SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ Confidential, | | for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

Cone Mills Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT | | OF FILING FEE (Check the appropriate box): |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Cone Mills Corporation

Greensboro, N.C.

September 2, 2003

Dear Shareholder:

On behalf of your Board of Directors, we are pleased to invite you to attend the Annual Meeting of Shareholders of Cone Mills Corporation to be held at 10:00 a.m. on Thursday, September 25, 2003, at the Cone Mills Corporate Offices, 804 Green Valley Road, Greensboro, North Carolina 27408.

The notice of meeting and proxy statement accompanying this letter describe the matters on which action will be taken. At the Annual Meeting we will also review the Corporation’s activities and provide time for questions from shareholders. We encourage you to read carefully all of these materials, as well as the copy of the Annual Report previously mailed to you.

Your participation at this year’s Annual Meeting is extremely important. Please sign and return the enclosed WHITE proxy card in the envelope provided as soon as possible to ensure that your shares will be voted at the meeting.

Sincerely,

John L. Bakane

Chairman of the Board,

President, and Chief Executive Officer

CONE

CONE MILLS

CORPORATION

CONE MILLS CORPORATION

Cone Corporate Offices

804 Green Valley Road

Greensboro, NC 27408

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

September 2, 2003

To the Holders of Common Stock of

Cone Mills Corporation:

The Annual Meeting of Shareholders of Cone Mills Corporation will be held at the Cone Mills Corporate Offices, 804 Green Valley Road, in Greensboro, North Carolina, on Thursday, September 25, 2003, at 10:00 a.m. for the following purposes:

| | 1. To | | elect three directors as Class II Directors for terms of three years, or until their successors are elected and qualified. |

| | 2. To | | ratify the appointment of McGladrey & Pullen, LLP as independent auditors for the Corporation for the current fiscal year. |

| | 3. To | | consider and act upon such other business as may properly come before the meeting and any adjournment thereof. |

The Board of Directors of the Corporation has fixed the close of business on July 24, 2003 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

This Annual Meeting is extremely important to all Cone Mills shareholders in light of dissident director Marc H. Kozberg’s attempt to oppose the Board of Directors’ nominees.

Your vote is important regardless of the number of shares you own. You are cordially invited to attend the meeting, but whether or not you plan to attend, please date and sign your WHITE proxy card and return it in the enclosed postage paid envelope. The giving of this proxy will not affect your right to vote in person in the event you find it convenient to attend the meeting.

If you have previously returned a green proxy card, you may change your vote by signing and returning the enclosed WHITE proxy card in the accompanying envelope.

If you have any questions or need any assistance in voting your shares, please contact our proxy solicitors, Georgeson Shareholder Communications, Inc. at 1-800-545-1786.

NEIL W. KOONCE

Vice President, General Counsel

and Secretary

CONE MILLS CORPORATION

Cone Corporate Offices

804 Green Valley Road

Greensboro, NC 27408

September 2, 2003

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD SEPTEMBER 25, 2003

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | | Why am I receiving this proxy statement? |

| A: | | The Board of Directors is soliciting proxies for the 2003 Annual Meeting of Shareholders. You are receiving this proxy statement because you own shares of Cone Mills common stock that entitle you to vote at the meeting. By use of a proxy, you can vote whether or not you attend the meeting. This proxy statement describes the matters to be voted upon at the meeting and provides information on those matters so that you can make an informed decision. |

The notice of annual meeting, this proxy statement and the enclosed WHITE proxy card are being mailed to shareholders on or about September 2, 2003.

When you sign and mail the proxy card, you appoint Terry L. Weatherford and Neil W. Koonce as your representatives at the meeting. Mr. Weatherford and Mr. Koonce will vote your shares at the meeting as you have instructed on your proxy. This way, your shares will be voted even if you cannot attend the meeting.

If an issue that is not on the proxy card comes up for vote at the meeting, Mr. Weatherford and Mr. Koonce will vote the shares for which they hold proxies in accordance with their best judgment.

| Q: | | What proposals will be voted on at the annual meeting? |

| A: | | There are two proposals scheduled to be voted on at the annual meeting: |

| | 1. | | Election of three directors to terms expiring at the 2006 annual meeting. |

| | 2. | | Ratification of the appointment of McGladrey & Pullen, LLP as independent auditors for Cone Mills for the current fiscal year. |

| Q: | | How does your Board of Directors recommend that I vote on each of the proposals? |

| A: | | The Board of Directors recommends that you vote as follows: |

| | • | | FOR the Board’s director nominees, and |

| | • | | FOR the ratification of the appointment of McGladrey & Pullen, LLP. |

| Q: | | Who are the Board’s nominees and why should I vote for them? |

| A: | | The Company’s nominees are incumbent Directors who together have 46 years of experience on the Board of Cone Mills. They have made enormous individual contributions to Cone Mills based on their considerable body of knowledge about our business and industry, their integrity, and their commitment to the highest standards of corporate governance. Our nominees are: |

| | • | | Jeanette Cone Kimmel, a Cone Mills Board member since 1971, brings to the Board a wealth of knowledge of the Company and the textile industry that has been invaluable to the Board over many years. |

1

| | • | | Dr. David T. Kollat, a Board member since 1999, is a widely recognized expert in the marketing field whose knowledge of the apparel market is extremely valuable to our Company. He also has been a Director of Limited Brands, Inc. since 1976. |

| | • | | Dr. John W. Rosenblum, a Board member since 1993, brings to the Board extensive experience in international business and issues of corporate governance. He was formerly Dean of the University of Virginia Darden Graduate School of Business Administration and Dean of the University of Richmond Jepson School of Leadership Studies. He also taught for 10 years at the Harvard Business School. |

| Q: | | What is the Cone Mills Shareholders’ Committee’s proposal and why should it be rejected? |

| A: | | A dissident group led by Marc H. Kozberg has publicly announced that it will solicit proxies to elect three directors to the Board which the Board opposes. Mr. Kozberg’s nominees’ experience in our industry is limited and unrelated to our core business. We do not believe that they have suggested any realistic plan for the Company to deal with the pervasive problems facing Cone Mills and the U.S. textile industry. The Board of Directors believes that its directors offer superior qualifications to those proposed by the dissident group and therefore urges you NOT to sign the GREEN proxies sent to you by the dissident group. |

| Q: | | What color proxy materials should I vote? |

| A: | | You should vote the WHITE Proxy card. |

WHITE proxy cards and voting instruction cards are being solicited on behalf of the Board of Directors in favor of the slate of directors proposed by the Board of Directors.

| Q: | | I have received a GREEN proxy card. Should I sign it and mail it? |

| A: | | No. The Board of Directors urges Cone Mills shareholders to discard any GREEN proxy or voting instruction cards sent by the dissident group that is soliciting proxies against the slate of directors proposed by the Board. |

| Q: | | I have already submitted a GREEN proxy card. May I change my vote? |

| A: | | Yes. You may revoke a previously granted GREEN proxy card or voting instruction card at any time prior to the annual meeting by either: |

| | 1. | | Signing and returning a later dated WHITE proxy or voting instruction card. |

| | 2. | | Attending the Annual Meeting and voting in person. |

| Q: | | If I plan to attend the Annual Meeting, should I still vote by proxy? |

| A: | | Yes. Casting your vote in advance does not affect your right to attend the meeting. Written ballots will be available at the annual meeting of shareholders of record. If you send in your WHITE proxy card and also attend the meeting, you do not need to vote again at the meeting. |

Beneficial owners who wish to vote in person must request a proxy executed in their favor from the nominee and bring that proxy to the meeting.

| Q: | | Who do I call if I have questions about materials I received in the mail? |

| A: | | If you have any questions about the proxy materials, please call Georgeson Shareholder Communications at: |

toll-free: 1-800-545-1786

banks and brokers: 212-440-9800

2

Voting Procedures

General

| Q: | | Who can attend the annual meeting? |

| A: | | Only Cone Mills shareholders and holders of valid proxies are invited to attend the meeting. |

If you are a proxy holder for a Cone Mills shareholder, then you must bring:

| | • | | the validly executed proxy naming you as the proxy holder, signed by a Cone Mills shareholder who owned Cone Mills shares as of the record date; |

| | • | | valid government-issued personal identification with a picture (such as a driver’s license or passport); and |

| | • | | if the shareholder whose proxy you hold was not a record holder of Cone Mills shares as of the record date, proof of the shareholder’s ownership of Cone Mills shares as of the record date, in the form of a letter or statement from a bank, broker, or other nominee or the voting instruction card provided by the broker, in each case, indicating that the shareholder owned those shares as of the record date. |

| A: | | Those persons named on our records as owners of Cone Mills common stock at the close of business on July 24, 2003, are entitled to one vote per share. If you purchased Cone Mills common stock after July 24, 2003, you are not entitled to vote. |

| Q: | | How many shares are entitled to vote? |

| A: | | There are 25,941,475 shares of common stock outstanding and entitled to vote. Each share is entitled to one vote. |

| A: | | A quorum is the minimum number of shares required to hold a meeting of shareholders. Under the Cone Mills bylaws, a majority of the outstanding shares of stock entitled to vote at the meeting, or 12,970,738 shares of common stock, must be represented in person or by proxy in order to constitute a quorum. |

| Q: | | Who tabulates the votes? |

| A: | | Representatives of Georgeson Shareholder Communications will count the votes. |

| Q: | | How many votes are needed for the proposals to pass? |

| A: | | The three nominees for director who receive the most votes will be elected. |

An affirmative vote of a majority of the votes cast on proposal 2 is needed for approval.

| Q: | | What shares are reflected on my proxy? |

| A: | | Your WHITE proxy card reflects all shares owned by you at the close of business on July 24, 2003. For Cone Mills 401(k) plan participants, shares held in your accounts as of that date are included in the separate WHITE proxy voting instruction card supplied by the plan trustee. |

| Q: | | Where can I find the voting results of the meeting? |

| A: | | We will publish results of the meeting in our Quarterly Report on Form 10-Q for the quarter ending September 28, 2003, to be filed with the Securities and Exchange Commission on or about November 12, 2003. |

Shareholders of Record

You are a shareholder of record if your Cone Mills shares are registered in your own name with our transfer agent, Wachovia Bank, N.A. If you are a shareholder of record, we are sending these proxy materials directly to you and you have the right to grant your voting proxy to the persons appointed by Cone Mills or to vote in person at the annual meeting.

3

| A: | | You may vote by signing, dating and mailing your WHITE proxy card. |

| Q: | | What if I abstain or withhold authority to vote on a proposal? |

| A: | | If you sign and return your proxy card marked “abstain” or “withhold” on any proposal, your shares will not be voted on that proposal and will not be counted as votes cast in the final tally of votes with regard to that proposal. However, your shares will be counted for purposes of determining whether a quorum is present. |

| Q: | | What does discretionary authority mean for shareholders of record? |

| A: | | If you sign and return your proxy card without making any selections, the persons named on the proxy will vote your shares “for” proposal 1 and “for” proposal 2. If other matters come before the meeting, the persons named on the proxy card will have the authority to vote on those matters for you as they determine. At this time, we are not aware of any matters that will come before the meeting other than those disclosed in this proxy statement. |

| Q: | | How do I change my vote? |

| A: | | A shareholder of record may revoke a proxy by giving written notice to the Secretary before the meeting, by delivering a later-dated proxy in writing, or by voting in person at the meeting. If you have already sent a proxy card solicited by the dissidents’ group, you may revoke it and provide your support to our nominees by signing, dating and returning the enclosed WHITE proxy card. |

Beneficial Shareholders

You are a beneficial shareholder if a brokerage firm, bank, trustee or other agent (called a “nominee”) holds your stock. This is often called ownership in “street name,” because your name does not appear in our stock records. If your shares are held in street name, these materials are being forwarded to you by your broker or nominee, who is considered the shareholder of record with respect to those shares.

| A: | | You must follow the voting procedures of your broker, bank or trustee. Detailed instructions should be included with your proxy materials. You also should confirm in writing your instructions to the person responsible for your account and provide a copy of those instructions to our proxy solicitor, Georgeson Shareholder Communications, so that they can attempt to ensure that your instructions are followed. |

| Q: | | What if I abstain or withhold authority to vote or do not give the nominee voting instructions? |

| A: | | Under the rules of the New York Stock Exchange, a nominee may not vote on some proposals without receiving specific voting instructions from the beneficial owner. This is called a “broker nonvote.” Brokerage firms and other nominees do have the authority to vote shares on certain routine matters for which their customers do not provide voting instructions. |

These routine matters include the election of directors (unless a third party solicits votes for its own nominees) and the ratification of the appointment of McGladrey & Pullen, LLP as Cone Mills’ independent auditors.

The intended solicitation of proxies announced by the dissident group, the Cone Mills Shareholders’ Committee, will prevent nominees from voting your shares in the election of directors if you do not provide specific voting instructions. The Board and management opposes the dissidents’ solicitation of proxies and respectfully urges you:

| | • | | to instruct your nominee to vote your shares “for” the election of the Board’s nominees as directors by following the voting procedures of your broker, bank or trustee, and |

| | • | | not to return any proxy forms sent to you by or on behalf of the dissidents’ group. |

4

If you sign and return your broker voting instruction card marked “abstain” or “withhold” on a proposal, or if there is a “broker nonvote,” your shares will not be voted on the proposal and will not be counted as votes cast in the final tally of votes with regard to that proposal. In each case, your shares are counted for purposes of determining whether a quorum is present.

| Q: | | What does discretionary authority mean for beneficial shareholders? |

| A: | | If you sign and return your voting instruction card provided by the nominee without making any selections, the shares may be voted by the nominee for you on proposal 2. The nominee may not vote your shares for you on proposal 1 (election of directors) if a third party solicits proxies for its own nominees. |

The Cone Mills Shareholders’ Committee, a dissident group led by director Marc H. Kozberg, has announced its intention to solicit proxies for the election of directors in opposition to the solicitation by the Board. If you sign and return your broker voting instruction card without making any selections with regard to proposal 1, the nominee will not be able to vote your shares for the Board’s nominees. The Board and management oppose the dissidents’ solicitation of proxies and urge you both to instruct your broker, bank or trustee to vote your shares in favor of the Board’s nominees and not to sign or return any proxy form sent to you by the dissidents.

If other matters come before the meeting, the nominee may vote on those matters for you, subject to the New York Stock Exchange’s rules on the exercise of discretionary authority. At this time, we are not aware of any matters that will come before the meeting other than those disclosed in this proxy statement.

| Q: | | How do I change my vote? |

| A: | | To change your vote, follow the nominee’s procedures on revoking or changing your proxy. |

Employees

| Q: | | How do I vote if my shares are held in the Company Stock Fund of the 401(k) Program? |

| A: | | The enclosed WHITE proxy will serve as a confidential voting instruction for the Cone Mills 401(k) program. |

Vanguard Fiduciary Trust Company, trustee of the Company Stock Fund of the 401(k) Program, will vote your shares as instructed by you. To allow sufficient time for the trustee to vote, your instructions must be received by September 22, 2003. If voting instructions have not been received from participants by that date, the shares allocated to those participants’ accounts will be voted on each issue in the same proportion to the shares as to which voting instructions have been received from other participants in the plan.

Your Board opposes the solicitation of proxies that has been announced by the Cone Mills Shareholders’ Committee, a dissident group led by director, Marc H. Kozberg. The Board and management respectfully request that you do not sign or return any proxy forms or voting instruction cards sent to you by the dissident group.

General Matters

| Q: | | What do I do if I haven’t yet received any proxy and voting information in the mail? |

| A: | | If you have not received your proxy materials, please call Georgeson Shareholder Communications at 1-800-545-1786. You may also obtain a copy of the Cone Mills definitive proxy statement on Schedule 14A dated as of September 2, 2003 which contains the proxy statement, free of charge at www.SEC.gov. |

| Q: | | Where do I mail my proxy card if I lost my return envelope? |

| A: | | Please mail your WHITE proxy card or voting instruction card to the following address: Georgeson Shareholder Communications, Inc. |

17 State Street, 10th Floor

New York, NY 10004

| Q: | | Who pays the cost of solicitation? |

| A: | | Cone Mills pays the cost of preparing, mailing and distributing these proxy materials and soliciting your proxy and reimburses brokerage firms and others for forwarding these proxy materials to you. |

5

In addition to solicitation by mail, solicitation may also be made by personal interview, fax, telephone and electric communication by our directors, officers and senior management employees without added compensation. We have engaged Georgeson Shareholder Communications, a proxy solicitation firm, to assist with the distribution of our proxy materials and the solicitation of votes at a cost not to exceed $100,000, plus reasonable out-of-pocket expenses. There will be no specially engaged Cone Mills employees to engage in proxy solicitation and Georgeson will utilize approximately 35 persons in connection with this solicitation. Cone Mills estimates the total costs to be incurred in relation to the proxy solicitation to be $250,000. To date, Cone Mills has incurred approximately $100,000 in such costs.

| Q: | | When are shareholder proposals for next year’s annual meeting due? |

| A: | | If you want to present a proposal to be considered for inclusion in next year’s proxy statement, it must be delivered in writing to the Secretary at the Cone Mills Corporate Offices, 804 Green Valley Road, Greensboro, North Carolina 27408, no later than December 1, 2003. Any such proposal also will need to comply with the regulations of the Securities and Exchange Commission relating to the inclusion of shareholder proposals in Cone Mills-sponsored proxy materials. |

If you want to present a proposal for consideration at next year’s annual meeting, without including the proposal in the proxy statement (including the nomination of one or more directors), you must provide written notice to the Secretary at the above address no later than February 14, 2004. If you do not give timely notice of your proposal, the management proxies will have discretionary authority to vote with respect to your proposal without any requirement for the proxy statement to disclose how management intends to exercise its discretion.

There are additional requirements under the proxy rules to present a proposal, such as continuing to own a minimum number of Cone Mills shares until the annual meeting and appearing in person at the meeting to explain your proposal.

| Q: | | How can I receive a copy of the annual report? |

| A: | | The annual report for the year ended December 29, 2002, was mailed to shareholders on or about April 25, 2003. If you would like a copy of the annual report, please write to the Secretary at the Cone Mills Corporate Offices, 804 Green Valley Road, Greensboro, NC 27408 or call us at 1-336-379-6220. You may view the annual report on our website at http://www.cone.com/us/corporate/investors/html. |

6

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth each person or entity that may be deemed to have beneficial ownership of more than five percent (5%) of the outstanding common stock of Cone Mills as of July 24, 2003:

Name of and Address

of Beneficial Owner (1)

| | Amount and Nature of

Beneficial Ownership

| | | Percentage of Class

| |

Kozberg Group

701 Xenia Avenue South

Suite 130

Golden Valley, MN 55416 | | 2,461,260 | (2) | | 9.5 | % |

Dimensional Fund Advisors Inc.

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401 | | 2,081,600 | (3) | | 8.0 | % |

| (1) | | Does not include Vanguard Fiduciary Trust Company, trustee of the Company Stock Fund of the 401(k) Program, which held of record for the plan 2,349,844 shares of common stock on July 24, 2003. This represents 9.1% of the outstanding common stock. The plan trustee votes shares held in the plan pursuant to the instructions provided by participants through the exercise of pass-through voting rights. Shares for which no voting instructions are received from the participants to whose accounts the shares are allocated are voted by the trustee in the same proportion as the instructions received on voted shares. Because the plan trustee exercises investment or dispositive rights only in accordance with the instructions of the participants, the trustee disclaims beneficial ownership. |

| (2) | | According to a Schedule 14A filed with the Securities and Exchange Commission by Marc H. Kozberg, and nine other holders, a Section 13(d)(3) group, the group beneficially owns 2,461,260 shares with various combinations of sole voting power, shared voting power, sole dispositive power, and shared dispositive power, and options to purchase 2,000 shares. Former Director Marvin W Goldstein resigned from the Board of Directors on March 4, 2003 and has withdrawn from the Section 13(d)(3) group. |

| (3) | | According to a Schedule 13G filed with the Securities and Exchange Commission by Dimensional Fund Advisors Inc. (“Dimensional”), Dimensional has sole voting power with respect to 2,081,600 shares, shared voting power on no shares, sole dispositive power on 2,081,600 shares, and no shared dispositive power. All securities reported on the Schedule 13G are owned by advisory clients of Dimensional, none of which to the knowledge of Dimensional beneficially owns more than 5% of the outstanding shares of Cone Mills common stock. Dimensional disclaims beneficial ownership of all such securities. |

7

SECURITY OWNERSHIP OF DIRECTORS, NOMINEES AND NAMED EXECUTIVE OFFICERS

The following table sets forth certain information with respect to the beneficial ownership of Cone Mills common stock as of July 24, 2003:

Name of Director

Nominee or Officer

| | Amount and Nature of

Beneficial Ownership (1)(2)

| | Percentage of Class

|

John L. Bakane (3) | | 379,733 | | 1.5% |

Doris R. Bray | | 55,020 | | * |

Haynes G. Griffin | | 40,433 | | * |

Jeanette Cone Kimmel | | 161,552 | | * |

David T. Kollat | | 45,562 | | * |

Marc H. Kozberg (7) | | 2,461,260 | | 9.5% |

Thomas E. McKenna (3) | | 72,424 | | * |

Charles M. Reid | | 61,472 | | * |

John W. Rosenblum | | 43,732 | | * |

Gary L. Smith (3)(4) | | 106,973 | | * |

Dewey L. Trogdon (5) | | 499,392 | | 1.9% |

Michael J. Whisenant (3) | | 161,666 | | * |

Cyrus C. Wilson | | 33,614 | | * |

Marvin A. Woolen, Jr. (3)(6) | | 119,495 | | * |

All Directors and Executive Officers as a Group (3)

(18 persons) | | 4,552,020 | | 17.1% |

| * | | Represents less than 1%. |

| (1) | | Unless otherwise indicated, all shares are owned of record and the beneficial ownership consists of sole voting power and sole investment power. Includes shares subject to options that are presently exercisable or are exercisable within 60 days of July 24, 2003 as follows: Mr. Bakane (191,000 shares); Mr. Smith (86,000 shares); Mr. Woolen (86,000 shares); Mr. Whisenant (73,000 shares); Mr. McKenna (71,000 Shares); 7,000 for each of Mrs. Bray, Mrs. Kimmel, Mr. Reid, Mr. Rosenblum and Mr. Trogdon; 5,000 for Mr. Wilson; 3,000 for each of Messrs. Griffin and Kollat; 2,000 for Mr. Kozberg and all Directors and Executive Officers as a Group (678,400 shares). Does not include an option to purchase 1,000 shares to be granted to each nonemployee director as of the fifth business day after the Annual Meeting of Shareholders, pursuant to the 1994 Stock Option Plan for Non-Employee Directors. |

| (2) | | Does not include shares of the Company’s Class A Preferred Stock allocated to the individual accounts of officers in the Cone Mills Corporation 1983 ESOP. |

| (3) | | Includes shares of common stock allocated to the individual accounts of Directors and Named Executive Officers, as defined under Executive Compensation, in the Company Stock Fund of the 401(k) Program as of July 24, 2003 as follows: |

Mr. Bakane | | 49,069 shares |

Mr. McKenna | | 1,330 shares |

Mr. Smith | | 8,636 shares |

Mr. Whisenant | | 18,866 shares |

Mr. Woolen | | 21,495 shares |

All Directors and Executive Officers as a group (18 persons) | | 168,520 shares |

| (4) | | Includes 1,000 shares owned of record by Mr. Smith’s wife. |

| (5) | | Includes 125,000 shares owned of record by Mr. Trogdon’s wife. |

| (6) | | Includes 500 shares held in a custodian account for Mr. Woolen’s minor son. |

| (7) | | Mr. Kozberg is a member of a Section 13(d)(3) group that beneficially owns 2,461,260 shares (9.5%). |

8

No director of the Company, other than Mr. Kozberg, has purchased or sold Cone Mills common stock during the past two years except for 1,000 shares of Cone Mills common stock purchased by Mr. Rosenblum in the open market on November 7, 2001 for $1.70 per share and except for 5,000 shares of Cone Mills common stock purchased by Mr. Trogdon in the open market on August 29, 2001 for $1.50 per share. The following table sets forth shares issued to each director of the Company other than Mr. Kozberg as compensation for his or her service as a director during the past two years:

Director

| | Shares Issued on November 6, 2001 at $1.60 per share

| | Shares Issued on February 12, 2002 at $2.12 per share

| | Shares Issued on May 1, 2002 at $ 3.84 per share

| | Shares Issued on July 30, 2002 at $ 2.78 per share

|

Doris R. Bray | | 3,907 | | 2,713 | | 1,889 | | 2,429 |

Haynes G. Griffin | | 3,594 | | 2,713 | | 2,149 | | 1,889 |

Jeanette Cone Kimmel | | 3,594 | | 2,713 | | 2,540 | | 2,249 |

David T. Kollat | | 3,282 | | 2,713 | | 2,279 | | 2,249 |

Charles M. Reid | | 2,594 | | 2,713 | | 2,149 | | 2,429 |

John W. Rosenblum | | 3,282 | | 2,477 | | 1,889 | | 2,249 |

Dewey Trogdon | | 3,594 | | 2,713 | | 1,889 | | 2,429 |

Cyrus C. Wilson | | 3,594 | | 2,949 | | 2,279 | | 2,249 |

PROPOSAL 1—ELECTION OF DIRECTORS

The Restated Articles of Incorporation of Cone Mills Corporation provide for a Board of Directors consisting of not less than nine (9) or more than fifteen (15) members as determined by the majority vote of the entire Board of Directors. The Board of Directors currently consists of ten (10) members. The Restated Articles of Incorporation further provide that the Board shall be divided into three classes, as nearly equal in number as the then total number of directors constituting the entire Board permits.

Three Class II Directors are to be voted on at the 2003 Annual Meeting. The persons elected at the Annual Meeting to the Class II directorships will serve terms of three years to expire at the Annual Meeting in the year 2006, or until their successors are elected and qualified. The Board’s nominees to serve as Class II Directors are Jeanette Cone Kimmel, David T. Kollat and John W. Rosenblum, each of whom is an incumbent director of Cone Mills.

The Board’s nominees—Jeanette Cone Kimmel, Dr. David T. Kollat and Dr. John W. Rosenblum—are incumbent Directors who together have 46 years of experience on the Board. They have made enormous individual contributions to Cone Mills based on their considerable body of knowledge about our business and industry, their integrity, and their commitment to the highest standards of corporate governance.

| | • | | Jeanette Cone Kimmel, 64, is a private investment manager. She has been a Cone Board member since 1971. Our longest-serving Director, Mrs. Kimmel brings to the Board a wealth of knowledge of Cone Mills and the textile industry that has been invaluable to the Board over many years. She is also an experienced corporate investor with keen insights drawn from a wide range of business experience. She is a graduate of Middlebury College. Mrs. Kimmel’s address is 300 East 56th Street, Apt. 29-F, New York, NY 10022. |

| | • | | Dr. David T. Kollat, 65, a Board member since 1999, is the founder and President of 22, Inc., a company specializing in research and consulting for retailers and soft goods manufacturers. Dr. Kollat is a widely recognized expert in the marketing field whose knowledge of the retail apparel market is extremely valuable to Cone Mills. The holder of a Doctor of Business Administration degree (DBA) from Indiana University, he has written extensively in the marketing field and was Professor of Marketing at Ohio State University from 1965 to 1972. He has served in various executive positions at The Limited, Inc. and its subsidiaries, including as Executive Vice President of The Limited, Inc. and its |

9

| | subsidiary, The Limited Stores, Inc. and as President of the Victoria’s Secret Mail Order Division. He has also been a Director of Limited Brands, Inc. (NYSE: LTD) since 1976. Dr. Kollat’s business address is 4410 Smothers Road, Westerville, OH 43081. |

| | · | | Dr. John W. Rosenblum, 59, a Director since 1993, has been Dean—Emeritus of Darden Graduate School of Business Administration, University of Virginia since 2001. Dr. Rosenblum brings to our Board extensive experience in international business and issues of corporate governance. He holds DBA and MBA degrees from Harvard University and taught for 10 years at the Harvard Business School. He has served as Dean of the University of Virginia Darden Graduate School of Business Administration (1983 to 1996), as Dean of the University of Richmond Jepson School of Leadership Studies (1996 – 2000), and as Professor of the University of Richmond Jepson School of Leadership Studies (2000 – 2001). He also serves on the boards of directors of Chesapeake Corporation and Grantham, Mayo, Von Otterloo & Co. LLC. Dr. Rosenblum’s address is 854 Crozet Avenue, Crozet VA 22932. |

The Board’s nominees will be elected if they receive a plurality of the votes cast for their class of directors. Abstentions and broker nonvotes will not affect the election results if a quorum is present. Unless otherwise specified, the persons named in the accompanying proxy intend to vote the shares represented by proxy for election of the nominees named above. If any nominee should not be available to serve for any reason (which is not anticipated), the proxy holders may vote for substitute nominees designated by the Board of Directors or the Board may reduce the number of directors to be elected. A proxy cannot be voted for more than the number of nominees named.

The Board of Directors recommends a vote FOR all three nominees named above for election as directors. Please do so by signing, dating and returning the enclosed WHITE proxy card.

10

The following information is furnished with respect to directors continuing in office:

| | | | | CLASS III ( Term expiring 2004) | | |

Doris R. Bray 230 N. Elm Street,

Suite 1500 Greensboro, NC 27401 | | 65 | | Member, Schell Bray Aycock Abel & Livingston P.L.L.C., Attorneys at Law (1987 – Present). | | 1989 |

Marc H. Kozberg 701 Zenia Avenue South Suite 130 Golden Valley, MN 55416 | | 41 | | Chief Executive Officer, Oak Ridge Capital Group, Inc., (2003 – Present); President, Equity Investment Advisors (2001 – Present); President, Dougherty Value Advisors (2000 – 2001); President of Dougherty Summit Advisors and a General Partner of Summit Capital Appreciation Fund LP (1998 – 2000); Senior Vice President of Investments, Dougherty Summit Securities LLC (1995 – 1998). | | 1999 |

Dewey L. Trogdon 804 Green Valley Road Greensboro, NC 27408 | | 71 | | Chairman of the Board of Directors of Cone Mills (1981 – May 6, 2003); Chief Executive Officer of Cone Mills (1980 – 1990); President of the Cone Mills (1979 – 1980; 1987 – 1989). | | 1978 |

Cyrus C. Wilson 3082 Seabrook Island Road John’s Island, SC 29455 | | 65 | | Independent Consultant in international marketing and business development (1993 – Present); Partner, Price Waterhouse L.L.P., (1985 – 1993); Director, R. W. Sidley Corporation (2001 – Present); Faculty, The Citadel (2002 – Present). | | 1998 |

| | | | | CLASS I (Term expiring 2005) | | |

John L. Bakane 804 Green Valley Road Greensboro, NC 27408 | | 52 | | Chairman of the Board of Directors of Cone Mills (May 6, 2003 – Present); President and Chief Executive Officer of Cone Mills (1998 – Present); Chief Operating Officer of Cone Mills (1998); Executive Vice President of Cone Mills (1995—1998); President, Apparel Products Group of Cone Mills (1997 – 1999); Chief Financial Officer of Cone Mills (1988 – 1997); Vice President of Cone Mills (1986 – 1995). | | 2003 |

Haynes G. Griffin 701 Green Valley Road Suite 302 Greensboro, NC 27408 | | 56 | | Member, Prospect Partners LLC, a business advisory firm; Chairman and Chief Executive Officer, Buzz Off Insect Shield, LLC (2001 – Present); Chief Executive Officer, Gemini Networks, Inc. (1999 – Present); Founding President and Chief Executive Officer of Vanguard Cellular Systems, Inc. which was acquired by AT&T in 1999. | | 1999 |

Charles M. Reid 2200 Carlisle Road Greensboro, NC 27408 | | 69 | | Director and Chairman of United Guaranty Corporation, a member company of American International Group (2001 – Present); President and CEO of United Guaranty (1987 – 2001). | | 1988 |

11

COMMITTEES AND DIRECTOR ATTENDANCE

During the fiscal year ended December 29, 2002, the Board of Directors held eight meetings and its standing committees, the Executive, Audit, Compensation, and Nominating Committee, held four, four, five, and two meetings, respectively. Each director attended at least 80% of the aggregate of Board of Directors meetings and meetings of Committees of the Board on which he or she served during 2002.

The Executive Committee generally has the same authority as the Board to manage the affairs of Cone Mills but is limited by North Carolina General Statutes 55-8-25(d) and our Bylaws. In general, the Executive Committee may not make determinations with respect to dissolutions, mergers, and amendments to the Articles of Incorporation or Bylaws, compensation or filling vacancies of directors or committees of directors, authorize the issuance or reacquisition of shares, or declaration of dividends. Executive Committee members are Charles M. Reid, Chair, John L. Bakane, Dewey L. Trogdon, Doris R. Bray, and Haynes G. Griffin.

Cone Mills has an Audit Committee. See “Audit Committee Report.” Audit Committee members are Cyrus C. Wilson, Chair, Haynes G. Griffin, and Jeanette Cone Kimmel.

We also have a Compensation Committee. See “Compensation Committee Report on Executive Compensation” and “Compensation Committee Interlocks and Insider Participation.” Compensation Committee members are Charles M. Reid, Chair, Jeanette Cone Kimmel, David T. Kollat and John W. Rosenblum.

The Nominating Committee consists of independent outside directors, Cyrus C. Wilson, Chair, Haynes G. Griffin, and John W. Rosenblum, one committee member from each director class. The Nominating Committee identifies the appropriate qualifications and characteristics for Board and Committee membership, consults with other Board members regarding its nomination process, recommends to the Board of Directors a slate of directors for election by the shareholders at the Annual Meeting, and recommends to the Board of Directors any changes in Board and Committee compensation. While the committee does not have a formal process to consider nominees recommended by security holders at the present time, its processes will be conformed to applicable laws, rules and regulations on a timely basis.

SECTION (16)(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under federal securities laws, the directors and executive officers of Cone Mills, and any persons holding more than 10% of our stock are required to report their ownership of the Company’s stock and any changes in that ownership to the Securities and Exchange Commission. Specific due dates for these reports have been established and we are required to report in this proxy statement any failure to file by these dates during fiscal 2002 or prior fiscal years. Cone Mills has received advice from special independent counsel to the independent Audit Committee that Director Marc H. Kozberg has failed to comply with Section 16(a) of the Securities Exchange Act of 1934 because he has not filed required Form 4 reports with respect to common stock beneficially owned by him by virtue of his Section 13(d)(3) group. The Company has advised Mr. Kozberg and his counsel of the advice it received, and Mr. Kozberg has not yet made these filings. Other than with respect to Mr. Kozberg, all of these filing requirements were satisfied except that one transaction involving the Company Stock Fund of the 401(k) Program by Thomas J. McKenna was unintentionally not reported for 2001. The transaction has subsequently been reported. In making this statement, Cone Mills has relied on the written representations of certain reporting persons and the directors and officers and copies of reports filed with the Commission.

EXECUTIVE COMPENSATION

The following information relates to all compensation awarded to, earned by or paid pursuant to a plan or otherwise, to (i) the Chief Executive Officer of Cone Mills (the “CEO”) and (ii) the four most highly compensated executive officers, other than the CEO, who were serving as executive officers of Cone Mills on December 29, 2002. The CEO and the four most highly compensated officers are referred to as the Named Executive Officers.

12

The following information does not reflect any compensation earned and paid to the Named Executive Officers subsequent to December 29, 2002, unless otherwise indicated. Any such compensation earned and paid to the Named Executive Officers during 2003 will be recorded in the proxy statement for the Cone Mills 2004 Annual Meeting of Shareholders, unless such compensation is required to be reported previously.

Summary Compensation Table

The following table sets forth for the Named Executive Officers for each of the last three fiscal years’ annual compensation amounts as indicated by the applicable table headings. Annual Compensation, columns (c), (d) and (e), includes base salary and bonus earned during the year covered and, if applicable, other annual compensation not properly categorized as salary or bonus. Long-Term Compensation, column (g), reports the number of shares underlying stock option grants to the Named Executive Officers during the respective fiscal year. The Named Executive Officers were not awarded, granted or paid any forms of compensation that are required to be reported as Long-Term Compensation, column (h).

SUMMARY COMPENSATION TABLE

| | | | | Annual

Compensation

| | | | Awards

| | | | Payouts

| | |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | | (i) |

Name and

Principal Position

| | Year

| | Salary

($)

| | Bonus

($)(1)

| | Other

Annual

Compensation

($)(2)

| | Restricted Stock Awards

($)

| | Underlying

Options

(#)

| | LTIP

Payouts

($)

| | All Other

Compensation

($)(3)

|

John L. Bakane

President and Chief

Executive Officer | | 2002

2001

2000 | | 512,502

500,000

442,000 | | 407,438

—

70,000 | | —

—

— | | —

—

— | | — 75,000

20,000 | | —

—

— | | 6,873

7,560

9,760 |

Gary L. Smith

Executive Vice President and

Chief Financial Officer | | 2002

2001

2000 | | 255,000

250,000

209,600 | | 197,453

28,000

41,500 | | —

—

— | | —

—

— | | —

50,000

40,000 | | —

—

— | | 6,873

5,820

5,071 |

Thomas E. McKenna

Executive Vice President, Denim Merchandising and Marketing | | 2002

2001

2000 | | 255,000

250,000

200,834 | | 184,320

22,000

35,900 | | —

—

— | | —

—

— | | —

50,000

40,000 | | —

—

— | | 6,873

5,820

5,033 |

Marvin A. Woolen, Jr.

Vice President,

Cotton Purchasing | | 2002

2001

2000 | | 155,000

250,000

242,000 | | 151,908

15,000

30,100 | | —

—

— | | —

—

— | | —

40,000

40,000 | | —

—

— | | 6,873

5,820

10,167 |

Michael J. Whisenant

Executive Vice President,

Denim Products Operations | | 2002

2001

2000 | | 227,502

215,000

195,000 | | 166,060

22,000

34,900 | | —

—

— | | —

—

— | | —

50,000

40,000 | | —

—

— | | 6,506 5,576

7,227 |

| (1) | | Incentives were paid pursuant to a management incentive plan for 2000. Discretionary bonuses were paid to certain individuals for 2001 and for 2002. Mr. Bakane declined the opportunity to be considered for either discretionary bonus. Incentives were paid pursuant to an executive incentive plan for 2002. The table reflects the total incentive paid for 2002. See “Compensation Committee Report on Executive Compensation.” |

| (2) | | Does not include the amount of the incremental cost of certain incidental benefits, perquisites and other benefits, securities or property which in the aggregate do not exceed the lesser of $50,000 or 10% of the total amount of salary and bonus reported for the Named Executive Officers. |

| (3) | | Represents matching contributions to the 401(k) Program and the dollar value of insurance premiums paid by Cone Mills with respect to group term life insurance and universal life insurance for benefit of the Named Executive Officers as follows: |

| | A. | | 401(k) Plan matching contributions for 2002 were $4,400 for each of Mr. Bakane, Mr. Smith, Mr. McKenna, Mr. Whisenant, and Mr. Woolen. |

| | B. | | Insurance premiums for 2002: Mr. Bakane ($2,473); Mr. Smith ($2,473); Mr. McKenna ($2,473); Mr. Woolen ($2,473); and Mr. Whisenant ($2,106). |

13

| | C. | | A service award of $2,500 was paid to Mr. Bakane in 2000 pursuant to our service award program. |

Option/SAR Grants Table

There were no options granted to the Named Executive Officers during the fiscal year ended December 29, 2002.

Aggregated Option Exercises and Year-End Option Value Table

The following table shows stock option exercises by the Named Executive Officers during 2002, including the aggregate value of gains on the date of exercise (“Value Realized”). The table also sets forth the number of shares covered by exercisable and unexercisable options as of December 29, 2002, and the values of “in-the-money” options, which are options where the fiscal year-end market price of the underlying common stock exceeds the exercise price of such stock options.

AGGREGATED OPTION EXERCISES IN FISCAL YEAR 2002 AND FISCAL YEAR END OPTION VALUES

| (a) | | (b) | | (c) | | (d) | | (e) |

| | | | | | | Number of Securities

Underlying

Unexercised Options

at 12/29/2002

| | Value of Unexercised In-the-

Money Options at

12/29/2002

($)(1)

|

Name

| | Shares

Acquired on Exercise (#)

| | Value Realized ($)

| | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable

|

John L. Bakane | | — | | — | | 208,850/54,500 | | 20,700/31,050 |

Gary L. Smith | | — | | — | | 85,000/49,000 | | 13,800/20,700 |

Thomas E. McKenna | | — | | — | | 63,000/48,000 | | 13,800/20,700 |

Marvin A. Woolen, Jr. | | — | | — | | 75,000/43,000 | | 11,040/16,560 |

Michael J. Whisenant | | — | | — | | 65,000/48,000 | | 13,800/20,700 |

| (1) | | Based on $1.80 fair market value (closing price on NYSE) on December 27, 2002, the last trading day of fiscal year 2002. |

Pension Plan Table

PENSION PLAN TABLE

Average Annual

Compensation ($)

For Highest

Consecutive Five

Years During Last

Ten Years Before

Retirement

| | | | | | | | | | | | | | | | | | | | |

| | Approximate Annual benefit ($) for Years of Service Indicated

|

| | 15th Year

| | 20th Year

| | 25th Year

| | 30th Year

| | 35th Year

|

| | PP

| | NQP

| | PP

| | NQP

| | PP

| | NQP

| | PP

| | NQP

| | PP

| | NQP

|

200,000 | | 59,800 | | 5,414 | | 76,700 | | 4,955 | | 89,400 | | 3,379 | | 100,100 | | 2,532 | | 107,300 | | 1,436 |

250,000 | | 63,200 | | 18,490 | | 82,100 | | 20,973 | | 96,700 | | 20,498 | | 109,000 | | 21,120 | | 117,300 | | 20,564 |

300,000 | | 63,200 | | 34,990 | | 82,100 | | 42,373 | | 96,700 | | 44,898 | | 109,000 | | 48,620 | | 117,300 | | 49,664 |

400,000 | | 63,200 | | 67,890 | | 82,100 | | 85,173 | | 96,700 | | 93,798 | | 109,000 | | 103,520 | | 117,300 | | 107,864 |

500,000 | | 63,200 | | 100,890 | | 82,100 | | 127,973 | | 96,700 | | 142,598 | | 109,000 | | 158,420 | | 117,300 | | 166,064 |

600,000 | | 63,200 | | 133,790 | | 82,100 | | 170,773 | | 96,700 | | 191,498 | | 109,000 | | 213,320 | | 117,300 | | 224,264 |

700,000 | | 63,200 | | 166,690 | | 82,100 | | 213,573 | | 96,700 | | 240,398 | | 109,000 | | 268,220 | | 117,300 | | 282,464 |

800,000 | | 63,200 | | 199,690 | | 82,100 | | 256,473 | | 96,700 | | 289,198 | | 109,000 | | 323,120 | | 117,300 | | 340,564 |

900,000 | | 63,200 | | 232,590 | | 82,100 | | 299,273 | | 96,700 | | 338,098 | | 109,000 | | 378,020 | | 117,300 | | 398,764 |

1,000,000 | | 63,200 | | 265,590 | | 82,100 | | 342,073 | | 96,700 | | 386,898 | | 109,000 | | 432,920 | | 117,300 | | 456,964 |

The above table sets forth in the “PP” column the estimated annual benefits payable upon retirement in 2003 at age 65 under the salaried employee program of the Pension Plan of Cone Mills Corporation (the “PP”) in the compensation and years of service categories indicated. Benefit amounts shown are payable for life with no contingent death benefits. Benefits are based upon total annual salary and bonus, compensation in excess of the amount covered by Social Security as determined in the year of retirement, and total years of service. The years

14

of service credited as of July 24, 2003 for the Named Executive Officers are: Mr. Bakane – 28 years; Mr. Smith – 21 years; Mr. McKenna – 22 years; Mr. Woolen – 8 years; and Mr. Whisenant – 36 years. The accrued benefits under the Pension Plan for salaried employees were frozen as of June 30, 2001 after granting 18 months of additional accredited service. Service after June 30, 2001 accrues no additional benefits but does count towards vesting and early retirement subsidies.

Pension benefits under the PP are subject to certain limitations imposed by the Internal Revenue Code of 1986, as amended. The aggregate annual pension that may be paid under the PP and all other defined benefit plans of the Corporation taken together is generally restricted to $160,000 in 2002 and $160,000 in 2003. In addition, the Internal Revenue Code limits annual compensation of each employee that can be taken into account in computing pension benefits to $200,000 in 2002 and $200,000 in 2003. These amounts may be adjusted in the future for cost of living as provided in the Internal Revenue Code. Pension benefits that cannot be paid from the PP for salaried employees by reason of the limitations in the Internal Revenue Code are provided by the Cone Mills Excess Benefit Plan and by the Supplemental Executive Retirement Plan, both of which are unfunded, nonqualified benefit plans. Such amounts are identified in the above table in the columns headed “NQP”. Accrued benefits under these plans were also frozen as of June 30, 2001. Cone Mills has established a “rabbi” trust agreement that will be funded upon a change of control with the accrued vested benefits in these nonqualified plans. A change of control is defined as a transaction in which a 50% change in the ownership of the outstanding shares occurs, a report is filed with the Securities and Exchange Commission on Schedule 13D or 14D-1, disclosing that a person has become the beneficial owner of more than 50% of the common stock, or a change in the majority of the directors during a two-year period of time not approved by two-thirds of the directors who were in office at the beginning of the period.

Cone Mills accrues annually the estimated expense for providing benefits under the PP and the nonqualified plans, as determined by an independent consulting actuary; however, this expense cannot be specifically allocated to any individual or to the Named Executive Officers as a group under the funding method used by the actuary.

Pension benefits provided by the PP with respect to service after 1983 are subject to a “floor offset” arrangement in conjunction with the Cone Mills Corporation 1983 ESOP (the “1983 ESOP”), a separate defined contribution pension plan maintained by Cone Mills. The amounts shown in the above table are calculated on the assumption that the participant elects to receive the maximum pension benefit available under the PP, and in accordance with the terms of each plan, authorizes a transfer of funds in his 1983 ESOP account to the trustee of the PP in a dollar amount equal to the actuarial equivalent of the pension benefit attributable to service after 1983. The balance, if any, in the 1983 ESOP account will be distributed to the participant. To the extent that a participant’s 1983 ESOP account is insufficient to fund the pension benefits attributable to service after 1983, the cost of benefits not covered by the 1983 ESOP will be funded through the PP. If the participant does not elect to transfer funds from his 1983 ESOP account to the trustee of PP, his account balance will be distributed in accordance with the terms of the 1983 ESOP, and his pension payable from the PP with respect to service after 1983 will be reduced (but not below zero) by the actuarial equivalent of his 1983 ESOP account balance. The 1983 ESOP is designed to invest primarily in qualifying securities under ERISA. Assets of the 1983 ESOP consist of shares of Cone Mills Class A Preferred Stock and other money market and marketable debt securities that are allocated to individual accounts of participants. The fair market value of the stock is determined by independent appraisal performed several times each year. No contributions to the 1983 ESOP have been made for salaried employees since 1986. The value of the account in the 1983 ESOP for each of the Named Executive Officers as of December 31, 2002 was: Mr. Bakane – $112,360; Mr. Smith – $44,246; Mr. McKenna – $59,523; Mr. Woolen – $0; and Mr. Whisenant – $123,985.

Compensation of Directors

Directors who are also officers of Cone Mills do not receive additional compensation for service as directors or as members of committees of the Board of Directors. Effective October 1, 2002, nonemployee directors

15

receive a retainer fee of $20,000 per year and an attendance fee of $1,500 per diem for meetings of the Board of Directors. No additional fee is paid for meetings of any committee of the Board held on the same day as a Board meeting. The fee for a Committee meeting not held on the same day as a Board meeting is $1,000. Meetings designated as telephone meetings are compensated at one half the normal rate. On May 6, 2003, the Board designated Charles M. Reid as Lead Director for the period until the 2004 Annual Meeting of Shareholders. In view of the Lead Director’s additional responsibilities and time commitment, the position’s meeting and retainer fees were increased to 50% above those paid to other non-executive directors. Travel expenses of directors incurred in attending meetings are reimbursed by Cone Mills in cash.

The shareholders approved at the 1994 Annual Meeting the 1994 Stock Option Plan for Non-Employee Directors whereby each nonemployee director receives each year after the annual meeting of shareholders a stock option grant to purchase 1,000 shares of Cone Mills common stock at the fair market value of a share of common stock on the grant date. The grant date is the fifth business day after the annual meeting.

The shareholders approved at the 2000 Annual Meeting the 2000 Stock Compensation Plan for Non-Employee Directors (“2000 Plan”), terminated effective August 8, 2002, which provided for the payment of directors’ fees to nonemployee directors in Cone Mills common stock rather than in cash and allowed nonemployee directors to defer payment of such fees. Pursuant to the terms of the 2000 Plan, each eligible director was granted on a quarterly basis either shares or deferred stock units as compensation for director’s fees earned as a retainer for serving as a director in that period and as fees for attendance at regular or special meetings of the Board or any committee of the Board. Each nonemployee director could elect on an annual basis whether to receive either shares or deferred stock units. The number of shares or deferred stock units granted each quarter was determined by the fair market value of a share of common stock on the fifth trading day after Cone Mills announced its earnings for the most recently ended fiscal quarter.

In 2002, retainers and attendance fees paid to all directors totaled 112,999 shares of common stock (cash equivalent of $298,924) and $66,000 in cash.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Charles M. Reid, Jeanette Cone Kimmel, David T. Kollat, and John W. Rosenblum, all of whom are directors who are not current or former employees of the Corporation.

Compensation Committee Report on Executive Compensation

Cone Mills’ executive compensation program is administered by the Compensation Committee of the Board of Directors. The Committee’s membership is comprised of independent directors, none of whom participate in any of the plans administered by the Committee. It is the responsibility of the Compensation Committee to review and make recommendations to the Board of Directors concerning the salaries and to approve grants of incentive compensation, stock options, restricted stock or performance shares for the Chief Executive Officer and the other executive officers of Cone Mills.

Compensation Policy

Cone Mills strives to provide executives with an opportunity to earn compensation that is fair, reasonable and competitive with that paid by comparable companies to executives in similar positions with similar duties and responsibilities. In accordance with the policy, the Committee is guided by three goals as it considers the compensation of executive officers. First, executive compensation must be effective in attracting, motivating and retaining executives who possess the skills and experience necessary to ensure our success. Second, Cone Mills should recognize and reward executives for their contributions to the success of the business. Third, we must be aware of the importance of planning and controlling the cost of executive compensation.

16

To implement this policy, Cone Mills maintains an executive compensation program that consists of base salaries, annual incentive plans, stock plans and competitive benefits. It is the belief of the Committee that through these components executives are provided compensation and benefits that are competitive; are provided incentives for additional annual compensation that is earned only upon achievement of performance standards as established and approved each year; and are provided long-term incentive compensation through the grant of stock options, restricted stock or performance shares that can appreciate in value.

In managing the compensation policy, the Committee considers the base salary, annual incentive, and bonus, and long-term incentives for each executive position as total direct compensation. The long-term incentive portion is comprised of stock options, valued by the Black-Scholes method, and restricted or performance shares. An analysis of total direct compensation is prepared by management for the Compensation Committee. In the analysis, our executive positions are matched with similar positions at other companies based on data from executive compensation surveys and a survey of the textile industry, including proxy statements of companies that are in the peer group for the Performance Graph set forth below. From the survey, a “target” of total direct compensation and the “mix” of the components for each executive position are developed by the Committee. These respective benchmarks are used as guidelines in developing the total compensation and the components for each position analyzed.

Base Salaries

The Committee’s objective in establishing the base salaries of the Named Executive Officers is to provide base salaries at competitive market levels with other industry leaders in order to reward and encourage individual performance. The base salary of the Chief Executive Officer is evaluated solely by the Compensation Committee and the base salary of other executive officers is determined by the Committee based upon recommendations from the Chief Executive Officer. Final approval of base salaries of the Chief Executive Officer and the other executive officers is made by the nonemployee members of the Board of Directors after receiving recommendations of the Committee. The Committee deems its compensation decisions to be a cumulative process involving a substantial amount of judgment concerning an executive’s experience and responsibilities against objective information furnished in advance of its deliberations.

In developing current base salary levels, including that of the Chief Executive Officer, the Committee reviewed management’s assessment of base salaries, annual bonus compensation, and other forms of annual cash compensation paid in the textile industry over the previous three years. Long-term incentives were not considered with no grants being made. In the analysis, a weighted composite for base salaries was calculated, then the Committee compared executive base salaries to the market composite and considered those comparisons in making base salary decisions. In general, the Committee targets executive base salaries at the textile average or composite/textile survey average; however, in a given year an individual executive’s base salary may vary from the average due to experience, performance, or other factors deemed relevant by the Committee and considered on a subjective basis. The base salaries of the Named Executive Officers, including the Chief Executive Officer, were increased on July 1, 2002 in order to maintain them closer to the market average rate and to allow for promotions or additional responsibilities, salaries having been frozen for eighteen months, as had other salaried employees. In addition, at the time of these salary increases, a discretionary bonus was paid to the Named Executive Officers, and other executive officers, to reflect their efforts in returning the Company to profitability and to assist in closing the gap between annual base salary and the market mean for comparable positions as reflected by the survey data. Mr. Bakane declined this discretionary bonus. For 2003, salary increases were granted to the Named Executive Officers, and other executive officers, to maintain competitive base salaries with comparable positions in the textile industry.

Incentive Compensation

The 1997 Senior Management Incentive Compensation Plan (“1997 Plan”) for the officers and division presidents and other key management employees as selected by the Committee expired December 31, 2001. For 2001 the 1997 Plan’s criteria were not met for payment of incentives under the plan and incentive awards could

17

not have been made in accordance with its provisions in any event. The 2002 Executive Incentive Compensation Plan (“2002 Plan”), approved by the shareholders at the 2002 Annual Meeting in furtherance of the original objectives of the 1997 Plan, was specifically designed to assure compensation paid is qualified performance- based compensation as defined in Section 162(m) of the Internal Revenue Code. (See discussion below entitled “Deductibility of Compensation.”) The 2002 Plan sets forth the business criteria on which incentive compensation can be granted according to preestablished objectives, numerical formulae and the process by which goals are established and compensation awarded. For 2002, the 2002 Plan’s criteria for payment of incentives under the plan were met. Accordingly, incentive awards were made pursuant to its provisions.

The Committee also believes that not all incentive compensation can be objectively measured even though it is based upon strategic performance goals and that some discretion is warranted in administering compensation plans. Upon the Committee’s recommendation, the Board of Directors established in 1996 a separate plan entitled the 1997 Senior Management Discretionary Bonus Plan (“1997 Bonus Plan”) to authorize the grant of a completely discretionary bonus in an amount not to exceed 30% of base salary if the Committee and the Board deem special circumstances warrant the grant. An award under the 1997 Bonus Plan would not qualify as performance-based compensation under the Internal Revenue Code, Section 162(m).

In January 2002, the Committee granted a total of $350,000 in discretionary bonuses to certain of its senior managers in recognition of contributions to the implementation of the 2001 Reinvention Plan, which were paid in second quarter 2002. Cone Mills recognized this compensation expense during 2001, and these amounts were reported in the Proxy Statement for the 2002 Annual Meeting of Shareholders. Mr. Bakane declined to participate in this discretionary bonus payment as well. Also see “Base Salaries” above.

Stock Options, Performance Shares, and Restricted Stock

The Amended and Restated 1992 Stock Plan expired on March 16, 2002. Options to purchase 318,000 shares of common stock were awarded under this plan in 2001 and 186,500 shares remained available for grant at the time of expiration. Cone Mills maintains the 2001 Stock Incentive Plan through which key management employees have received grants of stock options and may receive in the future grants of performance shares and performance units, stock appreciation rights, restricted stock, deferred shares, and other stock-based awards. Grants comprise the long-term incentive component of the total direct compensation analysis discussed above, and the Committee uses the analysis and recommendations of the Chief Executive Officer as a guideline in making awards to other participants. There were no grants under this plan in 2002.

Chief Executive Officer Compensation

Compensation for the Chief Executive Officer is established in accordance with the principles described above. As indicated, the Committee reviews the Chief Executive Officer’s performance and establishes his base salary considering the various factors described above. The amount of incentive compensation for the Chief Executive Officer under the 2002 Plan is based upon the achievement of certain goals established by the Committee at the beginning of each year. The percentage of incentive compensation earned is based on the level of success achieved within the pre-established ranges of performance measured by cash return on investment (CROI). Mr. Bakane’s annual base salary was increased from $500,000 to $525,000 effective July 1, 2002 as discussed above and he declined the opportunity to be considered for a discretionary bonus in 2002 as described above. Mr. Bakane’s base salary for 2003 has been established at $585,000.

Deductibility of Compensation

As part of the Omnibus Budget Reconciliation Act passed by Congress in 1993, the Internal Revenue Code was amended to add Section 162(m), which limits the deductibility for federal income tax purposes of compensation paid to the Chief Executive Officer and the next four most highly compensated executive officers of the Corporation. Under Section 162(m), compensation paid to each of these officers in excess of $1 million per year is not deductible unless it is “performance based.” The Committee did not consider the deductibility

18

limits in making its compensation decisions for any one of the Named Executive Officers for the 2001 or the 2002 fiscal years as the deductibility limits would not be exceeded under any circumstances. However, the Committee’s policy is to design and administer compensation programs that meet the objectives set forth above and reward executives for corporate performance that meets established financial goals and, to the extent reasonably practicable and to the extent consistent with its other compensation objectives, to maximize the amount of compensation expense that is tax deductible by the Corporation. The adoption of the 1997 Senior Management Incentive Compensation Plan and the amendments to the 1992 Stock Option Plan described above, the adoption of the 2001 Stock Incentive Plan and the 2002 Executive Incentive Compensation Plan were recommended as part of such policy.

Compensation Committee

Charles M. Reid, Chair

Jeanette Cone Kimmel

David T. Kollat

John W. Rosenblum

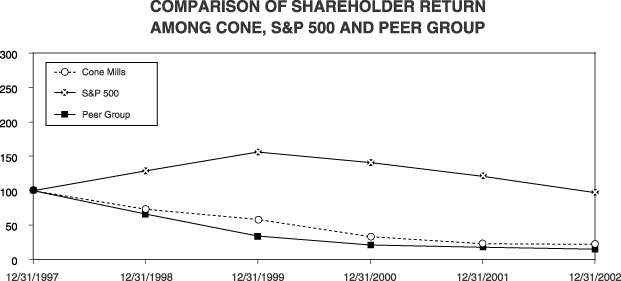

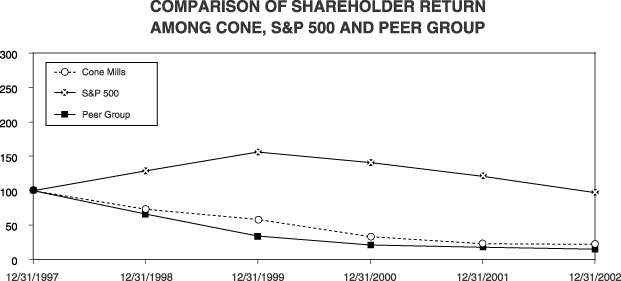

Performance Graph

The following graph compares the percentage change in the cumulative total shareholder return in Cone Mills common stock with the cumulative return of the Standard & Poor’s 500 Stock Index and with a peer group index for the period from December 31, 1997 to December 31, 2002 (assuming the reinvestment of any dividends and an investment of $100 in each on December 31, 1997). The peer group index has been constructed by calculating the cumulative total return of the common stock of the following companies: Burlington Industries, Inc.; Culp Inc.; Dan River Inc.; Delta Woodside Industries, Inc.; Galey & Lord, Inc; Guilford Mills, Inc.; Quaker Fabric Corporation; Tarrant Apparel Group; Unifi, Inc. and WestPoint Stevens, Inc. The return of each peer company was weighted according to its stock market capitalization as of the beginning of the period.

| | | 12/31/1997

| | 12/31/1998

| | 12/31/1999

| | 12/31/2000

| | 12/31/2001

| | 12/31/2002

|

Cone Mills | | $ | 100 | | $ | 73 | | $ | 58 | | $ | 33 | | $ | 23 | | $ | 22 |

S&P 500 | | $ | 100 | | $ | 129 | | $ | 156 | | $ | 141 | | $ | 121 | | $ | 97 |

Peer Group | | $ | 100 | | $ | 66 | | $ | 34 | | $ | 21 | | $ | 18 | | $ | 15 |

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Doris R. Bray, a Class III Director, is a member of Schell Bray Aycock Abel & Livingston P.L.L.C., a law firm that regularly serves as counsel to Cone Mills.

Audit Committee Report

The Audit Committee is appointed by the Board of Directors to assist the Board in monitoring the integrity of Cone Mills’ financial statements, the compliance of Cone Mills with legal and regulatory requirements and the independence and performance of the Company’s internal and external auditors. The Committee meets with management periodically to consider the adequacy of the Company’s internal controls and the objectivity of its financial reporting. The Committee discusses these matters with the Company’s independent auditors and with appropriate internal auditors and financial personnel. The Committee regularly meets privately with both the independent auditors and the internal auditors, each of whom has unrestricted access to the Committee. The Committee also recommends to the Board the appointment of the independent auditors and reviews periodically their performance and independence from management.

The Directors who serve on the Committee are all “Independent” for purposes of the New York Stock Exchange listing standards. That is, the Board of Directors has determined that there is no relationship with Cone Mills that may interfere with his or her independence from Cone Mills and its management. The Board has adopted a written charter setting out the audit-related functions the Committee is to perform, and the Board plans for the Committee and the written charter to be in full compliance with all new legal and regulatory requirements on a timely basis.

Management has primary responsibility for the Company’s financial statements and the overall reporting process, including the Company’s system of internal controls. The independent auditors audit the annual financial statements prepared by management, express an opinion as to whether those financial statements fairly present the financial position, results of operations and cash flows of Cone Mills in conformity with accounting principles generally accepted in the United States of America and discuss with the Committee any issues they believe should be raised.

For fiscal year 2002, the Committee reviewed Cone Mills’ audited financial statements and met with both management and McGladrey & Pullen, LLP, the Company’s independent auditors, to discuss those financial statements. Management has represented to the Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America.

The Committee has received from and discussed with McGladrey & Pullen, LLP the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). These items relate to that firm’s independence from Cone Mills. The Committee also discussed with McGladrey & Pullen, LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

Based on these reviews and discussions, the Committee recommended to the Board that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 29, 2002.

In addition, on the matter of auditor independence, the Committee provides the following information:

Audit Fees

The aggregate fees billed for professional services rendered for the audit of the Company’s annual financial statements for 2002 and the reviews of financial statements included in the Company’s reports on Form 10-Q were $222,620 and $218,335 for fiscal years 2002 and 2001, respectively.

20

Audit-Related Fees

Audit-related fees were $37,500 for 2002 and $33,500 for 2001. These were audit fees in connection with the Company’s employee benefit plans.

Tax Fees

Tax fees were $8,500 for 2002 and 2001 for the preparation of Form 5500’s for certain employee benefit plans as well as $75,000 for corporate structure consultation in 2001.

All Other Items

All other fees, all of which were related to miscellaneous items, none constituting financial information systems designed implementation fees, were $14,529 for 2002 and $14,462 for 2001.

Total Fees

Total fees were $283,149 for 2002 and $349,797 for 2001. The Committee has considered whether the rendering of these services is compatible with maintaining the independence of McGladrey & Pullen, LLP, and determined that it is compatible because all services rendered related directly to financial statements or reports of Cone Mills or its retirement plans as contained in various filings with the Securities and Exchange Commission.

Audit Committee

Cyrus C. Wilson, Chair

Haynes G. Griffin

Jeanette Cone Kimmel

PROPOSAL 2—SELECTION OF AUDITORS

The Board of Directors has appointed McGladrey & Pullen, LLP, independent certified public accountants, as auditors of Cone Mills’ records for the fiscal year 2003. McGladrey & Pullen, LLP or its predecessor, has acted as auditors for Cone Mills since 1943 and continues to be considered by the Board to be well qualified.

Although not required to do so, the Board believes it is desirable to submit its appointment of this firm to the shareholders at the Annual Meeting for ratification. Representatives of McGladrey & Pullen, LLP are expected to be present at the meeting and will be available to respond to appropriate questions or to make a statement if they desire to do so.

The Board of Directors recommends a vote FOR the ratification of the appointment of McGladrey & Pullen, LLP.

21

OTHER MATTERS

The Board of Directors is not aware of any matters, other than those described above, that will be presented for consideration at the 2003 Annual Meeting. If other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed white proxy card to vote thereon in accordance with their best judgment. Moreover, the Board reserves the right to adjourn, postpone or reschedule the Annual Meeting, depending on the circumstances and the Board’s belief that any such adjournment, postponement or rescheduling would be in the best interests of all Cone Mills shareholders.

By order of the Board of Directors.

NEIL W. KOONCE

NEIL W. KOONCE

Vice President, General Counsel and Secretary

22

CONE

CONE MILLS

CORPORATION

Annual Meeting of

Shareholders

to be held on September 25, 2003

FOLD AND DETACH HERE