INVESTOR PRESENTATION November 2022

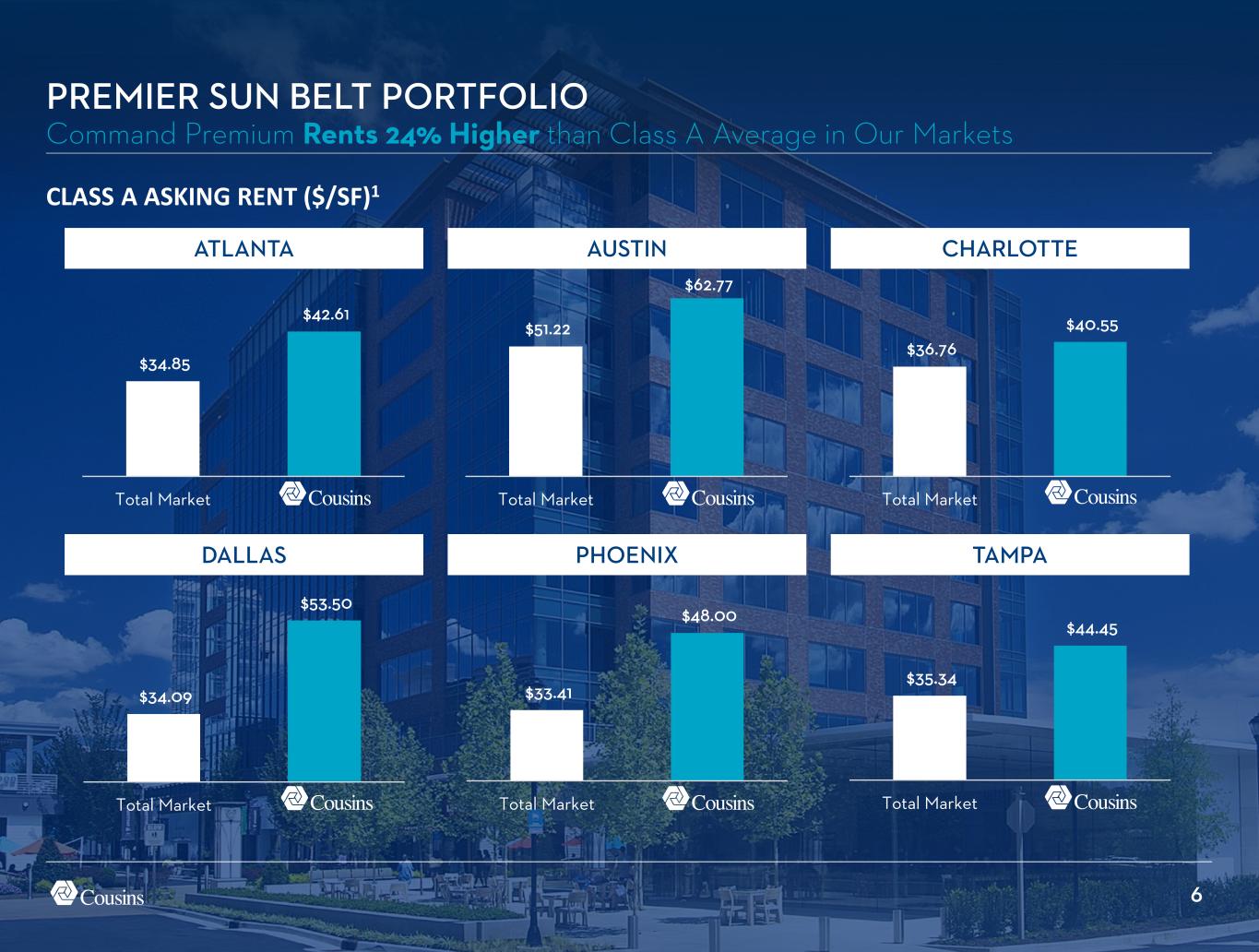

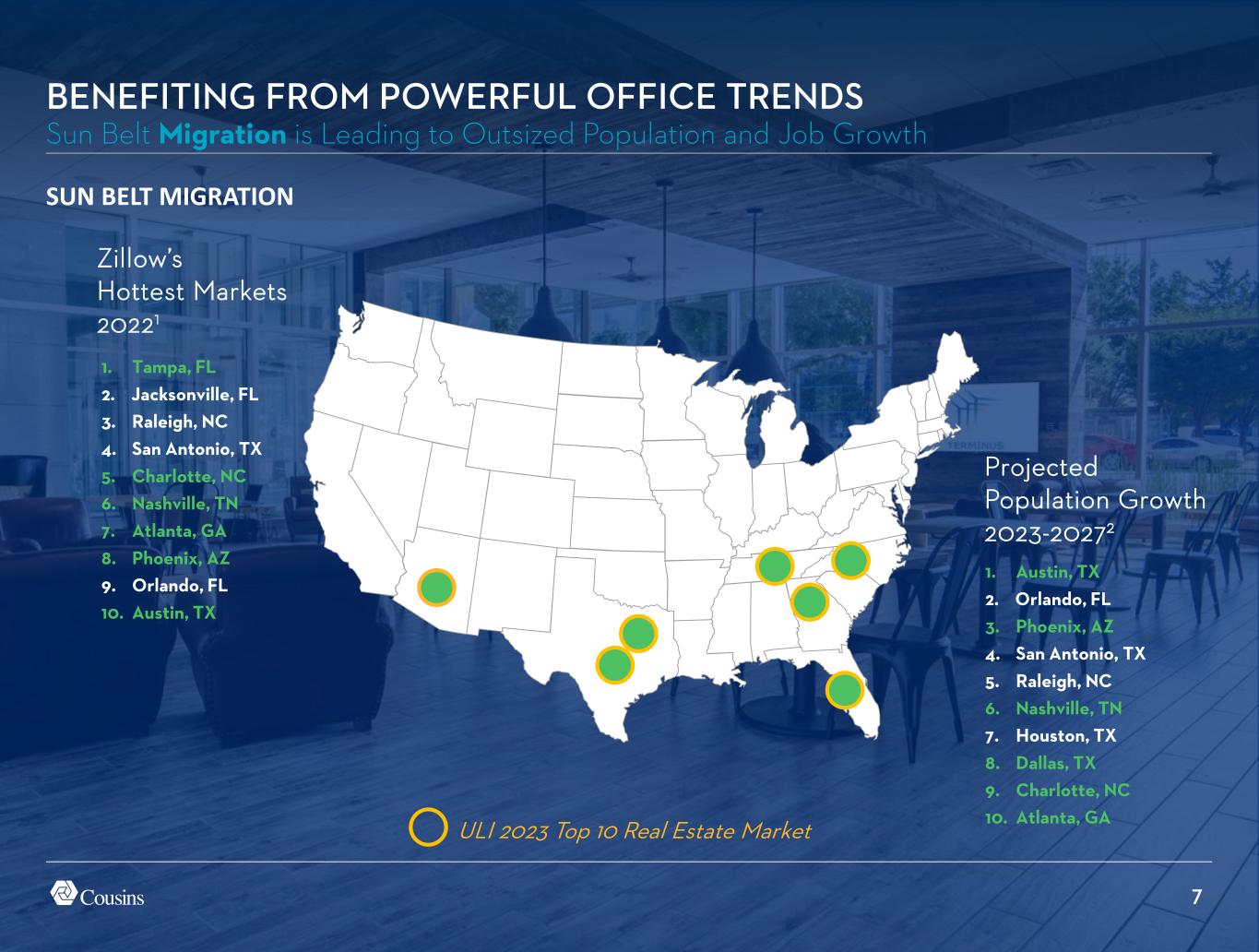

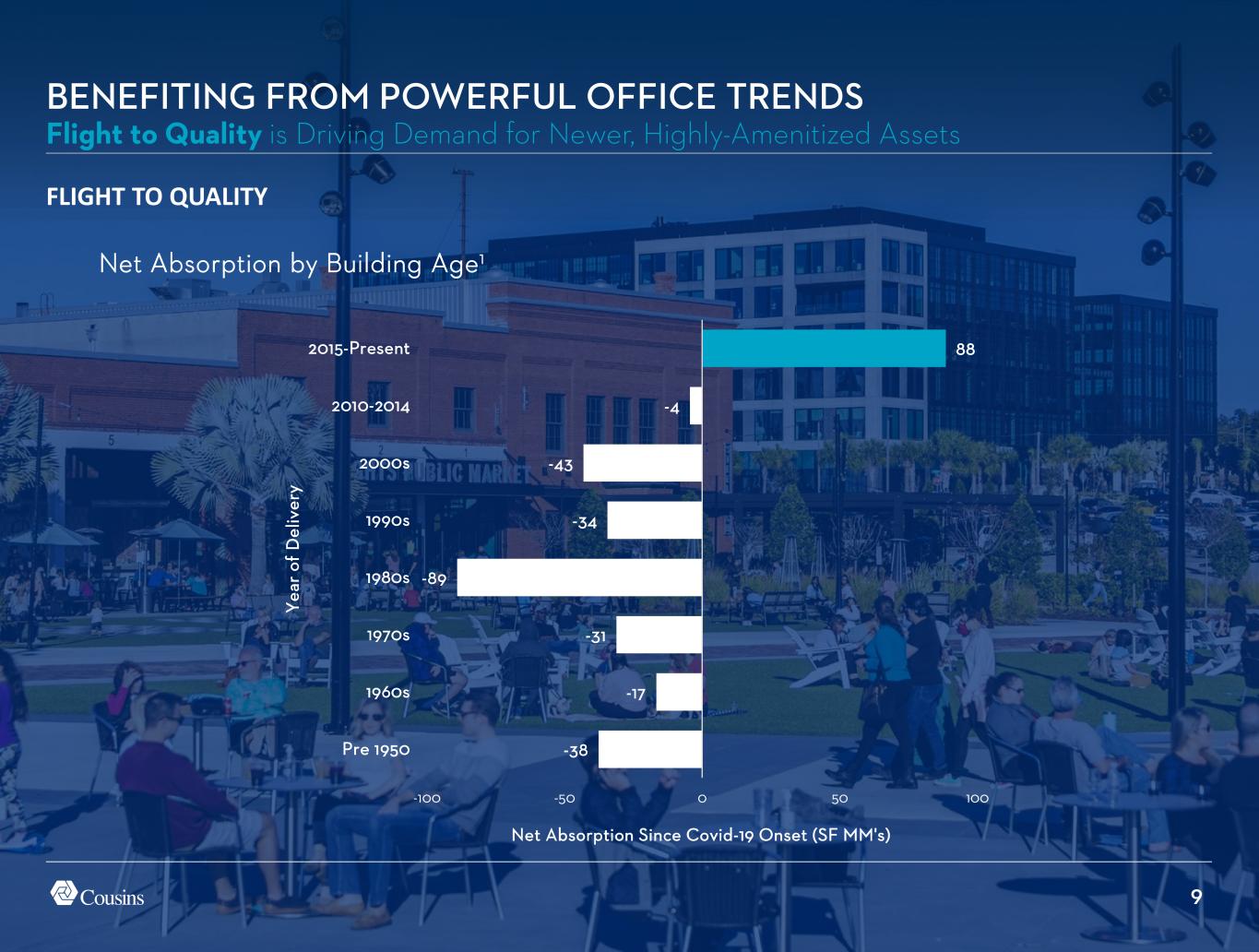

2 BENEFITING FROM POWERFUL OFFICE TRENDS BALANCE SHEET PRIMED FOR OPPORTUNITIES PREMIER SUN BELT PORTFOLIO TRACK RECORD OF SUCCESS WHY COUSINS? • Migration to the Sun Belt leading to outsized population and job growth • Flight to quality driving demand for newer, highly-amenitized assets • 100% Sun Belt / 100% Class A / 2004 average year built1 • 34% of portfolio less than 5 years old or recently redeveloped1,2 • CUZ asking rents 10% higher than pre-pandemic levels and 24% higher than Class A avg3,4 • Simple strategy with $704mm of liquidity7 • Leverage 4.75x Net Debt/EBITDA among the strongest in the office sector7 • Only 1.3% of total debt maturing in 2022 and 20238 • Strong in-place rent growth of 33% since 20179 • Attractive FAD growth of 23% since 20179 • Leader in driving NAV growth 13% since 20179 ATTRACTIVE DEVELOPMENT PIPELINE FOR FUTURE GROWTH • 1.5MM SF active development pipeline1 • Land bank supports another 4.6MM SF of development1 POSITIONED FOR ORGANIC GROWTH • Modest lease expirations well below office sector average5 • Near-term occupancy upside from recent success backfilling prior move-outs • Rolled-up cash rents 11.7% on average over the past two years6

35 COUSINS AT A GLANCE The Preeminent Sun Belt Office REIT NOI By Market1 18.8MM SF portfolio3 2004 average year built3 90.2% leased3 34% of portfolio less than 5 years old or recently redeveloped3,4 1.5MM SF development pipeline3 Dallas 2% Charlotte 9% Atlanta 37% Houston 3% Phoenix 9% Austin 31% Tampa 9% 4.6MM SF land bank3 Nashville2

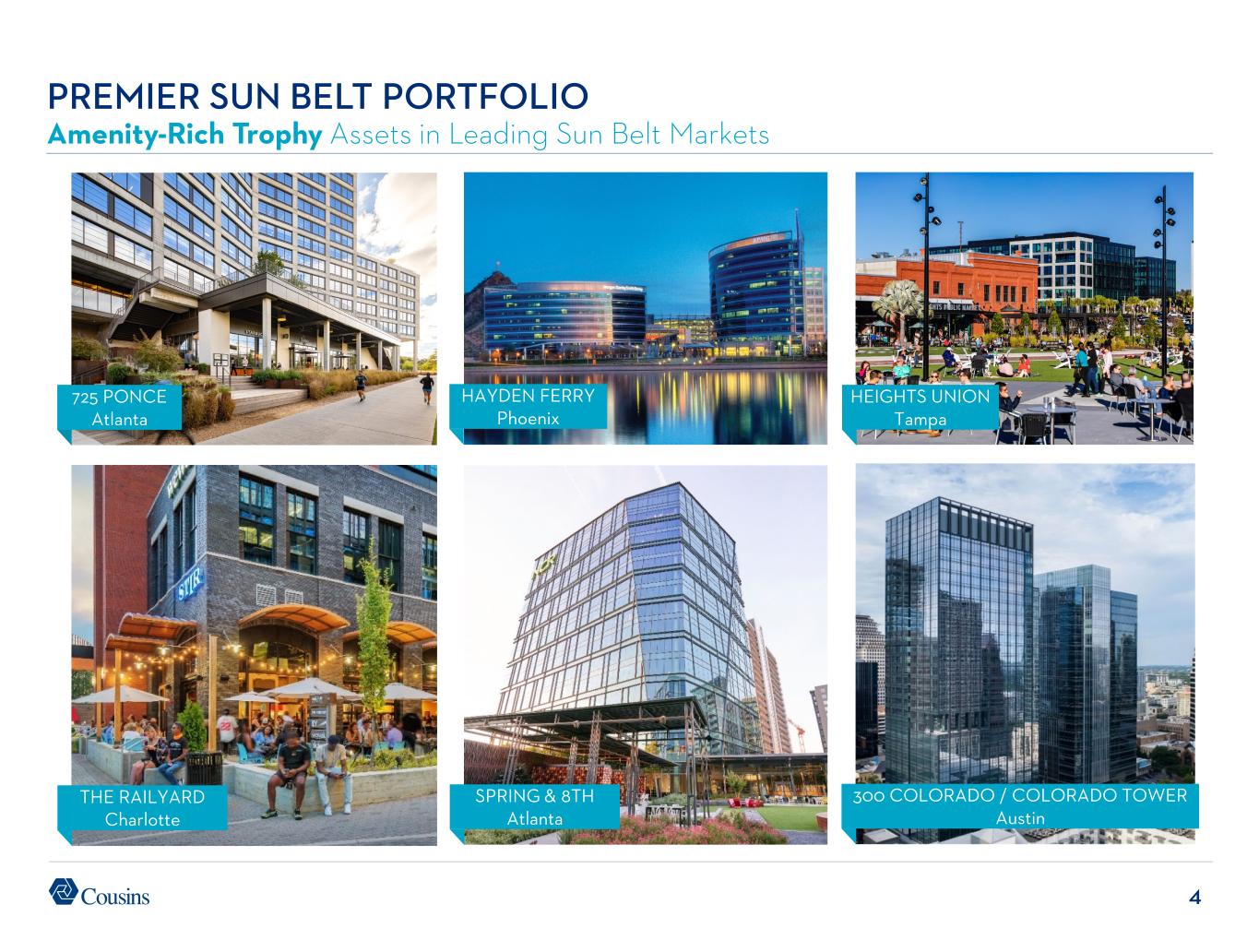

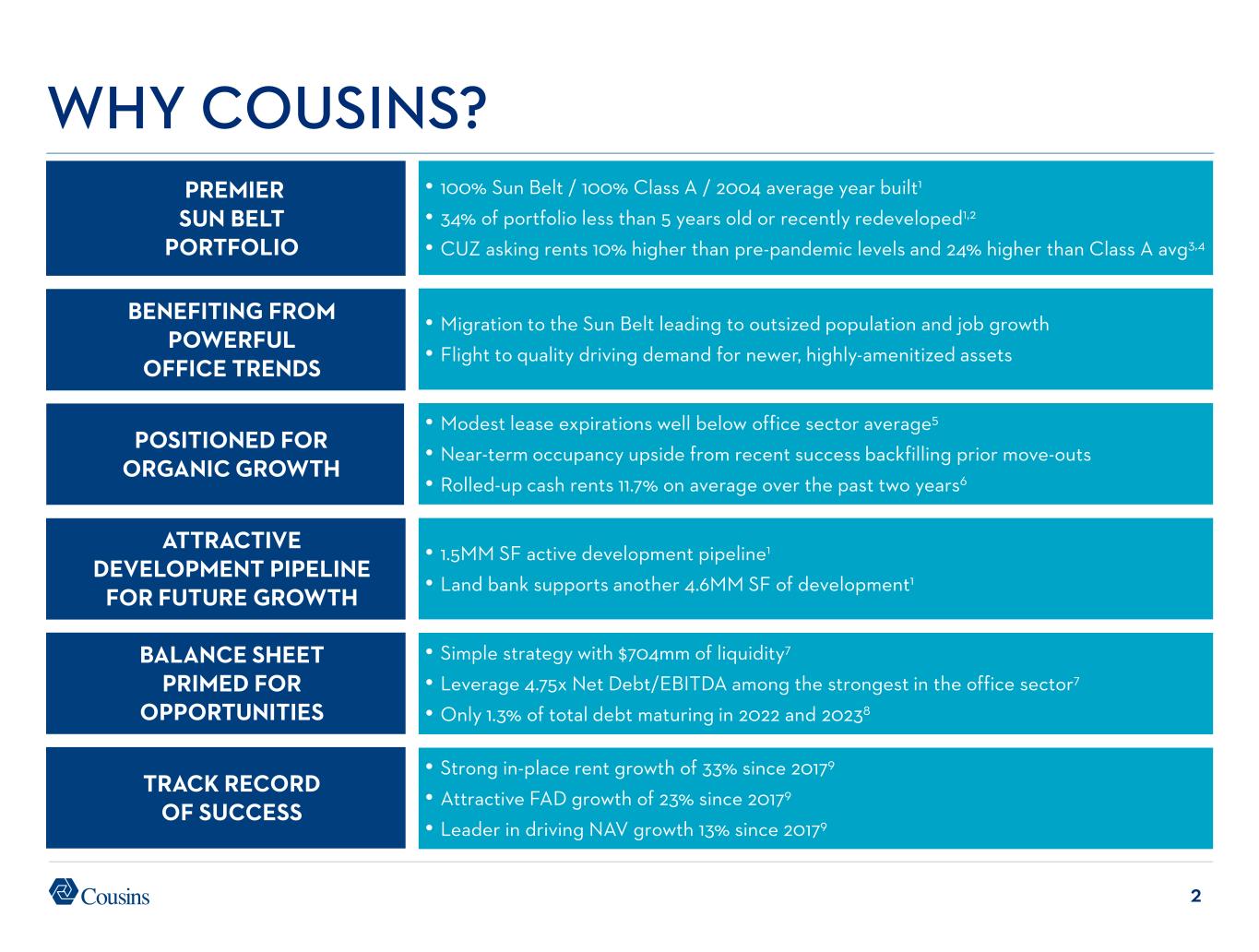

4 PREMIER SUN BELT PORTFOLIO Amenity-Rich Trophy Assets in Leading Sun Belt Markets 725 PONCE Atlanta HAYDEN FERRY Phoenix HEIGHTS UNION Tampa THE RAILYARD Charlotte SPRING & 8TH Atlanta 300 COLORADO / COLORADO TOWER Austin

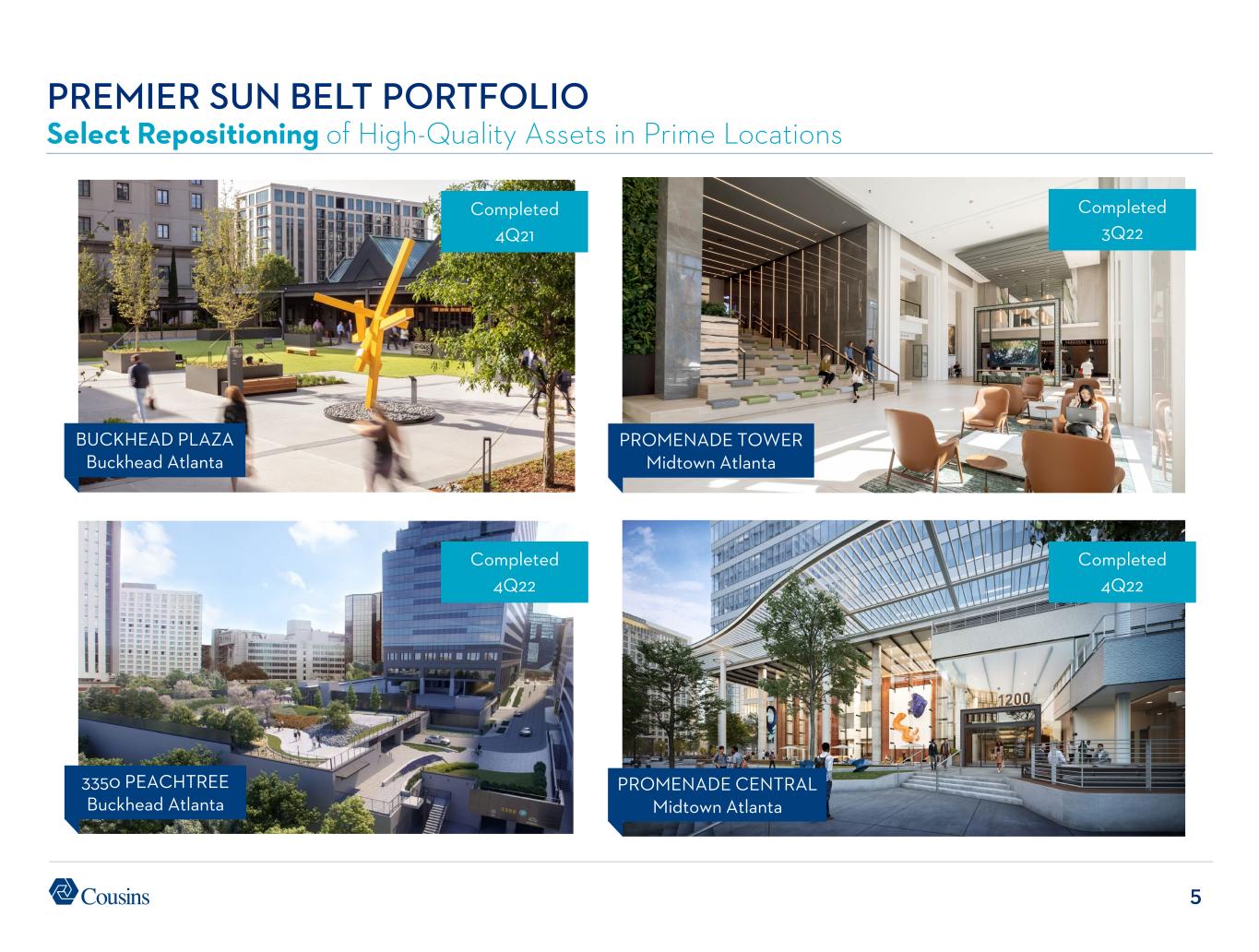

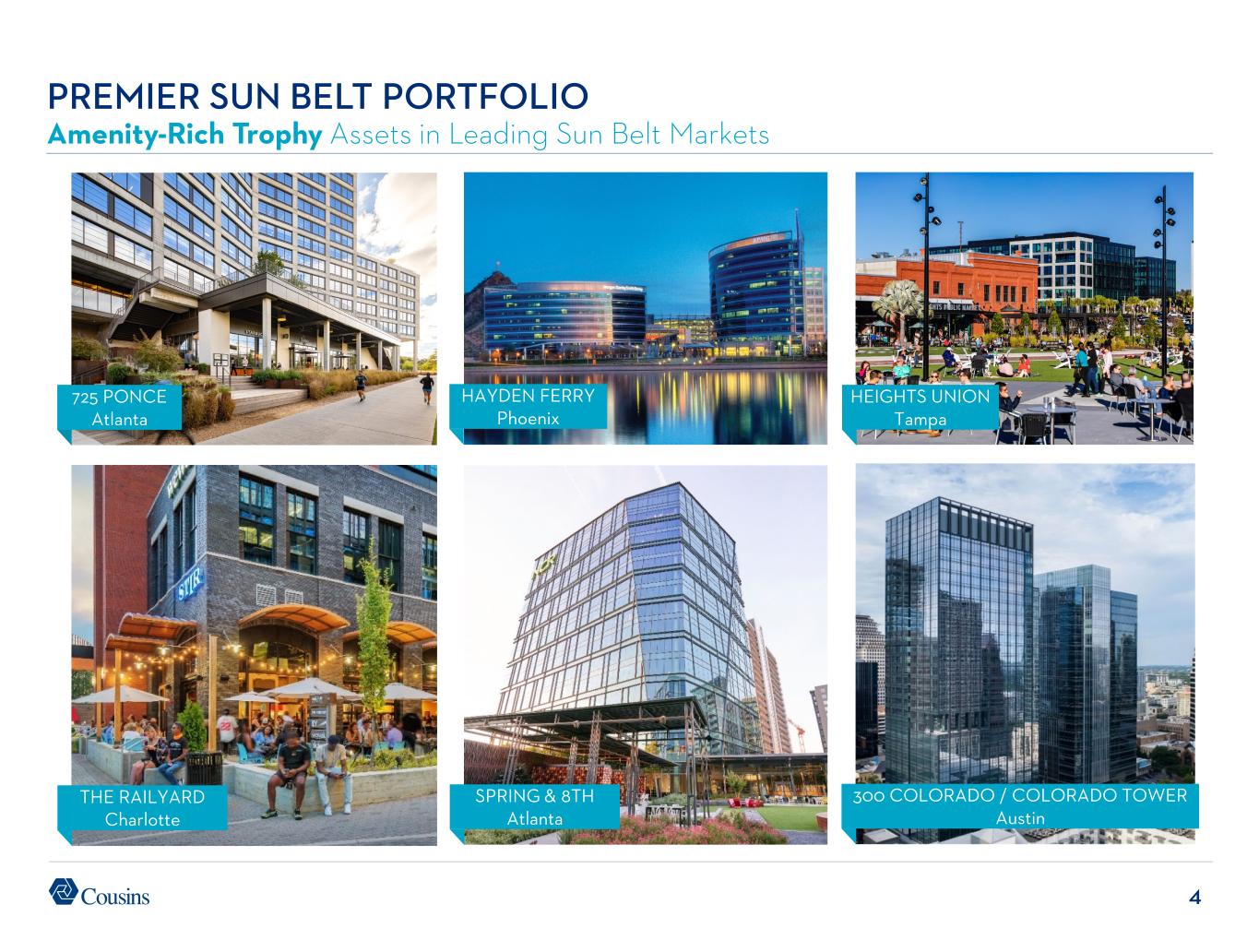

5 PREMIER SUN BELT PORTFOLIO Select Repositioning of High-Quality Assets in Prime Locations 3350 PEACHTREE Buckhead Atlanta Completed 4Q22 PROMENADE TOWER Midtown Atlanta Completed 3Q22 PROMENADE CENTRAL Midtown Atlanta Completed 4Q22 Completed 4Q21 BUCKHEAD PLAZA Buckhead Atlanta

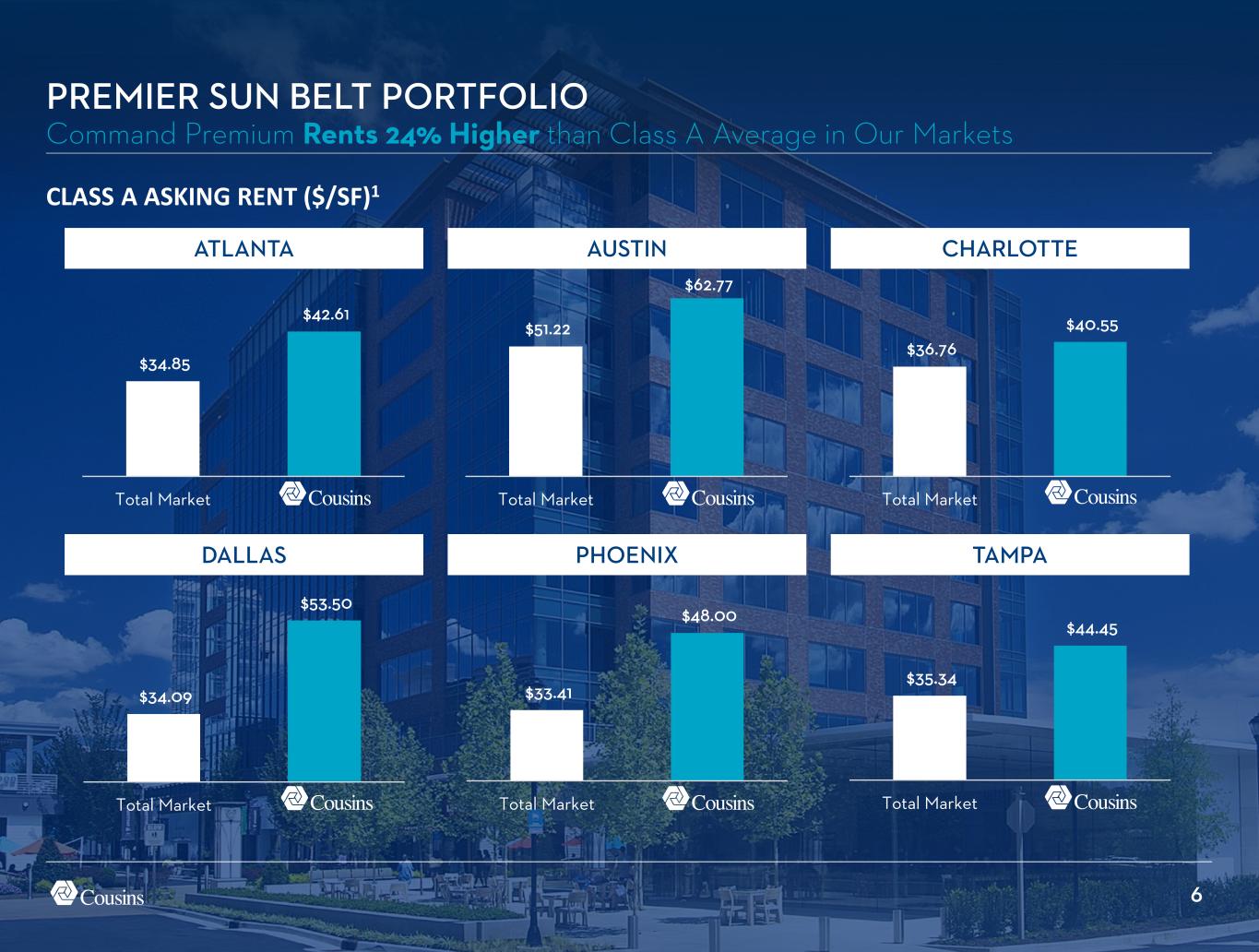

6 ATLANTA AUSTIN CHARLOTTE DALLAS PHOENIX TAMPA CLASS A ASKING RENT ($/SF)1 PREMIER SUN BELT PORTFOLIO Command Premium Rents 24% Higher than Class A Average in Our Markets $34.85 $42.61 Total Market $51.22 $62.77 Total Market $36.76 $40.55 Total Market $34.09 $53.50 Total Market $33.41 $48.00 Total Market $35.34 $44.45 Total Market

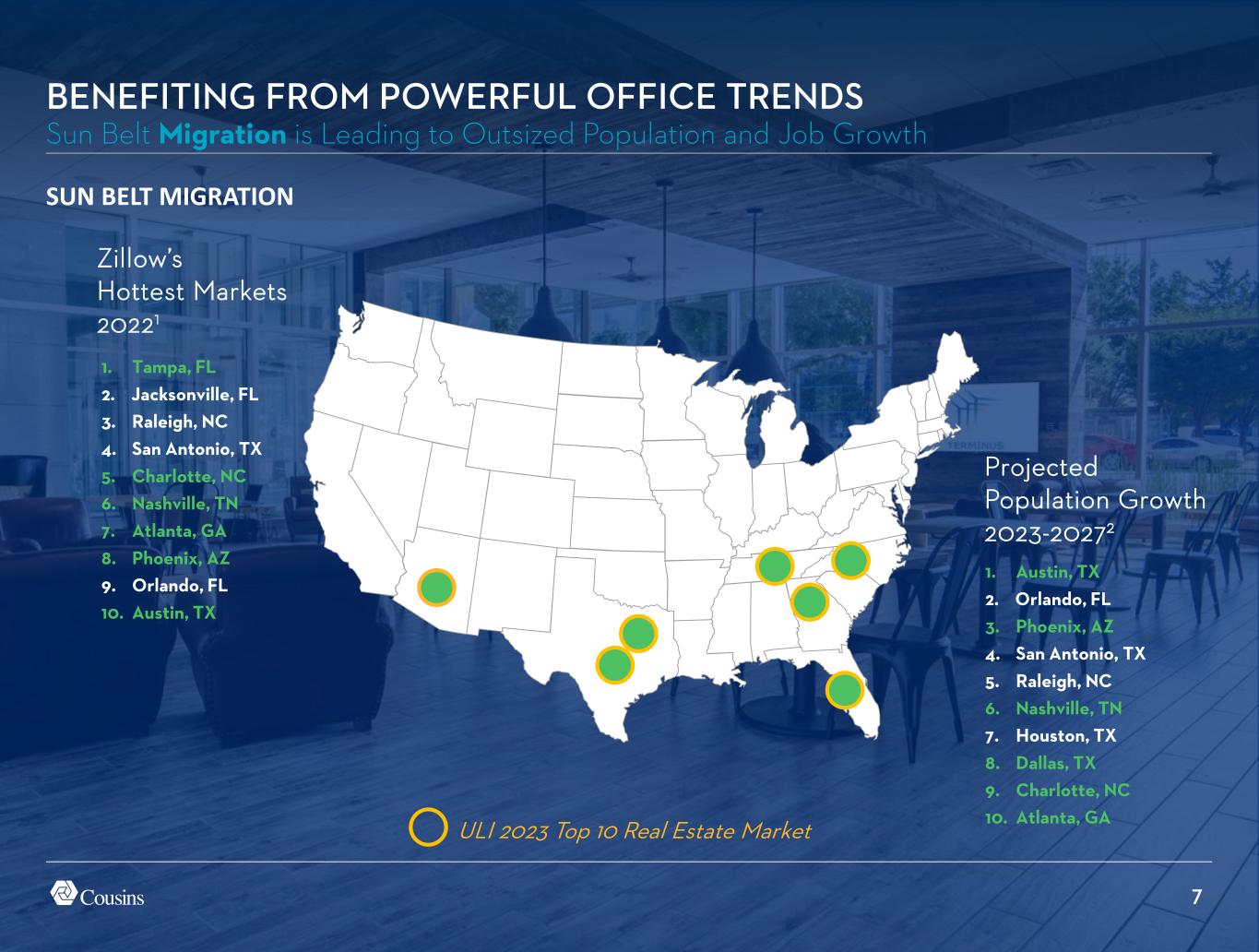

7 SUN BELT MIGRATION 1. Austin, TX 2. Orlando, FL 3. Phoenix, AZ 4. San Antonio, TX 5. Raleigh, NC 6. Nashville, TN 7. Houston, TX 8. Dallas, TX 9. Charlotte, NC 10. Atlanta, GA Projected Population Growth 2023-20272 BENEFITING FROM POWERFUL OFFICE TRENDS Sun Belt Migration is Leading to Outsized Population and Job Growth 1. Tampa, FL 2. Jacksonville, FL 3. Raleigh, NC 4. San Antonio, TX 5. Charlotte, NC 6. Nashville, TN 7. Atlanta, GA 8. Phoenix, AZ 9. Orlando, FL 10. Austin, TX Zillow’s Hottest Markets 20221 ULI 2023 Top 10 Real Estate Market

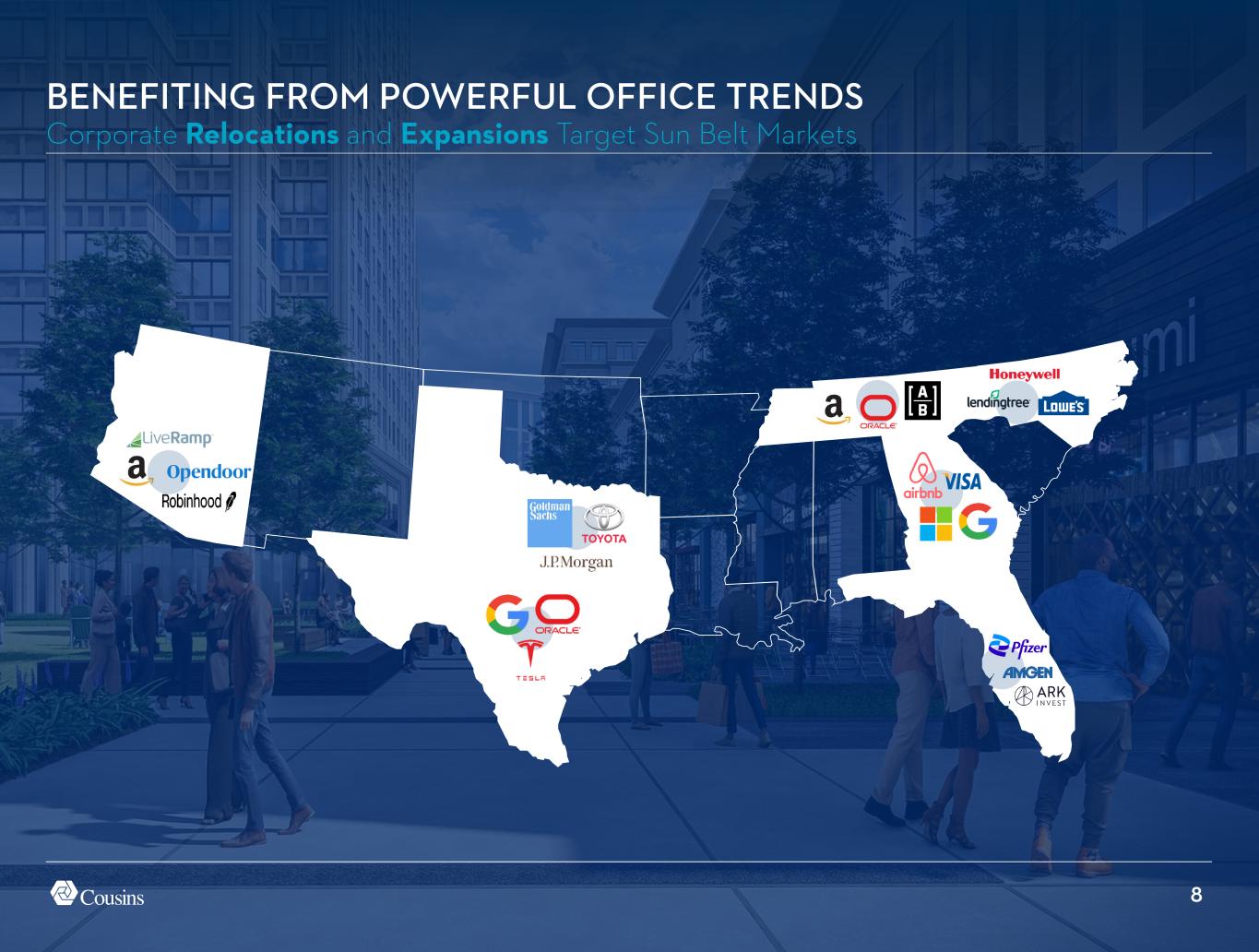

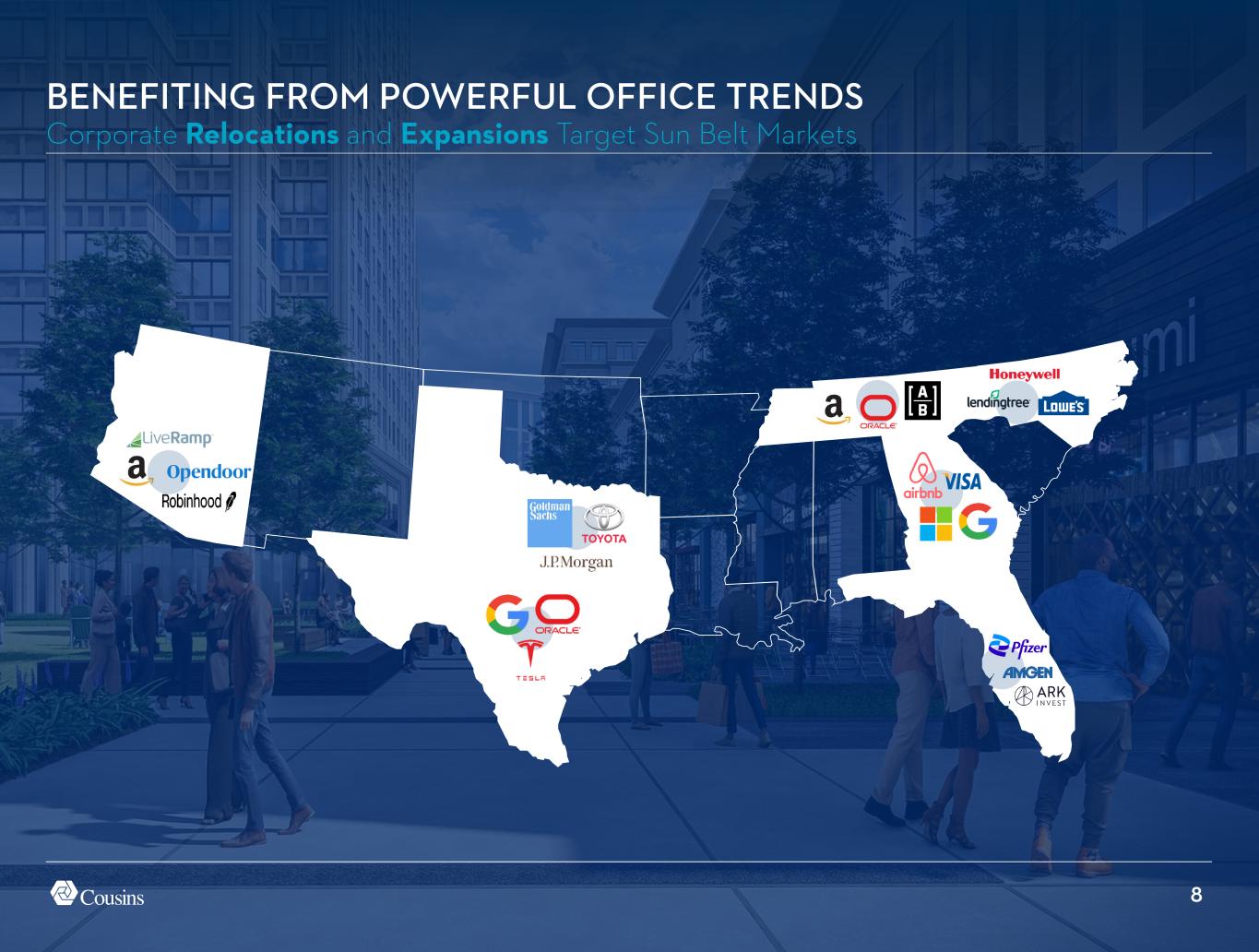

8 BENEFITING FROM POWERFUL OFFICE TRENDS Corporate Relocations and Expansions Target Sun Belt Markets

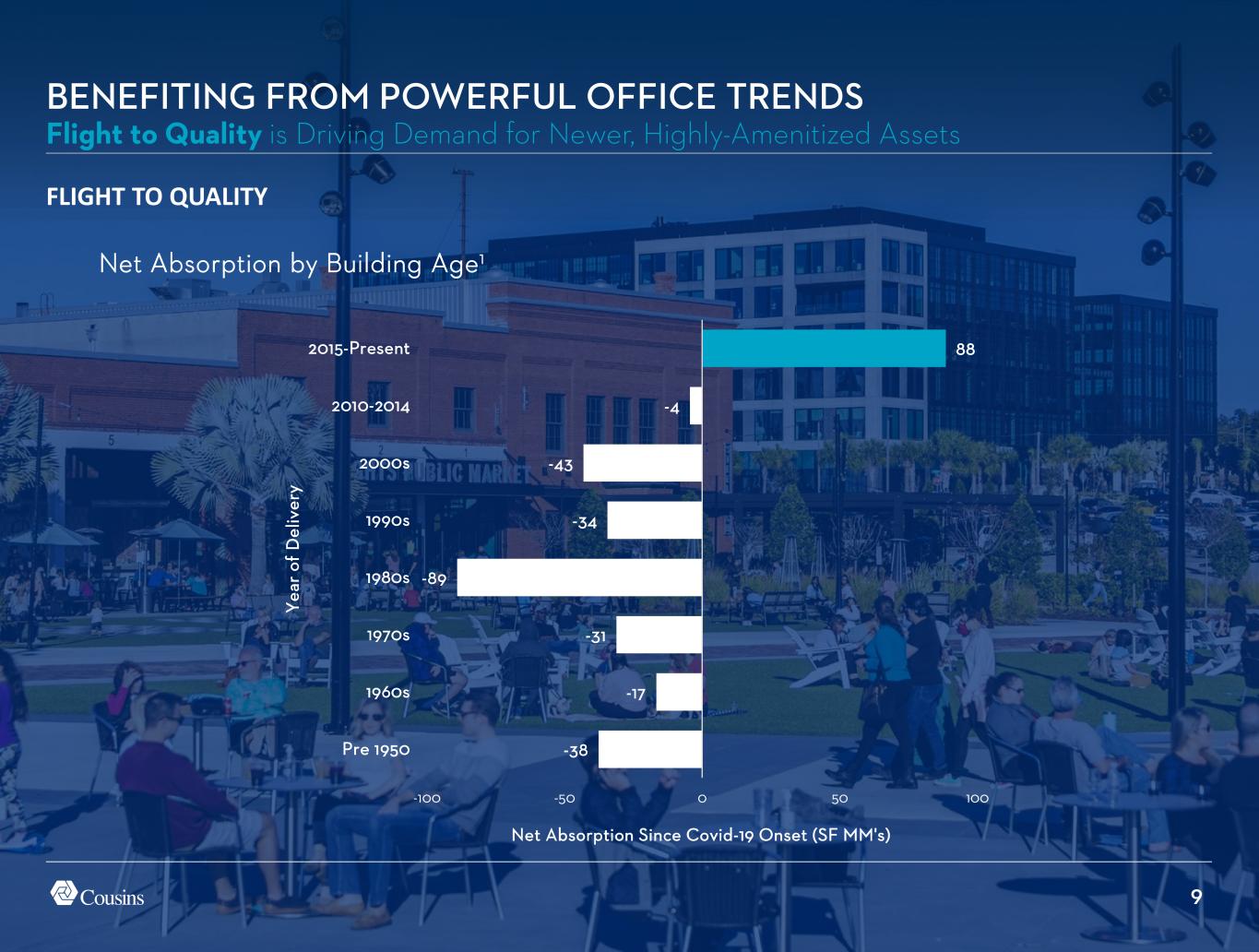

9 FLIGHT TO QUALITY Net Absorption by Building Age1 BENEFITING FROM POWERFUL OFFICE TRENDS Flight to Quality is Driving Demand for Newer, Highly-Amenitized Assets -38 -17 -31 -89 -34 -43 -4 88 -100 -50 0 50 100 Pre 1950 1960s 1970s 1980s 1990s 2000s 2010-2014 2015-Present Y ea r of D el iv er y Net Absorption Since Covid-19 Onset (SF MM's)

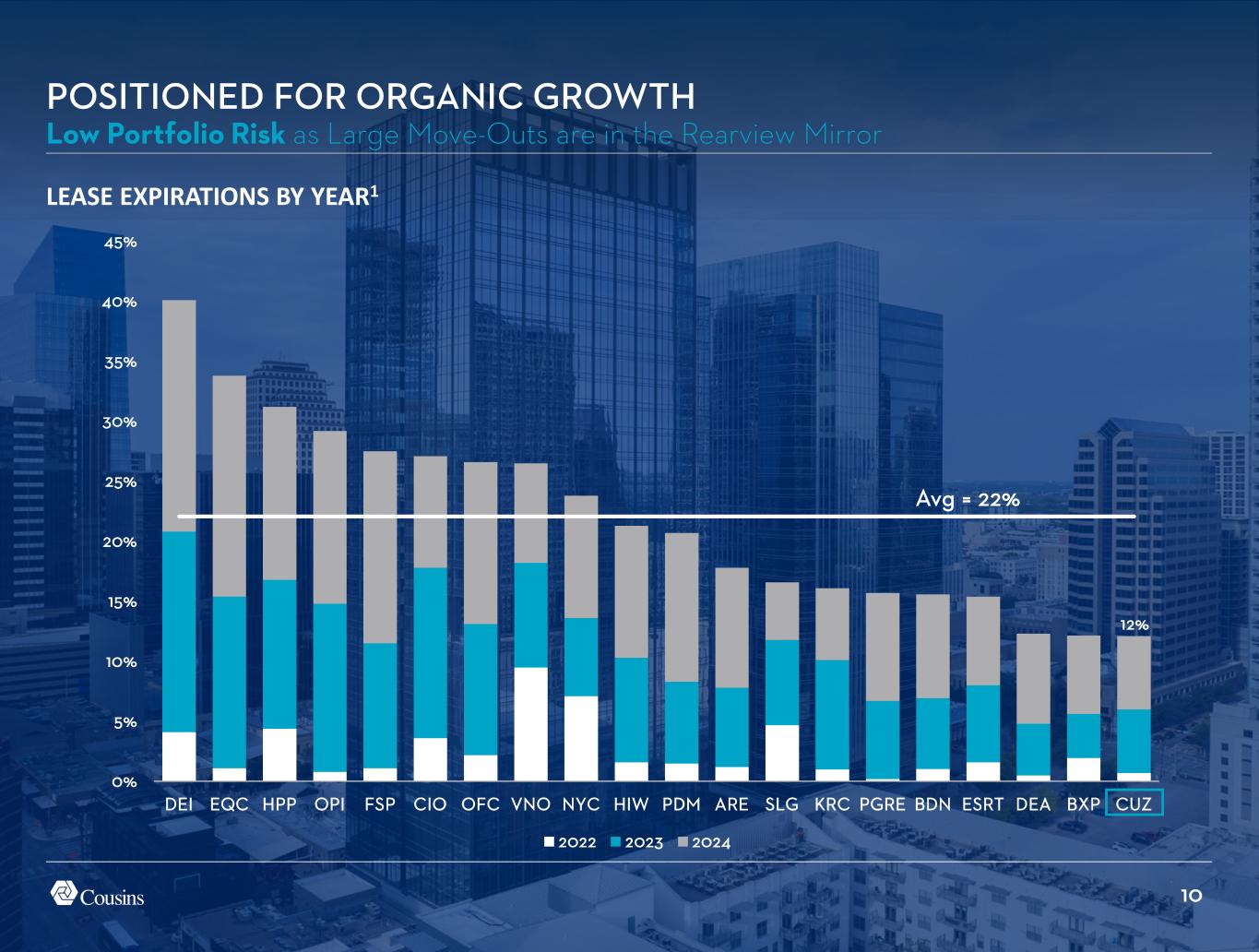

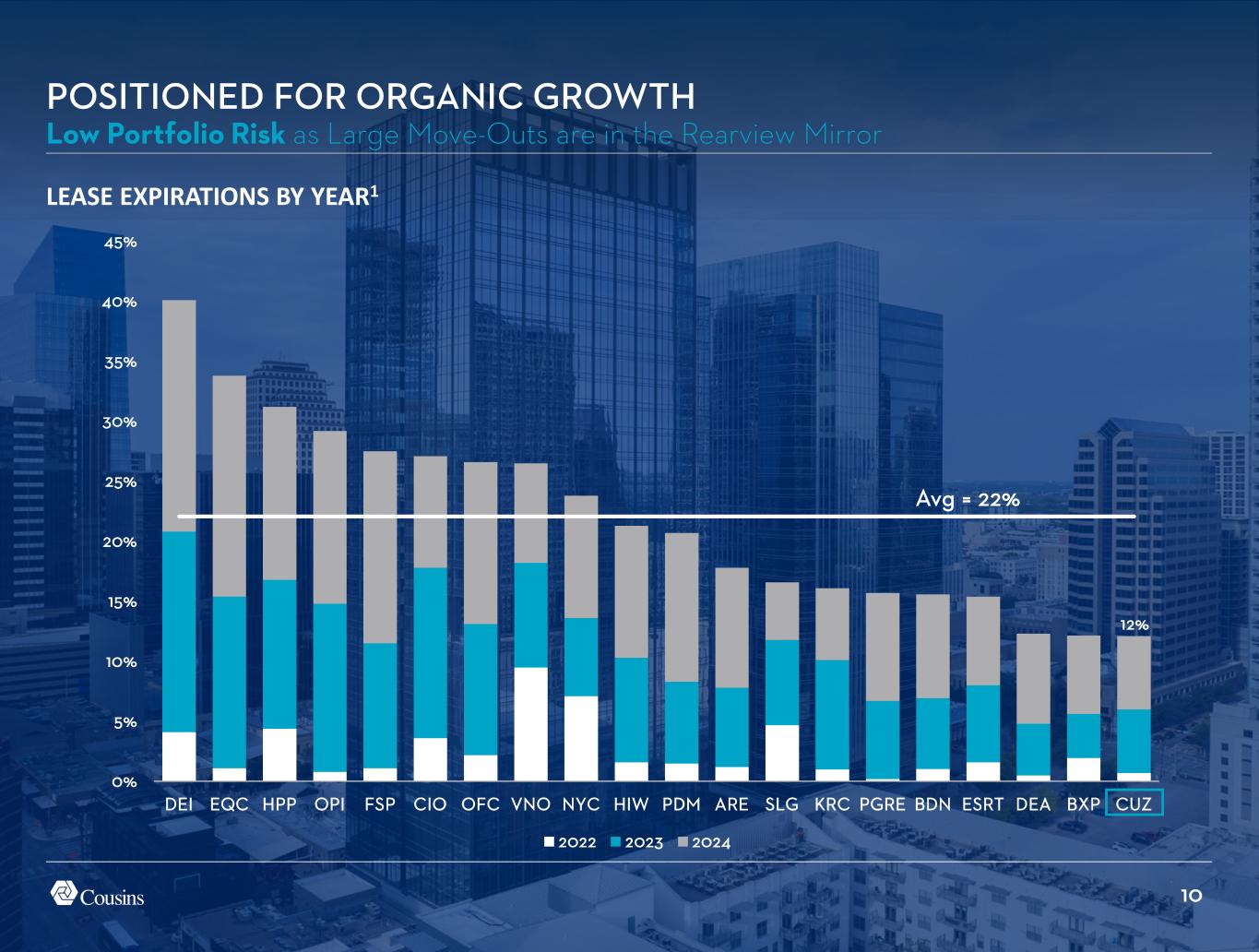

10 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% DEI EQC HPP OPI FSP CIO OFC VNO NYC HIW PDM ARE SLG KRC PGRE BDN ESRT DEA BXP CUZ 2022 2023 2024 LEASE EXPIRATIONS BY YEAR1 POSITIONED FOR ORGANIC GROWTH Low Portfolio Risk as Large Move-Outs are in the Rearview Mirror 12% Avg = 22%

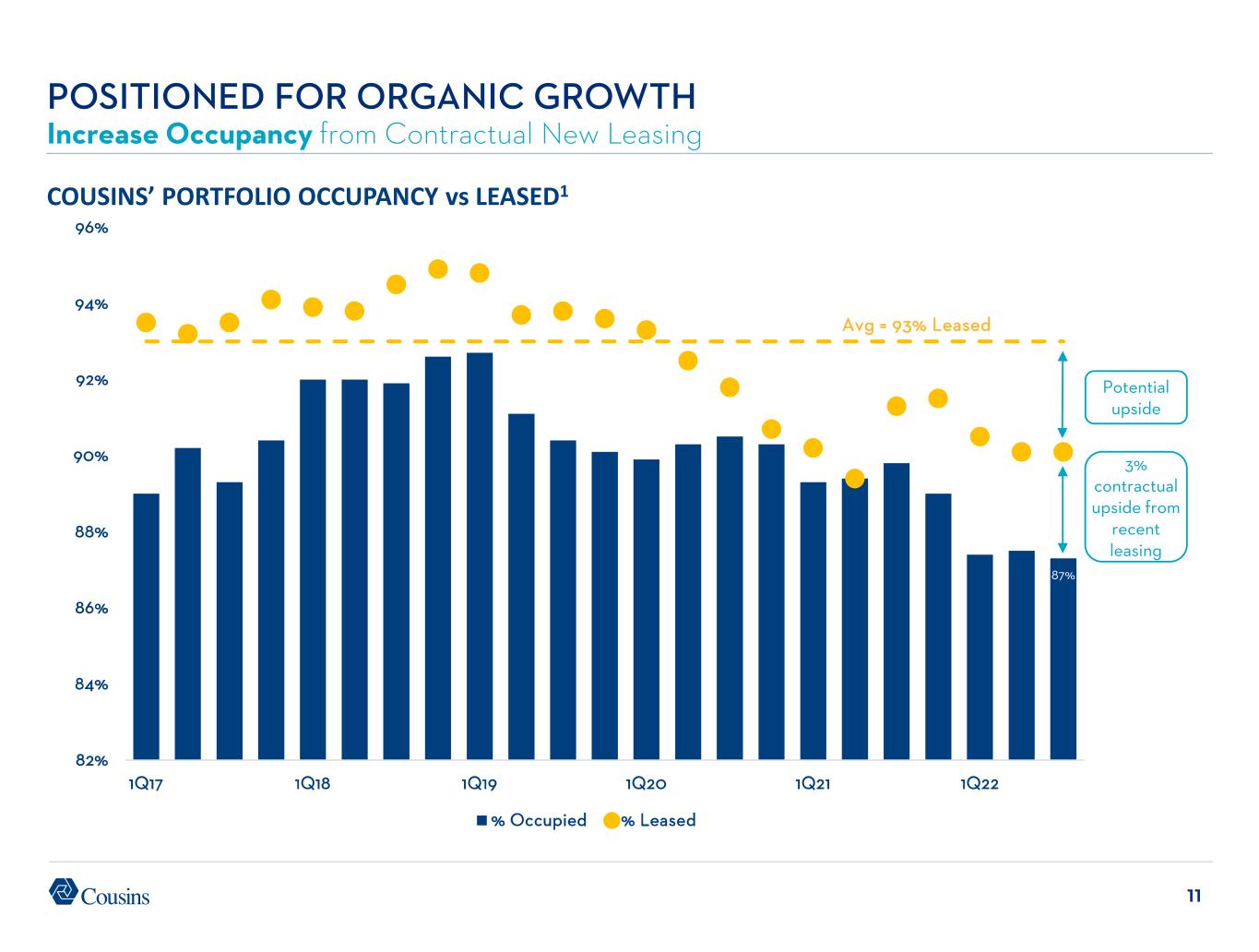

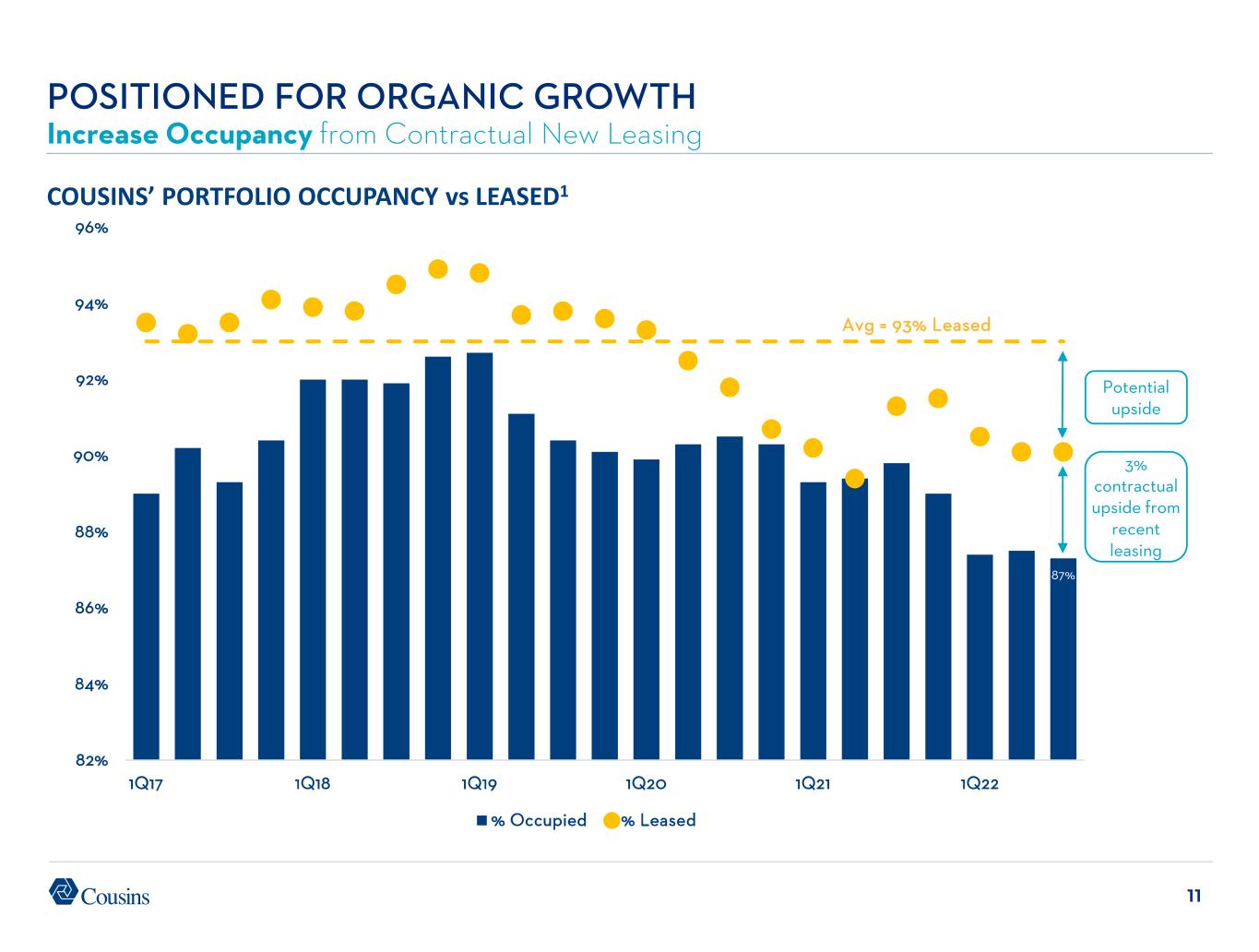

11 87% 82% 84% 86% 88% 90% 92% 94% 96% 1Q17 1Q18 1Q19 1Q20 1Q21 1Q22 % Occupied % Leased COUSINS’ PORTFOLIO OCCUPANCY vs LEASED1 POSITIONED FOR ORGANIC GROWTH Increase Occupancy from Contractual New Leasing Avg = 93% Leased 3% contractual upside from recent leasing Potential upside

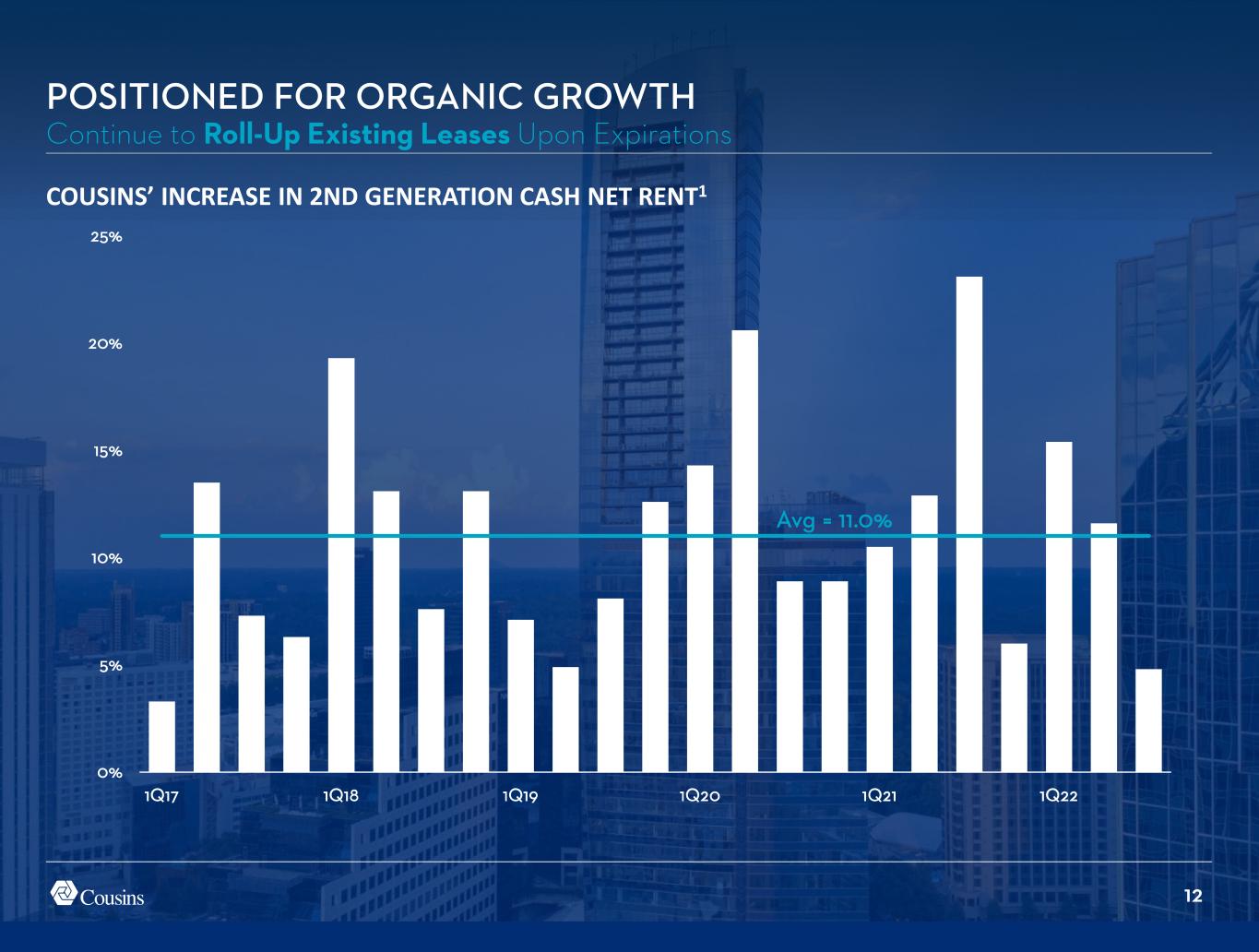

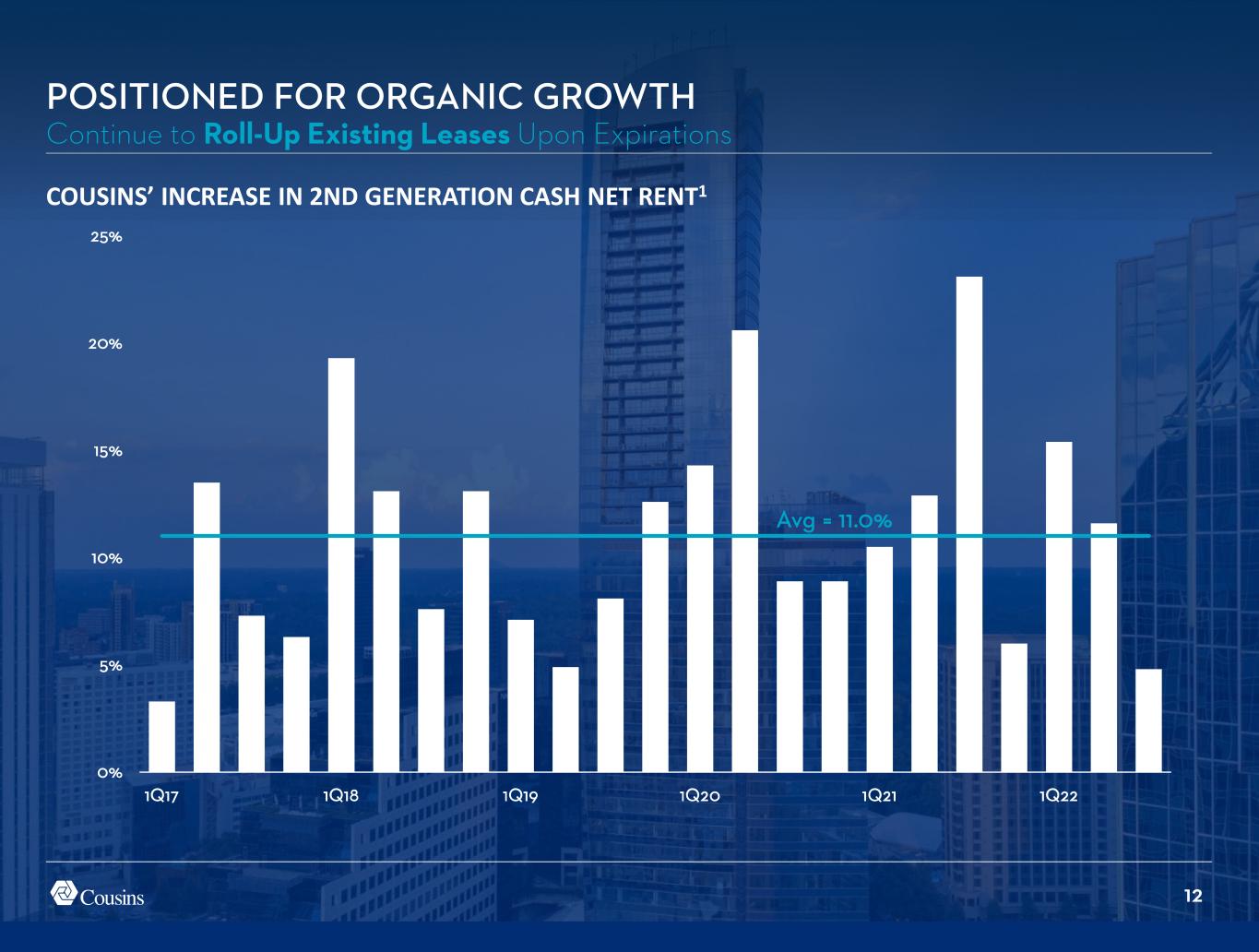

12 POSITIONED FOR ORGANIC GROWTH Continue to Roll-Up Existing Leases Upon Expirations 0% 5% 10% 15% 20% 25% 1Q17 1Q18 1Q19 1Q20 1Q21 1Q22 COUSINS’ INCREASE IN 2ND GENERATION CASH NET RENT1 Avg = 11.0%

13 PHOENIX 287K SF 90% Ownership 92% Pre-Leased1 $140MM CUZ Investment2 ATTRACTIVE DEVELOPMENT PIPELINE FOR FUTURE GROWTH 1.5MM SF Active Developments Delivering Over Next Two Years NEUHOFF CURRENT DEVELOPMENT PIPELINE DOMAIN 9100 MILL AUSTIN 338K SF 100% Ownership 97% Pre-Leased1 $147MM CUZ Investment2 NASHVILLE 448K SF Commercial/ 542 MF Units 50% Ownership 0% Pre-Leased1 $281MM CUZ Investment2

14 DOMAIN POINT LEGACY UNION TWO / THREE LEGACY 600K SF DALLAS MIDTOWN 420K SF 887 WEST PEACHTREE 3354 PEACHTREE ATLANTA AUSTIN 715 PONCE MIDTOWN 200K SF DOMAIN 900K SF TAMPA CORPORATE CENTER V WESTSHORE 170K SF DOMAIN CENTRAL CHARLOTTE 303 TREMONT SOUTH END STATION SOUTH END 700K SF SOUTH END 550K SF ATTRACTIVE DEVELOPMENT PIPELINE FOR FUTURE GROWTH Land Bank Supports 4.6MM SF1 of Additional New Development BUCKHEAD 500K SF DOMAIN 600K SF

15 ATTRACTIVE DEVELOPMENT PIPELINE FOR FUTURE GROWTH Significant Opportunities to Grow in Domain Submarket of Austin Domain Central I Future Development Domain Point 1 & 2 Domain 10 Domain 11 Domain 12 Domain 7 Domain 8 Domain 3Domain 4 Domain Point 3 & 4 Future Development Domain 2 Domain 9 Current Development Domain 3 & 4 Future Redevelopment Low-rise operating properties with up to 2MM SF redevelopment potential Operating Properties 2.1MM SF Current Development Pipeline 338K SF Future Development Pipeline1 1.5MM SF Future Redevelopment Pipeline1 2.0MM SF Total 6.0MM SF Cousins Domain Portfolio

16 NET DEBT/EBITDA1 $704MM Liquidity2 BALANCE SHEET PRIMED FOR OPPORTUNITIES Leverage Significantly Below Peers with Substantial Liquidity 4.75x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 16.0x SLG PGRE VNO DEA OPI BXP BDN FSP PDM OFC HPP CIO KRC HIW ESRT ARE CUZ Avg = 7.03x

17 BALANCE SHEET PRIMED FOR OPPORTUNITIES Near-Term Debt Maturities Well Below Office Peer Average PEER DEBT MATURITY SCHEDULES1 1.3% 0% 5% 10% 15% 20% 25% 30% PDM BDN HPP SLG BXP OPI VNO CIO PGRE DEA CUZ OFC ESRT KRC EQC ARE DEI NYC FSP HIW 2022 2023 Avg = 6.6% 2

18 COUSINS’ IN-PLACE GROSS RENT PER SF1 TRACK RECORD OF SUCCESS Strong In-Place Rent Growth $33.70 $44.85 $31.00 $33.00 $35.00 $37.00 $39.00 $41.00 $43.00 $45.00 1Q17 1Q18 1Q19 1Q20 1Q21 1Q22 33% INCREASE

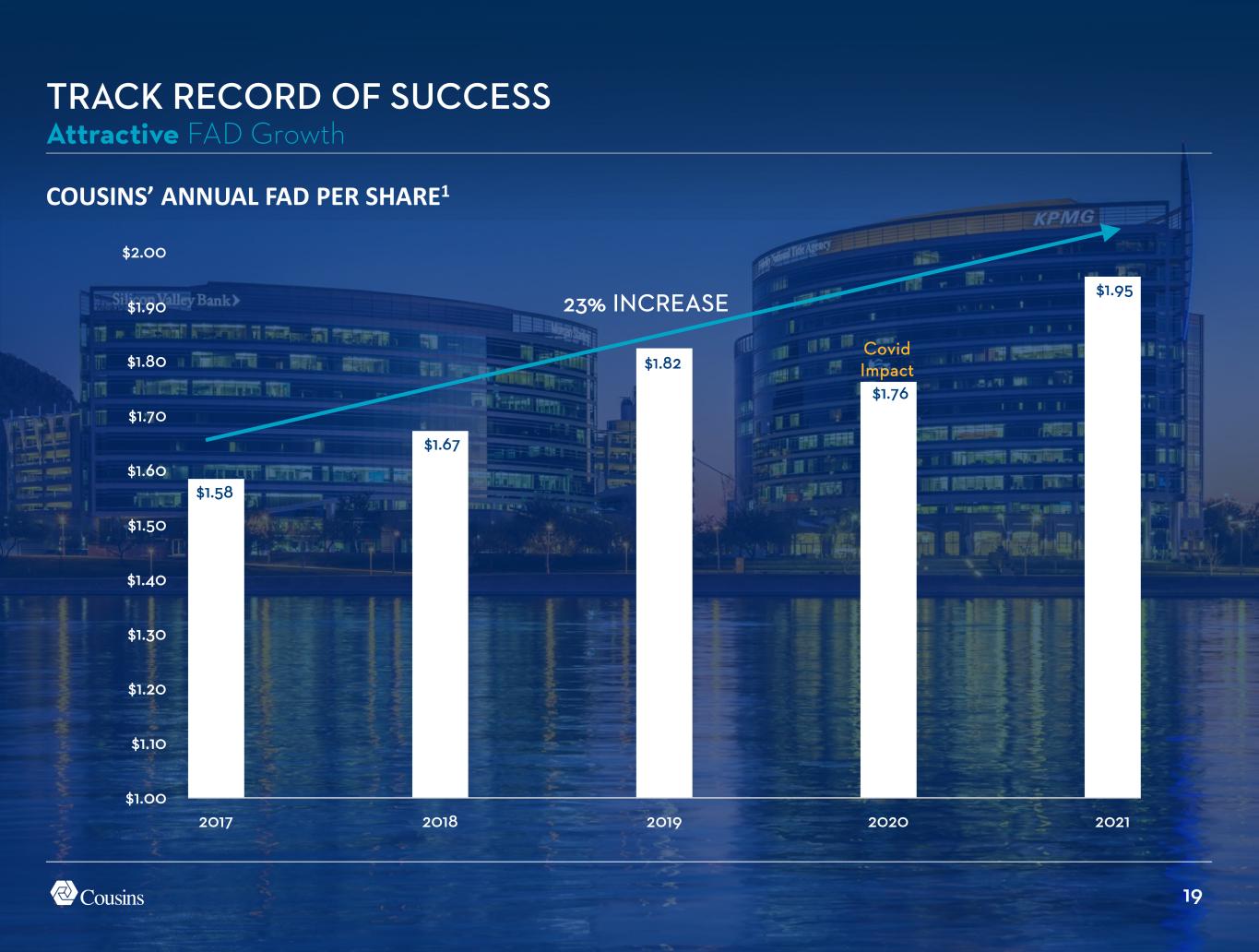

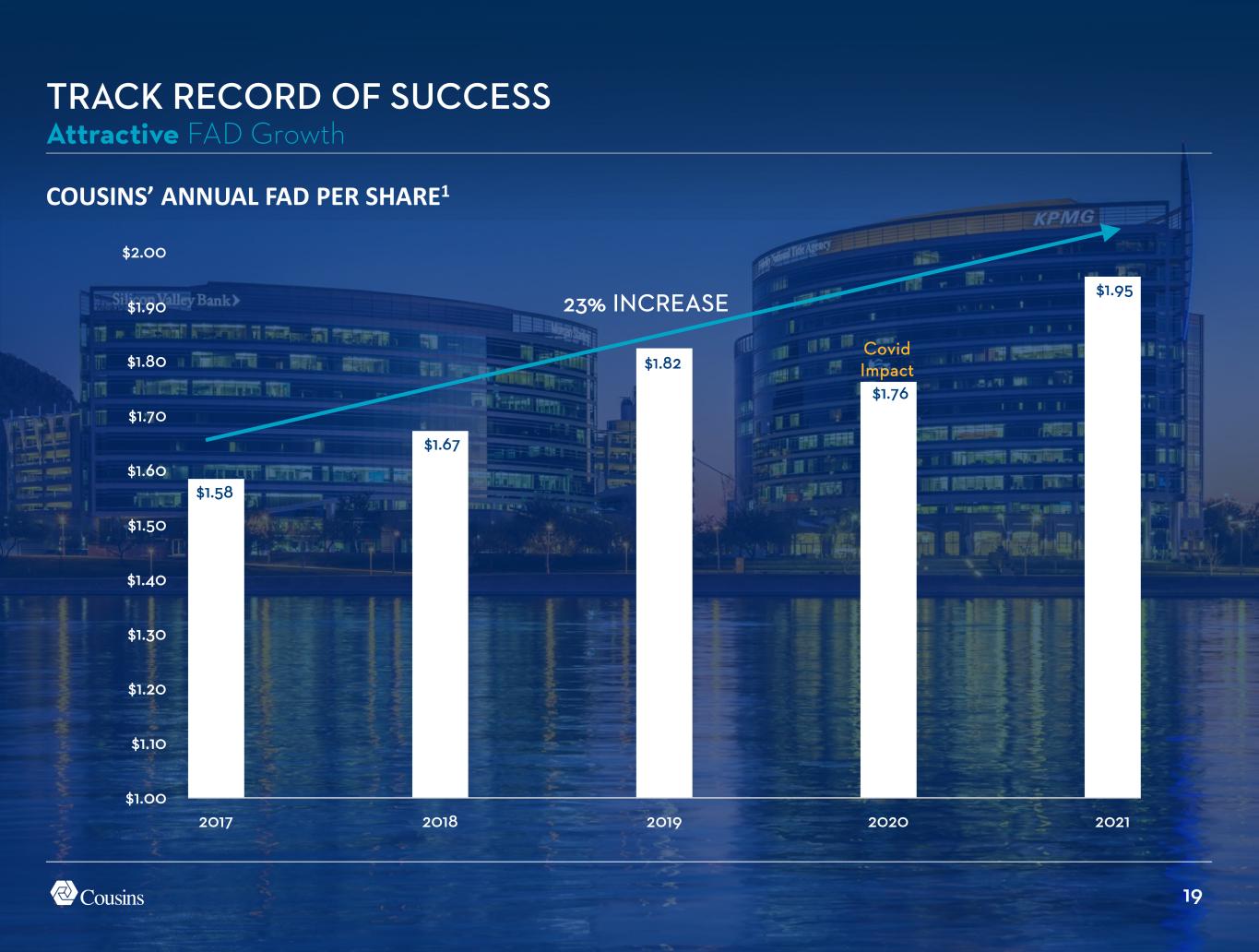

19 $1.58 $1.67 $1.82 $1.76 $1.95 $1.00 $1.10 $1.20 $1.30 $1.40 $1.50 $1.60 $1.70 $1.80 $1.90 $2.00 2017 2018 2019 2020 2021 COUSINS’ ANNUAL FAD PER SHARE1 23% INCREASE Covid Impact TRACK RECORD OF SUCCESS Attractive FAD Growth

20 NET ASSET VALUE APPRECIATION PER GREEN STREET1 TRACK RECORD OF SUCCESS Premier Sun Belt Portfolio Combined with Development Expertise Drives NAV Growth 13% -1% -14% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% 1Q17 1Q18 1Q19 1Q20 1Q21 1Q22 CUZ Non-Gateway Peer Avg Gateway Peer Avg

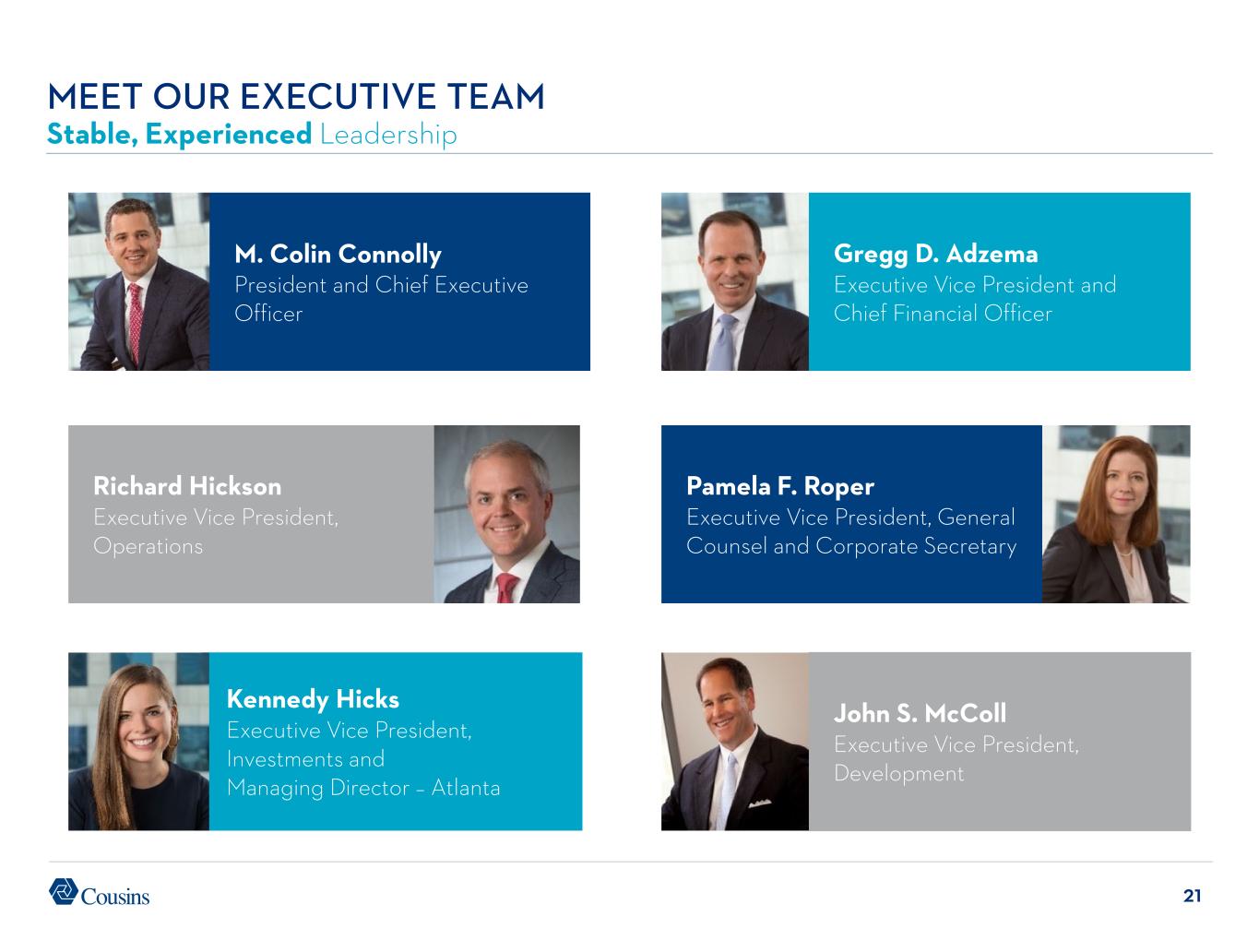

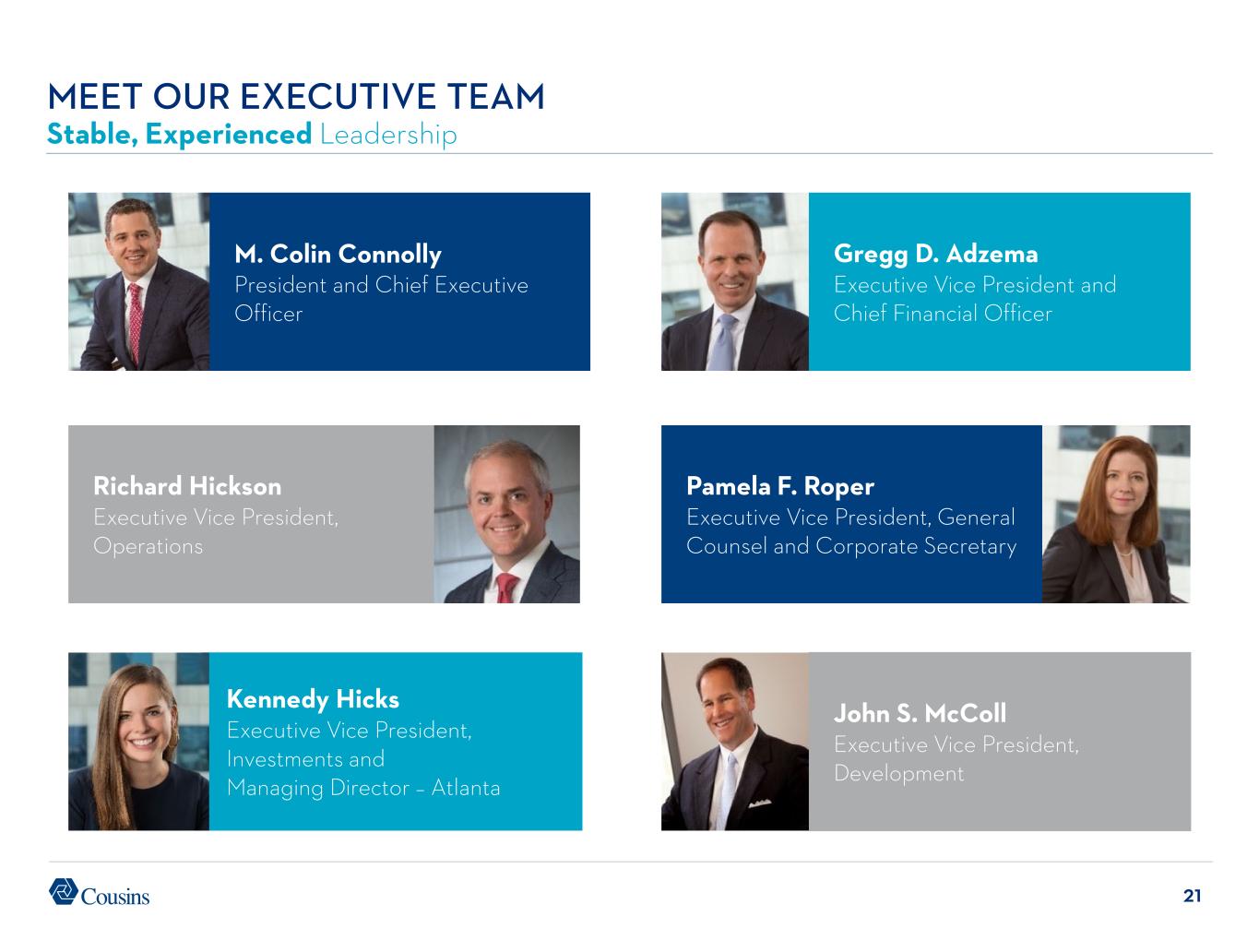

21 M. Colin Connolly President and Chief Executive Officer John S. McColl Executive Vice President, Development Gregg D. Adzema Executive Vice President and Chief Financial Officer Pamela F. Roper Executive Vice President, General Counsel and Corporate Secretary Richard Hickson Executive Vice President, Operations Kennedy Hicks Executive Vice President, Investments and Managing Director – Atlanta MEET OUR EXECUTIVE TEAM Stable, Experienced Leadership

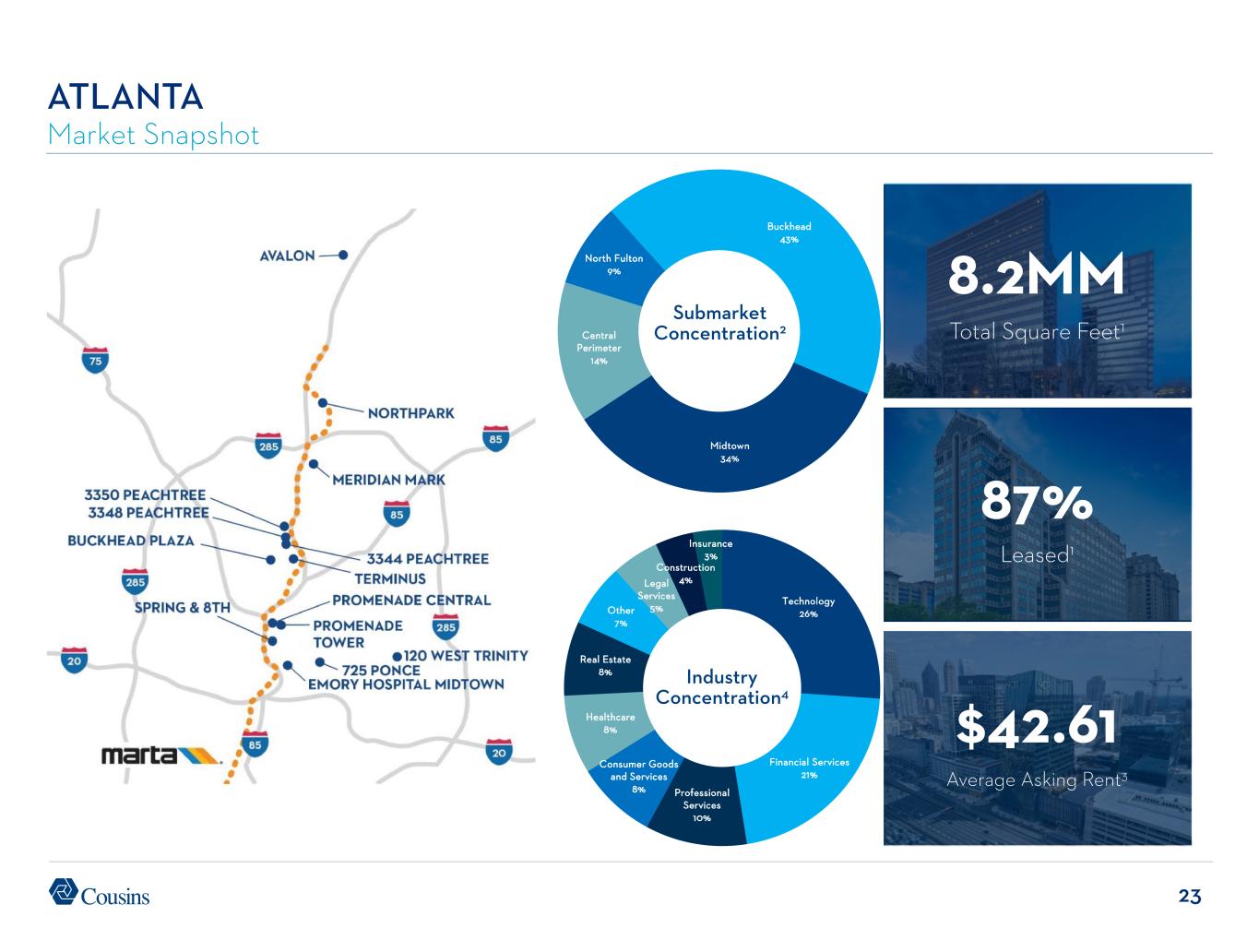

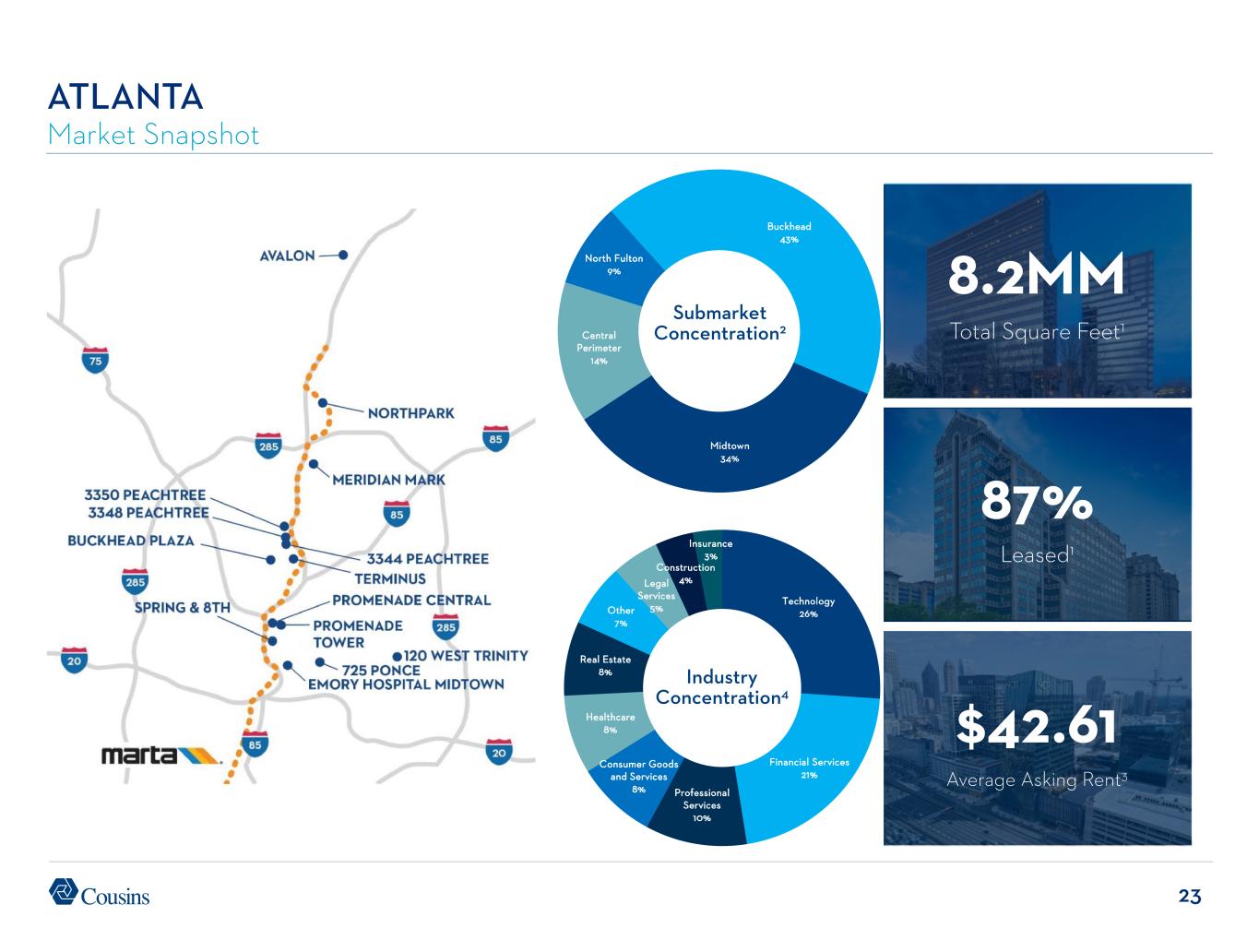

23 Submarket Concentration2 Industry Concentration4 ATLANTA Market Snapshot Technology 26% Financial Services 21% Professional Services 10% Consumer Goods and Services 8% Healthcare 8% Real Estate 8% Other 7% Legal Services 5% Construction 4% Insurance 3% Buckhead 43% Midtown 34% Central Perimeter 14% North Fulton 9% 8.2MM Total Square Feet1 87% Leased1 $42.61 Average Asking Rent3

24 AUSTIN Market Snapshot 4.6MM Total Square Feet1 95% Leased1 $62.77 Average Asking Rent3 Submarket Concentration2 Industry Concentration4 Domain 57% CBD 34% Southwest 6% Northwest 3% Technology 37% Professional Services 19% Legal Services 13% Energy 12% Financial Services 9% Other 5% Healthcare 3% Real Estate 2%

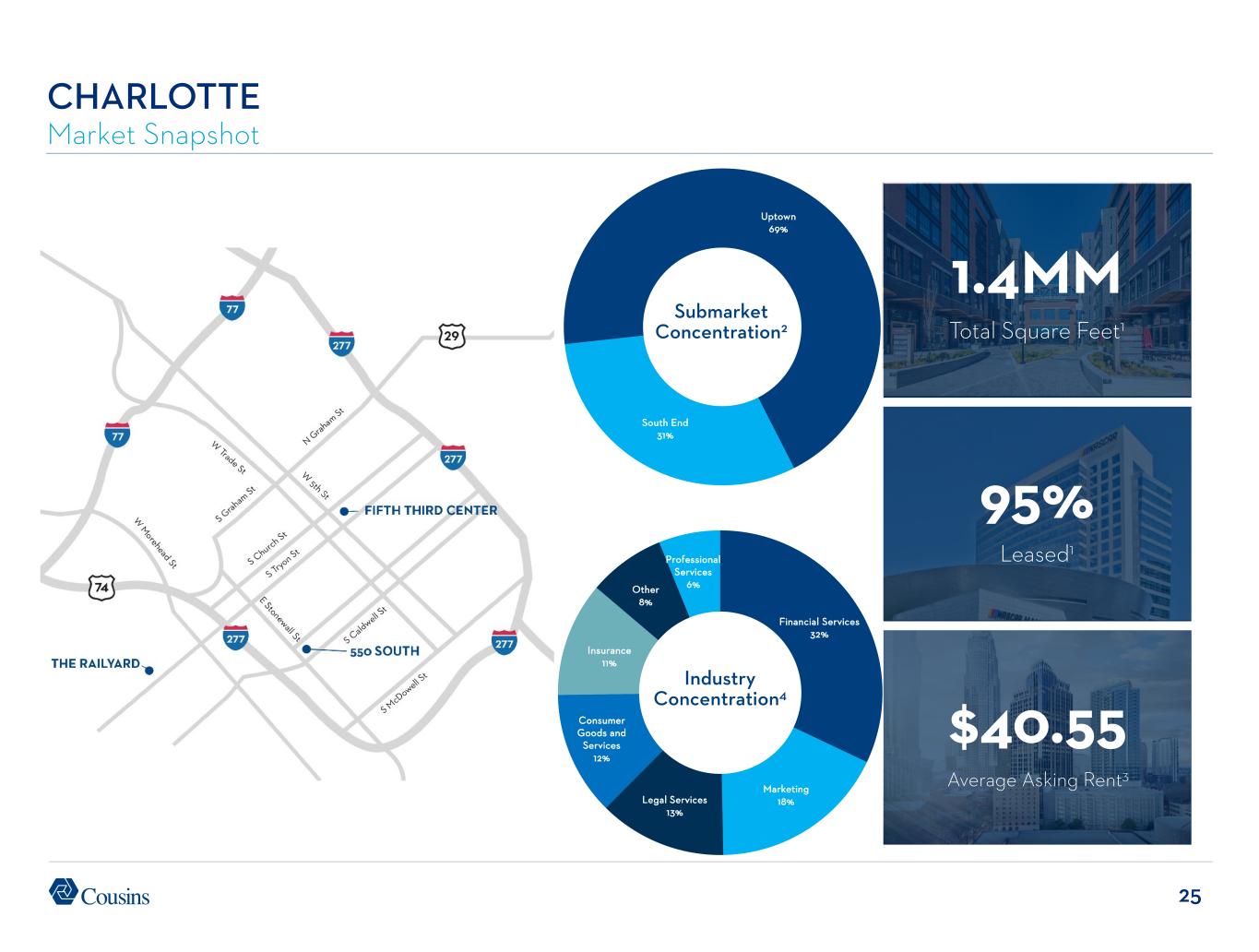

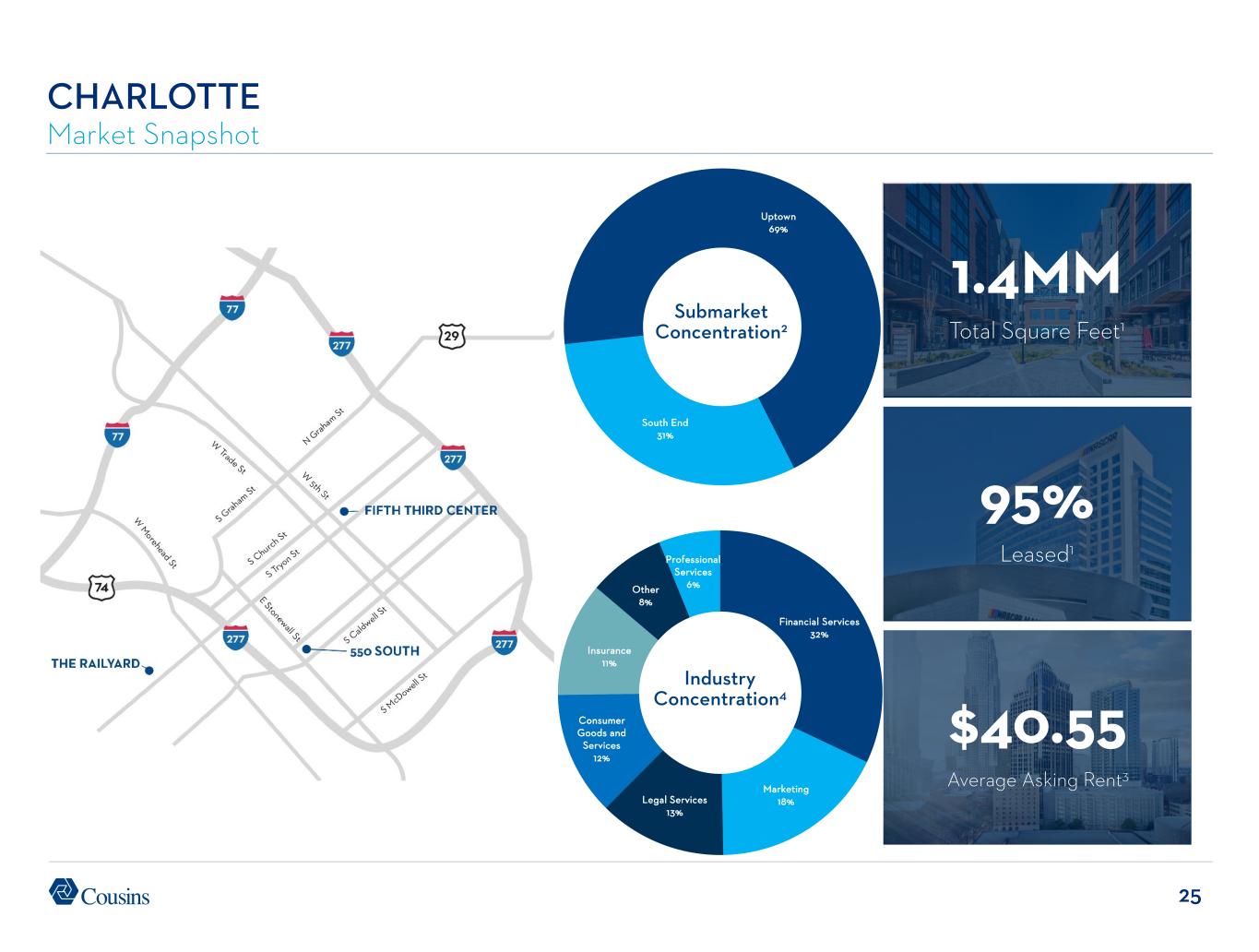

25 CHARLOTTE Market Snapshot 1.4MM Total Square Feet1 95% Leased1 $37.95 Average Asking Rent3 Submarket Concentration2 Industry Concentration4 $40.55 Average Asking Rent3 South End 31% Uptown 69% Financial Services 32% Marketing 18%Legal Services 13% Consumer Goods and Services 12% Insurance 11% Other 8% Professional Services 6%

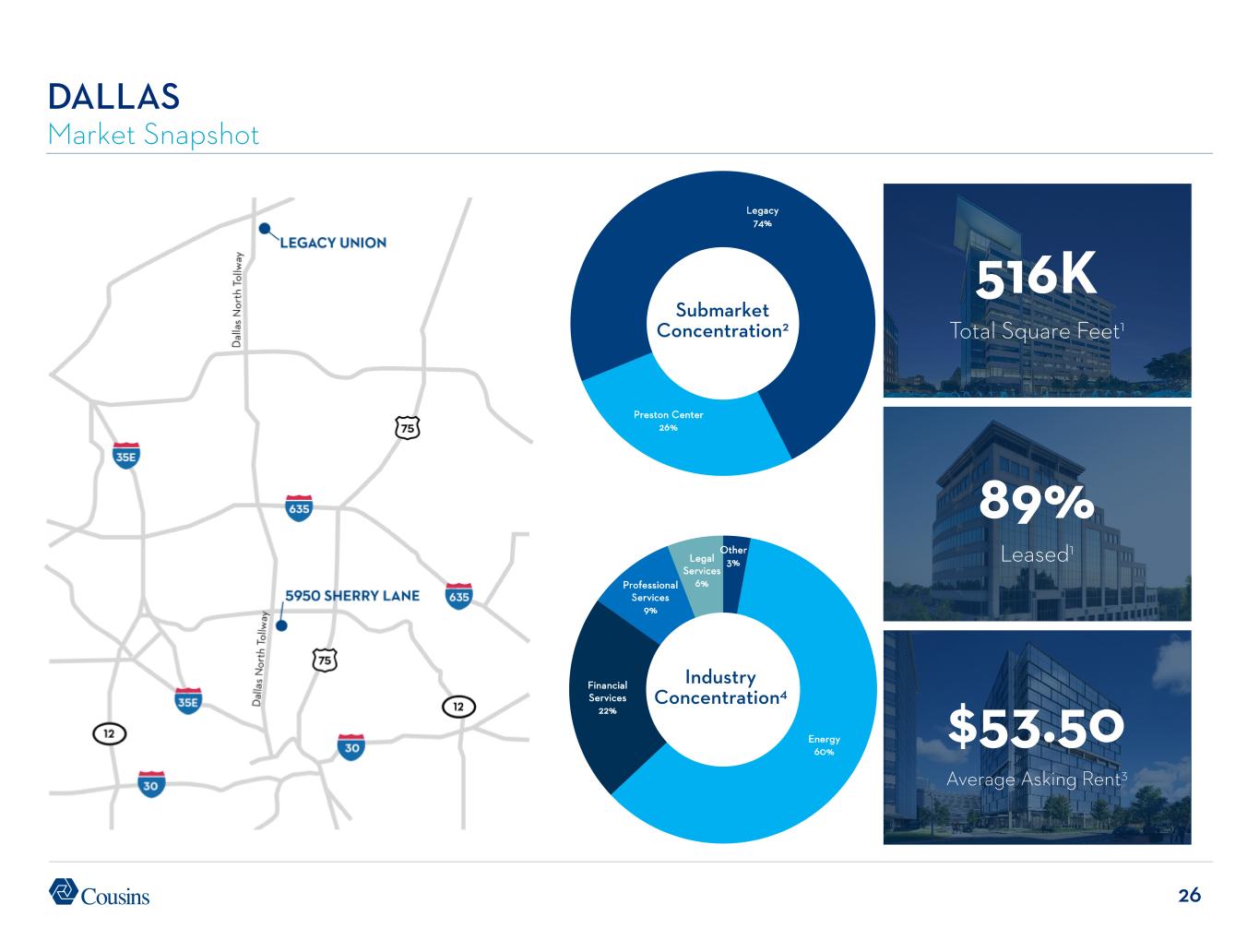

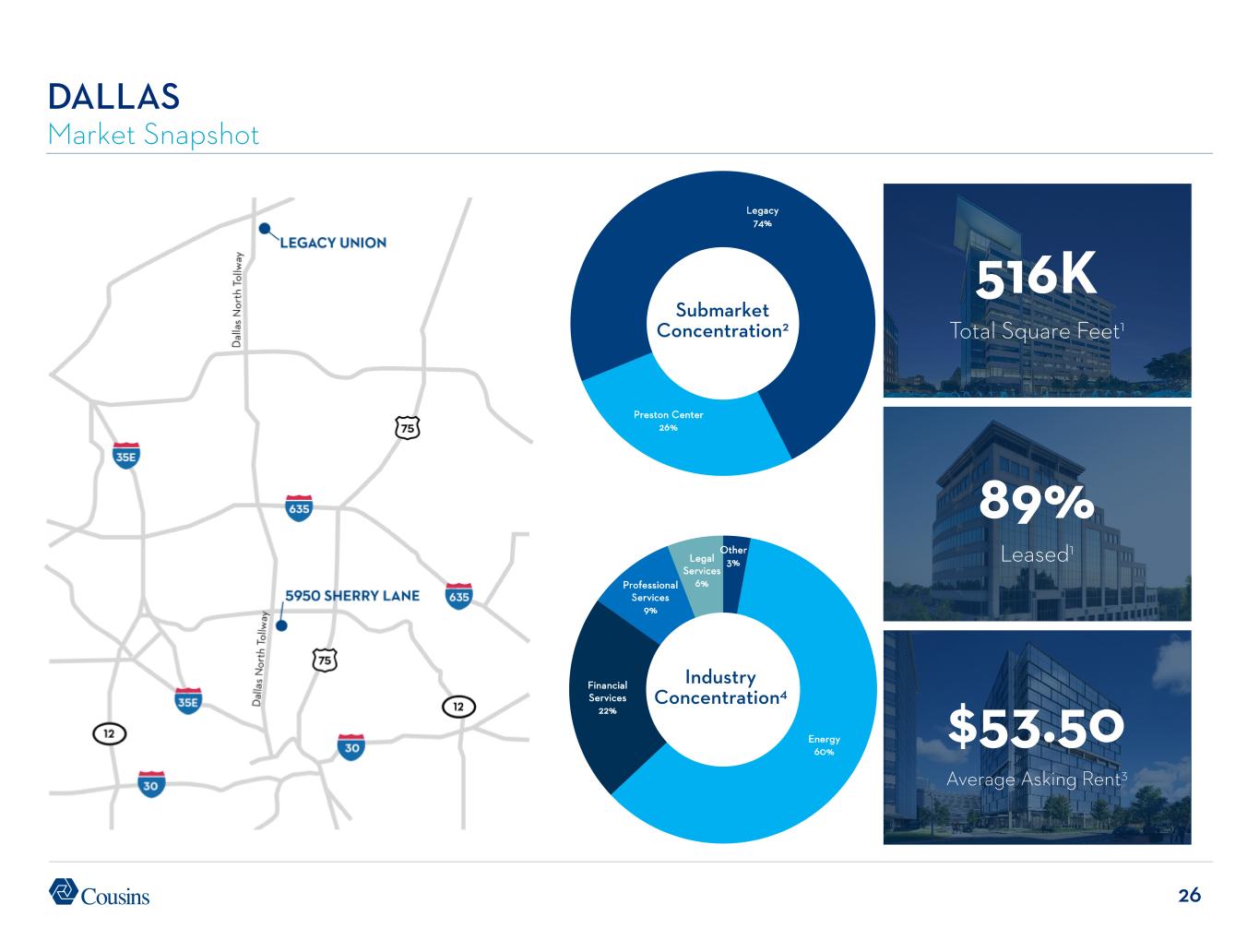

26 DALLAS Market Snapshot 89% Leased1 516K Total Square Feet1 $53.50 Average Asking Rent3 Submarket Concentration2 Industry Concentration4 Preston Center 26% Legacy 74% Other 3% Energy 60% Financial Services 22% Professional Services 9% Legal Services 6%

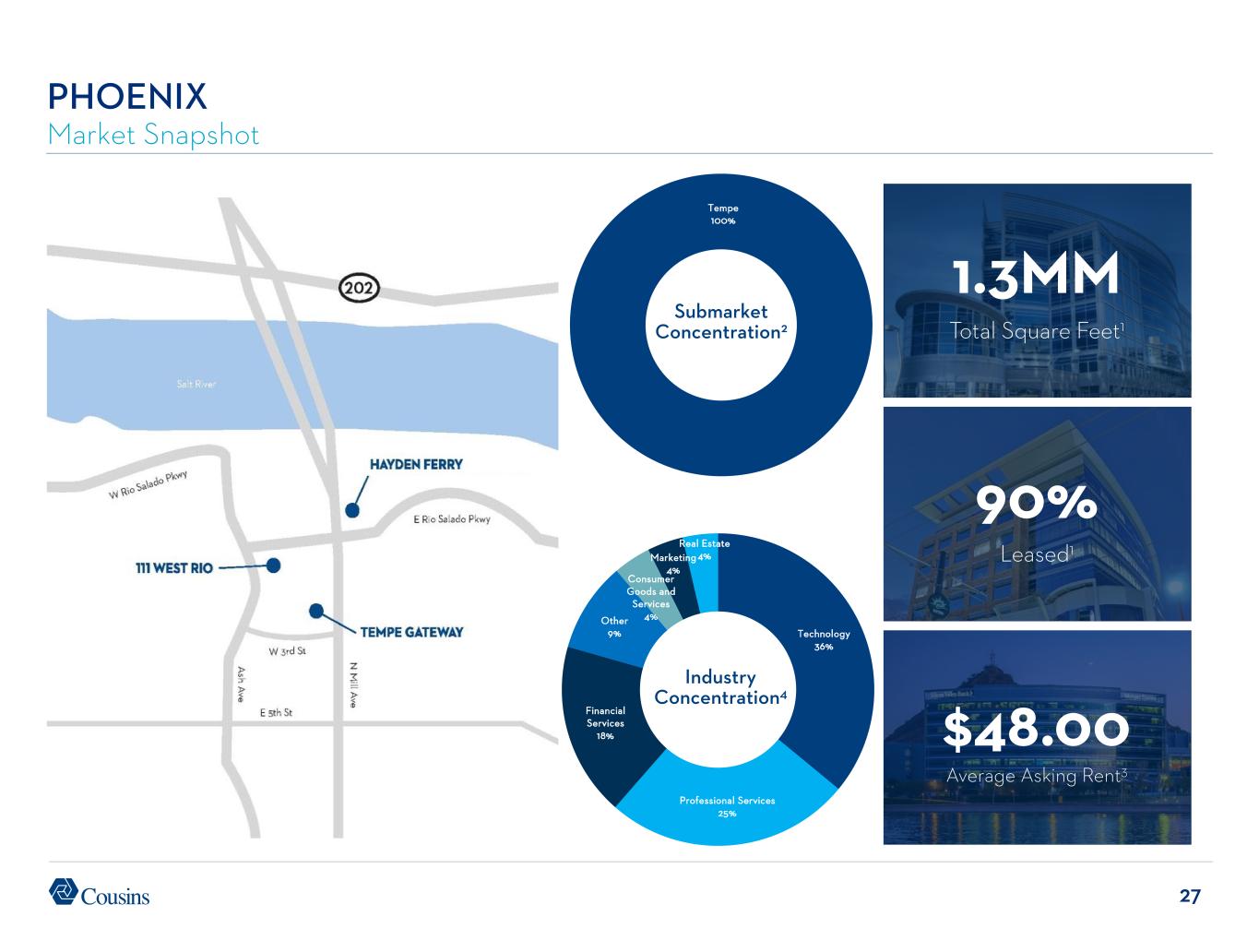

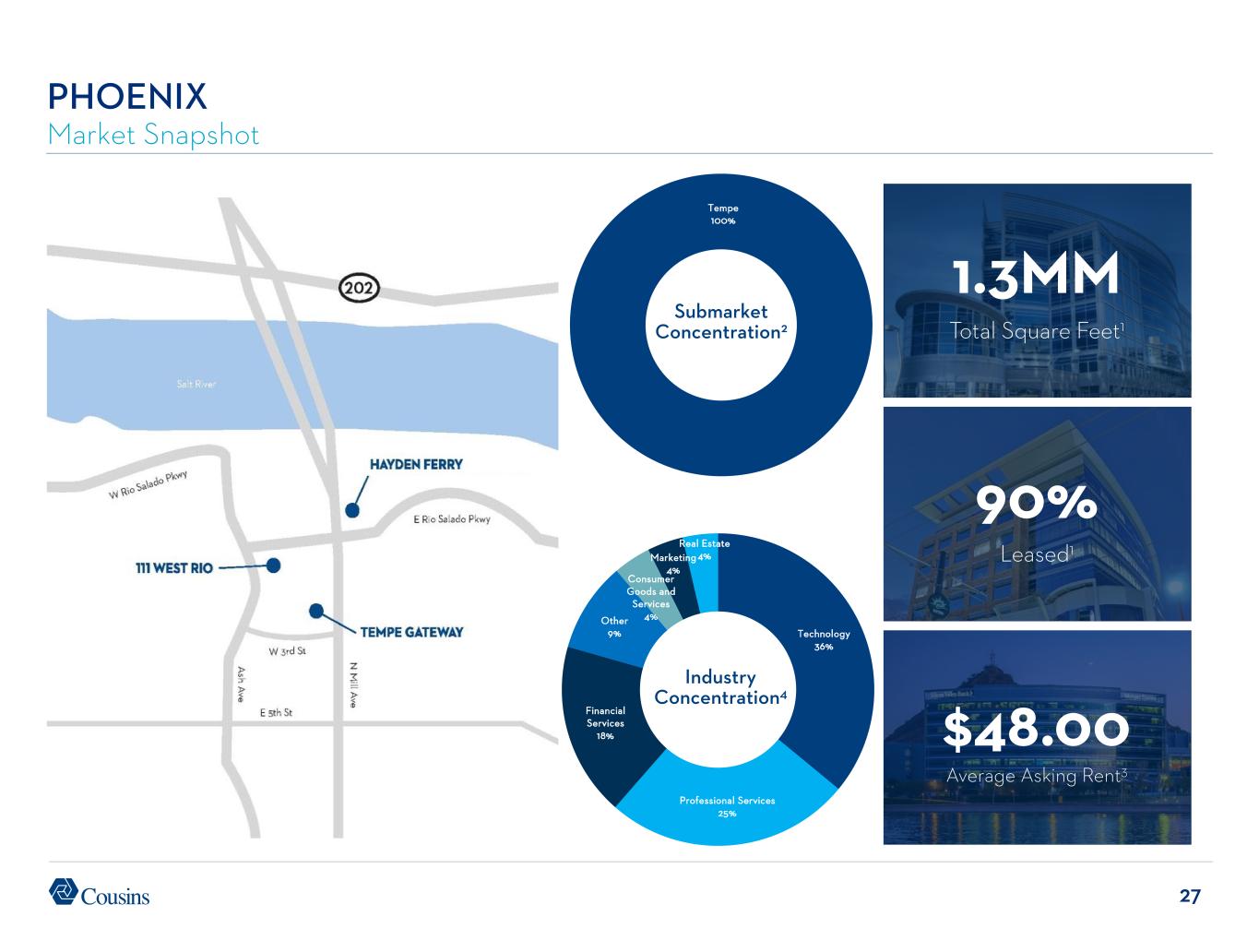

27 PHOENIX Market Snapshot 90% Leased1 1.3MM Total Square Feet1 Submarket Concentration2 Industry Concentration4 Tempe 100% $48.00 Average Asking Rent3 Technology 36% Professional Services 25% Financial Services 18% Other 9% Consumer Goods and Services 4% Marketing 4% Real Estate 4%

28 96% Leased1 2.0MM Total Square Feet1 $44.45 Average Asking Rent3 TAMPA Market Snapshot Submarket Concentration2 Industry Concentration4 Westshore 82% CBD 18% Healthcare 31% Consumer Goods and Services 14% Legal Services 13% Technology 10% Financial Services 9% Professional Services 9% Insurance 8% Other 6%

29 Page 13 – Attractive Development Pipeline for Future Growth 1. Represents office leased percentage as of 30-Sep-2022 filings. 2. Cousins share of total estimated project costs per 30-Sep-2022 filings. Page 14 – Attractive Development Pipeline for Future Growth 1. Represents Company’s estimate of developable SF, excluding redevelopment. Page 15 – Attractive Development Pipeline for Future Growth 1. Represents Company’s estimate of developable SF. Page 16 – Balance Sheet Primed for Opportunities 1. Represents total debt, including company’s share of unconsolidated debt, net of cash divided by quarterly Annualized Adjusted EBITDAre as reported in companies’ most recent quarterly filings as of 7-Nov-2022. Includes members of the FTSE NAREIT Equity Office Index that report EBITDA, with the exclusion of two outliers: NYC who has net debt/EBITDA in excess of 36x and EQC who has negative net debt/EBITDA. 2. Represents Cousins’ consolidated cash plus availability under Cousins’ Credit Facility as of 30-Sep-2022. Page 17 – Track Record 0f Success 1. As reported in companies’ most recent quarterly filings as of 7-Nov-2022. Pro forma for financing activities executed subsequent to 3Q22. Maturity dates exclude extension options if the options have not been executed. 2. Pro-forma for Terminus mortgage refinancing anticipated 4Q22 and Legacy mortgage payoff executed subsequent to 3Q22. Page 18 – Track Record 0f Success 1. Represents Cousins’ in-place gross rents per quarterly supplemental reports. Page 19 - Track Record 0f Success 1. Per company’s annual supplemental reports. Page 20 – Track Record 0f Success 1. Source: Green Street Weekly Pricing Report. Includes 12 office peers covered by Green Street for entire period. NAV estimates adjusted for splits and spin-offs per Green Street. Appendix – Market Snapshots 1. Represents portfolio statistics of Company as reported in Cousins’ 30-Sep-2022 quarterly supplement. 2. Calculation is based on pro rata share of NOI of Cousins assets for the quarter ended 30- Sep-2022. 3. Source: CoStar. Represents most recent weighted average gross rental rates of Cousins’ properties; where net rents are quoted, operating expenses are added to achieve gross rents. 4. Based on 3Q 2022 revenues. Management uses SIC codes when available along with judgment to determine tenant industry classification. Page 2 – Why Cousins? 1. As of 30-Sep-2022. 2. See endnote 4 for Page 3. 3. Based on CoStar average asking rents for same pool of Cousins assets from 4Q19 to 3Q22. 4. See endnote 1 for Page 6. 5. See endnote 1 for Page 10. 6. Per Cousins’ quarterly supplemental reports from 4Q20 – 3Q22. 7. See endnotes 1 and 2 for Page 16. 8. Pro-forma for Terminus mortgage refinancing anticipated 4Q22 and Legacy mortgage payoff executed subsequent to 3Q22. 9. See endnote 1 for Pages 18 – 20. Page 3 – Cousins at a Glance 1. Represents Cousins’ pro-rata share of third quarter NOI per 30-Sep-2022 filings, including NOI from operational developments. 2. Cousins is developing a mixed-use project called Neuhoff in Nashville through a 50% owned joint venture. 3. As of 30-Sep-2022. 4. Recently redeveloped includes five assets that have undergone major redevelopments in past five years. Page 6 – Premier Sun Belt Portfolio 1. Source: CoStar. Represents weighted average gross rental rates of 4 & 5 star properties as of 30- Sep-2022; where net rents are quoted, estimated operating expenses are added to achieve gross rents. Page 7 – Benefiting From Powerful Office Trends 1. Source: Zillow.com. Represents markets where home values are expected to appreciate faster than the rest of the U.S. in “Why Tampa will be 2022’s Hottest Market” article published 4-Jan- 2022. 2. Source: ULI 2023 Emerging Trends in Real Estate, IHS Markit, U.S. BLS. Includes cities with population greater than 2 million. Page 9 – Benefiting From Powerful Office Trends 1. Source: JLL U.S. Office Market Overview Q3 2022. Page 10 – Positioned for Organic Growth 1. Lease expirations as a percentage of total portfolio rent when available, otherwise percentage of square footage as reported in companies’ most recent quarterly filings as of 7-Nov-2022. Includes members of the FTSE NAREIT Equity Office Index who publish a quarterly supplement. Page 11 – Positioned for Organic Growth 1. Portfolio occupancy and leased percentages per Cousins’ quarterly supplemental reports. Page 12 – Positioned for Organic Growth 1. Increase in second generation net rent on a cash basis per Cousins’ quarterly supplemental reports. ENDNOTES

30 Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2021, and the Quarterly Report on Form 10-Q for the quarter ended September 30, 2022. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as: guidance and underlying assumptions; business and financial strategy; future debt financings; future acquisitions and dispositions of operating assets or joint venture interests; future acquisitions and dispositions of land, including ground leases; future development and redevelopment opportunities, including fee development opportunities; future issuances and repurchases of common stock, limited partnership units, or preferred stock; future distributions; projected capital expenditures; market and industry trends; entry into new markets or changes in existing market concentrations; future changes in interest rates; and all statements that address operating performance, events, or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders. Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information that is currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following: the availability and terms of capital; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions, investments, or dispositions; the potential dilutive effect of common stock or operating partnership unit issuances; the availability of buyers and pricing with respect to the disposition of assets; changes in national and local economic conditions, the real estate industry, and the commercial real estate markets in which we operate (including supply and demand changes), particularly in Atlanta, Austin, Charlotte, Phoenix, Tampa, Dallas, and Nashville, where we have high concentrations of our lease revenues, including the impact of high unemployment, volatility in the public equity and debt markets, and international economic and other conditions; the impact of a public health crisis, including the COVID-19 pandemic, and the governmental and third-party response to such a crisis, which may affect our key personnel, our tenants, and the costs of operating our assets; sociopolitical unrest such as political instability, civil unrest, armed hostilities, or political activism which may result in a disruption of day-to-day building operations; changes to our strategy in regard to our real estate assets which may require impairment to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, the ability to lease newly developed and/or recently acquired space, the failure of a tenant to commence or complete tenant improvements on schedule or to occupy leased space, and the risk of declining leasing rates; changes in the needs of our tenants brought about by the desire for co- working arrangements, trends toward utilizing less office space per employee, and the effect of employees working remotely; any adverse change in the financial condition of one or more of our tenants; volatility in interest rates and insurance rates; inflation and continuing increases in the inflation rate; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); cyber security breaches; changes in senior management, changes in the Board of Directors, and the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust and meet regulatory requirements; potential changes to state, local, or federal regulations applicable to our business; material changes in the rates, or the ability to pay, dividends on common shares or other securities; potential changes to the tax laws impacting REITs and real estate in general; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission ("SEC") by the Company. The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward- looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws. CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

3344 Peachtree Road NE Suite 1800 Atlanta, GA 30326 cousins.comGregg Adzema Executive Vice President and Chief Financial Officer gadzema@cousins.com 404.407.1116 Roni Imbeaux Vice President, Finance and Investor Relations rimbeaux@cousins.com 404.407.1104