Third Quarter 2011

Earnings Conference Call

Monday, November 7, 2011

Forward-looking Statements and

Segment Operating Earnings

Forward Looking Statements:

This presentation contains forward-looking statements, including statements about the future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company’s reports filed with the United States Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company’s website at www.crawfordandcompany.com.

Revenues Before Reimbursements (“Revenues”)

Revenues Before Reimbursements are referred to as “Revenues” in both consolidated and segment charts, bullets and tables throughout this presentation.

Segment Operating Earnings:

Under the Financial Accounting Standards Board’s Accounting Standards Codification Topic 280, “Segment Reporting,” the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, stock option expense, earnings or loss attributable to non-controlling interests, certain unallocated corporate and shared costs, and certain other nonrecurring gains and expenses.

Earnings Per Share:

In the 2011 third quarter, the Company paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock in the future due to the two-class method of computing EPS as required by the guidance in Accounting Standards Codification 260 - "Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Further references to EPS will generally be only for CRDB, as that is the more dilutive measure.

Non-GAAP Financial Information:

For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation

Market-Leading Global Businesses

The world’s largest fully-integrated independent

provider of global claims management solutions

EMEA-A/P Serves the U.K., European, Middle Eastern, African and Asia Pacific markets

Broadspire Serves large national accounts, carriers and self-insured entities

Americas Serves the U.S., Canadian and Latin American markets

Legal Settlement

Administration Provides administration for class action settlements and bankruptcy matters

The world’s largest fully-integrated independent

provider of global claims management solutions.

Today’s Agenda

Welcome and Opening Comments

Third Quarter 2011 Business and Financial Review

Third Quarter 2011 Operational Review

2011 Guidance and Future Operational Focus

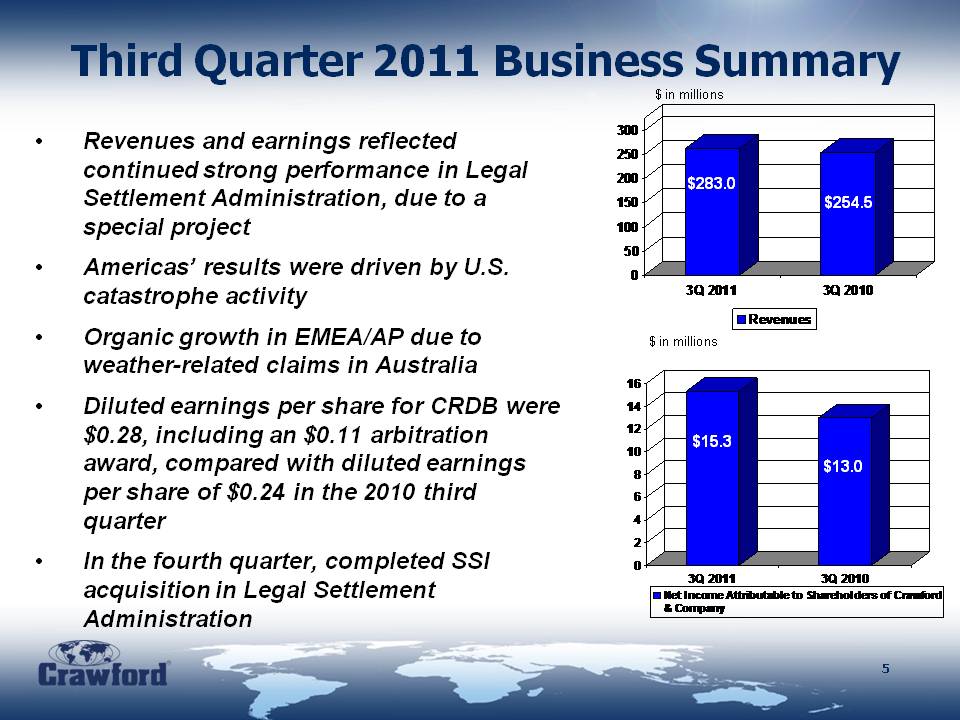

Third Quarter 2011 Business Summary

Revenues and earnings reflected continued strong performance in Legal Settlement Administration, due to a special project

Americas’ results were driven by U.S. catastrophe activity

Organic growth in EMEA/AP due to weather-related claims in Australia

Diluted earnings per share for CRDB were $0.28, including an $0.11 arbitration award, compared with diluted earnings per share of $0.24 in the 2010 third quarter

In the fourth quarter, completed SSI acquisition in Legal Settlement Administration

Third Quarter 2011

Financial Review

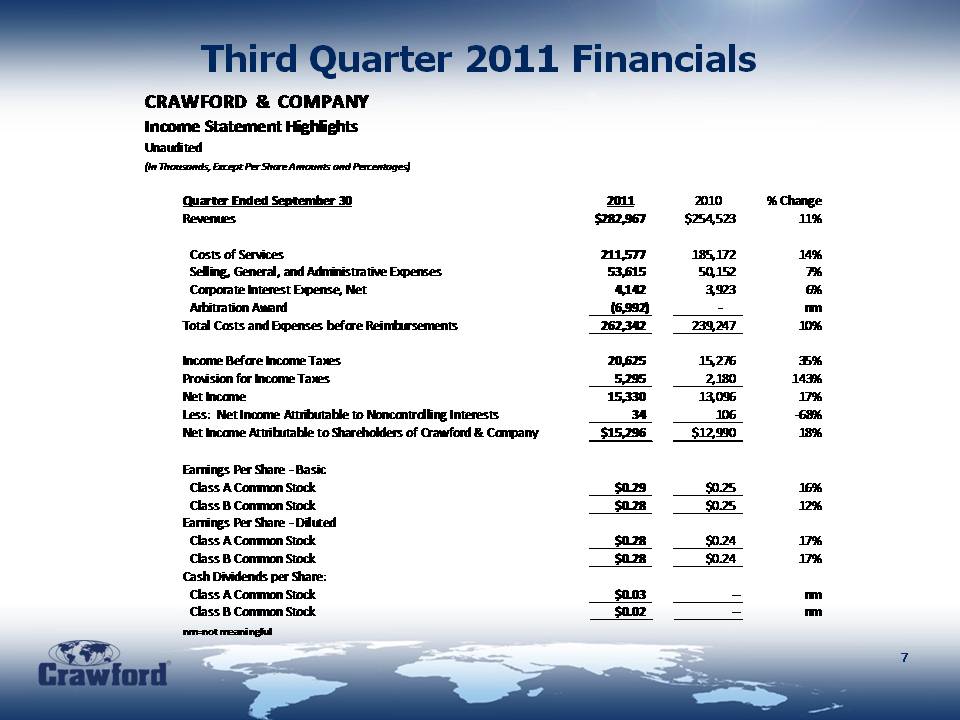

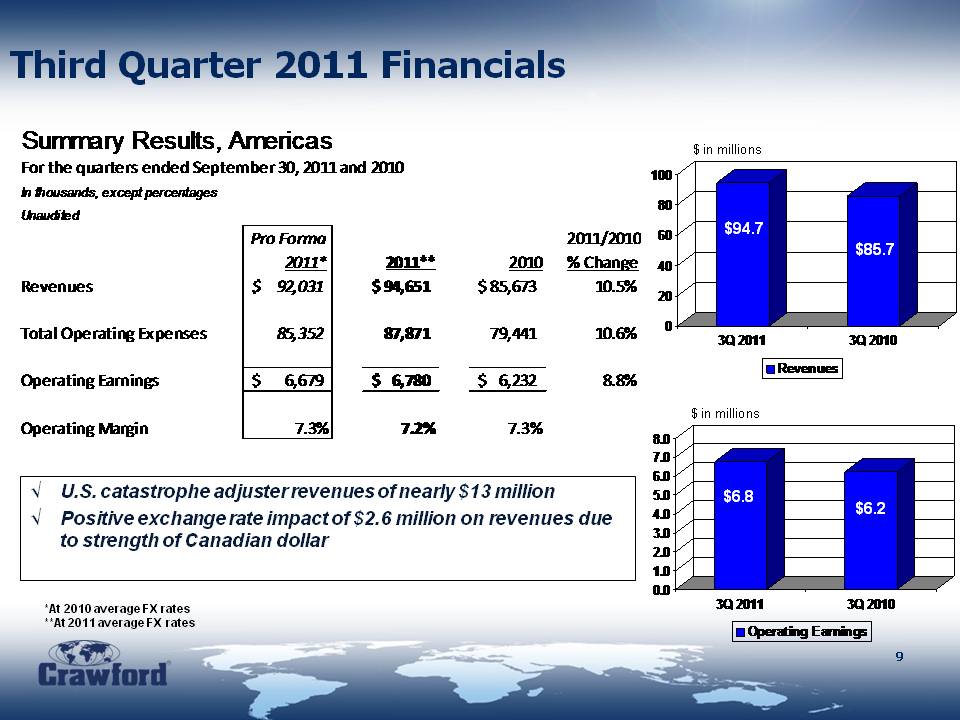

Third Quarter 2011 Financials

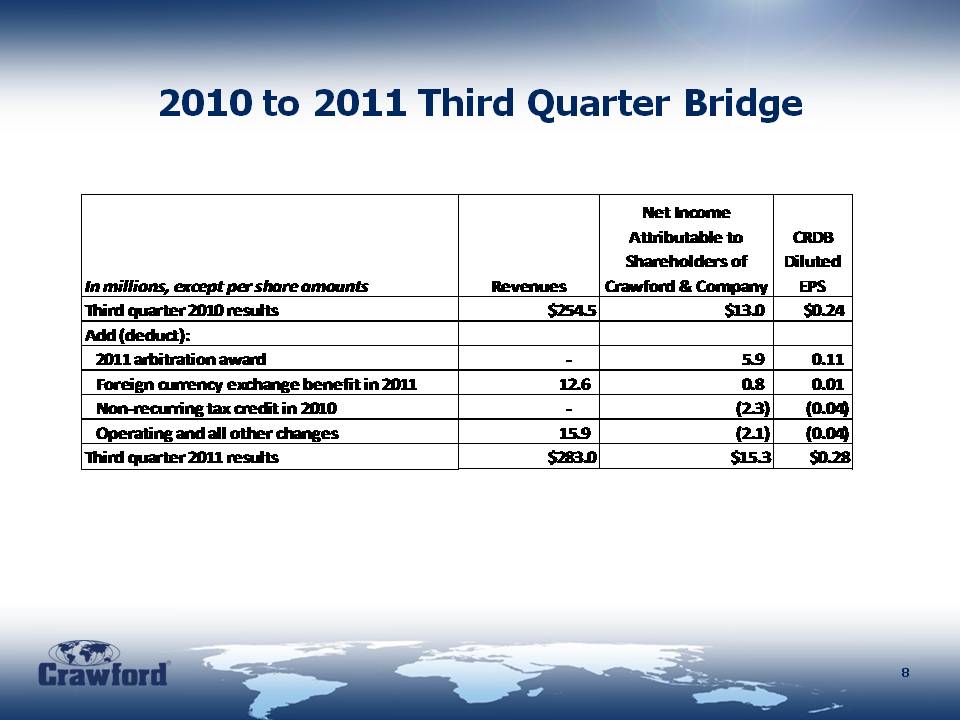

2010 to 2011 Third Quarter Bridge

Third Quarter 2011 Financials

U.S. catastrophe adjuster revenues of nearly $13 million

Positive exchange rate impact of $2.6 million on revenues due to strength of Canadian dollar

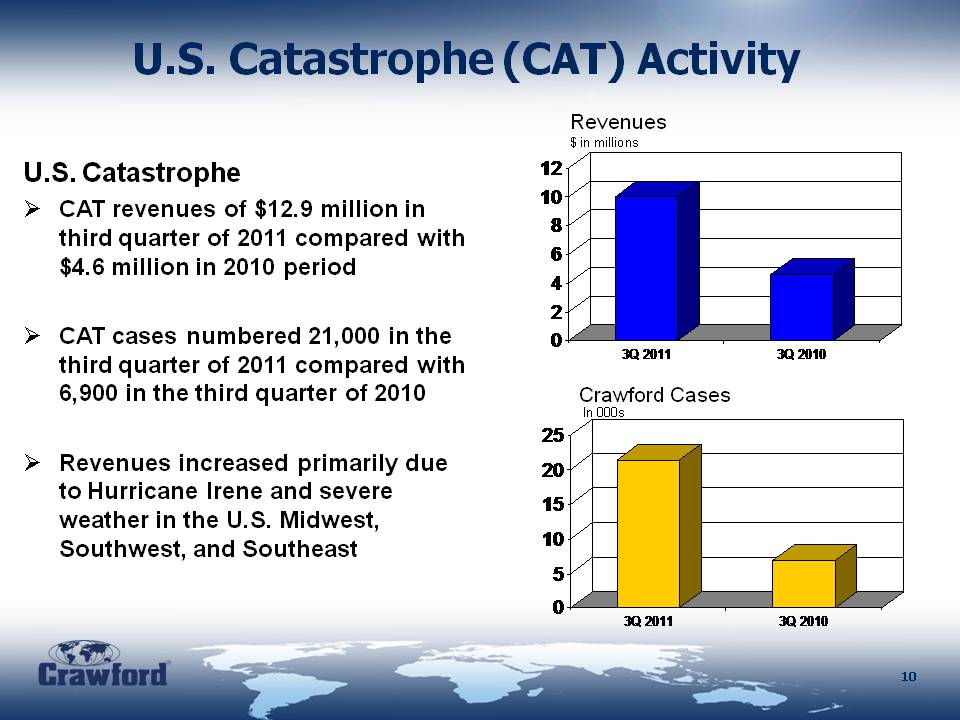

U.S. Catastrophe (CAT) Activity

U.S. Catastrophe

CAT revenues of $12.9 million in third quarter of 2011 compared with $4.6 million in 2010 period

CAT cases numbered 21,000 in the third quarter of 2011 compared with 6,900 in the third quarter of 2010

Revenues increased primarily due to Hurricane Irene and severe weather in the U.S. Midwest, Southwest, and Southeast

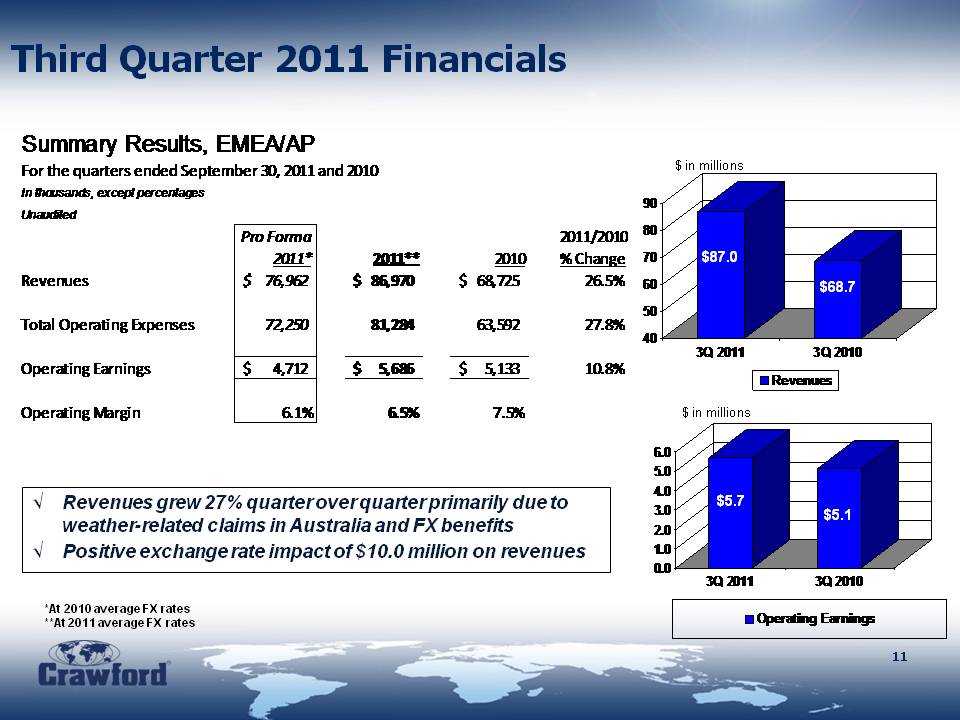

Third Quarter 2011 Financials

Revenues grew 27% quarter over quarter primarily due to weather-related claims in Australia and FX benefits

Positive exchange rate impact of $10.0 million on revenues

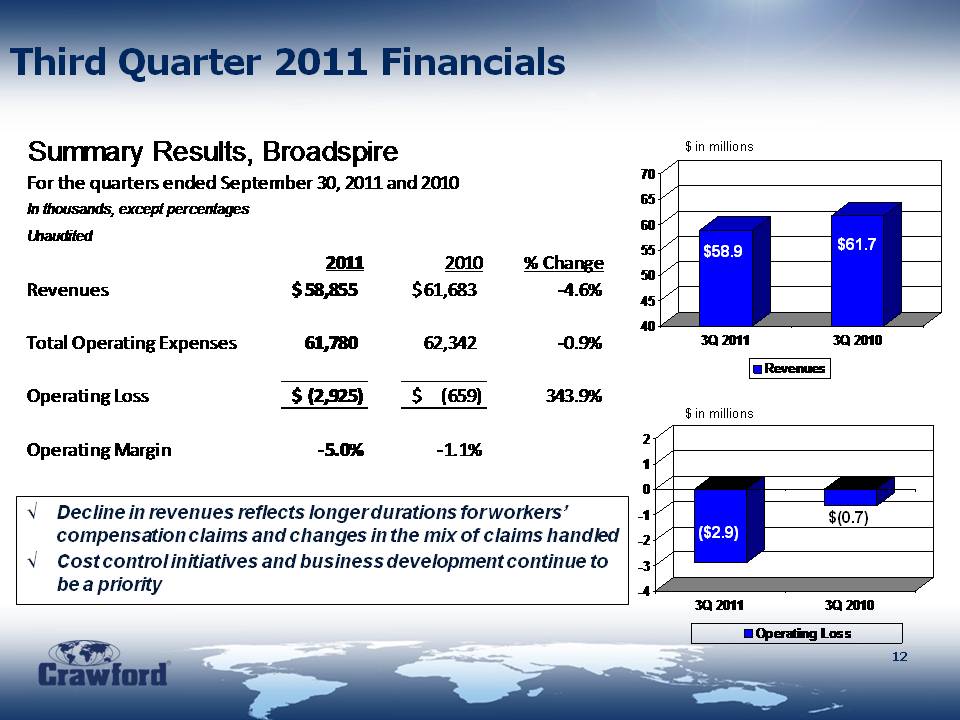

Third Quarter 2011 Financials

Decline in revenues reflects longer durations for workers’ compensation claims and changes in the mix of claims handled

Cost control initiatives and business development continue to be a priority

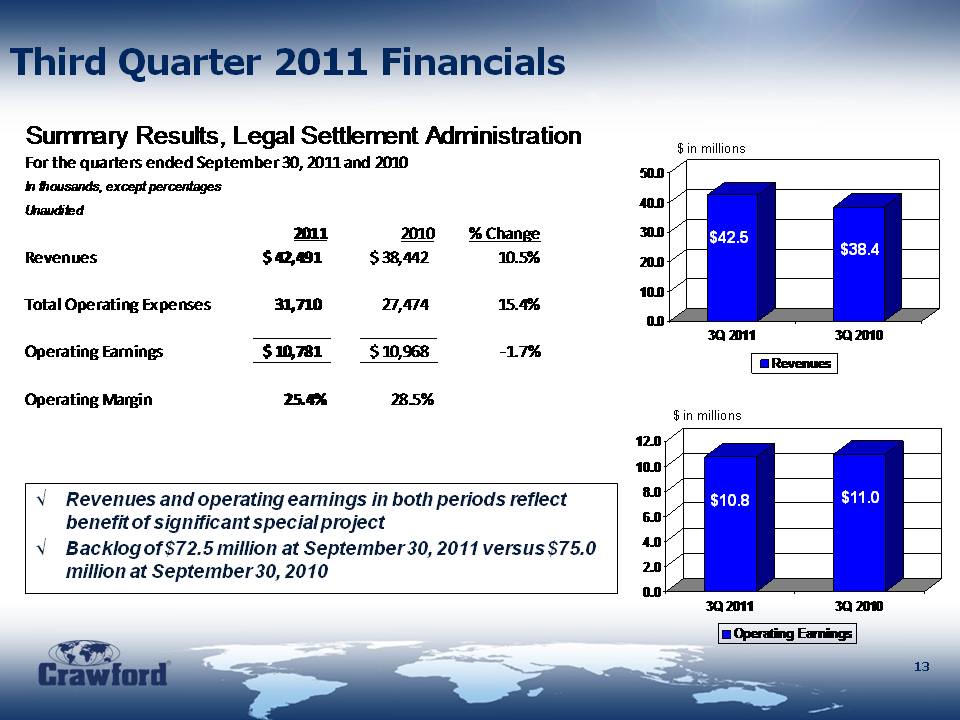

Third Quarter 2011 Financials

Revenues and operating earnings in both periods reflect benefit of significant special project

Backlog of $72.5 million at September 30, 2011 versus $75.0 million at September 30, 2010

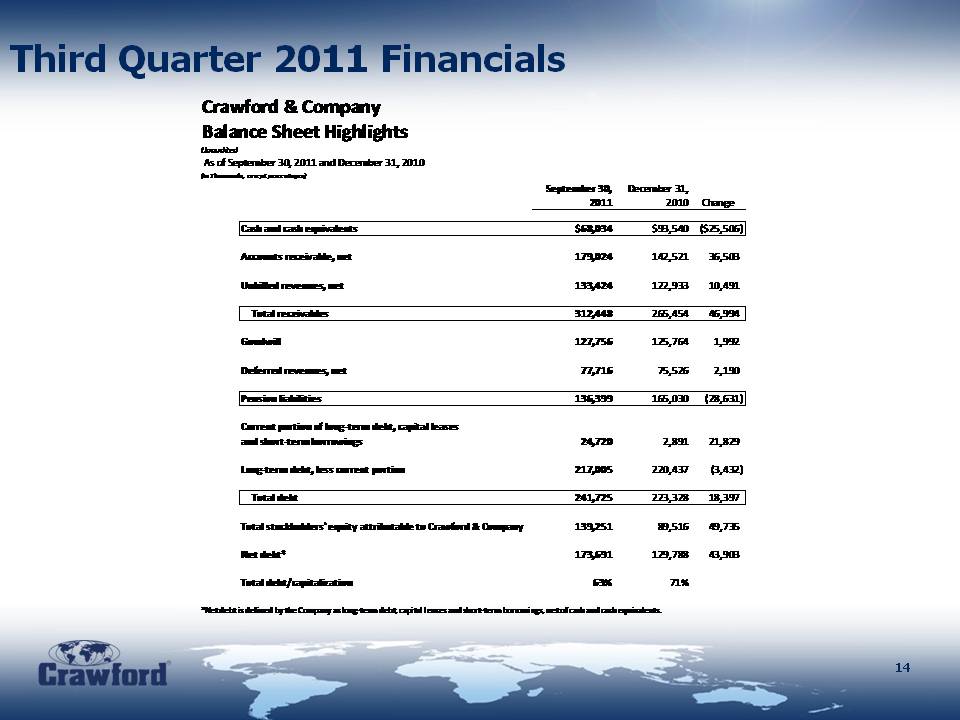

Third Quarter 2011 Financials

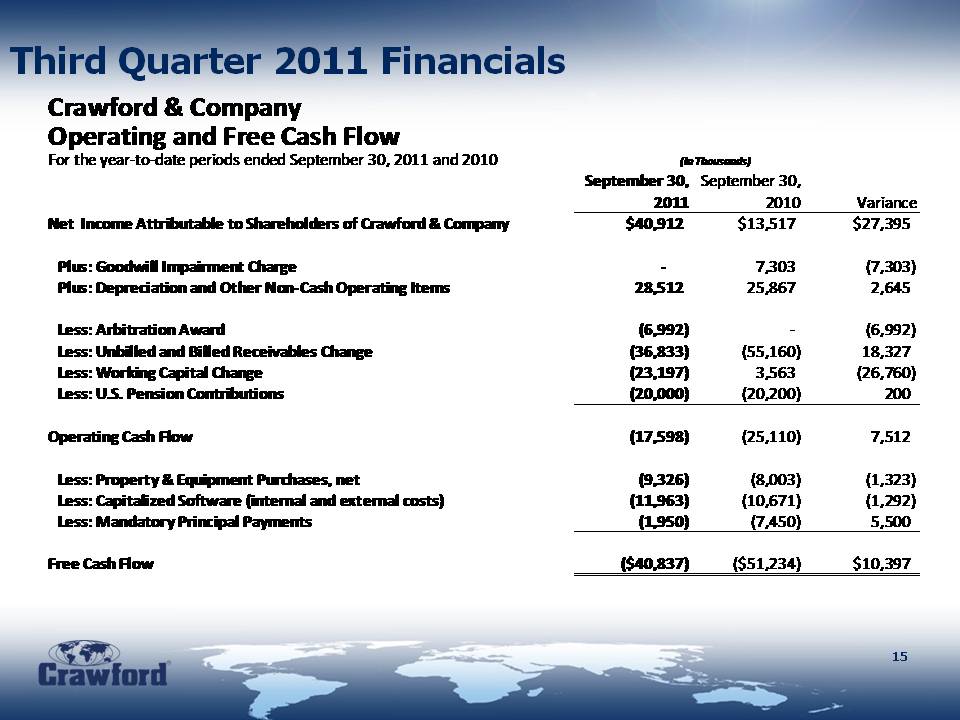

Third Quarter 2011 Financials

Reconciliation of Non-GAAP Items

Operational Review

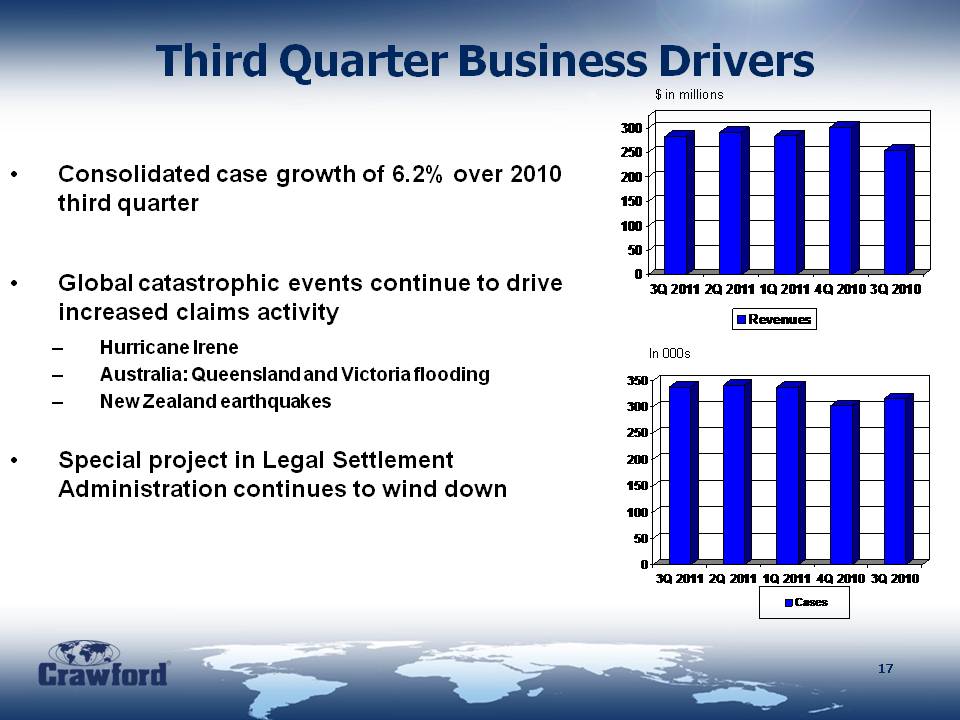

Third Quarter Business Drivers

Consolidated case growth of 6.2% over 2010 third quarter

Global catastrophic events continue to drive increased claims activity

Hurricane Irene

Australia: Queensland and Victoria flooding

New Zealand earthquakes

Special project in Legal Settlement Administration continues to wind down

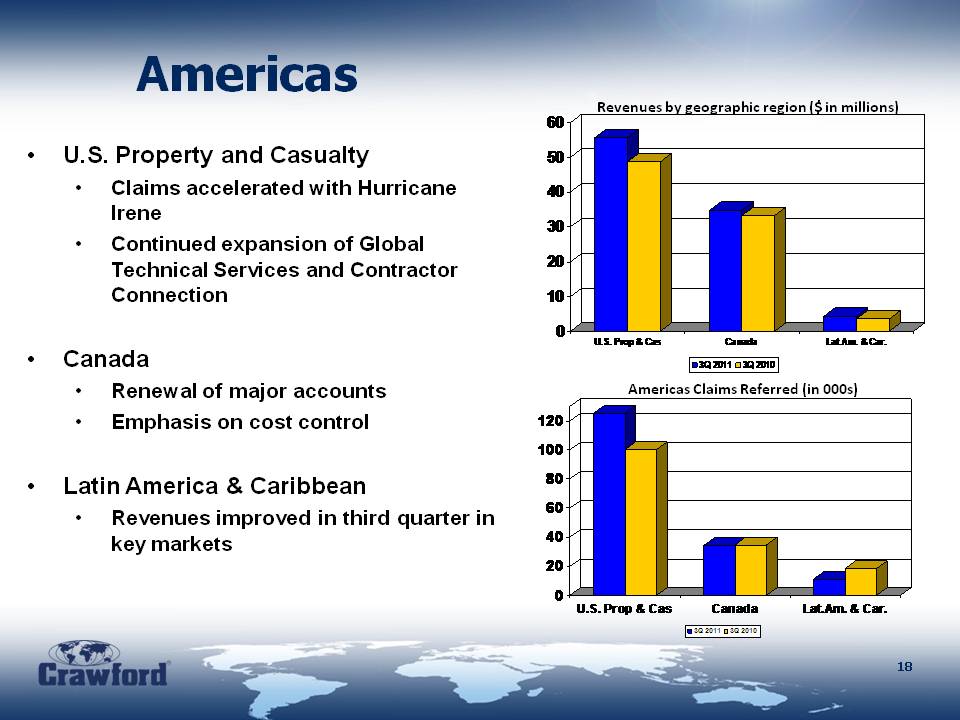

Americas

U.S. Property and Casualty

Claims accelerated with Hurricane Irene

Continued expansion of Global Technical Services and Contractor Connection

Canada

Renewal of major accounts

Emphasis on cost control

Latin America & Caribbean

Revenues improved in third quarter in key markets

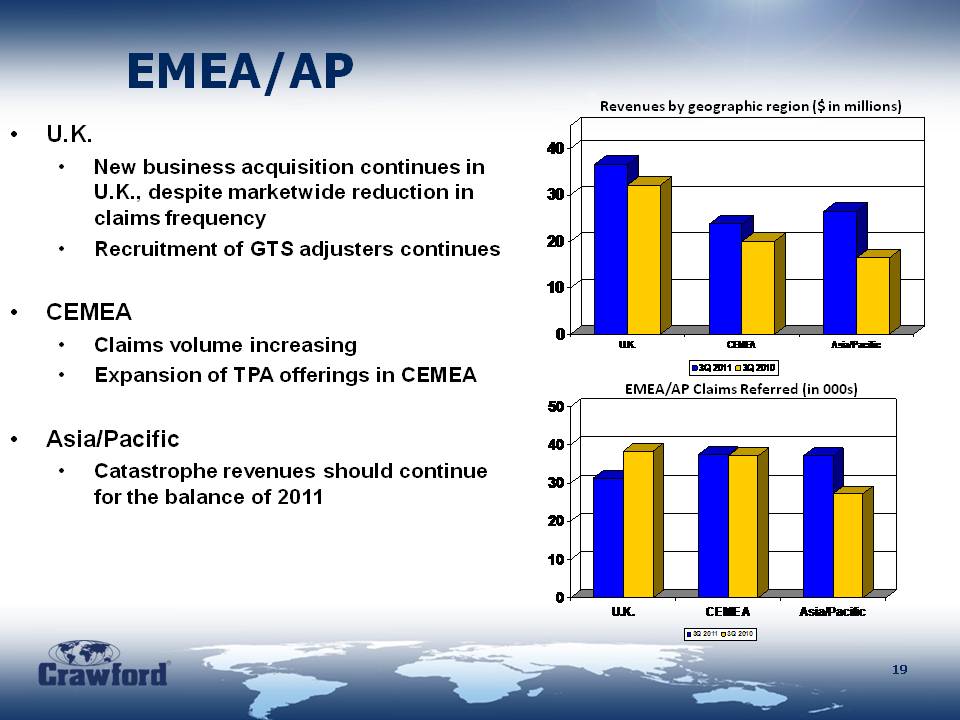

EMEA/AP

U.K.

New business acquisition continues in U.K., despite marketwide reduction in claims frequency

Recruitment of GTS adjusters continues

CEMEA

Claims volume increasing

Expansion of TPA offerings in CEMEA

Asia/Pacific

Catastrophe revenues should continue for the balance of 2011

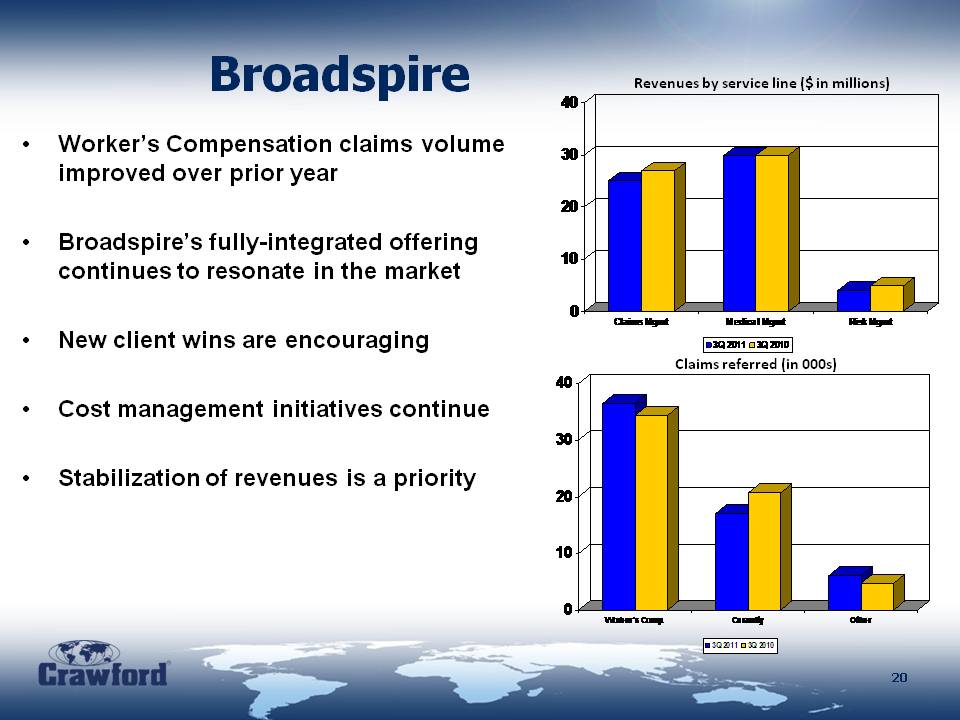

Broadspire

Worker’s Compensation claims volume improved over prior year

Broadspire’s fully-integrated offering continues to resonate in the market

New client wins are encouraging

Cost management initiatives continue

Stabilization of revenues is a priority

Legal Settlement Administration

Special project pace is expected to continue to slow during the fourth quarter

Pace of bankruptcies is increasing

Core businesses continue to perform well

Backlog at $72.5 million

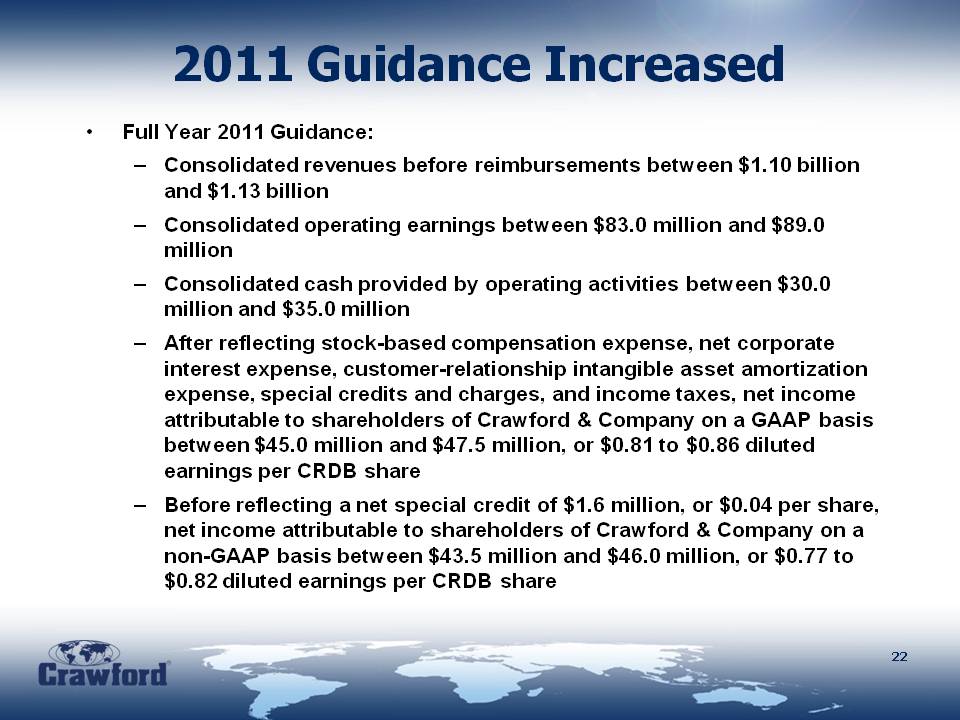

2011 Guidance Increased

Full Year 2011 Guidance:

Consolidated revenues before reimbursements between $1.10 billion and $1.13 billion

Consolidated operating earnings between $83.0 million and $89.0 million

Consolidated cash provided by operating activities between $30.0 million and $35.0 million

After reflecting stock-based compensation expense, net corporate interest expense, customer-relationship intangible asset amortization expense, special credits and charges, and income taxes, net income attributable to shareholders of Crawford & Company on a GAAP basis between $45.0 million and $47.5 million, or $0.81 to $0.86 diluted earnings per CRDB share

Before reflecting a net special credit of $1.6 million, or $0.04 per share, net income attributable to shareholders of Crawford & Company on a non-GAAP basis between $43.5 million and $46.0 million, or $0.77 to $0.82 diluted earnings per CRDB share

Operational Focus

Bring Broadspire to an acceptable operating level

Significant debt reduction

Continue to grow revenue and operating earnings

Capitalize on global opportunities

Enhance shareholder returns

Third Quarter 2011

Earnings Conference Call

Monday, November 7, 2011

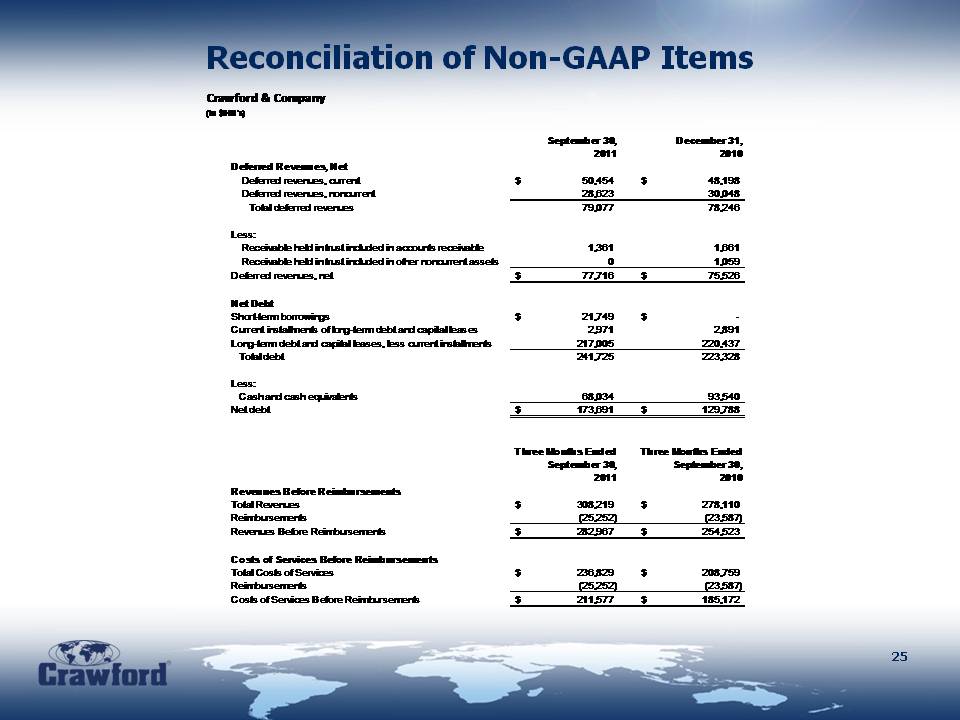

Reconciliation of Non-GAAP Items

Reconciliation of Non-GAAP Items

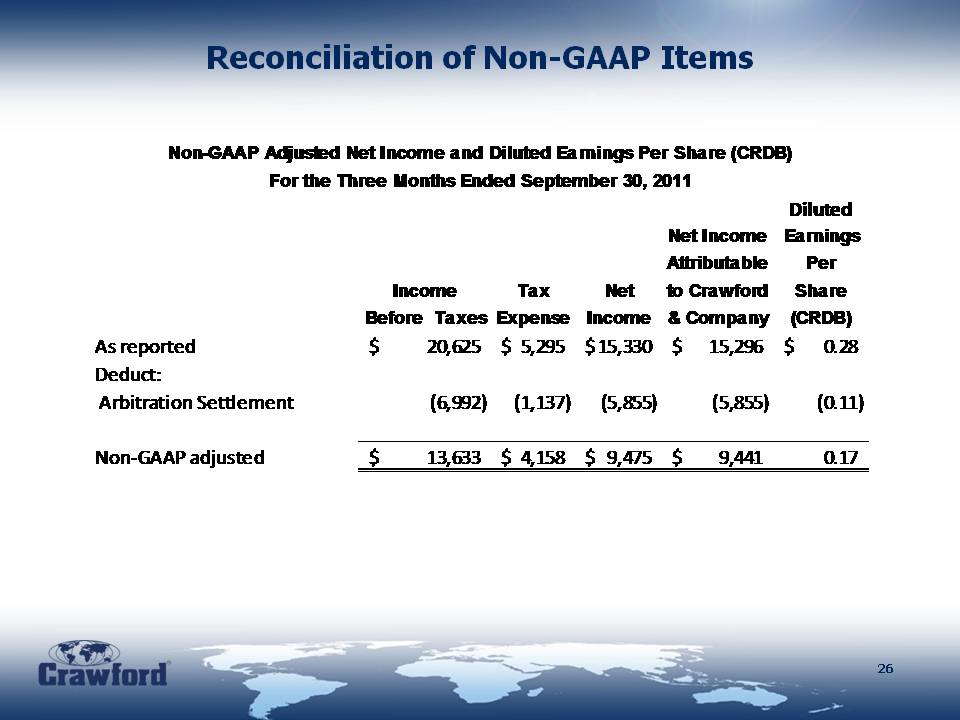

Reconciliation of Non-GAAP Items