Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

GLW similar filings

- 24 Oct 06 Results of Operations and Financial Condition

- 3 Oct 06 Robert F. Cummings, Jr. Joins Corning Board of Directors

- 1 Aug 06 Regulation FD Disclosure

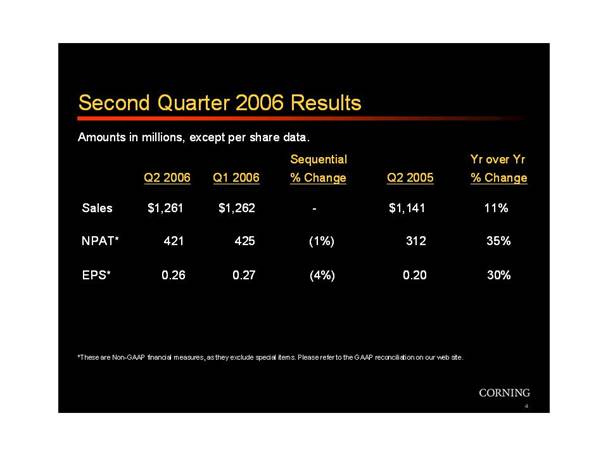

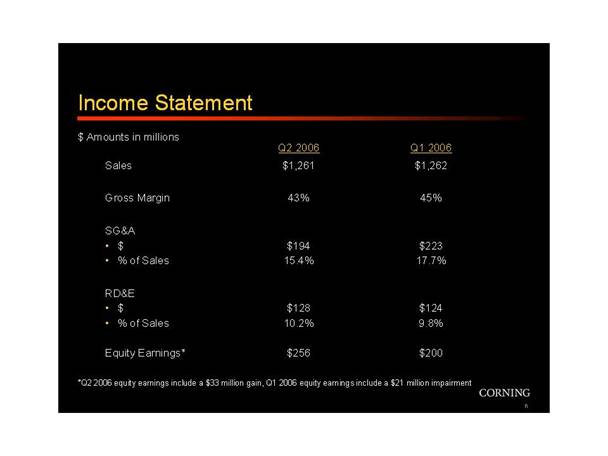

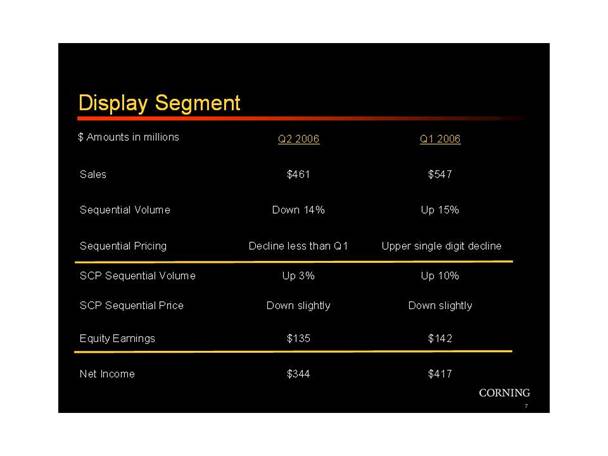

- 26 Jul 06 Second Quarter 2006 Conference Call

- 25 Jul 06 Results of Operations and Financial Condition

- 22 May 06 Corning to Meet with Investors; Reaffirms Second-Quarter Guidance

- 3 May 06 Departure of Directors or Principal Officers

Filing view

External links