SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-03196

CONSOLIDATED NATURAL GAS COMPANY

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 54-1966737 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

120 Tredegar Street Richmond, Virginia | | 23219 |

| (Address of principal executive offices) | | (Zip Code) |

(804) 819-2000

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class

| | Name of Each Exchange on Which Registered

|

| 6.0% Debentures due 2010 | | New York Stock Exchange |

| 6.8% Debentures due 2027 | | New York Stock Exchange |

| 6 5/8% Debentures due 2008 | | New York Stock Exchange |

| 6 7/8% Debentures due 2026 | | New York Stock Exchange |

| 6 5/8% Debentures due 2013 | | New York Stock Exchange |

| 7.8% Trust Preferred Securities, $25 Par | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was zero.

As of February 1, 2006, there were issued and outstanding 100 shares of the registrant’s common stock, without par value, all of which were held, beneficially and of record, by Dominion Resources, Inc.

THE REGISTRANT MEETS THE CONDITIONS SET FORTH IN GENERAL INSTRUCTION I.(1)(a) AND (b) OF FORM 10-K AND IS FILING THIS FORM 10-K UNDER THE REDUCED DISCLOSURE FORMAT.

DOCUMENTS INCORPORATED BY REFERENCE

None

Consolidated Natural Gas Company

Part I

Item 1. Business

The Company

Consolidated Natural Gas Company (CNG) operates in all phases of the natural gas business, explores for and produces oil, and provides a variety of retail energy marketing services. CNG is a wholly owned subsidiary of Dominion Resources, Inc. (Dominion), a fully integrated gas and electric holding company headquartered in Richmond, Virginia.

The terms “CNG,” “we,” “our” and “us” are used throughout this report and, depending on the context of their use, may refer to CNG, one of CNG’s consolidated subsidiaries or operating segments, or the entirety of CNG and its consolidated subsidiaries.

As of December 31, 2005, we had approximately 4,700 full-time employees. Approximately 2,500 employees are subject to collective bargaining agreements. We were incorporated in Delaware in 1999. Our principal executive offices are located at 120 Tredegar Street, Richmond, Virginia 23219 and our telephone number is (804) 819-2000.

Operating Segments

We manage our operations along three primary operating segments: Delivery, Energy and Exploration & Production. We also report our corporate and other functions as a segment. While we manage our daily operations as described below, our assets remain wholly owned by our legal subsidiaries. For additional financial information on business segments and geographic areas, see Notes 1 and 24 to our Consolidated Financial Statements.

Delivery

Delivery includes our regulated gas distribution and customer service operations as well as retail energy marketing operations. Gas distribution operations serve residential, commercial and industrial gas sales and transportation customers in Ohio, Pennsylvania and West Virginia. Retail energy marketing operations include the marketing of gas, electricity and related products and services to residential, industrial and small commercial customers in the Northeast, Mid-Atlantic and Midwest regions.

Competition

Deregulation is at varying stages in the three states in which our gas distribution subsidiaries operate. In Pennsylvania, supplier choice is available for all residential and small commercial customers. In Ohio, legislation has not been enacted to require supplier choice for residential and commercial natural gas consumers. However, we offer an Energy Choice program to customers on our own initiative, in cooperation with the Public Utilities Commission of Ohio (Ohio Commission). West Virginia does not require customer choice in its retail natural gas markets at this time. SeeRegulation—State Regulations for additional information.

Regulation

Our gas distribution service, including the rates we may charge to customers, is regulated by the Ohio Commission, the Pennsylvania Public Utility Commission (Pennsylvania Commission) and the West Virginia Public Service Commission (West Virginia Commission). SeeRegulation—State Regulations for additional information.

Properties

Delivery’s investment in its gas distribution network is located in the states of Ohio, Pennsylvania and West Virginia. The gas distribution network includes approximately 27,000 miles of pipe, exclusive of service pipe. Delivery also operates more than 200 billion cubic feet (bcf) of underground storage capacity in Ohio and Pennsylvania. SeeEnergy—Properties for additional information regarding Delivery’s storage properties.

Sources of Fuel Supply

Delivery is engaged in the sale and storage of natural gas through its operating subsidiaries. Delivery’s natural gas supply for its operations is obtained from various sources including: purchases from major and independent producers in the Mid-Continent and Gulf Coast regions; purchases from local producers in the Appalachian area; purchases from gas marketers; and withdrawals from underground storage fields owned by us or third parties.

Seasonality

Gas sales in the Delivery segment typically vary seasonally based on demand by residential and commercial customers for heating use due to changes in temperature.

Energy

Energy includes the following operations:

| · | | A regulated interstate gas transmission pipeline and storage system, serving our gas distribution businesses and other customers in the Northeast, Mid-Atlantic and Midwest regions; |

| · | | A liquefied natural gas (LNG) import and storage facility in Maryland; |

| · | | Certain natural gas production operations located in the Appalachian basin; and |

| · | | Certain producer services which consist of aggregation of gas supply and related wholesale activities. |

Competition

The Energy segment’s gas transmission operations compete with domestic and Canadian pipeline companies and gas marketers seeking to provide or arrange transportation, storage and other services for customers. Alternative energy sources, such as oil or coal, provide another level of competition. Although competition is based primarily on price, the array of services that can be provided to customers is also an important factor. The combination of capacity rights held on certain longline pipelines, a large storage

1

capability and the availability of numerous receipt and delivery points along our own pipeline system enable us to tailor our services to meet the needs of individual customers.

Regulation

Energy’s natural gas transmission, storage and LNG operations are subject to regulation by the Federal Energy Regulatory Commission (FERC). SeeRegulation—Federal Regulations for additional information.

Properties

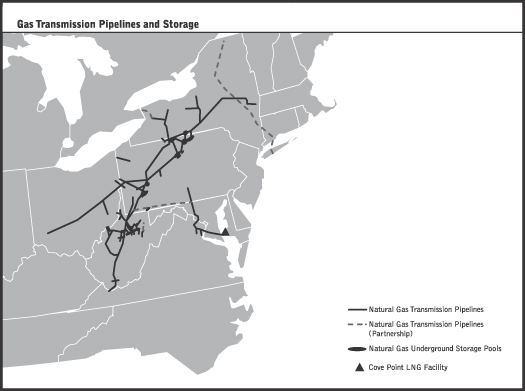

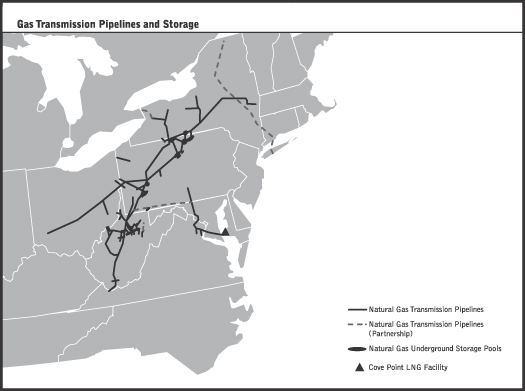

Energy has approximately 7,800 miles of gas transmission, gathering and storage pipelines located in the states of Maryland, New York, Ohio, Pennsylvania, Virginia and West Virginia.We also have storage operations involving both Energy and Delivery. These storage operations include 26 underground gas storage fields located in New York, Ohio, Pennsylvania and West Virginia, with more than 2,000 storage wells and approximately 373,000 acres of operated leaseholds.

The total designed capacity of the underground storage fields is approximately 970 billion cubic feet (bcf) of which approximately 200 bcf is operated by Delivery and 750 bcf is operated by Energy, with the remaining portion being operated by a third party. Six of the 26 storage fields are jointly-owned with other companies and have a capacity of 242 bcf. Energy also has approximately 8 bcf of above ground storage capacity at its Cove Point LNG facility. The Energy and Delivery segments together have more than 100 compressor stations with approximately 688,000 installed compressor horsepower.

The map below illustrates our gas transmission pipelines, storage facilities and LNG facility.

Sources of Energy Supply

Our large underground natural gas storage network and the location of our pipeline system provide a significant link between the country’s major gas pipelines and large markets in the Northeast and Mid-Atlantic regions and on the East Coast. Our pipelines are part of an interconnected gas transmission system, which continues to provide local distribution companies, marketers, power generators and commercial and industrial customers accessibility to supplies nationwide.

Our underground storage facilities play an important part in balancing gas supply with consumer demand and are essential to serving the Northeast, Mid-Atlantic and Midwest regions. In addition, storage capacity is an important element in the effective management of both gas supply and pipeline transport capacity.

Seasonality

The Energy segment is affected by seasonal changes in the prices of commodities that it actively markets.

2

Exploration & Production (E&P)

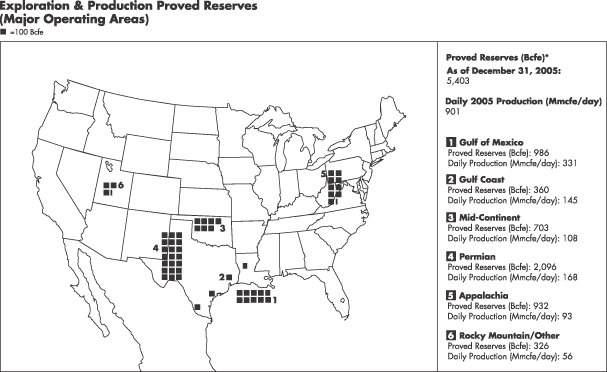

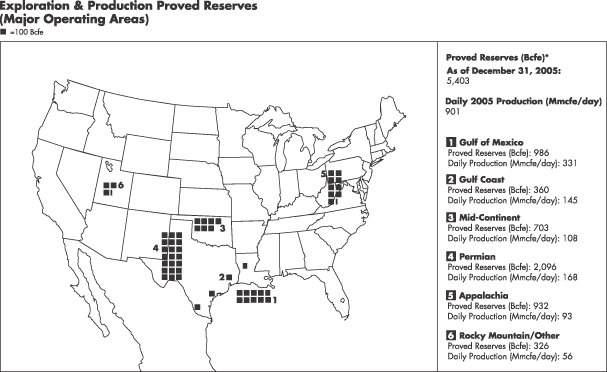

E&P includes our gas and oil exploration, development and production operations. These operations are located in several major producing basins in the lower 48 states, including the outer continental shelf and deepwater areas of the Gulf of Mexico.

Competition

E&P’s competitors range from major international oil companies to smaller independent producers. E&P faces significant competition in the bidding for federal offshore leases and in obtaining leases and drilling rights for onshore properties. As the operator of a number of properties, E&P also faces competition in securing drilling equipment and supplies for exploration and development.

In terms of its production activities, E&P sells most of its deliverable natural gas and oil into short and intermediate-term markets. E&P faces challenges related to the marketing of its natural gas and oil production due to the contraction of participants in the energy marketing industry. However, E&P owns a large and diverse natural gas and oil portfolio and maintains an active gas and oil marketing presence in its primary production regions which strengthens its knowledge of the marketplace and delivery options.

Regulation

Our operations are subject to regulation by numerous federal and state authorities. The pipeline transportation of our natural gas production is regulated by FERC, and pipelines operating on or across the Outer Continental Shelf are subject to the OuterContinental Shelf Lands Act, which requires open-access, non-discriminatory pipeline facilities. Our production operations in the Gulf of Mexico and most of our operations in the western United States are located on federal gas and oil leases administered by the Minerals Management Service (MMS) or the Bureau of Land Management. These leases are issued through a competitive bidding process and require our compliance with stringent regulations. Offshore production facilities must comply with MMS regulations relating to engineering, construction and operational specifications and the plugging and abandonment of wells. Our operations are also subject to numerous environmental regulations including regulations relating to oil spills into navigable waters of the United States. SeeRegulation—Federal Regulations andRegulation—Environmental Regulation for additional information.

Properties

E&P owns 5.4 trillion cubic feet of proved equivalent natural gas and oil reserves and produces approximately 0.9 bcfe of natural gas per day from its leasehold acreage and facility investments. We, either alone or with partners, hold interests in natural gas and oil lease acreage, wellbores, well facilities, production platforms and gathering systems. E&P also owns or holds rights to seismic data and other tools used in exploration and development drilling activities. E&P’s share of developed leasehold totals 2.3 million acres, with another 1.8 million acres held for future exploration and development drilling opportunities. See also Item 2. Properties for additional information on E&P’s properties.

Note: Includes the activities of the E&P segment and the production activity of Dominion Transmission, Inc., which is included in the Energy segment.

Bcfe = billion cubic feet equivalent

Mmcfe = million cubic feet equivalent

3

Seasonality

E&P’s business can be impacted by seasonal changes in the demand for natural gas and oil. Commodity prices, including prices for our unhedged natural gas and oil production, can be impacted by seasonal weather changes and weather effects.

Corporate

We also have a Corporate segment which includes the cost of our corporate and other functions, including the activities of CNG International, our power generating facility and other minor subsidiaries. It also includes specific items attributable to our operating segments that are excluded from the profit measures evaluated by management in assessing segment performance or allocating resources among the segments. (See Notes 1 and 24 to our Consolidated Financial Statements).

Regulation

We are subject to regulation by the Securities and Exchange Commission (SEC), FERC, the Environmental Protection Agency (EPA), the Department of Energy (DOE), the Army Corps of Engineers, and other federal, state and local authorities.

State Regulations

Our gas distribution service is regulated by the Ohio Commission, the Pennsylvania Commission and the West Virginia Commission.

Status of Gas Deregulation

Each of the three states in which we have gas distribution operations has enacted or considered legislation regarding deregulation of natural gas sales at the retail level.

Ohio—Ohio has not enacted legislation requiring supplier choice for residential and commercial natural gas consumers. However, in cooperation with the Ohio Commission, on our own initiative, we offer retail choice to customers. At December 31, 2005, approximately 697,000 of our 1.2 million Ohio customers were participating in this Energy Choice program. Large industrial customers in Ohio also source their own natural gas supplies. In April 2005, we filed an application with the Ohio Commission seeking approval of a plan to improve and expand our Energy Choice Program. Under the current structure, non-Energy Choice customers purchase gas directly from us at a monthly gas recovery cost (GCR) rate that includes true-up adjustments that can change significantly from one quarter to the next. We proposed to replace the GCR with a monthly market price that eliminates those adjustments, making it easier for customers to compare and switch to competitive suppliers. A ruling on this proposal is expected by the end of the first quarter of 2006. By the end of a transition period, and subject to Ohio Commission approval, we plan to exit the gas merchant function in Ohio entirely and have all customers select an alternate gas supplier. We will continue to remain the provider of last resort in the event of default by a supplier.

Pennsylvania—In Pennsylvania, supplier choice is available for all residential and small commercial customers. At December 31, 2005, approximately 75,000 residential and small commercial customers had opted for Energy Choice in our Pennsylvania service area. Nearly all Pennsylvania industrial and large commercial customers buy natural gas from nonregulated suppliers.

West Virginia—At this time, West Virginia has not enacted legislation to require customer choice in its retail natural gas markets. However, the West Virginia Commission has issued regulations to govern pooling services, one of the tools that natural gas suppliers may utilize to provide retail customer choice in the future and has issued rules requiring competitive gas service providers be licensed in West Virginia.

Rate Matters

Our gas distribution subsidiaries are subject to regulation of rates and other aspects of their businesses by the states in which they operate—Pennsylvania, Ohio and West Virginia. When necessary, our gas distribution subsidiaries seek general rate increases on a timely basis to recover increased operating costs. In addition to general rate increases, our gas distribution subsidiaries make routine separate filings with their respective state regulatory commissions to reflect changes in the costs of purchased gas. These purchased gas costs are generally subject to rate recovery through a mechanism that ensures dollar for dollar recovery of prudently incurred costs. Costs that are expected to be recovered in future rates are deferred as regulatory assets. The purchased gas cost recovery filings cover prospective one, three or twelve-month periods. Approved increases or decreases in GCR rates result in increases or decreases in revenues with corresponding increases or decreases in net purchased gas cost expenses.

Ohio—In December 2003, the Ohio Commission approved a joint application filed by us and several other Ohio natural gas companies for recovery of bad debt expense via a rider known as a bad debt tracker. The tracker insulates us from the effect of changes in bad debt expense, which is affected by the volatility of natural gas prices, weather and prices charged by competitive retail natural gas suppliers. The tracker is an adjustable rate that recovers the cost of bad debt in a manner similar to a GCR recovery rate. Instead of recovering bad debt costs through our base rates, we recover all eligible bad debt expenses through the bad debt tracker. Annually, we assess the need to adjust the tracker based on the preceding year’s unrecovered deferred bad debt expense.

Pennsylvania—In July 2004, the Pennsylvania Commission approved a settlement agreement between us and the Office of Consumer Advocate (OCA) in which the OCA agreed to drop its appeal of a previous Pennsylvania Commission order that allowed us to recover approximately $16.5 million in unrecovered purchased gas costs. As part of the settlement, all customer service and delivery charges will be fixed through December 31, 2008. Gas costs will continue to pass through to the customer through the purchased gas cost adjustment mechanism.

West Virginia—In October 2005, the West Virginia Public Service Commission issued a final order approving a $32 million increase in our base and purchased gas cost recovery rates. Under the order, the combined increase for base and purchased gas recovery rates for the 2005/2006 winter is subject to a 20 percent cap. The purchased gas cost recovery rate reflected the effect of the increase effective November 1, 2005 through January 1, 2006. Beginning January 2006, the increase was applied to both base and purchased gas cost recovery rates, with $4 million of the $32 million attributable to the base rate. The order also provides for the recovery of interest costs for any gas cost under-recovery as a result of the cap.

In May 2005, FERC approved a comprehensive rate settlement with our subsidiary, Dominion Transmission, Inc. (DTI), and its customers and interested state commissions. The settlement, which became effective July 1, 2005, reduces our natural

4

gas transportation and storage service revenues by approximately $49 million annually, through a combination of firm transportation rate reductions and reduced fuel retention levels for storage service customers. As part of the settlement, DTI and all signatory parties agreed to a rate moratorium until 2010.

Federal Regulations

Energy Policy Act of 2005 (EPACT)

In August 2005, the President of the United States signed EPACT. Key provisions include the following:

| · | | Repeal of the Public Utility Holding Company Act of 1935 (the 1935 Act); |

| · | | Provision for greater regulatory oversight by other federal and state authorities; |

| · | | Grant of enhanced merger approval authority to FERC; |

| · | | Grant of exclusive authority to FERC to approve applications for construction of LNG facilities; and |

| · | | Improvement of the processes for approval and permitting of interstate pipelines. |

Many of the changes Congress enacted must be implemented through public notice and proposed rule making by the federal agencies affected and this process is ongoing. We will continue to evaluate the effects that EPACT may have on our business.

Public Utility Holding Company Act of 2005

EPACT provided for the repeal of the 1935 Act in February 2006. The 1935 Act and related regulations issued by the SEC governed our activities with respect to the issuance and acquisition of securities, acquisition and sale of utility assets, certain transactions among affiliates, engaging in businesses activities not directly related to the utility or energy business and other matters. Upon the effective date of repeal of the 1935 Act, we will be considered a holding company under the Public Utility Holding Company Act of 2005 (PUHCA 2005), the rules and regulations of which will be administered by FERC. PUHCA 2005 is more limited in scope than the 1935 Act and relates primarily to certain record-keeping requirements and transactions involving public utilities and their affiliates.

Federal Energy Regulatory Commission

FERC regulates the transportation and sale for resale of natural gas in interstate commerce under the Natural Gas Act of 1938 and the Natural Gas Policy Act of 1978, as amended. Under the Natural Gas Act, FERC has authority over rates, terms and conditions of services performed by our interstate gas pipeline subsidiaries, including DTI and Dominion Cove Point LNG, LP. FERC also has jurisdiction over siting, construction and operation of natural gas import facilities and interstate natural gas pipeline facilities.

FERC Order 636 requires transmission pipelines to operate as open-access transporters and provide transportation and storage services on an equal basis for all gas suppliers, whether purchased from us or from another gas supplier.

Our interstate gas transportation and storage activities are conducted in accordance with certificates, tariffs and service agreements on file with FERC.

We are also subject to the Pipeline Safety Act of 2002, which includes new mandates regarding the inspection frequency for interstate and intrastate natural gas transmission and storage pipelines located in areas of high-density population where the consequences of potential pipeline accidents pose the greatest risk to people and their property. We have evaluated our naturalgas transmission and storage properties under the final regulations issued in December 2003 and have developed the required implementation plan including identification, testing and potential remediation activities.

We are also subject to FERC’s Standards of Conduct that govern conduct between interstate transmission gas and electricity providers and their marketing function or their energy related affiliates. The rules define the scope of the affiliates covered by the standards and are designed to prevent transmission providers from giving their marketing functions or affiliates undue preferences.

We implemented various rate filings, tariff changes and negotiated rate service agreements for our FERC-regulated businesses during 2005. In all material respects, these filings were approved by FERC in the form requested by us and were subject to only minor modifications.

Environmental Regulation

Each of our operating segments face substantial regulation and compliance costs with respect to environmental matters. For a discussion of significant aspects of these matters, see Item 3. Legal Proceedings and Note 19 to our Consolidated Financial Statements.

From time to time we may be identified as a potentially responsible party in relation to a Superfund site. The EPA (or a state) can either (a) allow such a party to conduct and pay for a remedial investigation, feasibility study and remedial action or (b) conduct the remedial investigation and action and then seek reimbursement from the parties. Each party can be held jointly, severally and strictly liable for all costs. These parties can also bring contribution actions against each other and seek reimbursement from their insurance companies. As a result, we may be responsible for the costs of remedial investigation and actions under the Superfund Act or other laws or regulations regarding the remediation of waste. We do not believe that any currently identified sites will result in significant liabilities.

We have applied for or obtained the necessary environmental permits for the operation of our regulated facilities. Many of these permits are subject to re-issuance and continuing review.

Recent Developments

On March 1, 2006 we entered into an agreement with Equitable Resources, Inc. to sell two of our wholly-owned regulated gas distribution subsidiaries, The Peoples Natural Gas Company and Hope Gas, Inc. for $969.6 million plus adjustments to reflect capital expenditures and changes in working capital. We expect to complete the transaction by the first quarter of 2007, subject to state regulatory approvals in Pennsylvania and West Virginia as well as approval under the federal Hart-Scott-Rodino Act.

Item 1A. Risk Factors

Our business is influenced by many factors that are difficult to predict, involve uncertainties that may materially affect actual results and are often beyond our control. We have identified a number of these factors below. For other factors that may cause actual results to differ materially from those indicated in any forward-looking statement or projection contained in this report, seeForward-Looking Statements in Item 7. Management’s Discussion and Analysis of Results of Operations (MD&A).

Our operations are weather sensitive. Our results of operations can be affected by changes in the weather. Weather conditions directly influence the demand for electricity and natural gas and affect the price of energy commodities. In addition, severe weather, including hurricanes and winter storms, can

5

be destructive, causing production delays and property damage that require us to incur additional expenses.

We are subject to complex governmental regulation that could adversely affect our operations. Our operations are subject to extensive federal, state and local regulation and may require numerous permits, approvals and certificates from various governmental agencies. We must also comply with environmental legislation and associated regulations. Management believes the necessary approvals have been obtained for our existing operations and that our business is conducted in accordance with applicable laws. However, new laws or regulations, or the revision or reinterpretation of existing laws or regulations, may require us to incur additional expenses.

Costs of environmental compliance, liabilities and litigation could exceed our estimates, which could adversely affect our results of operations. Compliance with federal, state and local environmental laws and regulations may result in increased capital, operating and other costs, including remediation and containment expenses and monitoring obligations. In addition, we may be a responsible party for environmental clean-up at a site identified by a regulatory body. Management cannot predict with certainty the amount and timing of all future expenditures related to environmental matters because of the difficulty of estimating clean-up and compliance costs, and the possibility that changes will be made to the current environmental laws and regulations. There is also uncertainty in quantifying liabilities under environmental laws that impose joint and several liability on all potentially responsible parties.

The use of derivative instruments could result in financial losses and liquidity constraints. We use derivative instruments, including futures, forwards, options and swaps, to manage our commodity and financial market risks. We could recognize financial losses on these contracts as a result of volatility in the market values of the underlying commodities or if a counterparty fails to perform under a contract. In the absence of actively quoted market prices and pricing information from external sources, the valuation of these contracts involves management’s judgment or use of estimates. As a result, changes in the underlying assumptions or use of alternative valuation methods could affect the reported fair value of these contracts.

In addition, we use financial derivatives to hedge future sales of our gas and oil production, which may limit the benefit we would otherwise receive from increases in commodity prices. These hedge arrangements generally include collateral requirements that require us to deposit funds or post letters of credit with counterparties to cover the fair value of covered contracts in excess of agreed upon credit limits. When commodity prices rise to levels substantially higher than the levels where we have hedged future sales, we may be required to use a material portion of our available liquidity and obtain additional liquidity to cover these collateral requirements. In some circumstances, this could have a compounding effect on our financial liquidity and results.

Derivatives designated under hedge accounting to the extent not offset by the hedged transaction can result in ineffectiveness losses. These losses primarily result from differences in the location and specifications of the derivative hedging instrument and the hedged item and could adversely affect our results of operations.

For additional information concerning derivatives and commodity-based contracts, seeMarket Risk Sensitive InstrumentsandRisk Management in Item 7A. Quantitative and Qualitative Disclosures About Market Risk and Notes 2 and 9 to our Consolidated Financial Statements.

Our exploration and production business is dependent on factors that cannot be predicted or controlled and that coulddamage facilities, disrupt production or reduce the book value of our assets. Factors that may affect our financial results include damage to or suspension of operations caused by weather, fire, explosion or other events to our or third party gas and oil facilities, fluctuations in natural gas and crude oil prices, results of future drilling and well completion activities and our ability to acquire additional land positions in competitive lease areas, as well as inherent operational risks that could disrupt production.

Short-term market declines in the prices of natural gas and oil could adversely affect our financial results by causing a permanent write-down of our natural gas and oil properties as required by the full cost method of accounting. Under the full cost method, all direct costs of property acquisition, exploration and development activities are capitalized. If net capitalized costs exceed the present value of estimated future net revenues based on hedge-adjusted period-end prices from the production of proved gas and oil reserves (the ceiling test) at the end of any quarterly period, then a permanent write-down of the assets must be recognized in that period.

We maintain business interruption insurance for offshore operations associated with our exploration and production business. We have placed our insurers on notice that we have suffered substantial property damage and business interruption loss related to Hurricanes Katrina and Rita. Failure to realize the full value of our claims could adversely affect our results of operations. Additionally, the increased level of hurricane activity in the Gulf of Mexico is likely to significantly increase the cost of business interruption insurance and could make it unavailable on commercially reasonable terms. Inability to insure our offshore Gulf of Mexico operations could adversely affect our results of operations.

An inability to access financial markets could affect the execution of our business plan. We rely on access to short-term money markets, longer-term capital markets and banks as significant sources of liquidity for capital requirements and collateral requirements related to hedges of future gas and oil production not satisfied by the cash flows from our operations. Management believes that we will maintain sufficient access to these financial markets based upon current credit ratings. However, certain disruptions outside of our control may increase our cost of borrowing or restrict our ability to access one or more financial markets. Such disruptions could include an economic downturn, the bankruptcy of an unrelated energy company or changes to our credit ratings. Restrictions on our ability to access financial markets may affect our ability to execute our business plan as scheduled.

Changing rating agency requirements could negatively affect our growth and business strategy. As of February 1, 2006, our senior unsecured debt is rated BBB, stable outlook, by Standard & Poor’s Ratings Group (Standard & Poor’s); A3, under review for possible downgrade, by Moody’s Investors Service (Moody’s); and BBB+, stable outlook, by Fitch Ratings Ltd. (Fitch). In order to maintain our current credit ratings in light of existing or future requirements, we may find it necessary to take steps or change our business plans in ways that may adversely affect our growth and earnings. A reduction in our credit ratings by Standard & Poor’s, Moody’s or Fitch could increase our borrowing costs and adversely affect operating results and could require us to post additional collateral in connection with some of our marketing activities.

Potential changes in accounting practices may adversely affect our financial results. We cannot predict the impact that future changes in accounting standards or practices may have on public companies in general, the energy industry or our operations specifically. New accounting standards could be issued that could

6

change the way we record revenues, expenses, assets and liabilities. These changes in accounting standards could adversely affect our reported earnings or could increase reported liabilities.

Failure to retain and attract key executive officers and other skilled professional and technical employees could have anadverse effect on our operations. Implementation of our growth strategy is dependent on our ability to recruit, retain and motivate employees. Competition for skilled employees in some areas is high and the inability to retain and attract these employees could adversely affect our business and future financial condition.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We share our principal office in Richmond, Virginia, with our parent company, Dominion. Such office space is leased. We lease offices in other cities in which our subsidiaries operate. Our assets consist primarily of investments in our subsidiaries, the principal properties of which are described below and in Item 1. Business.

Information detailing our gas and oil operations presented below includes the activities of the E&P segment and the production activity of DTI, which is included in the Energy segment:

Company-Owned Proved Gas and Oil Reserves

Estimated net quantities of proved gas and oil reserves at December 31 of each of the last three years were as follows:

| | | | | | | | | | | | |

| | | 2005 | | 2004 | | 2003 |

| | | Proved

Developed | | Total

Proved | | Proved

Developed | | Total

Proved | | Proved

Developed | | Total

Proved |

Proved gas reserves (bcf) | | 3,059 | | 4,219 | | 3,049 | | 4,202 | | 2,902 | | 4,039 |

Proved oil reserves (000 bbl) | | 144,417 | | 197,284 | | 100,780 | | 142,635 | | 53,776 | | 147,954 |

Total proved gas and oil reserves (bcfe) | | 3,925 | | 5,403 | | 3,654 | | 5,058 | | 3,224 | | 4,927 |

Certain of our subsidiaries file Form EIA-23 with the DOE, which reports gross proved reserves, including the working interest shares of other owners, for properties operated by such subsidiaries. The proved reserves reported in the table above represent our share of proved reserves for all properties, based on our ownership interest in each property. For properties we operate, the difference between the proved reserves reported on Form EIA-23 and the gross reserves associated with the Company-owned proved reserves reported in the table above, does not exceed five percent. Estimated proved reserves as of December 31, 2005 are based upon a study for each of our properties prepared by our staff engineers and reviewed by Ryder Scott Company, L.P. Calculations were prepared using standard geological and engineering methods generally accepted by the petroleum industry and in accordance with SEC guidelines.

Quantities of Gas and Oil Produced

Quantities of gas and oil produced during each of the last three years follow:

| | | | | | |

| | | 2005 | | 2004 | | 2003 |

Gas production (bcf) | | 242 | | 264 | | 281 |

Oil production (000 bbl) | | 14,543 | | 11,117 | | 9,436 |

Total gas and oil production (bcfe) | | 329 | | 331 | | 337 |

The average sales price per thousand cubic feet (mcf) of gas with hedging results (including transfers to other Company operations at market prices) realized during the years 2005, 2004 and 2003 was $5.08, $4.45 and $4.16, respectively. The respective average prices without hedging results per mcf of gas produced were $8.13, $6.01 and $5.32, respectively. The respective average sales prices realized for oil with hedging results were $29.92, $25.28 and $24.60 per barrel and the respectiveaverage prices without hedging results were $50.23, $39.96 and $29.37 per barrel. The average production (lifting) cost per mcf equivalent of gas and oil produced (as calculated per SEC guidelines) during the years 2005, 2004 and 2003 was $1.03, $0.78 and $0.75 respectively.

Acreage

Gross and net developed and undeveloped acreage at December 31, 2005 was:

| | | | | | | | |

| | | Developed Acreage | | Undeveloped Acreage |

| | | Gross | | Net | | Gross | | Net |

| (thousands) | | | | | | | | |

Acreage | | 3,771 | | 2,319 | | 3,224 | | 1,757 |

Net Wells Drilled in the Calendar Year

The number of net wells completed during each of the last three years follows:

| | | | | | |

| | | 2005 | | 2004 | | 2003 |

Exploratory: | | | | | | |

Productive | | 6 | | 7 | | 4 |

Dry | | 6 | | 7 | | 7 |

Total Exploratory | | 12 | | 14 | | 11 |

Development: | | | | | | |

Productive | | 817 | | 830 | | 719 |

Dry | | 34 | | 17 | | 33 |

Total Development | | 851 | | 847 | | 752 |

Total wells drilled (net) | | 863 | | 861 | | 763 |

As of December 31, 2005, 115 gross (75 net) wells were in the process of being drilled, including wells temporarily suspended.

7

As of December 31, 2005, 115 gross (75 net) wells were in the process of being drilled, including wells temporarily suspended.

Productive Wells

The number of productive gas and oil wells in which we had an interest at December 31, 2005, follows:

| | | | |

| | | Gross | | Net |

Total gas wells | | 15,653 | | 10,654 |

Total oil wells | | 3,399 | | 865 |

The number of productive wells includes 208 gross (80 net) multiple completion gas wells and 10 gross (4 net) multiple completion oil wells. Wells with multiple completions are counted only once for productive well count purposes.

Item 3. Legal Proceedings

From time to time, we are alleged to be in violation or in default under orders, statutes, rules or regulations relating to the environment, compliance plans imposed upon or agreed to by us, or permits issued by various local, state and federal agencies for the construction or operation of facilities. Administrative proceedings may also be pending on these matters. In addition, in the ordinary course of business, we are involved in various legal proceedings. We believe that the ultimate resolution of these proceedings will not have a material adverse effect on our financial position, liquidity or results of operations.

SeeRegulation in Item 1. Business and Note 19 to our Consolidated Financial Statements for additional information on rate matters and various regulatory proceedings to which we are a party.

Before being acquired by us, Louis Dreyfus Natural Gas Corp. (Louis Dreyfus) was one of numerous defendants in a lawsuit consolidated and now pending in the 93rd Judicial District Court in Hidalgo County, Texas. The lawsuit alleges that gas wells and related pipeline facilities operated by Louis Dreyfus, and other facilities operated by other defendants, caused an underground hydrocarbon plume in McAllen, Texas. The plaintiffs claim that they have suffered damages, including property damage and lost profits, as a result of the alleged plume and seek compensation for these items.

In July 1997, Jack Grynberg brought suit against us and several of our subsidiaries. The suit seeks damages for alleged fraudulent mismeasurement of gas volumes and underreporting of gas royalties from gas production taken from federal leases. The suit was consolidated with approximately 360 other cases in the U.S. District Court for the District of Wyoming. Parts of Mr. Grynberg’s claims were dismissed on the basis that they overlapped with Mr. Wright’s claims, which are noted below. Mr. Grynberg has filed an appeal. While some of the defendants have been dismissed from the case, the court denied our motion to dismiss and we appealed. The case is stayed pending a ruling, which is not expected until the second quarter of 2006.

In April 1998, Harrold E. (Gene) Wright filed suit against Dominion Exploration & Production, Inc. (formerly known as CNG Producing Company), a subsidiary of CNG, and numerous other companies under the False Claims Act. Wright alleged various fraudulent valuation practices in the payment of royalties due under federal oil and gas leases. Shortly after filing, this case was consolidated under the Federal Multidistrict Litigation rules with the Grynberg case noted above. A substantial portion of the claim against us was resolved by settlement in late 2002. The case was remanded back to the U.S. District Court for the Eastern District of Texas, which denied our motion to dismiss on jurisdictional grounds in January 2005. Discovery in this matter is currently underway.

In September 2005, DTI reached an agreement in principle on a proposed Consent Order and Agreement (COA) with the Pennsylvania Department of Environmental Protection (PADEP) which would supersede a 1990 COA between the parties. The agreement in principle resolves longstanding groundwater contamination issues at several DTI compressor stations in Pennsylvania and includes a penalty and environmental projects of $850,000 to be paid to PADEP and the Pennsylvania Department of Conservation and Natural Resources to resolve alleged violations. Negotiations are ongoing with both agencies to finalize language and payment mechanisms. As of December 31, 2005, DTI has accrued $850,000 for the penalty and environmental projects.

Item 4. Submission of Matters to a Vote of Security Holders

Omitted pursuant to General Instruction I.(2)(c).

8

Part II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Dominion Resources, Inc. owns all of our common stock. We paid quarterly cash dividends on our common stock as follows (in millions):

| | | | | | | | | | | | |

| | | Quarter |

| | | First | | Second | | Third | | Fourth |

2005 | | $ | 214 | | $ | 110 | | $ | 92 | | $ | 159 |

2004 | | $ | 183 | | $ | 88 | | $ | 70 | | $ | 141 |

Restrictions on the payment of dividends by us are discussed in Note 17 to our Consolidated Financial Statements.

Item 6. Selected Financial Data

Omitted pursuant to General Instruction I.(2)(a).

Item 7. Management’s Discussion and Analysis of Results of Operations

Management’s Discussion and Analysis of Results of Operations (MD&A) discusses our results of operations. MD&A should be read in conjunction with our Consolidated Financial Statements. The terms “Company,” “we,” “our” and “us” are used throughout this report and, depending on the context of its use, may represent any of the following: the legal entity, Consolidated Natural Gas Company; one of Consolidated Natural Gas Company’s consolidated subsidiaries or operating segments, or the entirety of Consolidated Natural Gas Company and its consolidated subsidiaries.

Contents of MD&A

The reader will find the following information in this MD&A:

| · | | Forward-Looking Statements |

| · | | Segment Results of Operations |

Forward-Looking Statements

This report contains statements concerning our expectations, plans, objectives, future financial performance and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private SecuritiesLitigation Reform Act of 1995. In most cases, the reader can identify these forward-looking statements by such words as “anticipate,” “estimate,” “forecast,” “expect,” “believe,” “should,” “could,” “plan,” “may” or other similar words.

We make forward-looking statements with full knowledge that risks and uncertainties exist that may cause actual results to differ materially from predicted results. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Additionally, other factors may cause actual results to differ materially from those indicated in any forward-looking statement. These factors include but are not limited to:

| · | | Unusual weather conditions and their effect on energy sales to customers and energy commodity prices; |

| · | | Extreme weather events, including hurricanes and winter storms, that can cause outages, production delays and property damage to our facilities; |

| · | | State and federal legislative and regulatory developments, including deregulation and changes in environmental and other laws and regulations to which we are subject; |

| · | | Cost of environmental compliance; |

| · | | Fluctuations in energy-related commodity prices and the effect these could have on our earnings, liquidity position and the underlying value of our assets; |

| · | | Counterparty credit risk; |

| · | | Capital market conditions, including price risk due to marketable securities held as investments in benefit plan trusts; |

| · | | Fluctuations in interest rates; |

| · | | Changes in rating agency requirements or credit ratings and the effect on availability and cost of capital; |

| · | | Changes in financial or regulatory accounting principles or policies imposed by governing bodies; |

| · | | Employee workforce factors including collective bargaining agreements and labor negotiations with union employees; |

| · | | The risks of operating businesses in regulated industries that are subject to changing regulatory structures; |

| · | | Changes in our ability to recover investments made under traditional regulation through rates; |

| · | | Receipt of approvals for and timing of closing dates for acquisitions and divestitures; |

| · | | Realization of expected business interruption insurance proceeds; and |

| · | | Political and economic conditions, including the threat of domestic terrorism, inflation and deflation. |

Additionally, other risks that could cause actual results to differ from predicted results are set forth in Item 1A. Risk Factors.

Our forward-looking statements are based on our beliefs and assumptions using information available at the time the statements are made. We caution the reader not to place undue reliance on our forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. We undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

9

Introduction

CNG operates in all phases of the natural gas business, explores for and produces gas and oil and provides a variety of energy marketing services. We are a wholly owned subsidiary of Dominion Resources, Inc. (Dominion).

We manage our operations through three primary operating segments: Delivery, Energy, and Exploration & Production. The contributions to net income by our primary operating segments are determined based on a measure of profit that we believe represents the segments’ core earnings. As a result, certain specific items attributable to those segments are not included in profit measures evaluated by management in assessing segment performance or allocating resources among the segments. Those specific items are reported in the Corporate segment.

Delivery includes our regulated gas distribution and customer service business as well as nonregulated retail energy marketing operations and related products and services. Our regulated gas distribution business serves residential, commercial and industrial gas sales and transportation customers in Ohio, Pennsylvania and West Virginia. Our nonregulated retail energy marketing operations markets gas, electricity and related products and services to residential, industrial and small commercial customers in the Northeast, Mid-Atlantic and Midwest.

Revenue provided by gas distribution operations is based primarily on rates established by state regulatory authorities and state law. The profitability of this business is dependent on its ability, through the rates it is permitted to charge, to recover costs and earn a reasonable return on its capital investments. Variability relates largely to changes in volumes, which are primarily weather sensitive, and changes in the cost of routine maintenance and repairs (including labor and benefits). Income from retail energy marketing operations varies in connection with changes in weather and commodity prices as well as the acquisition and loss of customers.

Energy includes our tariff-based natural gas transmission pipeline and storage business and the Cove Point liquefied natural gas (LNG) facility. It also includes certain natural gas production located in the Appalachian basin and producer services, which consist of aggregation of gas supply and related wholesale activities. The gas transmission pipeline and storage business serves our gas distribution businesses and other customers in the Northeast, Mid-Atlantic and Midwest.

Revenue provided by regulated gas transmission operations and the LNG facility is based primarily on rates approved by the Federal Energy Regulatory Commission (FERC). The profitability of these businesses is dependent on their ability, through the rates they are permitted to charge, to recover costs and earn a reasonable return on their capital investments. Variability results primarily from changes in rates, the demand for services, which is primarily weather dependent, and operating and maintenance expenditures (including labor and benefits).

Earnings for the Energy segment’s nonregulated businesses are subject to variability associated with changes in commodity prices. Energy’s nonregulated businesses use physical and financial arrangements to attempt to hedge this price risk. Certain hedging activities may require cash deposits to satisfy collateral requirements. Variability also results from changes in operating and maintenance expenditures (primarily labor and benefits).

Exploration & Production (E&P) includes our gas and oil exploration, development and production business. Operations are located in several major producing basins in the lower 48 states, including the outer continental shelf and deepwater areas of the Gulf of Mexico.

E&P generates income from the sale of natural gas and oil we produce from our reserves. Variability relates primarily to changes in commodity prices, which are market-based, and production volumes, which are impacted by numerous factors including drilling success, timing of development projects, and external factors such as storm-related damage caused by hurricanes. We attempt to manage commodity price volatility by hedging a substantial portion of our expected production. These hedging activities may require cash deposits to satisfy collateral requirements. We attempt to mitigate the financial impact of storm-related delays in production by maintaining business interruption insurance for our offshore operations. Our business interruption insurance covers delays caused by damage to both our production facilities and to third-party facilities downstream.

Corporateincludes our corporate and other functions, including the activities of CNG International (CNGI), our power generating facility and other minor subsidiaries. It also includes specific items attributable to our operating segments that are excluded from the profit measures evaluated by management in assessing segment performance or allocating resources among segments. We have sold the majority of CNGI’s assets. See Note 7 to our Consolidated Financial Statements.

Recent Developments

On March 1, 2006 we entered into an agreement with Equitable Resources, Inc. to sell two of our wholly-owned regulated gas distribution subsidiaries, The Peoples Natural Gas Company and Hope Gas, Inc., for $969.6 million plus adjustments to reflect capital expenditures and changes in working capital. We expect to complete the transaction by the first quarter of 2007, subject to state regulatory approvals in Pennsylvania and West Virginia, as well as approval under the federal Hart-Scott-Rodino Act.

Accounting Matters

Critical Accounting Policies and Estimates

We have identified the following accounting policies, including certain inherent estimates, that as a result of the judgments, uncertainties, uniqueness and complexities of the underlying accounting standards and operations involved, could result in material changes to our financial condition or results of operations under different conditions or using different assumptions. We have discussed the development, selection and disclosure of each of these with our Board of Directors that also serves as our Audit Committee.

Accounting for derivative contracts at fair value

We use derivative contracts such as futures, swaps and options to buy and sell energy-related commodities and to manage our commodity and financial markets risks. Derivative contracts, with certain exceptions, are subject to fair value accounting and are reported on our Consolidated Balance Sheets at fair value. Accounting requirements for derivatives and related hedging activities are complex and may be subject to further clarification by standard-setting bodies.

10

Fair value is based on actively quoted market prices, if available. In the absence of actively quoted market prices, we seek indicative price information from external sources, including broker quotes and industry publications. If pricing information from external sources is not available, we must estimate prices based on available historical and near-term future price information and use of statistical methods. For options and contracts with option-like characteristics where pricing information is not available from external sources, we generally use a modified Black-Scholes Model that considers time value, the volatility of the underlying commodities and other relevant assumptions. We use other option models under special circumstances, including a Spread Approximation Model, when contracts include different commodities or commodity locations and a Swing Option Model, when contracts allow either the buyer or seller the ability to exercise within a range of quantities. For contracts with unique characteristics, we estimate fair value using a discounted cash flow approach deemed appropriate in the circumstances and applied consistently from period to period. If pricing information is not available from external sources, judgment is required to develop the estimates of fair value. For individual contracts, the use of different valuation models or assumptions could have a material effect on the contract’s estimated fair value.

For cash flow hedges of forecasted transactions, we must estimate the future cash flows of the forecasted transactions, as well as evaluate the probability of occurrence and timing of such transactions. Changes in conditions or the occurrence of unforeseen events could require discontinuance of hedge accounting or could affect the timing of the reclassification of gains and/or losses on cash flow hedges from accumulated other comprehensive income (loss) (AOCI) into earnings.

Use of estimates in goodwill impairment testing

As of December 31, 2005, we reported $623 million of goodwill on our Consolidated Balance Sheet. The majority of this goodwill is allocated to the E&P reporting unit, with the remainder allocated to the Energy reporting unit. In April of each year, we test our goodwill for potential impairment, and perform additional tests more frequently if impairment indicators are present. The 2005 annual test did not result in the recognition of any goodwill impairment, as the estimated fair values of our reporting units exceeded their respective carrying amounts.

We estimate the fair value of our reporting units by using a combination of discounted cash flow analyses, based on our internal five-year strategic plan, and other valuation techniques that use multiples of earnings for peer group companies and analyses of recent business combinations involving peer group companies. These calculations are dependent on subjective factors such as our estimate of future cash flows, the selection of appropriate discount and growth rates, and the selection of peer group companies and recent transactions. These underlying assumptions and estimates are made as of a point in time; subsequent modifications, particularly changes in discount rates or growth rates inherent in our estimates of future cash flows, could result in a future impairment of goodwill. Although we have consistently applied the same methods in developing the assumptions and estimates that underlie the fair value calculations, such as estimates of future cash flows, and based those estimates on relevant information available at the time, such cash flow estimates are highly uncertain by nature and may vary significantly from actual results. If the estimates of future cash flows used in the 2005 annual test had been 10% lower, the resulting fair values would have still been greater than thecarrying values of each of those reporting units, indicating no impairment was present.

Employee benefit plans

We sponsor and also participate in certain Dominion noncontributory defined benefit pension plans and other postretirement benefit plans for eligible active employees, retirees and qualifying dependents. The costs of providing benefits under these plans are dependent, in part, on historical information such as employee demographics, the level of contributions made to the plans and earnings on plan assets. Assumptions about the future, including the expected rate of return on plan assets, discount rates applied to benefit obligations and the anticipated rate of increase in health care costs and participant compensation, also have a significant impact on employee benefit costs. The impact on pension and other postretirement benefit plan obligations associated with changes in these factors is generally recognized in our Consolidated Statements of Income over the remaining average service period of plan participants rather than immediately.

The selection of expected long-term rates of return on plan assets, discount rates and medical cost trend rates are critical assumptions. We determine the expected long-term rates of return on plan assets for pension plans and other postretirement benefit plans by using a combination of:

| · | | Historical return analysis to determine expected future risk premiums; |

| · | | Forward-looking return expectations derived from the yield on long-term bonds and the price earnings ratios of major stock market indices; |

| · | | Expected inflation and risk-free interest rate assumptions; and investment allocation of plan assets. The strategic target asset allocation for our pension fund is 45% U.S. equity securities, 8% non-U.S. equity securities, 22% debt securities and 25% other, such as real estate and private equity investments. |

Assisted by an independent actuary, we develop assumptions, which are then compared to the forecasts of other independent investment advisors to ensure reasonableness. An internal committee selects the final assumptions. We calculated our pension cost using an expected return on plan assets assumption of 8.75% for 2005, 2004 and 2003. We calculated our other postretirement benefit cost using an expected return on plan assets assumption of 8.0% for 2005, 2004 and 2003. The rate used in calculating other postretirement benefit cost is lower than the rate used in calculating pension cost because of differences in the relative amounts of various types of investments held as plan assets.

Discount rates are determined from analyses performed by a third-party actuarial firm of AA/Aa rated bonds with cash flows matching the expected payments to be made under our plans. The discount rate used to calculate 2005 pension and other postretirement benefit costs was 6.00% compared to the 6.25% and 6.75% discount rates used to calculate 2004 and 2003 pension and other postretirement benefit costs, respectively. Lower long-term bond yields were the primary reason for the decline in the discount rate from 2004 to 2005.

The medical cost trend rate assumption is established based on analyses performed by a third-party actuarial firm of various factors including the specific provisions of our medical plans, actual cost trends experienced and projected, and demographics of plan participants. Our medical cost trend rate assumption as of December 31, 2005 is 9.00% and is expected to gradually decrease to 5.00% in later years.

11

Accounting for regulated operations

The accounting for our regulated gas operations differs from the accounting for nonregulated operations in that we are required to reflect the effect of rate regulation in our Consolidated Financial Statements. Specifically, our regulated businesses record assets and liabilities that nonregulated companies would not report under accounting principles generally accepted in the United States of America. When it is probable that regulators will permit the recovery of current costs through future rates charged to customers, we defer these costs as regulatory assets that otherwise would be expensed by nonregulated companies. Likewise, we recognize regulatory liabilities when it is probable that regulators will require customer refunds through future rates and when revenue is collected from customers for expenditures that are not yet incurred. Regulatory assets are amortized into expense and regulatory liabilities are amortized into income over the recovery period authorized by the regulator.

We evaluate whether or not recovery of our regulatory assets through future regulated rates is probable and make various assumptions in our analyses. The expectations of future recovery are generally based on orders issued by regulatory commissions or historical experience, as well as discussions with applicable regulatory authorities. If recovery of regulatory assets is determined to be less than probable, the regulatory asset will be written off and an expense will be recorded in the period such assessment is made. We currently believe the recovery of our regulatory assets is probable. See Notes 2 and 12 to our Consolidated Financial Statements.

Accounting for gas and oil operations

We follow the full cost method of accounting for gas and oil exploration and production activities prescribed by the Securities and Exchange Commission (SEC). Under the full cost method, all direct costs of property acquisition, exploration and development activities are capitalized and subsequently depreciated using the units-of-production method. The depreciable base of costs includes estimated future costs to be incurred in developing proved gas and oil reserves, as well as capitalized asset retirement costs, net of projected salvage values. Capitalized costs in the depreciable base are subject to a ceiling test prescribed by the SEC. The test limits capitalized amounts to a ceiling—the present value of estimated future net revenues to be derived from the production of proved gas and oil reserves assuming period-end pricing adjusted for cash flow hedges in place. We perform the ceiling test quarterly and would recognize asset impairments to the extent that total capitalized costs exceed the ceiling. In addition, gains or losses on the sale or other disposition of gas and oil properties are not recognized, unless the gain or loss would significantly alter the relationship between capitalized costs and proved reserves of natural gas and oil.

Our estimate of proved reserves requires a large degree of judgment and is dependent on factors such as historical data, engineering estimates of proved reserve quantities, estimates of the amount and timing of future expenditures to develop theproved reserves, and estimates of future production from the proved reserves. Our estimated proved reserves as of December 31, 2005 are based upon studies for each of our properties prepared by our staff engineers and reviewed by Ryder Scott Company, L.P. Calculations were prepared using standard geological and engineering methods generally accepted by the petroleum industry and in accordance with SEC guidelines. Given the volatility of natural gas and oil prices, it is possible that our estimate of discounted future net cash flows from proved natural gas and oil reserves that is used to calculate the ceiling could materially change in the near-term.

The process to estimate reserves is imprecise, and estimates are subject to revision. If there is a significant variance in any of our estimates or assumptions in the future and revisions to the value of our proved reserves are necessary, related depletion expense and the calculation of the ceiling test would be affected and recognition of natural gas and oil property impairments could occur. See Notes 2 and 25 to our Consolidated Financial Statements.

Income taxes

Judgment and the use of estimates are required in developing the provision for income taxes and reporting of tax-related assets and liabilities. The interpretation of tax laws involves uncertainty, since tax authorities may interpret them differently. We establish liabilities for tax-related contingencies in accordance with Statement of Financial Accounting Standards (SFAS) No. 5,Accountingfor Contingencies, and review them in light of changing facts and circumstances. Ultimate resolution of income tax matters may result in favorable or unfavorable impacts to net income and cash flows and adjustments to tax-related assets and liabilities could be material. In addition, deferred income tax assets and liabilities are provided, representing future effects on income taxes for temporary differences between the bases of assets and liabilities for financial reporting and tax purposes. We evaluate quarterly the probability of realizing deferred tax assets by reviewing a forecast of future taxable income and the availability of tax planning strategies that can be implemented, if necessary, to realize deferred tax assets. Failure to achieve forecasted taxable income or successfully implement tax planning strategies may affect the realization of deferred tax assets.

Other

We enter into buy/sell and related agreements primarily as a means to reposition our offshore Gulf of Mexico crude oil production to more liquid marketing locations onshore. We typically enter into either a single or a series of buy/sell transactions in which we sell our crude oil production at the offshore field delivery point and buys similar quantities at Cushing, Oklahoma for sale to third parties. We are able to enhance profitability by selling to a wide array of refiners and/or trading companies at Cushing, one of the largest crude oil markets in the world, versus restricting sales to a limited number of refinery purchasers in the Gulf of Mexico.

12

Under the primary guidance of EITF Issue No. 99-19,Reporting Revenue Gross as a Principal versus Net as an Agent, we present the sales and purchases related to our crude oil buy/sell arrangements on a gross basis in our Consolidated Statements of Income. These transactions require physical delivery of the crude oil and the risks and rewards of ownership are evidenced by title transfer, assumption of environmental risk, transportation scheduling and counterparty nonperformance risk. Amounts currently shown on a gross basis in our Consolidated Statements of Income are summarized below.

| | | | | | | | | |

| Year Ended December 31, | | 2005 | | 2004 | | 2003 |

(millions) | | | | | | | | | |

Sale activity included in operating revenue | | $ | 377 | | $ | 290 | | $ | 181 |

Purchase activity included in operating expenses(1) | | | 362 | | | 271 | | | 163 |

| (1) | | Included in other energy-related commodity purchases |

In September 2005, the FASB ratified the EITF’s consensus on Issue No. 04-13,Accounting for Purchases and Sales of Inventory with the Same Counterparty, that will require buy/sell and related agreements to be presented on a net basis in our Consolidated Statements of Income if they are entered into in contemplation of one another. This new guidance is required to be applied to all new arrangements entered into, and modifications or renewals of existing arrangements, for reporting periods beginning April 1, 2006. We are currently assessing the impact that this new guidance may have on our income statement presentation of these transactions; however, there will be no impact on our results of operations or cash flows. See Note 4 to our Consolidated Financial Statements.

Results of Operations

Segment results include the impact of intersegment revenues and expenses, which may result in intersegment profit or loss. Presented below is a summary of contributions by our operating segments to net income:

| | | | | | | |

| Year Ended December 31, | | 2005 | | | 2004 | |

| (millions) | | | | | | |

Delivery | | $157 | | | $ | 184 | |

Energy | | 234 | | | | 228 | |

Exploration & Production | | 529 | | | | 520 | |

Primary operating segments | | 920 | | | | 932 | |

Corporate | | (367 | ) | | | (65 | ) |

Consolidated | | $553 | | | $ | 867 | |

Overview

2005 vs. 2004

Our 2005 results were significantly impacted by Hurricanes Katrina and Rita, which struck the Gulf Coast area in late August and late September 2005, respectively. Due to the hurricanes, our production assets in the Gulf of Mexico and, to a lesser extent, southern Louisiana were temporarily shut-in. The interruption in gas and oil production resulted in a $272 million after-tax loss related to the discontinuance of hedge accounting for certain gas and oil hedges. Results were also impacted by delays in production caused by damage to third-party downstream infrastructure.

Net income decreased 36% to $553 million as compared to 2004. The combined net income contribution of our primaryoperating segments decreased $12 million. See Note 24 to our Consolidated Financial Statements for more information about our operating segments. This decrease is primarily due to:

| · | | A lower contribution from our delivery operations reflecting higher bad debt, salary and interest expenses for the regulated operations; partially offset by |

| · | | A higher contribution from energy operations primarily reflecting higher gas prices at producer services and increased revenue from our LNG facility resulting from additional storage and increased pipeline capacity; and |

| · | | A higher contribution from exploration and production operations primarily reflecting higher realized prices for gas and oil and the recognition of business interruption insurance revenue associated with Hurricane Ivan partially offset by losses related to the discontinuance of hedge accounting, hedge ineffectiveness expense and higher interest expense. |

We incurred a $357 million after-tax loss in 2005 and a $61 million after-tax loss in 2004 in the Corporate segment related to our exploration and production operations’ discontinuance of hedge accounting for certain gas and oil hedges caused by hurricanes.

Analysis of Consolidated Operations

Presented below are selected amounts related to our results of operations:

| | | | | | | |

| Year Ended December 31, | | 2005 | | | 2004 |

| (millions) | | | | | |

Operating Revenue (1) | | $ | 8,072 | | | $ | 6,581 |

Operating Expenses | | | | | | | |

Electric fuel and energy purchases (1) | | | 341 | | | | 349 |

Purchased gas (1) | | | 3,782 | | | | 2,810 |

Other energy-related commodity purchases | | | 363 | | | | 274 |

Other operations and maintenance (1) | | | 1,547 | | | | 785 |

Depreciation, depletion and amortization | | | 670 | | | | 627 |

Other taxes | | | 302 | | | | 270 |

Other income | | | 30 | | | | 55 |

Interest and related charges (1) | | | 225 | | | | 172 |

Income tax expense | | | 317 | | | | 482 |

Cumulative effect of change in accounting principle, net of tax | | | (2 | ) | | | — |

| (1) | | Includes transactions with other Dominion subsidiaries related to Dominion’s enterprise-wide price risk management and other activities. See Note 22 to our Consolidated Financial Statements for a description of transactions with affiliates. |

An analysis of our results of operations for 2005 compared to 2004 follows:

Operating Revenueincreased 23% to $8.1 billion, primarily reflecting:

| · | | A $666 million increase in nonregulated gas sales largely reflecting a $588 million increase from gas aggregation activities and nonregulated retail energy marketing operations primarily due to higher prices and a $110 million increase from sales of gas purchased by exploration and production operations to facilitate gas transportation and satisfy other agreements. These increases in revenue were largely offset by corresponding increases inPurchased gas expense; |

| · | | A $341 million increase in regulated gas sales primarily related to the recovery of higher gas prices. The effect of this increase was offset by a comparable increase inPurchased gas expense; |

| · | | A $171 million increase in gas and oil production sales reflecting a $140 million increase from oil production sales primarily due to higher volumes and a $31 million increase |

13

| | from gas production sales. The increase in gas production sales was due to higher average realized prices, partially offset by lower volumes, largely resulting from interruptions in Gulf of Mexico production caused by Hurricanes Katrina and Rita; |

| · | | A $141 million increase in other energy-related commodity sales reflecting an $87 million increase in sales of purchased oil by exploration and production operations and a $54 million increase in sales of extracted products principally due to increased prices and volumes. This increase in purchased oil was largely offset by a corresponding increase inOther energy-related commodity purchases expense; |

| · | | A $103 million increase in gas transportation and storage revenue primarily due to additions of pipeline and storage capacity, additional gas transportation contracts, increased gathering and extraction revenue due to higher volumes and higher rates, partially offset by the effects of a rate settlement; and |

| · | | An $85 million increase in other revenue primarily reflecting the recognition of business interruption insurance revenue associated with Hurricane Ivan. |

Operating Expenses

Purchased gas expenseincreased 35% to $3.8 billion, principally resulting from a $522 million increase associated with gas aggregation activities and nonregulated retail energy marketing operations, a $305 million increase associated with regulated gas distribution operations and a $124 million increase related to exploration and production operations, all of which are discussed inOperating Revenue.