UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 3, 2011

| COOPER TIRE & RUBBER COMPANY |

| (Exact Name of Registrant as Specified in Charter) |

| Delaware | 001-04329 | 344297750 | ||

| (State or Other Jurisdiction | (Commission | (IRS Employer | ||

| of Incorporation) | File Number) | Identification No.) |

| 701 Lima Avenue, Findlay, Ohio | 45840 | |

| (Address of Principal Executive Offices) | (Zip Code) |

| Registrant’s telephone number, including area code: | (419) 423-1321 |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

On October 4, 2011, the management team of Cooper Tire & Rubber Company, a Delaware corporation (the "Company"), will be making the following slideshow presentation during various meetings with investors and analysts.

Available Information

Our internet address is http://www.coopertire.com. We webcast our earnings calls and certain events we participate in or host on the investor relations portion of our website, http://coopertire.com/investors.aspx. We also make available on our website free of charge a variety of information for investors. Our goal is to maintain the investor relations portion of the website as a portal through which investors can easily find or navigate to pertinent information about us, including:

• our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after we electronically file that material with or furnish it to the Securities and Exchange Commission (“SEC”);

• information on our business strategies, financial results and selected key performance indicators;

• announcements of our participation at investor conferences and other events;

• press releases on quarterly earnings, product and service announcements and legal developments;

• corporate governance information; and

• other news and announcements that we may post from time to time that investors might find useful or interesting.

The content of our website is not intended to be incorporated by reference into this presentation or in any other report or document we file with or furnish to the SEC, and any references to our website is intended to be inactive textual references only.

Forward-Looking Statements

This press release contains what the Company believes are “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995, regarding projections, expectations or matters that the Company anticipates may happen with respect to the future performance of the industries in which the Company operates, the economies of the United States and other countries, or the performance of the Company itself, which involve uncertainty and risk.

Such “forward-looking statements” are generally, though not always, preceded by words such as “anticipates,” “expects,” “will,” “should,” “believes,” “projects,” “intends,” “plans,” “estimates,” and similar terms that connote a view to the future and are not merely recitations of historical fact. Such statements are made solely on the basis of the Company’s current views and perceptions of future events, and there can be no assurance that such statements will prove to be true.

It is possible that actual results may differ materially from those projections or expectations due to a variety of factors, including but not limited to:

| · | changes in economic and business conditions in the world; |

| · | the failure to achieve expected sales levels; |

| · | consolidation among the Company's competitors or customers; |

| · | technology advancements; |

| · | the failure of the Company’s suppliers to timely deliver products in accordance with contract specifications; |

| · | changes in interest or foreign exchange rates; |

| · | changes in the Company’s customer relationships, including loss of particular business for competitive or other reasons; |

| · | the impact of reductions in the insurance program covering the principal risks to the Company, and other unanticipated events and conditions; |

2

| · | volatility in raw material and energy prices, including those of rubber, steel, petroleum based products and natural gas and the unavailability of such raw materials or energy sources; |

| · | the inability to obtain and maintain price increases to offset higher production or material costs; |

| · | increased competitive activity including actions by larger competitors or lower-cost producers; |

| · | the inability to recover the costs to develop and test new products or processes; |

| · | the risks associated with doing business outside of the United States; |

| · | changes in pension expense and/or funding resulting from investment performance of the Company’s pension plan assets and changes in discount rate, salary increase rate, and expected return on plan assets assumptions, or changes to related accounting regulations; |

| · | government regulatory initiatives; |

| · | the impact of labor problems, including a strike brought against the Company or against one or more of its large customers or suppliers; |

| · | litigation brought against the Company including products liability; |

| · | an adverse change in the Company’s credit ratings, which could increase its borrowing costs and/or hamper its access to the credit markets; |

| · | changes to the credit markets and/or access to those markets; |

| · | inaccurate assumptions used in developing the Company’s strategic plan or operating plans or the inability or failure to successfully implement such plans; |

| · | inability to adequately protect the Company’s intellectual property rights; |

| · | failure to successfully integrate acquisitions into operations or their related financings may impact liquidity and capital resources; |

| · | inability to use deferred tax assets; |

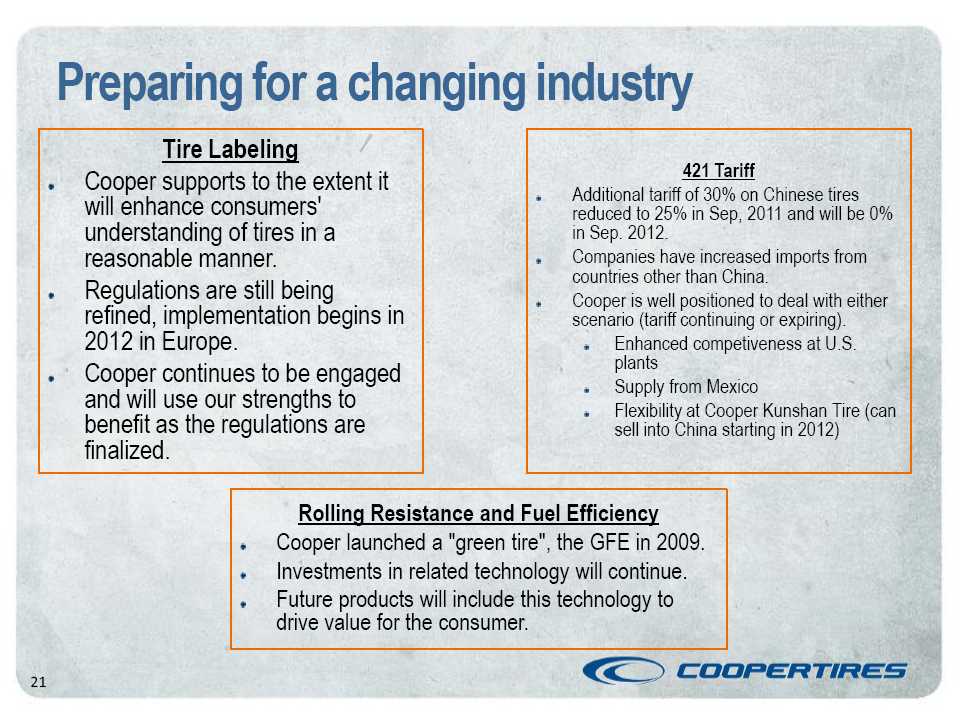

| · | changes to tariffs on certain tires imported into the United States from the People's Republic of China or the imposition of new tariffs or trade restrictions; |

| and changes in the Company’s relationship with joint-venture partners. |

It is not possible to foresee or identify all such factors. Any forward-looking statements in this report are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Prospective investors are cautioned that any such statements are not a guarantee of future performance and actual results or developments may differ materially from those projected.

The Company makes no commitment to update any forward-looking statement included herein or to disclose any facts, events or circumstances that may affect the accuracy of any forward-looking statement.

Further information covering issues that could materially affect financial performance is contained in the Company's periodic filings with the U. S. Securities and Exchange Commission.

3

4

5

6

7

8

9

10

11

12

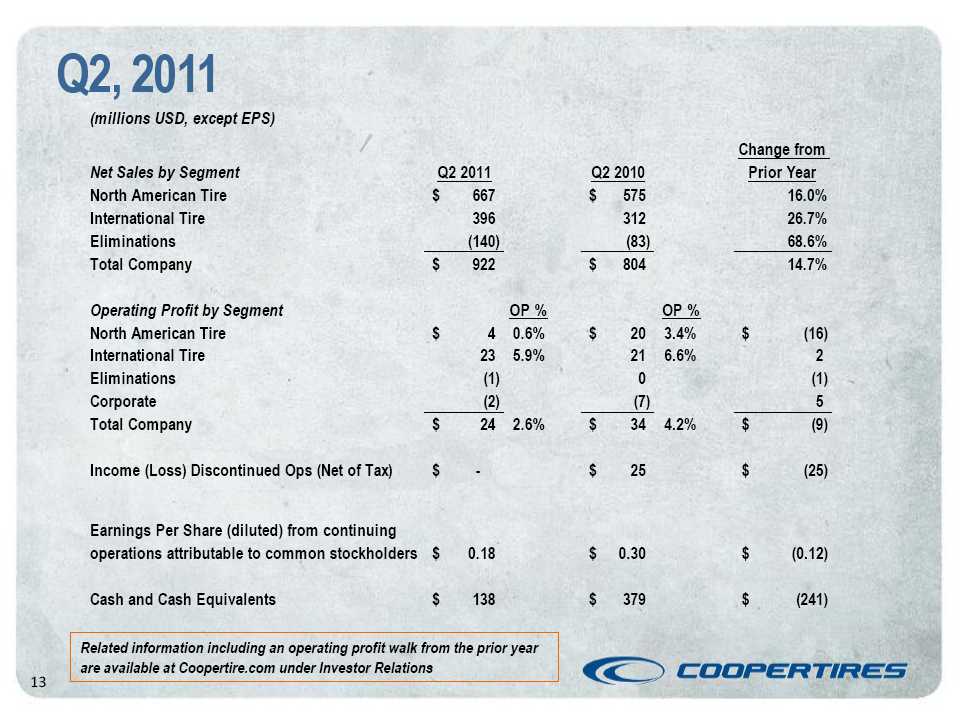

13

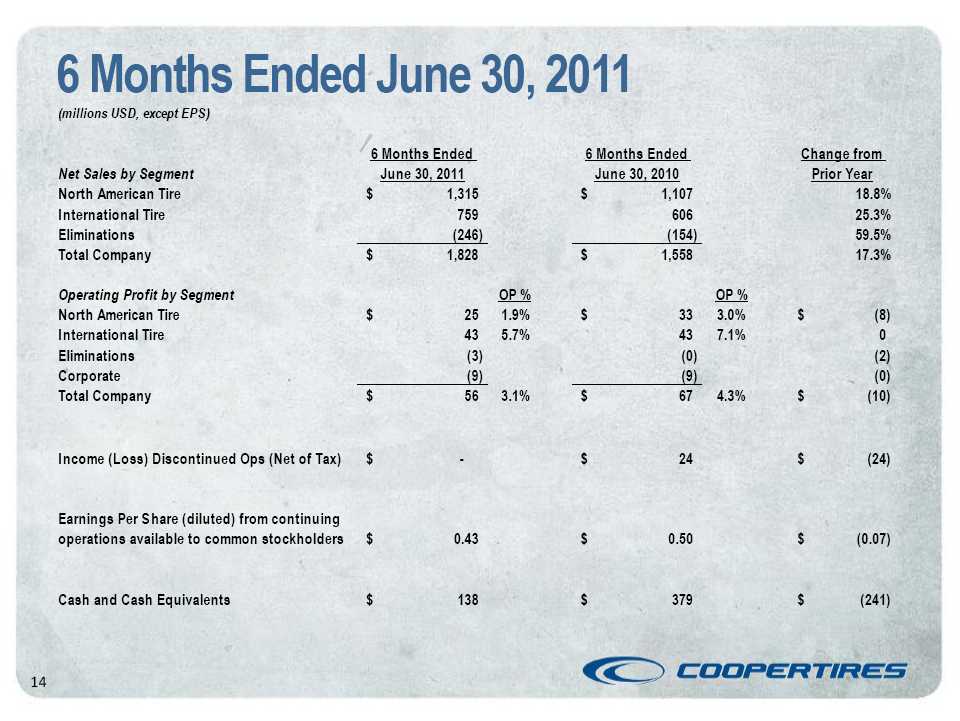

14

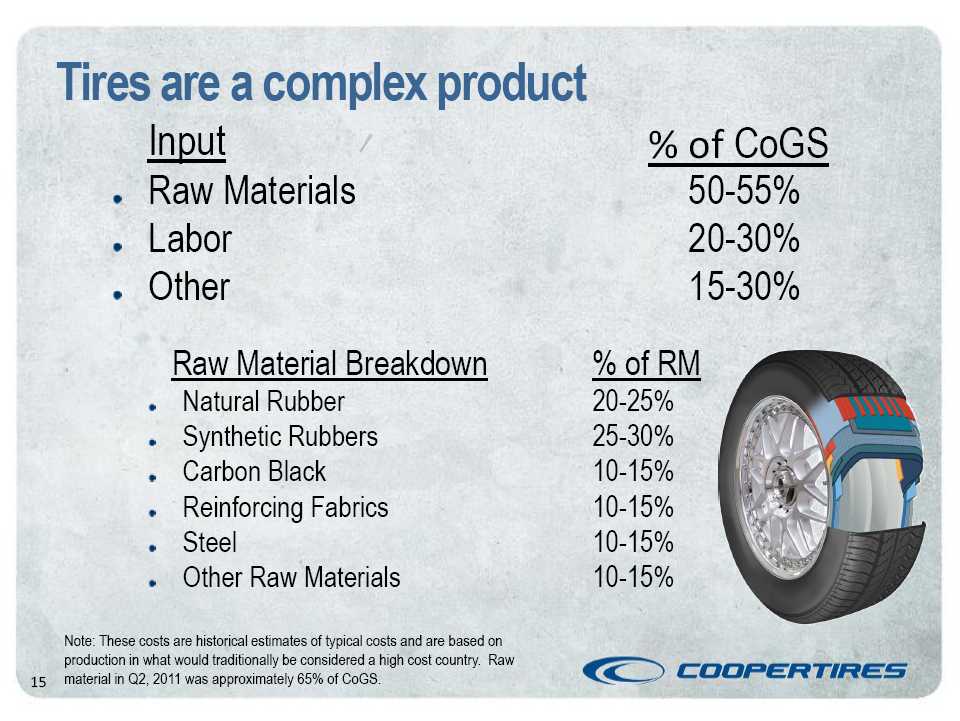

15

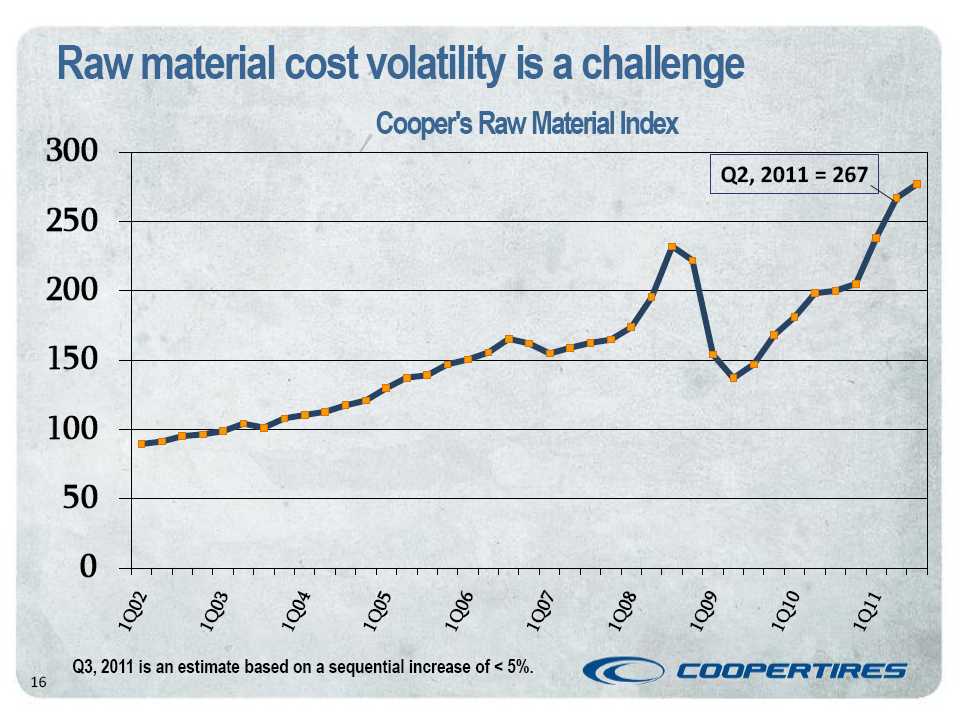

16

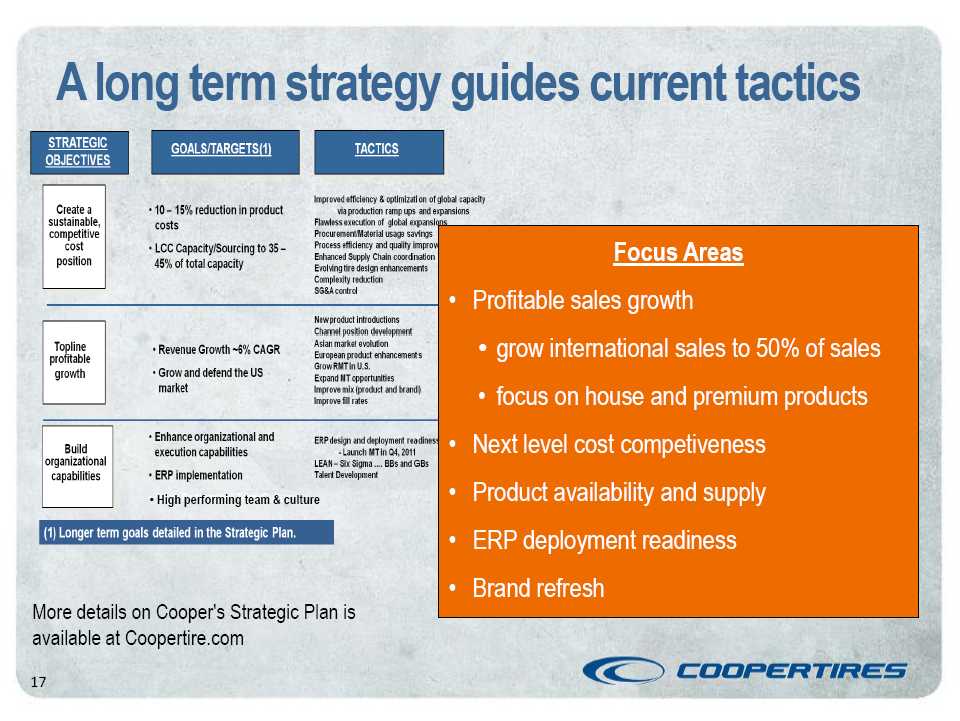

17

18

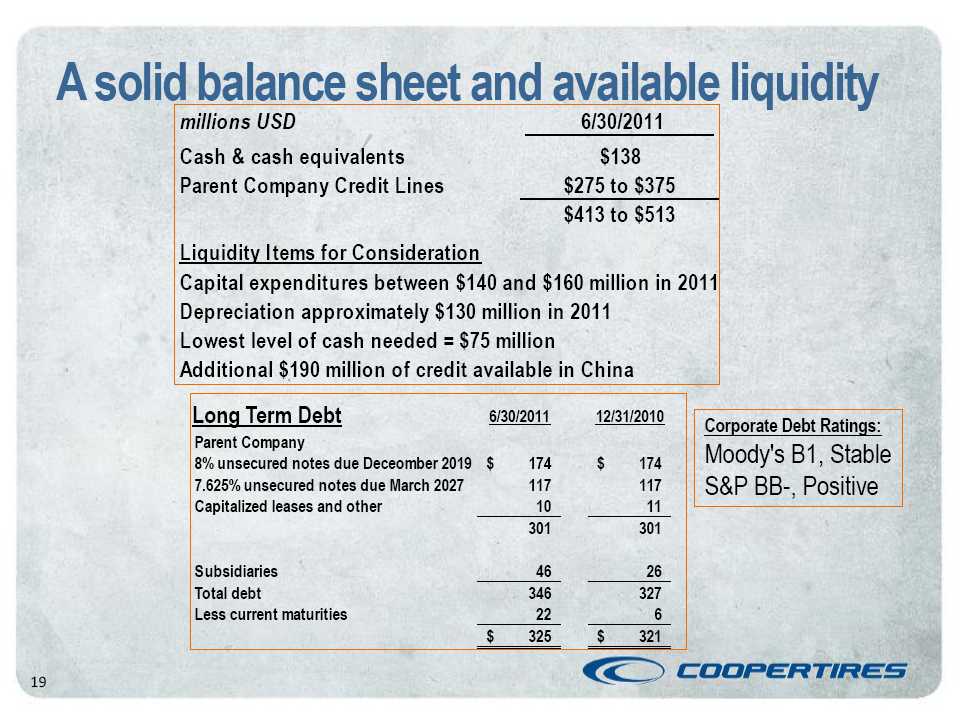

19

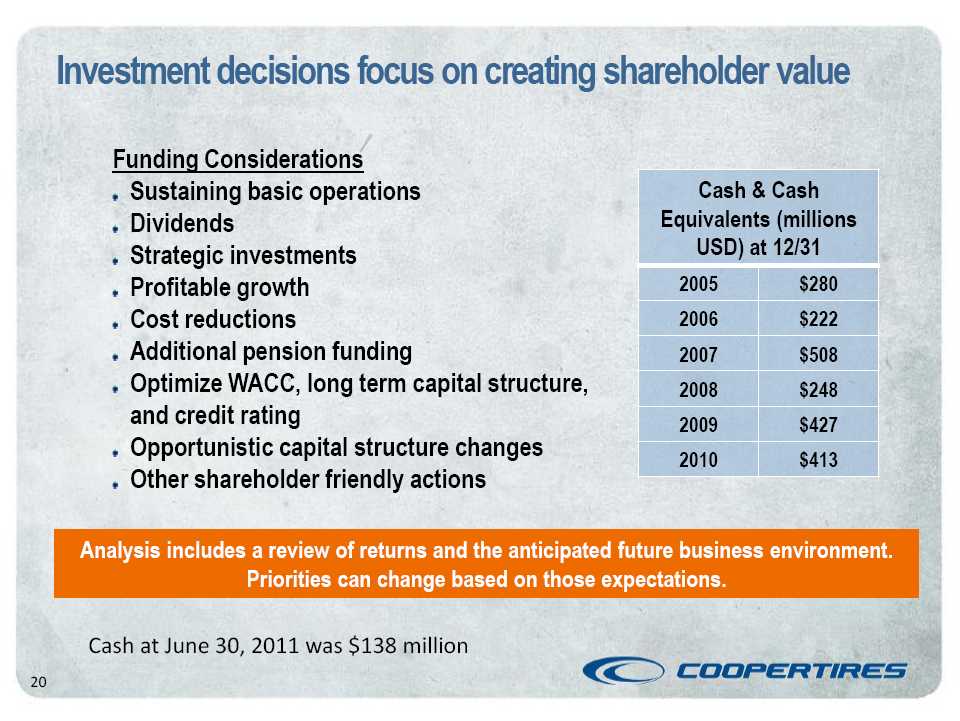

20

21

22

23

24

25

26

27

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

COOPER TIRE & RUBBER COMPANY | |||

| By: | /s/ Jack Jay McCracken | ||

| Name: Jack Jay McCracken | |||

| Title: Assistant Secretary | |||

Date: October 3, 2011

28