Exhibit 10.14

VP PERFORMANCE RECOGNITION PROGRAM

The Vice President Incentive Program (VPIP) recognizes and rewards AMD’s and FASL LLC’s Vice Presidents (Participants) for furthering AMD’s and FASL LLC’s ongoing success against both short- and long-term objectives.

| | • | TheShort-Term Plan (STP) provides an award for meeting or exceeding planned performance for the current fiscal year (Plan Year). |

| | • | TheLong-Term Plan (LTP) provides an annual award for sustained corporate performance over a three-fiscal-year period relative to external measures. |

Within these plans, the performance objectives are as follows:

| | | | |

Plan

| | Component

| | Metric(s)

|

| STP | | Corporate Performance Award (CPA) | | • Corporate Operating Profit vs. Plan |

| | | Group Performance Award (GPA) | | • Group Operating Profit vs. Plan |

| | | Individual Performance Award (IPA) | | • Performance against Balanced Scorecard |

| | |

| LTP | | Relative Profitability | | • AMD Return on Equity (ROE) vs. S&P 500 Return on Equity (ROE) over 3 years |

| | |

| | | Relative Sales Growth | | • AMD Sales Growth vs. WSTS Sales Growth over 3 years |

The following sections discuss the plan provisions in further detail. All awards are subject to the Plan funding, maximum and carryover provisions detailed in Section V. A separate communication outlining the assigned target percentages for each component of the Plans, and division assignments and financial goals for the STP, will be provided to Participants each year.

VP PERFORMANCE RECOGNITION PROGRAM

| III. | Short Term Plan (STP) |

The STP uses three different components to measure and reward the Participant’s annual contributions:Corporate, Group andIndividual.

The payout opportunity and the weight of each component vary depending upon the Participant’s role and the tier to which he/she is assigned by management.

The Corporate and Group Performance components of the Plan are split into two six-month performance periods. Planned corporate and operating group objectives for the first half of the year are generally based on the Board Approved Corporate Budget. Objectives for the second half are established using the mid-year update of the Corporate Budget.

| | A. | Corporate Performance Award (CPA) |

The CPA is earned by meeting or exceeding specific levels of Operating Profit (OP) against the Plan for the performance period.

For each half-year performance period a multiplier is derived based onActual OP vs.Planned OP. The multiplier is then applied against the CPA target bonus to determine the accrued award.

| | • | The threshold level, below which the multiplier is zero, is 80% of Planned OP by default. This threshold will be confirmed or revised for any Plan Year at the discretion of the CEO. |

| | • | The multiplier is 1.0 when Actual OP equals Planned OP. |

| | • | For performance between 80% and 100% of Planned OP, the multiplier is prorated on a straight-line basis. |

For performance above Planned OP in each half-year performance period, a pool of funds is created using a percentage of the OP above Planned OP. This percentage is determined each year by the Office of the CEO.

| | • | This pool is used to pay individual discretionary awards beyond target performance. |

VP PERFORMANCE RECOGNITION PROGRAM

| | • | Any pool award generated for the first-half performance period is held in reserve pending the final OP for the year. If, for the year, Actual OP is below the combined threshold for the two separate performance periods, any pool generated for the first half of the year is forfeited. |

There is no maximumaccruedaward on this component of the Plan. The maximumpaid in any year is subject to the Plan funding, maximum and carryover provisions explained in section V.

The following table illustrates four payment calculation examples for a participant with a CPA target of 10% of pay, a base salary of $225,000, and a pool of 10% of excess OP:

| | | | | | | | | | | | |

| | | First Half ($M)

|

| | | Planned

OP

| | OP Threshold

(80%)

| | Actual

OP

| | Perf.

%

| | Target Mult.

(Max=1.00)

| | $ Pool for Distribution

|

Case 1 | | 200 | | 160 | | 240 | | 120 | | 1.00 | | 4.00 |

Case 2 (Target Perf.) | | 200 | | 160 | | 200 | | 100 | | 1.00 | | 0.00 |

Case 3 | | 200 | | 160 | | 220 | | 110 | | 1.00 | | 2.00 |

Case 4 | | 200 | | 160 | | 170 | | 85 | | 0.25 | | 0.00 |

| | | | | | | | | | | | |

| | | Second Half ($M)

|

| | | Planned

OP

| | OP Threshold

(80%)

| | Actual

OP

| | Perf.

%

| | Target Mult.

(Max=1.00)

| | $ Pool for Distribution

|

Case 1 | | 300 | | 240 | | 315 | | 105 | | 1.00 | | 1.50 |

Case 2 (Target Perf.) | | 300 | | 240 | | 300 | | 100 | | 1.00 | | 0.00 |

Case 3 | | 300 | | 240 | | 165 | | 55 | | 0.00 | | 0.00 |

Case 4 | | 300 | | 240 | | 150 | | 50 | | 0.00 | | 0.00 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Annual ($M)

| | |

| | | Base

Salary

| | Combined

OP Threshold

| | Actual

OP

| | CPA

Mult.

| | CPA

Target

| | | Award

%

| | | Award $

| | Total $ Pool for

Distribution

| | |

Case 1 | | $ | 225,000 | | 400 | | 555 | | 1.00 | | 10.0 | % | | 10.00 | % | | $ | 22,500 | | 5.50 | | | Pool eliminated |

Case 2 (Target Perf.) | | $ | 225,000 | | 400 | | 500 | | 1.00 | | 10.0 | % | | 10.00 | % | | $ | 22,500 | | 0.00 | | | from First Half |

Case 3 | | $ | 225,000 | | 400 | | 385 | | 0.50 | | 10.0 | % | | 5.00 | % | | $ | 11,250 | | 0.00 | | ¬ | since combined |

Case 4 | | $ | 225,000 | | 400 | | 320 | | 0.13 | | 10.0 | % | | 1.30 | % | | $ | 2,925 | | 0.00 | |

| threshold not

met |

| | B. | Group Performance Award (GPA) |

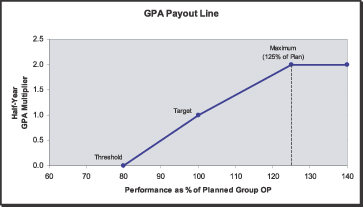

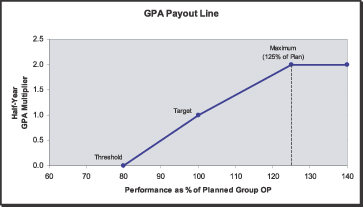

The GPA depends on Actual Group Operating Profit (OP) versus Planned Group OP. Similar to the CPA, for each half-year performance period a multiplier is derived based on Actual Group OP vs. Planned Group OP as illustrated in the following graph:

VP PERFORMANCE RECOGNITION PROGRAM

The multiplier is then applied against the GPA target award to determine the accrued award.

| | • | The threshold is 80% of planned Group OP, by default. |

| | • | The multiplier is 1.0 when Actual GOP equals Planned GOP. |

| | • | The maximum multiplier in each half-year period is 2.0, generally when 125% performance is achieved. |

| | • | The threshold and maximum are confirmed or revised in any Plan Year at the discretion of the CEO. |

| | • | The annual GPA is derived by taking the average of the two half year multipliers. |

The following table illustrates four sample payout calculations for a participant with a 25% GPA target:

| | | | | | | | | | | | | | | | | | | | | | |

| | | First Half

| | Second Half

|

| | | Planned

Group

Profit

| | Threshold

(80%)

| | Actual

| | Perf.

%

| | | Mult.

| | Planned

Group

Profit

| | Threshold

(80%)

| | Actual

| | Perf

%

| | | Mult.

|

Case 1 | | 100 | | 80 | | 85 | | 85 | % | | 0.25 | | 125 | | 100 | | 120 | | 96 | % | | 0.80 |

Case 2 (Target Perf.) | | 100 | | 80 | | 100 | | 100 | % | | 1.00 | | 125 | | 100 | | 125 | | 100 | % | | 1.00 |

Case 3 | | 100 | | 80 | | 75 | | 75 | % | | 0.00 | | 125 | | 100 | | 145 | | 116 | % | | 1.64 |

Case 4 | | 100 | | 80 | | 150 | | 130 | % | | 2.00 | | 125 | | 100 | | 150 | | 125 | % | | 2.00 |

| | | | | | | | | | | | | | |

| | | Annual

|

| | | Base

Salary

| | GPA

Mult.

| | GPA

Target

| | | GPA

%

| | | GPA

Award

|

Case 1 | | $ | 225,000 | | 0.53 | | 25.0 | % | | 13.1 | % | | $ | 29,531 |

Case 2 (Target Perf.) | | $ | 225,000 | | 1.00 | | 25.0 | % | | 25.0 | % | | $ | 56,250 |

Case 3 | | $ | 225,000 | | 0.82 | | 25.0 | % | | 20.5 | % | | $ | 46,125 |

Case 4 | | $ | 225,000 | | 2.00 | | 25.0 | % | | 50.0 | % | | $ | 112,500 |

VP PERFORMANCE RECOGNITION PROGRAM

| | C. | Individual Performance Award (IPA) |

The IPA is based on performance against the established Balanced Scorecard for the year. The IPA target is generally 10% of base salary. However, executive management may adjust the average target percent in any given Plan Year based on the performance of the Company, competitive practices and/or the role of a particular executive.

The total STP award is calculated as follows:

STP Award = CPA + GPA + IPA

The following table illustrates this payment calculation, combining the previous examples:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Base

Salary

| | CPA

| | GPA

| | IPA

| | Total Bonus Award

|

| | | | %

| | | $

| | %

| | | $

| | %

| | | $

| | %

| | | $

| | Additional

CPA Pool

Award

|

Case 1 | | $ | 225,000 | | 10.00 | % | | $ | 22,500 | | 13.13 | % | | $ | 29,531 | | 5.00 | % | | $ | 11,250 | | 28.13 | % | | $ | 63,281 | | Yes |

Case 2 (Target Perf.) | | $ | 225,000 | | 10.00 | % | | $ | 22,500 | | 25.00 | % | | $ | 56,250 | | 10.00 | % | | $ | 22,500 | | 45.00 | % | | $ | 101,250 | | |

Case 3 | | $ | 225,000 | | 5.00 | % | | $ | 11,250 | | 20.50 | % | | $ | 46,125 | | 12.00 | % | | $ | 27,000 | | 37.50 | % | | $ | 84,375 | | |

Case 4 | | $ | 225,000 | | 1.30 | % | | $ | 2,925 | | 50.00 | % | | $ | 112,500 | | 16.00 | % | | $ | 36,000 | | 67.30 | % | | $ | 151,425 | | |

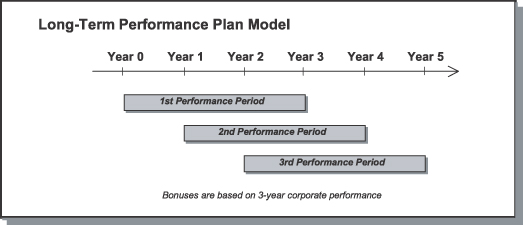

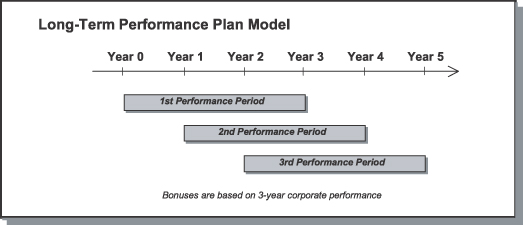

The LTP rewards sustained corporate performance for both Return on Equity (ROE) and sales growth relative to competitive measures over a rolling three-year period. The LTP has an annual target award of 30% of base salary and a maximum opportunity of 60% for all Participants, subject to proration provisions in Section VII F. The model below illustrates the LTP cycles.

VP PERFORMANCE RECOGNITION PROGRAM

| | • | ROE Component: compares AMD’s three-year ROE against the three-year ROE for the S&P 500. This component is weighted at 50%. |

| | • | Sales Component: compares the difference between AMD’s three-year sales growth and the three-year semiconductor industry sales growth, as published by Worldwide Semiconductor Trade Statistics (WSTS)2. This component is weighted at 50%. |

Target multipliers are derived as follows:

| | | | | | | | | | |

| | | | | Weighting

| | Performance Level

|

| | | | | | Threshold

| | Target (1.0 Multiplier)

| | Maximum (2.0 Multiplier)

|

Roe Component | | AMD ROE minus S&P 500 ROE(3-year) | | 50% | | -6% | | 0 | | 6% |

| | | | | |

Sales Component | | AMD Sales Growth % minus WSTS Sales Growth % (3-year) | | 50% | | -30% | | 0 | | 20% |

| 2 | Semiconductor industry data may be modified to be more representative of AMD’s product offerings. For instance, the DRAM market segment may be excluded from the Total Semiconductor Sales data. |

VP PERFORMANCE RECOGNITION PROGRAM

For example, if AMD’s 3-year ROE is 10% and the S&P ROE is 10%, the difference is 0. Therefore, a multiplier of 1.0 is generated for the ROE component. If AMD’s 3-year Sales Growth is 30% and the WSTS Sales Growth is 10%, the difference is 20%. Therefore, a multiplier of 2.0 is generated for the Sales component.

The Combined LTP Target Multiplier is calculated as follows:

(ROE Component Multiplier x 50%) + (Sales Component Multiplier x 50%) = Combined LTP Multiplier

So, in the example above, the Combined LTP Multiplier is 1.5:

(1.0 x 50%) + (2.0 x 50%) = 1.5

For either factor, the threshold performance level must be met in order for an LTP award to be generated. The maximum multiplier when both factors are added is two (2.0).

The LTP award is calculated as follows:

Combined LTP Multiplier x LTP Target (30%) x Base Salary = LTP

| V. | Plan Funding, Maximum Awards and Carryovers |

| | • | The Corporate Component of the STP is funded by a maximum of three percent of AMD’s adjusted Operating Profit, as defined in section VIII, for any given Plan Year. In the aggregate, if the Corporate awards exceed the 3 percent limit, each Participant’s award will be scaled back to conform. |

VP PERFORMANCE RECOGNITION PROGRAM

| | • | The Corporate Component will not be paid for any Plan Year in which Corporate OP is less than or equal to $0. |

| | • | The 3% of OP funding limitation applies to all STP Components for Officer participants |

| | • | For Vice Presidents below the Officer Level, the Group and the Individual Components are not affected by the 3% funding limitation. |

| | • | Assuming the 3% funding limitations above are met, accrued STP awards can be paid in amounts up to 3 times the target award. |

| | • | Any accrued STP award in excess of the 3 times target maximum will be carried forward and paid out over the following two years. One half of any carryover award will be paid following the first year of the carryover period. The remaining half will be paid following the second year of the carryover period. Carryover payments will be made coincident with the regular Plan payment schedule. |

| | • | Payment of LTP awards is subject to the 3% funding limitation. Awards generated but not paid due to the limitations will be carried over for possible payout in future Plan years. That amount will be carried over for up to three following Plan Years. Carryover award amounts will be paid at the earliest possible payout date (on a first in, first out basis) during the three-year carryover period, subject to the three percent maximum payout cap and other eligibility provisions. Any amount carried over but not payable during the three-year carryover period reverts to zero. |

Awards for the STP are generally paid out by the end of the first quarter following the close of a Plan Year. For the LTP, awards are paid as soon as possible after actual external performance data become available. Typically this will be in the 4th quarter following the plan year.

VP PERFORMANCE RECOGNITION PROGRAM

| VII. | Eligibility for Participation and Receipt of Awards |

| | A. | Unless otherwise determined by the CEO, all non-Sales Vice Presidents, Officers, Sr. Vice Presidents, and Group Vice Presidents are Participants in the Plan. |

| | B. | To be eligible to receive any accrued award under the Plan, a participant must be actively employed by AMD or FASL LLC on the actual date of payment of the award. |

| | C. | Payment to a Participant of any calculated award for which the Participant is otherwise eligible is contingent upon that Participant’s sustained satisfactory performance during the Plan period for which the award was calculated, as determined by the Participant’s immediate superior. |

| | D. | To be eligible to receive an accruedSTP award of any amount, a participant must have been actively employed in the Plan for some portion of the Plan Year. A participant who is actively employed for less than an entire Plan Year (i.e., became a participant mid-year or was on an unpaid leave), and who is otherwise eligible, will receive a prorated STP award, according to the number of months of active employment in the 12-month STP Plan Year. For purposes of this provision, a full month’s credit will be given where the Participant was actively employed in the Plan for at least 15 days of a partial month. |

| | E. | In the event of an employee status change resulting in an approved change of Plan tier (for which different target award levels exist or a group assignment changes), the participation period for each tier is determined using the proration method described above. The monthly salary immediately prior to the status change is used to compute all portions of the award for the first tier. The monthly salary at the end of the Plan Year is used to compute the award for the new tier. Calculations take into account the appropriate targets and maximums for each Plan tier. |

| | F. | To be eligible to receive anLTP award of any amount, a participant must have been actively employed in the Plan for at least 12 months. A participant who is actively employed for less than an entire three-year LTP award period (i.e., became a Participant at some time during the period, or was on an unpaid leave), and who is otherwise eligible to receive an LTP award, will receive an LTP award that is prorated according to the number of months of active employment out of the 36-month LTP award period. For purposes of this provision, a full |

VP PERFORMANCE RECOGNITION PROGRAM

month’s credit will be given where the Participant was actively employed for at least 15 days of a partial month.

| | G. | A participant who voluntarily terminates employment with AMD or FASL LLC and 1) has reached 60 years of age, 2) has 15 years of AMD and/or FASL LLC service,and 3) has been actively employed for at least 6 months in the Plan Year is eligible for a payment of an accrued award that is not prorated for less than a full-year’s service. Participants actively employed for less than 6 months are eligible for a prorated accrued award. The payment will be based on year-end financial performance and will be made at the same time as other Plan payments. The proration provisions, as discussed in D and F above, will apply. The above conditions apply to any LTP carryover. Any STP carryover is forfeited upon termination of any kind. |

| | H. | If a participant dies during the Plan Year, any accrued award for the current Plan Year will be paid in full so long as the Participant was on active status for at least 6 months of that year. If active for less than 6 months, any award generated at the end of the year will be prorated as above. Payments of any accrued award, including any earned LTP carryover amounts, will be made to the designated recipient of the participant’s final paycheck. Any STP carryover awards are forfeited. |

| | I. | No allowance will be made for factors beyond the control of the Plan Participants that either adversely or favorably affect the Plan’s performance. There is no vested entitlement to any accrued award as described above. Award payments are made at the sole discretion of the CEO. |

| | J. | AMD reserves the right to retroactively or prospectively modify or terminate the Plan, in whole or in part, and AMD reserves the right to deny the participation of, or payout of an award to, a Participant, at its sole discretion, with or without notice or cause. |

Base Salary is defined as the Participant’s annualized base pay rate at the end of the Plan Year or, in the case of Plan tier changes, the Participant’s annualized base pay rate at the end of the participation period for each separate tier. For a participant who exits the Plan, but retains eligibility, or changes Plan tiers during the year, the annualized salary will be calculated based on the salary in effect at the time of the change in status.

VP PERFORMANCE RECOGNITION PROGRAM

Participant is defined as a proven contributor in an eligible position subject to the participation guidelines established by senior management. The individual must be nominated by his or her Vice President and approved by senior management each Plan Year.

Operating Profit, for Plan purposes, is adjusted for pre-tax income/loss from FASL LLC, also referred to as Operating Profit on the Non-GAAP profit and loss statement. Operating Profit is also adjusted to add back any award payments from Corporate award plans.

Corporate Budgetis defined as the Corporate Financial Budget established in the 4th quarter of the previous year, generally during the month of November (unless defined otherwise by executive management for the Plan Year in question.)

Mid-Year Update is defined as the update of the Corporate Financial Budget established in the 2nd quarter of the current year, generally in May (unless defined otherwise by executive management for the Plan Year in question.)

Plan Yearis defined as the period between January 1 and December 31 of any given year.

The specifics of the Plan are highly confidential and are to be discussed only with the appropriate Vice President, Division Human Resources, or Compensation.