared to total estimated costs, including warranty costs, at completion of the contract. These estimates are reviewed and revised periodically throughout the lives of the contracts, and adjustments to profits resulting from such revisions are made cumulative to the date of the change. Estimated losses on long-term contracts are recorded in the period in which the losses become evident. Long-term U.S. government cost-reimbursable type contracts are also specifically covered by Accounting Research Bulletin No. 43 “Government Contracts, Cost-Plus Fixed-Fee Contracts” (“ARB 43”), in addition to SOP 81-1.

We have been engaged in the production and delivery of goods and services on a continual basis under contractual arrangements for many years. Historically, we have demonstrated an ability to accurately estimate revenues and expenses relating to our long-term contracts. However, there exist inherent risks and uncertainties in estimating revenues, expenses and progress toward completion, particularly on larger or longer-term contracts. If we do not accurately estimate the total sales, related costs and progress towards completion on such contracts, the estimated gross margins may be significantly impacted or losses may need to be recognized in future periods. Any such resulting changes in margins or contract losses could be material to our results of operations and financial position.

In addition, most government contracts have termination for convenience clauses that provide the customer with the right to terminate the contract at any time. Such terminations could impact the assumptions regarding total contract revenues and expenses utilized in recognizing profit under the percentage-of-completion method of accounting. Changes to these assumptions could materially impact our results of operations and financial position. Historically, we have not experienced material terminations of our long-term contracts.

26

We also address customer acceptance provisions in assessing our ability to perform our contractual obligations under long-term contracts. Our inability to perform on our long-term contracts could materially impact our results of operations and financial condition. Historically, we have been able to perform on our long-term contracts.

Accounting for Stock-Based Compensation. As discussed further in “Notes to Consolidated Financial Statements – Note 1(j) Accounting for Stock-Based Compensation,” we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123(R) on August 1, 2005 using the modified prospective method. Through July 31, 2005, we accounted for our stock option and employee stock purchase plans under the intrinsic value method of Accounting Principles Board (“APB”) Opinion No. 25, and as a result no compensation costs had been recognized in our historical consolidated statements of operations.

We have used and expect to continue to use the Black-Scholes option pricing model to compute the estimated fair value of stock-based awards. The Black-Scholes option pricing model includes assumptions regarding dividend yields, expected volatility, expected option term and risk-free interest rates. The assumptions used in computing the fair value of stock-based awards reflect our best estimates, but involve uncertainties relating to market and other conditions, many of which are outside of our control. We estimate expected volatility by considering the historical volatility of our stock, the implied volatility of publicly traded stock options in our stock and our expectations of volatility for the expected term of stock-based compensation awards. As a result, if other assumptions or estimates had been used for options granted, stock-based compensation expense that was recorded could have been materially different. Furthermore, if different assumptions are used in future periods, stock-based compensation expense could be materially impacted in the future.

Impairment of Goodwill and Other Intangible Assets. As of July 31, 2007, our company’s goodwill and other intangible assets aggregated $30.1 million. In assessing the recoverability of goodwill and other intangibles, we must make various assumptions regarding estimated future cash flows and other factors in determining the fair values of the respective assets. If these estimates or their related assumptions change in the future, we may be required to record impairment charges for these assets in future periods. Any such resulting impairment charges could be material to our results of operations.

Provision for Warranty Obligations. We provide warranty coverage for most of our products, including products under long-term contracts, for a period of at least one year from the date of shipment. We record a liability for estimated warranty expense based on historical claims, product failure rates and other factors. Some of our warranties are provided under long-term contracts, the costs of which are incorporated into our estimates of total contract costs. There exist inherent risks and uncertainties in estimating warranty expenses, particularly on larger or longer-term contracts. As such, if we do not accurately estimate our warranty costs, any changes to our original estimates could be material to our results of operations and financial condition.

Accounting for Income Taxes. Our deferred tax assets and liabilities are determined based on temporary differences between financial reporting and tax bases of assets and liabilities, applying enacted tax rates expected to be in effect for the year in which the differences are expected to reverse. The provision for income taxes is based on domestic and international statutory income tax rates in the tax jurisdictions where we operate, permanent differences between financial reporting and tax reporting and available credits and incentives. The U.S. Federal government is our most significant income tax jurisdiction. Significant judgment is required in determining income tax provisions and tax positions. We may be challenged upon review by the applicable taxing authority and positions taken by us may not be sustained. We provide tax reserves for tax exposures relating to periods subject to audit. The development of reserves for these exposures requires consideration of timing and judgments about tax issues and potential outcomes, and is a subjective critical estimate. In certain circumstances, the ultimate outcome of exposures and risks involves significant uncertainties. It is our policy to recognize interest and penalties related to uncertain tax positions in income tax expense. If actual outcomes differ materially from these estimates, they could have a material impact on our results of operations and financial position. As discussed in “Notes to Consolidated Financial Statements – Note 1(h) Income Taxes and Note 9 Income Taxes”, on August 1, 2007 we adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes, an interpretation of FASB Statement No. 109” (“FIN 48”).

Provisions for Excess and Obsolete Inventory. We record a provision for excess and obsolete inventory based on historical and future usage trends. Other factors may also influence our provision, including decisions to exit a product line, technological change and new product development. These factors could result in a change in the amount of excess and obsolete inventory on hand. Additionally, our estimates of future product demand may prove to be inaccurate, in which case we may have understated or overstated the provision required for excess and obsolete inventory. In the future, if we determine that our inventory was overvalued, we would be required to recognize such costs in our financial statements at the time of such determination. Any such charges could be material to our results of operations and financial condition.

27

Allowance for Doubtful Accounts. We perform credit evaluations of our customers and adjust credit limits based upon customer payment history and current creditworthiness, as determined by our review of our customers’ current credit information. Generally, we will require cash in advance or payment secured by irrevocable letters of credit before an order is accepted from an international customer that we do not do business with regularly. In addition, we seek to obtain insurance for certain international customers. We monitor collections and payments from our customers and maintain an allowance for doubtful accounts based upon our historical experience and any specific customer collection issues that we have identified. While such credit losses have historically been within our expectations and the allowances established, we cannot guarantee that we will continue to experience the same credit loss rates that we have in the past. Measurement of such losses requires consideration of historical loss experience, including the need to adjust for current conditions, and judgments about the probable effects of relevant observable data, including present economic conditions such as delinquency rates and the financial health of specific customers. Changes to the estimated allowance for doubtful accounts could be material to our results of operations and financial condition.

Results of Operations

The following table sets forth, for the periods indicated, certain income and expense items expressed as a percentage of our consolidated net sales:

| | | | | | | | | |

| |

|

|

|

|

|

| | Fiscal Years Ended July 31, |

| |

|

| | 2007 | | 2006 | | 2005 |

| |

| |

| |

|

Net sales | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Gross margin | | 43.4 | | | 40.7 | | | 41.4 | |

Selling, general and administrative expenses | | 16.4 | | | 17.1 | | | 16.8 | |

Research and development expenses | | 7.3 | | | 6.6 | | | 6.9 | |

Amortization of intangibles | | 0.6 | | | 0.6 | | | 0.8 | |

Operating income | | 19.1 | | | 16.3 | | | 16.9 | |

Interest expense (income), net | | (2.5 | ) | | (1.7 | ) | | (0.5 | ) |

Income before provision for income taxes | | 21.6 | | | 18.0 | | | 17.4 | |

Net income | | 14.6 | | | 11.6 | | | 11.9 | |

Comparison of Fiscal 2007 and 2006

Net Sales. Consolidated net sales were $445.7 million and $391.5 million for fiscal 2007 and 2006, respectively, representing an increase of $54.2 million, or 13.8%. The increase in net sales reflects growth in our telecommunications transmission and mobile data communications segments, partially offset by lower net sales in our RF microwave amplifiers segment.

Net sales in our telecommunications transmission segment were $219.9 million and $197.9 million for fiscal 2007 and 2006, respectively, an increase of $22.0 million, or 11.1%. The increase in net sales in this segment primarily reflects increased sales of our over-the-horizon microwave systems and satellite earth station products. Sales of our over-the-horizon microwave systems for fiscal 2007 were higher than fiscal 2006 due to deliveries of our new 16 Mbps troposcatter modem upgrade kits for use on the U.S. Department of Defense’s (“DoD”) AN/TRC-170 digital troposcatter terminals. On the other hand, sales of our over-the-horizon microwave systems, both direct and indirect, to our North African country end-customer were lower during fiscal 2007 as we believe the end-customer is between major phases of a multi-year roll-out of a large project. Net sales in fiscal 2007 include sales of $1.2 million relating to a gross profit adjustment, as discussed below, on a large over-the-horizon microwave system contract. Sales of satellite earth station products in fiscal 2007 were higher than fiscal 2006 as we continued to benefit from demand for our bandwidth efficient satellite earth station modems, including those used to support cellular backhaul applications. Our telecommunications transmission segment represented 49.3% of consolidated net sales for fiscal 2007 as compared to 50.5% for fiscal 2006.

Although sales in our telecommunications transmission segment can fluctuate from period-to-period based on the strength of our satellite earth station bookings and the receipt of and performance on large over-the-horizon microwave system contracts, we currently believe that net sales in our telecommunications transmission segment should increase in fiscal 2008. We believe that the demand drivers for our satellite earth station products remain strong and that we will receive at least one large over-the-horizon microwave system contract in fiscal 2008.

28

Net sales in our mobile data communications segment were $189.6 million and $149.5 million for fiscal 2007 and 2006, respectively, an increase of $40.1 million, or 26.8%. The increase in net sales was due to an increase in deliveries to the U.S. Army and Army National Guard for ongoing support of MTS program activities and higher sales of battlefield command and control applications to the U.S. military. This increase was partially offset by a decline in net sales of $17.3 million related to the impact of our decision, made in fiscal 2006, to significantly de-emphasize stand-alone sales of low margin turnkey employee mobility solutions. Net sales in fiscal 2007 and 2006 include sales of $1.1 million and $9.5 million, respectively, relating to gross profit adjustments on our original MTS contract, discussed below. Our mobile data communications segment represented 42.6% of consolidated net sales for fiscal 2007 as compared to 38.2% for fiscal 2006.

Our original (and subsequently extended) $463.2 million MTS contract expired in August 2007. We ultimately received total orders against the original MTS contract of $459.8 million. In August 2007, we were awarded a new IDIQ contract, with a ceiling value of $605.1 million, to continue to provide and support MTS products and services through July 12, 2010. In addition to our new MTS contract, we were also awarded a separate IDIQ contract to continue to provide our mobile data communication products and services in support of the U.S. Army’s BFT tracking system. This contract has a ceiling value of $216.0 million and continues through December 31, 2011. Although it is difficult to predict the timing and amount of funding that we expect to ultimately receive on our new MTS and BFT contracts, we currently anticipate that our mobile data communications segment will experience continued growth in fiscal 2008. Sales and profitability in our mobile data communications segment can fluctuate dramatically from period-to-period due to many factors including unpredictable funding, deployment and technology decisions by the U.S. government. Also, we are aware that the U.S. government has experienced delays in the receipt of certain components that are provided to us for incorporation into our mobile satellite transceivers. If we do not receive these U.S. government furnished components in a timely manner, we could experience delays in fulfilling funded and anticipated orders from our customers.

Net sales in our RF microwave amplifiers segment were $36.2 million for fiscal 2007 compared to $44.1 million for fiscal 2006, a decrease of $7.9 million, or 17.9%. The decrease in net sales was due to lower sales of our amplifiers that are incorporated into improvised explosive device jamming systems, as well as certain orders currently in backlog that are now expected to ship in fiscal 2008. A portion of our backlog is comprised of more complex amplifiers employing newer technology which has resulted in longer than expected production times to ensure that these amplifiers meet our customers’ specifications. Our RF microwave amplifiers segment represented 8.1% of consolidated net sales for fiscal 2007 as compared to 11.3% for fiscal 2006.

Based on the amount of our current backlog and anticipated future orders, we currently expect sales in our RF microwave amplifiers segment to increase in fiscal 2008. In the second half of fiscal 2007, we were selected by one of our customers to participate in the Counter Remote Controlled Improvised Explosive Device Electronic Warfare (“CREW”) program and we expect to receive additional orders for these types of amplifiers in fiscal 2008.

International sales (which include sales to U.S. companies for inclusion in products which are sold to international customers) represented 26.2% and 35.6% of consolidated net sales for fiscal 2007 and 2006, respectively. Domestic commercial sales represented 12.5% and 17.1% of consolidated net sales for fiscal 2007 and 2006, respectively. Sales to the U.S. government (including sales to prime contractors to the U.S. government) represented 61.3% and 47.3% of consolidated net sales for fiscal 2007 and 2006, respectively.

During fiscal 2007 and 2006, one customer, a prime contractor, represented 5.4% and 10.2% of consolidated net sales, respectively.

Gross Profit. Gross profit was $193.3 million and $159.3 million for fiscal 2007 and 2006, respectively, representing an increase of $34.0 million, or 21.3%. The increase in gross profit was primarily attributable to the increase in net sales discussed above, as well as an increase in the gross profit percentage to 43.4% for fiscal 2007 from 40.7% for 2006.

As discussed further below, we recorded favorable cumulative adjustments relating to certain long-term contracts, which were partially offset by a firmware-related warranty provision in both periods. Excluding the impact of these adjustments and the firmware-related warranty provision, to both net sales and gross profit, our gross profit as a percentage of sales for fiscal 2007 and 2006 would have been 41.0% and 39.8%, respectively. The increase in the adjusted gross profit percentage was primarily due to increased gross margins within our telecommunications transmission segment, primarily due to the benefit of higher sales of our new 16 Mbps troposcatter modem upgrade kits, and increased operating efficiencies in our mobile data communications segment, including the benefit of our decision to significantly de-emphasize stand-alone sales of low margin turnkey employee mobility solutions. The

29

increase in gross margins was offset, in part, by lower gross margins in our RF microwave amplifiers segment primarily due to lower sales and product mix.

During fiscal 2007 and 2006, we recorded favorable cumulative gross profit adjustments of $11.8 million (of which $10.7 million related to the mobile data communications segment and $1.1 million related to the telecommunications transmission segment) and $9.1 million (of which $8.5 million related to the mobile data communications segment and $0.6 million related to the RF microwave amplifiers segment), respectively, relating to our ongoing review of total estimated contract revenues and costs, and the related gross margin at completion, on long-term contracts. Offsetting these adjustments, in our mobile data communications segment and included in cost of sales for fiscal 2007 and 2006, is a firmware-related warranty provision of $0.1 million and $1.7 million, respectively.

The favorable cumulative gross profit adjustments recorded in both periods in our mobile data communications segment resulted from the increase in the estimated gross profit at completion on our original MTS contract. The adjustments are primarily related to increased operating efficiencies and, as it relates to fiscal 2007, the finalization of our total contract costs (including estimates for warranty obligations) relating to the completion of the original MTS contract. The favorable cumulative gross profit adjustment recorded in our telecommunications transmission segment during fiscal 2007 related to an increase in the estimated gross profit at completion on a large over-the-horizon microwave system contract. The favorable cumulative gross profit adjustment recorded in our RF microwave amplifiers segment during fiscal 2006 related to a U.S. military contract that was substantially completed in fiscal 2006.

Included in cost of sales for fiscal 2007 and 2006 are provisions for excess and obsolete inventory of $4.5 million and $2.0 million, respectively. As discussed in our “Critical Accounting Policies – Provisions for Excess and Obsolete Inventory,” we regularly review our inventory and record a provision for excess and obsolete inventory based on historical and projected usage assumptions.

Selling, General and Administrative Expenses. Selling, general and administrative expenses were $73.3 million and $67.1 million for fiscal 2007 and 2006, respectively, representing an increase of $6.2 million, or 9.2%. The increase in expenses was primarily attributable to higher payroll-related expenses (including amortization of stock-based compensation) and increased other costs associated with the growth of our business. This increase was offset, in part, by lower expenses in our mobile data communications segment as we continue to de-emphasize stand-alone sales of low margin turnkey employee mobility solutions. As a percentage of consolidated net sales, selling, general and administrative expenses were 16.4% and 17.1% for fiscal 2007 and 2006, respectively.

Amortization of stock-based compensation expense recorded as selling, general and administrative expenses increased to $5.8 million in fiscal 2007 from $4.6 million in fiscal 2006.

Research and Development Expenses. Research and development expenses were $32.5 million and $25.8 million for fiscal 2007 and 2006, respectively, representing an increase of $6.7 million, or 26.0%. Approximately $21.0 million and $19.0 million of such amounts, respectively, related to our telecommunications transmission segment, with the remaining expenses primarily related to our mobile data communications segment and, to a lesser extent, our RF microwave amplifiers segment. As a percentage of consolidated net sales, research and development expenses were 7.3% and 6.6% for fiscal 2007 and 2006, respectively.

As an investment for the future, we are continually enhancing our existing products and developing new products and technologies. Whenever possible, we seek customer funding for research and development to adapt our products to specialized customer requirements. During fiscal 2007 and 2006, customers reimbursed us $4.2 million and $4.4 million, respectively, which is not reflected in the reported research and development expenses, but is included in net sales with the related costs included in cost of sales.

Amortization of stock-based compensation expense recorded as research and development expenses increased to $1.1 million in fiscal 2007 from $0.7 million in fiscal 2006.

Amortization of Intangibles. Amortization of intangibles for fiscal 2007 and 2006 was $2.6 million and $2.5 million, respectively. The amortization primarily relates to intangibles with finite lives that we acquired in connection with various acquisitions (including the acquisitions of Insite and Digicast that occurred in fiscal 2007).

Operating Income. Operating income for fiscal 2007 and 2006 was $84.9 million and $63.9 million, respectively. The $21.0 million, or 32.9% increase, was primarily the result of the higher sales and gross profit, discussed above.

30

Operating income in our telecommunications transmission segment increased to $59.2 million for fiscal 2007 from $49.8 million for fiscal 2006, as a result of increased net sales and gross profit, partially offset by increased operating expenses. In addition, as discussed above under “Gross Profit,” included in operating income for fiscal 2007 is a cumulative adjustment related to a large over-the-horizon microwave systems contract which favorably impacted operating income by $0.9 million.

Our mobile data communications segment generated operating income of $45.4 million for fiscal 2007 compared to $21.7 million for fiscal 2006. The increase in operating income was primarily due to the increase in net sales and operating efficiencies achieved, including the benefit of lower selling, general and administrative expenses as we continue to de-emphasize stand-alone sales of low margin turnkey employee mobility solutions. In addition, as discussed above under “Gross Profit,” included in operating income for fiscal 2007 and 2006, are positive impacts from the cumulative adjustments, net of the respective firmware-related warranty provisions, of $9.1 million and $5.8 million, respectively.

Operating income in our RF microwave amplifiers segment decreased to $3.7 million for fiscal 2007 from $8.3 million for fiscal 2006 due primarily to lower net sales and lower gross margins. In addition, as discussed above under “Gross Profit,” included in operating income for fiscal 2006 is a cumulative adjustment which favorably impacted operating income by $0.5 million.

Unallocated operating expenses increased to $23.3 million for fiscal 2007 from $15.9 million for fiscal 2006 due primarily to higher payroll-related expenses (including increased amortization of stock-based compensation), as well as increased other costs associated with growing our business. Amortization of stock-based compensation expense increased to $7.4 million in fiscal 2007 from $5.7 million in fiscal 2006. This increase is primarily attributable to an increase in both the number and related fair value of stock-based awards that are being amortized over their respective service periods for fiscal 2007 as compared to fiscal 2006. Amortization of stock-based compensation is expected to increase in fiscal 2008 as a result of ongoing amortization of awards currently outstanding (including those issued through September 18, 2007).

Interest Expense. Interest expense was $2.7 million for both fiscal 2007 and 2006. Interest expense primarily relates to our 2.0% convertible senior notes.

Interest Income and Other. Interest income and other for fiscal 2007 was $14.2 million, as compared to $9.2 million for fiscal 2006. The $5.0 million increase was primarily due to an increase in interest rates and additional investable cash since July 2006.

Provision for Income Taxes. The provision for income taxes was $31.2 million and $25.2 million for fiscal 2007 and 2006, respectively. Our effective tax rate was 32.4% and 35.8% for fiscal 2007 and 2006, respectively.

The decrease in the effective tax rate was primarily attributable to the passage of legislation, in fiscal 2007, extending the Federal research and experimentation credit, including $0.6 million of tax benefits related to the retroactive application of the credit to fiscal 2006, and the approval by our stockholders of an amendment to the 2000 Stock Incentive Plan (the “Plan”) which will permit us to claim tax deductions for cash incentive awards anticipated to be paid under the Plan without limitation under §162(m) of the Internal Revenue Code. In addition, we also recorded incremental tax benefits aggregating $2.0 million during fiscal 2007 including a $1.0 million tax benefit due to the expiration of applicable statutes of limitations. Our tax rate for fiscal 2006 was favorably impacted by the recording of a net benefit of $0.6 million primarily relating to the favorable settlement of a state tax matter. Excluding adjustments, our effective tax rate for fiscal 2007 approximated 35.0%.

We currently expect that our fiscal 2008 effective tax rate will be approximately 35.0%. The expected increase in the effective tax rate from the 32.4% experienced in fiscal 2007 is primarily the result of (i) the items impacting the 2007 tax rate discussed above, (ii) the expiration, in December 2007, of the Federal research and experimentation credit, (iii) the repeal, in December 2006, of the extraterritorial income exclusion, offset by (iv) the scheduled phase-in of the deduction for domestic production activities.

Our Federal income tax return for the fiscal year ended July 31, 2004 is currently being audited by the Internal Revenue Service. Additional income tax returns for other fiscal years may also be examined. If the outcome of the audit differs materially from our original income tax provisions, it could have a material adverse effect on our results of operations and financial position.

31

Comparison of Fiscal 2006 and 2005

Net Sales. Consolidated net sales were $391.5 million and $307.9 million for fiscal 2006 and 2005, respectively, representing an increase of $83.6 million, or 27.2%. The increase in net sales was driven by an increase in our telecommunications transmission and our mobile data communications segments, partially offset by lower net sales in our RF microwave amplifiers segment.

Net sales in our telecommunications transmission segment were $197.9 million and $174.5 million for fiscal 2006 and 2005, respectively, an increase of $23.4 million, or 13.4%. The growth in this segment resulted primarily from an increase in demand for our satellite earth station products and sales related to a contract with a third-party commercial customer to outsource its manufacturing. Fiscal 2005 also includes a $4.0 million cumulative adjustment to net sales which resulted from lower than anticipated costs on two large over-the-horizon microwave system contracts. Sales in the over-the-horizon microwave systems product line can fluctuate dramatically from period to period based on the receipt of large contracts and our performance thereon. Our telecommunications transmission segment represented 50.5% of consolidated net sales for fiscal 2006 as compared to 56.7% for fiscal 2005.