Exhibit 99.4

Consolidated Tomoka

Consolidated-Tomoka Land Co.

1530 Cornerstone Blvd.,Ste. 100 (32117)

P.O. Box 10809

Daytona Beach, Florida 32120-0809

(386) 274-2202

(386) 274-1223 Facsimile

E-mail:CTLC@consolidatedtomoka.com

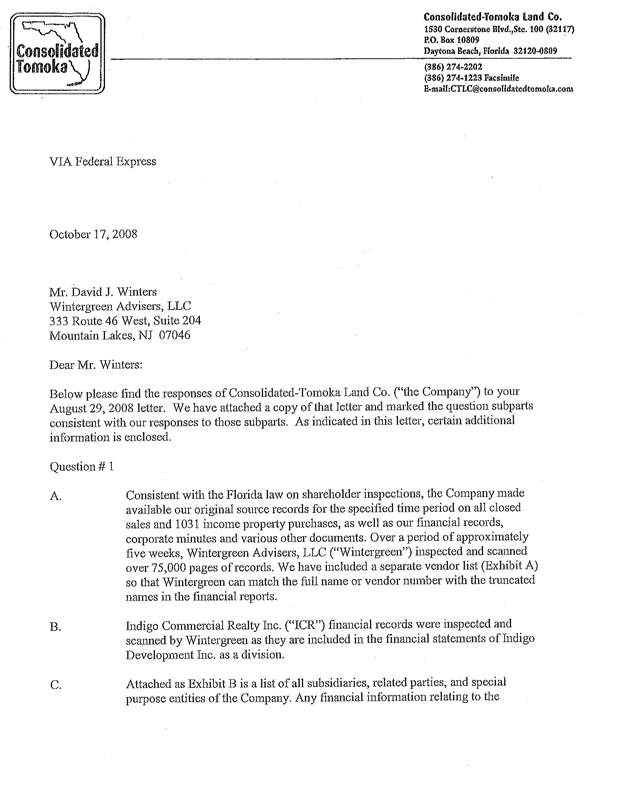

VIA Federal Express

October 17, 2008

Mr. David J. Winters

Wintergreen Advisers, LLC

333 Route 46 West, Suite 204

Mountain Lakes, NJ 07046

Dear Mr. Winters:

Below please find the responses of Consolidated-Tomoka Land Co. (“the Company”) to your August 29, 2008 letter. We have attached a copy of that letter and marked the question subparts consistent with our responses to those subparts. As indicated in this letter, certain additional information is enclosed.

Question # 1

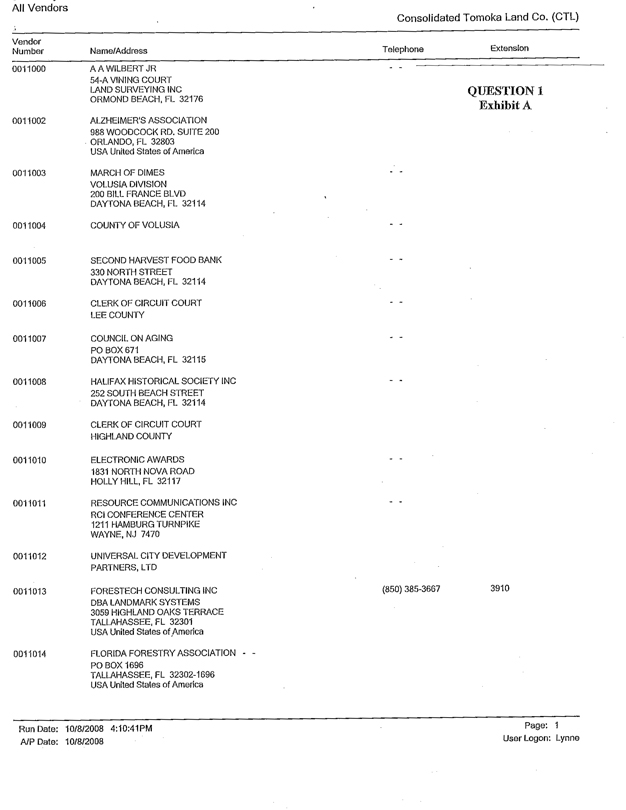

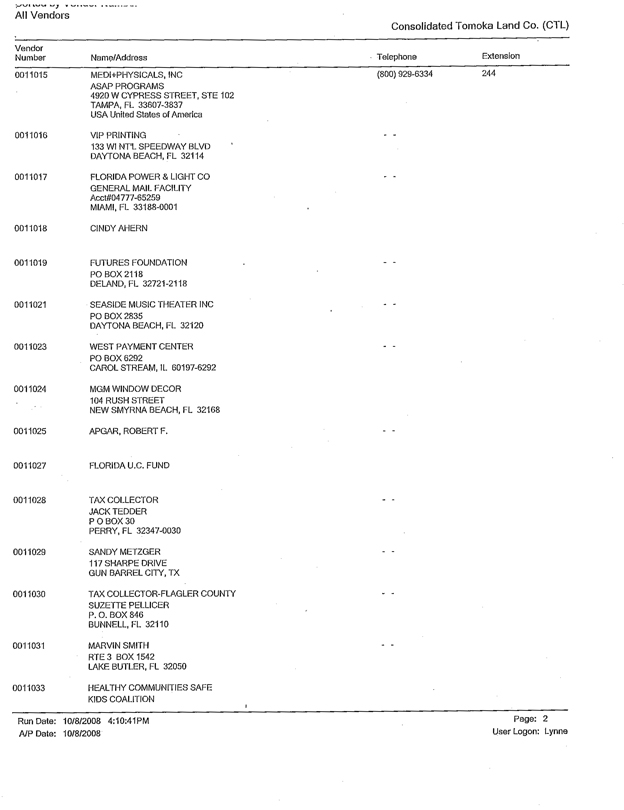

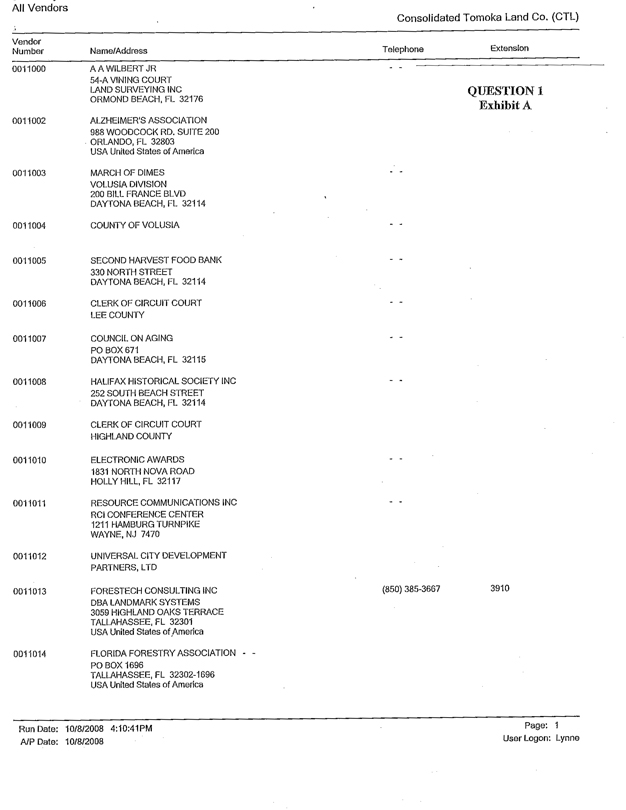

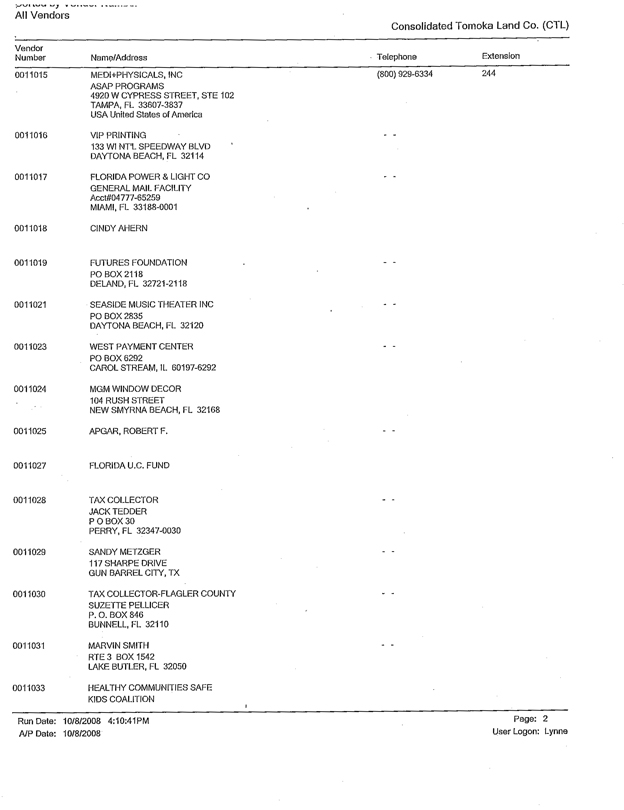

A. Consistent with the Florida law on shareholder inspections, the Company made available our original source records for the specified time period on all closed sales and 1031 income property purchases, as well as our financial records, corporate minutes and various other documents. Over a period of approximately five weeks, Wintergreen Advisers, LLC (“Wintergreen”) inspected and scanned over 75,000 pages of records. We have included a separate vendor list (Exhibit A) so that Wintergreen can match the full name or vendor number with the truncated names in the financial reports.

B. Indigo Commercial Realty Inc. (“ICR”) financial records were inspected and scanned by Wintergreen as they are included in the financial statements of Indigo Development Inc. as a division.

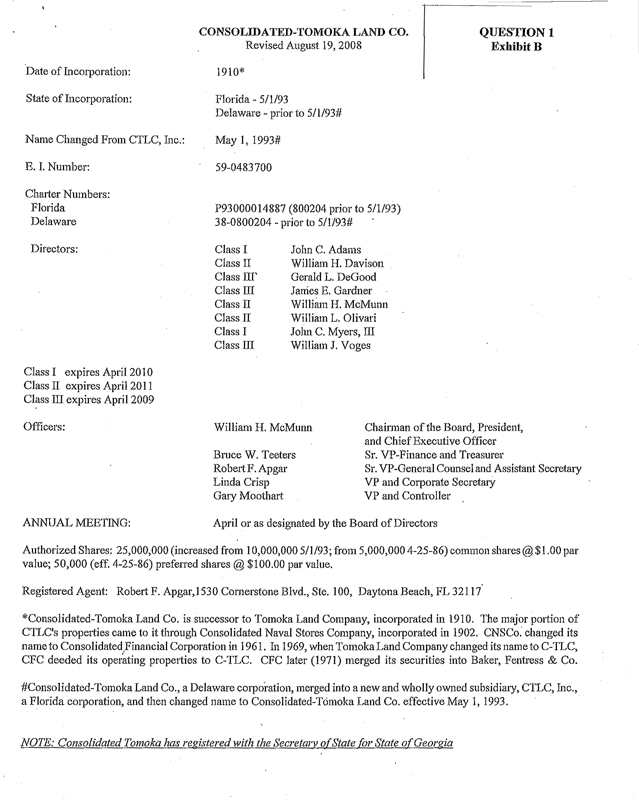

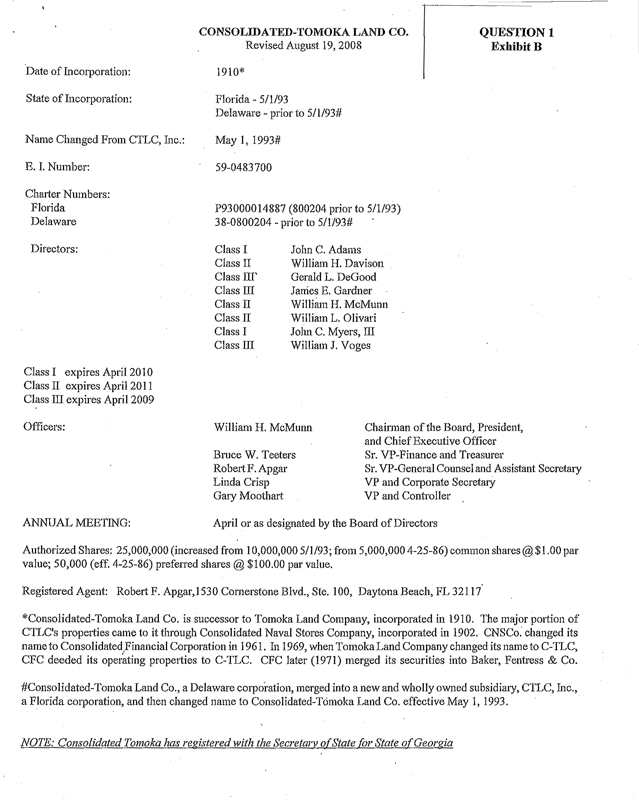

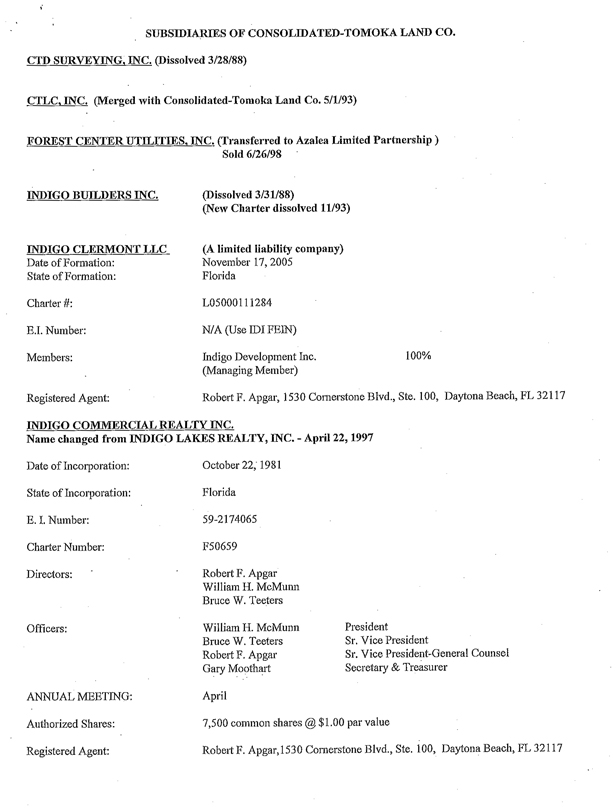

C. Attached as Exhibit B is a list of all subsidiaries, related parties, and special purpose entities of the Company. Any financial information relating to the

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

Company’s subsidiaries or special purpose entities has been provided in the financial information previously inspected and scanned by Wintergreen.

D. To the best of our knowledge, all management presentations that were responsive to your prior requests have been provided.

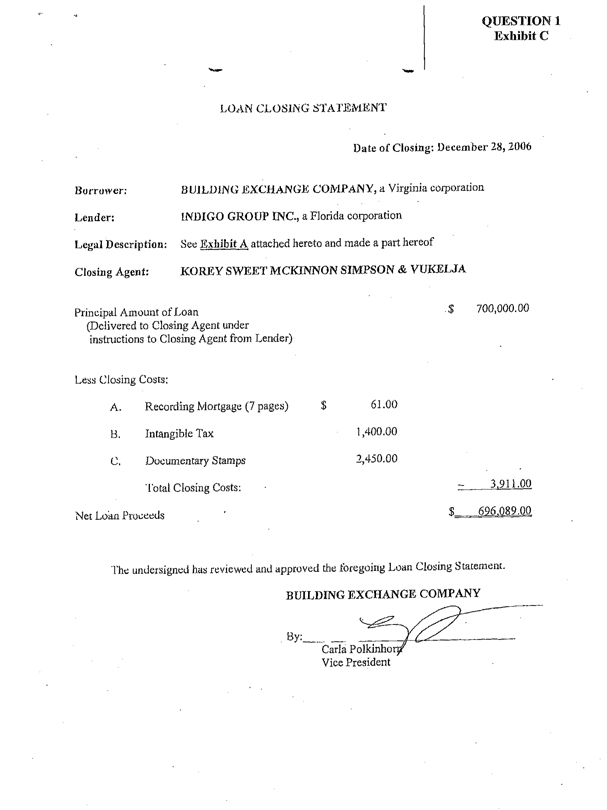

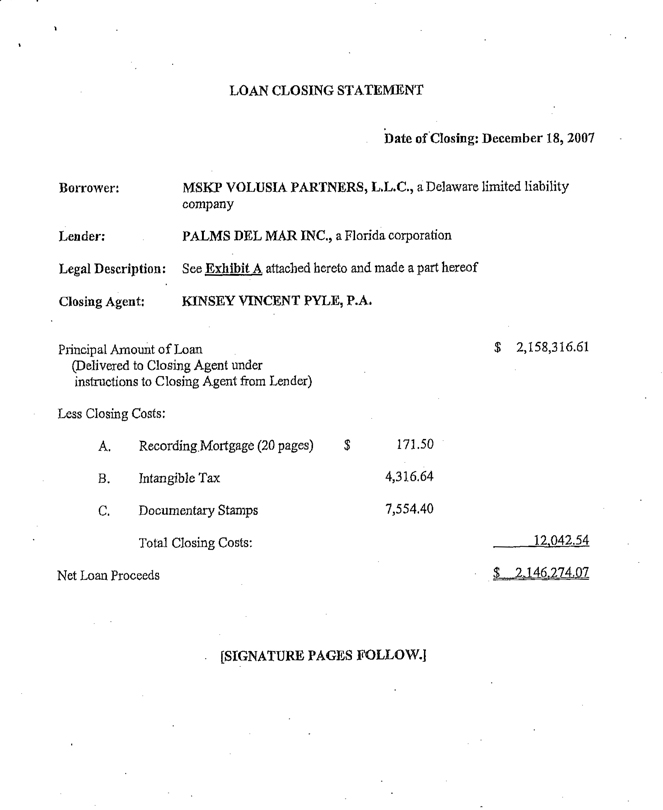

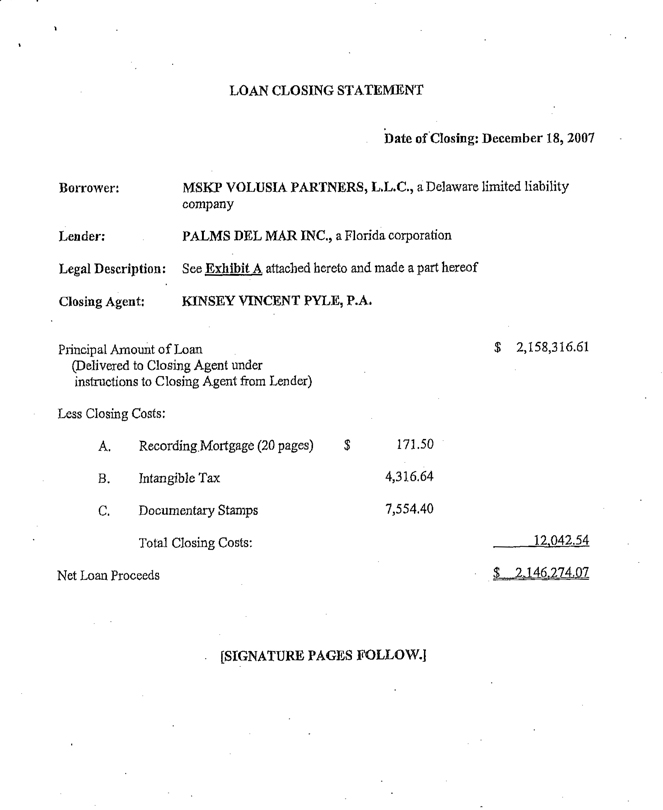

E. To the best of our knowledge, all seller or subsidiary financing documents, if applicable to any such sale, were included in the contract files Wintergreen inspected and scanned, with the exception of two loan closing statements related to a MSKP Volusia Partners’ transaction and to the Building Exchange Company transaction, copies of which are attached as Exhibit C.

F. All political contributions were made by checks drawn on the donor company’s account and are shown in the financial records provided to Wintergreen. No inkind contributions were made. Charitable contributions are also shown on the financial records previously provided. The Company also transferred road impact fee credits to Halifax Habitat for Humanity as a donation toward the construction of two homes in 2008 at the rate of approximately $2,174 per home. We have agreed to donate credits for a total of twelve Habitat homes.

Wintergreen inspected and scanned all sales transactions for the last 5 years. Two sales in 2006 (the sale of a surplus building in downtown Daytona Beach to Bethune-Cookman University for a new nursing school and the sale of a 28-acre site to the City of Daytona Beach for a new police headquarters facility near an area of current development on Company property) included the Company taking a charitable deduction on the difference between the appraised value and the contract price. The Company also donated 25.5 acres to the Volusia County School Board in 2007 for the immediate construction of a new elementary school, and also donated 11.4 acres to Volusia County in 2006 for a new gun range to move the existing range away from residential development. Charitable transactions were generally disclosed in our Annual Reports on Form 10-K for the fiscal years ended December 31, 2006 and December 31, 2007.

G. There are no employment contracts.

H. See responses above.

2

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

Question # 2

A. A “Read Around” file is one or more file folders continuously routed around the office to all managers and includes, for example, such items as magazines, invitations to seminars, monthly letters from trade groups and charities, newspaper clippings, notices of new regulations, letters and thank you notes received, that may be of interest to one or more of our managers. After a read around file has been circulated, the contents are routinely thrown away. Therefore, there are no saved “read around” files for Wintergreen to inspect or scan. Enclosed is the letter referenced in the cited e-mail (Exhibit D), which relates to Halifax Hospital. This letter is in a current file on Halifax Hospital and was not part of closed sale file that Wintergreen scanned.

B. To the best of our knowledge, all responsive files and e-mails have been provided. Cornerstone Office Park Owners Association Inc. is a commercial property owners’ association that manages and maintains the platted common areas of the office complex where the Company leases its office space.

C. Charles Wayne Group Ltd. (“CWLTD”) was a development venture founded in 1987 between the Company and four local businessmen with development, building, and brokerage expertise. In 1990, the Company acquired all of those businessmen’s interests in CWLTD and later changed the name to Indigo Group Ltd. (“IGL”). IGL is a wholly owned subsidiary of the Company. Its financial records for the requested period were provided to Wintergreen for inspection and scanning. Charles Wayne Properties (“CWP”) is an unrelated company. One of the principals of CWP is one of the four CWLTD businessmen referenced above. CWP acted as the seller’s broker in some of our 1031 purchases and has brought prospective purchasers to the Company for land purchases. To the best of our knowledge, CWP was paid a commission on only one sale of Company land during the requested inspection period.

As an introduction to our responses to questions 2.D, E, and F below, the Board of Directors of the Company (the “Board”) entrusts management with the day-to-day operations of the Company’s business. Our senior management team are talented professionals who know and understand our business, and have many years of experience. They are charged with the responsibility to use their best business judgment in discharging their responsibilities including the selection of title agents, environmental consultants, engineers, surveyors, appraisers, contractors, and other consultants to assist the Company in the sale, purchase, and development of real estate. In consultant selection, management uses good

3

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

common sense and exercises sound business judgment and practices in selecting such service providers. Factors considered include, but are not limited to, price, quality of service, timeliness of service, knowledge, and expertise. Often multiple quotes are obtained for certain services or for acquisitions in other locales.

D. In Florida, the rates charged for title insurance are established by the State and are referred to by the title insurance industry as “promulgated” rates. The rates charged are based on the purchase price of the properties to be insured. Additionally, a Florida court decision allows a title agent’s portion of the promulgated rate to be negotiated. As a result, in the sale of Company properties, we have negotiated with the title insurance agents that the premium charged to the Company is typically an amount equal to approximately two-thirds (2/3) of the promulgated rate (we also routinely negotiate other closing costs). We allow the buyer, if the buyer so chooses, to select its own title agent provided that the Company is not required to pay more than approximately two-thirds (2/3) of the promulgated rate. In addition to discounting the fee, title agents must have knowledge of our properties, be professional and responsive and provide accurate and timely services.

E. Please see paragraph immediately before response D above.

F. Please see paragraph immediately before response D above. First American Title Insurance Company is one of the largest national title insurance companies and is part of First American Corporation, a Fortune 500 company. First American Title purchased Volusia Title Services, Inc. in April 2005. After the purchase, we have continued to receive excellent, quality service at competitive prices from Volusia Title. First American Exchange Co., LLC (“First American Exchange”) acts as our intermediary, and we believe that using Volusia Title and First American Exchange helps facilitate our sales that utilize Section 1031 exchanges. Our Company has no other relationship with Volusia Title Services or First American Exchange other than the business relationship disclosed herein.

First American Exchange provides the Company with 1031 intermediary services based on an agreed fee schedule. Our experience with First American Exchange has been excellent in terms of service, responsiveness, and reliability. For transactions outside of Florida, First American Exchange is one of the resources used by the Company in selecting and securing quality professionals to provide due diligence and other services in those 1031 acquisitions.

4

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

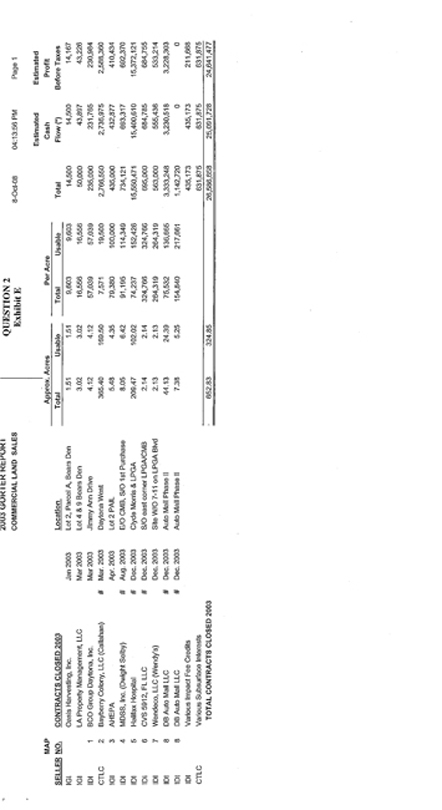

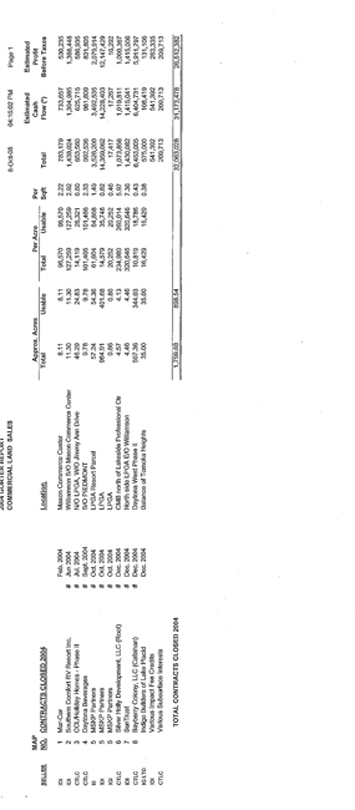

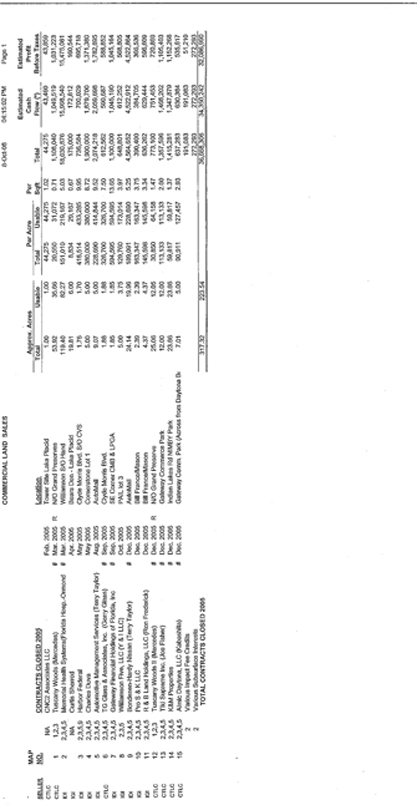

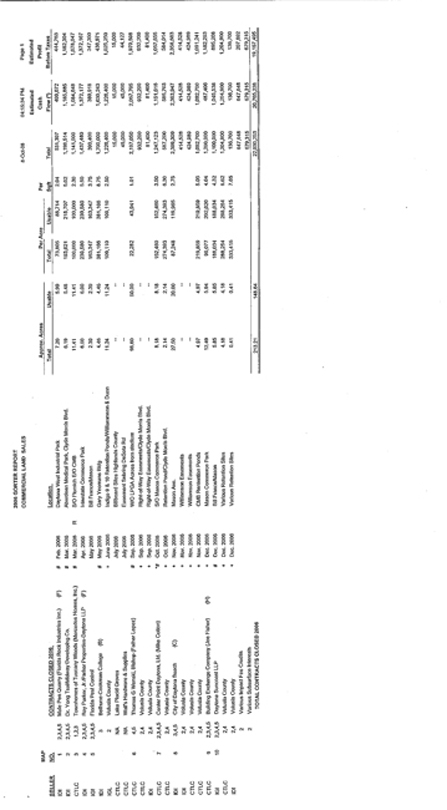

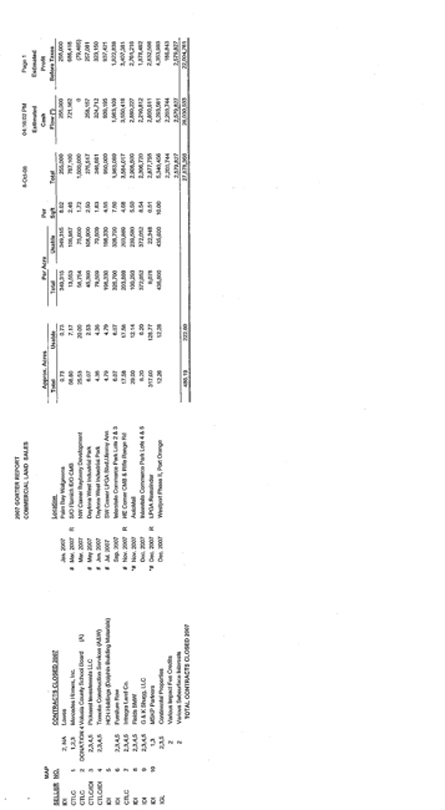

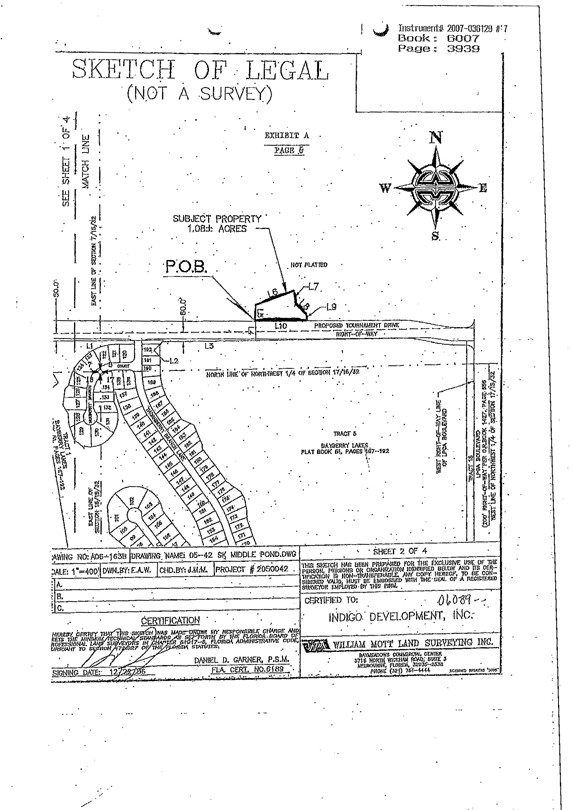

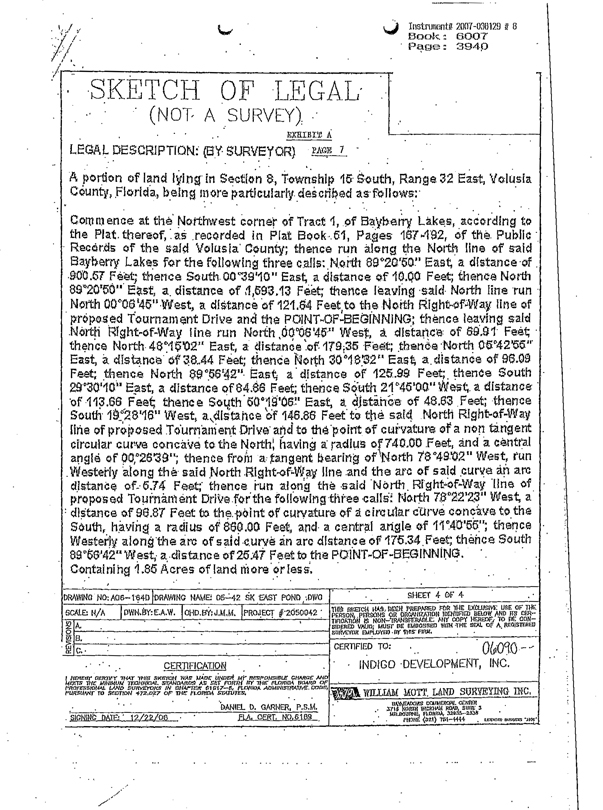

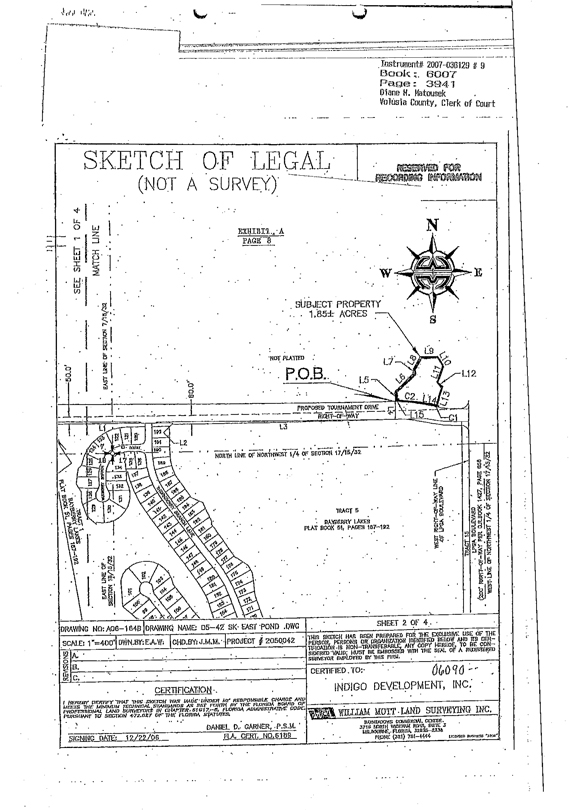

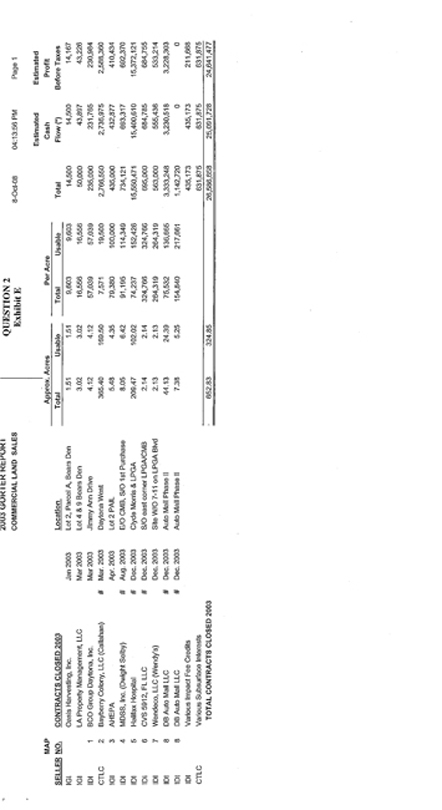

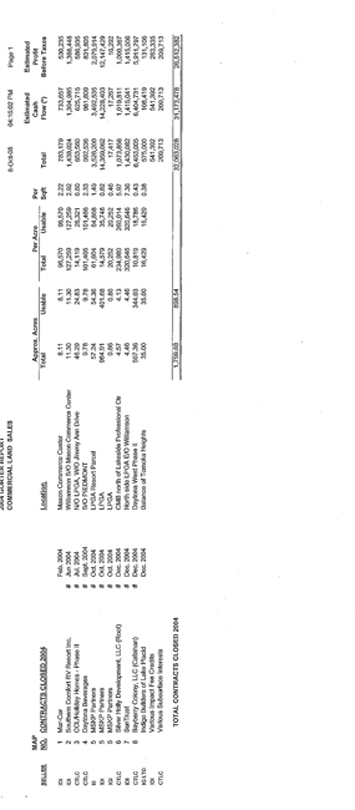

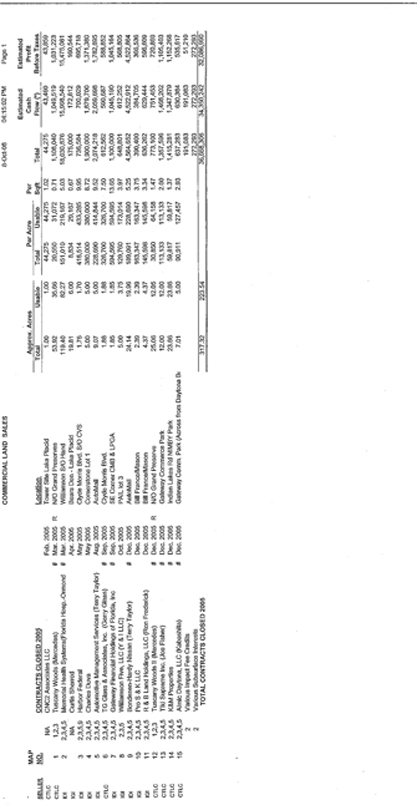

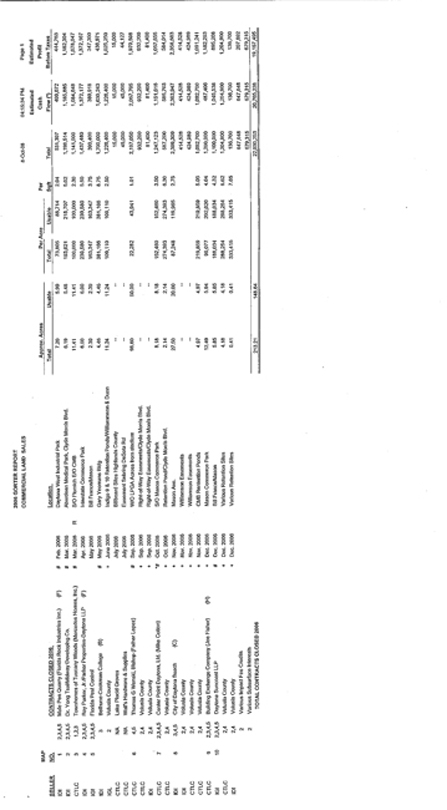

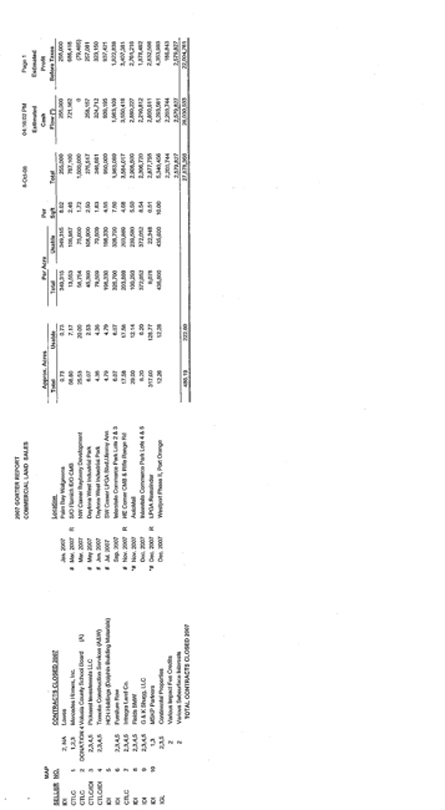

G. We are providing hard copies (Exhibit E) of the portion of the Gorter (activity) report listing all sale closings for the years 2003 to 2007. The portions not provided relate to transactions that did not close, or pending and non-publicly disclosed transactions.

H. Wintergreen has inspected and scanned the Silver Holly closing file. The sales contract provided that Tri-Square Realty, a company related to Silver Holly and the Root Company, was to be paid a “co-brokerage” commission consistent with Indigo Commercial Realty’s published commission schedule. It is very common for real estate companies to have a related or captive brokerage company for co-broking transactions, no different than the Company’s wholly owned subsidiary ICR.

As part of Mr. Voges’ employment with the Root Company, he is the resident agent and a director of Tri-Square Realty, but he is not a licensed real estate broker or salesman. He did not receive any commission or other compensation from the transaction.

Because Silver Holly is a related entity of the Root Company, which is managed by Mr. Voges, who is also a director of the Company, the Company took the necessary steps to address any potential conflict of interest on the part of the Company or Mr. Voges.

Prior to management executing the contract, it met with then Chairman of the Board, Bob D. Allen, to review the contract terms. The contract was also discussed at an Audit Committee meeting with outside auditors in attendance. This contract, which was within management’s approval authority and did not require Board approval, but was nonetheless disclosed and discussed at the next board meeting. It was determined that there was no interest that interfered in any material way with the interests of the Company because Silver Holly paid fair market price for the property and under similar market terms and conditions that would be offered to a third party buyer, including the real estate commission. The sale subsequently closed, and two office buildings were built by Silver Holly. The sale was disclosed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2004 and the Proxy Statement for our 2005 Annual Meeting of Shareholders as a related party transaction.

I. See response H. above.

5

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

J. Under our Code of Business Conduct and Ethics, it is the obligation of our directors, officers, and employees to disclose any conflict of interest. This policy does not prohibit a director, officer, or employee from buying property from the Company or doing business with a company that purchased property from the Company. A conflict of interest occurs when an individual’s private interest interferes in any material way with the interests of the Company as a whole; for example, such a conflict would arise if the transaction was not an arm’s length transaction at market terms and conditions or if special consideration was given that is not available to others and results in personal gain to that director or employee.

It is permissible for officers, directors, and employees to do business with vendors that are doing business with the Company provided that their private interest does not interfere in any material way with the interests of the Company as a whole, such as by receipt of special treatment or discounts not available to others because of their position with the Company. Other than our Code of Business and Ethics (which was adopted on April 28, 2004) and our Code of Ethical Conduct for Senior Financial Officers, we do not have any additional written policies on conflicts of interest.

Question # 3.

The Company has provided the relevant information sufficient for Wintergreen to perform its evaluation, including but not limited to our development manuals, pro forma financial statements, market studies, project budgets, financial documents, and contracts for vertical construction of our Mason Commerce Center.

Question # 4.

The term “paid outside of closing” refers to the fact that no commission was paid at closing to the Company’s wholly owned subsidiary ICR. ICR is usually involved in Company transactions and named in the contract as our broker. This creates a co-broker situation common in the industry such that the buyer’s broker has an expectation to receive only one-half (1/2) of the normal commission. Because ICR is an affiliate of the parent company, a commission check is not issued to ICR. Further, ICR does not pay any commissions to Company employees related to Company transactions. A review of the financial records already provided to Wintergreen will confirm this.

6

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

Question # 5.

The Company believes that it has provided all responsive information. The sections not provided to Wintergreen were either non-responsive or contained forward-looking non-public information.

Question # 6.

A. An income property report is provided to the Board at every Board meeting. In addition, a verbal presentation is presented by management followed by Board discussion. Wintergreen was provided with copies of these Board reports. Annually, at the July Board meeting, the Board reviews the currently approved business strategy and discusses and approves any modifications. Any significant modifications are reported in our Annual Report on Form 10-K.

B. The Company is receiving full rent on 100% of its income property portfolio. One of our tenants, CVS, closed four stores after its acquisition of Eckerd drug stores. Notwithstanding a store closure, the lease remains in full force and effect with all obligations of the lessee being fulfilled. Under the leases, CVS has the sole right to sublease these properties if it chooses to do so. To date CVS has sublet two of these properties, but CVS remains obligated to the landlord under the lease terms.

C. The majority of our portfolio of income properties are triple-net leases, and as such it is the lessee’s responsibility to maintain the properties and pay all expenses. Two properties, a Best Buy and a Dick’s Sporting Goods located near Atlanta, share certain common area maintenance. The Sembler Company manages the common maintenance, and the expense is billed back to the two lessees. Regarding other Company income properties, our corporate staff, working with our lessee’s real estate/facilities managers and store managers, monitor each property including periodic site inspections by our staff.

Question # 7.

A. Wintergreen was provided with our three internal Development and Income Properties Operations Manuals, which contain the Company’s strategies, plans, and operations. In addition the Company has consistently communicated its operating plan and any changes thereto through its Annual Reports on Form 10-K and other periodic reports and press releases.

7

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

B. Most of the Company’s leases include multiple options to extend the term with adjustments in rent. Our first requirement in evaluating a potential 1031 property is the potential long-term value of the real estate. We annually reevaluate each property.

Management and the Board are aware of the various options available to the Company if the lease term expires while the property is owned by the Company. The options available include the sale of the property, the lease of the property to a similar user or the same user, and the renovation of the property for another use, which could include the sale or lease of the renovated property. Part of Management’s selection process is a short and long-term evaluation of each property based on location, strength of the market area, and opinion of potential residual value at the end of the lease term.

Question # 8.

The Company has provided this information to Wintergreen.

Question # 9.

A. The Company has provided Wintergreen with all relevant copies of e-mails sent to and received from the Ladies Professional Golf Association, LPGA International, and Buena Vista Hospitality Group (“BVHG”). The Company believes that your request to also receive copies of all e-mails between BVHG employees that were not sent to the Company is beyond the reasonable scope and stated purpose of Wintergreen’s initial request.

B. Regardless of response A above, BVHG is willing to provide copies of its employees’ e-mails relevant to LPGA International daily operations, provided that a mutually acceptable confidentially agreement is signed and that it is compensated by Wintergreen for the full direct and indirect cost of reviewing and providing such e-mails. These terms were outlined in our counsel’s letter to your counsel dated September 16, 2008.

C. Wintergreen was provided with hard copies of all relevant LPGA International financial information, which was inspected and scanned by Wintergreen. The Company has no additional obligation to provide the same information in an electronic format.

8

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

D. The Company believes that the financial information provided to Wintergreen, which included financial statements and a journal of every check written, is sufficient for Wintergreen’s stated purpose. There is no reasonable business purpose in your request to have the Company provide boxes full of information that would include such-things as weather reports, mechanics’ inspection reports, food order lists, banquet contracts, starters’ check off sheets, advertising copy, menus, and similar such items. The Company does not have the time, manpower, or other resources to allocate to provide Wintergreen with such minute detail.

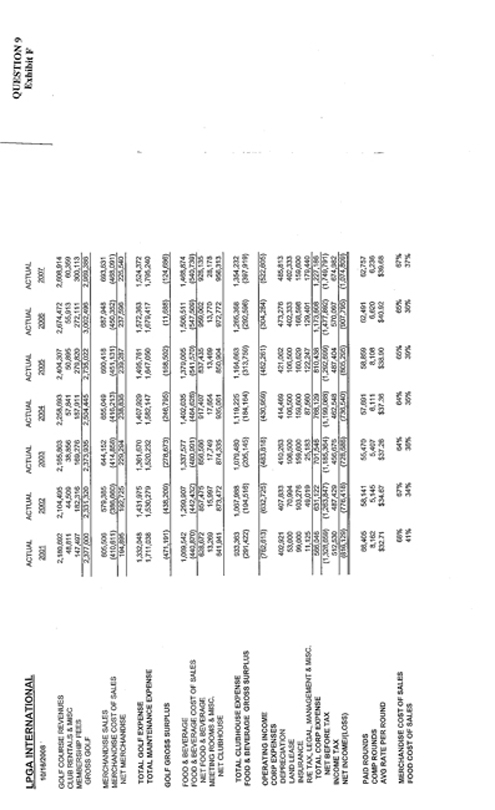

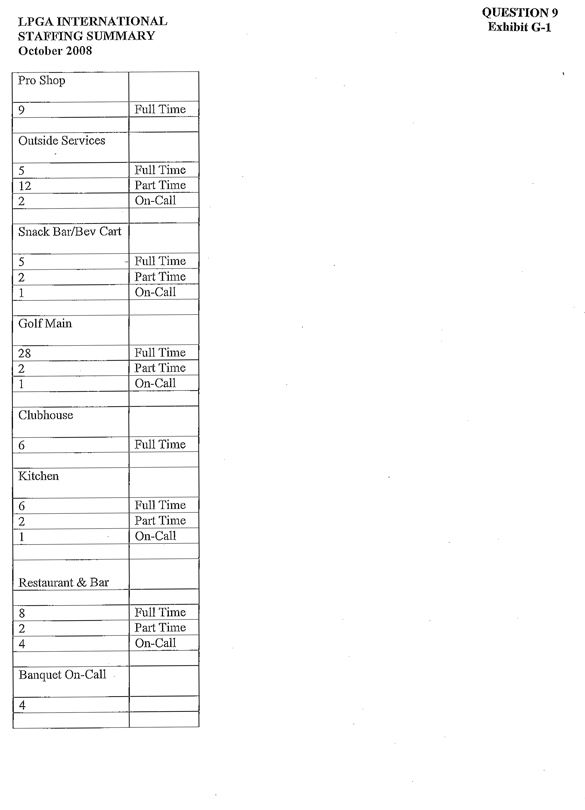

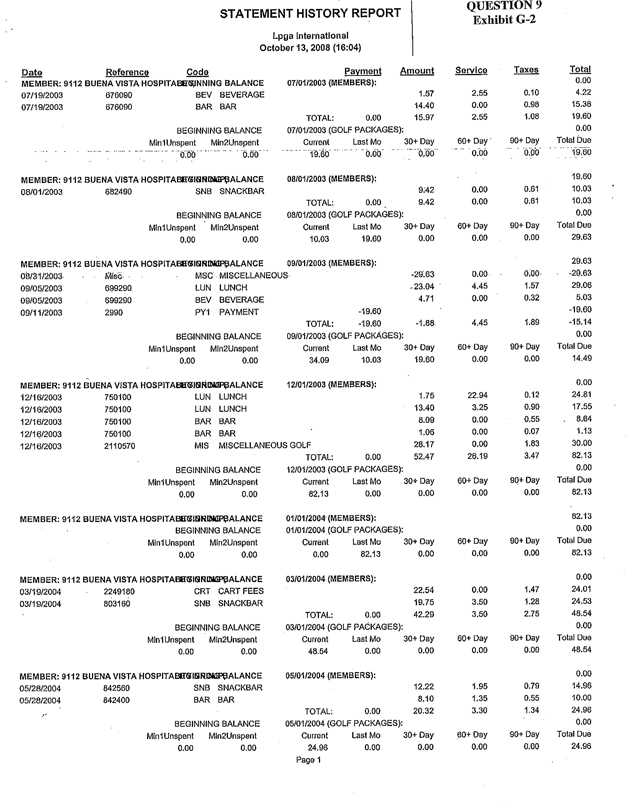

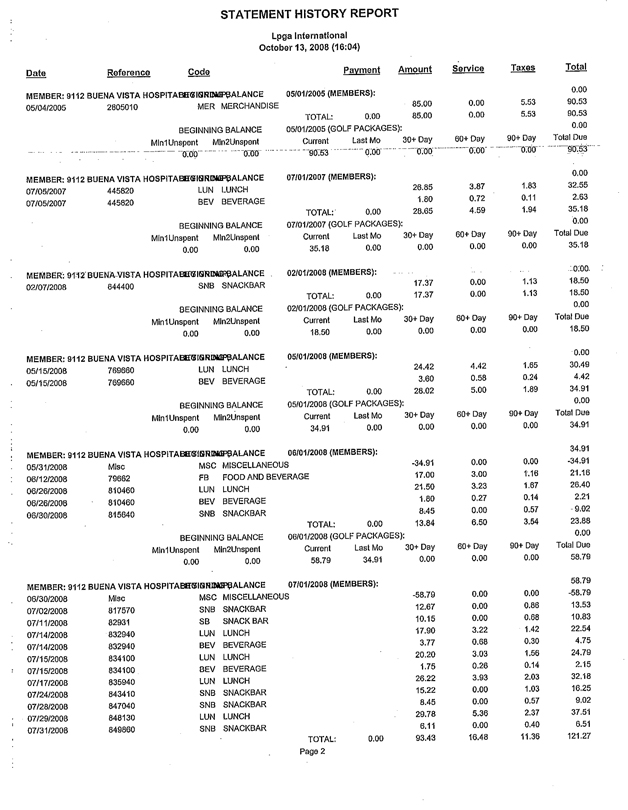

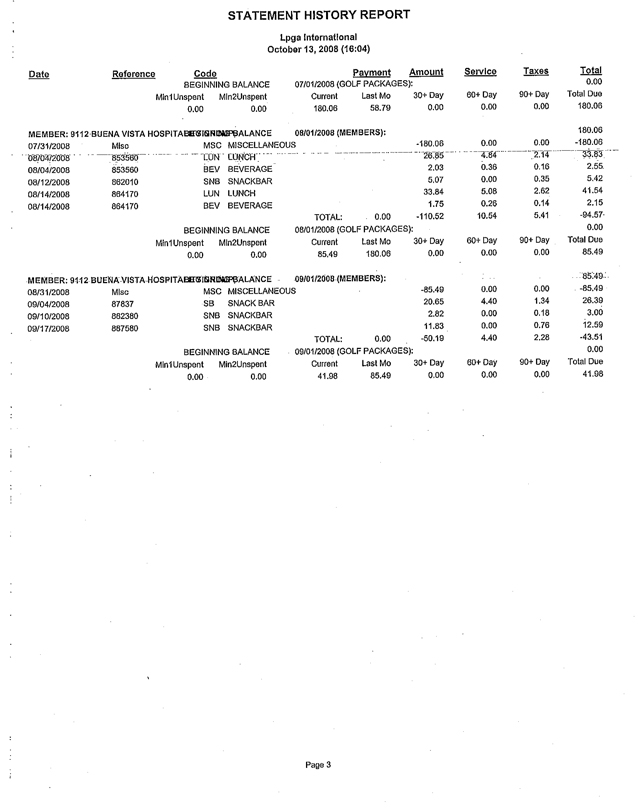

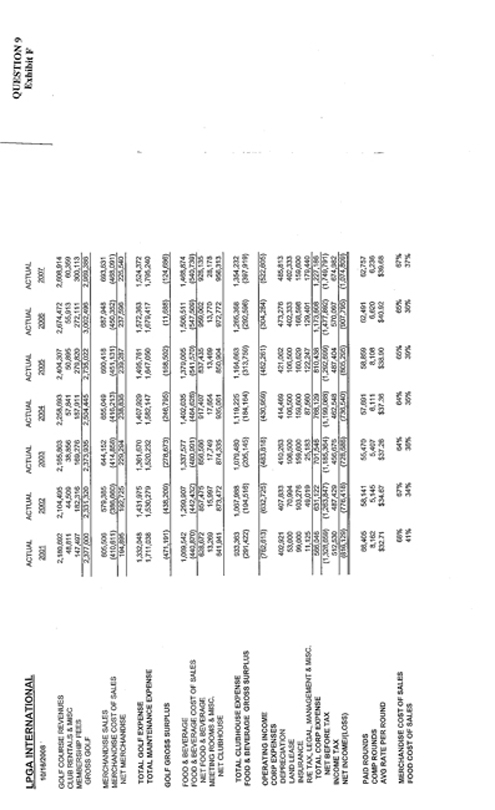

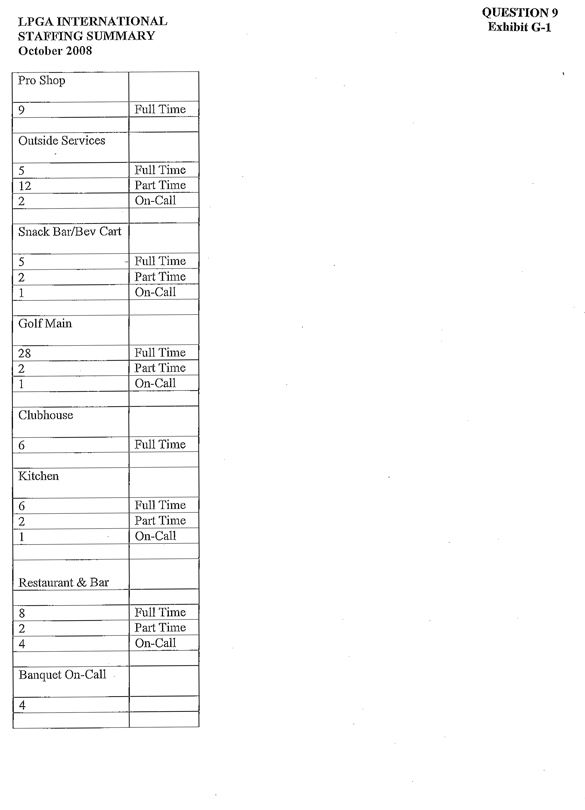

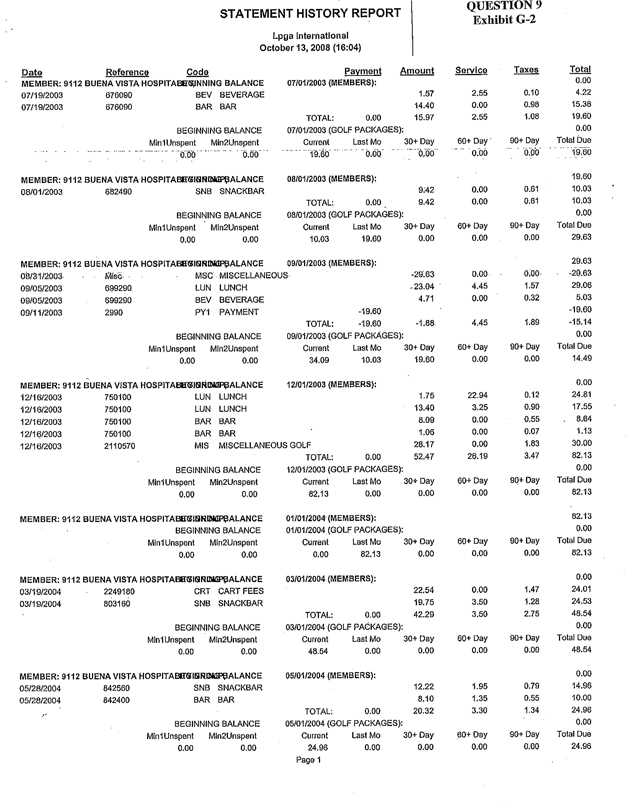

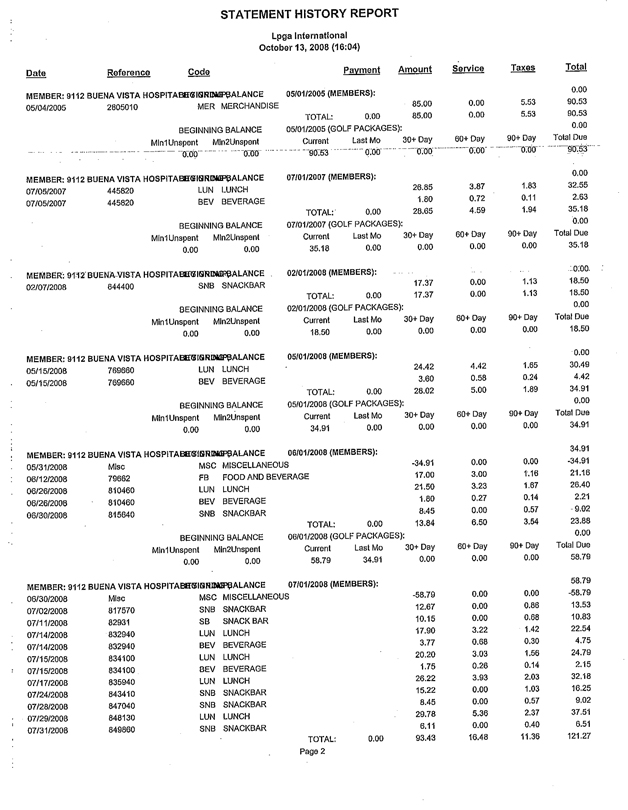

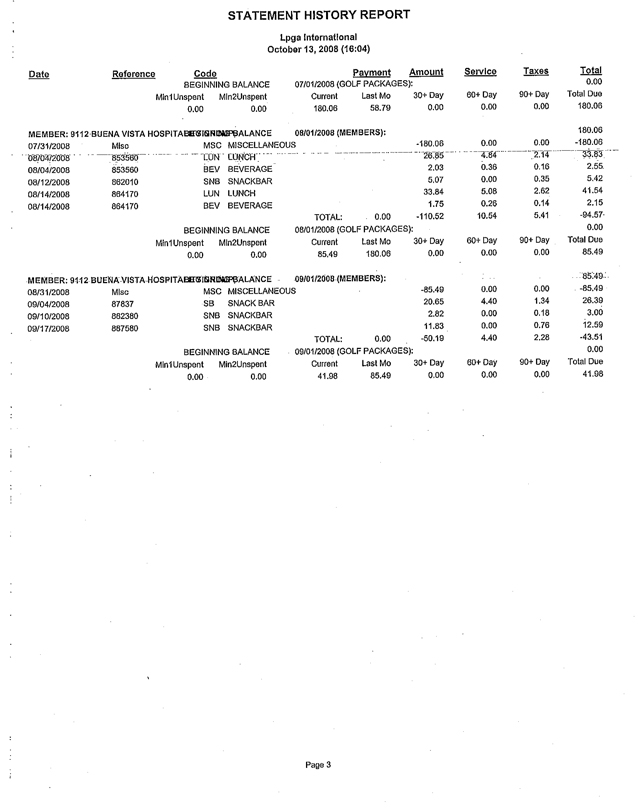

E. To accommodate Wintergreen’s stated purpose, we have provided a year over year (2001-2007) comparative summary (Exhibit F) of annual operations by operating units, which include average rounds, complimentary (“comp”) golf rounds, average rates, and food and beverage ratios. LPGA capital plans were previously provided to you. We are including a current staffing level summary (Exhibit G-l). BVHG does have a charge account established. The charge account records are attached as Exhibit G-2 and show a total of $764.79 charged for meals from January 1, 2003 through September 30, 2008.

F. The former on-site General Manager of LPGA International operations, a BVHG employee, provided written and oral reports at each Board meeting. In February 2007 that employee resigned, and the LPGA International management team was subsequently reorganized. The GM position was not filled. The CEO, as president of Indigo International Inc., has been meeting regularly with the BVHG management team for LPGA International to more closely monitor performance. After the reorganization, the Board reports were changed with the Controller presenting the financial performance, and the CEO updating the Board on all operational issues. Any relevant board presentations have been provided.

G. As part of the relocation of the Ladies Professional Golf Association (“LPGA”) to Daytona Beach, the LPGA was to receive certain comp golf rounds for their players, headquarters staff, and business guests. These rounds are included within the comp golf round totals. The Company also provides 12 complimentary social memberships to key LPGA managers. The LPGA is responsible for all charges made on these membership accounts.

All LPGA International full-time employees can play golf during non-working hours on a “space available” basis. All employee rounds are counted in the comp golf round totals.

9

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

The Company currently has five full golf memberships for its senior managers. Those employees, their family members, and guests receive complimentary golf, but must pay for their personal food and merchandise. Other Company managers may play golf on the same space available basis as LPGA International employees. All Company play is included in the comp golf round totals.

The majority of our golf play is daily fee. The Club currently has 74 full golf memberships and 34 social memberships. Our former Chairman, Bob. D. Allen, currently enjoys an honorary full golf membership (no monthly dues), but pays all personal charges. There are no other honorary, complimentary, or reduced rate memberships. LPGA International or the Company donates a modest number of “complimentary” golf rounds to certain local charities for fundraising purposes. Comp golf rounds donated to charities are generally restricted to off peak play.

The Company limits this practice to local charities that it supports. The Director of Golf Operations is responsible for monitoring all comp golf rounds.

Question # 10.

The Company previously addressed this question in its May 14, 2008 response to Wintergreen. Mr. Olivari is a well-respected, local businessman and principal of a local CPA firm. The Board was interested in recruiting Mr. Olivari, in part, because of the additional expertise he would add to our Audit Committee. During initial discussions with Mr. Olivari, he disclosed that he had recently joined the Halifax Foundation Board, which raises money for special needs of Daytona Beach’s local tax-supported public hospital. This was several years after the Company closed on the sale with Halifax Hospital. He also volunteers his professional services (as do other financial experts) on Halifax Hospital’s Finance and Budget Committee, which provides budget recommendations and financial review. It is purely an advisory committee. After thorough questioning, it was determined that Mr. Olivari’s positions did not cause a conflict of interest based on the following facts:

• Mr. Olivari is not an employee or board member of Halifax Hospital.

• The sale to Halifax Hospital was consummated several years before Mr. Olivari was considered for a Company Board seat and before he volunteered his services on the Foundation Board and Finance and Budget Committee.

10

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

• The Foundation and Finance and Budget Committee have no involvement in or decision making over the Halifax land purchase or its development.

Additionally, Mr. Olivari has stated that should any Halifax Hospital issues come before the Board he would recuse himself. He likewise would recuse himself if any Company issues come before either of his voluntary positions with Halifax.

The Halifax Hospital sale did not require Halifax Hospital to build a hospital on the purchased property as approval of new hospitals is regulated by the State of Florida. It simply restricted the land to medical uses including a hospital and required Halifax to construct a hospital office building and a medical services building within two certain time periods. Halifax’s failure to meet either of these obligations would terminate the one mile non-competitive hospital restriction placed on other Company property at closing. Further, the covenants provided the Company with the option to repurchase each of the two prime corners at the original purchase price if the required buildings were not constructed by the dates specified in the covenants. Wintergreen’s assumption that Halifax’s actions to date have hurt the values of the Company’s adjacent property is incorrect.

Question # 11

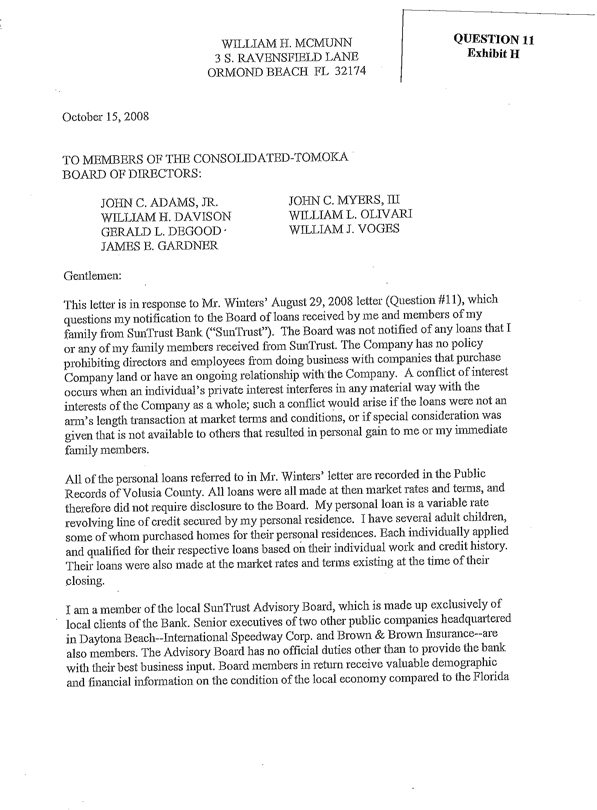

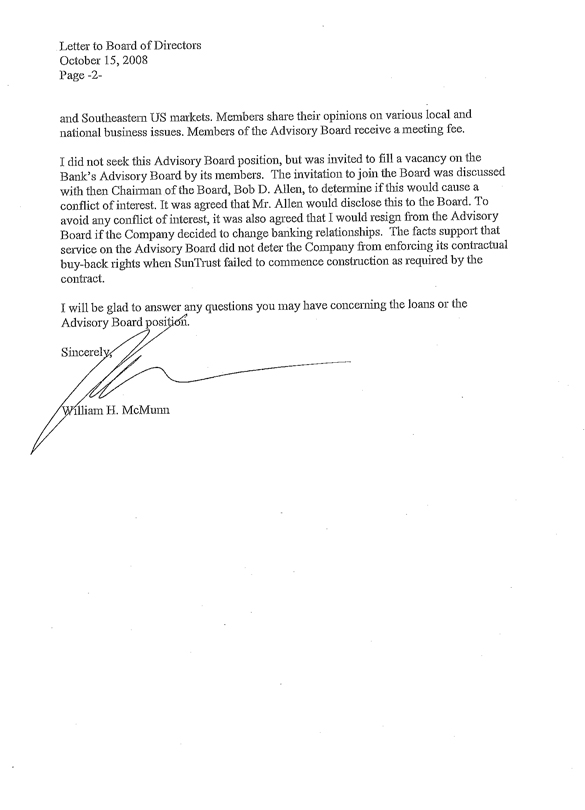

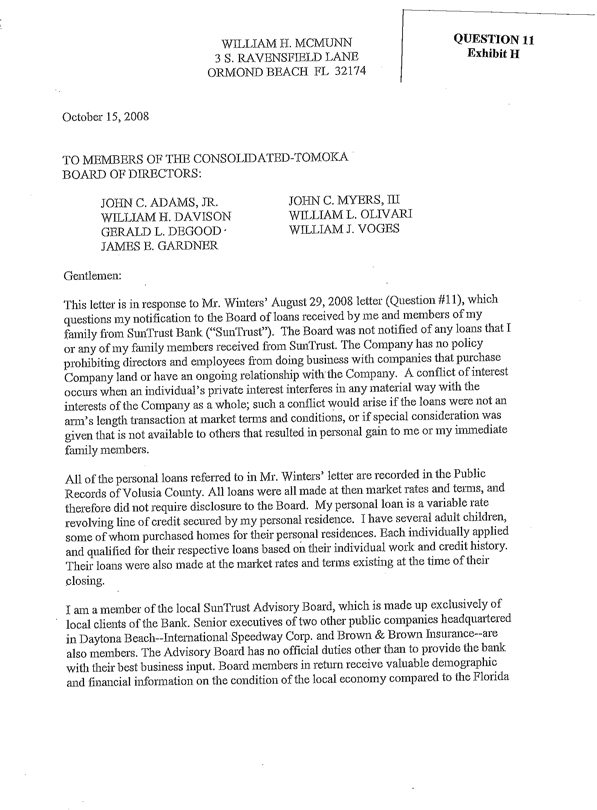

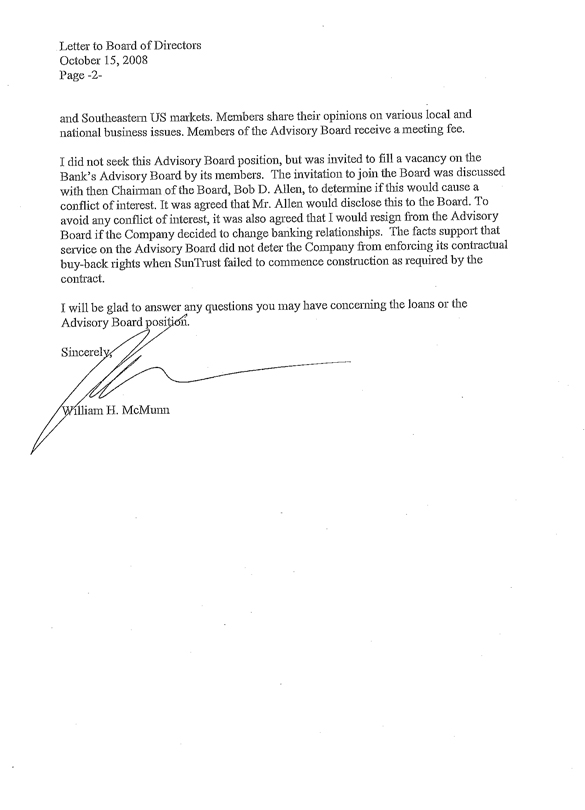

The Board was not notified of any loans Mr. McMunn or his family members received from SunTrust. The Company has no policy prohibiting employees from doing business with companies that purchase Company land or have an ongoing business relationship with the Company so long as the individual’s private interest does not interfere in any material way with the interests of the Company as a whole. (See response to question #2.J)

Mr. McMunn has provided the Board with a written explanation of the personal and family SunTrust loans and his SunTrust Advisory Board position. That letter is attached as Exhibit H.

Question # 12

A. As to Wintergreen’s question #12(b), please see response to question #11 above and Exhibit H. Mr. Davison’s abilities and qualifications were well known to the

11

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

Company and its directors. When Mr. Davison announced his decision to retire from SunTrust, the Board recruited him as a Board candidate. As stated in other correspondence to you, the Company notified SunTrust of its election to repurchase the property before Mr. Davison became a member of the Board. Only the actual closing took place after his election to the Board. There are no relevant documents related to Wintergreen’s question #12(c) as the Board considered the qualifications of Mr. Davison as a director nominee not those of his then employer.

B. As the senior Volusia County bank official for SunTrust, Mr. Davison periodically executed documents such as partial releases of mortgages. No releases related to the Company’s SunTrust loan were signed by Mr. Davison after he became a director.

C. Mr. Davison was chosen for his business and banking knowledge and local contacts. SunTrust’s decision not to build a branch bank within the specified time period was the result of a change in SunTrust’s corporate strategy, and was not a consideration in our Company’s decision to vet him as a director. The contract terms provided for a mutually agreeable remedy for non-construction - repurchase at our option at the original sales price. In fact, SunTrust asked the Company to waive the build obligation to allow them to “land bank” the site for future use, which request was not granted by the Company because we did not believe it was in the Company’s best long-term interest. We believe the market value of this property at the date of the repurchase was considerably higher than that paid by SunTrust in 2004.

Question # 13

Indigo Clermont LLC is an entity that was formed for the 1031 purchase of one of our CVS stores in Clermont. Special purpose entities are utilized in reverse 1031 transactions. None of our special purpose entities have separate bank accounts. We believe that all responsive documents were produced.

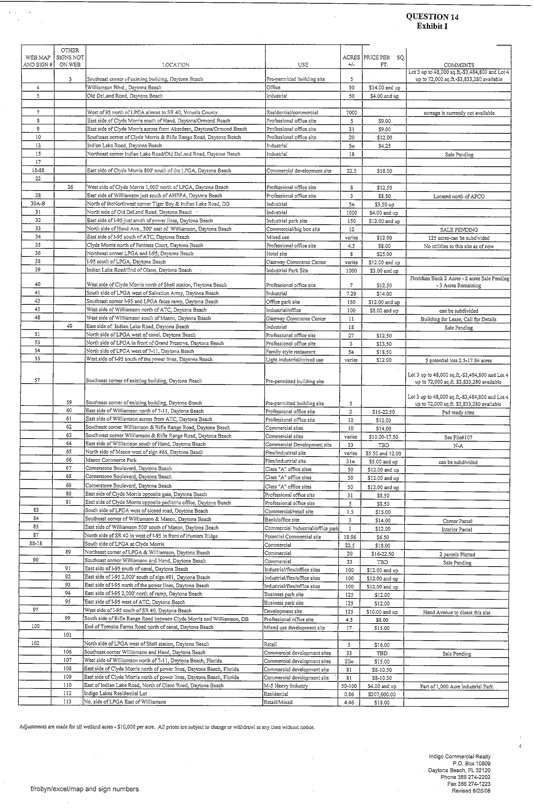

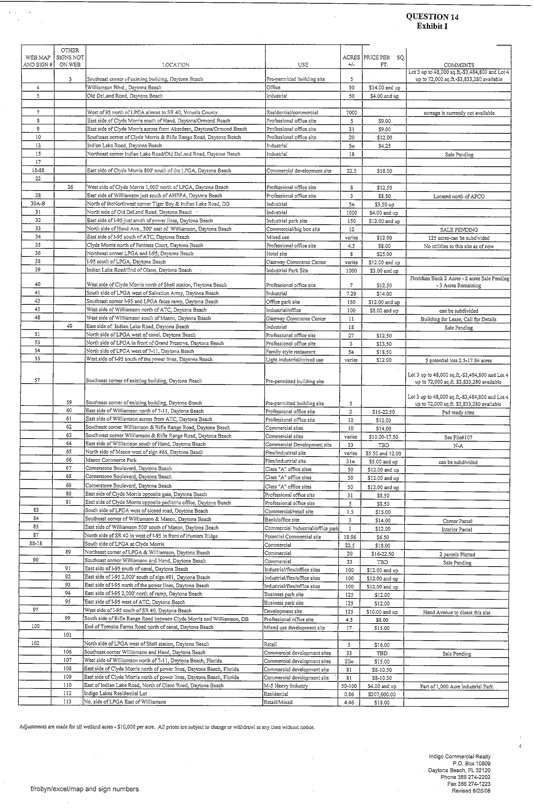

Question # 14

A. We are again providing a copy of our current inventory of land available for sale or lease (Exhibit I). In March 2008, the Company met with Fred Perlstadt of Wintergreen and your independent real estate consultants and provided them with written and oral information.

12

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

B. The Company’s CEO, Chief Financial Officer, and Manager-Land Holdings work together as a committee to set asking prices for property. The Company strives to keep a diversified inventory of properties based on our master “Activity Center” plan. Prices are determined based on the location, proposed use and density. The Manager-Land Holdings monitors various real estate information, tracks current real estate closings, and contacts Realtors and appraisers to keep current on land prices and sales. This information is used to periodically modify our current price list as needed.

The Company receives feedback from our potential customers, Realtors, and appraisers that our prices are consistently at the top of the market. As Daytona Beach’s largest owner of vacant land, the Company’s pricing largely sets the market.

Because the Company prices our land at the top of the local market and generally does not discount to make a sale, the absorption of our land is naturally controlled by market conditions.

The Company’s self-development is limited to certain types of uses. For example, the Company would not attempt to self-develop such uses as schools, hospitals, hotels, franchised restaurants, and retail shopping. The self-development of office buildings with some pre-leasing, flex office warehouses, and large warehouse buildings tied to pre-leases are examples of currently approved self-development projects. We have our greatest expertise with these uses, our current staffing levels are sufficient to manage them professionally, and these projects would qualify for future 1031 tax treatment.

Question # 15

A. We believe that all relevant and responsive information has been provided.

B. The Company looks for possible large land acquisitions with potential similar to our existing land holdings, provided the purchase does not create significant new debt. During the recent real estate boom, prices were driven up to the point where it did not make business sense to acquire and hold large tracts of land for future development. With today’s real estate devaluation, it is possible that certain potential large land acquisitions will arise and make good business sense.

The 3,400-acre property mentioned was not an appropriate investment because it was overpriced, and consequently it was not presented to the Board.

13

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

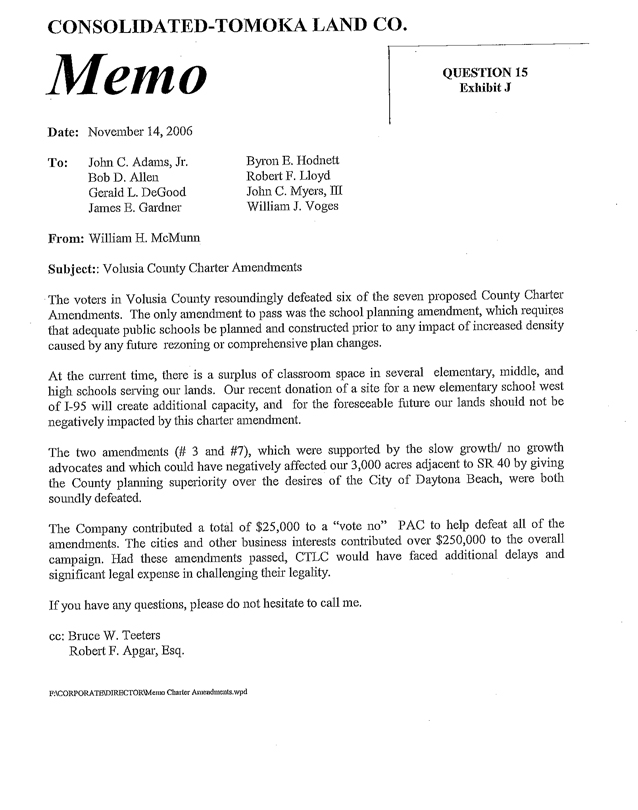

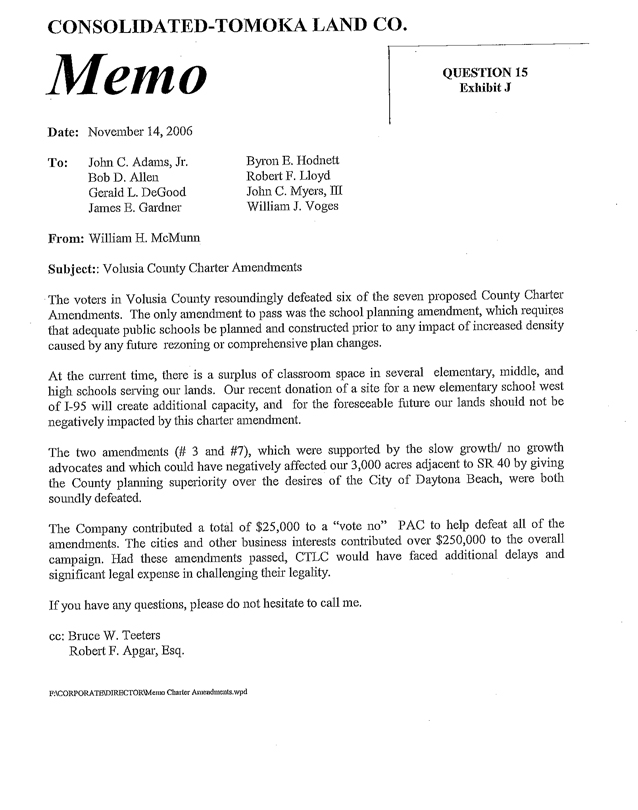

C. This memo was sent to the Board and the issue had been discussed at Board meetings prior to the date of the memo. This memo related to certain ballot initiatives proposed by Volusia County that our Company, the City of Daytona Beach, and many others opposed. All amendments but one, school concurrency, were defeated. A copy of the memo is attached as Exhibit J. All relevant information requested has been provided to the best of our knowledge.

D. Your question was addressed in our response to questions 11 and 12 above. You also have copies of various Company minutes regarding your inquiry.

E. KPMG reviewed the same documents that were provided to Wintergreen. The Company has no access to any KPMG work papers.

F. KPMG, together with other audit functions, reviews Company sales closings and 1031 purchases. The Company has no access to any internal work papers of KPMG done by their employees during the audit.

G. The Audit Committee and the Board were well aware of Mr. Adams’ employment with Brown & Brown, Inc. (“Brown & Brown”), a major national insurance brokerage business headquartered in Daytona Beach. Mr. Adams, prior to his retirement, was principally engaged in Brown & Brown’s acquisitions of new insurance agencies and was not the agent for our business, nor did he receive any compensation from our account. Mr. Adams is the Board’s resident expert on insurance coverage and market rates.

Brown & Brown’s responsibilities as our independent agent are to advise the Company on suitable coverages and to bring multiple quotes for each line of business. Final selection of vendors is a management decision, not a Board decision. Consequently, Mr. Adams never voted on Company insurance coverage or the retention of Brown & Brown as our agent.

In 2006, the Company employed an out of the area independent insurance professional to review our coverages and check quotes and ratings of companies recommended. Aside from a few minor recommendations that were adopted by the Company, the report indicated that the Company was getting quality coverage from strong companies at very competitive prices.

14

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

Question # 16

Sections that are missing were not provided because they were non-responsive to your request.

Question # 17

A. To the best of our knowledge, Wintergreen has been provided with hard copies of all relevant and responsive documentation which Wintergreen scanned.

B. Grant Thornton L.L.P, (“Grant Thornton”) was engaged by the Audit Committee to document and test the Company’s system of internal controls. In that role, Grant Thornton essentially acts as the internal auditor of the Company. Pursuant to the Company’s agreement with Grant Thornton, all work product/or reports are prepared solely for the internal use of the Company’s management, employees, and Board of Directors.

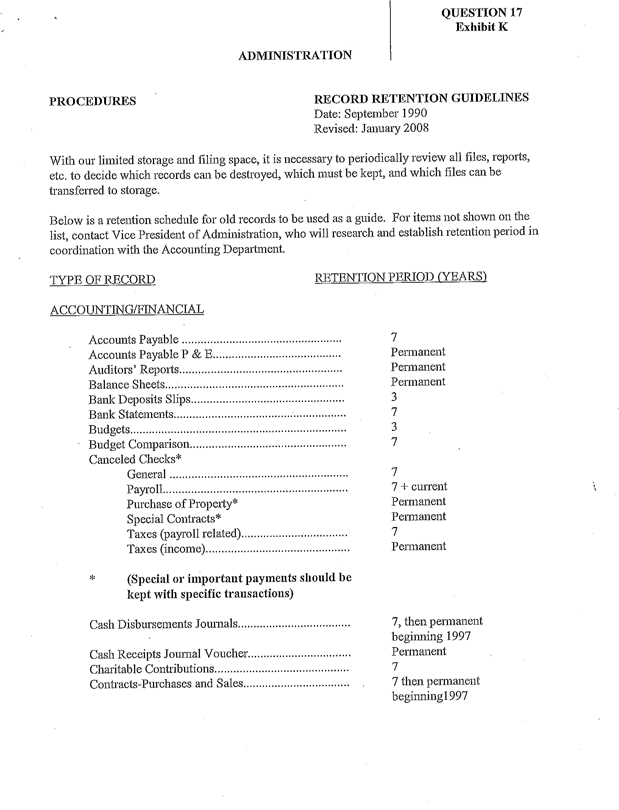

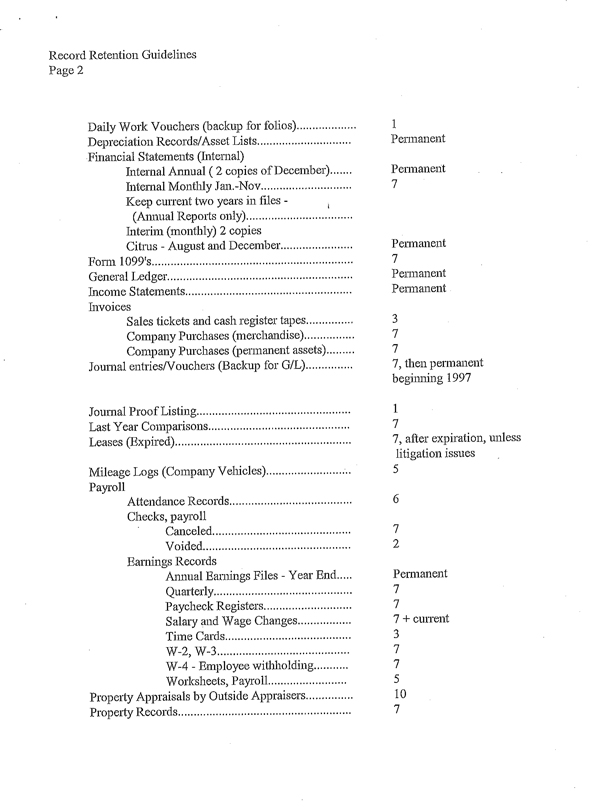

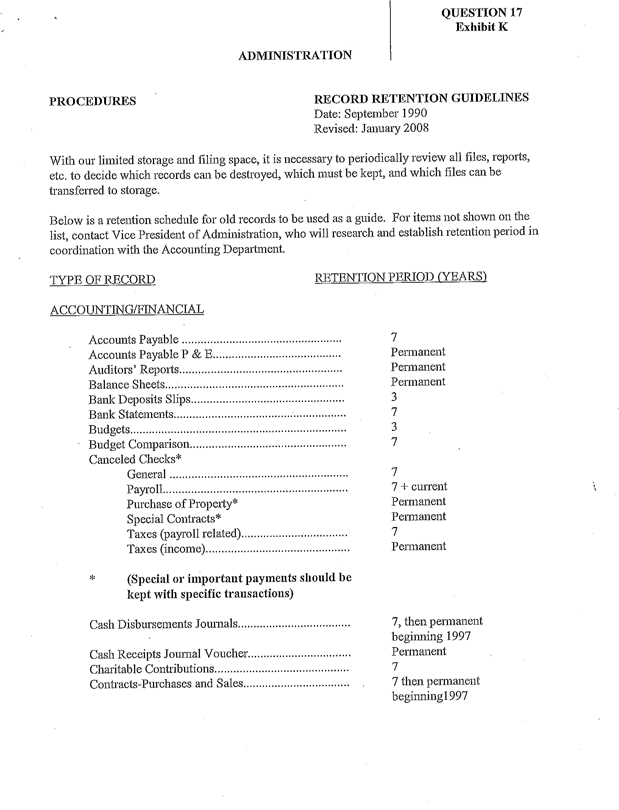

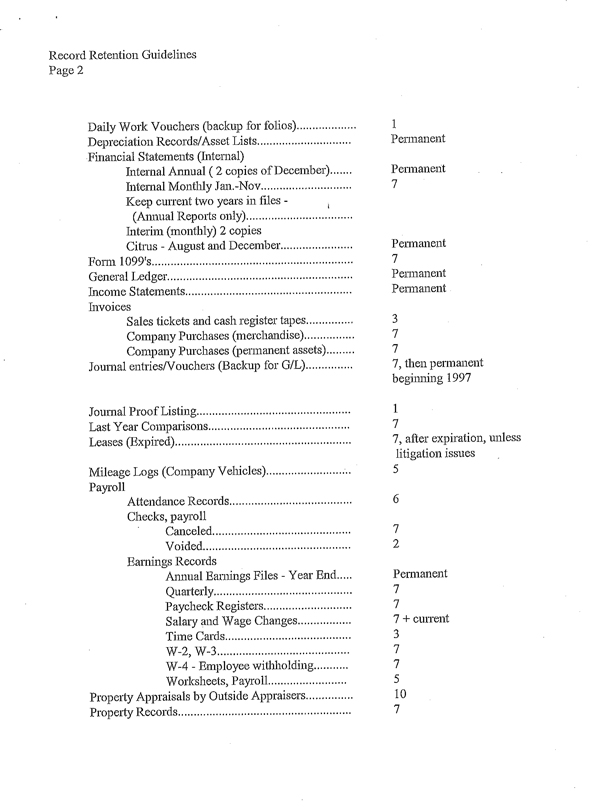

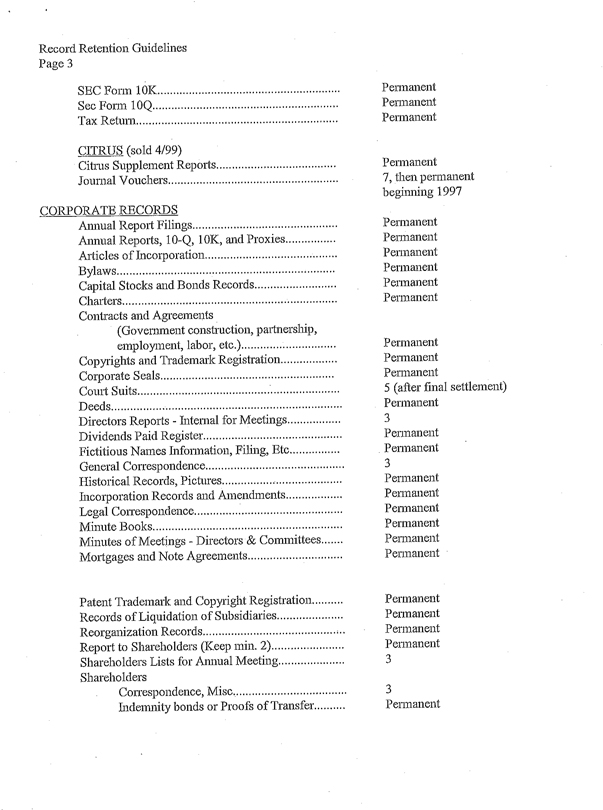

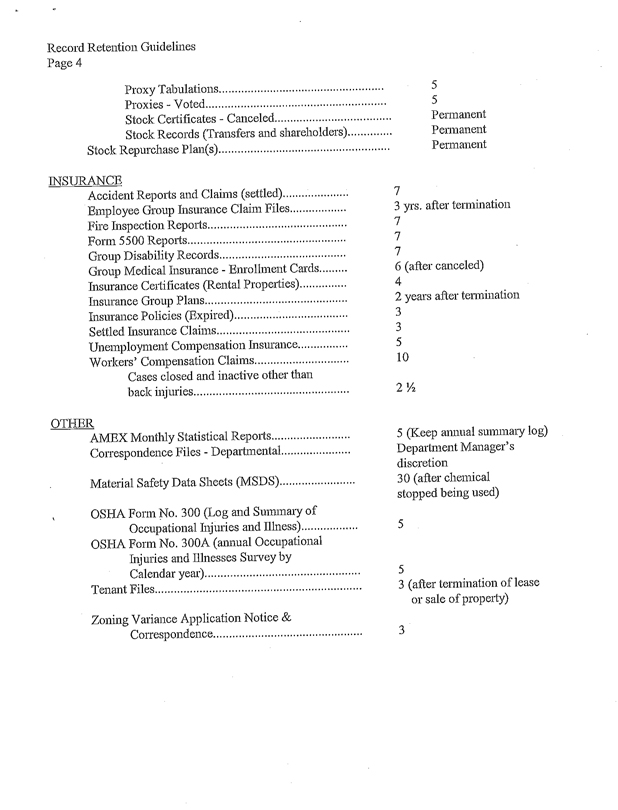

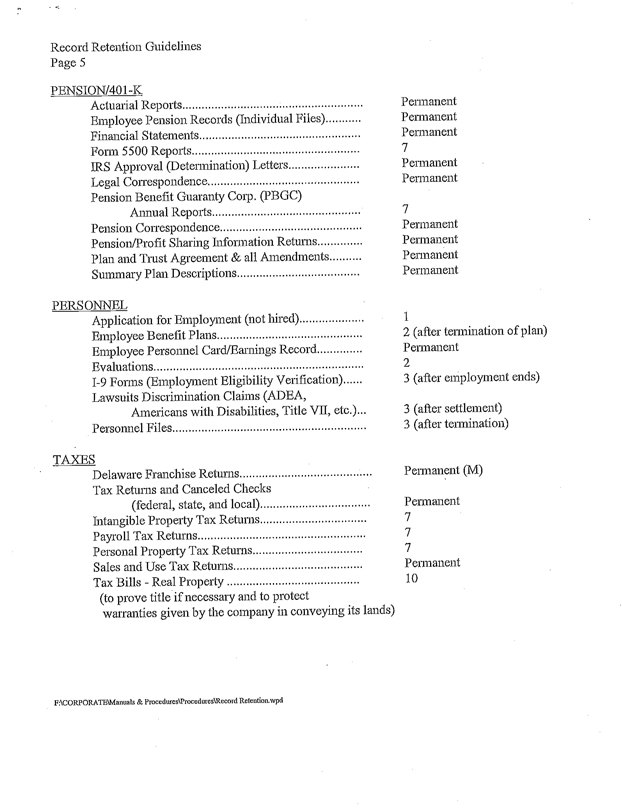

C. We are providing a copy of our records retention policy (Exhibit K). Our Audit Committee has the primary responsibility for oversight of Sarbanes Oxley compliance for the Company.

It is the Company’s view that we have provided more than sufficient information and explanations to fully address all of the concerns raised in the last several Wintergreen letters.

The Company believes that the underlying and unresolved issues that have created the current strained relations involve a philosophical difference, centered around Wintergreen’s desire that the Company: (1) discontinue the outright sale of our lands in favor of self-development or land leases; (2) discontinue our 1031 tax-fee exchange and diversified reinvestment strategy into triple-net lease properties throughout the southeast; (3) discontinue our current quarterly dividend; and (4) establish an aggressive stock repurchase program.

If we have incorrectly stated any of these core differences that separate the parties, which we base on our interpretation of your prior correspondence and conversations with the Board and management, we would respectfully request that you inform us so we may properly address them.

15

Mr. David J. Winters

Wintergreen Advisers, LLC

October 17, 2008

In today’s turbulent economic and real estate markets, the Company, Wintergreen, and all of the other shareholders would best be served if we sit down and attempt to reach a consensus on the major issues of disagreement, rather than continue to exchange letters and fulfill information requests that take up valuable management time and corporate resources or both companies.

We look forward to scheduling a meeting.

Sincerely,

William H. McMunn

President and

Chief Executive Officer

Enclosures

cc: Board of Directors of Consolidated-Tomoka Land Co.

Robert F. Apgar, Esq.

David A. Jones, Esq., Holland & Knight

Tom McAleavey, Esq., Holland & Knight

16

WINTERGRBEN

ADVISERS

August 29, 2008

VIA TELECOPY AND FEDEX

Consolidated-Tomoka Land Co.

c/o Linda Crisp, Corporate Secretary

1530 Cornerstone Blvd., Suite 100

Daytona Beach, FL 32117

Re: Demand for Inspection of Corporate Records by Shareholder

Dear Ms. Crisp:

As we wrote to you on May 30, 2008, Wintergreen Advisers, LLC (the “Adviser”) may be deemed to beneficially own 1,481,474 shares of common stock, par value $1.00 per share, of Consolidated-Tomoka Land Co. (“CTO”). The Adviser desires to inspect and copy certain of CTO’s books and records. In our May 30th letter, the Adviser made a formal demand to inspect and copy such records pursuant to Section 607.1602, Florida Statutes. The inspection is being conducted pursuant to Florida law for the purposes of (a) enabling the Adviser to determine whether the affairs of CTO are being properly administered by CTO’s corporate officers and (b) ascertaining the value of CTO’s stock.

In fulfilling these purposes, the Adviser met with CTO representatives at CTO’s offices in Daytona Beach on various dates this summer to inspect and copy books and records of CTO. To date, the books and records made available to the Adviser have omitted numerous books and records described and sought in the initial demand. Although CTO is legally obligated under Florida law to be fully responsive to our initial requests, to this point CTO has been anything but fully responsive. We reiterate our initial demand and specifically demand full and complete responses. Set forth below are the items we described in our initial demand followed, on an item-by-item basis, by an explanation as to how the books and records produced to date by CTO do not adequately respond to the initial demand.

1. Documents (for purposes of this letter, the word “documents” is defined in the broadest possible terms, and includes electronic records and e-mail) related to CTO’s day-to-day financial operations over the past three years, including, but not limited to, any and all: (a) financial statements; and (b) documents showing CTO’s cash expenses, categorized by type of expense.

A Wintergreen was not provided with any electronic documents relating to CTO’s finances (i.e., files from any accounting software). There are many instances where the paper files Wintergreen scanned are truncated (see, for example, cto-

Wintergreen Advisers, LLC I 333 Route 46 West I Suite 204 I Mountain Lakes, NJ 07046

Page 2

Consolidated-Tomoka Land Co.

August 29, 2008

06-12-08-2005-IndigoDevGrp-fi-000037). Please provide all electronic documents which are responsive to our requests, whether such demands are on-site, archived or otherwise organized or maintained.

B Wintergreen was not provided financial records related to CTO subsidiary Indigo Commercial Realty. Wintergreen demands these records, both paper and electronic documents, along with financial records for any other subsidiaries not previously provided.

C Please provide a complete list of all subsidiaries, related parties, affiliated, companies, special purpose entities, etc., whether active or dormant.

D Please provide all management presentations or executive summaries, both paper and electronic format, that are responsive to all of the items in this letter (not specific to Item. 1).

E Please provide documents related to any loans outstanding on seller-financed transactions.

F Please list all political and charitable contributions made (whether in cash or in kind, such as land or services) during the request period.

G Please provide copies of all employment contracts for executives of CTO and its subsidiary companies.

H Please provide all responsive documents related to these points or confirm that none exist.

2. Documents related to CTO’s real property transactions, including Section 1031 exchanges, over the past five years, including, but not limited to: (i) closing statements; (ii) information regarding the buyers, sellers, lenders, title agents, attorneys, brokers, Section 1031 exchange consultants and any other individuals or institutions involved in such transactions; and (iii) information regarding how funds were transferred pursuant to such transactions and to whom such funds were transferred.

A A May 19, 2008 e-mail from William McMunn mentions a letter regarding the Halifax Hospital deal is in a “read around file.” Neither this file nor “read around files” related to any of CTO’s other real property transaction was produced. Please produce all these files, whether in paper or electronic format, or confirm that none exist.

B Please provide all documents relating to transactions with Cornerstone Office Park Owners Association or confirm that none exist.

C Please provide any documents describing CTO’s relationship with the Charles Wayne Group. Apparently, the Charles Wayne group was at one time affiliated

Page 3

Consolidated-Tomoka Land Co.

August 29, 2008

with CTO and now acts as a broker on many of CTO’s land sales and income property transactions. Please provide all documents that relate to fees, commissions or other consideration paid to the Charles Wayne Group, as well as all documents detailing any existing business relationships between CTO and the Charles Wayne Group, or confirm that none exist.

D CTO did not provide any information regarding why CTO routinely chooses to utilize Volusia Title Services or Equity Title and Closing Corp. as the title and/or closing agent for its land sales. Please provide any documents that explain CTO’s policy/procedure/practice in selecting such agents.

E Please provide all documents showing that third-party transaction services are put out to competitive bidding or confirm that none exist.

F Volusia Title Services also appears affiliated with First American Exchange Company, which acts as CTO’s intermediary on most of its 1031 transactions. Please provide all documents detailing any existing business relationships between CTO, Volusia Title Services and/or First American Exchange Company and any of their subsidiary and/or parent companies or confirm that none exist

G Please provide any Excel spreadsheets or other similar charts or summary documents of corporate record-keeping to organize these transactions, such as the “Garter report” mentioned several times in board minutes (e.g. cto-071408-MgmtMinutes2005-2008-000079), or confirm that none exist.

H In addition, scanned document cto-062008-2004-SilverHolly-ContNotes-000056 refers to CTO’s sale of approximately 4.5 acres of land to Silver Holly Development, LLC in December 2004 for $1.074 million. As apart of this transaction, Tri-Square Realty, Inc. received a $42,215.75 commission. CTO board member William Voges is vice president, director and registered agent of Tri-Square Realty. Please provide any documents given to the board or its audit committee that show that this transaction was reviewed and approved by independent directors, outside counsel and auditors, that the directors who approved this transaction were made aware of the commission being paid to Mr. Voges’ firm, and that Mr. Voges recused himself from the discussion or confirm that none exist.

I Was CTO’s conflict of interest policy complied with in connection with this transaction with Silver Holly? Please produce all documents concerning such compliance for this and all other transactions during the timeframe of our demand, or confirm that none exist.

J The “Code of Business Conduct and Ethics” adopted April 28, 2004 and “Code of Ethical Conduct for Senior Financial Officers” adopted February 5, 2004 state that employees and directors should avoid all actual or apparent conflicts of interest, but do not provide any policy, practice or procedure for evaluating any

Page 4

Consolidated-Tomoka Land Co.

August 29, 2008

actual, apparent or potential conflict of interest. Please provide copies of any such policy and procedures that existed before the January 23, 2007 adoption of CTO’s “Related Party Transaction Policy and Procedures” or confirm that no such documents exist.

3. Documents related to the development of CTO’s real estate properties over the past five years, including, but not limited to, any and all: (a) information regarding the developers, managers and other individuals or institutions involved in the ongoing development of such properties; and (b) advice or recommendations made in furtherance of the development of such properties, including, but not limited to, any and all documents, CTO board minutes and presentations reflecting how and why the development of the two 15,000 square foot office buildings currently under construction was accomplished.

Very few documents were produced with respect to this item. CTO spent a great deal of time and money on the development of the two 15,000 square foot office buildings, but CTO provided almost no documents, presentations, e-mails, etc. relating to these buildings (such as bids, contractor selection process, budgets, budget variances, tenant projections, commitments, updates to the board, ongoing income projections, etc. regarding the Gateway Commerce Center and any other developments for which CTO has coordinated development), and all related improvements, including clearing, drainage, zoning changes, variances and road and infrastructure development. Please provide all documents related to this or confirm that none exist.

4. Documents reflecting any and all fees paid in relation to CTO’s real property transactions and the development of CTO’s properties referenced in items 2 and 3 above, including, but not limited to: (a) to whom these fees were paid; and (b) how such fees were paid.

CTO has not produced any documents regarding any commissions paid to Indigo Commercial Realty, commissions paid by CTO to CTO employees, or information regarding “commissions paid outside closing” (see, for example, cto-06-18-08-2003-DaytonaBeachAuto-FinalDocs-000058—“ICR Paid Outside Closing”). There are multiple references to commissions paid outside closing. Please provide all documents containing this information and any policy/practice/procedure related to the payment of commissions, fees and/or any other consideration or confirm that none exist.

5. Documents reflecting CTO’s evaluation of the strategies of purchase of income properties versus the self-development of properties and other alternatives for the development of properties, including, but not limited to, any and all: (a) presentations made to the CTO board; (b) financial projections relating to such evaluation; (c) CTO board minutes from meetings regarding such evaluation; and (d) reports of consultants.

Page 5

Consolidated-Tomoka Land Co.

August 29, 2008

CTO has produced some parts of presentations on this matter, but they are not complete (see item 16 below). The required documents include presentations and summaries that were prepared for or delivered to committees or subcommittees as well as for the full board. Please provide full copies of all responsive presentations and other documents.

6. Documents reflecting the day-to-day operations of CTO’s income properties, including, but not limited to, documents reflecting: (a) the costs associated with, and the depreciation of, such properties; and (b) information relating to buyers, sellers, title agents, attorneys, brokers, managers and any other individuals or institutions involved with the purchase and ongoing business of these properties, including, but not limited to: (i) how such individuals or institutions are hired by CTO; (ii) why such individuals or institutions are hired more often than others; and (iii) how such individuals or institutions are being compensated by CTO, if at all.

A No presentations to the board or any committees or subcommittees regarding performance of income properties or management’s plans for implementing the income property strategy were produced, nor were management reports on the status of these properties or reports by entity. Please provide these documents or confirm that none exist.

B Please provide all documents showing CTO’s efforts to re-lease or otherwise realize value from all income properties which are currently unoccupied by their contracted tenants, which apparently include CVS stores in Sanford, Melbourne, Sebring and Roseland, Florida, or confirm that none exist.

C Who monitors the performance of income properties and the management companies that are responsible for the day-to-day operations of several of these properties (i.e., the Sembler Company) and how is this monitoring accomplished? Please provide all documents related to this or confirm that none exist.

7. Documents evidencing any and all plans for the numerous and geographically diverse parcels of land CTO will own once the leases on CTO’s properties described in item 6 above expire.

No documents were produced for this item. Please provide all documents related to this or confirm that none exist.

Has management or the board discussed what will be done with the various properties when the leases expire? Please provide all documents related to future plans or confirm that none exist.

8. Copies of CTO’s lease agreements for income-producing properties, including all exhibits.

Page 6

Consolidated-Tomoka Land Co.

August 29, 2008

Please provide all documents related to this or confirm that all responsive documents were produced.

9. Documents related to the day-to-day operations of the LPGA golf course since the commencement of its operations, including, but not limited to, any and all: (a) financial statements; (b) documents showing the golf course’s gross and net income and losses; and (c) CTO board minutes and presentations from meetings regarding the operation of the golf course.

A No e-mails were produced from the lpgaintenational.com e-mail domain, other than from e-mails incoming to CTO personnel from Ipgainternational.com accounts. Please provide all responsive emails from the lpgamternational.com domain as well as any other internet domains or e-mail accounts owned or controlled by CTO.

B Please provide all correspondence and e-mails between CTO and/or LPGAInternational.com, the Ladies Professional Golf Association or the management company, Buena Vista Hospitality Group (“BVHG”).

C As in item 1 above, no electronic documents or files related to the LPGA golf course’s finances were produced. Please provide all documents related to this or confirm that none exist.

D With respect to BVHG, only the contract was produced. Please provide all documents relating to the day-to-day operations of the golf course including, but not limited to, the following reports provided by BVHG (yearly, going back to inception): Annual Operating and Maintenance Plan and five-year Capital Program.

E Please provide all documents detailing staffing levels and the BVHG charge account, as well as any business-related golf privileges and complimentary memberships, or confirm that none exist. Given that CTO’s golf course operations have consistently lost money for approximately the past decade, these documents should be critical to understanding the valuation of the operation and whether or not the golf course affairs are being properly administered.

F The January 23, 2008 presentation to the board states on page cto-071408-No9-BoardPresent-Golf-l0310000306 “LPGA International operations as well as the LPGA International Financial Statements will be discussed at the Directors’ meeting,” while previous presentations provided an overview and commentary of LPGA International operations; the same is true of the April 23, 2008 presentation to the board (cto-071408-No9-BoardPresent-Golf~1031-000312). Please explain why this policy was changed and provide any documents that were provided and minutes of discussions that took-place at these board meetings or confirm that none exist.

Page 7

Consolidated-Tomoka Land Co.

August 29, 2008

G Please provide all management presentations and executive summaries that have not been produced to date regarding rounds played (both paid and complementary), and membership (both paid and complementary, including a list of all persons who hold complementary membership). What services, amenities or privileges are included in the ‘free passes’? Who has control of the passes for the free rounds of golf, greens fees, lunches, etc.? Please provide all documents related to this or confirm that none exist.

10. Documents reflecting CTO’s notification and level of awareness of Mr. Olivari’s involvement with Halifax Hospital and its supporting foundation, including, but not limited to, CTO board and committee minutes from meetings regarding Mr. Olivari’s nomination and election to the CTO board.

CTO only produced Mr. Olivari’s background file. Are there any other documents responsive to this item or more detailed documentation of discussions that were held by the board regarding Mr. Olivari’s nomination and fitness to serve as an independent director? Please provide all documents or confirm that none exist.

Please provide any documents that explain the board’s or CTO’s reasoning behind nominating Mr. Olivari to the board of directors after the entity he is associated with (Halifax Hospital) refused to build the hospital it was contractually obligated to build on land bought from CTO. This broken deal would seem to have caused great financial harm to CTO and its shareholders by depressing the value of CTO-owned land surrounding the hospital site and would therefore raise the question of why CTO would then reward Halifax Hospital by placing Mr. Olivari on the board of directors. Please provide all documents related to this or confirm that none exist.

11. Documents reflecting CTO’s notification and level of awareness that (a) William McMunn and members of his immediate family were the recipients of loans from SunTrust Bank granted during the interval between (i) the December 2004 sale by CTO subsidiary Indigo Group to SunTrust Bank of the property located at 2030 LPGA Boulevard in Daytona Beach and (ii) the June 2007 return sale of the same property by SunTrust Bank to Indigo Group and (b) Mr. McMunn sought election to and thereafter was elected in September 2005 to the board of directors of SunTrust Bank of East Central Florida.

No documents were produced that are responsive to this item. Please provide all documents related to this or confirm that none exist.

Was CTO’s board made aware of this potential conflict of interest? Please provide all documents related to this or confirm that none exist.

12. Documents related to the decision to recommend the election of William Davison, outgoing president of a SunTrust regional subsidiary, to CTO’s board of

Page 8

Consolidated-Tomoka Land Co.

August 29, 2008

directors effective April 2007, including, but not limited, to any documents that relate to the consideration, if any, given by CTO to whether (a) outstanding loans from SunTrust to CTO, (b) outstanding loans from SunTrust to Mr. McMunn and members of his immediate family, or (c) SunTrust’s failure to build its regional headquarters on the property located at 2030 LPGA Boulevard in Daytona Beach, were relevant to the recommendation of Mr. Davison’s election to CTO’s board.

A CTO only produced Mr. Davison’s background file. No documents were produced that are responsive to clauses (b) or (c) of this item. Are there any other documents responsive to this item? Please provide any documents related to this or confirm that none exist.

B In his background file, on page cto-071408-Davison-000032, Mr. Davison states that “the responsibility for the CTO banking relationship is with the bank officers who are part of the commercial banking unit located in Orlando, FL. Decisions and accountability for the CTO banking relationship are governed by these officers.” This would seem to contradict documents cto-062508-2004-SunTrustBank-000205, cto-06-16-08-2003 Bayberry_ColonyLLC-FinalDocs-000080, cto-06-16-08-2003-Bayberry_ColonyLLC-GenCorr-000218 and cto-06-16-08-2003-Bayberry_ColonyLLC-GenCorr-000219, which show that Mr. Davison clearly had a banking relationship with CTO. Please provide any documents showing that the board was made aware of this relationship, and that it was discussed and approved at the board level, or confirm that none exist.

C Please provide any documents that explain the board’s or CTO’s reasoning behind nominating Mr. Davison to the board of directors after the entity both he and CTO Chief Executive Officer William McMunn are associated with (SunTrust Bank, East Central Florida) refused to build the bank it was contractually obligated to build on land bought from CTO. The pattern established with Mr. Olivari and Mr. Davison of CTO’s board rewarding people whose affiliates refuse to honor contracts with CTO by nominating them to CTO’s board of directors raises serious doubts that the affairs of CTO are being properly administered. Within the scope and timeframe of this demand, what documents exist to provide an explanation for this phenomenon? Please provide all documents related to this or confirm that none exist.

13. Documents related to CTO’s ownership interest in, business dealings of, staffing of or acquisitions of real property in cooperation with, Indigo Clermont LLC since its formation in 2005.

Please confirm that all responsive documents were produced.

Page 9

Consolidated-Tomoka Land Co.

August 29, 2008

14. Documents reflecting the list of properties CTO has available for sale in 2008, including, but not limited to, documents showing: (a) how and why such properties were determined to be sold; and (b) the size (in acres) of such properties.

A No documents were produced that are responsive to parts (a) and (b) of this item. Please provide a current list of the properties available for sale in 2008 or confirm that none exists.

B Please provide all documents showing how CTO determines what acreage to sell and how it sets the prices, including all documents containing analysis and review of comparable listings and transactions, presentations to the board or committees or subcommittees showing that the sales prices reflect fair market value and that selling land at these prices is the best potential use of the land (versus self-development or holding the land until a future time), or confirm that no such documents exist.

15. Minutes of all meetings of the board of directors and board committees from January 1, 2005 to the present.

A Please confirm that all minutes of board, committee and sub-committee minutes of CTO and all of its subsidiaries for the requested period were produced.

B The July 27, 2005 board presentation (cto-071408-No9-BoardPresent-Golf-1031-000230) states that “management is constantly in the market for opportunities to acquire large tracts of raw land in the path of future development”; the October 26, 2005 Board presentation (cto-071408-No9-BoardPresent-Golf-1031-000239) states that “on an ongoing basis, Management will be comparing alternatives for funding wholesale acquisitions of raw land,” and the April 23, 2008 report to directors mentions the possible acquisition of a “3,400 acre raw land opportunity in Ft. Myers, FL” (cto-071408-No9-BoardPresent-Golf-1031-000308). Please provide any analysis done, presentations given to the board or otherwise prepared by management or outside advisors, and any other documents related to the strategy of acquiring further raw acreage or confirm that no such documents exist.

C Please provide all memos between CTO management and its board, such as the memorandum referenced at the bottom of page cto-071408-MgmtMinutes2005-2008-000079 (“WHM to send possible memo to the Board re: Charter Amendments after election”).

D Regarding the SunTrust repurchase (see cto-06-13-2007-BoardMinutes-000104), were any directors considered interested or related parties at the time of the transaction (given that CTO board member William Davison was President and CEO of SunTrust Bank of East Central Florida at the time, and CTO CEO William McMunn was on the board of SunTrust Bank of East Central Florida at the time)? What information, if any, was provided to the audit

Page 10

Consolidated-Tomoka Land Co.

August 29, 2008

committee, other committees or subcommittees, auditors and outside counsel regarding this potential conflict of interest? Please provide a copy of all related documents or confirm that no such documents exist.

E The board minutes state that KPMG reviewed the SunTrust transaction. Please provide the documents relating to this review or confirm that none exist.

F What other transactions has KPMG reviewed during the period covered by the Adviser’s demand for books and records? Please provide all related documents or confirm that none exist.

G The audit committee minutes do not reflect any discussion regarding the potential conflict of interest presented by CTO and LPGA International purchasing insurance policies from or through Brown & Brown, Inc., of which John C. Adams was executive vice president while also serving as a CTO board member and a member of CTO’s audit committee. Do any documents exist relating to any discussion or analysis of this potential conflict of interest? Was this potential conflict reviewed by the audit committee, outside counsel and auditors? Did Mr. Adams recuse himself from any discussions related to this matter? Please provide all documents relating to such review or confirm that no such documents exist.

16. Minutes of all meetings of the board of directors and board committees prior to January 1, 2005 relating to any of CTO’s Section 1031 exchanges or to the LPGA golf course.

Several presentations to the board are incomplete and are missing multiple pages (for example, cto071408-No9-BoardPresent-Golf-1031-000191 goes from page 13 to page 16; cto-071408-No9-BoardPresent-Golf-1031-000226 presentation starts on page 14). Please provide full copies of all management presentations given to the board and all committees and subcommittees.

17. All internal memoranda, analyses and presentations that relate to any of the foregoing items.

A Except for e-mail, no electronic documents have been produced by CTO. Surely, CTO has electronic documents, such as management presentations, executive summaries, financial accounting files, etc. These electronic documents must be produced.

B CTO produced board presentations and certifications from Grant Thornton LLP from years prior to 2005, but not for later periods. Please produce all subsequent accountants’ presentations and certifications or confirm that none exist.

Page 11

Consolidated-Tomoka Land Co.

August 29, 2008

C Finally, please provide a copy of CTO’s document retention policy, practices and procedures, and advise who at CTO has primary responsibility for Sarbanes Oxley compliance, or confirm that no such documents exist.

The Adviser requests that the documents CTO produces in response to this demand be organized in accordance with the above list. In accordance with Florida law, the Adviser is prepared to inspect and copy such additional documents at CTO’s principal office on Thursday and Friday, September 11 and 12, 2008.

Please direct any questions regarding the statutory demands contained in this correspondence to our special Florida counsel, Ronald Albert, Jr. (305.373.9474) or Mark F. Raymond (305.373.9425) of Broad and Cassel, One Biscayne Tower, 2 South Biscayne Boulevard, Miami, Florida 33131, or to our legal counsel, Patricia Poglinco (212.574.1247), or Fola Adamolekun (212.574.1320), of Seward & Kissel LLP, One Battery Park Plaza, New York, New York 10004.

Sincerely yours,

David J. Winters, Managing Member

Wintergreen Advisers, LLC

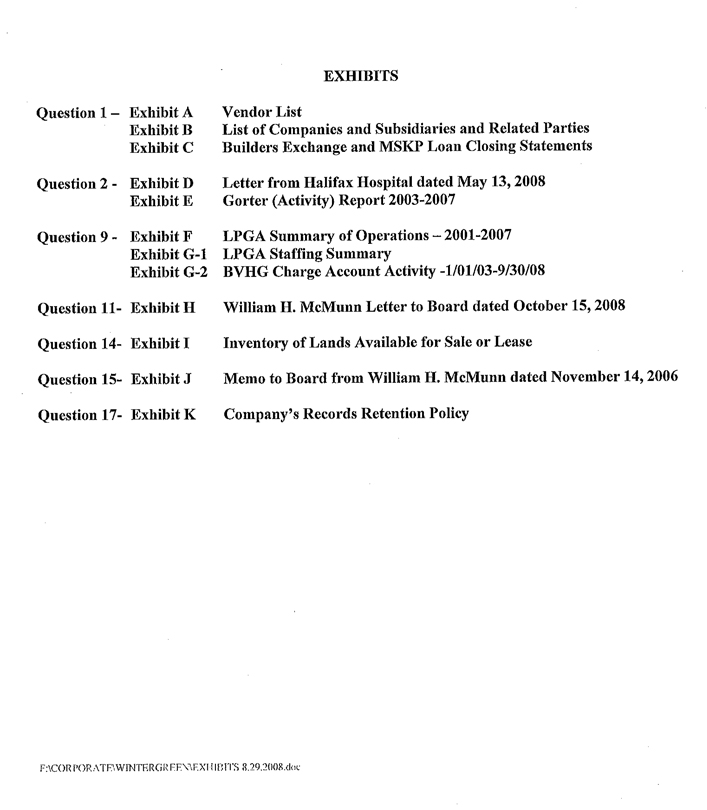

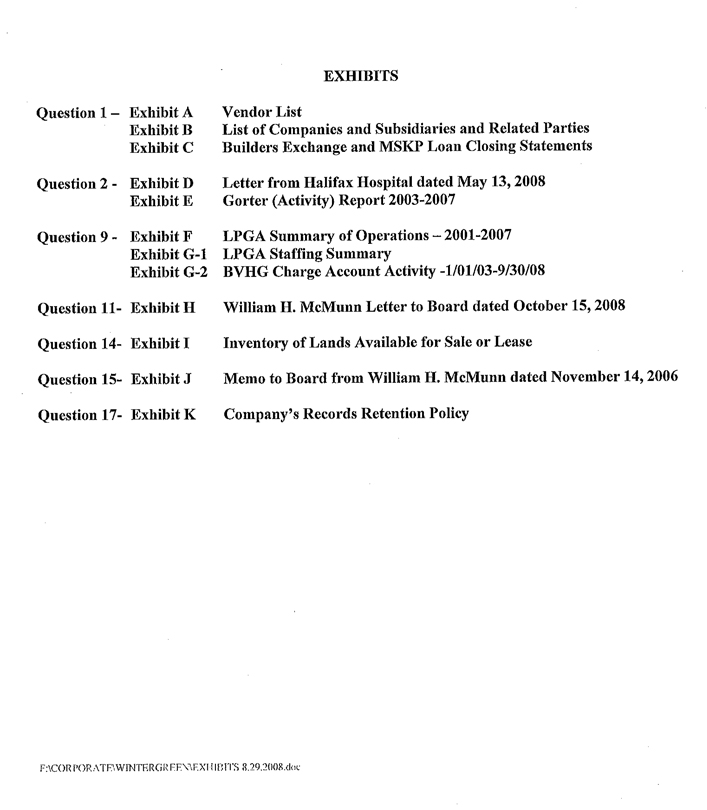

EXHIBITS

Question 1 - Exhibit A Vendor List

Exhibit B List of Companies and Subsidiaries and Related Parties

Exhibit C Builders Exchange and MSKP Loan Closing Statements

Question 2 - Exhibit D Letter from Halifax Hospital dated May 13, 2008

Exhibit E Gorter (Activity) Report 2003-2007

Question 9 - Exhibit F LPGA Summary of Operations – 2001-2007

Exhibit G-l LPGA Staffing Summary

Exhibit G-2 BVHG Charge Account Activity – 1/01/03-9/30/08

Question 11 - Exhibit H William H. McMunn Letter to Board dated October 15, 2008

Question 14 - Exhibit I Inventory of Lands Available for Sale or Lease

Question 15 - Exhibit J Memo to Board from William H. McMunn dated November 14, 2006

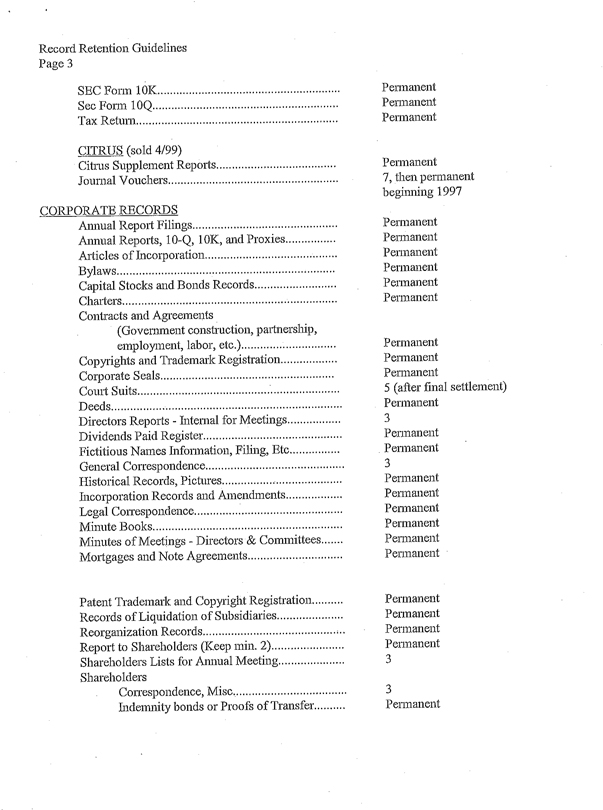

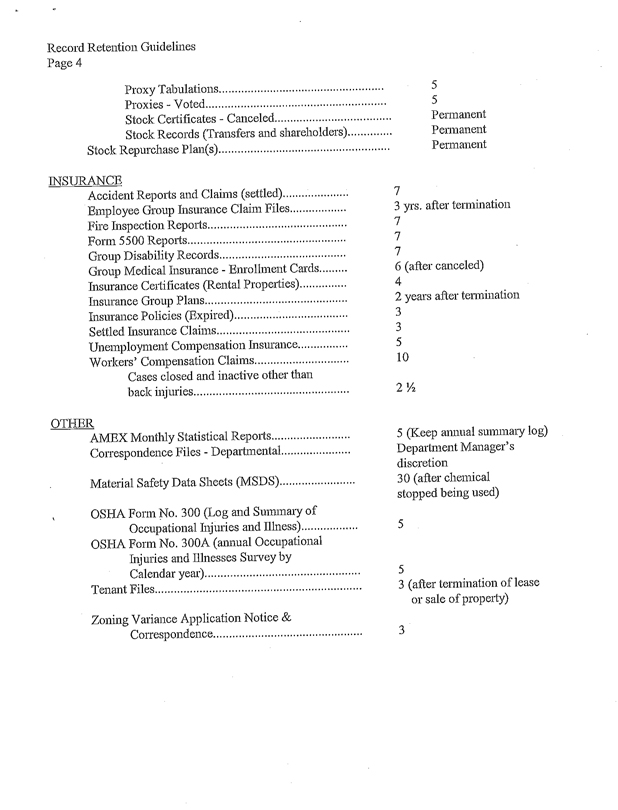

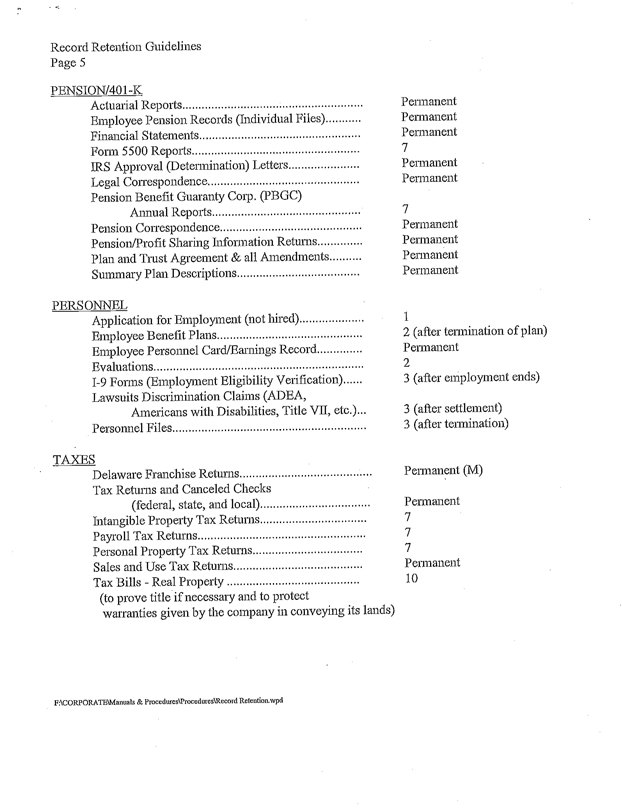

Question 17 - Exhibit K Company’s Records Retention Policy

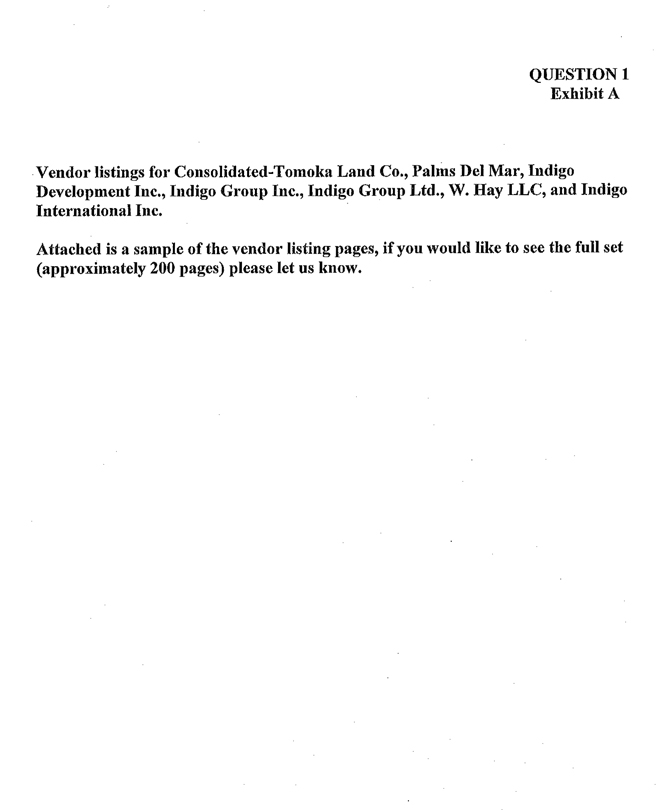

QUESTION 1

Exhibit A

Vendor listings for Consolidated-Tomoka Land Co., Palms Del Mar, Indigo Development Inc., Indigo Group Inc., Indigo Group Ltd., W. Hay LLC, and Indigo International Inc.

Attached is a sample of the vendor listing pages, if you would like to see the full set (approximately 200 pages) please let us know.

All Vendors

Consolidated Tomoka Land Co. (CTL)

Vendor Number Name/Address Telephone Extension

0011000 A A WILBERT JR 54-A VINING COURT LAND SURVEYING INC ORMOND BEACH, FL 32176 - - QUESTION 1

Exhibit A

0011002 ALZHEIMER’S ASSOCIATION 988 WOODCOCK RD. SUITE 200 ORLANDO, FL 32803 USA United States of America

0011003 MARCH OF DIMES VOLUSIA DIVISION 200 BILL FRANCE BLVD DAYTONA BEACH, FL 32114 - -

0011004 COUNTY OF VOLUSIA - -

0011005 SECOND HARVEST FOOD BANK 330 NORTH STREET DAYTONA BEACH, FL 32114 - -

0011006 CLERK OF CIRCUIT COURT LEE COUNTY - -

0011007 COUNCIL ON AGING PO BOX 671 DAYTONA BEACH, FL 32115 - -

0011008 HALIFAX HISTORICAL SOCIETY INC 252 SOUTH BEACH STREET DAYTONA BEACH, FL 32114 - -

0011009 CLERK OF CIRCUIT COURT HIGHLAND COUNTY

0011010 ELECTRONIC AWARDS 1831 NORTH NOVA ROAD HOLLY HILL, FL 32117 - -

0011011 RESOURCE COMMUNICATIONS INC RCI CONFERENCE CENTER 1211 HAMBURG TURNPIKE WAYNE, NJ 7470 - -

0011012 UNIVERSAL CITY DEVELOPMENT PARTNERS, LTD

0011013 FORESTECH CONSULTING INC DBA LANDMARK SYSTEMS 3059 HIGHLAND OAKS TERRACE TALLAHASSEE, FL 32301 USA United States of America (850) 385-3667 3910

0011014 FLORIDA FORESTRY ASSOCIATION - - PO BOX 1696 TALLAHASSEE, FL 32302-1696 USA United States of America

Run Date: 10/8/2008 4:10:41PM Page: 1

A/P Date: 10/8/2008 User Logon: Lynne

All Vendors

Consolidated Tomoka Land Co. (CTL)

Vendor Number Name/Address Telephone Extension

0011015 MEDI+PHYSICALS, INC ASAP PROGRAMS 4920 W CYPRESS STREET, STE 102 TAMPA, FL 33607-3837 USA United States of America (800) 929-6334 244

0011016 VIP PRINTING 133 Wl NT’L SPEEDWAY BLVD DAYTONA BEACH, FL 32114 - -

0011017 FLORIDA POWER & LIGHT CO GENERAL MAIL FACILITY Acct#04777-65259 MIAMI, FL 33188-0001

0011018 CINDY AHERN

0011019 FUTURES FOUNDATION PO BOX 2118 DELAND, FL 32721-2118 - -

0011021 SEASIDE MUSIC THEATER INC PO BOX 2835 DAYTONA BEACH, FL 32120 - -

0011023 WEST PAYMENT CENTER PO BOX 6292 CAROL STREAM, IL 60197-6292 - -

0011024 MGM WINDOW DECOR 104 RUSH STREET NEW SMYRNA BEACH, FL 32168

0011025 APGAR, ROBERT F. - -

0011027 FLORIDA U.C. FUND

0011028 TAX COLLECTOR JACK TEDDER P O BOX 30 PERRY, FL 32347-0030 - -

0011029 SANDY METZGER 117 SHARPE DRIVE GUN BARREL CITY, TX - -

0011030 TAX COLLECTOR-FLAGLER COUNTY SUZETTE PELLICER P. O. BOX 846 BUNNELL, FL 32110 - -

0011031 MARVIN SMITH RTE 3 BOX 1542 LAKE BUTLER, FL 32050 - -

0011033 HEALTHY COMMUNITIES SAFE KIDS COALITION

Run Date: 10/8/2008 4:10:41PM Page: 2

A/P Date: 10/8/2008 User Logon: Lynne

CONSOLIDATED-TOMOKA LAND CO. QUESTION 1

Revised August 19, 2008 Exhibit B

Date of Incorporation: 1910*

State of Incorporation: Florida - 5/1/93

Delaware - prior to 5/l/93#

Name Changed From CTLC, Inc.: May 1, 1993#

E.I. Number: 59-0483700

Charter Numbers:

Florida P93000014887 (800204 prior to 5/1/93)

Delaware 38-0800204 - prior to 5/l/93#

Directors: Class I John C. Adams

Class II William H. Davison

Class III Gerald L. DeGood

Class III James E. Gardner

Class II William H. McMunn

Class II William L. Olivari

Class I John C. Myers, III

Class III William J. Voges

Class I expires April 2010

Class II expires April 2011

Class III expires April 2009

Officers: William H. McMunn Chairman of the Board, President,

and Chief Executive Officer

Bruce W. Teeters Sr. VP-Finance and Treasurer

Robert F. Apgar Sr. VP-General Counsel and Assistant Secretary

Linda Crisp VP and Corporate Secretary

Gary Moothart VP and Controller

ANNUAL MEETING: April or as designated by the Board of Directors

Authorized Shares: 25,000,000 (increased from 10,000,000 5/1/93; from 5,000,000 4-25-86) common shares @ $1.00 par value; 50,000 (eff. 4-25-86) preferred shares @ $100.00 par value.

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

*Consolidated-Tomoka Land Co. is successor to Tomoka Land Company, incorporated in 1910. The major portion of CTLC’s properties came to it through Consolidated Naval Stores Company, incorporated in 1902. CNSCo. changed its name to Consolidated Financial Corporation in 1961. In 1969, when Tomoka Land Company changed its name to C-TLC, CFC deeded its operating properties to C-TLC. CFC later (1971) merged its securities into Baker, Fentress & Co.

#Consolidated-Tomoka Land Co., a Delaware corporation, merged into a new and wholly owned subsidiary, CTLC, Inc., a Florida corporation, and then changed name to Consolidated-Tomoka Land Co. effective May 1, 1993.

NOTE: Consolidated Tomoka has registered with the Secretary of State for State of Georgia

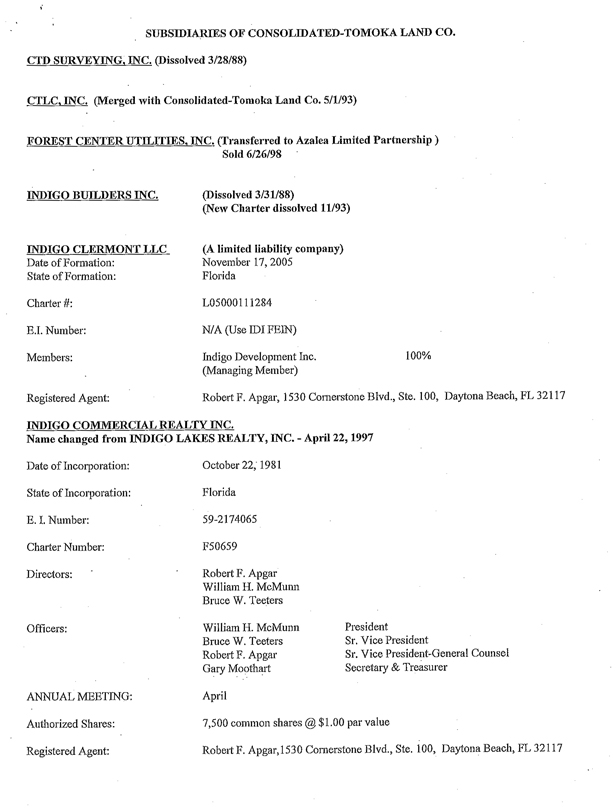

SUBSIDIARIES OF CONSOLIDATED-TOMOKA LAND CO.

CTD SURVEYING, INC. (Dissolved 3/28/88)

CTLC, INC. (Merged with Consolidated-Tomoka Land Co. 5/1/93)

FOREST CENTER UTILITIES, INC. (Transferred to Azalea Limited Partnership )

Sold 6/26/98

INDIGO BUILDERS INC. (Dissolved 3/31/88)

(New Charter dissolved 11/93)

INDIGO CLERMONT LLC (A limited liability company)

Date of Formation: November 17, 2005

State of Formation: Florida

Charter #: L05000111284

E.I. Number: N/A (Use IDI FEIN)

Members: Indigo Development Inc. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

INDIGO COMMERCIAL REALTY INC.

Name changed from INDIGO LAKES REALTY, INC. - April 22,1997

Date of Incorporation: October 22, 1981

State of Incorporation: Florida

E.I. Number: 59-2174065

Charter Number: F50659

Directors: Robert F. Apgar

William H. McMunn

Bruce W. Teeters

Officers: William H. McMunn President

Bruce W. Teeters Sr. Vice President

Robert F. Apgar Sr. Vice President-General Counsel

Gary Moothart Secretary & Treasurer

ANNUAL MEETING: April

Authorized Shares: 7,500 common shares @ $1.00 par value

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

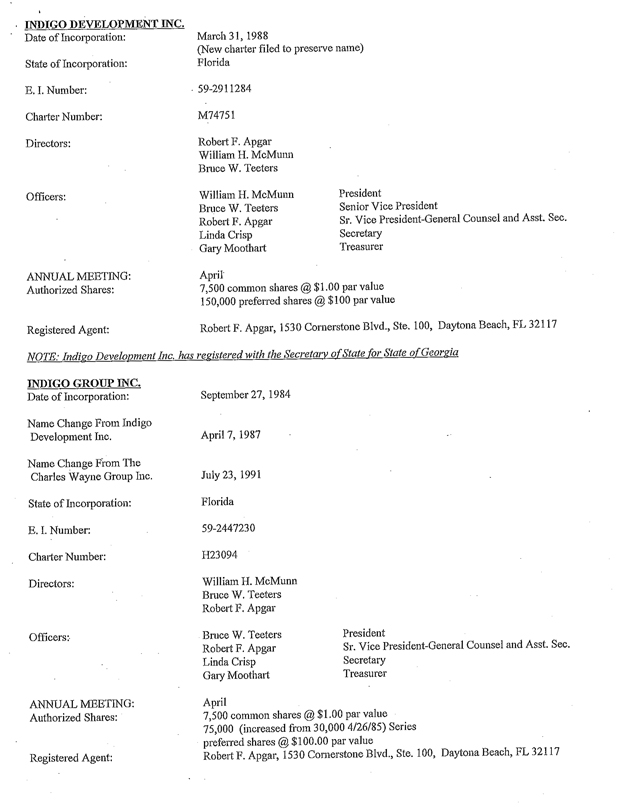

INDIGO DEVELOPMENT INC.

Date of Incorporation: March 31, 1988

(New charter filed to preserve name)

State of Incorporation: Florida

E.I. Number: 59-2911284

Charter Number: M74751

Directors: Robert F. Apgar

William H. McMunn

Bruce W. Teeters

Officers: William H. McMunn President

Bruce W. Teeters Senior Vice President

Robert F. Apgar Sr. Vice President-General Counsel and Asst. Sec.

Linda Crisp Secretary

Gary Moothart Treasurer

ANNUAL MEETING: April

Authorized Shares: 7,500 common shares @ $1.00 par value

150,000 preferred shares @ $100 par value

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

NOTE: Indigo Development Inc. has registered with the Secretary of State for State of Georgia

INDIGO GROUP INC.

Date of Incorporation: September 27, 1984

Name Change From Indigo Development Inc. April 7, 1987

Name Change From The Charles Wayne Group Inc. July 23, 1991

State of Incorporation: Florida

E.I. Number: 59-2447230

Charter Number: H23094

Directors: William H. McMunn

Bruce W. Teeters

Robert F. Apgar

Officers: Bruce W. Teeters President

Robert F. Apgar Sr. Vice President-General Counsel and Asst. Sec.

Linda Crisp Secretary

Gary Moothart Treasurer

ANNUAL MEETING: April

Authorized Shares: 7,500 common shares @ $1.00 par value

75,000 (increased from 30,000 4/26/85) Series

preferred shares @ $100.00 par value

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

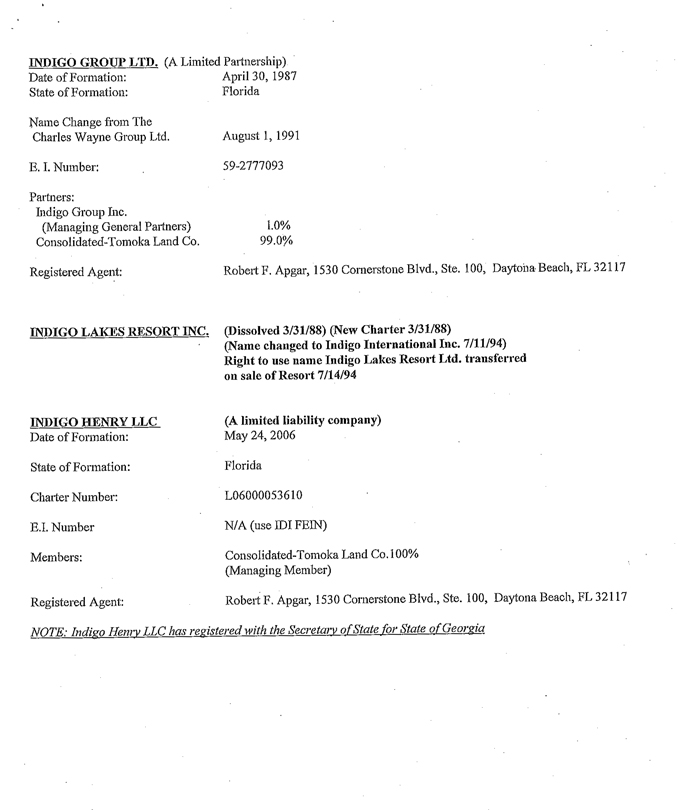

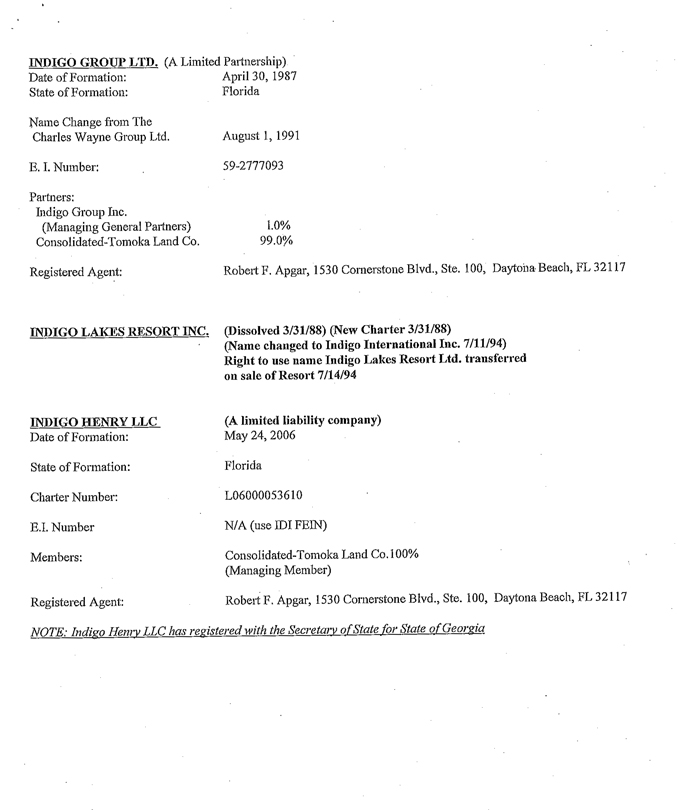

INDIGO GROUP LTD. (A Limited Partnership)

Date of Formation: April 30, 1987

State of Formation: Florida

Name Change from The

Charles Wayne Group Ltd. August 1, 1991

E.I. Number: 59-2777093

Partners:

Indigo Group Inc.

(Managing General Partners) 1.0%

Consolidated-Tomoka Land Co. 99.0%

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

INDIGO LAKES RESORT INC. (Dissolved 3/31/88) (New Charter 3/31/88)

(Name changed to Indigo International Inc. 7/11/94)

Right to use name Indigo Lakes Resort Ltd.

transferred on sale of Resort 7/14/94

INDIGO HENRY LLC (A limited liability company)

Date of Formation: May 24, 2006

State of Formation: Florida

Charter Number: L06000053610

E.I. Number N/A (use IDI FEIN)

Members: Consolidated-Tomoka Land Co. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

NOTE: Indigo Henry LLC has registered with the Secretary of State for State of Georgia

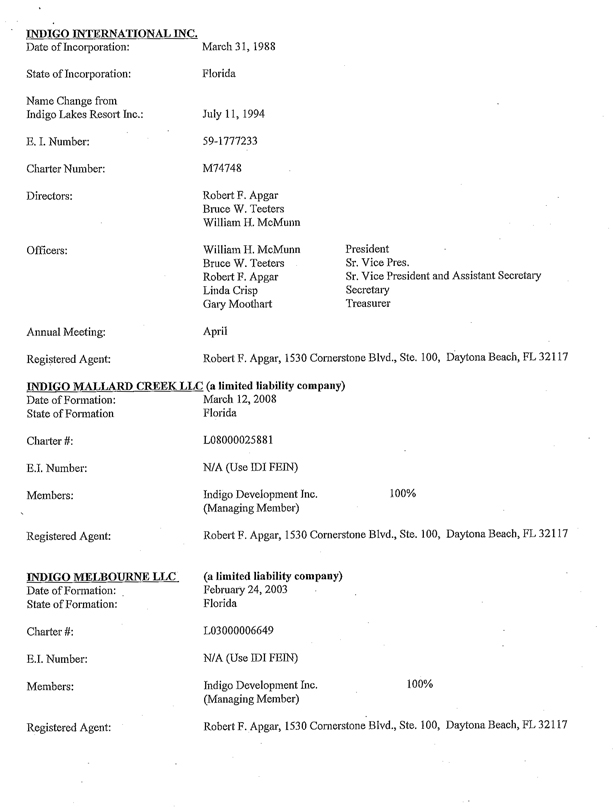

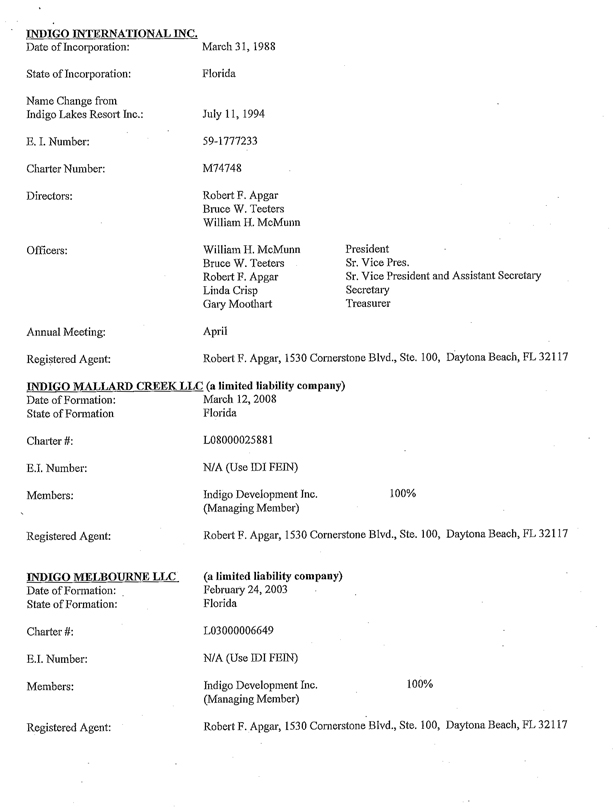

INDIGO INTERNATIONAL INC.

Date of Incorporation: March 31, 1988

State of Incorporation: Florida

Name Change from

Indigo Lakes Resort Inc.: July 11, 1994

E.I. Number: 59-1777233

Charter Number: M74748

Directors: Robert F. Apgar

Bruce W. Teeters

William H. McMunn

Officers: William H. McMunn President

Bruce W. Teeters Sr. Vice Pres.

Robert F. Apgar Sr. Vice President and Assistant Secretary

Linda Crisp Secretary

Gary Moothart Treasurer

Annual Meeting: April

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

INDIGO MALLARD CREEK LLC (a limited liability company)

Date of Formation: March 12, 2008

State of Formation Florida

Charter #: L08000025881

E.I. Number: N/A (Use IDI FEIN)

Members: Indigo Development Inc. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

INDIGO MELBOURNE LLC (a limited liability company)

Date of Formation: February 24, 2003

State of Formation: Florida

Charter #: L03000006649

E.I. Number: N/A (Use IDI FEIN)

Members: Indigo Development Inc. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

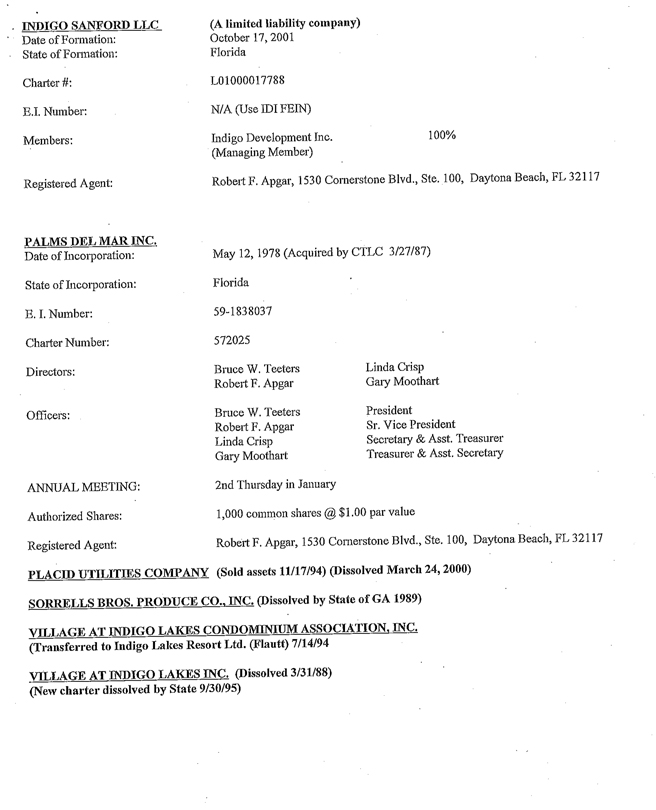

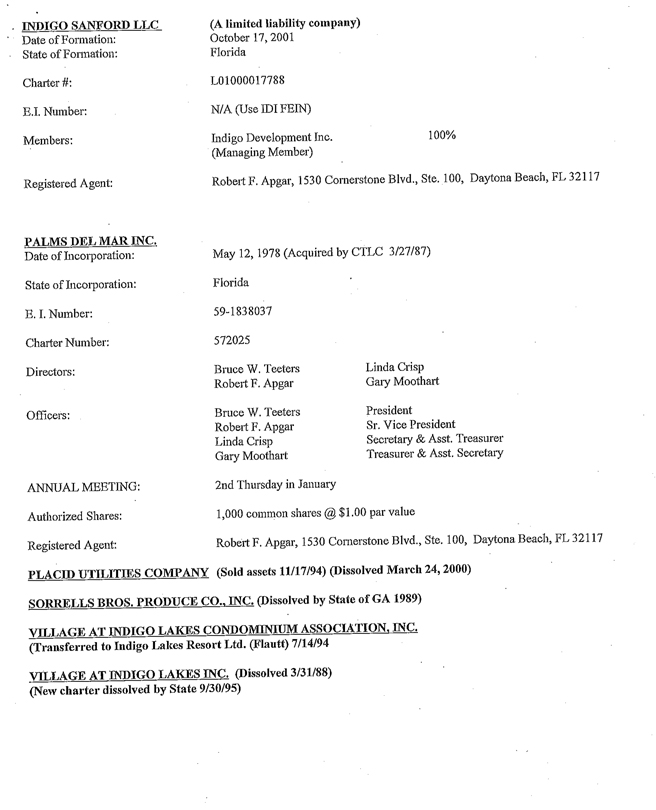

INDIGO SANFORD LLC (A limited liability company)

Date of Formation: October 17, 2001

State of Formation: Florida

Charter#: L01000017788

E.I. Number: N/A (Use IDI FEIN)

Members: Indigo Development Inc. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

PALMS DEL MAR INC.

Date of Incorporation: May 12, 1978 (Acquired by CTLC 3/27/87)

State of Incorporation: Florida

E. I. Number: 59-1838037

Charter Number: 572025

Directors: Bruce W. Teeters Linda Crisp

Robert F. Apgar Gary Moothart

Officers: Bruce W. Teeters President

Robert F. Apgar Sr. Vice President

Linda Crisp Secretary & Asst. Treasurer

Gary Moothart Treasurer & Asst. Secretary

ANNUAL MEETING: 2nd Thursday in January

Authorized Shares: 1,000 common shares @ $1.00 par value

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

PLACID UTILITIES COMPANY (Sold assets 11/17/94) (Dissolved March 24, 2000)

SORRELLS BROS. PRODUCE CO., INC. (Dissolved by State of GA 1989)

VILLAGE AT INDIGO LAKES CONDOMINIUM ASSOCIATION, INC. (Transferred to Indigo Lakes Resort Ltd. (Flautt) 7/14/94

VILLAGE AT INDIGO LAKES INC. (Dissolved 3/31/88)

(New charter dissolved by State 9/30/95)

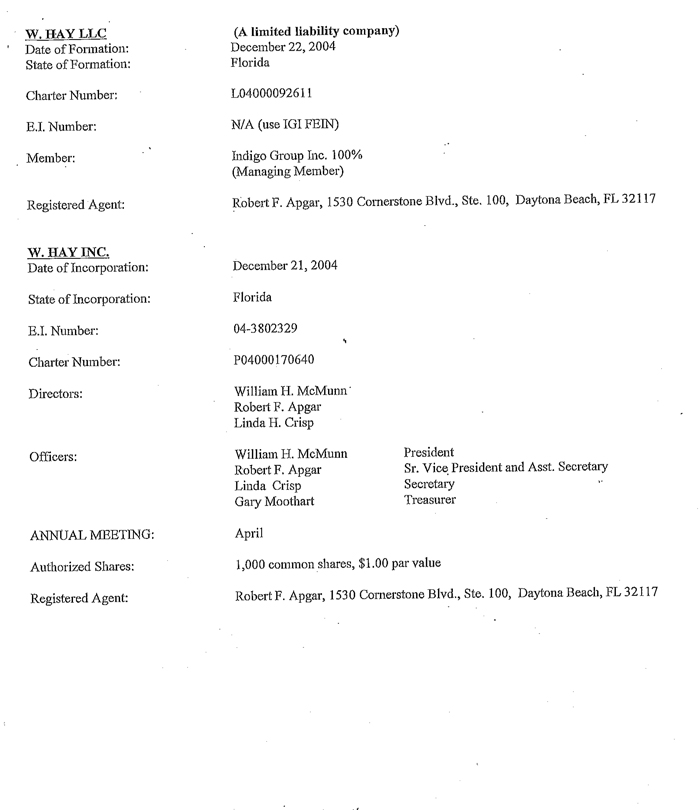

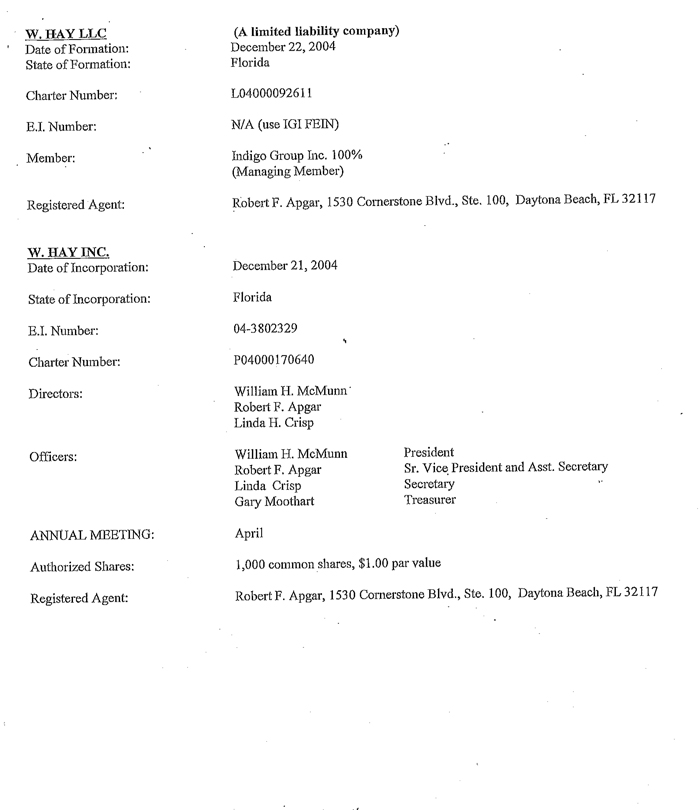

W. HAY LLC (A limited liability company)

Date of Formation: December 22, 2004

State of Formation: Florida

Charter Number: L04000092611

E.I. Number: N/A (use IGI FEIN)

Member: Indigo Group Inc. 100%

(Managing Member)

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

W. HAY INC.

Date of Incorporation: December 21, 2004

State of Incorporation: Florida

B.I. Number: 04-3802329

Charter Number: P04000170640

Directors: William H. McMunn

Robert F. Apgar

Linda H. Crisp

Officers: William H. McMunn President

Robert F. Apgar Sr. Vice President and Asst. Secretary

Linda Crisp Secretary

Gary Moothart Treasurer

ANNUAL MEETING: April

Authorized Shares: 1,000 common shares, $1.00 par value

Registered Agent: Robert F. Apgar, 1530 Cornerstone Blvd., Ste. 100, Daytona Beach, FL 32117

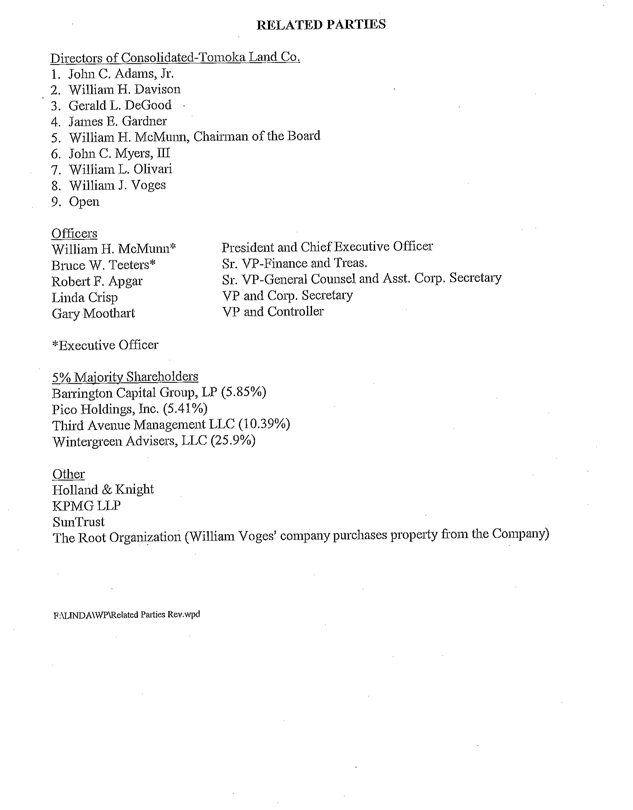

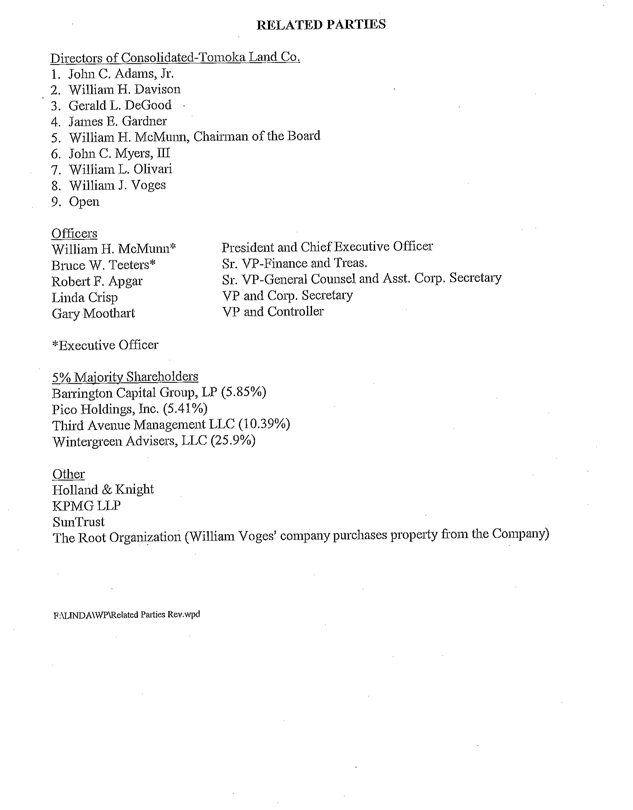

RELATED PARTIES

Directors of Consolidated-Tomoka Land Co.

1. John C. Adams, Jr.

2. William H. Davison

3. Gerald L. DeGood

4. James E. Gardner

5. William H. McMunn, Chairman of the Board

6. John C. Myers, III

7. William L. Olivari

8. William J. Voges

9. Open

Officers

William H. McMunn* President and Chief Executive Officer

Bruce W. Teeters* Sr. VP-Finance and Treas.

Robert F. Apgar Sr. VP-General Counsel and Asst. Corp. Secretary

Linda Crisp VP and Corp. Secretary

Gary Moothart VP and Controller

* Executive Officer

5% Majority Shareholders

Barrington Capital Group, LP (5.85 %)

Pico Holdings, Inc. (5.41%)

Third Avenue Management LLC (10.39%)

Wintergreen Advisers, LLC (25.9%)

Other

Holland & Knight

KPMG LLP

SunTrust

The Root Organization (William Voges’ company purchases property from the Company)

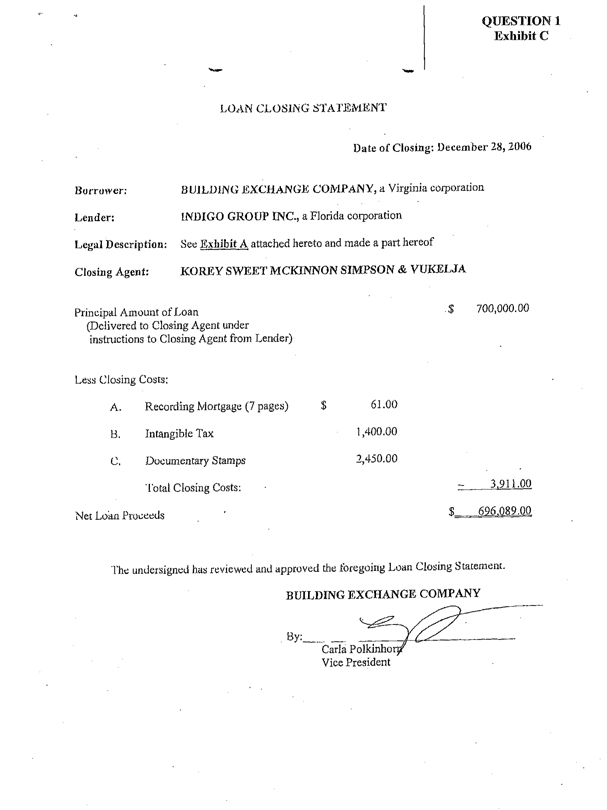

QUESTION 1

Exhibit C

LOAN CLOSING STATEMENT

Date of Closing: December 28, 2006

Borrower: BUILDING EXCHANGE COMPANY, a Virginia corporation

Lender: INDIGO GROUP INC., a Florida corporation

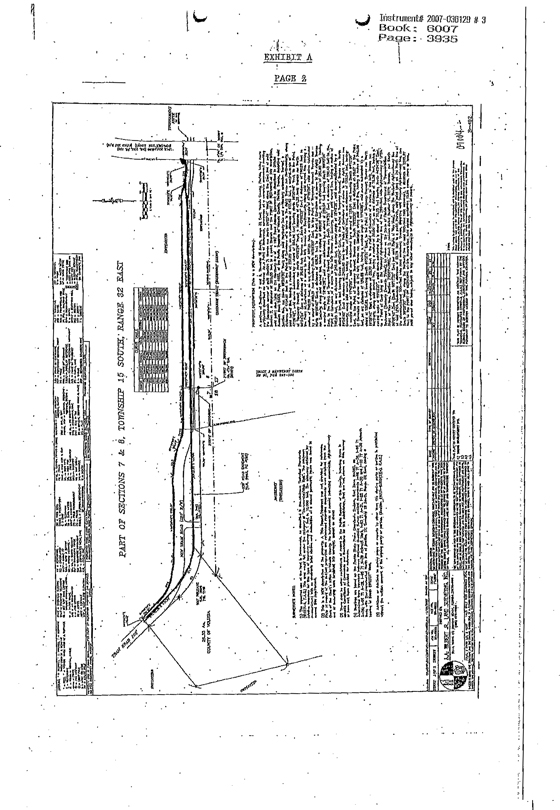

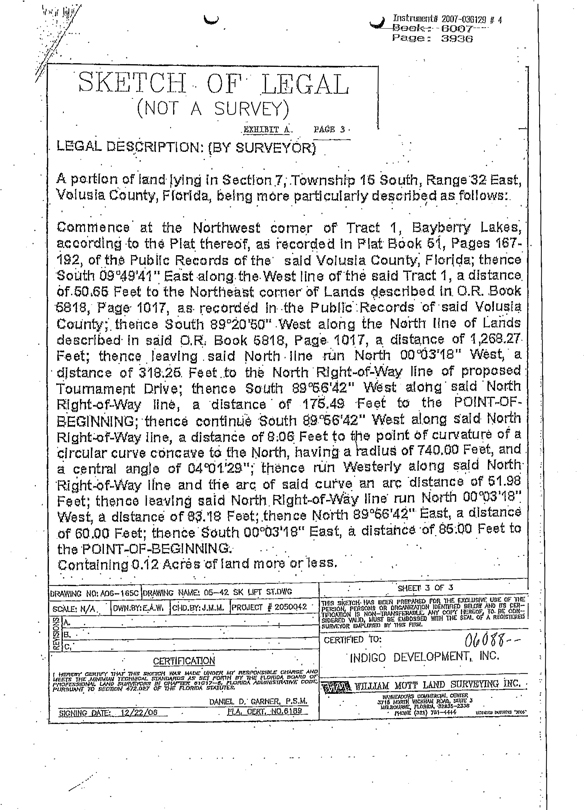

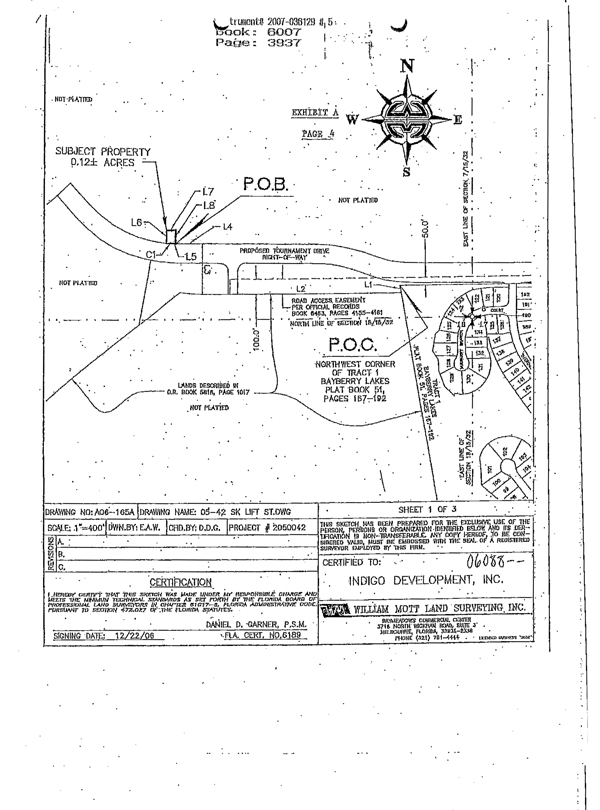

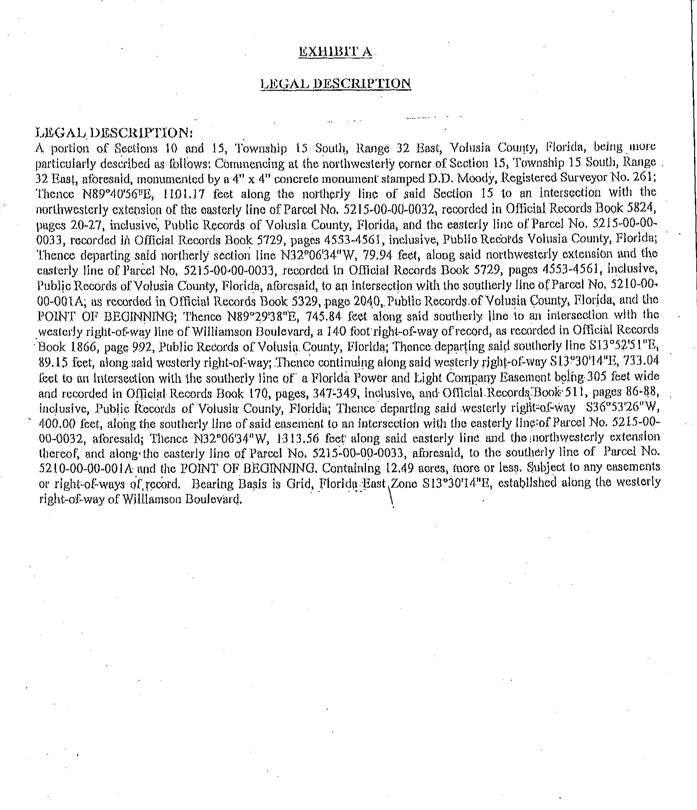

Legal Description: See Exhibit A attached hereto and made a part hereof

Closing Agent: KOREY SWEET MCKINNON SIMPSON & VUKELJA

Principal Amount of Loan $700,000.00

(Delivered to Closing Agent under

instructions to Closing Agent from Lender)

Less Closing Costs:

A. Recording Mortgage (7 pages) $61.00

B. Intangible Tax 1,400.00