(NYSE MKT: CTO) Year End 2015 Investor Presentation Published: March 7, 2016

If we refer to “we,” “us,” “our,” or “the Company,” we mean Consolidated-Tomoka Land Co. and its consolidated subsidiaries. Certain statements contained in this presentation (other than statements of historical fact) are forward-looking statements. Words such as “believe,” “estimate,” “expect,” “intend,” “anticipate,” “will,” “could,” “may,” “should,” “plan,” “potential,” “predict,” “forecast,” “project,” and similar expressions and variations thereof identify certain of such forward-looking statements, which speak only as of the dates on which they were made. Although forward-looking statements are made based upon management’s expectations and beliefs concerning future developments and their potential effect upon the Company, a number of factors could cause the Company’s actual results to differ materially from those set forth in the forward-looking statements. Such factors may include uncertainties associated with closing land transactions or other dispositions of assets, including the likelihood, timing, and final transaction terms thereof, the estimate of the cost of completing infrastructure work affiliated with certain land transactions and the impact on the total estimated gain as well as the timing of the recognition of that gain, our ability to obtain necessary governmental approvals for our land transactions or to satisfy other closing conditions, as well as the uncertainties and risk factors discussed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the Securities and Exchange Commission. There can be no assurance that future developments will be in accordance with management’s expectations or that the effect of future developments on the Company will be those anticipated by management.

A Snapshot ($ in millions except share data) Positioned for Growth As of December 31, 2015 (unless otherwise noted) Assuming the reinvestment of dividends Total debt reflects face value for Convertible Notes of $75mm Includes restricted cash CTO: 2015 Share Performance (1) -5.5% RMZ Index: 2015 Index Performance (1) 2.5% CTO: Stock Price (as of February 19, 2016) $48.20 Equity Market Capitalization (as of February 19, 2016) $284.8 Total Debt (2) $173.7 Cash (3) $18.1 Other Liabilities $97.2 Total Enterprise Value (Equity Market Cap as of February 19, 2016) $458.5 Debt less Cash (3) / Total Enterprise Value (Enterprise Value as of February 19, 2016) 33.9% Annual Dividend / Yield (based on stock price as of February 19, 2016) $0.08 / 0.17%

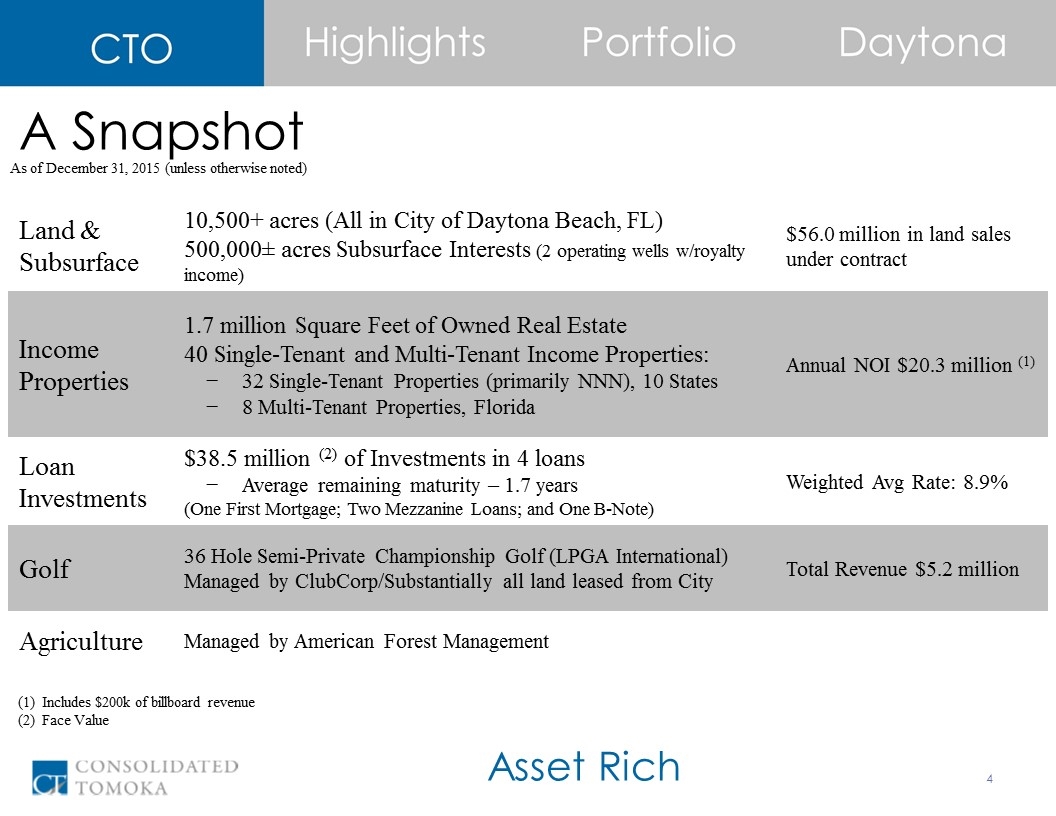

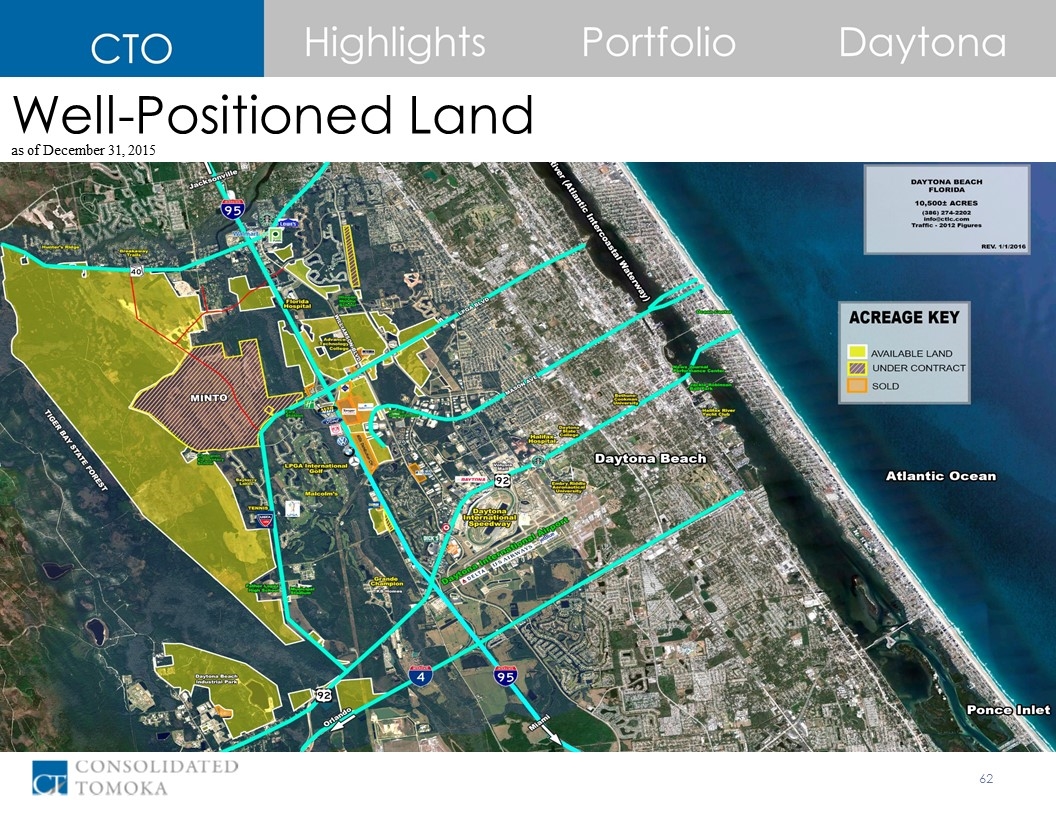

Land & Subsurface 10,500+ acres (All in City of Daytona Beach, FL) 500,000± acres Subsurface Interests (2 operating wells w/royalty income) $56.0 million in land sales under contract Income Properties 1.7 million Square Feet of Owned Real Estate 40 Single-Tenant and Multi-Tenant Income Properties: 32 Single-Tenant Properties (primarily NNN), 10 States 8 Multi-Tenant Properties, Florida Annual NOI $20.3 million (1) Loan Investments $38.5 million (2) of Investments in 4 loans Average remaining maturity – 1.7 years (One First Mortgage; Two Mezzanine Loans; and One B-Note) Weighted Avg Rate: 8.9% Golf 36 Hole Semi-Private Championship Golf (LPGA International) Managed by ClubCorp/Substantially all land leased from City Total Revenue $5.2 million Agriculture Managed by American Forest Management A Snapshot As of December 31, 2015 (unless otherwise noted) Asset Rich Includes $200k of billboard revenue Face Value

Cash Flow PositiveFocus on growing high quality (consistent) cash flows Focus on geographic diversity/key markets Development LightLimit exposure to development Focus on bringing in high quality/experienced owner/operators (Tanger, Minto, Distribution Center company) Efficient G&AOnly 14 employees and 6 independent directors Low ‘frictional costs’ compared w/other real estate companies Modest Leverage Modest leverage at attractive rates and flexible structures CTO’s ‘Formula’ for Success

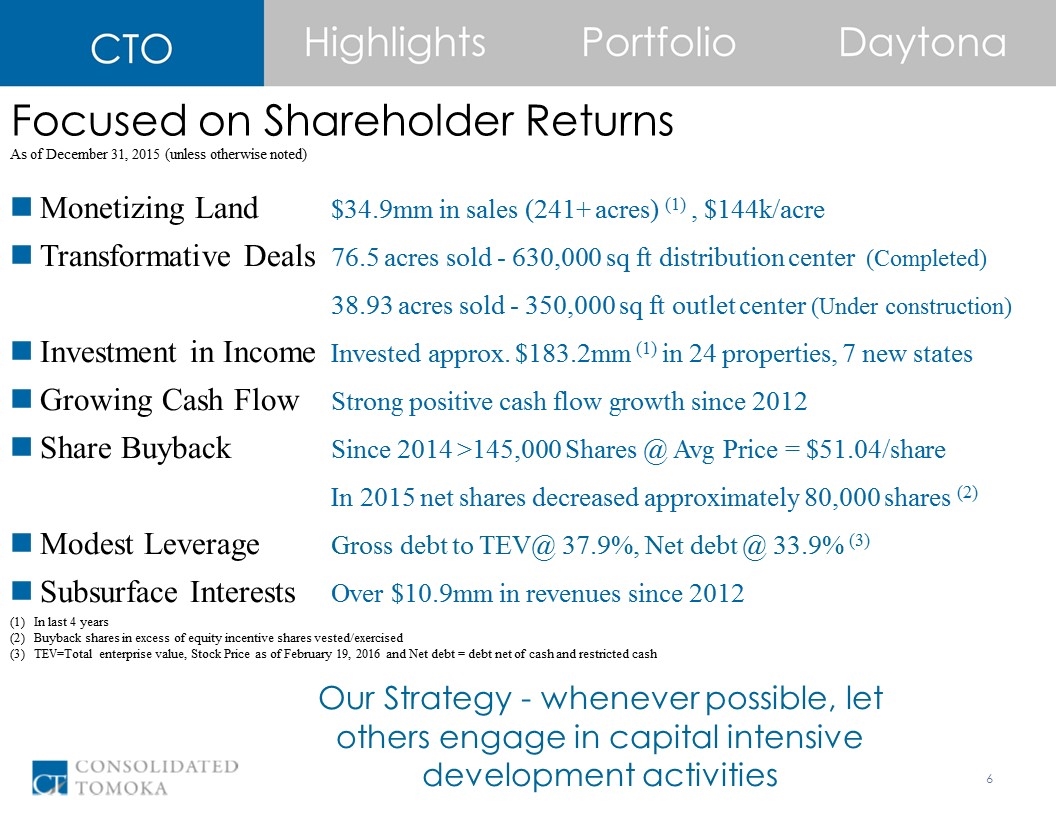

Monetizing Land$34.9mm in sales (241+ acres) (1) , $144k/acre Transformative Deals76.5 acres sold - 630,000 sq ft distribution center (Completed) 38.93 acres sold - 350,000 sq ft outlet center (Under construction) Investment in IncomeInvested approx. $183.2mm (1) in 24 properties, 7 new states Growing Cash FlowStrong positive cash flow growth since 2012 Share BuybackSince 2014 >145,000 Shares @ Avg Price = $51.04/share In 2015 net shares decreased approximately 80,000 shares (2) Modest Leverage Gross debt to TEV@ 37.9%, Net debt @ 33.9% (3) Subsurface InterestsOver $10.9mm in revenues since 2012 Focused on Shareholder Returns Our Strategy - whenever possible, let others engage in capital intensive development activities In last 4 years Buyback shares in excess of equity incentive shares vested/exercised TEV=Total enterprise value, Stock Price as of February 19, 2016 and Net debt = debt net of cash and restricted cash As of December 31, 2015 (unless otherwise noted)

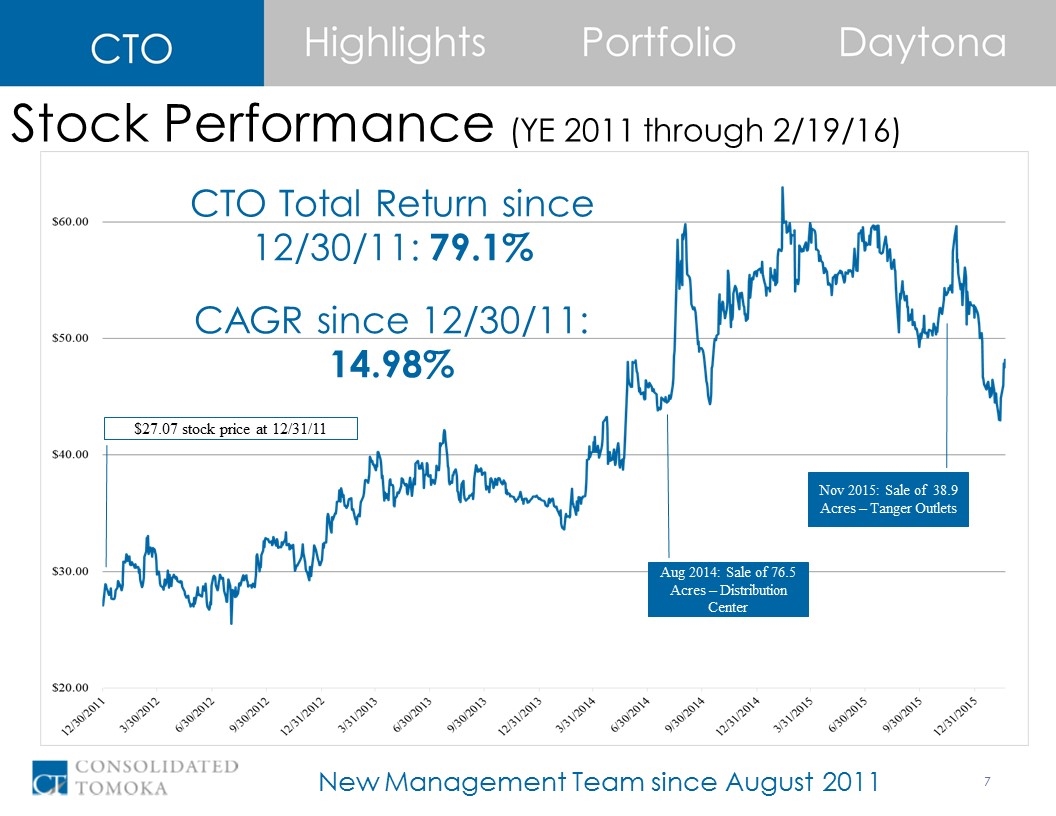

Stock Performance (YE 2011 through 2/19/16) Aug 2014: Sale of 76.5 Acres – Distribution Center Nov 2015: Sale of 38.9 Acres – Tanger Outlets $27.07 stock price at 12/31/11 New Management Team since August 2011 CTO Total Return since 12/30/11: 79.1% CAGR since 12/30/11: 14.98%

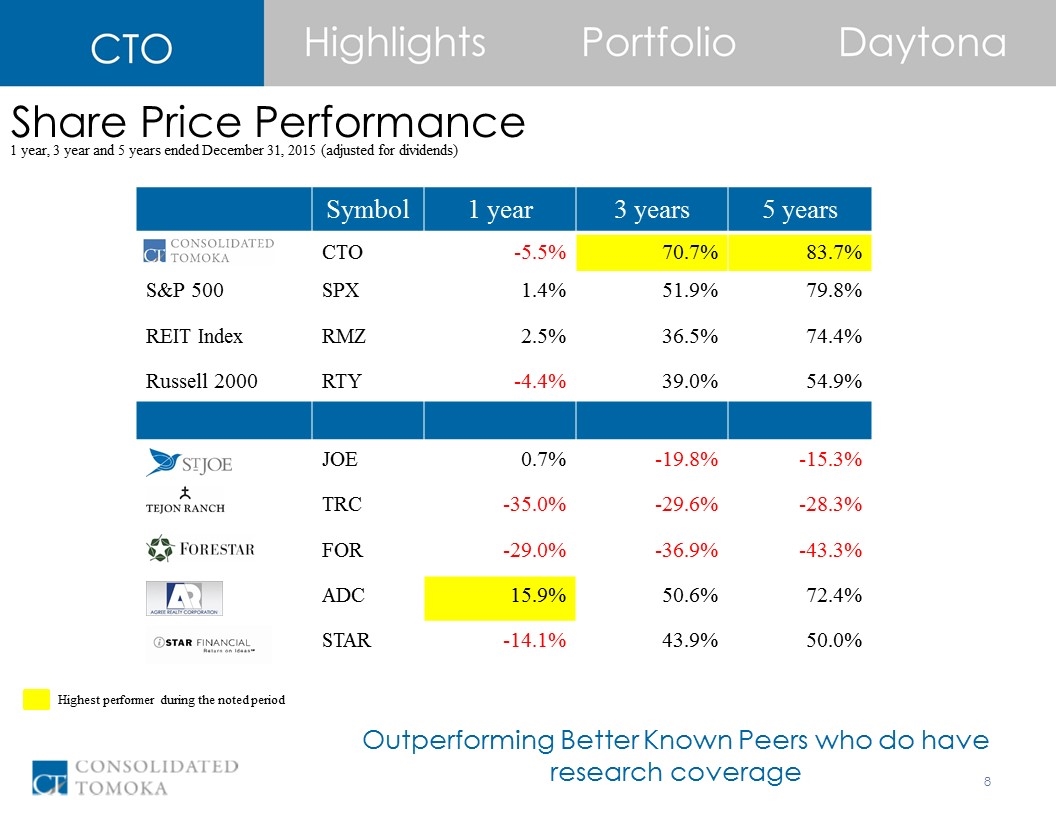

Share Price Performance 1 year, 3 year and 5 years ended December 31, 2015 (adjusted for dividends) Symbol 1 year 3 years 5 years CTO -5.5% 70.7% 83.7% S&P 500 SPX 1.4% 51.9% 79.8% REIT Index RMZ 2.5% 36.5% 74.4% Russell 2000 RTY -4.4% 39.0% 54.9% JOE 0.7% -19.8% -15.3% TRC -35.0% -29.6% -28.3% FOR -29.0% -36.9% -43.3% ADC 15.9% 50.6% 72.4% STAR -14.1% 43.9% 50.0% Outperforming Better Known Peers who do have research coverage Highest performer during the noted period

Total Revenues ($000’s) Operating Income ($000’s) Annual Results for 2011 – 2015 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Basic Earnings Per Share Positive Trends Book Value Per Share CAGR: 35.0% CAGR: 224.5% CAGR: 4.1% CAGR: 188.8%

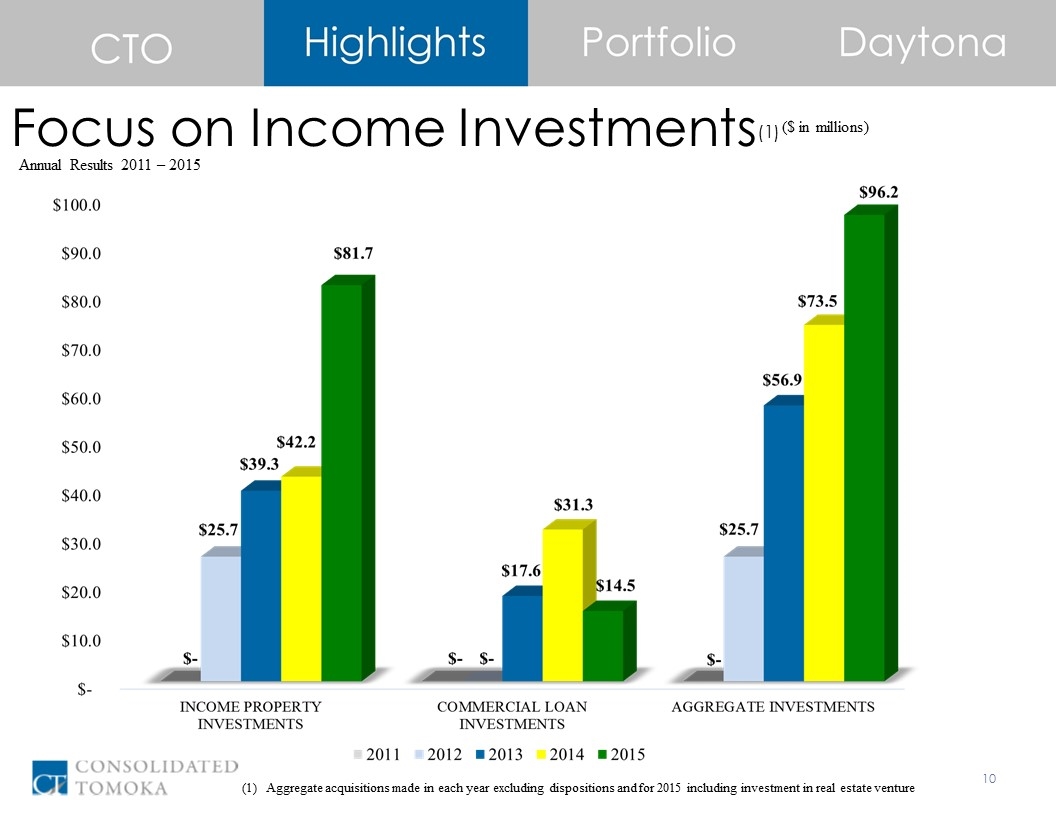

Focus on Income Investments(1) Annual Results 2011 – 2015 ($ in millions) Aggregate acquisitions made in each year excluding dispositions and for 2015 including investment in real estate venture

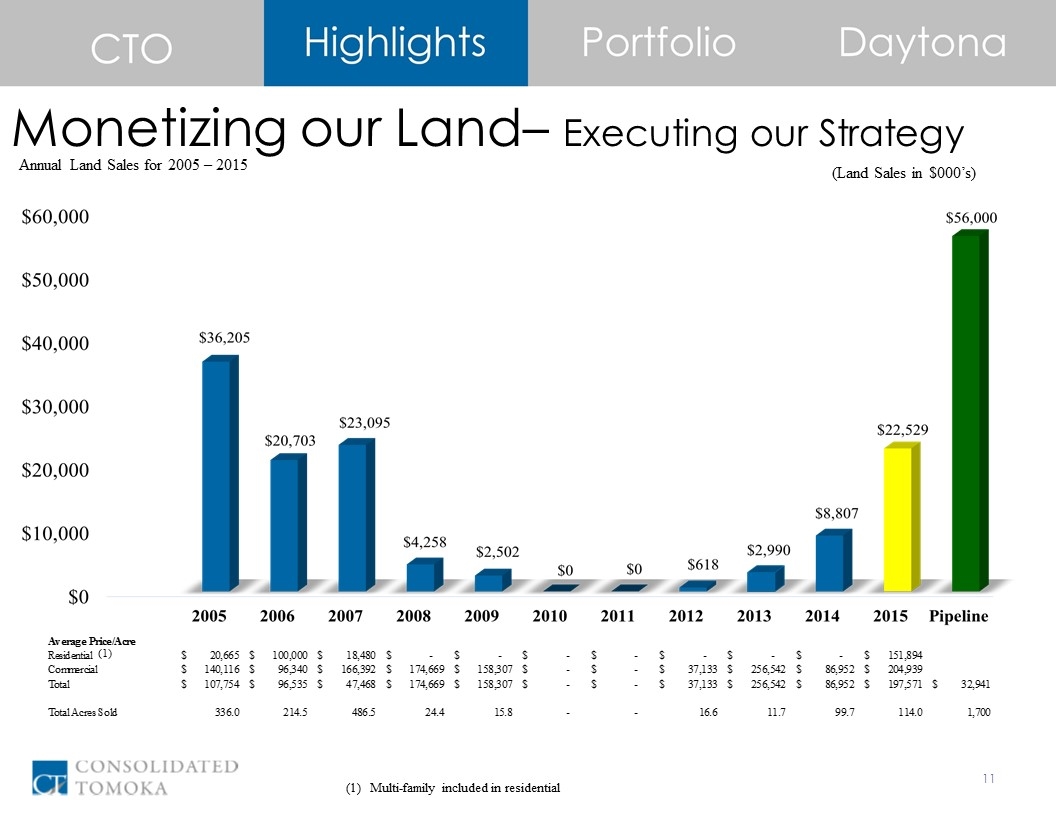

Monetizing our Land– Executing our Strategy Annual Land Sales for 2005 – 2015 (Land Sales in $000’s) Multi-family included in residential (1)

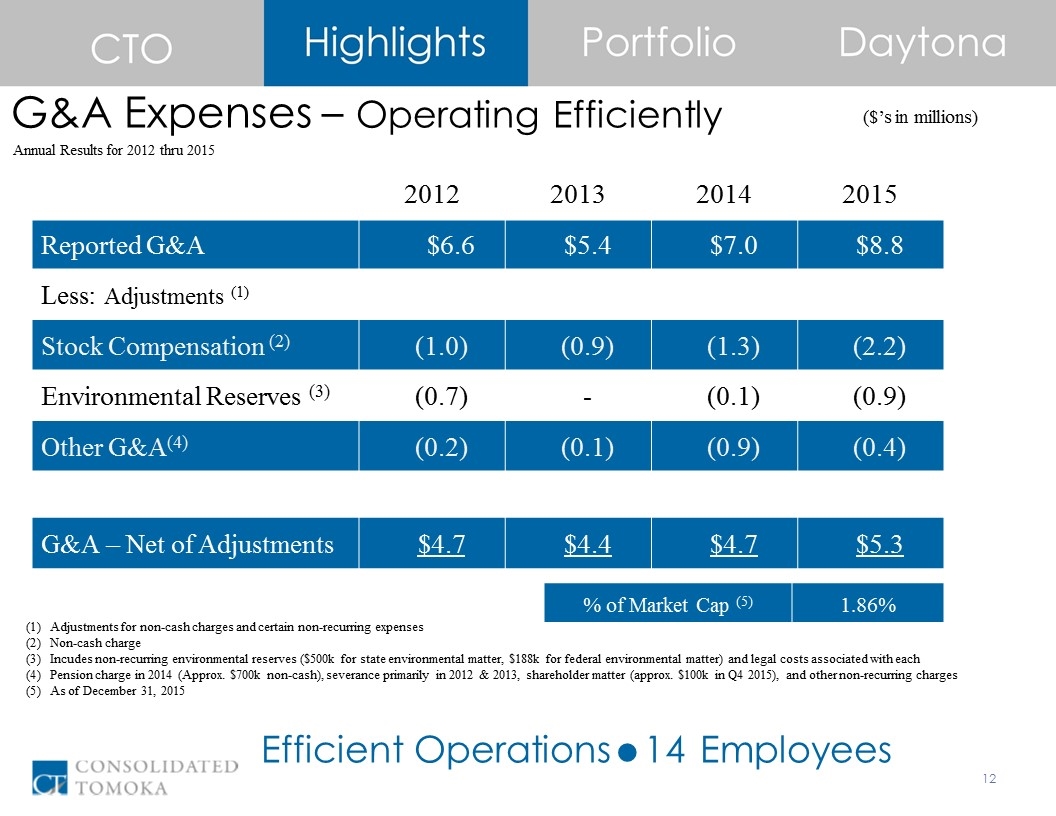

G&A Expenses – Operating Efficiently ($’s in millions) Annual Results for 2012 thru 2015 % of Market Cap (5) 1.86% 2012 2013 2014 2015 Reported G&A $6.6 $5.4 $7.0 $8.8 Less: Adjustments (1) Stock Compensation (2) (1.0) (0.9) (1.3) (2.2) Environmental Reserves (3) (0.7) - (0.1) (0.9) Other G&A(4) (0.2) (0.1) (0.9) (0.4) G&A – Net of Adjustments $4.7 $4.4 $4.7 $5.3 Adjustments for non-cash charges and certain non-recurring expenses Non-cash charge Incudes non-recurring environmental reserves ($500k for state environmental matter, $188k for federal environmental matter) and legal costs associated with each Pension charge in 2014 (Approx. $700k non-cash), severance primarily in 2012 & 2013, shareholder matter (approx. $100k in Q4 2015), and other non-recurring charges As of December 31, 2015 Efficient Operations=14 Employees

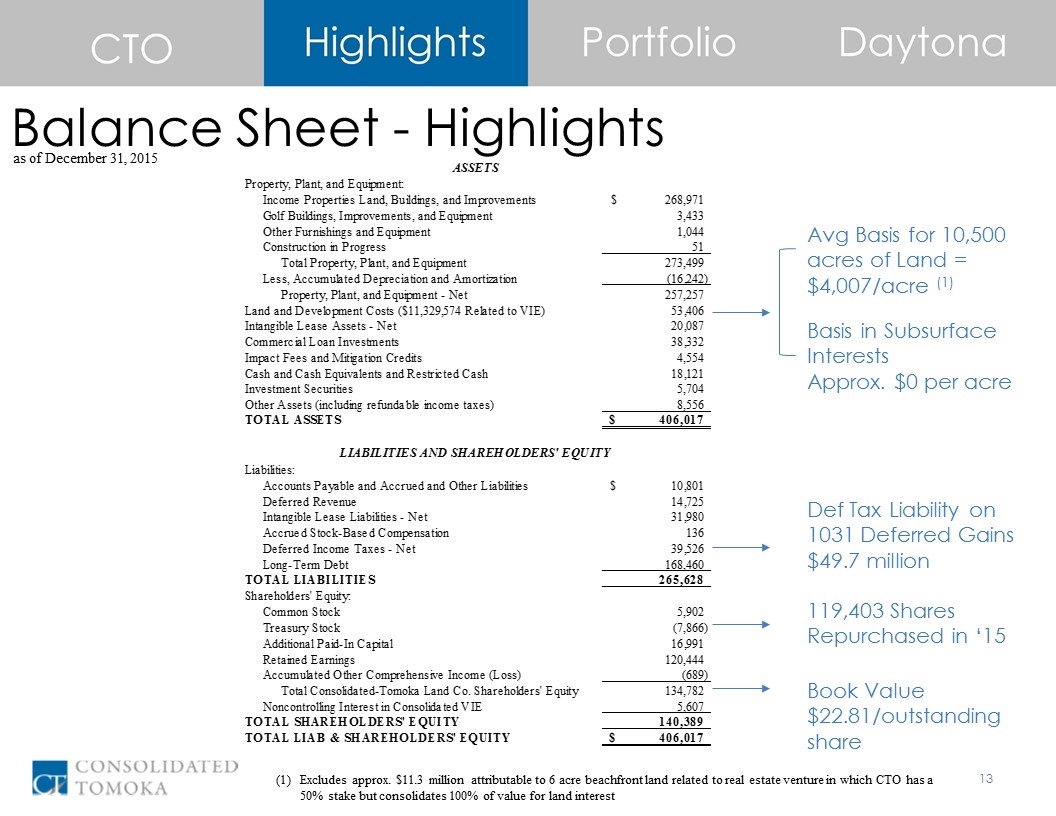

Balance Sheet - Highlights as of December 31, 2015 Excludes approx. $11.3 million attributable to 6 acre beachfront land related to real estate venture in which CTO has a 50% stake but consolidates 100% of value for land interest Avg Basis for 10,500 acres of Land = $4,007/acre (1) Basis in Subsurface Interests Approx. $0 per acre Def Tax Liability on 1031 Deferred Gains $49.7 million 119,403 Shares Repurchased in ‘15 Book Value $22.81/outstanding share

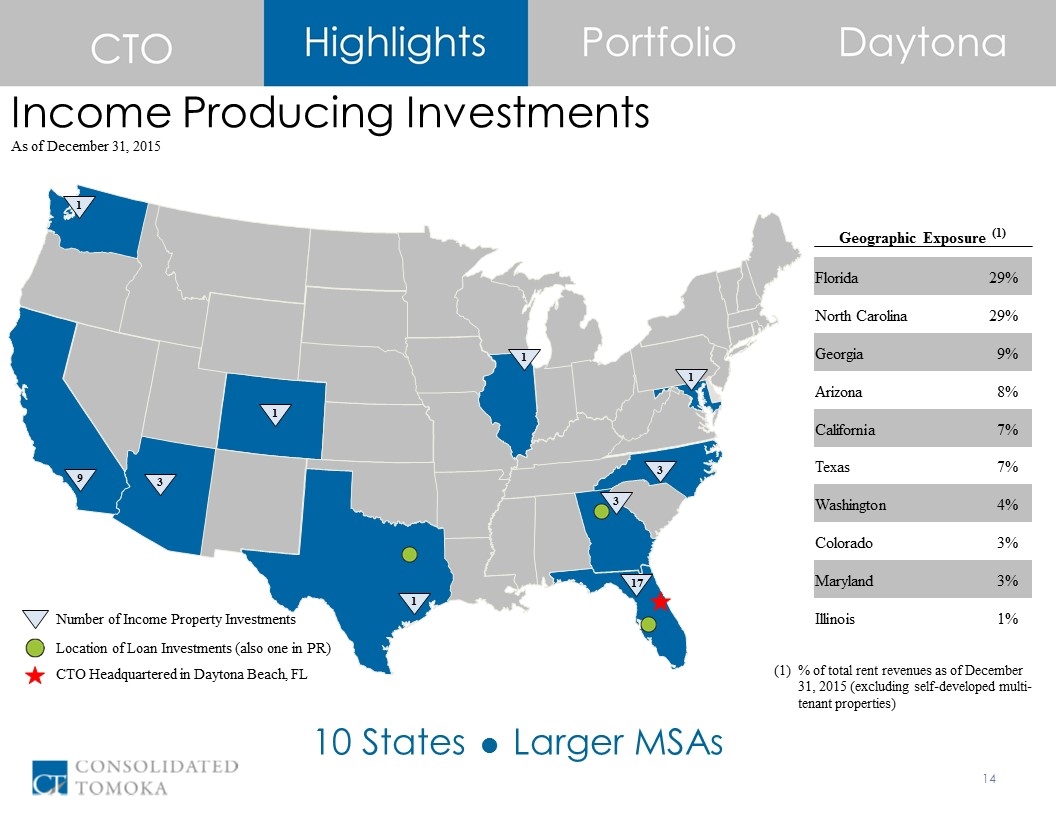

Location of Loan Investments (also one in PR) Number of Income Property Investments CTO Headquartered in Daytona Beach, FL 1 3 9 3 17 1 1 1 1 3 Income Producing Investments % of total rent revenues as of December 31, 2015 (excluding self-developed multi-tenant properties) Geographic Exposure (1) Florida 29% North Carolina 29% Georgia 9% Arizona 8% California 7% Texas 7% Washington 4% Colorado 3% Maryland 3% Illinois 1% 10 States = Larger MSAs As of December 31, 2015

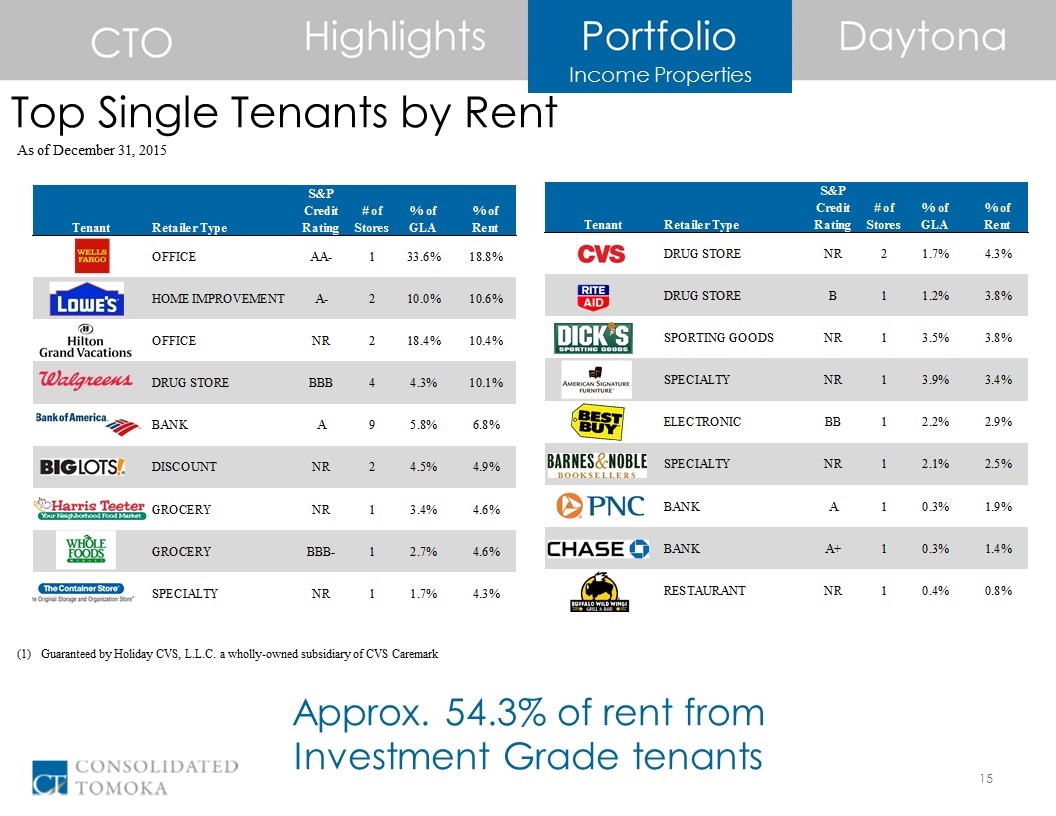

Income Properties Top Single Tenants by Rent As of December 31, 2015 Approx. 54.3% of rent from Investment Grade tenants Guaranteed by Holiday CVS, L.L.C. a wholly-owned subsidiary of CVS Caremark (1)

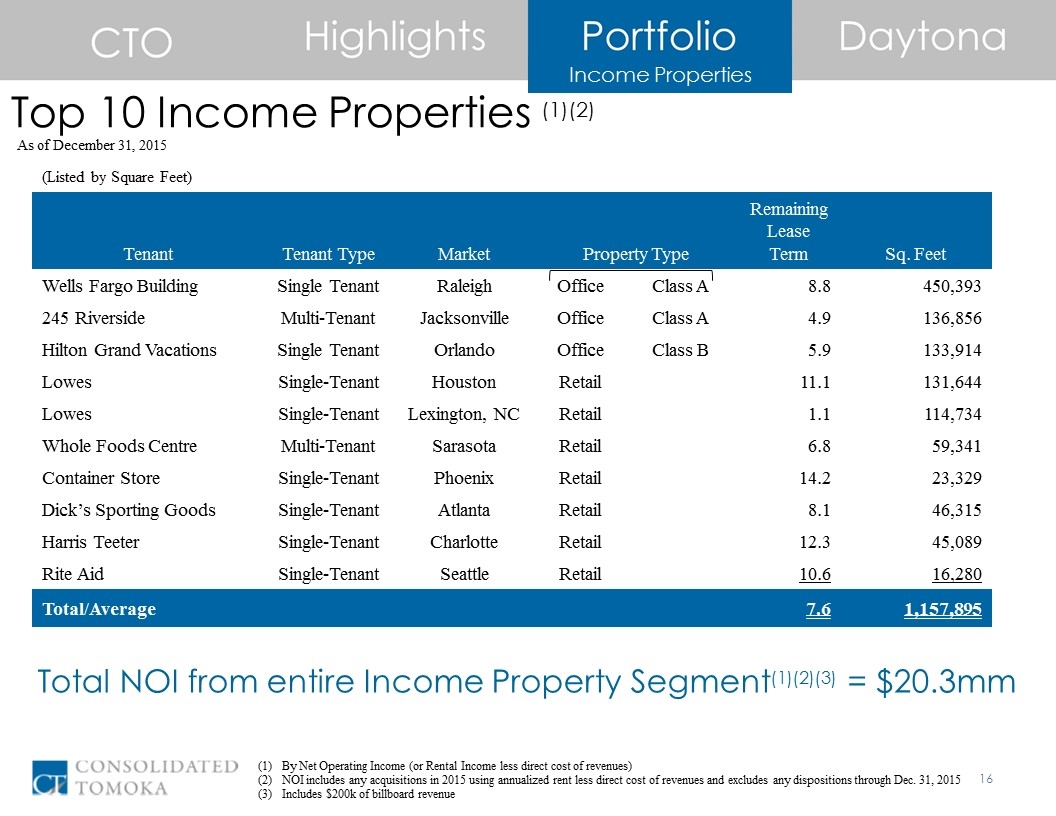

Income Properties Top 10 Income Properties (1)(2) Tenant Tenant Type Market Property Type Remaining Lease Term Sq. Feet Wells Fargo Building Single Tenant Raleigh Office Class A 8.8 450,393 245 Riverside Multi-Tenant Jacksonville Office Class A 4.9 136,856 Hilton Grand Vacations Single Tenant Orlando Office Class B 5.9 133,914 Lowes Single-Tenant Houston Retail 11.1 131,644 Lowes Single-Tenant Lexington, NC Retail 1.1 114,734 Whole Foods Centre Multi-Tenant Sarasota Retail 6.8 59,341 Container Store Single-Tenant Phoenix Retail 14.2 23,329 Dick’s Sporting Goods Single-Tenant Atlanta Retail 8.1 46,315 Harris Teeter Single-Tenant Charlotte Retail 12.3 45,089 Rite Aid Single-Tenant Seattle Retail 10.6 16,280 Total/Average 7.6 1,157,895 Total NOI from entire Income Property Segment(1)(2)(3) = $20.3mm By Net Operating Income (or Rental Income less direct cost of revenues) NOI includes any acquisitions in 2015 using annualized rent less direct cost of revenues and excludes any dispositions through Dec. 31, 2015 Includes $200k of billboard revenue (Listed by Square Feet) As of December 31, 2015

2015 Acquisition Income Properties Core Investment Wells Fargo Building (Raleigh, NC) Single-Tenant $42.3mm Investment Single-Tenant Class A Office Rent @ 50% below market Investment basis - $94/sq. ft. or approx. 50% below replacement cost 9.1 years weighted average remaining on lease @ acquisition Rent Escalation in 2019 450,393 Square Feet Investment Grade Tenant: Wells Fargo Bank N.A. (AA-) Approx. 40.0 acres

2015 Acquisition Income Properties Core Investment 245 Riverside (Jacksonville, FL) Multi-Tenant $25.1mm Investment Class A Office Strong Retail/Residential development activity in area Investment basis ($185/sq ft) below replacement cost 5.4 years weighted average remaining on leases @ acquisition 99% Occupied 136,856 Square Feet Former St. Joe Headquarters built in 2003

2015 Acquisition Income Properties 14.7 years remaining on lease @ acquisition 3-mi Pop. 106,525 3-mi Avg HHI $76,173 23,329 Square Feet 2015 New Construction Single-Tenant, Triple Net Lease Outparcel to Macerich’s Arrowhead Mall (avg. sales of $650 per sq. ft.) Major renovation of mall announced by Macerich Core Investment The Container Store (Glendale, AZ) Single-Tenant $8.6mm Investment

2014 Acquisition Income Properties Core Investment 7.1 years weighted average remaining on leases @ acquisition 59,341 Square Feet - 95% Occupied 3-mi Pop. 68,157 3-mi Avg HHI $63,561 36,000 square feet (or 61% of property) leased to free standing Whole Foods Market BBB- Credit 9 yrs remaining on lease @ acquisition 23,000 square feet of ground floor retail 455 space parking garage Whole Foods Market Centre (Sarasota, FL) Multi-Tenant $19.1mm Investment

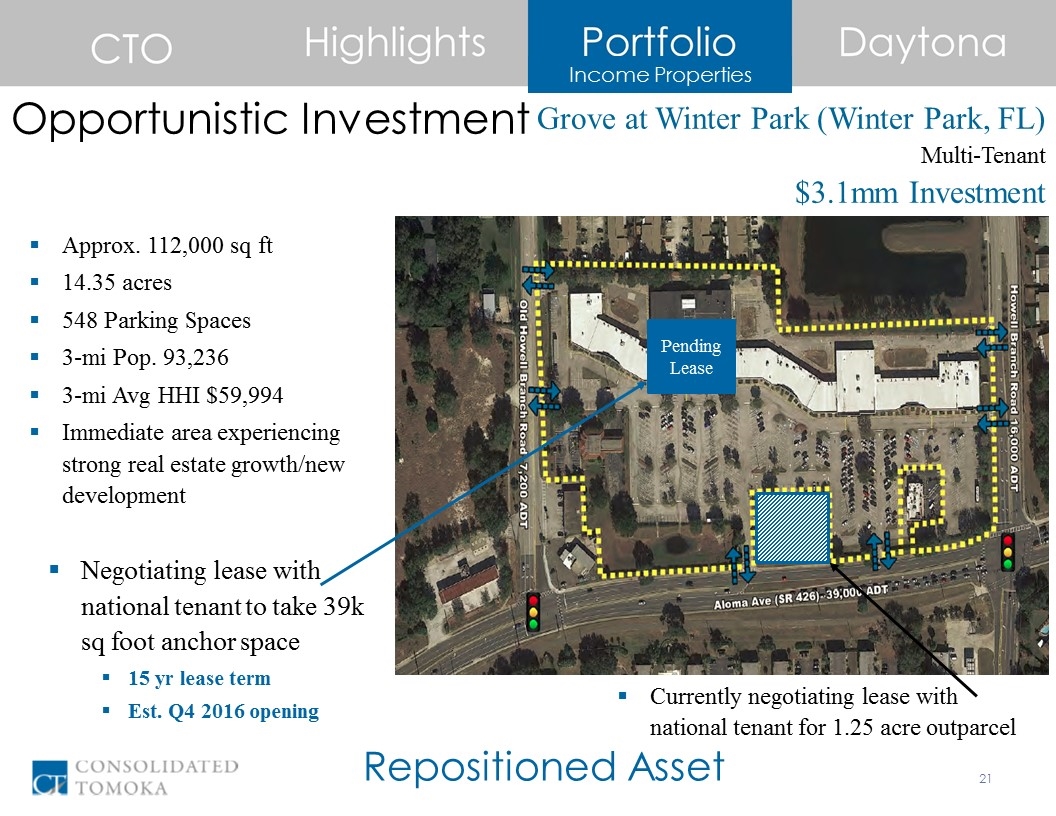

Opportunistic Investment Income Properties Repositioned Asset Approx. 112,000 sq ft 14.35 acres 548 Parking Spaces 3-mi Pop. 93,236 3-mi Avg HHI $59,994 Immediate area experiencing strong real estate growth/new development Grove at Winter Park (Winter Park, FL) Multi-Tenant $3.1mm Investment Negotiating lease with national tenant to take 39k sq foot anchor space 15 yr lease term Est. Q4 2016 opening Currently negotiating lease with national tenant for 1.25 acre outparcel Pending Lease

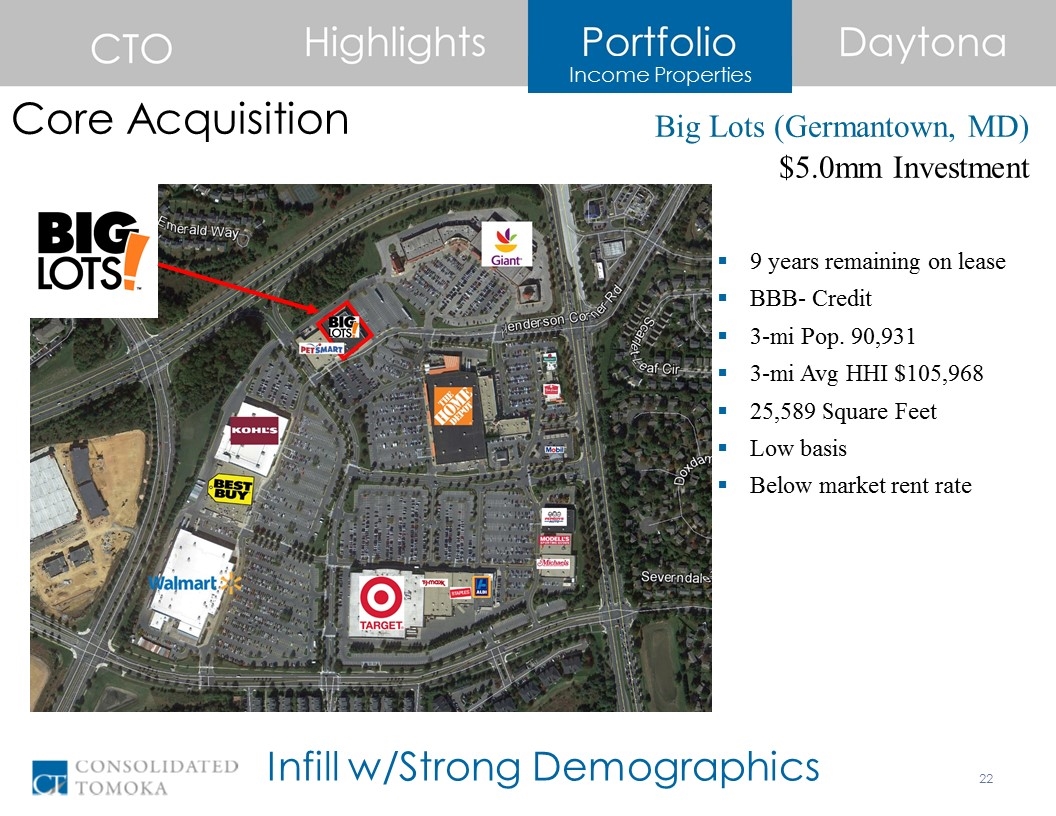

Core Acquisition Income Properties Infill w/Strong Demographics 9 years remaining on lease BBB- Credit 3-mi Pop. 90,931 3-mi Avg HHI $105,968 25,589 Square Feet Low basis Below market rent rate Big Lots (Germantown, MD) $5.0mm Investment

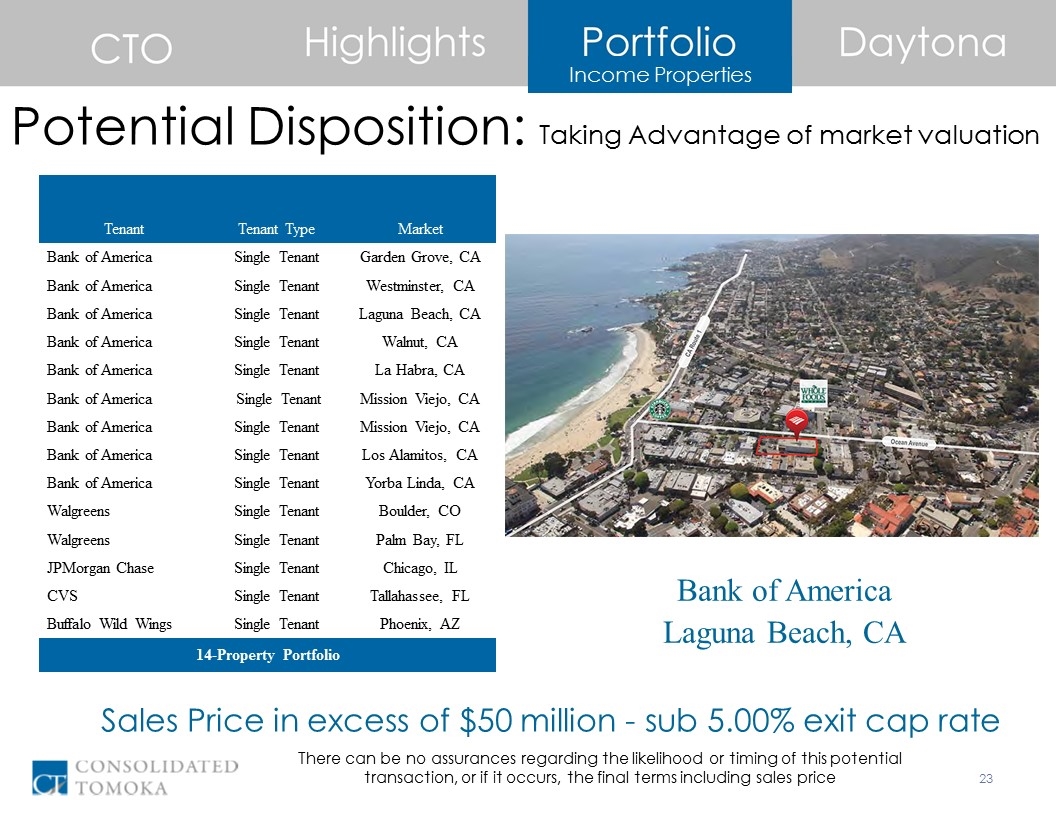

Income Properties Potential Disposition: Taking Advantage of market valuation Bank of America Laguna Beach, CA Tenant Tenant Type Market Bank of America Single Tenant Garden Grove, CA Bank of America Single Tenant Westminster, CA Bank of America Single Tenant Laguna Beach, CA Bank of America Single Tenant Walnut, CA Bank of America Single Tenant La Habra, CA Bank of America Single Tenant Mission Viejo, CA Bank of America Single Tenant Mission Viejo, CA Bank of America Single Tenant Los Alamitos, CA Bank of America Single Tenant Yorba Linda, CA Walgreens Single Tenant Boulder, CO Walgreens Single Tenant Palm Bay, FL JPMorgan Chase Single Tenant Chicago, IL CVS Single Tenant Tallahassee, FL Buffalo Wild Wings Single Tenant Phoenix, AZ 14-Property Portfolio Sales Price in excess of $50 million - sub 5.00% exit cap rate There can be no assurances regarding the likelihood or timing of this potential transaction, or if it occurs, the final terms including sales price

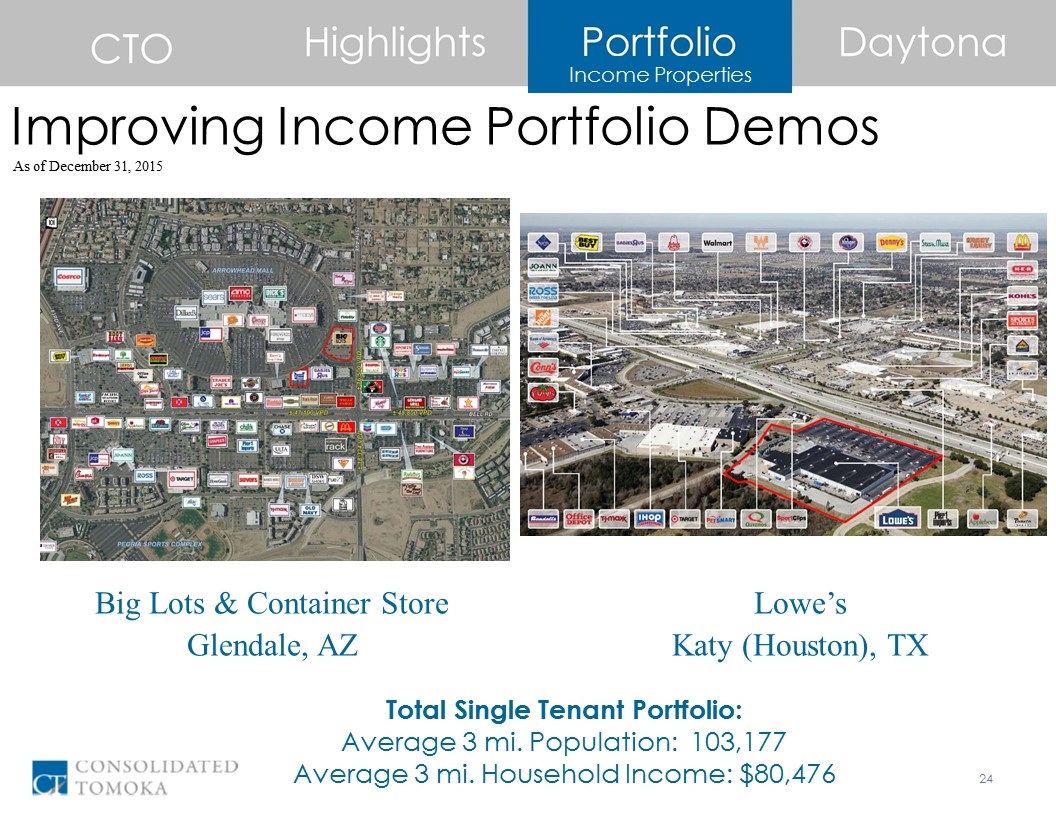

Income Properties Improving Income Portfolio Demos Total Single Tenant Portfolio: Average 3 mi. Population: 103,177 Average 3 mi. Household Income: $80,476 Big Lots & Container Store Glendale, AZ Lowe’s Katy (Houston), TX As of December 31, 2015

Self-Developed Properties: weighted average occupancy 91% Income Properties as of December 31, 2015 Concierge Office 22,000 sq. ft. Year Built: 2009 100% leased Major Tenants Merrill Lynch KB Homes Mason Commerce Center 31,000 sq. ft. Year Built: 2009 100% leased Major Tenants State of Florida Williamson Business Park 31,000 sq. ft. Year Built: 2014 75% leased Major Tenants Teledyne Oil & Gas Lamar Outdoor Developing Our Land When Appropriate = Strong Leasing

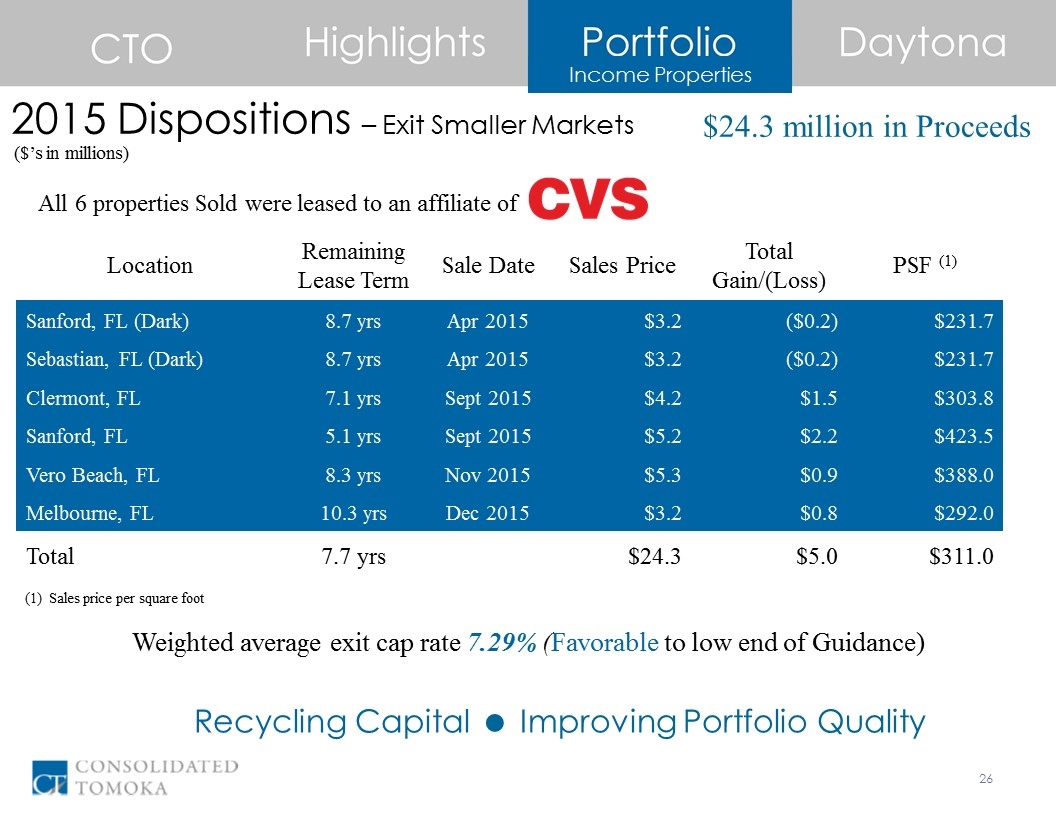

2015 Dispositions – Exit Smaller Markets Income Properties Recycling Capital = Improving Portfolio Quality $24.3 million in Proceeds All 6 properties Sold were leased to an affiliate of ($’s in millions) Weighted average exit cap rate 7.29% (Favorable to low end of Guidance) Sales price per square foot Location Remaining Lease Term Sale Date Sales Price Total Gain/(Loss) PSF (1) Sanford, FL (Dark) 8.7 yrs Apr 2015 $3.2 ($0.2) $231.7 Sebastian, FL (Dark) 8.7 yrs Apr 2015 $3.2 ($0.2) $231.7 Clermont, FL 7.1 yrs Sept 2015 $4.2 $1.5 $303.8 Sanford, FL 5.1 yrs Sept 2015 $5.2 $2.2 $423.5 Vero Beach, FL 8.3 yrs Nov 2015 $5.3 $0.9 $388.0 Melbourne, FL 10.3 yrs Dec 2015 $3.2 $0.8 $292.0 Total 7.7 yrs $$24.3 $5.0 $311.0

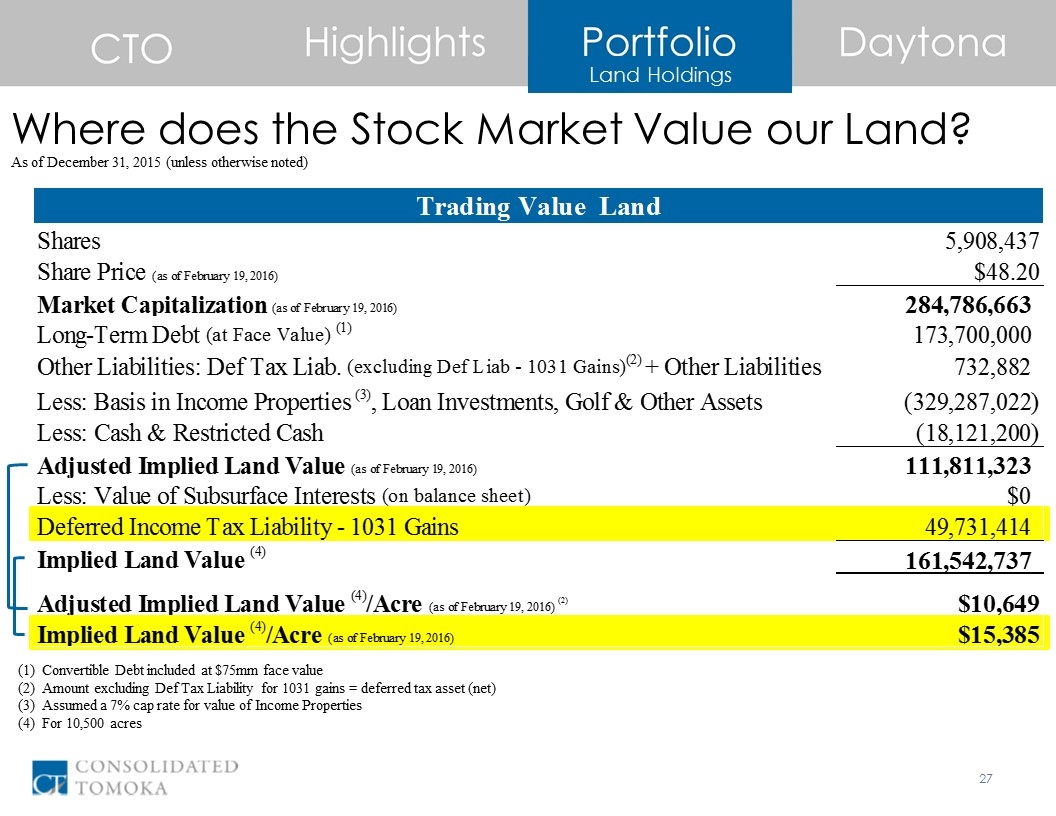

Land Holdings Where does the Stock Market Value our Land? As of December 31, 2015 (unless otherwise noted) Convertible Debt included at $75mm face value Amount excluding Def Tax Liability for 1031 gains = deferred tax asset (net) Assumed a 7% cap rate for value of Income Properties For 10,500 acres

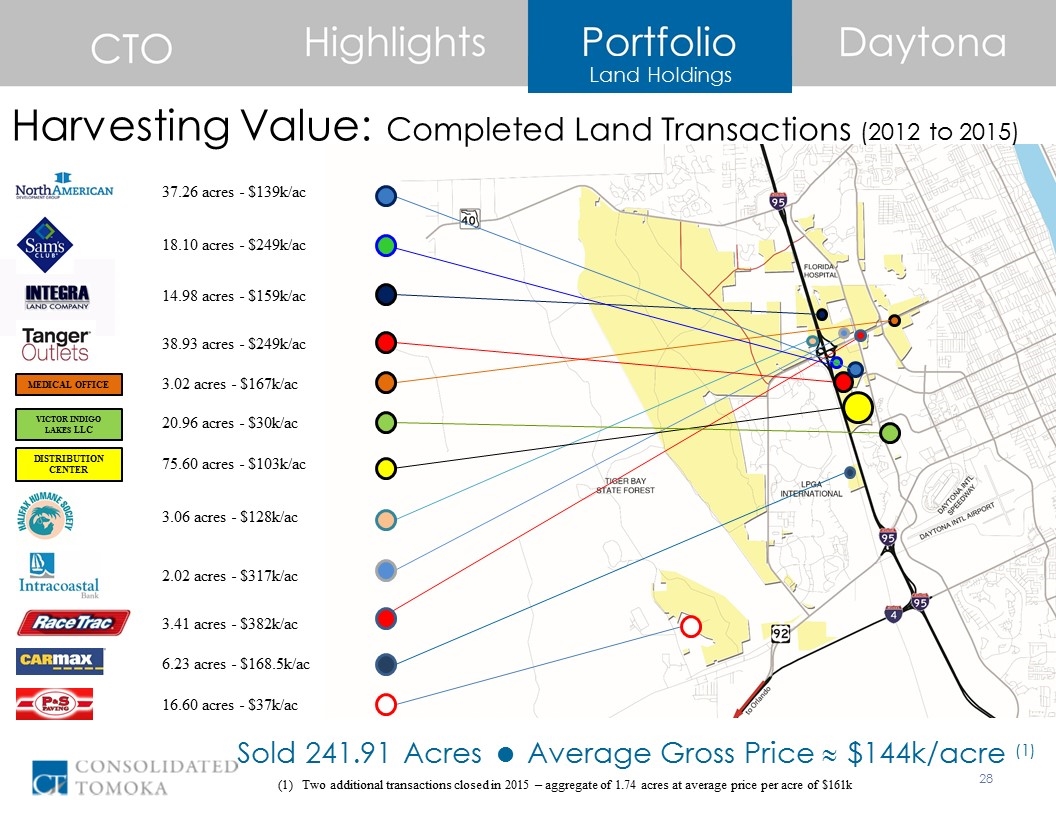

Land Holdings 20.96 acres - $30k/ac Harvesting Value: Completed Land Transactions (2012 to 2015) Sold 241.91 Acres = Average Gross Price » $144k/acre (1) DISTRIBUTION CENTER VICTOR INDIGO LAKES LLC 75.60 acres - $103k/ac 3.06 acres - $128k/ac 2.02 acres - $317k/ac 3.41 acres - $382k/ac 6.23 acres - $168.5k/ac 16.60 acres - $37k/ac 3.02 acres - $167k/ac MEDICAL OFFICE 38.93 acres - $249k/ac Two additional transactions closed in 2015 – aggregate of 1.74 acres at average price per acre of $161k 18.10 acres - $249k/ac 14.98 acres - $159k/ac 37.26 acres - $139k/ac

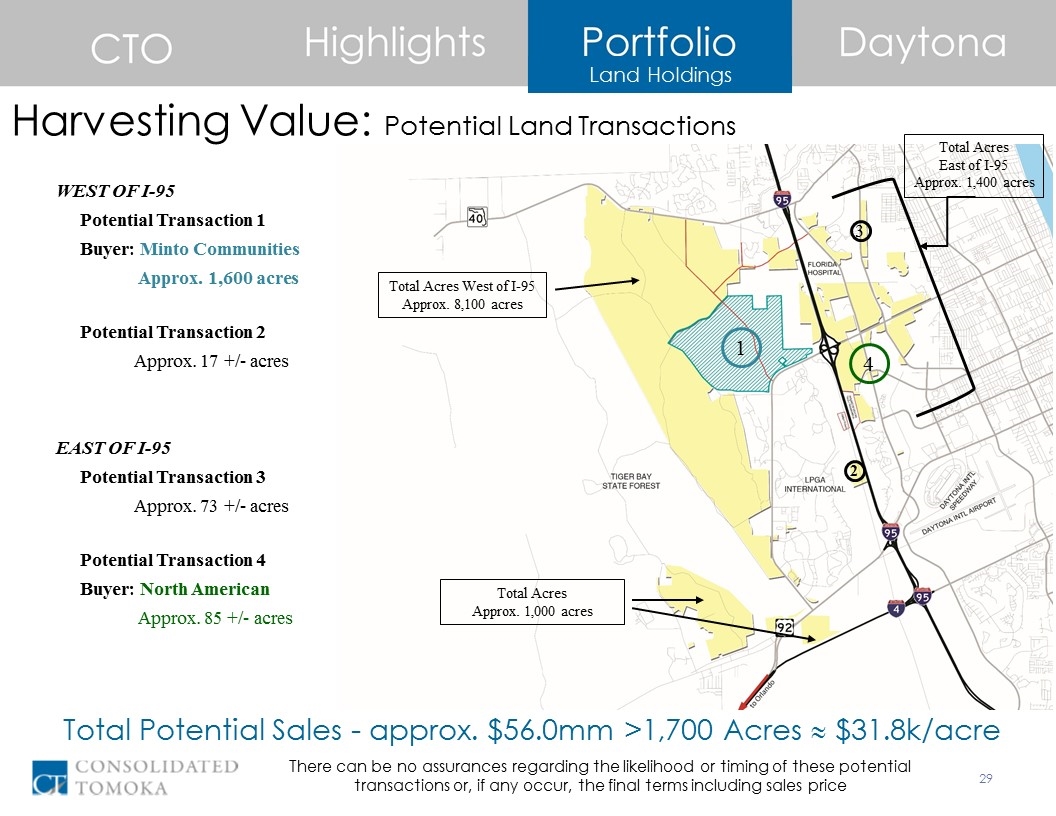

Land Holdings WEST OF I-95 Potential Transaction 1 Buyer: Minto Communities Approx. 1,600 acres Potential Transaction 2 Approx. 17 +/- acres EAST OF I-95 Potential Transaction 3 Approx. 73 +/- acres Potential Transaction 4 Buyer: North American Approx. 85 +/- acres Harvesting Value: Potential Land Transactions Total Potential Sales - approx. $56.0mm >1,700 Acres » $31.8k/acre Total Acres West of I-95 Approx. 8,100 acres Total Acres Approx. 1,000 acres Total Acres East of I-95 Approx. 1,400 acres There can be no assurances regarding the likelihood or timing of these potential transactions or, if any occur, the final terms including sales price 3 2 1 4

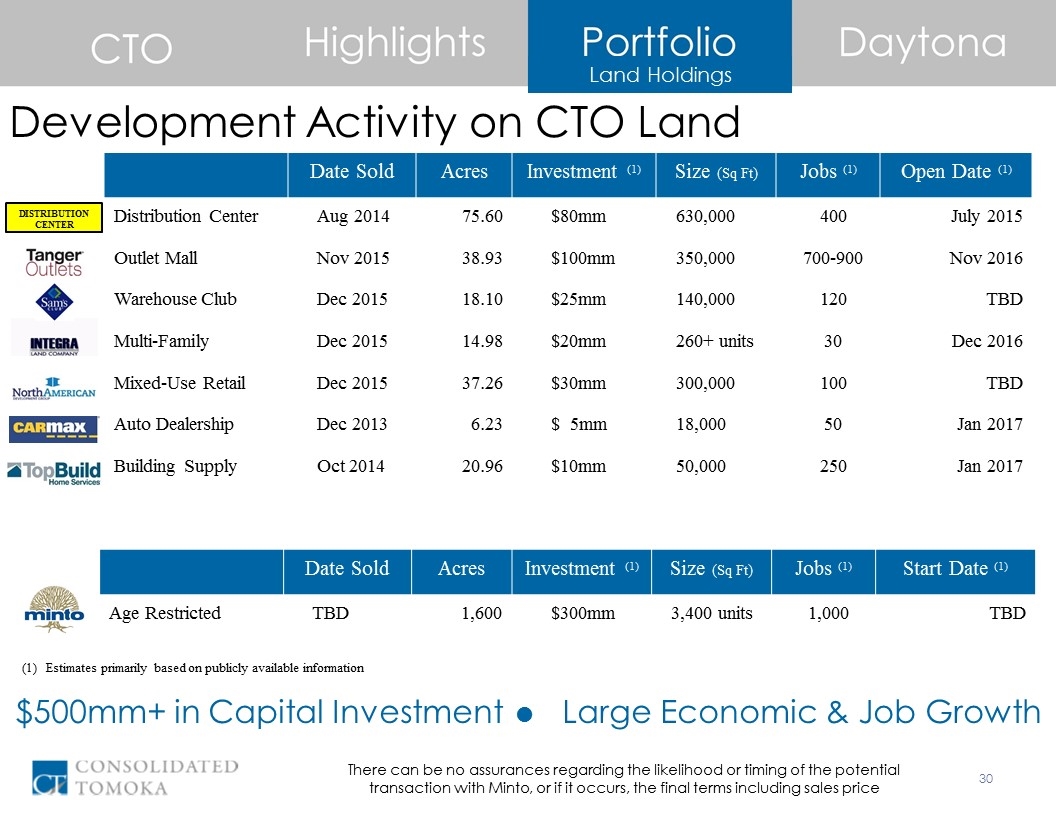

Land Holdings Development Activity on CTO Land There can be no assurances regarding the likelihood or timing of the potential transaction with Minto, or if it occurs, the final terms including sales price Date Sold Acres Investment (1) Size (Sq Ft) Jobs (1) Open Date (1) Distribution Center Aug 2014 75.60 $80mm 630,000 400 July 2015 Outlet Mall Nov 2015 38.93 $100mm 350,000 700-900 Nov 2016 Warehouse Club Dec 2015 18.10 $25mm 140,000 120 TBD Multi-Family Dec 2015 14.98 $20mm 260+ units 30 Dec 2016 Mixed-Use Retail Dec 2015 37.26 $30mm 300,000 100 TBD Auto Dealership Dec 2013 6.23 $ 5mm 18,000 50 Jan 2017 Building Supply Oct 2014 20.96 $10mm 50,000 250 Jan 2017 $500mm+ in Capital Investment = Large Economic & Job Growth DISTRIBUTION CENTER Date Sold Acres Investment (1) Size (Sq Ft) Jobs (1) Start Date (1) Age Restricted TBD 1,600 $300mm 3,400 units 1,000 TBD Estimates primarily based on publicly available information

Land Holdings Potential Land Sale – Minto Communities Approximately 1,600 Acre Parcel Age-Restricted Planned Residential Community Across from LPGA International Golf Club 3,400+/- single-family homes Golf-cart friendly lifestyle Resort-style town center with clubhouse, restaurants, and recreational and fitness facilities Projected 300+ homes developed per year Entitlements/Permitting in process There can be no assurances regarding the likelihood or timing of this potential transaction, or if it occurs, the final terms including sales price Residential (Age-Restricted) Community Potential Close – 2nd half of 2016

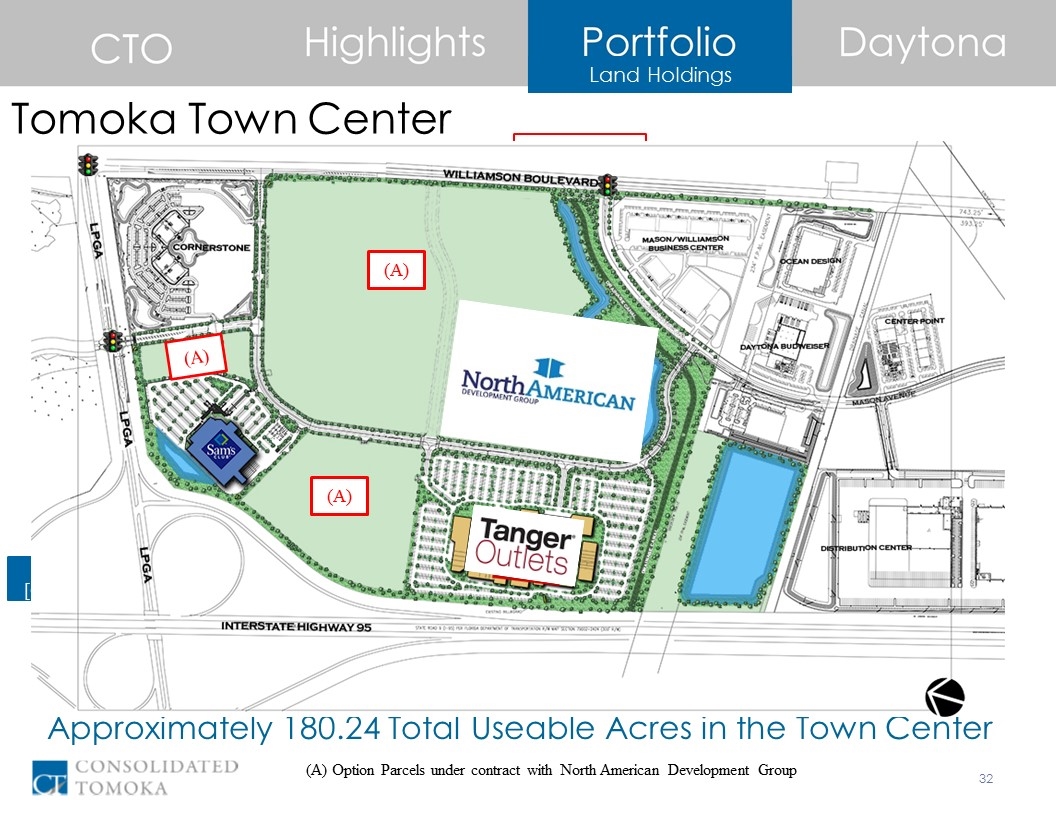

18.10 Acres [Closed Dec ‘15] 38.93 Acres [Closed Nov ‘15] 23.77 Acres 37.26 Acres [Closed Dec ‘15] 4.39 Acres 57.79 Acres Land Holdings Approximately 180.24 Total Useable Acres in the Town Center Tomoka Town Center (A) (A) (A) (A) Option Parcels under contract with North American Development Group

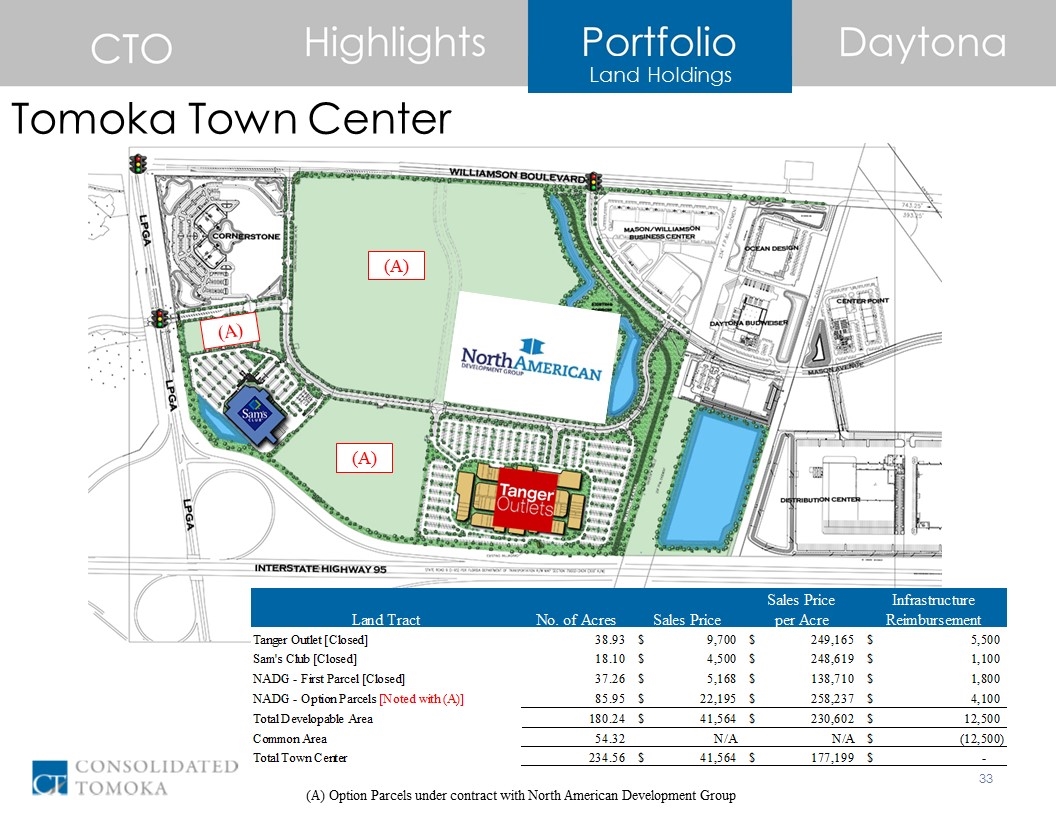

Land Holdings Tomoka Town Center (A) (A) (A) (A) Option Parcels under contract with North American Development Group

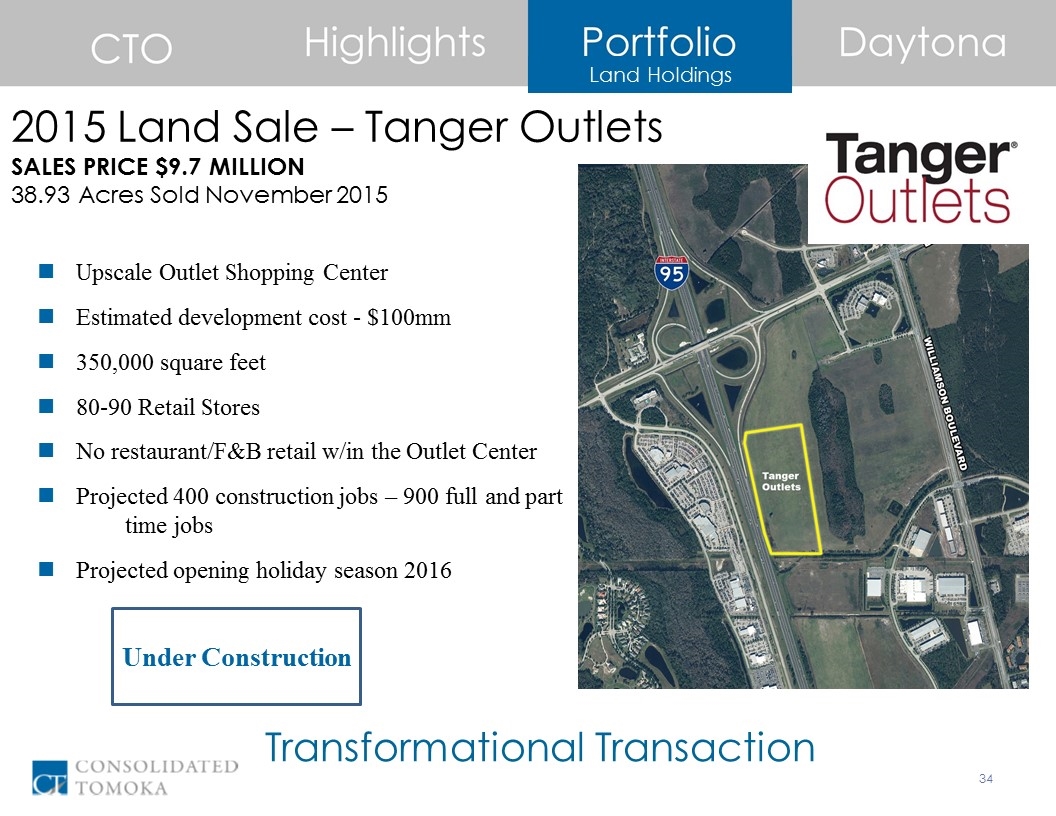

Land Holdings 2015 Land Sale – Tanger Outlets Transformational Transaction SALES PRICE $9.7 MILLION 38.93 Acres Sold November 2015 Upscale Outlet Shopping Center Estimated development cost - $100mm 350,000 square feet 80-90 Retail Stores No restaurant/F&B retail w/in the Outlet Center Projected 400 construction jobs – 900 full and part time jobs Projected opening holiday season 2016 Under Construction

Land Holdings Tanger Outlets as of 2.11.16

Land Holdings Tanger Outlets Conceptual

Land Holdings 2015 Land Sale – Integra Land Co. Approximately 14.98 Acre Parcel Multi-Family Rental Community Estimated 260+ rental apartments Received planning/entitlement approvals Multi-Family Project SALES PRICE $2.4 MILLION 14.98 Acres Sold December 2015 Under Construction

Land Holdings Integra as of 2.11.16

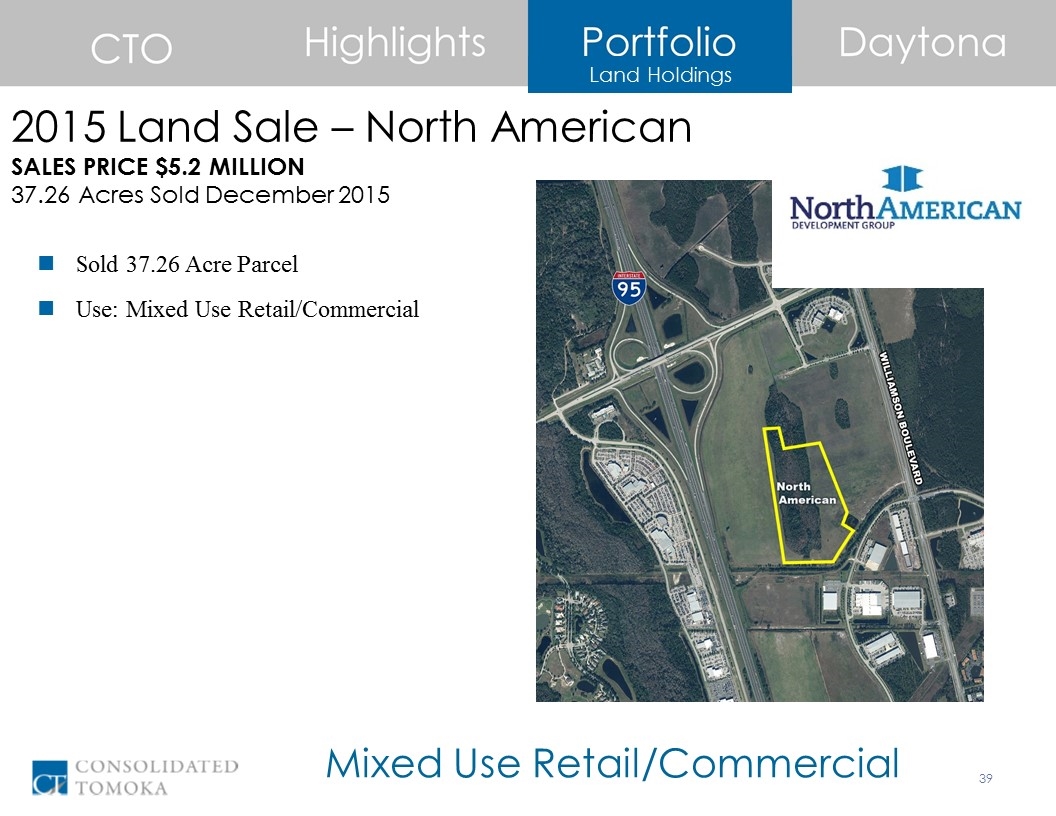

Land Holdings 2015 Land Sale – North American Sold 37.26 Acre Parcel Use: Mixed Use Retail/Commercial Mixed Use Retail/Commercial SALES PRICE $5.2 MILLION 37.26 Acres Sold December 2015

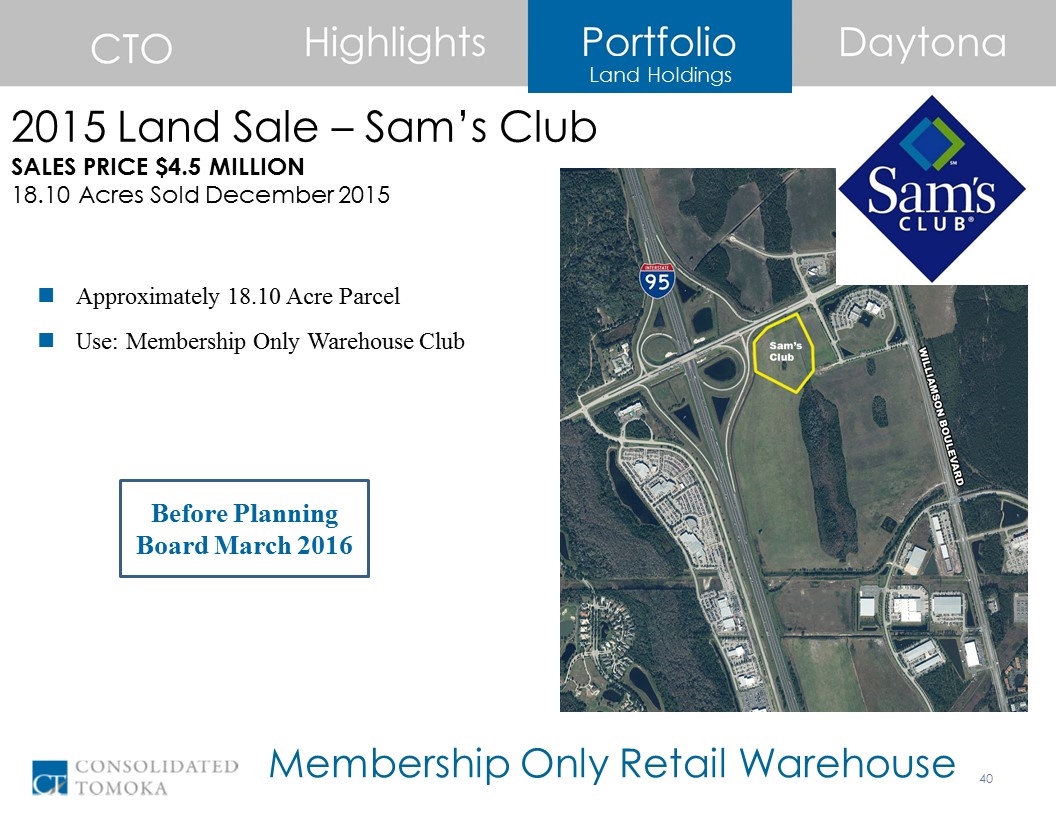

Land Holdings 2015 Land Sale – Sam’s Club Approximately 18.10 Acre Parcel Use: Membership Only Warehouse Club Membership Only Retail Warehouse SALES PRICE $4.5 MILLION 18.10 Acres Sold December 2015 Before Planning Board March 2016

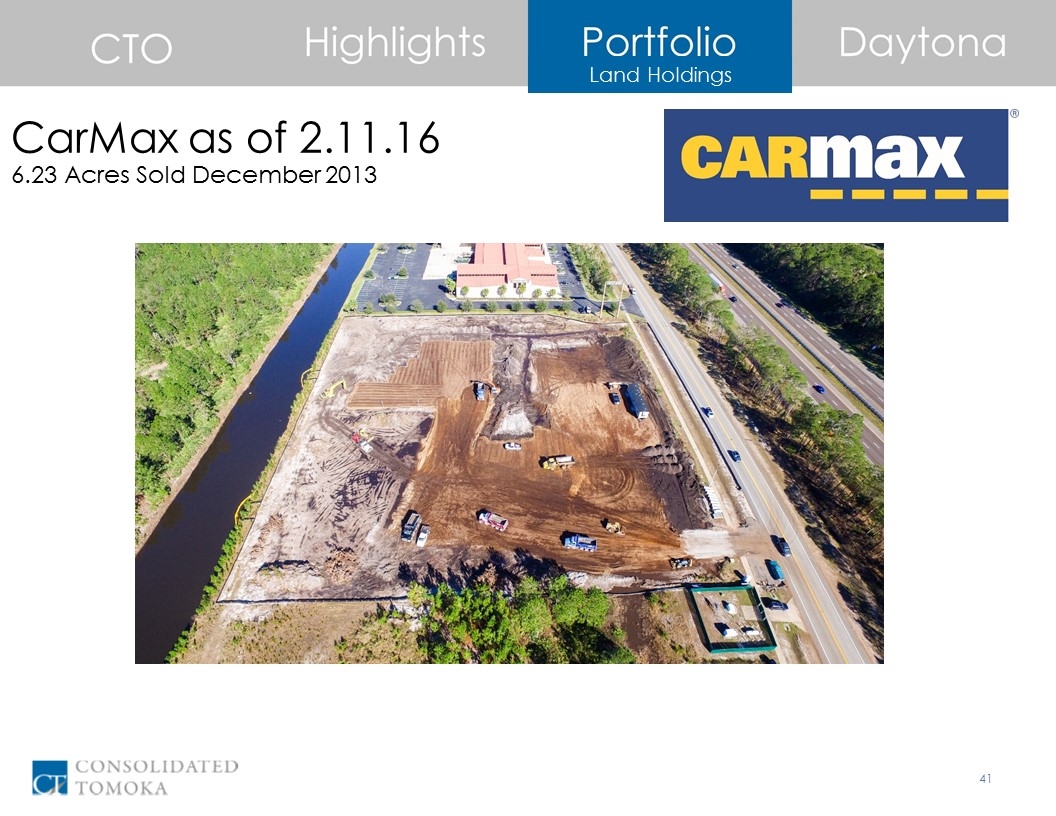

Land Holdings CarMax as of 2.11.16 6.23 Acres Sold December 2013

Land Holdings TopBuild as of 2.11.16 20.96 Acres Sold October 2014

2014 Land Sale – Distribution Center SALES PRICE $7.8 MILLION 630,000 sq ft refrigerated facility 75.60 Acres Estimated 400 jobs Land Holdings Stock Cars Aren’t the Only Things that Move Fast in Daytona Development started Q3 2014 and Facility Opened Q2 2015

Land Holdings Real Estate Venture – Ocean Front Property There can be no assurances regarding the likelihood or timing of a potential sale or other transaction related to this land, or if a transaction does occur, the final terms including sales price 6.04 Acre Parcel on Daytona Beach 3.63 Developable acres Approximately 500 feet of ocean frontage Less than ¼ mile from proposed site for Hard Rock Hotel Property Summary Approximately $5.7mm Investment 50% ownership interest in Venture CTO earns base management fee CTO receives 9% preferred interest Anticipated Uses: Hotel, Condo, Vacation Ownership, Commercial-Retail Venture Transaction Summary Opportunistic Investment

Loan Investments Commercial Loan Investments As of December 31, 2015 $10.0mm Mezzanine Loan Dallas, TX Rate: LIBOR + 725 Maturity: Sept. ‘16 $9.0mm B-Note Sarasota, FL Rate: LIBOR + 750 Maturity: June ‘16 $5.0mm Mezzanine Loan Atlanta, GA Rate: 12% fixed Maturity: Feb ‘19 $38.5 million invested (1) Wgtd. Avg. Rate 8.9% Attractive Spreads DFW HYATT The GLENN HOTEL SOUTHGATE MALL $14.5mm First Mortgage San Juan, PR Rate: LIBOR + 900 Maturity: Sept. ‘18 SAN JUAN SHERATON Face Value

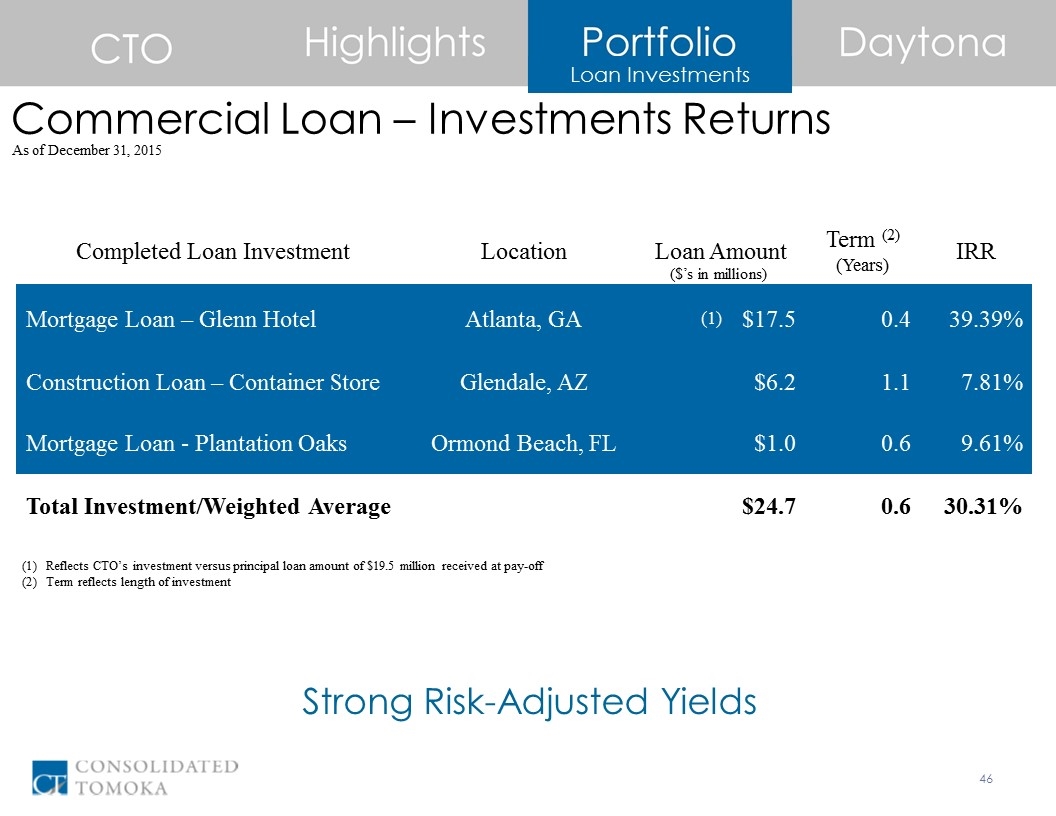

Loan Investments Commercial Loan – Investments Returns Strong Risk-Adjusted Yields As of December 31, 2015 Completed Loan Investment Location Loan Amount Term (2) (Years) IRR Mortgage Loan – Glenn Hotel Atlanta, GA $17.5 0.4 39.39% Construction Loan – Container Store Glendale, AZ $6.2 1.1 7.81% Mortgage Loan - Plantation Oaks Ormond Beach, FL $1.0 0.6 9.61% Total Investment/Weighted Average $24.7 0.6 30.31% Reflects CTO’s investment versus principal loan amount of $19.5 million received at pay-off Term reflects length of investment ($’s in millions) (1)

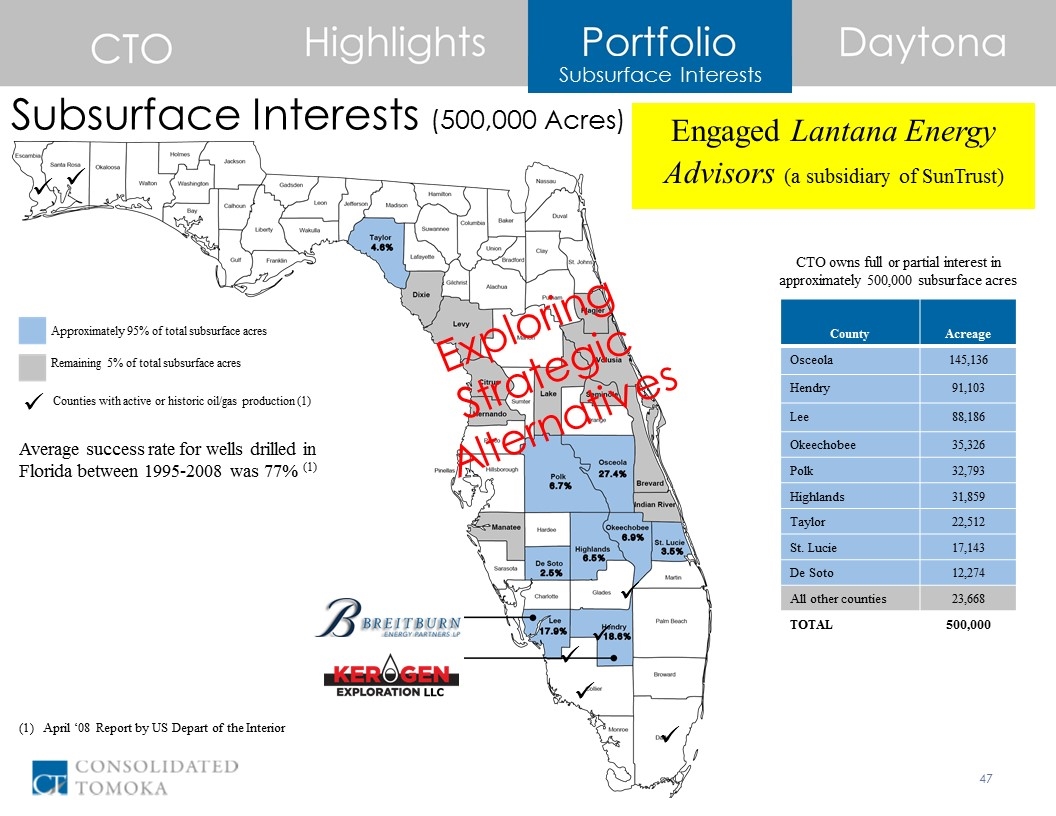

Approximately 95% of total subsurface acres Remaining 5% of total subsurface acres ü ü ü ü ü ü Counties with active or historic oil/gas production (1) ü ü Subsurface Interests Subsurface Interests (500,000 Acres) Average success rate for wells drilled in Florida between 1995-2008 was 77% (1) April ‘08 Report by US Depart of the Interior Exploring Strategic Alternatives County Acreage Osceola 145,136 Hendry 91,103 Lee 88,186 Okeechobee 35,326 Polk 32,793 Highlands 31,859 Taylor 22,512 St. Lucie 17,143 De Soto 12,274 All other counties 23,668 TOTAL 500,000 CTO owns full or partial interest in approximately 500,000 subsurface acres Engaged Lantana Energy Advisors (a subsidiary of SunTrust)

Lease with Kerogen Florida Energy Co. Amended 8-year oil exploration lease Sept 2015 $175k payment - drilling requirements Sept 2015 $1.2mm payment – 5th year rent payment Leased acres total 25,000 in Hendry County, FL Renewable each September for remaining 3 years at Lessee’s option 2015: $1.86mm in revenue (vs. $3.5mm in 2014) Lease with BreitBurn Energy – 2 Operating Wells 2015: $68k in royalty revenue (vs. $198k in 2014) Surface entry rights release revenue in 2015: approx. $1.1 million Book value approximately $0 at 12/31/15 No capital investment requirements for CTO Subsurface Interests

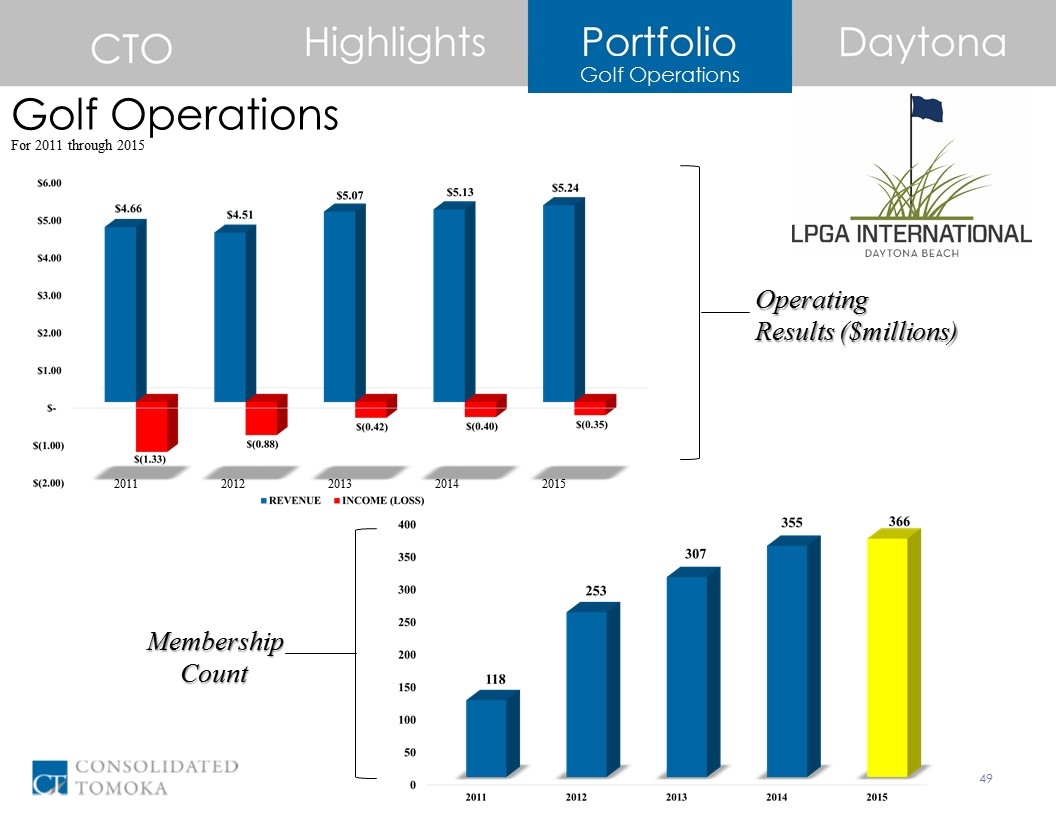

Golf Operations Golf Operations Operating Results ($millions) Membership Count For 2011 through 2015 2011 2012 2013 2014 2015

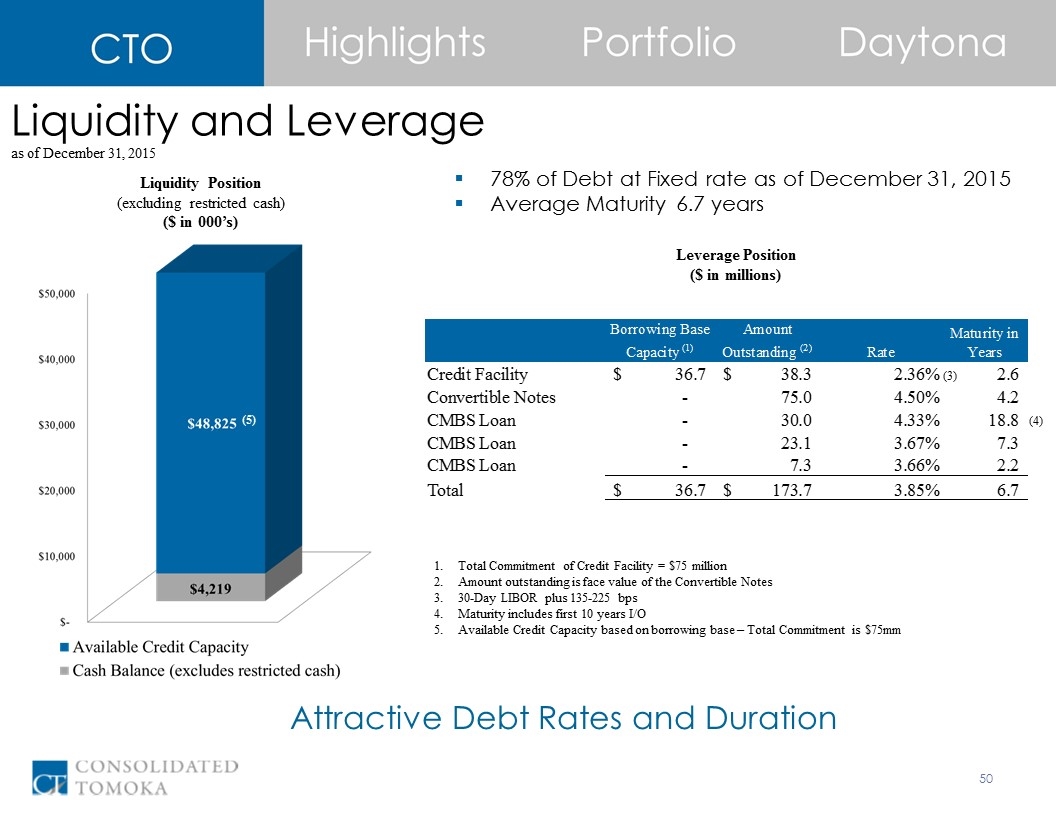

Liquidity and Leverage as of December 31, 2015 Liquidity Position (excluding restricted cash) ($ in 000’s) Leverage Position ($ in millions) Total Commitment of Credit Facility = $75 million Amount outstanding is face value of the Convertible Notes 30-Day LIBOR plus 135-225 bps Maturity includes first 10 years I/O Available Credit Capacity based on borrowing base – Total Commitment is $75mm 78% of Debt at Fixed rate as of December 31, 2015 Average Maturity 6.7 years (5) Attractive Debt Rates and Duration (3) (4)

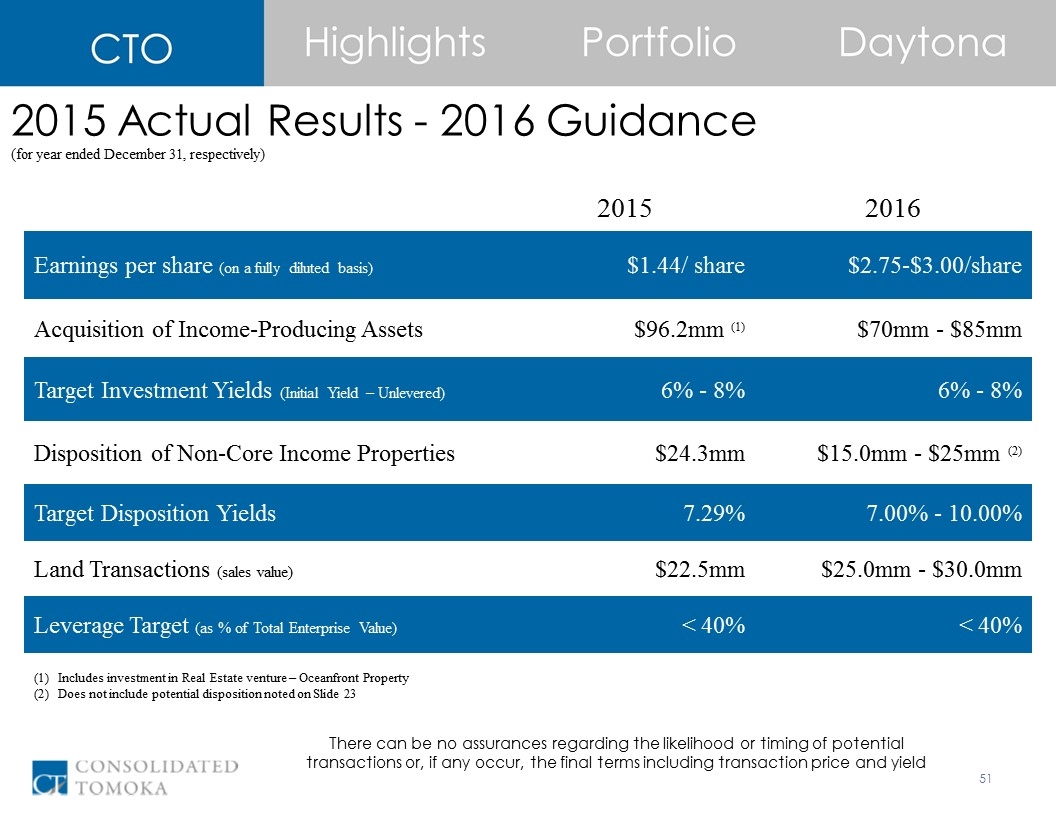

2015 2016 Earnings per share (on a fully diluted basis) $1.44/ share $2.75-$3.00/share Acquisition of Income-Producing Assets $96.2mm (1) $70mm - $85mm Target Investment Yields (Initial Yield – Unlevered) 6% - 8% 6% - 8% Disposition of Non-Core Income Properties $24.3mm $15.0mm - $25mm (2) Target Disposition Yields 7.29% 7.00% - 10.00% Land Transactions (sales value) $22.5mm $25.0mm - $30.0mm Leverage Target (as % of Total Enterprise Value) < 40% < 40% 2015 Actual Results - 2016 Guidance There can be no assurances regarding the likelihood or timing of potential transactions or, if any occur, the final terms including transaction price and yield Includes investment in Real Estate venture – Oceanfront Property Does not include potential disposition noted on Slide 23 (for year ended December 31, respectively)

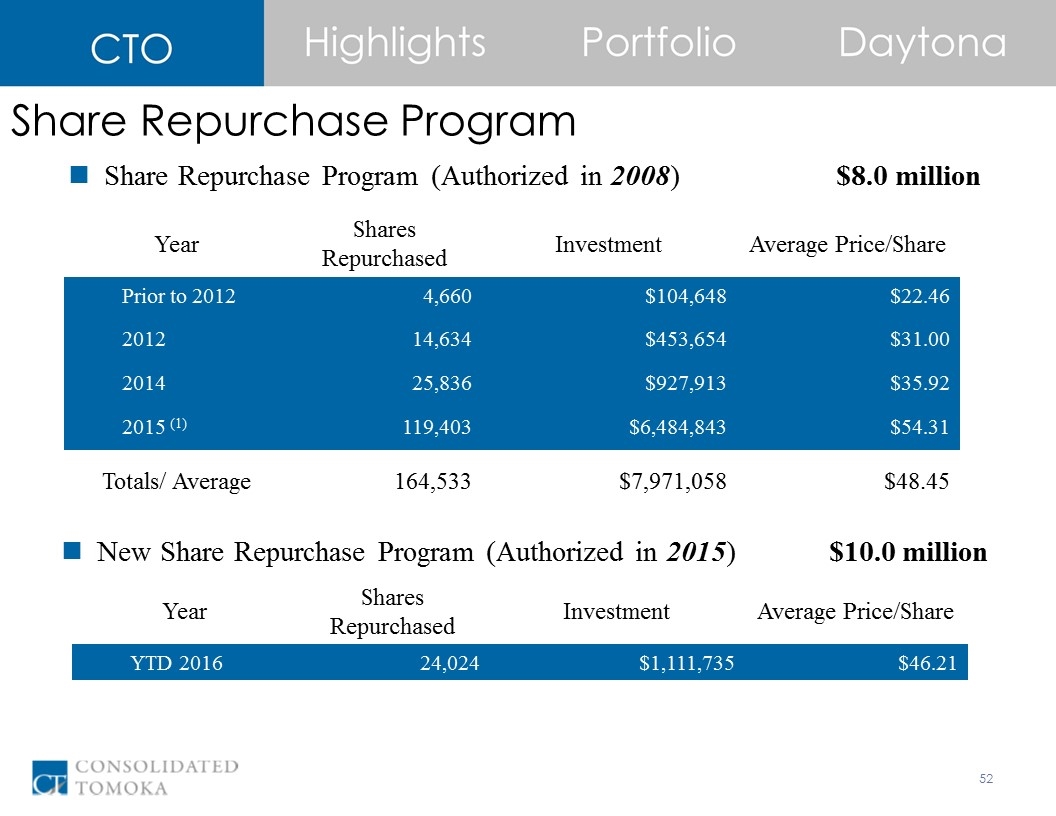

Share Repurchase Program Year Shares Repurchased Investment Average Price/Share Prior to 2012 4,660 $104,648 $22.46 2012 14,634 $453,654 $31.00 2014 25,836 $927,913 $35.92 2015 (1) 119,403 $6,484,843 $54.31 Totals/ Average 164,533 $7,971,058 $48.45 Share Repurchase Program (Authorized in 2008)$8.0 million New Share Repurchase Program (Authorized in 2015)$10.0 million Year Shares Repurchased Investment Average Price/Share YTD 2016 24,024 $1,111,735 $46.21

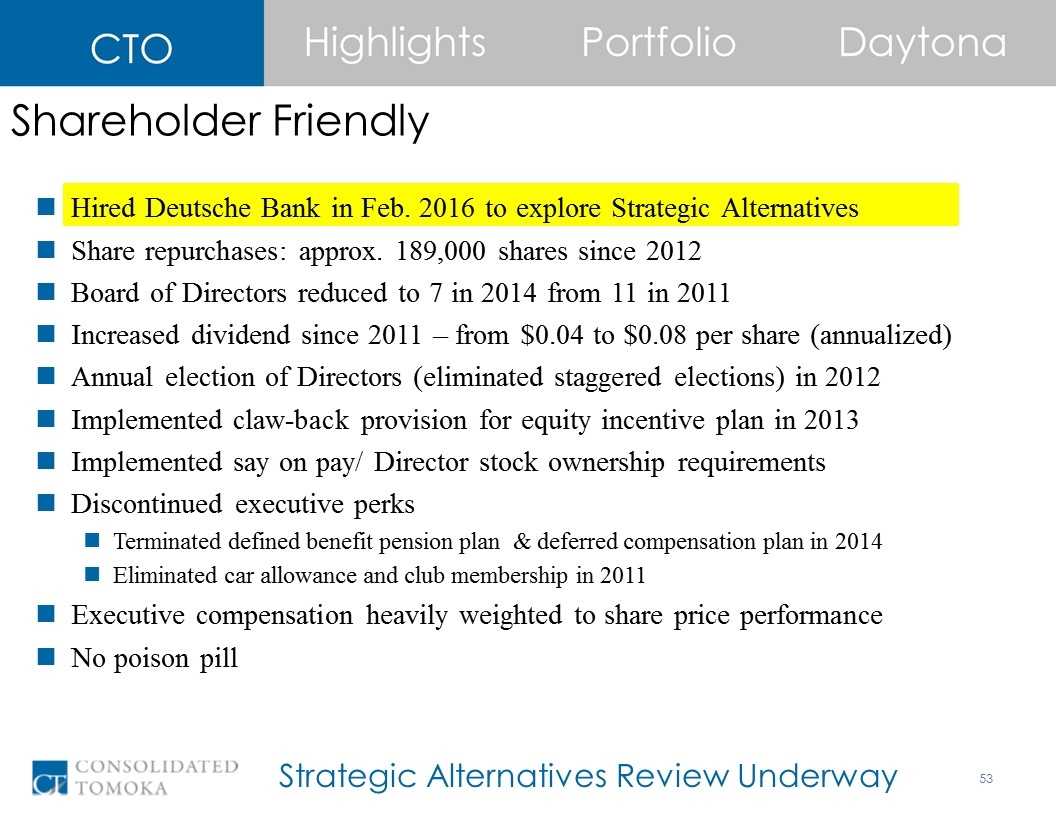

Hired Deutsche Bank in Feb. 2016 to explore Strategic Alternatives Share repurchases: approx. 189,000 shares since 2012 Board of Directors reduced to 7 in 2014 from 11 in 2011 Increased dividend since 2011 – from $0.04 to $0.08 per share (annualized) Annual election of Directors (eliminated staggered elections) in 2012 Implemented claw-back provision for equity incentive plan in 2013 Implemented say on pay/ Director stock ownership requirements Discontinued executive perks Terminated defined benefit pension plan & deferred compensation plan in 2014 Eliminated car allowance and club membership in 2011 Executive compensation heavily weighted to share price performance No poison pill Shareholder Friendly Strategic Alternatives Review Underway

Shareholder Shares % Wintergreen Advisers LLC 1,543,075 25.96 BlackRock Institutional 317,386 5.34 Dimensional Fund Advisors, Inc. 186,939 3.14 Vanguard Group, Inc. 178,654 3.01 Andalusian Capital Partners, LP 174,979 2.94 Carlson Capital LP 107,604 1.81 Fenimore Asset Management 86,280 1.45 State Street Corp 76,453 1.29 Potrero Capital Research 72,851 1.23 Cardinal Capital Management 65,903 1.11 TOP SHAREHOLDERS 2,810,124 47.28% Top Institutional Shareholders (1) Source: Bloomberg as of February 17, 2016

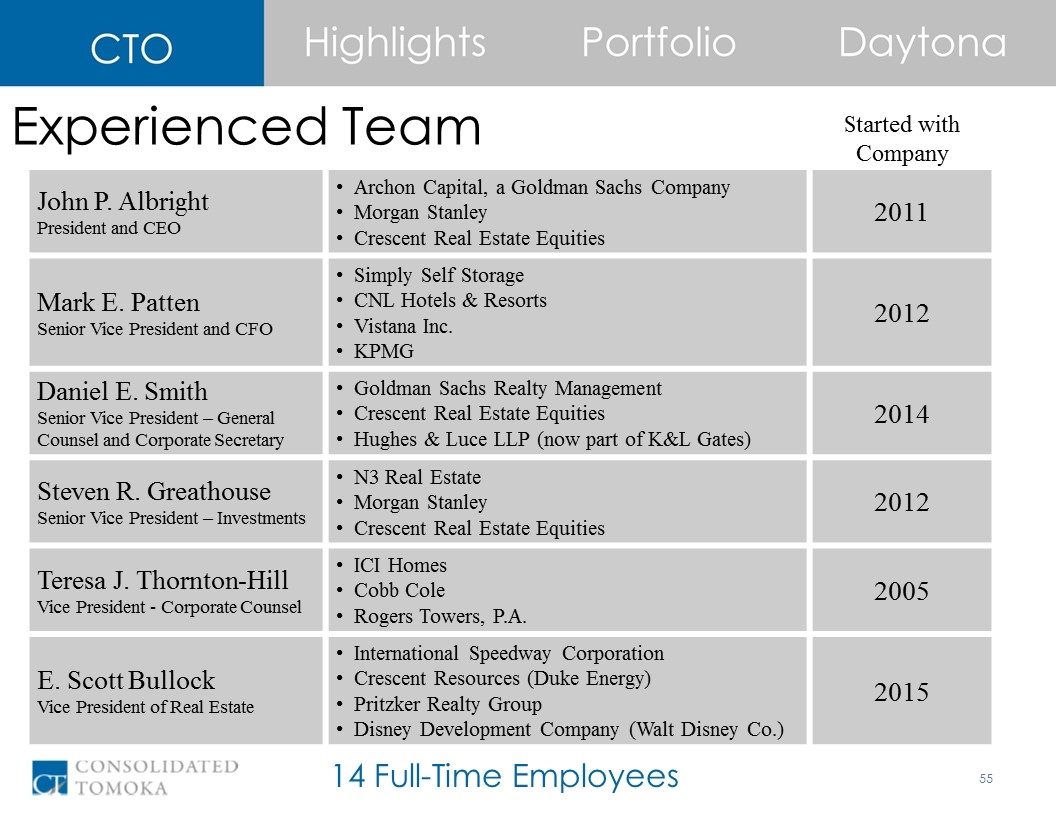

John P. Albright President and CEO Archon Capital, a Goldman Sachs Company Morgan Stanley Crescent Real Estate Equities 2011 Mark E. Patten Senior Vice President and CFO Simply Self Storage CNL Hotels & Resorts Vistana Inc. KPMG 2012 Daniel E. Smith Senior Vice President – General Counsel and Corporate Secretary Goldman Sachs Realty Management Crescent Real Estate Equities Hughes & Luce LLP (now part of K&L Gates) 2014 Steven R. Greathouse Senior Vice President – Investments N3 Real Estate Morgan Stanley Crescent Real Estate Equities 2012 Teresa J. Thornton-Hill Vice President - Corporate Counsel ICI Homes Cobb Cole Rogers Towers, P.A. 2005 E. Scott Bullock Vice President of Real Estate International Speedway Corporation Crescent Resources (Duke Energy) Pritzker Realty Group Disney Development Company (Walt Disney Co.) 2015 Experienced Team 14 Full-Time Employees Started with Company

Director Since John P. Albright President & Chief Executive Officer of the Company 2012 John J. Allen President of Allen Land Group, Inc. 2009 Jeffry B. Fuqua Chairman of the Board of the Company and President of Amick Holdings, Inc. 2009 William L. Olivari Certified Public Accountant and Partner of Olivari and Associates 2008 Howard C. Serkin Chairman of Heritage Capital Group, Inc. 2011 A. Chester Skinner, III Vice Chairman of the Board of the Company and President of Skinner Bros. Realty Co. 2010 Thomas P. Warlow, III President & Chairman - The Martin Andersen-Gracia Andersen Foundation, Inc. 2010 Board of Directors

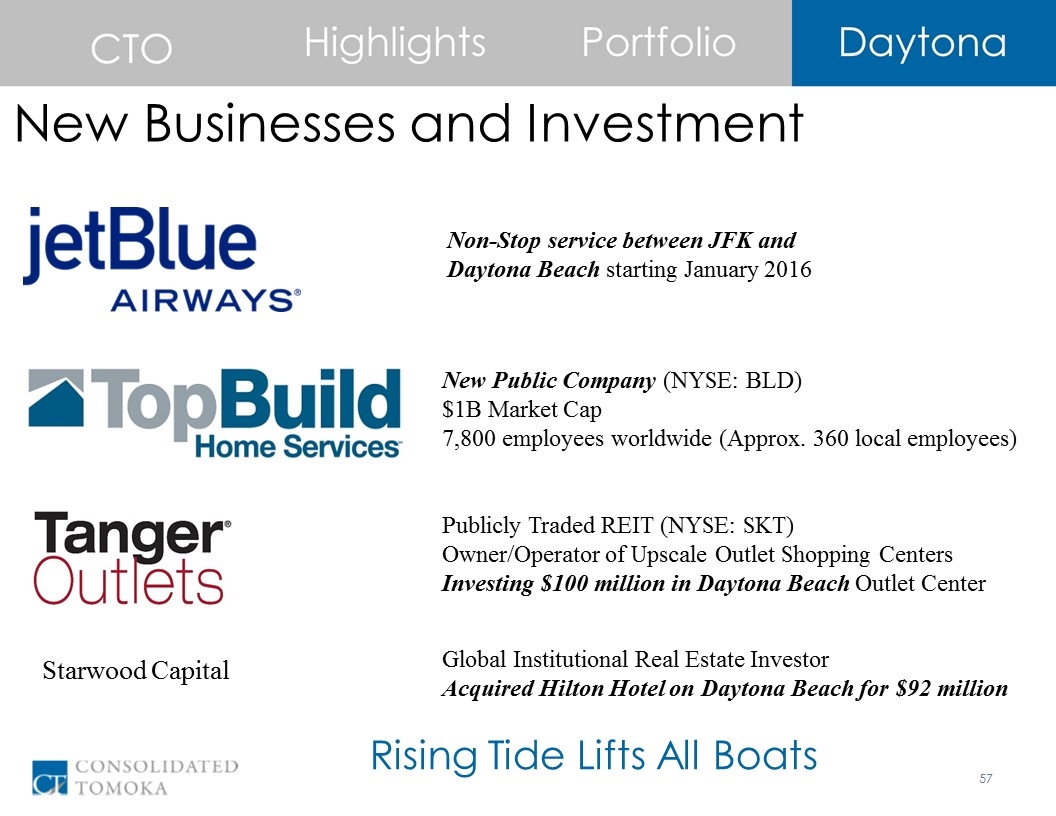

New Businesses and Investment Rising Tide Lifts All Boats Non-Stop service between JFK and Daytona Beach starting January 2016 New Public Company (NYSE: BLD) $1B Market Cap 7,800 employees worldwide (Approx. 360 local employees) Publicly Traded REIT (NYSE: SKT) Owner/Operator of Upscale Outlet Shopping Centers Investing $100 million in Daytona Beach Outlet Center Starwood Capital Global Institutional Real Estate Investor Acquired Hilton Hotel on Daytona Beach for $92 million

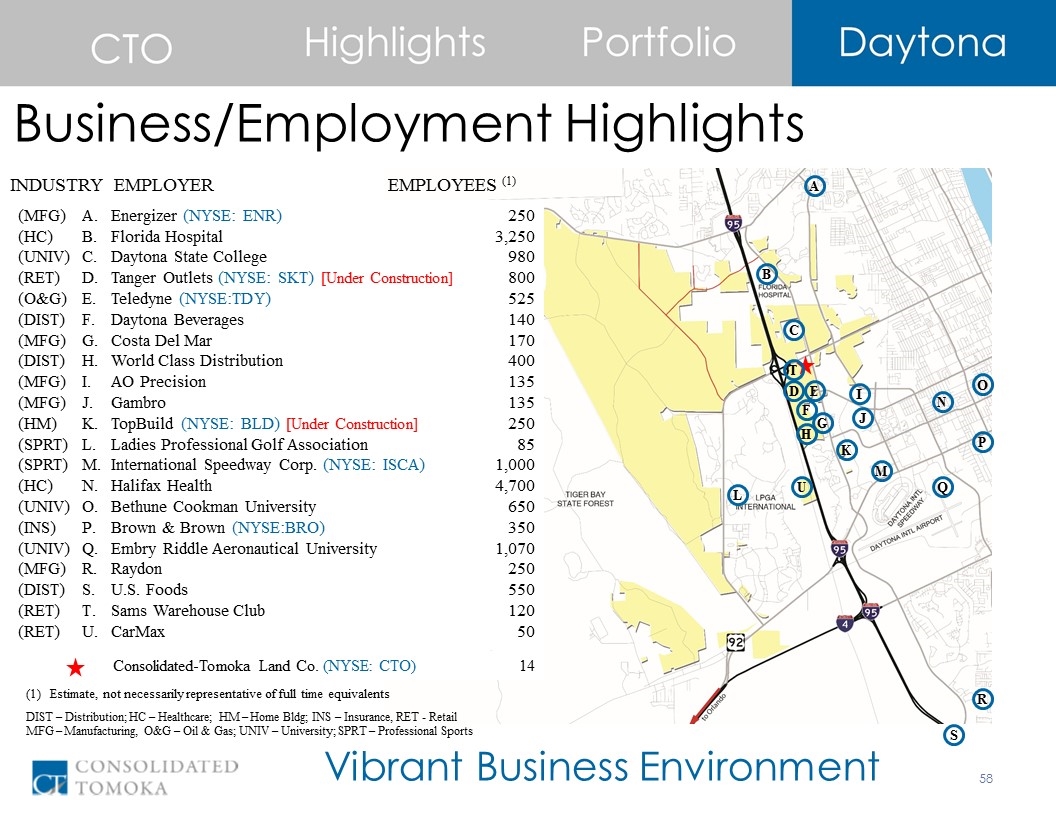

A B C G D F I L E O K Q N R Business/Employment Highlights Vibrant Business Environment Consolidated-Tomoka Land Co. (NYSE: CTO) 14 S P H J DIST – Distribution; HC – Healthcare; HM – Home Bldg; INS – Insurance, RET - Retail MFG – Manufacturing, O&G – Oil & Gas; UNIV – University; SPRT – Professional Sports M Estimate, not necessarily representative of full time equivalents (MFG) (HC) (UNIV) (RET) (O&G) (DIST) (MFG) (DIST) (MFG) (MFG) (HM) (SPRT) (SPRT) (HC) (UNIV) (INS) (UNIV) (MFG) (DIST) (RET) (RET) EMPLOYER EMPLOYEES (1) INDUSTRY A B C D E F G H I J K L M N O P Q R S Energizer (NYSE: ENR) Florida Hospital Daytona State College Tanger Outlets (NYSE: SKT) [Under Construction] Teledyne (NYSE:TDY) Daytona Beverages Costa Del Mar World Class Distribution AO Precision Gambro TopBuild (NYSE: BLD) [Under Construction] Ladies Professional Golf Association International Speedway Corp. (NYSE: ISCA) Halifax Health Bethune Cookman University Brown & Brown (NYSE:BRO) Embry Riddle Aeronautical University Raydon U.S. Foods Sams Warehouse Club CarMax 250 3,250 980 800 525 140 170 400 135 135 250 85 1,000 4,700 650 350 1,070 250 550 120 50 T U

Consolidated-Tomoka Land Co. 1530 Cornerstone Boulevard Daytona Beach, FL 32117 main: 386.274.2202 fax: 386.274.1223 email: info@ctlc.com web: www.ctlc.com NYSE MKT: CTO For additional information, please see our most recent Annual Report on Form 10-K, copies of which may be obtained by writing the corporate secretary at the address above, or at www.ctlc.com. Explore Daytona at www.exploredb.com Contact Us

Appendix

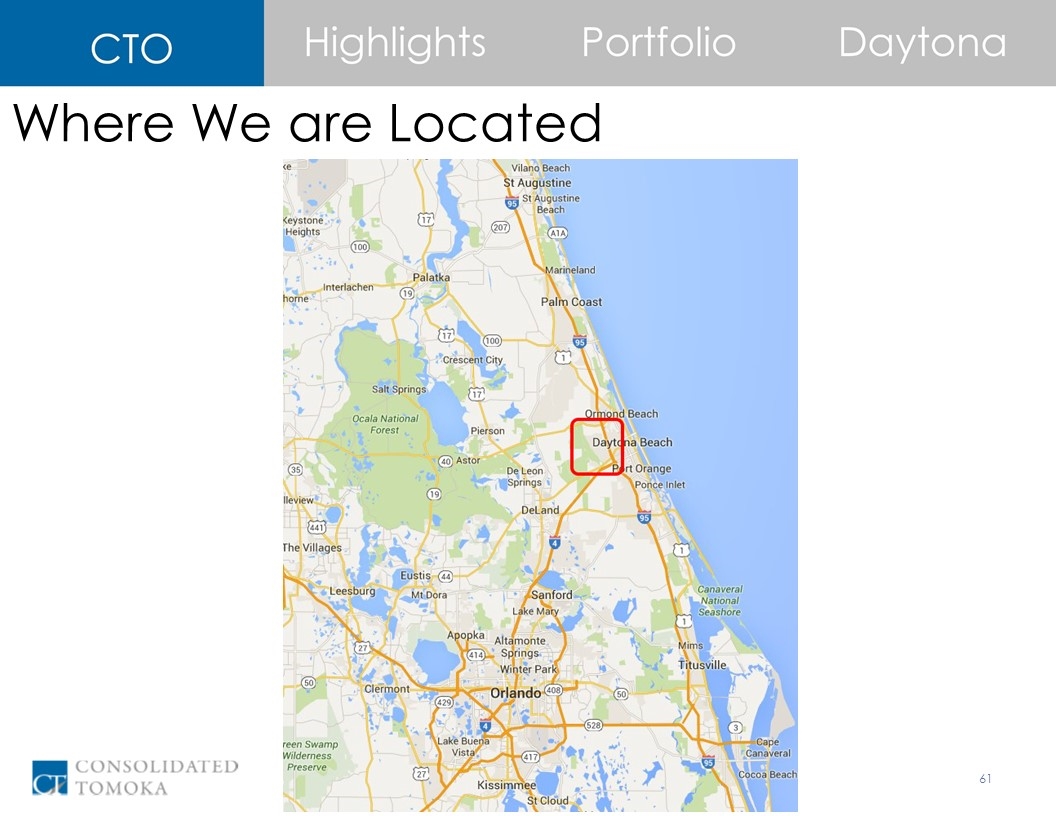

Where We are Located

Well-Positioned Land as of December 31, 2015

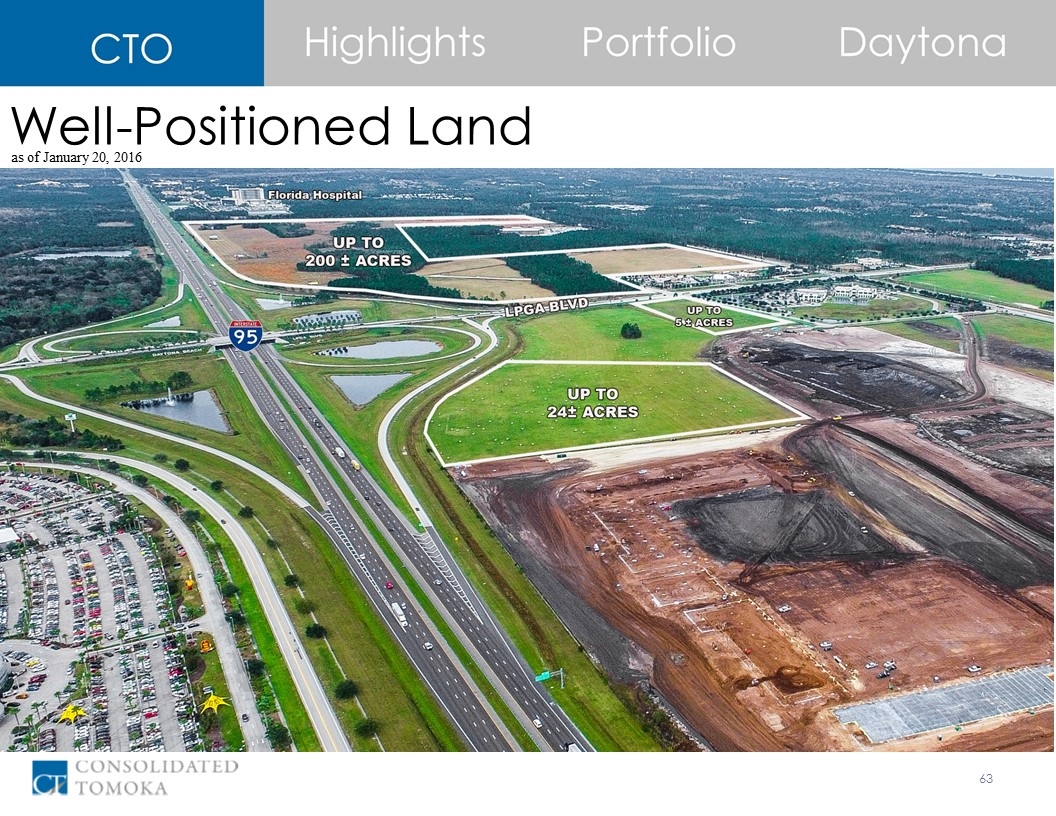

Well-Positioned Land as of January 20, 2016

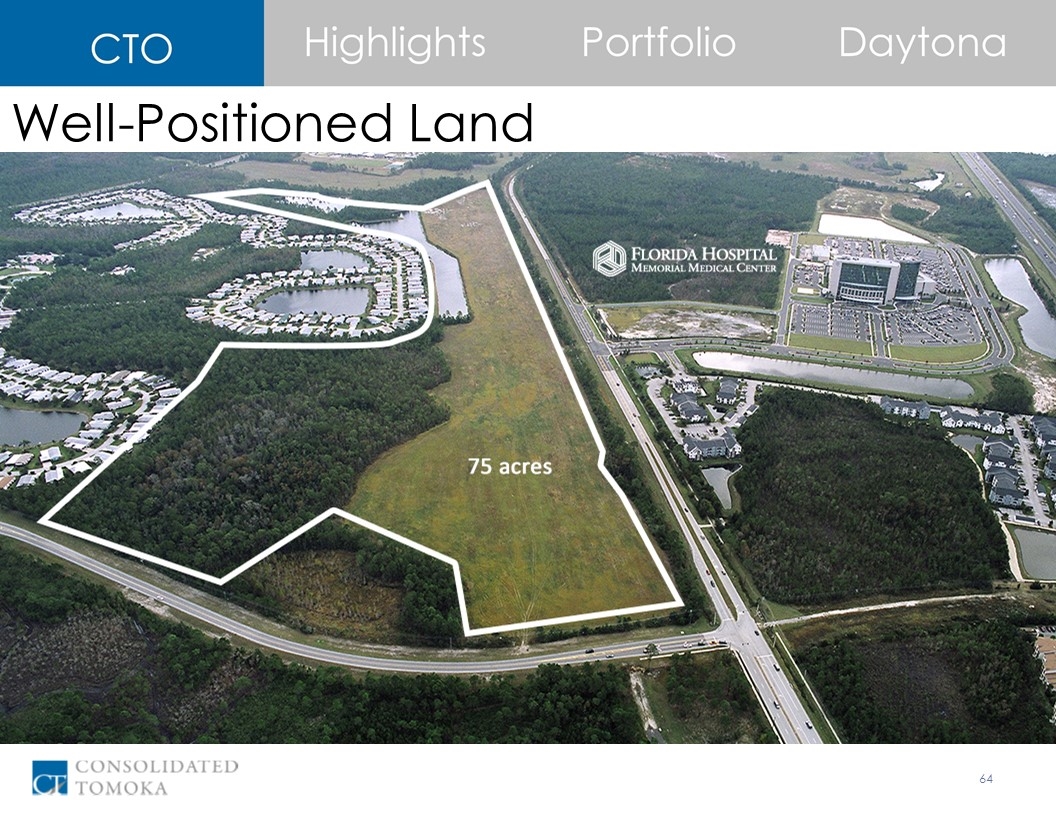

Well-Positioned Land

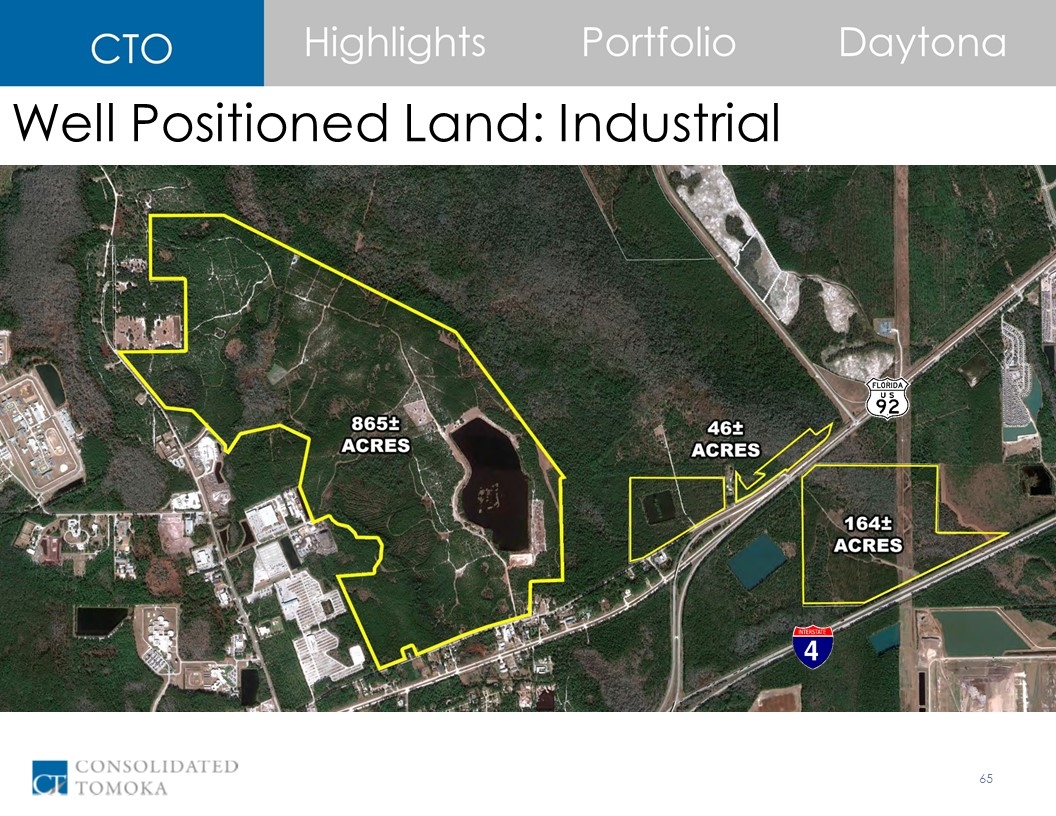

Well Positioned Land: Industrial

Well Positioned Land: Williamson Crossing

Well Positioned Land: North of LPGA

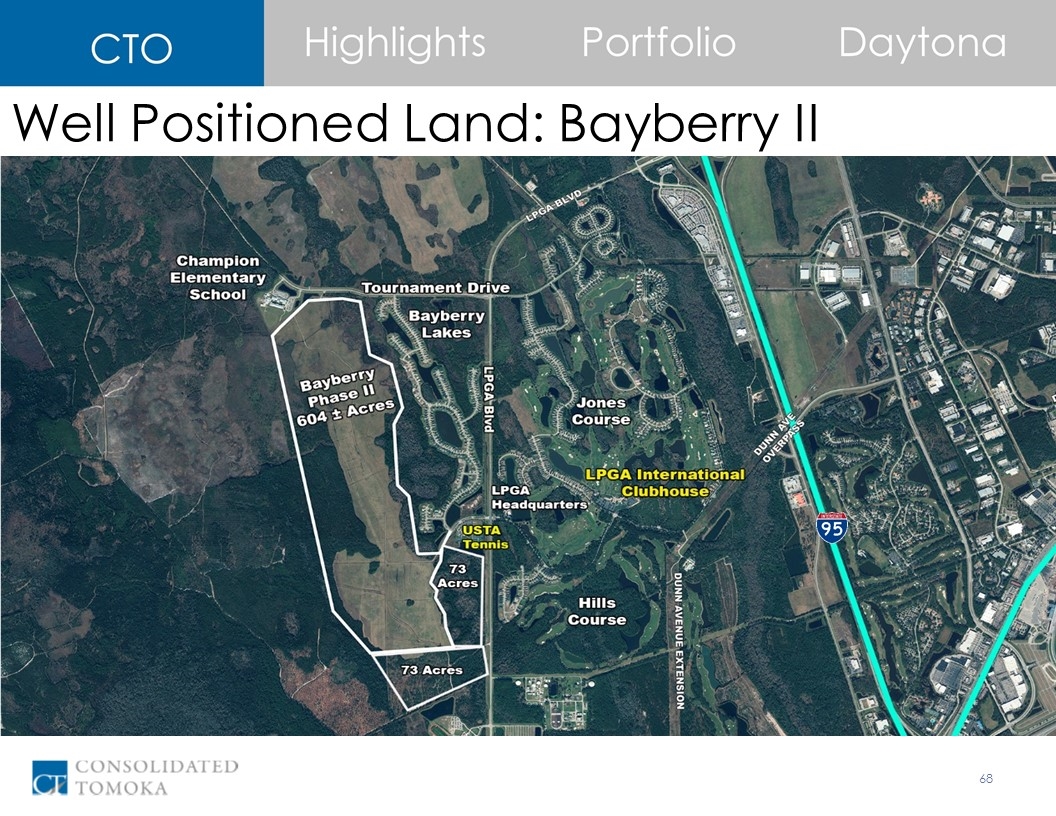

Well Positioned Land: Bayberry II

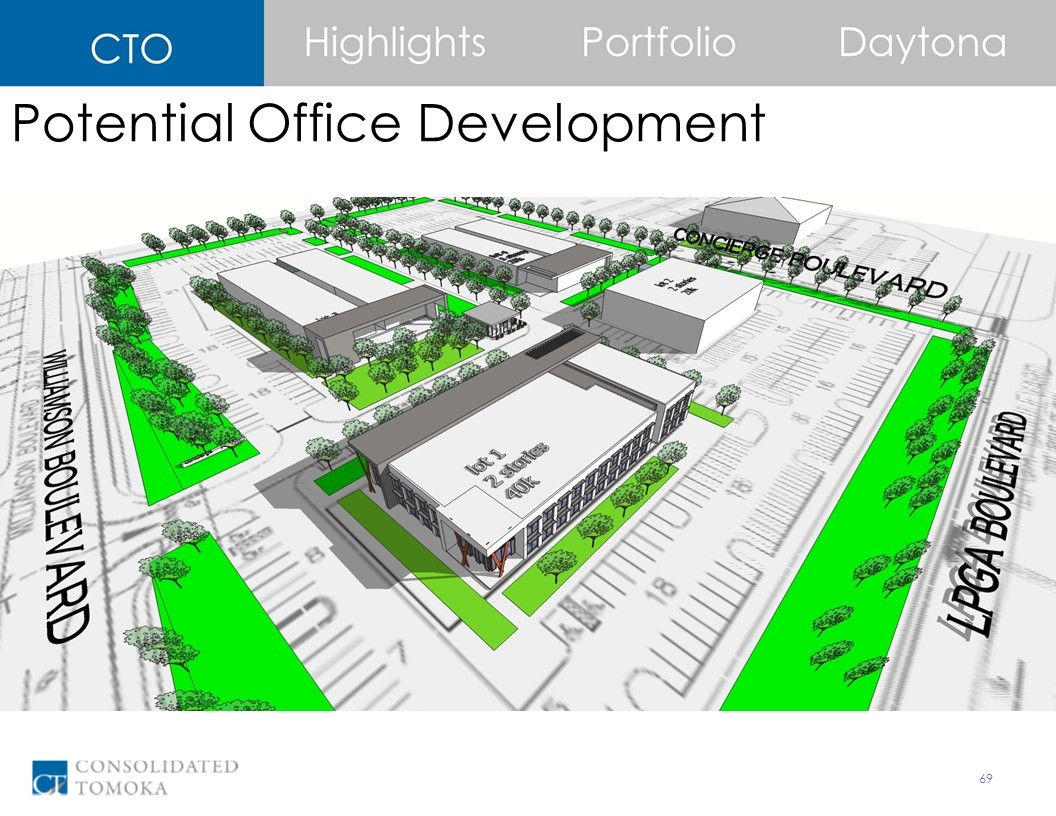

Potential Office Development