Exhibit 99.3

2019 Year - End Investor Call February 20, 2020

Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabi lit ies allocated to such business, but rather represent a direct interest in Eversource Energy's assets and liabilities as a whole. EPS by business i s a non - GAAP (not determined using generally accepted accounting principles) measure that is calculated by dividing the net income or loss attributable to co mmon shareholders of each business by the weighted average diluted Eversource Energy common shares outstanding for the period. Earnings discussions al so include non - GAAP financial measures referencing 2019 earnings and EPS excluding the NPT impairment charge. Eversource Energy uses these non - GAAP financial measures to evaluate and provide details of earnings results by business and to more fully compare and explain 2019 results w ith out including the impact of the NPT impairment charge. Management believes the NPT impairment charge is not indicative of Eversource Energy’s ongoing pe rformance. Due to the nature and significance of the NPT impairment charge on net income attributable to common shareholders, management believ es that the non - GAAP presentation is a more meaningful representation of Eversource Energy’s financial performance and provides additional and use ful information to readers in analyzing historical and future performance of the business. Non - GAAP financial measures should not be considered as alterna tives to Eversource Energy’s consolidated net income attributable to common shareholders or EPS determined in accordance with GAAP as indicators of Eversource Energy’s operating performance. This includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, assumpti ons of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking state ments” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements throu gh the use of words or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could” and ot her similar expressions. Forward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those inc luded in the forward - looking statements. Factors that may cause actual results to differ materially from those included in the forward - looking statements in clude, but are not limited to: cyberattacks or breaches, including those resulting in the compromise of the confidentiality of our proprietary information a nd the personal information of our customers; ability or inability to commence and complete our major strategic development projects and opportunities; acts of war or terrorism, physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas and water distri but ion systems; actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard performance of third - party supplie rs and service providers; fluctuations in weather patterns, including extreme weather due to climate change; changes in business conditions, which coul d i nclude disruptive technology or development of alternative energy sources related to our current or future business model; contamination of, or di sruption in, our water supplies; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment a bil ity; changes in levels or timing of capital expenditures; disruptions in the capital markets or other events that make our access to necessary capital mor e difficult or costly; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations; changes in accountin g s tandards and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC) and up dat ed as necessary, and are available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors ar e difficult to predict and contain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control . You should not place undue reliance on the forward - looking statements; each speaks only as of the date on which such statement is made, except as req uired by federal securities laws, and Eversource Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Agenda Jim Judge Chairman, President & CEO Phil Lembo Executive Vice President and CFO ▪ 2019 Successes ▪ Clean Energy Leadership ▪ Offshore Wind Update ▪ Shareholder Value ▪ 2019 Performance ▪ 2020 Outlook ▪ 2020 - 2024 Capex and Growth Rate ▪ Regulatory Update ▪ Financing Plans 2

Jim Judge Chairman, President & Chief Executive Officer 3

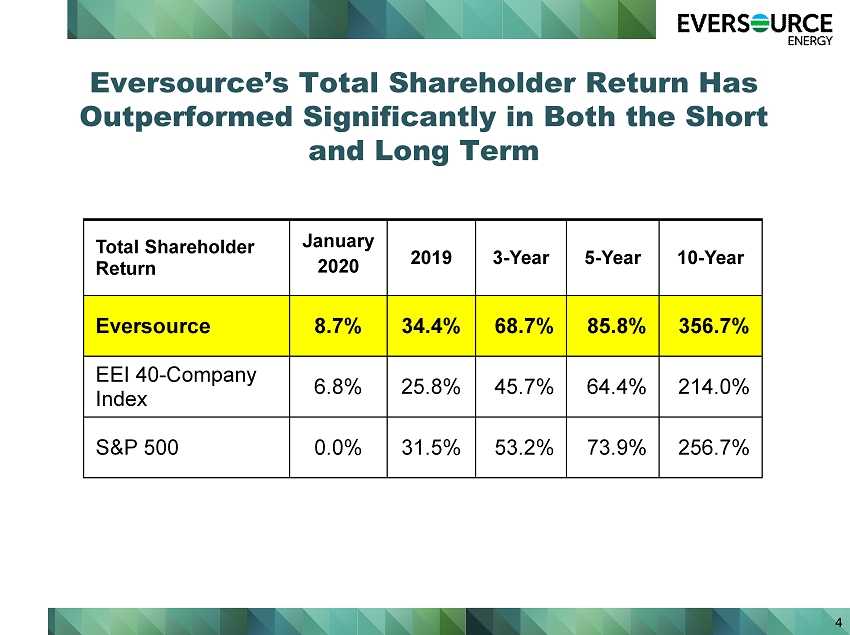

Eversource’s Total Shareholder Return Has Outperformed Significantly in Both the Short and Long Term 4 Total Shareholder Return January 2020 2019 3 - Year 5 - Year 10 - Year Eversource 8.7% 34.4% 68.7% 85.8% 356.7% EEI 40 - Company Index 6.8% 25.8% 45.7% 64.4% 214.0% S&P 500 0.0% 31.5% 53.2% 73.9% 256.7%

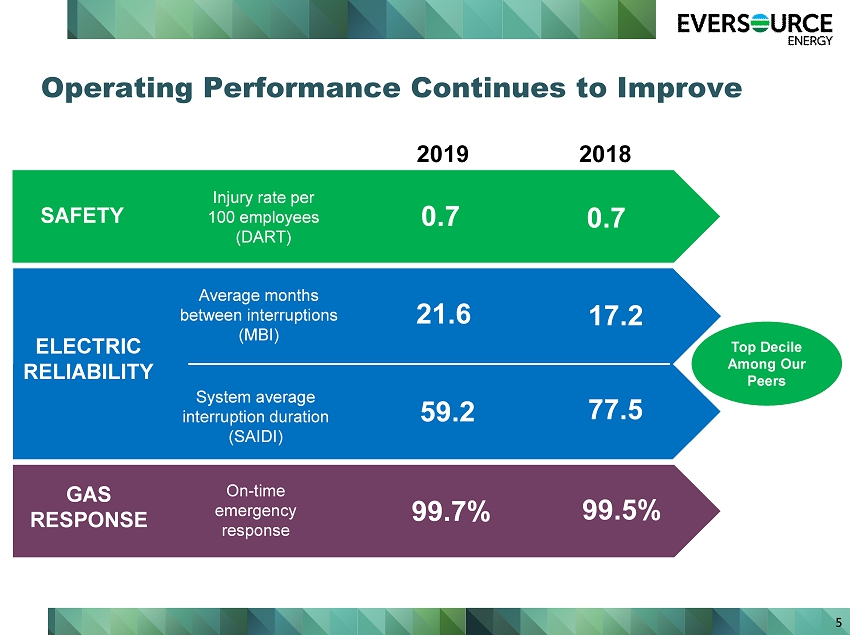

Operating Performance Continues to Improve SAFETY Injury rate per 100 employees (DART) 0.7 Average months between interruptions (MBI) System average interruption duration (SAIDI) On - time emergency response GAS RESPONSE ELECTRIC RELIABILITY 0.7 2019 2018 21.6 17.2 59.2 7 7.5 99.7% 99.5% Top Decile Among Our Peers 5

Eversource Recognized as the Leading Energy Company 6 #1 Energy and Utilities Company on Newsweek magazine’s Most Responsible Companies list Eversource became a Most Honored Company in 2020 Top level ESG and ESG risk rating #1 for utilities on list of America’s Most Just Companies

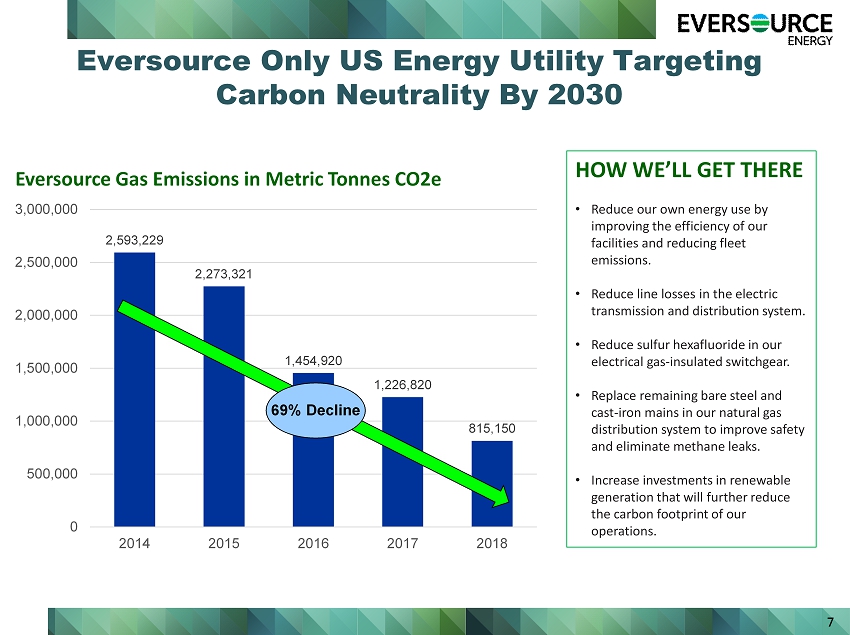

7 Eversource Gas Emissions in Metric Tonnes CO2e Eversource Only US Energy Utility Targeting Carbon Neutrality By 2030 HOW WE’LL GET THERE • Reduce our own energy use by improving the efficiency of our facilities and reducing fleet emissions. • Reduce line losses in the electric transmission and distribution system. • Reduce sulfur hexafluoride in our electrical gas - insulated switchgear. • Replace remaining bare steel and cast - iron mains in our natural gas distribution system to improve safety and eliminate methane leaks. • Increase investments in renewable generation that will further reduce the carbon footprint of our operations. 2,593,229 2,273,321 1,454,920 1,226,820 815,150 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 2014 2015 2016 2017 2018 69% Decline

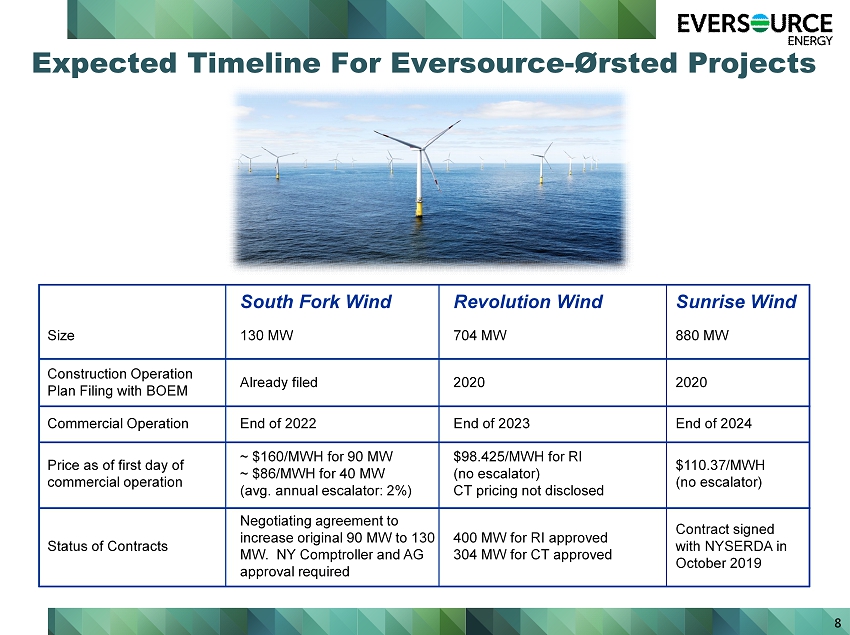

South Fork Wind Revolution Wind Sunrise Wind Size 130 MW 704 MW 880 MW Construction Operation Plan Filing with BOEM Already filed 2020 2020 Commercial Operation End of 2022 End of 2023 End of 2024 Price as of first day of commercial operation ~ $160/MWH for 90 MW ~ $86/MWH for 40 MW (avg. annual escalator: 2%) $98.425/MWH for RI (no escalator) CT pricing not disclosed $110.37/MWH (no escalator) Status of Contracts Negotiating agreement to increase original 90 MW to 130 MW. NY Comptroller and AG approval required 400 MW for RI approved 304 MW for CT approved Contract signed with NYSERDA in October 2019 8 Expected Timeline For Eversource - Ørsted Projects

9 Not to scale Revolution Wind South Fork Wind Block Island Wind Deepwater Northern Lease Bay State Wind Lease Mayflower Lease 20 - 25 Miles 35 - 40 Miles 60 - 65 Miles Distance to Mainland Our Competitiveness in New England and New York Auctions Benefits From Our Superior Lease Locations

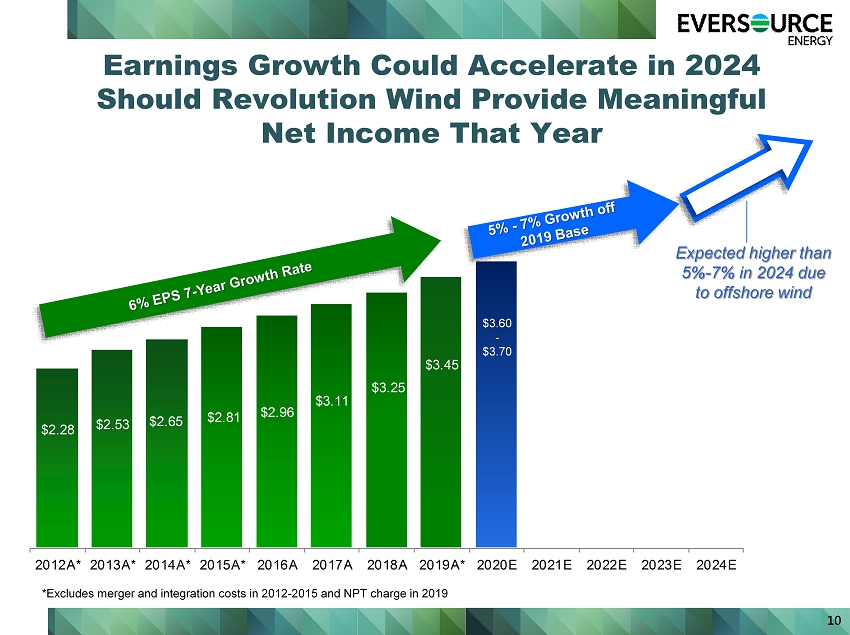

10 Earnings Growth Could Accelerate in 2024 Should Revolution Wind Provide Meaningful Net Income That Year $2.28 $2.53 $2.65 $2.81 $2.96 $3.11 $3.25 $3.45 2012A* 2013A* 2014A* 2015A* 2016A 2017A 2018A 2019A* 2020E 2021E 2022E 2023E 2024E *Excludes merger and integration costs in 2012 - 2015 and NPT charge in 2019 Expected higher than 5% - 7% in 2024 due to offshore wind $3.60 - $3.70

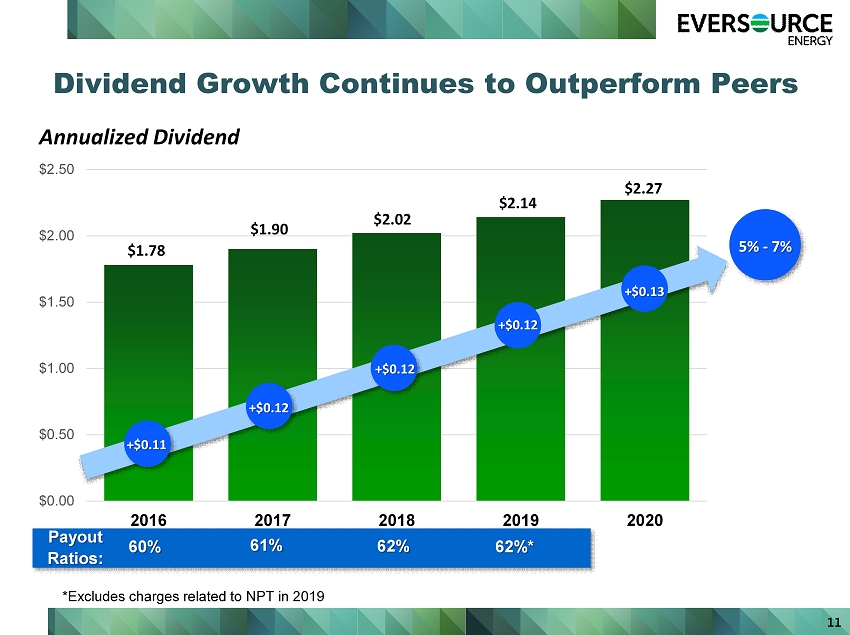

Dividend Growth Continues to Outperform Peers 11 Annualized Dividend 5% - 7% $1.78 $2.02 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 2016 2017 2018 2019 2020 Payout Ratios: 60% 61% 62% 62%* +$0.11 +$0.12 +$0.12 +$0.12 $2.27 $1.90 $2.14 *Excludes charges related to NPT in 2019 +$0.13

Phil Lembo Executive Vice President & Chief Financial Officer 12

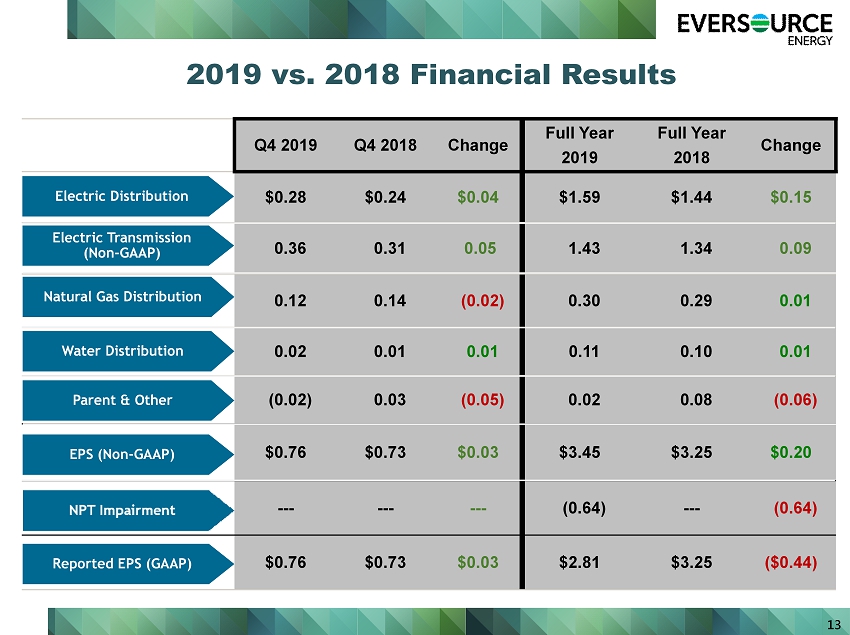

Q4 2019 Q4 2018 Change Full Year 2019 Full Year 2018 Change $0.28 $0.24 $0.04 $1.59 $1.44 $0.15 0.36 0.31 0.05 1.43 1.34 0.09 0.12 0.14 (0.02) 0.30 0.29 0.01 0.02 0.01 0.01 0.11 0.10 0.01 (0.02) 0.03 (0.05) 0.02 0.08 (0.06) $0.76 $0.73 $0.03 $3.45 $3.25 $0.20 --- --- --- (0.64) --- (0.64) $0.76 $0.73 $0.03 $2.81 $3.25 ($0.44) Natural Gas Distribution Electric Transmission (Non - GAAP) Electric Distribution Water Distribution Reported EPS (GAAP) 13 2019 vs. 2018 Financial Results Parent & Other EPS (Non - GAAP)

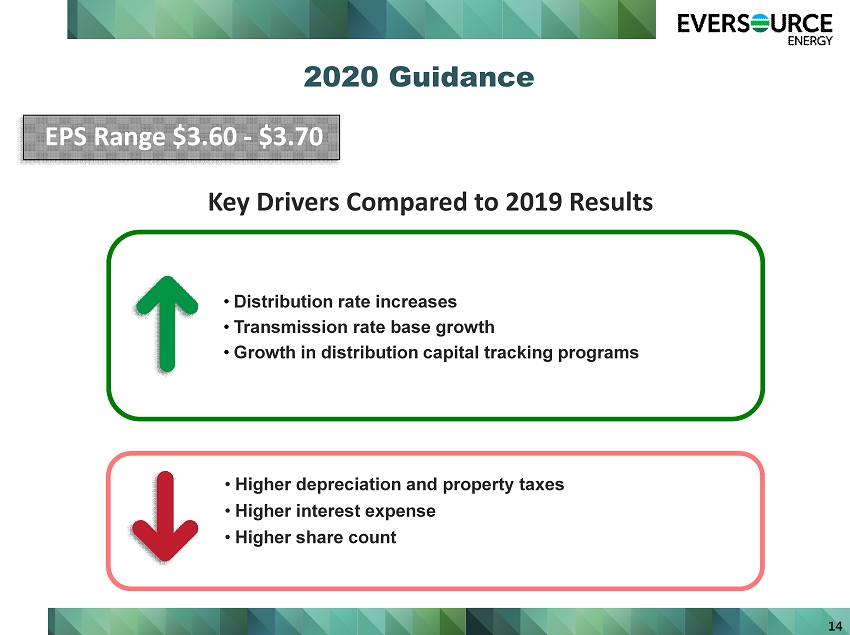

2020 Guidance Key Drivers Compared to 2019 Results EPS Range $3.60 - $3.70 • Distribution rate increases • Transmission rate base growth • Growth in distribution capital tracking programs • Higher depreciation and property taxes • Higher interest expense • Higher share count 14

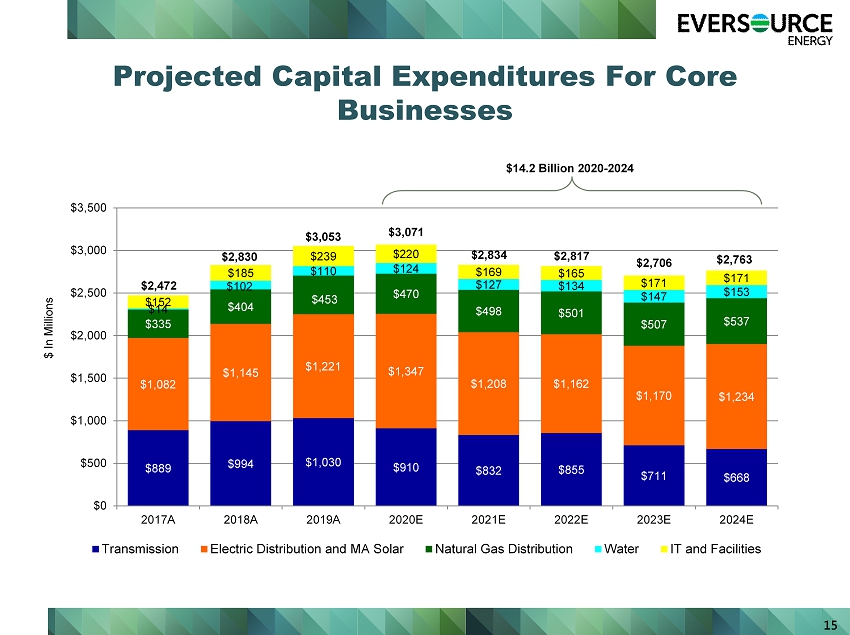

15 $889 $994 $1,030 $910 $832 $855 $711 $668 $1,082 $1,145 $1,221 $1,347 $1,208 $1,162 $1,170 $1,234 $335 $404 $453 $470 $498 $501 $507 $537 $14 $102 $110 $124 $127 $134 $147 $153 $152 $185 $239 $220 $169 $165 $171 $171 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E Transmission Electric Distribution and MA Solar Natural Gas Distribution Water IT and Facilities $2,817 $2,834 $ In Millions Projected Capital Expenditures For Core Businesses $3,053 $2,830 $2,472 $14.2 Billion 2020 - 2024 $3,071 $2,706 $2,763

16 $1.65 Billion Increase in 2020 - 2023 Core Business Capex Since February 2019 Plan Transmission Represents 60% of Increase $2,358 $4,515 $1,871 $514 $523 $3,308 $4,887 $1,976 $532 $725 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 Electric Transmission Electric Distribution Natural Gas Distribution Water IT and Facilities Feb. 2019 Plan Feb. 2020 Plan Up $202 million $ in Millions Up $950 million Up $18 million Up $105 million Up $372 million

17 Incremental Investments Expected to Grow Aquarion Rate Base Nearly 3 Times Faster Than Before Eversource Acquisition $690 $710 $740 $760 $820 $887 $927 $996 $1,077 $1,167 $1,257 2014A 2015A 2016A 2017A 2018A 2019A 2020E* 2021E* 2022E* 2023E* 2024E* Year - End Rate Base $ in Millions *Reflects rate base reduction due to Town of Hingham, MA vote in April 2019 to acquire Aquarion MA’s assets in Hingham, Hull, and N. Cohasset for more than $100 million.

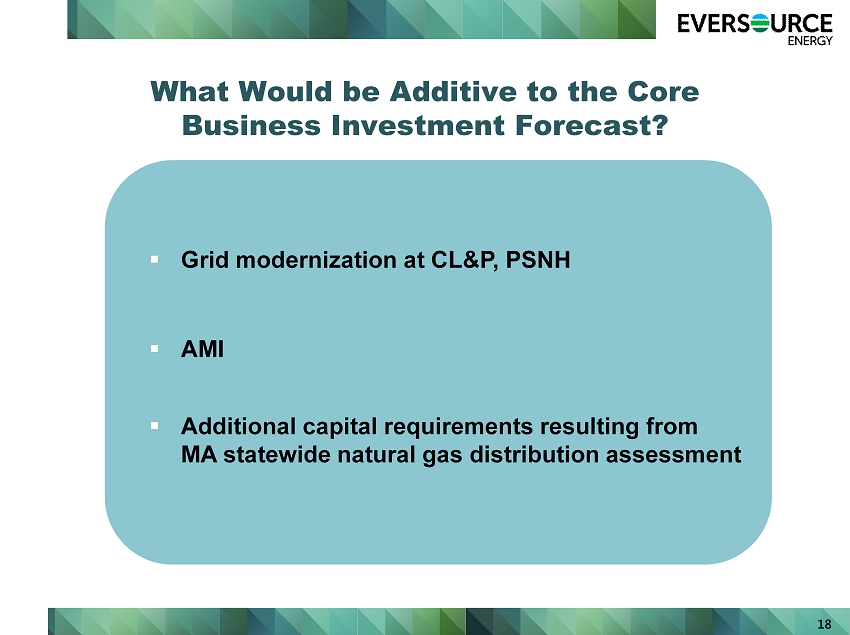

18 What Would be Additive to the Core Business Investment Forecast? ▪ Grid modernization at CL&P, PSNH ▪ AMI ▪ Additional capital requirements resulting from MA statewide natural gas distribution assessment

47% 11% 19 2018 Year - End Rate Base Projected 2024 Year - End Rate Base Transmission Electric Distribution & MA Solar Natural Gas Distribution Water $18.1 billion* $27.0 billion* Rate Base by Core Business – Current and Future 37% 14% 45% 5% 5% 36% Note: Excludes offshore wind investments *Rate base estimates do not include CWIP, which totaled $1.72 billion as of 12/31/18

Factors Expected to Contribute to EPS Growth in Addition to Rate Base Growth » Improved results at distribution companies that underearned their allowed returns in 2018 » Incentives from growing energy efficiency programs » Conservatism of O&M guidance; flat through forecast period 20

21 Current Rate Cases • PSNH filed a general rate case to raise annual base distribution rates by approximately $70 million on a permanent basis, effective 7/1/20, including an increase sought on a temporary basis - In June, following settlement with Staff, the NHPUC authorized PSNH to raise annual distribution rates by $28 million on a temporary basis, effective 7/1/19, until decision on permanent rates is implemented ▪ NHPUC - reported Distribution ROE was 8.07% for the 12 months ended 12/31/19 (9.67% authorized) ▪ Staff recommendation: $24.4 million increase, 8.25% ROE, and 50% equity ratio ▪ Next key dates: Late March 2020 settlement sessions; April 7, 2020 – target date for filing any settlement; April 14 - 23, 2020 – hearings; May 20, 2020 – NHPUC order PSNH • On 11/8/19, NSTAR Gas filed a rate request seeking a $38 million base rate adjustment, effective 10/1/20 • Request includes a proposed Performance Based Rate (PBR) mechanism (tied to a 5 - year stayout ) • PBR adjustment includes inflation plus approximately 1.3% adder • First general rate review since 2014 • NSTAR Gas currently has the lowest gas distribution rates in MA • Proposed authorized ROE: 10.45%; capital structure 54.85% equity; 45.15% long - term debt • Next key dates: March 20, 2020 - intervenor testimony; May 4 - 29, 2020 - hearings • Final decision expected by September 30, 2020 NSTAR Gas

22 FERC Transmission New England ROE Update • Oct. 2018 FERC Order in New England ROE cases proposed new methodology to address issues raised by Court in vacating Opinion 531A (New England ROE Complaint I) • This new methodology provided a path forward to resolve 2011, 2012, 2014 and 2016 complaints against New England transmission ROEs • Briefs and reply briefs filed in early 2019, but timing of decision unclear due to FERC commissioner vacancies • Current base: 10.57%; Cap: 11.74% (2014 Opinion 531A) • Illustrative base: 10.41%; Cap: 13.08% (Oct. 2018 proposed new method) • Original FERC - proposed new methodology averaged DCF, CAPM, risk premium, expected earnings • FERC changed methodology again in a November 2019 MISO TO Order and applied only DCF & CAPM methodologies; impact on New England cases unclear • New England Transmission Owners filed comments with FERC in December 2019 critical of many aspects of MISO decision, including exclusion of risk premium and expected earnings methodologies

23 Status of ES Equity Issuances $1.3 billion block equity • 5.98 million shares issued on 6/4/19 • 6 million shares from forward sale closed on 12/30/19 • Remaining 5.96 million shares will close by 5/29/20 $500 million from DRP, employee plans • Nearly 1.1 million Treasury Shares issued from 1/1/19 through 1/31/20 $700 million from “At the Market” program • No shares issued to date

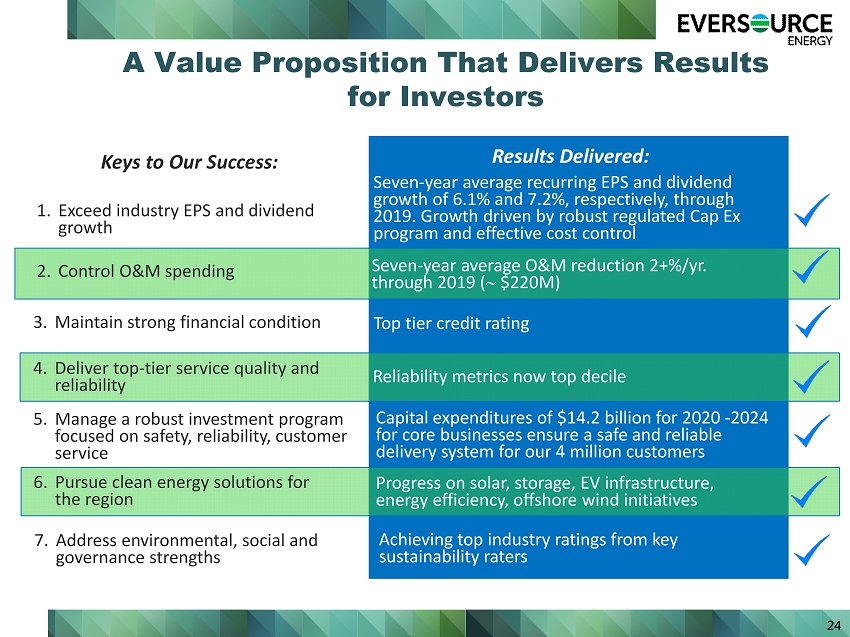

A Value Proposition That Delivers Results for Investors Keys to Our Success: Results Delivered: 2. Control O&M spending Seven - year average O&M reduction 2+%/yr. through 2019 ( $220M) 1. Exceed industry EPS and dividend growth Seven - year average recurring EPS and dividend growth of 6.1% and 7.2%, respectively, through 2019. Growth driven by robust regulated Cap Ex program and effective cost control 4. Deliver top - tier service quality and reliability Reliability metrics now top decile 5. Manage a robust investment program focused on safety, reliability, customer service Capital expenditures of $14.2 billion for 2020 - 2024 for core businesses ensure a safe and reliable delivery system for our 4 million customers 3. Maintain strong financial condition 24 Top tier credit rating 6. Pursue clean energy solutions for the region Progress on solar, storage, EV infrastructure, energy efficiency, offshore wind initiatives 7. Address environmental, social and governance strengths Achieving top industry ratings from key sustainability raters

25 APPENDIX

26 $432 $466 $460 $384 $209 $184 $182 $141 $302 $334 $380 $366 $478 $436 $296 $284 $155 $194 $190 $160 $145 $235 $233 $243 $0 $200 $400 $600 $800 $1,000 $1,200 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E CL&P NSTAR Electric PSNH $ in Millions Projected Transmission Capital Expenditures Other concepts under development $855 $832 $910 $1,030 $994 $889 $711 $668

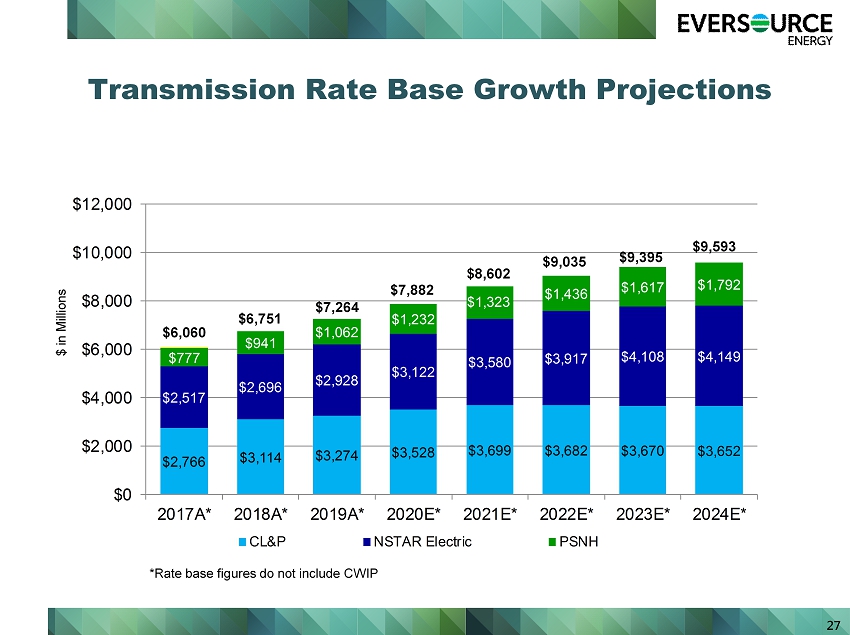

$2,766 $3,114 $3,274 $3,528 $3,699 $3,682 $3,670 $3,652 $2,517 $2,696 $2,928 $3,122 $3,580 $3,917 $4,108 $4,149 $777 $941 $1,062 $1,232 $1,323 $1,436 $1,617 $1,792 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 2017A* 2018A* 2019A* 2020E* 2021E* 2022E* 2023E* 2024E* CL&P NSTAR Electric PSNH Transmission Rate Base Growth Projections $ in Millions $6,060 $6,751 $7,264 $7,882 27 $8,602 $9,035 $9,395 $9,593 *Rate base figures do not include CWIP

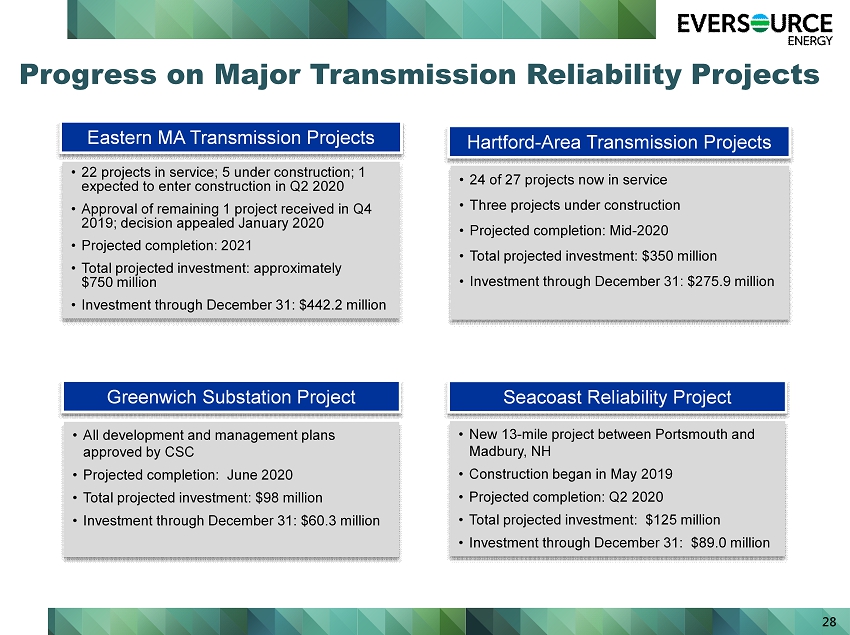

28 • New 13 - mile project between Portsmouth and Madbury , NH • Construction began in May 2019 • Projected completion: Q2 2020 • Total projected investment: $125 million • Investment through December 31: $89.0 million Seacoast Reliability Project • 24 of 27 projects now in service • Three projects under construction • Projected completion: Mid - 2020 • Total projected investment: $350 million • Investment through December 31: $275.9 million Hartford - Area Transmission Projects Progress on Major Transmission Reliability Projects • All development and management plans approved by CSC • Projected completion: June 2020 • Total projected investment: $98 million • Investment through December 31: $60.3 million Greenwich Substation Project Eastern MA Transmission Projects • 22 projects in service; 5 under construction; 1 expected to enter construction in Q2 2020 • Approval of remaining 1 project received in Q4 2019; decision appealed January 2020 • Projected completion: 2021 • Total projected investment: approximately $750 million • Investment through December 31: $442.2 million

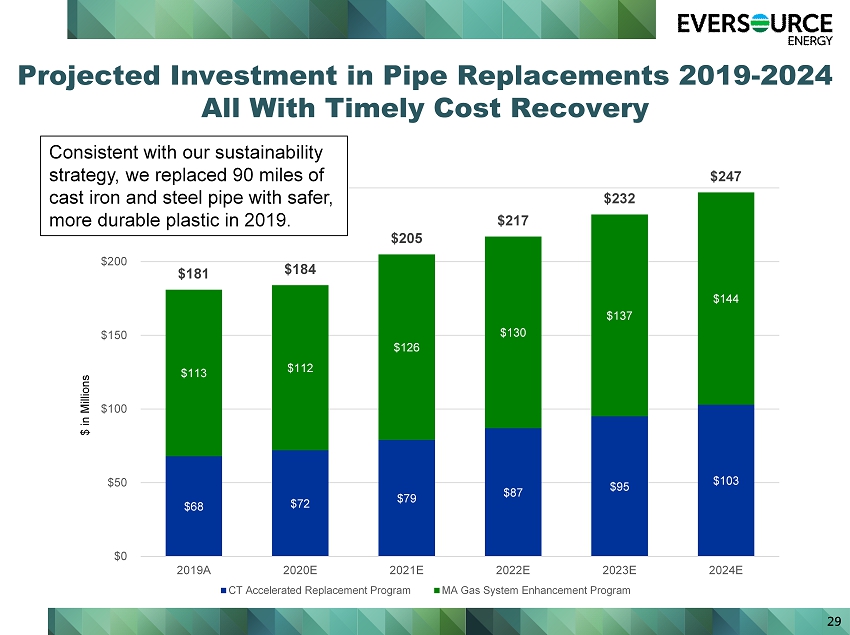

Projected Investment in Pipe Replacements 2019 - 2024 All With Timely Cost Recovery $68 $72 $79 $87 $95 $103 $113 $112 $126 $130 $137 $144 $181 $184 $205 $217 $232 $247 $0 $50 $100 $150 $200 $250 2019A 2020E 2021E 2022E 2023E 2024E CT Accelerated Replacement Program MA Gas System Enhancement Program 29 Consistent with our sustainability strategy, we replaced 90 miles of cast iron and steel pipe with safer, more durable plastic in 2019. $ in Millions

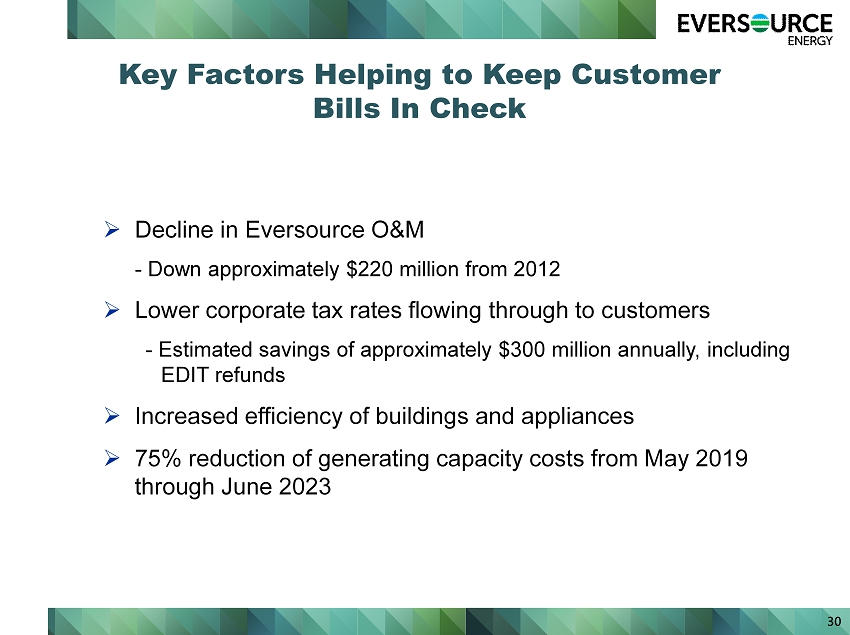

Key Factors Helping to Keep Customer Bills In Check » Decline in Eversource O&M - Down approximately $220 million from 2012 » Lower corporate tax rates flowing through to customers - Estimated savings of approximately $300 million annually, including EDIT refunds » Increased efficiency of buildings and appliances » 75% reduction of generating capacity costs from May 2019 through June 2023 30

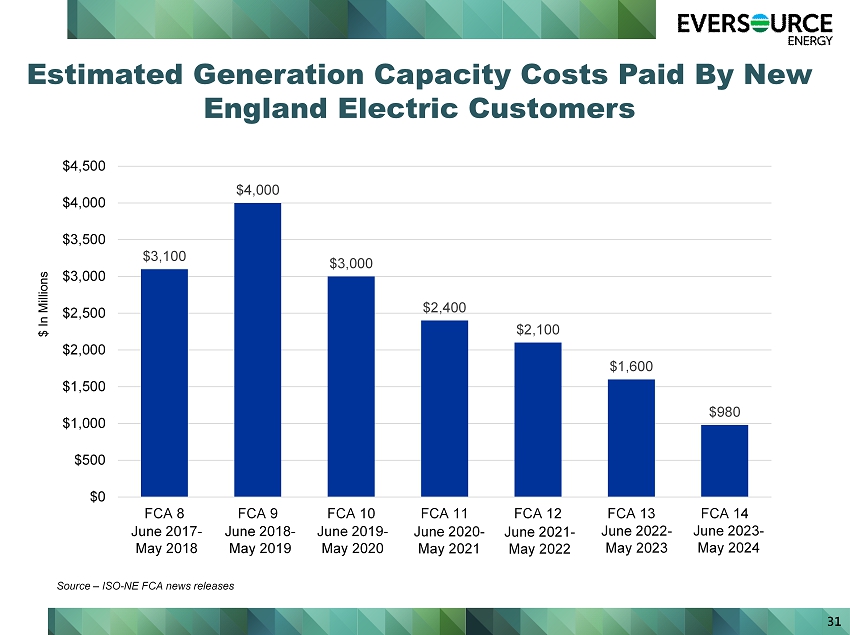

Estimated Generation Capacity Costs Paid By New England Electric Customers $3,100 $4,000 $3,000 $2,400 $2,100 $1,600 $980 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 FCA 8 FCA 9 FCA 10 FCA 11 FCA 12 FCA 13 FCA 14 June 2017 - May 2018 June 2021 - May 2022 June 2022 - May 2023 June 2023 - May 2024 June 2020 - May 2021 June 2019 - May 2020 June 2018 - May 2019 $ In Millions Source – ISO - NE FCA news releases 31

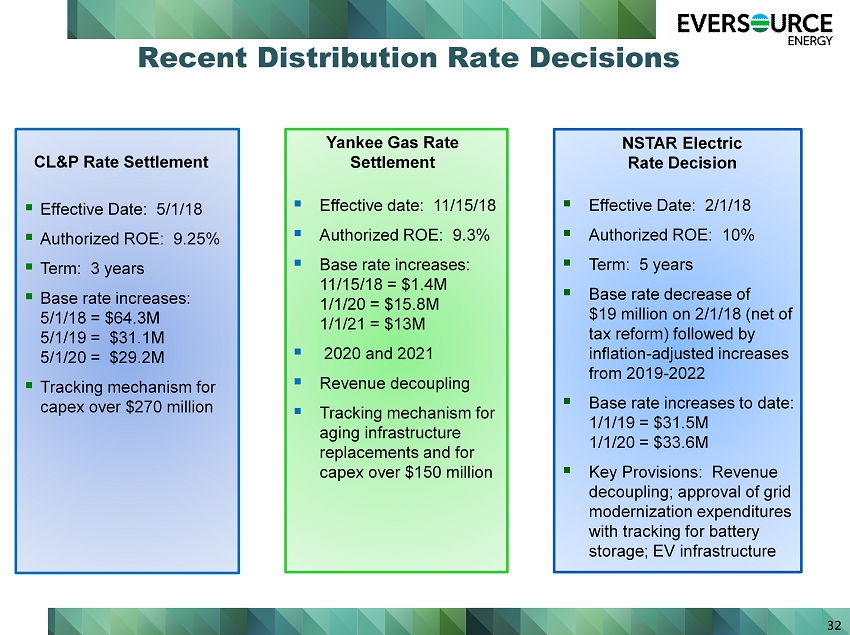

32 ▪ Effective Date: 5/1/18 ▪ Authorized ROE: 9.25% ▪ Term: 3 years ▪ Base rate increases: 5/1/18 = $64.3M 5/1/19 = $31.1M 5/1/20 = $29.2M ▪ Tracking mechanism for capex over $270 million ▪ Effective date: 11/15/18 ▪ Authorized ROE: 9.3% ▪ Base rate increases: 11/15/18 = $1.4M 1/1/20 = $15.8M 1/1/21 = $13M ▪ 2020 and 2021 ▪ Revenue decoupling ▪ Tracking mechanism for aging infrastructure replacements and for capex over $150 million Recent Distribution Rate Decisions Yankee Gas Rate Settlement CL&P Rate Settlement NSTAR Electric Rate Decision ▪ Effective Date: 2/1/18 ▪ Authorized ROE: 10% ▪ Term: 5 years ▪ Base rate decrease of $19 million on 2/1/18 (net of tax reform) followed by inflation - adjusted increases from 2019 - 2022 ▪ Base rate increases to date: 1/1/19 = $31.5M 1/1/20 = $33.6M ▪ Key Provisions: Revenue decoupling; approval of grid modernization expenditures with tracking for battery storage; EV infrastructure

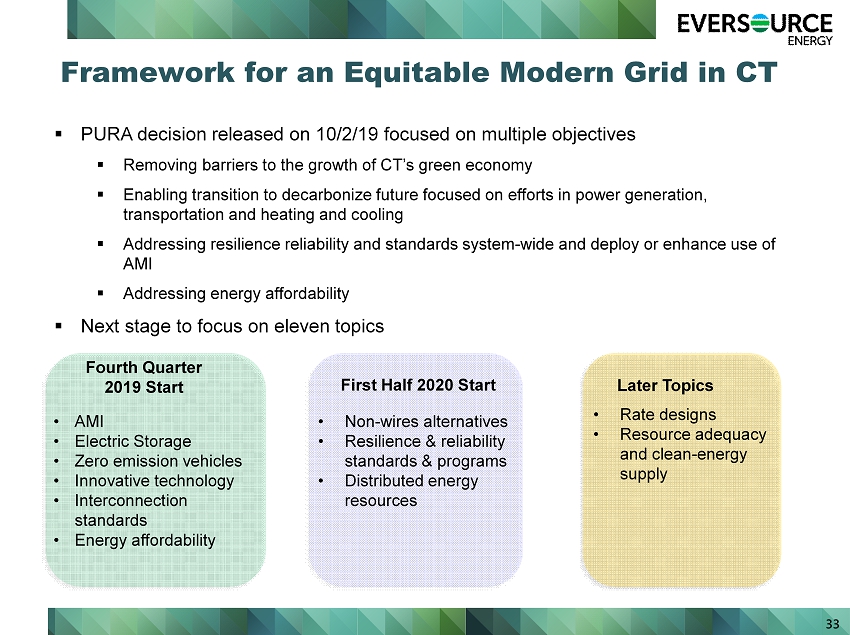

• AMI • Electric Storage • Zero emission vehicles • Innovative technology • Interconnection standards • Energy affordability 33 ▪ PURA decision released on 10/2/19 focused on multiple objectives ▪ Removing barriers to the growth of CT’s green economy ▪ Enabling transition to decarbonize future focused on efforts in power generation, transportation and heating and cooling ▪ Addressing resilience reliability and standards system - wide and deploy or enhance use of AMI ▪ Addressing energy affordability ▪ Next stage to focus on eleven topics Fourth Quarter 2019 Start First Half 2020 Start Later Topics • Non - wires alternatives • Resilience & reliability standards & programs • Distributed energy resources • Rate designs • Resource adequacy and clean - energy supply Framework for an Equitable Modern Grid in CT

34 NSTAR Electric Clean Energy and Grid Modernization Initiatives Grid Modernization: • Approved $133 million in grid facing investments in visibility and automation • New 2021 - 2023 plan due to DPU by mid - 2020 Solar: • All sites now in service • 70 MW in operation Storage: • Planning and permitting under way on $55 million of projects on Cape Cod and Martha’s Vineyard • Completion expected by early 2021 EV Infrastructure: • Executing on $45 million effort to build 3,500 new charging ports • Expected completion by early/mid 2021

MA Grid Mod Status – Implementing 2018 - 2020 Plan Preparing Filing for 2021 - 2023 Plan 35 MA Grid Mod Tracked Investments 2018 - 2020 ($233MM) Next Steps File new three - year plan in mid - 2020 for 2021 - 2023 implementation MA DPU order in grid modernization proceeding approved $133MM in tracked spending on a portfolio of investments. Work expected to be substantially complete by 12/31/20. Order also approved using grid modernization tracking mechanism for $100MM in energy storage and electric vehicle investments approved in previous rate case. Approximately 90% of work expected to be complete by 12/31/20.

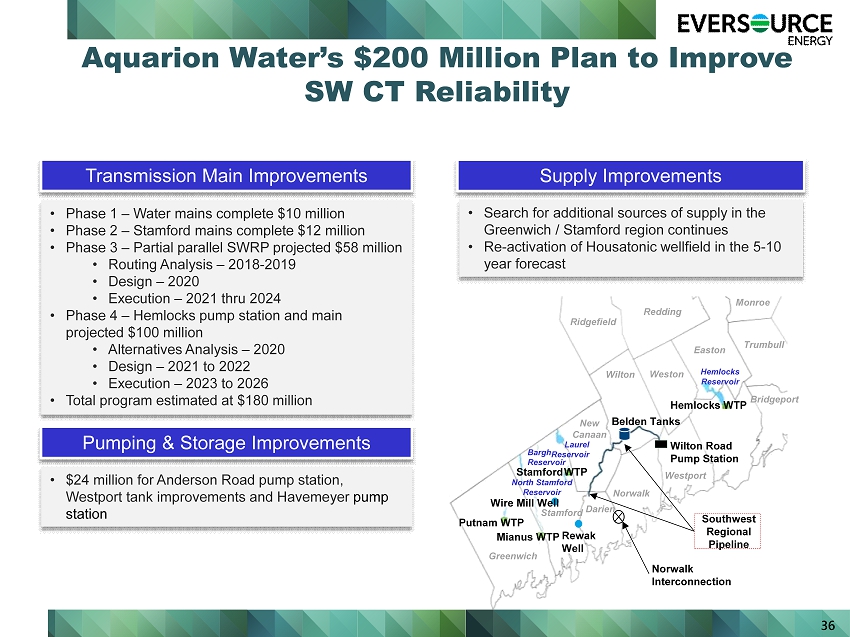

36 Aquarion Water’s $200 Million Plan to Improve SW CT Reliability • Phase 1 – Water mains complete $10 million • Phase 2 – Stamford mains complete $12 million • Phase 3 – Partial parallel SWRP projected $58 million • Routing Analysis – 2018 - 2019 • Design – 2020 • Execution – 2021 thru 2024 • Phase 4 – Hemlocks pump station and main projected $100 million • Alternatives Analysis – 2020 • Design – 2021 to 2022 • Execution – 2023 to 2026 • Total program estimated at $180 million Transmission Main Improvements Putnam WTP Mianus WTP Stamford WTP Rewak Well Southwest Regional Pipeline Belden Tanks Wilton Road Pump Station Hemlocks WTP Norwalk Interconnection Greenwich Stamford Darien Norwalk New Canaan Wilton Ridgefield Redding Monroe Trumbull Easton Weston Bridgeport Westport Laurel Reservoir Bargh Reservoir North Stamford Reservoir Hemlocks Reservoir Wire Mill Well Supply Improvements Pumping & Storage Improvements • $24 million for Anderson Road pump station, Westport tank improvements and Havemeyer pump station • Search for additional sources of supply in the Greenwich / Stamford region continues • Re - activation of Housatonic wellfield in the 5 - 10 year forecast

37 Customers, Shareholders Benefiting From Lower Interest Rates Recent Maturities Size (in $millions) Coupon Length in Years ES Parent $350 4.50% 10 CL&P $250 5.50% 10 NSTAR Electric $95 5.10% 10 PSNH $150 4.50% 10 Yankee Gas $50 $50 5.26% 4.87% 15 10 NSTAR Gas $125 $25 4.46% 9.95% 10 30 Recent Issuances Size (in $millions) Coupon Length in Years ES Parent $350 3.45% 30 CL&P $300 $200 4.00% (3.846% Yield) 3.20% (2.422% Yield) 29 8 NSTAR Electric $400 3.25% 10 PSNH $300 3.60% 30 Yankee Gas $100 $100 2.23% 3.30% 5 30 NSTAR Gas $75 3.74% 30 12/31/2018 12/31/2019 Eversource Parent Weighted Avg. Commercial Paper Rate 2.77% 1.98% NSTAR Electric Weighted Avg. Commercial Paper Rate 2.50% 1.63%