INVESTOR PRESENTATION November 2016 Simple Platform. Trophy Assets. Opportunistic Investments.

Table of Contents Cousins Overview Post-Transactions 1 Cousins Strategic Objectives 2 Assemble Trophy Office Portfolio in High Growth Sun Belt Markets 3-5 Achieve Compelling Critical Mass in Leading Urban Submarkets 6-7 Command Premium Rents in Our Markets 8 Secure a Diversified Customer Base 9 Maintain a Conservative Balance Sheet Positioned for Growth 10 Appendix 11-17 Contact Information and Disclaimer 18

Cousins Overview Post-Transactions Class A Office Portfolio » 34 first class assets1 » 14.6 million rentable square feet1 » 80% urban2 » Average 433,000 square feet per office asset3 » Average year built 19973 » 93% leased1 High Growth Sunbelt Markets » Atlanta » Austin » Charlotte » Orlando » Phoenix » Tampa Strong, simple balance sheet » Intermediate goal of ~4.5x net debt/EBITDA » Among best in the office REIT industry Value Creation Expertise4 » $506 million development pipeline » Office portion 84% leased 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share; excludes Cousins and Legacy Parkway assets which have sold or under contract for sale as of 2-Nov-2016. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway, 2016 asset sales and assets under contract for sale as of 2-Nov-2016. 3. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings. Excludes Cousins mixed use assets and Cousins and Legacy Parkway assets which have sold or under contract for sale as of 2-Nov-2016. 4. As reported in Cousins 30-Sept-2016 filings; at CUZ share. Market Concentration2 1 Atlanta 42% Charlotte 18% Austin 18% Tampa 10% Phoenix 6% Orlando 5% Miami 1%

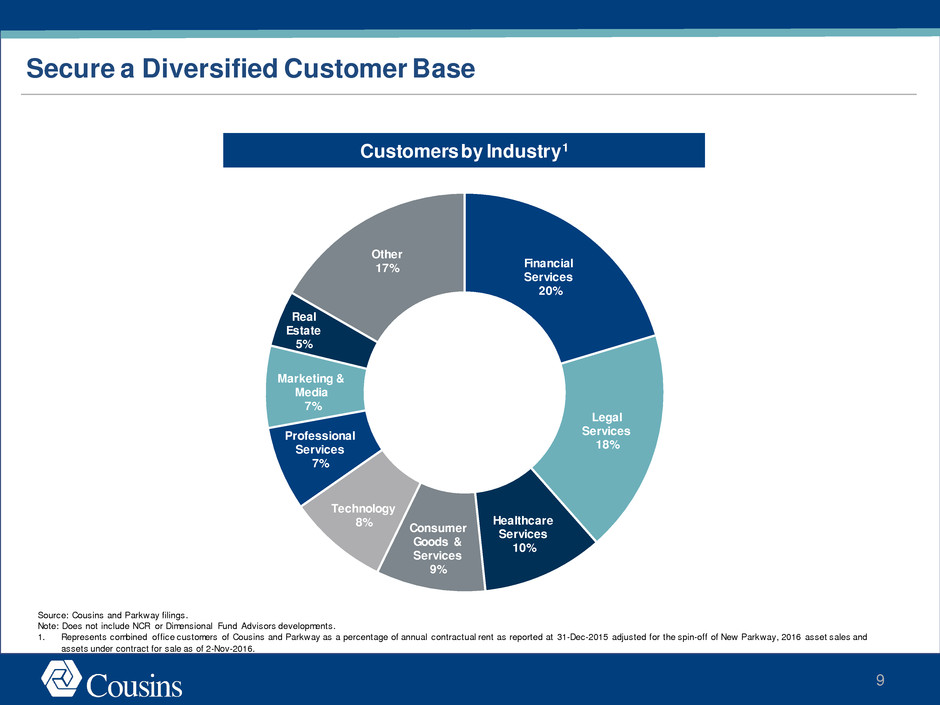

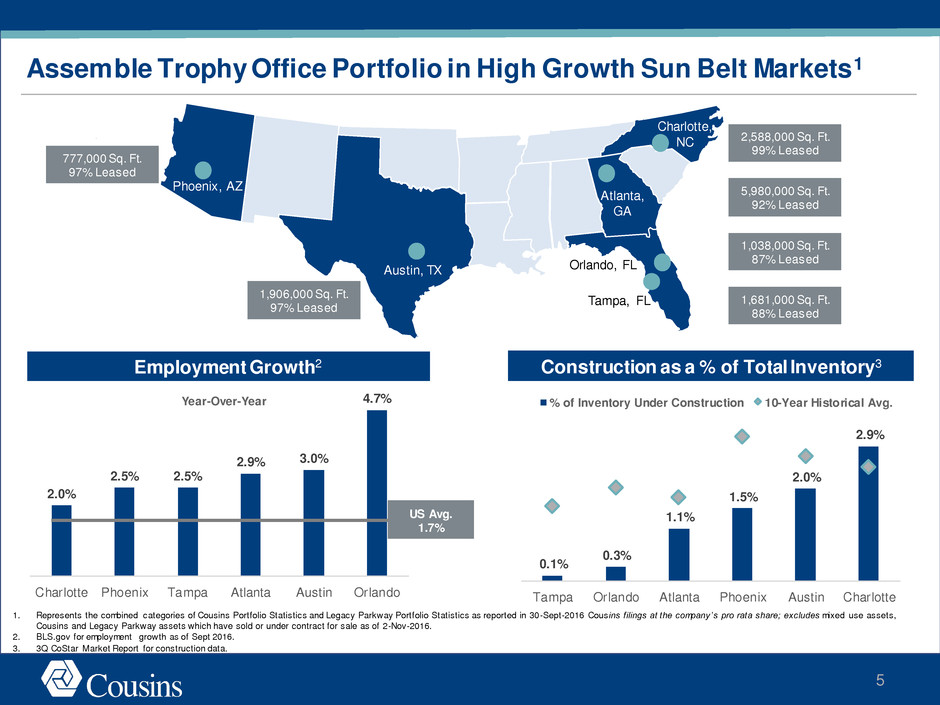

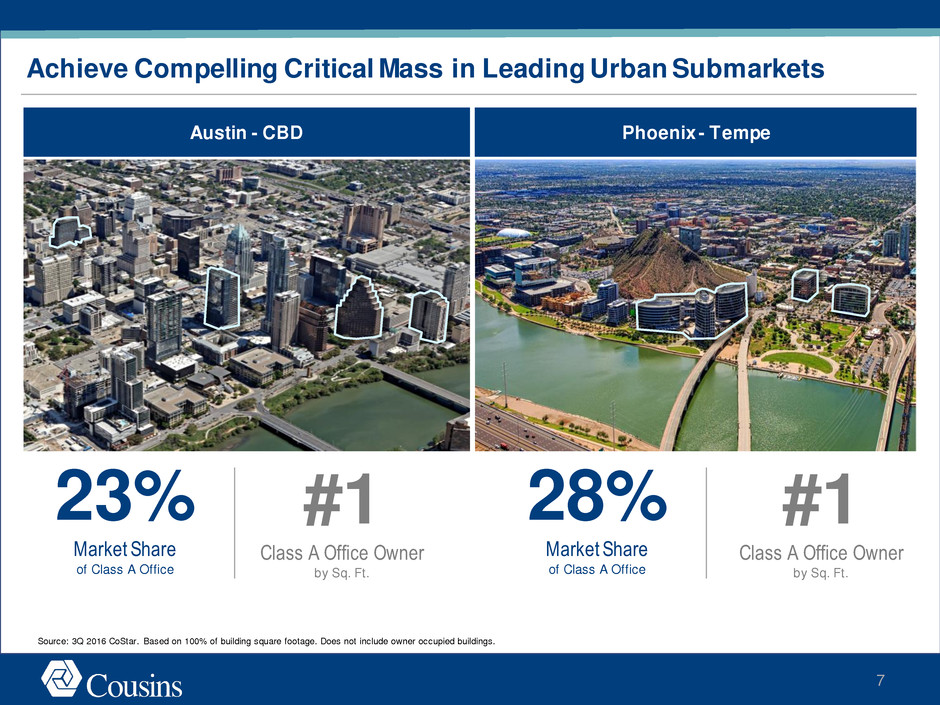

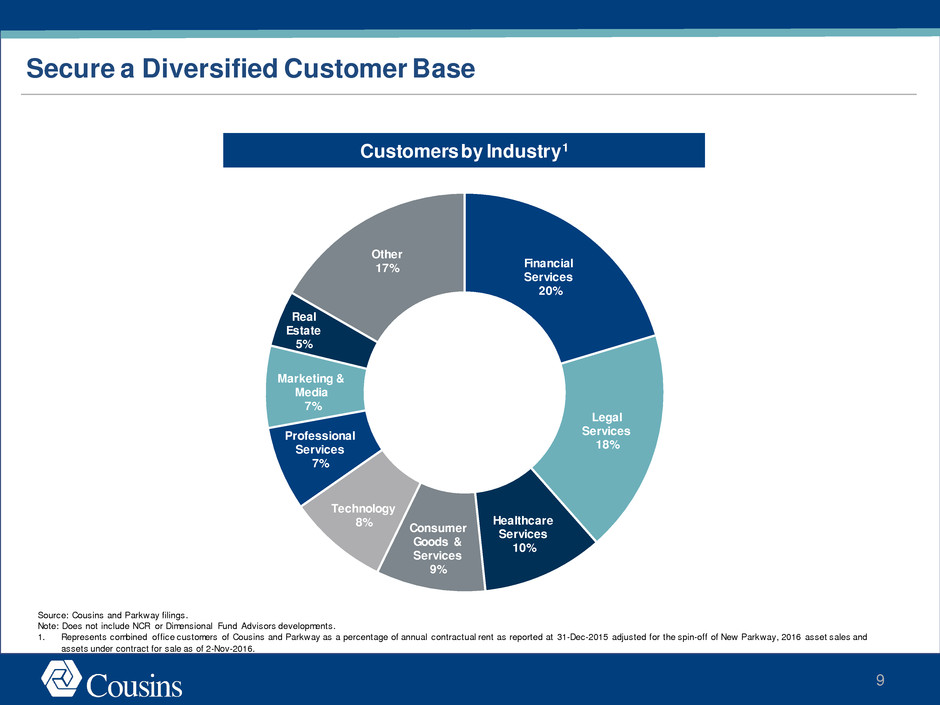

Cousins Strategic Objectives Assemble trophy office portfolio in high growth Sun Belt markets Post Transactions: 14.6 mm square feet1 of Class A office assets in high growth urban Sun Belt markets Achieve compelling critical mass in leading urban submarkets Post Transactions: #1 Class A office owner2 in four of the strongest urban submarkets in the Sun Belt Command premium rents in our markets Post Transactions: Cousins assets command 18% - 52% premium3 in their respective markets Secure a diversified customer base Post Transactions: No single industry represents more than 20% of our customer base4. Maintain a conservative balance sheet positioned for growth Post Transactions: Increased scale, simple capital structure and industry leading leverage 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share; excludes Cousins and Legacy Parkway assets which have sold or under contract for sale as of 2-Nov-2016. 2. See slides 6-7 for source and data. 3. See slide 8 for source and data. 4. See slide 9 for source and data. 2

Assemble Trophy Office Portfolio in High Growth Sun Belt Markets Source: Q3 2016 Cousins filings. Promenade / Atlanta, GA 777,000 Sq. Ft.; 95% Leased Terminus / Atlanta, GA 1,226,000 Sq. Ft.; 91% Leased Fifth Third Center / Charlotte, NC 698,000 Sq. Ft.; 97% Leased Hayden Ferry Lakeside / Phoenix, AZ 789,000 Sq. Ft.; 95% Leased San Jacinto Center / Austin, TX 406,000 Sq. Ft.; 100% Leased One Buckhead Plaza / Atlanta, GA 464,000 Sq. Ft.; 96% Leased Colorado Tower / Austin, TX 373,000 Sq. Ft.; 100% Leased 3

Assemble Trophy Office Portfolio in High Growth Sun Belt Markets 4 Source: Q3 2016 Cousins filings. 816 Congress / Austin, TX 435,000 Sq. Ft.; 95% Leased 3344 Peachtree / Atlanta, GA 485,000 Sq. Ft.; 99% Leased Bank of America Center / Orlando, FL 421,000 Sq. Ft.; 91% Leased Northpark Town Center / Atlanta, GA 1,528,000 Sq. Ft.; 88% Leased One Eleven Congress / Austin, TX 519,000 Sq. Ft.; 94% Leased Hearst Tower / Charlotte, NC 963,000 Sq. Ft.; 98% Leased Tempe Gateway / Phoenix, AZ 264,000 Sq. Ft.; 99% Leased 3350 Peachtree / Atlanta, GA 413,000 Sq. Ft.; 93% Leased

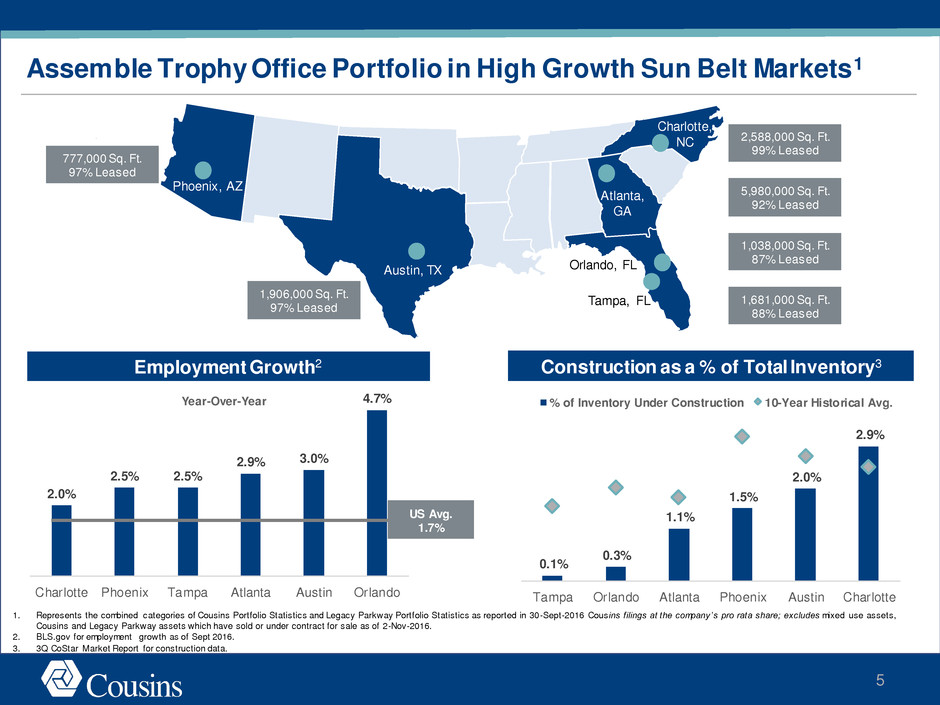

Assemble Trophy Office Portfolio in High Growth Sun Belt Markets1 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share; excludes mixed use assets, Cousins and Legacy Parkway assets which have sold or under contract for sale as of 2-Nov-2016. 2. BLS.gov for employment growth as of Sept 2016. 3. 3Q CoStar Market Report for construction data. 2.0% 2.5% 2.5% 2.9% 3.0% 4.7% Charlotte Phoenix Tampa Atlanta Austin Orlando Employment Growth2 Construction as a % of Total Inventory3 US Avg. 1.7% Phoenix, AZ Austin, TX Tampa, FL Orlando, FL Atlanta, GA Charlotte, NC Year-Over-Year 777,000 Sq. Ft. 97% Leased 1,906,000 Sq. Ft. 97% Leased 1,681,000 Sq. Ft. 88% Leased 5,980,000 Sq. Ft. 92% Leased 1,038,000 Sq. Ft. 87% Leased 2,588,000 Sq. Ft. 99% Leased 0.1% 0.3% 1.1% 1.5% 2.0% 2.9% Tampa Orlando Atlanta Phoenix Austin Charlotte % of Inventory Under Construction 10-Year Historical Avg. 5

Achieve Compelling Critical Mass in Leading Urban Submarkets Atlanta - Buckhead Charlotte - Uptown Source: 3Q 2016 CoStar. Based on 100% of building square footage. Does not include owner occupied buildings. 21% Market Share of Class A Office #1 Class A Office Owner by Sq. Ft. 20% Market Share of Class A Office #1 Class A Office Owner by Sq. Ft. 6

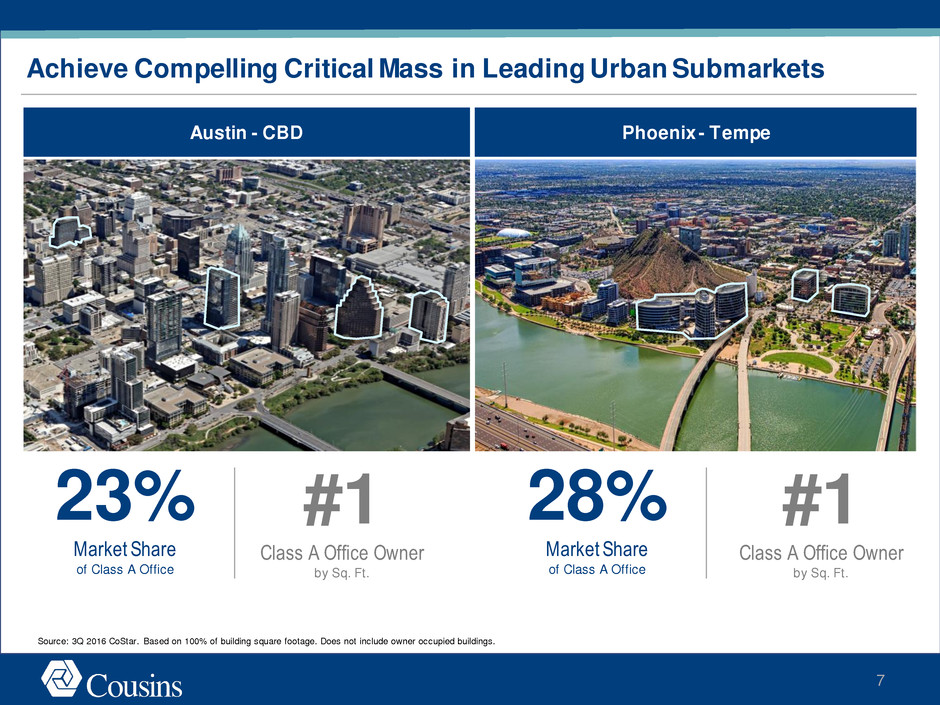

7 Austin - CBD Phoenix - Tempe 23% Market Share of Class A Office 28% Market Share of Class A Office #1 Class A Office Owner by Sq. Ft. #1 Class A Office Owner by Sq. Ft. Source: 3Q 2016 CoStar. Based on 100% of building square footage. Does not include owner occupied buildings. Achieve Compelling Critical Mass in Leading Urban Submarkets

$23.53 $25.56 $27.73 $20 $22 $24 $26 $28 $30 Orlando CBD Cousins CBD $28.04 $29.41 $41.50 $20 $25 $30 $35 $40 $45 Phoenix Tempe Cousins Tempe $25.81 $28.18 $31.66 $20 $25 $30 $35 $40 $45 Tampa Bay Westshore Cousins Westshore $37.77 $48.23 $51.49 $25 $30 $35 $40 $45 $50 $55 $60 Austin CBD Cousins CBD Austin $26.74 $29.88 $33.36 $20 $24 $28 $32 $36 $40 Charlotte Metro Uptown Cousins Uptown Charlotte $26.50 $33.42 $40.16 $20 $24 $28 $32 $36 $40 $44 Atlanta Buckhead Cousins Buckhead Atlanta Command Premium Rents in Our Markets Orlando Phoenix Tampa 8 Source: CoStar 3Q 2016 Market Reports. 1. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 52% Higher 36% Higher 25% Higher 23% Higher 48% Higher 18% Higher Class A Asking Rent ($/Sq. Ft.1)

Secure a Diversified Customer Base 9 Customers by Industry1 Source: Cousins and Parkway filings. Note: Does not include NCR or Dimensional Fund Advisors developments. 1. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015 adjusted for the spin-off of New Parkway, 2016 asset sales and assets under contract for sale as of 2-Nov-2016. Financial Services 20% Legal Services 18% Healthcare Services 10% Consumer Goods & Services 9% Technology 8% Professional Services 7% Marketing & Media 7% Real Estate 5% Other 17%

$566MM Maintain a Conservative Balance Sheet Positioned for Growth Near-Term Refinance Opportunities Wtd. Avg. Interest Rate 5.6% 4.4%3.0% 6.1% 4.3% 3.8% Net Debt / EBITDA1 Debt Maturity Schedule (mm)5 1. HIW / BXP / KRC / SNL Office Index leverage represents net debt divided by latest quarter annualized EBITDA per 3Q 2016 respective company filings. 2. Represents the combined undepreciated book value of Cousins and Parkway derived from 31-Dec-2015 company filings adjusted for the Houston spin-off, 2016 actual sales and 2016 projected sales. Undepreciated book value represents total assets in accordance with GAAP plus accumulated depreciation of real estate assets and accumulated depreciation of intangible assets. 3. Represents management’s intermediate leverage goal. 4. SNL Office Index is calculated as the average net debt to EBITDA for companies that disclose such metrics in 3Q 2016 company filings. 5. Represents combined debt of Cousins as reported in 3Q 16 and Parkway as reported in 2Q 2016 company filings adjusted for the Houston spin-off, the repayment of Parkway term debt at closing, the repayment of debt associated with assets sold, and the repayment of One Orlando Center debt. Increased scale » ~$4.8 billion undepreciated book value2 » Improves access to capital Low leverage » Intermediate goal of ~4.5x net debt/EBITDA3 » Simple capital structure » Among best in the office REIT industry Refinance opportunities » ~$500mm 2017 debt maturities » Take advantage of historically low long-term rates 10 $512MM $53MM $58MM $45MM $106MM $517MM 2017 2018 2019 2020 2021 2022 2023+ ~4.5x 4.8x 5.1x 6.4x 6.8x Cousins Intermediate Goal³ HIW KRC BXP SNL Office Index⁴

Appendix 11

Financial Serv ices 19% Healthcare Serv ices 17% Technology 13% Consumer Goods & Serv ices 8% Real Estate 8% Legal Serv ices 8% Insurance 6% Prof essional Serv ices 5% Other 16% Atlanta Snapshot Office Portfolio Composition1 Properties 13 Total Square Feet 5,980,000 % Leased 92% % Urban2 75% Average Year Built 1994 Average Asking Rent PSF3 $35.27 10-Year Class-A Office Trends5 Industry Concentration4 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share; excludes Cousins mixed use assets and Cousins assets which have sold as of 2- Nov-2016. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. Excludes Cousins mixed use assets and Cousins assets which have sold as of 2-Nov-2016. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015 adjusted for 2016 asset sales. 5. Source: Costar 5.2% 88% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 12

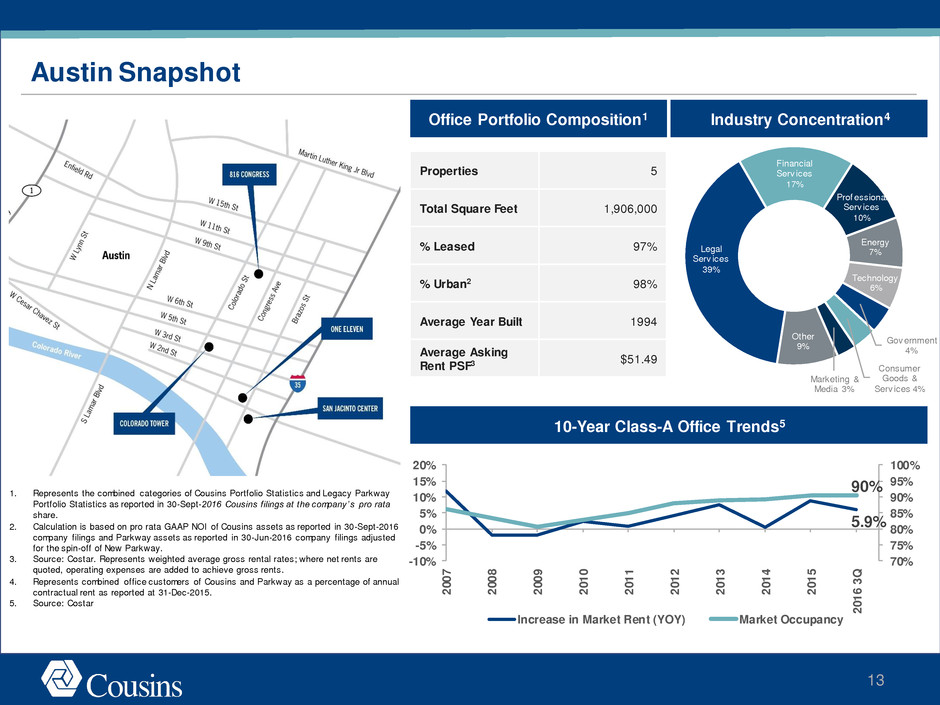

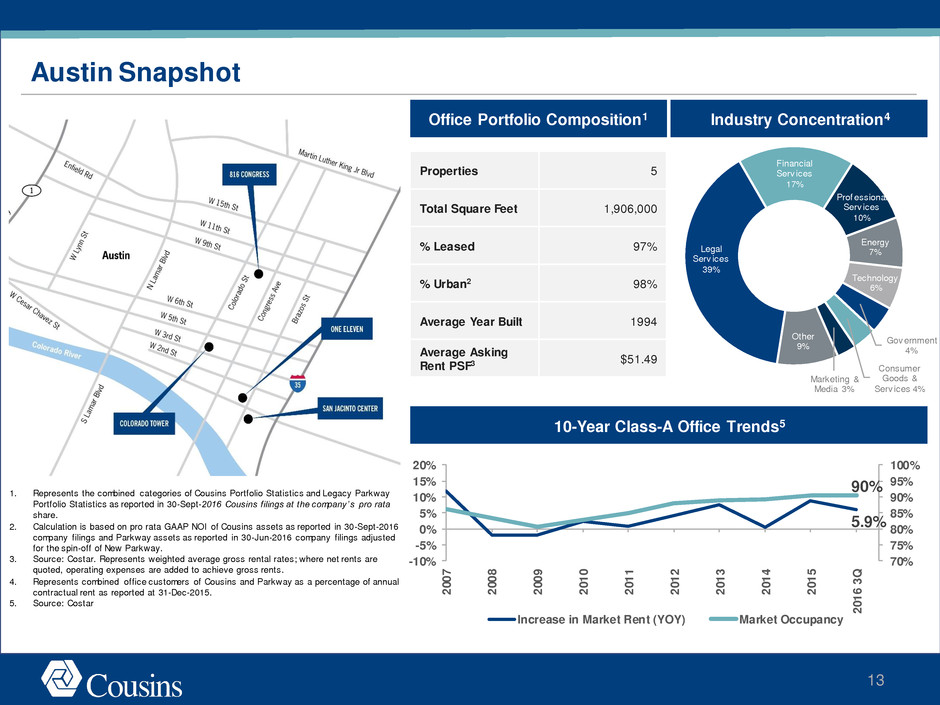

Legal Serv ices 39% Financial Serv ices 17% Prof essional Serv ices 10% Energy 7% Technology 6% Gov ernment 4% Consumer Goods & Serv ices 4% Marketing & Media 3% Other 9% Austin Snapshot Office Portfolio Composition1 Properties 5 Total Square Feet 1,906,000 % Leased 97% % Urban2 98% Average Year Built 1994 Average Asking Rent PSF3 $51.49 10-Year Class-A Office Trends5 Industry Concentration4 5.9% 90% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 13 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015. 5. Source: Costar

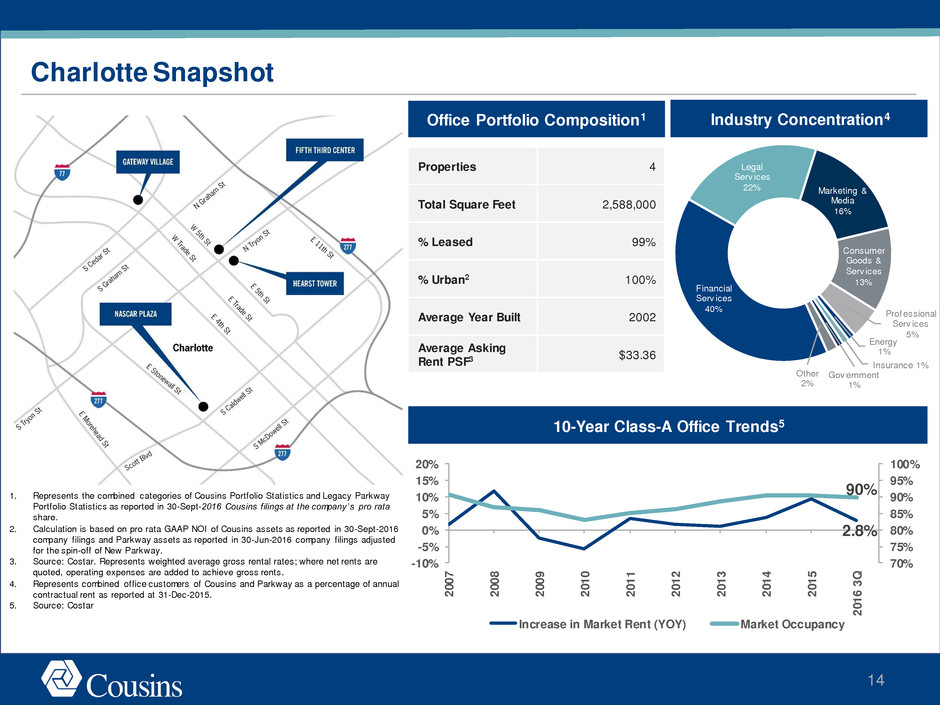

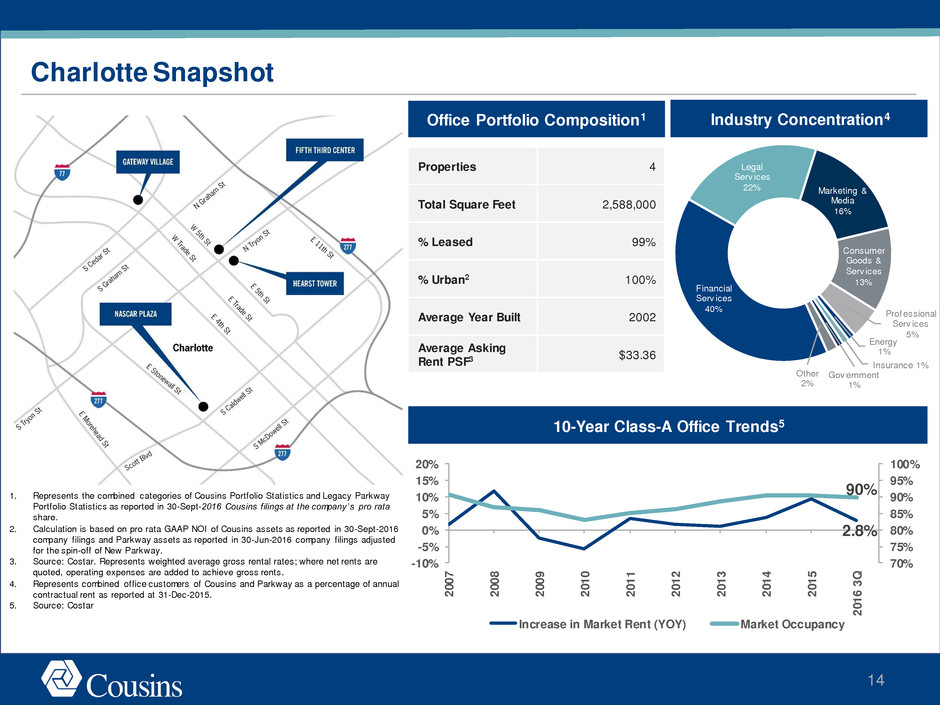

Financial Serv ices 40% Legal Serv ices 22% Marketing & Media 16% Consumer Goods & Serv ices 13% Prof essional Serv ices 5% Energy 1% Insurance 1% Gov ernment 1% Other 2% Charlotte Snapshot Office Portfolio Composition1 Properties 4 Total Square Feet 2,588,000 % Leased 99% % Urban2 100% Average Year Built 2002 Average Asking Rent PSF3 $33.36 10-Year Class-A Office Trends5 Industry Concentration4 2.8% 90% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 14 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015. 5. Source: Costar

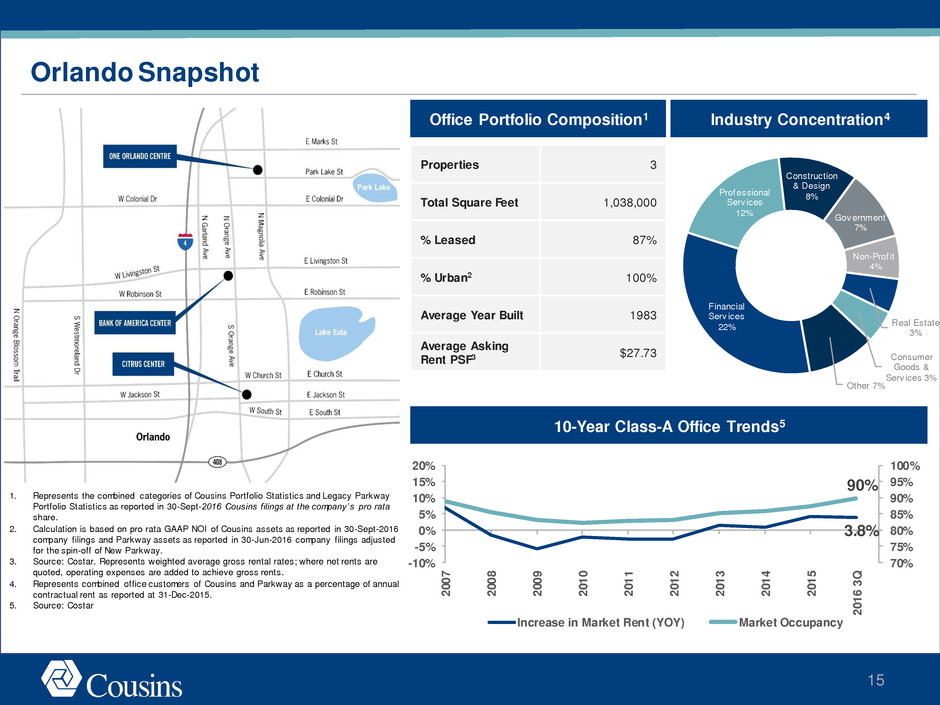

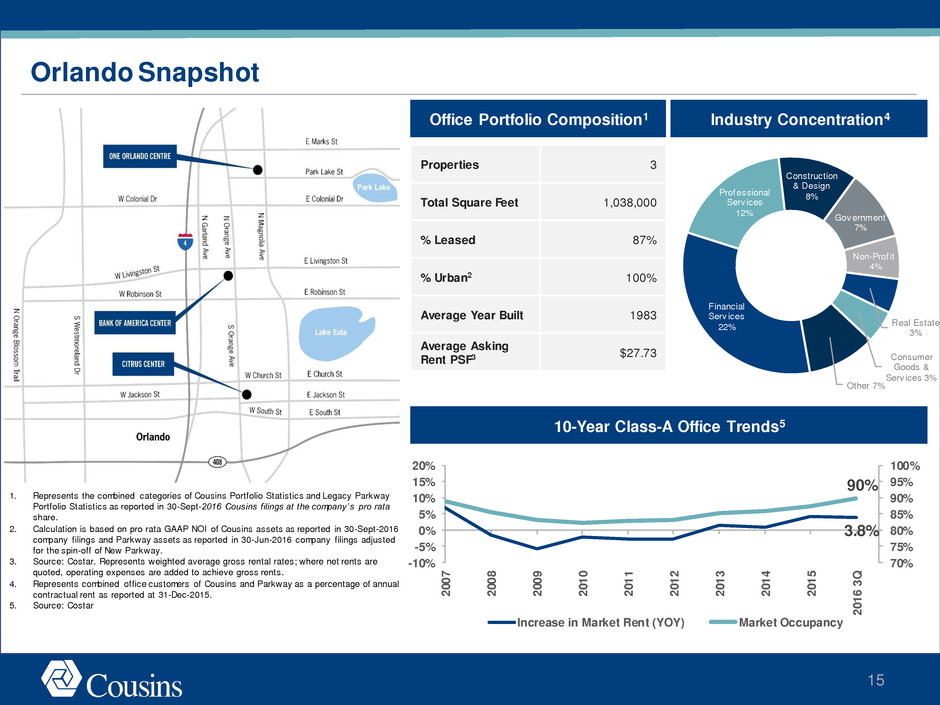

Financial Serv ices 22% Prof essional Serv ices 12% Construction & Design 8% Gov ernment 7% Non-Prof it 4% Real Estate 3% Consumer Goods & Serv ices 3% Other 7% Orlando Snapshot Office Portfolio Composition1 Properties 3 Total Square Feet 1,038,000 % Leased 87% % Urban2 100% Average Year Built 1983 Average Asking Rent PSF3 $27.73 10-Year Class-A Office Trends5 Industry Concentration4 3.8% 90% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 15 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015. 5. Source: Costar

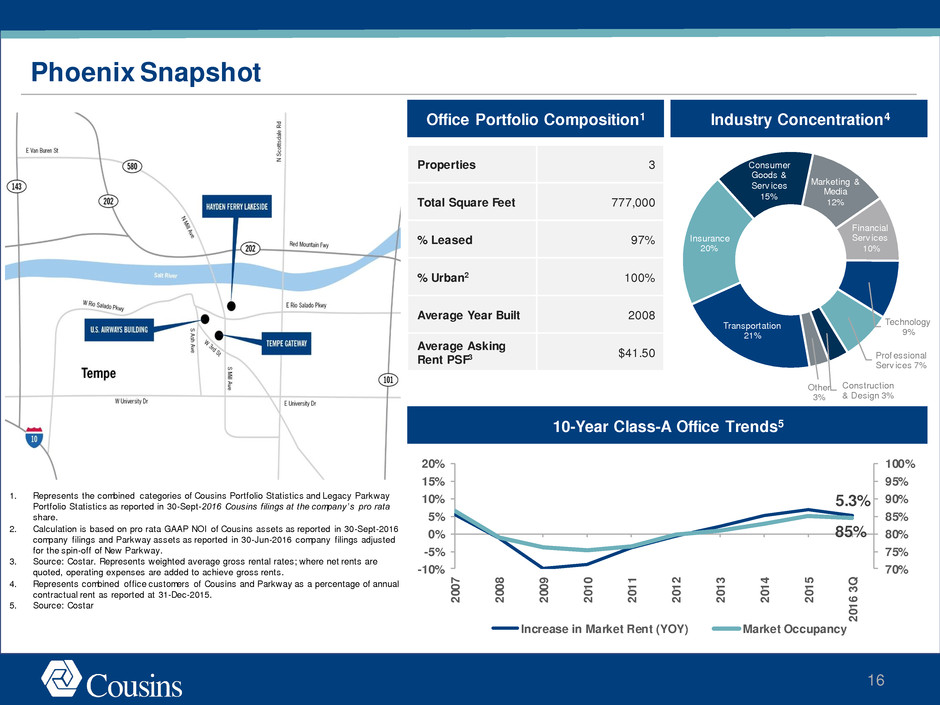

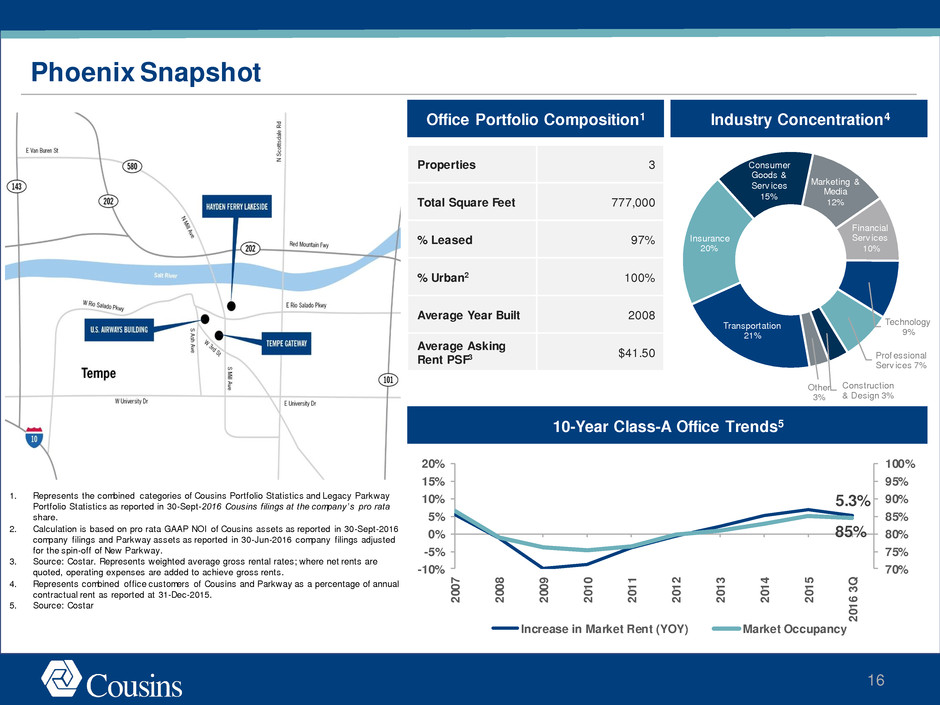

Transportation 21% Insurance 20% Consumer Goods & Serv ices 15% Marketing & Media 12% Financial Serv ices 10% Technology 9% Prof essional Serv ices 7% Construction & Design 3% Other 3% Phoenix Snapshot Office Portfolio Composition1 Properties 3 Total Square Feet 777,000 % Leased 97% % Urban2 100% Average Year Built 2008 Average Asking Rent PSF3 $41.50 10-Year Class-A Office Trends5 Industry Concentration4 5.3% 85% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 16 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015. 5. Source: Costar

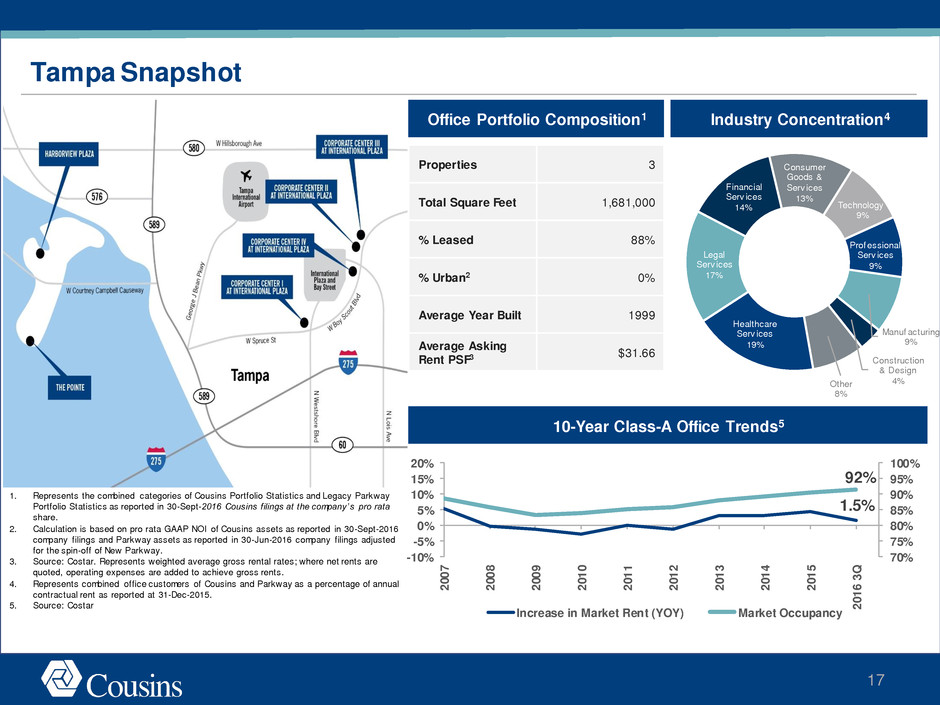

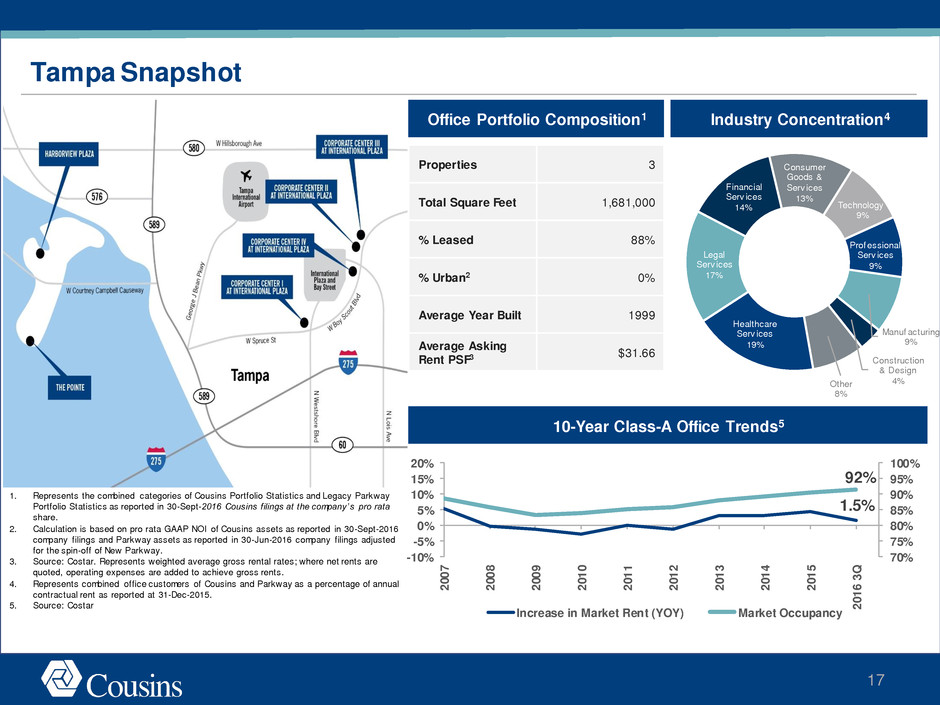

Healthcare Serv ices 19% Legal Serv ices 17% Financial Serv ices 14% Consumer Goods & Serv ices 13% Technology 9% Prof essional Serv ices 9% Manuf acturing 9% Construction & Design 4%Other 8% Tampa Snapshot Office Portfolio Composition1 Properties 3 Total Square Feet 1,681,000 % Leased 88% % Urban2 0% Average Year Built 1999 Average Asking Rent PSF3 $31.66 10-Year Class-A Office Trends5 Industry Concentration4 1.5% 92% 70% 75% 80% 85% 90% 95% 100% -10% -5% 0% 5% 10% 15% 20% 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 3 Q Increase in Market Rent (YOY) Market Occupancy 17 1. Represents the combined categories of Cousins Portfolio Statistics and Legacy Parkway Portfolio Statistics as reported in 30-Sept-2016 Cousins filings at the company’s pro rata share. 2. Calculation is based on pro rata GAAP NOI of Cousins assets as reported in 30-Sept-2016 company filings and Parkway assets as reported in 30-Jun-2016 company filings adjusted for the spin-off of New Parkway. 3. Source: Costar. Represents weighted average gross rental rates; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Represents combined office customers of Cousins and Parkway as a percentage of annual contractual rent as reported at 31-Dec-2015. 5. Source: Costar

Contact Information and Disclaimer Cautionary Note Regarding Forward-Looking Statements This document may include “forward-looking statements” within the meaning of federal and state securities laws and are subject to uncertainties and risks. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which Cousins Properties Incorporated (“Cousins”) operates, and beliefs of and assumptions made by Cousins’ management, involve uncertainties that could significantly affect the financial or operating results of Cousins. Such forward-looking statements include, but are not limited to, statements about the benefits of the recent merger and spin-off transactions involving Cousins, Parkway Properties, Inc. and Parkway, Inc., including future financial and operating results, plans, objectives, expectations and intentions. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and, therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation, risks related to the ability to successfully integrate our operations and employees following the merger; the ability to realize anticipated benefits and synergies of the transactions; potential changes to tax legislation; changes in demand for developed properties; adverse changes in financial condition of joint venture partner(s) or major tenants; risks associated with the acquisition, development, expansion, leasing and management of properties; risks associated with the geographic concentration of our portfolio; risks associated with the industry concentration of tenants; risks related to national and local economic conditions, the real estate industry in general, and the commercial real estate markets in particular; competition from other developers or investors; the ability to retain key personnel; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission (“SEC”) by Cousins. Cousins does not intend, and undertakes no obligation, to update any forward-looking statement. Unless otherwise noted, all information in this presentation is as of September 30, 2016. Contact Information Gregg Adzema Marli Quesinberry Executive Vice President and Vice President, Investor Relations and Chief Financial Officer Corporate Communications greggadzema@cousinsproperties.com marliquesinberry@cousinsproperties.com (404) 407-1116 (404) 407-1898 18