As to resources (ores, minerals, polymers, and processed chemicals) required in manufacturing operations, availability appears to be adequate. Corning’s suppliers from time to time may experience capacity limitations in their own operations, or may eliminate certain product lines; nevertheless, Corning believes it has adequate programs to ensure a reliable supply of batch chemicals and raw materials. For many products, Corning has alternate glass compositions that would allow operations to continue without interruption in the event of specific materials shortages.

Certain key materials and proprietary equipment used in the manufacturing of products are currently sole sourced or available only from a limited number of suppliers. Any future difficulty in obtaining sufficient and timely delivery of components could result in delays or reductions in product shipments, or reduce Corning’s gross margins.

Inventions by members of Corning’s research and engineering staff have been, and continue to be, important to the Company’s growth. Patents have been granted on many of these inventions in the United States and other countries. Some of these patents have been licensed to other manufacturers, including companies in which Corning has equity investments. Many of the earlier patents have now expired, but Corning continues to seek and obtain patents protecting its newer innovations. In 2006, Corning was granted over 195 patents in the U.S. and over 275 patents in countries outside the U.S.

Each business segment possesses its own patent portfolio that provides certain competitive advantages in protecting Corning’s innovations. Corning has historically enforced, and will continue to enforce, its intellectual property rights. At the end of 2006, Corning and its wholly owned subsidiaries owned over 4,700 unexpired patents in various countries of which about 2,350 were U.S. patents. Between 2007 and 2009, approximately 1% of these patents will expire, while at the same time Corning intends to seek patents protecting its newer innovations. Worldwide, Corning has over 3,400 patent applications in process, with about 950 in process in the U.S. Corning believes that its patent portfolio will continue to provide a competitive advantage in protecting Corning’s innovation, although Corning’s competitors in each of its businesses are actively seeking patent protection as well.

The Display Technologies segment has over 270 patents in various countries of which over 90 were U.S. patents. No one patent is considered material to this business segment. Some of the important issued U.S. patents in this segment include patents relating to glass compositions and methods for the use and manufacture of glass substrates for display applications. There is no group of important Display Technology segment patents set to expire between 2007 and 2009.

The Telecommunications segment has over 1,650 patents in various countries of which over 800 were U.S. patents. No one patent is considered material to this business segment. Some of the important issued U.S. patents in this segment include: (i) patents relating to optical fiber products including dispersion compensating fiber, low loss optical fiber and high data rate optical fiber and processes and equipment for manufacturing optical fiber including methods for making optical fiber preforms and methods for drawing, cooling and winding optical fiber; (ii) patents relating to optical fiber ribbons and methods for making such ribbon, fiber optic cable designs and methods for installing optical fiber cable; and (iii) patents relating to optical fiber and electrical connectors and associated methods of manufacture. A few patents relating to optical fiber connectors will expire between 2007 and 2009.

The Environmental Technologies segment has over 550 patents in various countries of which over 260 were U.S. patents. No one patent is considered material to this business segment. Some of the important issued U.S. patents in this segment include patents relating to cellular ceramic honeycomb products, together with ceramic batch and binder system compositions, honeycomb extrusion and firing processes, and honeycomb extrusion dies and equipment for the high-volume, low-cost manufacture of such products. One family of patents relating to batch formation of ceramic honeycomb products will expire between 2007 and 2009.

The Life Sciences segment has over 175 patents in various countries of which over 75 are U.S. patents. No one patent is considered material to this business segment. Some of the important issued U.S. patents in this segment include patents relating to methods and apparatus for the manufacture and use of scientific laboratory equipment including nucleic acid arrays, multiwell plates, and cell culture products as well as equipment for label independent drug discovery. There is no group of important Life Sciences segment patents set to expire between 2007 and 2009.

Many of these patents are used in Corning’s operations or are licensed for use by others, and Corning is licensed to use patents owned by others. Corning has entered into cross licensing arrangements with some major competitors, but the scope of such licenses has been limited to specific product areas or technologies.

Corning’s principal trademarks include the following: Corning, Celcor, DuraTrap, Eagle2000, EagleXG, Epic, HPFS, Pyrex, SMF-28e, Steuben, Lanscape, Evolant, and Vycor.

Protection of the Environment

Corning has a program to ensure that its facilities are in compliance with state, federal and foreign pollution-control regulations. This program resulted in capital and operating expenditures during the past several years. In order to maintain compliance with such regulations, capital expenditures for pollution control in continuing operations were approximately $50 million in 2006 and are estimated to be $13 million in 2007.

Corning’s 2006 operating results from continuing operations were charged with approximately $44 million for depreciation, maintenance, waste disposal and other operating expenses associated with pollution control. Corning believes that its compliance program will not place it at a competitive disadvantage.

Employees

At December 31, 2006, Corning had approximately 24,500 full-time employees, including approximately 10,100 employees in the United States. From time to time, Corning also retains consultants, independent contractors, and temporary and part-time workers. Unions are certified as bargaining agents from approximately 30% of Corning’s United States employees.

Executive Officers of the Registrant

Wendell P. Weeks President and Chief Executive Officer

Mr. Weeks joined Corning in 1983 and was named a vice president and deputy general manager of the Telecommunications Products division in 1995, vice president and general manager—Telecommunications Products in 1996, senior vice president in 1997, senior vice president of Opto-Electronics in 1998, executive vice president of Optical Communications in 1999, president, Corning Optical Communications in 2001, President and Chief Operating Officer in 2002 and to his present position in 2005. Mr. Weeks will become chairman and chief executive officer on April 26, 2007. Mr. Weeks is a director of Merck & Co., Inc. Director since 2000. Age 47.

James B. Flaws Vice Chairman and Chief Financial Officer

Mr. Flaws joined Corning in 1973 and served in a variety of controller and business management positions. Mr. Flaws was elected assistant treasurer of Corning in 1993, vice president and controller in 1997 and vice president of finance and treasurer in May 1997, senior vice president and chief financial officer in December 1997, executive vice president and chief financial officer in 1999 and to his current position in 2002. Mr. Flaws is a director of Dow Corning Corporation. Mr. Flaws has been a member of Corning’s Board of Directors since 2000. Age 58.

Peter F. Volanakis Chief Operating Officer

Mr. Volanakis joined Corning in 1982 and subsequently held various marketing, development and commercial positions in several divisions. He was named managing director Corning GmbH in 1992, executive vice president of CCS Holding, Inc., formerly known as Siecor Corporation, in 1995, senior vice president of Advanced Display Products in 1997, executive vice president of Display Technologies and Life Sciences in 1999 and president of Corning Technologies in 2001. Mr. Volanakis was elected to his current position on April 28, 2005. Mr. Volanakis will become president and chief operating officer on April 26, 2007. Mr. Volanakis is a director of Dow Corning Corporation. Mr. Volanakis has been a member of Corning’s Board of Directors since 2000. Age 51.

8

Kirk P. Gregg Executive Vice President and Chief Administrative Officer

Mr. Gregg joined Corning in 1993 as director of Executive Compensation. He was named vice president of Executive Resources and Employee Benefits in 1994, senior vice president, administration in December 1997 and to his current position in 2002. Prior to joining Corning, Mr. Gregg was with General Dynamics Corporation as corporate director, Key Management Programs, and was responsible for executive compensation and benefits, executive development and recruiting. Age 47.

Joseph A. Miller Executive Vice President and Chief Technology Officer

Dr. Miller joined Corning in 2001 as senior vice president and chief technology officer. He was appointed to his current position in 2002. Prior to joining Corning, Dr. Miller was with E.I. DuPont de Nemours, Inc., where he served as chief technology officer and senior vice president for research and development since 1994. He began his career with DuPont in 1966. Dr. Miller is a director of Wilson Greatbatch Technologies and Dow Corning Corporation. Age 65.

Pamela C. Schneider Senior Vice President and Operations Chief of Staff

Ms. Schneider joined Corning in 1986 as senior financial analyst in the Controllers Division. In 1988 she became manager of internal audit. In 1990 she was named controller and in 1991 chief financial officer of Corning Asahi Video Products Company. In January 1993, she was appointed vice president and chief financial officer and in 1995 vice president for Corning Consumer Products Company. In 1997, she was named vice president and in 1999 senior vice president, Human Resources and Diversity Officer for Corning. Ms. Schneider was appointed to her present position in April 2002. Age 52.

Katherine A. Asbeck Senior Vice President - Finance

Ms. Asbeck joined Corning in 1991 as director of accounting. She was appointed assistant controller in 1993, designated chief accounting officer in 1994, elected vice president and controller in 1997 and senior vice president in 2001. She was elected to her current position in October 2005. Ms. Asbeck is a director of Samsung Corning Co., Ltd. and Samsung Corning Precision Glass Co., Ltd. Age 50.

William D. Eggers Senior Vice President and General Counsel

Mr. Eggers joined Corning in 1997 as vice president and deputy general counsel. He was elected senior vice president and general counsel in February 1998. Mr. Eggers was a Partner with the Rochester firm of Nixon, Hargrave, Devans & Doyle, LLP, before joining Corning. Mr. Eggers is a director of Chemung Financial Corp. Age 62.

Mark S. Rogus Senior Vice President and Treasurer

Mr. Rogus joined Corning in 1996 as manager of corporate finance. He was appointed assistant treasurer in 1999, vice president and treasurer in 2000 and was elected to his current position in 2004. Prior to joining Corning, Mr. Rogus held various business development positions at Wachovia Bank. Mr. Rogus is a director of Cormetech, Inc. Age 47.

Larry Aiello Jr. President and Chief Executive Officer – Corning Cable Systems

Mr. Aiello joined Corning in 1973 and served in several positions in manufacturing from 1975 to 1981. He was named manager-Domestic Accounting in 1981, controller-Telecommunications Products Division in 1984, director-Control and Analysis in 1987 and assistant controller and director in 1989. He was named division vice president and director-Business Development and Planning, Opto-Electronics Group in 1990, general manager-Component Products Group in 1992, vice president and controller, Corning Incorporated in 1993, senior vice president-International and president-Corning International Corporation in 1997, senior vice president and chief of staff-Corning Optical Communications in 2000 and to his current position in 2002. Age 57.

9

Robert B. Brown Executive Vice President, Environmental Technologies

Mr. Brown joined Corning in 1972 and served in a variety of manufacturing and engineering positions. He was appointed division vice president-manufacturing and engineering, Telecommunications Products Division in 1995, vice president manufacturing and engineering, Opto-Electronics in 1999, president-Corning Lasertron in February 2000, vice president and general manager-Amplification Products in December 2000, vice president and general manager – Optical Fiber in April 2002, senior vice president and general manager – Telecommunications in 2003, senior vice president and general manager – Environmental Technologies in January 2005, and to his current position in August 2005. Mr. Brown is a director of Cormetech, Inc. Age 56.

Lawrence D. McRae Senior Vice President, Strategy and Corporate Development

Mr. McRae joined Corning in 1985 and served in various financial, sales and marketing positions. He was appointed vice president-Corporate Development in 2000, senior vice president-Corporate Development in 2003 and most recently, senior vice president-Strategy and Corporate Development in October 2005. Mr. McRae is on the board of directors of Dow Corning Corporation, Samsung Corning Co., Ltd. and Samsung Corning Precision Glass Co., Ltd. Age 48.

Eric S. Musser Vice President and General Manager, Optical Fiber

Mr. Musser joined Corning in 1986 and held various manufacturing, planning and quality positions. He assumed the role of President for Corning Lasertron in 2000, became Corning’s director of Manufacturing Operations, Photonic Technologies in 2002, then division vice president, Development and Engineering in 2003, and was elected to his current position in January 2005. Age 47.

Jane D. Poulin Chief Accounting Officer and Division Vice President

Ms. Poulin joined Corning in September 2005. Prior to joining Corning, she was an Associate Chief Accountant in the Office of the Chief Accountant of the U.S. Securities and Exchange Commission from June 2000 to September 2005. She previously served as corporate controller at a privately held manufacturer and was an audit senior manager at Ernst & Young LLP. Age 44.

Tony Tripeny Vice President and Corporate Controller

Mr. Tripeny became the corporate accounting manager for Corning Cable Systems in 1985. After serving in other financial functions, he was appointed chief financial officer of Corning Cable Systems in 2000. In 2003, he became group controller for Corning’s Telecommunications business, and division vice president and operations controller of Corning in 2004, and was elected to his current position in October 2005. Age 47.

Document Availability

A copy of Corning’s 2006 Annual Report on Form 10-K filed with the Securities and Exchange Commission is available upon written request to Ms. Denise A. Hauselt, Secretary and Assistant General Counsel, Corning Incorporated, HQ-E2-10, Corning, NY 14831. The Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments pursuant to Section 13(a) or 15(d) of the Exchange Act and other filings are available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC, and can be accessed electronically free of charge, through the Investor Relations category of the Corning home page on the Internet at www.corning.com. The information contained on the Company’s website is not included in, or incorporated by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Set forth below are some of the principal risks and uncertainties that could cause our actual business results to differ materially from any forward-looking statements contained in this Report. Future results could be materially affected by general industry and market conditions, changes in laws or accounting rules, general economic and political conditions, including a global economic slowdown, fluctuation of interest rates or currency exchange rates, terrorism, political unrest or international conflicts, political instability or major health concerns, natural disasters or other disruptions of expected business conditions. These risk factors should be considered in addition to our cautionary comments concerning forward-looking statements in this Annual Report.

10

Our sales could be negatively impacted if one or more of our key customers substantially reduce orders for our products

Corning’s ten largest customers account for about 50% of our sales. No individual customer accounts for more than 10% of consolidated sales except for AU Optronics Corporation (AUO) which accounted for 13% of consolidated sales in 2006.

In addition, a relatively small number of customers accounted for a high percentage of net sales in each of our reportable operating segments. For 2006, three customers of the Display Technologies segment, which individually accounted for more than 10% of segment net sales, represented 64% of total segment sales when combined. In the Telecommunications segment, two customers, which individually accounted for more than 10% of segment net sales, represented 25% of total segment sales when combined. In the Environmental Technologies segment, three customers, which individually accounted for more than 10% of segment net sales, represented 72% of total segment sales in aggregate. In the Life Sciences segment, one distributor accounted for 43% of this segment’s sales in 2006.

Samsung Corning Precision’s sales were also concentrated in 2006, with sales to two LCD panel makers located in South Korea accounting for approximately 92% of total Samsung Corning Precision sales.

Although the sale of LCD glass substrates has increased in 2006, there can be no assurance that positive trends will continue. Our customers are LCD panel and color filter makers. As they switch to larger size glass, the pace of their orders may be uneven while they adjust their manufacturing processes and facilities. Additionally, consumer preferences for panels of differing sizes, price, or other seasonal factors, may lead to pauses in market growth from time to time. Our customers may not be able to maintain profitable operations or access sufficient capital to fund ongoing and future planned expansions, which may limit their pace of orders to us. Emerging technologies could replace our glass substrates for certain applications resulting in a decline in demand for our LCD products.

Our Telecommunications segment customers’ purchases of our products are affected by their capital expansion plans, general market and economic uncertainty and regulatory changes, including broadband policy. Sales in the Telecommunications segment are expected to be impacted by the pace of Verizon Communication Inc. (Verizon) fiber-to-the-premises deployments. Our sales will be dependent on Verizon’s planned targets for homes passed and connected. Changes in Verizon’s deployment plan could adversely affect future sales in any quarter or for the full year.

In the Environmental Technologies segment, sales of our ceramic substrate and filter products for automotive and diesel emissions and pollution control are expected to fluctuate with vehicle production. Changes in governmental laws and regulations for air quality and emission controls may also influence future sales. Sales in our Environmental Technologies segment are to four catalyzers and emission system component manufacturers. Our customers sell these systems to automotive original equipment manufacturers and diesel engine manufacturers. Sales within this segment may be affected by adverse developments in the U.S. auto industry or by such factors as higher fuel prices that may affect vehicles sales.

Sales in our Life Sciences segment were historically through two large distributors to government entities, pharmaceutical and biotechnology companies, hospitals, universities and other research facilities. During 2005, we did not renew the contract with one large distributor and transitioned the sales through this distributor to our remaining primary distributor and other existing and developing channels. This change had an adverse impact on sales volumes. In 2006, our remaining primary distributor accounted for 43% of Life Sciences segment sales.

11

If the markets for our products do not develop and expand as we anticipate, demand for our products may decline, which would negatively impact our results of operations and financial performance

The markets for our products are characterized by rapidly changing technologies, evolving industry or government standards and new product introductions. Our success is expected to depend, in substantial part, on the successful introduction of new products, or upgrades of current products, and our ability to compete with new technologies. The following factors related to our products and markets, if not achieved, could have an adverse impact on our results of operations:

- our ability to introduce leading products such as glass substrates for liquid crystal displays, opticalfiber and cable and hardware and equipment, and environmental substrate products that can commandcompetitive prices;

- our ability to achieve a favorable sales mix of large generation sizes of liquid crystal display glass;

- our ability to develop new products in response to government regulations and laws, particularly dieselfilter products in the Environmental Technologies segment;

- continued strong demand for notebook computers and LCD monitors;

- growth in purchases of LCD televisions to replace other technologies;

- screen size of LCD televisions, which affects glass demands; and

- growth of the fiber-to-the-premises build-out in North America.

We face pricing pressures in each of our leading businesses that could adversely affect our results of operations and financial performance

We face pricing pressure in each of our leading businesses as a result of intense competition, emerging new technologies, or over-capacity. While we will work toward reducing our costs to offset pricing pressures, we may not be able to achieve proportionate reductions in costs. As a result of overcapacity in the Telecommunications segment, we anticipate pricing pressures will continue into 2007 and beyond. Pricing pressure in our Display Technologies segment was at a historically high level in 2006. Although we are taking steps to reduce the rate of price decline in 2007, we cannot be assured of success. Our 2007 pricing strategy may also result in lost market share.

We face risks related to our international operations and sales

We have customers and significant operations, including manufacturing and sales, located outside the U.S. We have large manufacturing operations for liquid crystal display glass substrates in Taiwan and the Asia-Pacific region, including an equity investment in Samsung Corning Precision operating in South Korea that makes glass substrates for the LCD market. All of our Display segment customers are located in the Asia-Pacific region. As a result of these and other international operations, we face a number of risks, including:

- geographical concentration of our factories and operations;

- periodic health concerns;

- difficulty of managing global operations;

- difficulty in protecting intellectual property;

- tariffs, duties and other trade barriers including anti-dumping duties;

- undeveloped legal systems;

- natural disasters;

- potential power loss affecting glass production and equipment damage;

- political and economic instability in foreign markets, and

- foreign currency risk.

Any of these items could cause our sales or profitability to be significantly reduced.

12

We face risks due to foreign currency fluctuations

Because we have significant customers and operations outside the U.S., fluctuations in foreign currencies, especially the Japanese yen, the New Taiwan dollar, the Korean won, and the euro, affect our sales and profit levels. Foreign exchange rates may make our products less competitive in countries where local currencies decline in value relative to the dollar and Japanese yen. Sales in our Display Technologies segment, representing 41% of Corning’s sales, are denominated in Japanese yen. The expected sales growth of the Display Technologies segment will increase our exposure to currency fluctuations. Although we hedge significant transaction and balance sheet currency exposures, we do not hedge translation risk and thus changes in exchange rates (especially the yen) may significantly impact our reported revenues and results of operations.

If the financial condition of our customers declines, our credit risks could increase

Although we have a rigorous process to administer credit and believe our reserve is adequate, we have experienced, and in the future may experience, losses as a result of our inability to collect our accounts receivable. If our customers fail to meet their payment obligations to us, we could experience reduced cash flows and losses in excess of amounts reserved. Some customers of our Display Technologies segment are thinly capitalized and/ or marginally profitable. In our Environmental products segment, the U.S. auto customers and certain of their suppliers have encountered credit downgrades or, in the case of Delphi Corporation, bankruptcy. These factors may result in an inability to collect receivables or a possible loss in business. As of December 31, 2006, reserves for trade receivables totaled approximately $21 million.

If we do not successfully adjust our manufacturing volumes and fixed cost structure, or achieve manufacturing yields or sufficient product reliability, our operating results could suffer, and we may not achieve anticipated profitability levels

We are investing heavily in additional manufacturing capacity of certain businesses, including liquid crystal display glass and diesel emission substrates and filters. The speed of constructing the new facilities presents challenges. We may face technical and process issues in moving to commercial production. There can be no assurance that Corning will be able to pace its capacity expansion to the actual demand. It is possible that manufacturing capacity may exceed customer demand during certain periods.

The manufacturing of our products involves highly complex and precise processes, requiring production in highly controlled and dust-free environments. Changes in our manufacturing processes could significantly reduce our manufacturing yields and product reliability. In some cases, existing manufacturing may be insufficient to achieve the requirements of our customers. We will need to develop new manufacturing processes and techniques to achieve targeted volume, pricing and cost levels that will permit profitable operations. While we continue to fund projects to improve our manufacturing techniques and processes, we may not achieve satisfactory cost levels in our manufacturing activities that will fully satisfy our profitability targets.

Our future operating results depend on our ability to purchase a sufficient amount of materials, parts, and manufacturing equipment components to meet the demands of our customers

Our ability to meet customer demand depends, in part, on our ability to obtain timely and adequate delivery of materials, parts and components from our suppliers. We may experience shortages that could adversely affect our operations. Although we work closely with our suppliers to avoid shortages, there can be no assurances that we will not encounter these problems in the future. Furthermore, certain manufacturing equipment or components are available only from a single source or limited sources. We may not be able to find alternate sources in a timely manner. A reduction or interruption in supplies, or a significant increase in the price of supplies, could have a material adverse effect on our businesses.

13

We have incurred, and may in the future incur, restructuring and other charges, the amounts of which are difficult to predict accurately

We have recorded several charges for restructuring, impairment of assets, and the write-off of cost and equity based investments. It is possible we may record additional charges for restructuring or other asset impairments if additional actions become necessary.

We have incurred, and may in the future incur, goodwill and other intangible asset impairment charges

At December 31, 2006, Corning had goodwill and other intangible assets of $316 million. While we believe the estimates and judgments about future cash flows used in the goodwill impairment tests are reasonable, we cannot provide assurance that future impairment charges will not be required if the expected cash flow estimates as projected by management do not occur.

If our products or materials purchased from our suppliers experience performance issues, our business will suffer

Our business depends on the production of products of consistently high quality. Our products, components and materials purchased from our suppliers, are typically tested for quality. These testing procedures are limited to evaluating our products under likely and foreseeable failure scenarios. For various reasons, our products, including materials purchased from our suppliers, may fail to perform as expected. In some cases, product redesigns or additional expense may be required to correct a defect. A significant or systemic product failure could result in customer relations problems, lost sales, and financial damages.

We face competition in most of our businesses

We expect that we will face additional competition from existing competitors, low cost manufacturers and new entrants. We must invest in research and development, expand our engineering, manufacturing and marketing capabilities, and continue to improve customer service and support in order to remain competitive. We cannot provide assurance that we will be able to maintain or improve our competitive position.

We may experience difficulties in enforcing our intellectual property rights and we may be subject to claims of infringement of the intellectual property rights of others

We may encounter difficulties in protecting our intellectual property rights or obtaining rights to additional intellectual property necessary to permit us to continue or expand our businesses. We cannot assure you that the patents that we hold or may obtain will provide meaningful protection against our competitors. Litigation may be necessary to enforce our intellectual property rights. Litigation is inherently uncertain and the outcome is often unpredictable. Other companies hold patents on technologies used in our industries and are aggressively seeking to expand, enforce and license their patent portfolios.

The intellectual property rights of others could inhibit our ability to introduce new products. We are, and may in the future be, subject to claims of intellectual property infringement or misappropriation that may result in loss of revenue, require us to incur substantial costs, or lead to monetary damages or injunctive relief against us. We cannot assure you as to the outcome of such claims.

Current or future litigation may harm our financial condition or results of operations

Pending, threatened or future litigation is subject to inherent uncertainties. Our financial condition or results of operations may be adversely affected by unfavorable outcomes, expenses and costs exceeding amounts estimated or insured. In particular, we have been named as a defendant in numerous lawsuits alleging personal injury from exposure to asbestos. As described in Legal Proceedings, our negotiations with the representatives of asbestos claimants produced a tentative plan of settlement through a PCC Plan of Reorganization, but this Plan has not been confirmed by the Bankruptcy Court. The proponents of the Plan have moved for reconsideration of the order entered by the Court on December 21, 2006 denying Plan confirmation. It is reasonably possible that changes to the Plan may be negotiated, but the elements of the Plan and final approval are subject to a number of contingencies. Total charges of $816 million have been recorded through December 31, 2006; however, additional charges or credits are possible due to the potential fluctuation in the price of our common stock, other adjustments in the proposed settlement, and other litigation factors.

14

We face risks through our equity method investments in companies that we do not control

Corning’s net income includes significant equity in earnings of associated companies. For the year ended December 31, 2006, we recognized $960 million of equity earnings, of which $889 million came from our two largest investments: Dow Corning Corporation (which makes silicone products) and Samsung Corning Precision (which makes liquid crystal display glass). Samsung Corning Precision is located in the Asia-Pacific region and is subject to political and geographic risks mentioned above, as well as business and other risks within the Display segment. Our equity investments may not continue to perform at the same levels as in recent years. In 2005 and 2006, we recognized equity losses associated with Samsung Corning Co., Ltd. (our 50% equity method investment that makes glass panels and funnels for conventional televisions), which recorded fixed asset and other impairment charges. As the conventional television market will be negatively impacted by strong growth in the LCD glass market, it is reasonably possible that Samsung Corning Co., Ltd. may incur additional restructuring or impairment charges or net operating losses in the future.

We may not have adequate insurance coverage for claims against us

We face the risk of loss resulting from product liability, securities, fiduciary liability, intellectual property, antitrust, contractual, warranty, fraud and other lawsuits, whether or not such claims are valid. In addition, our product liability, fiduciary, directors and officers, property, natural catastrophe and comprehensive general liability insurance may not be adequate to cover such claims or may not be available to the extent we expect. Our insurance costs can be volatile and, at any time, can increase given changes in market supply and demand. We may not be able to obtain adequate insurance coverage in the future at acceptable costs. A successful claim that exceeds or is not covered by our policies could require us to pay substantial sums. Some of the carriers in our excess insurance programs are in liquidation and may not be able to respond if we should have claims reaching into excess layers. The financial health of other insurers may deteriorate. In addition, we may not be able to obtain adequate insurance coverage for certain risk such as political risk, terrorism or war.

Changes in accounting may affect our reported earnings and operating income

Generally accepted accounting principles and accompanying accounting pronouncements, implementation guidelines, and interpretations for many areas of our business, such as revenue recognition, accounting for investments, and accounting for stock options, are very complex and involve significant and sometimes subjective judgments. Changes in these rules or their interpretation could significantly impact our reported earnings and operating income and could add significant volatility to those measures in the future, without a corresponding change in our cash flows.

Other

Additional information in response to Item 1 is found in Note 19 (Operating Segments) to the consolidated financial statements and selected financial data.

Item 1B. Unresolved Staff Comments

None.

15

Item 2. Properties

We operate approximately 47 manufacturing plants and processing facilities, of which approximately one half are located in the U.S. We own substantially all of our executive and corporate buildings, which are located in Corning, New York. We also own substantially all of our manufacturing and research and development facilities and more than half of our sales and administrative facilities.

For the years ended 2006, 2005 and 2004, we invested a total of $3.6 billion, primarily in facilities outside the U.S. in our Display Technologies segment. Of the $1.2 billion spent in 2006, $721 million was for facilities outside the U.S.

Manufacturing, sales and administrative, and research and development facilities have an aggregate floor space of approximately 24 million square feet. Distribution of this total area follows:

| (million square feet) | Total | | Domestic | | Foreign |

| Manufacturing | 18 | | | 7 | | | 11 | |

| Sales and administrative | 4 | | | 3 | | | 1 | |

| Research and development | 2 | | | 2 | | | | |

| Total | 24 | | | 12 | | | 12 | |

Total assets and capital expenditures by operating segment are included in Note 19 (Operating Segments) to the Consolidated Financial Statements. Information concerning lease commitments is included in Note 14 (Commitments, Contingencies, and Guarantees) to the Consolidated Financial Statements.

During 2006, we continued the restructuring program that closed or consolidated certain smaller manufacturing facilities. Throughout 2007 we expect to have excess manufacturing capacity in our Telecommunications segment and will not utilize a portion of space in the facilities listed above. The largest unused portion is our optical fiber manufacturing facility in Concord, North Carolina that has been mothballed until fiber demand rebounds. We believe that the Concord facility can be returned to productive capacity within six to nine months of a decision to do so.

Item 3. Legal Proceedings

Environmental Litigation.Corning has been named by the Environmental Protection Agency (the Agency) under the Superfund Act, or by state governments under similar state laws, as a potentially responsible party at 18 active hazardous waste sites. Under the Superfund Act, all parties who may have contributed any waste to a hazardous waste site, identified by such Agency, are jointly and severally liable for the cost of cleanup unless the Agency agrees otherwise. It is Corning’s policy to accrue for its estimated liability related to Superfund sites and other environmental liabilities related to property owned by Corning based on expert analysis and continual monitoring by both internal and external consultants. Corning has accrued approximately $16 million (undiscounted) for its estimated liability for environmental cleanup and litigation at December 31, 2006. Based upon the information developed to date, management believes that the accrued reserve is a reasonable estimate of the Company’s liability and that the risk of an additional loss in an amount materially higher than that accrued is remote.

Dow Corning Bankruptcy.Corning and Dow Chemical each own 50% of the common stock of Dow Corning In May 1995, Dow Corning filed for bankruptcy protection to address pending and claimed liabilities arising from many thousand breast implant product lawsuits. On June 1, 2004, Dow Corning emerged from Chapter 11 with a Plan of Reorganization (the Plan) which provided for the settlement or other resolution of implant claims. The Plan also includes releases for Corning and Dow Chemical as shareholders in exchange for contributions to the Plan.

16

Under the terms of the Plan, Dow Corning has established and is funding a Settlement Trust and a Litigation Facility to provide a means for tort claimants to settle or litigate their claims. Inclusive of insurance, Dow Corning has paid approximately $1.5 billion to the Settlement Trust. As of December 31, 2006, Dow Corning had recorded a reserve for breast implant litigation of $1.7 billion and anticipates insurance receivables of $185 million. As a separate matter arising from the bankruptcy proceedings, Dow Corning is defending claims asserted by a number of commercial creditors who claim additional interest at default rates and enforcement costs, during the period from May 1995 through June 2004. On July 26, 2006, the U.S. Court of Appeals vacated the judgment of the District Court fixing the interest component, ruled that default interest and enforcement costs may be awarded subject to equitable factors to be determined, and directed that the matter be remanded for further proceedings. Dow Corning filed a petition for rehearing by the Court of Appeals, which was denied. It has filed a petition for writ of certiorari with the U.S. Supreme Court, which has not yet been decided. As of December 31, 2006, Dow Corning has estimated the interest payable to commercial creditors to be within the range of $68 million to $208 million. As Dow Corning management believes no single amount within the range appears to be a better estimate than any other amount within the range, Dow Corning has recorded the minimum liability within the range. Should Dow Corning not prevail in this matter, Corning’s equity earnings would be reduced by its 50% share of the amount in excess of $68 million, net of applicable tax benefits. There are a number of other claims in the bankruptcy proceedings against Dow Corning awaiting resolution by the U.S. District Court, and it is reasonably possible that Dow Corning may record bankruptcy-related charges in the future. There are no remaining tort claims against Corning, other than those that will be channeled by the Plan into facilities established by the Plan or otherwise defended by the Litigation Facility.

Pittsburgh Corning Corporation.Corning and PPG Industries, Inc. (PPG) each own 50% of the capital stock of Pittsburgh Corning Corporation (PCC). Over a period of more than two decades, PCC and several other defendants have been named in numerous lawsuits involving claims alleging personal injury from exposure to asbestos. On April 16, 2000, PCC filed for Chapter 11 reorganization in the U.S. Bankruptcy Court for the Western District of Pennsylvania. As a result of PCC’s bankruptcy filing, Corning recorded an after-tax charge of $36 million in 2001 to fully impair its investment in PCC and discontinued recognition of equity earnings. At the time PCC filed for bankruptcy protection, there were approximately 12,400 claims pending against Corning in state court lawsuits alleging various theories of liability based on exposure to PCC’s asbestos products and typically requesting monetary damages in excess of one million dollars per claim. Corning has defended those claims on the basis of the separate corporate status of PCC and the absence of any facts supporting claims of direct liability arising from PCC’s asbestos products. Corning is also currently named in approximately 10,900 other cases (approximately 42,300 claims) alleging injuries from asbestos and similar amounts of monetary damages per claim. Those cases have been covered by insurance without material impact to Corning to date. Asbestos litigation is inherently difficult, and past trends in resolving these claims may not be indicators of future outcomes.

In the bankruptcy court in April 2000, PCC obtained a preliminary injunction against the prosecution of asbestos actions arising from PCC’s products against its two shareholders to afford the parties a period of time in which to negotiate a plan of reorganization for PCC (the PCC Plan).

On May 14, 2002, PPG announced that it had agreed with certain of its insurance carriers and representatives of current and future asbestos claimants on the terms of a settlement arrangement applicable to claims arising from PCC’s products.

On March 28, 2003, Corning announced that it had reached agreement with the representatives of asbestos claimants for the settlement of all current and future asbestos claims against it and PCC, which might arise from PCC products or operations. The proposed settlement, if the Plan is approved and becomes effective, will require Corning to relinquish its equity interest in PCC, contribute its equity interest in Pittsburgh Corning Europe N.V. (PCE), a Belgian corporation, and contribute 25 million shares of Corning common stock. Corning also agreed to pay a total of $140 million in six annual installments (present value $131 million at March 2003), beginning one year after the Plan becomes effective, with 5.5 percent interest from June 2004, and to assign certain insurance policy proceeds from its primary insurance and a portion of its excess insurance at the time of settlement.

17

Since March 28, 2003, we have recorded total net charges of $816 million to reflect the agreed settlement contributions and subsequent adjustments for the change in the fair value of the components.

The liability expected to be settled by contribution of our investment in PCE, assigned insurance proceeds, and the 25 million shares of our common stock (totaling $656 million at December 31, 2006) is recorded in the other accrued liabilities component in our consolidated balance sheets. This portion of the PCC liability is considered a “due on demand” obligation and is classified as a current liability. The remaining portion of the settlement liability (totaling $160 million at December 31, 2006), representing the net present value of the cash payments, is recorded in the other liabilities component in our consolidated balance sheets.

Two of Corning’s primary insurers and several excess insurers have commenced litigation for a declaration of the rights and obligations of the parties under insurance policies, including rights that may be affected by the settlement arrangement described above. Corning is vigorously contesting these cases. Management is unable to predict the outcome of this insurance litigation.

The PCC Plan received a favorable vote from creditors in March 2004. Hearings to consider objections to the Plan were held in the Bankruptcy Court in May 2004. In February, 2006, the Bankruptcy Court requested that the Plan proponents delete references to Section 105(a) of the Bankruptcy Code and resubmit the Plan. The final round of oral argument was held on July 21, 2006. On December 21, 2006, the Bankruptcy Court issued an order denying confirmation of the Plan for reasons set out in a memorandum opinion. The opinion generally supports the elements of the Plan except for the breadth of the channeling injunction applicable to claims against either of the two shareholders when those claims do not derive from the products or operations of PCC itself. The Court declared a three part test whereby other claims may be channeled if PCC is named a defendant, a shareholder is named, and conspiracy theories are alleged. Several parties, including Corning, have filed motions of reconsideration, which are scheduled for a hearing before the Bankruptcy Court on March 5, 2007. If the Bankruptcy Court does not approve the PCC Plan in its current form, changes to the Plan are probable as it is likely that the Court will allow the proponents time to propose amendments. The outcome of these proceedings is uncertain, and confirmation of the current Plan or any amended Plan is subject to a number of contingencies. However, apart from the quarterly mark-to-market adjustment in the value of the components of the settlement, management believes that the likelihood of a material adverse impact to Corning’s financial statements is remote.

Seoul Guarantee Insurance Co. and other creditors against Samsung Group and affiliates. As of March 2005, Samsung Corning Precision Glass Co., Ltd. (Samsung Corning Precision) and Samsung Corning Co. Ltd. (Samsung Corning) are two of approximately thirty co-defendants in a lawsuit filed by Seoul Guarantee Insurance Co. and 14 other creditors (SGI and Creditors) for alleged breach of an agreement that approximately thirty affiliates of the Samsung group entered into with SGI and Creditors in September 1999. The lawsuit is pending in the courts of Korea. According to the agreement, the Samsung affiliates agreed to sell 3.5 million shares of Samsung Life Insurance Co., Ltd. (SLI) by December 31, 2000, which were transferred to SGI and Creditors in connection with the petition for court receivership of Samsung Motor Inc. In the lawsuit, SGI and Creditors allege that, in the event that the proceeds of sale of the SLI shares is less than 2.45 trillion Korean won (approximately $2.64 billion), the Samsung affiliates allegedly agreed to compensate SGI and Creditors for the shortfall, by other means, including Samsung affiliates’ purchase of equity or subordinated debentures to be issued by SGI and Creditors. Any excess proceeds are to be distributed to the Samsung affiliates. As of March 2005, the shares of Samsung Life Insurance Co., Ltd. had not been sold. The suit asks for damages of approximately $4.6 billion plus penalty interest. Samsung Corning Precision and Samsung Corning combined guarantees should represent no more than 3.1% of the Samsung affiliates’ total financial obligation. Although noting that the outcome of these matters is uncertain, Samsung Corning Precision and Samsung Corning have stated that these matters are not likely to result in a material ultimate loss to their financial statements. No claim in these matters has been asserted against Corning Incorporated.

18

Ellsworth Industrial Park, Downers Grove, IL Environmental Litigation. In August 2005, Corning was named as a fourth party defendant in a class action, Ann Muniz v. Rexnord Corp, filed in the U.S. District Court for the N.D. Illinois, claiming an unspecified amount of damages and asserting various personal injury and property damage claims against a number of corporate defendants. These claims allegedly arise from the release of solvents from the operations of several manufacturers at the Ellsworth Industrial Park into soil and ground water. On July 10, 2006, plaintiffs settled with a number of defendants and third-party defendants for $15.75 million, and the settling defendants are mediating allocation. In November 2006, Corning settled with three of the third-party defendants for a total of approximately $99,000. The claim of the remaining third-party defendant against Corning is scheduled for trial in March 2007. Corning was also named as a third or fourth party defendant in two personal injury lawsuits against a number of corporate defendants as a result of an alleged groundwater contamination at this industrial park site. Corning has a number of defenses to these claims, which management intends to contest vigorously. Management believes these matters are not likely to be material to the financial statements of Corning in any period.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

| (a) | | Corning Incorporated common stock is listed on the New York Stock Exchange and the SWX Swiss Exchange. In addition, it is traded on the Boston, Midwest, Pacific and Philadelphia stock exchanges. Common stock options are traded on the Chicago Board Options Exchange. The abbreviated ticker symbol for Corning Incorporated is “GLW.” |

The following table sets forth the high and low sales price of Corning’s common stock as reported on the Composite Tape.

| | First | | Second | | Third | | Fourth |

| | Quarter | | Quarter | | Quarter | | Quarter |

| 2006 | | | | | | | | | | | |

| Price range | | | | | | | | | | | |

| High | $ | 28.28 | | $ | 29.61 | | $ | 24.90 | | $ | 25.57 |

| Low | $ | 19.35 | | $ | 20.39 | | $ | 17.50 | | $ | 18.62 |

| 2005 | | | | | | | | | | | |

| Price range | | | | | | | | | | | |

| High | $ | 12.40 | | $ | 17.08 | | $ | 21.95 | | $ | 21.62 |

| Low | $ | 10.61 | | $ | 10.97 | | $ | 16.03 | | $ | 16.61 |

As of December 31, 2006, there were approximately 25,700 record holders of common stock and approximately 595,000 beneficial shareholders.

Corning discontinued the payment of dividends on its common stock in 2001. |

19

Equity Compensation Plan Information

The following table shows the total number of outstanding options and shares available for other future issuances of options under all of our existing equity compensation plans, including our 2005 Employee Equity Participation Program, our 2003 Equity Plan for Non-Employee Directors and our 2002 Worldwide Employee Share Purchase Plan as of December 31, 2006.

| | | A | | B | | C |

| | | | | | | | | | Number of |

| | | | | | | | | | Securities |

| | | | | | | | | | Remaining Available |

| | | Securities To | | | | | | for Future Issuance |

| | | Be Issued Upon | | Weighted-Average | | Under Equity |

| | | Exercise of | | Exercise Price | | Compensation Plans |

| | | Outstanding | | of Outstanding | | (excluding securities |

| | | Options, Warrants | | Options, Warrants | | reflected in column |

| Plan Category | | and Rights | | and Rights | | A) |

| Equity Compensation Plans Approved | | | | | | | | | | |

| by Security Holders (1) | | 95,729,896 | | | $ | 24.19 | | | 116,065,029 | |

| Equity Compensation Plans Not | | | | | | | | | | |

| Approved by Security Holders | | 0 | | | $ | 0.00 | | | 0 | |

| Total | | 95,729,896 | | | $ | 24.19 | | | 116,065,029 | |

| (1) | | Shares indicated are total grants under the most recent shareholder approved plans as well as any shares remaining outstanding from any prior shareholder approved plans. |

20

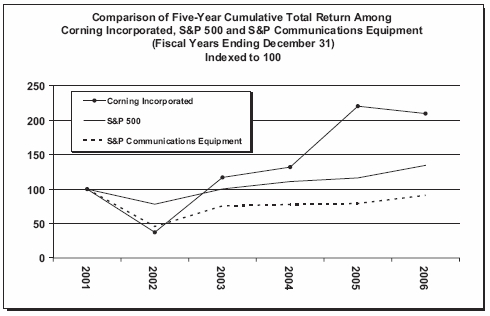

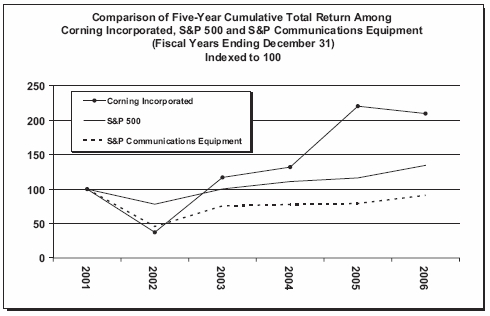

Performance Graph

The following graph illustrates the cumulative total shareholder return over the last five years of Corning’s Common Stock, the S&P 500 and the S&P Communications Equipment Companies (in which Corning is currently included). The graph includes the capital weighted performance results of those companies in the communications equipment companies classification that are also included in the S&P 500.

| (b) | | Not applicable. |

| |

| (c) | | This table provides information about our purchases of our common stock during the fiscal fourth quarter of 2006: |

| Issuer Purchases of Equity Securities* | | | | | | | | | | | |

| | | | | | | | | | | | Approximate |

| | | Total | | | | | | Total Number of | | Dollar Value of |

| | | Number | | Average | | Shares Purchased | | Shares that May |

| | | of Shares | | Price Paid | | as Part of Publicly | | Yet Be Purchased |

| Period | | Purchased** | | per Share** | | Announced Plan* | | Under the Plan* |

| October 1-31, 2006 | | 60,379 | | | $ | 21.91 | | | 0 | | $ | 0 | |

| November 1-30, 2006 | | 120,300 | | | $ | 20.87 | | | 0 | | $ | 0 | |

| December 1-31, 2006 | | 54,416 | | | $ | 21.06 | | | 0 | | $ | 0 | |

| Total | | 235,095 | | | $ | 21.18 | | | 0 | | $ | 0 | |

| * | | During the quarter ended December 31, 2006, we did not have a publicly announced program for repurchase of shares of our common stock. We did not repurchase our common stock in open-market transactions outside of such a program. |

| |

| ** | | This column reflects the following transactions during the fiscal fourth quarter of 2006: (i) the deemed surrender to us of 225,220 shares of common stock to pay the exercise price and to satisfy tax withholding obligations in connection with the exercise of employee stock options, and (ii) the surrender to us of 9,875 shares of common stock to satisfy tax withholding obligations in connection with the vesting of restricted stock issued to employees. |

21

Item 6. Selected Financial Data (Unaudited)

(In millions, except per share amounts and number of employees)

| | Years ended December31, |

| | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| Results of Operations | | | | | | | | | | | | | | | | | |

| Net sales | $ | 5,174 | | $ | 4,579 | | $ | 3,854 | | | $ | 3,090 | | | $ | 3,164 | |

| Research, development and engineering | | | | | | | | | | | | | | | | | |

| expenses | $ | 517 | | $ | 443 | | $ | 355 | | | $ | 344 | | | $ | 483 | |

| Equity in earnings of affiliated companies, net of | | | | | | | | | | | | | | | | | |

| impairments | $ | 960 | | $ | 611 | | $ | 454 | | | $ | 216 | | | $ | 116 | |

| Income (loss) from continuing operations | $ | 1,855 | | $ | 585 | | $ | (2,251 | ) | | $ | (280 | ) | | $ | (1,780 | ) |

| Income from discontinued operations | | | | | | | | 20 | | | | | | | | 478 | |

| Net income (loss) | $ | 1,855 | | $ | 585 | | $ | (2,231 | ) | | $ | (280 | ) | | $ | (1,302 | ) |

| Basic earnings (loss) per common share from: | | | | | | | | | | | | | | | | | |

| Continuing operations | $ | 1.20 | | $ | 0.40 | | $ | (1.62 | ) | | $ | (0.22 | ) | | $ | (1.85 | ) |

| Discontinued operations | | | | | | | | 0.01 | | | | | | | | 0.46 | |

| Basic earnings (loss) per common share | $ | 1.20 | | $ | 0.40 | | $ | (1.61 | ) | | $ | (0.22 | ) | | $ | (1.39 | ) |

| Diluted earnings (loss) per common share from: | | | | | | | | | | | | | | | | | |

| Continuing operations | $ | 1.16 | | $ | 0.38 | | $ | (1.62 | ) | | $ | (0.22 | ) | | $ | (1.85 | ) |

| Discontinued operations | | | | | | | | 0.01 | | | | | | | | 0.46 | |

| Diluted earnings (loss) per common share | $ | 1.16 | | $ | 0.38 | | $ | (1.61 | ) | | $ | (0.22 | ) | | $ | (1.39 | ) |

| Shares used in computing per share amounts: | | | | | | | | | | | | | | | | | |

| Basic earnings (loss) per common share | | 1,550 | | | 1,464 | | | 1,386 | | | | 1,274 | | | | 1,030 | |

| Diluted earnings (loss) per common share | | 1,594 | | | 1,535 | | | 1,386 | | | | 1,274 | | | | 1,030 | |

| Financial Position | | | | | | | | | | | | | | | | | |

| Working capital | $ | 2,479 | | $ | 1,490 | | $ | 804 | | | $ | 1,077 | | | $ | 2,145 | |

| Total assets | $ | 13,065 | | $ | 11,207 | | $ | 9,736 | | | $ | 10,816 | | | $ | 11,406 | |

| Long-term debt | $ | 1,696 | | $ | 1,789 | | $ | 2,214 | | | $ | 2,668 | | | $ | 3,963 | |

| Shareholders’ equity | $ | 7,246 | | $ | 5,487 | | $ | 3,701 | | | $ | 5,411 | | | $ | 4,691 | |

| Selected Data | | | | | | | | | | | | | | | | | |

| Capital expenditures | $ | 1,182 | | $ | 1,553 | | $ | 857 | | | $ | 366 | | | $ | 357 | |

| Depreciation and amortization | $ | 591 | | $ | 512 | | $ | 523 | | | $ | 517 | | | $ | 661 | |

| Number of employees (1) | | 24,500 | | | 26,000 | | | 24,700 | | | | 20,600 | | | | 23,200 | |

Reference should be made to the Notes to consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| (1) | | Amounts do not include employees of discontinued operations. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Our key priorities for 2006 remained unchanged from the previous two years: protect our financial health, improve our profitability, and invest in the future. We made significant progress on all three in 2006.

Financial Health

In 2006, our balance sheet remained strong and we delivered positive cash flows from operating activities. Significant activities in 2006 included the following:

22

- We issued $250 million aggregate principal amount of 7.25% senior unsecured notes due 2036 for generalcorporate purposes and in support of an objective to extend the timing of future debt maturities.

- We reduced our long-term debt in the following transactions:

| | – | | We redeemed $119 million of our 6.25% Euro notes, due in 2010; |

| |

| – | | We repurchased $96 million of our 6.3% notes due in 2009; and |

| |

| – | | We redeemed $125 million of our 8.3% medium-term notes due in 2025. |

- We received $171 million in deposits against orders relating to our multi-year supply agreements withcustomers in the Display Technologies segment. These agreements have helped us to meet the rapidgrowth of the LCD market.

- All three of our rating agencies upgraded our ratings to either BBB or Baa2.

- We generated cash flows from operating activities in excess of our capital expenditures.

We ended 2006 with $3.2 billion in cash, cash equivalents and short-term investments. This represents an increase of $733 million from December 31, 2005.

In November 2006, we amended our revolving credit facility so that it now provides us access to a $1.1 billion unsecured multi-currency revolving line of credit through March 2011. We believe we have sufficient liquidity for the next several years to fund operations, capital expenditures and scheduled debt repayments.

Profitability

For the year ended December 31, 2006, we generated net income of $1,855 million or $1.16 per share compared to net income of $585 million or $0.38 per share for 2005.

We recorded restructuring, impairment, and other charges and credits in the past three years which affect the comparability of those years. Refer to Note 3 (Restructuring, Impairment and Other Charges and (Credits)), Note 7 (Income Taxes), and Note 8 (Investments) to the consolidated financial statements for additional information.

Investing in our future

We remain committed to investing in research, development, and engineering to drive innovation. We are investing in a wide variety of technologies with a focus on glass substrates for active matrix LCDs, diesel filters and substrates in response to tightening emissions control standards, and the optical fiber and cable and hardware and equipment that will enable fiber-to-the-premises.

Our research, development and engineering expenditures have increased by $74 million or 17% compared to 2005. We believe our spending levels are adequate to support our growth strategies.

We also remain committed to investing in manufacturing capacity to match increased demand in our businesses. Our capital expenditures are primarily focused on expanding manufacturing capacity for LCD glass substrates in the Display Technologies segment and diesel products in the Environmental Technologies segment. Total capital expenditures for 2006 were $1,182 million, of which $829 million was directed toward our Display Technologies segment and $146 million was invested in our Environmental Technologies segment primarily in anticipation of the emerging market for diesel emission control systems.

We expect our 2007 capital spending to be in the range of $1.1 billion to $1.2 billion, of which approximately $700 million will be directed toward our Display Technologies segment and approximately $100 million will be directed toward our Environmental Technologies segment.

23

RESULTS OF CONTINUING OPERATIONS

Selected highlights from our continuing operations follow (dollars in millions):

| | | | | | | | | | | | | | | %Change |

| | | 2006 | | 2005 | | 2004 | | 06 vs. 05 | | 05 vs. 04 |

| Net sales | | $ | 5,174 | | | $ | 4,579 | | | $ | 3,854 | | | 13 | | | 19 | |

| Gross margin | | $ | 2,283 | | | $ | 1,984 | | | $ | 1,415 | | | 15 | | | 40 | |

| (gross margin %) | | | 44% | | | | 43% | | | | 37% | | | | | | | |

| Selling, general and administrative expenses | | $ | 857 | | | $ | 756 | | | $ | 653 | | | 13 | | | 16 | |

| (as a % of revenues) | | | 17% | | | | 17% | | | | 17% | | | | | | | |

| Research, development and engineering expenses | | $ | 517 | | | $ | 443 | | | $ | 355 | | | 17 | | | 25 | |

| (as a % of revenues) | | | 10% | | | | 10% | | | | 9% | | | | | | | |

| Restructuring, impairment and other charges | | | | | | | | | | | | | | | | | | |

| and (credits) | | $ | 54 | | | $ | (38 | ) | | $ | 1,789 | | | (242 | ) | | (102 | ) |

| (as a % of revenues) | | | 1% | | | | (1)% | | | | 46% | | | | | | | |

| Asbestos settlement | | $ | (2 | ) | | $ | 218 | | | $ | 65 | | | (101 | ) | | 235 | |

| (as a % of revenues) | | | 0% | | | | 5% | | | | 2% | | | | | | | |

| Income (loss) from continuing operations before | | | | | | | | | | | | | | | | | | |

| income taxes | | $ | 961 | | | $ | 559 | | | $ | (1,604 | ) | | 72 | | | (135 | ) |

| (as a % of revenues) | | | 19% | | | | 12% | | | | (42)% | | | | | | | |

| Provision for income taxes | | $ | (55 | ) | | $ | (578 | ) | | $ | (1,084 | ) | | (90 | ) | | (47 | ) |

| (as a % of revenues) | | | (1)% | | | | (13)% | | | | (28)% | | | | | | | |

| Equity in earnings of affiliated companies, net | | | | | | | | | | | | | | | | | | |

| of impairments | | $ | 960 | | | $ | 611 | | | $ | 454 | | | 57 | | | 35 | |

| (as a % of revenues) | | | 19% | | | | 13% | | | | 12% | | | | | | | |

| Income (loss) from continuing operations | | $ | 1,855 | | | $ | 585 | | | $ | (2,251 | ) | | 217 | | | (126 | ) |

| (as a % of revenues) | | | 36% | | | | 13% | | | | (58)% | | | | | | | |

Net Sales

The net sales increase in 2006 compared to 2005 was the result of increased demand for LCD glass substrates in our Display Technologies segment and year-over-year increased volume in the Telecommunications segment. Net sales for all other segments were comparable to the prior year. Movements in foreign exchange rates negatively impacted 2006 net sales by approximately $125 million (or 3%) when compared with 2005.

The net sales increase in 2005 compared to 2004 was the result of a significant increase in demand for LCD glass substrates in our Display Technologies segment. Modest gains in demand for products in our Telecommunications segment to support fiber-to-the-premises projects and in our Environmental Technologies segment also contributed to the sales increase. The impact of movements in foreign exchange rates on 2005 net sales was less than 1% when compared with net sales in 2004.

Reflecting the growth in our Display Technologies segment, net sales into international markets continued to surpass those into the U.S. market. For 2006, 2005, and 2004, sales into international markets accounted for 71%, 71%, and 65% of net sales, respectively.

Cost of Sales

The types of expenses included in the cost of sales line item are: raw materials consumption, including direct and indirect materials; salaries, wages and benefits; depreciation and amortization; production utilities; production-related purchasing; warehousing (including receiving and inspection); repairs and maintenance; inter-location inventory transfer costs; production and warehousing facility property insurance; rent for production facilities; and other production overhead.

24

Gross Margin

As a percentage of net sales, 2006 gross margin was up slightly from 2005 driven primarily by our Display Technologies segment. Gross margins for this segment were essentially even with 2005 reflecting the negative impact of price declines offset by higher volumes and cost reductions. Display Technologies segment sales increased from 38% of total Corning’s sales in 2005 to 41% of Corning’s sales in 2006. As Display Technologies has a higher gross margin than our consolidated gross margin, the added concentration in Display Technologies in 2006 caused Corning’s gross margin percentage to increase from 43% in 2005 to 44% in 2006.

For 2005, as a percentage of net sales, gross margin improved 6 percentage points versus 2004. The improvement was driven by increased volume, improved mix of large generation glass and manufacturing efficiencies in our Display Technologies segment.

Selling, General, and Administrative Expenses

The increase in selling, general and administrative expenses for 2006 compared to 2005, in dollars, was primarily due to an increase in stock-based compensation expense as a result of the Company’s adoption of Statement of Financial Accounting Standards (SFAS) No. 123 (revised 2004) Share-Based Payment (SFAS 123(R)), effective January 1, 2006. The increase in spending in 2005 compared to 2004 was primarily driven by increases in compensation costs. As a percent of net sales, selling, general, and administrative expenses were comparable for all periods presented.

The types of expenses included in the selling, general and administrative expenses line item are: salaries, wages and benefits; travel; sales commissions; professional fees; and depreciation and amortization, utilities, and rent for administrative facilities.

Share-Based Compensation

Prior to January 1, 2006, the Company accounted for share-based awards granted under the Company’s stock compensation programs using the intrinsic value method in accordance with Accounting Principles Board Opinion (APB) No. 25, “Accounting for Stock Issued to Employees” (APB 25) and SFAS No. 123, “Accounting for Stock-Based Compensation” (SFAS 123). Under the intrinsic value method, no share-based compensation cost related to stock options had been recognized in the Company’s consolidated statements of operations, because the exercise price was at least equal to the market value of the common stock on the grant date. As a result, the recognition of share-based compensation cost was generally limited to the expense attributed to restricted stock awards, and stock option modifications. As permitted under SFAS 123, the Company reported pro-forma disclosures presenting results and earnings per share as if we had used the fair value recognition provisions of SFAS 123 in the notes to the Company’s consolidated financial statements.

Effective January 1, 2006, the Company adopted the provisions of SFAS 123(R) using the modified prospective application method. Under the modified prospective application method, compensation cost recognized in 2006 includes: (a) compensation cost for all share-based awards granted prior to, but not yet vested as of January 1, 2006 based on the grant date fair value estimated in accordance with the original provisions of SFAS 123, and (b) compensation cost for all share-based awards granted subsequent to January 1, 2006, based on the grant date fair value estimated in accordance with the provisions of SFAS 123(R). Compensation cost is recognized in the consolidated statements of operations over the period during which an employee is required to provide service in exchange for the award. In accordance with the modified prospective application method, results for prior periods have not been restated. The adoption of SFAS 123(R) resulted in a decrease of $0.05 in basic and diluted earnings per share for the year ended December 31, 2006. See Note 18 (Share-based Compensation) to the consolidated financial statements for further detail on the impact of SFAS 123(R).

25

Research, Development, and Engineering Expenses

Research, development and engineering expenditures increased by $74 million in 2006 when compared to 2005, but remained consistent as a percentage of net sales. Expenditures in 2006 were focused on our Display Technologies, Environmental Technologies and Telecommunications segments as we looked to capitalize on market opportunities in those segments. Expenses in 2006 also included costs associated with exploratory projects to support future growth. Expenditures increased in 2005 when compared to 2004, due to increased spending to support growth initiatives including glass substrates for LCDs, diesel filter and substrates in response to tightening emissions control standards, as well as exploratory projects.

Restructuring, Impairment and Other Charges and (Credits)

Corning recorded significant net charges in 2004 which affect the comparability of our results for 2006, 2005, and 2004. A summary of the net charges and credits for all years presented is provided in the following table (in millions):

| | | For the years ended December 31, |

| | | 2006 | | 2005 | | 2004 |

| Impairment of goodwill | | | | | | | | | | $ | 1,420 | |

| Impairment of long-lived assets other than goodwill | | | | | | | | | | | | |

| Assets to be disposed of by sale or abandonment | | $ | (2 | ) | | $ | 6 | | | | 302 | |

| Assets to be held and used | | | 50 | | | | | | | | 24 | |

| Reversal of currency translation adjustment | | | | | | | (84 | ) | | | | |

| Accelerated depreciation | | | | | | | | | | | 37 | |

| Loss on sale of businesses | | | | | | | | | | | 12 | |

| Impairment of available-for-sale securities | | | | | | | 25 | | | | | |

| Restructuring charges and (credits) | | | 6 | | | | 15 | | | | (6 | ) |

| Total restructuring, impairment other charges and (credits) | | $ | 54 | | | $ | (38 | ) | | $ | 1,789 | |

Impairment of Goodwill

2004 Impairment Charge

Pursuant to SFAS No. 142, “Goodwill and Other Intangible Assets,” (SFAS 142) goodwill is required to be tested for impairment annually at the reporting unit level. In addition, goodwill should be tested for impairment between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of the reporting unit below its related carrying value. In the third quarter of 2004, we identified certain factors that caused us to lower our estimates and projections for the long-term revenue growth of the Telecommunications segment, which indicated that the fair value of the Telecommunications segment reporting unit was less than its carrying value. We performed an interim impairment test of the Telecommunications segment goodwill in the third quarter of 2004 and, as a result, recorded an impairment charge of $1,420 million to reduce the carrying value of goodwill to its implied fair value at September 30, 2004 of $117 million.

Impairment of Long-Lived Assets Other Than Goodwill

Given our restructuring actions and the market conditions facing certain of our businesses, at various times throughout 2004 to 2006, we performed evaluations of the recoverability of our held for use long-lived assets other than goodwill. When an impairment evaluation was required, we developed expected future cash flows against which to compare the carrying value of the asset group being evaluated. If our projections indicated that our long lived assets were not recoverable through future cash flows, we were then required to estimate the fair value of the long-lived assets, limited to property, plant and equipment, using the expected cash flow approach as a measure of fair value.

26

2006 Impairment Charge

Assets to be held and used

In 2006, we recorded an asset held for use impairment charge of $44 million to impair certain long-lived assets of our Telecommunications segment in accordance with SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets” (SFAS 144). Due to our lowered long-term outlook for this business, we determined that an event of impairment, as defined by SFAS 144, had occurred in that business, which further required us to test this asset group for impairment. We assess recoverability of the carrying value of long-lived assets at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities. We estimated the fair value of the long-lived assets for this business using a discounted expected cash flow approach as a measure of fair value. As a result of our impairment evaluation, we recorded an impairment charge to write-down the asset group to its estimated fair value.

2004 Impairment Charge

Assets to be disposed of by sale or abandonment

These charges comprise the following:

- Telecommunications segment: In 2004, we recorded a net charge of $344 million to impair plant and equipmentrelated to certain facilities to be disposed of or shutdown. Approximately $332 million of this net charge wascomprised of the partially completed sections of our Concord, N.C. optical fiber facility. As a result of ourlowered outlook, we have permanently abandoned this construction in progress as we no longer believe thedemand for optical fiber will warrant the investment necessary to complete this facility. We have mothballedand will continue to depreciate the separate previously-operated portion of the Concord fiber facility.

- Other businesses: We recorded net credits of $42 million, primarily for gains on the sale of assets CorningAsahi Video Products (CAV) sold to a third party in China. This represented proceeds in excess of assumedsalvage values for assets previously impaired. This represented the substantial completion of the sale ofCAV’s assets.

Assets to be held and used

In 2004, due to our decision to permanently abandon certain assets and lower our long-term outlook for the Telecommunications segment in 2004, we determined that an event of impairment had occurred in our Telecommunications segment which required us to test the segment’s long-lived assets other than goodwill for impairment. As a result of this impairment evaluation, we recorded a $24 million impairment charge in the third quarter of 2004 to write-down certain assets to fair value.

Other Credits

2005 Reversal of Currency Translation Adjustment

In 2003, Corning sold its photonic business operations to Avanex. The photonics business was the sole operation of Corning O.T.I. S.r.l. (OTI), a wholly-owned Italian subsidiary of Corning, whose results were included in Corning’s Telecommunications segment. Subsequent to the sale of the operating assets of OTI to Avanex, Corning began liquidating OTI. In October 2005, the assets of OTI were determined to be substantially liquidated. As a result of the substantial liquidation, OTI’s cumulative translation account was reversed, resulting in a gain of $84 million in the fourth quarter.

27

Accelerated Depreciation

2004 Accelerated Depreciation

We recorded $37 million of accelerated depreciation relating to the final shutdown of our semiconductor materials manufacturing facility in Charleston, South Carolina, which we announced in the fourth quarter of 2003.

Loss on Sale of Businesses

2004 Loss on Sale of Business