Exhibit 99.1

Two Great Companies,

One Exciting Future

Presentation to Investors

July 24, 2006

Safe Harbor Statement

This document contains forward-looking statements, which are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are commonly identified by words such as “would,” “may,” “will,” “expects,” and other terms with similar meaning. Forward-looking statements are based on current beliefs, assumptions and expectations and speak only as of the date of this document and involve risks and uncertainties that could cause actual results to differ materially from current expectations. The material factors that could cause actual results to differ materially from current expectations include, without limitation, the following: (1) the possibility that there are unexpected delays in obtaining regulatory approvals, (2) failure to obtain approval of ATI shareholders or the court of the Plan of Arrangement, (3) actions that may be taken by the competitors, customers and suppliers of AMD or ATI that may cause the transaction to be delayed or not completed, (4) the possibility that the revenues, cost savings, growth prospects and any or other synergies expected from the proposed transaction may not be fully realized or may take longer to realize than expected, (5) the possibility that the transaction may not be accretive as expected, (6) that the company may not achieve year-end or longer-term targeted gross margins, research and development expenses, selling, general or administrative expenses, operating margins, capital structure or debt-to-capitalization, (7) that Intel Corporation’s pricing, marketing programs, product bundling, new product introductions or other activities will negatively impact sales, (8) that the company may require additional capital and may not be able to raise sufficient capital, on favorable terms or at all, (9) delays associated with integrating the companies, including employees and operations, after the transaction is completed, (10) the possible impairment of goodwill and other long-lived assets resulting from the transaction and the resulting impact on the combined company’s assets and earnings, (11) unexpected variations in market growth and demand for the combined company’s products (in the mixes available) and technologies, (12) rapid and frequent technology changes in the computing and consumer electronics segments, (13) potential constraints on the ability to develop, launch and ramp new products on a timely basis, (14) R&D costs associated with the development of new products, and (15) other factors that may affect future results of the combined company described in the section entitled “Risk Factors” in the management information circular to be mailed to ATI’s shareholders and in AMD and ATI’s filings with the U.S. Securities and Exchange Commission (“SEC”) that are available on the SEC’s web site located at http://www.sec.gov, including the section entitled “Risk Factors” in AMD’ s Form 10-Q for the fiscal quarter ended March 26, 2006 and the section entitled “Risks and Uncertainties” in Exhibit 1 to ATI’s Form 40-F for the fiscal year ended August 31, 2005. Please see Item 3.12 “Narrative Description of the Business – Risks and Uncertainties” in ATI’s 2005 Annual Information Form and the Risks and Uncertainties section of ATI’s annual MD&A on page 30 of ATI’s 2005 Annual report filed on the SEDAR website maintained by the Canadian Securities Administrators at http://www.sedar.com. Readers are strongly urged to read the full cautionary statements contained in those materials. We assume no obligation to update or revise any forward-looking statement, including any financial targets or projections, whether as a result of new information, future events or any other reason. Additional Information In connection with the proposed transaction, ATI intends to file a management proxy circular with the Canadian securities regulatory authorities. Investors and security holders are urged to read the management proxy circular when it becomes available because it will contain important information about AMD, ATI and the transaction. Investors and security holders may obtain the management proxy circular free of charge at the website of the Canadian System for Electronic Document Analysis and Retrieval (SEDAR) maintained by the Canadian Securities Administrators at http://www.sedar.com. Investors and security holders may obtain any documents relating to the transaction filed by AMD with the SEC free of charge at the SEC’s website located at http://www.sec.gov.

2

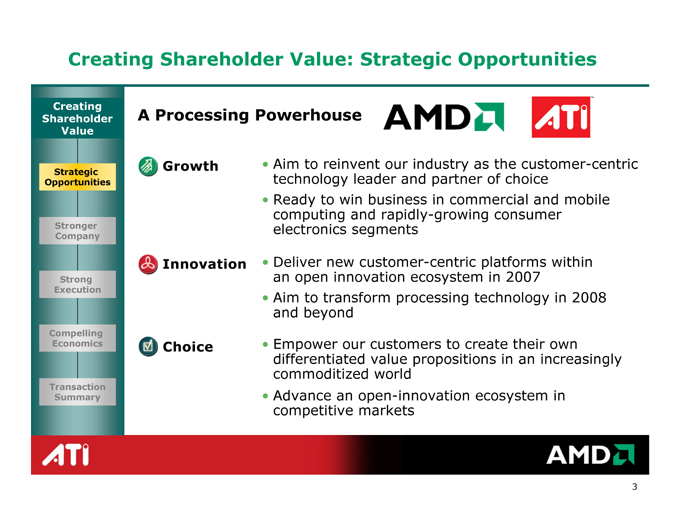

Creating Shareholder Value: Strategic Opportunities

Creating

Shareholder

Value

Strategic

Opportunities

Stronger

Company

Strong

Execution

Compelling

Economics

Transaction

Summary

A Processing Powerhouse

Growth

Aim to reinvent our industry as the customer-centric technology leader and partner of choice

Ready to win business in commercial and mobile computing and rapidly-growing consumer electronics segments

Innovation

Deliver new customer-centric platforms within an open innovation ecosystem in 2007

Aim to transform processing technology in 2008 and beyond

Choice

Empower our customers to create their own differentiated value propositions in an increasingly commoditized world

Advance an open-innovation ecosystem in competitive markets

3

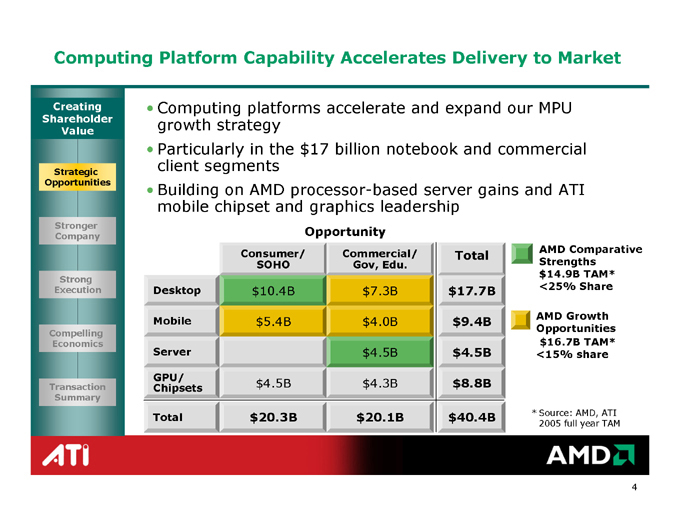

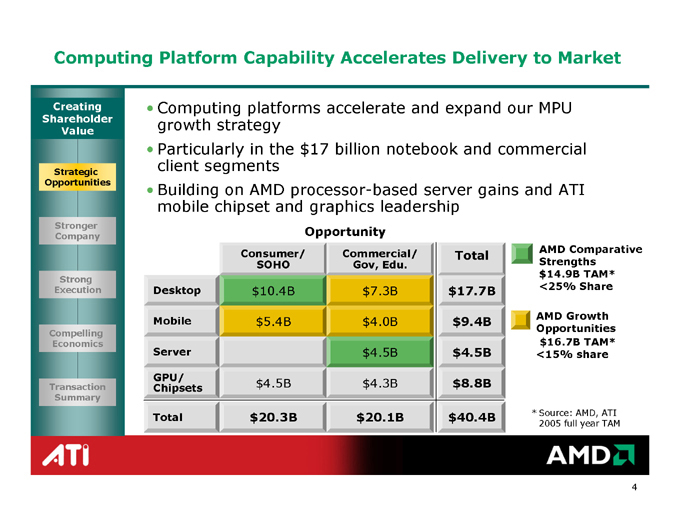

Computing Platform Capability Accelerates Delivery to Market Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Computing platforms accelerate and expand our MPU growth strategy

Particularly in the $17 billion notebook and commercial client segments

Building on AMD processor-based server gains and ATI mobile chipset and graphics leadership

Consumer/ SOHO

Commercial/ Gov, Edu.

Total Desktop

$17.7B $7.3B $10.4B

Mobile

$4.0B $5.4B $9.4B

Server

$4.5B $4.5B

GPU/

Chipsets

$4.3B $4.5B $8.8B

Total

$40.4B $20.1B $20.3B

AMD Comparative Strengths $14.9B TAM*<25% Share

AMD Growth Opportunities $16.7B TAM*<15% share

* Source: AMD, ATI

2005 full year TAM

4

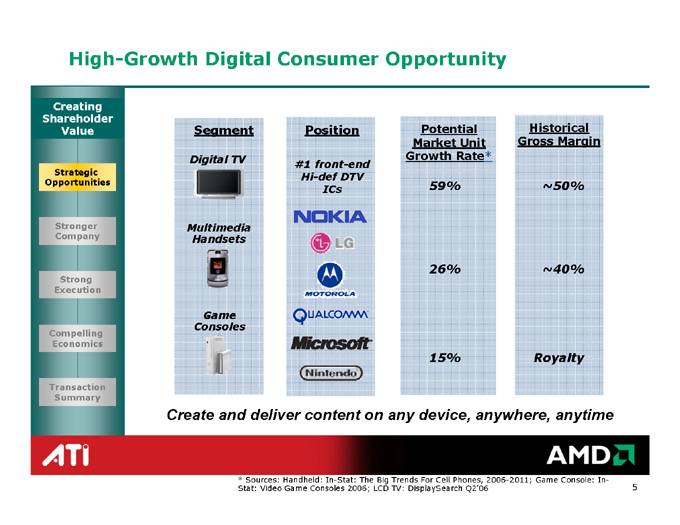

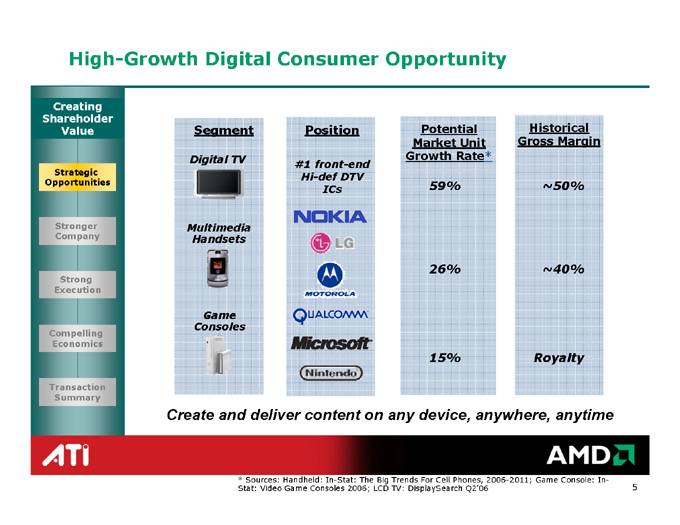

High-Growth Digital Consumer Opportunity

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Segment

Digital TV

Multimedia Handsets

Game Consoles

Position

#1 front-end Hi-def DTV ICs

Potential Market Unit Growth Rate*

59%

26%

15%

Historical Gross Margin

~50%

~40%

Royalty

Create and deliver content on any device, anywhere, anytime

* Sources: Handheld: In-Stat: The Big Trends For Cell Phones, 2006-2011; Game Console: In-Stat: Video Game Consoles 2006; LCD TV: DisplaySearch Q2’06

5

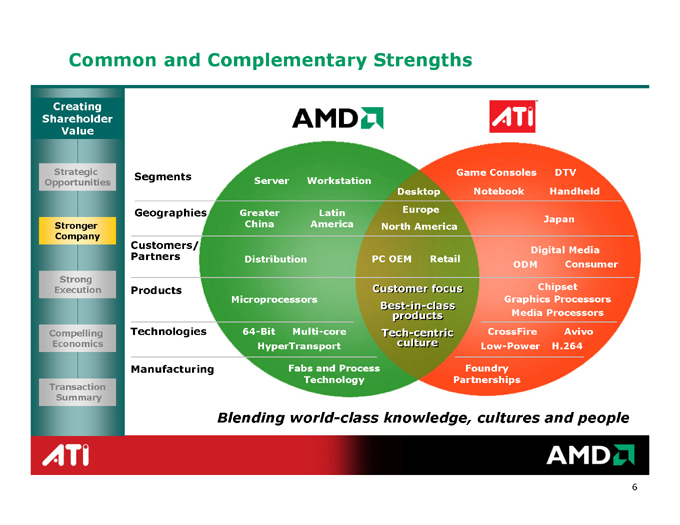

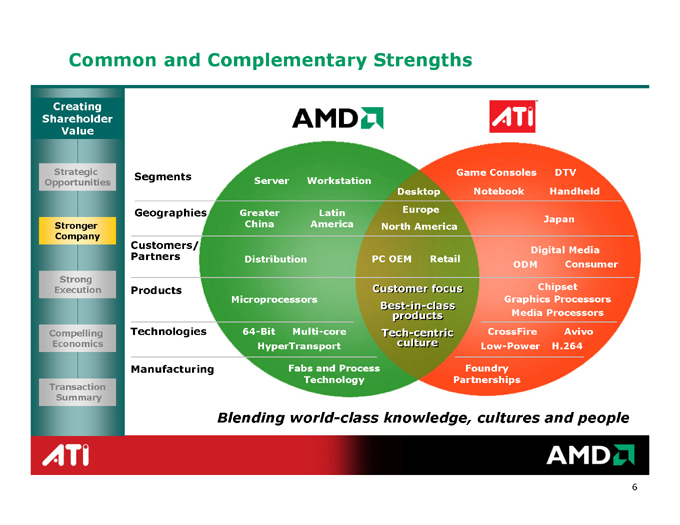

Common and Complementary Strengths

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Segments

Server

Workstation

Desktop

Game Consoles Notebook

DTV Handheld

Geographies

Greater China

Latin America

Europe North America

Japan

Customers/Partners

Distribution

PC OEM

Retail

Digital Media

ODM

Consumer

Products

Microprocessors

Customer focus

Best-in-class products

Chipset

Graphics Processors

Media Processors

Technologies

64-Bit

Multi-core

HyperTransport

Tech-centric culture

CrossFire

Low-Power

Avivo

H.264

Manufacturing

Fabs and Process Technology

Foundry Partnerships

Blending world-class knowledge, cultures and people

6

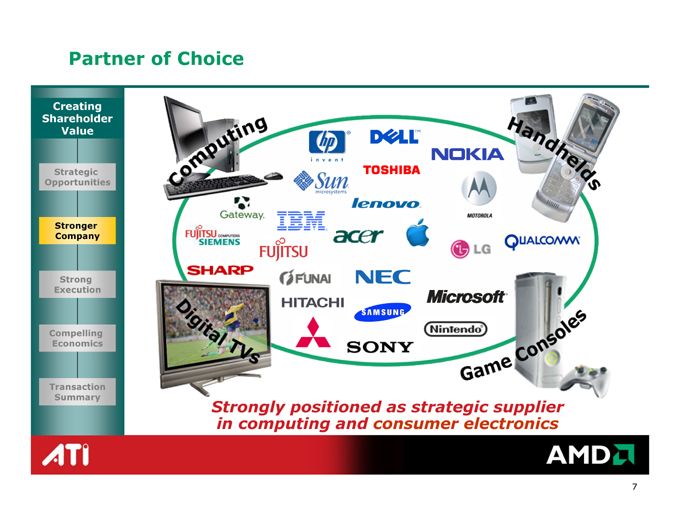

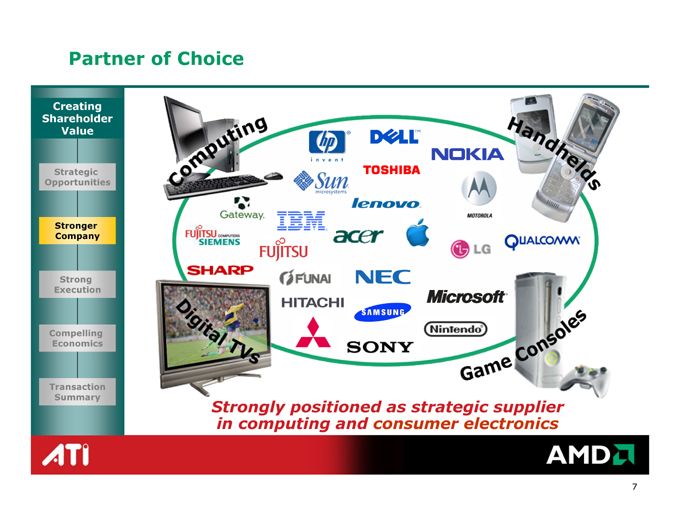

Partner of Choice

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Computing

Digital TVs

Handhelds

Game Consoles

Strongly positioned as strategic supplier in computing and consumer electronics

7

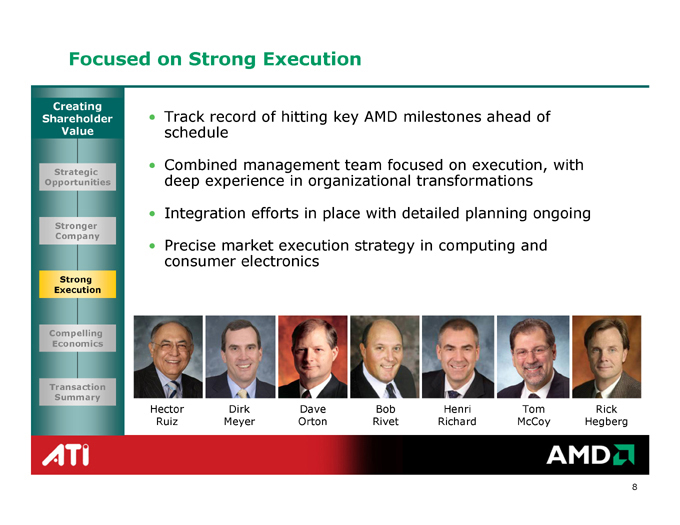

Focused on Strong Execution

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Track record of hitting key AMD milestones ahead of schedule

Combined management team focused on execution, with deep experience in organizational transformations

Integration efforts in place with detailed planning ongoing

Precise market execution strategy in computing and consumer electronics

Hector Ruiz

Dirk Meyer

Dave Orton

Bob Rivet

Henri Richard

Tom McCoy

Rick Hegberg

8

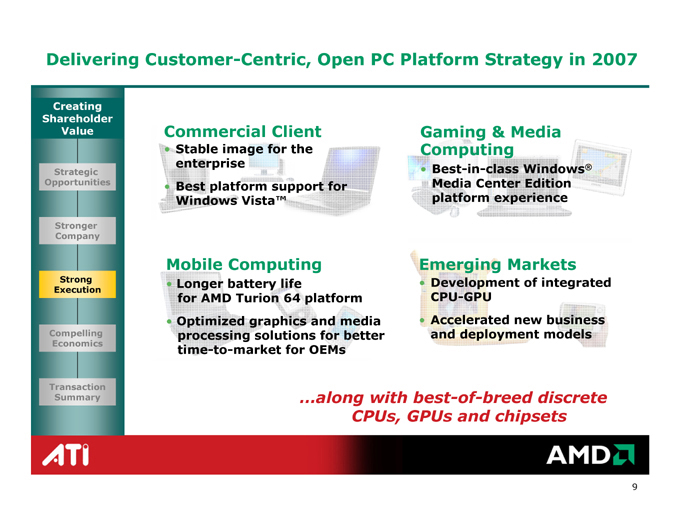

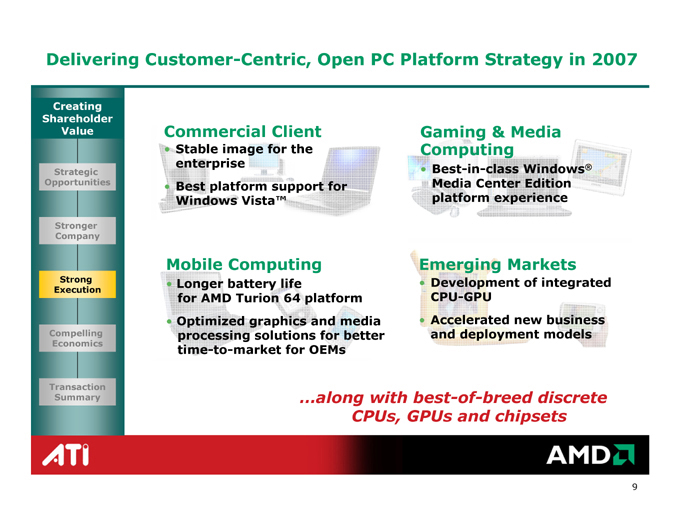

Delivering Customer-Centric, Open PC Platform Strategy in 2007

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Commercial Client

Stable image for the enterprise

Best platform support for Windows Vista™

Gaming & Media Computing

Best-in-class Windows® Media Center Edition platform experience

Mobile Computing

Longer battery life for AMD Turion 64 platform

Optimized graphics and media processing solutions for better time-to-market for OEMs

Emerging Markets

Development of integrated CPU-GPU

Accelerated new business and deployment models

…along with best-of-breed discrete CPUs, GPUs and chipsets

9

Aim to Transform Processing Technology in 2008 and Beyond

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Combine our key building blocks with a unified development effort to create specialized solutions that our customers seek

CPU

Drivers BIOS

Chipset

Drivers BIOS

GPU

Drivers BIOS

Platforms

General Purpose

BIOS, Driver, Software

CPU GPU Chipset

Data Centric

BIOS, Driver, Software

CPU GPU Chipset

Graphics Centric

BIOS, Driver, Software

CPU GPU Video

Chipset

Media Centric

BIOS, Driver, Software

CPU

GPU

Video

Chipset

10

Optimizing Consumer Electronics Opportunities

Creating

Shareholder

Value

Strategic

Opportunities

Stronger

Company

Strong

Execution

Compelling

Economics

Transaction

Summary

Accelerate multimedia adoption on handhelds

Support TV, video, photography, music, 3D graphics and more

Drive features and image quality for LCD and plasma TVs

Enhance digital TV at affordable price points for the best home theatre experience

DIGITAL TV PRODUCTS

MULTIMEDIA AND HANDHELD PRODUCTS

11

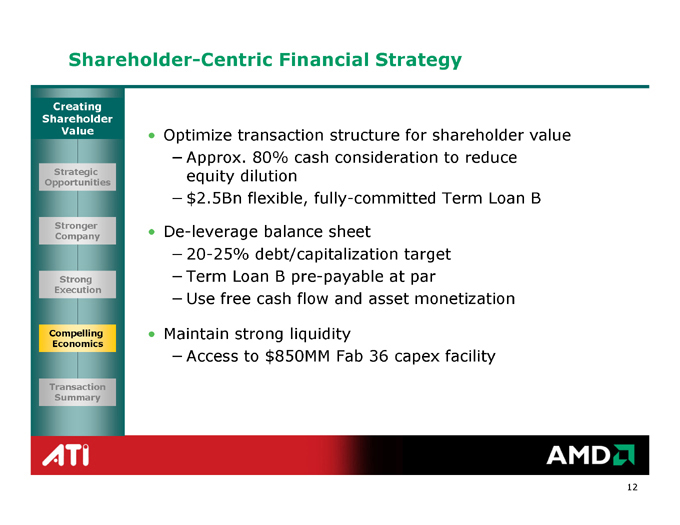

Shareholder-Centric Financial Strategy

Creating

Shareholder

Value

Strategic

Opportunities

Stronger

Company

Strong

Execution

Compelling

Economics

Transaction

Summary

Optimize transaction structure for shareholder value

Approx. 80% cash consideration to reduce equity dilution

$2.5Bn flexible, fully-committed Term Loan B

De-leverage balance sheet

20-25% debt/capitalization target

Term Loan B pre-payable at par

Use free cash flow and asset monetization

Maintain strong liquidity

Access to $850MM Fab 36 capex facility

12

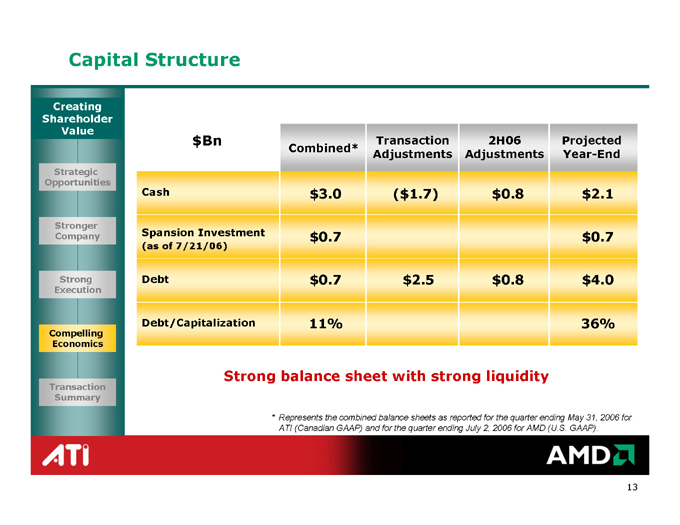

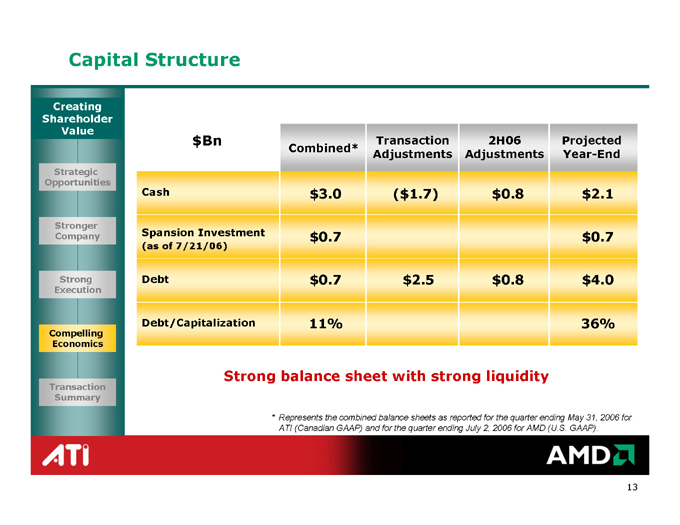

Capital Structure

Creating

Shareholder

Value

Strategic

Opportunities

Stronger

Company

Strong

Execution

Compelling

Economics

Transaction

Summary

$Bn Combined* Transaction Adjustments 2H06 Adjustments Projected Year-End

Cash $3.0 ($1.7) $0.8 $2.1

Spansion Investment $0.7 $0.7

(as of 7/21/06)

Debt $0.7 $2.5 $0.8 $4.0

Debt/Capitalization 11% 36%

Strong balance sheet with strong liquidity

* Represents the combined balance sheets as reported for the quarter ending May 31, 2006 for ATI (Canadian GAAP) and for the quarter ending July 2, 2006 for AMD (U.S. GAAP).

13

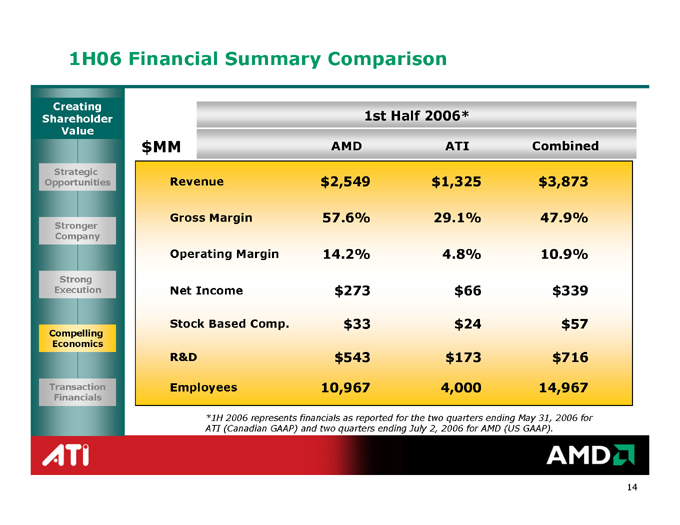

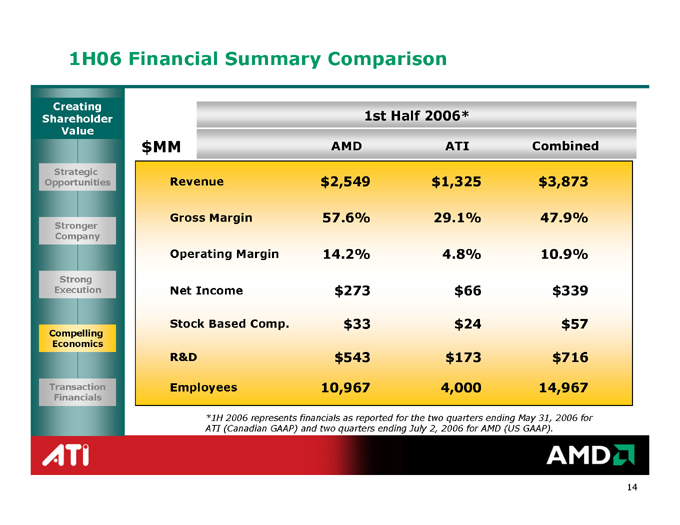

1H06 Financial Summary Comparison

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Financials

1st Half 2006*

$MM

AMD

ATI

Combined

$1,325

$2,549

Revenue

$3,873

29.1%

57.6%

Gross Margin

47.9%

4.8%

14.2%

Operating Margin

10.9%

$66

$273

Net Income

$339

$24

$33

Stock Based Comp.

$57

$173

$543

R&D

$716

14,967

4,000

10,967

Employees

*1H 2006 represents financials as reported for the two quarters ending May 31, 2006 for ATI (Canadian GAAP) and two quarters ending July 2, 2006 for AMD (US GAAP).

14

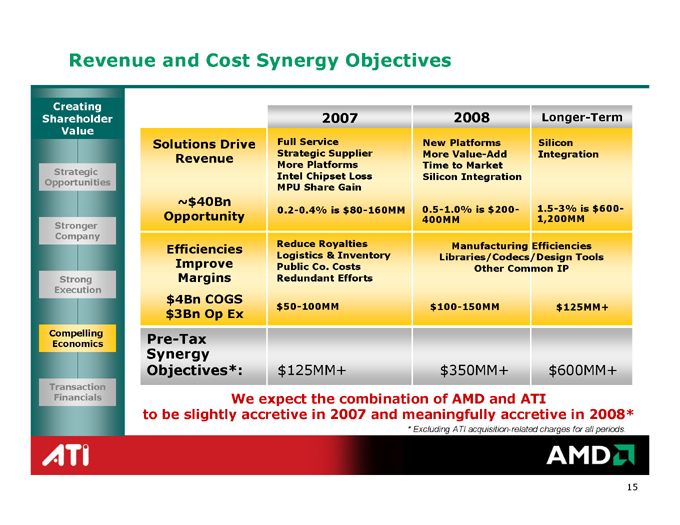

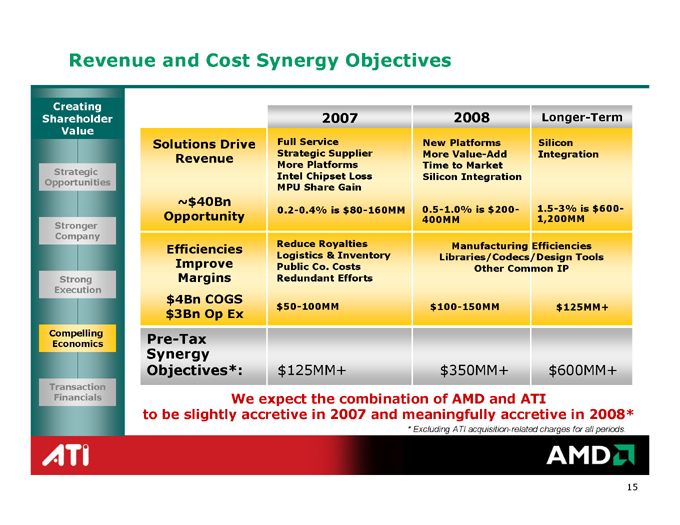

Revenue and Cost Synergy Objectives

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

2008

2007

Longer-Term

New Platforms More Value-Add Time to Market Silicon Integration

Solutions Drive Revenue

~$40Bn Opportunity

Silicon Integration

Full Service Strategic Supplier More Platforms Intel Chipset Loss MPU Share Gain

0.2-0.4% is $80-160MM

0.5-1.0% is $200-400MM

1.5-3% is $600-1,200MM

Reduce Royalties Logistics & Inventory Public Co. Costs Redundant Efforts

$50-100MM

Manufacturing Efficiencies Libraries/Codecs/Design Tools Other Common IP

Efficiencies Improve Margins

$4Bn COGS

$3Bn Op Ex

$125MM+

$100-150MM

Pre-Tax Synergy Objectives*:

$125MM+ $350MM+ $600MM+

We expect the combination of AMD and ATI

to be slightly accretive in 2007 and meaningfully accretive in 2008*

* Excluding ATI acquisition-related charges for all periods.

15

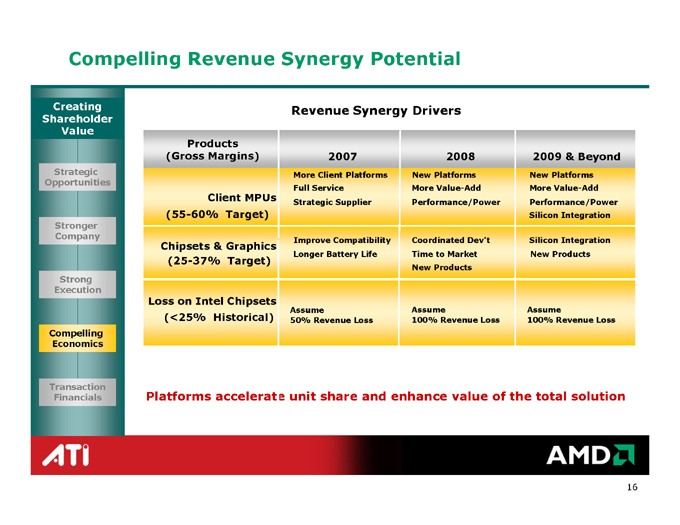

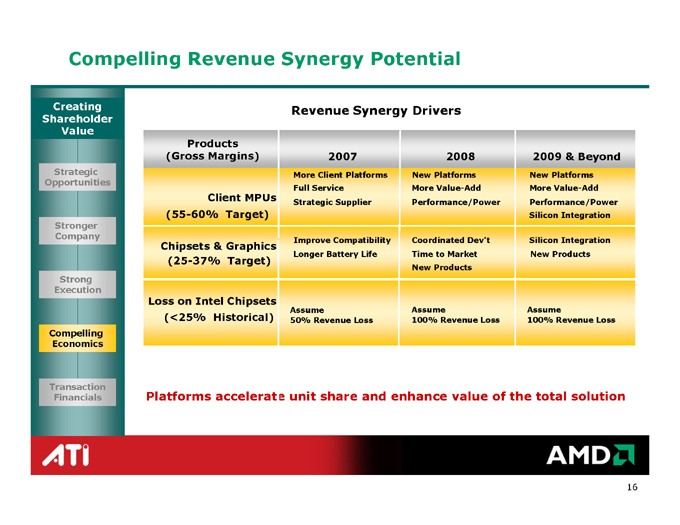

Compelling Revenue Synergy Potential

Creating

Shareholder

Value

Strategic

Opportunities

Stronger

Company

Strong

Execution

Compelling

Economics

Transaction

Financials

Revenue Synergy Drivers

| | | | | | |

Products | | | | | | |

(Gross Margins) | | 2007 | | 2008 | | 2009 & Beyond |

| | | More Client Platforms | | New Platforms | | New Platforms |

| | | Full Service | | More Value-Add | | More Value-Add |

Client MPUs | | Strategic Supplier | | Performance/Power | | Performance/Power |

(55-60% Target) | | | | | | Silicon Integration |

| | | | | | | |

| | | Improve Compatibility | | Coordinated Dev’t | | Silicon Integration |

Chipsets & Graphics | | | | | | |

| | | Longer Battery Life | | Time to Market | | New Products |

(25-37% Target) | | | | | | |

| | | | | New Products | | |

| | | | | | | |

| | | | | | | |

Loss on Intel Chipsets | | | | | | |

| | | Assume | | Assume | | Assume |

(<25% Historical) | | 50% Revenue Loss | | 100% Revenue Loss | | 100% Revenue Loss |

Platforms accelerate unit share and enhance value of the total solution

16

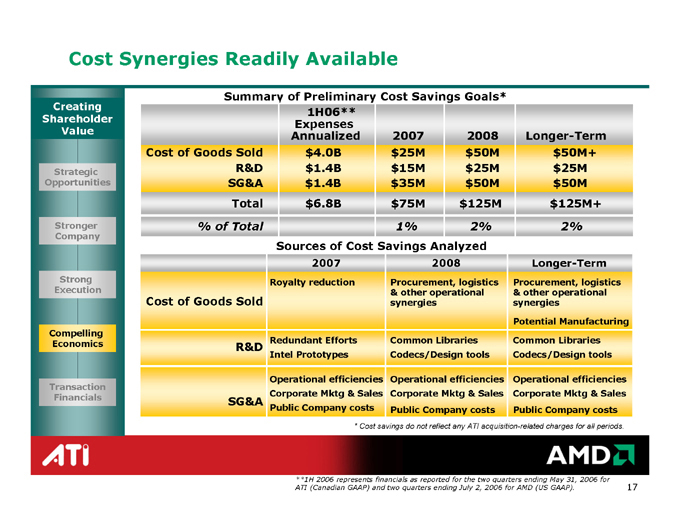

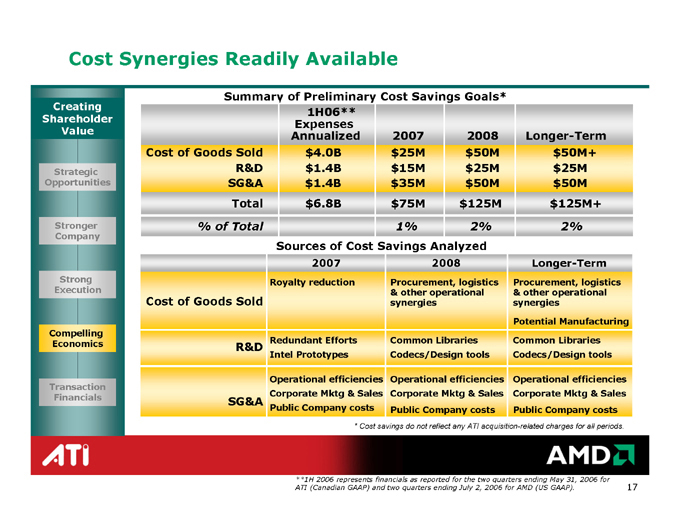

Cost Synergies Readily Available

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Financials

Summary of Preliminary Cost Savings Goals*

Annualized 2007 2008 Longer-Term

Cost of Goods Sold $4.0B $25M $50M $50M+

R&D $1.4B $15M $25M $25M

SG&A $1.4B $35M $50M $50M

Total $6.8B $75M $125M $125M+

% of Total 1% 2% 2%

Sources of Cost Savings Analyzed

Longer-Term

2008

2007

Procurement, logistics

Procurement, logistics

Royalty reduction & other operational & other operational synergies

synergies Cost of Goods Sold

Potential Manufacturing

Common Libraries

Redundant Efforts

R&D

Common Libraries

Codecs/Design tools

Intel Prototypes

Codecs/Design tools

Operational efficiencies

Operational efficiencies

Operational efficiencies

Corporate Mktg & Sales

Corporate Mktg & Sales

SG&A

Corporate Mktg & Sales

Public Company costs

Public Company costs

Public Company costs

* Cost savings do not reflect any ATI acquisition-related charges for all periods.

**1H 2006 represents financials as reported for the two quarters ending May 31, 2006 for ATI (Canadian GAAP) and two quarters ending July 2, 2006 for AMD (US GAAP).

17

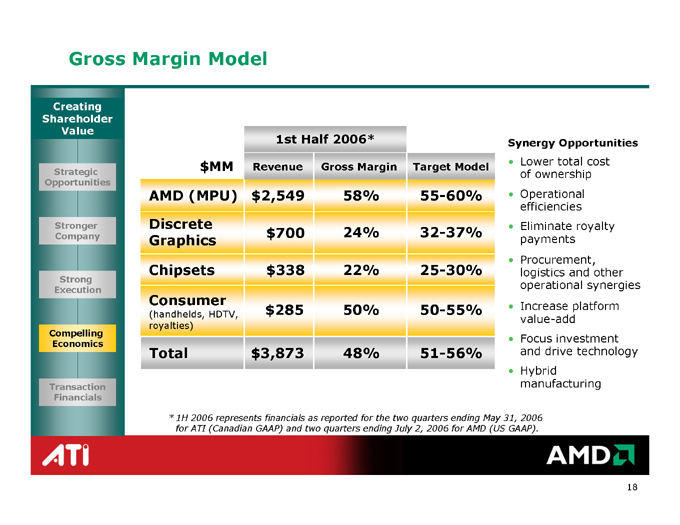

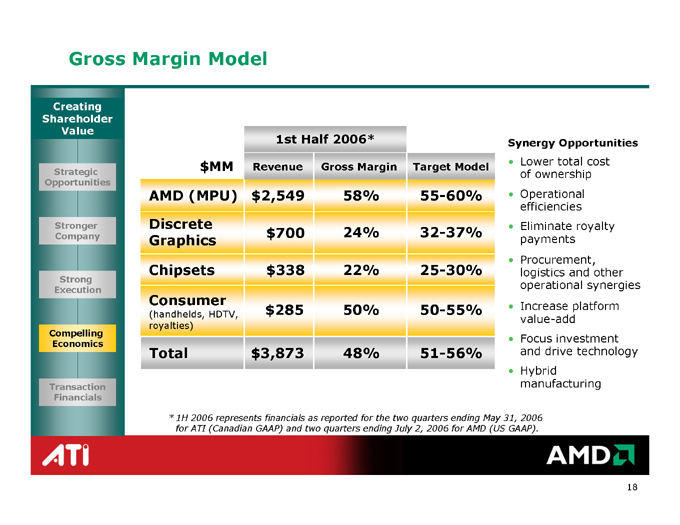

Gross Margin Model

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Financials

1st Half 2006*

Synergy Opportunities

Lower total cost of ownership

Operational efficiencies

Eliminate royalty payments

Procurement, logistics and other operational synergies

Increase platform value-add

Focus investment and drive technology

Hybrid manufacturing $MM Gross Margin Revenue Target Model 58% $2,549 AMD (MPU) 55-60% Discrete Graphics

24% $700 32-37% 25-30% 22% $338 Chipsets Consumer (handhelds, HDTV, royalties) 50% $285 50-55% 48% $3,873

Total 51-56%

* 1H 2006 represents financials as reported for the two quarters ending May 31, 2006 for ATI (Canadian GAAP) and two quarters ending July 2, 2006 for AMD (US GAAP).

18

New Target Financial Model

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Financials

Old AMD New AMD

Model 1H06* Combined Model

Revenue 100% 100% 100%

Gross Margin 55-60% 48% 51-56%

R&D 18-23% 18% 18-21%

SG&A 12-16% 18% 11-14%

Operating Margin 18-24% 11% 18-24%

* 1H 2006 represents financials as reported for the two quarters ending May 31, 2006 for ATI (Canadian GAAP) and two quarters ending July 2, 2006 for AMD (US GAAP).

19

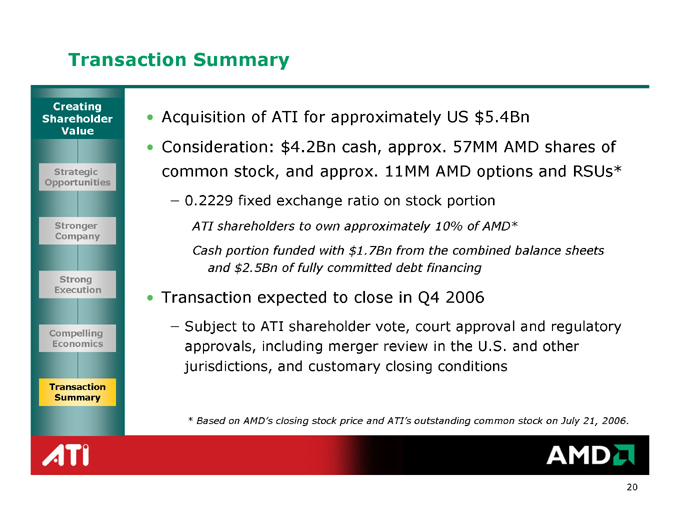

Transaction Summary

Creating Shareholder Value

Strategic Opportunities

Stronger Company

Strong Execution

Compelling Economics

Transaction Summary

Acquisition of ATI for approximately US $5.4Bn

Consideration: $4.2Bn cash, approx. 57MM AMD shares of common stock, and approx. 11MM AMD options and RSUs*

0.2229 fixed exchange ratio on stock portion

ATI shareholders to own approximately 10% of AMD*

Cash portion funded with $1.7Bn from the combined balance sheets and $2.5Bn of fully committed debt financing

Transaction expected to close in Q4 2006

Subject to ATI shareholder vote, court approval and regulatory approvals, including merger review in the U.S. and other jurisdictions, and customary closing conditions

* Based on AMD’s closing stock price and ATI’s outstanding common stock on July 21, 2006.

20