EVERSOURCE ENERGY Q2 2023 RESULTS August 1, 2023 2023 Second Quarter Results Exhibit 99.3

EVERSOURCE ENERGY Q2 2023 RESULTS 1 Safe Harbor Statement All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings discussion includes financial measures that are not recognized under generally accepted accounting prin cip les (non - GAAP) referencing earnings and EPS excluding the impairment charge for the offshore wind investment and certain transaction, transition and other charge s. EPS by business is also a non - GAAP financial measure and is calculated by dividing the Net Income Attributable to Common Shareholders of each business by the we igh ted average diluted Eversource Energy common shares outstanding for the period. The earnings and EPS of each business do not represent a direct legal intere st in the assets and liabilities of such business, but rather represent a direct interest in Eversource Energy’s assets and liabilities as a whole. Eversource Energy us es these non - GAAP financial measures to evaluate and provide details of earnings results by business and to more fully compare and explain results without including the se items. This information is among the primary indicators management uses as a basis for evaluating performance and planning and forecasting of future periods. Mana gem ent believes the impacts of the impairment charge for the offshore wind investment and transaction, transition and other charges are not indicative of Everso urc e Energy’s ongoing costs and performance. Management views these charges as not directly related to the ongoing operations of the business and therefore not an indicator of baseline operating performance. Due to the nature and significance of the effect of these items on net income attributable to common shareholder s a nd EPS, management believes that the non - GAAP presentation is a more meaningful representation of Eversource Energy’s financial performance and provides addition al and useful information to readers in analyzing historical and future performance of the business. These non - GAAP financial measures should not be considered as a lternatives to Eversource Energy’s reported net income attributable to common shareholders or EPS determined in accordance with GAAP as indicators of Eversource En ergy’s operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, as sumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statem ents” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of w ords or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could” and other similar expressions. Fo rward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - looking statemen ts. Forward - looking statements are based on the current expectations, estimates, assumptions or projections of management and are not guarantees of future performa nce. These expectations, estimates, assumptions or projections may vary materially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that may cause our actual results or outcomes to differ materially from those co ntained in our forward - looking statements, including, but not limited to: cyberattacks or breaches, including those resulting in the compromise of the confi den tiality of our proprietary information and the personal information of our customers; disruptions in the capital markets or other events that make our access to necessa ry capital more difficult or costly; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability; ability or in ability to commence and complete our major strategic development projects and opportunities; the ability to sell Eversource’s 50 percent interest in three offshor e w ind projects under development on the timeline we expect, to satisfy the investment tax credit qualifications related to the tax equity investment in the South For k W ind project, and the ability of the Revolution Wind and Sunrise Wind projects to qualify for the investment tax credit adders, and to successfully reprice the Sunrise Wind ORE C contract; acts of war or terrorism, physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and wa ter distribution systems; actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard performance of third - party suppliers and se rvice providers; fluctuations in weather patterns, including extreme weather due to climate change; changes in business conditions, which could include disruptive tec hno logy or development of alternative energy sources related to our current or future business model; contamination of, or disruption in, our water supplies; chang es in levels or timing of capital expenditures; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations ; c hanges in accounting standards and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to predict and contain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control. You should not place undue r eli ance on the forward - looking statements, as each speaks only as of the date on which such statement is made, and, except as required by federal securities la ws, Eversource Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

EVERSOURCE ENERGY Q2 2023 RESULTS Agenda 2 Joe Nolan Chairman, President & CEO John Moreira EVP, CFO & Treasurer □ Customer Focus Areas and Clean Energy Initiatives □ 2022 Sustainability and DE&I Reports Published □ Offshore Wind Update □ Q2 2023 Financial Results □ Offshore Wind Impairment □ Financing Update

EVERSOURCE ENERGY Q2 2023 RESULTS 3 Electric Reliability Clean Water Supply Energy Efficiency Renewable Energy Electric Delivery Gas Delivery Clean Water Delivery Providing Safe and Reliable Electric, Gas, and Clean Water Delivery to Customers 12 months 19.5 months 0 5 10 15 20 25 2011 2022 120 minutes 65 minutes 0 50 100 150 2011 2022 Electric Service Average Duration of Interruption (Minutes) Electric Service Months Between Interruptions

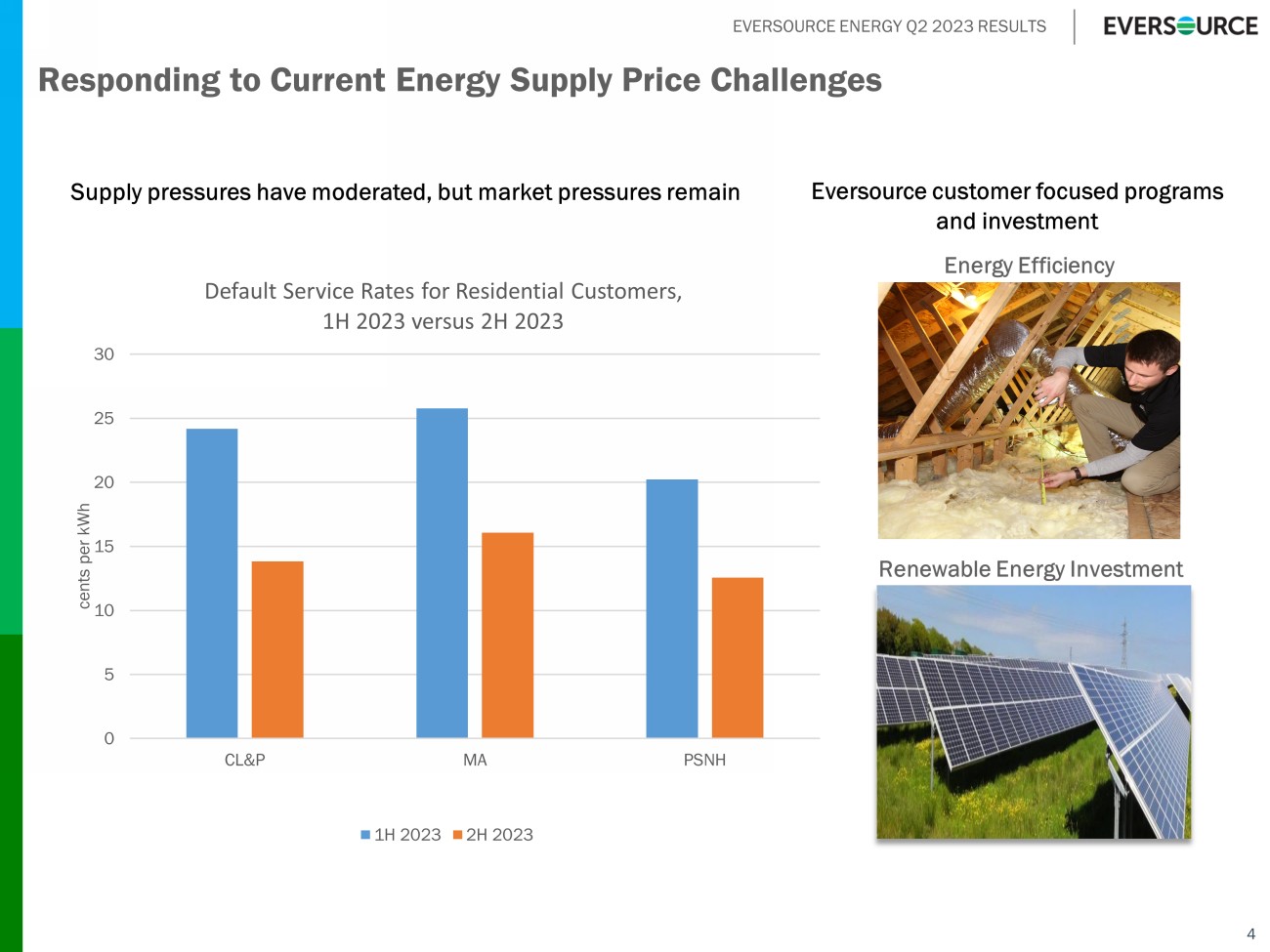

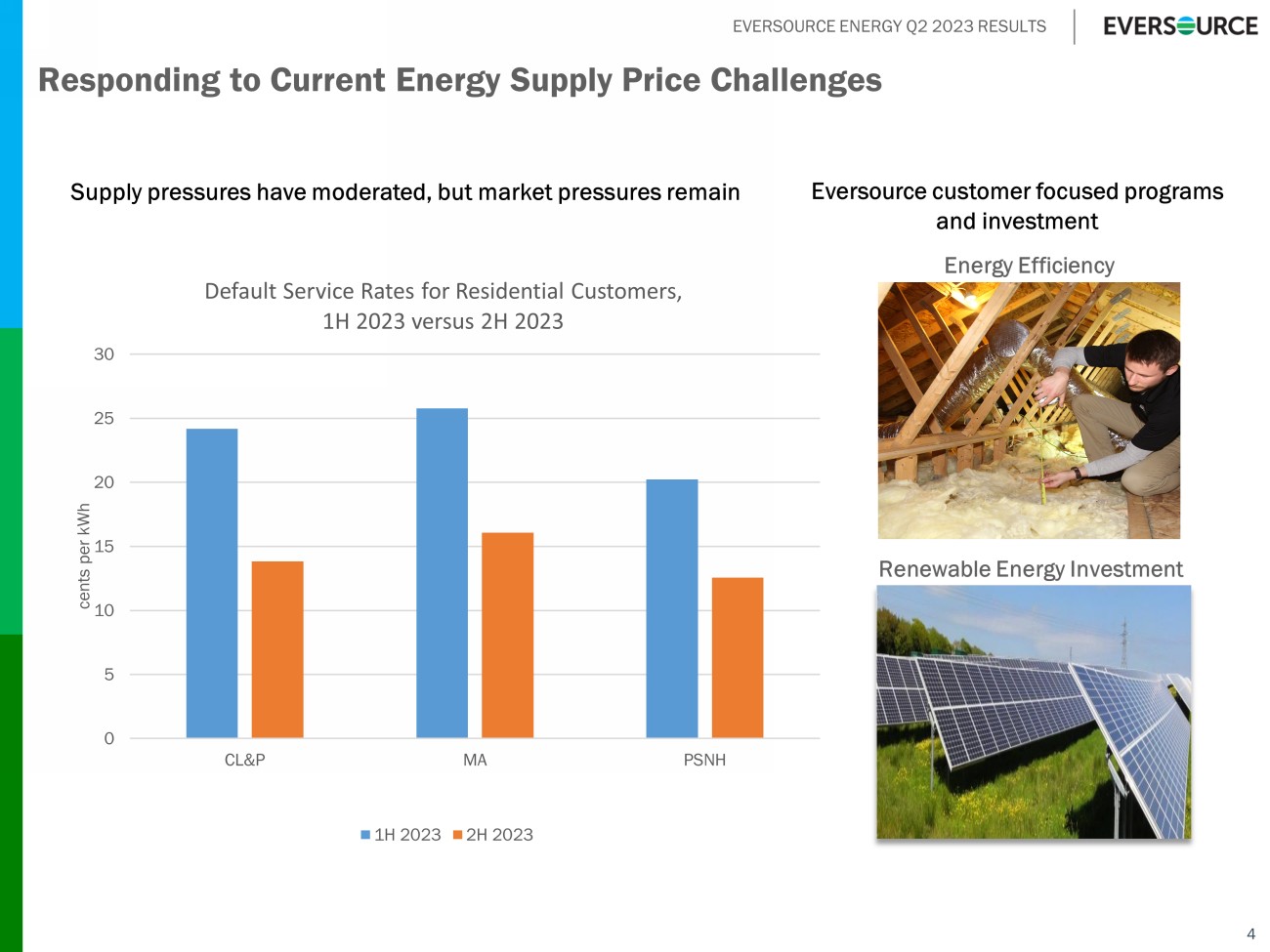

EVERSOURCE ENERGY Q2 2023 RESULTS Responding to Current Energy Supply Price Challenges 4 Electric Reliability Clean Water Supply Energy Efficiency Renewable Energy Investment Supply pressures have moderated, but market pressures remain Eversource customer focused programs and investment 0 5 10 15 20 25 30 CL&P MA PSNH cents per kWh Default Service Rates for Residential Customers, 1H 2023 versus 2H 2023 1H 2023 2H 2023

EVERSOURCE ENERGY Q2 2023 RESULTS 5 Eversource 2022 Sustainability and Diversity, Equity and Inclusion Reports □ Highlights our progress to advance environmental, social and governance (ESG) performance □ Working to develop specific, measurable, near - term GHG reduction targets for Science Based Targets initiative □ Progress on our commitment to Net Zero by 2030 2022 Sustainability Report 2022 Diversity, Equity & Inclusion Report □ Includes overview of our DE&I strategy, goals and accomplishments □ Report includes metrics on workforce composition and key DE&I corporate performance measures

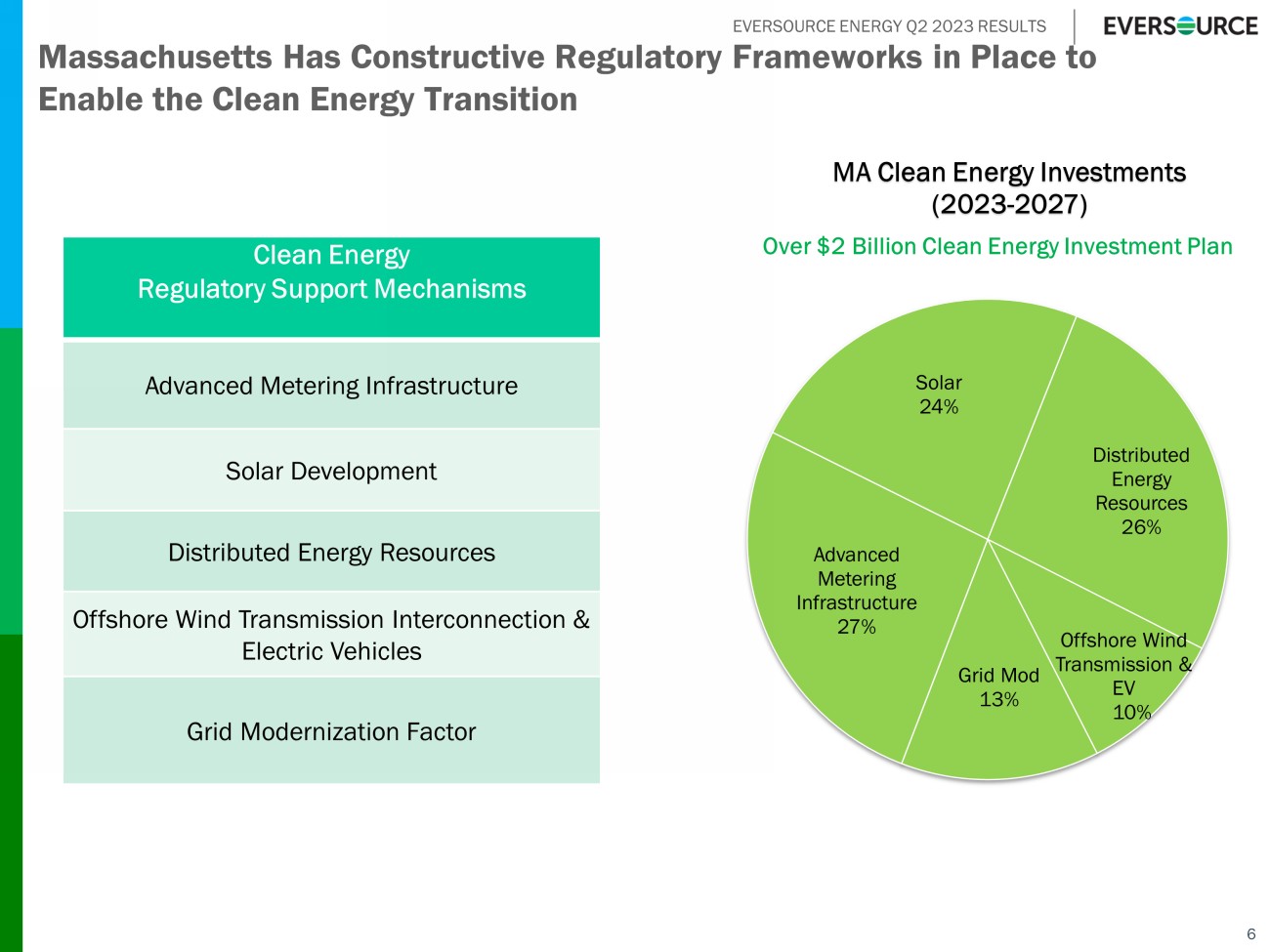

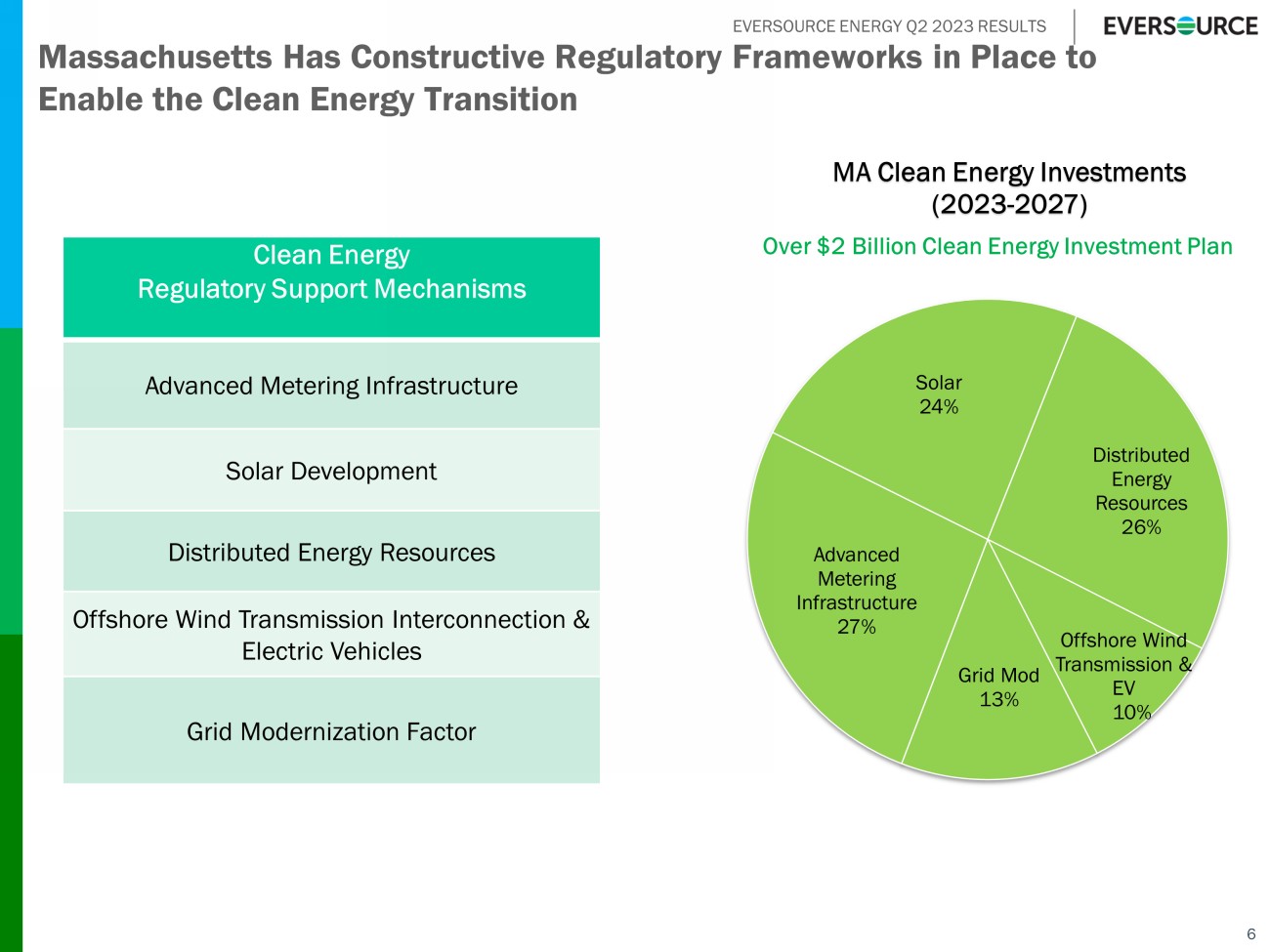

EVERSOURCE ENERGY Q2 2023 RESULTS 6 Massachusetts Has Constructive Regulatory Frameworks in Place to Enable the Clean Energy Transition Clean Energy Regulatory Support Mechanisms Advanced Metering Infrastructure Solar Development Distributed Energy Resources Offshore Wind Transmission Interconnection & Electric Vehicles Grid Modernization Factor Advanced Metering Infrastructure 27% Solar 24% Distributed Energy Resources 26% Offshore Wind Transmission & EV 10% Grid Mod 13% MA Clean Energy Investments (2023 - 2027) Over $2 Billion Clean Energy Investment Plan

EVERSOURCE ENERGY Q2 2023 RESULTS Offshore Wind Update □ South Fork Wind (130 MW) construction continues to advance towards a late 2023 in - service date □ Construction of onshore substation and transmission cable is complete □ Installation of offshore substation and subsea transmission cable recently completed, testing and energization will soon begin □ Wind turbine pre - assembly underway in New London, CT, and installation offshore will begin once monopile foundation installation is complete □ BOEM issued Revolution Wind’s Final Environmental Impact Statement on July 17, 2023 □ Completed strategic review and currently advancing the completion of the project sale 7

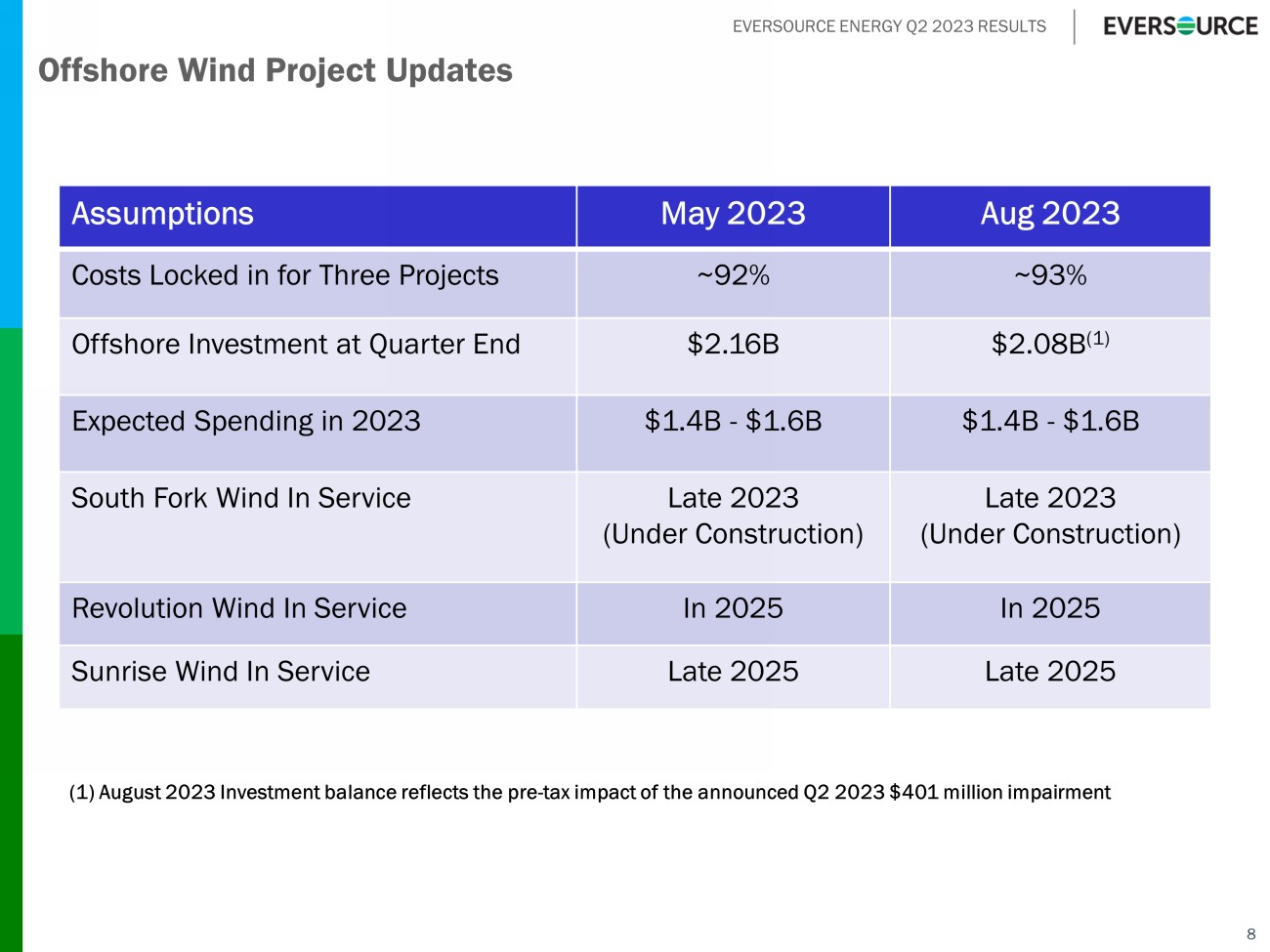

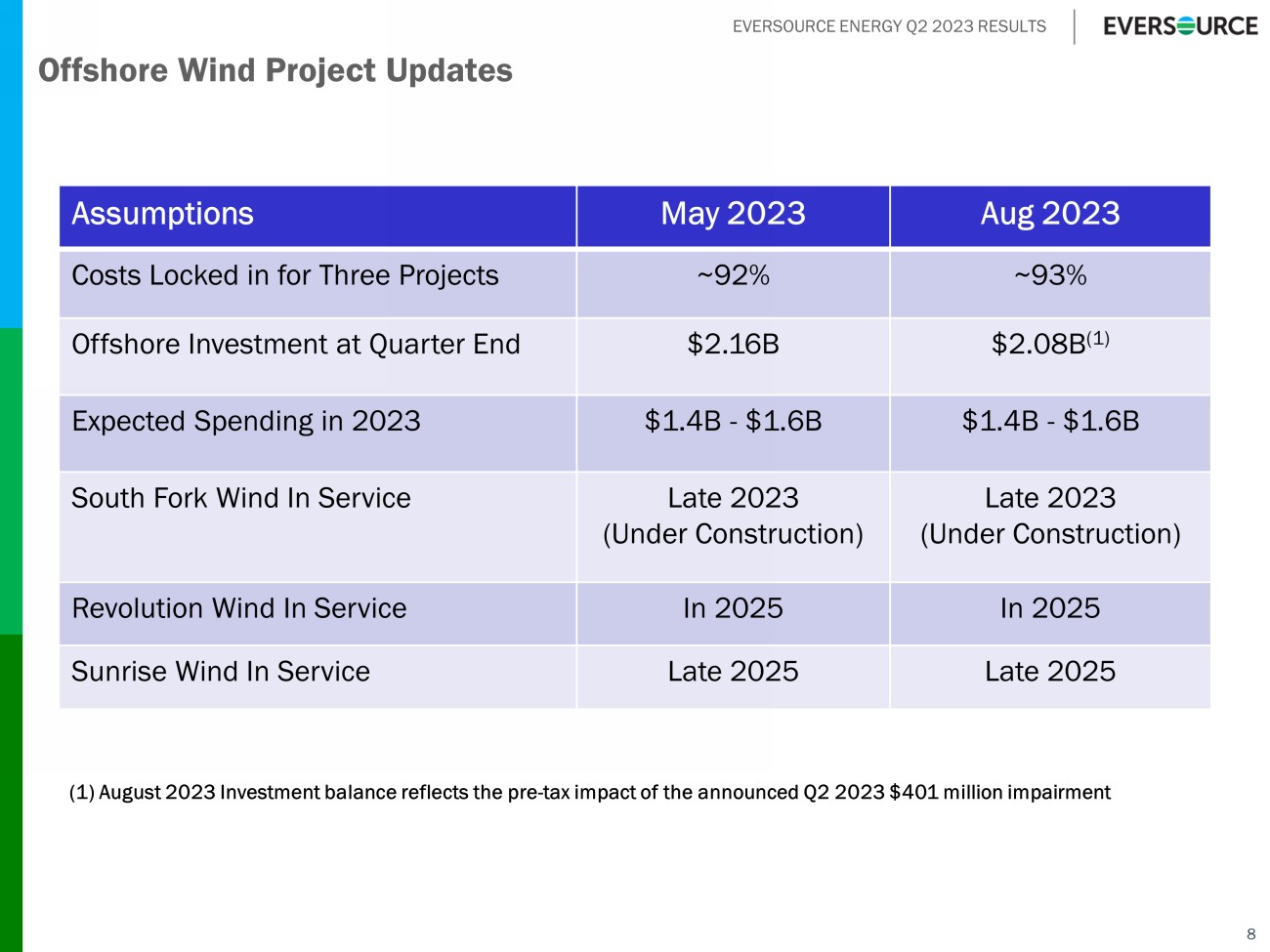

EVERSOURCE ENERGY Q2 2023 RESULTS 8 Assumptions May 2023 Aug 2023 Costs Locked in for Three Projects ~92% ~93% Offshore Investment at Quarter End $2.16B $2.08B (1) Expected Spending in 2023 $1.4B - $1.6B $1.4B - $1.6B South Fork Wind In Service Late 2023 (Under Construction) Late 2023 (Under Construction) Revolution Wind In Service In 2025 In 2025 Sunrise Wind In Service Late 2025 Late 2025 Offshore Wind Project Updates (1) August 2023 Investment balance reflects the pre - tax impact of the announced Q2 2023 $401 million impairment

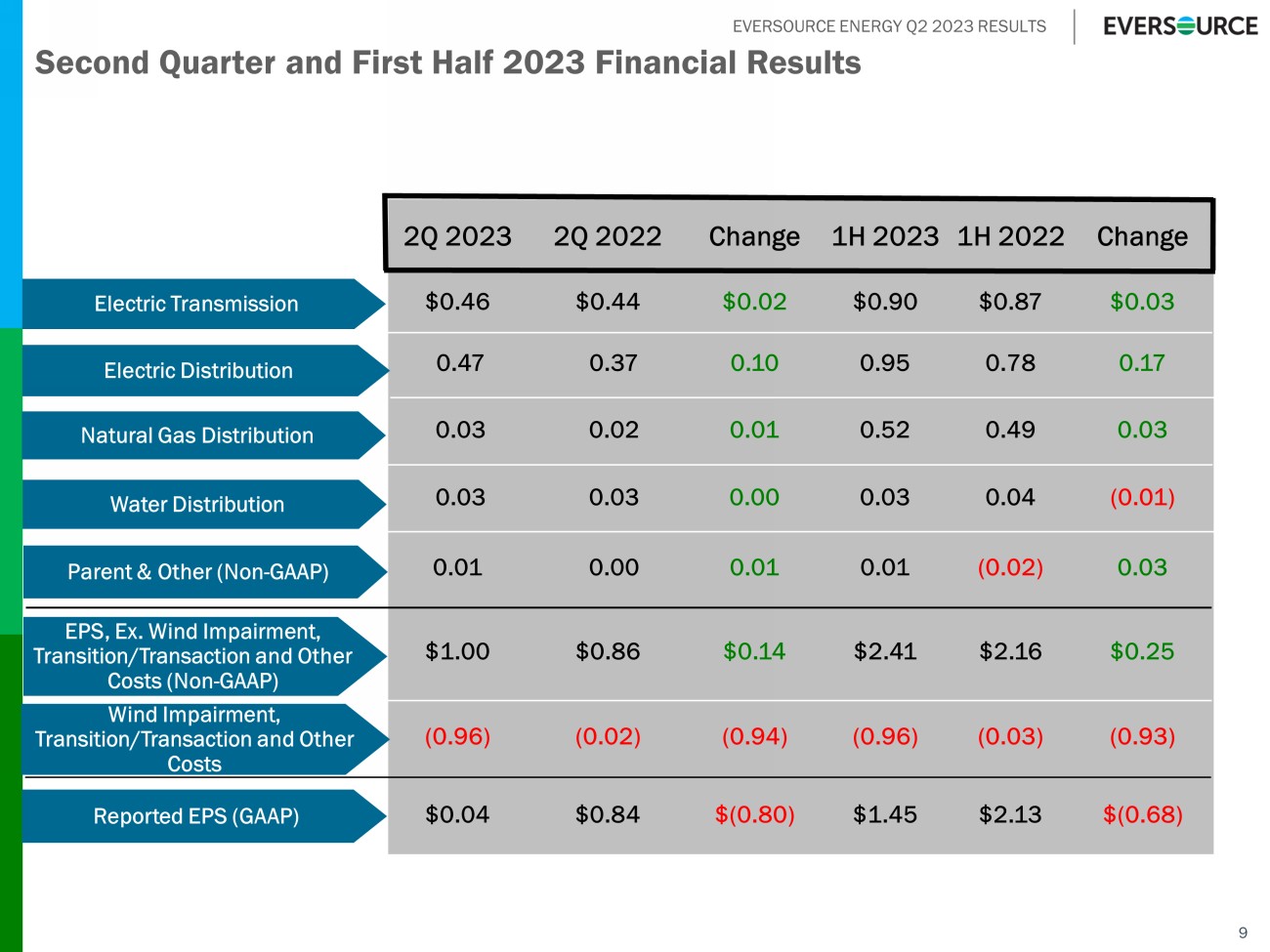

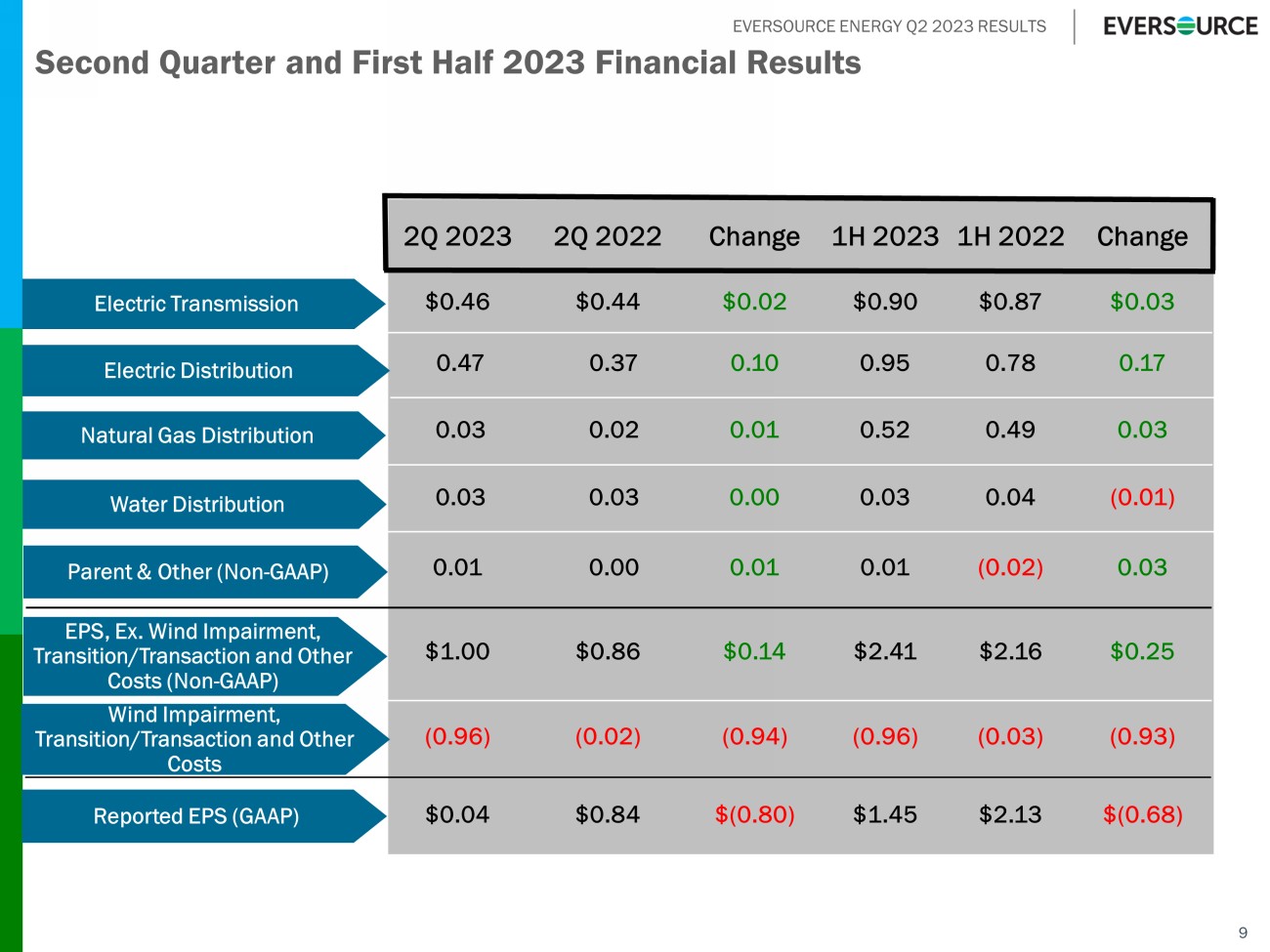

EVERSOURCE ENERGY Q2 2023 RESULTS 9 2Q 2023 2Q 2022 Change 1H 2023 1H 2022 Change $0.46 $0.44 $0.02 $0.90 $0.87 $0.03 0.47 0.37 0.10 0.95 0.78 0.17 0.03 0.02 0.01 0.52 0.49 0.03 0.03 0.03 0.00 0.03 0.04 (0.01) 0.01 0.00 0.01 0.01 (0.02) 0.03 $1.00 $0.86 $0.14 $2.41 $2.16 $0.25 (0.96) (0.02) (0.94) (0.96) (0.03) (0.93) $0.04 $0.84 $(0.80) $1.45 $2.13 $(0.68) Electric Transmission Electric Distribution Natural Gas Distribution Parent & Other (Non - GAAP) Water Distribution EPS, Ex. Wind Impairment, Transition/Transaction and Other Costs (Non - GAAP) Wind Impairment, Transition/Transaction and Other Costs Reported EPS (GAAP) Second Quarter and First Half 2023 Financial Results

EVERSOURCE ENERGY Q2 2023 RESULTS Eversource Offshore Wind Financial Update □ The s ale of 50 percent interest in uncommitted lease area of 175,000 developable acres off the south coast of Massachusetts to Ørsted for $625 million in an all - cash transaction o On July 27, received approval from the Committee on Foreign Investment in the United States o Transaction is expected to close by the end of the third quarter of 2023 □ Eversource to invest in the tax equity for South Fork for $575 million immediately after closing on the sale of the uncommitted acreage o Half of $575 million returned to Eversource as a 50% equity partner in South Fork o Investment Tax Credits (ITC) expected to be used in the fourth quarter of 2023 and first half of 2024 to lower Eversource’s cash tax obligation □ In the final phase of advancing the sale of 50% interest in South Fork Wind, Revolution Wind, and Sunrise Wind □ Eversource recorded a non - recurring after - tax impairment charge of $331 million in the second quarter □ Proceeds from the transactions will be used to pay off parent - company debt □ Eversource remains committed to being a catalyst in the region’s clean energy transition, with our regulated companies building many of the facilities that will enable renewable generation 10

EVERSOURCE ENERGY Q2 2023 RESULTS 11 Well Performing Core Businesses Drive EPS CAGR Solidly into Upper Half of 5 – 7% Through 2027 $2.28 $2.53 $2.65 $2.81 $2.96 $3.11 $3.25 $3.45 $3.64 $3.86 $4.09 $4.25 - $4.43 2012A* 2013A* 2014A* 2015A* 2016A 2017A 2018A 2019A* 2020A* 2021A* 2022A* 2023E* 2024E 2025E 2026E 2027E * Reflects non - GAAP results, excludes nonrecurring charges

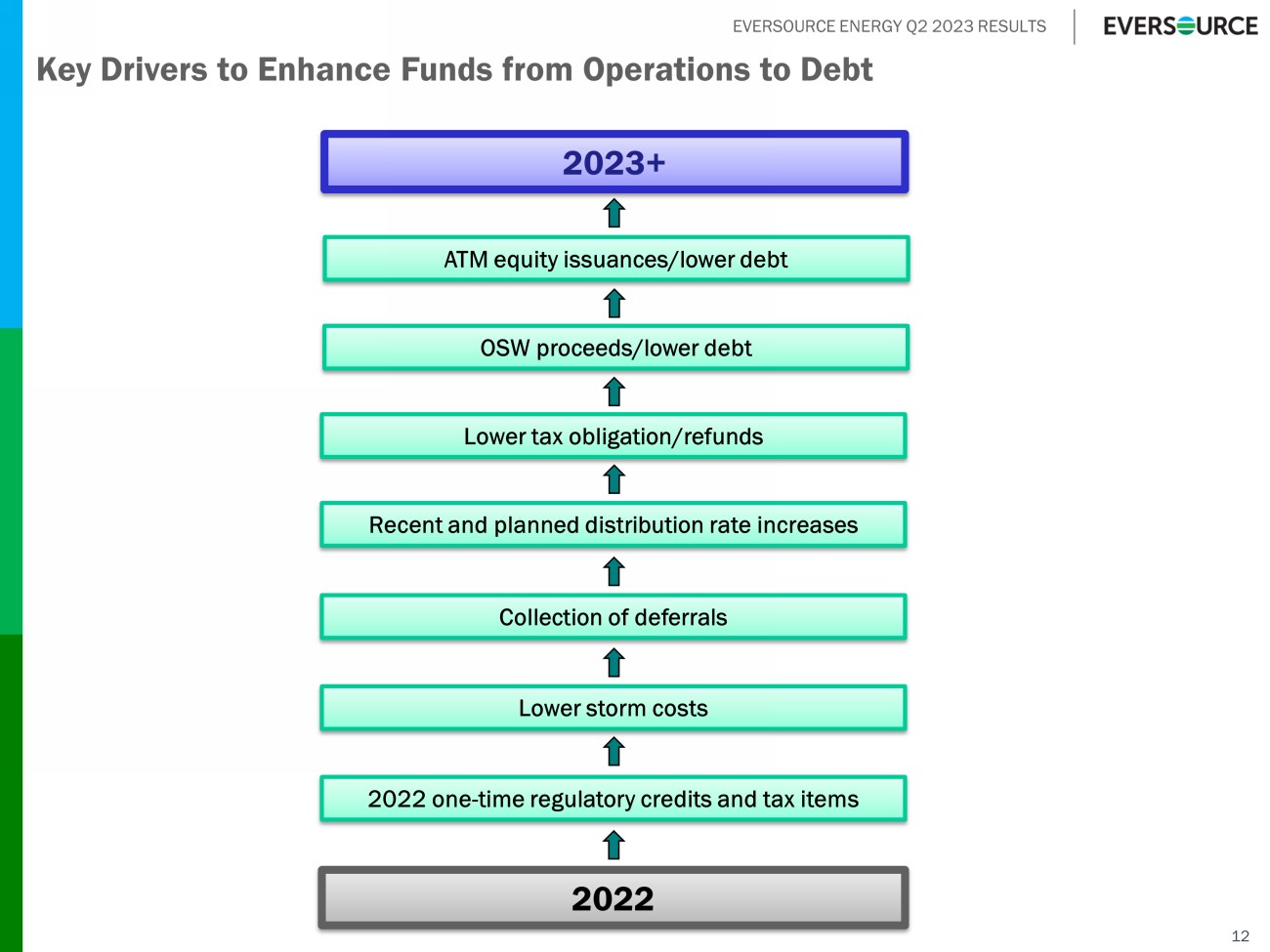

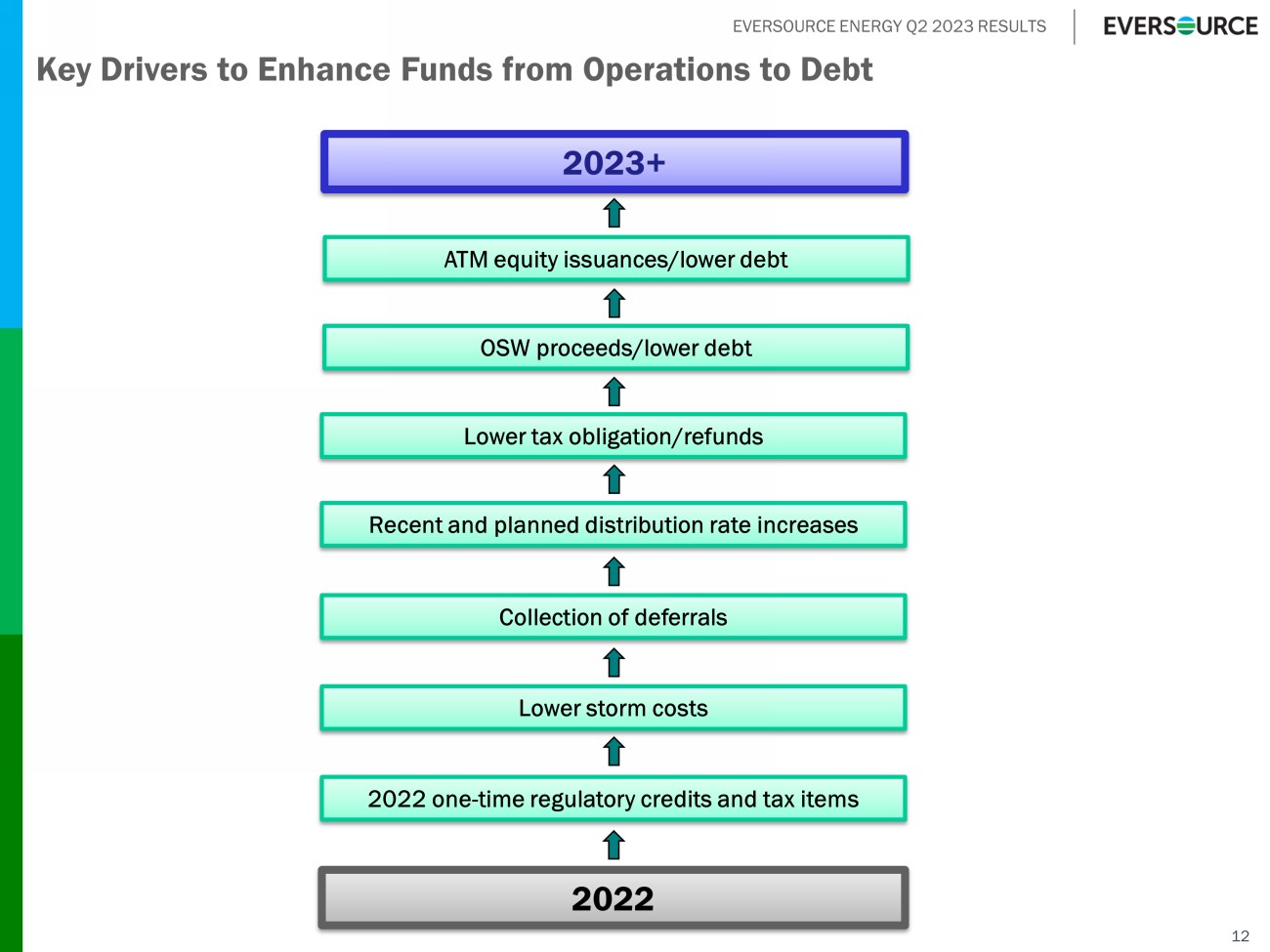

EVERSOURCE ENERGY Q2 2023 RESULTS 12 Key Drivers to Enhance Funds from Operations to Debt 2023+ Collection of deferrals Lower tax obligation/refunds 2022 one - time regulatory credits and tax items Recent and planned distribution rate increases Lower storm costs 2022 OSW proceeds/lower debt ATM equity issuances/lower debt

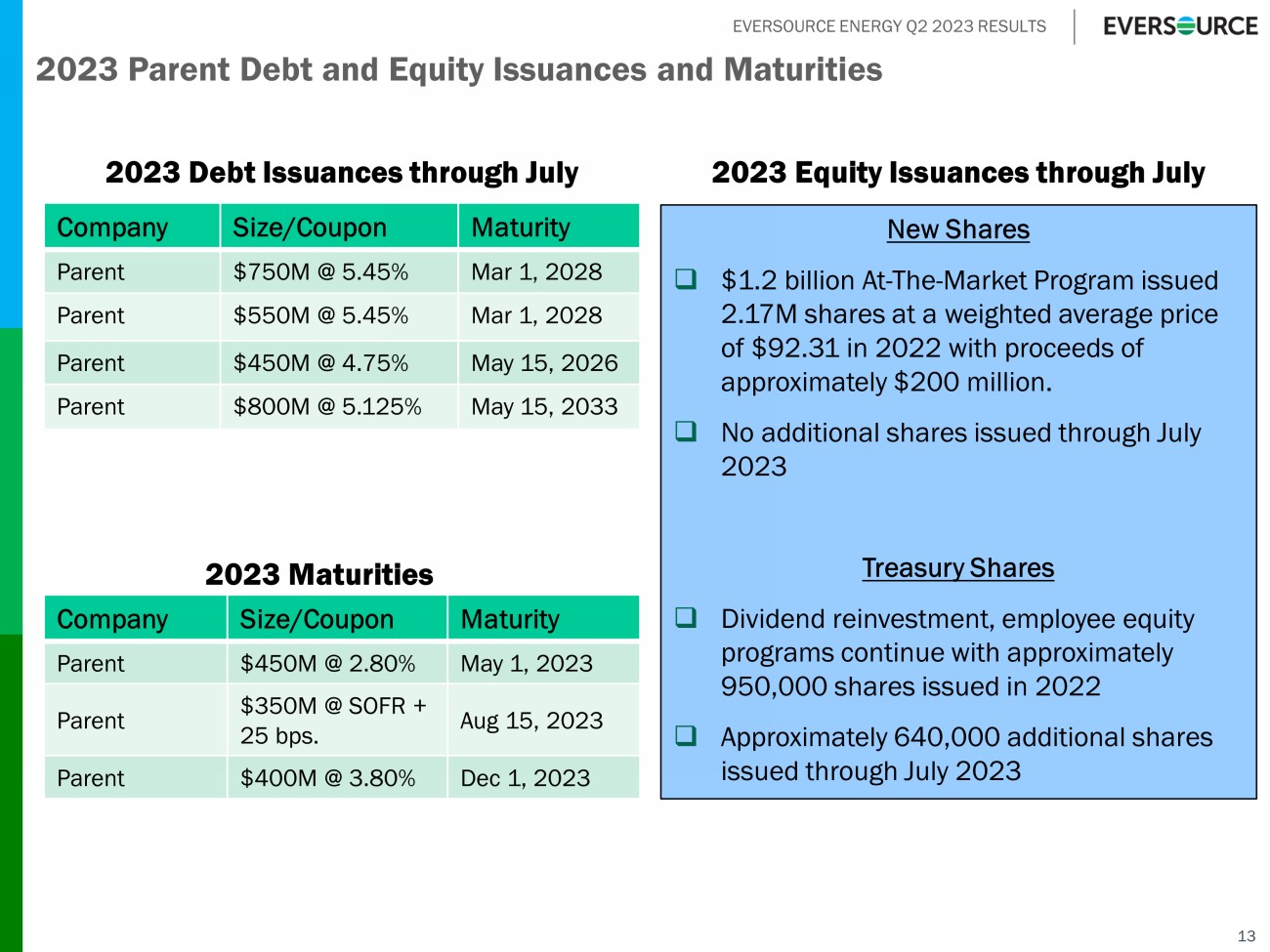

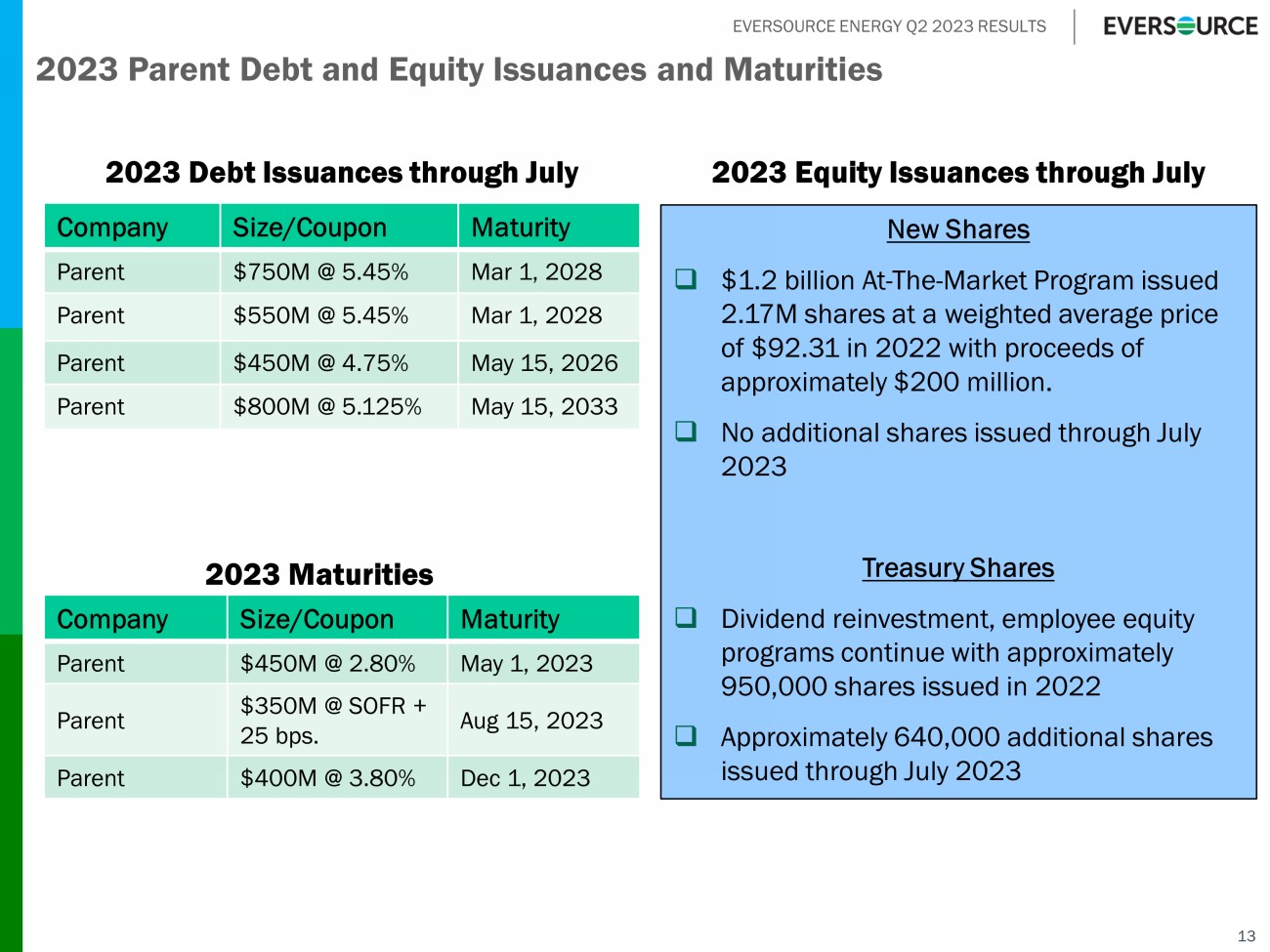

EVERSOURCE ENERGY Q2 2023 RESULTS Company Size/Coupon Maturity Parent $450M @ 2.80% May 1, 2023 Parent $350M @ SOFR + 25 bps. Aug 15, 2023 Parent $400M @ 3.80% Dec 1, 2023 13 2023 Parent Debt and Equity Issuances and Maturities 2023 Debt Issuances through July 2023 Maturities Company Size/Coupon Maturity Parent $750M @ 5.45% Mar 1, 2028 Parent $550M @ 5.45% Mar 1, 2028 Parent $450M @ 4.75% May 15, 2026 Parent $800M @ 5.125% May 15, 2033 New Shares □ $1.2 billion At - The - Market Program issued 2.17M shares at a weighted average price of $92.31 in 2022 with proceeds of approximately $200 million. □ No additional shares issued through July 2023 Treasury Shares □ Dividend reinvestment, employee equity programs continue with approximately 950,000 shares issued in 2022 □ Approximately 640,000 additional shares issued through July 2023 2023 Equity Issuances through July

EVERSOURCE ENERGY Q2 2023 RESULTS 14 APPENDIX

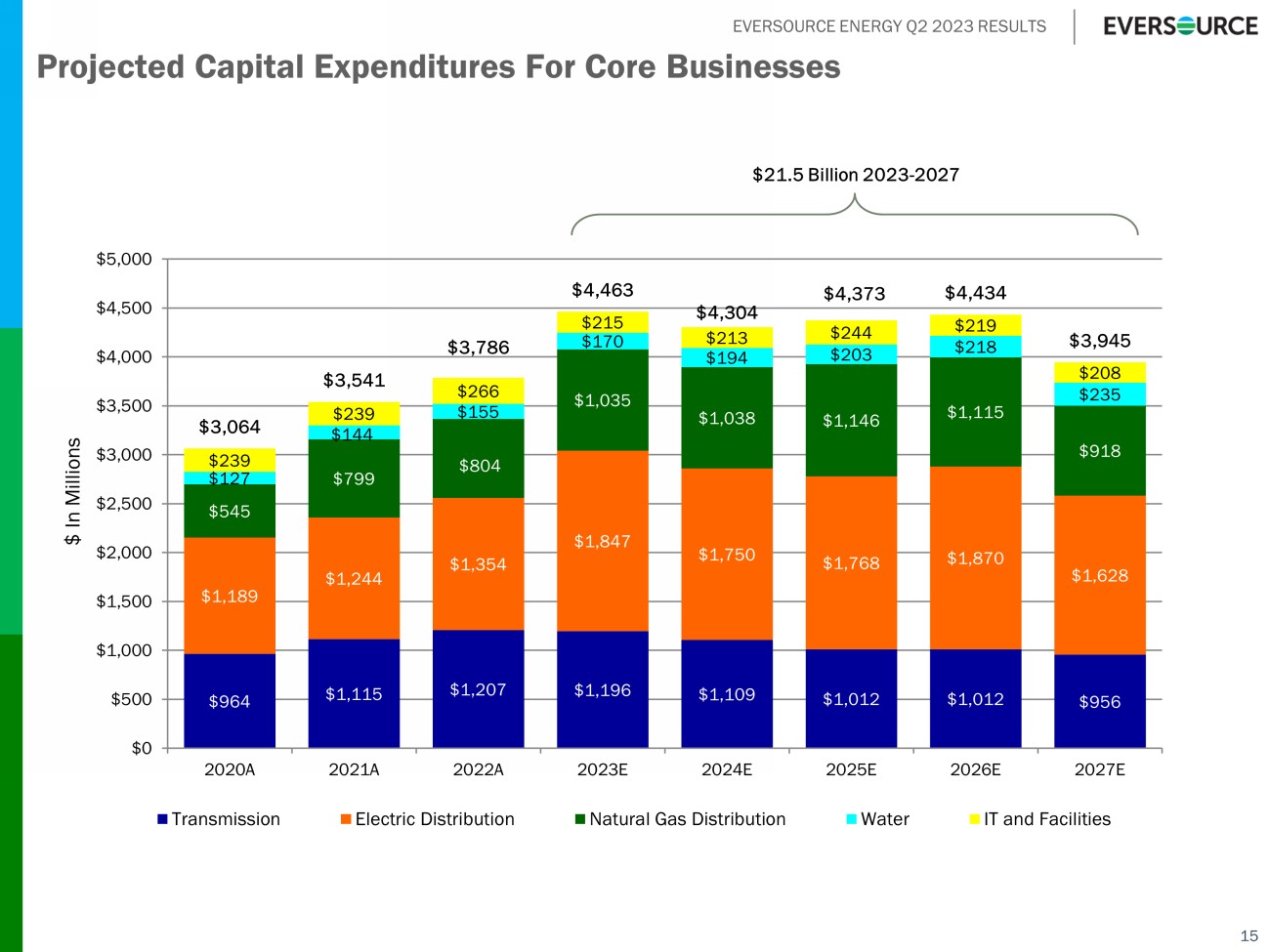

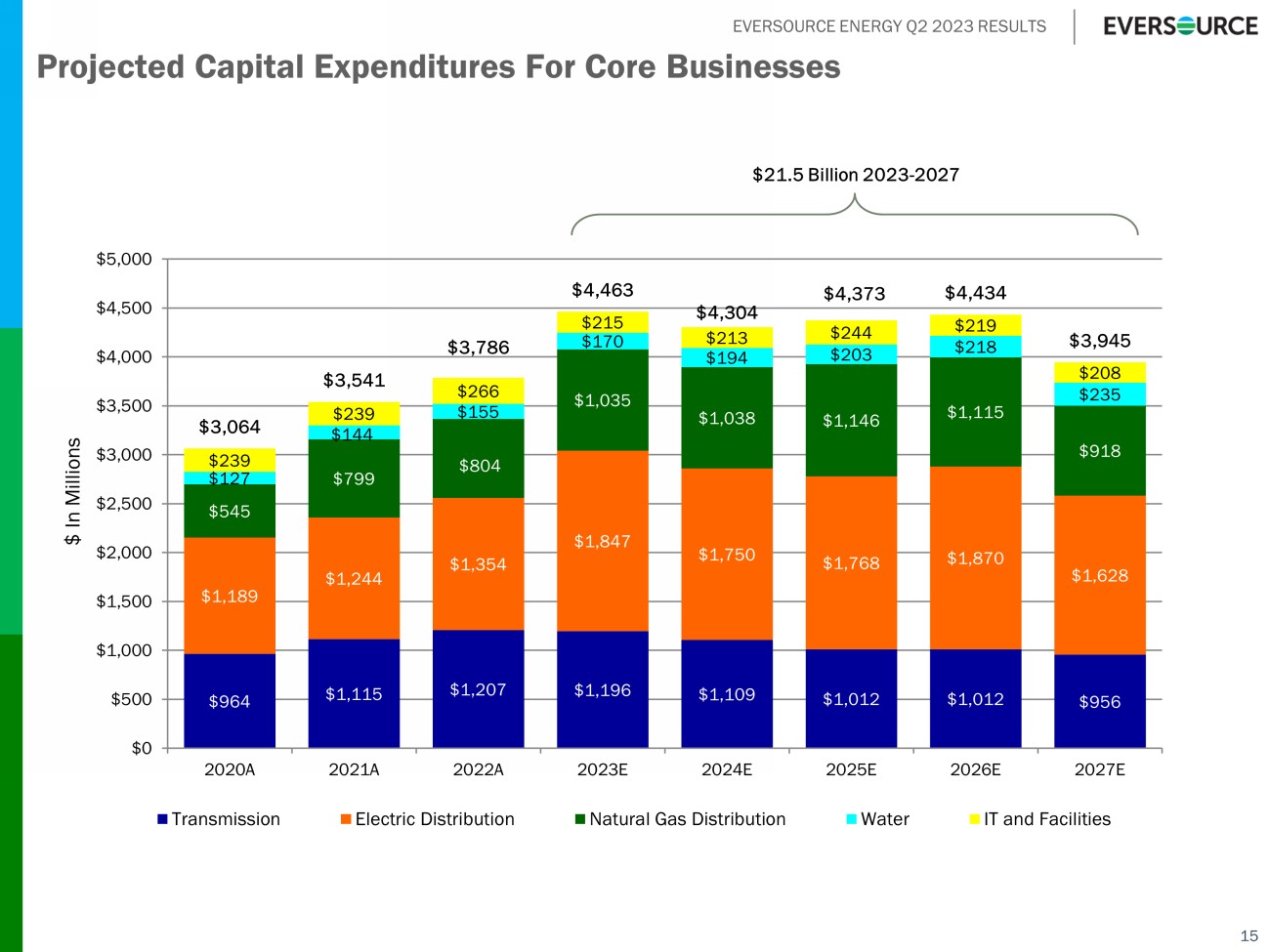

EVERSOURCE ENERGY Q2 2023 RESULTS Projected Capital Expenditures For Core Businesses 15 $964 $1,115 $1,207 $1,196 $1,109 $1,012 $1,012 $956 $1,189 $1,244 $1,354 $1,847 $1,750 $1,768 $1,870 $1,628 $545 $799 $804 $1,035 $1,038 $1,146 $1,115 $918 $127 $144 $155 $170 $194 $203 $218 $235 $239 $239 $266 $215 $213 $244 $219 $208 $3,064 $3,541 $3,786 $4,463 $4,304 $4,373 $4,434 $3,945 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2020A 2021A 2022A 2023E 2024E 2025E 2026E 2027E Transmission Electric Distribution Natural Gas Distribution Water IT and Facilities $ In Millions $21.5 Billion 2023 - 2027

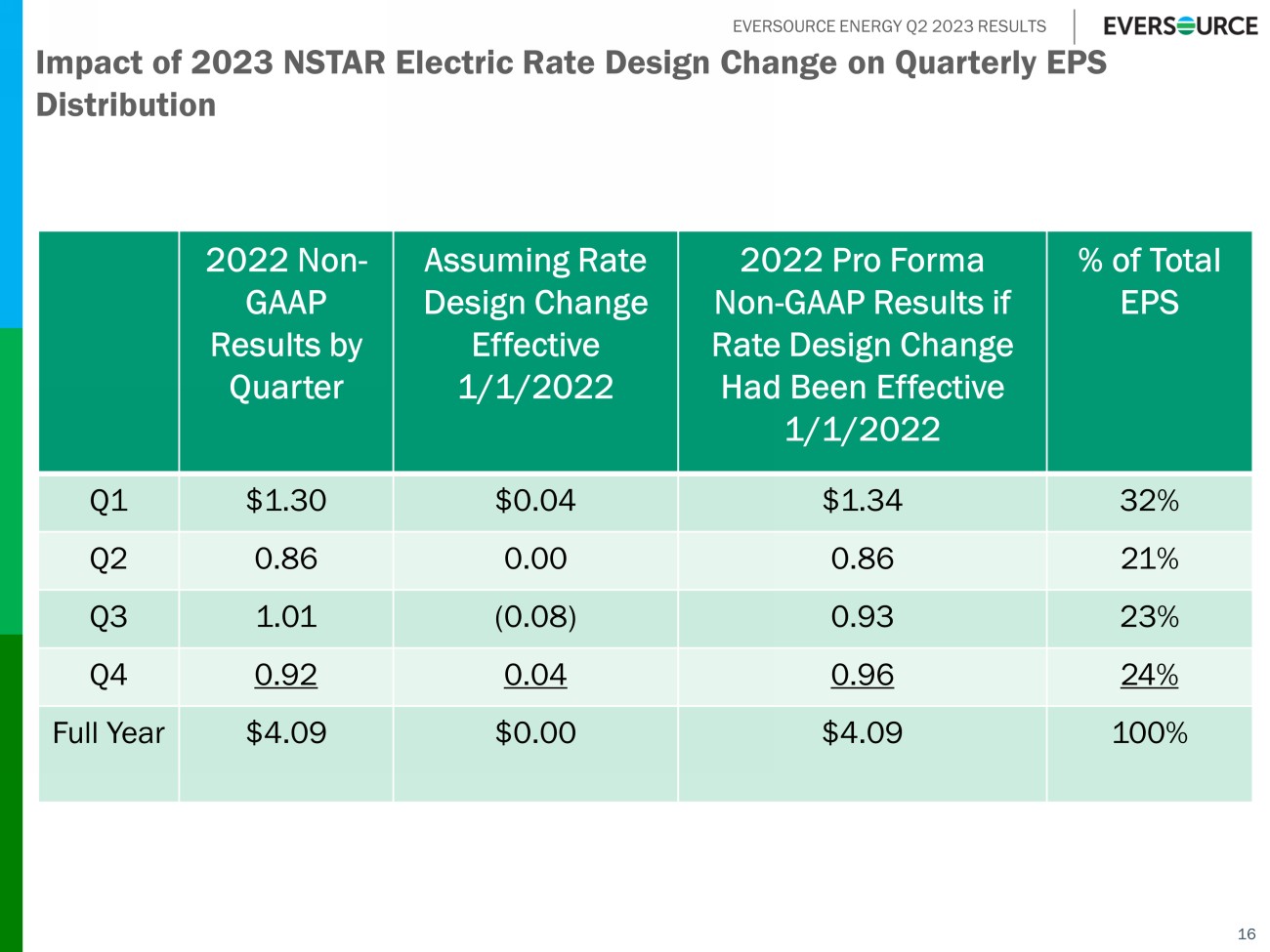

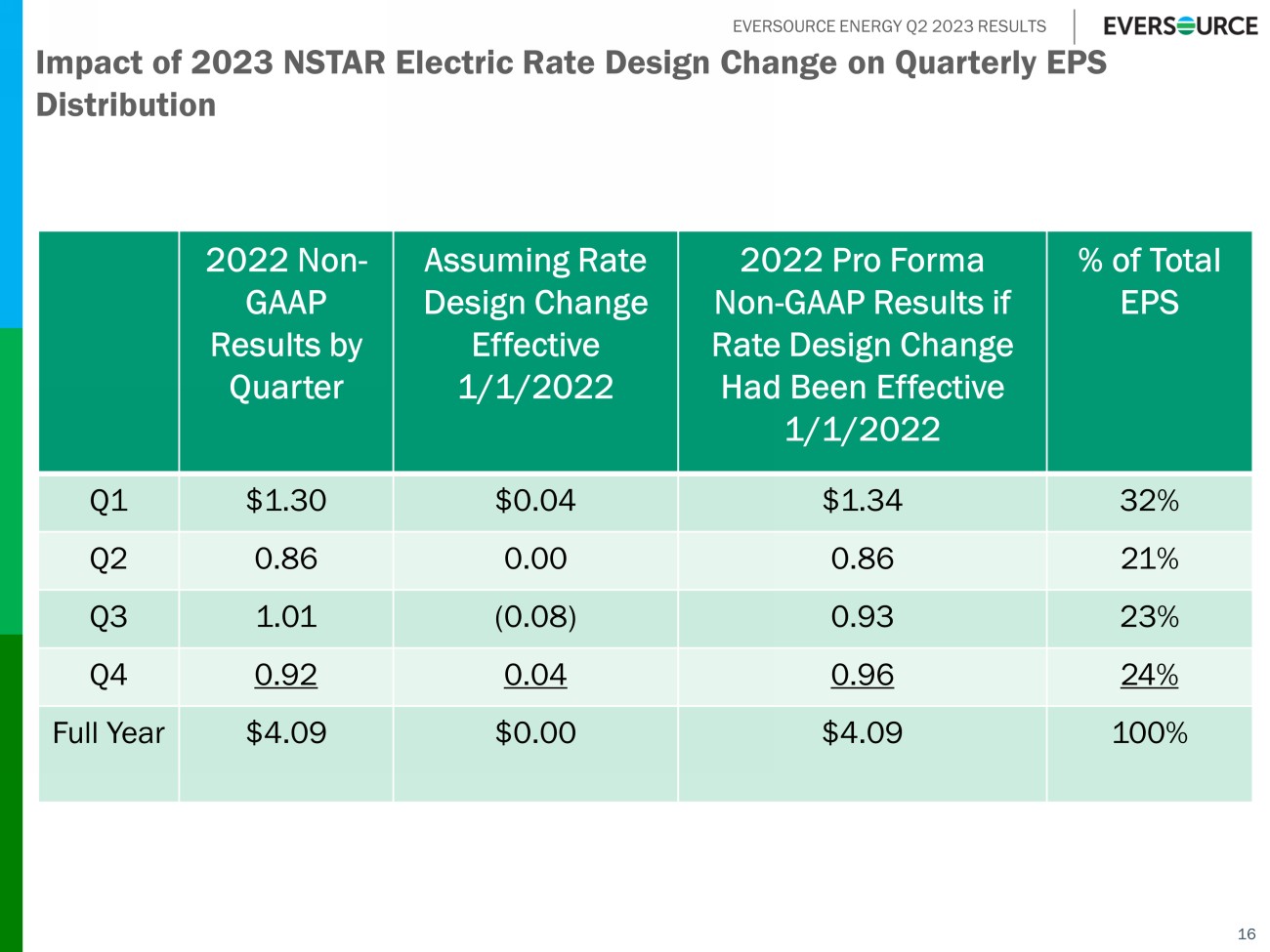

EVERSOURCE ENERGY Q2 2023 RESULTS 16 Impact of 2023 NSTAR Electric Rate Design Change on Quarterly EPS Distribution 2022 Non - GAAP Results by Quarter Assuming Rate Design Change Effective 1/1/2022 2022 Pro Forma Non - GAAP Results if Rate Design Change Had Been Effective 1/1/2022 % of Total EPS Q1 $1.30 $0.04 $1.34 32% Q2 0.86 0.00 0.86 21% Q3 1.01 (0.08) 0.93 23% Q4 0.92 0.04 0.96 24% Full Year $4.09 $0.00 $4.09 100%