QuickLinks -- Click here to rapidly navigate through this documentEXHIBIT 10.7

COORS BREWING COMPANY

2004 COORS INCENTIVE PLAN

(CIP)

PARTICIPANTS:

All Directors and above and employees in salary bands E01 to E07 and N01 to N11 are eligible to participate in the Coors Incentive Plan (the "Plan"). No individual in another short-term incentive plan will be eligible for participation in the Plan.

Participants who are newly hired or promoted into an eligible position during the Plan year will be eligible to receive a prorated share of the incentive payment based on the number of calendar days spent in an eligible position divided by the actual number of days during the year of the Plan. Non-exempt part-time participants will be eligible to receive a prorated incentive payment based on eligible standard hours worked in the Plan year (overtime hours are excluded for bonus calculations) as a percentage of standard full-time hours for the Plan year.

BONUS PAYOUT PARAMETERS:

All participants will be evaluated based on one or more separate bonus components, including the achievement of Company financial performance goals, individual performance goals, and plant goals, if applicable. In addition, participants who are designated as "Key Leaders" by the Compensation Committee of the Company's Board of Directors (the "Compensation Committee"), which group generally consists of the Chairman of Coors Brewing Company (the "Chairman"), the President and Chief Executive Officer of Coors Brewing Company (the "President"), and Levels 1, 2, 3 and 4, will also be evaluated in part on the basis of a Debt Reduction component.

PARTICIPATION LEVELS AND PARAMETERS:

Annual incentive target percents are based on salary bands and positions. The salary bands, positions and applicable participation percent, as of January 1, 2004, or the new hire/promotion date if later, is used for incentive calculations as follows:

Position

| | Target %

| | Debt

Reduction

| | CBL

| | CBW

| | US

| | Global

| | Individual

|

|---|

| CEO/Chairman | | 100%/80% | | 25% | | | | | | | | 75% | | |

| Level 1 | | | | | | | | | | | | | | |

| CEO (CBL) | | 65% | | 25% | | 50% | | | | | | | | 25% |

| CFO (Global) | | 65% | | 25% | | | | | | | | 50% | | 25% |

| COO (Global) | | 65% | | 25% | | | | | | 50% | | | | 25% |

| Level 2 | | | | | | | | | | | | | | |

| CPO; CLO | | 55% | | 25% | | | | | | | | 50% | | 25% |

| President CBW | | 55% | | | | | | 75% | | | | | | 25% |

| Other Chief Officers | | 55% | | 25% | | | | | | 50% | | | | 25% |

- *

- All Level 2 are Chief Officers.

| |

| | Corporate

| | Brewery Operations & Technology

| | Container

|

|---|

Salary Band/Position

| | Target

%

| | Company

| | Debt

Reduction

| | Individual

| | Company

| | Individual

| | Plant

| | Individual

| | Plant

|

|---|

| Level 3 (debt red. Plan) | | 45% | | 40% | | | | 60% | | | | | | | | | | |

| | | | | 25% | | 15% | | 60% | | | | | | | | | | |

| Level 4 | | 40% | | 40% | | | | 60% | | 20% | | 60% | | 20% | | 60% | | 40% |

| Director | | 30% | | 40% | | | | 60% | | 20% | | 60% | | 20% | | 60% | | 40% |

| E07 | | 25% | | | | | | | | | | | | | | | | |

| E06 | | 20% | | | | | | | | | | | | | | | | |

| E05 | | 15% | | 40% | | | | 60% | | 20% | | 60% | | 20% | | 60% | | 40% |

| E01-E04 | | 10% | | | | | | | | | | | | | | | | |

| N01-N11 | | 5% | | | | | | | | | | | | | | | | |

- *

- Only certain of the participants who are in Levels 1, 2, 3 or 4 have been designated as "Key Leaders" by the Compensation Committee. Those participants will have a portion of their bonus based on the debt reduction component. Anyone who is in Levels 1, 2, 3 or 4 who has not been designated as a "Key Leader" will have the CBC portion of the Company financial performance goal determined in accordance with a multiplier of 75% for persons in Levels 1 and 2 and 40% for persons in Levels 3 and 4.

If a participant in the Plan changes salary bands during the calendar year and the target percentage changes, the participant's bonuses will be based upon a prorated calculation using the number of days during the calendar year in each salary band and applying the target percentages and performance goals applicable to each salary band. If a participant changes salary bands during the year but the target percentage does not change, the original salary band target and performance goals shall continue to apply and there shall be no proration of the bonus calculation.

All participants will be measured on some combination of Company, Debt Reduction, Plant (if applicable) and Individual performance goals, depending on their position in the Company, in accordance with the tables set forth above. Each individual measurement component constitutes a separate bonus arrangement, but the separate individual bonus components will be payable, to the extent amounts are payable in accordance with the terms hereof, at the same time as a part of one payment.

The senior officers responsible for Coors Operations and Technology and the senior officer responsible for Human Resources have authority to subdivide the separate Individual bonus component to reflect other performance criteria without the necessity of further approval by the Company's Board of Directors or shareholders.

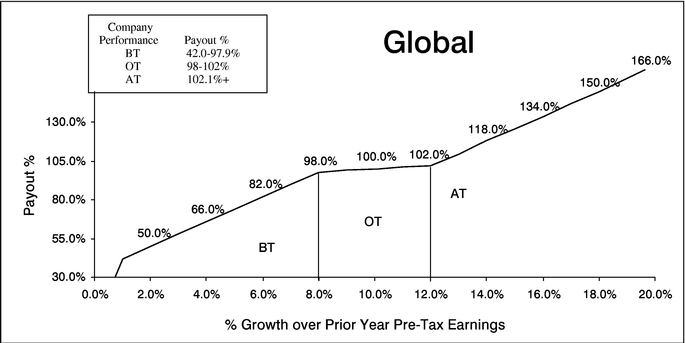

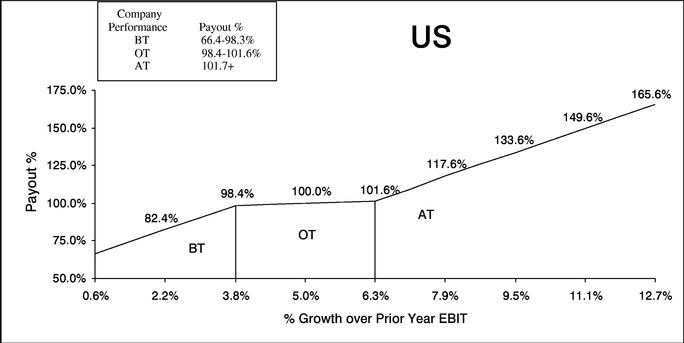

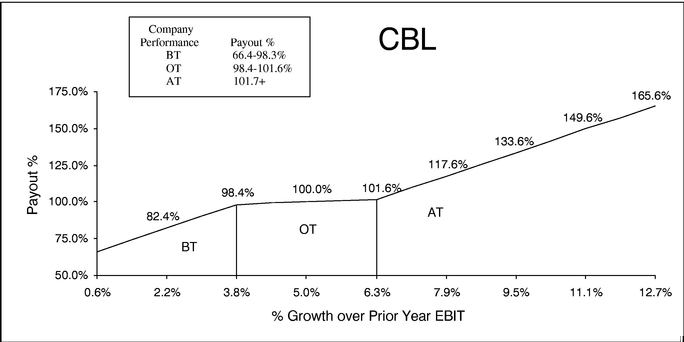

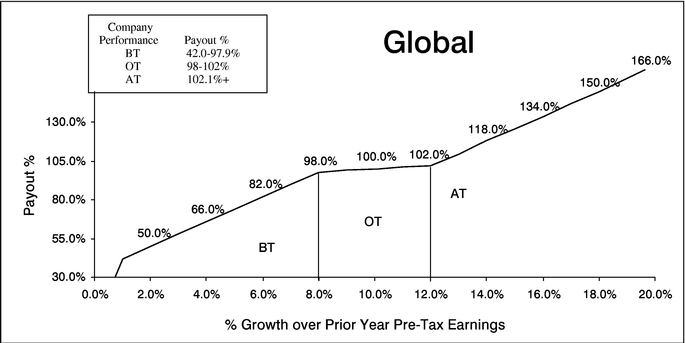

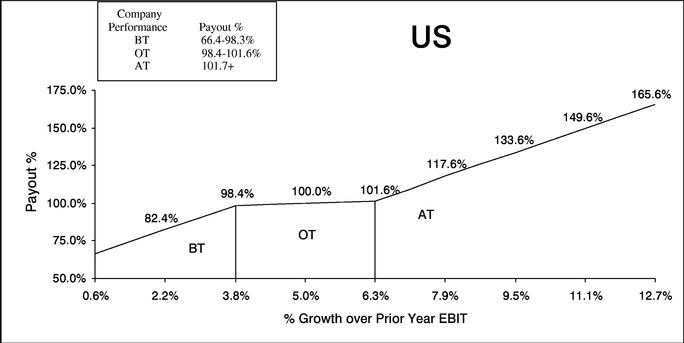

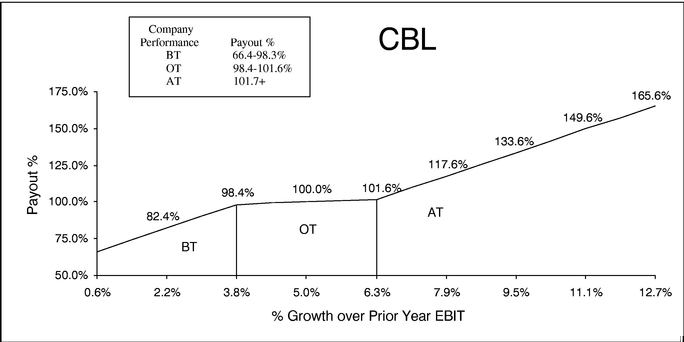

COMPANY FINANCIAL TARGETS:

Achievement of annual Company financial goals will be measured based on growth in earnings before interest and taxes ("EBIT") or Pretax Earnings (applicable to CBC Global participants) for 2004 before special charges or credits and after incentive plan payouts (in millions) over the similar items for 2003, computed in accordance with the Company Component Payout graph set forth on Schedule A attached hereto and hereby made a part of this Plan. Schedule A provides an example of the calculations that would be used for those individuals participating in the Plan whose targeted percentage increase in Pretax Earnings is 10%. Similar calculations would be made for participants whose targeted percentage increase in EBIT or Pretax Earnings, as described below, is more or less than the targeted increase set forth on Schedule A. The payout percentages for growth in EBIT or Pretax Earnings falling between whole percentage amounts shall be interpolated in the manner shown on Schedule A. The targeted financial goals based on growth in EBIT or Pretax Earnings for 2004 shall

2

be established in writing by the Compensation Committee within the time parameters required by section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code") and the Regulations thereunder. For 2004, the targeted increase in Pretax Earnings for participants whose scope of responsibility is CBC Global shall be 10%, the targeted increase in EBIT for participants whose scope of responsibility is Coors U.S. shall be 5%, the targeted increase in EBIT for participants whose scope of responsibility is CBW shall be 4%, and the targeted increase in EBIT for participants whose scope of responsibility is CBL shall be 5%. At the Company's sole discretion, it may choose to use line/operational results as a substitute for certain organizational targets in lieu of the Company financial targets, provided, however, that the Company may not change the Company financial targets in any way with respect to individuals who are subject to the deduction limits of section 162(m) of the Code.

Definitions:

EBIT—Earnings before interest and taxes for external financial reporting purposes as prepared by the Company's outside auditors and as shown on the Company's Annual Report. Earnings are defined as Revenues (amounts received from the sales of beer) less Costs (manufacturing costs including brewing, packaging, raw materials, and freight, and all other costs required to run the business including marketing, selling, support costs, etc.). This includes both Domestic and International and would also include the revenue and expenses associated with entering an international market.

Pretax Earnings—Income before income taxes for external financial reporting purposes as prepared by the Company's outside auditors and as shown on the Company's Annual Report. Income is defined as Revenues (amounts received from the sales of beer) less Costs (manufacturing costs including brewing, packaging, raw materials, and freight, and all other costs required to run the business including marketing, selling, support costs, interest expense/(income), etc.). This includes both Domestic and International and would also include the revenue and expenses associated with entering an international market.

Special Charges (Credits)—Extraordinary items (one-time unusual events) which are set forth on Schedule B attached hereto and hereby made a part of this Plan or which are otherwise separately identified in the Company's external financial statements as prepared by the Company's outside auditors.

If the Company financial goals are achieved, each eligible participant will receive a separate bonus based on the Company component. None of the Company bonus portion will be paid if growth in EBIT or Pretax Earnings for 2004 over 2003 falls below a minimum of 1%. The payout percentage for the Company bonus portion will be determined based upon the growth in EBIT or Pretax Earnings for 2004 over 2003 in accordance with the example set forth on Schedule A for those participants having a targeted increase in Pretax Earnings of 10%.

In addition, if the increase in Pretax Earnings for 2004, calculated according to the method set forth in the preceding paragraphs of this section, "Company Financial Targets," is equal to or greater than 10%, the CEO will receive a bonus of $250,000 in addition to other amounts payable under this Plan. The bonus payable under this paragraph shall be subject to $2 million cap described below but shall not be subject to 54% share of the Performance Pool allocated to the President described below.

Individuals with Plant responsibility will be linked to performance measures for hourly employees in Operations, provided, however, that individuals whose compensation is subject to the deduction limits of section 162(m) of the Code shall have their bonuses based solely on a criteria specified herein.

Notwithstanding the foregoing, the maximum bonus that may be paid to any individual under this Plan for calendar 2004 with respect to the Company financial bonus portion of the Plan and the debt reduction bonus portion of the Plan, in the aggregate, shall be $2 million. The additional $250,000 bonus that may become payable to the CEO shall be subject to the $2 million maximum.

3

Furthermore the maximum bonus that may be paid to the Chairman and to the President shall not exceed specified percentages of a performance pool for 2004 which shall be equal to 0.9% of Pretax Earnings as reported in the Company's annual report for the year ending December 31, 2004 (the "Performance Pool"). The share of the Performance Pool that is allocated to the Chairman is 46% and the share of the Performance Pool that is allocated to the President is 54%. The additional $250,000 bonus that may become payable to the CEO/President shall not be subject to the 54% share of the Performance Pool. The Compensation Committee shall have the discretion to reduce the amount payable to either or both of the Chairman or the President, based upon the Debt Reduction incentive bonus arrangement described below, which shall be applicable with respect to 25% of the target bonus opportunity for the Chairman and the President, provided however, that any reduction shall be made in accordance with the requirements of section 162(m) of the Code and shall not result in the increase in any other bonus payable under the Plan.

DEBT REDUCTION INCENTIVE BONUS:

The Debt Reduction incentive bonus is based on the amount of reduction of the Company's "debt" during calendar 2004. For this purpose, the Company's debt reduction means the sum of all debt principal repayments made in 2004, less all new debt financing in 2004. The on-target and maximum debt reduction amounts described below and set forth in the table below shall be adjusted dollar for dollar based on the difference between the planned and actual cash provided from stock option exercises during 2004.

The on-target range for the Debt Reduction bonus for the year 2004 is $220 to $249 million.

Debt Reduction Payout Parameters

| | Debt Reduction

| | Payout Multiplier

| | Payout % with

25% Target

| | Payout % with

15% Target

| |

|---|

| Sliding Scale | | | | | | | | | |

| Minimum (payout threshold) | | $165MM | | 75 | % | 18.75 | % | 11.25 | % |

| | | $176MM | | 80 | % | 20 | % | 12.0 | % |

| | | $187MM | | 85 | % | 21.3 | % | 12.8 | % |

| | | $198MM | | 90 | % | 22.5 | % | 13.5 | % |

| Cliff | | | | | | | | | |

| On Target | | $220-249MM | | 100 | % | 25 | % | 15 | % |

| Maximum (payout cap) | | $250MM or more | | 150 | % | 37.5 | % | 22.5 | % |

INDIVIDUAL PERFORMANCE GOALS:

The individual bonus is based on both Company financial performance and achievement of individual performance goals. The individual incentive opportunity can increase or decrease, based on performance, according to whether an individual is Below Target (BT), On Target (OT), or Above Target (AT), according to guidelines developed by Human Resources, and on Company Financial Performance, in accordance with the parameters set forth on Schedule D attached hereto and hereby made a part of this Plan. The actual individual multiplier to be used for each individual employee will fall within the ranges shown on Schedule C, depending upon both individual performance and Company performance, as determined by the supervisor of each individual employee.

Individual performance goals will be documented and agreed upon by the later of February 1 of the Plan year or 30 days after the start date in the Plan. Each participant will meet with his or her immediate supervisor to develop individual goals in support of the Company strategies. These goals will be written and signed off by the participant and the supervisor before implementation. At the end of the Plan year each supervisor must submit in writing the results of each individual performance goal

4

and the individual performance multiplier, which shall fall within the parameters set forth on Schedule C, based upon both individual and Company performance.

PLANT PERFORMANCE:

The final portion of the bonus applies to those individuals with plant responsibilities. This piece will be funded separately from the corporate component, according to specific plant performance measures as identified by Human Resources and plant senior management. Payouts will be based on achievement against specifically identified goals.

FORM AND TIMING OF PAYMENTS:

At the end of the plan year final awards will be calculated. The payment of the Company financial bonus to certain individuals shall be subject to the additional Compensation Committee certification requirements described below. Payments will be made as soon as practicable after the end of the plan year and after any necessary Compensation Committee certification required under this Plan.

FEDERAL, STATE AND FICA TAX WITHHOLDING:

The Company will be required to withhold all applicable federal, state, local and foreign income, employment and other taxes on the awards.

TAX TREATMENT:

Participants realize taxable income at the date the incentive payout is received.

DISCLAIMER:

The Compensation Committee reserves the right to change, amend or terminate this Plan at any time, for any reason at its sole discretion. This Plan supersedes all prior documentation relating to the Annual Coors Incentive Plan.

SHAREHOLDER APPROVAL:

Notwithstanding the foregoing provisions of this Plan, no bonus shall be paid under this Plan to an employee to the extent that such payment would be non-deductible under the provisions of section 162(m) of the Code unless and until the stockholders of the Company have approved this Plan and the material terms of the performance goals established under this Plan in conformity with the requirements of section 162(m) of the Code and the Regulations thereunder.

COMPENSATION COMMITTEE CERTIFICATION:

Prior to the payment of any amounts hereunder to an individual whose compensation is subject to the deduction limitations of section 162(m) of the Code, the Compensation Committee shall certify in writing the extent to which the performance factors established by the Compensation Committee have been satisfied and shall approve the payment of such bonuses to such individuals.

NOT EMPLOYMENT CONTRACT:

At no time is this plan to be considered an employment contract between the participants and the Company. It does not guarantee participants the right to be continued as an employee of the Company. It does not affect a participant's right to leave the Company or the Company's right to discharge a participant.

5

TERMINATION PROVISIONS:

Participants must be on the payroll as of 1-1-2005 to receive payment. Any exceptions must be approved by the CEO, provided, however, that any individual whose compensation is subject to the deduction limitations of section 162(m) of the Code cannot receive an exception to the employment requirement. Participants on LOA (leave of absence) will receive a prorata share based on days worked.

6

SCHEDULE A

Business Unit Targets Within CIP

7

8

SCHEDULE B

The following shall be the Special Charges (Credits) referred to in the Plan:

- 1.

- Impact of fluctuation in exchange rates, if significant, as approved by the Compensation Committee.

- 2.

- Atypical, unplanned initiatives or investments for which Plan relief is formally granted by the Compensation Committee (e.g., sale of Anaheim distributorships).

- 3.

- Significant shifts in customer inventories, or initiatives which move profits potentially out of one year and into another, in each case as approved by the Compensation Committee.

- 4.

- Major shifts in the external environment which invalidate key planning assumptions (e.g., change in pension plan return assumptions), as approved by the Compensation Committee.

- 5.

- Significant errors in or changes to planning assumptions made at a corporate level which cause profit deviations either between the reporting segments or the enterprise as a whole, as approved by the Compensation Committee.

- 6.

- Significant changes in accounting guidance, regulations and interpretations which impact the Company's reported results, as approved by the Compensation Committee.

- 7.

- All adjustments hereunder shall provide consistency across business units, in terms of common sets of assumptions and the discretion to be applied to the foregoing factors, as approved by the Compensation Committee.

9

SCHEDULE C

Individual Multiplier Grid

| | Company Performance

(growth vs. prior year)

|

|---|

Individual Performance

|

|---|

| | AT

| | OT

| | BT

|

|---|

| AT | | 120-160% | | 110-150% | | 80-130% |

| OT | | 95-130% | | 85-120% | | 65-100% |

| BT | | 0-70% | | 0-60% | | 0-50% |

10

QuickLinks

COORS BREWING COMPANY 2004 COORS INCENTIVE PLAN (CIP)