Q1 2016 SUPPLEMENTAL INFORMATION

|

| |

| Forward-Looking Statements | |

| |

| |

| Funds From Operations - Detail | |

| |

| |

| |

| Office Lease Expirations | |

| |

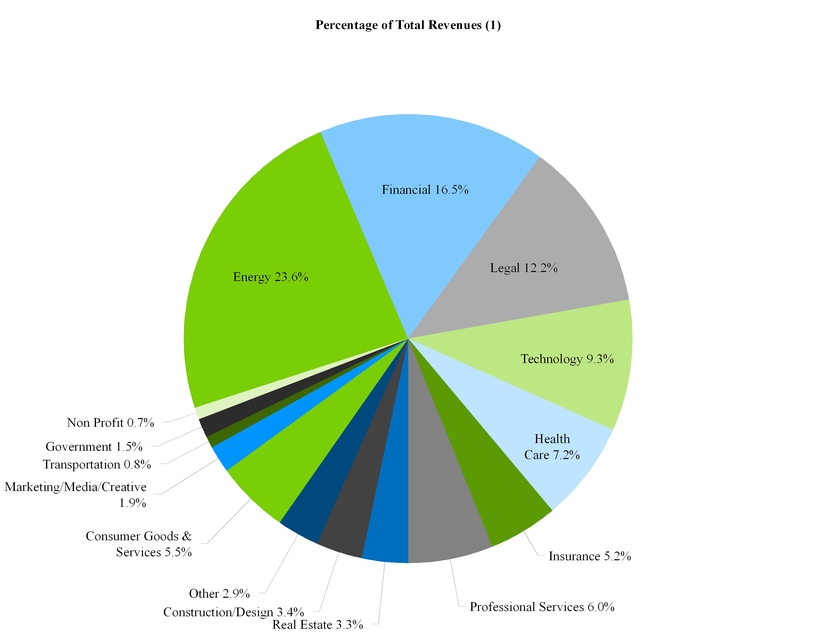

| Tenant Industry Diversification | |

| Investment Activity | |

| |

| Land Inventory | |

| |

| Non-GAAP Financial Measures - Calculations and Reconciliations | |

| Non-GAAP Financial Measures - Discussion | |

| Additional Information | |

|

| | |

| Cousins Properties Incorporated | | Q1 2016 Supplemental Information |

|

| | |

| FORWARD-LOOKING STATEMENTS |

Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2015 and in the Quarterly Report on Form 10-Q for the three months ended March 31, 2016. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as, our business and financial strategy; our ability to obtain future financing arrangements; future acquisitions and future dispositions of operating assets; future acquisitions of land; future development and redevelopment opportunities; future dispositions of land and other non-core assets; future repurchases of common stock; projected operating results; market and industry trends; future distributions; projected capital expenditures; interest rates; statements about the benefits of the proposed transactions involving the Company and Parkway Properties Inc. ("Parkway"), including future financial and operating results, plans, objectives, expectations and intentions; all statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders; benefits of the proposed transactions to tenants, employees, stockholders and other constituents of the combined company; integrating our companies; cost savings; and the expected timetable for completing the proposed transactions.

Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following, the availability and terms of capital and financing; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions and investments or from dispositions; the potential dilutive effect of common stock offerings; the failure to achieve benefits from the repurchase of common stock; the availability of buyers and adequate pricing with respect to the disposition of assets; risks and uncertainties related to national and local economic conditions, the real estate industry in general, and the commercial real estate markets in particular; changes to our strategy with regard to land and other non-core holdings that require impairment losses to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, and the ability to lease newly developed and/or recently acquired space; the adverse change in the financial condition of one or more of our major tenants; volatility in interest rates and insurance rates; the availability of sufficient investment opportunities; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and meet regulatory requirements; risks associated with the ability to consummate the proposed merger and the timing of the closing of the proposed merger; risks associated with the ability to consummate the proposed spin-off of a company holding the Houston assets of the Company and Parkway (“HoustonCo”) and the timing of the closing of the proposed spin-off; risks associated with the ability to list the common stock of HoustonCo on the New York Stock Exchange following the proposed spin-off; risks associated with the ability to consummate certain asset sales contemplated by Parkway and the timing of the closing of such proposed asset sales; risks associated with the ability to consummate the proposed reorganization of certain assets and liabilities of Cousins and Parkway, including the contemplated structuring of the Company and HoustonCo as “UPREITs” following the consummation of the proposed transactions; the failure to obtain the necessary debt financing arrangements set forth in the commitment letter received in connection with the proposed transactions; the ability to secure favorable interest rates on any borrowings incurred in connection with the proposed transactions; the impact of such indebtedness incurred in connection with the proposed transactions; the ability to successfully integrate our operations and employees; the ability to realize anticipated benefits and synergies of the proposed transactions; material changes in the dividend rates on securities or the ability to pay dividends on common shares or other securities; potential changes to tax legislation; changes in demand for developed properties; risks associated with the acquisition, development, expansion, leasing and management of properties; risks associated with the geographic concentration of the Company, Parkway or HoustonCo; the potential impact of announcement of the proposed transactions or consummation of the proposed transactions on relationships, including with tenants, employees, customers and competitors; the unfavorable outcome of any legal proceedings that have been or may be instituted against the Company, Parkway or any company spun-off by the combined company; significant costs related to uninsured losses, condemnation, or environmental issues; the amount of the costs, fees, expenses and charges related to the proposed transactions and the actual terms of the financings that may be obtained in connection with the proposed transactions; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by the Company and Parkway.

The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws.

|

| | |

| Cousins Properties Incorporated | 3 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| Property Statistics | | | | | | | |

| Consolidated Operating Properties | 12 |

| 13 |

| 13 |

| 12 |

| 12 |

| 12 |

| 11 |

|

| Consolidated Rentable Square Feet (in thousands) | 13,034 |

| 13,407 |

| 13,407 |

| 12,563 |

| 12.122 |

| 12,122 |

| 11,993 |

|

| Unconsolidated Operating Properties | 5 |

| 5 |

| 5 |

| 6 |

| 6 |

| 6 |

| 6 |

|

| Unconsolidated Rentable Square Feet (in thousands) | 3,129 |

| 3,129 |

| 3,129 |

| 3,431 |

| 3.434 |

| 3,434 |

| 3,435 |

|

| Total Operating Properties | 17 |

| 18 |

| 18 |

| 18 |

| 18 |

| 18 |

| 17 |

|

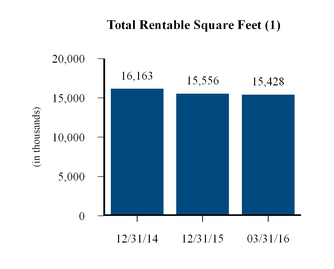

| Total Rentable Square Feet (in thousands) | 16,163 |

| 16,536 |

| 16,536 |

| 15,994 |

| 15.556 |

| 15,556 |

| 15,428 |

|

| | | | | | | | |

| | | | | | | | |

| Office Leasing Activity (1) | | | | | | | |

| Net Leased during the period (square feet in thousands) | 1,874 |

| 441 |

| 521 |

| 770 |

| 1,240 |

| 2,972 |

| 220 |

|

| Net Rent (per square foot) | $22.88 | $18.93 | $23.23 | $23.42 | $15.13 | $18.30 | $23.55 |

| Total Leasing Costs (per square foot) | (5.71) |

| (4.62) |

| (6.27) |

| (5.83) |

| (1.66) |

| (3.64) |

| (6.31) |

|

| Net Effective Rent (per square foot) | $17.17 | $14.31 | $16.96 | $17.59 | $13.47 | $14.66 | $17.24 |

| Change in Second Generation Net Rent | 38.0 | % | 33.6 | % | 43.8 | % | 28.1 | % | 38.5 | % | 36.7 | % | 18.9 | % |

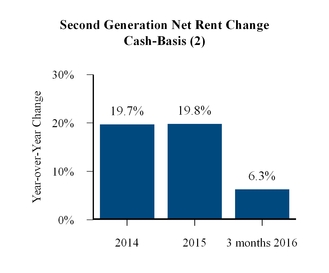

| Change in Cash-Basis Second Generation Net Rent | 19.7 | % | 8.0 | % | 32.8 | % | 14.1 | % | 23.8 | % | 19.8 | % | 6.3 | % |

| | | | | | | | |

| Same Property Information (2) | | | | | | | |

| Percent Leased (period end) | 91.2 | % | 91.7 | % | 91.7 | % | 91.8 | % | 91.6 | % | 91.6 | % | 90.3 | % |

| Weighted Average Occupancy | 89.7 | % | 91.5 | % | 90.4 | % | 90.6 | % | 90.7 | % | 90.7 | % | 89.4 | % |

| Change in Net Operating Income (over prior year period) | 3.6 | % | 5.2 | % | 1.6 | % | 1.1 | % | 6.2 | % | 3.3 | % | 4.3 | % |

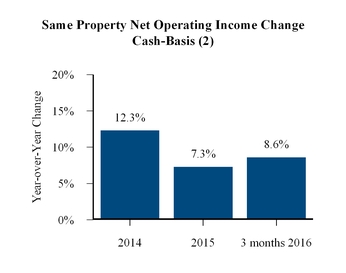

| Change in Cash-Basis Net Operating Income (over prior year period) | 12.3 | % | 15.9 | % | 5.2 | % | 1.2 | % | 8.2 | % | 7.3 | % | 8.6 | % |

| | | | | | | | |

| Development Pipeline | | | | | | | |

| Estimated Project Costs (in thousands) (3) | $226,575 | $100,475 | $161,975 | $306,500 | $261,500 | $261,500 | $326,300 |

| Estimated Project Costs (3) / Total Undepreciated Assets | 7.0 | % | 3.0 | % | 4.7 | % | 8.6 | % | 7.6 | % | 7.6 | % | 9.5 | % |

| | | | | | | | |

| Market Capitalization (4) | | | | | | | |

| Common Stock Price (period end) | $11.42 | $10.60 | $10.38 | $9.22 | $9.43 | $9.43 | $10.38 |

| Common Shares Outstanding (period end in thousands) | 216,513 |

| 216,470 |

| 216,686 |

| 214,671 |

| 211,513 |

| 211,513 |

| 210,107 |

|

| Equity Market Capitalization (in thousands) | $2,472,578 | $2,294,582 | $2,249,201 | $1,979,267 | $1,994,568 | $1,994,568 | $2,180,911 |

| Debt (in thousands) | 1,007,502 |

| 1,069,376 |

| 1,075,013 |

| 1,006,764 |

| 947,017 |

| 947,017 |

| 992,241 |

|

| Total Market Capitalization (in thousands) | $3,480,080 | $3,361,958 | $3,324,214 | $2,986,031 | $2,941,585 | $2,941,585 | $3,173,152 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 4 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| Credit Ratios (4) | | | | | | | |

| Debt/Total Market Capitalization | 29.0 | % | 31.7 | % | 32.3 | % | 33.7 | % | 32.2 | % | 32.2 | % | 31.3 | % |

| Debt/Total Undepreciated Assets | 29.5 | % | 30.7 | % | 30.6 | % | 28.3 | % | 27.5 | % | 27.5 | % | 28.8 | % |

| Fixed Charges Coverage | 4.27 |

| 4.67 |

| 4.54 |

| 5.19 |

| 4.98 |

| 4.84 |

| 4.49 |

|

| Debt/Annualized EBITDA | 4.05 |

| 4.77 |

| 4.86 |

| 4.02 |

| 4.00 |

| 4.00 |

| 4.66 |

|

| | | | | | | | |

| Dividend Information (4) | | | | | | | |

| Common Dividend per Share | $0.30 | $0.08 | $0.08 | $0.08 | $0.08 | $0.32 | $0.08 |

| FFO Payout Ratio | 37.3 | % | 37.8 | % | 38.3 | % | 33.0 | % | 35.0 | % | 35.9 | % | 38.9 | % |

| FAD Payout Ratio | 61.6 | % | 67.8 | % | 71.5 | % | 54.8 | % | 58.9 | % | 62.6 | % | 56.7 | % |

| | | | | | | | |

| Operations Ratios (4) | | | | | | | |

| Annualized General and Administrative Expenses/Total Undepreciated Assets | 0.58 | % | 0.41 | % | 0.67 | % | 0.33 | % | 0.53 | % | 0.50 | % | 0.99 | % |

| | | | | | | | |

| Additional Information (4) | | | | | | | |

| Straight Line Rental Revenue | $22,093 | $6,285 | $5,786 | $4,623 | $3,315 | $20,009 | $3,595 |

| Above and Below Market Rents Amortization | $8,047 | $2,030 | $1,973 | $2,030 | $1,948 | $7,981 | $1,834 |

| Second Generation Capital Expenditures | $35,054 | $12,139 | $13,259 | $14,208 | $14,608 | $54,214 | $7,904 |

| | | | | | | | |

(1) See Office Leasing Activity on page 14 herein for additional detail and explanations.

(2) Same Property Information is derived from the pool of office properties, as defined, in the period originally reported. See Same Property Performance on page 13 and Non-GAAP Financial Measures - Calculations and Reconciliations on page 25 for additional information.

(3) Cousins' share of development expenditures.

(4) See Non-GAAP Financial Measures - Calculations and Reconciliations.

|

| | |

| Cousins Properties Incorporated | 5 | Q1 2016 Supplemental Information |

(1) Total rentable square feet is based on the total portfolio.

(2) Office properties only.

Note: See additional information included herein for calculations, definitions, and reconciliations to GAAP financial measures.

|

| | |

| Cousins Properties Incorporated | 6 | Q1 2016 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - SUMMARY |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | |

| Net Operating Income | | | | | | | |

| Office | 206,551 |

| 56,734 |

| 59,269 |

| 59,329 |

| 59,878 |

| 235,210 |

| 57,894 |

|

| Other | 9,122 |

| 1,319 |

| 1,505 |

| 1,487 |

| 1,711 |

| 6,022 |

| 1,619 |

|

| Total Net Operating Income | 215,673 |

| 58,053 |

| 60,774 |

| 60,816 |

| 61,589 |

| 241,232 |

| 59,513 |

|

| Sales Less Cost of Sales | 3,910 |

| 810 |

| (324 | ) | 3,016 |

| 403 |

| 3,905 |

| — |

|

| Fee Income | 12,520 |

| 1,816 |

| 1,704 |

| 1,686 |

| 2,091 |

| 7,297 |

| 2,199 |

|

| Other Income | 5,401 |

| 407 |

| 238 |

| 845 |

| 961 |

| 2,451 |

| 1,121 |

|

| | | | | | | | |

| Reimbursed Expenses | (3,652 | ) | (1,111 | ) | (717 | ) | (686 | ) | (916 | ) | (3,430 | ) | (870 | ) |

| General and Administrative Expenses | (19,972 | ) | (3,595 | ) | (5,936 | ) | (2,971 | ) | (4,597 | ) | (17,099 | ) | (8,492 | ) |

| Interest Expense | (36,474 | ) | (9,498 | ) | (9,696 | ) | (9,518 | ) | (9,466 | ) | (38,178 | ) | (9,421 | ) |

| Other Expenses | (4,824 | ) | (476 | ) | (431 | ) | (307 | ) | (546 | ) | (1,760 | ) | (216 | ) |

| Income Tax Benefit (Provision) | 20 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Depreciation and Amortization of Non-Real Estate Assets | (913 | ) | (471 | ) | (374 | ) | (414 | ) | (410 | ) | (1,669 | ) | (377 | ) |

| Preferred Stock Dividends and Original Issuance Costs | (6,485 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| FFO | 165,204 |

| 45,935 |

| 45,238 |

| 52,467 |

| 49,109 |

| 192,749 |

| 43,457 |

|

| Weighted Average Shares - Basic | 204,216 |

| 216,568 |

| 216,630 |

| 216,261 |

| 213,872 |

| 215,827 |

| 210,904 |

|

| Weighted Average Shares - Diluted | 204,460 |

| 216,754 |

| 216,766 |

| 216,374 |

| 213,978 |

| 215,979 |

| 210,974 |

|

| FFO per Share - Basic and Diluted | 0.81 |

| 0.21 |

| 0.21 |

| 0.24 |

| 0.23 |

| 0.89 |

| 0.21 |

|

|

| | |

| Cousins Properties Incorporated | 7 | Q1 2016 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | |

| Net Operating Income | | | | | | | |

| Office Consolidated Properties | | | | | | | |

| Greenway Plaza | 77,379 |

| 18,403 |

| 18,916 |

| 19,544 |

| 19,688 |

| 76,551 |

| 18,692 |

|

| Post Oak Central | 23,437 |

| 6,675 |

| 6,516 |

| 6,495 |

| 6,973 |

| 26,659 |

| 6,626 |

|

| Northpark Town Center | 5,794 |

| 5,825 |

| 5,651 |

| 5,127 |

| 5,797 |

| 22,400 |

| 5,607 |

|

| 191 Peachtree Tower | 17,009 |

| 4,082 |

| 4,060 |

| 4,173 |

| 4,706 |

| 17,021 |

| 4,516 |

|

| Fifth Third Center | 5,631 |

| 3,641 |

| 3,709 |

| 3,770 |

| 3,836 |

| 14,956 |

| 4,238 |

|

| Promenade | 11,435 |

| 3,542 |

| 3,581 |

| 3,623 |

| 3,239 |

| 13,985 |

| 3,740 |

|

| The American Cancer Society Center | 12,373 |

| 3,114 |

| 3,206 |

| 3,039 |

| 3,073 |

| 12,432 |

| 3,310 |

|

| Colorado Tower | — |

| 328 |

| 1,797 |

| 2,156 |

| 2,487 |

| 6,768 |

| 2,724 |

|

| 816 Congress Avenue | 6,992 |

| 1,858 |

| 2,117 |

| 2,268 |

| 2,283 |

| 8,526 |

| 2,468 |

|

| Meridian Mark Plaza | 3,728 |

| 918 |

| 954 |

| 946 |

| 959 |

| 3,777 |

| 908 |

|

| Other (2) | 22,813 |

| 3,717 |

| 4,273 |

| 3,544 |

| 2,111 |

| 13,645 |

| 15 |

|

| Subtotal - Office Consolidated | 186,591 |

| 52,103 |

| 54,780 |

| 54,685 |

| 55,152 |

| 216,720 |

| 52,844 |

|

| | | | | | | | |

| Office Unconsolidated Properties | | | | | | | |

| Terminus 100 | 7,555 |

| 1,922 |

| 1,754 |

| 1,780 |

| 1,812 |

| 7,268 |

| 1,872 |

|

| Terminus 200 | 5,504 |

| 1,436 |

| 1,442 |

| 1,575 |

| 1,616 |

| 6,069 |

| 1,658 |

|

| Emory University Hospital Midtown Medical Office Tower | 3,960 |

| 987 |

| 996 |

| 992 |

| 999 |

| 3,974 |

| 987 |

|

| Gateway Village (1) | 1,208 |

| 302 |

| 302 |

| 302 |

| 302 |

| 1,208 |

| 536 |

|

| Other | (51 | ) | (5 | ) | (5 | ) | (5 | ) | (3 | ) | (18 | ) | (3 | ) |

| Subtotal - Office Unconsolidated | 18,176 |

| 4,642 |

| 4,489 |

| 4,644 |

| 4,726 |

| 18,501 |

| 5,050 |

|

| | | | | | | | |

| Discontinued Operations | 1,782 |

| (11 | ) | — |

| — |

| — |

| (11 | ) | — |

|

| | |

| | | | |

|

| Total Office Net Operating Income | 206,551 |

| 56,734 |

| 59,269 |

| 59,329 |

| 59,878 |

| 235,210 |

| 57,894 |

|

| | | | | | | | |

| Other | | | | | | | |

| Consolidated Properties (2) | 1,383 |

| (24 | ) | 10 |

| — |

| 205 |

| 191 |

| 23 |

|

| | | | | | | | |

| Unconsolidated Properties | | | | | | | |

| Emory Point Apartments (Phase I) | 4,647 |

| 1,071 |

| 1,244 |

| 1,213 |

| 1,171 |

| 4,699 |

| 1,185 |

|

| Emory Point Retail (Phase I) | 1,080 |

| 281 |

| 255 |

| 222 |

| 136 |

| 894 |

| 248 |

|

| Emory Point Apartments (Phase II) | — |

| — |

| — |

| 1 |

| 180 |

| 181 |

| 96 |

|

| Emory Point Retail (Phase II) | — |

| — |

| — |

| 56 |

| 24 |

| 80 |

| 72 |

|

| Other (2) | 1,993 |

| (6 | ) | (4 | ) | (5 | ) | (5 | ) | (20 | ) | (5 | ) |

| Subtotal - Other | 7,720 |

| 1,346 |

| 1,495 |

| 1,487 |

| 1,506 |

| 5,834 |

| 1,596 |

|

| | | | | | | | |

| Discontinued Operations | 19 |

| (3 | ) | — |

| — |

| — |

| (3 | ) | — |

|

| | |

| | | | |

|

| Total Other Net Operating Income | 9,122 |

| 1,319 |

| 1,505 |

| 1,487 |

| 1,711 |

| 6,022 |

| 1,619 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total Net Operating Income | 215,673 |

| 58,053 |

| 60,774 |

| 60,816 |

| 61,589 |

| 241,232 |

| 59,513 |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 8 | Q1 2016 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | |

| Sales Less Cost of Sales | | | | | | | |

| Land Sales Less Cost of Sales - Consolidated | 1,703 |

| 810 |

| (566 | ) | 978 |

| 403 |

| 1,625 |

| — |

|

| Land Sales Less Cost of Sales - Unconsolidated | 2,207 |

| — |

| 242 |

| 2,038 |

| — |

| 2,280 |

| — |

|

| Total Sales Less Cost of Sales | 3,910 |

| 810 |

| (324 | ) | 3,016 |

| 403 |

| 3,905 |

| — |

|

| | | | | | | | |

| | | | | | | | |

| Fee Income | | | | | | | |

| Development Fees | 7,265 |

| 308 |

| 461 |

| 531 |

| 478 |

| 1,778 |

| 608 |

|

| Management Fees (3) | 5,082 |

| 1,503 |

| 1,184 |

| 1,128 |

| 1,373 |

| 5,188 |

| 1,325 |

|

| Leasing & Other Fees | 173 |

| 5 |

| 59 |

| 27 |

| 240 |

| 331 |

| 266 |

|

| Total Fee Income | 12,520 |

| 1,816 |

| 1,704 |

| 1,686 |

| 2,091 |

| 7,297 |

| 2,199 |

|

| | | | | | | | |

| Other Income | |

|

| | | | | |

| Termination Fees | 4,573 |

| 193 |

| 28 |

| 499 |

| 547 |

| 1,267 |

| 186 |

|

| Termination Fees - Discontinued Operations | 2 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Interest and Other Income | 261 |

| 55 |

| 22 |

| 222 |

| 138 |

| 437 |

| 389 |

|

| Interest and Other Income - Discontinued Operations | 4 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Other - Unconsolidated | 561 |

| 159 |

| 188 |

| 124 |

| 276 |

| 747 |

| 546 |

|

| Total Other Income | 5,401 |

| 407 |

| 238 |

| 845 |

| 961 |

| 2,451 |

| 1,121 |

|

| | | | | | | | |

| | | | | | | | |

| Reimbursed Expenses | (3,652 | ) | (1,111 | ) | (717 | ) | (686 | ) | (916 | ) | (3,430 | ) | (870 | ) |

| | | | | | | | |

| General and Administrative Expenses | (19,972 | ) | (3,595 | ) | (5,936 | ) | (2,971 | ) | (4,597 | ) | (17,099 | ) | (8,492 | ) |

| | | | | | | | |

| Interest Expense | | | | | | | |

| Consolidated Debt | | | | | | | |

| The American Cancer Society Center | (8,710 | ) | (2,131 | ) | (2,147 | ) | (2,164 | ) | (2,157 | ) | (8,599 | ) | (2,126 | ) |

| Post Oak Central | (8,127 | ) | (2,010 | ) | (2,001 | ) | (1,992 | ) | (1,983 | ) | (7,986 | ) | (1,974 | ) |

| Promenade | (4,850 | ) | (1,194 | ) | (1,187 | ) | (1,180 | ) | (1,173 | ) | (4,734 | ) | (1,165 | ) |

| Unsecured Credit Facility | (3,354 | ) | (966 | ) | (1,072 | ) | (1,089 | ) | (962 | ) | (4,089 | ) | (832 | ) |

| 191 Peachtree Tower | (3,444 | ) | (861 | ) | (861 | ) | (861 | ) | (861 | ) | (3,444 | ) | (861 | ) |

| 816 Congress Avenue | (709 | ) | (817 | ) | (818 | ) | (817 | ) | (817 | ) | (3,269 | ) | (817 | ) |

| Meridian Mark Plaza | (1,562 | ) | (387 | ) | (385 | ) | (384 | ) | (382 | ) | (1,538 | ) | (381 | ) |

| The Points at Waterview | (872 | ) | (213 | ) | (211 | ) | (209 | ) | (8 | ) | (641 | ) | — |

|

| Other | (234 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Capitalized | 2,752 |

| 902 |

| 813 |

| 1,023 |

| 839 |

| 3,577 |

| 742 |

|

| Subtotal - Consolidated | (29,110 | ) | (7,677 | ) | (7,869 | ) | (7,673 | ) | (7,504 | ) | (30,723 | ) | (7,414 | ) |

| | | | | | | | |

| Unconsolidated Debt | | | | | | | |

| Terminus 100 | (3,494 | ) | (865 | ) | (861 | ) | (857 | ) | (853 | ) | (3,436 | ) | (848 | ) |

| Terminus 200 | (1,560 | ) | (390 | ) | (390 | ) | (390 | ) | (390 | ) | (1,560 | ) | (390 | ) |

| Emory University Hospital Midtown Medical Office Tower | (1,336 | ) | (334 | ) | (334 | ) | (333 | ) | (332 | ) | (1,333 | ) | (330 | ) |

| Emory Point | (974 | ) | (232 | ) | (242 | ) | (265 | ) | (387 | ) | (1,126 | ) | (439 | ) |

| Other | — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Subtotal - Unconsolidated | (7,364 | ) | (1,821 | ) | (1,827 | ) | (1,845 | ) | (1,962 | ) | (7,455 | ) | (2,007 | ) |

| | |

| | | | | |

| Total Interest Expense | (36,474 | ) | (9,498 | ) | (9,696 | ) | (9,518 | ) | (9,466 | ) | (38,178 | ) | (9,421 | ) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 9 | Q1 2016 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | |

| Other Expenses | | | | | | | |

| Noncontrolling Interests | (424 | ) | — |

| — |

| — |

| (111 | ) | (111 | ) | — |

|

| Property Taxes and Other Holding Costs | (1,223 | ) | (287 | ) | (242 | ) | (141 | ) | (158 | ) | (828 | ) | (89 | ) |

| Predevelopment & Other | (2,047 | ) | (106 | ) | (187 | ) | (147 | ) | (82 | ) | (522 | ) | (108 | ) |

| Acquisition and Related Costs | (1,130 | ) | (83 | ) | (2 | ) | (19 | ) | (195 | ) | (299 | ) | (19 | ) |

| Total Other Expenses | (4,824 | ) | (476 | ) | (431 | ) | (307 | ) | (546 | ) | (1,760 | ) | (216 | ) |

| | | | | | | | |

| Income Tax Provision (Benefit) | 20 |

| — |

| — |

| — |

| — |

| — |

| |

| | | | | | |

| |

| Depreciation and Amortization of Non-Real Estate Assets | | | | | | | |

| Consolidated | (867 | ) | (423 | ) | (374 | ) | (414 | ) | (410 | ) | (1,621 | ) | (377 | ) |

| Unconsolidated | (46 | ) | (48 | ) | — |

| — |

| — |

| (48 | ) | — |

|

| Total Non-Real Estate Depreciation and Amortization | (913 | ) | (471 | ) | (374 | ) | (414 | ) | (410 | ) | (1,669 | ) | (377 | ) |

| | | | | | | | |

| Preferred Stock Dividends and Original Issuance Costs | (6,485 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| | | | | | | | |

| FFO | 165,204 |

| 45,935 |

| 45,238 |

| 52,467 |

| 49,109 |

| 192,749 |

| 43,457 |

|

| Weighted Average Shares - Basic | 204,216 |

| 216,568 |

| 216,630 |

| 216,261 |

| 213,872 |

| 215,827 |

| 210,904 |

|

| Weighted Average Shares - Diluted | 204,460 |

| 216,754 |

| 216,766 |

| 216,374 |

| 213,978 |

| 215,979 |

| 210,974 |

|

| FFO per Share - Basic and Diluted | 0.81 |

| 0.21 |

| 0.21 |

| 0.24 |

| 0.23 |

| 0.89 |

| 0.21 |

|

|

| | | | | | | | | | | | | | | | | |

| Note: Amounts may differ slightly from other schedules contained herein due to rounding. |

| (1) The Company receives an 11.46% current return on its $11.1 million investment in Gateway Village and recognizes this amount as NOI from this venture. |

| (2) Represents NOI for properties sold prior to March 31, 2016. |

| (3) Management Fees include reimbursement of expenses that are included in the "Reimbursed Expenses" line item. |

|

| | |

| Cousins Properties Incorporated | 10 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| Company's Share |

| Property Description |

| Metropolitan Area |

| Rentable Square Feet |

| Financial Statement Presentation |

| Company's Ownership Interest |

| End of Period Leased 1Q16 |

| End of Period Leased 4Q15 |

| Weighted Average Occupancy 1Q16 |

| Weighted Average Occupancy 4Q15 |

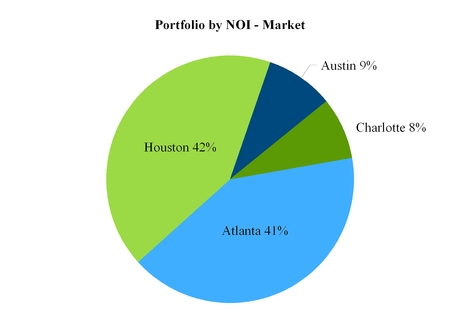

| % of Total Net Operating Income (1) |

| Property Level Debt ($000) |

| Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Greenway Plaza (2) |

| Houston |

| 4,348,000 |

|

| Consolidated |

| 100 | % |

| 89.4 | % |

| 89.8 | % |

| 87.8 | % |

| 88.7 | % |

| 31 | % |

| $ | — |

|

| Post Oak Central (2) |

| Houston |

| 1,280,000 |

|

| Consolidated |

| 100 | % |

| 94.2 | % |

| 95.4 | % |

| 95.0 | % |

| 95.7 | % |

| 11 | % |

| 180,123 |

|

| Colorado Tower |

| Austin |

| 373,000 |

|

| Consolidated |

| 100 | % |

| 100.0 | % |

| 100.0 | % |

| 87.4 | % |

| 76.8 | % |

| 5 | % |

| — |

|

| 816 Congress |

| Austin |

| 435,000 |

|

| Consolidated |

| 100 | % |

| 98.9 | % |

| 93.4 | % |

| 93.4 | % |

| 91.6 | % |

| 4 | % |

| 84,294 |

|

| Research Park V |

| Austin |

| 173,000 |

|

| Consolidated |

| 100 | % |

| 44.9 | % |

| 29.9 | % |

| — | % |

| — | % |

| — | % |

| — |

|

| Texas |

|

|

| 6,609,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 51 | % |

| 264,417 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Northpark Town Center (2) |

| Atlanta |

| 1,528,000 |

|

| Consolidated |

| 100 | % |

| 84.0 | % |

| 84.5 | % |

| 85.7 | % |

| 85.2 | % |

| 9 | % |

| — |

|

| 191 Peachtree Tower |

| Atlanta |

| 1,225,000 |

|

| Consolidated |

| 100 | % |

| 87.8 | % |

| 91.5 | % |

| 87.5 | % |

| 89.4 | % |

| 8 | % |

| 99,765 |

|

| Promenade |

| Atlanta |

| 777,000 |

|

| Consolidated |

| 100 | % |

| 93.0 | % |

| 93.0 | % |

| 88.9 | % |

| 91.0 | % |

| 6 | % |

| 107,117 |

|

| The American Cancer Society Center |

| Atlanta |

| 996,000 |

|

| Consolidated |

| 100 | % |

| 83.4 | % |

| 86.6 | % |

| 86.0 | % |

| 86.6 | % |

| 6 | % |

| 128,761 |

|

| Terminus 100 |

| Atlanta |

| 660,000 |

|

| Unconsolidated |

| 50 | % |

| 92.3 | % |

| 92.3 | % |

| 91.6 | % |

| 90.5 | % |

| 3 | % |

| 64,295 |

|

| Terminus 200 |

| Atlanta |

| 566,000 |

|

| Unconsolidated |

| 50 | % |

| 91.3 | % |

| 92.2 | % |

| 92.2 | % |

| 90.4 | % |

| 3 | % |

| 41,000 |

|

| Meridian Mark Plaza |

| Atlanta |

| 160,000 |

|

| Consolidated |

| 100 | % |

| 93.8 | % |

| 98.2 | % |

| 94.9 | % |

| 97.7 | % |

| 2 | % |

| 24,751 |

|

| Emory University Hospital Midtown Medical Office Tower |

| Atlanta |

| 358,000 |

|

| Unconsolidated |

| 50 | % |

| 96.8 | % |

| 98.8 | % |

| 98.6 | % |

| 99.7 | % |

| 2 | % |

| 36,963 |

|

| Georgia |

|

|

| 6,270,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 39 | % |

| 502,652 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fifth Third Center |

| Charlotte |

| 698,000 |

|

| Consolidated |

| 100 | % |

| 95.8 | % |

| 94.6 | % |

| 89.8 | % |

| 84.5 | % |

| 7 | % |

| — |

|

| Gateway Village |

| Charlotte |

| 1,065,000 |

|

| Unconsolidated |

| 50 | % |

| 100.0 | % |

| 100.0 | % |

| 100.0 | % |

| 100.0 | % |

| 1 | % |

| 6,427 |

|

| North Carolina |

|

|

| 1,763,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8 | % |

| 6,427 |

|

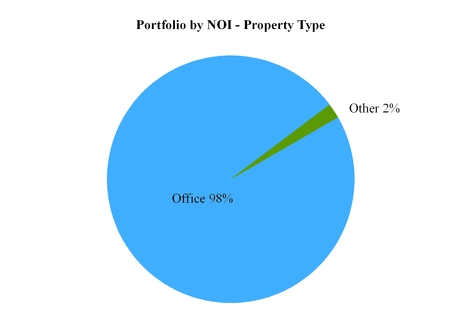

| Total Office Properties |

|

|

| 14,642,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 98 | % |

| $ | 773,496 |

|

| Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Emory Point Apartments (Phase I) (3) |

| Atlanta |

| 404,000 |

|

| Unconsolidated |

| 75 | % |

| 94.4 | % |

| 95.7 | % |

| 94.4 | % |

| 96.0 | % |

| 2 | % |

| 36,123 |

|

| Emory Point Retail (Phase I) |

| Atlanta |

| 80,000 |

|

| Unconsolidated |

| 75 | % |

| 84.7 | % |

| 84.7 | % |

| 81.5 | % |

| 76.8 | % |

| — | % |

| 7,399 |

|

| Emory Point Apartments (Phase II) (3) |

| Atlanta |

| 257,000 |

|

| Unconsolidated |

| 75 | % |

| 48.5 | % |

| 42.7 | % |

| 44.1 | % |

| 36.4 | % |

| — | % |

| 27,390 |

|

| Emory Point Retail (Phase II) |

| Atlanta |

| 45,000 |

|

| Unconsolidated |

| 75 | % |

| 75.7 | % |

| 69.1 | % |

| 62.3 | % |

| 57.5 | % |

| — | % |

| 4,833 |

|

| Total Other |

|

|

| 786,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 | % |

| $ | 75,745 |

|

| Total Portfolio |

|

|

| 15,428,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 100 | % |

| $ | 849,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) | Net Operating Income represents the Company's share of rental property revenues less rental property operating expenses. Calculation is based on amounts for the three months ended March 31, 2016. |

| (2) | Contains multiple buildings that are grouped together for reporting purposes. |

| (3) | Phase I consists of 443 units and Phase II consists of 307 units. | | | | | | |

| | | | | | | |

|

| | |

| Cousins Properties Incorporated | 11 | Q1 2016 Supplemental Information |

|

| | |

| Cousins Properties Incorporated | 12 | Q1 2016 Supplemental Information |

|

| | |

| SAME PROPERTY PERFORMANCE (1) |

|

| | | | | | | | | | | | | | | | | |

| | Net Operating Income ($ in thousands) | | | | |

| | Three Months Ended | | | | |

| | March 31, 2016 | | March 31, 2015 | | December 31, 2015 | | 1Q16 vs. 1Q15

% Change | | 1Q16 vs. 4Q15% Change |

| Property Revenues (2) | $ | 75,376 |

| | $ | 73,487 |

| | $ | 74,980 |

| | 2.6 | % | | 0.5 | % |

| Property Operating Expenses (2) | 30,599 |

| | 30,551 |

| | 29,631 |

| | 0.2 | % | | 3.3 | % |

| Property Net Operating Income | $ | 44,777 |

| | $ | 42,936 |

|

| $ | 45,349 |

| | 4.3 | % | | (1.3 | )% |

| | | | | | | |

| |

|

| | | | | | | | | | |

| Cash Basis Property Revenues (3) | $ | 72,226 |

| | $ | 68,872 |

| | $ | 71,993 |

| | 4.9 | % | | 0.3 | % |

| Cash Basis Property Operating Expenses (4) | 30,611 |

| | 30,568 |

| | 29,648 |

| | 0.1 | % | | 3.2 | % |

| Cash Basis Property Net Operating Income | $ | 41,615 |

| | $ | 38,304 |

|

| $ | 42,345 |

| | 8.6 | % | | (1.7 | )% |

| | | | | | | | | | |

| End of Period Leased | 90.3 | % | | 91.0 | % | | 91.2 | % | | | | |

| Weighted Average Occupancy | 89.4 | % | | 90.9 | % | | 90.2 | % | | | | |

|

| |

| (1) | Same Properties include those office properties that were operational and stabilized on January 1, 2015, excluding properties subsequently sold. Properties included in this reporting period are as follows: |

| | Greenway Plaza The American Cancer Society Center Promenade |

| | Post Oak Central Terminus 100 Meridian Mark Plaza |

| | 191 Peachtree Tower Terminus 200 Emory University Hospital Midtown Medical Office Tower |

| | 816 Congress |

| (2) | Property Revenues and Expenses include results for the Company and its share of unconsolidated joint ventures. |

| (3) | Cash Basis Same Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Property Revenues, excluding straight-line rents, amortization of lease inducements and amortization of acquired above and below market rents. |

| (4) | Cash Basis Same Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. |

|

| | |

| Cousins Properties Incorporated | 13 | Q1 2016 Supplemental Information |

|

| | |

| OFFICE LEASING ACTIVITY(1) |

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2016 | |

| | New | | Renewal | | Expansion | | Total | |

| Gross leased (square feet) | | | | | | | 271,700 |

| |

| Less: Leases one year or less, amenity leases, percentage rent leases, storage leases, intercompany leases, and license agreements | | | | | | | (51,468 | ) | |

| Net leased (square feet) | 75,719 |

| | 121,305 |

| | 23,208 |

| | 220,232 |

| |

| Number of transactions | 10 |

| | 15 |

| | 4 |

| | 29 |

| |

| Lease term (years) (2) | 6.0 |

| | 7.5 |

| | 6.8 |

| | 6.9 |

| |

| | | | | | | | | |

| Net rent (per square foot) (2)(3) | $ | 25.26 |

| | $ | 22.97 |

| | $ | 21.04 |

| | $ | 23.55 |

| |

| Total leasing costs (per square foot) (2)(4) | (8.28 | ) | | (4.55 | ) | | (9.14 | ) | | (6.31 | ) | |

| Net effective rent (per square foot) (2) | $ | 16.98 |

| | $ | 18.42 |

| | $ | 11.90 |

| | $ | 17.24 |

| |

| | | | | | | | | |

| Second generation leased square feet (2)(5) | | | | | | | 154,100 |

| |

| Increase in second generation net rent (2)(3)(5) | | | | 18.9 | % | |

| Increase in cash basis second generation net rent (2)(5)(6) | | 6.3 | % | |

| | | | | | | | | |

| (1) Excludes apartment and retail leasing. |

| (2) Weighted average. |

| (3) Represents straight-lined net rent per square foot (operating expenses deducted from gross leases) over the lease term. |

| (4) Includes tenant improvements, external leasing commissions, and free rent. |

| (5) Excludes leases executed for spaces that were vacant upon acquisition, new leases in development properties, and leases for spaces that have been vacant for one year or more. |

| (6) Represents increase in net rent at the end of term paid by the prior tenant compared to net rent at beginning of term paid by the current tenant. For early renewals, represents increase in net rent at the end of the term of the original lease compared to net rent at the beginning of the extended term of the lease. |

|

| | |

| Cousins Properties Incorporated | 14 | Q1 2016 Supplemental Information |

Lease Expirations by Year

|

| | | | | | | | | | | | | | | | | |

| Year of Expiration |

| Square Feet

Expiring (1) |

| % of Leased Space |

| Annual Contractual Rents ($000's) (1)(2) |

| % of Total Annual Contractual Rents |

| Annual Contractual Rent/Sq. Ft. (2) |

| | | | | | | | | | | |

| 2016 | | 424,220 |

| | 3.5 | % | | $ | 8,370 |

| | 2.9 | % | | $ | 19.73 |

|

| 2017 | | 778,768 |

| | 6.5 | % | | 16,741 |

| | 5.8 | % | | 21.50 |

|

| 2018 | | 601,212 |

| | 5.0 | % | | 13,790 |

| | 4.8 | % | | 22.94 |

|

| 2019 | | 1,555,295 |

| | 13.0 | % | | 34,962 |

| | 12.1 | % | | 22.48 |

|

| 2020 | | 752,000 |

| | 6.3 | % | | 17,275 |

| | 6.0 | % | | 22.97 |

|

| 2021 | | 1,206,771 |

| | 10.1 | % | | 30,232 |

| | 10.4 | % | | 25.05 |

|

| 2022 | | 1,379,636 |

| | 11.5 | % | | 33,029 |

| | 11.4 | % | | 23.94 |

|

| 2023 | | 1,539,359 |

| | 12.9 | % | | 35,142 |

| | 12.1 | % | | 22.83 |

|

| 2024 | | 737,151 |

| | 6.2 | % | | 21,028 |

| | 7.2 | % | | 28.53 |

|

| 2025 &Thereafter | | 2,997,685 |

| | 25.0 | % | | 79,129 |

| | 27.3 | % | | 26.40 |

|

| | | | | | | | | | | |

| Total | | 11,972,097 |

| | 100.0 | % | | $ | 289,698 |

| | 100.0 | % | | $ | 24.20 |

|

Lease Expirations Greater than 100,000 Square Feet Through Year End 2019

|

| | | | | | | | | |

| Expiration Date | | Tenant | | Market | | Building | | Square Feet Expiring (1) |

| January 2019 | | National Union Fire Insurance Company | | Atlanta | | Northpark Town Center | | 105,362 |

|

| September 2019 | | Stewart Information Services | | Houston | | Post Oak Central | | 196,745 |

|

| December 2019 | | Apache Corporation | | Houston | | Post Oak Central | | 524,342 |

|

| | | | | | | | | |

|

| | | |

(1) Company's share.

|

(2) Annual Contractual Rent shown is the rate in the year of expiration. It includes the minimum contractual rent paid by the tenant which may or may not include a base year of operating expenses depending upon the terms of the lease.

|

| | | | |

|

| | |

| Cousins Properties Incorporated | 15 | Q1 2016 Supplemental Information |

Note: Company's share

|

| | |

| Cousins Properties Incorporated | 16 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | |

| | Tenant (1) | Company's Share of Square Footage | | Company's Share of Annualized Base Rent | Percentage of Total Company's Share of Annualized Base Rent (2) | Average Remaining Lease Term (Years) (3) |

| 1 |

| Occidental Oil & Gas Corp. | 961,491 |

| | $ | 18,506,912 |

| 8% | 10 |

| 2 |

| Apache Corporation | 524,342 |

| | 9,328,417 |

| 4% | 4 |

| 3 |

| Invesco Management Group, Inc. | 400,332 |

| | 6,792,682 |

| 3% | 8 |

| 4 |

| Bank of America (4) | 829,923 |

| | 5,831,104 |

| 2% | 8 |

| 5 |

| McGuireWoods LLP | 198,648 |

| | 5,617,946 |

| 2% | 10 |

| 6 |

| Deloitte, LLP | 259,998 |

| | 5,397,558 |

| 2% | 8 |

| 7 |

| Transocean Offshore Deepwater | 250,450 |

| | 5,064,984 |

| 2% | 7 |

| 8 |

| Smith, Gambrell & Russell, LLP | 159,136 |

| | 4,863,347 |

| 2% | 5 |

| 9 |

| American Cancer Society, Inc. | 275,160 |

| | 4,831,176 |

| 2% | 6 |

| 10 |

| Parsley Energy, L.P. | 135,107 |

| | 4,016,731 |

| 2% | 9 |

| 11 |

| US South Communications | 191,709 |

| | 3,778,141 |

| 2% | 6 |

| 12 |

| Stewart Information Services Corporation | 200,323 |

| | 3,576,883 |

| 2% | 4 |

| 13 |

| CO Space Properties, LLC | 120,298 |

| | 3,522,607 |

| 2% | 4 |

| 14 |

| Direct Energy | 198,969 |

| | 3,006,051 |

| 1% | 7 |

| 15 |

| National Union Fire Insurance Company | 106,472 |

| | 2,982,609 |

| 1% | 3 |

| 16 |

| Northside Hospital | 101,326 |

| | 2,960,542 |

| 1% | 7 |

| 17 |

| Gulf South Pipeline Company LP | 98,616 |

| | 2,366,784 |

| 1% | 8 |

| 18 |

| Emory University | 90,093 |

| | 2,254,916 |

| 1% | 12 |

| 19 |

| Thompson, Ventulett, Stainback & Assoc | 67,418 |

| | 2,157,376 |

| 1% | 8 |

| 20 |

| GDF SUEZ Energy North America | 134,602 |

| | 2,093,621 |

| 1% | 4 |

| | Total Top 20 | 5,304,413 |

| | $ | 98,950,387 |

| 42% | 7 |

| | | | | | | |

| (1) |

| In some cases, the actual tenant may be an affiliate of the entity shown. |

| (2) |

| Annualized Base Rent represents the annualized minimum rent paid by the tenant as of the date of this report. If the tenant is in a free rent period as of the date of this report, Annualized Base Rent represents the annualized minimum contractual rent the tenant will pay in the first month it is required to pay rent which may or may not include a base year of operating expenses depending upon the terms of the lease. |

| (3) |

| Weighted average. |

| (4) |

| A portion of the Company's economic exposure for this tenant is limited to a fixed return through a joint venture arrangement. |

| Note: |

| This schedule includes tenants whose leases have commenced and/or have taken occupancy. Leases that have been signed but have not commenced are excluded from this schedule. |

|

| | |

| Cousins Properties Incorporated | 17 | Q1 2016 Supplemental Information |

|

| | |

| TENANT INDUSTRY DIVERSIFICATION |

(1) Based on total portfolio holdings.

|

| | |

| Cousins Properties Incorporated | 18 | Q1 2016 Supplemental Information |

Completed Property Acquisitions

|

| | | | | | | | | | | | | | | | |

| Property | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Purchase Price ($ in thousands) |

| | | | | | | | | | | | | |

| 2014 | | | | | | | | | | | | |

| Fifth Third Center | | Office | | Charlotte | | 100.0 | % | | 3Q | | 698,000 |

| | $ | 215,000 |

|

| Northpark Town Center | | Office | | Atlanta | | 100.0 | % | | 4Q | | 1,528,000 |

| | 348,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Post Oak Central | | Office | | Houston | | 100.0 | % | | 1Q | | 1,280,000 |

| | 230,900 |

|

| Terminus 200 | | Office | | Atlanta | | 50.0 | % | | 1Q | | 566,000 |

| | 164,000 |

|

| 816 Congress | | Office | | Austin | | 100.0 | % | | 2Q | | 435,000 |

| | 102,400 |

|

| Greenway Plaza | | Office | | Houston | | 100.0 | % | | 3Q | | 4,348,000 |

| | 950,000 |

|

| 777 Main | | Office | | Fort Worth | | 100.0 | % | | 3Q | | 980,000 |

| | 160,000 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| 2100 Ross | | Office | | Dallas | | 100.0 | % | | 3Q | | 844,000 |

| | 59,200 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | 10,679,000 |

| | $ | 2,229,500 |

|

| | | | | | | | | | | | | |

Completed Property Developments

|

| | | | | | | | | | | | | | | | |

| Project | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Total Project Cost ($ in thousands) |

| | | | | | | | | | | | | |

| 2015 | | | | | | | | | | | | |

| Colorado Tower | | Office | | Austin | | 100.0 | % | | 1Q | | 373,000 |

| | $ | 126,100 |

|

| Emory Point - Phase II | | Mixed | | Atlanta | | 75.0 | % | | 3Q | | 302,000 |

| | 75,400 |

|

| Research Park V | | Office | | Austin | | 100.0 | % | | 4Q | | 173,000 |

| | 45,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Emory Point - Phase I | | Mixed | | Atlanta | | 75.0 | % | | 4Q | | 484,000 |

| | 102,300 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| Mahan Village | | Retail | | Tallahassee | | 50.5 | % | | 4Q | | 147,000 |

| | 25,800 |

|

| | | | | | | | | | | | | |

| | | | | | | | |

|

| 1,479,000 |

| | $ | 374,600 |

|

|

| | |

| Cousins Properties Incorporated | 19 | Q1 2016 Supplemental Information |

Completed Property Dispositions |

| | | | | | | | | | | | | | | | |

| Property | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Sales Price ($ in thousands) |

| 2016 | | | | | | | | | | | | |

| 100 North Point Center East | | Office | | Atlanta | | 100.0 | % | | 1Q | | 129,000 |

| | $ | 22,000 |

|

| | | | | | | | | | | | | |

| 2015 | | | | | | | | | | | | |

| 2100 Ross | | Office | | Dallas | | 100.0 | % | | 3Q | | 844,000 |

| | 131,000 |

|

| 200, 333, and 555 North Point Center East | | Office | | Atlanta | | 100.0 | % | | 4Q | | 411,000 |

| | 70,300 |

|

| The Points at Waterview | | Office | | Dallas | | 100.0 | % | | 4Q | | 203,000 |

| | 26,800 |

|

| | | | | | | | | | | | | |

| 2014 | | | | | | | | | | | | |

| 600 University Park Place | | Office | | Birmingham | | 100.0 | % | | 1Q | | 123,000 |

| | 19,700 |

|

| Lakeshore Park Plaza | | Office | | Birmingham | | 100.0 | % | | 3Q | | 197,000 |

| | 25,000 |

|

| Mahan Village | | Retail | | Florida | | 50.5 | % | | 4Q | | 147,000 |

| | 29,500 |

|

| Cousins Watkins LLC | | Retail | | Other | | 50.5 | % | | 4Q | | 339,000 |

| | 79,500 |

|

| 777 Main | | Office | | Fort Worth | | 100.0 | % | | 4Q | | 980,000 |

| | 167,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Terminus 100 | | Office | | Atlanta | | 100.0 | % | | 1Q | | 656,000 |

| | 209,200 |

|

| Tiffany Springs MarketCenter | | Retail | | Kansas City | | 88.5 | % | | 3Q | | 238,000 |

| | 53,500 |

|

| The Avenue Murfreesboro | | Retail | | Nashville | | 50.0 | % | | 3Q | | 752,000 |

| | 164,000 |

|

| CP Venture Two LLC | | Retail | | Other | | 10.3 | % | | 3Q | | 934,000 |

| | 226,100 |

|

| CP Venture Five LLC | | Retail | | Other | | 11.5 | % | | 3Q | | 1,179,000 |

| | 296,200 |

|

| Inhibitex | | Office | | Atlanta | | 100.0 | % | | 4Q | | 51,000 |

| | 8,300 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| The Avenue Collierville | | Retail | | Memphis | | 100.0 | % | | 2Q | | 511,000 |

| | 55,000 |

|

| Galleria 75 | | Office | | Atlanta | | 100.0 | % | | 2Q | | 111,000 |

| | 9,200 |

|

| Ten Peachtree Place | | Office | | Atlanta | | 50.0 | % | | 2Q | | 260,000 |

| | 45,300 |

|

| The Avenue Web Gin | | Retail | | Atlanta | | 100.0 | % | | 4Q | | 322,000 |

| | 59,600 |

|

| The Avenue Forsyth | | Retail | | Atlanta | | 88.5 | % | | 4Q | | 524,000 |

| | 119,000 |

|

| Cosmopolitan Center | | Office | | Atlanta | | 100.0 | % | | 4Q | | 51,000 |

| | 7,000 |

|

| Palisades West | | Office | | Austin | | 50.0 | % | | 4Q | | 373,000 |

| | 64,800 |

|

| Presbyterian Medical Plaza | | Office | | Charlotte | | 11.5 | % | | 4Q | | 69,000 |

| | 4,500 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | 9,404,000 |

| | $ | 1,892,500 |

|

|

| | |

| Cousins Properties Incorporated | 20 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Project |

| Type |

| Metropolitan Area |

| Company's Ownership Interest |

| Project Start Date |

| Number of Square Feet /Apartment Units |

| Estimated Project Cost (2) ($ in thousands) |

| Project Cost Incurred to Date (2) ($ in thousands) |

| Percent Leased |

| Initial Occupancy (3) |

| Estimated Stabilization (4) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Carolina Square | | Mixed | | Chapel Hill, NC | | 50 | % | | 2Q15 | | | | $ | 123,000 |

| | $ | 21,385 |

| | | | | | |

| Office | | | | | | | | | | 159,000 |

| | | | | | 67 | % | | 3Q17 | | 3Q18 |

| Retail | | | | | | | | | | 43,000 |

| | | | | | 46 | % | | 3Q17 | | 3Q18 |

| Apartments | | | | | | | | | | 246 |

| | | | | | — | % | | 3Q17 | | 3Q18 |

| | | | | | | | | | | | | | | | | | | | | |

| NCR Phase I | | Office | | Atlanta, GA | | 100 | % | | 3Q15 | | 485,000 |

| | 200,000 |

| | 33,068 |

| | 100 | % | | 1Q18 | | 1Q18 |

| | | | | | | | | | | | | | | | | | | | | |

| 8000 Avalon | | Office | | Atlanta, GA | | 90 | % | | 1Q16 | | 224,000 |

| | 72,000 |

| | 8,803 |

| | — | % | | 2Q17 | | 2Q18 |

| | | | | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | $ | 395,000 |

| | $ | 63,256 |

| | | | | | |

|

| | | | | |

| (1) | This schedule shows projects currently under active development through the substantial completion of construction. Amounts included in the estimated project cost column represent the estimated costs of the project through stabilization. Significant estimation is required to derive these costs, and the final costs may differ from these estimates. The projected stabilization dates are also estimates and are subject to change as the project proceeds through the development process.

|

| (2) | Amount represents 100% of the estimated project cost. Carolina Square is expected to be funded with a combination of equity from the partners and up to $80.0 million from a construction loan, which had no outstanding balance as of March 31, 2016.

|

| (3) | Represents the quarter which the Company estimates the first tenant occupies space.

|

| (4) | Stabilization represents the earlier of the quarter in which the Company estimates it will achieve 90% economic occupancy or one year from initial occupancy.

|

| | | | | | |

|

| | |

| Cousins Properties Incorporated | 21 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | |

| | | Metropolitan Area | | Company's Ownership Interest | | Total Developable Land (Acres) | | Company's Share |

| Commercial | | | | | | | | |

| | | | | | | | | |

| North Point | | Atlanta | | 100.0% | | 32 |

| | |

| Wildwood Office Park | | Atlanta | | 50.0% | | 22 |

| | |

| The Avenue Forsyth-Adjacent Land | | Atlanta | | 100.0% | | 10 |

| | |

| NCR Phase II (1) | | Atlanta | | 100.0% | | 1 |

| | |

| Georgia | | | | | | 65 |

| | |

| | | | | | | | | |

| DFA | | Charlotte | | 50.0% | | 2 |

| | |

| North Carolina | | | | | | 2 |

| | |

| | | | | | | | | |

| Victory Center | | Dallas | | 75.0% | | 3 |

| | |

| Texas | | | | | | 3 |

| | |

| | | | | | | | | |

| Commercial Land Held (Acres) | | | | | | 70 |

| | 57 |

|

| Cost Basis of Commercial Land Held | | | | | | $ | 52,084 |

| | $ | 26,937 |

|

| | | | | | | | | |

| Residential (2) | | | | | | | | |

| | | | | | | | | |

| Paulding County | | Atlanta | | 50.0% | | 478 |

| | |

| Callaway Gardens (3) | | Atlanta | | 100.0% | | 217 |

| | |

| Georgia | | | | | | 695 |

| | |

| | | | | | | | | |

| Padre Island | | Corpus Christi | | 50.0% | | 15 |

| | |

| Texas | | | | | | 15 |

| | |

| | | | | | | | | |

| Residential Land Held (Acres) | | | | | | 710 |

| | 464 |

|

| Cost Basis of Residential Land Held | | | | | | $ | 11,834 |

| | $ | 8,297 |

|

| | | | | | | | | |

| Grand Total Land Held (Acres) | | | | | | 780 |

| | 521 |

|

| Grand Total Cost Basis of Land Held | | | | | | $ | 63,918 |

| | $ | 35,234 |

|

| | | | | | | | | |

|

| | | | | |

| (1) | Represents land adjacent to NCR Development project. Upon completion of the NCR development project, NCR is required to pay rent on this land. |

| (2) | Residential represents land that may be sold to third parties as lots or in large tracts for residential development.

|

| (3) | Company's ownership interest is shown at 100% as Callaway Gardens is owned in a joint venture which is consolidated with the Company.

|

|

| | |

| Cousins Properties Incorporated | 22 | Q1 2016 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Company's Share of Debt Maturities and Principal Payments | | | | | | |

| Description (Interest Rate Base, if not fixed) | Company's Ownership Interest | | Rate at End of Quarter | | Maturity Date | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | Thereafter | | Total Principal | | Deferred Loan Costs (1) | | Total | | Company's Share Recourse (2) |

| Consolidated Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floating Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Facility, Unsecured (LIBOR + 1.10%-1.45%; $500mm facility)(3) | 100.0 | % | | 1.54 | % | | 5/28/19 | | $ | — |

| | $ | — |

| | $ | — |

| | $ | 143,000 |

| | $ | — |

| | $ | — |

| | $143,000 | | $ | — |

| | $143,000 | | $143,000 |

| Total Floating Rate Debt | | | | | | | — |

| | — |

| | — |

| | 143,000 |

| | — |

| | — |

| | 143,000 |

| | | | 143,000 |

| | 143,000 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| The American Cancer Society Center (4) | 100.0 | % | | 6.45 | % | | 9/1/17 | | 1,376 |

| | 127,508 |

| | — |

| | — |

| | — |

| | — |

| | 128,884 |

| | (123 | ) | | 128,761 |

| | — |

|

| 191 Peachtree Tower | 100.0 | % | | 3.35 | % | | 10/1/18 | | 1,305 |

| | 2,013 |

| | 96,682 |

| | — |

| | — |

| | — |

| | 100,000 |

| | (235 | ) | | 99,765 |

| | — |

|

| Meridian Mark Plaza | 100.0 | % | | 6.00 | % | | 8/1/20 | | 345 |

| | 484 |

| | 514 |

| | 546 |

| | 22,978 |

| | — |

| | 24,867 |

| | (116 | ) | | 24,751 |

| | — |

|

| Post Oak Central | 100.0 | % | | 4.26 | % | | 10/1/20 | | 2,627 |

| | 3,636 |

| | 3,794 |

| | 3,959 |

| | 166,896 |

| | — |

| | 180,912 |

| | (789 | ) | | 180,123 |

| | — |

|

| Promenade | 100.0 | % | | 4.27 | % | | 10/1/22 | | 2,158 |

| | 2,986 |

| | 3,116 |

| | 3,252 |

| | 3,394 |

| | 92,593 |

| | 107,499 |

| | (382 | ) | | 107,117 |

| | — |

|

| 816 Congress | 100.0 | % | | 3.75 | % | | 11/1/24 | | 128 |

| | 1,568 |

| | 1,628 |

| | 1,690 |

| | 1,754 |

| | 78,232 |

| | 85,000 |

| | (706 | ) | | 84,294 |

| | — |

|

| Total Fixed Rate Debt | | | | | | | 7,939 |

| | 138,195 |

| | 105,734 |

| | 9,447 |

| | 195,022 |

| | 170,825 |

| | 627,162 |

| | (2,351 | ) | | 624,811 |

| | — |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Consolidated Debt | | | | | | | 7,939 |

| | 138,195 |

| | 105,734 |

| | 152,447 |

| | 195,022 |

| | 170,825 |

| | 770,162 |

| | (2,351 | ) | | 767,811 |

| | 143,000 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Unconsolidated Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floating Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| Emory Point I (LIBOR + 1.75%) (5) | 75.0 | % | | 2.19 | % | | 10/9/16 |

| 43,522 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 43,522 |

| | — |

| | 43,522 |

| | — |

|

| Emory Point II (LIBOR + 1.85%, $46mm facility) (5) | 75.0 | % | | 2.29 | % | | 10/9/16 | | 32,223 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 32,223 |

| | — |

| | 32,223 |

| | 3,222 |

|

| Carolina Square (LIBOR + 1.90%, $79.755mm facility) (6) | 50.0 | % | | 2.34 | % | | 5/1/18 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total Floating Rate Debt | | | | | | | 75,745 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 75,745 |

| | — |

| | 75,745 |

| | 3,222 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed Rate Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gateway Village (7) | 50.0 | % | | 6.41 | % | | 12/1/16 | | 6,427 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 6,427 |

| | — |

| | 6,427 |

| | — |

|

| Terminus 100 | 50.0 | % | | 5.25 | % | | 1/1/23 | | 964 |

| | 1,346 |

| | 1,418 |

| | 1,494 |

| | 1,575 |

| | 57,498 |

| | 64,295 |

| | — |

| | 64,295 |

| | — |

|

| Terminus 200 | 50.0 | % | | 3.79 | % | | 1/1/23 | | 559 |

| | 770 |

| | 800 |

| | 831 |

| | 863 |

| | 37,177 |

| | 41,000 |

| | — |

| | 41,000 |

| | — |

|

| Emory University Hospital Midtown Medical Office Tower | 50.0 | % | | 3.50 | % | | 6/1/23 | | 552 |

| | 758 |

| | 785 |

| | 813 |

| | 842 |

| | 33,213 |

| | 36,963 |

| | — |

| | 36,963 |

| | — |

|

| Total Fixed Rate Debt | | | | | | | 8,502 |

| | 2,874 |

| | 3,003 |

| | 3,138 |

| | 3,280 |

| | 127,888 |

| | 148,685 |

| | — |

| | 148,685 |

| | — |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Unconsolidated Debt | | | | | | | 84,247 |

| | 2,874 |

| | 3,003 |

| | 3,138 |

| | 3,280 |

| | 127,888 |

| | 224,430 |

| | — |

| | 224,430 |

| | 3,222 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Debt | | | | | | | $ | 92,186 |

| | $ | 141,069 |

| | $ | 108,737 |

| | $ | 155,585 |

| | $ | 198,302 |

| | $ | 298,713 |

| | $ | 994,592 |

| | $ | (2,351 | ) | | $ | 992,241 |

| | $ | 146,222 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

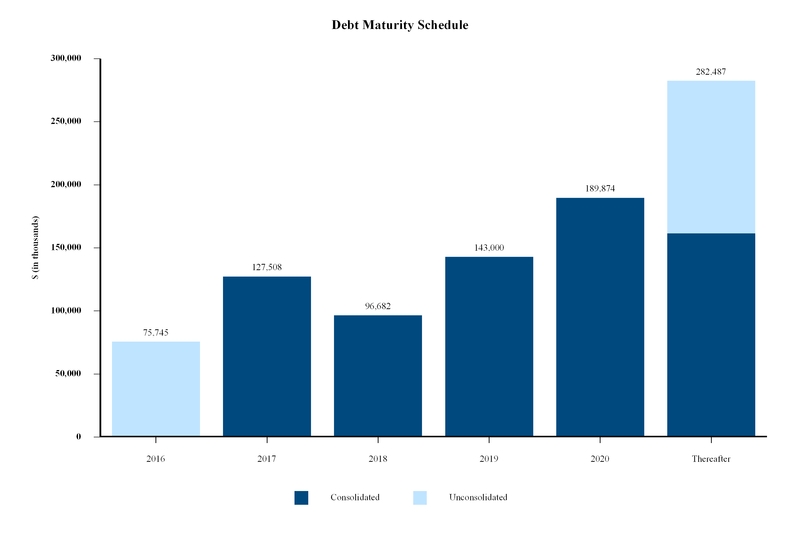

| Total Maturities (8) | | | | | | | $ | 75,745 |

| | $ | 127,508 |

| | $ | 96,682 |

| | $ | 143,000 |

| | $ | 189,874 |

| | $ | 282,487 |

| | $ | 915,296 |

| | | | | | |

| % of Maturities | | | | | | | 8% | | 14% | | 11% | | 15% | | 21% | | 31% | | 100% | | | | | | |

Floating and Fixed Rate Debt Analysis

|

| | | | | | | | | | | | | |

| | | Total Debt ($) | | Total Debt (%) | | Weighted Average Interest Rate | | Weighted Average Maturity (Yrs.) |

| Floating Rate Debt | | $ | 218,745 |

| | 22 | % | | 1.78 | % | | 2.2 |

|

| Fixed Rate Debt | | 775,847 |

| | 78 | % | | 4.55 | % | | 4.9 |

|

| Total Debt | | $ | 994,592 |

| | 100 | % | | 3.94 | % | | 4.3 |

|

| | | | | | | | | |

(1) A new accounting standard was adopted in the first quarter of 2016 that requires deferred loan costs of mortgage debt to be recorded as a reduction from notes payable on the balance sheet. This standard does not apply to revolving credit facilities and such costs related to credit facilities continue to be recorded in other assets on the balance sheet.

(2) Non-recourse loans are subject to customary carve-outs.

(3) The spread over LIBOR at March 31, 2016 was 1.10%.

(4) The real estate and other assets of this property are restricted under a loan agreement such that these assets are not available to settle other debts of the Company.

(5) The Emory Point I and II loans have two one-year extension options, if certain conditions are met.

(6) The Company and its partner each guarantee 12.5% of the outstanding loan amount.

(7) Based on the structure of the venture and the nature of the related debt, the Company excludes the Gateway Village debt in certain of its leverage calculations.

(8) Maturities include lump sum principal payments due at the maturity date. Maturities do not include scheduled principal payments due prior to the maturity date.

|

| | |

| Cousins Properties Incorporated | 23 | Q1 2016 Supplemental Information |

|

| | |

| Cousins Properties Incorporated | 24 | Q1 2016 Supplemental Information |

|

| | |

| NON-GAAP FINANCIAL MEASURES - CALCULATIONS AND RECONCILIATIONS |

|

| | | | | | | | | | | | | | |

| | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | | | | | | |

| 2nd Generation TI & Leasing Costs & Building CAPEX | | | | | | | |

| Second Generation Leasing Related Costs | 31,187 |

| 11,632 |

| 12,294 |

| 10,941 |

| 11,954 |

| 46,821 |

| 4,867 |

|

| Second Generation Building Improvements | 3,867 |

| 507 |

| 965 |

| 3,267 |

| 2,654 |

| 7,393 |

| 3,037 |

|

| | 35,054 |

| 12,139 |

| 13,259 |

| 14,208 |

| 14,608 |

| 54,214 |

| 7,904 |

|

| Net Operating Income | | | | | | | |

| | | | | | | | |

| Office Consolidated Properties | 186,593 |

| 52,103 |

| 54,780 |

| 54,685 |

| 55,152 |

| 216,720 |

| 52,844 |

|

| Other Consolidated Properties | 1,385 |

| (24 | ) | 10 |

| — |

| 205 |

| 191 |

| 23 |

|

| Net Operating Income - Consolidated | 187,978 |

| 52,079 |

| 54,790 |

| 54,685 |

| 55,357 |

| 216,911 |

| 52,867 |

|

| | |

|

| | | |

|

|

|

|

| Rental Property Revenues | 343,910 |

| 90,033 |

| 96,177 |

| 96,016 |

| 90,842 |

| 373,068 |

| 88,476 |

|

| Rental Property Operating Expenses | (155,934 | ) | (37,954 | ) | (41,387 | ) | (41,331 | ) | (35,485 | ) | (156,157 | ) | (35,609 | ) |

| Net Operating Income - Consolidated | 187,976 |

| 52,079 |

| 54,790 |

| 54,685 |

| 55,357 |

| 216,911 |

| 52,867 |

|

| | |

|

| | | | | |

| Income from Discontinued Operations | |

|

| | | | | |

| Rental Property Revenues | 2,927 |

| 4 |

| — |

| — |

| — |

| 4 |

| — |

|

| Rental Property Operating Expenses | (1,128 | ) | (18 | ) | — |

| — |

| — |

| (18 | ) | — |

|

| Net Operating Income | 1,799 |

| (14 | ) | — |

| — |

| — |

| (14 | ) | — |

|

| | | | | | |

|

| |

| Termination Fees | 2 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Interest and Other Income (Expense) | 3 |

| — |

| (6 | ) | 6 |

| (21 | ) | (21 | ) | — |

|

| FFO from Discontinued Operations | 1,804 |

| (14 | ) | (6 | ) | 6 |

| (21 | ) | (35 | ) | — |

|

| | |

|

| | | |

|

| |

| Third Party Management and Leasing Revenues | — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Third Party Management and Leasing Expenses | (2 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| FFO from Third Party Management and Leasing | (2 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| | |

|

| | | |

|

| |

| FFO from Discontinued Operations | 1,802 |

| (14 | ) | (6 | ) | 6 |

| (21 | ) | (35 | ) | — |

|

| | |

|

| | | |

|

| |

| Depreciation and Amortization of Real Estate | — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Income from Discontinued Operations | 1,802 |

| (14 | ) | (6 | ) | 6 |

| (21 | ) | (35 | ) | — |

|

| | | | | | | | |

| Income (Loss) from Unconsolidated Joint Ventures | | | | | | | |

| Net Operating Income | | | | | | | |

| Office Properties | 18,176 |

| 4,642 |

| 4,489 |

| 4,644 |

| 4,726 |

| 18,501 |

| 5,049 |

|

| Other Properties | 7,720 |

| 1,346 |

| 1,495 |

| 1,487 |

| 1,506 |

| 5,834 |

| 1,597 |

|

| Net Operating Income | 25,896 |

| 5,988 |

| 5,984 |

| 6,131 |

| 6,232 |

| 24,335 |

| 6,646 |

|

| Sales Less Cost of Sales | 2,207 |

| — |

| 242 |

| 2,038 |

| — |

| 2,280 |

| — |

|

| Termination Fees | 185 |

| 120 |

| 28 |

| 271 |

| — |

| 419 |

| — |

|

| Interest Expense | (7,364 | ) | (1,822 | ) | (1,827 | ) | (1,845 | ) | (1,961 | ) | (7,455 | ) | (2,007 | ) |

| Other Expense | 536 |

| 68 |

| 106 |

| 12 |

| 182 |

| 368 |

| 454 |

|

| Depreciation and Amortization of Non-Real Estate Assets | (46 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Funds from Operations - Unconsolidated Joint Ventures | 21,414 |

| 4,354 |

| 4,533 |

| 6,607 |

| 4,453 |

| 19,947 |

| 5,093 |

|

| Gain on Sale of Depreciated Investment Properties, net | 1,767 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Depreciation and Amortization of Real Estate | (11,913 | ) | (2,743 | ) | (2,772 | ) | (2,891 | ) | (3,239 | ) | (11,645 | ) | (3,259 | ) |

| Net Income from Unconsolidated Joint Ventures | 11,268 |

| 1,611 |

| 1,761 |

| 3,716 |

| 1,214 |

| 8,302 |

| 1,834 |

|

|

| | |

| Cousins Properties Incorporated | 25 | Q1 2016 Supplemental Information |

|

| | |

| NON-GAAP FINANCIAL MEASURES - CALCULATIONS AND RECONCILIATIONS |

|

| | | | | | | | | | | | | | |

| | | | | | | | |

| | 2014 | 2015 1st | 2015 2nd | 2015 3rd | 2015 4th | 2015 | 2016 1st |

| | | | | | | | |

| | | | | | | | |

| Market Capitalization | | | | | | | |

| Common Stock price at Period End | 11.42 |

| 10.60 |

| 10.38 |

| 9.22 |

| 9.43 |

| 9.43 |

| 10.38 |

|

| Number of Common Shares Outstanding at Period End | 216,513 |

| 216,470 |

| 216,686 |

| 214,671 |

| 211,513 |

| 211,513 |

| 210,107 |

|

| Common Stock Capitalization | 2,472,578 |

| 2,294,582 |

| 2,249,201 |

| 1,979,267 |

| 1,994,568 |

| 1,994,568 |

| 2,180,911 |

|

| | |

|

| | | | | |

| Preferred Stock Series B Price at Liquidation Value | — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Preferred Stock at Liquidation Value | — |

| — |

| — |

| — |

| — |

| — |

| — |

|

| | |

|

| | | |

|

|

|

|

| Debt | 792,344 |

| 849,948 |

| 849,772 |

| 779,570 |

| 721,293 |

| 721,293 |

| 767,811 |

|

| Share of Unconsolidated Debt | 215,158 |

| 219,428 |

| 225,241 |

| 227,194 |

| 225,724 |

| 225,724 |

| 224,430 |

|

| Debt (2) | 1,007,502 |

| 1,069,376 |

| 1,075,013 |

| 1,006,764 |

| 947,017 |

| 947,017 |

| 992,241 |

|

| | | | | | |

|

| |

| Total Market Capitalization | 3,480,080 |

| 3,361,958 |

| 3,324,214 |

| 2,986,031 |

| 2,941,585 |

| 2,941,585 |

| 3,173,152 |

|

| | | | | | | | |

| EBITDA (2) | | | | | | | |

| FFO | 165,204 |

| 45,935 |

| 45,238 |

| 52,467 |

| 49,109 |

| 192,749 |

| 43,457 |

|

| Interest Expense | 36,474 |

| 9,498 |

| 9,696 |

| 9,518 |

| 9,466 |

| 38,178 |

| 9,421 |

|

| Non-Real Estate Depreciation and Amortization | 913 |

| 423 |

| 374 |

| 414 |

| 410 |

| 1,621 |

| 377 |

|

| Income Tax Provision (Benefit) | (20 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Gain on Sale of Third Party Management & Leasing Business | 3 |

| — |

| — |

| — |

| — |

| — |