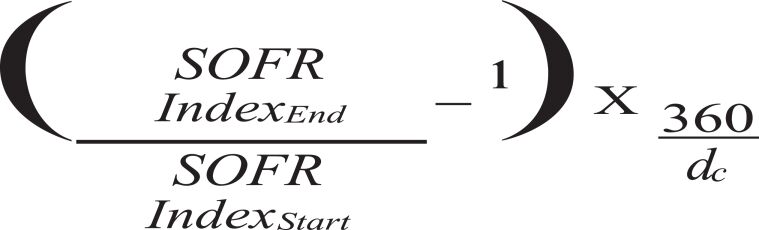

Calculation of the Floating Interest Rate

The “Calculation Agent” means a banking institution or trust company appointed by us to act as calculation agent, initially The Bank of New York Mellon.

Absent willful misconduct, bad faith or manifest error, the calculation of the applicable interest rate for each Interest Period by the Calculation Agent, or in certain circumstances described above, by the Company (or its Designee), will be final and binding on the Company, the Trustee and the holders of the 2024 C Floating Rate Debentures.

None of the Trustee, paying agent, registrar or Calculation Agent shall be under any obligation (i) to monitor, determine or verify the unavailability or cessation of SOFR, the SOFR Index or any applicable Benchmark, or whether or when there has occurred, or to give notice to any other transaction party of the occurrence of, any Benchmark Transition Event or related Benchmark Replacement Date, (ii) to select, determine or designate any alternative method, Benchmark Replacement or alternative index, or other successor or replacement alternative index, or whether any conditions to the designation of such a rate or index have been satisfied, (iii) to select, determine or designate any Benchmark Replacement Adjustment, or other modifier to any replacement or successor index, or (iv) to determine whether or what Benchmark Replacement Conforming Changes with respect to such alternative method, Benchmark Replacement or alternative index are necessary or advisable, if any, in connection with any of the foregoing.

None of the Trustee, paying agent, registrar or Calculation Agent shall be liable for any inability, failure or delay on its part to perform any of its duties described in this prospectus supplement and the accompanying prospectus as a result of the unavailability of SOFR, the SOFR Index or other applicable Benchmark Replacement, including as a result of any failure, inability, delay, error or inaccuracy on the part of any other transaction party in providing any direction, instruction, notice or information contemplated by this prospectus supplement and the accompanying prospectus and reasonably required for the performance of such duties.

No Optional Redemption

The 2024 C Floating Rate Debentures will not be subject to redemption at our option.

Fixed Rate Debentures

We will pay interest on the Fixed Rate Debentures at the rate per annum stated on the first page of this prospectus supplement in the title of each particular series. Interest on the Fixed Rate Debentures will accrue from November , 2024 or from the most recent interest payment date to which interest has been paid.

Interest on the 2024 D Fixed Rate Debentures is payable initially on and thereafter semi-annually on and each year to holders of record at the close of business on the record date for the applicable interest payment date, which will be (i) the business day immediately preceding such interest payment date so long as all of the 2024 D Fixed Rate Debentures remain in book-entry form or (ii) the fifteenth day, whether or not such day is a business day, of the calendar month next preceding such interest payment date if any of the 2024 D Fixed Rate Debentures do not remain in book-entry form, in each case, except as otherwise provided in the Indenture.

Interest on the 2024 E Fixed Rate Debentures is payable initially on and thereafter semi-annually on and each year to holders of record at the close of business on the record date for the applicable interest payment date, which will be (i) the business day immediately preceding such interest payment date so long as all of the 2024 E Fixed Rate Debentures remain in book-entry form or (ii) the fifteenth day, whether or not such day is a business day, of the calendar month next preceding such interest payment date if any of the 2024 E Fixed Rate Debentures do not remain in book-entry form, in each case, except as otherwise provided in the Indenture.

S-13