- TAP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Molson Coors Beverage (TAP) DEF 14ADefinitive proxy

Filed: 5 Apr 23, 5:00pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

MOLSON COORS BEVERAGE COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Peter H. Coors Chair |  Andrew T. Molson Vice Chair | P.O. Box 4030

111 Blvd. Robert-Bourassa |

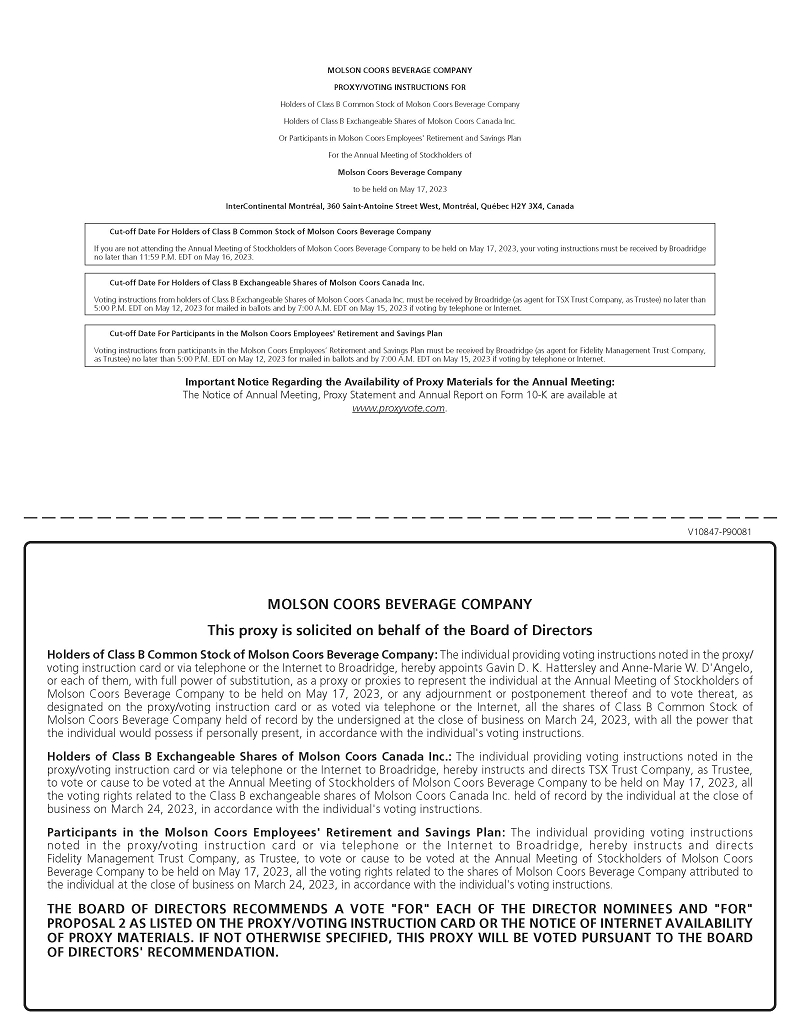

You are invited to attend our 2023 Annual Meeting of Stockholders (Annual Meeting), which will be held on Wednesday, May 17, 2023, at 11:00 a.m., Eastern Daylight Time, at the InterContinental Montréal, 360 Saint-Antoine Street West, Montréal, Québec H2Y 3X4, Canada. Molson Coors Beverage Company (Molson Coors, Company, we, us or our) traditionally alternates its annual meetings between its two principal executive offices in Montréal, Québec, and Golden, Colorado.

At the Annual Meeting, we will ask our stockholders to:

elect our Board of Directors;

approve, in a non-binding advisory vote, the compensation of the named executive officers (NEOs);

approve, in a non-binding advisory vote, the frequency of future non-binding advisory votes on the compensation of our NEOs; and

ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

We will also discuss any new business matters properly brought before the Annual Meeting. PLEASE NOTE: The Annual Meeting is expected to last less than 30 minutes.

The attached 2023 Notice of Annual Meeting and Proxy Statement explains our voting procedures, describes the business we will conduct at the Annual Meeting, and provides information about our Company that you should consider when you vote your shares.

2022 was a year of continued progress executing our strategy toward our goal of delivering top and bottom-line growth. We achieved this progress amidst a globally challenging macro-economic and operational environment, and while continuing to invest strongly in our business, strengthen our balance sheet, and return cash to shareholders. We are proud of our accomplishments which have laid a strong foundation as we strive for long-term, sustainable top- and bottom-line growth.

Our 2022 performance was driven by positive net pricing and favorable sales mix across both our business units. This led to robust net sales per hectoliter growth of 9.3% in constant currency(1). Financial volumes declined 2.1% for the year. This was largely due to lower financial volumes in our Americas business unit, which related to softer beer industries in the U.S. and Canada, as well as the Québec labor strike that impacted our second and third quarters during the year. Conversely, our EMEA&APAC business unit grew financial and brand volumes, driven by the U.K., which is our largest market in Europe.

Constant currency is a non-GAAP measure. See Annex A to this Proxy Statement for the definition of constant currency.

1 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Underpinning our performance are our core brands. Coors Light and Miller Lite are collectively the healthiest they have been in years, with these iconic brands posting their strongest combined full-year dollar share performance in the U.S. in a decade. In Canada, Molson Canadian grew industry share for the full year, and in the U.K., Carling continued to be the number one brand in the market.

We continued to aggressively premiumize our portfolio, not only with hard seltzers, but with Simply Spiked LemonadeTM in the U.S. and Madrí in the U.K., which in a few short years has become one of our top five largest above premium brands globally. Also, we expanded beyond the beer aisle with opportunities to scale in high-growth and above premium segments in energy and spirits. This progress is demonstrated by the fact that our above premium brand portfolio reached over 28% of our global net sales revenue in 2022, up from approximately 23% in 2019, the year our updated business strategy was announced. Not only is this a record for the company, but it demonstrates we are truly changing the shape of our portfolio.

We delivered healthy operating cash flow and successfully completed another cost savings program in 2022. We did this while adhering to our prudent capital allocation priorities. These included: continuing to invest to support the long-term health of the business; reducing our net debt by $0.6 billion and our net debt to underlying EBITDA ratio to under 3x; and, returning cash to shareholders, which included a 12% increase to our quarterly dividend since 2021.

Our investments in our business not only work to strengthen our brands but help to improve efficiencies. We have added meaningful capabilities throughout our network that support both improving production efficiencies and delivering our sustainability goals.

As one of the world’s largest global beverage companies, we have a long history of sustainability and are committed to driving long-lasting, meaningful change by incorporating sustainability into all aspects of our business. As detailed in Our Imprint ESG Report, we are committed to leaving a positive imprint on our People and Planet and are making progress against our 2025 goals.

In fact, in an effort to best ensure we have strong oversight and management of our environmental, social and governance (ESG) programs and accelerate progress toward our 2025 goals, starting in 2022 and continuing in 2023, a portion of the short-term compensation for the Molson Coors Leadership Team (approximately the top 100 senior leaders in our organization), is based on a number of quantitative ESG metrics, including emissions, water, employee diversity representation and safety.

As we look ahead, we recognize that the near-term macro and operating environments remain challenging. However, with strong brands across all price segments, coupled with our continued investments in our business and significant improvements in our financial flexibility, we believe we have a strong foundation for continued growth in 2023 and beyond.

And, of course, none of this would be possible without the hard work and dedication of our over 16,000 employees, our incredible partners, and our best-in-class distributor network. We are grateful to you all for your enduring support.

In closing, we hope you will be able to attend the Annual Meeting. Whether or not you plan to attend, your vote is important to us. We urge you to review our proxy materials and promptly cast your vote by telephone, via the internet, or mark, sign, date and return the proxy/voting instruction card in the envelope provided, so that your shares will be represented and voted at the Annual Meeting even if you cannot personally attend.

Thank you for your support of Molson Coors.

Sincerely,

Peter H. Coors |

Andrew T. Molson |

April 5, 2023

2 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. From time to time, we may also provide oral or written forward-looking statements in other materials we release to the public. Such forward-looking statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995.

Statements that refer to, among other things, projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. In addition, statements that we make in this Proxy Statement that are not statements of historical fact may also be forward-looking statements. Words such as “expects,” “intend,” “goals,” “plans,” “believes,” “continues,” “may,” “anticipate,” “seek,” “estimate,” “outlook,” “trends,” “future benefits,” “potential,” “projects,” “strategies,” and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking and other statements in this Proxy Statement regarding our environmental and sustainability plans and goals are not an indication that these statements are necessarily material to investors or required to be disclosed in our filings with the Securities and Exchange Commission (SEC).

Forward-looking statements are subject to risks and uncertainties that could cause actual results to be materially different from those indicated (both favorably and unfavorably). These risks and uncertainties include, but are not limited to, those described in Part I—Item 1A “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and those described from time to time in our past and future reports filed with the SEC. Caution should be taken not to place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date when made and we undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

3 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

2023 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | 5 |

PROXY SUMMARY | 7 |

Overview of Voting Matters and Board Recommendations | 7 |

Corporate Governance Highlights | 7 |

Director Nominee Highlights | 8 |

2022.Compensation Highlights | 10 |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS | 12 |

2023 Nominees for Class A Directors | 13 |

2023 Nominees for Class B Directors | 23 |

Board Skills & Experience and Demographic Matrix | 26 |

Position of Director Emeritus | 27 |

Family Relationship Disclosure | 27 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | 28 |

Corporate Responsibility | 28 |

Board and Committee Governance | 30 |

Stockholder Engagement | 38 |

Certain Governance Policies | 40 |

DIRECTOR COMPENSATION | 41 |

General | 41 |

2022 Compensation | 41 |

Director Stock Ownership Requirements | 41 |

Director Compensation Table | 42 |

RELATED PERSON TRANSACTIONS | 44 |

Approval of Related Person Transactions | 44 |

Certain Related Person Transactions | 44 |

MANAGEMENT | 46 |

PROPOSAL NO. 2 — ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION (THE ADVISORY SAY-ON-PAY VOTE) | 48 |

COMPENSATION DISCUSSION AND ANALYSIS (CD&A) | 49 |

Introduction | 49 |

Executive Summary | 49 |

Executive Compensation Philosophy | 52 |

Oversight of Executive Compensation Programs | 55 |

Components of Executive Compensation and 2022 Executive Pay Outcomes | 56 |

Additional Information Regarding Executive Pay | 62 |

COMPENSATION & HR COMMITTEE REPORT | 63 |

EXECUTIVE COMPENSATION | 64 |

Summary Compensation Table | 64 |

Grants of Plan Based Awards | 66 |

Outstanding Equity Awards at Fiscal Year-End | 68 |

Option Exercises and Stock Vested | 69 |

Pension Benefits | 70 |

Non-Qualified Deferred Compensation | 71 |

Potential Payments Upon Termination or Change in Control | 72 |

Material Terms of Employment Agreements and Letters | 74 |

CEO Pay Ratio | 74 |

PAY VERSUS PERFORMANCE | 75 |

Financial Performance Measures | 77 |

Analysis of the Information Presented in the Pay Versus Performance Table | 77 |

PROPOSAL NO. 3 — ADVISORY VOTE ON THE FREQUENCY OF FUTURE STOCKHOLDER VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION (THE ADVISORY SAY-ON-FREQUENCY VOTE) | 78 |

PROPOSAL NO. 4 — RATIFY APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023 | 79 |

AUDIT COMMITTEE REPORT | 81 |

BENEFICIAL OWNERSHIP | 82 |

QUESTIONS AND ANSWERS | 85 |

OTHER BUSINESS | 94 |

ANNEX A | 95 |

Use of Constant Currency | 95 |

4 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Time and Date May 17, 2023 11:00 a.m., Eastern Daylight Time |  Place InterContinental Montréal Montréal, Québec H2Y 3X4, Canada |  Record Date March 24, 2023 |

The 2023 Annual Meeting of Stockholders (Annual Meeting) of Molson Coors Beverage Company (Company, we, us or our) will be held for the following purposes:

PROPOSAL NO. 1 To elect the 14 director nominees identified in the accompanying Proxy Statement. |

| PROPOSAL NO. 3 To approve, in a non-binding advisory vote, the frequency of future non-binding advisory votes on the compensation of our NEOs. |

PROPOSAL NO. 2 To approve, in a non-binding advisory vote, the compensation of the named executive officers (NEOs). |

| PROPOSAL NO. 4 To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

And to transact such other business as may be brought properly before the Annual Meeting and any and all adjournments or postponements thereof.

PLEASE NOTE: The Annual Meeting is expected to last less than 30 minutes.

Record Date

Stockholders of record at the close of business on March 24, 2023 (Record Date) are entitled to receive notice of, and to vote at, the Annual Meeting and any and all adjournments or postponements thereof.

For a detailed description of our classes of stock and the exchangeable shares issued by Molson Coors Canada Inc., a Canadian corporation and our wholly-owned indirect subsidiary, please refer to the “Questions and Answers” section of this Proxy Statement.

Notice of Internet Availability of Proxy Materials

We will begin mailing a Notice of Internet Availability of Proxy Materials for the Annual Meeting on or about April 5, 2023. The Notice of Internet Availability will explain how to access our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and how to vote.

Voting Your Shares

We hope you will be able to attend the Annual Meeting. Whether or not you plan to attend, your vote is important to us. We urge you to review our proxy materials and promptly submit your proxy/voting instructions by telephone or via the internet, or mark, sign, date and return the proxy/voting instruction card in the envelope provided, so that your shares will be represented and voted at the Annual Meeting, even if you cannot personally attend.

Thank you for your interest in our Company. We look forward to seeing you at the Annual Meeting.

By order of our Board of Directors, Molson Coors Beverage Company

Dated: April 5, 2023

Anne-Marie W. D’Angelo

Chief Legal & Government Affairs Officer and Secretary

5 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

The Board of Directors (Board) of Molson Coors Beverage Company (Molson Coors, Company, we, us or our) is furnishing this Proxy Statement in connection with the solicitation of proxies for use at the 2023 Annual Meeting of Stockholders (Annual Meeting), which will be held on May 17, 2023, at 11:00 a.m., Eastern Daylight Time, at the InterContinental Montréal, 360 Saint-Antoine Street West, Montréal, Québec H2Y 3X4, Canada. The proxies may also be voted at any adjournments or postponements of the Annual Meeting.

We have dual principal executive offices located at P.O. Box 4030, NH353, Golden, Colorado 80401 USA and 111 Boulevard Robert-Bourassa, 9th Floor, Montréal, Québec, H3C 2M1 Canada (Principal Executive Offices).

We will begin mailing a Notice of Internet Availability of Proxy Materials for the Annual Meeting, containing instructions on how to access our proxy materials and vote, on or about April 5, 2023.

Even if you plan to attend the Annual Meeting, please vote right away using one of the following voting methods (see the “Questions and Answers” section of this Proxy Statement for additional details). Make sure to have your proxy/voting instruction card in hand and follow the instructions.

You can vote in advance in one of the following three ways:

VIA THE INTERNET PRIOR TO THE ANNUAL MEETING Visit the website listed on your proxy/voting instruction card |  BY TELEPHONE Call the telephone number listed on your proxy/voting instruction card |  BY MAIL Sign, date and return your proxy/voting instruction card in the enclosed envelope |

All properly executed proxies delivered by mail, and all properly completed proxies submitted via the Internet or by telephone that are delivered pursuant to this solicitation, will be voted at the Annual Meeting in accordance with the directions given in the proxy, unless the proxy is properly revoked prior to completion of voting at the Annual Meeting. | ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 17, 2023 The Notice of Annual Meeting, this Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (Annual Report) are available at www.proxyvote.com. | ||

6 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider. You should read the entire Proxy Statement carefully before voting.

Proposal | Recommendation | Page of Proxy |

Election of 14 director nominees (Proposal No. 1) | FOR all director nominees | 12 |

Advisory approval of NEO compensation (Proposal No. 2) | FOR | 48 |

Advisory approval of the frequency of future advisory stockholder votes on NEO compensation (Proposal No. 3) | EVERY YEAR | 78 |

Ratification of appointment of PricewaterhouseCoopers LLP (PwC) as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal No. 4) | FOR | 79 |

We are committed to strong corporate governance, sustainability and the accountability of our Board and our senior management team to our stockholders. Highlights of our corporate governance program include:

Election of six new directors since September 2019 as part of our Board refreshment efforts and stockholder dialogue, which increased the number of women directors to three and the number of ethnically or racially diverse directors to three;

Formal incorporation of environmental, social and governance (ESG) priorities and metrics into the Company’s culture and values, as well as short-term incentive awards for the Molson Coors Leadership Team (MCLT), representing approximately the top 100 senior leaders in our organization;

Regular Board and committee review of our significant ESG matters, including human capital initiatives (including diversity, equity and inclusion (DEI)), corporate citizenship, social responsibility, environmental matters, and public policy issues;

Separation of our Chief Executive Officer (CEO) and Board Chair positions;

Regular executive sessions of independent directors at Board meetings that are chaired by the independent director member of the Governance Committee (the Independent Governance Committee Member);

Independent Governance Committee Member reviews and approves Board and committee agendas, together with the Board Chair and the Vice Chair;

Ongoing review and annual assessment of Board composition, including diversity of opinion, personal and professional background and experience, as well as diversity of gender, race or ethnicity, nationality, age and country of origin;

Ongoing review and assessment of Board refreshment matters;

An age 72 retirement policy for independent directors as detailed further in the “Board Composition and Refreshment” section of this Proxy Statement;

Annual election of all directors;

Independent Audit, Compensation and Human Resources (Compensation & HR) and Finance committees;

Active stockholder engagement;

Significant director and executive officer stock ownership requirements;

Annual Board and committee self-evaluations and regular discussions regarding Board and committee effectiveness;

Robust anti-pledging policy and prohibition on hedging and short sales;

Annual advisory vote by Class A and Class B stockholders, voting together as a single class, to approve the compensation of our named executive officers (NEOs);

Executive compensation clawback policy; and

Majority independent Board.

7 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Name | Age(1) | Director Since | Primary Occupation | Committee Memberships | Independent |

Julia M. Brown | 53 | 2021 | CEO, JMB Legacy Consulting LLC; Former Chief Procurement Officer of multiple global companies | Compensation & HR |  |

David S. Coors | 41 | 2020 | Vice President of Full Strength Spirits, Molson Coors | Governance |

|

Peter H. Coors | 76 | 2005 | Chair of the Board, Molson Coors | Governance |

|

Mary Lynn Ferguson-McHugh | 63 | 2015 | Former CEO, Family Care and New Business, The Procter & Gamble Company | Compensation & HR |  |

Gavin D.K. Hattersley | 60 | 2019 | President and CEO, Molson Coors | None |

|

Andrew T. Molson | 55 | 2005 | Partner and Chairman, AVENIR GLOBAL | Governance |

|

Geoffrey E. Molson | 52 | 2009 | General Partner, President and CEO, CH Group Limited Partnership | Governance |

|

Nessa O’Sullivan | 58 | 2020 | CFO and Executive Director, Brambles Limited | Audit; Finance |  |

Louis Vachon | 60 | 2012 | Operating Partner, J.C. Flowers & Co. | Finance |  |

Leroy J. Williams, Jr. | 58 | 2022 | CEO, CyberTekIQ, LLC | Audit; Finance |  |

James “Sandy” A. Winnefeld, Jr. | 66 | 2020 | National Security and Business Consultant | Audit; Compensation & HR |  |

Name | Age(1) | Director Since | Primary Occupation | Committee Memberships | Independent |

Roger G. Eaton | 62 | 2012 | Former CEO of KFC, a division of Yum! brands | Audit; Finance |  |

Charles M. Herington | 63 | 2005 | Chief Operating Officer, Vice Chairman and President of Global Operations, Zumba Fitness, LLC | Audit |  |

H. Sanford Riley | 72(2) | 2005 | President and CEO, Richardson Financial Group Limited | Compensation & HR; Governance |  |

(1) Age as of the Record Date (as defined herein). (2) See the “Board Composition and Refreshment” section of this Proxy Statement for more information regarding our director retirement policy. | |||||

8 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Includes director nominees who hold a non-U.S. passport, including individuals that also hold a U.S. passport.

Tenure measured from the February 2005 merger of Molson Inc. with and into Adolph Coors Company LLC through the Record Date.

Skills and Experience

9 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

We ask our stockholders annually to vote to approve, on an advisory (non-binding) basis, the compensation of our NEOs. We provide our NEOs with short- and long-term compensation opportunities that encourage increasing Company performance to enhance stockholder value while avoiding excessive risk-taking. We maintain compensation plans that tie a substantial portion of our NEOs’ overall target annual compensation to the achievement of corporate and individual performance goals over both short- and long-term periods. The Compensation & HR Committee employs multiple performance measures and strives to award an appropriate mix of annual and long-term equity incentives to avoid overweighting short-term objectives. Our Board, primarily through the Compensation & HR Committee, defines and oversees our executive compensation program, which is based on a pay-for-performance philosophy and designed to accomplish the following goals:

Pay for Performance

Pay for Performance

Compensation Competitive with the Market

Compensation Competitive with the Market

Every Compensation Element Should Serve a Purpose

Every Compensation Element Should Serve a Purpose

What We Do | What We Don’t Do | ||

| Tie a significant portion of compensation to performance |  | Design our executive compensation program to encourage excessive risk taking |

| Use a balance of short- and long-term incentive awards with diverse performance metrics for both |  | Re-price stock options without stockholder approval |

| Award incentive compensation subject to clawback policy |  | Provide excise tax gross-ups to executives |

| Consider peer group and comparable industry data in setting compensation |  | Allow hedging of Company stock |

| Establish significant executive and director stock ownership guidelines and evaluate compliance annually |  | Award excessive perquisites |

| Retain an independent compensation consultant |  | Offer excessive change in control or severance benefits |

| Actively engage with investors regarding executive compensation and governance practices |  | Pay dividend equivalents on unvested stock awards |

| A portion (10%) of the short-term incentive awards for the MCLT is based on an ESG scorecard composed of certain quantitative ESG metrics |

|

|

Collectively, the metrics for our short- and long-term incentive programs inspire our executive team to focus on earning more, using less, and investing wisely, as shown below. The performance measures are all explained in detail below.

Business Goal | Performance Measures(1) | Drivers |

Earn More | Adjusted Underlying Income Before Income Taxes, | • Build extraordinary brands • Strengthen customer excellence • Drive disruptive growth |

Use Less | Adjusted Underlying Income Before Income Taxes, | • Drive synergies and cost savings • Increase productivity • Increase efficiency of spend |

Invest Wisely | Adjusted Underlying Income Before Income Taxes, | • Brand-led growth opportunities • Strengthen balance sheet |

Performance measures, with the exception of Relative TSR, are non-GAAP and adjusted for changes in foreign currency movement versus the comparable period. See the “2022 MCIP Performance Metrics” section of this Proxy Statement for definitions of these non-GAAP performance measures.

10 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

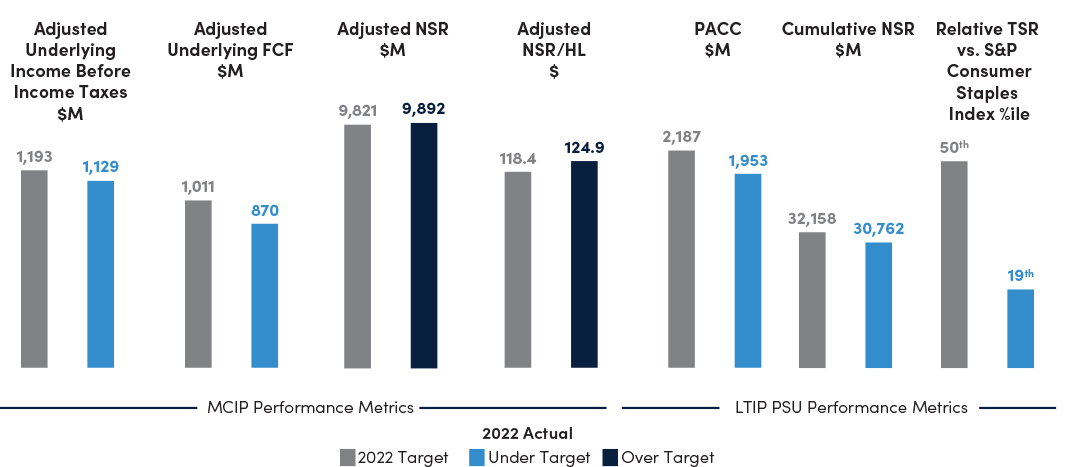

2022 MCIP Metric (Weight)(1),(2) | 2022 Overall Company Highlights(3) |

Adjusted Underlying Income Before Income Taxes (22.5%) | • Adjusted Underlying Income Before Income Taxes was below our 2022 MCIP threshold driven by lower financial volumes and cost inflation, mainly on materials, transportation and energy costs, partially offset by positive net pricing, lower marketing, general and administrative expense and favorable sales mix. |

Adjusted Underlying FCF (22.5%) | • Underlying FCF cash of $852.9 million, which was lower than 2021 and below our 2022 MCIP threshold, primarily due to lower net cash provided by operating activities. |

Adjusted NSR (22.5%) | • Net sales increased 7.0% on a constant currency basis(4) from 2021 and was above our 2022 MCIP target, primarily due to positive net pricing and favorable sales mix, partially offset by lower financial volumes. |

Adjusted NSR / HL (22.5%) | • NSR / HL on a brand volume basis in constant currency basis(4) increased 9.5%, which was significantly above our 2022 MCIP target, primarily due to positive net pricing and favorable sales mix resulting from portfolio premiumization and favorable channel mix.(5) |

ESG Scorecard (10%) | • We made progress on our ESG metrics but in the aggregate fell below the 2022 targets. |

2020 to 2022 PSU Metric | 2020 to 2022 Highlights |

Cumulative NSR | • We did not achieve our 2020-2022 threshold performance level for Cumulative NSR. |

PACC | • We achieved between threshold and target performance levels for our 2020-2022 PACC. |

Relative TSR | • Relative TSR over the three-year performance period was in the 19th percentile relative to the companies in the S&P Consumer Staples Index at the end of the performance period, which was below threshold. |

(1) Performance measures, as defined in the “2022 MCIP Performance Metrics” section of this Proxy Statement, with the exception of Relative TSR, are non-GAAP, and such non-GAAP performance measures are adjusted for changes in foreign currency movement versus the comparable period. (2) See the “Annual Incentives” and “Long-Term Incentives” sections of this Proxy Statement for further information about our MCIP, LTIP and actual performance. (3) The 2022 Overall Company Highlights do not contemplate the adjustments required for the MCIP metrics. (4) Constant currency is a non-GAAP measure. See Annex A to this Proxy Statement for the definition of constant currency. (5) See our Annual Report for further information on financial volume. |

Name | Title |

Gavin D.K. Hattersley | President and CEO |

Tracey I. Joubert | CFO |

Michelle St. Jacques | Chief Commercial Officer(1) |

Anne-Marie D’Angelo | Chief Legal & Government Affairs Officer |

Sergey Yeskov | President & CEO of EMEA&APAC |

(1) Effective March 1, 2023, Ms. St. Jacques was appointed the Company’s Chief Commercial Officer. Ms. St. Jacques previously served as the Company’s Chief Marketing Officer from November 2019 to February 2023. | |

Incentive Plan | Affected NEOs | Performance Result |

2022 Enterprise MCIP | Hattersley, Joubert, D’Angelo | 77% |

2022 Americas MCIP | St. Jacques | 81% |

2022 EMEA&APAC MCIP | Yeskov | 137% |

2020 to 2022 PSUs | All | 0% |

11 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

At the Annual Meeting, the holders of the Class A common stock and the Special Class A voting stock (as instructed by the holders of Class A exchangeable shares) (collectively, the Class A Holders) may not cast votes for a greater number of director nominees than the 11 Class A nominees named in this Proxy Statement, and the holders of the Class B common stock and the Special Class B voting stock (as instructed by the holders of the Class B exchangeable shares) (collectively, the Class B Holders) may not cast votes for a greater number of director nominees than the three Class B nominees named in this Proxy Statement. Each of the director nominees has consented to serve if elected. If any nominee becomes unavailable to serve as a director, a substitute nominee may be designated. In that case, the individuals named as proxies will vote for the substitute nominees designated.

When determining the appropriate size of the Board, one objective is to fix a size that facilitates substantive discussions by the whole Board in which each director can participate meaningfully. Our Board has currently set the number of directors at 15, consisting of 12 Class A directors and three Class B directors. However, only 14 directors are being nominated for election at the Annual Meeting, leaving one Class A director vacancy, which must be held by a member of management according to our Restated Certificate of Incorporation, as amended to date (Restated Certificate of Incorporation). Our Board does not currently plan to fill this Class A director vacancy.

Our Restated Certificate of Incorporation and Amended and Restated Bylaws, as amended and restated to date (Bylaws) allow for our Board to change its size by resolution which must be approved by at least two-thirds of the authorized number of directors (including vacancies). However, any decrease in the number of directors to less than 15 must be approved by the holders of the Class A common stock and Special Class A voting stock, voting together as a class. In addition, any increase in the number of directors must be divisible by three, with one-third of such new directorships to be filled by the Governance Committee, one-third of such directorships to be filled by the Class A-C Nominating Subcommittee, and one-third of such directorships to be filled by the Class A-M Nominating Subcommittee.

The following summaries set forth certain biographical information regarding each director nominee, including the particular knowledge, qualifications or areas of expertise considered for nomination to our Board. For more information on how the nominees are selected, please refer to the “Nomination Process” section of this Proxy Statement.

12 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 53

Director of

Independent | JULIA M. BROWN | |

SKILLS AND QUALIFICATIONS: • Multi-brand international company experience • Consumer-packaged goods experience • Food and beverage company experience • Operations, supply chain and procurement experience • Commercial and transformation experience • Vendor experience • Global sustainability experience • Outside public board experience | COMMITTEE ASSIGNMENT: • Compensation & HR U.S. PUBLIC COMPANY BOARDS: • Solo Brands, Inc. (NYSE: DTC) since 2021 • The Honest Company, Inc. (Nasdaq: HNST) since 2022 U.K. PUBLIC COMPANY BOARDS: • Ocado Group plc (LSE: OCDO) since 2023 | |

EXPERIENCE: • JMB Legacy Consulting LLC, a consulting firm (2021 – Present) • CEO & Founder (2021 – Present) • Mars Wrigley, a division of Mars, Incorporated, a global manufacturer of confectionery, food, and pet care products and services (2020 – 2021) • Chief Procurement Officer (2020 – 2021) • Carnival Corporation & plc (NYSE: CCL), a global cruise company and leisure travel company (2015 – 2020) • Chief Procurement Officer (2015 – 2020) • Kraft Foods (Nasdaq: KHC), a global food and beverage company, and then Mondelēz International, Inc. (Nasdaq: MDLZ), a global snack company, when it was spun off from Kraft Foods Inc. in 2012 (2008 – 2015) • Chief Procurement Officer (2008 – 2015) • The Clorox Company (NYSE: CLX), a global manufacturer and marketer of consumer and professional products (2005 to 2008) • Vice President, Corporate Procurement and Contract Manufacturing (2005 to 2008) • The Gillette Company, Inc., a manufacturer of safety razors and other personal care products (2004 – 2005) • Senior Director, Procurement, Global Direct Materials and Strategic Sourcing (2004 – 2005) • Diageo plc (NYSE: DEO), an alcoholic beverage company (1999 – 2003) • Director, Procurement, Acquisition Integration and Development (2001 – 2003) • Purchases Group Leader for Global Cosmetics (1999 – 2001) • The Procter & Gamble Company (NYSE: PG), a global consumer goods company (1991 – 1999) • Senior Purchasing Manager (1995 – 1999) • Various roles of increasing responsibility (1991 – 1994) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Shutterfly Inc. (2020 – Present) • The Venetian (2022 – Present) • CoreTrust Purchasing Group LLC (2022 – Present) | EDUCATION: • Honors Bachelor of Commerce, McMaster University (Hamilton, Canada) | |

13 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 41

Director of

| DAVID S. COORS | |

SKILLS AND QUALIFICATIONS: • P&L management • Current executive • Brand building and marketing experience • Extensive knowledge of our history and culture • Long-term, highly-committed significant stockholder • U.S. beer business expertise • International and craft beer expertise • Alcoholic spirits distillation and distribution experience | COMMITTEE ASSIGNMENT: • Governance | |

EXPERIENCE: • Molson Coors (2010 – Present) • Vice President of Full Strength Spirits, Molson Coors (2023 – Present) • Vice President of Next Generation Beverages, Molson Coors (2019 – 2023) • Senior Director of Global Craft and Retail (2017 – 2018) • General Manager of Australasia (2013 – 2016) • Various management positions (2010 – 2013) • AC Golden Brewing Company LLC, a subsidiary of Molson Coors (2018 – Present) • President (2018 – Present) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Board of Trustees, Adolph Coors Company LLC • The Yuengling Company LLC, a joint venture between Molson Coors and a D.G. Yuengling & Son, Inc. affiliate Not-for-Profit/Other • Mario St. George Boiardi Foundation • Coors Western Art Advisory Committee • Visit Denver | EDUCATION: • Master of Business Administration and Master of Engineering Management, Kellogg School of Management at Northwestern University • Bachelor of Science in Operations Research and Industrial Engineering, Cornell University College of Engineering | |

14 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 76

Director of

Board Chair | PETER H. COORS | |

SKILLS AND QUALIFICATIONS: • Former CEO of our Company • Long-term, highly-committed significant stockholder • Extensive knowledge of our history and culture • Strong relationships with U.S. distributors and retailers • Recognized beer industry leader • U.S. beer business expertise • Company brand ambassador | COMMITTEE ASSIGNMENT: • Governance | |

EXPERIENCE: • Molson Coors (1971 – 2019) • Chief Customer Relations Officer (CCRO), Molson Coors (2016 – 2019) • Chairman of the Board of Directors, MillerCoors LLC (July 2008 until we acquired full ownership of the joint venture in 2016) • Several executive and management positions at Adolph Coors Company, Coors Brewing Company and Molson Coors, including as CEO (2000 – 2002) and as Board Chair (2002 – 2005) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Board of Trustees, Adolph Coors Company LLC • Manager, Keystone Holdings LLC • Director, Coors Brewing Company, a wholly-owned subsidiary Former U.S. Public Company Boards • U.S. Bancorp (NYSE: USB) (1996 – 2008) • H.J. Heinz Company (Nasdaq: KHC) (2001 – 2006) | Not-for-Profit/Other • President, Adolph Coors Foundation, a family charitable foundation • Director, American Enterprise Institute • Director, Western Stock Show Association • Director, ACE Scholarships • Director, Colorado Concern • Director, Colorado Succeeds • Director, Denver Art Museum Foundation • Director, PEMA Foundation • Trustee Emeritus, Denver Area Council of the Boy Scouts of America | |

15 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 63

Director of

Independent | MARY LYNN FERGUSON-MCHUGH | |

SKILLS AND QUALIFICATIONS: • P&L management • Operations background • Brand building, marketing and innovation expertise • Consumer insight experience • Consumer-packaged goods experience • Supply chain and logistics experience • Digital experience | COMMITTEE ASSIGNMENT: • Compensation & HR (Chair) U.K. PUBLIC COMPANY BOARDS: • Smurfit Kappa Group plc (LSE: SKG) since 2023 | |

EXPERIENCE: • The Procter & Gamble Company (NYSE: PG), a global consumer goods company (1986 – October 2021) • CEO of Family Care and New Business (2019 – 2021) • Group President, Global Family Care and P&G Ventures (2015 – 2019) • Group President, Western Europe and then as Group President, Europe (2011 – 2014) • Various roles of increasing responsibility (1986 – 2010) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Gojo Industries, Inc. • FJ Management Inc. | EDUCATION: • Master of Business Administration, Wharton School of Business at the University of Pennsylvania • Bachelor of Science degree from the University of the Pacific | |

Age 60

Director of

| GAVIN D.K. HATTERSLEY | |

SKILLS AND QUALIFICATIONS: • President and CEO of our Company • Beer business experience • Former CFO of our Company • International business expertise • P&L management • Financial expertise • Digital expertise • Corporate Development/M&A experience | COMMITTEE ASSIGNMENT: • None | |

EXPERIENCE: • Molson Coors (2002 – Present) • President and CEO (2019 – Present) • CEO, MillerCoors LLC (n/k/a Molson Coors Beverage Company USA LLC), our U.S. business (2015 –2019) • CFO, Molson Coors (2012 – 2015) • Executive Vice President and CFO, MillerCoors LLC (2008 – 2012) • Senior Vice President, Miller Brewing Company (2002 – 2008) • SAB Limited of Johannesburg, South Africa, a beer brewer (1997 – 2002) • CFO (1999 – 2002) • Various Financial Management Positions (1997 – 1998) • Barloworld Limited, an industrial brand management company (1987 – 1996) • Various Finance Positions (1987 – 1996) | ||

EDUCATION: • Honors Degree in Accounting Science, University of South Africa • Bachelor’s Degree, University of South Africa • Passed Public Accountants and Auditors Board exams in 1987 | ||

16 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 55

Director of

Board Vice Chair | ANDREW T. MOLSON | |

SKILLS AND QUALIFICATIONS: • Extensive knowledge of our history and culture • Long-term, highly-committed significant stockholder • CEO experience • Public relations experience • Corporate governance expertise • Canadian beer business expertise • Outside public board experience • Digital experience | COMMITTEE ASSIGNMENT: • Governance (Chair) U.S./CANADIAN PUBLIC COMPANY BOARDS: • Theratechnologies Inc. (Nasdaq: THTX; TSX: TH) since 2020 CANADIAN PUBLIC COMPANY BOARDS: • Dundee Corporation (TSX: DC.A) since 2015 | |

EXPERIENCE: • AVENIR GLOBAL, a network uniting seven strategic communications firms across Canada, the U.S., Europe and the Middle East, including NATIONAL Public Relations, AXON, Madano, SHIFT Communications, Padilla, Cherry and Hanover (1997 – Present) • Chairman (1997 – Present) • RES PUBLICA, the parent company of AVENIR GLOBAL (1997 – Present) • Partner and Chairman (1997 – Present) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Groupe Deschênes Inc. • CH Group Limited Partnership Not-for-Profit/Other • President, Molson Foundation • Director, Institute for Governance of Private and Public Organizations • Director, Concordia University Foundation • Director, Evenko Foundation for Emerging Talent • Director, Québec Blue Cross Former For-Profit Company Boards • The Group Jean Coutu PJC Inc. (2014 – 2018) | EDUCATION: • Law Degree, Laval University • Master of Science degree in Corporate Governance and Ethics, University of London • Bachelor of Arts degree, Princeton University OTHER DESIGNATIONS: • Member of the Order of Canada • Knight of the National Order of Québec | |

17 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 52

Director of

| GEOFFREY E. MOLSON | |

SKILLS AND QUALIFICATIONS: • Extensive knowledge of our history and culture • Long-term, highly-committed significant stockholder • CEO experience • P&L management and operations background • Beer sales and marketing background • Key account management experience • Distributor development experience • Sports and entertainment industry background and experience • Canadian beer business expertise • Outside director experience | COMMITTEE ASSIGNMENT: • Governance | |

EXPERIENCE: • CH Group Limited Partnership, a sports and entertainment company and owner of the Montréal Canadiens, the Bell Centre, L’Équipe Spectra and Gestion evenko (2009 – Present) • General Partner (2009 – Present) • President and CEO (2011 – Present) • Molson Coors (2009 – Present) • Ambassador, representing the Molson family in key strategic areas of our business • Board Chair (2015 – 2017) • Molson Inc. (1999 – 2009) • Various roles of increasing responsibility, including its former U.S. business (1999 – 2009) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • RES PUBLICA Consulting Group Not-for-Profit/Other • Member, Molson Foundation • Director, St. Mary’s Hospital Foundation • Director, Montréal Canadiens Children’s Foundation | EDUCATION: • Master of Business Administration, Babson Business School • Bachelor of Arts degree in Economics, St. Lawrence University OTHER DESIGNATIONS: • Member of the Order of Canada • Knight of the National Order of Québec | |

18 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 58

Director of

Independent | NESSA O’SULLIVAN | |

SKILLS AND QUALIFICATIONS: • Financial expertise and audit experience • Public company CFO experience • Sustainability/ESG experience • Operations background • International business experience • Global brands experience • Consumer-packaged goods experience, including food and beverage • Supply chain and logistics experience • Strategy, corporate development/M&A and capital markets experience • Outside public company board experience | COMMITTEE ASSIGNMENT: • Audit • Finance AUSTRALIAN PUBLIC COMPANY BOARDS: • Brambles Limited (ASX: BXB) since April 2017 | |

EXPERIENCE: • Brambles Limited (ASX: BXB), a global logistics company (2016 – Present) • Executive Director (2017 – Present) • CFO (2016 – Present) • Coca-Cola Amatil Limited (ASX: CCL), an Australian bottler of non-alcoholic beverages (2005 – 2015) • Group CFO roles (2008 – 2015) • Various roles of increasing responsibility (2005 – 2007) • Yum! Brands, Inc. (NYSE: YUM), a quick service food corporation (1993 – 2005) • CFO SOPAC Region & VP Finance (2000 – 2005) • Various roles of increasing responsibility (1993 – 2000) • Tyco Grinnell, a fire protection system manufacturer (1990 – 1993) • Regional Financial Controller (1990 – 1993) • Price Waterhouse (1985 – 1990) • Auditor/Consultant (1985 – 1990) | ||

EDUCATION: • Fellow, Institute of Chartered Accountants in Ireland • Bachelor of Commerce Degree, University College Dublin • Graduate, Australian Institute of Company Directors | ||

19 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 60

Director of

Independent | LOUIS VACHON | |

SKILLS AND QUALIFICATIONS: • Financial markets expertise • Financing experience • Strategic planning experience • CEO experience • Canadian market experience • Outside public board experience | COMMITTEE ASSIGNMENT: • Finance (Chair) U.S./CANADIAN PUBLIC COMPANY BOARDS: • BCE Inc. (TSX: BCE) (NYSE: BCE) since 2022 CANADIAN PUBLIC COMPANY BOARDS: • Alimentation Couche-Tard Inc. (TSX: ATD.A) since 2021 • MDA Ltd. (TSX: MDA) since 2022 | |

EXPERIENCE: • J.C. Flowers & Co., a private investment firm (2022 – Present) • Operating Partner (2022 – Present) • National Bank of Canada, a commercial banking institute (1996 – 2021) • President and CEO (2007 – 2021) • Director (2006 – 2021) • Various roles of increasing responsibility (1996 – 2007) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Groupe CH Inc. OTHER DESIGNATIONS: • Member of the Order of Canada • Officer of the National Order of Québec • Knight of the National Order of Montréal | EDUCATION: • Master of International Business degree in International Finance, The Fletcher School at Tufts University • Bachelor of Arts degree in Economics, Bates College • CFA certification, CFA Institute | |

20 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 58

Director of

Independent | LEROY J. WILLIAMS, JR. | |

SKILLS AND QUALIFICATIONS: • CEO experience • Global technology and cybersecurity expertise • M&A experience • Financial services / banking experience • P&L management • Outside public board experience | COMMITTEE ASSIGNMENT: • Audit • Finance U.S. PUBLIC COMPANY BOARDS: • UMB Financial Corporation (NYSE:UMBF) since 2016 | |

EXPERIENCE: • CyberTekIQ, LLC, an information technology consulting firm (2016 – Present) • Founder and CEO (2016 – Present) • Ball Corporation, a global packaging provider (NYSE: BLL) (2005 – 2016) • Global Chief Information Officer (2005 – 2016) • State of Colorado (2001 – 2005) • Secretary of Technology • Acting Executive Director for the Department of Labor & Employment • Qwest Communications and its affiliates, telecommunications companies • Various roles of increasing responsibility • Norwest (now Wells Fargo), a financial services company • Senior Technical Consultant • United States Army • Telecommunications Specialist | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Director, J.E. Dunn Construction Group • Board Advisor, Taiga Biotechnologies Inc. Not-for-Profit • Director, The Daniels Fund | EDUCATION: • Master of Business Administration, University of Denver • Bachelor of Science degree in Information Systems Management, Denver Technical College | |

21 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 66

Director of

Independent | JAMES “SANDY” A. WINNEFELD, JR. | |

SKILLS AND QUALIFICATIONS: • Senior leadership experience • Global technology and cybersecurity expertise • International and governmental affairs experience • Global security environment expertise • Human resource management experience • Strategic planning experience • Risk management/oversight expertise • Outside public board experience | COMMITTEE ASSIGNMENT: • Audit • Compensation & HR U.S. PUBLIC COMPANY BOARDS: • Raytheon Technologies Corporation (NYSE:RTX) since 2017 | |

EXPERIENCE: • United States Navy (1978 – 2015) • Vice Chairman of the Joint Chiefs of Staff (the United States’ number two ranking military officer) (2011 – 2015) • Various positions of increasing responsibility, including Commander, U.S. Northern Command (USNORTHCOM); Commander, North American Aerospace Defense Command (NORAD); Commander, U.S. Sixth Fleet; and Commander, Allied Joint Command Lisbon, United States Navy (1978 – 2011) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Director, Alliance Laundry Systems LLC • Chairman, Cytec Defense Materials LLC • Director, Enterprise Holdings, Inc. Advisor • BDT Capital Partners, LLC, a private equity firm Other Professional Experience • Professor of International Affairs, Sam Nunn School of International Affairs at the Georgia Institute of Technology • Senior Non-Resident Fellow, Belfer Center for Science and International Affairs at the Kennedy School at Harvard University | Not-for-Profit • Co-Founder (with Mr. Winnefeld’s spouse Mary), Stop the Addiction Fatality Epidemic (S.A.F.E.) • Chair, President’s Intelligence Advisory Board • Member, Georgia Tech Foundation, Inc. EDUCATION: • Bachelor of Aerospace Engineering, Georgia Institute of Technology • Graduate, The Naval War College and the Naval Nuclear Power School | |

22 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 62

Director of

Independent | ROGER G. EATON | |

SKILLS AND QUALIFICATIONS: • CEO experience • Financial expert • Audit experience • Global retail brand management • P&L management and operations background • International business experience • Digital experience • Corporate Development/M&A experience | COMMITTEE ASSIGNMENT: • Audit (Chair) • Finance | |

EXPERIENCE: • Yum! Brands, Inc., a quick service food corporation (NYSE: YUM) (2008 – 2019) • CEO, KFC (2015 – 2019) • Chief Operations Officer, Yum! Brands, Inc. (2011 – 2015) • President, KFC (2014 – 2015) • Operational Excellence Officer, Yum! Brands, Inc. (2011) • CEO and President, KFC USA (2008 – 2011) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Director, Arnott’s Biscuits Holdings Pty Limited • Director, George and Matilda Eyecare • Chairman, Ipic Pty Ltd. (parent company of George and Matilda Eyecare) | EDUCATION: • Post graduate diploma in Accounting and a Bachelor’s Degree in Commerce, University of Natal — Durban in South Africa • Passed the South African Public Accountants and Auditors Board exams in 1982 • Member, Australian Institute of Chartered Accountants | |

23 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 63

Director of

Independent | CHARLES M. HERINGTON | |

SKILLS AND QUALIFICATIONS: • CEO experience • Marketing and brand building experience • Executive leadership and management experience • Multicultural lens from living as a Latin in multiple countries • Direct P&L responsibilities in Canada, U.S., Latin America, Asia Pacific, Central and Eastern European • Outside public board experience • Corporate Development/M&A experience | COMMITTEE ASSIGNMENT: • Audit U.S./CANADIAN PUBLIC COMPANY BOARDS: • Gildan Activewear Inc. (NYSE/TSX: GIL) since 2018 | |

EXPERIENCE: • Zumba Fitness LLC, a worldwide provider of dance fitness classes (2012 – Present) • Chief Operating Officer, Vice-Chairman and President of Global Operations (2012 – Present) • Avon Products Inc., a multinational cosmetics, skin care, fragrance and personal care company (2006 – 2012) • Executive Vice-President of Developing and Emerging Markets Group (Office of the Chairman) (2006 – 2012) • America Online, web portal and online service provider (1999 – 2006) • President and CEO, America Online (AOLA) Latin America (1999 – 2006) • Revlon, multinational cosmetics, skin care, fragrance and personal care company (1997 – 1999) • President, Latin America (1997 – 1999) • PepsiCo, Inc. (Nasdaq: PEP), a multinational food, snack, and beverage corporation (1990 – 1997) • Division President, PepsiCo Restaurants Latin America (1990 – 1997) • The Procter & Gamble Company (NYSE: PG), a global consumer goods company (1981 – 1990) • Various brand management positions (1981 – 1990) | ||

OTHER BOARDS/EXPERIENCE: For-Profit • Chairman, Quirch Foods, LLC • Director, HyCite Enterprises, LLC • Director, Accupac, LLC Former U.S. Public Company Boards • NII Holdings, Inc. (Nasdaq: NIHD) (2002 – 2015) | EDUCATION: • Chemical Engineering Degree, Instituto Tecnológico y de Estudios Superiores de Monterrey | |

24 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Age 72(1)

Director of

Independent | H. SANFORD RILEY | |

SKILLS AND QUALIFICATIONS: • Financial expertise • P&L management and operations background • Corporate governance expertise • Leadership in highly-regulated global industry • CEO experience • Outside public board experience • Corporate Development/M&A experience | COMMITTEE ASSIGNMENTS: • Compensation & HR • Governance (Independent Member) CANADIAN PUBLIC COMPANY BOARDS: • RF Capital Group Inc. (TSX: RCG) since 2021 | |

EXPERIENCE: • Richardson Financial Group Limited, a specialized financial services company (2003 – Present) • President and CEO (2003 – Present) | ||

OTHER BOARDS/EXPERIENCE: Former Canadian Public Company Boards • The North West Company (TSX: NWC) (2002 – 2022) • Canadian Western Bank (TSX: CWB) (2011 – 2022) • GMP Capital, Inc. (TSX: GMP) (2009 – 2017) • Manitoba Telecom Services Inc. (TSX: MBT) (2011 – 2017) Not-for-Profit • Chairman, University of Winnipeg Foundation | EDUCATION: • J.D., Osgoode Hall Law School • Bachelor of Arts degree, Queen’s University OTHER DESIGNATIONS: • Member of the Order of Canada • Member of the Order of Manitoba | |

See the “Board Composition and Refreshment” section of this Proxy Statement for more information regarding our director retirement policy.

25 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

This table provides a summary view of the qualifications, experience and demographic information of each director nominee.

| |||||||||||||||

CEO/P&L Mgmt-Overall | • | • | • | • | • | • | • | • | • | • | • | • | • | • | |

CEO-Current |

|

|

|

| • |

| • |

|

| • |

|

|

| • | |

CEO-Former |

|

| • |

|

| • |

|

| • |

|

|

| • | • | |

P&L Mgmt-Current |

| • |

|

| • | • | • | • |

| • |

|

| • | • | |

Brand Management |

| • | • | • | • | • | • |

|

|

|

| • | • | • | |

Audit |

|

|

|

|

|

|

| • | • |

|

| • | • |

| |

Finance |

|

|

|

| • |

|

| • | • | • |

| • | • | • | |

Human Resource Management | • |

| • | • | • | • | • | • | • | • | • | • | • | • | |

International | • | • | • | • | • | • | • | • | • | • | • | • | • | • | |

Supply Chain | • |

| • | • | • |

|

| • |

| • |

| • |

| • | |

Procurement/Logistics | • | • | • | • | • |

|

| • |

| • | • | • |

|

| |

M&A |

|

| • |

| • | • | • |

| • | • |

| • | • | • | |

e-Commerce/Digital | • | • |

| • | • | • |

| • | • | • |

| • | • |

| |

Cybersecurity/ | • |

|

|

|

|

|

| • |

| • | • |

|

|

| |

Innovation | • | • | • | • | • | • | • |

|

| • |

| • | • |

| |

Regulatory Affairs |

|

| • | • | • | • |

|

| • |

| • |

|

| • | |

Consumer Products | • | • | • | • | • | • | • | • |

| • |

| • | • | • | |

Demographic Information | |||||||||||||||

Tenure (Years)(1) | 2 | 3 | 18 | 8 | 4 | 18 | 14 | 3 | 11 | 1 | 3 | 11 | 18 | 18 | |

Age (Years)(1) | 53 | 41 | 76 | 63 | 60 | 55 | 52 | 58 | 60 | 58 | 66 | 62 | 63 | 72 | |

Diversity — Gender | • |

|

| • |

|

|

| • |

|

|

|

|

|

| |

Diversity — Ethnic/Racial | • |

|

|

|

|

|

|

|

| • |

|

| • |

| |

Citizen of Another Country(2) | • |

|

|

|

| • | • | • | • |

|

| • | • | • | |

(1) Tenure and age calculated as of the Record Date (2) Holds a non-US passport, including individuals that are also US citizens | |||||||||||||||

26 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Eric H. Molson (formerly the Chair of our Company) has served as a Director Emeritus since May 2009. Mr. Molson may be invited to attend meetings of our Board on a non-voting basis.

Peter H. Coors and David S. Coors are father and son. Andrew T. Molson and Geoffrey E. Molson are brothers, and Eric H. Molson is their father.

27 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

We are committed to strong corporate governance, corporate responsibility and the accountability of our Board and our senior management team to our stockholders. Our Board is elected annually by the stockholders to oversee their interests in the long-term success of our Company and its stakeholders.

KEY CORPORATE GOVERNANCE DOCUMENTS

Please visit our website at www.molsoncoors.com (under “About Us—Governance and Ethics”) to view the following documents:

Restated Certificate of Incorporation

Restated Certificate of Incorporation

Bylaws

Bylaws

Code of Business Conduct

Code of Business Conduct

Board of Directors Charter & Corporate Governance Guidelines (Governance Guidelines)

Board of Directors Charter & Corporate Governance Guidelines (Governance Guidelines)

Charters for the Audit Committee, Compensation & HR Committee, Finance Committee, and Governance Committee

Charters for the Audit Committee, Compensation & HR Committee, Finance Committee, and Governance Committee

Please note, the information provided on our website (or any other website referred to in this Proxy Statement) is not part of this Proxy Statement and is not incorporated by reference as part of this Proxy Statement.

We believe in producing beverages we can be proud of, which is why our People & Planet initiatives are fundamental to how Molson Coors operates. Our ESG strategy reflects our People & Planet focus areas and is underpinned by a foundation of strong corporate governance and ethics. These focus areas include DEI, environmental stewardship, sustainable sourcing and alcohol responsibility as well as investing in our people and communities. We have established quantitative goals in the following areas:

People |  Water |  Climate |  Packaging |

Making diversity, equity, and inclusion part of everything we do - from how we work together to how we grow our company | Using water prudently and supporting water stewardship in high-stress watersheds where we operate | Reducing greenhouse gas emissions across our value chain to achieve net zero by at least 2050 | Ensuring packaging is recyclable, reusable or compostable and innovating for a more circular economy |

Our Board is responsible for overseeing and monitoring our overall People & Planet efforts, with specific areas of oversight delegated to the committees of the Board. The Board receives regular reports and recommendations from management and the Board committees to help guide our strategy, from Planet goals related to water, packaging and climate change, to People initiatives focused on retaining and developing a diverse and talented workforce. The Audit Committee oversees certain elements of our ESG strategy, programs and reporting, as well as our enterprise risk management program. The Compensation & HR Committee is responsible for establishing and reviewing the overall compensation philosophy of our Company and providing oversight on certain human capital matters, including our talent retention and development, leadership development, talent pipeline, programs and systems for performance management and inclusion initiatives. Further, the Finance and Governance committees are also responsible for certain People & Planet matters as outlined below.

28 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

Board/Committee | Primary Areas of ESG Oversight |

Board | • Oversee and monitor the Company’s overall ESG program (with specific areas of oversight delegated to the Audit, Compensation & Human Resources, Finance and Governance Committees) • Review certain corporate citizenship, social responsibility and public policy issues of significance to the Company, including the Company’s own policies and programs, and public disclosures related to ESG matters • Review regular reports from the committees on ESG matters |

Audit Committee | • Receive regular reports from the Company on certain of its ESG programs, policies and practices, and related performance • Oversee the Company’s ESG report, data assurance, and controls related disclosure matters • Oversee and monitor the Company’s risk management efforts, including regarding ESG matters • Review the Company’s ethics and compliance program and reports of significant matters and the Company’s responses and follow-up |

Compensation & Human Resources Committee | • Oversee and monitor the Company’s policies and strategies relating to certain human capital management initiatives, including DEI, learning and development, and leadership team succession • Review and monitor trends related to alignment of executive compensation matters to ESG strategy and initiatives • Receive regular reports from the Company regarding its incentive plan design and performance against short- and long-term incentive programs |

Finance Committee | • Oversee and monitor the Company’s renewable energy procurement and related risk management • Review regular reports from the Company regarding its supplier diversity efforts |

Governance Committee | • Monitor best practices, trends, developments and issues relating to corporate governance practices and policies of the Company • Oversee and assess the composition of the Board, including diversity of skills, experience, opinions, as well as diversity of gender, race or ethnicity, nationality or country of origin, and other factors • Oversee the Company’s corporate and political action committee political contributions, and receive annual reports overviewing the Company’s political activities |

As one of the world’s largest global beverage companies, we have a long history of sustainability and are committed to driving long-lasting, meaningful change by incorporating sustainability into all aspects of our business. In 2017, we launched Our Imprint strategy, which included a set of ambitious 2025 environmental sustainability goals. Informed by a materiality assessment and with the United Nations Sustainable Development Goals in mind, we focused our efforts where we believe we can have the most positive impact on our Planet: Climate, Water and Packaging. Highlights for 2022 include announcing the elimination of six-pack plastic rings by 2025 for all North American brands and submitting our SBTi commitment to achieving net zero GHG emissions across our value chain by at least 2050.

In 2020, we added new People aspirations through 2023 to reflect our renewed commitment to putting people first and building a more diverse, equitable and inclusive culture. We strive to provide meaningful experiences for our employees and believe that building a strong and diverse workforce has a significant influence on our success as a business and our ability to deliver on our purpose. We value and respect our differences and believe that diversity with equity and inclusion is the key to collaboration and a winning team culture. As we work to build a more diverse and inclusive workforce and management team, we have developed programs to promote the recruitment, retention and development of diverse leaders and team members. Two examples include our PACE program which focuses on developing and accelerating the leadership capability of early- to mid-career women; and the TAP2LEAD program, a leadership development program focused on growing our diverse talent aligned to our DEI strategy. We believe we have made positive progress on our representation goals in 2022, increasing the representation of women in our worldwide workforce and increasing the representation of people of color in our U.S. workforce.

As a global beverage company, deeply rooted in the beer business, Molson Coors is a charter member of the International Alliance for Responsible Drinking (IARD). This collaborative industry body represents the 13 leading beer, wine and spirits companies, and partners with public sector, civil society and private stakeholders to address the global public health issue of harmful drinking. IARD works with governments globally to support the World Health Organization’s Noncommunicable Diseases Global Monitoring Framework target of 10% reduction in harmful use of alcohol by 2025.

Metrics that support Our Imprint commitments are embedded in the performance goals for leaders of our organization that have the ability to impact the goals. In addition, starting in 2022 and continuing in 2023, 10% of the short-term incentive awards for the MCLT is based on a scorecard composed of certain quantitative ESG metrics.

More information about our strategy and progress can be found in the Molson Coors Our Imprint ESG Report,

29 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

available at www.molsoncoors.com/sustainability. The information provided on our website (or any other website referred to in this statement) is not part of this Proxy Statement and is not incorporated by reference as part of this Proxy Statement.

Our full Board, the majority of which is independent, oversees the corporate governance of our Company. Our Board has adopted Governance Guidelines to promote effective corporate governance and the proper functioning of the Board and its committees. The Governance Guidelines set forth a common set of expectations as to how our Board should function, including with respect to the composition of our Board, the criteria to be used in selecting director nominees, Board and Committee oversight of the Company’s ESG strategy and initiatives, expectations of our directors, and evaluation of the performance of our Board and its committees. Our Board and the Governance Committee regularly review developments in corporate governance and consider stockholder feedback to respond to new developments as necessary and appropriate.

All of our directors and employees, including our CEO, CFO and other executive and senior officers, are bound by our Code of Business Conduct which complies with the requirements of the New York Stock Exchange (NYSE) and the Securities and Exchange Commission (SEC) to confirm that our business is conducted in a legal and ethical manner. The Code of Business Conduct covers areas of professional conduct, including employment policies, conflicts of interest, fair dealing and the protection of confidential information, as well as strict adherence to all laws and regulations applicable to the conduct of our business. We will disclose future amendments to, or waivers from, certain provisions of the Code of Business Conduct for executive officers and directors on our website at www.molsoncoors.com within four business days following the date of such amendment or waiver.

Our Board believes its leadership structure is appropriate because it effectively allocates authority, responsibility and oversight between management and the non-management directors, including with respect to risk oversight, as discussed below. We separate the roles of Chair and CEO.

Chair and Vice Chair. According to our Bylaws, the Chair is appointed by the Class A-C Nominating Subcommittee or the Class A-M Nominating Subcommittee, alternating on a biennial basis. The Vice Chair is appointed by the Class Nominating Subcommittee that does not appoint the Chair. Peter H. Coors was appointed Chair by the Class A-C Nominating Subcommittee effective May 2021, and he will serve in this position until this Annual Meeting. Andrew T. Molson was appointed Vice Chair by the Class A-M Nominating Subcommittee effective May 2021 and he will serve in this position until this 2023 Annual Meeting. Effective as of the conclusion of this Annual Meeting, the Class A-M Nominating Subcommittee has appointed Geoffrey E. Molson to serve as Chair, and the Class A-C Nominating Subcommittee appointed David S. Coors to serve as Vice Chair, and each will serve in their respective position until the 2025 Annual Meeting.

Independent Governance Committee Member. The Independent Governance Committee Member plays a crucial role in acting as an intermediary between the Coors and Molson families, the independent directors, and members of management. The Independent Governance Committee Member also has additional governance responsibilities pursuant to the Governance Guidelines and Restated Certificate of Incorporation, including (1) reviewing and approving Board and committee agendas, together with the Chair and Vice Chair, (2) convening, reviewing and approving agenda for, and chairing executive sessions that typically occur during each regular Board meeting of the independent directors without non-independent directors or members of management present, (3) reporting to the Board, Chair or management, as appropriate, on any issues, requests or concerns identified during the independent director executive sessions, and (4) overseeing, with the support of the Company Secretary, the annual Board and committee evaluation process.

Our Board is responsible for overseeing our enterprise risk management program (ERM Program) to confirm it is appropriately designed to identify and manage the principal short, medium, and longer-term risks of our business. Our Board recognizes that achievement of our strategic objectives necessarily involves internal and external risks, and that as our business evolves, risks applicable to our business change. The ERM Program is a proactive and ongoing process, led by our legal and risk professionals and senior management, to identify and assess risks, and to build out and track mitigation and reduction efforts. The ERM program is designed to enable

30 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

us to appropriately manage, prioritize and mitigate risks, while fostering a culture of integrity, risk awareness and compliance within our Company. As shown below, our Board has tasked its committees with certain risk management responsibilities, and these committees regularly report to the Board regarding the matters within their area of responsibility. These discussions help to inform strategic decisions with transparency into the accompanying opportunities and challenges relevant to our business.

Board/Committee | Primary Areas of Risk Oversight |

Board | • Oversee, monitor and annually review our ERM Program • Adopt a strategic planning process and annually approve a strategic financial and corporate plan for the Company that takes into account, among other things, the opportunities and risks of our business • Confirm the dedication of resources and implementation of appropriate systems to manage the principal risks of our business • Oversee related party transactions (shared with the Audit Committee) • Review regular reports from management on material risks, the degree of exposure to those risks, and plans to address such risks • Review reports on risk assessment from the Board committees |

Audit Committee | • Oversee, review and discuss with the independent auditors, financial and senior management, the internal auditors, the ethics and compliance managers and the Board, the Company’s policies and procedures with respect to risk assessment and risk management. • Oversee, review and discuss with management, internal audit and the independent auditors, the Company’s ERM program, policies and procedures with respect to the assessment and management of principal and emerging risks facing the Company (including major financial risk exposures, and the risks related to the Company’s tax and finance compliance activities, the Company’s technology, cybersecurity and information security, and certain ESG matters) and the steps management has taken to monitor and control such risks • Approve and oversee the Company’s anti-pledging policy in order to protect the Company against potential risks resulting from any pledging of the Company’s stock • Oversee related party transactions (shared with our Board) • Oversee our internal controls and internal audit function • Oversee risks related to certain of the Company’s ESG programs, policies and practices, including those related to alcohol policy and environmental matters • Oversee risks related to the Company’s cybersecurity, technology, and information security programs and review emerging cybersecurity, technology, and information security developments and threats, and the Company’s strategy to mitigate cybersecurity, technology, and information security risks |

Compensation & HR Committee | • Oversee the risks relating to our compensation and benefit plans, and human resource programs • Oversee and monitor the Company’s risks, policies and strategies relating to certain human capital management initiatives, including employee talent, performance, development, total rewards, and DEI policies and programs |

Finance Committee | • Oversee financial risk management strategies, including capital structure, debt portfolio, pension plans, taxes, hedging, currency, interest rates, commodity and other derivatives • Monitor interest rate risk relating to the Company’s debt portfolio • Oversee risk management efforts related to the Company’s renewable energy procurement activities |

Governance Committee | • Oversee the Company’s corporate and political action committee political contributions and political activities • Monitors best practices, trends, developments and issues related to corporate governance practices and policies, in the context of the Company’s shareholder profile and “controlled company” status for NYSE and Toronto Stock Exchange (TSX) purposes • Oversee, evaluate and recommend to the Board policies for retirement, resignation and retention of directors |

Management is charged with managing the business and the risks associated with the enterprise and reporting regularly to our Board. Management primarily regulates risk through robust internal processes and control environments, comprehensive internal and external audit processes, the overall ERM Program, a strong ethics and compliance department, and by adhering to the Code of Business Conduct and our other policies. Management routinely communicates business risks identified through the ERM Program or otherwise to our Board or the appropriate

31 | ||

| MOLSON COORS BEVERAGE CO. | 2023 Proxy Statement | |

committees and individual directors. Further, the Board’s role in risk oversight of the Company is consistent with our leadership structure, with the CEO and other members of senior management having responsibility for assessing and managing our risk exposure, and the Board and its committees providing oversight in connection with those efforts. Our risk oversight framework also aligns with our disclosure controls and procedures. For example, our quarterly and annual financial results and related disclosures are reviewed by its disclosure committee, comprised of senior management and pertinent members of management, most of which participate in the risk assessment practices described above.

From time to time, we also utilize industry information sources, such as professional services firms or subscription resources, to assess trends and benchmark data relevant to our industry. These insights are incorporated into our ERM Program with appropriate mitigation plans and performance indicators as needed. They are regularly reported to the Audit Committee and Board as part of our ongoing ERM Program process.