Searchable text section of graphics shown above

[LOGO]

MARCH 2006

Analyst & Investor Event

[LOGO]

1

Note on Forward-Looking Statements | [LOGO] |

This presentation, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current views and assumptions of future events and financial performance and are subject to uncertainty and changes in circumstances. Readers of this presentation should understand that these statements are not guarantees of performance or results. Many factors could affect the company’s actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements. These factors include, among other things, future economic circumstances, industry conditions, company performance and financial results, availability and prices of raw materials, product pricing, competitive environment and related market conditions, operating efficiencies, access to capital, actions of governments and regulatory factors affecting the company’s businesses and other risks described in the company’s reports filed with the Securities and Exchange Commission. The company cautions readers not to place undue reliance on any forward-looking statements included in this presentation, which speak only as of the date made.

This presentation includes certain “non-GAAP” financial measures as defined by SEC rules. As required by the SEC we have provided a reconciliation of those measures to the most directly comparable GAAP measures and presented in accordance with Generally Accepted Accounting Principles located in the appendix of this presentation.

2

[LOGO]

MARCH 2006

Analyst & Investor Event

Welcome

Gary Rodkin

President and CEO

[LOGO]

3

[LOGO]

ConAgra Foods: Significant Potential

Blocking & Tackling | |

| |

Underleveraged Brands | |

| [GRAPHIC] |

Cost Structure | |

| |

Commodity Expertise | |

4

Blocking & Tackling | |

| |

Underleveraged Brands | |

| [GRAPHIC] |

Cost Structure | |

| |

Commodity Expertise | |

| |

WHY HASN’T IT HAPPENED YET?? | |

5

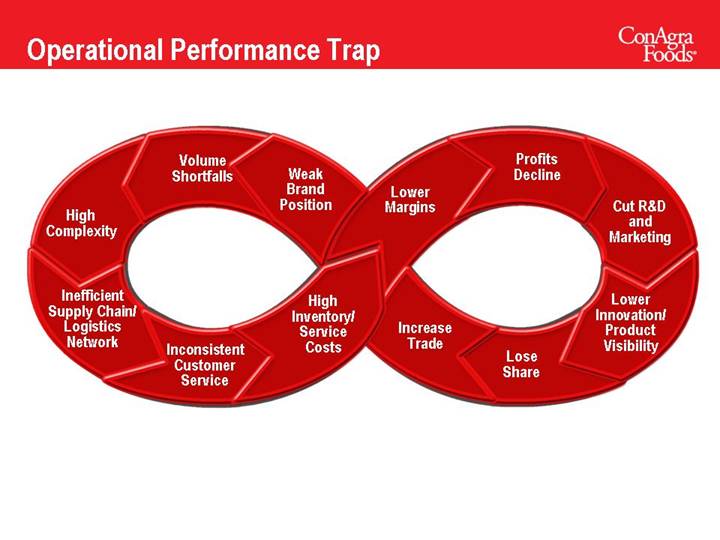

Operational Performance Trap

High

Complexity | | Volume

Shortfalls | | Weak

Brand

Position | | Lower

Margins | | Profits

Decline | | Cut R&D

and

Marketing |

| | | | | | | | | | |

Inefficient

Supply Chain/

Logistics

Network | | Inconsistent

Customer

Service | | High

Inventory/

Service

Costs | | Increase

Trade | | Lose

Share | | Lower

Innovation/

Product

Visibility |

6

The New CAG:

A true operating company

that delivers sustainable

profitable growth

7

Building the New ConAgra Foods

8

Culture: A Root Cause of Underperformance

Independent Operating Company Heritage

Silo Mentality

Resistance to “Corporate”

Size, Not Scale

9

Culture: Implementing Change

Simplicity | | Collaboration |

| | |

Results |

| | |

Accountability |

Execute with Excellence

10

Building the New ConAgra Foods

Culture | |

| |

| [GRAPHIC] |

| |

Portfolio | |

11

Fewer, Bigger, Better

More and Better Marketing

12

More and Better Marketing

[LOGO]

13

More & Better

[LOGO]

[GRAPHIC]

16

Fewer, Bigger, Better

More and Better Marketing

Platform Innovation

17

Platform Innovation: Brands

[LOGO]

18

Platform Innovation: Categories

[GRAPHIC]

19

Platform Innovation: Technology

[LOGO] | | [LOGO] |

[GRAPHIC] | | [GRAPHIC] |

| | |

[LOGO] | | [LOGO] |

[GRAPHIC] | | [GRAPHIC] |

20

Fewer, Bigger, Better

More and Better Marketing

Platform Innovation

In-Store Execution

21

In-Store Execution

[GRAPHIC]

22

Fewer, Bigger, Better

More and Better Marketing

Platform Innovation

In-Store Execution

Divest Non-Core Operations

23

Divest Non-Core Operations

• Packaged Meats | [LOGO] |

• Cheese | |

• Seafood | |

24

Refrigerated Meats: Clear Divestiture Candidate

15% CAG Sales

15% CAG Sales

Minimal EBIT

Complex and Inefficient

Poor Execution and Customer Service Levels

Likely Constant Drag on CAG Financial Metrics

25

Refrigerated Meats: Clear Divestiture Candidate

15% CAG Sales

15% CAG Sales

Minimal EBIT

Complex and Inefficient

Poor Execution and Customer Service Levels

Likely Constant Drag on CAG Financial Metrics

CONSTANT DISTRACTION

26

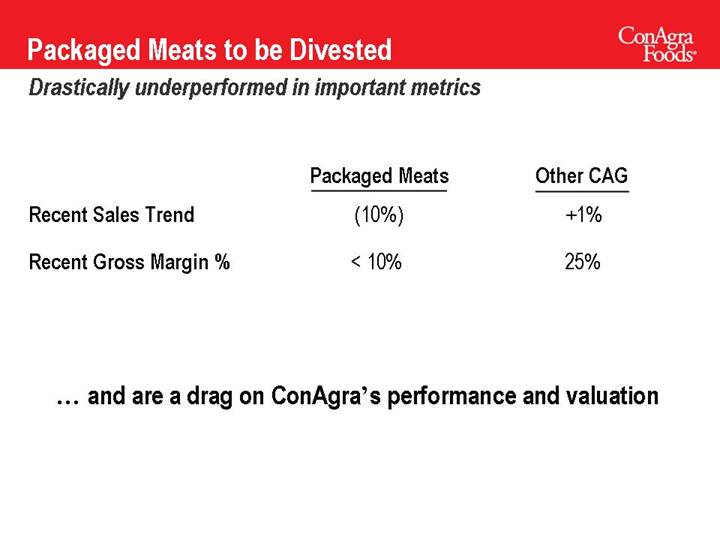

Packaged Meats to be Divested

Drastically underperformed in important metrics

| | Packaged Meats | | Other CAG | |

Recent Sales Trend | | (10 | )% | +1 | % |

Recent Gross Margin % | | < 10 | % | 25 | % |

… and are a drag on ConAgra’s performance and valuation

27

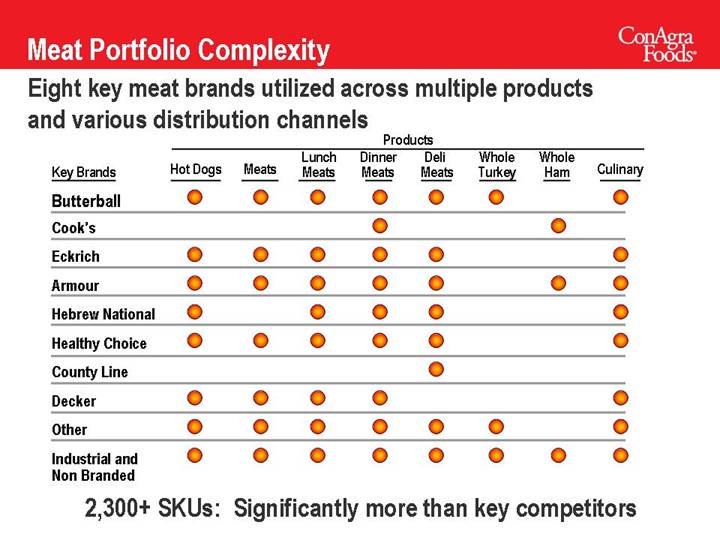

Meat Portfolio Complexity

Eight key meat brands utilized across multiple products and various distribution channels

| | Products | |

Key Brands | | Hot Dogs | | Meats | | Lunch

Meats | | Dinner

Meats | | Deli

Meats | | Whole

Turkey | | Whole

Ham | | Culinary | |

Butterball | | X | | X | | X | | X | | X | | X | | | | X | |

Cook’s | | | | | | | | X | | | | | | X | | | |

Eckrich | | X | | X | | X | | X | | X | | | | | | X | |

Armour | | X | | X | | X | | X | | X | | | | X | | X | |

Hebrew National | | X | | | | X | | X | | X | | | | | | X | |

Healthy Choice | | X | | X | | X | | X | | X | | | | | | X | |

County Line | | | | | | | | | | X | | | | | | | |

Decker | | X | | X | | X | | X | | | | | | | | X | |

Other | | X | | X | | X | | X | | X | | X | | | | X | |

Industrial and Non Branded | | X | | X | | X | | X | | X | | X | | X | | X | |

2,300+ SKUs: Significantly more than key competitors

28

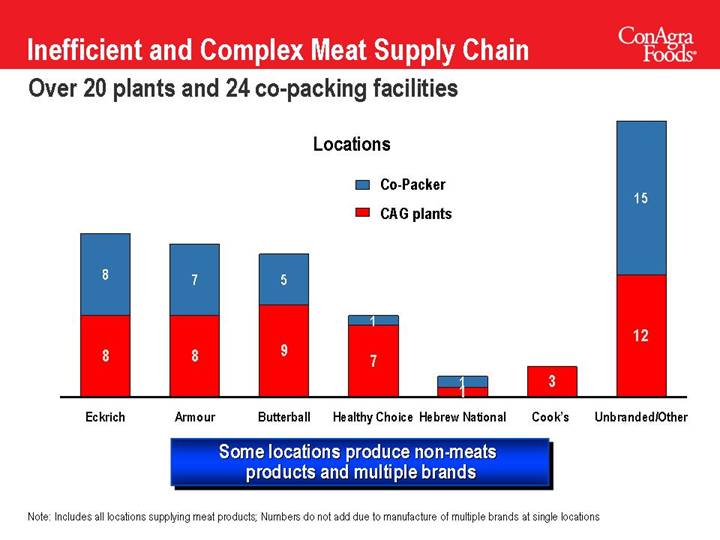

Inefficient and Complex Meat Supply Chain

Over 20 plants and 24 co-packing facilities

Locations

[CHART]

Some locations produce non-meats products and multiple brands

Note: Includes all locations supplying meat products; Numbers do not add due to manufacture of multiple brands at single locations

29

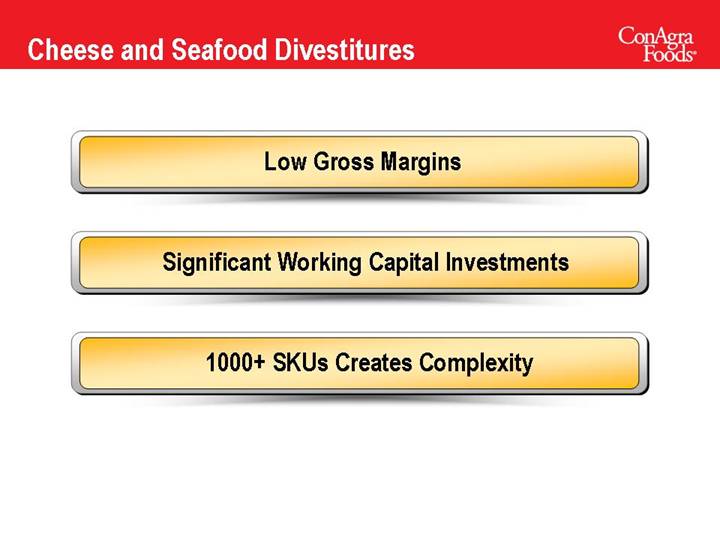

Cheese and Seafood Divestitures

Low Gross Margins

Significant Working Capital Investments

1000+ SKUs Creates Complexity

30

Impact of Divestitures on ConAgra Foods

Improved Business Fundamentals

• Streamlined Portfolio

• Catalyst for:

• Reduced complexity

• Faster progress on other key initiatives

Enables Aggressive Attack on Costs

31

Building the New ConAgra Foods

Culture | |

| |

Portfolio | [GRAPHIC] |

| |

Cost Structure | |

32

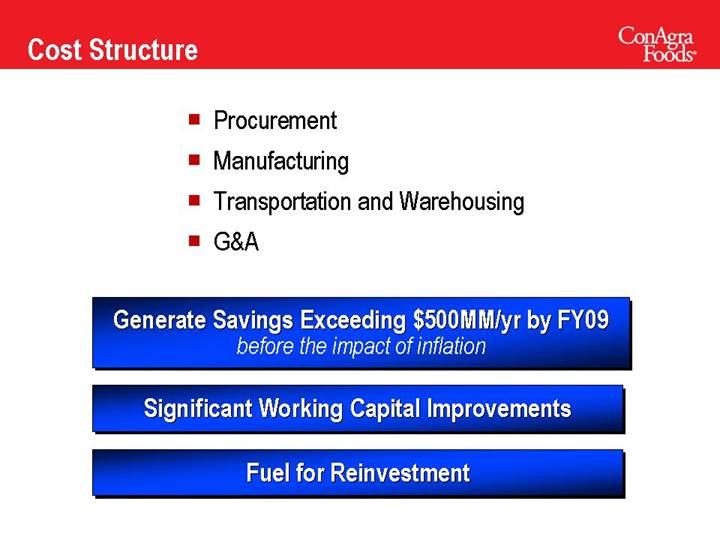

Cost Structure

• Procurement

• Manufacturing

• Transportation and Warehousing

• G&A

Generate Savings Exceeding $500MM/yr by FY09

before the impact of inflation

Significant Working Capital Improvements

Fuel for Reinvestment

33

Major Financial News Today

Lowering the Earnings Base to $1.10-$1.15*

• Portfolio changes

• Brand investment

Cost Reduction Programs with Implementation Costs

More Sustainable Dividend Level

* See Appendix A for reconciliation

34

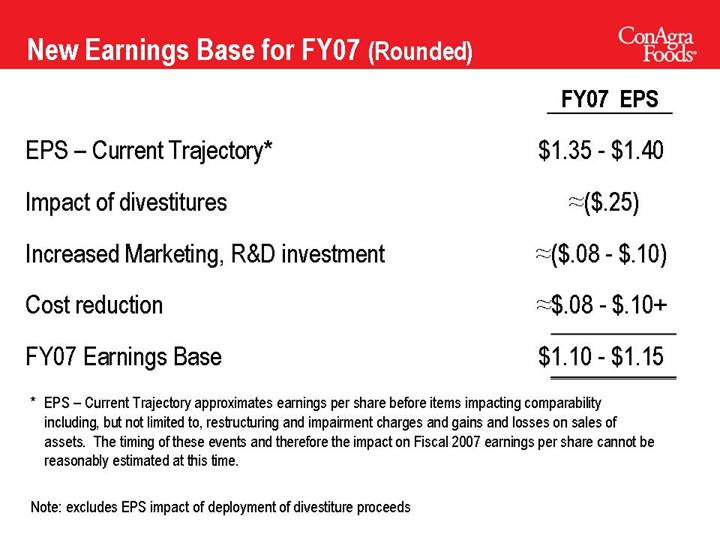

New Earnings Base for FY07 (Rounded)

| | FY07 EPS | |

EPS – Current Trajectory* | | $1.35 - $1.40 | |

| | | |

Impact of divestitures | |  ($.25) ($.25)

| |

| | | |

Increased Marketing, R&D investment | |  ($.08 - $.10) ($.08 - $.10)

| |

| | | |

Cost reduction | |  $.08 - $.10+ $.08 - $.10+

| |

| | | |

FY07 Earnings Base | | $1.10 - $1.15 | |

* EPS – Current Trajectory approximates earnings per share before items impacting comparability including, but not limited to, restructuring and impairment charges and gains and losses on sales of assets. The timing of these events and therefore the impact on Fiscal 2007 earnings per share cannot be reasonably estimated at this time.

Note: excludes EPS impact of deployment of divestiture proceeds

35

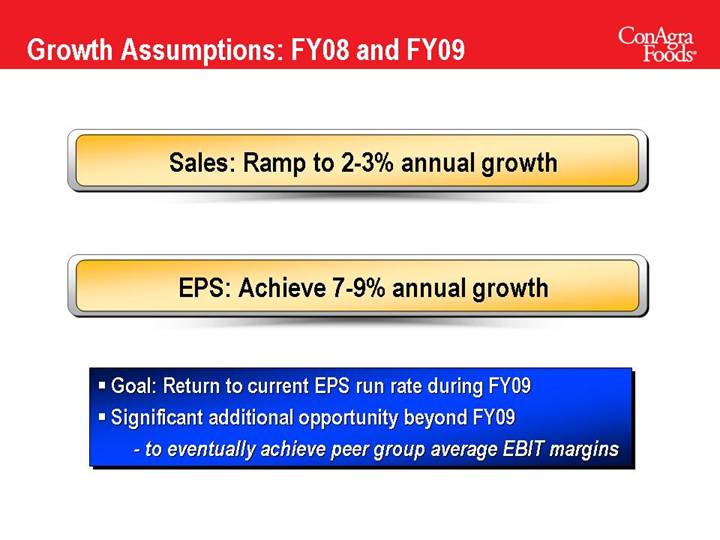

Growth Assumptions: FY08 and FY09

Sales: Ramp to 2-3% annual growth

EPS: Achieve 7-9% annual growth

• Goal: Return to current EPS run rate during FY09

• Significant additional opportunity beyond FY09

• to eventually achieve peer group average EBIT margins

36

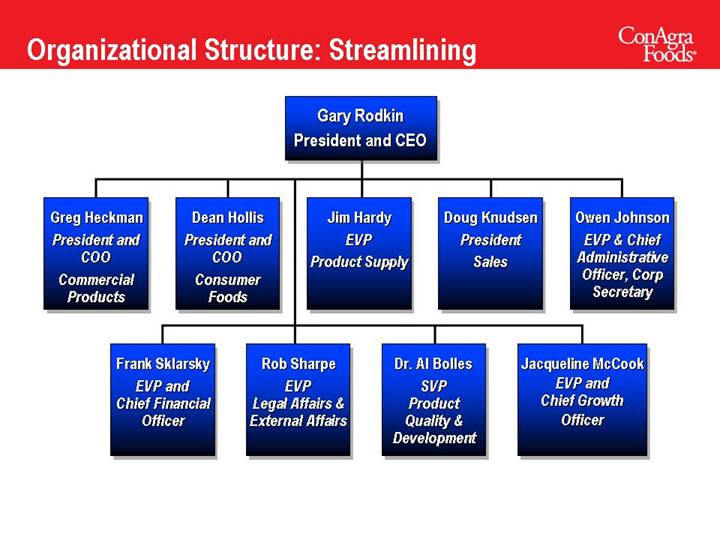

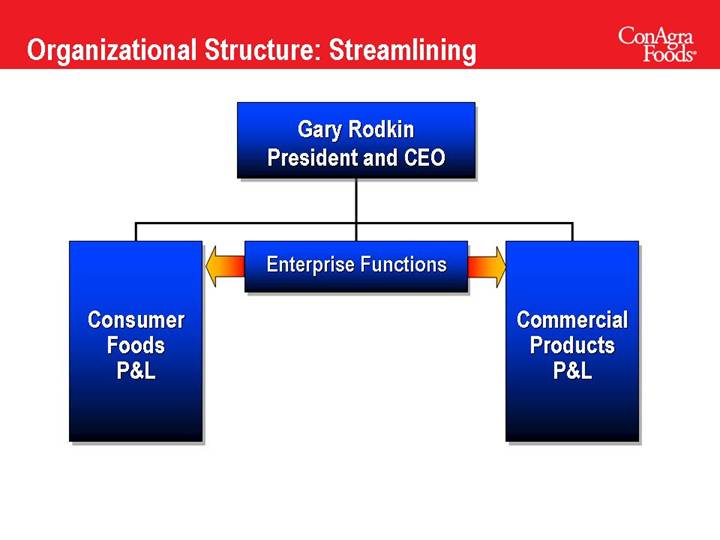

Organizational Structure: Streamlining

| | | | Gary Rodkin

President and CEO | | | | |

| | | | | | | | |

Greg Heckman

President and

COO

Commercial

Products | | Dean Hollis

President and

COO

Consumer

Foods | | Jim Hardy

EVP

Product Supply | | Doug Knudsen

President

Sales | | Owen Johnson

EVP & Chief

Administrative

Officer, Corp

Secretary |

| | | | | | |

Frank Sklarsky

EVP and

Chief Financial

Officer | | Rob Sharpe

EVP

Legal Affairs &

External Affairs | | Dr. Al Bolles

SVP

Product

Quality &

Development | | Jacqueline McCook

EVP and

Chief Growth Officer |

37

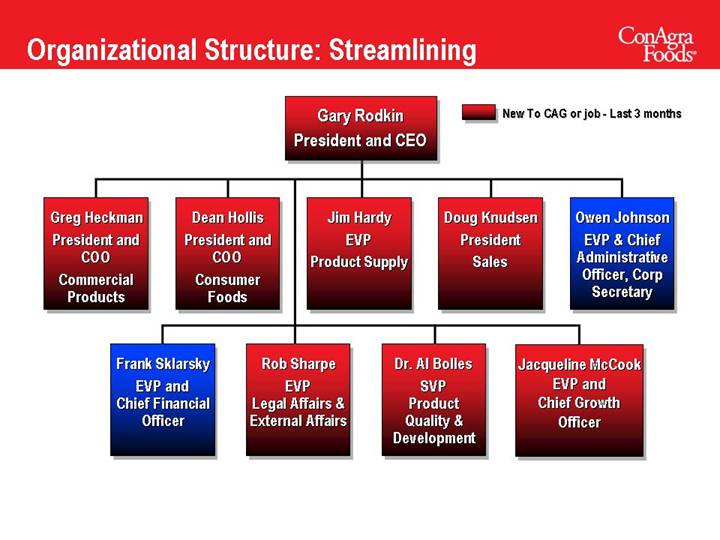

| | | | Gary Rodkin

President and CEO | | New To CAG or job - Last 3 months |

| | | | | | | | |

Greg Heckman

President and

COO

Commercial

Products | | Dean Hollis

President and

COO

Consumer

Foods | | Jim Hardy

EVP

Product Supply | | Doug Knudsen

President

Sales | | Owen Johnson

EVP & Chief

Administrative

Officer, Corp

Secretary |

| | | | | | |

Frank Sklarsky

EVP and

Chief Financial

Officer | | Rob Sharpe

EVP

Legal Affairs &

External Affairs | | Dr. Al Bolles

SVP

Product

Quality &

Development | | Jacqueline McCook

EVP and

Chief Growth

Officer |

38

| | Gary Rodkin President and CEO | | |

| | | | |

Consumer

Foods

P&L | | Enterprise Functions | | Commercial

Products

P&L |

39

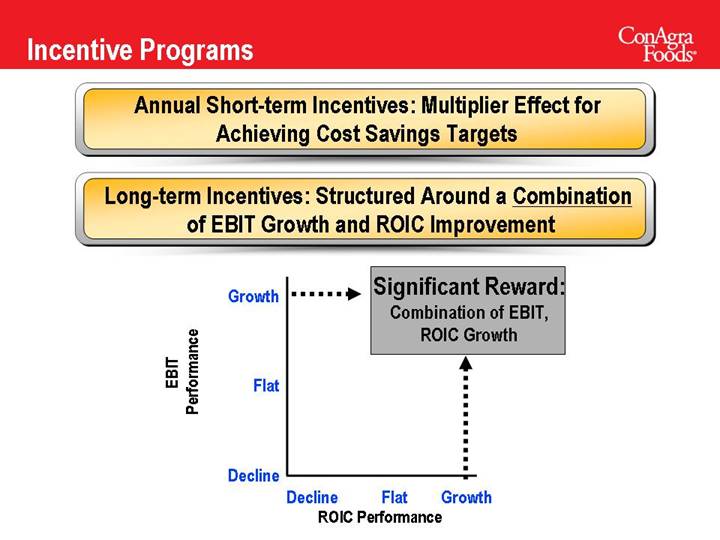

Incentive Programs

Annual Short-term Incentives: Multiplier Effect for Achieving Cost Savings Targets

Long-term Incentives: Structured Around a Combination

of EBIT Growth and ROIC Improvement

[CHART]

40

Former Vision

America’s

Favorite

Food Company

41

New Focus

The New CAG:

A true operating company

that delivers sustainable

profitable growth

42

Summary of the New ConAgra Foods

• | | Restructure and rewire organization | | Integrated enterprise | |

• | | Focus the portfolio | | Better ROI | |

• | | Aggressively attack cost structure | | Improved margins | |

• | | Savings fuel top-line investment | | Drive marketing and innovation | |

Execute with Excellence

43

Meeting Agenda

Consumer

Foods | | Sales

Strategies | | Commercial

Products |

Productivity

&

Operations | | Financial Goals

&

Objectives |

44

[GRAPHIC]

[LOGO]

MARCH 2006

Analyst & Investor Event

Consumer Foods

Dean Hollis

President & COO,

Consumer Foods

45

Consumer Foods

[LOGO]

Brand Portfolio

Product Fundamentals

Profiles of Progress

46

Consumer Foods: $7+ Billion in Sales

Meals & Entrees | | Condiments & Sides | | Snacks & Desserts |

| | | | |

[LOGO] | | [LOGO] | | [LOGO] |

47

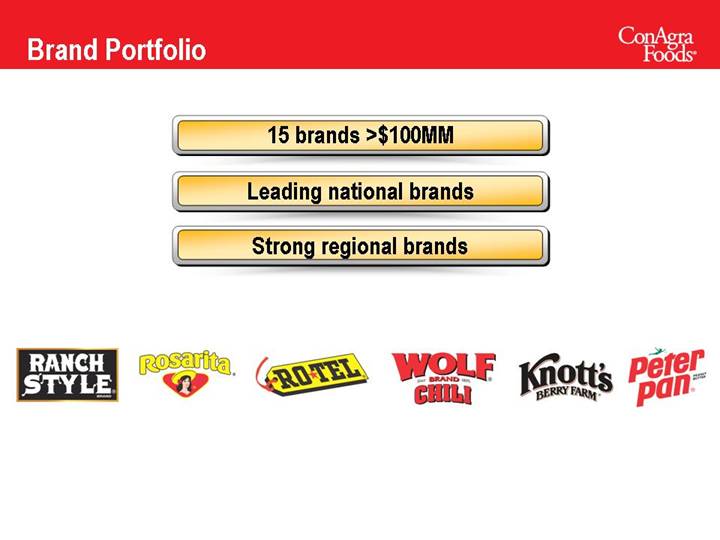

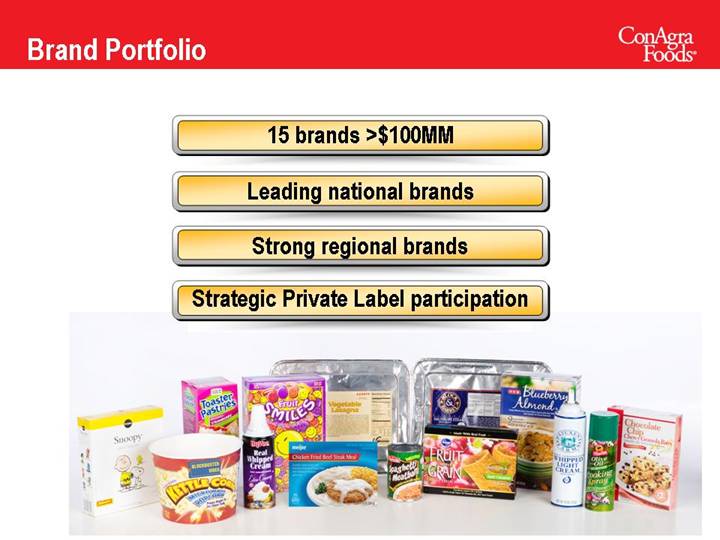

Brand Portfolio

15 brands >$100MM

Leading national brands

[LOGO]

48

15 brands >$100MM

Leading national brands

Strong regional brands

[LOGO]

49

15 brands >$100MM

Leading national brands

Strong regional brands

Strategic Private Label participation

[GRAPHIC]

50

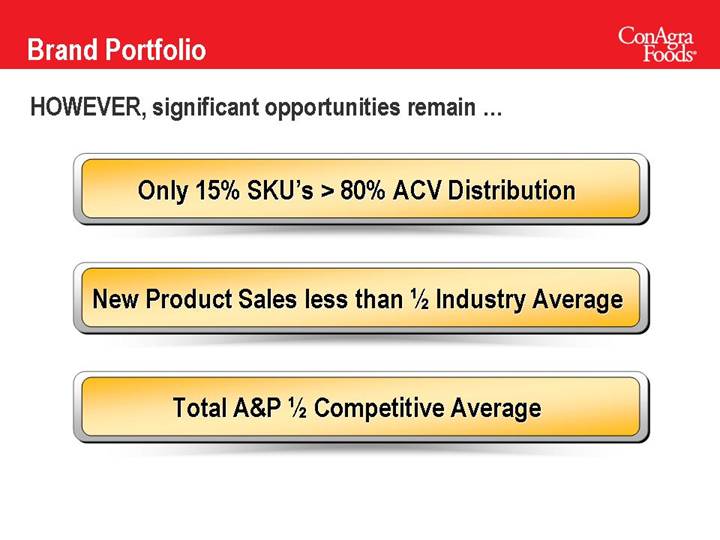

HOWEVER, significant opportunities remain …

Only 15% SKU’s > 80% ACV Distribution

New Product Sales less than 1/2 Industry Average

Total A&P ½ Competitive Average

51

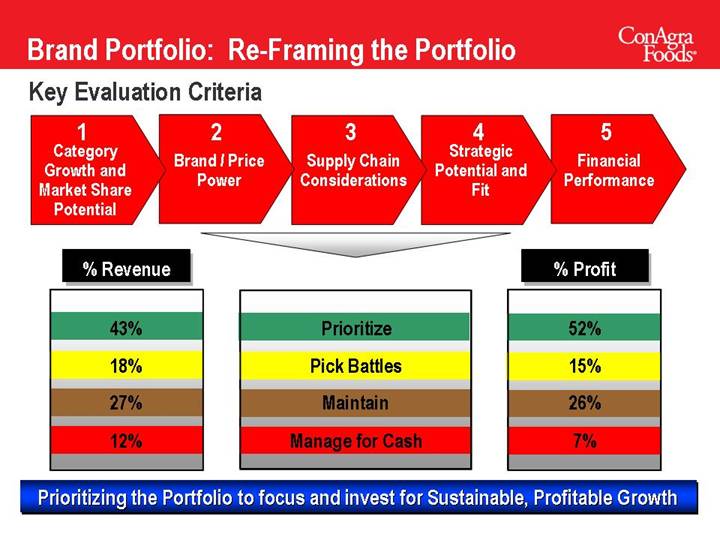

Brand Portfolio: Re-Framing the Portfolio

Key Evaluation Criteria

1 | | 2 | | 3 | | 4 | | 5 |

Category Growth and Market Share Potential | | Brand / Price

Power | | Supply Chain

Considerations | | Strategic

Potential and

Fit | | Financial

Performance |

% Revenue | | | | % Profit |

| | | | |

43% | | Prioritize | | 52% |

| | | | |

18% | | Pick Battles | | 15% |

| | | | |

27% | | Maintain | | 26% |

| | | | |

12% | | Manage for Cash | | 7% |

Prioritizing the Portfolio to focus and invest for Sustainable, Profitable Growth

52

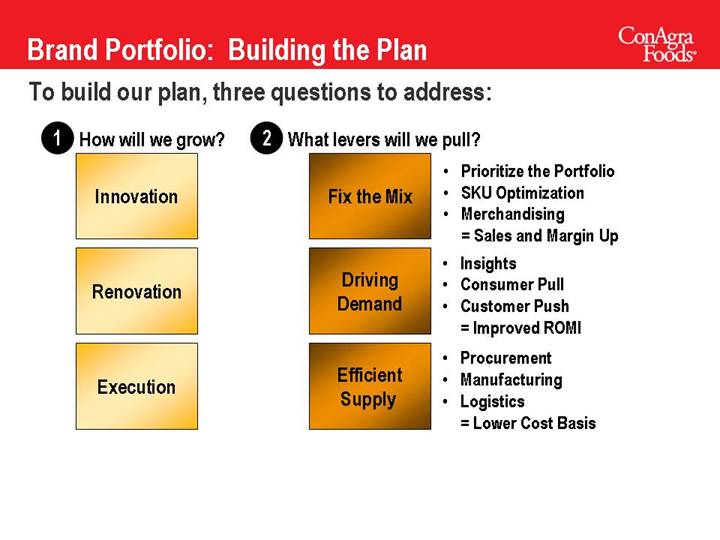

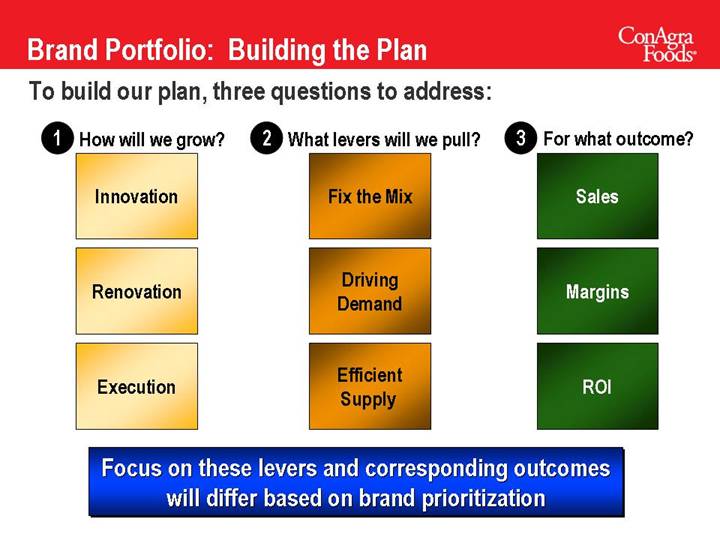

Brand Portfolio: Building the Plan

To build our plan, three questions to address:

1 How will we grow?

Innovation | | [GRAPHIC] | | | | | | |

| | | | | | | | |

Renovation | | [GRAPHIC] | | | | | | |

| | | | | | | | |

Execution | | Blocking and Tackling | | | | | | |

53

To build our plan, three questions to address:

1 How will we grow? | | 2 What levers will we pull? | | |

| | | | |

Innovation

| | Fix the Mix

| | • Prioritize the Portfolio

• SKU Optimization

• Merchandising • Sales and Margin Up |

| | | | |

Renovation

| | Driving

Demand

| | • Insights

• Consumer Pull

• Customer Push • Improved ROMI |

| | | | |

Execution

| | Efficient

Supply

| | • Procurement

• Manufacturing

• Logistics • Lower Cost Basis |

54

To build our plan, three questions to address:

1 How will we grow? | | 2 What levers will we pull? | | 3 For what outcome? |

| | | | |

Innovation | | Fix the Mix | | Sales |

| | | | |

Renovation

| | Driving

Demand | | Margins

|

| | | | |

Execution

| | Efficient

Supply | | ROI

|

Focus on these levers and corresponding outcomes will differ based on brand prioritization

55

Brand Portfolio: Relevant to Consumer Trends

• Health and wellness | | [LOGO] |

| | |

• Flavor adventure | | |

| | |

• Uncompromised quality | | |

| | |

• Trusted value brands | | |

| | |

• CONVENIENCE | | |

56

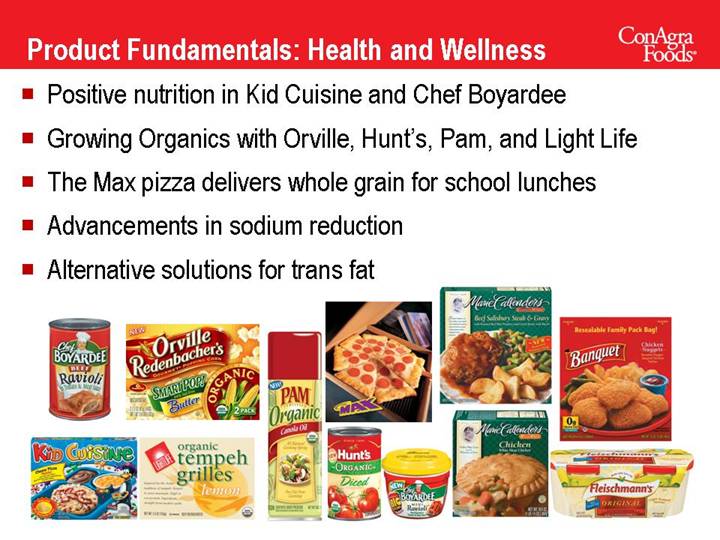

Product Fundamentals: Health and Wellness

• Positive nutrition in Kid Cuisine and Chef Boyardee

• Growing Organics with Orville, Hunt’s, Pam, and Light Life

• The Max pizza delivers whole grain for school lunches

• Advancements in sodium reduction

• Alternative solutions for trans fat

[GRAPHIC]

57

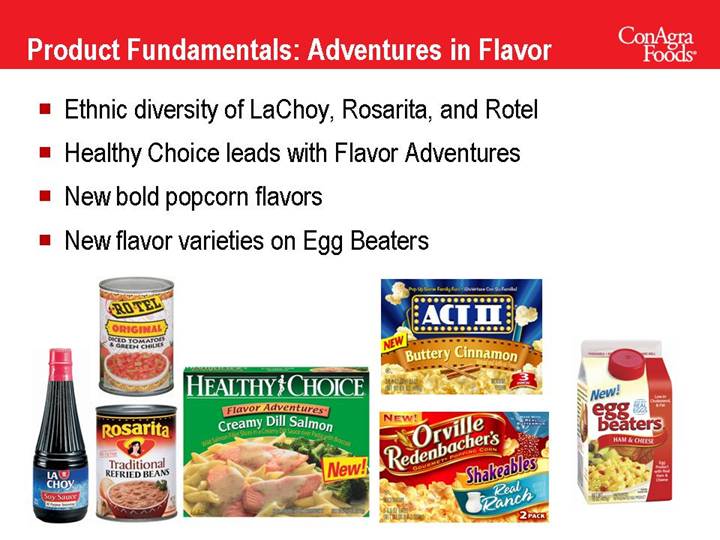

Product Fundamentals: Adventures in Flavor

• Ethnic diversity of LaChoy, Rosarita, and Rotel

• �� Healthy Choice leads with Flavor Adventures

• New bold popcorn flavors

• New flavor varieties on Egg Beaters

[GRAPHIC]

58

Product Fundamentals: Unsurpassed Quality

• Hebrew National = highest quality / Kosher “certified”

• Egg Beaters – real eggs, real difference

• Reddi-wip – made with real cream

• Marie Callender’s Crocks - fresh frozen meats and vegetables

• Snack Pack Pudding – milk #1 ingredient

[GRAPHIC]

59

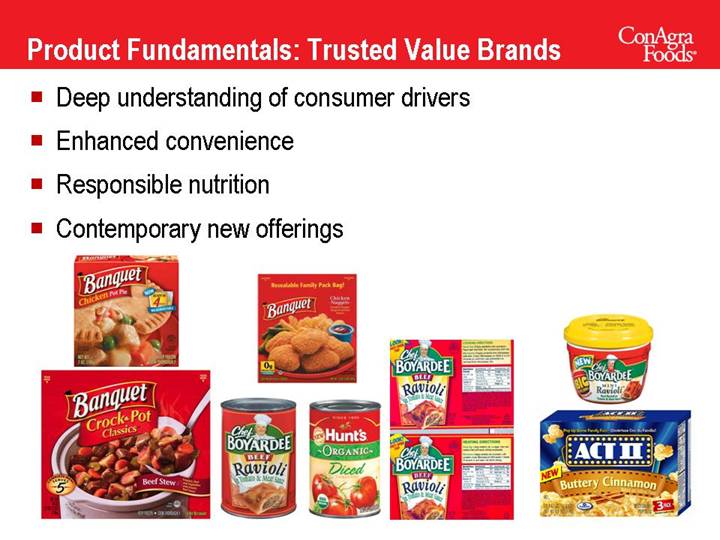

Product Fundamentals: Trusted Value Brands

• Deep understanding of consumer drivers

• Enhanced convenience

• Responsible nutrition

• Contemporary new offerings

[GRAPHIC]

60

Product Fundamentals: Convenience = Margin Up

• Microwaveable meal solutions in minutes

• Meals with emphasis on “family” time

• Healthy meals for active lifestyles

• Portion controlled snacking

[GRAPHIC]

61

Profile of Progress: Egg Beaters

Expanding Frame of Reference: Targeting Shell Egg Users

• New advertising message

• Relevant new items

• Retail shelf adjacency

[GRAPHIC]

62

Profile of Progress: Slim Jim

Better Connecting with Core Consumers

• Targeted advertising, sponsorships and grass roots promotions

• New distribution across all channels

• Multiple “points of interruption” across the store

[GRAPHIC]

64

Profile of Progress: Chef Boyardee

Driving Purchase Frequency and Buy Rate

• Improved nutritionals across the line

• New varieties expanding consumption

• Shelf merchandising improves shopability

[GRAPHIC]

65

Profile of Progress: Reddi-wip

Increasing Usage Occasions

• In-store tie-ins with seasonal “host foods”

• New advertising and in-store promotions reinforcing everyday usage

• New distribution opportunities, initially in club channel

[GRAPHIC]

67

Profile of Progress: Healthy Choice

Franchise Growth Via Consumer Immersion

• Product improvements driving sales +30%

• “Green is Good” increasing HHP +16%

• New product pipeline re-loaded in FY07

[GRAPHIC]

68

The New ConAgra Foods

Finally, Prioritizing the Brand Portfolio

Focused on Meaningful Consumer Trends

Serious about Renovation and Innovation

Execute with Excellence

69

[GRAPHIC]

[LOGO]

MARCH 2006

Analyst & Investor Event

Sales Strategies

Doug Knudsen

President, Sales

[LOGO]

70

What’s Different ?

PAST | | PRESENT |

| | |

5 Different Sales Organizations | | “ONE” Unified Sales Force |

| | |

Multiple Systems / Limited Tools | | “ONE” System with Integrated Sales Tools |

| | |

“Push” Sales Focus | | “Pull” Focus / Consumption Based |

| | |

Trade Promotion Dependent | | Balanced Mix (Marketing / Trade) |

| | |

Volume Based Incentive | | Net Sales / Profit Based Incentive |

Transition From Sales Managers to “Business Managers”

71

Sales Organization Priorities

Base Volume Growth

Trade Spending Effectiveness

Channel Opportunities

72

Base Volume Growth - Gold Store Initiative

• Objectives

• Drive BASE category growth for customers

• Increase everyday demand for ConAgra Foods brands

• Reduce reliance on trade spending

• Opportunities

• Fix the Mix - ideal assortment

• Improved shelf presence / adjacencies

• Increased secondary placements

• Optimum Everyday Pricing

73

Gold Store Initiative | [GRAPHIC] |

All Brands MUST Grow

FOCUS Sales Execution on Top 10 Categories

OBJECTIVE

Grow Key Categories | | • Grow Priority Brands | | • Flawless In-Store Execution |

Microwave Popcorn | | | | Canned Pasta | | |

| | | | | | |

Meat Snacks | | | | Liquid Eggs | | |

| | | | | | |

Whipped Toppings | | [LOGO] | | Cooking Sprays | | [LOGO] |

| | | | | | |

Canned Tomatoes | | | | Frozen Meals | | |

| | | | | | |

Premium Hot Dogs | | | | Sloppy Joe Mix | | |

74

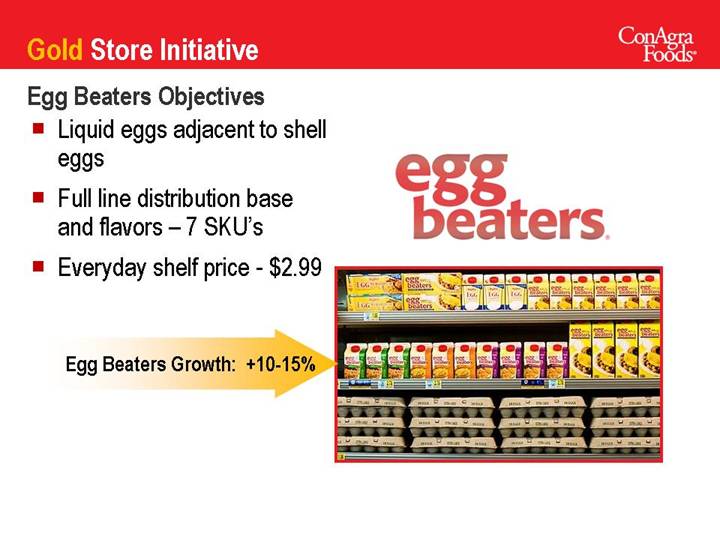

Egg Beaters Objectives

• | Liquid eggs adjacent to shell eggs | |

| | |

• | Full line distribution base and flavors – 7 SKU’s | [LOGO] |

| | |

• | Everyday shelf price - $2.99 | |

| | |

| Egg Beaters Growth: +10-15% | [GRAPHIC] |

75

Whipped Topping Objectives

• | Adjacent to rfg pudding at eye level | |

| | |

• | Minimum 5 SKU’s | |

| | |

• | Cooler Program with Host Foods | [LOGO] |

| | |

| • Cocoa, Pies, Berries, Ice Cream | |

| | |

| Reddi-Wip Growth: +10-12% | [GRAPHIC] |

| | |

| [GRAPHIC] | |

76

Chef Boyardee Objectives

• | Core Four at eye level | |

| | |

• | 40 oz. Center Shelf | |

| | [LOGO] |

• | Chef Brand Block | |

| | |

• | Minimum 18 SKU’s | |

| | |

| Chef Growth: +6-9% | [GRAPHIC] |

77

Trade Spending Effectiveness

• $1.6B+ Annual Investment (Ex Divestitures)

• Recently implemented Trade Promotion Management (TPM) system

• Fully integrated module of SAP

• Disciplined process and controls

• Visibility to profitability by customer

• Analytics by customer, brand and event level

• (STEP Tool) Strategic Trade Effectiveness Program

• What-if scenarios using history and statistics

• Models sales, profitability and ROI by event

• Post-event analysis (Measure, Learn & Change)

78

Improving Trade Effectiveness

| | From | | To | | Impact |

| | | | | | |

[GRAPHIC]

$500MM Brand | | $0.79 & $0.89

Features | | 5/$5 Features | | Sales +8%

+ + + ROI |

| | | | | | |

[GRAPHIC] | | $1.99 TPRs | | 2/$4 Features | | |

$100MM Brand | | | | | | Sales +10% |

| | 4 Weeks | | 1 Week | | + + + ROI |

| | Promoted | | Promoted | | |

79

Trade Spending Effectiveness

Opportunities

• Shift lowest 10% ROI events

• Target Customer’s most effective merchandising vehicle

Goal: 3% Reduction = $50MM

TRADE WILL BE EFFECTIVELY MANAGED

80

Channel Opportunities

ConAgra Foods Sales by Major Retail Channel (%)

Fastest Growing Channels

[CHART]

81

Channel Opportunity: Membership / Club

| Index = 75% to competitive set |

Membership/Club | |

| |

[GRAPHIC] | [GRAPHIC] |

82

Channel Opportunity: Emerging Formats

Emerging Formats | |

| |

[LOGO] | [GRAPHIC] |

83

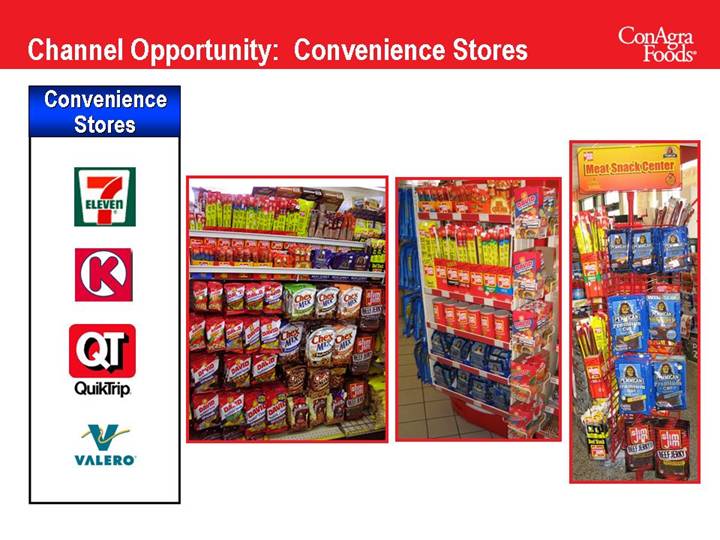

Channel Opportunity: Convenience Stores

Convenience Stores | |

| |

[LOGO] | [GRAPHIC] |

84

Convenience Stores | | [LOGO] |

| | Before | | After |

| | | | |

[LOGO] | | [GRAPHIC] | | [GRAPHIC] |

85

The New ConAgra Foods

Base Volume Growth

Trade Spending Effectiveness

Channel Opportunities

Execute with Excellence

86

[GRAPHIC] | [LOGO] | |

| MARCH 2006 | |

| Analyst & Investor Event | |

| Commercial Products | |

| | |

| Greg Heckman | |

| | |

| President & COO, | |

| Commercial Products | |

[LOGO]

87

Food Products Sales Channel Breakdown

Consumer

Foods | | Sales

Channels | | Commercial

Products |

| | | | |

80% | | Retail Outlets | | 10% |

| | | | |

15% | | Foodservice | | 60% |

| | | | |

5% | | Food Mfg/Industrial | | 30% |

88

Commercial Products: $4+ Billion in Sales

Recognized Business To Business Brands

Significant Scale

Solid Track Record

Expansive Customer Portfolio

Focused Growth Agenda

89

Recognized Business to Business Brands

[LOGO] | | | | [LOGO] |

| | | | |

• Wheat Flours | | | | • Onion |

• Oat Products | | | | • Garlic |

• Barley Products | | [LOGO] | | • Vegetables |

| | | | • Chili Peppers |

| | • French Fries | | |

| | • Mashed Potatoes | | |

[LOGO] | | • Hash Browns | | |

| | • Dough-Enrobed Hand Helds | | |

• Seasoning Blends | | • Appetizers | | [LOGO] |

• Flavors | | | | |

• Bases | | | | • Agricultural Commodities |

• Spices | | | | • Energy Commodities |

| | | | • Commodity Services |

| | | | • Risk Management |

90

Significant Scale

[LOGO] | | • #1 in North America, #2 globally |

| | |

| | • #3 in North American wheat milling |

| | |

| | • #1 in North American dehydrated onion, garlic and chili peppers |

| | |

| | • Complete portfolio of Agricultural and Energy commodities and services |

91

ConAgra Trade Group: Linking Supply & Demand

| Economic Analysis & | |

| Market Transparency | |

| | |

| | |

Trading & | Flywheel | Transactional |

Merchandising | of | Platform |

| Earnings | |

| | |

| | |

| Logistical | |

| Services | |

Benefits to CAG:

Opportunities to lower input costs

Earnings diversification

92

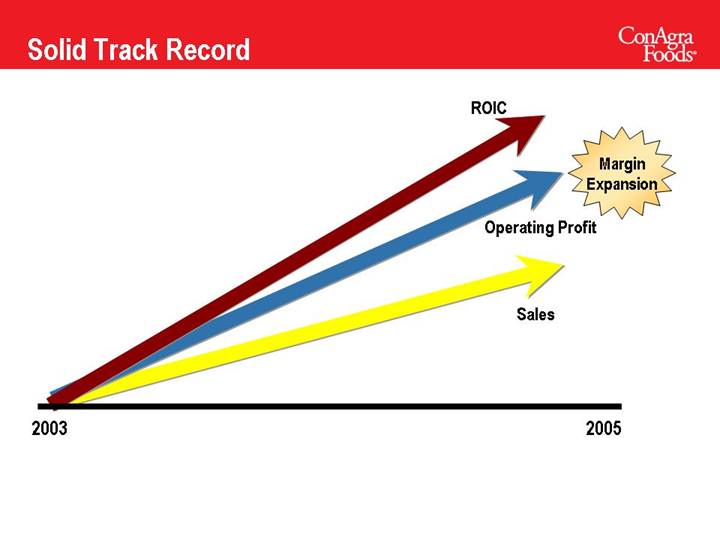

Solid Track Record

[CHART]

93

Expansive Customer Portfolio

Foodservice | | Food Manufacturing | | Industrial | | Retail | |

| | | | | | | |

| | | | | | | |

[LOGO] | | [LOGO] | | [LOGO] | | [LOGO] | |

94

Focused Growth Agenda

Expand on Strengths | | |

| | |

Relevant Innovation | | [CHART] |

| | |

Customer Solutions | | |

95

Expand on Strengths

[LOGO] | | • Global footprint anchors growth |

| | |

[LOGO] | | • Whole grain portfolio on trend |

| | |

[LOGO] | | • Industry leadership in product quality |

| | |

[LOGO] | | • Customized value with speed |

| | |

[LOGO] | | • Energy and agriculture converging |

96

Relevant Innovation

[LOGO] | | |

| | |

“MyFries” with i3 Advantage | | |

indulgent — intelligent — innovative | | |

| | |

• 100% satisfaction with up to 25% less fat | | |

| | [GRAPHIC] |

• No compromise on taste or texture | | |

| | |

• New process technology | | |

| | |

• Launching this year | | |

97

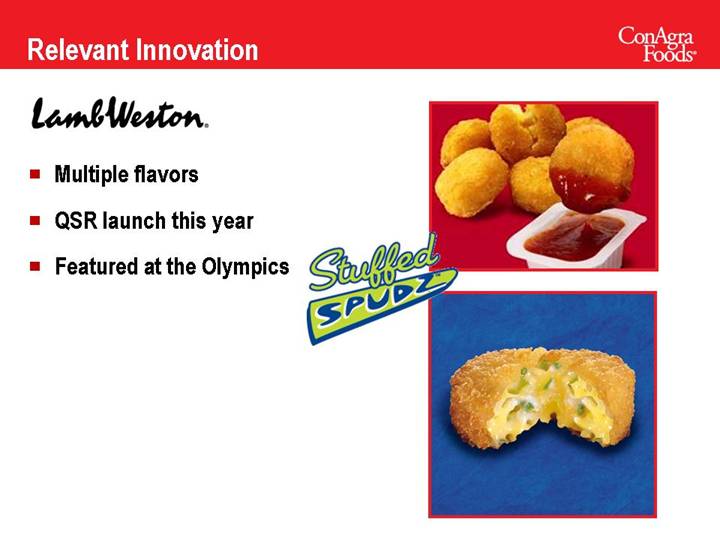

[LOGO] | | |

| | |

• Multiple flavors | | |

| | [GRAPHIC] |

• QSR launch this year | | |

| | |

• Featured at the Olympics | | |

98

[LOGO] | | |

| | |

• Ultragrain® 100% Whole Grain | | |

| | [GRAPHIC] |

• Multiple applications | | |

| | |

• Industry changing | | |

99

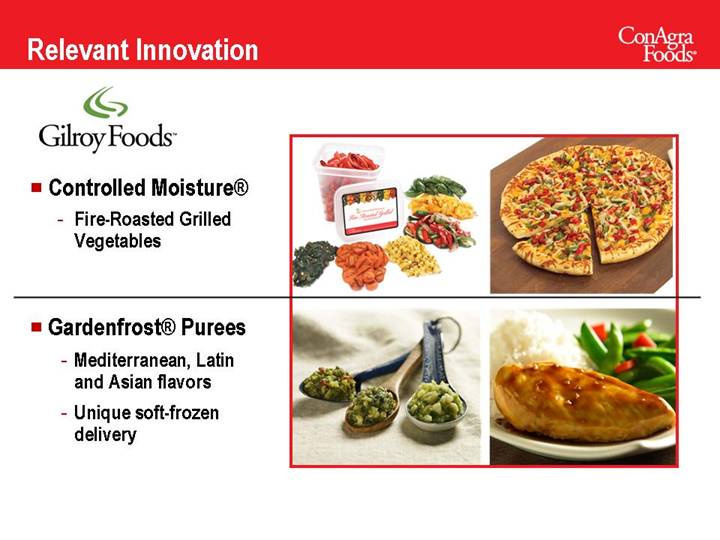

[LOGO] | | |

| | |

• Controlled Moisture® | | |

| | |

• Fire-Roasted Grilled Vegetables | | |

| | [GRAPHIC] |

| | |

• Gardenfrost® Purees | | |

| | |

• Mediterranean, Latin and Asian flavors | | |

| | |

• Unique soft-frozen delivery | | |

100

[LOGO] | | |

| | |

• Amplify® salt enhancement technology | | |

| | [GRAPHIC] |

• Allows reduction of sodium without sacrificing taste | | |

| | |

• Sodium reduced up to 50% depending on application | | |

101

Customer Solutions

Consumer Insights | | |

| | |

Culinary COE | | |

| | |

Technical Services/Support | | [GRAPHIC] |

| | |

Product/Service Combinations | | |

| | |

Commodity Service Provider | | |

102

The New ConAgra Foods

Extend Core Competencies

Sustain Momentum

Capture Opportunities

Leverage ConAgra Foods

Execute with Excellence

103

[GRAPHIC] | [LOGO] |

| MARCH 2006 |

| Analyst & Investor Event |

| Driving Supply Chain |

| Excellence |

| |

| Jim Hardy |

| |

| Executive Vice President, |

| Supply Chain |

[LOGO]

104

Product Supply

Link and Leverage

Opportunity Ahead

105

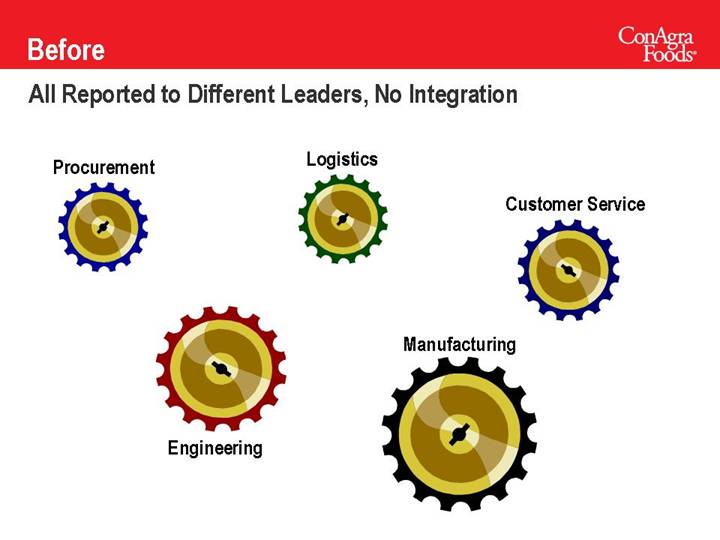

Before

All Reported to Different Leaders, No Integration

| | Logistics | | |

Procurement | | [GRAPHIC] | | |

[GRAPHIC] | | | | Customer Service |

| | | | [GRAPHIC] |

| Engineering | | Manufacturing | |

| [GRAPHIC] | | [GRAPHIC] | |

106

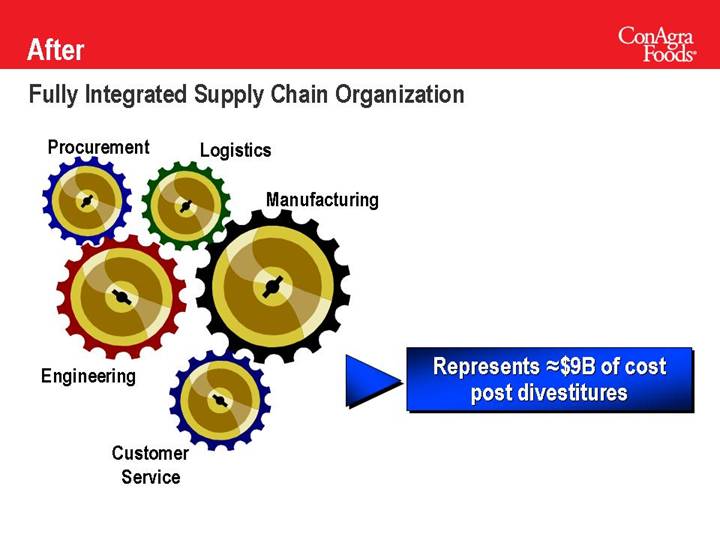

After

Fully Integrated Supply Chain Organization

Procurement | Logistics | | |

[GRAPHIC] | [GRAPHIC] | | |

| | Manufacturing | |

| | [GRAPHIC] | |

| | | |

[GRAPHIC] | | | |

Engineering | | | |

| [GRAPHIC] | | Represents  $9B of cost post divestitures $9B of cost post divestitures |

| Customer | | |

| Service | | |

| | | |

107

Enterprise Product Supply Vision

World Class Organization

Continuous Improvement

Zero Loss Culture

Gross Margin Expansion

108

Strategic Priorities

Get the Fundamentals Right

Re-engineer the Organization

Rationalize our Asset Base

Drive Sustainable Business Improvements

109

Product Supply

Opportunity Ahead

110

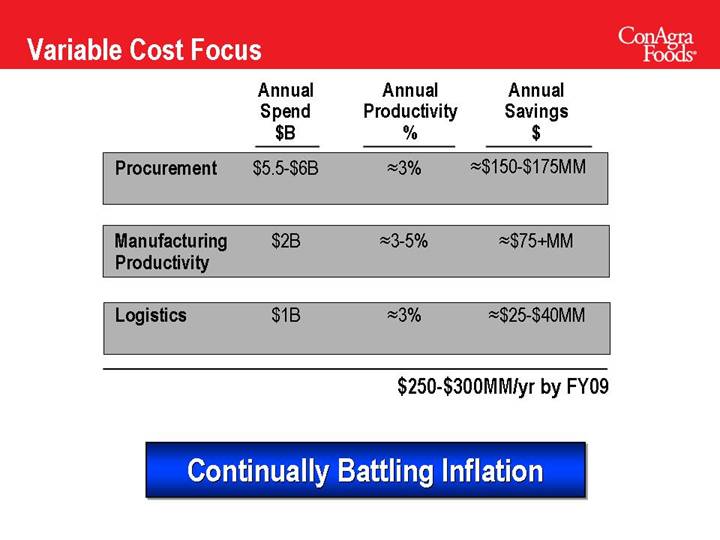

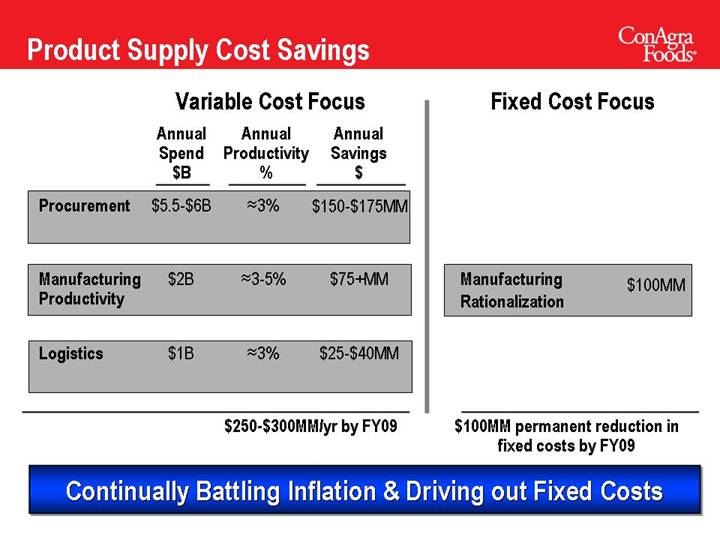

Variable Cost Focus

| | Annual

Spend | | Annual

Productivity | | Annual

Savings | |

| | $B | | % | | $ | |

Procurement | | $5.5-$6B | |  3% 3%

| |  $150-$175MM $150-$175MM

| |

| | | | | | | |

Manufacturing Productivity | | $2B | |  3-5% 3-5%

| |  $75+MM $75+MM

| |

| | | | | | | |

Logistics | | $1B | |  3% 3%

| |  $25-$40MM $25-$40MM

| |

$250-$300MM/yr by FY09

Continually Battling Inflation

111

Variable Cost Savings—Procurement

Opportunity

• < 10% of indirect spend negotiated by procurement

• Too many specifications

• Complex product designs

• No visibility to inbound freight costs

Action Plan

• Consolidate total spend and better leverage strategic suppliers

• Partner with R&D to eliminate complexity

• Develop a formula pricing purchasing strategy

Opportunity:

$150-$175MM Annual Savings

112

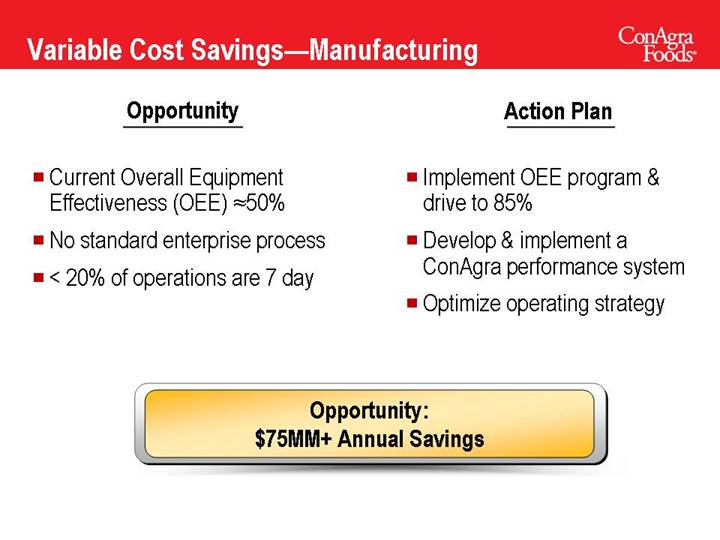

Variable Cost Savings—Manufacturing

Opportunity

• Current Overall Equipment Effectiveness (OEE)  50%

50%

• No standard enterprise process

• < 20% of operations are 7 day

Action Plan

• Implement OEE program & drive to 85%

• Develop & implement a ConAgra performance system

• Optimize operating strategy

Opportunity:

$75MM+ Annual Savings

113

Variable Cost Savings—Logistics

Opportunity

• Not leveraging our scale

• Too much inventory

• Too many product touches

• Limited regional manufacturing capability

Action Plan

• Significantly reduce finished goods inventories

• Expand regional manufacturing capability

• Consolidate Mixing Center network and better leverage freight scale

• Drive efficient customer programs

Opportunity:

$25-$40MM Annual Savings

114

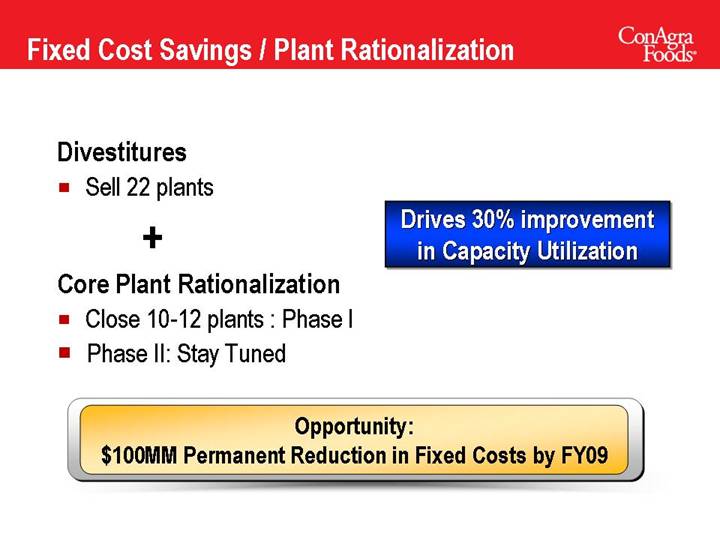

Fixed Cost Savings / Plant Rationalization

Divestitures | | |

| | |

• Sell 22 plants | | |

| | Drives 30% improvement |

+ | | in Capacity Utilization |

| | |

Core Plant Rationalization | | |

| | |

• Close 10-12 plants : Phase I | | |

| | |

• Phase II: Stay Tuned | | |

Opportunity:

$100MM Permanent Reduction in Fixed Costs by FY09

115

Product Supply Cost Savings

Variable Cost Focus |

| | | | | | | |

| | Annual

Spend | | Annual

Productivity | | Annual

Savings | |

| | $B | | % | | $ | |

| | | | | | | |

Procurement | | $5.5-$6B | |  3% 3%

| | $150-$175MM | |

| | | | | | | |

Manufacturing Productivity | | $2B | |  3-5% 3-5%

| | $75+MM | |

| | | | | | | |

Logistics | | $1B | |  3% 3%

| | $25-$40MM | |

| | | | | | | |

| | | | | | | |

| | | | $250-$300MM/yr by FY09 | |

Fixed Cost Focus |

| | |

Manufacturing | $100MM | |

Rationalization | | |

| | |

$100MM permanent reduction in

fixed costs by FY09 | |

Continually Battling Inflation & Driving out Fixed Costs

116

The New ConAgra Foods

Leverage the Integration of the Supply Chain

Link Product Supply to Critical Business Strategies

Pursuing a Rich Portfolio of Cost Savings Opportunities

Execute with Excellence

117

[LOGO]

MARCH 2006

Analyst & Investor Event

[LOGO]

118

[GRAPHIC] | [LOGO] |

| MARCH 2006 |

| Analyst & Investor Event |

| Financial Objectives & Goals |

| |

| Frank Sklarsky |

| EVP and Chief Financial Officer |

[LOGO]

119

Topics for Discussion

• Major Factors Influencing Outlook | | • Special Charges |

| | |

• New Earnings Base | | • Capital Spending |

| | |

• FY07 - FY09 Goals | | • Capital Allocation |

• Leading Indicators

120

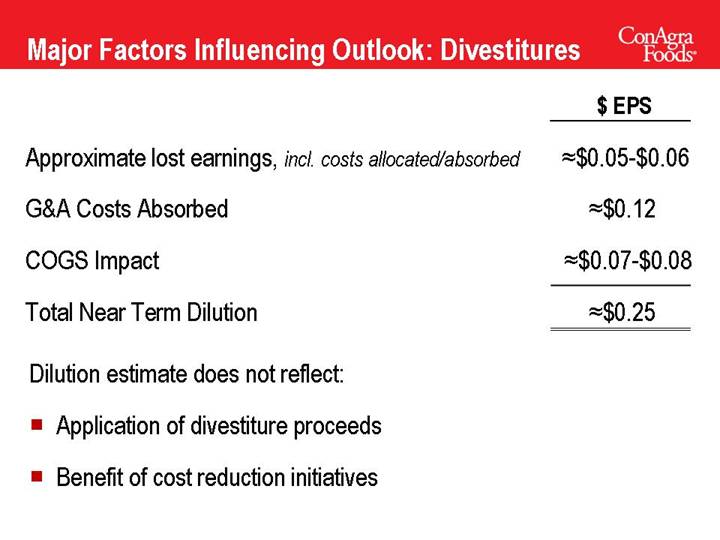

Major Factors Influencing Outlook: Divestitures

| | $ EPS | |

| | | |

Approximate lost earnings, incl. costs allocated/absorbed | |  $0.05-$0.06 $0.05-$0.06

| |

| | | |

G&A Costs Absorbed | |  $0.12 $0.12

| |

| | | |

COGS Impact | |  $0.07-$0.08 $0.07-$0.08

| |

| | | |

Total Near Term Dilution | |  $0.25 $0.25

| |

Dilution estimate does not reflect:

• Application of divestiture proceeds

• Benefit of cost reduction initiatives

121

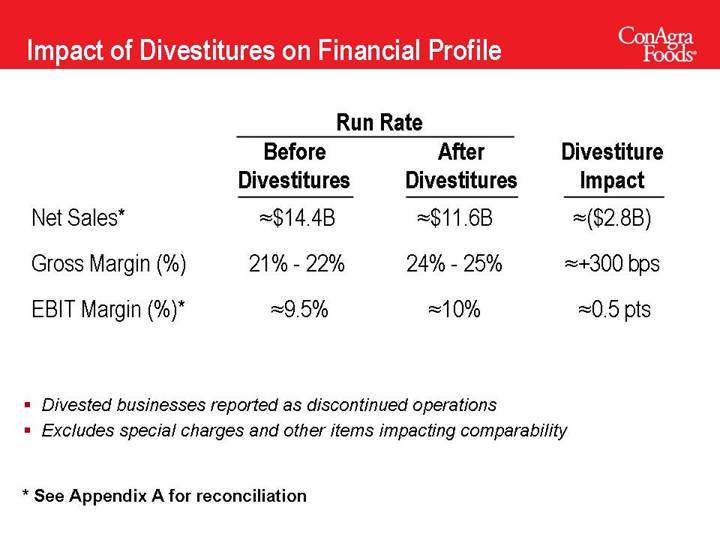

Impact of Divestitures on Financial Profile

| | Run Rate | | | |

| | Before | | After | | Divestiture | |

| | Divestitures | | Divestitures | | Impact | |

| | | | | | | |

Net Sales* | |  $14.4B $14.4B

| |  $11.6B $11.6B

| |  ($2.8B) ($2.8B)

| |

| | | | | | | |

Gross Margin (%) | | 21% - 22% | | 24% - 25% | |  +300 bps +300 bps

| |

| | | | | | | |

EBIT Margin (%)* | |  9.5% 9.5%

| |  10% 10%

| |  0.5 pts 0.5 pts

| |

• Divested businesses reported as discontinued operations

• Excludes special charges and other items impacting comparability

* See Appendix A for reconciliation

122

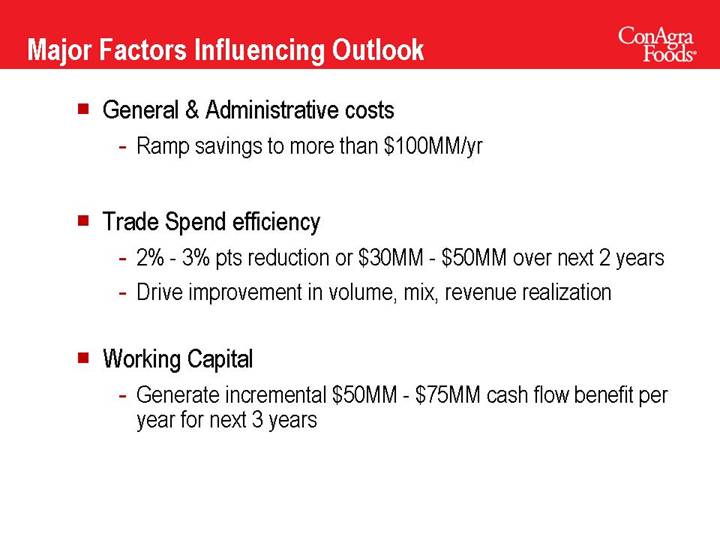

Major Factors Influencing Outlook

• Supply Chain: Variable Cost Focus

• Ramp to  3%+ COGS productivity savings, annually

3%+ COGS productivity savings, annually

• Represents gross savings, before impact of inflation

• Supply Chain: Fixed Cost Focus – Plant Rationalization

• Achieve $100MM by FY09

• Savings carry over into future years

• Supply Chain: Net Target

• Contribute net $100MM+ to bottom line by FY09

123

• General & Administrative costs

• Ramp savings to more than $100MM/yr

• Trade Spend efficiency

• 2% - 3% pts reduction or $30MM - $50MM over next 2 years

• Drive improvement in volume, mix, revenue realization

• Working Capital

• Generate incremental $50MM - $75MM cash flow benefit per year for next 3 years

124

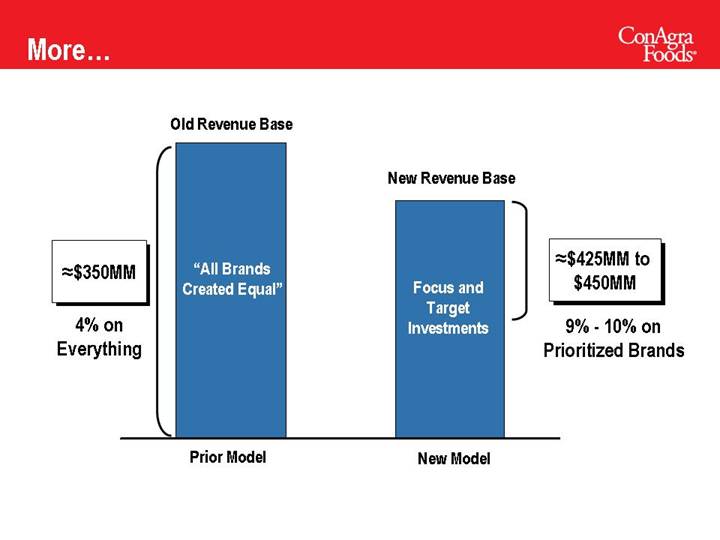

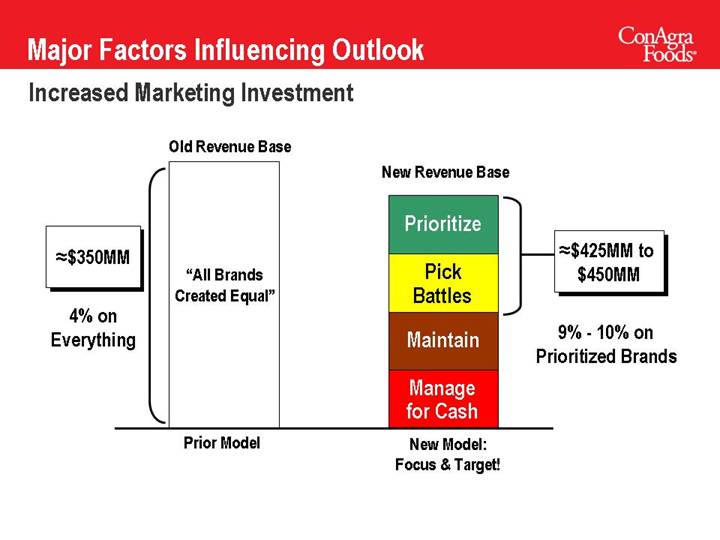

Increased Marketing Investment | | | |

| | | | |

| Old Revenue Base | | New Revenue Base | |

| | | | |

| | | Prioritize |  $425MM to $425MM to

|

$350MM $350MM

| | | | $450MM |

| “All Brands | | Pick | |

| Created Equal” | | Battles | |

| | | | |

4% on | | | Maintain | 9% - 10% on |

Everything | | | | Prioritized Brands |

| | | Manage | |

| | | for Cash | |

| | | | |

| | | | |

| Prior Model | | New Model: | |

| | | Focus & Target! | |

125

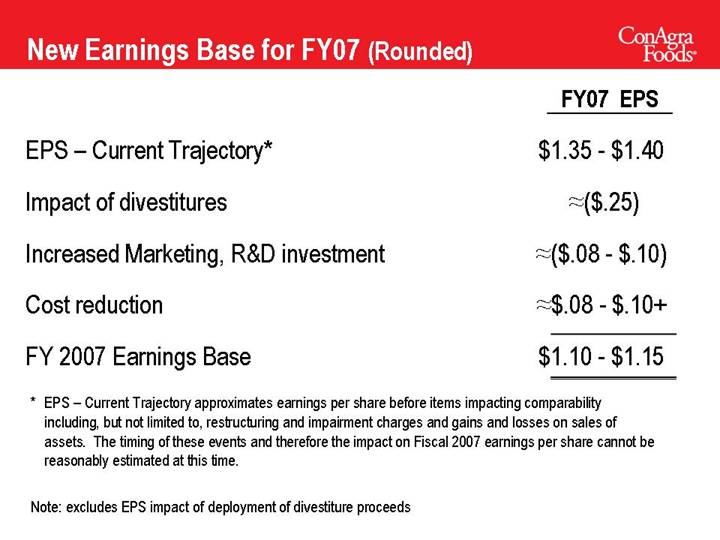

New Earnings Base for FY07 (Rounded)

| | FY07 EPS | |

| | | |

EPS – Current Trajectory* | | $1.35 - $1.40 | |

| | | |

Impact of divestitures | |  ($.25) ($.25)

| |

| | | |

Increased Marketing, R&D investment | |  ($.08 - $.10) ($.08 - $.10)

| |

| | | |

Cost reduction | |  $.08 - $.10+ $.08 - $.10+

| |

| | | |

FY 2007 Earnings Base | | $1.10 - $1.15 | |

* EPS – Current Trajectory approximates earnings per share before items impacting comparability including, but not limited to, restructuring and impairment charges and gains and losses on sales of assets. The timing of these events and therefore the impact on Fiscal 2007 earnings per share cannot be reasonably estimated at this time.

Note: excludes EPS impact of deployment of divestiture proceeds

126

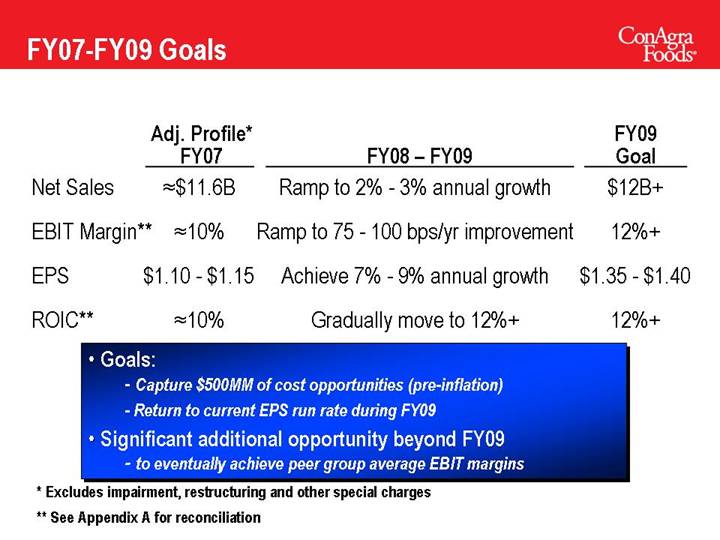

FY07-FY09 Goals

| | Adj. Profile*

FY07 | | FY08 – FY09 | | FY09

Goal | |

| | | | | | | |

Net Sales | |  $11.6B $11.6B

| | Ramp to 2% - 3% annual growth | | $12B+ | |

| | | | | | | |

EBIT Margin** | |  10% 10%

| | Ramp to 75 - 100 bps/yr improvement | | 12%+ | |

| | | | | | | |

EPS | | $1.10 - $1.15 | | Achieve 7% - 9% annual growth | | $1.35 - $1.40 | |

| | | | | | | |

ROIC** | |  10% 10%

| | Gradually move to 12%+ | | 12%+ | |

• Goals:

• Capture $500MM of cost opportunities (pre-inflation)

• Return to current EPS run rate during FY09

• Significant additional opportunity beyond FY09

• to eventually achieve peer group average EBIT margins

* Excludes impairment, restructuring and other special charges

** See Appendix A for reconciliation

127

EBIT Growth Model: Directional Patterns

Near Term: | |

SG&A savings more significant | |

1 -2 Yrs And After: | |

Gross Margin more significant | |

[CHART]

128

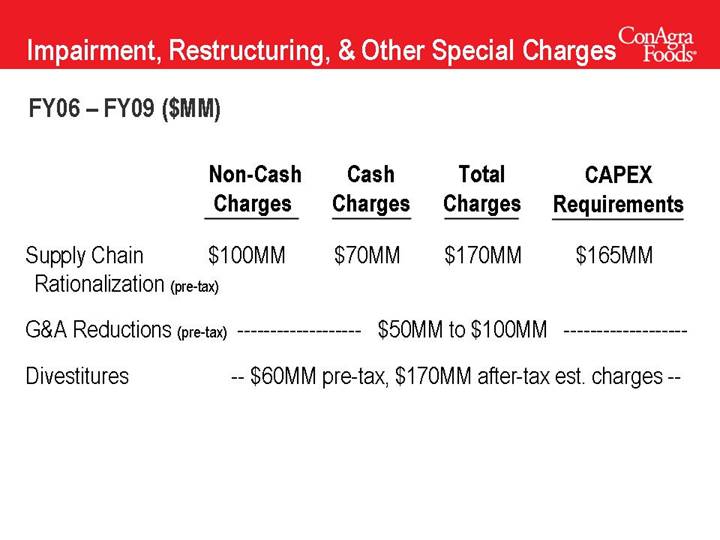

Impairment, Restructuring, & Other Special Charges

FY06 – FY09 ($MM)

| | Non-Cash | | Cash | | Total | | CAPEX | |

| | Charges | | Charges | | Charges | | Requirements | |

| | | | | | | | | |

Supply Chain Rationalization (pre-tax) | | $100MM | | $70MM | | $170MM | | $165MM | |

| | | | | | | | | |

G&A Reductions (pre-tax) | | | | $50MM to $100MM | | | |

| | | | | | | |

Divestitures | | — $60MM pre-tax, $170MM after-tax est. charges — | |

129

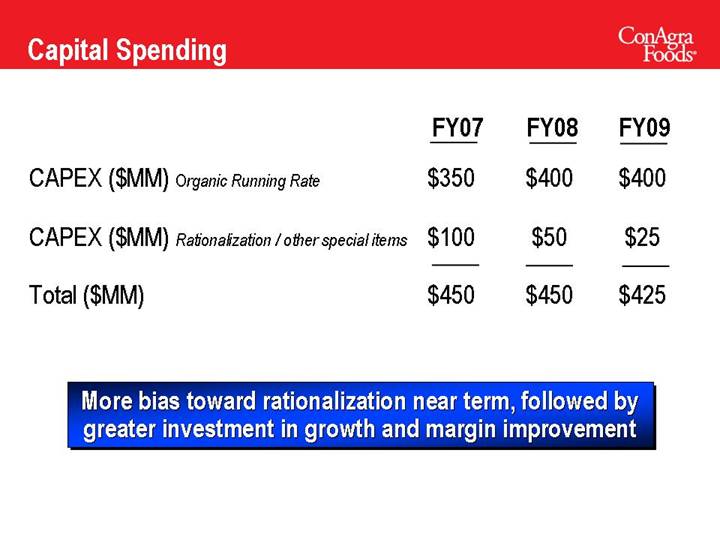

Capital Spending

| | FY07 | | FY08 | | FY09 | |

| | | | | | | |

CAPEX ($MM) Organic Running Rate | | $ | 350 | | $ | 400 | | $ | 400 | |

| | | | | | | |

CAPEX ($MM) Rationalization / other special items | | $ | 100 | | $ | 50 | | $ | 25 | |

| | | | | | | |

Total ($MM) | | $ | 450 | | $ | 450 | | $ | 425 | |

More bias toward rationalization near term, followed by greater investment in growth and margin improvement

130

Capital Allocation Goals

��

• Healthy balance sheet

• Solid investment grade credit rating

• Flexibility to make investments

• CapEx for rationalization and process excellence

• Brand building

• A&P, R&D, Innovation

• ROIC-based capital allocation

• Benchmark vs. benefit of share repurchases

131

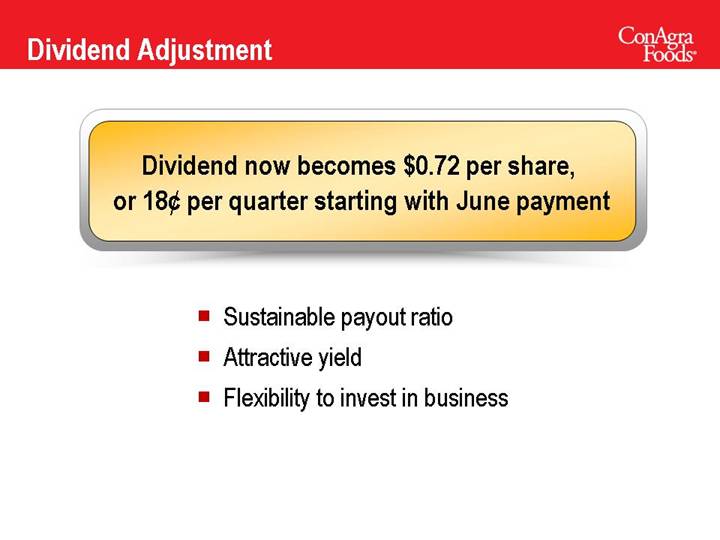

Dividend Adjustment

Dividend now becomes $0.72 per share, or 18¢ per quarter starting with June payment

• Sustainable payout ratio

• Attractive yield

• Flexibility to invest in business

132

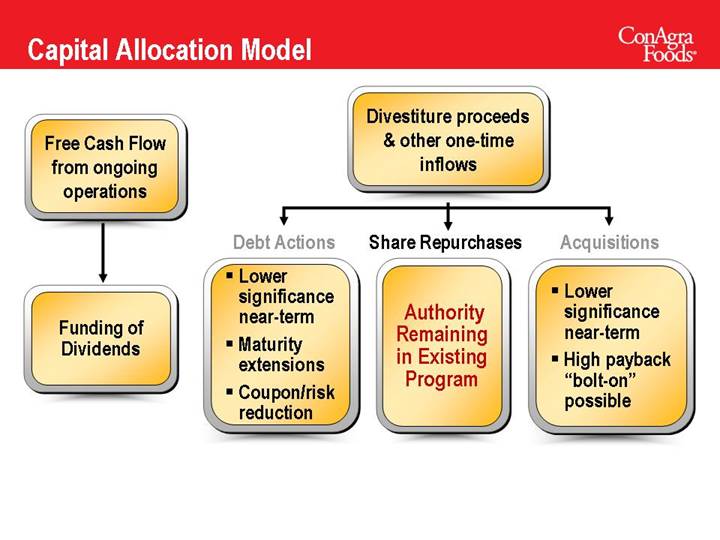

Capital Allocation Model

Free Cash Flow

from ongoing

operations | | Divestiture proceeds

& other one-time

inflows |

| | | | | | |

| | Debt Actions | | Share Repurchases | | Acquisitions |

| | | | | | |

| | • Lower significance near-term | | Authority Remaining in | | • Lower significance near-term |

Funding of Dividends | | • Maturity extensions • Coupon/risk reduction | | Existing

Program | | • High payback “bolt-on” possible |

133

Leading Indicators of Progress

Gross Margin Expansion

A&P / R&D Spend on Consumer Foods

Growth & Market Share of Priority Brands

Overall Manufacturing Efficiency

G&A as a % Sales

134

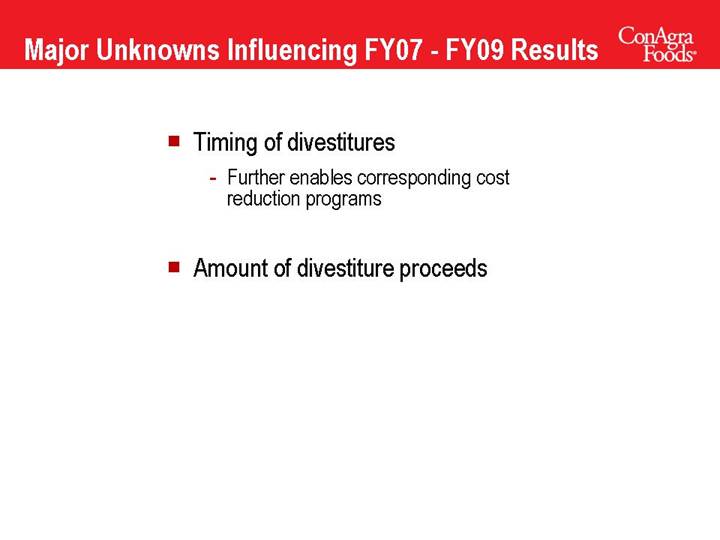

Major Unknowns Influencing FY07 - FY09 Results

• Timing of divestitures

• Further enables corresponding cost reduction programs

• Amount of divestiture proceeds

135

[LOGO] |

|

MARCH 2006 |

Analyst & Investor Event |

Summary |

| |

Gary Rodkin |

|

President and CEO |

[LOGO]

136

Operational Excellence

Simplification | | Consistent Bottom Line Through Top Line Growth | | Stronger

Base

Foundation | | Higher

Margins | | Growing

Profits | | Higher R&D

and

Marketing

Investment |

| | | | | | | | | | |

Rationalized

Supply Chain | | Consistently

Great Customer

Service | | Lower

Inventory/

Service

Costs | | Gain

Share | | Grow

Volume | | Consumer/

Customer

Bigger/Better

Innovation |

Execute with Excellence

137

The New CAG:

A true operating company that delivers sustainable profitable growth

138

[LOGO]

MARCH 2006

Analyst & Investor Event

[LOGO]

139

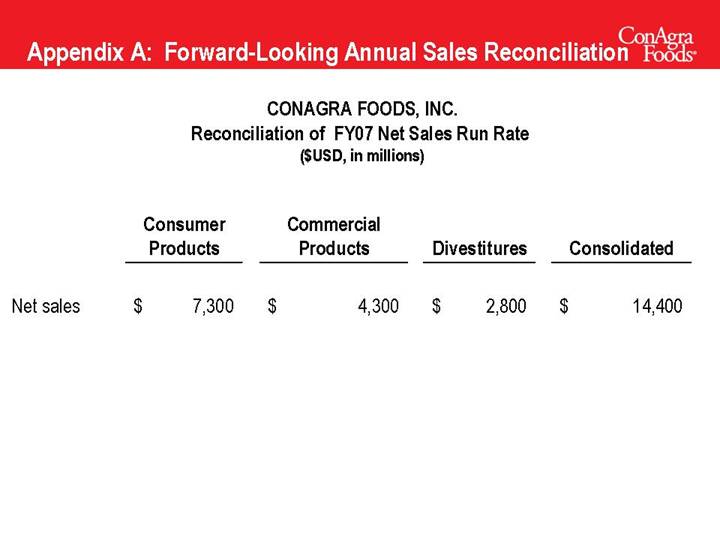

Appendix A: Forward-Looking Annual Sales Reconciliation

CONAGRA FOODS, INC.

Reconciliation of FY07 Net Sales Run Rate

($USD, in millions)

| | Consumer

Products | | Commercial

Products | | Divestitures | | Consolidated | |

| | | | | | | | | |

Net sales | | $ | 7,300 | | $ | 4,300 | | $ | 2,800 | | $ | 14,400 | |

| | | | | | | | | | | | | |

140

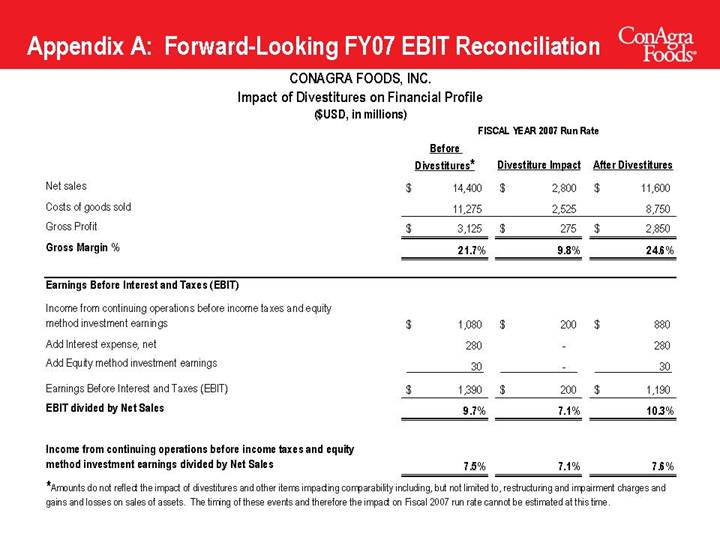

Appendix A: Forward-Looking FY07 EBIT Reconciliation

CONAGRA FOODS, INC.

Impact of Divestitures on Financial Profile

($USD, in millions)

| | FISCAL YEAR 2007 Run Rate | |

| | Before

Divestitures* | | Divestiture Impact | | After Divestitures | |

| | | | | | | |

Net sales | | $ | 14,400 | | $ | 2,800 | | $ | 11,600 | |

Costs of goods sold | | 11,275 | | 2,525 | | 8,750 | |

Gross Profit | | $ | 3,125 | | $ | 275 | | $ | 2,850 | |

Gross Margin % | | 21.7 | % | 9.8 | % | 24.6 | % |

| | | | | | | |

Earnings Before Interest and Taxes (EBIT) | | | | | | | |

| | | | | | | |

Income from continuing operations before income taxes and equity method investment earnings | | $ | 1,080 | | $ | 200 | | $ | 880 | |

Add Interest expense, net | | 280 | | — | | 280 | |

Add Equity method investment earnings | | 30 | | — | | 30 | |

Earnings Before Interest and Taxes (EBIT) | | $ | 1,390 | | $ | 200 | | $ | 1,190 | |

EBIT divided by Net Sales | | 9.7 | % | 7.1 | % | 10.3 | % |

| | | | | | | |

Income from continuing operations before income taxes and equity method investment earnings divided by Net Sales | | 7.5 | % | 7.1 | % | 7.6 | % |

*Amounts do not reflect the impact of divestitures and other items impacting comparability including, but not limited to, restructuring and impairment charges and gains and losses on sales of assets. The timing of these events and therefore the impact on Fiscal 2007 run rate cannot be estimated at this time.

141

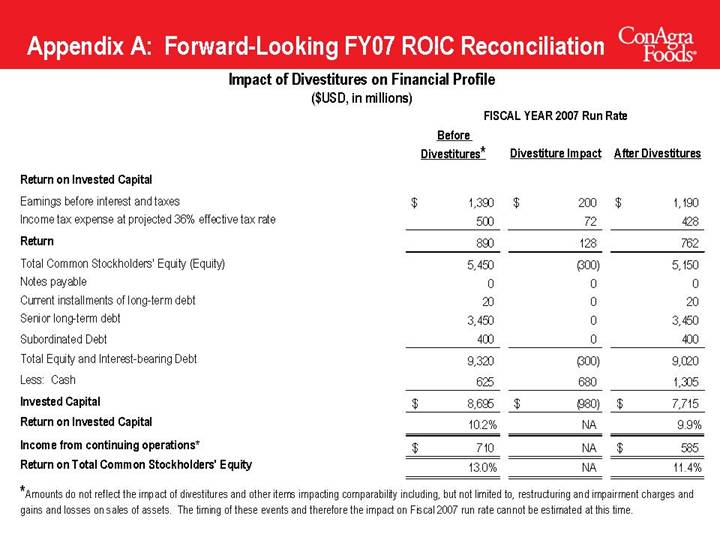

Appendix A: Forward-Looking FY07 ROIC Reconciliation

Impact of Divestitures on Financial Profile

($USD, in millions)

| | FISCAL YEAR 2007 Run Rate | |

| | Before

Divestitures* | | Divestiture Impact | | After Divestitures | |

| | | | | | | |

Return on Invested Capital | | | | | | | |

Earnings before interest and taxes | | $ | 1,390 | | $ | 200 | | $ | 1,190 | |

Income tax expense at projected 36% effective tax rate | | 500 | | 72 | | 428 | |

Return | | 890 | | 128 | | 762 | |

Total Common Stockholders’ Equity (Equity) | | 5,450 | | (300 | ) | 5,150 | |

Notes payable | | 0 | | 0 | | 0 | |

Current installments of long-term debt | | 20 | | 0 | | 20 | |

Senior long-term debt | | 3,450 | | 0 | | 3,450 | |

Subordinated Debt | | 400 | | 0 | | 400 | |

Total Equity and Interest-bearing Debt | | 9,320 | | (300 | ) | 9,020 | |

Less: Cash | | 625 | | 680 | | 1,305 | |

Invested Capital | | $ | 8,695 | | $ | (980 | ) | $ | 7,715 | |

Return on Invested Capital | | 10.2 | % | NA | | 9.9 | % |

Income from continuing operations* | | $ | 710 | | NA | | $ | 585 | |

Return on Total Common Stockholders’ Equity | | 13.0 | % | NA | | 11.4 | % |

*Amounts do not reflect the impact of divestitures and other items impacting comparability including, but not limited to, restructuring and impairment charges and gains and losses on sales of assets. The timing of these events and therefore the impact on Fiscal 2007 run rate cannot be estimated at this time.

142