|

| |

| Forward-Looking Statements | |

| |

| |

| Funds From Operations - Detail | |

| |

| |

| |

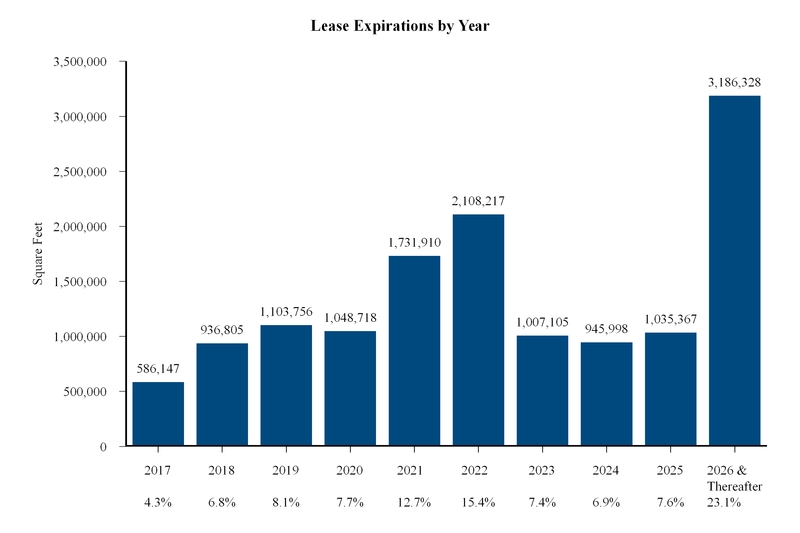

| Office Lease Expirations | |

| |

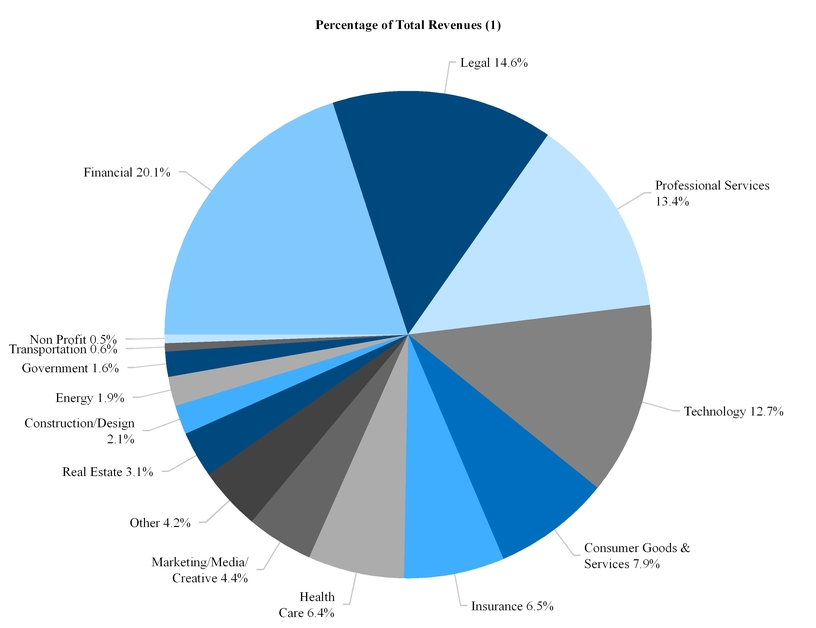

| Tenant Industry Diversification | |

| Investment Activity | |

| |

| Land Inventory | |

| |

| Non-GAAP Financial Measures - Calculations and Reconciliations | |

| Non-GAAP Financial Measures - Discussion | |

| | |

|

| | |

| Cousins Properties Incorporated | | Q1 2017 Supplemental Information |

|

| | |

| FORWARD-LOOKING STATEMENTS |

Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2016 and in the Quarterly Report on Form 10-Q for the three months ended March 31, 2017. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as, our business and financial strategy; our ability to obtain future financing; future acquisitions and dispositions of operating assets; future acquisitions of land; future development and redevelopment opportunities; future dispositions of land and other non-core assets; future repurchases of common stock; projected operating results; market and industry trends; future distributions; projected capital expenditures; interest rates; the impact of the transactions involving the Company, Parkway Properties Inc. ("Parkway"), and Parkway, Inc. ("New Parkway"); future financial and operating results, plans, objectives, expectations, and intentions; all statements that address operating performance, events, or developments that management expects or anticipates will occur in the future — including statements relating to creating value for stockholders; impact of the transactions with Parkway and New Parkway on tenants, employees, stockholders, and other constituents of the combined companies; and integrating Parkway with us.

Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following: the availability and terms of capital; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions, investments or dispositions; the potential dilutive effect of common stock or operating partnership unit issuances; the failure to achieve benefits from the repurchase of common stock; the availability of buyers and adequate pricing with respect to the disposition of assets; risks and uncertainties related to national and local economic conditions, the real estate industry, and the commercial real estate markets in which we operate, particularly in Atlanta, Charlotte, and Austin where we have high concentrations of our annualized lease revenue; changes to our strategy with regard to land and other non-core holdings that may require impairment losses to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, and the ability to lease newly developed and/or recently acquired space, and the risk of declining leasing rates; the adverse change in the financial condition of one or more of our major tenants; volatility in interest rates and insurance rates; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and to meet regulatory requirements; risks associated with litigation resulting from the transactions with Parkway and from liabilities or contingent liabilities assumed in the transactions with Parkway; risks associated with any errors or omissions in financial or other information of Parkway that has been previously provided to the public; the ability to successfully integrate our operations and employees in connection with the transactions with Parkway and New Parkway; the ability to realize anticipated benefits and synergies of the transactions with Parkway and New Parkway; potential changes to state, local, or federal regulations applicable to our business; material changes in the dividend rates on securities or the ability to pay dividends on common shares or other securities; potential changes to the tax laws impacting REITs and real estate in general; significant costs related to uninsured losses, condemnation, or environmental issues; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission by the Company.

The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws.

|

| | |

| Cousins Properties Incorporated | 3 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| Property Statistics | | | | | | | |

| Consolidated Operating Properties | 12 |

| 11 |

| 11 |

| 11 |

| 25 |

| 25 |

| 26 |

|

| Consolidated Rentable Square Feet (in thousands) | 12,122 |

| 11,993 |

| 11,993 |

| 11,993 |

| 13,024 |

| 13,024 |

| 13,249 |

|

| Unconsolidated Operating Properties | 6 |

| 6 |

| 6 |

| 6 |

| 8 |

| 8 |

| 7 |

|

| Unconsolidated Rentable Square Feet (in thousands) | 3,434 |

| 3,435 |

| 3,435 |

| 3,435 |

| 3,999 |

| 3,999 |

| 3,774 |

|

| Total Operating Properties | 18 |

| 17 |

| 17 |

| 17 |

| 33 |

| 33 |

| 33 |

|

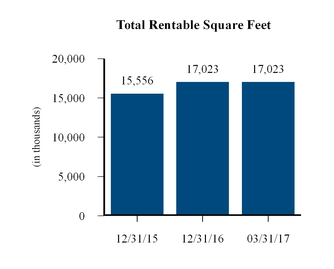

| Total Rentable Square Feet (in thousands) | 15,556 |

| 15,428 |

| 15,428 |

| 15,428 |

| 17,023 |

| 17,023 |

| 17,023 |

|

| | | | | | | | |

| Office Leasing Activity (1) | | | | | | | |

| Net Leased during the period (square feet in thousands) | 2,972 |

| 220 |

| 402 |

| 971 |

| 761 | 2,354 |

| 571 |

|

| Net Rent (per square foot) | $18.30 | $23.55 | $22.73 | $23.51 | $26.32 | $24.52 | $26.10 |

| Total Leasing Costs (per square foot) | (3.64) |

| (6.31) |

| (7.08) |

| (6.18) |

| (6.08) |

| (6.35) |

| (7.44) |

|

| Net Effective Rent (per square foot) | $14.66 | $17.24 | $15.65 | $17.33 | $20.24 | $18.17 | $18.66 |

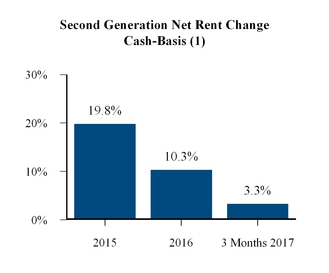

| Change in Second Generation Net Rent | 36.7 | % | 18.9 | % | 17.2 | % | 27.9 | % | 18.7 | % | 20.0 | % | 15.8 | % |

| Change in Cash-Basis Second Generation Net Rent | 19.8 | % | 1.8% |

| 4.3 | % | 9.1 | % | 14.7 | % | 10.3 | % | 3.3 | % |

| | | | | | | | |

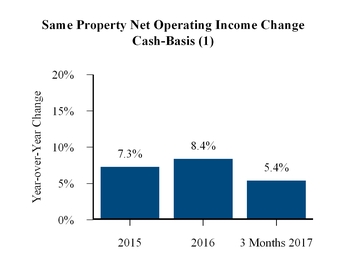

| Same Property Information (2) | | | | | | | |

| Percent Leased (period end) | 91.6 | % | 90.3 | % | 90.7 | % | 91.2 | % | 91.8 | % | 91.8 | % | 92.1 | % |

| Weighted Average Occupancy | 90.7 | % | 89.4 | % | 89.2 | % | 89.5 | % | 89.4 | % | 89.4 | % | 89.9 | % |

| Change in Net Operating Income (over prior year period) | 3.3 | % | 4.3 | % | 1.4 | % | 3.6 | % | 4.4 | % | 6.1 | % | 5.5 | % |

| Change in Cash-Basis Net Operating Income (over prior year period) | 7.3 | % | 8.6 | % | 3.9 | % | 4.3 | % | 7.1 | % | 8.4 | % | 5.4 | % |

| | | | | | | | |

| Development Pipeline | | | | | | | |

| Estimated Project Costs (in thousands) (3) | $261,500 | $326,300 | $340,200 | $506,200 | $512,200 | $512,200 | $529,200 |

| Estimated Project Costs (3) / Total Undepreciated Assets | 7.6 | % | 9.5 | % | 9.6 | % | 13.7 | % | 10.5 | % | 10.5 | % | 10.6 | % |

| | | | | | | | |

| Market Capitalization (4) | | | | | | | |

| Common Stock Price (period end) | $9.43 | $10.38 | $10.40 | $10.44 | $8.51 | $8.51 | $8.27 |

| Common Shares/Units Outstanding (period end in thousands) | 211,513 |

| 210,107 |

| 210,171 |

| 210,170 |

| 401,596 |

| 401,596 |

| 426,823 |

|

| Equity Market Capitalization (in thousands) | $1,994,568 | $2,180,911 | $2,185,778 | $2,194,175 | $3,417,582 | $3,417,582 | $3,529,826 |

| Debt (in thousands) | 947,017 |

| 992,241 |

| 999,999 |

| 1,112,322 |

| 1,632,270 |

| 1,632,270 |

| 1,498,044 |

|

| Total Market Capitalization (in thousands) | $2,941,585 | $3,173,152 | $3,185,777 | $3,306,497 | $5,049,852 | $5,049,852 | $5,027,870 |

| | | | | | | | |

| Credit Ratios (4) | | | | | | | |

| Debt/Total Market Capitalization | 32.2 | % | 31.3 | % | 31.4 | % | 33.6 | % | 32.3 | % | 32.3 | % | 29.8 | % |

| Debt/Total Undepreciated Assets | 27.5 | % | 28.8 | % | 28.3 | % | 30.1 | % | 33.5 | % | 33.5 | % | 30.1 | % |

| Fixed Charges Coverage | 4.84 |

| 4.49 |

| 4.43 |

| 4.46 |

| 5.04 |

| 4.63 |

| 5.13 |

|

| Debt/Annualized EBITDA | 4.00 |

| 4.66 |

| 4.51 |

| 4.76 |

| 5.33 |

| 5.33 |

| 4.60 |

|

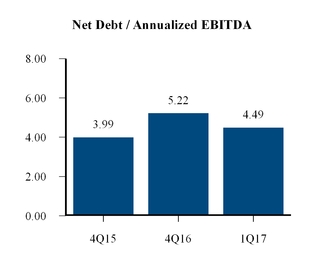

| Net Debt/Annualized EBITDA | 3.99 |

| 4.63 |

| 4.51 |

| 4.34 |

| 5.22 |

| 5.22 |

| 4.49 |

|

|

| | |

| Cousins Properties Incorporated | 4 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| Dividend Information (4) | | | | | | | |

| Common Dividend per Share | $0.32 | $0.08 | $0.08 | $0.08 | $0.06 | $0.30 | $0.06 |

| FFO Payout Ratio | 35.9 | % | 38.9 | % | 38.8 | % | 36.2 | % | 85.9 | % | 46.1 | % | 37.5 | % |

| FAD Payout Ratio | 62.5 | % | 56.7 | % | 62.8 | % | 59.0 | % | 61.7 | % | 60.1 | % | 58.6 | % |

| | | | | | | | |

| Operations Ratios (4) | | | | | | | |

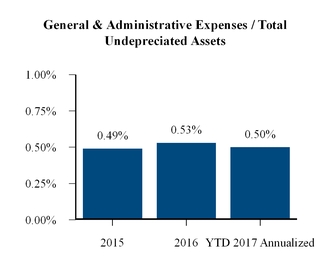

| Annualized General and Administrative Expenses/Total Undepreciated Assets | 0.49 | % | 0.96 | % | 0.53 | % | 0.47 | % | 0.68 | % | 0.53 | % | 0.50 | % |

| | | | | | | | |

| Additional Information (4) | | | | | | | |

| Straight Line Rental Revenue | $20,009 | $3,595 | $3,434 | $3,449 | $8,489 | $18,967 | $9,282 |

| Above and Below Market Rents Amortization | $7,981 | $1,834 | $1,854 | $1,907 | $1,502 | $7,097 | $1,526 |

| Second Generation Capital Expenditures | $54,214 | $7,904 | $13,166 | $13,968 | $11,838 | $46,876 | $10,971 |

| | | | | | | | |

(1) See Office Leasing Activity on page 17 for additional detail and explanations.

(2) Same Property Information is derived from the pool of office properties, as defined, in the period originally reported. See Same Property Performance on page 15 and Non-GAAP Financial Measures - Calculations and Reconciliations on page 32 for additional information.

(3) Cousins' share of development expenditures.

(4) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 29.

|

| | |

| Cousins Properties Incorporated | 5 | Q1 2017 Supplemental Information |

(1) Office properties only.

Note: See additional information included herein for calculations, definitions, and reconciliations to GAAP financial measures.

|

| | |

| Cousins Properties Incorporated | 6 | Q1 2017 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - SUMMARY |

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| | | | | | | | |

| Net Operating Income | | | | | | | |

| Office | $ | 235,210 |

| $ | 57,894 |

| $ | 57,275 |

| $ | 59,873 |

| $ | 77,837 |

| $ | 252,879 |

| $ | 77,942 |

|

| Other | 6,022 |

| 1,619 |

| 1,733 |

| 1,748 |

| 2,302 |

| 7,402 |

| 2,225 |

|

| Total Net Operating Income | 241,232 |

| 59,513 |

| 59,008 |

| 61,621 |

| 80,139 |

| 260,281 |

| 80,167 |

|

| Sales Less Cost of Sales | 3,905 |

| — |

| — |

| — |

| 3,770 |

| 3,770 |

| — |

|

| Fee Income | 7,297 |

| 2,199 |

| 1,824 |

| 1,945 |

| 2,379 |

| 8,347 |

| 1,936 |

|

| Other Income | 2,451 |

| 1,121 |

| 280 |

| 287 |

| 3,837 |

| 5,525 |

| 6,889 |

|

| | | | | | | | |

| Reimbursed Expenses | (3,430 | ) | (870 | ) | (798 | ) | (795 | ) | (796 | ) | (3,259 | ) | (865 | ) |

| General and Administrative Expenses | (16,918 | ) | (8,243 | ) | (4,691 | ) | (4,368 | ) | (8,290 | ) | (25,592 | ) | (6,182 | ) |

| Interest Expense | (38,178 | ) | (9,421 | ) | (9,360 | ) | (9,748 | ) | (12,566 | ) | (41,095 | ) | (12,066 | ) |

| Other Expenses | (1,941 | ) | (465 | ) | (2,640 | ) | (2,175 | ) | (40,704 | ) | (45,984 | ) | (2,391 | ) |

| Depreciation and Amortization of Non-Real Estate Assets | (1,669 | ) | (377 | ) | (335 | ) | (328 | ) | (325 | ) | (1,365 | ) | (451 | ) |

| FFO | $ | 192,749 |

| $ | 43,457 |

| $ | 43,288 |

| $ | 46,439 |

| $ | 27,444 |

| $ | 160,628 |

| $ | 67,037 |

|

| Weighted Average Shares - Diluted | 215,979 |

| 210,974 |

| 210,362 |

| 210,326 |

| 391,413 |

| 256,023 |

| 411,186 |

|

| FFO per Share | 0.89 |

| 0.21 |

| 0.21 |

| 0.22 |

| 0.07 |

| 0.63 |

| 0.16 |

|

|

| | |

| Cousins Properties Incorporated | 7 | Q1 2017 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| | | | | | | | |

| Net Operating Income | | | | | | | |

| Office | | | | | | | |

| Consolidated Properties | | | | | | | |

| Hearst Tower | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 5,957 |

| $ | 5,957 |

| $ | 6,356 |

|

| Northpark Town Center (1) | 22,400 |

| 5,607 |

| 5,097 |

| 5,599 |

| 5,841 |

| 22,144 |

| 5,410 |

|

| Hayden Ferry (1) | — |

| — |

| — |

| — |

| 3,881 |

| 3,881 |

| 5,209 |

|

| Fifth Third Center | 14,956 |

| 4,238 |

| 4,349 |

| 4,451 |

| 4,463 |

| 17,501 |

| 4,842 |

|

| Corporate Center (1) | — |

| — |

| — |

| — |

| 5,005 |

| 5,005 |

| 4,761 |

|

| Promenade | 13,985 |

| 3,740 |

| 3,419 |

| 3,839 |

| 3,557 |

| 14,555 |

| 4,173 |

|

| San Jacinto Center | — |

| — |

| — |

| — |

| 3,456 |

| 3,456 |

| 4,038 |

|

| One Eleven Congress | — |

| — |

| — |

| — |

| 3,256 |

| 3,256 |

| 3,713 |

|

| Colorado Tower | 6,768 |

| 2,724 |

| 3,064 |

| 3,221 |

| 3,399 |

| 12,408 |

| 3,383 |

|

| The American Cancer Society Center | 12,432 |

| 3,310 |

| 3,151 |

| 3,198 |

| 3,231 |

| 12,890 |

| 3,342 |

|

| 3344 Peachtree | — |

| — |

| — |

| — |

| 3,505 |

| 3,505 |

| 3,235 |

|

| One Buckhead Plaza | — |

| — |

| — |

| — |

| 2,817 |

| 2,817 |

| 3,097 |

|

| 816 Congress Avenue | 8,526 |

| 2,468 |

| 2,555 |

| 2,514 |

| 2,363 |

| 9,900 |

| 2,694 |

|

| NASCAR Plaza | — |

| — |

| — |

| — |

| 2,507 |

| 2,507 |

| 2,477 |

|

| 3350 Peachtree | — |

| — |

| — |

| — |

| 2,006 |

| 2,006 |

| 2,264 |

|

| Tempe Gateway | — |

| — |

| — |

| — |

| 1,966 |

| 1,966 |

| 2,008 |

|

| Bank of America Center | — |

| — |

| — |

| — |

| 1,451 |

| 1,451 |

| 1,507 |

|

| 3348 Peachtree | — |

| — |

| — |

| — |

| 1,541 |

| 1,541 |

| 1,491 |

|

| Two Buckhead Plaza | — |

| — |

| — |

| — |

| 1,369 |

| 1,369 |

| 1,321 |

|

| One Orlando Centre | — |

| — |

| — |

| — |

| 795 |

| 795 |

| 1,277 |

|

| The Pointe | — |

| — |

| — |

| — |

| 1,227 |

| 1,227 |

| 1,146 |

|

| Citrus Center | — |

| — |

| — |

| — |

| 1,019 |

| 1,019 |

| 1,006 |

|

| Meridian Mark Plaza | 3,777 |

| 908 |

| 857 |

| 954 |

| 955 |

| 3,674 |

| 989 |

|

| Harborview Plaza | — |

| — |

| — |

| — |

| 898 |

| 898 |

| 930 |

|

| Research Park V | — |

| — |

| 144 |

| 288 |

| 412 |

| 844 |

| 359 |

|

| Other (2) | 30,664 |

| 4,531 |

| 4,300 |

| 4,388 |

| 3,097 |

| 16,316 |

| 6 |

|

| Subtotal - Office Consolidated | 113,508 |

| 27,526 |

| 26,936 |

| 28,452 |

| 69,974 |

| 152,888 |

| 71,034 |

|

| | | | | | | | |

| Unconsolidated Properties (3) | | | | | | | |

| Terminus 100 | 7,268 |

| 1,872 |

| 1,978 |

| 1,899 |

| 1,837 |

| 7,586 |

| 1,912 |

|

| Terminus 200 | 6,069 |

| 1,658 |

| 1,770 |

| 1,678 |

| 1,648 |

| 6,754 |

| 1,798 |

|

| Gateway Village (4) | 1,208 |

| 536 |

| 451 |

| 460 |

| 1,003 |

| 2,450 |

| 1,751 |

|

| Emory University Hospital Midtown Medical Office Tower | 3,974 |

| 987 |

| 1,000 |

| 975 |

| 1,008 |

| 3,970 |

| 989 |

|

| Courvoisier Centre | — |

| — |

| — |

| — |

| 410 |

| 410 |

| 462 |

|

| 111 West Rio (US Airways Bldg) | — |

| — |

| — |

| — |

| 220 |

| 220 |

| — |

|

| Other | (18 | ) | (3 | ) | 14 |

| 1 |

| (2 | ) | 10 |

| (4 | ) |

| Subtotal - Office Unconsolidated | 18,501 |

| 5,050 |

| 5,213 |

| 5,013 |

| 6,124 |

| 21,400 |

| 6,908 |

|

| | | | | | | | |

| Discontinued Operations (5) | 103,201 |

| 25,318 |

| 25,126 |

| 26,408 |

| 1,739 |

| 78,591 |

| — |

|

| | | | | | | | |

| Total Office Net Operating Income | 235,210 |

| 57,894 |

| 57,275 |

| 59,873 |

| 77,837 |

| 252,879 |

| 77,942 |

|

| | | | | | | | |

| Other | | | | | | | |

| Consolidated Properties | | | | | | | |

| Other | 191 |

| 23 |

| (8 | ) | 1 |

| — |

| 16 |

| (43 | ) |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 8 | Q1 2017 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| | | | | | | | |

| Unconsolidated Properties (3) | | | | | | | |

| Emory Point Apartments (Phase I) | 4,699 |

| 1,185 |

| 1,250 |

| 1,014 |

| 1,092 |

| 4,541 |

| 1,133 |

|

| Emory Point Apartments (Phase II) | 181 |

| 96 |

| 204 |

| 408 |

| 768 |

| 1,476 |

| 745 |

|

| Emory Point Retail (Phase I) | 894 |

| 248 |

| 218 |

| 247 |

| 277 |

| 990 |

| 293 |

|

| Emory Point Retail (Phase II) | 80 |

| 72 |

| 75 |

| 84 |

| 171 |

| 402 |

| 103 |

|

| Other | (20 | ) | (5 | ) | (6 | ) | (6 | ) | (6 | ) | (23 | ) | (6 | ) |

| Subtotal - Other Unconsolidated | 5,834 |

| 1,596 |

| 1,741 |

| 1,747 |

| 2,302 |

| 7,386 |

| 2,268 |

|

| | | | | | | | |

| Discontinued Operations | (3 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| | | |

|

| | | |

| Total Other Net Operating Income | 6,022 |

| 1,619 |

| 1,733 |

| 1,748 |

| 2,302 |

| 7,402 |

| 2,225 |

|

| | | | | | | | |

| Total Net Operating Income | 241,232 |

| 59,513 |

| 59,008 |

| 61,621 |

| 80,139 |

| 260,281 |

| 80,167 |

|

| | | | | | | | |

| Sales Less Cost of Sales | | | | | | | |

| Land Sales Less Cost of Sales - Consolidated | 1,625 |

| — |

| — |

| — |

| 3,580 |

| 3,580 |

| — |

|

| Land Sales Less Cost of Sales - Unconsolidated (3) | 2,280 |

| — |

| — |

| — |

| 190 |

| 190 |

| — |

|

| Total Sales Less Cost of Sales | 3,905 |

| — |

| — |

| — |

| 3,770 |

| 3,770 |

| — |

|

| | | | | | | | |

| Fee Income | | | | | | | |

| Management Fees (6) | 5,188 |

| 1,325 |

| 1,263 |

| 1,253 |

| 1,317 |

| 5,158 |

| 1,402 |

|

| Development Fees | 1,778 |

| 608 |

| 486 |

| 549 |

| 634 |

| 2,277 |

| 432 |

|

| Leasing & Other Fees | 331 |

| 266 |

| 75 |

| 143 |

| 428 |

| 912 |

| 102 |

|

| Total Fee Income | 7,297 |

| 2,199 |

| 1,824 |

| 1,945 |

| 2,379 |

| 8,347 |

| 1,936 |

|

| | | | | | | | |

| Other Income | | | | | | | |

| Termination Fees | 817 |

| — |

| — |

| — |

| 3,122 |

| 3,122 |

| 6,197 |

|

| Interest and Other Income | 460 |

| 390 |

| 27 |

| 153 |

| 358 |

| 928 |

| 347 |

|

| Other - Unconsolidated (3) | 747 |

| 546 |

| 151 |

| 134 |

| 357 |

| 1,188 |

| 345 |

|

| Interest and Other Income - Discontinued Operations | (23 | ) | (1 | ) | — |

| — |

| — |

| (1 | ) | — |

|

| Termination Fees - Discontinued Operations (5) | 450 |

| 186 |

| 102 |

| — |

| — |

| 288 |

| — |

|

| Total Other Income | 2,451 |

| 1,121 |

| 280 |

| 287 |

| 3,837 |

| 5,525 |

| 6,889 |

|

| | | | | | | | |

| Total Fee and Other Income | 9,748 |

| 3,320 |

| 2,104 |

| 2,232 |

| 6,216 |

| 13,872 |

| 8,825 |

|

| | | | | | | | |

| Reimbursed Expenses | (3,430 | ) | (870 | ) | (798 | ) | (795 | ) | (796 | ) | (3,259 | ) | (865 | ) |

| | | | | | | | |

| General and Administrative Expenses | (16,918 | ) | (8,243 | ) | (4,691 | ) | (4,368 | ) | (8,290 | ) | (25,592 | ) | (6,182 | ) |

| | | | | | | | |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 9 | Q1 2017 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| | | | | | | | |

| Interest Expense | | | | | | | |

| Consolidated Debt | | |

|

| | | |

| The American Cancer Society Center | (8,599 | ) | (2,126 | ) | (2,119 | ) | (2,134 | ) | (2,127 | ) | (8,506 | ) | (2,073 | ) |

| Term Loan | — |

| — |

| — |

| — |

| (386 | ) | (386 | ) | (1,288 | ) |

| Fifth Third Center | — |

| — |

| — |

| (427 | ) | (1,275 | ) | (1,702 | ) | (1,272 | ) |

| Promenade | (4,734 | ) | (1,165 | ) | (1,157 | ) | (1,150 | ) | (1,142 | ) | (4,614 | ) | (1,134 | ) |

| Colorado Tower | — |

| — |

| — |

| (353 | ) | (1,059 | ) | (1,412 | ) | (1,059 | ) |

| Unsecured Credit Facility | (4,089 | ) | (832 | ) | (1,053 | ) | (870 | ) | (1,159 | ) | (3,914 | ) | (1,035 | ) |

| 816 Congress Avenue | (3,269 | ) | (817 | ) | (817 | ) | (817 | ) | (817 | ) | (3,268 | ) | (814 | ) |

| One Eleven Congress | — |

| — |

| — |

| — |

| (800 | ) | (800 | ) | (716 | ) |

| San Jacinto Center | — |

| — |

| — |

| — |

| (632 | ) | (632 | ) | (567 | ) |

| 3344 Peachtree | — |

| — |

| — |

| — |

| (460 | ) | (460 | ) | (505 | ) |

| Meridian Mark Plaza | (1,538 | ) | (381 | ) | (379 | ) | (377 | ) | (375 | ) | (1,512 | ) | (373 | ) |

| Two Buckhead Plaza | — |

| — |

| — |

| — |

| (324 | ) | (324 | ) | (319 | ) |

| The Pointe | — |

| — |

| — |

| — |

| (171 | ) | (171 | ) | (176 | ) |

| Other | (4,085 | ) | (861 | ) | (860 | ) | (856 | ) | (1,070 | ) | (3,647 | ) | — |

|

| Capitalized | 3,577 |

| 742 |

| 1,016 |

| 1,230 |

| 1,709 |

| 4,697 |

| 1,590 |

|

| Subtotal - Consolidated | (22,737 | ) | (5,440 | ) | (5,369 | ) | (5,754 | ) | (10,088 | ) | (26,651 | ) | (9,741 | ) |

| | | | | | | | |

| Unconsolidated Debt (3) | | |

|

| | | |

| Terminus 100 | (3,436 | ) | (848 | ) | (844 | ) | (840 | ) | (836 | ) | (3,368 | ) | (831 | ) |

| Emory Point | (1,126 | ) | (439 | ) | (464 | ) | (484 | ) | (542 | ) | (1,929 | ) | (535 | ) |

| Terminus 200 | (1,560 | ) | (390 | ) | (389 | ) | (387 | ) | (385 | ) | (1,551 | ) | (383 | ) |

| Emory University Hospital Midtown Medical Office Tower | (1,333 | ) | (330 | ) | (329 | ) | (327 | ) | (325 | ) | (1,311 | ) | (324 | ) |

| Courvoisier Centre | — |

| — |

| — |

| — |

| (239 | ) | (239 | ) | (252 | ) |

| Other | — |

| — |

| — |

| — |

| (25 | ) | (25 | ) | — |

|

| Subtotal - Unconsolidated | (7,455 | ) | (2,007 | ) | (2,026 | ) | (2,038 | ) | (2,352 | ) | (8,423 | ) | (2,325 | ) |

| | | | | | | | |

| Discontinued Operations (5) | (7,986 | ) | (1,974 | ) | (1,965 | ) | (1,956 | ) | (126 | ) | (6,021 | ) | — |

|

| | | | | | | | |

| Total Interest Expense | (38,178 | ) | (9,421 | ) | (9,360 | ) | (9,748 | ) | (12,566 | ) | (41,095 | ) | (12,066 | ) |

| | | | | | | | |

| Other Expenses | | | | | | | |

| Transaction Costs - Merger | — |

| (19 | ) | (2,424 | ) | (1,446 | ) | (20,633 | ) | (24,522 | ) | (1,930 | ) |

| Property Taxes and Other Holding Costs | (828 | ) | (89 | ) | (98 | ) | (95 | ) | (158 | ) | (440 | ) | (304 | ) |

| Predevelopment & Other | (522 | ) | (108 | ) | (118 | ) | (140 | ) | (577 | ) | (943 | ) | (129 | ) |

| Severance | (181 | ) | (249 | ) | — |

| — |

| — |

| (249 | ) | (28 | ) |

| Transaction Costs - Spin-off | — |

| — |

| — |

| (494 | ) | (5,855 | ) | (6,349 | ) | — |

|

| Loss on Extinguishment of Debt | — |

| — |

| — |

| — |

| (5,180 | ) | (5,180 | ) | — |

|

| Impairment Losses (7) | — |

| — |

| — |

| — |

| (4,526 | ) | (4,526 | ) | — |

|

| Acquisition Costs | (299 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Partners' share of FFO in consolidated joint ventures | (111 | ) | — |

| — |

| — |

| (3,775 | ) | (3,775 | ) | — |

|

| Total Other Expenses | (1,941 | ) | (465 | ) | (2,640 | ) | (2,175 | ) | (40,704 | ) | (45,984 | ) | (2,391 | ) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 10 | Q1 2017 Supplemental Information |

|

| | |

| FUNDS FROM OPERATIONS - DETAIL |

|

| | | | | | | | | | | | | | | | | | | | | |

| | 2015 | 2016 1st | 2016 2nd | 2016 3rd | 2016 4th | 2016 | 2017 1st |

| | | | | | | | |

| Depreciation and Amortization of Non-Real Estate Assets | | | | | | | |

| Consolidated | (1,621 | ) | (377 | ) | (335 | ) | (328 | ) | (325 | ) | (1,365 | ) | (451 | ) |

| Unconsolidated (3) | (48 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Total Depreciation and Amortization of Non-Real Estate Assets | (1,669 | ) | (377 | ) | (335 | ) | (328 | ) | (325 | ) | (1,365 | ) | (451 | ) |

| | | | | | | | |

| | | | | | | | |

| FFO | 192,749 |

| 43,457 |

| 43,288 |

| 46,439 |

| 27,444 |

| 160,628 |

| 67,037 |

|

| Weighted Average Shares - Diluted | 215,979 |

| 210,974 |

| 210,362 |

| 210,326 |

| 391,413 |

| 256,023 |

| 411,186 |

|

| FFO per Share | 0.89 |

| 0.21 |

| 0.21 |

| 0.22 |

| 0.07 |

| 0.63 |

| 0.16 |

|

|

| | | | | | | | | | | | | | | | | |

| Note: Amounts may differ slightly from other schedules contained herein due to rounding. |

| (1) Contains multiple buildings that are grouped together for reporting purposes. |

| (2) Represents properties sold and loans repaid prior to March 31, 2017 that are not considered discontinued operations. |

(3) Unconsolidated amounts include amounts recorded in unconsolidated joint ventures for the respective category multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes including these amounts in the categories indicated is meaningful to investors and analysts. |

(4) Through December 1, 2016, the Company received an 11.46% current return on its $11.1 million investment in Gateway Village and, when certain other revenue criteria were met, received additional returns. The Company recognized these amounts as NOI from this venture. After December 1, 2016, net income and cash flows were allocated 50% to each joint venture member. |

| (5) Primarily represents Greenway Plaza and Post Oak Central. |

| (6) Management Fees include reimbursement of expenses that are included in the "Reimbursed Expenses" line item. |

| (7) Represents an impairment charge on Callaway Gardens land as a result of the Company withdrawing from the joint venture. |

|

| | |

| Cousins Properties Incorporated | 11 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description |

| Metropolitan Area |

| Rentable Square Feet |

| Financial Statement Presentation |

| Company's Ownership Interest |

| End of Period Leased 1Q17 | | End of Period Leased 4Q16 |

| Weighted Average Occupancy 1Q17 | | Weighted Average Occupancy 4Q16 |

| % of Total

Net Operating

Income (1) | | Property Level Debt ($000) (2) |

| OFFICE PROPERTIES |

|

|

|

|

|

|

|

|

|

| | |

|

| | |

|

|

|

|

| Northpark Town Center (3) | | Atlanta | | 1,528,000 |

| | Consolidated | | 100% | | 90.6% | | 85.2% | | 84.5% | | 85.1% | | 6.8% | | $ | — |

|

| Promenade | | Atlanta | | 777,000 |

| | Consolidated | | 100% | | 94.4% | | 94.5% | | 93.4% | | 91.6% | | 5.2% | | 104,278 |

|

| | The American Cancer Society Center | | Atlanta | | 996,000 |

| | Consolidated | | 100% | | 85.9% | | 85.9% | | 85.6% | | 83.2% | | 4.2% | | 126,961 |

|

| | 3344 Peachtree | | Atlanta | | 484,000 |

| | Consolidated | | 100% | | 90.6% | | 96.1% | | 90.1% | | 93.4% | | 4.0% | | 79,311 |

|

| | One Buckhead Plaza | | Atlanta | | 461,000 |

| | Consolidated | | 100% | | 94.3% | | 94.2% | | 92.5% | | 94.0% | | 3.9% | | — |

|

| | 3350 Peachtree | | Atlanta | | 413,000 |

| | Consolidated | | 100% | | 92.9% | | 92.9% | | 92.9% | | 92.9% | | 2.8% | | — |

|

| Terminus 100 | | Atlanta | | 660,000 |

| | Unconsolidated | | 50% | | 90.6% | | 90.6% | | 88.2% | | 90.0% | | 2.4% | | 62,929 |

|

| Terminus 200 | | Atlanta | | 566,000 |

| | Unconsolidated | | 50% | | 96.4% | | 96.4% | | 95.8% | | 91.3% | | 2.2% | | 40,219 |

|

| | 3348 Peachtree | | Atlanta | | 258,000 |

| | Consolidated | | 100% | | 90.6% | | 91.2% | | 91.0% | | 92.8% | | 1.9% | | — |

|

| | Two Buckhead Plaza | | Atlanta | | 210,000 |

| | Consolidated | | 100% | | 84.5% | | 83.1% | | 83.1% | | 81.1% | | 1.6% | | 52,999 |

|

| | Meridian Mark Plaza | | Atlanta | | 160,000 |

| | Consolidated | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 1.2% | | 24,315 |

|

| | Emory University Hospital Midtown Medical Office Tower | | Atlanta | | 358,000 |

| | Unconsolidated | | 50% | | 94.9% | | 96.2% | | 95.6% | | 97.0% | | 1.2% | | 36,077 |

|

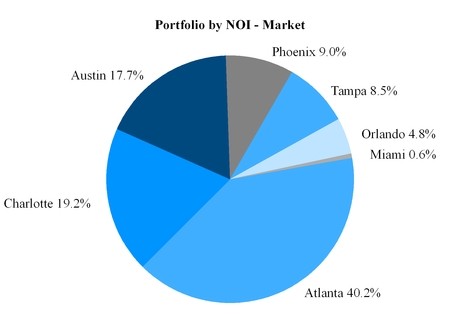

| ATLANTA | | | | 6,871,000 |

| | | | | | 91.2% | | 90.3% | | 89.1% | | 89.0% | | 37.4% | | 527,089 |

|

| | | | | | | | | | | | | | | | | | | | | |

| | Hearst Tower | | Charlotte | | 966,000 |

| | Consolidated | | 100% | | 98.7% | | 98.7% | | 98.4% | | 97.1% | | 7.9% | | — |

|

| | Fifth Third Center | | Charlotte | | 698,000 |

| | Consolidated | | 100% | | 96.7% | | 96.7% | | 96.6% | | 95.9% | | 6.0% | | 148,153 |

|

| | NASCAR Plaza | | Charlotte | | 394,000 |

| | Consolidated | | 100% | | 98.2% | | 98.2% | | 98.2% | | 95.3% | | 3.1% | | — |

|

| | Gateway Village | | Charlotte | | 1,061,000 |

| | Unconsolidated | | 50% | | 99.4% | | 99.3% | | 99.4% | | 94.9% | | 2.2% | | — |

|

| | CHARLOTTE | | | | 3,119,000 |

| | | | | | 98.2% | | 98.2% | | 98.1% | | 96.0% | | 19.2% | | 148,153 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | San Jacinto Center | | Austin | | 406,000 |

| | Consolidated | | 100% | | 99.7% | | 99.8% | | 99.7% | | 99.4% | | 5.0% | | 101,602 |

|

| | One Eleven Congress | | Austin | | 519,000 |

| | Consolidated | | 100% | | 90.5% | | 90.6% | | 82.0% | | 81.7% | | 4.6% | | 128,771 |

|

| Colorado Tower | | Austin | | 373,000 |

| | Consolidated | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 4.2% | | 119,093 |

|

| 816 Congress | | Austin | | 435,000 |

| | Consolidated | | 100% | | 95.0% | | 93.2% | | 92.8% | | 91.1% | | 3.4% | | 83,862 |

|

| Research Park V | | Austin | | 173,000 |

| | Consolidated | | 100% | | 97.1% | | 97.1% | | 56.1% | | 41.3% | | 0.5% | | — |

|

| AUSTIN | | | | 1,906,000 |

| | | | | | 95.9% | | 95.6% | | 89.4% | | 87.5% | | 17.7% | | 433,328 |

|

| | | | | | | | | | | | | | | | | | | | | |

| | Corporate Center (3) | | Tampa | | 1,224,000 |

| | Consolidated | | 100% | | 94.2% | | 84.4% | | 84.0% | | 81.8% | | 5.9% | | — |

|

| | The Pointe | | Tampa | | 253,000 |

| | Consolidated | | 100% | | 92.7% | | 96.2% | | 90.7% | | 96.1% | | 1.4% | | 23,209 |

|

| | Harborview Plaza | | Tampa | | 205,000 |

| | Consolidated | | 100% | | 98.0% | | 98.0% | | 98.0% | | 98.0% | | 1.2% | | — |

|

| | TAMPA | | | | 1,682,000 |

| | | | | | 94.5% | | 87.8% | | 86.8% | | 85.9% | | 8.5% | | 23,209 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Hayden Ferry (3) | | Phoenix | | 789,000 |

| | Consolidated | | 100% | | 93.8% | | 93.8% | | 88.4% | | 88.0% | | 6.5% | | — |

|

| Tempe Gateway |

| Phoenix |

| 264,000 |

|

| Consolidated |

| 100% |

| 98.4% | | 98.4% | | 98.4% | | 98.4% | | 2.5% | | — |

|

| 111 West Rio (US Airways Bldg) |

| Phoenix |

| 225,000 |

|

| Consolidated |

| 100% |

| 100.0% | | 100.0% |

| —% | | —% |

| —% |

| — |

|

| | PHOENIX | | | | 1,278,000 |

| | | | | | 95.9% | | 95.9% | | 74.9% | | 74.7% | | 9.0% | | — |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Bank of America Center | | Orlando | | 421,000 |

| | Consolidated | | 100% | | 87.2% | | 87.7% | | 86.9% | | 88.3% | | 1.9% | | — |

|

| | One Orlando Centre | | Orlando | | 356,000 |

| | Consolidated | | 100% | | 82.6% | | 82.4% | | 80.2% | | 73.2% | | 1.6% | | — |

|

| | Citrus Center | | Orlando | | 261,000 |

| | Consolidated | | 100% | | 92.1% | | 94.3% | | 91.5% | | 91.6% | | 1.3% | | — |

|

| | ORLANDO | | | | 1,038,000 |

| | | | | | 86.8% | | 87.5% | | 85.7% | | 84.0% | | 4.8% | | — |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Courvoisier Centre (3) | | Miami | | 343,000 |

| | Unconsolidated | | 20% | | 87.7% | | 86.5% | | 86.0% | | 84.1% | | 0.6% | | 22,282 |

|

| | MIAMI | | | | 343,000 |

| | | | | | 87.7% | | 86.5% | | 86.0% | | 84.1% | | 0.6% | | 22,282 |

|

| | | | | | | | | | | | | | | | | | | | | | |

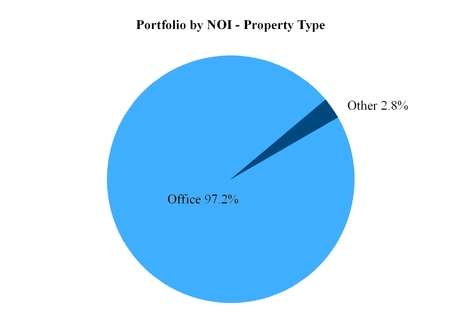

| | TOTAL OFFICE PROPERTIES | | | | 16,237,000 |

| | | | | | 93.5% | | 92.4% | | 89.0% | | 88.1% | | 97.2% | | $ | 1,154,061 |

|

| | | | | | | | | | | | | | | | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 12 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Property Description | | Metropolitan Area | | Rentable Square Feet | | Financial Statement Presentation | | Company's Ownership Interest | | End of Period Leased 1Q17 | | End of Period Leased 4Q16 | | Weighted Average Occupancy 1Q17 | | Weighted Average Occupancy 4Q16 | | % of Total

Net Operating

Income (1) | | Property Level Debt ($000) (2) |

| | OTHER PROPERTIES | | | | | | | | | | | | | | | | | | | | |

| | Emory Point Apartments (Phase I) (4) | | Atlanta | | 404,000 |

| | Unconsolidated | | 75% | | 95.0% | | 95.9% | | 95.2% | | 95.3% | | 1.4% | | 36,231 |

|

| | Emory Point Apartments (Phase II) (4) | | Atlanta | | 257,000 |

| | Unconsolidated | | 75% | | 94.1% | | 91.9% | | 92.6% | | 87.9% | | 0.9% | | 28,676 |

|

| | Emory Point Retail (Phase I) | | Atlanta | | 80,000 |

| | Unconsolidated | | 75% | | 78.8% | | 90.0% | | 82.6% | | 86.5% | | 0.4% | | 7,175 |

|

| | Emory Point Retail (Phase II) | | Atlanta | | 45,000 |

| | Unconsolidated | | 75% | | 79.1% | | 78.9% | | 77.0% | | 75.0% | | 0.1% | | 5,021 |

|

| | TOTAL OTHER PROPERTIES | | | | 786,000 |

| | | | | | 92.1% | | 93.0% | | 92.0% | | 90.8% | | 2.8% | | 77,103 |

|

| | TOTAL PORTFOLIO | | | | 17,023,000 |

| | | | | | | | | | | | | | 100% | | 1,231,164 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Net Operating Income represents the Company's share of rental property revenues less rental property operating expenses for the three months ended March 31, 2017. |

| (2) | Property level debt represents the Company's share of total debt as of March 31, 2017. |

| (3) | Contains multiple buildings that are grouped together for reporting purposes. |

| (4) | Phase I consists of 443 units, and Phase II consists of 307 units. | | |

|

| | |

| Cousins Properties Incorporated | 13 | Q1 2017 Supplemental Information |

|

| | |

| Cousins Properties Incorporated | 14 | Q1 2017 Supplemental Information |

|

| | |

| SAME PROPERTY PERFORMANCE (1) |

|

| | | | | | | | | | |

| | COUSINS PROPERTIES INCORPORATED |

| | Net Operating Income ($ in thousands) |

| | Three Months Ended |

| | March 31, 2017 |

| | March 31, 2016 |

| | 1Q17 vs. 1Q16

% Change |

| Property Revenues (2) | $ | 41,754 |

| | $ | 39,699 |

| | 5.2 | % |

| Property Operating Expenses (2) | 15,608 |

| | 14,913 |

| | 4.7 | % |

| Property Net Operating Income | $ | 26,146 |

| | $ | 24,786 |

| | 5.5 | % |

| | | | | | |

| Cash Basis Property Revenues (3) | $ | 39,351 |

| | $ | 37,439 |

| | 5.1 | % |

| Cash Basis Property Operating Expenses (4) | 15,620 |

| | 14,925 |

| | 4.7 | % |

| Cash Basis Property Net Operating Income | $ | 23,731 |

| | $ | 22,514 |

| | 5.4 | % |

| | | | | | |

| End of Period Leased | 92.1 | % | | 89.5 | % | | |

| Weighted Average Occupancy | 89.9 | % | | 88.8 | % | | |

| | | | | | |

|

| | | |

| (1) | Same Properties include those office properties that were operational and stabilized on January 1, 2016, excluding properties subsequently sold. See Non-GAAP Financial Measures - Calculation and Reconciliations. Properties included in this reporting period are as follows: |

| | North Park Town Center | Emory University Hospital Midtown Medical Office Tower | Meridian Mark Plaza |

| | Promenade | Terminus 100 | Terminus 200 |

| | 816 Congress | Fifth Third Center | The American Cancer Society Center |

| | | | |

| (2) | Property Revenues and Expenses include results for the Company and its share of unconsolidated joint ventures. Net operating income for unconsolidated joint ventures is calculated as property revenue less property expenses at the joint ventures multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures, but believes that including these amounts with consolidated net operating income is meaningful to investors and analysts. |

| (3) | Cash Basis Same Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Property Revenues, excluding straight-line rents, amortization of lease inducements, and amortization of acquired above and below market rents. |

| (4) | Cash Basis Same Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. |

|

| | |

| Cousins Properties Incorporated | 15 | Q1 2017 Supplemental Information |

|

| | |

| SAME PROPERTY PERFORMANCE (1) |

|

| | | | | | | | | | |

| | LEGACY PARKWAY PROPERTIES |

| | Net Operating Income ($ in thousands) |

| | Three Months Ended |

| | March 31, 2017 |

| | March 31, 2016 |

| | 1Q17 vs. 1Q16

% Change |

| Cash Basis Property Revenues (2) | $ | 60,977 |

| | $ | 55,953 |

| | 9.0 | % |

| Cash Basis Property Operating Expenses (3) | 24,206 |

| | 23,007 |

| | 5.2 | % |

| Cash Basis Property Net Operating Income | $ | 36,771 |

| | $ | 32,946 |

| | 11.6 | % |

| | | | | | |

| End of Period Leased | 93.6 | % | | 89.3 | % | | |

| Weighted Average Occupancy | 90.8 | % | | 88.8 | % | | |

|

| | | |

| (1) | Same Properties include those office properties that were operational and stabilized on January 1, 2016, excluding properties subsequently sold. Properties included in this reporting period are as follows: |

| | 3344 Peachtree | Harborview Plaza | One Orlando Centre |

| | 3348 Peachtree | Hayden Ferry (4) | San Jacinto Center |

| | 3350 Peachtree | Hearst Tower | Tempe Gateway |

| | Bank of America Center | NASCAR Plaza | The Pointe |

| | Citrus Center | One Buckhead Plaza | Two Buckhead Plaza |

| | Corporate Center | One Eleven Congress | |

| | | | |

| (2) | Cash Basis Same Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Property Revenues, excluding straight-line rents, amortization of lease inducements, and amortization of acquired above and below market rents. |

| (3) | Cash Basis Same Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. |

| (4) | Hayden Ferry Building III commenced operations in November 2015 and is excluded from Same Property pool. |

|

| | |

| Cousins Properties Incorporated | 16 | Q1 2017 Supplemental Information |

|

| | |

| OFFICE LEASING ACTIVITY(1) |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2017 |

| | New | | Renewal | | Expansion | | Total |

| Gross leased (square feet) | | | | | | | 633,236 |

| Less: Leases one year or less, amenity leases, percentage rent leases, storage leases, intercompany leases, and license agreements | | | | | | | (62,492) |

| Net leased (square feet) | 423,428 |

| | 107,262 |

| | 40,054 |

| | 570,744 |

| Number of transactions | 21 |

| | 16 |

| | 3 |

| | 40 |

| Lease term (years) (2) | 10.6 |

| | 4.5 |

| | 5.0 |

| | 9.1 |

| | | | | | | | |

| Net rent (per square foot) (3) | $ | 25.71 |

| | $ | 27.70 |

| | $ | 25.94 |

| | $ | 26.10 |

|

| Total leasing costs (per square foot) (4) | (7.99 | ) | | (4.95 | ) | | (8.22 | ) | | (7.44 | ) |

| Net effective rent (per square foot) | $ | 17.72 |

| | $ | 22.75 |

| | $ | 17.72 |

| | $ | 18.66 |

|

| | | | | | | | |

| Second generation leased square feet (5) | | | | | | | 311,772 |

|

| Increase in second generation net rent (2)(3)(5) | | | | 15.8 | % |

| Increase in cash basis second generation net rent (2)(5)(6) | | 3.3 | % |

| | | | | | | | |

| (1) Excludes apartment and retail leasing at our mixed-use projects. |

| (2) Weighted average. |

| (3) Represents straight-lined net rent per square foot (operating expenses deducted from gross leases) over the lease term. |

| (4) Includes tenant improvements, external leasing commissions, and free rent. |

| (5) Excludes leases executed for spaces that were vacant upon acquisition, new leases in development properties, and leases for spaces that have been vacant for one year or more. |

| (6) Represents increase in net rent at the end of term paid by the prior tenant compared to net rent at beginning of term paid by the current tenant. For early renewals, represents increase in net rent at the end of the term of the original lease compared to net rent at the beginning of the extended term of the lease. |

|

| | |

| Cousins Properties Incorporated | 17 | Q1 2017 Supplemental Information |

|

| | |

| OFFICE LEASE EXPIRATIONS (1) |

Lease Expirations by Year

|

| | | | | | | | | | | | | | | | | |

| Year of Expiration |

| Square Feet

Expiring |

| % of Leased Space |

| Annual Contractual Rents ($000's) (2) |

| % of Total Annual Contractual Rents |

| Annual Contractual Rent/Sq. Ft. (2) |

| | | | | | | | | | | |

| 2017 | | 586,147 |

| | 4.3 | % | | $ | 15,683 |

| | 3.7 | % | | $ | 26.76 |

|

| 2018 | | 936,805 |

| | 6.8 | % | | 27,544 |

| | 6.6 | % | | 29.40 |

|

| 2019 | | 1,103,756 |

| | 8.1 | % | | 32,771 |

| | 7.8 | % | | 29.69 |

|

| 2020 | | 1,048,718 |

| | 7.7 | % | | 31,498 |

| | 7.5 | % | | 30.03 |

|

| 2021 | | 1,731,910 |

| | 12.7 | % | | 51,750 |

| | 12.3 | % | | 29.88 |

|

| 2022 | | 2,108,217 |

| | 15.4 | % | | 59,697 |

| | 14.1 | % | | 28.32 |

|

| 2023 | | 1,007,105 |

| | 7.4 | % | | 30,801 |

| | 7.3 | % | | 30.58 |

|

| 2024 | | 945,998 |

| | 6.9 | % | | 34,067 |

| | 8.1 | % | | 36.01 |

|

| 2025 | | 1,035,367 |

| | 7.6 | % | | 35,132 |

| | 8.3 | % | | 33.93 |

|

| 2026 & Thereafter | | 3,186,328 |

| | 23.1 | % | | 102,854 |

| | 24.3 | % | | 32.28 |

|

| | | | | | | | | | | |

| Total | | 13,690,351 |

| | 100.0 | % | | $ | 421,797 |

| | 100.0 | % | | $ | 30.81 |

|

Lease Expirations Greater than 100,000 Square Feet Through Year End 2020

|

| | | | | | | | | |

| Expiration Date | | Tenant | | Market | | Building | | Square Feet Expiring |

| January 2019 | | National Union Fire Insurance Company | | Atlanta | | Northpark Town Center | | 105,362 |

|

| April 2020 | | CO Space Properties LLC | | Atlanta | | American Cancer Society Center | | 120,298 |

|

|

| | | |

| (1) Company's share. |

(2) Annual Contractual Rent shown is the rate in the year of expiration. It includes the minimum contractual rent paid by the tenant which may or may not include a base year of operating expenses depending upon the terms of the lease.

|

| | | | |

|

| | |

| Cousins Properties Incorporated | 18 | Q1 2017 Supplemental Information |

|

| | |

| OFFICE LEASE EXPIRATIONS (1) |

Note: Company's share

|

| | |

| Cousins Properties Incorporated | 19 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | | | | |

| | Tenant (1) | | Number of Buildings Occupied | | Number of Markets Occupied | | Company's Share of Square Footage | | Company's Share of Annualized Base Rent (2) | | Percentage of Total Company's Share of Annualized Base Rent | | Average Remaining Lease Term (Years) (3) |

| 1 |

| Bank of America | | 4 | | 2 | | 1,139,724 |

| | $ | 19,427,031 |

| | 5.5% | | 6 |

| 2 |

| Wells Fargo Bank, N.A. | | 6 | | 5 | | 304,310 |

| | 8,705,408 |

| | 2.5% | | 5 |

| 3 |

| Blue Cross Blue Shield | | 1 | | 1 | | 227,592 |

| | 6,133,605 |

| | 1.8% | | 4 |

| 4 |

| McGuireWoods LLP | | 3 | | 3 | | 198,648 |

| | 5,743,205 |

| | 1.6% | | 9 |

| 5 |

| Hearst Communications, Inc. | | 1 | | 1 | | 181,323 |

| | 5,558,666 |

| | 1.6% | | 10 |

| 6 |

| Smith, Gambrell & Russell, LLP | | 1 | | 1 | | 159,136 |

| | 4,959,620 |

| | 1.4% | | 4 |

| 7 |

| OSI Restaurant Partners, LLC (dba Outback

Steakhouse) | | 1 | | 1 | | 167,723 |

| | 4,886,131 |

| | 1.4% | | 8 |

| 8 |

| American Cancer Society, Inc. | | 1 | | 1 | | 275,160 |

| | 4,831,741 |

| | 1.4% | | 3 |

| 9 |

| NASCAR Media Group, LLC | | 1 | | 1 | | 139,461 |

| | 4,658,907 |

| | 1.3% | | 4 |

| 10 |

| Parsley Energy, LP | | 1 | | 1 | | 135,107 |

| | 4,116,710 |

| | 1.2% | | 8 |

| 11 |

| Board of Regents of the University System of Georgia (dba Georgia State University) | | 1 | | 1 | | 135,124 |

| | 3,884,815 |

| | 1.1% | | 7 |

| 12 |

| US South Communications (dba InComm) | | 1 | | 1 | | 191,709 |

| | 3,853,276 |

| | 1.1% | | 5 |

| 13 |

| K & L Gates LLP | | 1 | | 1 | | 110,914 |

| | 3,736,155 |

| | 1.1% | | 11 |

| 14 |

| Amazon | | 3 | | 2 | | 107,788 |

| | 3,728,168 |

| | 1.1% | | 6 |

| 15 |

| Carlton Fields Jorden Burt, PA | | 1 | | 1 | | 93,868 |

| | 3,661,791 |

| | 1.0% | | 9 |

| 16 |

| CO Space Properties, LLC (dba Internap) | | 1 | | 1 | | 120,298 |

| | 3,611,153 |

| | 1.0% | | 3 |

| 17 |

| Fifth Third Bank | | 2 | | 2 | | 120,436 |

| | 3,383,671 |

| | 1.0% | | 4 |

| 18 |

| Regus Equity Business Centers, LLC | | 7 | | 5 | | 119,041 |

| | 3,307,136 |

| | 1.0% | | 3 |

| 19 |

| National Union Fire Insurance Company (dba AIG) | | 1 | | 1 | | 105,362 |

| | 3,037,233 |

| | 0.9% | | 2 |

| 20 |

| SVB Financial Group (dba Silicon Valley Bank) | | 1 | | 1 | | 100,532 |

| | 2,987,108 |

| | 0.9% | | 7 |

| | Grand Total | | | | | | 4,133,256 |

| | $ | 104,211,530 |

| | 29.7% | | 6 |

| | | | | | | | | | | | | | |

| (1) |

| In some cases, the actual tenant may be an affiliate of the entity shown. |

| (2) |

| Annualized Base Rent represents the annualized minimum rent paid by the tenant as of the date of this report. If the tenant is in a free rent period as of the date of this report, Annualized Base Rent represents the annualized minimum contractual rent the tenant will pay in the first month it is required to pay rent which may or may not include a base year of operating expenses depending upon the terms of the lease. |

| (3) |

| Weighted average. |

| Note: |

| This schedule includes tenants whose leases have commenced and/or who have taken occupancy. Leases that have been signed but have not commenced are excluded from this schedule. |

|

| | |

| Cousins Properties Incorporated | 20 | Q1 2017 Supplemental Information |

|

| | |

| TENANT INDUSTRY DIVERSIFICATION |

(1) Represents Company's share of total revenues.

|

| | |

| Cousins Properties Incorporated | 21 | Q1 2017 Supplemental Information |

Completed Property Acquisitions

|

| | | | | | | | | | | | | | | |

| Property | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Purchase Price ($ in thousands) |

| | | | | | | | | | | | | |

| 2017 | | | | | | | | | | | | |

| 111 West Rio (1) | | Office | | Phoenix | | 100.0% | | 1Q | | 225,000 |

| | $ | 19,600 |

|

| | | | | | | | | | | | | |

| 2016 | | | | | | | | | | | | |

| Parkway Properties | | Office | | Various | | Various | | 4Q | | 8,819,000 |

| | (2 | ) |

| Cousins Fund II, L.P. (3) | | Office | | Various | | 100.0% | | 4Q | | (3 | ) | | 279,100 |

|

| | | | | | | | | | | | | |

| 2014 | | | | | | | | | | | | |

| Fifth Third Center | | Office | | Charlotte | | 100.0% | | 3Q | | 698,000 |

| | 215,000 |

|

| Northpark Town Center | | Office | | Atlanta | | 100.0% | | 4Q | | 1,528,000 |

| | 348,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Post Oak Central | | Office | | Houston | | 100.0% | | 1Q | | 1,280,000 |

| | 230,900 |

|

| Terminus 200 | | Office | | Atlanta | | 50.0% | | 1Q | | 566,000 |

| | 164,000 |

|

| 816 Congress | | Office | | Austin | | 100.0% | | 2Q | | 435,000 |

| | 102,400 |

|

| Greenway Plaza | | Office | | Houston | | 100.0% | | 3Q | | 4,348,000 |

| | 950,000 |

|

| 777 Main | | Office | | Fort Worth | | 100.0% | | 3Q | | 980,000 |

| | 160,000 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| 2100 Ross | | Office | | Dallas | | 100.0% | | 3Q | | 844,000 |

| | 59,200 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | 19,723,000 |

| | $ | 2,528,200 |

|

| | | | | | | | | | | | | |

Completed Property Developments

|

| | | | | | | | | | | | | | | |

| Project | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Total Project Cost ($ in thousands) |

| | | | | | | | | | | | | |

| 2015 | | | | | | | | | | | | |

| Colorado Tower | | Office | | Austin | | 100.0% | | 1Q | | 373,000 |

| | $ | 126,100 |

|

| Emory Point - Phase II | | Mixed | | Atlanta | | 75.0% | | 3Q | | 302,000 |

| | 75,400 |

|

| Research Park V | | Office | | Austin | | 100.0% | | 4Q | | 173,000 |

| | 45,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Emory Point - Phase I | | Mixed | | Atlanta | | 75.0% | | 4Q | | 484,000 |

| | 102,300 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| Mahan Village | | Retail | | Tallahassee | | 50.5% | | 4Q | | 147,000 |

| | 25,800 |

|

| | | | | | | | | | | | | |

| | | | | | | | |

|

| 1,479,000 |

| | $ | 374,600 |

|

|

| | |

| Cousins Properties Incorporated | 22 | Q1 2017 Supplemental Information |

Completed Property Dispositions |

| | | | | | | | | | | | | | | |

| Property | | Type | | Metropolitan Area | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Sales Price ($ in thousands) |

| 2016 | | | | | | | | | | | | |

| 100 North Point Center East | | Office | | Atlanta | | 100.0% | | 1Q | | 129,000 |

| | $ | 22,000 |

|

| Post Oak Central | | Office | | Houston | | 100.0% | | 4Q | | 1,280,000 |

| | (2 | ) |

| Greenway Plaza | | Office | | Houston | | 100.0% | | 4Q | | 4,348,000 |

| | (2 | ) |

| Two Liberty Place | | Office | | Philadelphia | | 100.0% | | 4Q | | 941,000 |

| | 219,000 |

|

| 191 Peachtree | | Office | | Atlanta | | 100.0% | | 4Q | | 1,225,000 |

| | 267,500 |

|

| Lincoln Place | | Office | | Miami | | 100.0% | | 4Q | | 140,000 |

| | 80,000 |

|

| The Forum | | Office | | Atlanta | | 100.0% | | 4Q | | 220,000 |

| | 70,000 |

|

| | | | | | | | | | | | | |

| 2015 | | | | | | | | | | | | |

| 2100 Ross | | Office | | Dallas | | 100.0% | | 3Q | | 844,000 |

| | 131,000 |

|

| 200, 333, and 555 North Point Center East | | Office | | Atlanta | | 100.0% | | 4Q | | 411,000 |

| | 70,300 |

|

| The Points at Waterview | | Office | | Dallas | | 100.0% | | 4Q | | 203,000 |

| | 26,800 |

|

| | | | | | | | | | | | | |

| 2014 | | | | | | | | | | | | |

| 600 University Park Place | | Office | | Birmingham | | 100.0% | | 1Q | | 123,000 |

| | 19,700 |

|

| Lakeshore Park Plaza | | Office | | Birmingham | | 100.0% | | 3Q | | 197,000 |

| | 25,000 |

|

| Mahan Village | | Retail | | Florida | | 50.5% | | 4Q | | 147,000 |

| | 29,500 |

|

| Cousins Watkins LLC | | Retail | | Other | | 50.5% | | 4Q | | 339,000 |

| | 50,000 |

|

| 777 Main | | Office | | Fort Worth | | 100.0% | | 4Q | | 980,000 |

| | 167,000 |

|

| | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | |

| Terminus 100 | | Office | | Atlanta | | 100.0% | | 1Q | | 656,000 |

| | 209,200 |

|

| Tiffany Springs MarketCenter | | Retail | | Kansas City | | 88.5% | | 3Q | | 238,000 |

| | 53,500 |

|

| The Avenue Murfreesboro | | Retail | | Nashville | | 50.0% | | 3Q | | 752,000 |

| | 164,000 |

|

| CP Venture Two LLC | | Retail | | Other | | 10.3% | | 3Q | | 934,000 |

| | 226,100 |

|

| CP Venture Five LLC | | Retail | | Other | | 11.5% | | 3Q | | 1,179,000 |

| | 296,200 |

|

| Inhibitex | | Office | | Atlanta | | 100.0% | | 4Q | | 51,000 |

| | 8,300 |

|

| | | | | | | | | | | | | |

| 2012 | | | | | | | | | | | | |

| The Avenue Collierville | | Retail | | Memphis | | 100.0% | | 2Q | | 511,000 |

| | 55,000 |

|

| Galleria 75 | | Office | | Atlanta | | 100.0% | | 2Q | | 111,000 |

| | 9,200 |

|

| Ten Peachtree Place | | Office | | Atlanta | | 50.0% | | 2Q | | 260,000 |

| | 45,300 |

|

| The Avenue Webb Gin | | Retail | | Atlanta | | 100.0% | | 4Q | | 322,000 |

| | 59,600 |

|

| The Avenue Forsyth | | Retail | | Atlanta | | 88.5% | | 4Q | | 524,000 |

| | 119,000 |

|

| Cosmopolitan Center | | Office | | Atlanta | | 100.0% | | 4Q | | 51,000 |

| | 7,000 |

|

| Palisades West | | Office | | Austin | | 50.0% | | 4Q | | 373,000 |

| | 64,800 |

|

| Presbyterian Medical Plaza | | Office | | Charlotte | | 11.5% | | 4Q | | 69,000 |

| | 4,500 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | 17,558,000 |

| | $ | 2,499,500 |

|

(1) The Company acquired a 74.6% interest in 111 West Rio as part of the Parkway merger, and in the first quarter of 2017, purchased the remaining 25.4% interest from American Airlines.

(2) This transaction was part of the Parkway Merger. See further information in footnote 3 of the Form 10-K for the year ended

December 31, 2016, footnote 3 of the Form 10-Q for the quarter ended March 31, 2017, and reports filed with the SEC by the Company, Parkway, and New Parkway.

(3) Purchased the outside interest (approximately 70%) in a consolidated partnership for $279.1 million; this included cash from the sale of Two Liberty Place in

Philadelphia as well as the Hayden Ferry buildings in Tempe and 3344 Peachtree in Atlanta. Cousins now owns 100% of these buildings.

|

| | |

| Cousins Properties Incorporated | 23 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Project |

| Type |

| Metropolitan Area |

| Company's Ownership Interest |

| Project Start Date |

| Number of Square Feet /Apartment Units |

| Estimated Project Cost (2) ($ in thousands) | | Company's Share of Estimated Project Costs |

| Project Cost Incurred to Date ($ in thousands) | | Company's Share of Project Costs Incurred to Date |

| Percent Leased |

| Initial Occupancy (3) |

| Estimated Stabilization (4) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Carolina Square | | Mixed | | Chapel Hill, NC | | 50 | % | | 2Q15 | | | | $ | 123,000 |

| | $ | 61,500 |

| | $ | 80,109 |

| | $ | 40,055 |

| | | | | | |

| Office | | | | | | | | | | 158,000 |

| | | | | | | | | | 74 | % | | 3Q17 | | 3Q18 |

| Retail | | | | | | | | | | 44,000 |

| | | | | | | | | | 61 | % | | 3Q17 | | 3Q18 |

| Apartments | | | | | | | | | | 246 |

| | | | | | | | | | — | % | | 3Q17 | | 3Q18 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

864 Spring Street

(NCR Phase I) | | Office | | Atlanta, GA | | 100 | % | | 3Q15 | | 502,000 |

| | 219,000 |

| | 219,000 |

| | 130,184 |

| | 130,184 |

| | 100 | % | | 1Q18 | | 1Q18 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 8000 Avalon | | Office | | Atlanta, GA | | 90 | % | | 1Q16 | | 224,000 |

| | 73,000 |

| | 65,700 |

| | 48,915 |

| | 44,024 |

| | 40 | % | | 2Q17 | | 2Q18 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

858 Spring Street

(NCR Phase II) | | Office | | Atlanta, GA | | 100 | % | | 4Q16 | | 260,000 |

| | 119,000 |

| | 119,000 |

| | 24,410 |

| | 24,410 |

| | 100 | % | | 4Q18 | | 4Q18 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dimensional Place | | Office | | Charlotte, NC | | 50 | % | | 4Q16 | | | | 94,000 |

| | 47,000 |

| | 22,486 |

| | 11,243 |

| | | | | | |

| Office | | | | | | | | | | 266,000 |

| | | | | | | | | | 100 | % | | 4Q18 | | 4Q18 |

| Retail | | | | | | | | | | 16,000 |

| | | | | | | | | | — | % | | 4Q18 | | 4Q18 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| 120 West Trinity | | Mixed | | Atlanta, GA | | 20 | % | | 1Q17 | | | | 85,000 |

| | 17,000 |

| | 11,192 |

| | 2,238 |

| | | | | | |

| Office | | | | | | | | | | 33,000 |

| | | | | | | | | | — | % | | 1Q19 | | 1Q20 |

| Retail | | | | | | | | | | 19,000 |

| | | | | | | | | | — | % | | 1Q19 | | 1Q20 |

| Apartments | | | | | | | | | | 330 |

| | | | | | | | | | — | % | | 1Q19 | | 1Q20 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | $ | 713,000 |

| | $ | 529,200 |

| | $ | 317,296 |

| | $ | 252,154 |

| | | | | | |

|

| | | | | |

| (1) | This schedule shows projects currently under active development and/or projects with a contractual obligation through the substantial completion of construction. Amounts included in the estimated project cost column represent the estimated costs of the project through stabilization. Significant estimation is required to derive these costs, and the final costs may differ from these estimates. The projected stabilization dates are also estimates and are subject to change as the project proceeds through the development process. |

| (2) | Amount represents 100% of the estimated project cost. Carolina Square is expected to be funded with a combination of equity from the partners and up to $79.8 million from a construction loan, which has $37.4 million outstanding as of March 31, 2017. |

| (3) | Represents the quarter which the Company estimates the first tenant occupies space. |

| (4) | Stabilization represents the earlier of the quarter in which the Company estimates it will achieve 90% economic occupancy or one year from initial occupancy. |

|

| | |

| Cousins Properties Incorporated | 24 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | |

| | | Metropolitan Area | | Type | | Company's Ownership Interest | | Total Developable Land (Acres) | | Company's Share |

| | | | | | | | | | | |

| North Point | | Atlanta | | Commercial | | 100% | | 12 |

| | |

| Wildwood Office Park | | Atlanta | | Commercial | | 50% | | 22 |

| | |

| The Avenue Forsyth-Adjacent Land | | Atlanta | | Commercial | | 100% | | 10 |

| | |

| Georgia | | | | | | | | 44 |

| | |

| | | | | | | | | | | |

| Victory Center | | Dallas | | Commercial | | 75% | | 3 |

| | |

| Texas | | | | | | | | 3 |

| | |

| | | | | | | | | | | |

| Corporate Center | | Tampa | | Commercial | | 100% | | 7 |

| | |

| Florida | | | | | | | | 7 |

| | |

| | | | | | | | | | | |

| Padre Island | | Corpus Christi | | Residential | | 50% | | 15 |

| | |

| Texas | | | | | | | | 15 |

| | |

| | | | | | | | | | | |

| Total Land Held (Acres) | | | | | | | | 69 |

| | 51 |

|

| Total Land Held (Cost Basis) | | | | | | | | $ | 49,272 |

| | $ | 19,265 |

|

| | | | | | | | | | | |

|

| | |

| Cousins Properties Incorporated | 25 | Q1 2017 Supplemental Information |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Company's Share of Debt Maturities and Principal Payments | | | | | | |

| Description (Interest Rate Base, if not fixed) | Company's Ownership Interest | | Rate at End of Quarter | | Maturity Date | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | Thereafter | | Total Principal | | Deferred Loan Costs | | Above/Below Market Value | | Total |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floating Rate | | | | | | | | | | | | | | | | | | | | | | | | | |

| Term Loan, Unsecured (LIBOR + 1.20%-1.70%) (1) | 100% | | 2.18% | | 12/2/21 | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 250,000 |

| | $ | — |

| | $ | 250,000 |

| | $ | (1,826 | ) | | $ | — |

| | $ | 248,174 |

|

| Credit Facility, Unsecured (LIBOR + 1.10%-1.45%) (2) | 100% | | 2.08% | | 5/28/19 | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Total Floating Rate Debt | | | | | | | — |

|

| — |

|

| — |

|

| — |

|

| 250,000 |

|

| — |

|

| 250,000 |

|

| (1,826 | ) |

| — |

|

| 248,174 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fixed Rate | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fifth Third Center | 100% | | 3.37% | | 10/1/26 | | 2,229 |

| | 3,061 |

| | 3,165 |

| | 3,274 |

| | 3,386 |

| | 133,671 |

| | 148,786 |

| | (633 | ) | | — |

| | 148,153 |

|

| One Eleven Congress (6) | 100% | | 6.08% | | 6/11/17 | | 128,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 128,000 |

| | — |

| | 771 |

| | 128,771 |

|

| The American Cancer Society Center (3) | 100% | | 6.45% | | 9/1/17 | | 126,997 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 126,997 |

| | (36 | ) | | — |

| | 126,961 |

|

| Colorado Tower | 100% | | 3.45% | | 9/1/26 | | — |

| | 573 |

| | 2,343 |

| | 2,425 |

| | 2,510 |

| | 112,149 |

| | 120,000 |

| | (907 | ) | | — |

| | 119,093 |

|

| Promenade | 100% | | 4.27% | | 10/1/22 | | 2,252 |

| | 3,116 |

| | 3,252 |

| | 3,394 |

| | 3,541 |

| | 89,052 |

| | 104,607 |

| | (329 | ) | | — |

| | 104,278 |

|

| San Jacinto (6) | 100% | | 6.05% | | 6/11/17 | | 101,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 101,000 |

| | — |

| | 602 |

| | 101,602 |

|

| 816 Congress | 100% | | 3.75% | | 11/1/24 | | 1,181 |

| | 1,629 |

| | 1,690 |

| | 1,754 |

| | 1,821 |

| | 76,411 |

| | 84,486 |

| | (624 | ) | | — |

| | 83,862 |

|

| 3344 Peachtree | 100% | | 4.75% | | 10/1/17 | | 78,453 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 78,453 |

| | — |

| | 858 |

| | 79,311 |

|

| Two Buckhead Plaza | 100% | | 6.43% | | 10/1/17 | | 52,000 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 52,000 |

| | — |

| | 999 |

| | 52,999 |

|

| Meridian Mark Plaza | 100% | | 6.00% | | 8/1/20 | | 366 |

| | 514 |

| | 546 |

| | 22,978 |

| | — |

| | — |

| | 24,404 |

| | (89 | ) | | — |

| | 24,315 |

|

| The Pointe | 100% | | 4.01% | | 2/10/19 | | 326 |

| | 456 |

| | 22,056 |

| | — |

| | — |

| | — |

| | 22,838 |

| | — |

| | 371 |

| | 23,209 |

|

| Total Fixed Rate Debt | | | | | | | 492,804 |

|

| 9,349 |

|

| 33,052 |

|

| 33,825 |

|

| 11,258 |

|

| 411,283 |

|

| 991,571 |

|

| (2,618 | ) |

| 3,601 |

| | 992,554 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Consolidated Debt | | | | | | | $ | 492,804 |

|

| $ | 9,349 |

|

| $ | 33,052 |

|

| $ | 33,825 |

|

| $ | 261,258 |

| | $ | 411,283 |

|

| $ | 1,241,571 |

|

| $ | (4,444 | ) |

| $ | 3,601 |

| | $ | 1,240,728 |

|

| | | | | | | | | | | | | | | | | | | |

| | | | | |

|

| Unconsolidated Debt | | | | | | | | | | | | | | | | | | | | | | | | | |

| Floating Rate | | | | | | | | | | | | | | | | | | | | | | | | | |

| Emory Point I (LIBOR + 1.75%, $61.1mm facility) (4) | 75% | | 2.73% | | 10/9/17 | | 43,522 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 43,522 |

| | (116 | ) | | — |

| | 43,406 |

|

| Emory Point II (LIBOR + 1.85%, $46mm facility) (4) | 75% | | 2.83% | | 10/9/17 | | 33,796 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 33,796 |

| | (99 | ) | | — |

| | 33,697 |

|

| Carolina Square (LIBOR + 1.90%, $79.8mm facility) | 50% | | 2.70% | | 5/1/18 | | — |

| | 18,706 |

| | — |

| | — |

| | — |

| | — |

| | 18,706 |

| | — |

| | — |

| | 18,706 |

|

| Total Floating Rate Debt | | | | | | | 77,318 |

|

| 18,706 |

|

| — |

|

| — |

|

| — |

| | — |

|

| 96,024 |

|

| (215 | ) |

| — |

| | 95,809 |

|

| | | | | | | | | | | | | | | | | | . | | | | | | | | |

| Fixed Rate | | | | | | | | | | | | | | | | | | | | | | | | | |

| Terminus 100 | 50% | | 5.25% | | 1/1/23 | | 1,016 |

| | 1,418 |

| | 1,494 |

| | 1,575 |

| | 1,659 |

| | 55,840 |

| | 63,002 |

| | (73 | ) | | — |

| | 62,929 |

|

| Terminus 200 | 50% | | 3.79% | | 1/1/23 | | 580 |

| | 800 |

| | 831 |

| | 863 |

| | 896 |

| | 36,281 |

| | 40,251 |

| | (32 | ) | | — |

| | 40,219 |

|

| Emory University Hospital Midtown Medical Office Tower | 50% | | 3.50% | | 6/1/23 | | 571 |

| | 785 |

| | 814 |

| | 842 |

| | 872 |

| | 32,340 |

| | 36,224 |

| | (147 | ) | | — |

| | 36,077 |

|

| Courvoisier Centre | 20% | | 4.60% | | 3/1/26 | | — |

| | — |

| | — |

| | — |

| | — |

| | 21,300 |

| | 21,300 |

| | — |

| | 982 |

| | 22,282 |

|

| Total Fixed Rate Debt | | | | | | | 2,167 |

|

| 3,003 |

|

| 3,139 |

|

| 3,280 |

|

| 3,427 |

| | 145,761 |

|

| 160,777 |

|

| (252 | ) |

| 982 |

| | 161,507 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Unconsolidated Debt | | | | | | | 79,485 |

|

| 21,709 |

|

| 3,139 |

|

| 3,280 |

|

| 3,427 |

| | 145,761 |

|

| 256,801 |

|

| (467 | ) |

| 982 |

| | 257,316 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Debt | | | | | | | $ | 572,289 |

|

| $ | 31,058 |

|

| $ | 36,191 |

|

| $ | 37,105 |

|

| $ | 264,685 |

| | $ | 557,044 |

|

| $ | 1,498,372 |

|

| $ | (4,911 | ) |

| $ | 4,583 |

| | $ | 1,498,044 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

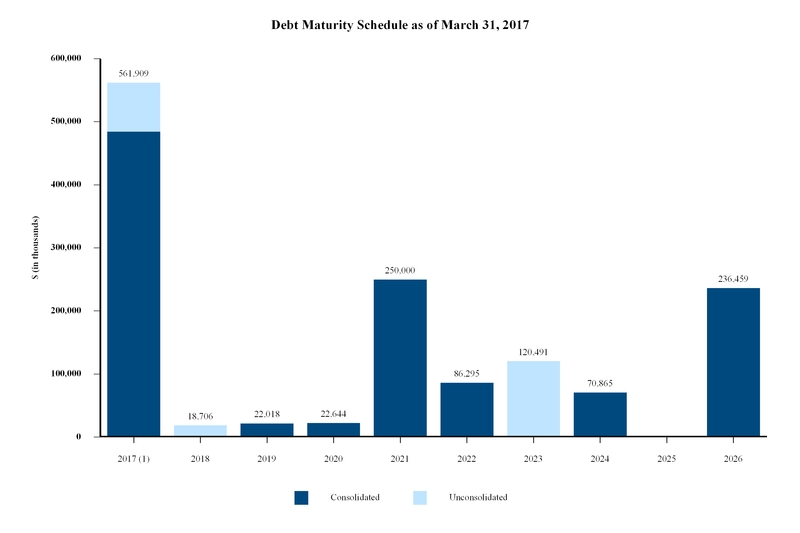

| Total Maturities (5) | | | | | | | $ | 561,909 |

| | $ | 18,706 |

| | $ | 22,018 |

| | $ | 22,644 |

| | $ | 250,000 |

| | $ | 514,110 |

| | $ | 1,389,387 |

|

| | | | | |

| % of Maturities | | | | | | | 40 | % | | 1 | % | | 2 | % | | 2 | % | | 18 | % | | 37 | % | | 100 | % | | | | | | |

|

| | |

| Cousins Properties Incorporated | 26 | Q1 2017 Supplemental Information |

Floating and Fixed Rate Debt Analysis

|

| | | | | | | | | | | | | |

| | | Total Debt ($) | | Total Debt (%) | | Weighted Average Interest Rate | | Weighted Average Maturity (Yrs.) |

| Floating Rate Debt | | $ | 346,024 |

| | 23 | % | | 2.34 | % | | 3.6 |

|

| Fixed Rate Debt | | 1,152,348 |

| | 77 | % | | 4.81 | % | | 4.4 |

|

| Total Debt | | $ | 1,498,372 |

| | 100 | % | | 4.24 | % | | 4.2 |

|

(1) Total borrowing capacity of the Term Loan as of March 31, 2017 was $250 million. The spread over LIBOR at March 31, 2017 was 1.20%.

(2) Total borrowing capacity of the Credit Facility as of March 31, 2017 was $500 million. The spread over LIBOR at March 31, 2017 was 1.10%.

(3) The real estate and other assets of this property are restricted under a loan agreement such that these assets are not available to settle other debts of the Company.