Exhibit 99.2

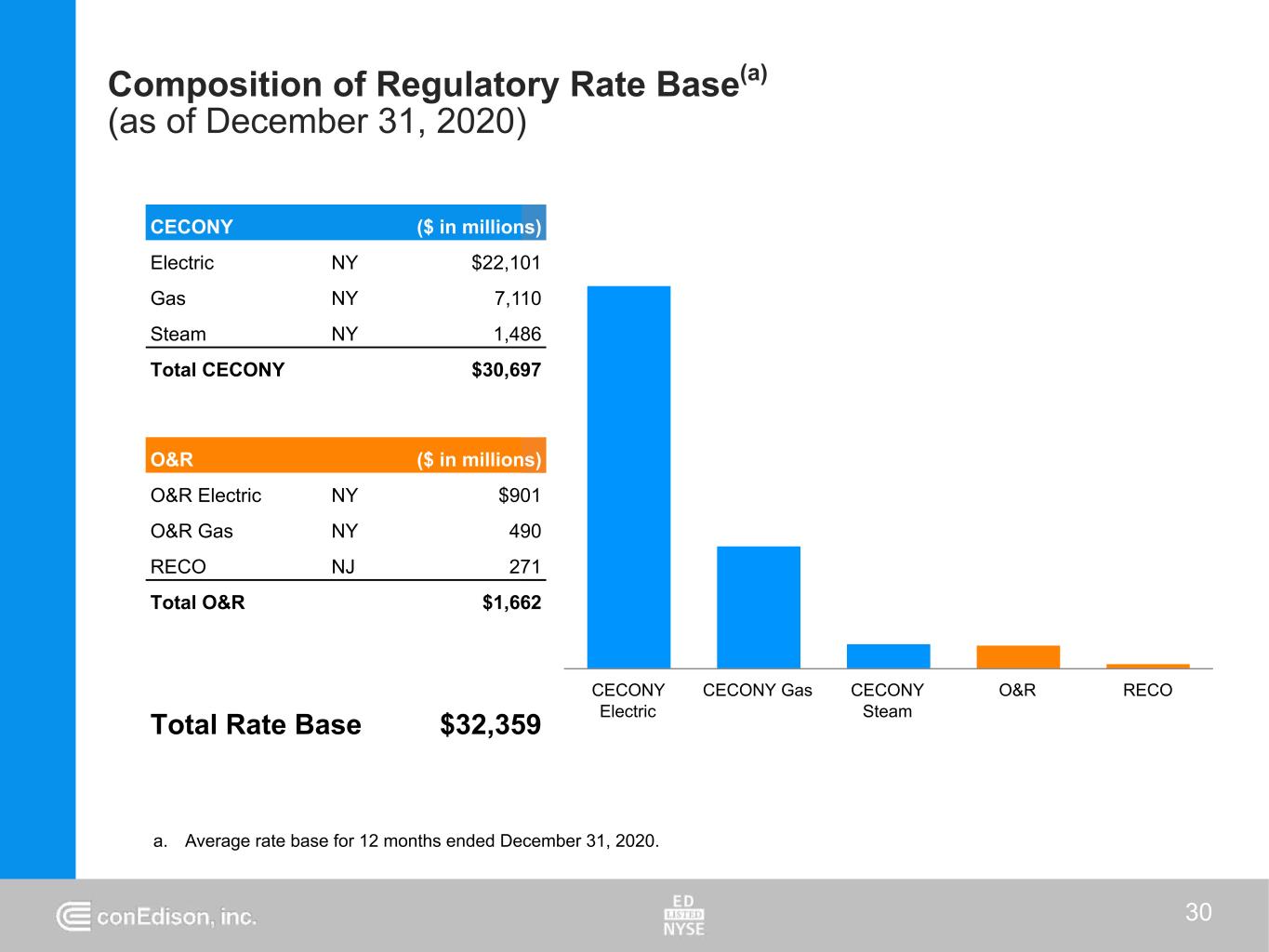

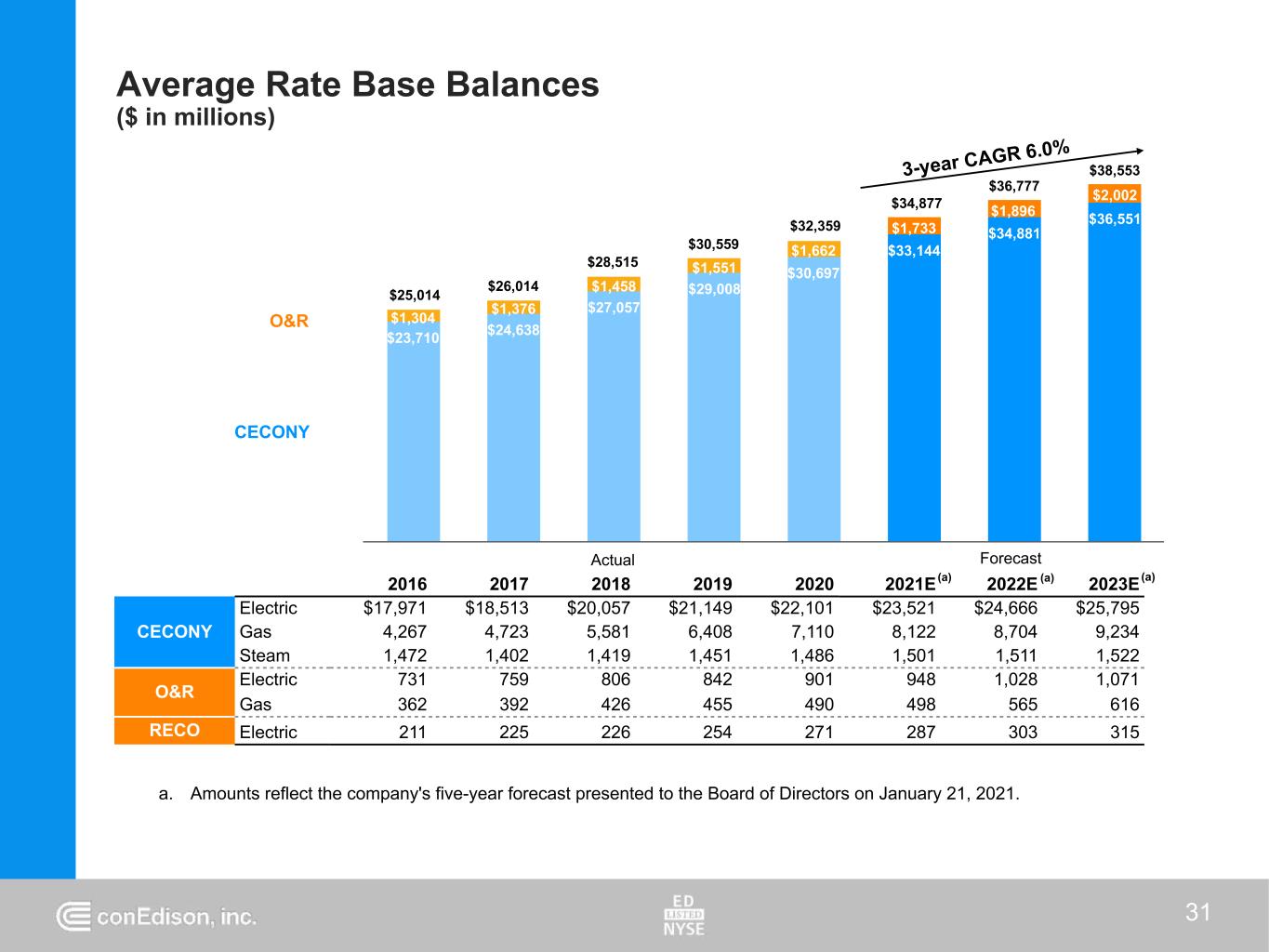

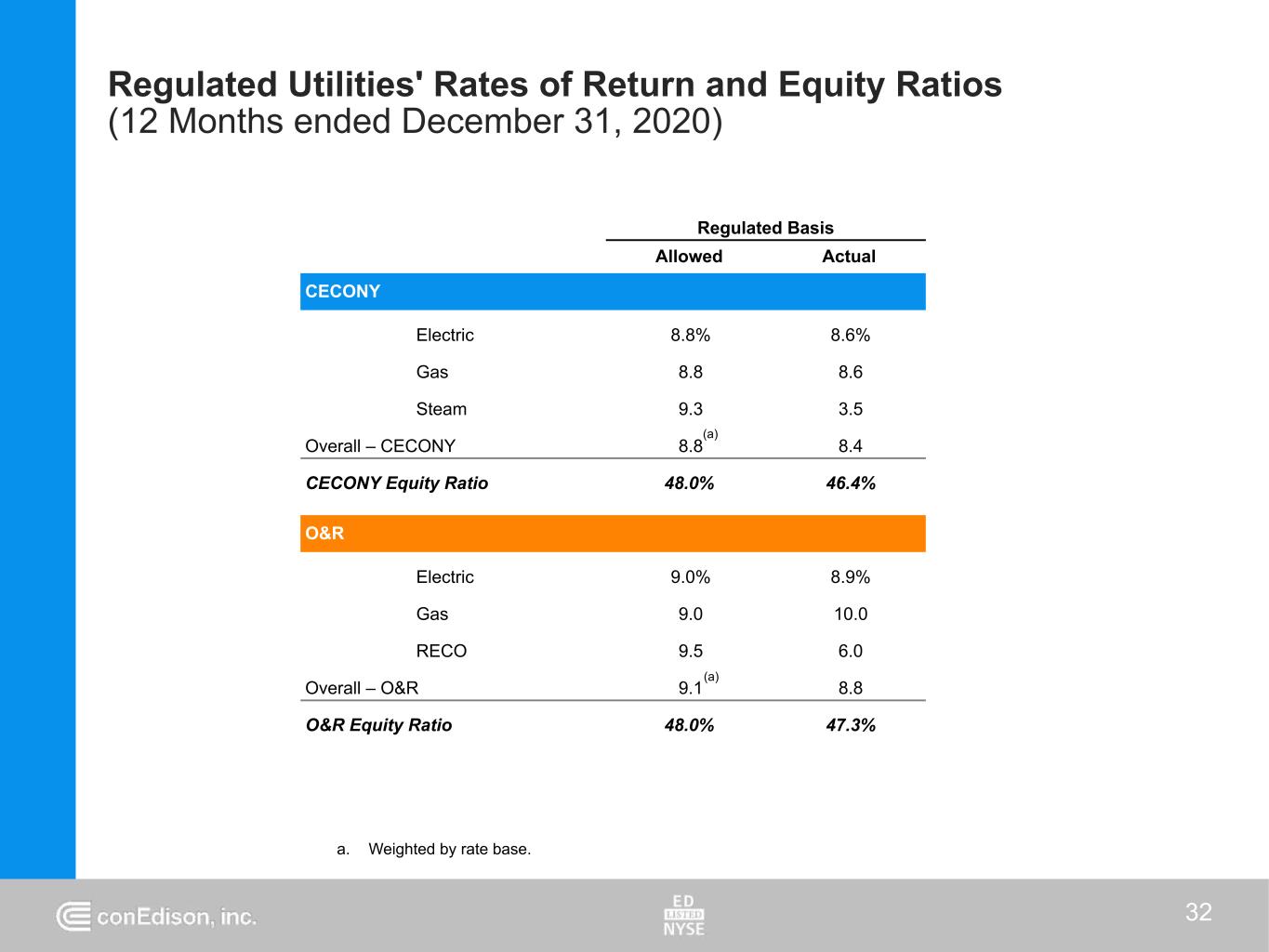

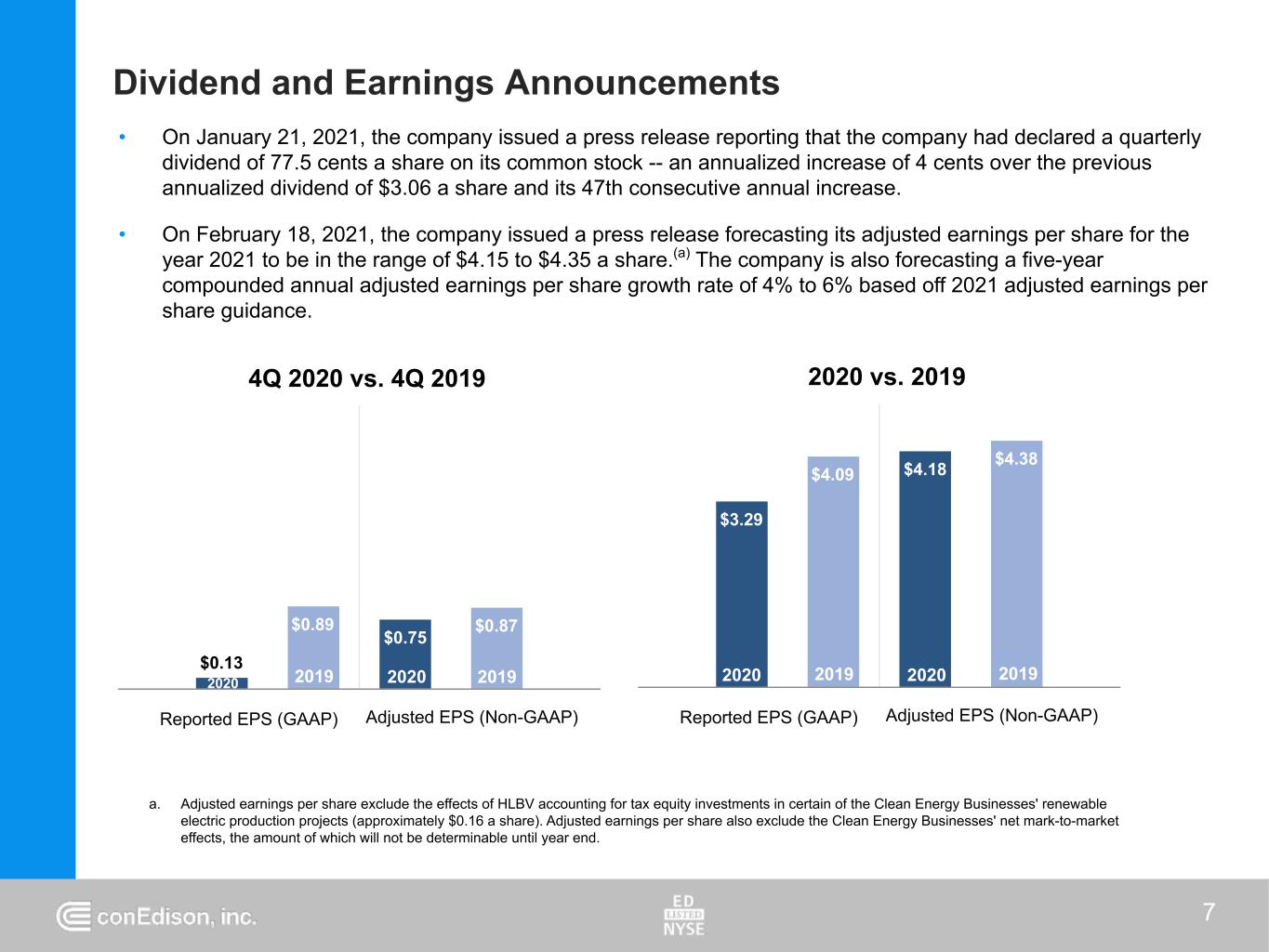

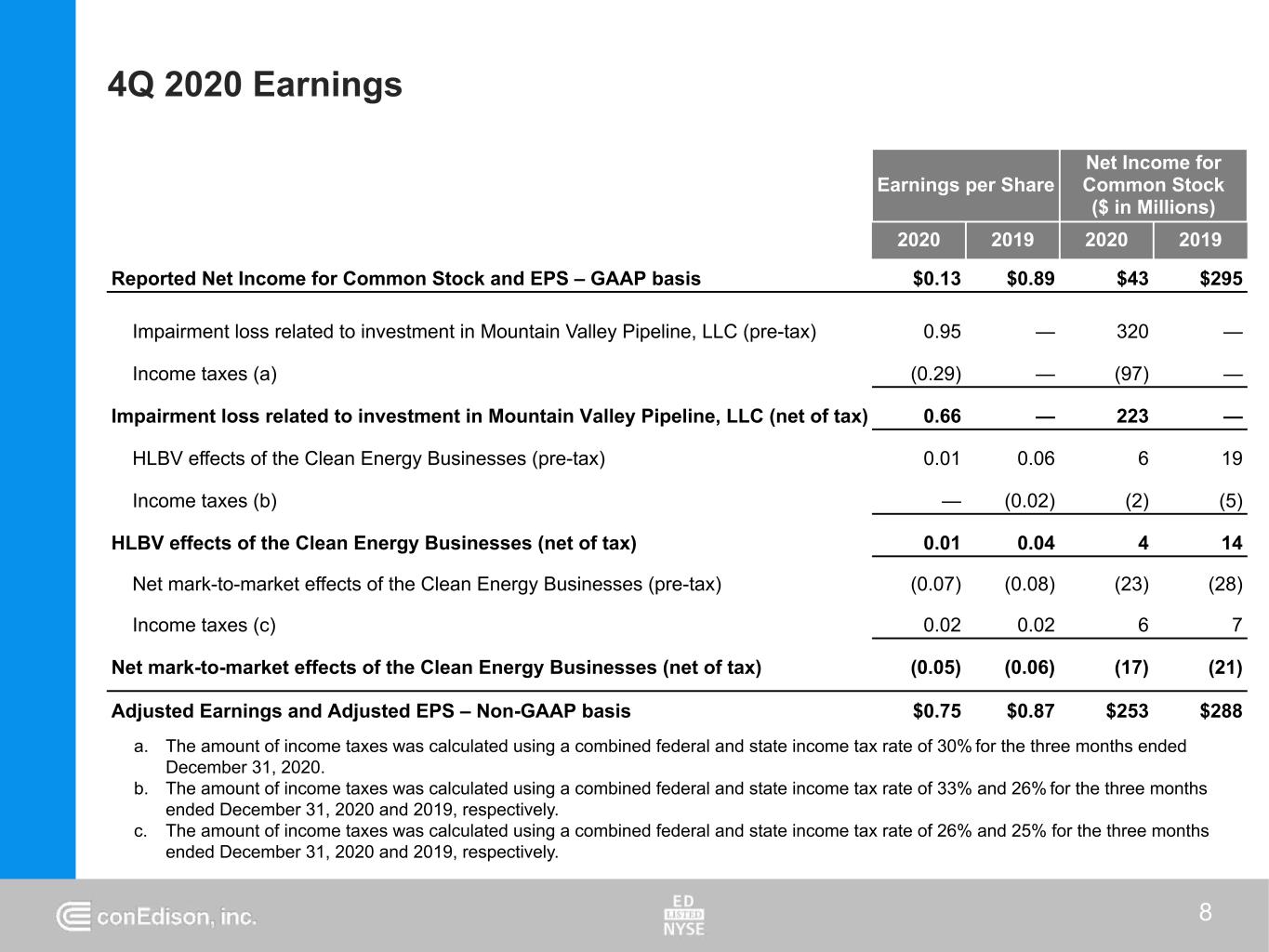

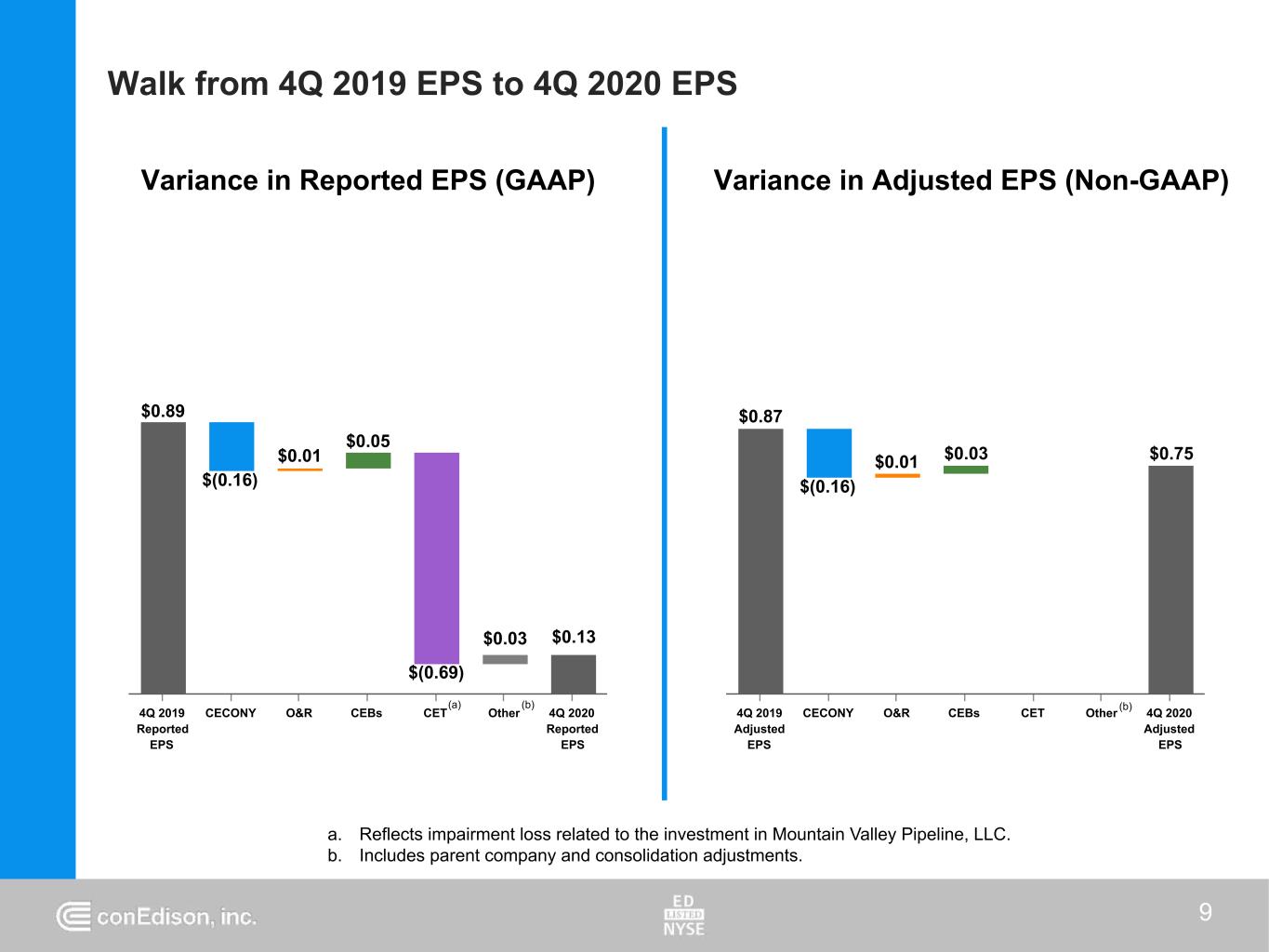

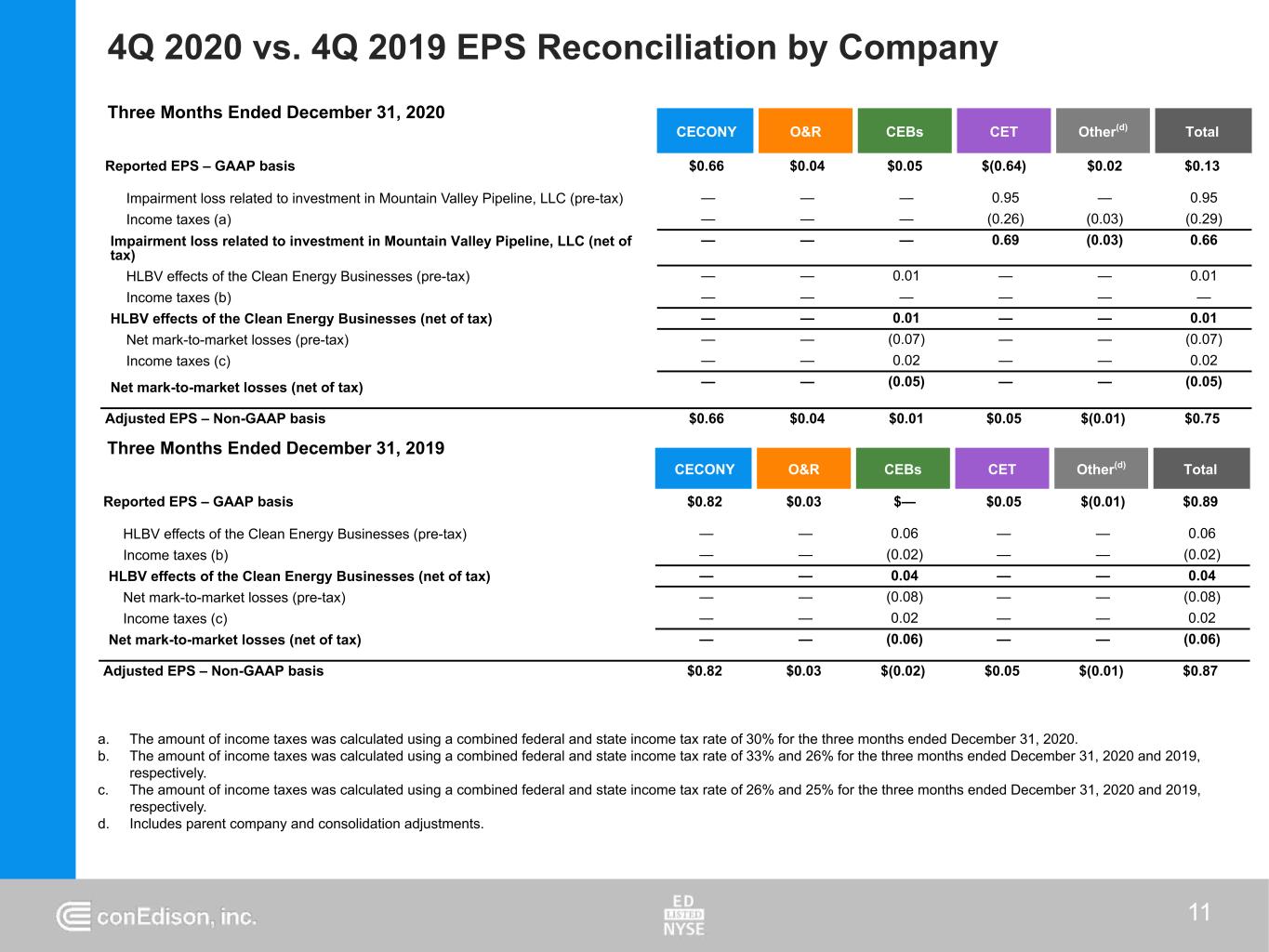

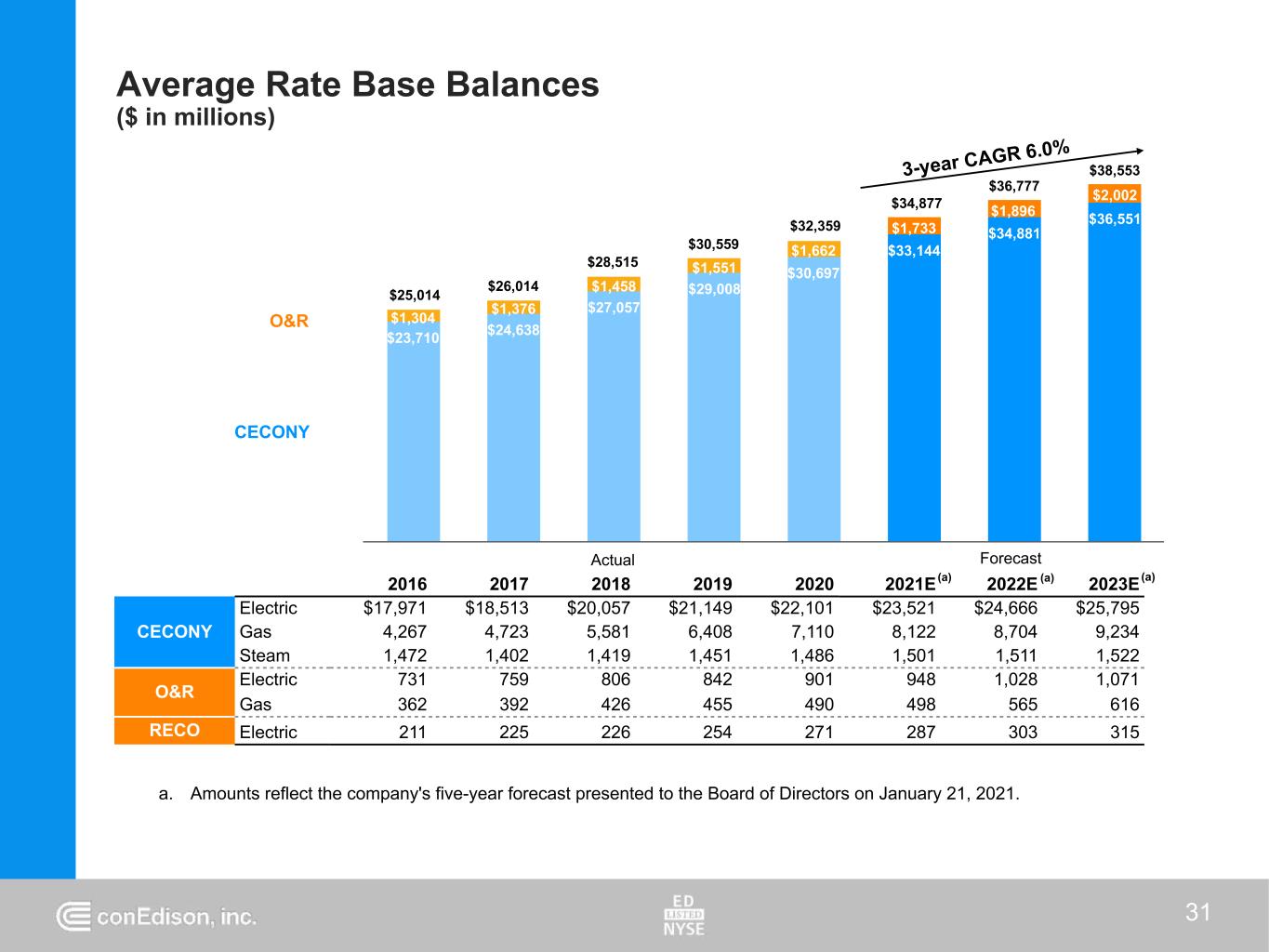

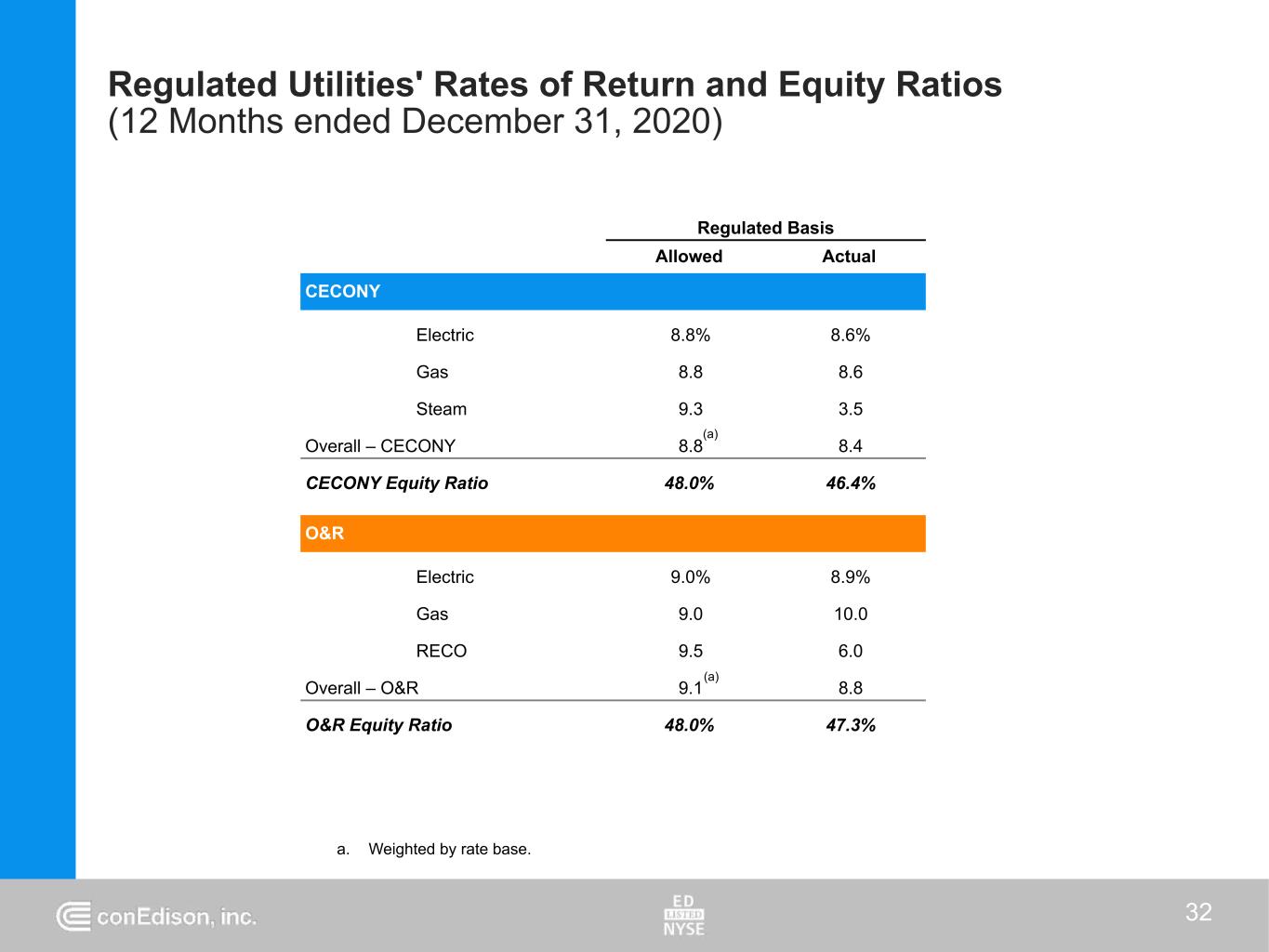

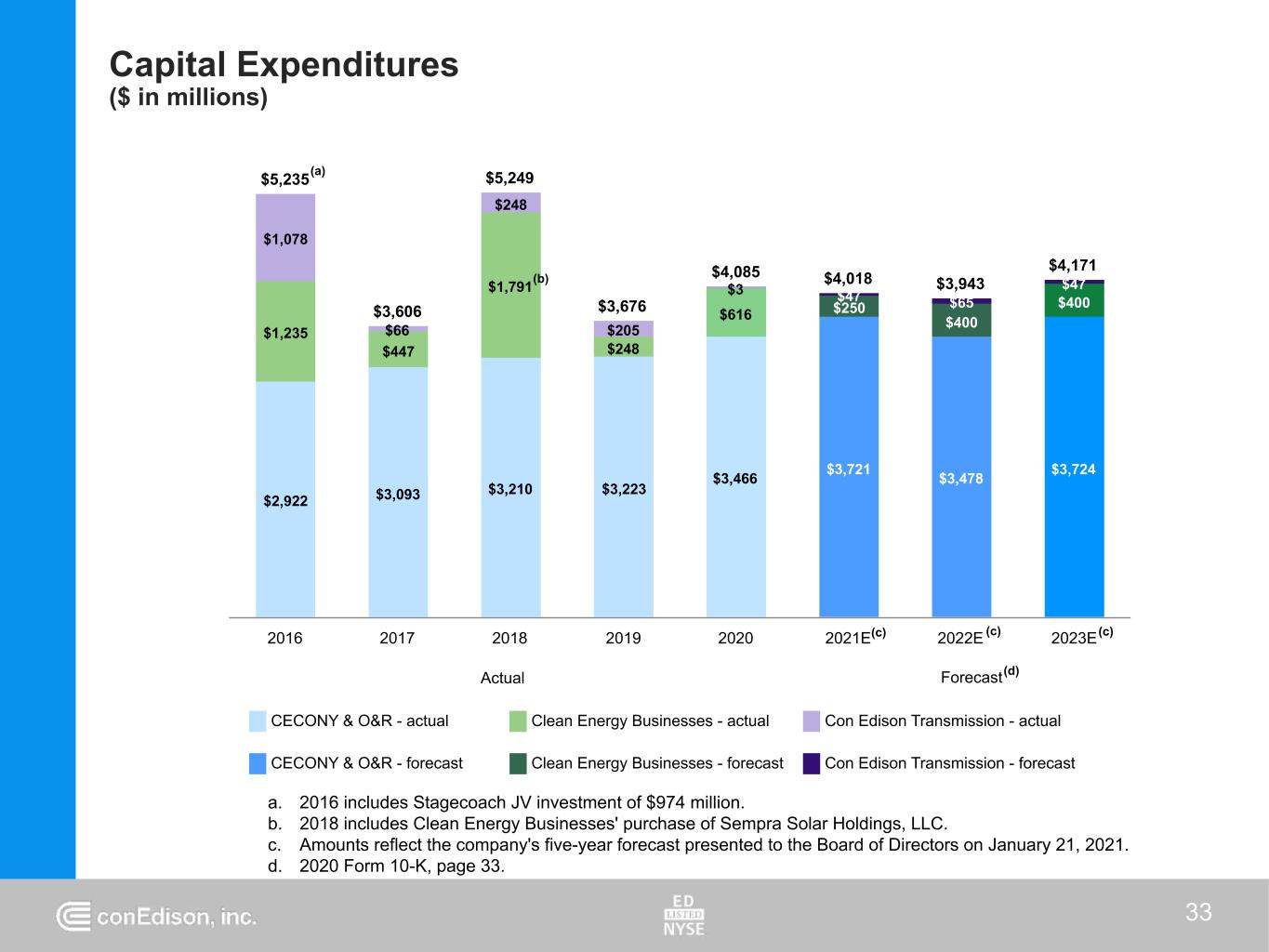

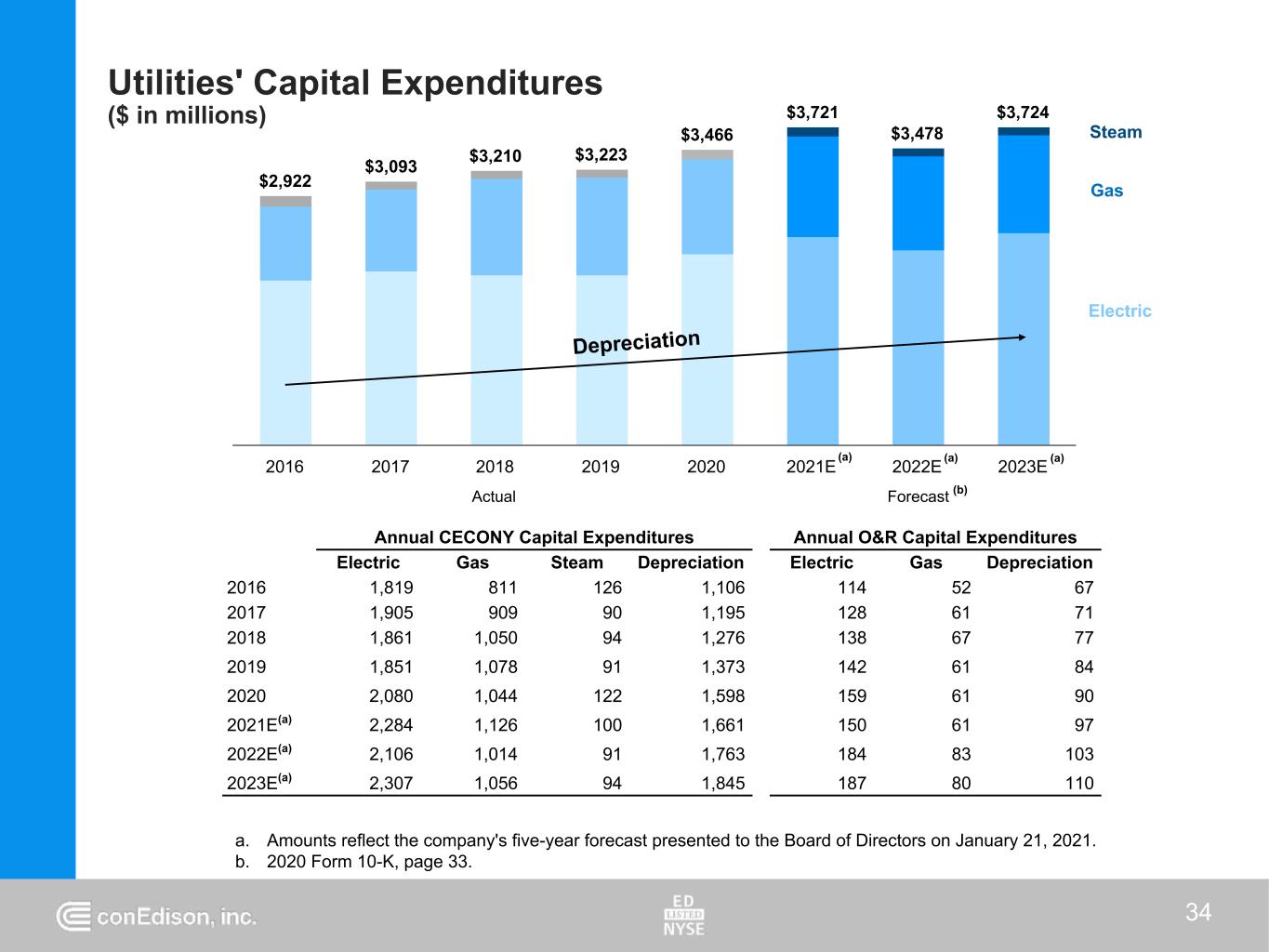

Table of Contents 3 Page Organizational Structure and Plan 4 – 5 Our Clean Energy Commitment 6 Dividend and Earnings Announcements 7 4Q 2020 Earnings 8 – 11 4Q 2020 Developments 12 – 17 2020 Earnings 18 – 21 Five-Year Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 22 Earnings Adjustment Mechanisms (EAMs) and Positive Incentives 23 The Coronavirus Disease (COVID-19) Pandemic 24 – 28 CECONY Operations and Maintenance Expenses 29 Composition of Regulatory Rate Base 30 Average Rate Base Balances 31 Regulated Utilities' Rates of Return and Equity Ratios 32 Capital Expenditures and Utilities' Capital Expenditures 33 – 34 2020 Financing Activity 35 Financing Plan for 2021 – 2023 36 Capital Structure and Commercial Paper Borrowings 37 – 38 Liquidity Update 39 Transparent Rate-Making Process 40 Utilities' Rate Adjustments for Tax Cuts and Jobs Act of 2017 (TCJA) 41 – 42 The Coronavirus Aid Relief and Economic Security (CARES) Act and 2021 Appropriations Act 43 Utilities' Sales and Revenues 44 – 48 2020 Summary Segmented Financial Statements 49 – 52 Environmental, Social and Corporate Governance 53 – 55 Rating Agency Credit Metrics 56 List of Notes to 2020 Form 10-K Financial Statements 57

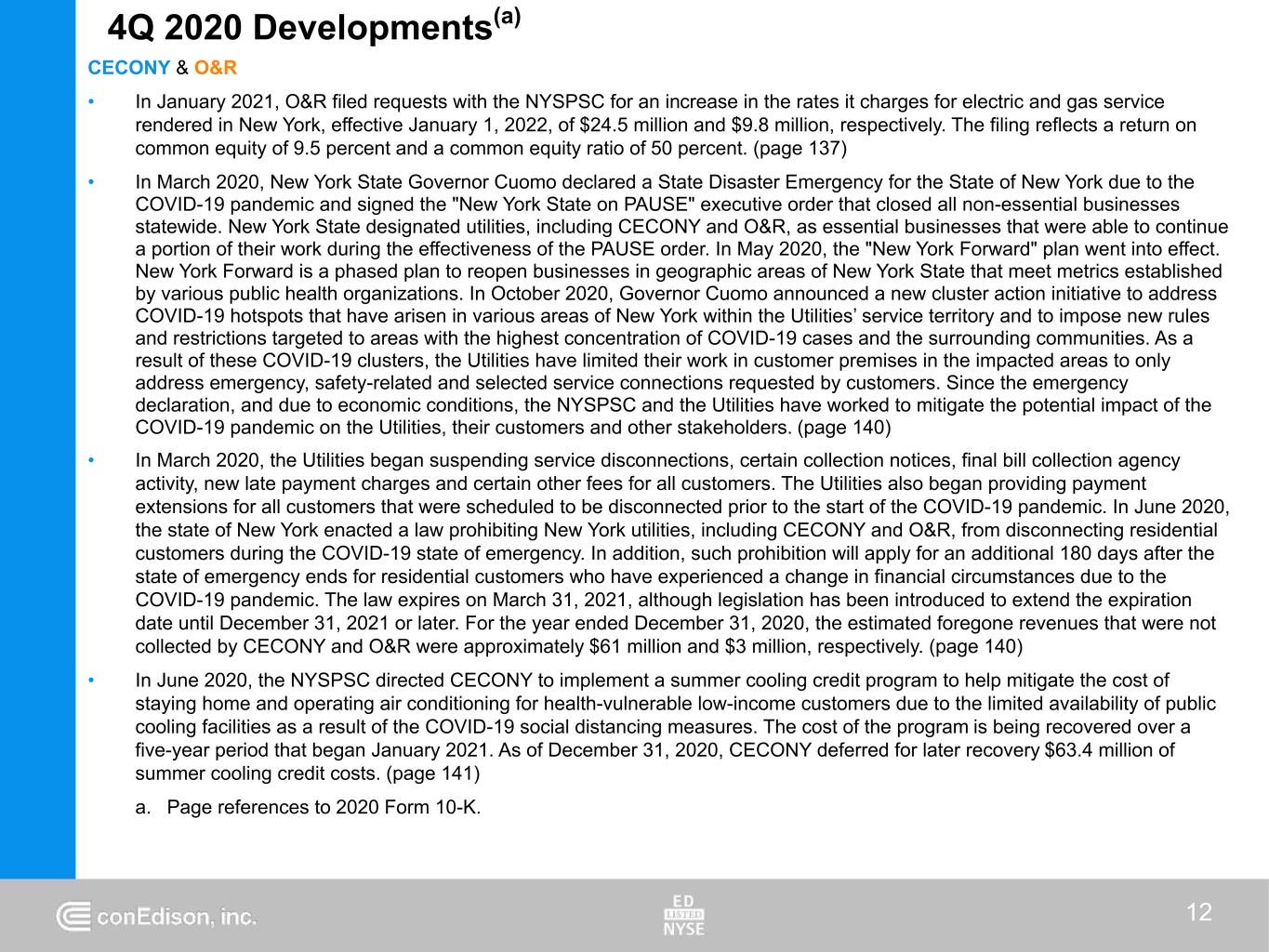

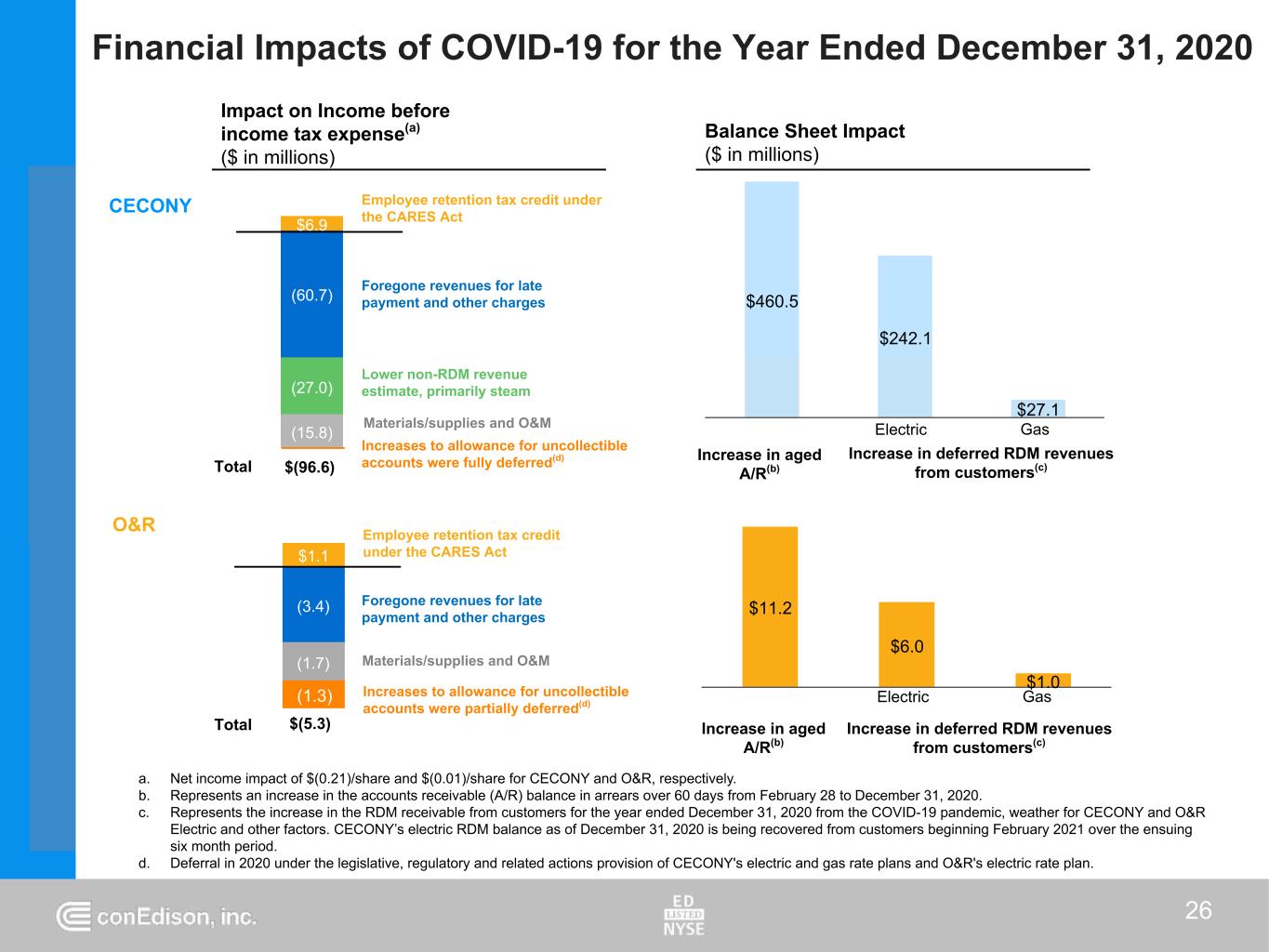

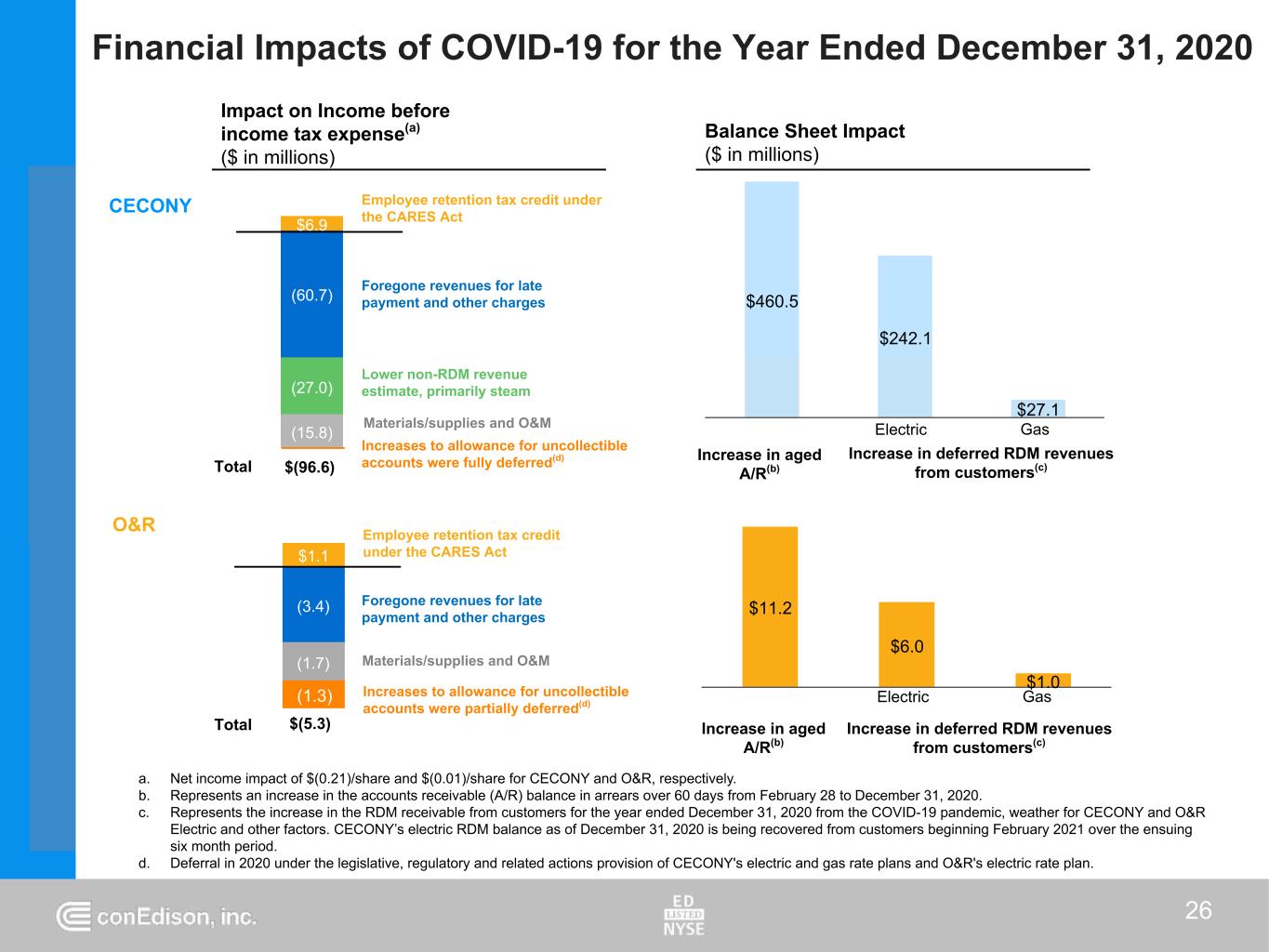

4Q 2020 Developments(a) 12 CECONY & O&R • In January 2021, O&R filed requests with the NYSPSC for an increase in the rates it charges for electric and gas service rendered in New York, effective January 1, 2022, of $24.5 million and $9.8 million, respectively. The filing reflects a return on common equity of 9.5 percent and a common equity ratio of 50 percent. (page 137) • In March 2020, New York State Governor Cuomo declared a State Disaster Emergency for the State of New York due to the COVID-19 pandemic and signed the "New York State on PAUSE" executive order that closed all non-essential businesses statewide. New York State designated utilities, including CECONY and O&R, as essential businesses that were able to continue a portion of their work during the effectiveness of the PAUSE order. In May 2020, the "New York Forward" plan went into effect. New York Forward is a phased plan to reopen businesses in geographic areas of New York State that meet metrics established by various public health organizations. In October 2020, Governor Cuomo announced a new cluster action initiative to address COVID-19 hotspots that have arisen in various areas of New York within the Utilities’ service territory and to impose new rules and restrictions targeted to areas with the highest concentration of COVID-19 cases and the surrounding communities. As a result of these COVID-19 clusters, the Utilities have limited their work in customer premises in the impacted areas to only address emergency, safety-related and selected service connections requested by customers. Since the emergency declaration, and due to economic conditions, the NYSPSC and the Utilities have worked to mitigate the potential impact of the COVID-19 pandemic on the Utilities, their customers and other stakeholders. (page 140) • In March 2020, the Utilities began suspending service disconnections, certain collection notices, final bill collection agency activity, new late payment charges and certain other fees for all customers. The Utilities also began providing payment extensions for all customers that were scheduled to be disconnected prior to the start of the COVID-19 pandemic. In June 2020, the state of New York enacted a law prohibiting New York utilities, including CECONY and O&R, from disconnecting residential customers during the COVID-19 state of emergency. In addition, such prohibition will apply for an additional 180 days after the state of emergency ends for residential customers who have experienced a change in financial circumstances due to the COVID-19 pandemic. The law expires on March 31, 2021, although legislation has been introduced to extend the expiration date until December 31, 2021 or later. For the year ended December 31, 2020, the estimated foregone revenues that were not collected by CECONY and O&R were approximately $61 million and $3 million, respectively. (page 140) • In June 2020, the NYSPSC directed CECONY to implement a summer cooling credit program to help mitigate the cost of staying home and operating air conditioning for health-vulnerable low-income customers due to the limited availability of public cooling facilities as a result of the COVID-19 social distancing measures. The cost of the program is being recovered over a five-year period that began January 2021. As of December 31, 2020, CECONY deferred for later recovery $63.4 million of summer cooling credit costs. (page 141) a. Page references to 2020 Form 10-K.

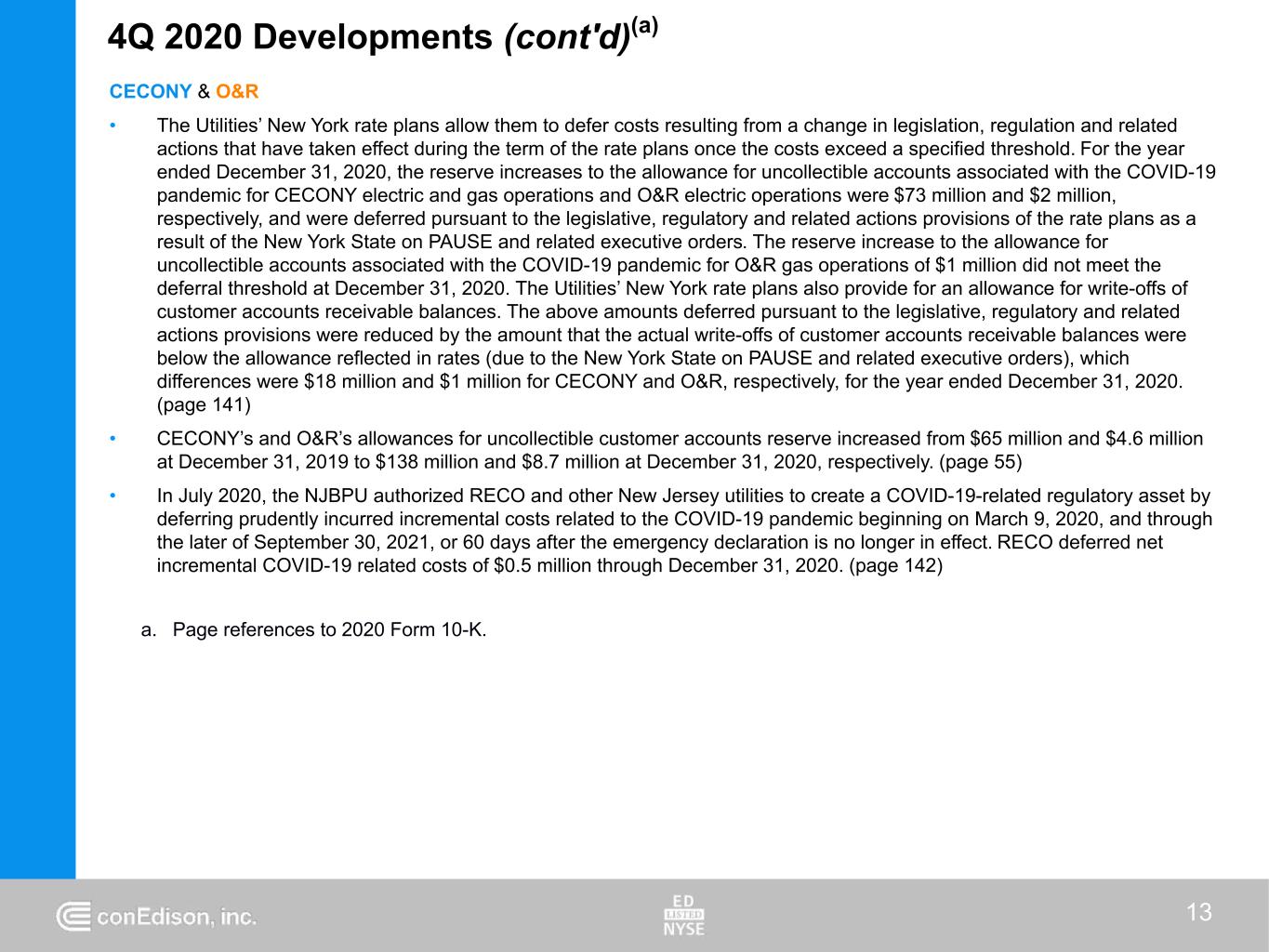

4Q 2020 Developments (cont'd)(a) 13 CECONY & O&R • The Utilities’ New York rate plans allow them to defer costs resulting from a change in legislation, regulation and related actions that have taken effect during the term of the rate plans once the costs exceed a specified threshold. For the year ended December 31, 2020, the reserve increases to the allowance for uncollectible accounts associated with the COVID-19 pandemic for CECONY electric and gas operations and O&R electric operations were $73 million and $2 million, respectively, and were deferred pursuant to the legislative, regulatory and related actions provisions of the rate plans as a result of the New York State on PAUSE and related executive orders. The reserve increase to the allowance for uncollectible accounts associated with the COVID-19 pandemic for O&R gas operations of $1 million did not meet the deferral threshold at December 31, 2020. The Utilities’ New York rate plans also provide for an allowance for write-offs of customer accounts receivable balances. The above amounts deferred pursuant to the legislative, regulatory and related actions provisions were reduced by the amount that the actual write-offs of customer accounts receivable balances were below the allowance reflected in rates (due to the New York State on PAUSE and related executive orders), which differences were $18 million and $1 million for CECONY and O&R, respectively, for the year ended December 31, 2020. (page 141) • CECONY’s and O&R’s allowances for uncollectible customer accounts reserve increased from $65 million and $4.6 million at December 31, 2019 to $138 million and $8.7 million at December 31, 2020, respectively. (page 55) • In July 2020, the NJBPU authorized RECO and other New Jersey utilities to create a COVID-19-related regulatory asset by deferring prudently incurred incremental costs related to the COVID-19 pandemic beginning on March 9, 2020, and through the later of September 30, 2021, or 60 days after the emergency declaration is no longer in effect. RECO deferred net incremental COVID-19 related costs of $0.5 million through December 31, 2020. (page 142) a. Page references to 2020 Form 10-K.

4Q 2020 Developments (cont'd)(a) 14 CECONY & O&R • In November 2020, the NYSPSC issued an order in its proceedings investigating July 2019 outages in Manhattan and Brooklyn, and pursue civil or administrative penalties in the amount of up to $24.8 million for CECONY’s alleged failure to comply with certain requirements. The order further indicated that should the NYSPSC confirm some or all of the apparent violations identified in the order or other orders issued by the NYSPSC in the future in connection with this proceeding, and should such confirmed violations be classified as findings of repeated violations of the Public Service Law or rules or regulations adopted pursuant thereto that demonstrate a failure of CECONY to continue to provide safe and adequate service, the NYSPSC would be authorized to commence a proceeding under Public Service Law Section 68(2) to revoke or modify CECONY’s certificate as it relates to its service territory or any portion thereof. (page 143) • In December 2020, CECONY filed a response to the NYSPSC order demonstrating why the NYSPSC should not commence a penalty or prudence action against CECONY. CECONY stated that the NYSPSC order misapplied Section 25- a of the Public Service Law by ignoring the reasonable compliance standard under the statute and instead, was imposing a strict liability standard. For both outages, CECONY presented evidence that it either had complied or reasonably complied with NYSPSC requirements. With respect to the Manhattan outage, CECONY stated that a prudency proceeding was not justified because CECONY’s actions with respect to the Manhattan outage were reasonable based on the information the company had at the time. With respect to the Brooklyn outage, the company stated that the order failed to allege that improper company actions caused the outage. During 2019, CECONY recorded negative revenue adjustments associated with reliability performance provisions of $15 million in aggregate primarily related to these outages. CECONY has not accrued any additional liability related to this matter and is unable to determine the outcome of this proceeding at this time. (page 143) a. Page references to 2020 Form 10-K.

4Q 2020 Developments (cont'd)(a) 15 CECONY & O&R • In August 2020, Tropical Storm Isaias caused significant damage to the Utilities’ electric distribution systems and interrupted service to approximately 330,000 CECONY electric customers and approximately 200,000 O&R electric customers. As of December 31, 2020, CECONY incurred costs for Tropical Storm Isaias of $153 million (including $77 million of operation and maintenance expenses charged against a storm reserve pursuant to its electric rate plan, $58 million of capital expenditures and $18 million of operation and maintenance expenses). As of December 31, 2020, O&R incurred costs for Tropical Storm Isaias of $34 million (including $26 million of operation and maintenance expenses charged against a storm reserve pursuant to its New York electric rate plan and $8 million of capital expenditures). The Utilities’ electric rate plans provide for recovery of operating costs and capital expenditures under different provisions. The Utilities’ incremental operating costs attributable to storms are to be deferred for recovery as a regulatory asset under their electric rate plans, while capital expenditures, up to specified levels, are reflected in rates under their electric rate plans. In addition, as of December 31, 2020, CECONY and O&R incurred costs of $7.5 million and $2.9 million, respectively, for food and medicine spoilage claims. The provisions of the Utilities’ New York electric rate plans that impose negative revenue adjustments for operating performance provide for exceptions for major storms and catastrophic events beyond the control of the companies, including natural disasters such as hurricanes and floods. (page 143) • In November 2020, the NYSPSC issued an order in its proceedings investigating the New York utilities’ preparation for and response to Tropical Storm Isaias that ordered the Utilities to show cause why (i) civil penalties or appropriate injunctive relief should not be imposed against CECONY (in the amount of up to $102.3 million relating to 33 alleged violations) and against O&R (in the amount of up to $19 million relating to 38 alleged violations) to remedy such noncompliance, and (ii) a prudence proceeding should not be commenced against the Utilities for potentially imprudent expenditures of ratepayer funds related to the matter. The order stated that given the continuing nature of the investigation of this matter by the New York State Department of Public Service (NYSDPS), the NYSPSC may amend the order to include any subsequently determined apparent violations identified by the NYSDPS. In addition, the order indicated that should the NYSPSC confirm some or all of the apparent violations identified in the order or other orders issued by the NYSPSC in the future in connection with this proceeding, and should such respective confirmed violations be classified as findings of repeated violations of the Public Service Law or rules or regulations adopted pursuant thereto that demonstrate a failure of CECONY and/or O&R to continue to provide safe and adequate service, the NYSPSC would be authorized to commence a proceeding under Public Service Law Section 68(2) to revoke or modify CECONY’s and/or O&R’s certificate as it relates to its service territory or any portion thereof. (page 144) • In December 2020, CECONY and O&R filed responses to the NYSPSC order demonstrating why the NYSPSC should not commence penalty or prudence actions against them. The Utilities stated that the NYSPSC orders misapplied Section 25-a of the Public Service Law by ignoring the reasonable compliance standard under the statute and instead, was imposing a strict liability standard. CECONY and O&R also presented evidence that the order either misrepresented the applicable requirements or ignored that the Utilities were acting pursuant to practices approved by the NYSPSC. Finally, CECONY and O&R stated that there was no basis to commence a prudence proceeding because the Utilities acted reasonably based on the information available and the circumstances at the time. The Utilities have not accrued a liability related to this matter and are unable to determine the outcome of this proceeding at this time. (page 144) a. Page references to 2020 Form 10-K.

4Q 2020 Developments (cont'd)(a) CECONY & O&R • In October 2020, the NYSPSC issued an order instituting a proceeding to consider requiring New York’s large, investor-owned utilities, including CECONY and O&R, to annually disclose what risks climate change poses to their companies, investors and customers going forward. The order notes that some holding companies, including Con Edison, already disclose climate change risks at the holding company level, but states that the NYSPSC believes that climate-related risk disclosures should be issued specific to the operating companies in New York, such as CECONY and O&R, and that such climate-related risk disclosures should be included annually with the utilities’ financial reports. In December 2020, CECONY and O&R, along with other large New York utilities, filed comments supporting climate change risk disclosures in annual reports filed with the NYSPSC and recommended the use of an industry-specific template. (page 144) • In 2019, the New York State Department of Environmental Conservation (NYSDEC) issued regulations that may require the retirement or seasonal unavailability of fossil-fueled electric generating units owned by CECONY and others in New York City. The NYSDEC rule limits nitrous oxides (NOx) emissions during the ozone season from May through September and affects older peaking units that are generally located downstate and needed during periods of high electric demand or for local reliability purposes. Compliance with the rule will require affected units (approximately 1,400 MW in CECONY's service territory, of which 65 MW is owned by CECONY) to cease operation during the ozone season, install emission controls, repower, or retire by 2023 or 2025. The New York Independent System Operator (NYISO), in its 2020 Reliability Needs Assessment study that was approved by the NYISO board, reported local and bulk transmission system reliability needs that are expected to be caused by the retirement or unavailability of some of the impacted units. In January 2021, CECONY updated its local transmission plan to address the local transmission system reliability needs and expects to submit a plan to the NYISO to address the bulk transmission system reliability needs in the first half of 2021. The local transmission projects were also submitted to the NYSPSC in November 2020 as part of the New York utilities’ Transmission and Distribution Investment Working Group Report, due to the benefits they provide towards meeting New York State’s clean energy goals. CECONY’s implementation of all or part of its plans will be dependent upon the availability of market solutions and/or NYISO’s selection of regulated solutions proposed by others. CECONY estimates that the costs of implementing plans to solve the local reliability needs, if required, to be approximately $780 million over 4 years and is unable to estimate the amount to implement plans to solve the bulk reliability needs, if required. In December 2020, CECONY filed a petition with the NYSPSC to recover the potential costs to solve both requirements and expect such costs to be recovered, including a full rate of return, in rates from customers. (pages 23-24) a. Page references to 2020 Form 10-K. 16

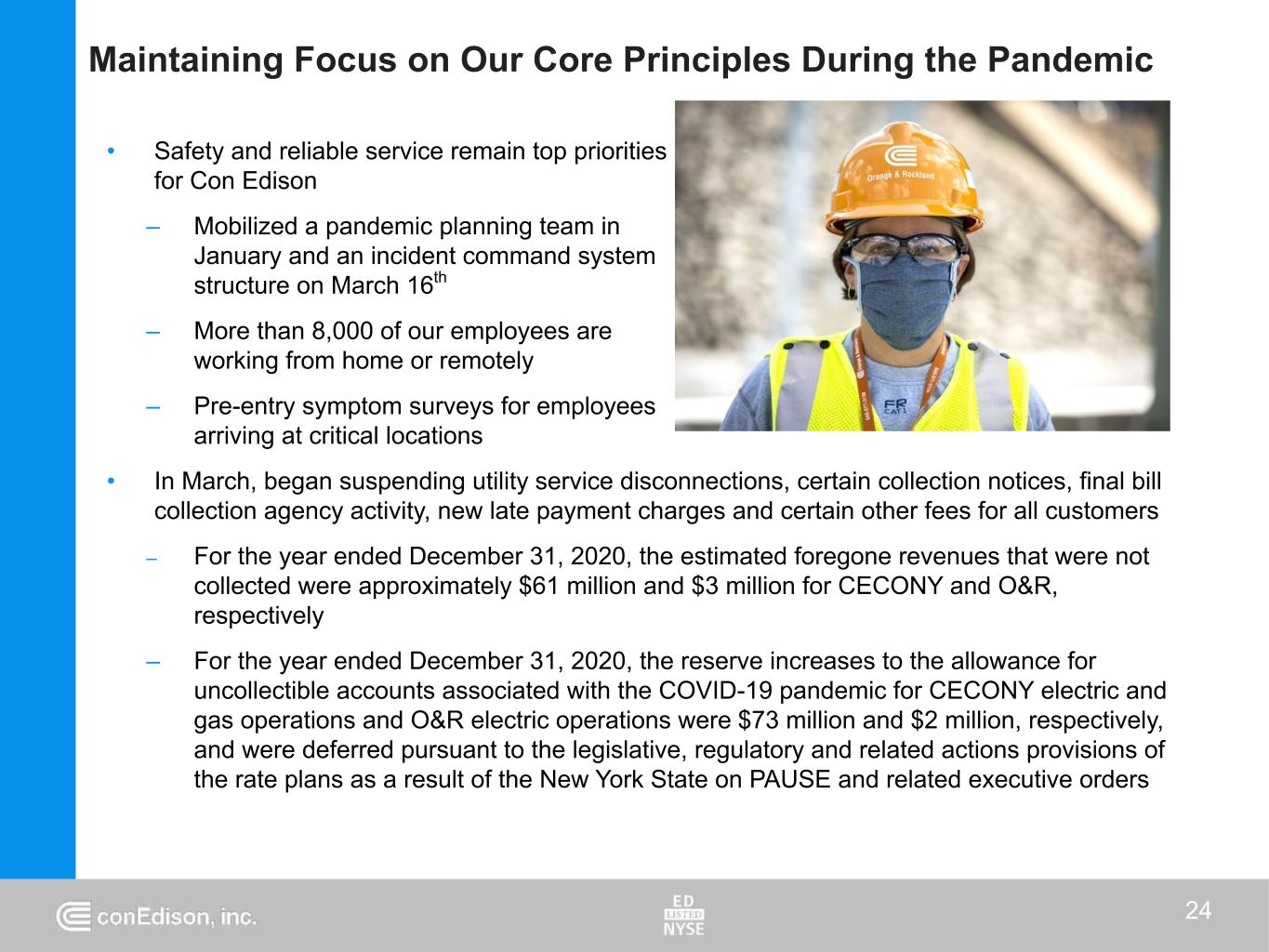

Maintaining Focus on Our Core Principles During the Pandemic 24 • Safety and reliable service remain top priorities for Con Edison – Mobilized a pandemic planning team in January and an incident command system structure on March 16th – More than 8,000 of our employees are working from home or remotely – Pre-entry symptom surveys for employees arriving at critical locations • In March, began suspending utility service disconnections, certain collection notices, final bill collection agency activity, new late payment charges and certain other fees for all customers – For the year ended December 31, 2020, the estimated foregone revenues that were not collected were approximately $61 million and $3 million for CECONY and O&R, respectively – For the year ended December 31, 2020, the reserve increases to the allowance for uncollectible accounts associated with the COVID-19 pandemic for CECONY electric and gas operations and O&R electric operations were $73 million and $2 million, respectively, and were deferred pursuant to the legislative, regulatory and related actions provisions of the rate plans as a result of the New York State on PAUSE and related executive orders

Supporting the Community During the Pandemic • Deployed 1 MW generator to support the field hospital setup located at the Brooklyn Cruise Terminal in Red Hook • Expanded grid service or provided engineering services for emergency field hospitals: – At Westchester County Center to support a 100-bed facility – At Javits Center to support a 2,500-bed facility – Into Central Park’s East Meadow to support Mount Sinai Hospital’s emergency facility – At U.S. Open facility in Queens to support a 500-bed facility • Provided donations to the Mayor’s Fund "NYC Healthcare Heroes Fund“ and the FDNY and NYPD Foundations to support NYC first responders • Donated almost 100,000 N95 masks for healthcare workers • Building 40,000 face shields in our machine shop for healthcare workers 25

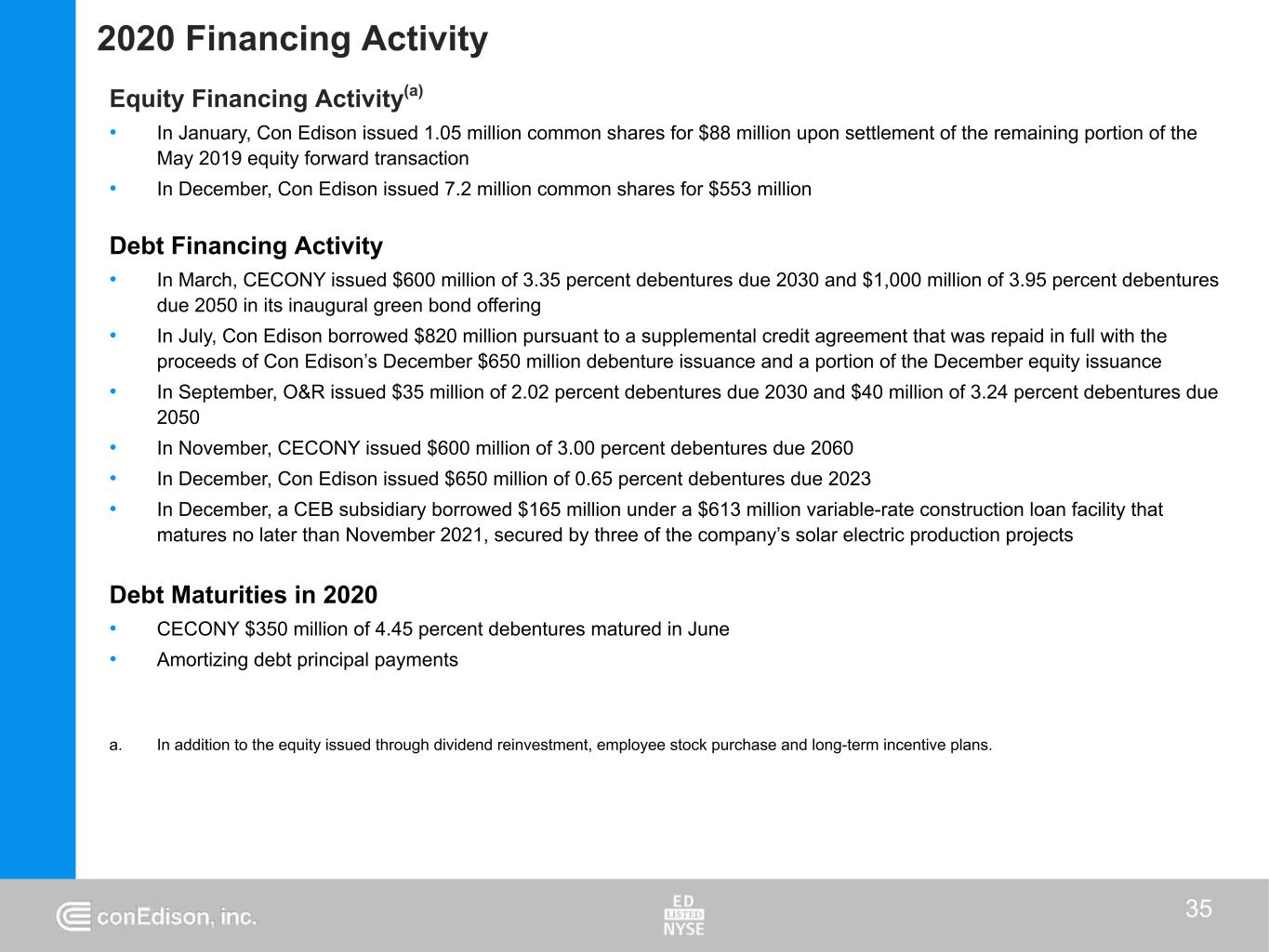

35 2020 Financing Activity Equity Financing Activity(a) • In January, Con Edison issued 1.05 million common shares for $88 million upon settlement of the remaining portion of the May 2019 equity forward transaction • In December, Con Edison issued 7.2 million common shares for $553 million Debt Financing Activity • In March, CECONY issued $600 million of 3.35 percent debentures due 2030 and $1,000 million of 3.95 percent debentures due 2050 in its inaugural green bond offering • In July, Con Edison borrowed $820 million pursuant to a supplemental credit agreement that was repaid in full with the proceeds of Con Edison’s December $650 million debenture issuance and a portion of the December equity issuance • In September, O&R issued $35 million of 2.02 percent debentures due 2030 and $40 million of 3.24 percent debentures due 2050 • In November, CECONY issued $600 million of 3.00 percent debentures due 2060 • In December, Con Edison issued $650 million of 0.65 percent debentures due 2023 • In December, a CEB subsidiary borrowed $165 million under a $613 million variable-rate construction loan facility that matures no later than November 2021, secured by three of the company’s solar electric production projects Debt Maturities in 2020 • CECONY $350 million of 4.45 percent debentures matured in June • Amortizing debt principal payments a. In addition to the equity issued through dividend reinvestment, employee stock purchase and long-term incentive plans.

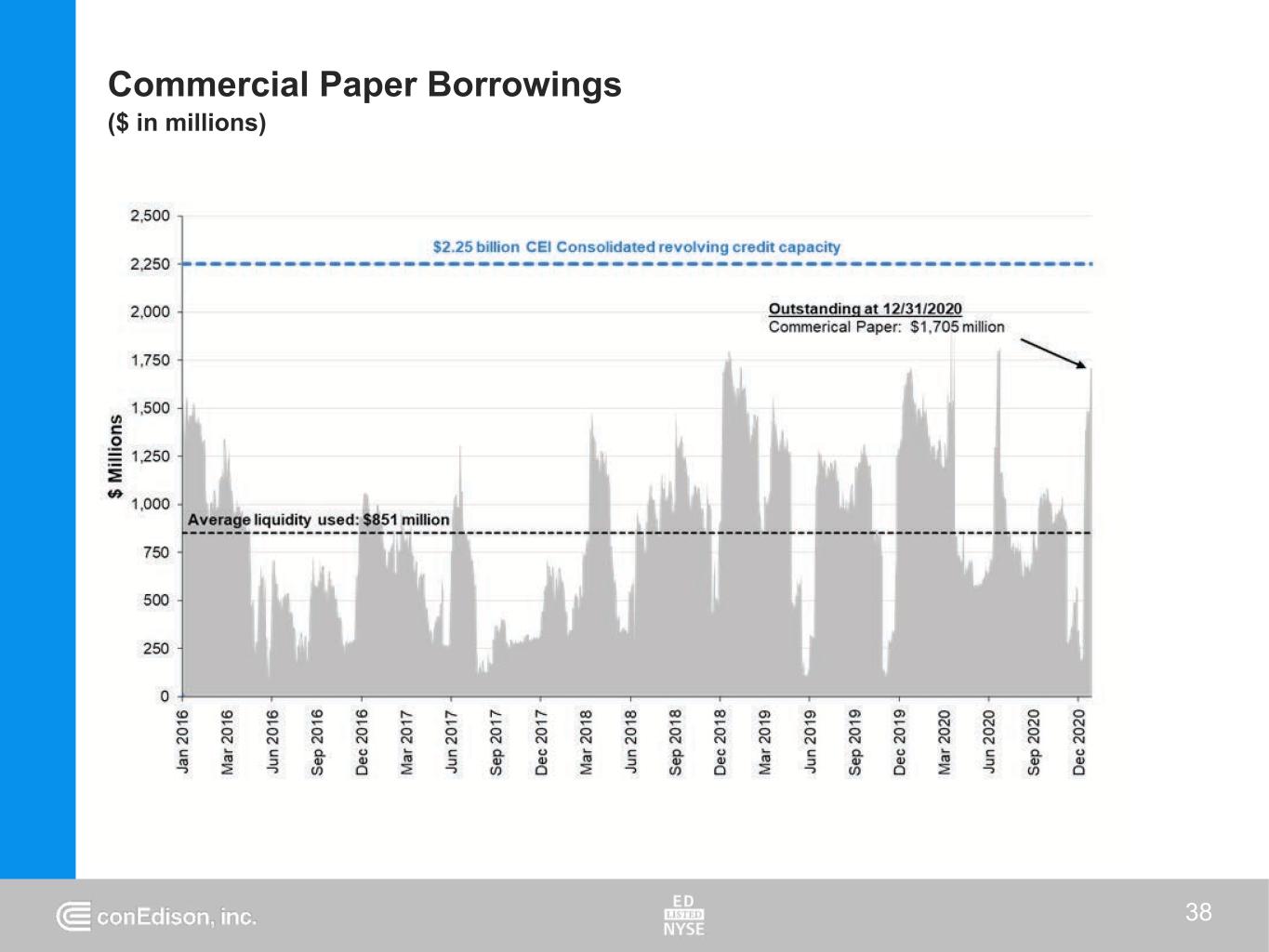

Liquidity Update 39 • Con Edison’s $2,250 million credit facility supports commercial paper borrowing with $545 million of remaining capacity available as of December 31, 2020. Additionally Con Edison had $1,272 million of cash and temporary cash investments as of December 31, 2020 • Debt maturities / amortizations for 2020 amounted to $518 million: CECONY $350 million (June); CEB $165 million; and Con Edison $3 million • Steps we have taken in 2020 to improve our liquidity position – In March, CECONY issued $1,600 million of green debentures – In July, Con Edison borrowed $820 million pursuant to a term loan which was subsequently prepaid in December – In September, O&R issued $75 million of debentures – In November, CECONY issued $600 million of debentures – In December, Con Edison issued $650 million of debentures and $553 million of equity – In December, a CEB subsidiary borrowed $165 million of project debt under a $613 million construction loan facility

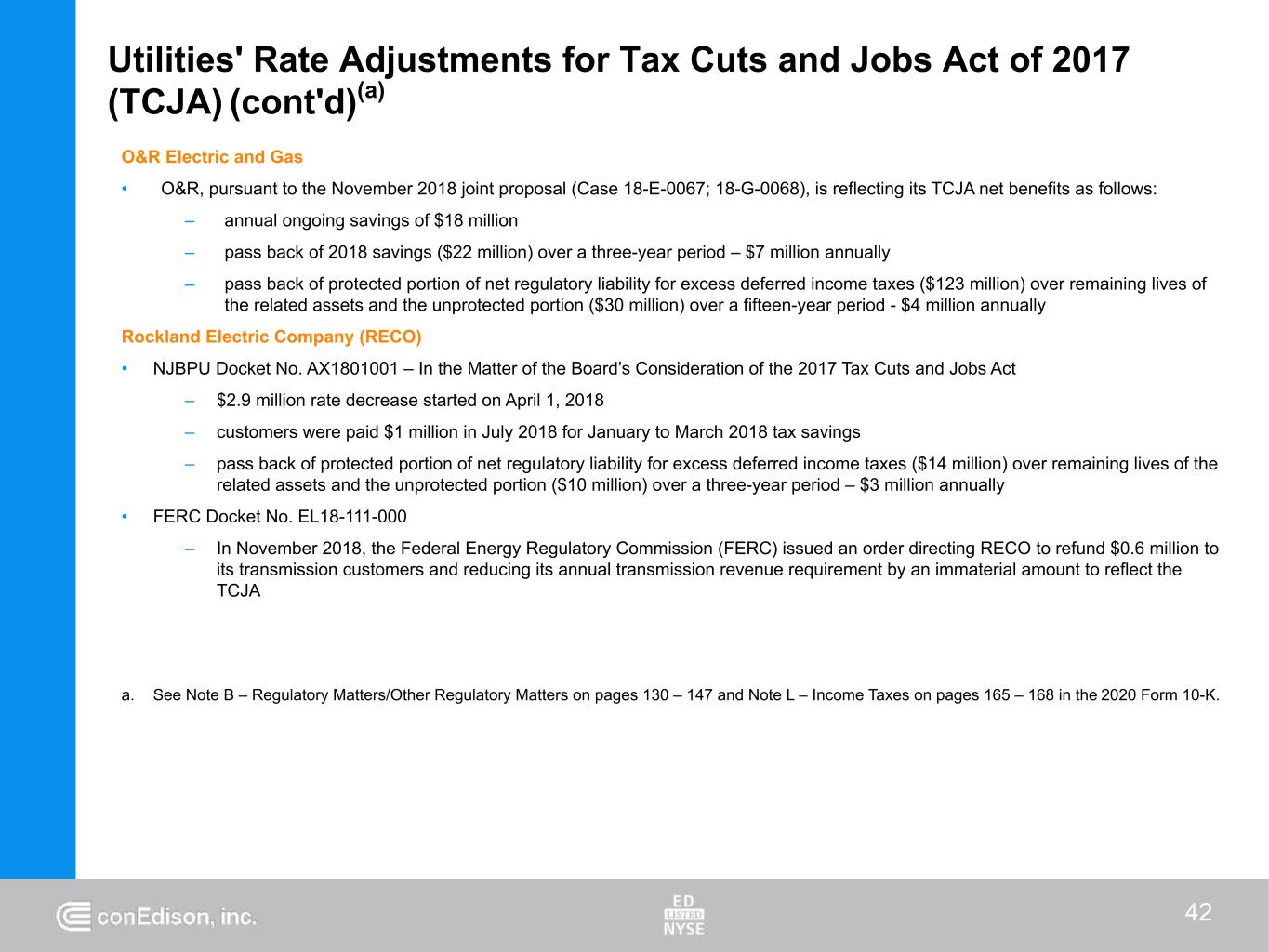

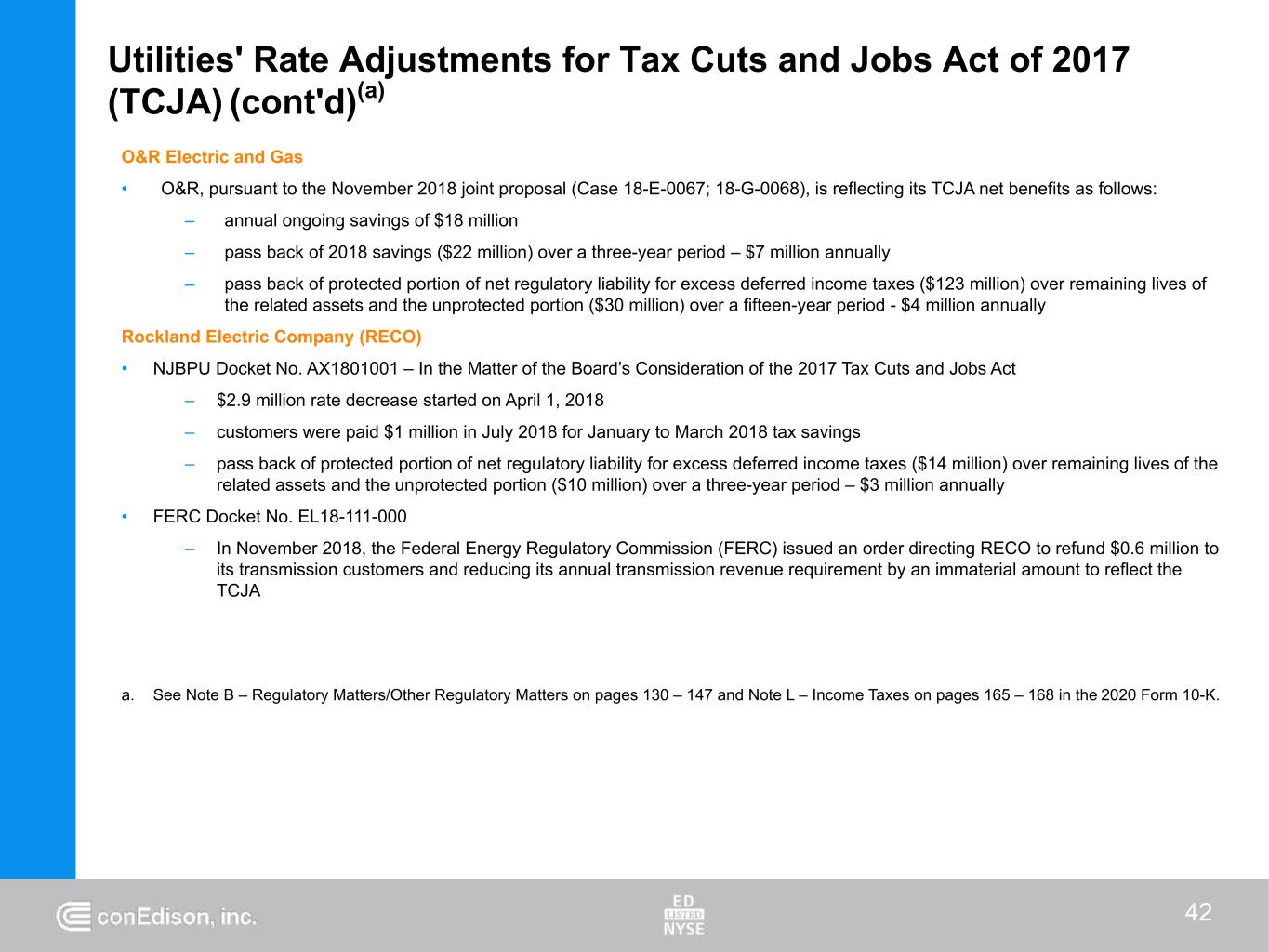

O&R Electric and Gas • O&R, pursuant to the November 2018 joint proposal (Case 18-E-0067; 18-G-0068), is reflecting its TCJA net benefits as follows: – annual ongoing savings of $18 million – pass back of 2018 savings ($22 million) over a three-year period – $7 million annually – pass back of protected portion of net regulatory liability for excess deferred income taxes ($123 million) over remaining lives of the related assets and the unprotected portion ($30 million) over a fifteen-year period - $4 million annually Rockland Electric Company (RECO) • NJBPU Docket No. AX1801001 – In the Matter of the Board’s Consideration of the 2017 Tax Cuts and Jobs Act – $2.9 million rate decrease started on April 1, 2018 – customers were paid $1 million in July 2018 for January to March 2018 tax savings – pass back of protected portion of net regulatory liability for excess deferred income taxes ($14 million) over remaining lives of the related assets and the unprotected portion ($10 million) over a three-year period – $3 million annually • FERC Docket No. EL18-111-000 – In November 2018, the Federal Energy Regulatory Commission (FERC) issued an order directing RECO to refund $0.6 million to its transmission customers and reducing its annual transmission revenue requirement by an immaterial amount to reflect the TCJA a. See Note B – Regulatory Matters/Other Regulatory Matters on pages 130 – 147 and Note L – Income Taxes on pages 165 – 168 in the 2020 Form 10-K. Utilities' Rate Adjustments for Tax Cuts and Jobs Act of 2017 (TCJA) (cont'd)(a) 42

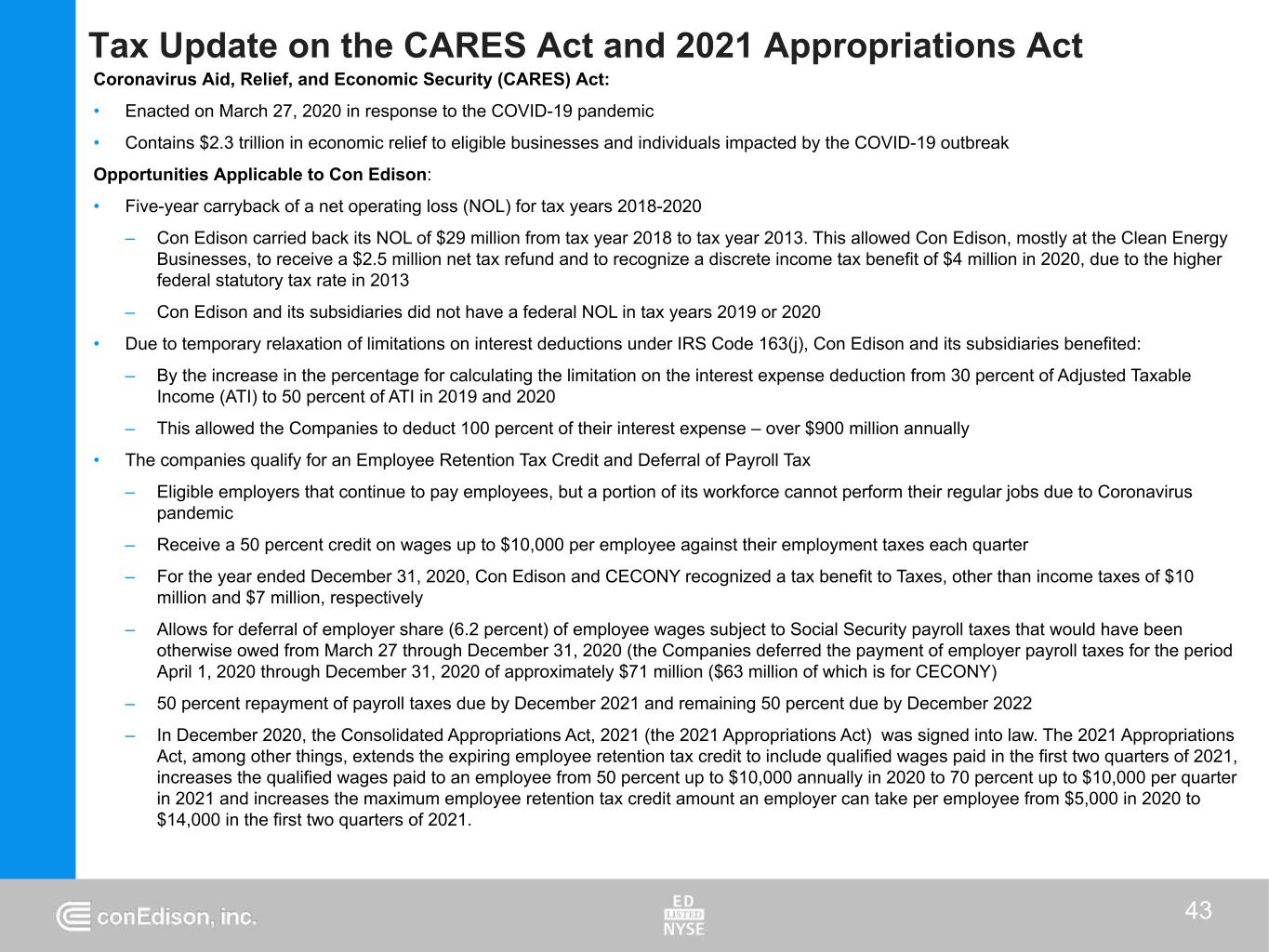

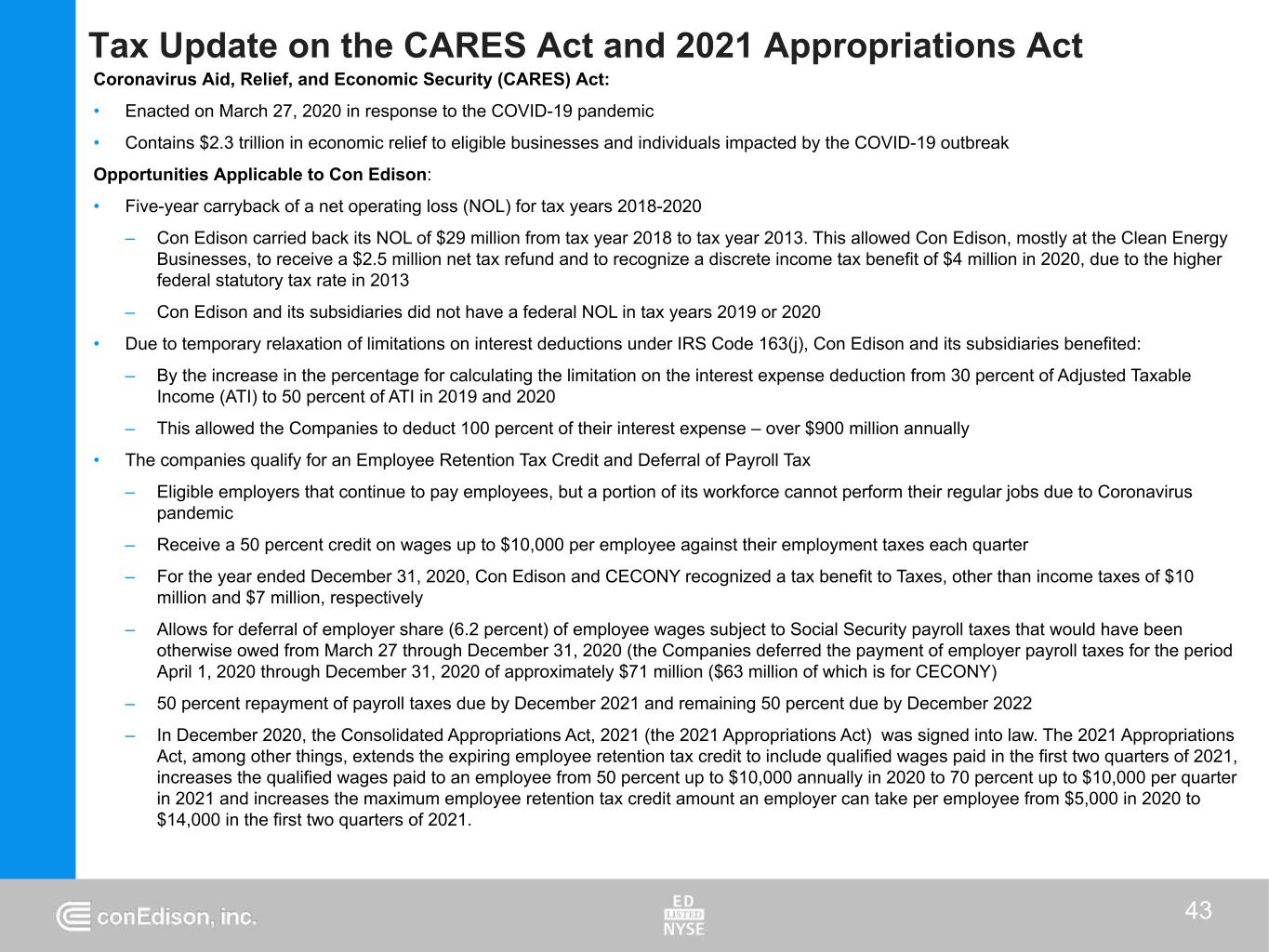

Tax Update on the CARES Act and 2021 Appropriations Act 43 Coronavirus Aid, Relief, and Economic Security (CARES) Act: • Enacted on March 27, 2020 in response to the COVID-19 pandemic • Contains $2.3 trillion in economic relief to eligible businesses and individuals impacted by the COVID-19 outbreak Opportunities Applicable to Con Edison: • Five-year carryback of a net operating loss (NOL) for tax years 2018-2020 – Con Edison carried back its NOL of $29 million from tax year 2018 to tax year 2013. This allowed Con Edison, mostly at the Clean Energy Businesses, to receive a $2.5 million net tax refund and to recognize a discrete income tax benefit of $4 million in 2020, due to the higher federal statutory tax rate in 2013 – Con Edison and its subsidiaries did not have a federal NOL in tax years 2019 or 2020 • Due to temporary relaxation of limitations on interest deductions under IRS Code 163(j), Con Edison and its subsidiaries benefited: – By the increase in the percentage for calculating the limitation on the interest expense deduction from 30 percent of Adjusted Taxable Income (ATI) to 50 percent of ATI in 2019 and 2020 – This allowed the Companies to deduct 100 percent of their interest expense – over $900 million annually • The companies qualify for an Employee Retention Tax Credit and Deferral of Payroll Tax – Eligible employers that continue to pay employees, but a portion of its workforce cannot perform their regular jobs due to Coronavirus pandemic – Receive a 50 percent credit on wages up to $10,000 per employee against their employment taxes each quarter – For the year ended December 31, 2020, Con Edison and CECONY recognized a tax benefit to Taxes, other than income taxes of $10 million and $7 million, respectively – Allows for deferral of employer share (6.2 percent) of employee wages subject to Social Security payroll taxes that would have been otherwise owed from March 27 through December 31, 2020 (the Companies deferred the payment of employer payroll taxes for the period April 1, 2020 through December 31, 2020 of approximately $71 million ($63 million of which is for CECONY) – 50 percent repayment of payroll taxes due by December 2021 and remaining 50 percent due by December 2022 – In December 2020, the Consolidated Appropriations Act, 2021 (the 2021 Appropriations Act) was signed into law. The 2021 Appropriations Act, among other things, extends the expiring employee retention tax credit to include qualified wages paid in the first two quarters of 2021, increases the qualified wages paid to an employee from 50 percent up to $10,000 annually in 2020 to 70 percent up to $10,000 per quarter in 2021 and increases the maximum employee retention tax credit amount an employer can take per employee from $5,000 in 2020 to $14,000 in the first two quarters of 2021.

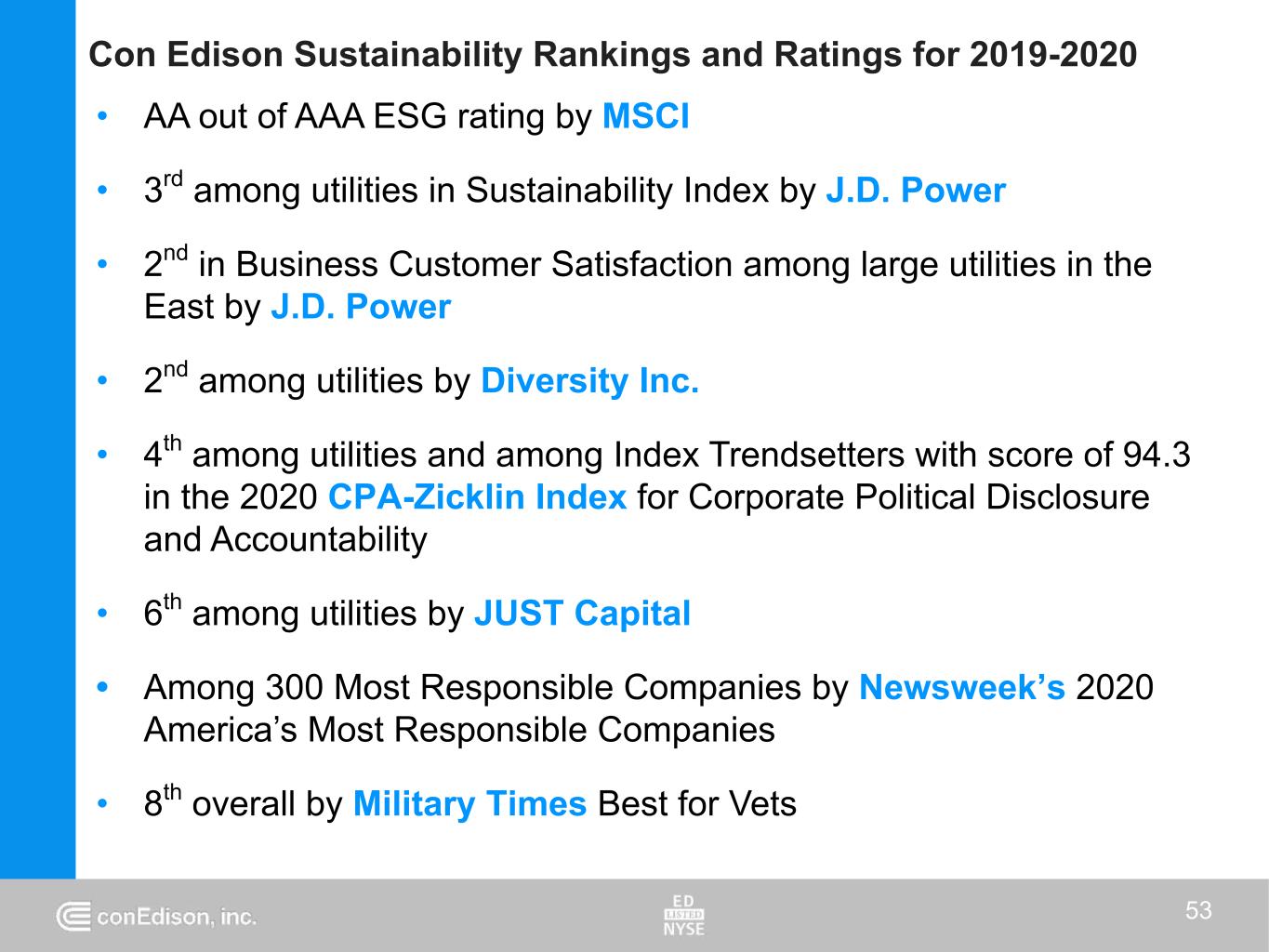

Con Edison Sustainability Rankings and Ratings for 2019-2020 • AA out of AAA ESG rating by MSCI • 3rd among utilities in Sustainability Index by J.D. Power • 2nd in Business Customer Satisfaction among large utilities in the East by J.D. Power • 2nd among utilities by Diversity Inc. • 4th among utilities and among Index Trendsetters with score of 94.3 in the 2020 CPA-Zicklin Index for Corporate Political Disclosure and Accountability • 6th among utilities by JUST Capital • Among 300 Most Responsible Companies by Newsweek’s 2020 America’s Most Responsible Companies • 8th overall by Military Times Best for Vets 53

Con Edison Environmental, Social & Governance (ESG) Resources • ESG Presentation – Con Edison's Environmental Social & Governance presentation on August 26, 2020 • Sustainability Report – Con Edison's 2019 Sustainability report • Our ESG reporting standards: • Edison Electric Institute / American Gas Association ESG templates – Industry reporting standards • Sustainability Accounting Standards Board (SASB) – Broad ESG reporting standard adopted by Con Edison in 2020 • Task Force on Climate-Related Financial Disclosures (TCFD) – broad ESG reporting standard adopted by Con Edison in 2020 Link to more ESG resources: https://conedison.gcs-web.com/environmental-social-and-governance-esg-resources 54 B

Con Edison Environmental, Social & Governance Resources (cont'd) • Con Edison’s Clean Energy Vision looking toward a clean energy future • Climate Change Vulnerability Study – December 2019 • The 2019 Diversity and Inclusion Report examines Con Edison's diverse and inclusive culture • 2020 Proxy Statement • Highlighting how the Company supports our communities through Community Partnerships • Our Standards of Business Conduct guide our Political Engagement Link to more ESG resources: https://conedison.gcs-web.com/environmental-social-and-governance-esg-resources 55

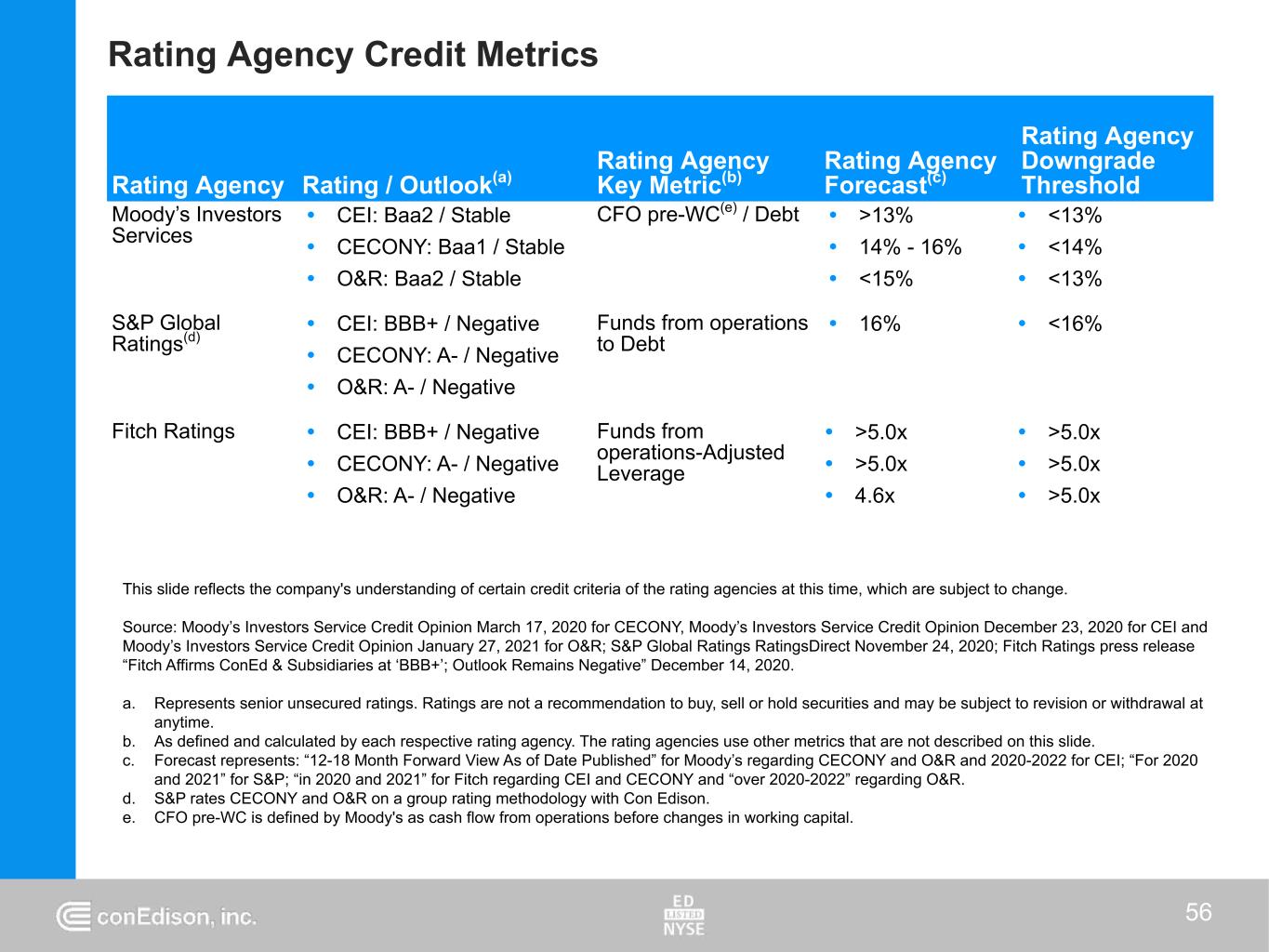

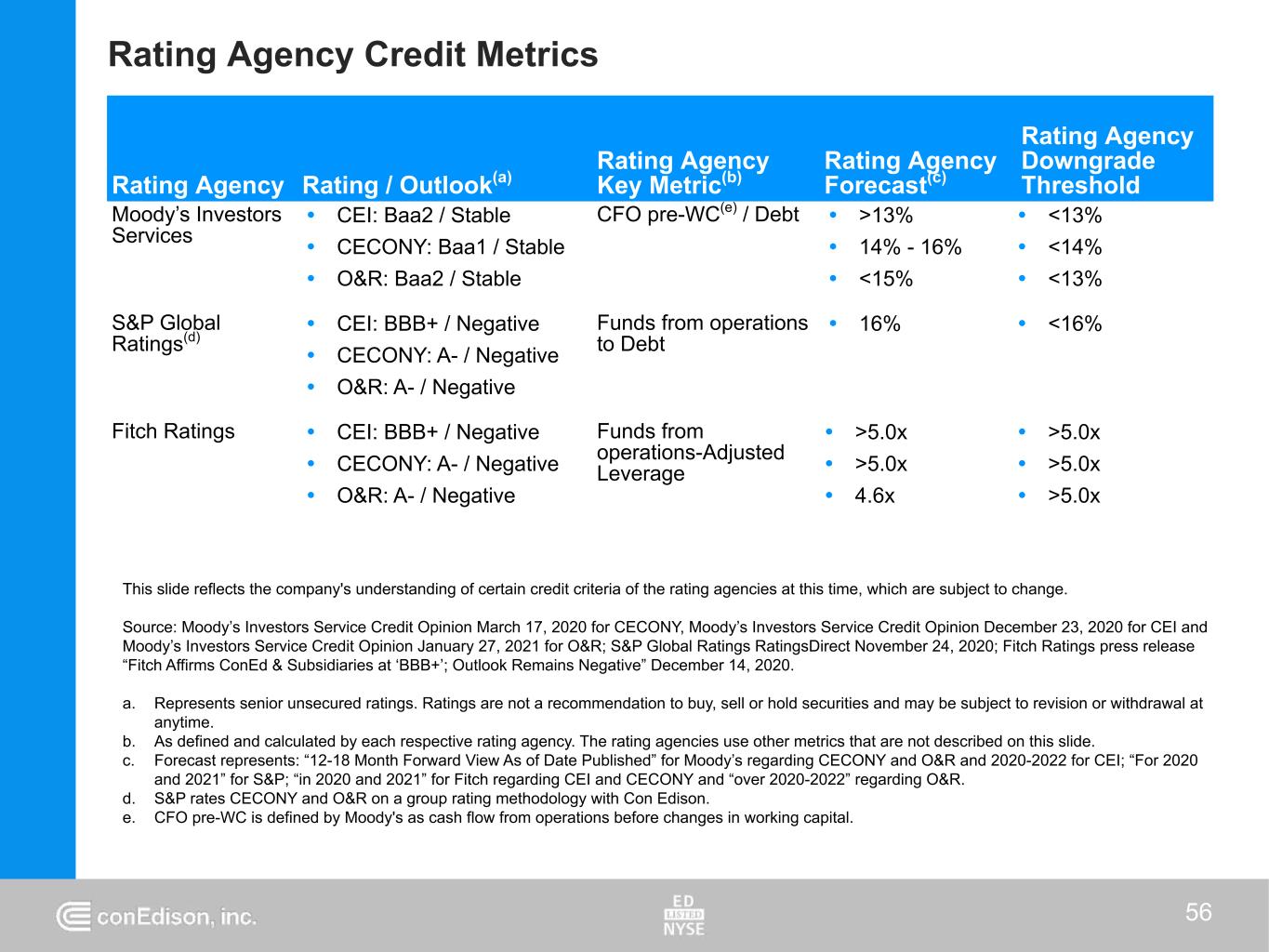

Rating Agency Credit Metrics This slide reflects the company's understanding of certain credit criteria of the rating agencies at this time, which are subject to change. Source: Moody’s Investors Service Credit Opinion March 17, 2020 for CECONY, Moody’s Investors Service Credit Opinion December 23, 2020 for CEI and Moody’s Investors Service Credit Opinion January 27, 2021 for O&R; S&P Global Ratings RatingsDirect November 24, 2020; Fitch Ratings press release “Fitch Affirms ConEd & Subsidiaries at ‘BBB+’; Outlook Remains Negative” December 14, 2020. a. Represents senior unsecured ratings. Ratings are not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at anytime. b. As defined and calculated by each respective rating agency. The rating agencies use other metrics that are not described on this slide. c. Forecast represents: “12-18 Month Forward View As of Date Published” for Moody’s regarding CECONY and O&R and 2020-2022 for CEI; “For 2020 and 2021” for S&P; “in 2020 and 2021” for Fitch regarding CEI and CECONY and “over 2020-2022” regarding O&R. d. S&P rates CECONY and O&R on a group rating methodology with Con Edison. e. CFO pre-WC is defined by Moody's as cash flow from operations before changes in working capital. 56 Rating Agency Rating / Outlook(a) Rating Agency Key Metric(b) Rating Agency Forecast(c) Rating Agency Downgrade Threshold Moody’s Investors Services Ÿ CEI: Baa2 / Stable Ÿ CECONY: Baa1 / Stable Ÿ O&R: Baa2 / Stable CFO pre-WC(e) / Debt Ÿ >13% Ÿ 14% - 16% Ÿ <15% Ÿ <13% Ÿ <14% Ÿ <13% S&P Global Ratings(d) Ÿ CEI: BBB+ / Negative Ÿ CECONY: A- / Negative Ÿ O&R: A- / Negative Funds from operations to Debt Ÿ 16% Ÿ <16% Fitch Ratings Ÿ CEI: BBB+ / Negative Ÿ CECONY: A- / Negative Ÿ O&R: A- / Negative Funds from operations-Adjusted Leverage Ÿ >5.0x Ÿ >5.0x Ÿ 4.6x Ÿ >5.0x Ÿ >5.0x Ÿ >5.0x

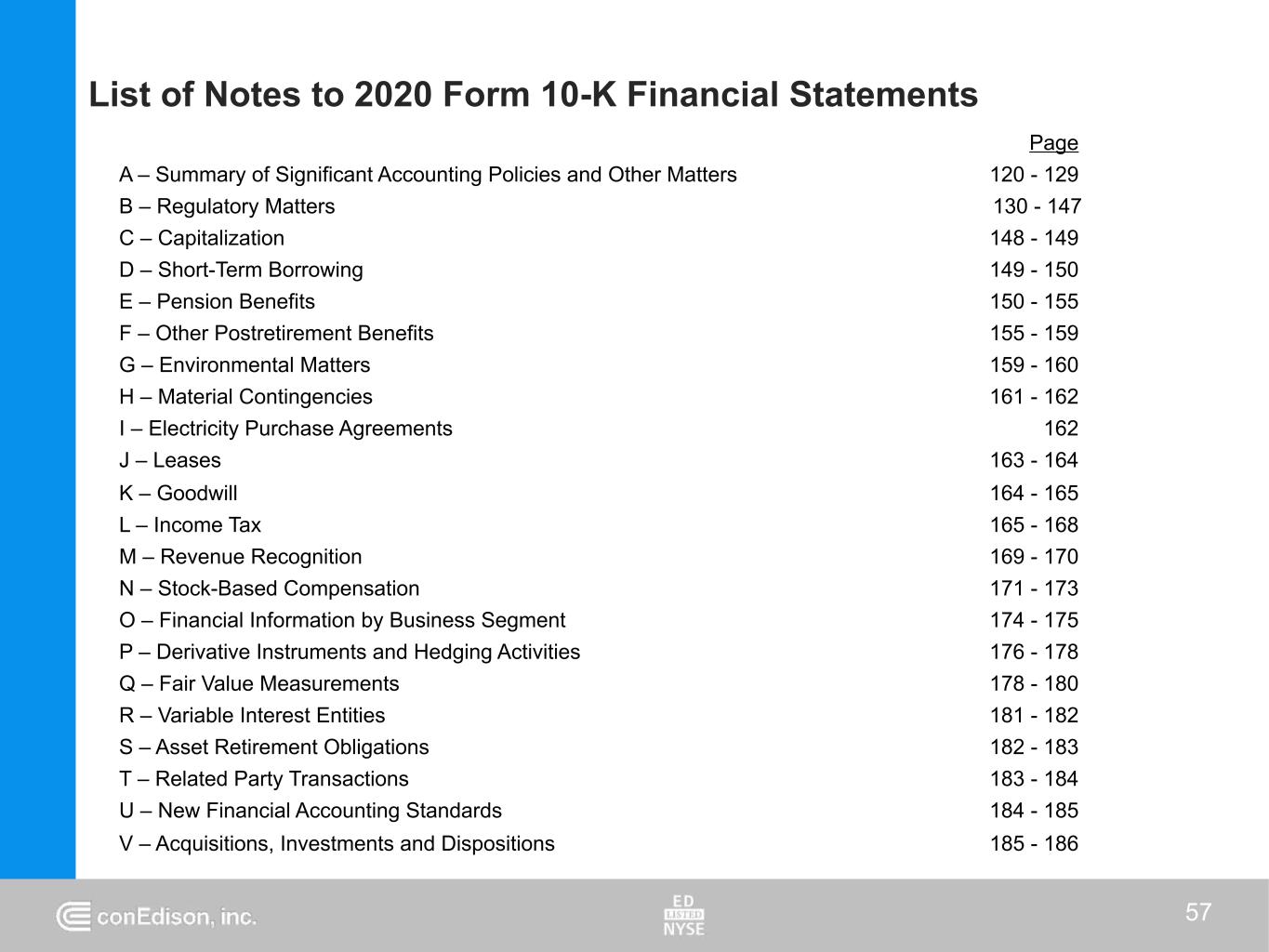

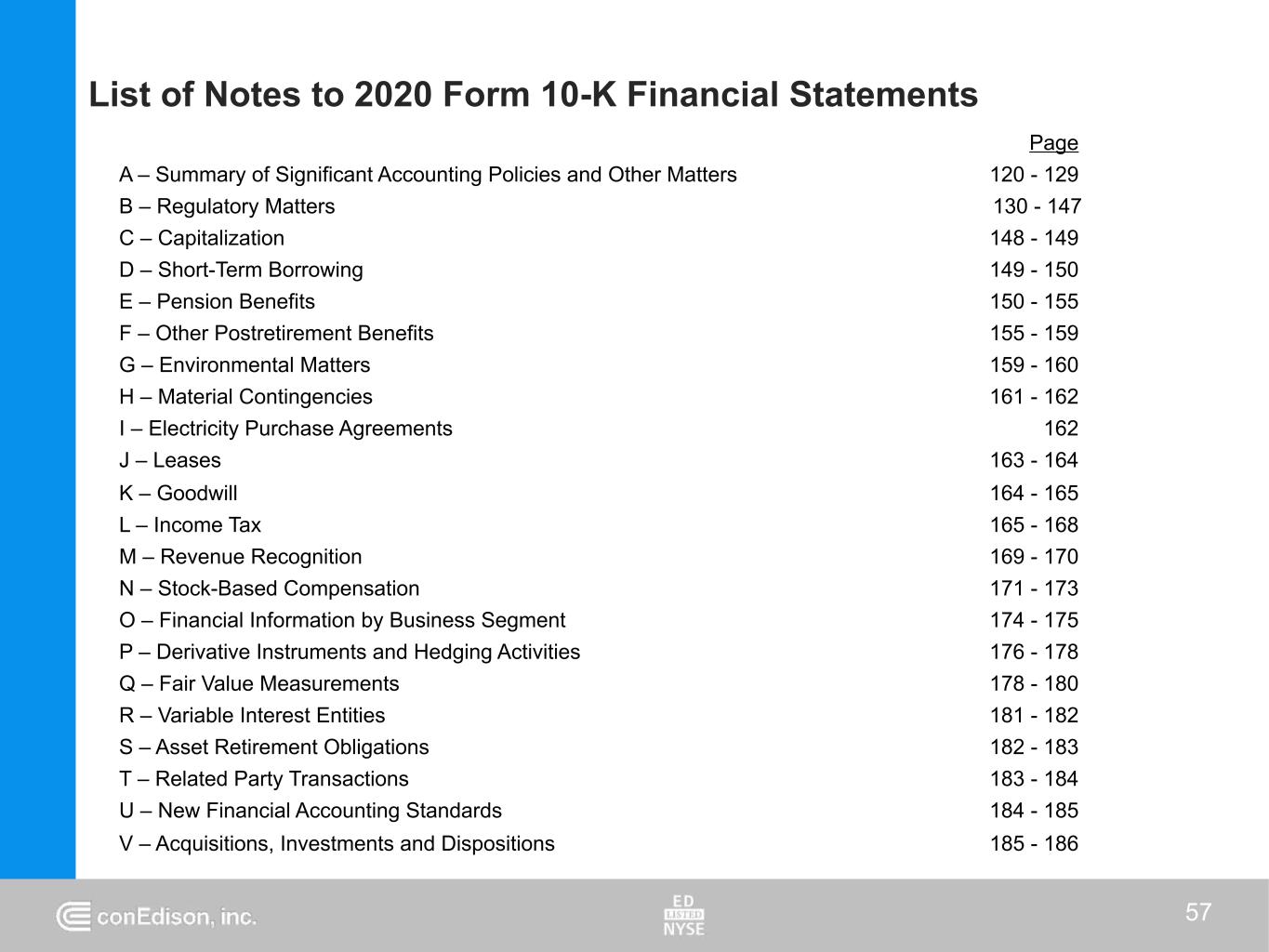

List of Notes to 2020 Form 10-K Financial Statements 57 Page A – Summary of Significant Accounting Policies and Other Matters 120 - 129 B – Regulatory Matters 130 - 147 C – Capitalization 148 - 149 D – Short-Term Borrowing 149 - 150 E – Pension Benefits 150 - 155 F – Other Postretirement Benefits 155 - 159 G – Environmental Matters 159 - 160 H – Material Contingencies 161 - 162 I – Electricity Purchase Agreements 162 J – Leases 163 - 164 K – Goodwill 164 - 165 L – Income Tax 165 - 168 M – Revenue Recognition 169 - 170 N – Stock-Based Compensation 171 - 173 O – Financial Information by Business Segment 174 - 175 P – Derivative Instruments and Hedging Activities 176 - 178 Q – Fair Value Measurements 178 - 180 R – Variable Interest Entities 181 - 182 S – Asset Retirement Obligations 182 - 183 T – Related Party Transactions 183 - 184 U – New Financial Accounting Standards 184 - 185 V – Acquisitions, Investments and Dispositions 185 - 186