| | | | | |

| Forward-Looking Statements | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Same Property Performance | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

| Cousins Properties | 1 | Q1 2023 Supplemental Information |

| | | | | | | | |

| FORWARD-LOOKING STATEMENTS |

Certain matters contained in this report are “forward-looking statements” within the meaning of the federal securities laws and are subject to uncertainties and risks, as itemized in Item 1A included in the Annual Report on Form 10-K for the year ended December 31, 2022, and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. These forward-looking statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations, plans, and objectives. They also include, among other things, statements regarding subjects that are forward-looking by their nature, such as: guidance and underlying assumptions; business and financial strategy; future debt financings; future acquisitions and dispositions of operating assets or joint venture interests; future acquisitions and dispositions of land, including ground leases; future development and redevelopment opportunities, including fee development opportunities; future issuances and repurchases of common stock, limited partnership units, or preferred stock; future distributions; projected capital expenditures; market and industry trends; entry into new markets, changes in existing market concentrations, or exits from existing markets; future changes in interest rates and liquidity of capital markets; and all statements that address operating performance, events, investments, or developments that we expect or anticipate will occur in the future — including statements relating to creating value for stockholders.

Any forward-looking statements are based upon management's beliefs, assumptions, and expectations of our future performance, taking into account information that is currently available. These beliefs, assumptions, and expectations may change as a result of possible events or factors, not all of which are known. If a change occurs, our business, financial condition, liquidity, and results of operations may vary materially from those expressed in forward-looking statements. Actual results may vary from forward-looking statements due to, but not limited to, the following: the availability and terms of capital; the ability to refinance or repay indebtedness as it matures; the failure of purchase, sale, or other contracts to ultimately close; the failure to achieve anticipated benefits from acquisitions, investments, or dispositions; the potential dilutive effect of common stock or operating partnership unit issuances; the availability of buyers and pricing with respect to the disposition of assets; changes in national and local economic conditions, the real estate industry, and the commercial real estate markets in which we operate (including supply and demand changes), particularly in Atlanta, Austin, Phoenix, Tampa, Charlotte, Dallas, and Nashville, including the impact of high unemployment, volatility in the public equity and debt markets, and international economic and other conditions; the impact of a public health crisis and the governmental and third-party response to such a crisis, which may affect our key personnel, our tenants, and the costs of operating our assets; sociopolitical unrest such as political instability, civil unrest, armed hostilities, or political activism which may result in a disruption of day-to-day building operations; changes to our strategy in regard to our real estate assets which may require impairment to be recognized; leasing risks, including the ability to obtain new tenants or renew expiring tenants, the ability to lease newly developed and/or recently acquired space, the failure of a tenant to commence or complete tenant improvements on schedule or to occupy leased space, and the risk of declining leasing rates; changes in the needs of our tenants brought about by the desire for co-working arrangements, trends toward utilizing less office space per employee, and the effect of employees working remotely; any adverse change in the financial condition of one or more of our tenants; volatility in interest rates and insurance rates; inflation and continuing increases in the inflation rate; competition from other developers or investors; the risks associated with real estate developments (such as zoning approval, receipt of required permits, construction delays, cost overruns, and leasing risk); cyber security breaches; changes in senior management, changes in the Board of Directors, and the loss of key personnel; the potential liability for uninsured losses, condemnation, or environmental issues; the potential liability for a failure to meet regulatory requirements; the financial condition and liquidity of, or disputes with, joint venture partners; any failure to comply with debt covenants under credit agreements; any failure to continue to qualify for taxation as a real estate investment trust or meet regulatory requirements; potential changes to state, local, or federal regulations applicable to our business; material changes in the rates, or the ability to pay, dividends on common shares or other securities; potential changes to the tax laws impacting REITs and real estate in general; and those additional risks and factors discussed in reports filed with the Securities and Exchange Commission ("SEC") by the Company.

The words “believes,” “expects,” “anticipates,” “estimates,” “plans,” “may,” “intend,” “will,” or similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions, and expectations reflected in any forward-looking statements are reasonable, we can give no assurance that such plans, intentions, or expectations will be achieved. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of future events, new information, or otherwise, except as required under U.S. federal securities laws.

| | | | | | | | |

| Cousins Properties | 2 | Q1 2023 Supplemental Information |

COUSINS PROPERTIES REPORTS FIRST QUARTER 2023 RESULTS

Raises and Narrows Full Year 2023 FFO Guidance

ATLANTA (April 27, 2023) - Cousins Properties (NYSE:CUZ) today reported its results of operations for the quarter ended March 31, 2023.

“We had a productive start to 2023 with solid increases in same property cash NOI and second generation cash rent growth,” said Colin Connolly, president and chief executive officer of Cousins Properties. "While minimal near-term lease expirations translated into modest renewals this quarter, looking forward, the late-stage leasing pipeline has meaningfully accelerated, including opportunities at our Neuhoff development project in Nashville. As the office sector rebalances in favor of quality, Cousins is well-positioned to thrive with our premier Sun Belt trophy portfolio and exceptionally strong balance sheet."

Financial Results

For first quarter 2023:

•Net income available to common stockholders was $22.2 million, or $0.15 per share, compared to $28.0 million, or $0.19 per share, for first quarter 2022.

•Funds From Operations ("FFO") was $98.1 million, or $0.65 per share, compared to $99.4 million, or $0.67 per share, for first quarter 2022.

•We continue to record revenue on our lease with SVB Financial at our Hayden Ferry property in Phoenix on a straight-line basis without any reserve. SVB Financial is current on the financial obligations of its lease through May 2023, and there has been no rejection of the lease under SVB Financial's bankruptcy.

Operations and Leasing Activity

For first quarter 2023:

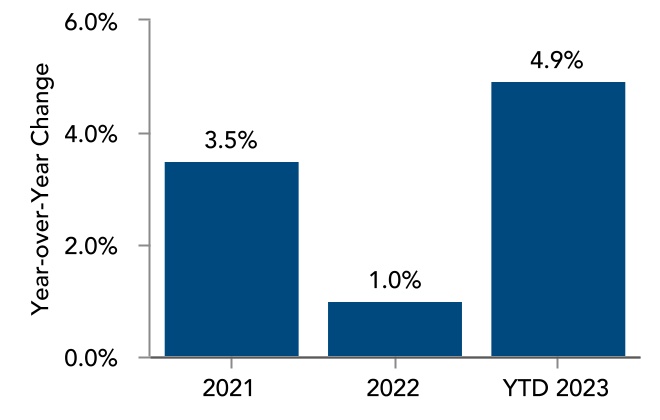

•Same property net operating income ("NOI") on a cash-basis increased 4.9%.

•Second generation net rent per square foot on a cash-basis increased 6.1%.

•Executed 258,000 square feet of office leases, including 159,000 square feet of new and expansion leases, representing 62% of total leasing activity.

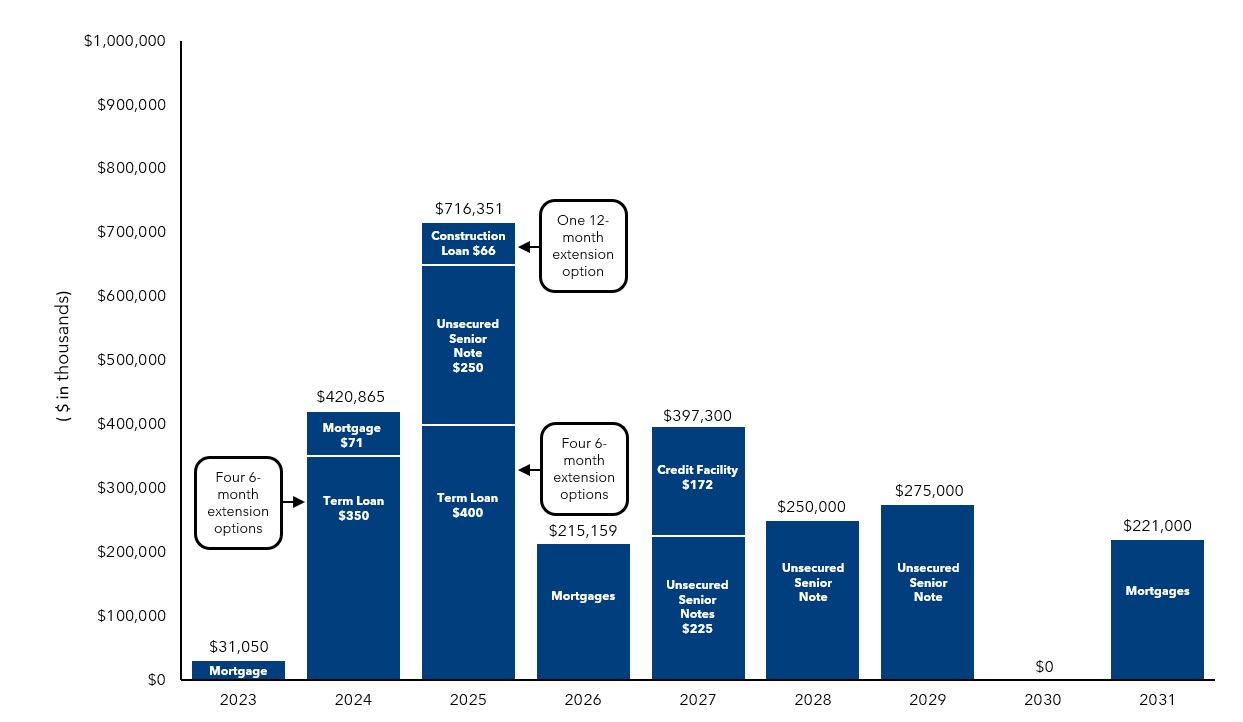

Financing Activity

•Subsequent to quarter end, we executed a loan application for our Medical Offices at Emory Hospital property in Atlanta, which is owned in a 50-50 joint venture with Emory University. This $83 million interest-only mortgage loan will have a nine-year term and a fixed interest rate of 4.80%. It is expected to close in the second quarter, with the proceeds used to pay off the existing $62 million mortgage maturing June 1, 2023.

•Subsequent to quarter end, we entered into a floating-to-fixed interest rate swap on $200 million of our recently issued $400 million Term Loan maturing March 2025, fixing the underlying daily SOFR rate at 4.298% through maturity.

| | | | | | | | |

| Cousins Properties | 3 | Q1 2023 Supplemental Information |

Earnings Guidance

Full year 2023 earnings guidance updated as follows:

•Net income between $0.56 and $0.66 per share, updated from previous guidance of $0.57 and $0.69 per share.

•FFO between $2.55 and $2.65 per share, up from previous guidance between $2.52 and $2.64 per share.

•The change to FFO is primarily driven by higher parking income and anticipated termination fees.

•Guidance does not include any operating property acquisitions, operating property dispositions, or development starts.

•Guidance reflects management’s current plans and assumptions as of the date of this report and is subject to the risks and uncertainties more fully described in our Securities and Exchange Commission filings. Actual results could differ materially from this guidance.

Investor Conference Call and Webcast

The Company will conduct a conference call at 11:00 a.m. (Eastern Time) on Friday, April 28, 2023 to discuss the results of the quarter ended March 31, 2023. The number to call for this interactive teleconference is (877) 247-1056. The live webcast of this call can be accessed on the Company's website, www.cousins.com, through the “Cousins Properties First Quarter Conference Call” link on the Investor Relations page. A replay of the conference call will be available for seven days by dialing (877) 344-7529 and entering the passcode 2582611. The playback can also be accessed on the Company's website.

| | | | | | | | |

| Cousins Properties | 4 | Q1 2023 Supplemental Information |

THE COMPANY

Cousins Properties Incorporated ("Cousins") is a fully integrated, self-administered, and self-managed real estate investment trust (REIT). The Company, based in Atlanta and acting through its operating partnership, Cousins Properties LP, primarily invests in Class A office buildings located in high-growth Sun Belt markets. Founded in 1958, Cousins creates shareholder value through its extensive expertise in the development, acquisition, leasing, and management of high-quality real estate assets. The Company has a comprehensive strategy in place based on a simple platform, trophy assets, and opportunistic investments. For more information, please visit www.cousins.com.

MANAGEMENT

| | | | | | | | | | | |

| M. Colin Connolly | Gregg D. Adzema | Kennedy Hicks | Richard G. Hickson IV |

| President & Chief Executive Officer | Executive Vice President & Chief Financial Officer | Executive Vice President, Chief Investment Officer & Managing Director | Executive Vice President, Operations |

| | | |

| John S. McColl | Pamela F. Roper | Jeffrey D. Symes | |

| Executive Vice President, Development | Executive Vice President, General Counsel & Corporate Secretary | Senior Vice President &

Chief Accounting Officer | |

BOARD OF DIRECTORS

| | | | | | | | |

| Robert M. Chapman | Charles T. Cannada | M. Colin Connolly |

| Non-executive Chairman of Cousins Properties, Chief Executive Officer of Centerpoint Properties Trust | Private Investor | President and Chief Executive Officer of Cousins Properties |

| | |

| Scott W. Fordham | Lillian C. Giornelli | R. Kent Griffin Jr. |

Former Chief Executive Officer and

Director of TIER REIT, Inc. | Chairman, Chief Executive Officer and Trustee of

The Cousins Foundation Inc. | Managing Director of Phicas Investors |

| | |

| Donna W. Hyland | Dionne Nelson | R. Dary Stone |

President and Chief Executive Officer of

Children's Healthcare of Atlanta | President and Chief Executive Officer of

Laurel Street Residential | President and Chief Executive Officer of R.D. Stone Interests |

COMPANY INFORMATION / EQUITY COVERAGE(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Headquarters | Transfer Agent | | Barclays | BofA Securities | BMO Capital Markets | Evercore ISI | Green Street | Jefferies |

3344 Peachtree Road NE

Suite 1800

Atlanta GA 30326

404.407.1000 | American Stock Transfer &

Trust Company LLC

astfinancial.com

800.937.5449 | | Anthony Powell 212.526.8768 | Camille Bonnel

416.369.2140 | John Kim

212.885.4115 | Steve Sakwa

212.446.9642 | Dylan Burzinski

949.640.8780 | Peter Abramowitz

212.336.7241 |

| | | | | | | | |

| Investor Relations | Stock Exchange | | J.P. Morgan | Mizuho Securities | RW Baird | Truist Securities | Wells Fargo | Wolfe Research |

Roni Imbeaux

Vice President, Finance &

Investor Relations

rimbeaux@cousins.com

404.407.1104 | NYSE: CUZ | | Anthony Paolone

212.622.6682 | Vikram Malhotra

212.282.3827 | Nicholas Thillman

414.298.5053 | Michael Lewis

212.319.5659 | Blaine Heck

443.263.6529 | Andrew Rosivach

646.582.9250 |

(1) Please note that any opinions, estimates, or forecasts regarding Cousins' performance made by the analysts listed above are theirs alone and do not represent opinions, forecasts, or predictions of Cousins or its management. Cousins does not, by its reference above or distribution, imply its endorsement of, or concurrence with, such information, conclusions, or recommendations.

| | | | | | | | |

| Cousins Properties | 5 | Q1 2023 Supplemental Information |

| | | | | | | | |

| CONSOLIDATED BALANCE SHEETS |

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| |

| March 31, 2023 | | December 31, 2022 |

| Assets: | | | |

| Real estate assets: | | | |

| Operating properties, net of accumulated depreciation of $1,131,555 and $1,079,662 in 2023 and 2022, respectively | $ | 6,744,701 | | | $ | 6,738,354 | |

| Projects under development | 119,291 | | | 111,400 | |

| Land | 158,430 | | | 158,430 | |

| 7,022,422 | | | 7,008,184 | |

| | | |

| | | |

| | | |

| Cash and cash equivalents | 3,585 | | | 5,145 | |

| | | |

| Accounts receivable | 9,634 | | | 8,653 | |

| Deferred rents receivable | 192,713 | | | 184,043 | |

| Investment in unconsolidated joint ventures | 136,721 | | | 112,839 | |

| Intangible assets, net | 129,838 | | | 136,240 | |

| Other assets, net | 88,057 | | | 81,912 | |

| Total assets | $ | 7,582,970 | | | $ | 7,537,016 | |

| Liabilities: | | | |

| Notes payable | $ | 2,448,942 | | | $ | 2,334,606 | |

| Accounts payable and accrued expenses | 205,018 | | | 271,103 | |

| Deferred income | 154,088 | | | 128,636 | |

| Intangible liabilities, net | 49,831 | | | 52,280 | |

| Other liabilities | 104,055 | | | 103,442 | |

| | | |

| Total liabilities | 2,961,934 | | | 2,890,067 | |

| Commitments and contingencies | | | |

| Equity: | | | |

| Stockholders' investment: | | | |

| | | |

| Common stock, $1 par value per share, 300,000,000 shares authorized, 154,255,888 and 154,019,214 issued, and 151,693,864 and 151,457,190 outstanding in 2023 and 2022, respectively | 154,256 | | | 154,019 | |

| Additional paid-in capital | 5,631,076 | | | 5,630,327 | |

| Treasury stock at cost, 2,562,024 shares in 2023 and 2022 | (147,157) | | | (147,157) | |

| Distributions in excess of cumulative net income | (1,039,694) | | | (1,013,292) | |

| Accumulated other comprehensive income | 537 | | | 1,767 | |

| Total stockholders' investment | 4,599,018 | | | 4,625,664 | |

| Nonredeemable noncontrolling interests | 22,018 | | | 21,285 | |

| Total equity | 4,621,036 | | | 4,646,949 | |

| Total liabilities and equity | $ | 7,582,970 | | | $ | 7,537,016 | |

| | | | | | | | |

| Cousins Properties | 6 | Q1 2023 Supplemental Information |

| | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

(unaudited; in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | |

| March 31, | | | |

| | 2023 | | 2022 | | | | | |

| Revenues: | | | | | | | | |

| Rental property revenues | $ | 200,076 | | | $ | 183,227 | | | | | | |

| Fee income | 374 | | | 1,388 | | | | | | |

| Other | 2,278 | | | 2,283 | | | | | | |

| | 202,728 | | | 186,898 | | | | | | |

| Expenses: | | | | | | | | |

| Rental property operating expenses | 71,213 | | | 64,877 | | | | | | |

| Reimbursed expenses | 207 | | | 360 | | | | | | |

| General and administrative expenses | 8,438 | | | 8,063 | | | | | | |

| Interest expense | 25,030 | | | 15,525 | | | | | | |

| | | | | | | | |

| Depreciation and amortization | 75,770 | | | 70,744 | | | | | | |

| | | | | | | | |

| Other | 385 | | | 221 | | | | | | |

| | 181,043 | | | 159,790 | | | | | | |

| | | | | | | | |

| Income from unconsolidated joint ventures | 673 | | | 1,124 | | | | | | |

| | | | | | | | |

| Loss on investment property transactions | (2) | | | (69) | | | | | | |

| | | | | | | | |

| Net income | 22,356 | | | 28,163 | | | | | | |

| Net income attributable to noncontrolling interests | (160) | | | (179) | | | | | | |

| Net income available to common stockholders | $ | 22,196 | | | $ | 27,984 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income per common share — basic and diluted | $ | 0.15 | | | $ | 0.19 | | | | | | |

| Weighted average shares — basic | 151,579 | | | 148,739 | | | | | | |

| Weighted average shares — diluted | 151,880 | | | 149,002 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Cousins Properties | 7 | Q1 2023 Supplemental Information |

| | | | | | | | |

| KEY PERFORMANCE METRICS (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 2021 | | | | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | 2022 | 2023 1st | | | |

| Property Statistics | | | | | | | | | | | | | | | | | | |

| Consolidated Operating Properties | | | | | | 32 | | | | 33 | 33 | 33 | 34 | 34 | 34 | | | |

| Consolidated Rentable Square Feet (in thousands) | | | | | | 17,758 | | | | 18,136 | 18,136 | 18,136 | 18,424 | 18,424 | 18,444 | | | |

| Unconsolidated Operating Properties | | | | | | 3 | | | | 3 | 3 | 2 | 2 | 2 | 2 | | | |

| Unconsolidated Rentable Square Feet (in thousands) | | | | | | 1,179 | | | | 1,179 | 1,179 | 711 | 711 | 711 | 711 | | | |

| Total Operating Properties | | | | | | 35 | | | | 36 | 36 | 35 | 36 | 36 | 36 | | | |

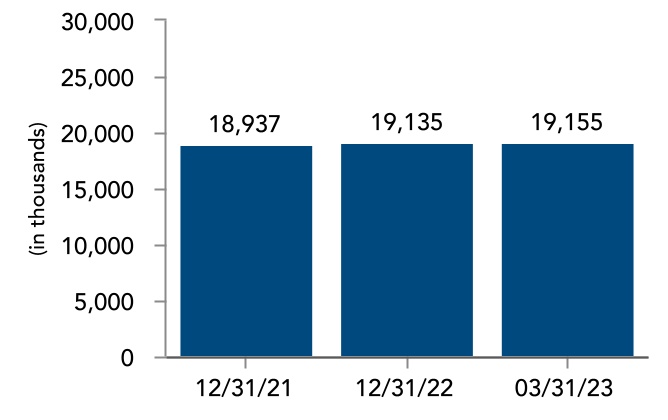

| Total Rentable Square Feet (in thousands) | | | | | | 18,937 | | | | 19,315 | 19,315 | 18,847 | 19,135 | 19,135 | 19,155 | | | |

| | | | | | | | | | | | | | | | | | |

| Office Leasing Activity (2) | | | | | | | | | | | | | | | | | | |

| Net Leased during the Period (SF, in thousands) | | | | | | 2,096 | | | | 324 | 588 | 431 | 632 | 1,976 | 258 | | | |

| | | | | | | | | | | | | | | | | | |

| Net Rent (per SF) | | | | | | $35.24 | | | | $35.45 | $32.34 | $35.49 | $34.04 | $34.08 | $34.45 | | | |

| Net Free Rent (per SF) | | | | | | (1.45) | | | | (2.36) | (0.99) | (1.97) | (2.69) | (1.97) | (2.07) | | | |

| Leasing Commissions (per SF) | | | | | | (2.77) | | | | (3.01) | (2.65) | (2.86) | (2.60) | (2.74) | (2.83) | | | |

| Tenant Improvements (per SF) | | | | | | (5.47) | | | | (6.34) | (5.33) | (5.69) | (6.61) | (5.98) | (6.29) | | | |

| Leasing Costs (per SF) | | | | | | (9.69) | | | | (11.71) | (8.97) | (10.52) | (11.90) | (10.69) | (11.19) | | | |

| Net Effective Rent (per SF) | | | | | | $25.55 | | | | $23.74 | $23.37 | $24.97 | $22.14 | $23.39 | $23.26 | | | |

| Change in Second Generation Net Rent | | | | | | 24.7 | % | | | | 27.4 | % | 27.2 | % | 20.4 | % | 18.6 | % | 23.2 | % | 20.1 | % | | | |

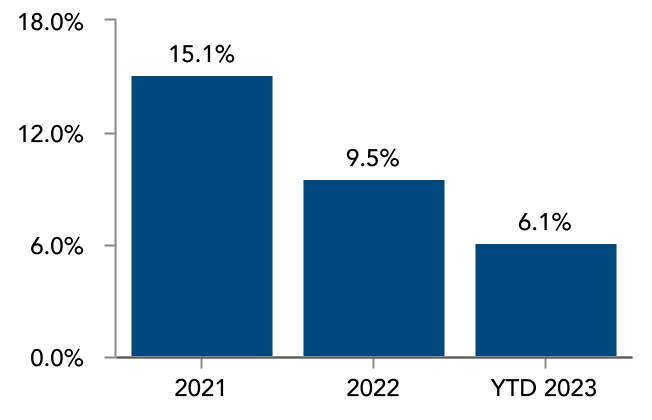

| Change in Cash-Basis Second Generation Net Rent | | | | | | 15.1 | % | | | | 15.4 | % | 11.6 | % | 4.8 | % | 7.3 | % | 9.5 | % | 6.1 | % | | | |

| | | | | | | | | | | | | | | | | | |

| Same Property Information (3) | | | | | | | | | | | | | | | | | | |

| Percent Leased (period end) | | | | | | 90.5 | % | | | | 90.0 | % | 89.7 | % | 89.2 | % | 90.1 | % | 90.1 | % | 90.6 | % | | | |

| Weighted Average Occupancy | | | | | | 90.0 | % | | | | 87.0 | % | 86.9 | % | 86.6 | % | 86.2 | % | 86.6 | % | 87.0 | % | | | |

| Change in NOI (over prior year period) | | | | | | (0.5) | % | | | | (2.0) | % | (2.2) | % | 1.8 | % | 2.3 | % | 0.0 | % | 5.3 | % | | | |

| Change in Cash-Basis NOI (over prior year period) | | | | | | 3.5 | % | | | | 0.1 | % | (0.2) | % | 1.5 | % | 2.5 | % | 1.0 | % | 4.9 | % | | | |

| | | | | | | | | | | | | | | | | | |

| Development Pipeline (4) | | | | | | | | | | | | | | | | | | |

| Estimated Project Costs (in thousands) | | | | | | $759,000 | | | | $566,000 | $566,000 | $568,900 | $428,500 | $428,500 | $428,500 | | | |

| Estimated Project Costs/Total Undepreciated Assets | | | | | | 8.9 | % | | | | 6.6 | % | 6.5 | % | 6.5 | % | 4.8 | % | 4.8 | % | 4.8 | % | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Market Capitalization | | | | | | | | | | | | | | | | | | |

| Common Stock Price | | | | | | $40.28 | | | | $40.29 | $29.23 | $23.35 | $25.29 | $25.29 | $21.38 | | | |

| Common Stock/Units Outstanding (in thousands) | | | | | | 148,713 | | | | 148,788 | 151,465 | 151,459 | 151,482 | 151,482 | 151,718 | | | |

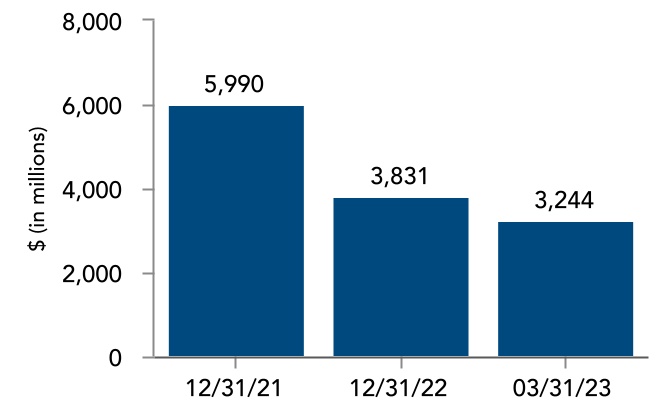

| Equity Market Capitalization (in thousands) | | | | | | $5,990,160 | | | | $5,994,669 | $4,427,322 | $3,536,568 | $3,830,980 | $3,830,980 | $3,243,731 | | | |

| Debt (in thousands) | | | | | | 2,350,314 | | | | 2,462,197 | 2,425,339 | 2,372,931 | 2,424,004 | 2,424,004 | 2,544,956 | | | |

| Total Market Capitalization (in thousands) | | | | | | $8,340,474 | | | | $8,456,866 | $6,852,661 | $5,909,499 | $6,254,984 | $6,254,984 | $5,788,687 | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Continued on next page | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Cousins Properties | 8 | Q1 2023 Supplemental Information |

| | | | | | | | |

| KEY PERFORMANCE METRICS (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 2021 | | | | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | 2022 | 2023 1st | | | |

| Credit Ratios | | | | | | | | | | | | | | | | | | |

| Net Debt/Total Market Capitalization | | | | | | 28.0 | % | | | | 28.9 | % | 35.1 | % | 39.9 | % | 38.6 | % | 38.6 | % | 43.7 | % | | | |

| Net Debt/Total Undepreciated Assets | | | | | | 27.5 | % | | | | 28.4 | % | 27.7 | % | 26.7 | % | 27.2 | % | 27.2 | % | 28.1 | % | | | |

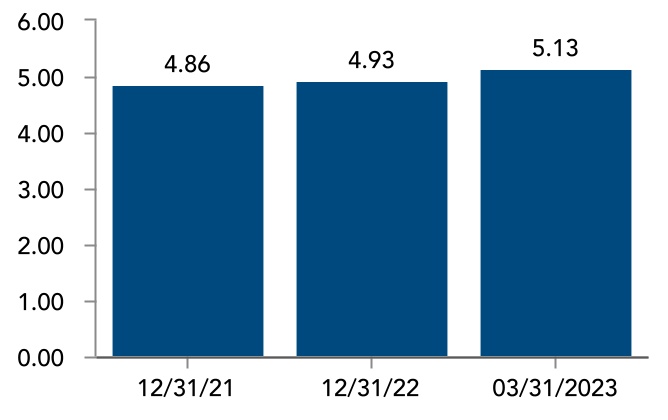

Net Debt/Annualized EBITDAre | | | | | | 4.86 | | | | 5.28 | 4.93 | 4.75 | 4.93 | 4.93 | 5.13 | | | |

Fixed Charges Coverage (EBITDAre) | | | | | | 5.45 | | | | 5.56 | 5.56 | 5.13 | 4.72 | 5.21 | 4.48 | | | |

| | | | | | | | | | | | | | | | | | |

| Dividend Information | | | | | | | | | | | | | | | | | | |

| Common Dividend per Share | | | | | | $1.24 | | | | $0.32 | $0.32 | $0.32 | $0.32 | $1.28 | $0.32 | | | |

| | | | | | | | | | | | | | | | | | |

| Funds From Operations (FFO) Payout Ratio | | | | | | 45.3 | % | | | | 48.7 | % | 46.3 | % | 46.4 | % | 48.4 | % | 47.4 | % | 49.5 | % | | | |

| Funds Available for Distribution (FAD) Payout Ratio | | | | | | 63.1 | % | | | | 67.3 | % | 70.6 | % | 72.2 | % | 76.6 | % | 70.6 | % | 63.8 | % | | | |

| | | | | | | | | | | | | | | | | | |

| Operations Ratio | | | | | | | | | | | | | | | | | | |

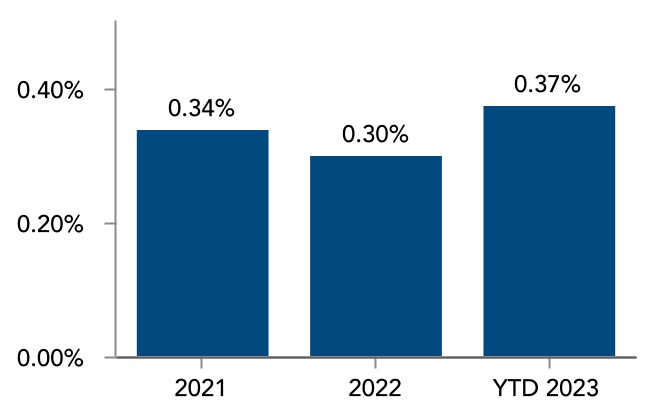

| Annualized General and Administrative Expenses/ Total Undepreciated Assets | | | | | | 0.34 | % | | | | 0.38 | % | 0.32 | % | 0.29 | % | 0.30 | % | 0.30 | % | 0.37 | % | | | |

| | | | | | | | | | | | | | | | | | |

| Additional Information | | | | | | | | | | | | | | | | | | |

| In-Place Gross Rent (per SF) (5) | | | | | | $42.85 | | | | $43.90 | $44.39 | $44.85 | $44.87 | $44.87 | $46.02 | | | |

| Straight-Line Rental Revenue (in thousands) | | | | | | $25,503 | | | | $5,501 | $6,378 | $8,966 | $8,108 | $28,953 | $8,431 | | | |

Above and Below Market Rents Amortization, Net (in thousands) | | | | | | $8,392 | | | | $1,771 | $1,669 | $1,538 | $1,466 | $6,444 | $1,559 | | | |

Second Generation Capital Expenditures (in thousands) | | | | | | $81,642 | | | | $21,280 | $24,324 | $26,636 | $27,261 | $99,501 | $13,728 | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| (1) | | For Non-GAAP Financial Measures, see the calculations and reconciliations on pages 31-37. |

| (2) | | See Office Leasing Activity on page 19 for additional detail and explanations. |

| (3) | | Same Property Information is derived from the pool of same office properties as existed in the period originally reported. See Same Property Performance on page 18 and Non-GAAP Financial Measures - Calculations and Reconciliations on page 31 for additional information. |

| (4) | | The Company's share of estimated project costs. See Development Pipeline on page 25 for additional detail. |

| |

| (5) | | In-place gross rent equals the annualized cash rent including the tenant's share of estimated operating expenses, if applicable, as of the end of the period divided by occupied square feet. |

| | | | | | | | |

| Cousins Properties | 9 | Q1 2023 Supplemental Information |

Total Rentable Square Feet Equity Market Capitalization Net Debt / Annualized EBITDAre

Same Property NOI Change Second Generation Net Rent Change Annualized General & Administrative

Cash-Basis (1) Cash-Basis (1) Expenses / Total Undepreciated Assets

(1) Office properties only.

Note: See additional information included herein for calculations, definitions, and reconciliations to GAAP financial measures.

| | | | | | | | |

| Cousins Properties | 10 | Q1 2023 Supplemental Information |

| | | | | | | | |

| FUNDS FROM OPERATIONS - SUMMARY |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | (amounts in thousands, except per share amounts) |

| | | | | | 2021 | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | | 2022 | 2023 1st | | | |

| Net Income | | | | | | $ | 278,996 | | $ | 28,163 | | $ | 34,164 | | $ | 80,769 | | $ | 24,349 | | | $ | 167,445 | | $ | 22,356 | | | | |

| Fee and Other Income | | | | | | (21,115) | | (5,133) | | (2,955) | | (1,957) | | (1,198) | | | (11,243) | | (2,788) | | | | |

| General and Administrative Expenses | | | | | | 29,321 | | 8,063 | | 6,996 | | 6,498 | | 6,762 | | | 28,319 | | 8,438 | | | | |

| Interest Expense | | | | | | 67,027 | | 15,525 | | 16,549 | | 18,380 | | 22,083 | | | 72,537 | | 25,030 | | | | |

| | | | | | | | | | | | | | | | |

| Depreciation and Amortization | | | | | | 288,092 | | 70,744 | | 69,861 | | 79,116 | | 75,866 | | | 295,587 | | 75,770 | | | | |

| | | | | | | | | | | | | | | | |

| Reimbursed and Other Expenses | | | | | | 4,607 | | 581 | | 1,102 | | 649 | | 1,826 | | | 4,158 | | 592 | | | | |

| Income from Unconsolidated Joint Ventures | | | | | | (6,801) | | (1,124) | | (5,280) | | (634) | | (662) | | | (7,700) | | (673) | | | | |

| NOI from Unconsolidated Joint Ventures | | | | | | 19,223 | | 2,719 | | 2,542 | | 2,819 | | 1,444 | | | 9,524 | | 1,409 | | | | |

| Transaction Loss (Gain) | | | | | | (165,630) | | 69 | | 72 | | (56,240) | | (328) | | | (56,427) | | 2 | | | | |

| NOI (1) | | | | | | $ | 493,720 | | $ | 119,607 | | $ | 123,051 | | $ | 129,400 | | $ | 130,142 | | | $ | 502,200 | | $ | 130,136 | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Fee and Other Income (1) | | | | | | 21,362 | | 5,168 | | 3,046 | | 2,013 | | 1,232 | | | 11,459 | | 2,825 | | | | |

| General and Administrative Expenses | | | | | | (29,321) | | (8,063) | | (6,996) | | (6,498) | | (6,762) | | | (28,319) | | (8,438) | | | | |

| Interest Expense (1) | | | | | | (69,937) | | (16,142) | | (17,238) | | (19,390) | | (22,370) | | | (75,140) | | (25,310) | | | | |

| Reimbursed and Other Expenses (1) | | | | | | (5,936) | | (990) | | (1,474) | | (955) | | (1,942) | | | (5,361) | | (1,011) | | | | |

| Depreciation and Amortization of Non-Real Estate Assets | | | | | | (623) | | (155) | | (158) | | (138) | | (107) | | | (558) | | (108) | | | | |

| Gain (Loss) on Sales of Undepreciated Investment Properties | | | | | | (64) | | — | | 4,500 | | (22) | | — | | | 4,478 | | — | | | | |

| FFO (1) | | | | | | $ | 409,201 | | $ | 99,425 | | $ | 104,731 | | $ | 104,410 | | $ | 100,193 | | | $ | 408,759 | | $ | 98,094 | | | | |

| Weighted Average Shares - Diluted | | | | | | 148,891 | | 149,002 | | 149,142 | | 151,695 | | 151,835 | | | 150,419 | | 151,880 | | | | |

| FFO per Share (1) | | | | | | $ | 2.75 | | $ | 0.67 | | $ | 0.70 | | $ | 0.69 | | $ | 0.66 | | | $ | 2.72 | | $ | 0.65 | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

(1) The above amounts include our share of amounts from unconsolidated joint ventures for the respective category. The Company does not control the operations of these unconsolidated joint ventures but believes including these amounts is meaningful to investors and analysts.

| | | | | | | | |

| Cousins Properties | 11 | Q1 2023 Supplemental Information |

| | | | | | | | |

| FUNDS FROM OPERATIONS - DETAIL (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | (amounts in thousands, except per share amounts) |

| | | | | | 2021 | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | | 2022 | 2023 1st |

| NOI | | | | | | | | | | | | | |

| Consolidated Properties | | | | | | | | | | | | | |

| The Domain (2) | | | | | | $ | 60,987 | | $ | 15,443 | | $ | 15,510 | | $ | 18,478 | | $ | 19,273 | | | $ | 68,704 | | $ | 18,144 | |

| Terminus (2) | | | | | | 27,148 | | 7,439 | | 7,673 | | 9,228 | | 8,568 | | | 32,908 | | 8,097 | |

| Corporate Center (2) | | | | | | 29,106 | | 7,050 | | 7,090 | | 7,144 | | 7,310 | | | 28,594 | | 7,467 | |

| Spring & 8th (2) | | | | | | 29,413 | | 7,424 | | 7,282 | | 7,352 | | 7,361 | | | 29,419 | | 7,361 | |

| Hayden Ferry (2) | | | | | | 24,528 | | 6,133 | | 5,990 | | 6,094 | | 6,087 | | | 24,304 | | 5,934 | |

| Northpark (2) | | | | | | 26,562 | | 6,098 | | 6,317 | | 5,278 | | 5,006 | | | 22,699 | | 5,136 | |

| 725 Ponce | | | | | | 7,669 | | 4,527 | | 4,686 | | 4,596 | | 4,734 | | | 18,543 | | 4,777 | |

| Buckhead Plaza (2) | | | | | | 12,577 | | 3,646 | | 4,013 | | 4,563 | | 4,758 | | | 16,980 | | 4,766 | |

| Fifth Third Center | | | | | | 18,592 | | 4,229 | | 4,340 | | 4,675 | | 4,431 | | | 17,675 | | 4,732 | |

| One Eleven Congress | | | | | | 18,193 | | 4,342 | | 4,531 | | 4,547 | | 3,978 | | | 17,398 | | 4,246 | |

| Avalon (2) | | | | | | 14,381 | | 3,637 | | 3,969 | | 4,156 | | 4,165 | | | 15,927 | | 4,243 | |

| 3344 Peachtree | | | | | | 14,927 | | 3,966 | | 3,931 | | 3,848 | | 3,946 | | | 15,691 | | 3,992 | |

| San Jacinto Center | | | | | | 15,652 | | 4,252 | | 4,316 | | 4,113 | | 3,322 | | | 16,003 | | 3,940 | |

| 300 Colorado | | | | | | 1,130 | | 3,275 | | 3,050 | | 2,762 | | 4,033 | | | 13,120 | | 3,772 | |

| The Terrace (2) | | | | | | 16,713 | | 3,133 | | 3,583 | | 3,225 | | 3,472 | | | 13,413 | | 3,698 | |

| 100 Mill | | | | | | — | | — | | 1,405 | | 2,550 | | 3,343 | | | 7,298 | | 3,603 | |

| BriarLake Plaza (2) | | | | | | 18,142 | | 3,879 | | 3,740 | | 3,547 | | 3,580 | | | 14,746 | | 3,545 | |

| Promenade Tower | | | | | | 14,933 | | 2,968 | | 2,901 | | 2,867 | | 3,434 | | | 12,170 | | 3,377 | |

| The RailYard | | | | | | 12,496 | | 3,153 | | 3,258 | | 3,255 | | 3,234 | | | 12,900 | | 3,332 | |

| Colorado Tower | | | | | | 13,060 | | 3,155 | | 2,746 | | 3,226 | | 3,325 | | | 12,452 | | 3,282 | |

| 550 South | | | | | | 10,593 | | 2,652 | | 2,665 | | 2,654 | | 2,723 | | | 10,694 | | 2,698 | |

| Legacy Union One | | | | | | 9,466 | | 2,357 | | 2,342 | | 2,355 | | 2,367 | | | 9,421 | | 2,364 | |

| Heights Union (2) | | | | | | 1,303 | | 1,641 | | 1,461 | | 2,033 | | 3,177 | | | 8,312 | | 2,338 | |

| Domain Point (2) | | | | | | 5,055 | | 1,761 | | 1,741 | | 1,837 | | 1,746 | | | 7,085 | | 2,025 | |

| 3350 Peachtree | | | | | | 6,083 | | 992 | | 1,771 | | 1,339 | | 1,418 | | | 5,520 | | 1,477 | |

| 111 West Rio | | | | | | 5,630 | | 1,419 | | 1,416 | | 1,424 | | 1,410 | | | 5,669 | | 1,417 | |

| Meridian Mark Plaza | | | | | | 4,110 | | 1,042 | | 1,408 | | 1,268 | | 1,243 | | | 4,961 | | 1,286 | |

| Research Park V | | | | | | 4,044 | | 1,059 | | 1,087 | | 1,162 | | 1,160 | | | 4,468 | | 1,166 | |

| The Pointe | | | | | | 4,685 | | 1,156 | | 1,211 | | 1,234 | | 1,251 | | | 4,852 | | 1,056 | |

| 3348 Peachtree | | | | | | 5,427 | | 1,257 | | 1,348 | | 984 | | 1,183 | | | 4,772 | | 1,050 | |

| 5950 Sherry Lane | | | | | | 4,549 | | 951 | | 849 | | 841 | | 828 | | | 3,469 | | 861 | |

| Harborview Plaza | | | | | | 3,211 | | 844 | | 882 | | 842 | | 861 | | | 3,429 | | 849 | |

| Tempe Gateway | | | | | | 6,086 | | 1,423 | | 1,057 | | 1,077 | | 716 | | | 4,273 | | 819 | |

| Promenade Central (3) | | | | | | 9,026 | | — | | — | | — | | 224 | | | 224 | | 716 | |

| Other (4) | | | | | | 19,020 | | 585 | | 940 | | 2,027 | | 1,031 | | | 4,583 | | 1,161 | |

| Subtotal - Consolidated | | | | | | 474,497 | | 116,888 | | 120,509 | | 126,581 | | 128,698 | | | 492,676 | | 128,727 | |

| Continued on next page | |

| | | | | | | | |

| Cousins Properties | 12 | Q1 2023 Supplemental Information |

| | | | | | | | |

| FUNDS FROM OPERATIONS - DETAIL (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | (amounts in thousands, except per share amounts) |

| | | | | | 2021 | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | | 2022 | 2023 1st |

| Unconsolidated Properties (5) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Medical Offices at Emory Hospital | | | | | | 4,332 | | 1,112 | | 1,152 | | 1,126 | | 1,141 | | | 4,531 | | 1,054 | |

| 120 West Trinity (2) | | | | | | 827 | | 301 | | 305 | | 350 | | 346 | | | 1,302 | | 326 | |

| 300 Colorado | | | | | | 2,931 | | — | | — | | — | | — | | | — | | — | |

| Other (6) | | | | | | 11,133 | | 1,306 | | 1,085 | | 1,343 | | (43) | | | 3,691 | | 29 | |

| Subtotal - Unconsolidated | | | | | | 19,223 | | 2,719 | | 2,542 | | 2,819 | | 1,444 | | | 9,524 | | 1,409 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Net Operating Income (1) | | | | | | 493,720 | | 119,607 | | 123,051 | | 129,400 | | 130,142 | | | 502,200 | | 130,136 | |

| Gain (Loss) on Sales of Undepreciated Investment Properties | | | | | | | | | | | | | |

| Consolidated | | | | | | (64) | | — | | — | | — | | — | | | — | | — | |

| Unconsolidated (5) | | | | | | — | | — | | 4,500 | | (22) | | — | | | 4,478 | | — | |

| Total Gain (Loss) on Sales of Undepreciated Investment Properties | | | | | | (64) | | — | | 4,500 | | (22) | | — | | | 4,478 | | — | |

| | | | | | | | | | | | | |

| Fee and Other Income | | | | | | | | | | | | | |

| Development Fees | | | | | | 12,081 | | 817 | | 1,404 | | 957 | | — | | | 3,178 | | — | |

| Management Fees (7) | | | | | | 3,374 | | 571 | | 901 | | 720 | | 749 | | | 2,941 | | 374 | |

| Termination Fees | | | | | | 5,105 | | 1,462 | | 449 | | 242 | | 311 | | | 2,464 | | 136 | |

| Termination Fees - Unconsolidated (5) | | | | | | 81 | | — | | — | | — | | — | | | — | | — | |

| Leasing & Other Fees | | | | | | 104 | | — | | — | | — | | — | | | — | | — | |

| | | | | | | | | | | | | |

| Interest and Other Income | | | | | | 450 | | 2,283 | | 201 | | 38 | | 138 | | | 2,660 | | 2,278 | |

| Interest and Other Income - Unconsolidated (5) | | | | | | 167 | | 35 | | 91 | | 56 | | 34 | | | 216 | | 37 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Fee and Other Income | | | | | | 21,362 | | 5,168 | | 3,046 | | 2,013 | | 1,232 | | | 11,459 | | 2,825 | |

| | | | | | | | | | | | | |

| General and Administrative Expenses | | | | | | (29,321) | | (8,063) | | (6,996) | | (6,498) | | (6,762) | | | (28,319) | | (8,438) | |

| | | | | | | | | | | | | |

| Interest Expense | | | | | | | | | | | | | |

| Consolidated Interest Expense | | | | | | | | | | | | | |

| Term Loan, Unsecured ($400M) | | | | | | — | | — | | — | | — | | (4,936) | | | (4,936) | | (5,856) | |

| Term Loan, Unsecured ($350M) | | | | | | (4,332) | | (1,430) | | (1,918) | | (3,279) | | (4,982) | | | (11,609) | | (4,902) | |

| Terminus (2) | | | | | | (5,779) | | (1,406) | | (1,309) | | (1,293) | | (1,636) | | | (5,644) | | (3,513) | |

| Credit Facility, Unsecured | | | | | | (5,602) | | (1,795) | | (2,585) | | (3,533) | | (1,846) | | | (9,759) | | (3,054) | |

| Senior Notes, Unsecured ($275M) | | | | | | (10,975) | | (2,744) | | (2,744) | | (2,743) | | (2,744) | | | (10,975) | | (2,744) | |

| Senior Notes, Unsecured ($250M) | | | | | | (9,958) | | (2,490) | | (2,489) | | (2,490) | | (2,489) | | | (9,958) | | (2,490) | |

| Senior Notes, Unsecured ($250M) | | | | | | (9,764) | | (2,441) | | (2,441) | | (2,441) | | (2,441) | | | (9,764) | | (2,441) | |

| Senior Notes, Unsecured ($125M) | | | | | | (4,789) | | (1,197) | | (1,198) | | (1,197) | | (1,197) | | | (4,789) | | (1,197) | |

| Fifth Third Center | | | | | | (4,625) | | (1,138) | | (1,131) | | (1,123) | | (1,116) | | | (4,508) | | (1,108) | |

| Senior Notes, Unsecured ($100M) | | | | | | (4,145) | | (1,036) | | (1,037) | | (1,036) | | (1,036) | | | (4,145) | | (1,036) | |

| Colorado Tower | | | | | | (4,006) | | (988) | | (982) | | (976) | | (971) | | | (3,917) | | (965) | |

| Continued on next page | |

| | | | | | | | |

| Cousins Properties | 13 | Q1 2023 Supplemental Information |

| | | | | | | | |

| FUNDS FROM OPERATIONS - DETAIL (1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | (amounts in thousands, except per share amounts) |

| | | | | | 2021 | 2022 1st | 2022 2nd | 2022 3rd | 2022 4th | | 2022 | 2023 1st |

| Domain 10 | | | | | | (3,095) | | (792) | | (788) | | (783) | | (778) | | | (3,141) | | (774) | |

| Other (8) | | | | | | (6,213) | | (1,519) | | (1,518) | | (1,512) | | (243) | | | (4,792) | | (41) | |

| Capitalized (9) | | | | | | 6,257 | | 3,451 | | 3,591 | | 4,026 | | 4,332 | | | 15,400 | | 5,091 | |

| Subtotal - Consolidated Interest Expense | | | | | | (67,026) | | (15,525) | | (16,549) | | (18,380) | | (22,083) | | | (72,537) | | (25,030) | |

| Unconsolidated Interest Expense (5) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Medical Offices at Emory Hospital | | | | | | (1,170) | | (288) | | (286) | | (284) | | (289) | | | (1,147) | | (280) | |

| Other (8) | | | | | | (1,741) | | (329) | | (403) | | (726) | | 2 | | | (1,456) | | — | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Subtotal - Unconsolidated Interest Expense | | | | | | (2,911) | | (617) | | (689) | | (1,010) | | (287) | | | (2,603) | | (280) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Interest Expense | | | | | | (69,937) | | (16,142) | | (17,238) | | (19,390) | | (22,370) | | | (75,140) | | (25,310) | |

| | | | | | | | | | | | | |

| Reimbursed and Other Expenses | | | | | | | | | | | | | |

| Reimbursed Expenses (7) | | | | | | (2,476) | | (360) | | (677) | | (418) | | (569) | | | (2,024) | | (207) | |

| Property Taxes and Other Holding Costs | | | | | | (941) | | (230) | | (262) | | (247) | | (326) | | | (1,065) | | (323) | |

| Partners' Share of FFO in Consolidated Joint Ventures | | | | | | (1,284) | | (396) | | (258) | | (288) | | (362) | | | (1,304) | | (406) | |

| Severance | | | | | | (406) | | — | | (170) | | — | | — | | | (170) | | (72) | |

| Gain (Loss) on Extinguishment of Debt | | | | | | — | | — | | (100) | | — | | 269 | | | 169 | | — | |

| Predevelopment & Other Costs | | | | | | (829) | | (4) | | (7) | | (2) | | (954) | | | (967) | | (3) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Reimbursed and Other Expenses | | | | | | (5,936) | | (990) | | (1,474) | | (955) | | (1,942) | | | (5,361) | | (1,011) | |

| | | | | | | | | | | | | |

| Depreciation and Amortization of Non-Real Estate Assets | | | | | | (623) | | (155) | | (158) | | (138) | | (107) | | | (558) | | (108) | |

| | | | | | | | | | | | | |

| FFO | | | | | | $ | 409,201 | | $ | 99,425 | | $ | 104,731 | | $ | 104,410 | | $ | 100,193 | | | $ | 408,759 | | $ | 98,094 | |

| Weighted Average Shares - Diluted | | | | | | 148,891 | | 149,002 | | 149,142 | | 151,695 | | 151,835 | | | 150,419 | | 151,880 | |

| FFO per Share | | | | | | $ | 2.75 | | $ | 0.67 | | $ | 0.70 | | $ | 0.69 | | $ | 0.66 | | | $ | 2.72 | | $ | 0.65 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note: | Amounts may differ slightly from other schedules contained herein due to rounding. |

| (1) See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 31. |

| (2) Contains multiple buildings that are grouped together for reporting purposes. |

| (3) Promenade Central is in the final stages of redevelopment and not yet stabilized. |

| (4) Primarily represents properties sold prior to March 31, 2023, see page 24. Also includes College Street Garage and properties in the final stages of development and not yet stabilized. |

| (5) Unconsolidated amounts include amounts recorded in unconsolidated joint ventures for the respective category multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures but believes including these amounts in the categories indicated is meaningful to investors and analysts. |

| |

| (6) Primarily represents unconsolidated investments sold prior to March 31, 2023, see page 24. Also includes NOI from unconsolidated investments not yet stabilized. |

| (7) Reimbursed Expenses include costs incurred by the Company for management services provided to our unconsolidated joint ventures. The reimbursement of these costs by the unconsolidated joint ventures is included in Management Fees. |

| (8) Represents interest on consolidated loans repaid and our share of interests on loans of unconsolidated investments sold prior to March 31, 2023. |

| (9) Amounts of consolidated interest expense related to consolidated debt that are capitalized to consolidated development and redevelopment projects as well as to equity in unconsolidated development projects. |

| |

| | | | | | | | |

| Cousins Properties | 14 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office Properties (1) | | Rentable Square Feet | | Financial Statement Presentation | | | | Company's Ownership Interest | | End of Period Leased | | Weighted Average Occupancy (2) | | % of Total

NOI / 1Q23 | | Property Level Debt ($ in thousands) (3) | | |

| | | | | | 1Q23 | | 4Q22 | | 1Q23 | | 4Q22 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Terminus (4) | | 1,226,000 | | | Consolidated | | | | 100% | | 86.4% | | 88.7% | | 81.1% | | 83.2% | | 6.2% | | $ | 220,653 | | | |

| Spring & 8th (4) | | 765,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 5.7% | | — | | | |

| Northpark (4) | | 1,539,000 | | | Consolidated | | | | 100% | | 76.7% | | 76.1% | | 74.6% | | 71.7% | | 4.0% | | — | | | |

| 725 Ponce | | 372,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 98.4% | | 98.4% | | 3.7% | | — | | | |

| Buckhead Plaza (4) | | 678,000 | | | Consolidated | | | | 100% | | 90.6% | | 93.8% | | 85.7% | | 86.0% | | 3.7% | | — | | | |

| Avalon (4) | | 480,000 | | | Consolidated | | | | 100% | | 100.0% | | 97.8% | | 97.3% | | 98.7% | | 3.3% | | — | | | |

| 3344 Peachtree | | 484,000 | | | Consolidated | | | | 100% | | 96.9% | | 96.9% | | 96.9% | | 95.8% | | 3.1% | | — | | | |

| Promenade Tower | | 777,000 | | | Consolidated | | | | 100% | | 81.7% | | 77.8% | | 71.2% | | 75.0% | | 2.6% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 3350 Peachtree | | 413,000 | | | Consolidated | | | | 100% | | 57.8% | | 57.0% | | 53.3% | | 52.5% | | 1.1% | | — | | | |

| Meridian Mark Plaza | | 160,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 1.0% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Medical Offices at Emory Hospital | | 358,000 | | | Unconsolidated | | | | 50% | | 99.5% | | 99.5% | | 99.5% | | 98.3% | | 0.7% | | 31,203 | | | |

| 3348 Peachtree | | 258,000 | | | Consolidated | | | | 100% | | 76.3% | | 75.5% | | 74.9% | | 74.9% | | 0.7% | | — | | | |

| Promenade Central (5) (6) | | 378,000 | | | Consolidated | | | | 100% | | 61.6% | | 60.7% | | 19.9% | | 11.1% | | 0.6% | | — | | | |

| 120 West Trinity Office | | 43,000 | | | Unconsolidated | | | | 20% | | 100.0% | | 100.0% | | 100.0% | | 90.4% | | 0.1% | | — | | | |

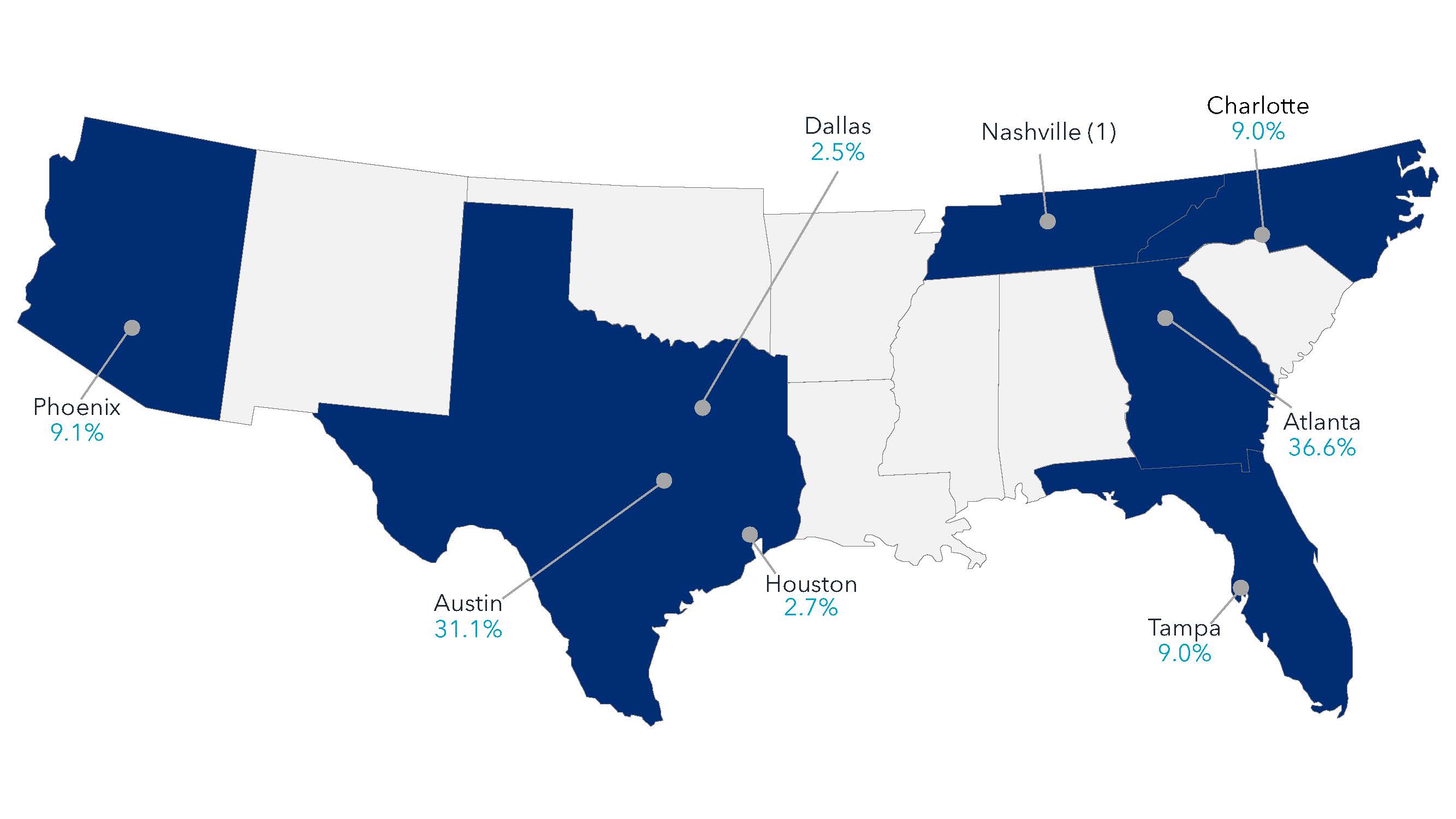

| ATLANTA (6) | | 7,931,000 | | | | | | | | | 86.6% | | 86.5% | | 83.2% | | 83.3% | | 36.5% | | 251,856 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| The Domain (4) | | 1,899,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 99.8% | | 100.0% | | 14.1% | | 73,539 | | | |

| One Eleven Congress | | 519,000 | | | Consolidated | | | | 100% | | 83.6% | | 83.8% | | 80.7% | | 80.6% | | 3.3% | | — | | | |

| San Jacinto Center | | 399,000 | | | Consolidated | | | | 100% | | 93.9% | | 93.9% | | 80.8% | | 78.7% | | 3.0% | | — | | | |

| 300 Colorado | | 378,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 88.3% | | 88.3% | | 2.9% | | — | | | |

| The Terrace (4) | | 619,000 | | | Consolidated | | | | 100% | | 79.4% | | 80.7% | | 79.2% | | 76.2% | | 2.8% | | — | | | |

| Colorado Tower | | 373,000 | | | Consolidated | | | | 100% | | 97.4% | | 97.4% | | 87.6% | | 89.2% | | 2.5% | | 108,559 | | | |

| Domain Point (4) | | 240,000 | | | Consolidated | | | | 96.5% | | 100.0% | | 100.0% | | 97.7% | | 96.6% | | 1.6% | | — | | | |

| Research Park V | | 173,000 | | | Consolidated | | | | 100% | | 97.1% | | 97.1% | | 97.1% | | 97.1% | | 0.9% | | — | | | |

| AUSTIN | | 4,600,000 | | | | | | | | | 94.5% | | 94.7% | | 91.1% | | 90.6% | | 31.1% | | 182,098 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Hayden Ferry (4) | | 792,000 | | | Consolidated | | | | 100% | | 93.1% | | 94.2% | | 89.7% | | 91.0% | | 4.6% | | — | | | |

| 100 Mill (5) | | 288,000 | | | Consolidated | | | | 90% | | 92.3% | | 92.3% | | 92.3% | | 92.3% | | 2.8% | | — | | | |

| 111 West Rio | | 225,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 1.1% | | — | | | |

| Tempe Gateway | | 264,000 | | | Consolidated | | | | 100% | | 55.2% | | 65.4% | | 46.9% | | 51.4% | | 0.6% | | — | | | |

| PHOENIX | | 1,569,000 | | | | | | | | | 87.5% | | 89.8% | | 84.3% | | 85.7% | | 9.1% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Center (4) | | 1,227,000 | | | Consolidated | | | | 100% | | 96.2% | | 97.2% | | 96.9% | | 95.1% | | 5.7% | | — | | | |

| Heights Union (4) (5) | | 294,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 94.1% | | 94.1% | | 1.8% | | — | | | |

| The Pointe | | 253,000 | | | Consolidated | | | | 100% | | 87.3% | | 92.1% | | 86.0% | | 89.0% | | 0.8% | | — | | | |

| Harborview Plaza | | 205,000 | | | Consolidated | | | | 100% | | 80.8% | | 80.8% | | 80.8% | | 80.8% | | 0.7% | | — | | | |

| TAMPA | | 1,979,000 | | | | | | | | | 94.1% | | 95.2% | | 93.4% | | 92.7% | | 9.0% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fifth Third Center | | 692,000 | | | Consolidated | | | | 100% | | 90.8% | | 90.8% | | 90.8% | | 90.8% | | 3.6% | | 129,046 | | | |

| The RailYard | | 329,000 | | | Consolidated | | | | 100% | | 99.4% | | 99.4% | | 99.0% | | 98.6% | | 2.6% | | — | | | |

| 550 South | | 394,000 | | | Consolidated | | | | 100% | | 97.9% | | 97.9% | | 97.9% | | 97.9% | | 2.1% | | — | | | |

| CHARLOTTE | | 1,415,000 | | | | | | | | | 94.8% | | 94.8% | | 94.7% | | 94.6% | | 8.3% | | 129,046 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Continued on next page | |

| | | | | | | | |

| Cousins Properties | 15 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office Properties (1) | | Rentable Square Feet | | Financial Statement Presentation | | | | Company's Ownership Interest | | End of Period Leased | | Weighted Average Occupancy (2) | | % of Total

NOI / 1Q23 | | Property Level Debt ($ in thousands) (3) | | |

| | | | | | 1Q23 | | 4Q22 | | 1Q23 | | 4Q22 | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| BriarLake Plaza (4) | | 835,000 | | | Consolidated | | | | 100% | | 97.5% | | 95.5% | | 76.3% | | 75.5% | | 2.7% | | — | | | |

| HOUSTON | | 835,000 | | | | | | | | | 97.5% | | 95.5% | | 76.3% | | 75.5% | | 2.7% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Legacy Union One | | 319,000 | | | Consolidated | | | | 100% | | 100.0% | | 100.0% | | 100.0% | | 100.0% | | 1.8% | | — | | | |

| 5950 Sherry Lane | | 197,000 | | | Consolidated | | | | 100% | | 76.3% | | 73.4% | | 76.9% | | 71.9% | | 0.7% | | — | | | |

| DALLAS | | 516,000 | | | | | | | | | 91.0% | | 89.8% | | 91.2% | | 89.3% | | 2.5% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL OFFICE (6) | | 18,845,000 | | | | | | | | | 90.8% | | 91.0% | | 87.2% | | 87.1% | | 99.2% | | $ | 563,000 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Other Properties (1) | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| College Street Garage - Charlotte (5) | | N/A | | Consolidated | | | | 100% | | N/A | | N/A | | N/A | | N/A | | 0.7% | | — | | | |

| 120 West Trinity Apartment - Atlanta (330 units) (5) | | 310,000 | | | Unconsolidated | | | | 20% | | 97.1% | | 93.8% | | 95.7% | | 93.3% | | 0.1% | | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL OTHER | | 310,000 | | | | | | | | | 97.1% | | 93.8% | | 95.7% | | 93.3% | | 0.8% | | $ | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL (6) | | 19,155,000 | | | | | | | | | 90.8% | | 91.0% | | 87.2% | | 87.1% | | 100.0% | | $ | 563,000 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| (1) | | Represents the Company's operating properties, excluding properties on the development pipeline, and properties sold prior to March 31, 2023. |

| (2) | | The weighted average economic occupancy of the property over the period for which the property was available for occupancy. |

| (3) | | The Company's share of property-specific mortgage debt, including net of unamortized loan costs, as of March 31, 2023. |

| (4) | | Contains two or more buildings that are grouped together for reporting purposes. |

| (5) | | Not included in Same Property as of March 31, 2023. |

| (6) | | While under redevelopment and until stabilization, Promenade Central was excluded from the Atlanta, Total Office, and Total Portfolio calculations of end of period leased and weighted average occupancy at and for the quarters ended March 31, 2023 and December 31, 2022. Promenade Central will be added back to the total calculations when weighted average occupancy stabilizes, which is the earlier of when it reaches 90% occupancy or in fourth quarter 2023 (one year after the redevelopment activity was substantially complete). |

| |

| |

| |

| |

| | | | | | | | |

| Cousins Properties | 16 | Q1 2023 Supplemental Information |

First Quarter 2023 Portfolio NOI by Market

(1) The Company is developing a mixed-use project in Nashville through a 50% owned joint venture. See pages 25 and 30 for additional details.

| | | | | | | | |

| Cousins Properties | 17 | Q1 2023 Supplemental Information |

| | | | | | | | |

| SAME PROPERTY PERFORMANCE (1) |

| | | | | | | | | | | | | | | | | |

| |

| ($ in thousands) |

| Three Months Ended March 31, |

| 2023 | | 2022 | | % Change |

| Rental Property Revenues (2) | $ | 191,299 | | $ | 180,020 | | 6.3 | % |

| Rental Property Operating Expenses (2) | 69,279 | | 64,191 | | 7.9 | % |

| Same Property Net Operating Income | $ | 122,020 | | $ | 115,829 | | 5.3 | % |

| | | | | |

| Cash-Basis Rental Property Revenues (3) | $ | 182,455 | | $ | 172,005 | | 6.1 | % |

| Cash-Basis Rental Property Operating Expenses (4) | 69,057 | | 63,931 | | 8.0 | % |

| Cash-Basis Same Property Net Operating Income | $ | 113,398 | | $ | 108,074 | | 4.9 | % |

| | | | | |

| End of Period Leased | 90.6 | % | | 90.5 | % | | |

| Weighted Average Occupancy | 87.0 | % | | 87.4 | % | | |

| | | | | |

| |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | |

| (1) | Same Properties include those office properties that were stabilized and owned by the Company for the entirety of all comparable reporting periods presented. See Portfolio Statistics on pages 15 and 16 for footnotes indicating which properties are not included in Same Property. See Non-GAAP Financial Measures - Calculations and Reconciliations beginning on page 31. |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| (2) | Rental Property Revenues and Expenses include results for the Company and its share of unconsolidated joint ventures and exclude termination fee income. Net operating income for unconsolidated joint ventures is calculated as Rental Property Revenues less termination fee income and Rental Property Expenses at the joint ventures, multiplied by the Company's ownership interest. The Company does not control the operations of the unconsolidated joint ventures but believes that including these amounts with consolidated net operating income is meaningful to investors and analysts. |

| (3) | Cash-Basis Rental Property Revenues include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Revenues, excluding termination fee income, straight-line rents, and other deferred income amortization, amortization of lease inducements, and amortization of acquired above and below market rents. |

| (4) | Cash-Basis Rental Property Operating Expenses include that of the Company and its share of unconsolidated joint ventures. It represents Rental Property Operating Expenses, excluding straight-line ground rent expense and amortization of above and below market ground rent expense. |

| |

| |

| |

| | | | | | | | |

| Cousins Properties | 18 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Three Months Ended March 31, 2023 | | |

| New | | Renewal | | Expansion | | Total | | | | | | | | |

| Gross leased square feet (1) | | | | | | | 330,108 | | | | | | | | |

| Less exclusions (2) | | | | | | | (72,270) | | | | | | | | |

| Net leased square feet | 148,394 | | | 99,199 | | | 10,245 | | | 257,838 | | | | | | | | |

| Number of transactions | 11 | | | 14 | | | 4 | | | 29 | | | | | | | | |

| Lease term in years (3) | 9.6 | | | 3.1 | | | 5.4 | | | 6.9 | | | | | | | | |

| | | | | | | | | | | | | | | |

Net effective rent calculation (per square foot

per year) (3) | | | | | | | | | | | | | | | |

| Net annualized rent (4) | $ | 37.46 | | | $ | 30.16 | | | $ | 32.51 | | | $ | 34.45 | | | | | | | | | |

| Net free rent | (2.70) | | | (1.11) | | | (2.24) | | | (2.07) | | | | | | | | | |

| Leasing commissions | (3.13) | | | (2.41) | | | (2.58) | | | (2.83) | | | | | | | | | |

| Tenant improvements | (8.72) | | | (2.60) | | | (6.78) | | | (6.29) | | | | | | | | | |

| Total leasing costs | (14.55) | | | (6.12) | | | (11.60) | | | (11.19) | | | | | | | | | |

| Net effective rent | $ | 22.91 | | | $ | 24.04 | | | $ | 20.91 | | | $ | 23.26 | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Second generation leased square footage (5) | | | | | | | 155,936 | | | | | | | | |

| Increase in straight-line basis second generation net rent per square foot (6) | | 20.1 | % | | | | | | | | |

| Increase in cash-basis second generation net rent per square foot (7) | | 6.1 | % | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

| | | | | |

| (1) | Comprised of total square feet leased, unadjusted for ownership share and excluding apartment leasing. |

| (2) | Adjusted for leases one year or less, leases for retail, amenity, storage, percentage rent, and intercompany space. |

| (3) | Weighted average of net leased square feet. |

| (4) | Straight-line net rent per square foot (operating expense reimbursements deducted from gross leases) over the lease term prior to any deductions for leasing costs. |

| (5) | Excludes leases executed for spaces that were vacant upon acquisition, new leases in development properties, and leases for spaces that have been vacant for one year or more. |

| (6) | Increase in second generation straight-line basis net annualized rent on a weighted average basis. |

| (7) | Increase in second generation net cash rent at the end of the term paid by the prior tenant compared to net cash rent at the beginning of the term (after any free rent period) paid by the current tenant on a weighted average basis. For early renewals, the increase in net cash rent at the end of the term of the original lease is compared to net cash rent at the beginning of the extended term of the lease. Net cash rent is net of any recovery of operating expenses but prior to any deductions for leasing costs. |

| | | | | | | | |

| Cousins Properties | 19 | Q1 2023 Supplemental Information |

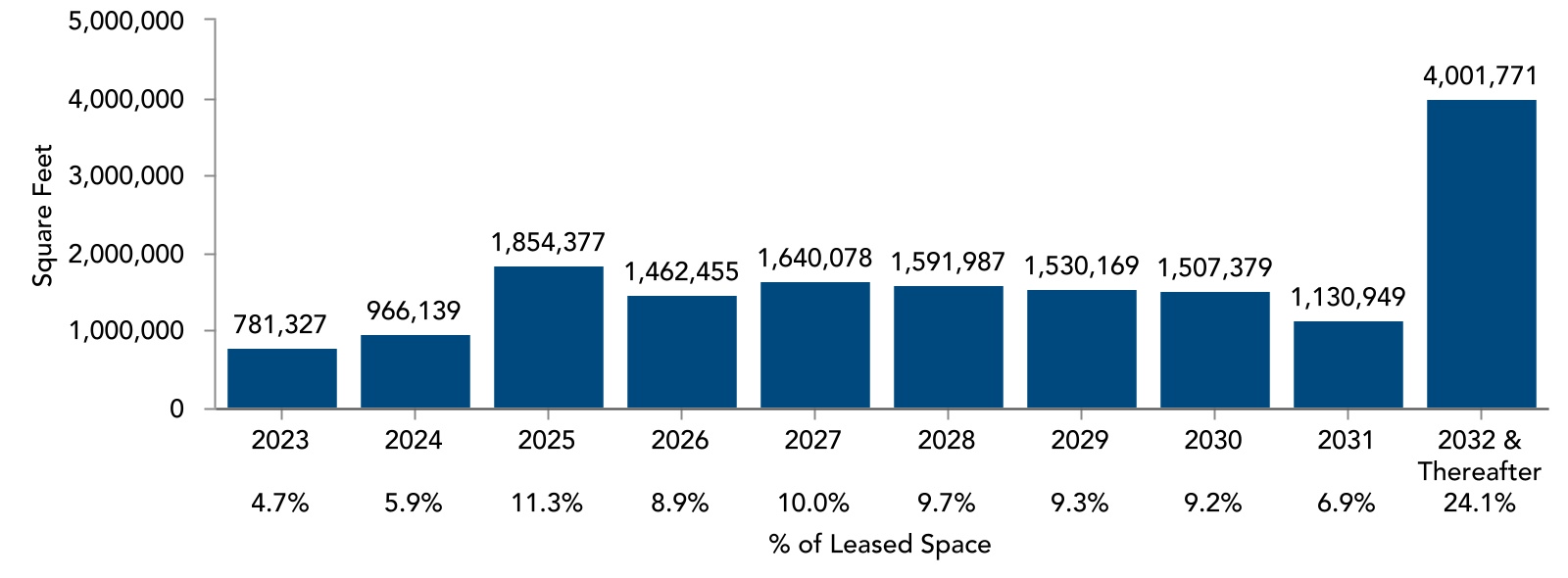

Lease Expirations by Year (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year of Expiration | | Square Feet

Expiring | | % of Leased

Space | | Annual

Contractual Rent

($ in thousands) (2) | | % of Annual

Contractual

Rent | | Annual

Contractual

Rent/Sq. Ft. |

| | | | | | | | | | |

| 2023 | | 781,327 | | | 4.7 | % | | $ | 33,781 | | | 3.9 | % | | $ | 43.23 | |

| 2024 | | 966,139 | | | 5.9 | % | | 43,617 | | | 5.1 | % | | 45.15 | |

| 2025 | | 1,854,377 | | | 11.3 | % | | 86,798 | | | 10.1 | % | | 46.81 | |

| 2026 | | 1,462,455 | | | 8.9 | % | | 69,586 | | | 8.1 | % | | 47.58 | |

| 2027 | | 1,640,078 | | | 10.0 | % | | 74,026 | | | 8.6 | % | | 45.14 | |

| 2028 | | 1,591,987 | | | 9.7 | % | | 79,740 | | | 9.2 | % | | 50.09 | |

| 2029 | | 1,530,169 | | | 9.3 | % | | 78,762 | | | 9.1 | % | | 51.47 | |

| 2030 | | 1,507,379 | | | 9.2 | % | | 100,208 | | | 11.6 | % | | 66.48 | |

| 2031 | | 1,130,949 | | | 6.9 | % | | 68,235 | | | 7.9 | % | | 60.33 | |

| 2032 & Thereafter | | 4,001,771 | | | 24.1 | % | | 227,650 | | | 26.4 | % | | 56.89 | |

| | | | | | | | | | |

| Total | | 16,466,631 | | | 100.0 | % | | $ | 862,403 | | | 100.0 | % | | $ | 52.37 | |

| | | | | | | | | | | |

(1) Company's share of leases expiring after March 31, 2023. Expiring square footage for which new leases have been executed is reflected based on the expiration date of the new lease. |

| (2) Annual Contractual Rent is the estimated rent in the year of expiration. It includes the minimum base rent and an estimate of the tenant's share of operating expenses, if applicable, as defined in the respective leases. |

| | | | | | | | |

| Cousins Properties | 20 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Tenant (1) | | Number of Properties Occupied | | Number of Markets Occupied | | Company's Share of Square Footage | | Company's Share of Annualized Rent

($ in thousands) (2) | | Percentage of Company's Share of Annualized Rent | | Weighted Average Remaining Lease Term (Years) |

| 1 | | Amazon | | 5 | | 3 | | 1,005,416 | | | $ | 52,947 | | | 7.3% | | 6.1 |

| 2 | | NCR Corporation | | 2 | | 2 | | 815,634 | | | 40,379 | | | 5.6% | | 10.2 |

| 3 | | Pioneer Natural Resources | | 2 | | 1 | | 359,660 | | | 25,868 | | | 3.6% | | 8.4 |

| 4 | | Meta Platforms | | 1 | | 1 | | 422,252 | | | 25,009 | | | 3.4% | | 6.9 |

| 5 | | Expedia | | 1 | | 1 | | 315,882 | | | 17,683 | | | 2.4% | | 8.0 |

| 6 | | Bank of America | | 2 | | 2 | | 347,139 | | | 12,387 | | | 1.7% | | 2.7 |

| 7 | | Apache | | 1 | | 1 | | 210,012 | | | 9,658 | | | 1.3% | | 13.7 |

| 8 | | Wells Fargo | | 5 | | 3 | | 201,801 | | | 9,139 | | | 1.3% | | 2.9 |

| 9 | | SVB Financial Group (3) | | 1 | | 1 | | 204,751 | | | 8,596 | | | 1.2% | | 2.8 |

| 10 | | Ovintiv USA | | 1 | | 1 | | 318,582 | | | 8,190 | | | 1.1% | | 4.3 |

| 11 | | WeWork Companies | | 4 | | 2 | | 169,050 | | | 7,902 | | | 1.1% | | 10.5 |

| 12 | | ADP | | 1 | | 1 | | 225,000 | | | 7,500 | | | 1.0% | | 5.0 |

| 13 | | Westrock Shared Services | | 1 | | 1 | | 205,185 | | | 7,309 | | | 1.0% | | 7.1 |

| 14 | | Regus Equity Business Centers | | 5 | | 4 | | 145,119 | | | 7,141 | | | 1.0% | | 5.7 |

| 15 | | BlackRock | | 1 | | 1 | | 131,656 | | | 6,937 | | | 1.0% | | 13.2 |

| 16 | | McGuireWoods | | 2 | | 2 | | 187,119 | | | 6,769 | | | 0.9% | | 3.7 |

| 17 | | Workrise Technologies | | 1 | | 1 | | 93,210 | | | 6,650 | | | 0.9% | | 5.3 |

| 18 | | Amgen | | 1 | | 1 | | 163,169 | | | 6,456 | | | 0.9% | | 5.6 |

| 19 | | Samsung Engineering America | | 1 | | 1 | | 133,860 | | | 6,348 | | | 0.9% | | 3.7 |

| 20 | | McKinsey & Company Inc. | | 2 | | 2 | | 130,513 | | | 6,243 | | | 0.9% | | 9.6 |

| Total | | | | | | 5,785,010 | | | $ | 279,111 | | | 38.5% | | 6.9 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| (1) | In some cases, the actual tenant may be an affiliate of the entity shown. |

| (2) | Annualized Rent represents the annualized cash rent including the tenant's share of estimated operating expenses, if applicable, paid by the tenant as of March 31, 2023. If the tenant is in a free rent period as of March 31, 2023, Annualized Rent represents the annualized contractual rent the tenant will pay in the first month it is required to pay full cash rent. |

| (3) | Information related to SVB Financial Group's ("SVB Financial") lease can be found in an 8-K we filed on March 15, 2023. The Company continues to record revenue on our lease with SVB Financial at the Hayden Ferry property in Phoenix on a straight-line basis without any reserve. SVB Financial is current on the financial obligations of its lease through May 2023, and there has been no rejection of the lease to date under SVB Financial's bankruptcy.

|

| Note: | This schedule includes leases that have commenced. Leases that have been signed but have not commenced are excluded. |

| | | | | | | | |

| Cousins Properties | 21 | Q1 2023 Supplemental Information |

| | | | | | | | |

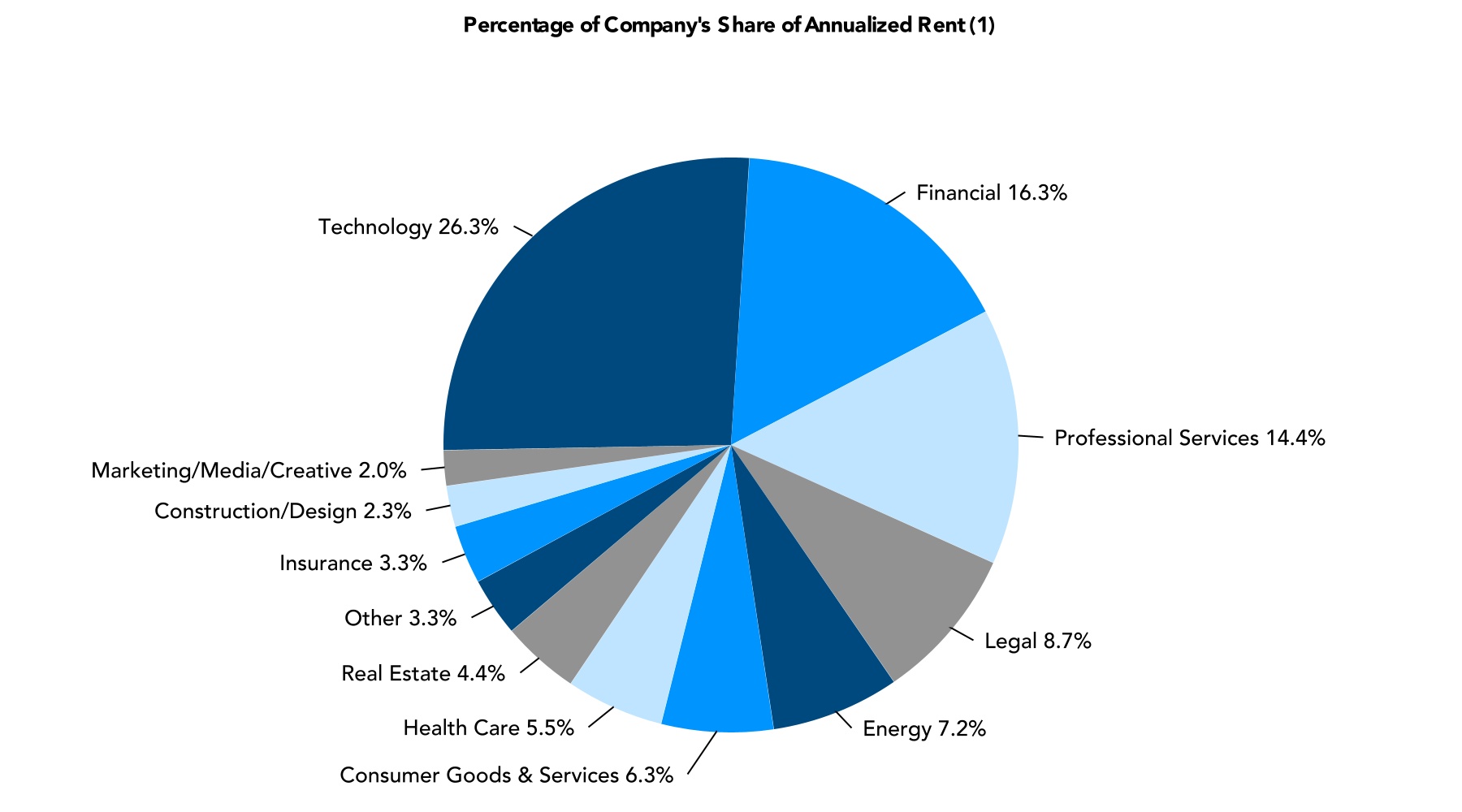

| TENANT INDUSTRY DIVERSIFICATION |

Note: Management uses SIC codes when available, along with judgment, to determine tenant industry classification.

(1) Annualized Rent represents the annualized rent including the tenant's share of estimated operating expenses, if applicable, paid by the tenant as of March 31, 2023. If the tenant is in a free rent period as of March 31, 2023, Annualized Rent represents the annualized contractual rent the tenant will pay in the first month the tenant is required to pay full rent.

| | | | | | | | |

| Cousins Properties | 22 | Q1 2023 Supplemental Information |

Completed Operating Property Acquisitions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | | Type | | Market | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Purchase Price

($ in thousands) (1) |

| | | | | | | | | | | | |

| 2022 | | | | | | | | | | | | |

| Avalon (2) | | Office | | Atlanta | | 100% | | 2Q | | 480,000 | | | $ | 43,400 | |

| | | | | | | | | | | | |

| 2021 | | | | | | | | | | | | |

| 725 Ponce | | Office | | Atlanta | | 100% | | 3Q | | 372,000 | | | 300,200 | |

| Heights Union | | Office | | Tampa | | 100% | | 4Q | | 294,000 | | | 144,800 | |

| | | | | | | | | | | | |

| 2020 | | | | | | | | | | | | |

| The RailYard | | Office | | Charlotte | | 100% | | 4Q | | 329,000 | | | 201,300 | |

| | | | | | | | | | | | |

| 2019 | | | | | | | | | | | | |

| Promenade Central | | Office | | Atlanta | | 100% | | 1Q | | 370,000 | | | 82,000 | |

| TIER REIT, Inc. | | Office | | Various | | Various | | 2Q | | 5,799,000 | | | (3) | |

| Terminus (4) | | Office | | Atlanta | | 100% | | 4Q | | 1,226,000 | | | 246,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | 8,870,000 | | | $ | 1,017,700 | |

Completed Property Developments

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Project | | Type | | Market | | Company's Ownership Interest | | Timing (5) | | Square Feet | | Total Project Cost ($ in thousands) (1) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| 2022 | | | | | | | | | | | | |

| 300 Colorado | | Office | | Austin | | 100% | | 1Q | | 369,000 | | | $ | 193,000 | |

| 100 Mill | | Office | | Phoenix | | 90% | | 4Q | | 288,000 | | | 156,000 | |

| | | | | | | | | | | | |

| 2021 | | | | | | | | | | | | |

| 10000 Avalon | | Office | | Atlanta | | 90% | | 1Q | | 251,000 | | | 96,000 | |

| 120 West Trinity | | Mixed | | Atlanta | | 20% | | 2Q | | 353,000 | | | 89,000 | |

| Domain 10 | | Office | | Austin | | 100% | | 3Q | | 300,000 | | | 111,000 | |

| | | | | | | | | | | | |

| 2020 | | | | | | | | | | | | |

| Domain 12 | | Office | | Austin | | 100% | | 4Q | | 320,000 | | | 117,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| 2019 | | | | | | | | | | | | |

| Dimensional Place | | Office | | Charlotte | | 50% | | 1Q | | 281,000 | | | 96,000 | |

| | | | | | | | | | | | |

| 2018 | | | | | | | | | | | | |

| Spring & 8th | | Office | | Atlanta | | 100% | | 1Q/4Q | | 765,000 | | | 336,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | 2,927,000 | | | $ | 1,194,000 | |

(1) Except as otherwise noted, amounts represent total purchase prices, total project costs paid by the Company and, where applicable, its joint venture partner,

including certain allocated costs required by GAAP that were not incurred by the joint venture.

(2) Purchased outside interest of 10% in HICO Avalon LLC and HICO Avalon II LLC for $43 million in a transaction that valued the properties at $302 million.

(3) Properties acquired in the merger with TIER REIT, Inc.

(4) Purchased outside interest of 50% in Terminus Office Holdings, LLC for $246 million before reductions for existing mortgage debt.

(5) Represents timing of stabilization (90% economic occupancy or one year beyond the cessation of major construction activity).

Continued on next page

| | | | | | | | |

| Cousins Properties | 23 | Q1 2023 Supplemental Information |

Completed Operating Property Dispositions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | | Type | | Market | | Company's Ownership Interest | | Timing | | Square Feet | | Gross Sales Price

($ in thousands) | |

| 2022 | | | | | | | | | | | | | |

| Carolina Square | | Mixed | | Charlotte | | 50% | | 3Q | | 468,000 | | | $ | 105,000 | | (1) |

| 2021 | | | | | | | | | | | | | |

| Burnett Plaza | | Office | | Fort Worth | | 100% | | 2Q | | 1,023,000 | | | 137,500 | | |

| One South at the Plaza | | Office | | Charlotte | | 100% | | 3Q | | 891,000 | | | 271,500 | | |

| Dimensional Place | | Office | | Charlotte | | 50% | | 3Q | | 281,000 | | | 60,800 | | (1) |

| | | | | | | | | | | | | |

| 816 Congress | | Office | | Austin | | 100% | | 4Q | | 435,000 | | | 174,000 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| 2020 | | | | | | | | | | | | | |

| Hearst Tower | | Office | | Charlotte | | 100% | | 1Q | | 966,000 | | | 455,500 | | |

| Gateway Village | | Office | | Charlotte | | 50% | | 1Q | | 1,061,000 | | | 52,200 | | (1) |

| Woodcrest | | Office | | Cherry Hill | | 100% | | 1Q | | 386,000 | | | 25,300 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | 5,511,000 | | | $ | 1,281,800 | | |

(1) Amount represents proceeds, before debt and other adjustments, received by the Company for the sale of its unconsolidated interest in the joint venture to its partner.

| | | | | | | | |

| Cousins Properties | 24 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Project | | Type | | Market | | Company's Ownership Interest | | Construction Start Date | | Square Feet/Units | | Estimated Project Cost (1) (2)

($ in thousands) | | Company's Share of Estimated Project Cost (2)

($ in thousands) | | Project Cost Incurred to Date (2)

($ in thousands) | | Company's Share of Project Cost Incurred to Date (2)

($ in thousands) | | Percent Leased | | Initial Revenue Recognition (3) | | Estimated Stabilization (4) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Neuhoff (5) | | Mixed | | Nashville | | 50 | % | | 3Q21 | | | | $ | 563,000 | | | $ | 281,500 | | | $ | 370,234 | | | $ | 185,117 | | | | | | | |

| Commercial | | | | | | | | | | 448,000 | | | | | | | | | | — | % | | 4Q23 | | 4Q24 |

| Apartments | | | | | | | | | | 542 | | | | | | | | | | — | % | | 2Q24 | | 2Q25 |

| Domain 9 | | Office | | Austin | | 100 | % | | 2Q21 | | 338,000 | | 147,000 | | | 147,000 | | | 114,532 | | | 114,532 | | | 97 | % | | 1Q24 | | 1Q25 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | $ | 710,000 | | | $ | 428,500 | | | $ | 484,766 | | | $ | 299,649 | | | | | | | |

| | | | | |

| (1) | This schedule shows projects currently under active development through the substantial completion of construction as well as properties in an initial lease up period prior to stabilization. Amounts included in the estimated project cost column are the estimated costs of the project through stabilization. Significant estimation is required to derive these costs, and the final costs may differ from these estimates. |

| (2) | Estimated and incurred project costs are construction costs plus financing costs on project-specific debt. Neuhoff has a project-specific construction loan (see Note 5). The above schedule excludes any financing cost assumptions for projects without project-specific debt and any other incremental capitalized costs required by GAAP. |

| (3) | Initial revenue recognition represents the quarter within which the Company first recognized or estimates it will begin recognizing revenue under GAAP. |

| (4) | A project is stabilized when it is substantially complete and held for occupancy, which is the earlier of (1) the date on which the project achieves 90% economic occupancy or (2) one year from cessation of major construction activity on the core building development. Until the project is stabilized, the Company capitalizes interest, real estate taxes, and certain operating expenses on the unoccupied portion of development properties, which have ongoing construction of tenant improvements. |

| (5) | The Neuhoff estimated project cost will be funded with a combination of $250.6 million of equity contributed by the joint venture partners and a $312.7 million construction loan. |

| | | | | | | | |

| Cousins Properties | 25 | Q1 2023 Supplemental Information |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Market | | Company's Ownership Interest | | Financial Statement Presentation | | Total Developable Land (Acres) | | Cost Basis of Land ($ in thousands) |

| | | | | | | | | | |

| 3354/3356 Peachtree | | Atlanta | | 95% | | Consolidated | | 3.2 | | | |

| 715 Ponce | | Atlanta | | 50% | | Unconsolidated | | 1.0 | | | |

| 887 West Peachtree (1) | | Atlanta | | 100% | | Consolidated | | 1.6 | | | |

| The Avenue Forsyth-Adjacent Land | | Atlanta | | 100% | | Consolidated | | 10.4 | | | |

| Domain Point 3 | | Austin | | 90% | | Consolidated | | 1.7 | | | |