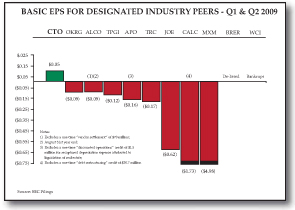

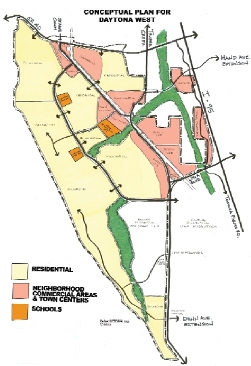

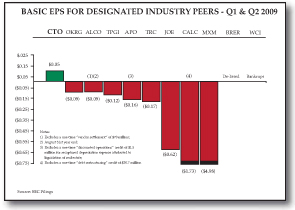

As we enter the fourth quarter, we want to update you on the state of our business and highlight several events that we believe will have an impact on the Company. During 2009 we saw the continuation of a global recession and no discernible improvement in the Florida real estate market. In response to the economic slowdown, the Florida Legislature adopted major changes to Florida’s growth management laws that regulate our industry. These events will affect the Florida real estate industry for years to come. Fortunately, Consolidated-Tomoka Land Co. (NYSE Amex: CTO) is well-positioned to weather the current downturn and capitalize on opportunities in the Florida real estate market over the next several years. Due to our unique business strategy developed in 1999, Consolidated Tomoka remains financially strong and profitable. By reinvesting land sale proceeds using tax-deferred exchanges into high quality, income-producing properties, the Company has created a reliable source of recurring income. Currently, our income property portfolio generates over $9 million in annual revenue. With an average remaining lease term of 11 years, we anticipate that the Company will meet its operating capital requirements for the foreseeable future without having to liquidate portions of its valuable real estate holdings at below-market prices in order to generate cash—as so many in the real estate industry and other industries have been forced to do. During the first and second quarters of 2009, the Company per share of $0.06 and $0.03, respectively. As illustrated, we outperformed virtually every Company in our designated peer group, with most of our peer group companies posting negative earnings per share in either the first or second quarter of 2009. Consolidated Tomoka was the only company in our designated peer group that was profitable from continuing operations during the first half of 2009. | | | | During the first nine months of 2009, the Company made progress in a number of other areas: CAPITAL INVESTMENT IN ROADS During the first quarter of 2009, Consolidated Tomoka, the City of Daytona Beach, and Volusia County signed an agreement to construct the Dunn Avenue Extension. When completed, Dunn Avenue – a major east-west corridor – will extend across Interstate 95 and connect the east side of the City to our westerly commercial landholdings. We believe improved access will increase the development potential and future value of our lands. The Company will invest $1.125 million towards the construction of this estimated $13 million thoroughfare extension, with the balance of the funding coming from local partners, Federal stimulus funds, and other matching grants. FLORIDA GROWTH MANAGEMENT LEGISLATION (SB 360) In May, the Florida Legislature passed Senate Bill 360, which provides for sweeping changes to Florida’s growth management laws. We believe these changes will result in significant benefits to the Company. Specifically, under the new law: • the Company will no longer be required to develop large projects under the Florida Development of Regional Impact (DRI) statute, which should result in significant cost savings and eliminate prolonged regulatory review; • the DRI exemption will now allow the Company to market conceptual plans for all of its Daytona Beach lands; and | | | |

• there is an exemption from road concurrency requirements (failing roads), which will relieve qualified new development from the additional expense of rectifying certain existing road deficiencies. NEW DEVELOPMENTS The Daytona Beach Police Department opened its new headquarters in February, Florida Hospital opened its Memorial Medical Center in July, and Champion Elementary School opened for the current school year. All three facilities were originally part of our landholdings and will promote and serve future growth on our lands. In response to interest in medical offices near Florida |