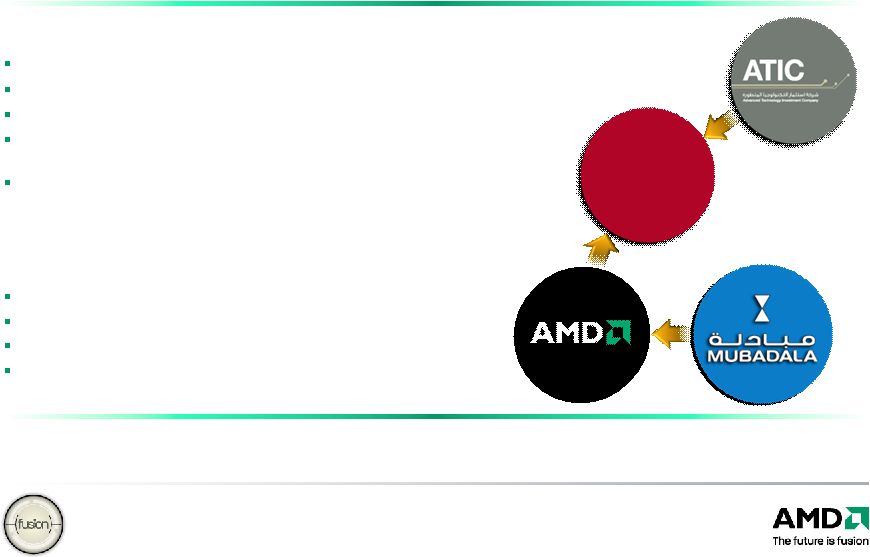

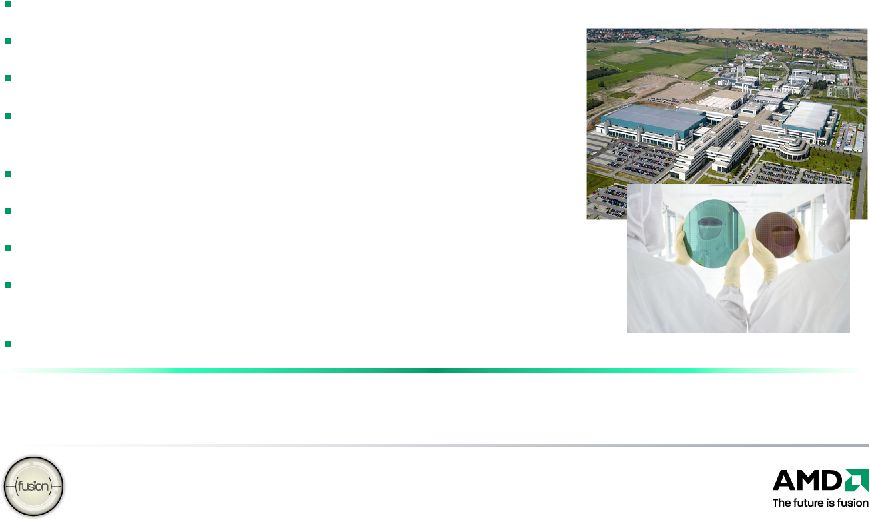

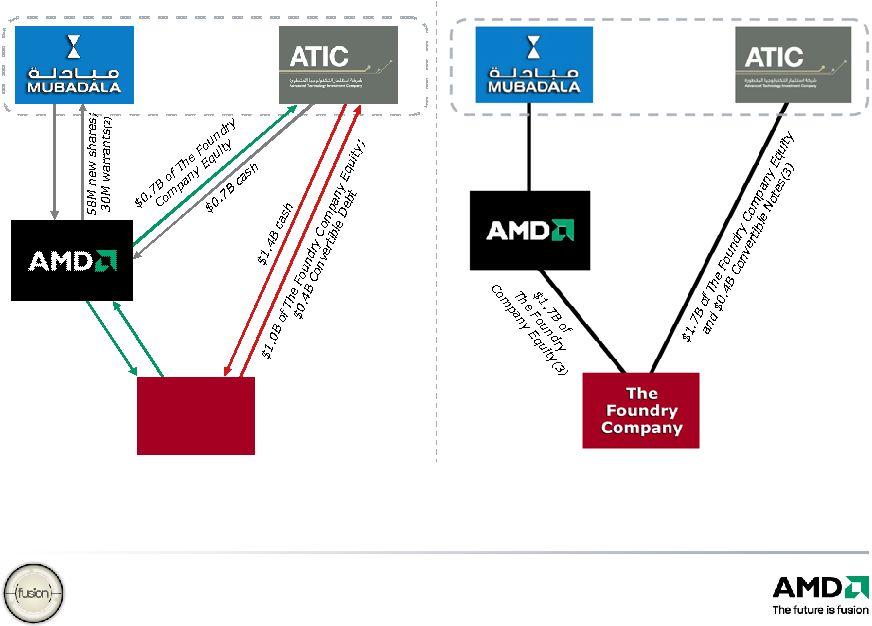

| Investor Roadshow | October 7, 2008 12 Transaction Summary AMD will sell to Mubadala 58M new shares and 30M warrants(1) in exchange $0.3B which will increase Mubadala’s ownership in AMD to 19.3% on a fully diluted basis Mubadala has a right to designate a member of the Board of Directors of AMD (1) Warrants will have an exercise price of $0.01 AMD will transfer people, manufacturing assets, Fab36 debt and some intellectual property ATIC to invest $2.1B in capital: - $1.4B to The Foundry Company - $0.7B to AMD - ATIC will hold convertible notes in The Foundry Company The joint venture will be owned on a fully-converted common basis 44.4% by AMD and 55.6% by ATIC. - AMD and ATIC will be The Foundry Company’s only shareholders. At close each will have equal voting rights - 80% of ATIC’s equity in the form of Class B Preferred shares with a preferred 12% return upon a liquidity event - ATIC’s economic ownership will increase over time based on the differences in securities held by AMD and ATIC, and depending on whether AMD elects to invest proportionally with ATIC in future capital infusions to support The Foundry Company’s growth - Have a Board of Directors whose membership is equally divided between representatives of AMD and ATIC Minimum of $3.6B and up to $6.0B of future funding over five years to The Foundry Company, primarily for New York and Dresden facilities - AMD has the option, but not the obligation, to provide additional capital to be invested in The Foundry Company AMD will have guaranteed access to advanced manufacturing services and capacity The Foundry Company will have an exclusive supply agreement with limited exceptions to manufacture AMD processors and to manufacture, where competitive, certain percentages of other AMD semiconductor products. The Foundry Company The Foundry Company |