QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

Filed by a Party other than the Registrantý |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

ý |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Cone Mills Corporation |

(Name of Registrant as Specified In Its Charter) |

Cone Mills Shareholders' Committee |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CONE MILLS SHAREHOLDERS' COMMITTEE

701 XENIA AVENUE SOUTH

GOLDEN VALLEY, MN 55416

September 10, 2003

Dear Fellow Shareholder:

You should have recently received the Cone Mills Shareholders' Committee proxy statement and GREEN proxy card. We are asking your support to elect three highly qualified new directors to the Cone Mills Board. We are taking this step because we believe that the incumbent Board and management have demonstrated that they lack the vision and commitment necessary to effect the changes required for Cone Mill to prosper. Consider the following:

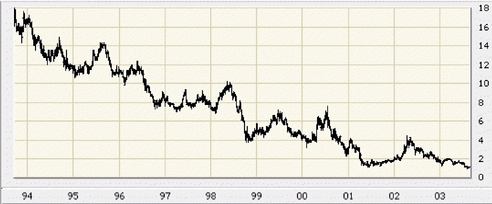

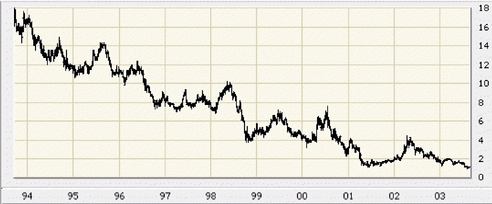

$100 INVESTED IN CONE MILLS STOCK IN SEPTEMBER 1993 IS WORTH

$5.95 TODAY, LESS THAN 6% OF ITS ORIGINAL VALUE.

In our opinion, the stock price alone speaks volumes to their failed leadership. You deserve better.

DON'T BE MISLED

Attacks on me do not address the problems facing Cone Mills. If questioning the current Board's leadership and taking an active interest in Cone Mills and its shareholders for the last four years is disruptive, I plead guilty. The Board's response to my "disruptive" action was to remove me from the Executive Committee and retain a law firm to review the SEC filings made by me and other members of the Committee. On the other hand, this past year we:

- •

- Supported a shareholders' rights offering to raise capital that would have given shareholders an alternative that we believe was superior to the WLR Recovery Fund II, L.P. proposal. It was rejected.

- •

- Offered to arrange a meeting with Pegasus Capital Advisors and Cone management as a possible financing resource. Management refused to meet with them.

- •

- Introduced three potential buyers for Cone Mills unprofitable Cone Jacquards division. All were rebuffed.

Who will provide the leadership necessary to address Cone's problems? Of the 46 years of experience on the Cone Mills Board claimed by the Board's nominees, all but 8 years were served by Ms. Kimmel, who has no experience in the industry other than being a descendent of the Company's founders. Our nominees include a successful business owner who is the Company's largest individual shareholder, a turnaround specialist who was instrumental in developing the Company's plan that resulted in its first profitable year in many years, and one of the recognized national experts in corporate debt financing.We urge you to carefully review the detailed information contained in our proxy statement.

IT'S TIME FOR A CHANGE!

The Committee believes that refocusing Cone Mills on its consistently profitable core business—manufacturing denim—would go a long way towards restoring it to financial health and profitable growth. Upon their election, our nominees would seek to do the following:

- •

- Immediately retain a qualified investment banking firm to rid Cone Mills of its crippling non-producing assets, including the unprofitable Cone Jacquards and Cone Finishing businesses and its unproductive real estate holdings;

- •

- Use the funds generated by the disposition of these money-losing operations to pay down debt, strengthen the balance sheet and refinance remaining debt on more favorable terms;

- •

- Explore the disposition of Cone Mills' ownership in its Parras Cone joint venture while retaining the associated profitable marketing and management agreement; and

- •

- Retain experienced investor relations counsel to enhance Cone Mills' visibility among investors and to communicate the Cone Mills turnaround story to the institutional investment community.

YOUR VOTE IS IMPORTANT!

The election of the Committee's nominees will send a clear message to the incumbent Cone Mills Board. It will be a mandate for change, a demand that the Board seriously consider and act on these important initiatives.

In our view the choice is clear. The Committee's nominees are talented and extremely successful professionals. They are committed to achieving for all shareholders the value that we are convinced Cone Mills can deliver. While they will not constitute a majority of the Board, they will be a strong and vocal presence in the Boardroom, reminding the other directors that they were elected to serve the shareholders. We urge you to act today to protect your investment by signing, dating and returning the GREEN proxy card.

Thank you for your support.

On behalf of the Shareholders' Committee,

Marc H. Kozberg

PLEASE SIGN, DATE AND RETURN THE GREEN PROXY CARD TODAY!

If you have any questions, or need assistance in voting

your shares, please call our proxy solicitor:

INNISFREE M&A INCORPORATED

TOLL-FREE, at 1-877-456-3507.

Do not for any reason return the white card sent to you by Cone Mills' management. Doing so may revoke your vote for us. Remember—only your latest dated proxy will count. If you have returned a white proxy card, you have every legal right to change your vote by signing, dating and returning a new GREEN proxy card today.

QuickLinks

$100 INVESTED IN CONE MILLS STOCK IN SEPTEMBER 1993 IS WORTH $5.95 TODAY, LESS THAN 6% OF ITS ORIGINAL VALUE.DON'T BE MISLEDIT'S TIME FOR A CHANGE!YOUR VOTE IS IMPORTANT!