Crawford & Company FOURTH QUARTER AND FULL YEAR 2013 EARNINGS CONFERENCE CALL February 26, 2014

• Forward-looking statements —This presentation contains forward-looking statements, including statements about the future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company’s present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company’s reports filed with the United States Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company’s website at www.crawfordandcompany.com. —Crawford’s business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of claims and revenue for the Company, are generally not subject to accurate forecasting. • Revenues Before Reimbursements (“Revenues”) —Revenues Before Reimbursements are referred to as “Revenues” in both consolidated and segment charts, bullets and tables throughout this presentation. • Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board’s Accounting Standards Codification ("ASC") Topic 280, “Segment Reporting,” the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, stock option expense, earnings or loss attributable to non-controlling interests, certain unallocated corporate and shared costs and credits, and special charges and credits. Consolidated operating earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. • Earnings Per Share —In certain periods, the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by the guidance in ASC Topic 260 - "Earnings Per Share". The two- class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. • Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. 2 FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

3 • The world’s largest independent provider of global claims management solutions • Multiple globally recognized brand names: Crawford, Broadspire, GCG • Clients include multinational insurance carriers, brokers and local insurance firms as well as 200 of the Fortune 500 EMEA-A/P Broadspire Legal Settlement Administration Americas Serves large national accounts, carriers and self-insured entities Serves the U.K., European, Middle Eastern, African and Asia Pacific markets Serves the U.S., Canadian and Latin American markets Provides administration for class action settlements and bankruptcy matters Global Business Services Leader

Today’s Agenda Welcome and Opening Comments Fourth Quarter and Full Year 2013 Financial Review Fourth Quarter and Full Year 2013 Operational Review Guidance and Strategic Initiatives

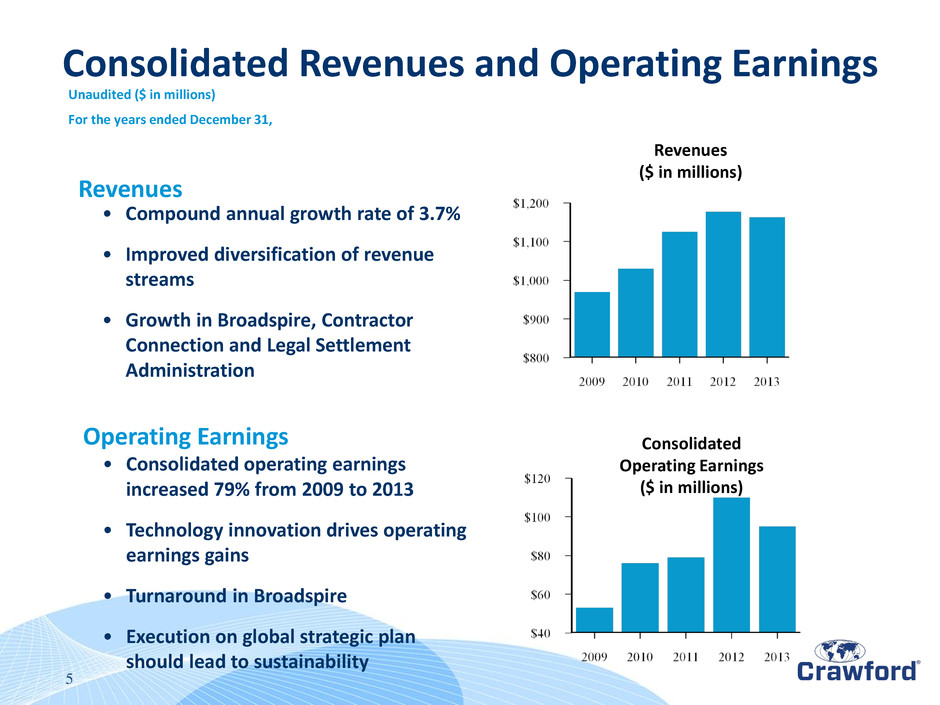

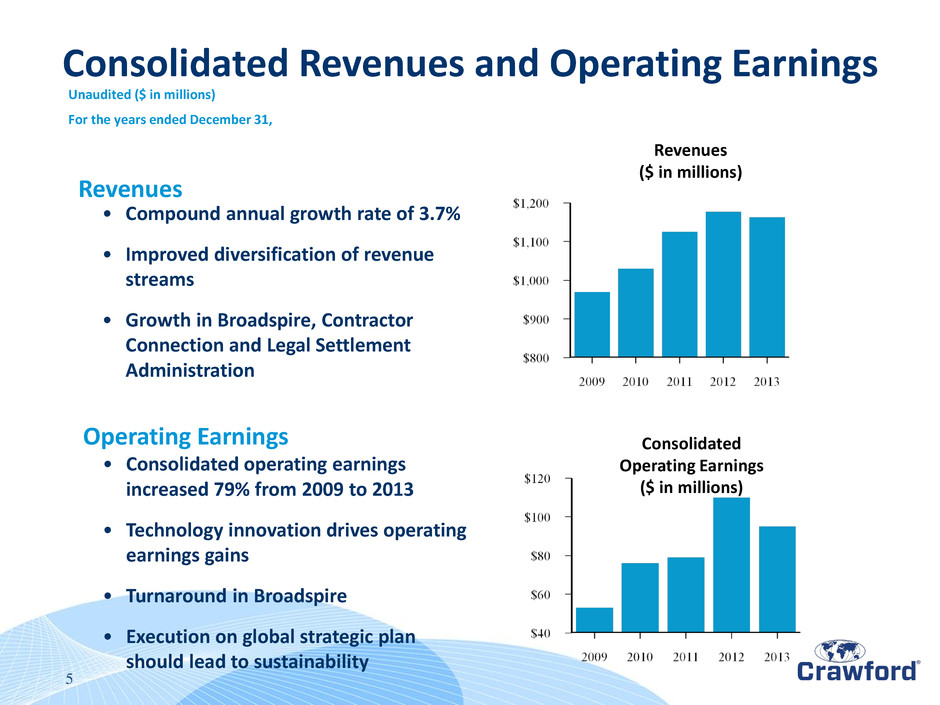

Consolidated Operating Earnings ($ in millions) Revenues ($ in millions) 5 Revenues • Compound annual growth rate of 3.7% • Improved diversification of revenue streams • Growth in Broadspire, Contractor Connection and Legal Settlement Administration Operating Earnings • Consolidated operating earnings increased 79% from 2009 to 2013 • Technology innovation drives operating earnings gains • Turnaround in Broadspire • Execution on global strategic plan should lead to sustainability Unaudited ($ in millions) For the years ended December 31, Consolidated Revenues and Operating Earnings

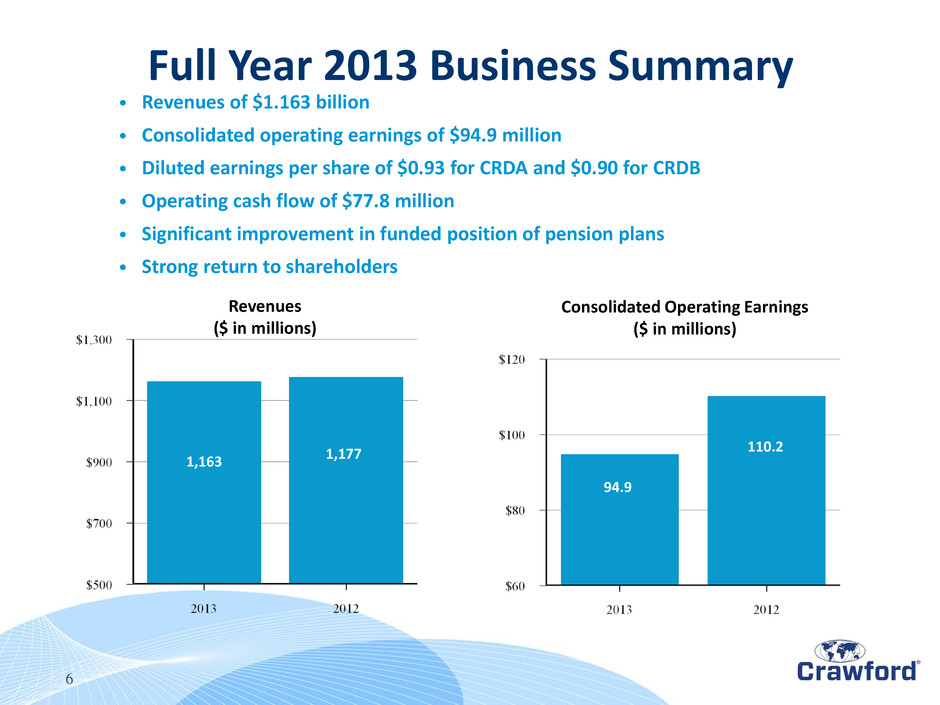

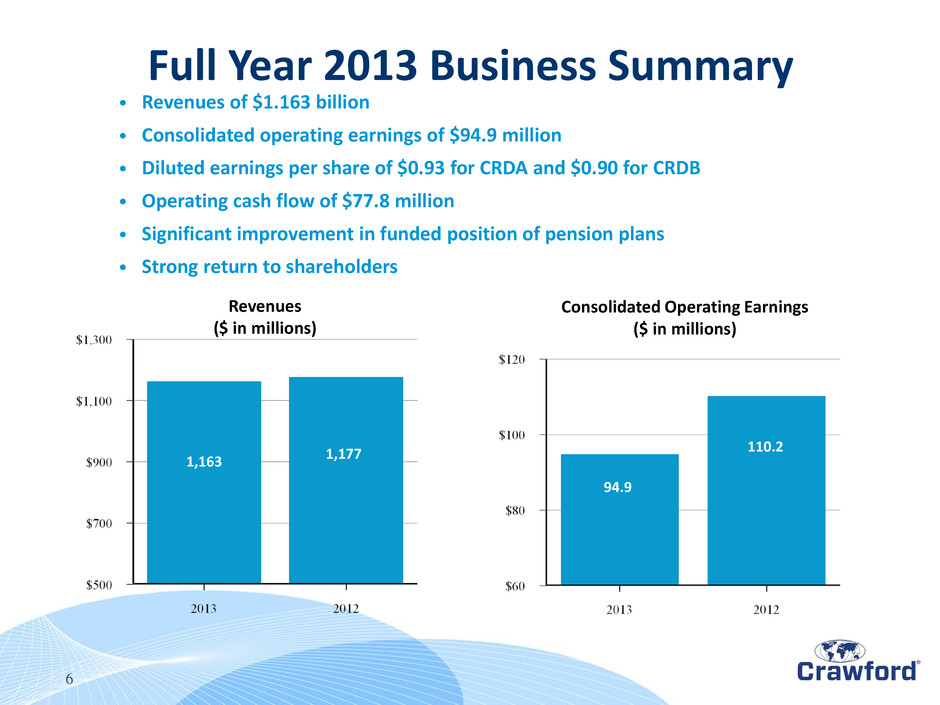

1,163 6 110.2 1,177 94.9 Revenues ($ in millions) Consolidated Operating Earnings ($ in millions) • Revenues of $1.163 billion • Consolidated operating earnings of $94.9 million • Diluted earnings per share of $0.93 for CRDA and $0.90 for CRDB • Operating cash flow of $77.8 million • Significant improvement in funded position of pension plans • Strong return to shareholders Full Year 2013 Business Summary

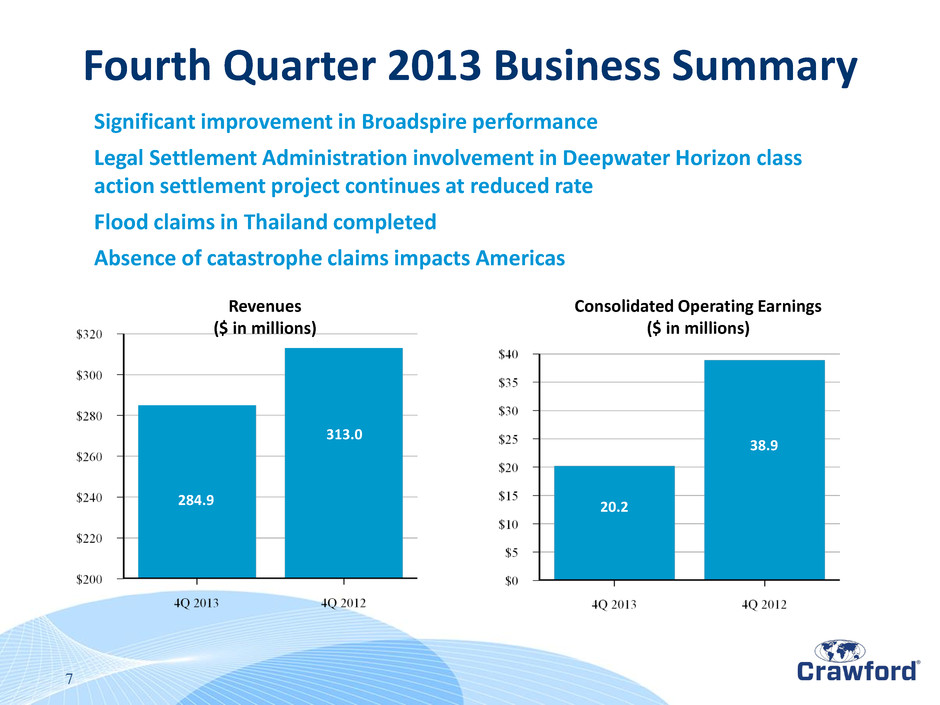

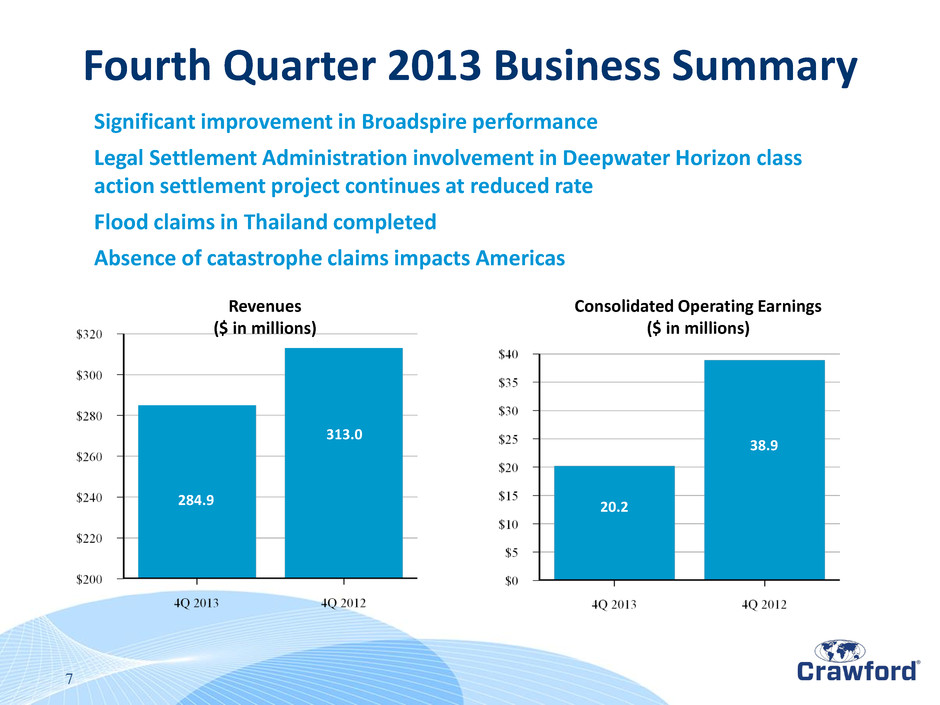

284.9 313.0 20.2 38.9 7 Revenues ($ in millions) Consolidated Operating Earnings ($ in millions) Significant improvement in Broadspire performance Legal Settlement Administration involvement in Deepwater Horizon class action settlement project continues at reduced rate Flood claims in Thailand completed Absence of catastrophe claims impacts Americas Fourth Quarter 2013 Business Summary

Fourth Quarter and Full Year 2013 Financial Review

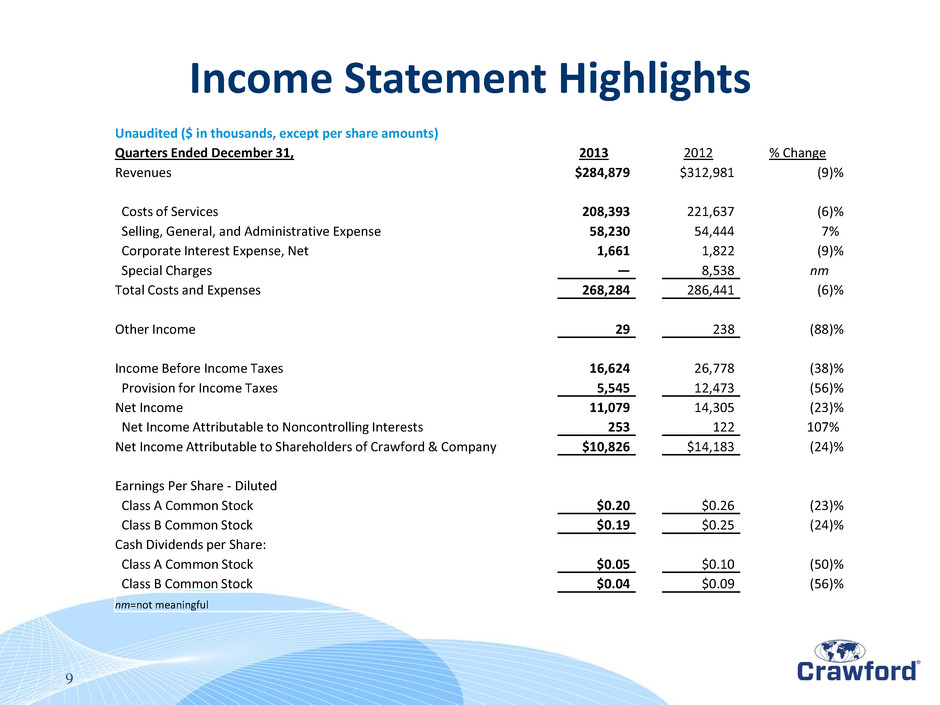

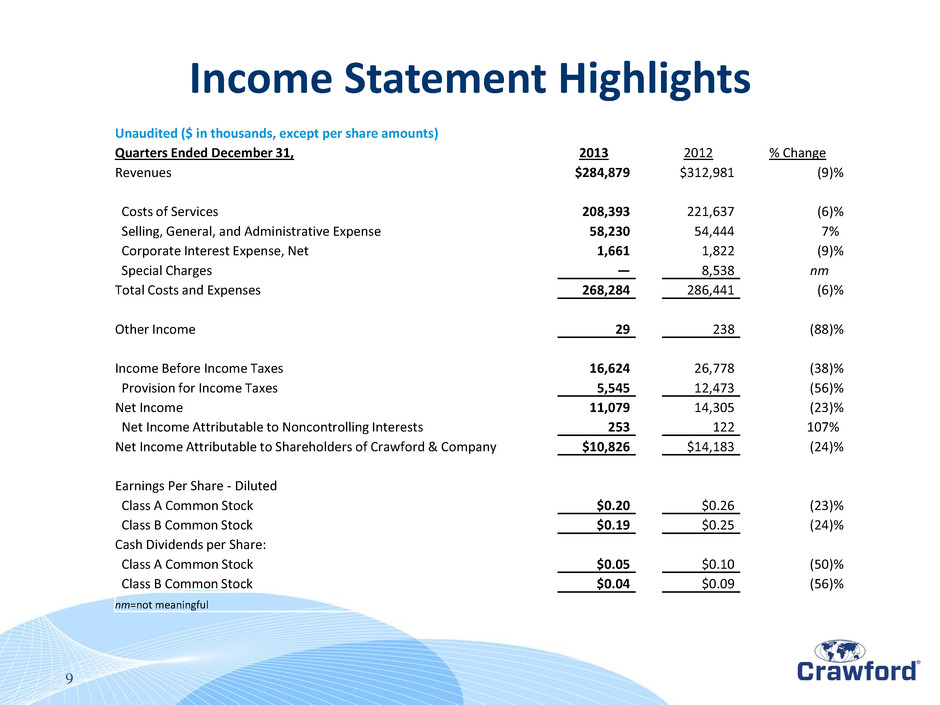

Unaudited ($ in thousands, except per share amounts) Quarters Ended December 31, 2013 2012 % Change Revenues $284,879 $312,981 (9 )% Costs of Services 208,393 221,637 (6 )% Selling, General, and Administrative Expense 58,230 54,444 7 % Corporate Interest Expense, Net 1,661 1,822 (9 )% Special Charges — 8,538 nm Total Costs and Expenses 268,284 286,441 (6 )% Other Income 29 238 (88 )% Income Before Income Taxes 16,624 26,778 (38 )% Provision for Income Taxes 5,545 12,473 (56 )% Net Income 11,079 14,305 (23 )% Net Income Attributable to Noncontrolling Interests 253 122 107 % Net Income Attributable to Shareholders of Crawford & Company $10,826 $14,183 (24 )% Earnings Per Share - Diluted Class A Common Stock $0.20 $0.26 (23 )% Class B Common Stock $0.19 $0.25 (24 )% Cash Dividends per Share: Class A Common Stock $0.05 $0.10 (50 )% Class B Common Stock $0.04 $0.09 (56 )% nm=not meaningful 9 Income Statement Highlights

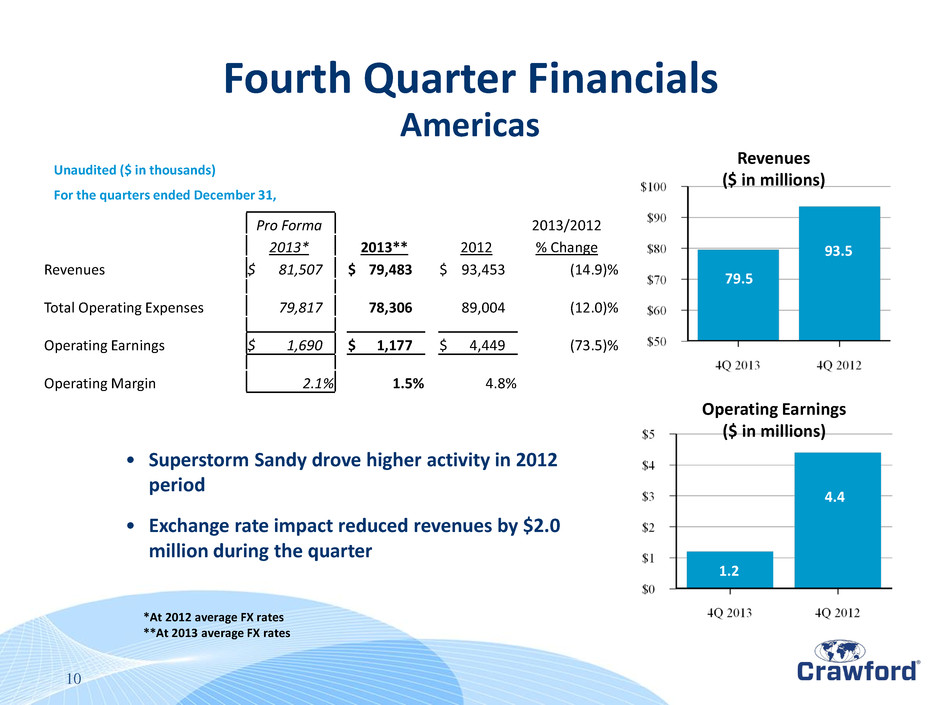

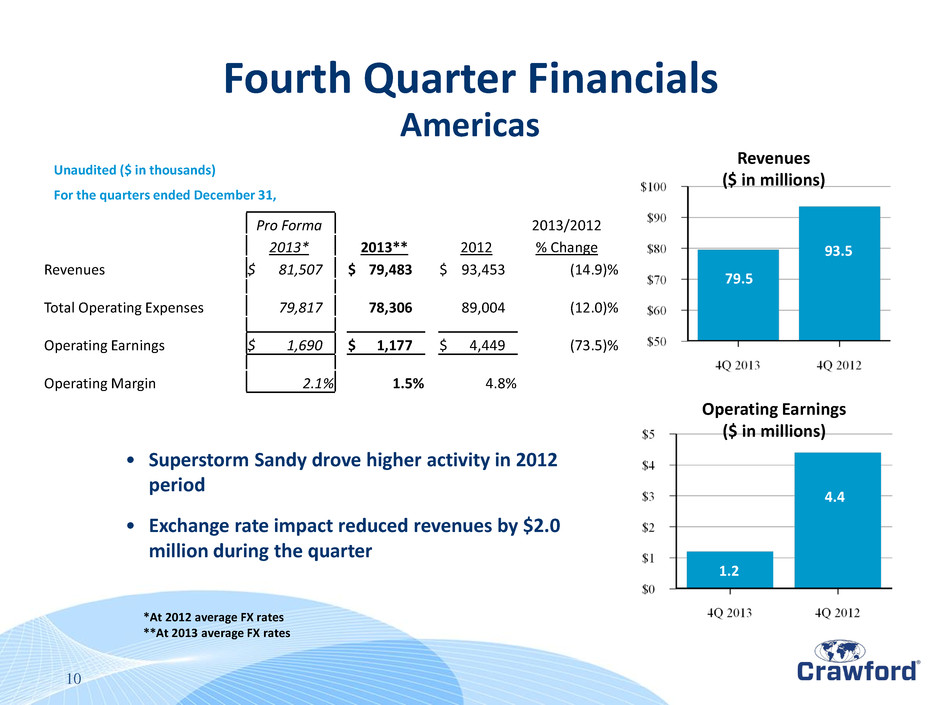

Pro Forma 2013/2012 2013* 2013** 2012 % Change Revenues $ 81,507 $ 79,483 $ 93,453 (14.9 )% Total Operating Expenses 79,817 78,306 89,004 (12.0 )% Operating Earnings $ 1,690 $ 1,177 $ 4,449 (73.5 )% Operating Margin 2.1 % 1.5 % 4.8 % 85 .9 6. 5 95 .9 79.5 93.5 4.4 10 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, *At 2012 average FX rates **At 2013 average FX rates Americas Fourth Quarter Financials 1.2 • Superstorm Sandy drove higher activity in 2012 period • Exchange rate impact reduced revenues by $2.0 million during the quarter

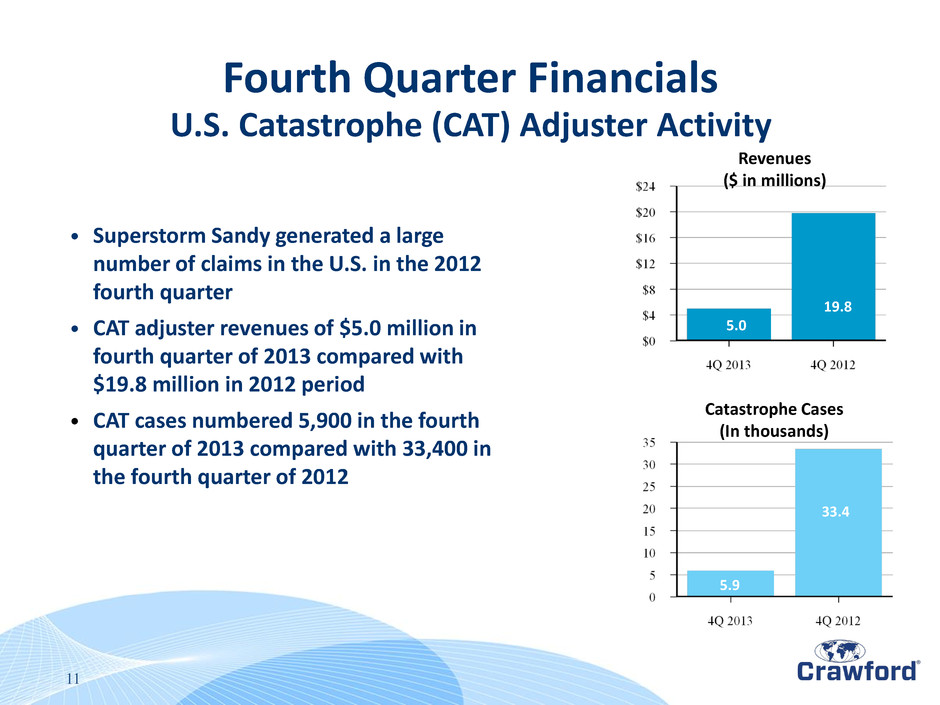

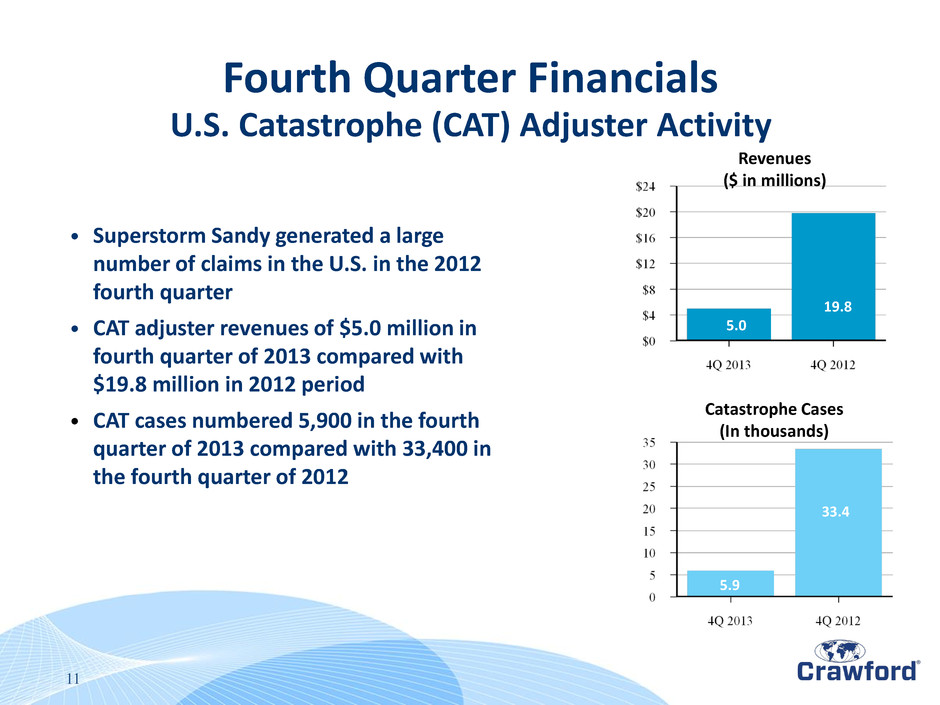

9. 1 33.4 85 .9 6. 5 5.0 1 .8 33.4 11 Revenues ($ in millions) Catastrophe Cases (In thousands) • Superstorm Sandy generated a large number of claims in the U.S. in the 2012 fourth quarter • CAT adjuster revenues of $5.0 million in fourth quarter of 2013 compared with $19.8 million in 2012 period • CAT cases numbered 5,900 in the fourth quarter of 2013 compared with 33,400 in the fourth quarter of 2012 U.S. Catastrophe (CAT) Adjuster Activity Fourth Quarter Financials 5.9

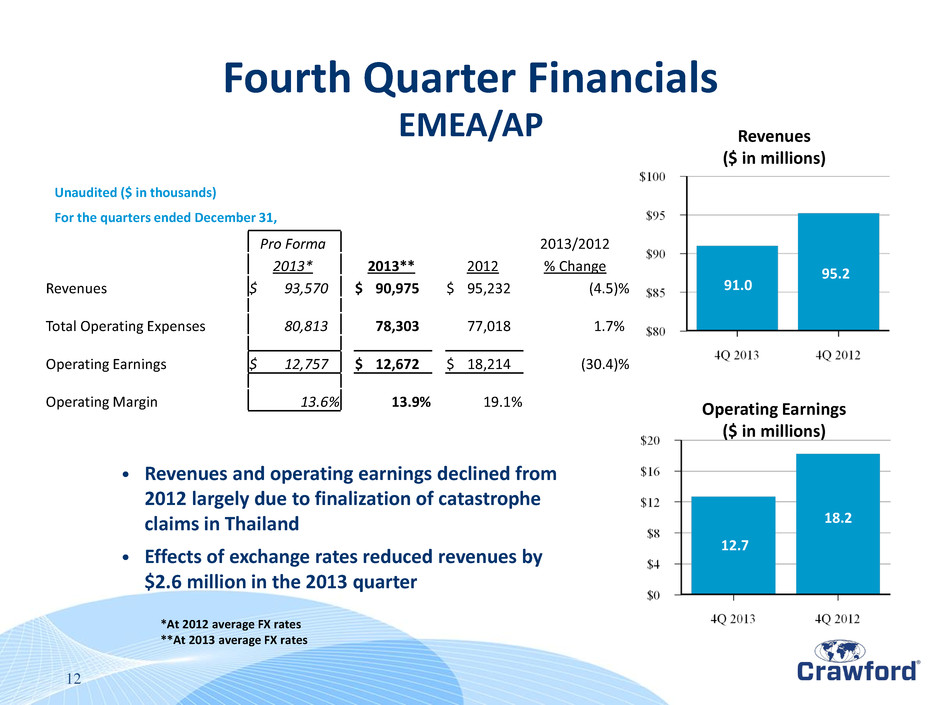

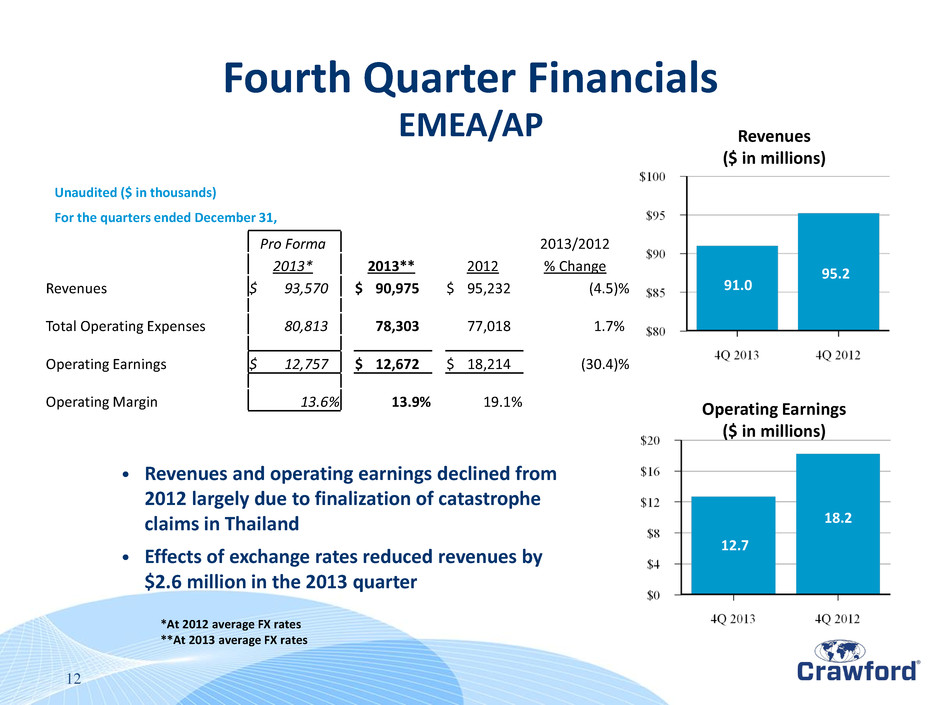

91.0 95.2 18.2 12.7 Pro Forma 2013/2012 2013* 2013** 2012 % Change Revenues $ 93,570 $ 90,975 $ 95,232 (4.5 )% Total Operating Expenses 80,813 78,303 77,018 1.7 % Operating Earnings $ 12,757 $ 12,672 $ 18,214 (30.4 )% Operating Margin 13.6 % 13.9 % 19.1 % 12 Operating Earnings ($ in millions) Revenues ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Revenues and operating earnings declined from 2012 largely due to finalization of catastrophe claims in Thailand • Effects of exchange rates reduced revenues by $2.6 million in the 2013 quarter *At 2012 average FX rates **At 2013 average FX rates EMEA/AP Fourth Quarter Financials

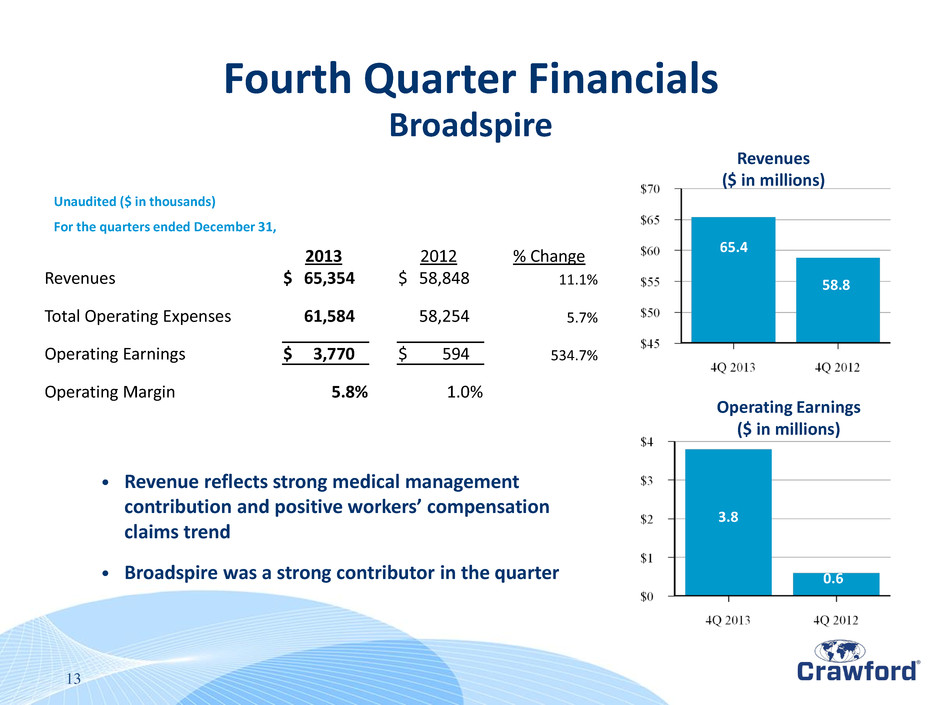

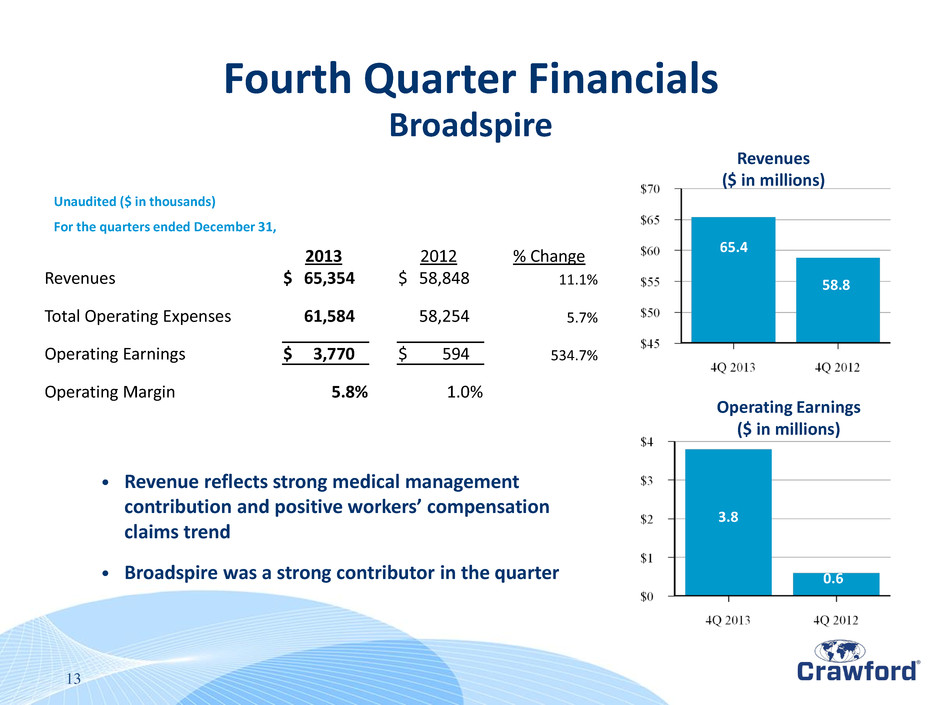

65.4 58.8 3.8 2013 2012 % Change Revenues $ 65,354 $ 58,848 11.1 % Total Operating Expenses 61,584 58,254 5.7 % Operating Earnings $ 3,770 $ 594 534.7 % Operating Margin 5.8 % 1.0 % 13 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Revenue reflects strong medical management contribution and positive workers’ compensation claims trend • Broadspire was a strong contributor in the quarter Broadspire Fourth Quarter Financials 0.6

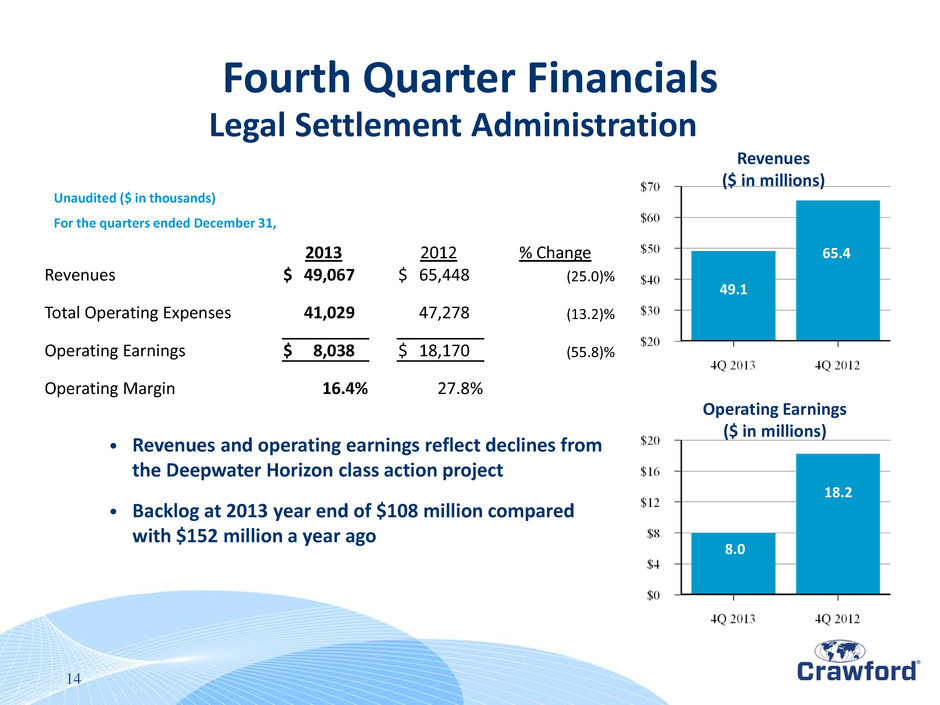

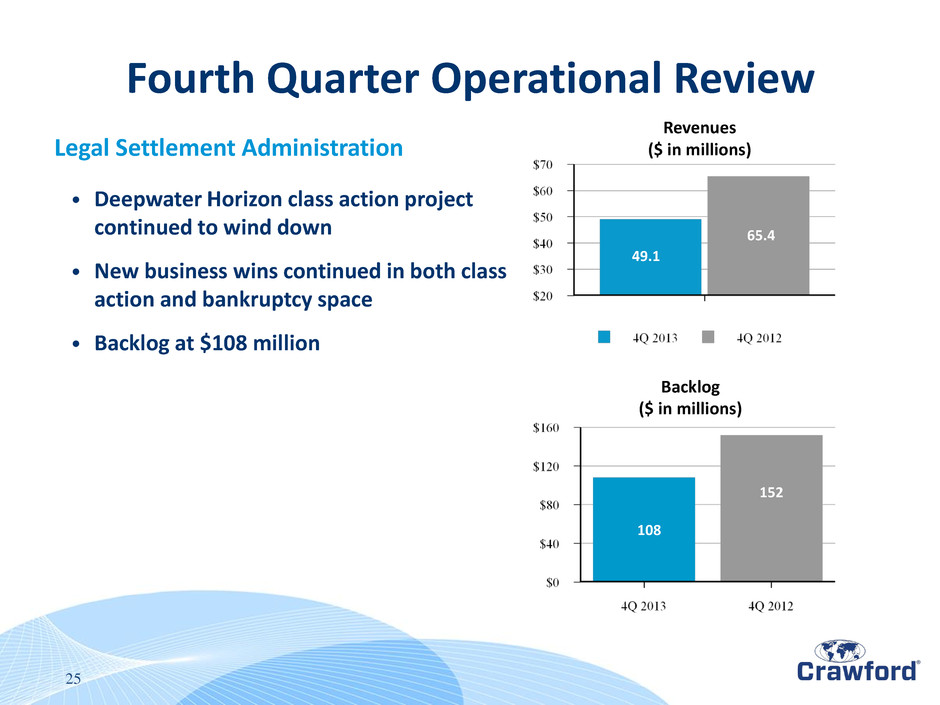

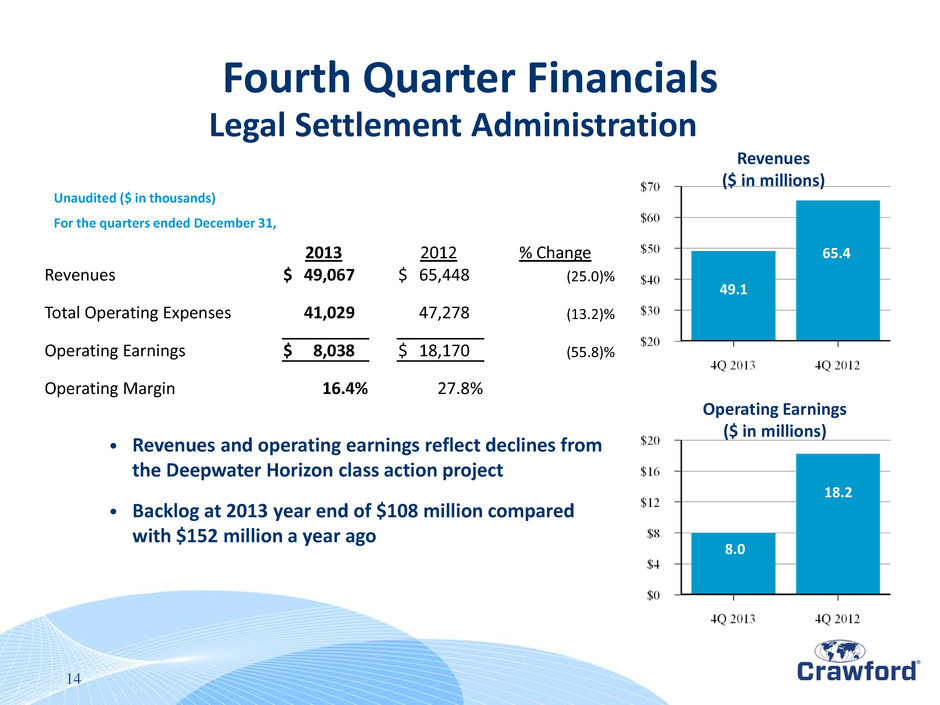

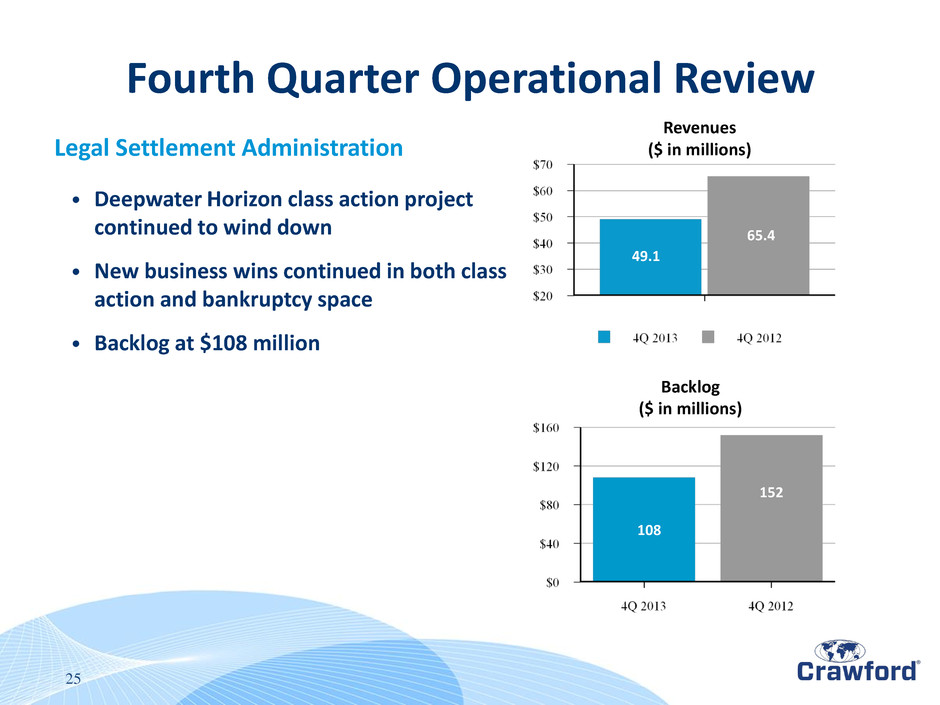

49.1 65.4 18.2 8.0 2013 2012 % Change Revenues $ 49,067 $ 65,448 (25.0 )% Total Operating Expenses 41,029 47,278 (13.2 )% Operating Earnings $ 8,038 $ 18,170 (55.8 )% Operating Margin 16.4 % 27.8 % 14 Revenues ($ in millions) Operating Earnings ($ in millions) Unaudited ($ in thousands) For the quarters ended December 31, • Revenues and operating earnings reflect declines from the Deepwater Horizon class action project • Backlog at 2013 year end of $108 million compared with $152 million a year ago Legal Settlement Administration Fourth Quarter Financials

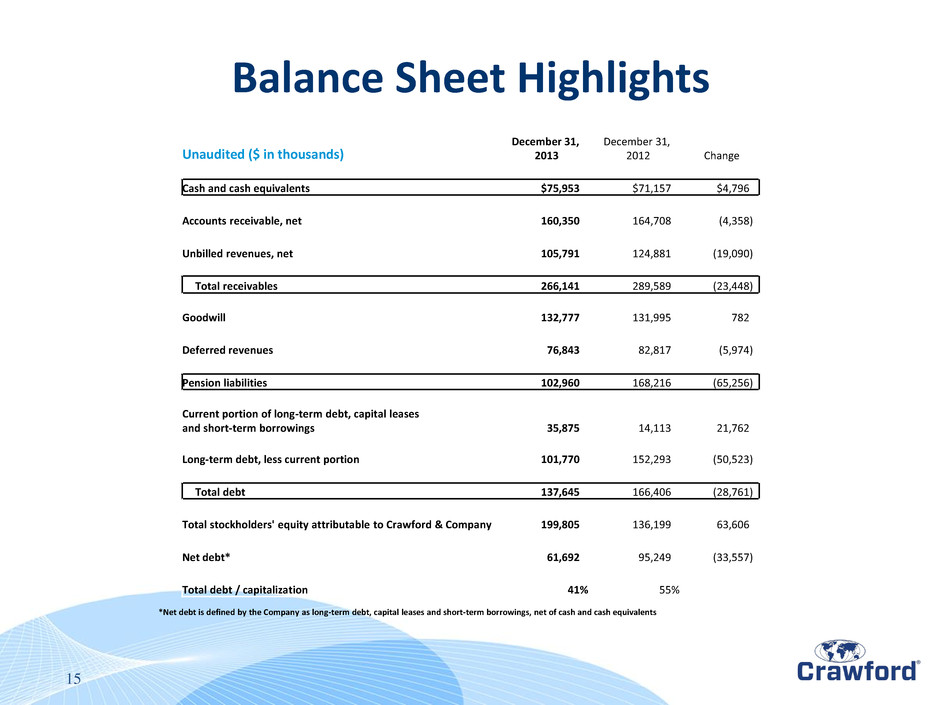

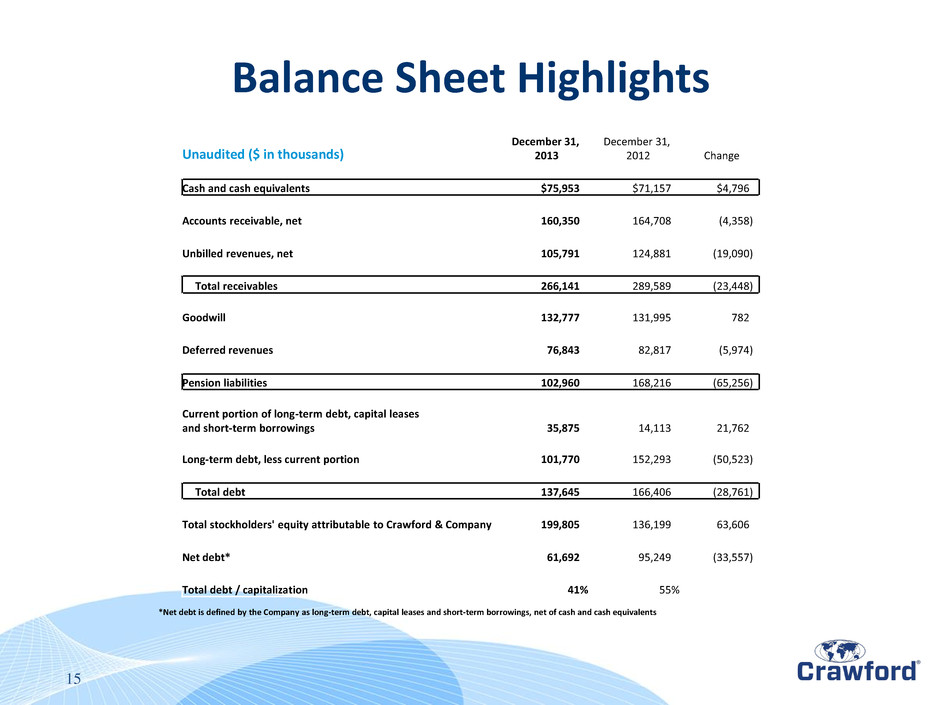

15 Unaudited ($ in thousands) December 31, 2013 December 31, 2012 Change Cash and cash equivalents $75,953 $71,157 $4,796 Accounts receivable, net 160,350 164,708 (4,358 ) Unbilled revenues, net 105,791 124,881 (19,090 ) Total receivables 266,141 289,589 (23,448 ) Goodwill 132,777 131,995 782 Deferred revenues 76,843 82,817 (5,974 ) Pension liabilities 102,960 168,216 (65,256 ) Current portion of long-term debt, capital leases and short-term borrowings 35,875 14,113 21,762 Long-term debt, less current portion 101,770 152,293 (50,523 ) Total debt 137,645 166,406 (28,761 ) Total stockholders' equity attributable to Crawford & Company 199,805 136,199 63,606 Net debt* 61,692 95,249 (33,557 ) Total debt / capitalization 41 % 55 % *Net debt is defined by the Company as long-term debt, capital leases and short-term borrowings, net of cash and cash equivalents Balance Sheet Highlights

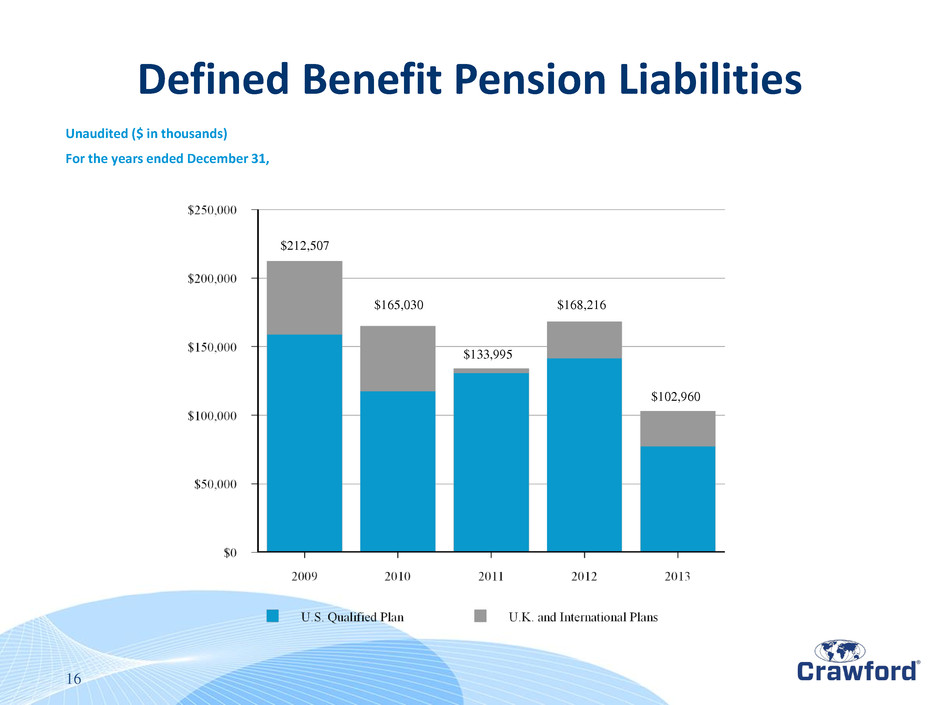

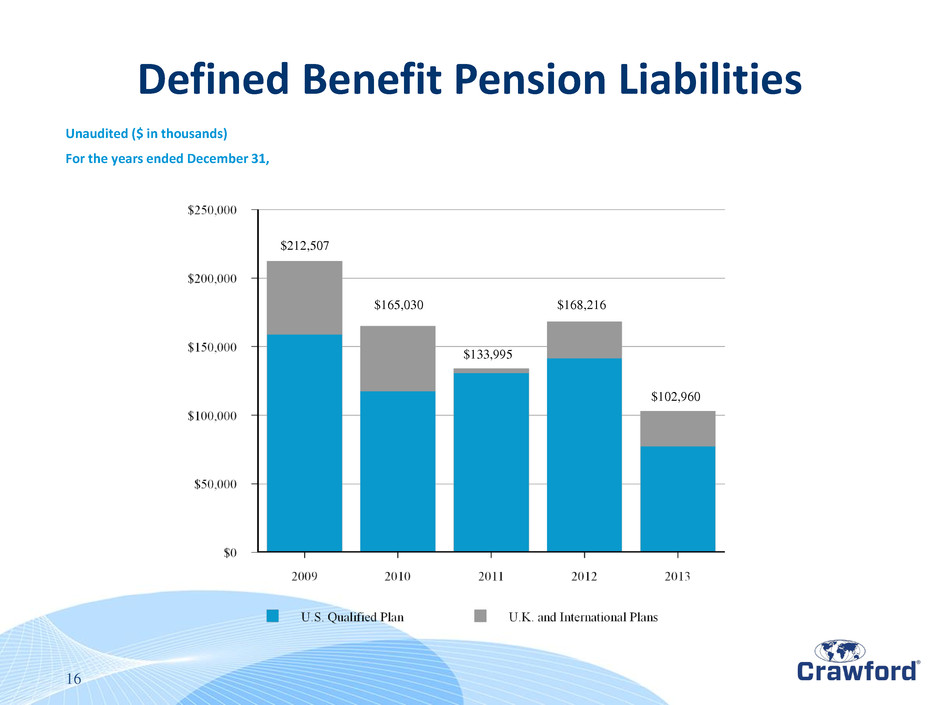

Unaudited ($ in thousands) For the years ended December 31, $102,960 $168,216 $133,995 $165,030 $212,507 16 Defined Benefit Pension Liabilities

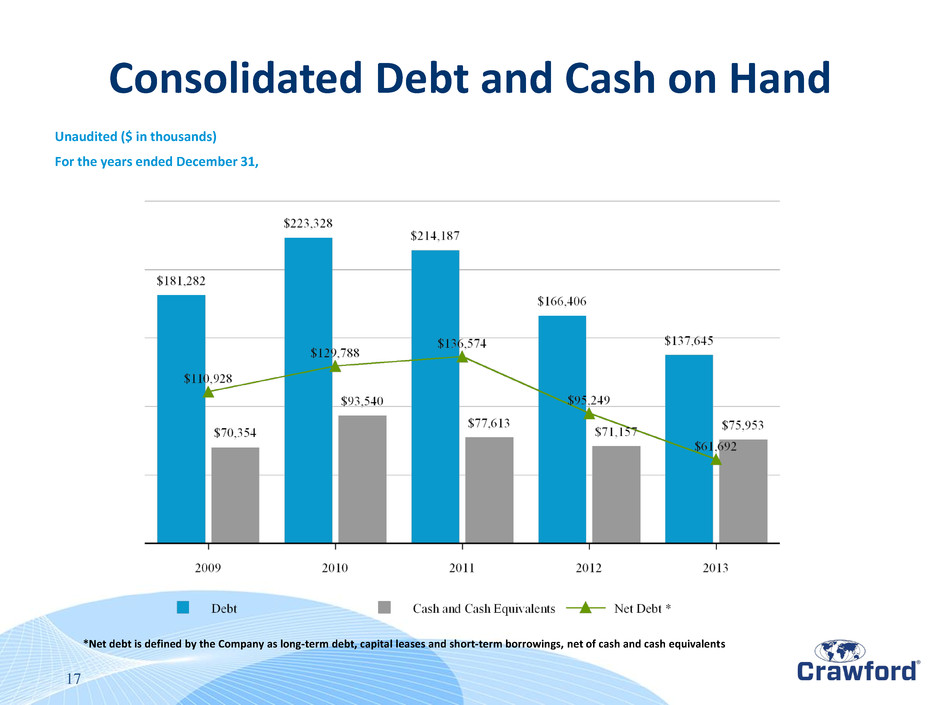

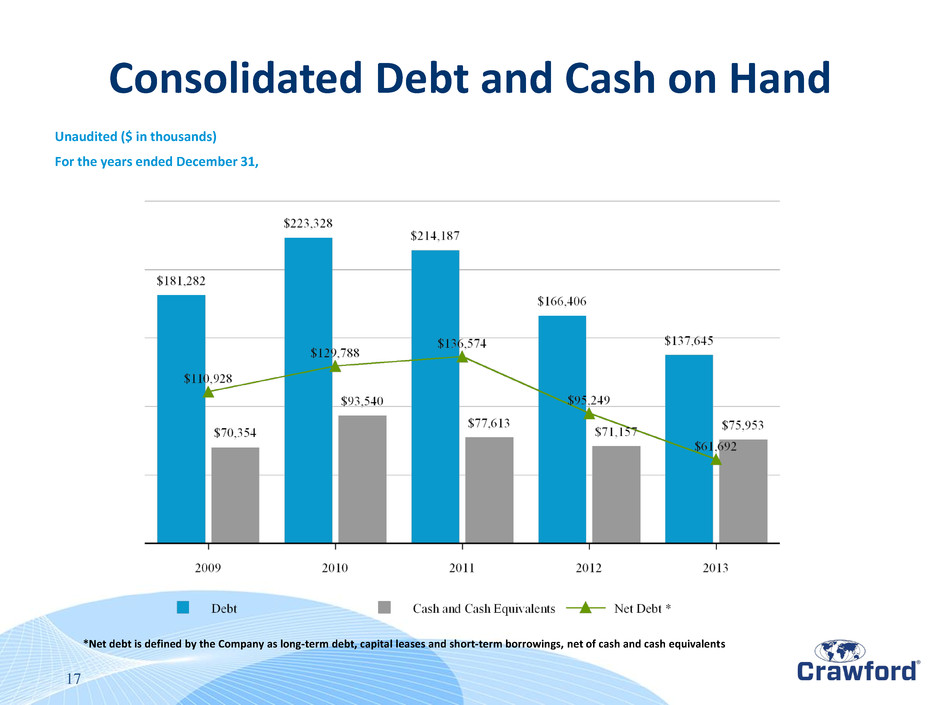

17 Unaudited ($ in thousands) For the years ended December 31, *Net debt is defined by the Company as long-term debt, capital leases and short-term borrowings, net of cash and cash equivalents Consolidated Debt and Cash on Hand

18 2013 2012 Variance Net Income Attributable to Shareholders of Crawford & Company $50,978 $48,888 $2,090 Depreciation and Other Non-Cash Operating Items 38,096 37,322 774 Unbilled and Billed Receivables Change 18,630 (22,922 ) 41,552 Working Capital Change (11,910 ) 43,041 (54,951 ) U.S. Pension Contributions (17,950 ) (13,476 ) (4,474 ) Operating Cash Flow 77,844 92,853 (15,009 ) Property & Equipment Purchases, net (14,037 ) (15,375 ) 1,338 Capitalized Software (internal and external costs) (16,976 ) (17,801 ) 825 Free Cash Flow $46,831 $59,677 ($12,846 ) Unaudited ($ in thousands) For the years ended December 31, Operating and Free Cash Flow

19 Dividends: • During the fourth quarter, Crawford paid a regular quarterly dividend of $0.05 on CRDA and $0.04 on CRDB • For the year, Crawford paid dividends of $0.18 per share on CRDA and $0.14 per share on CRDB Share Repurchase: • During the fourth quarter, Crawford repurchased 229,086 shares of CRDA at an average cost of $7.50 per share • Through December 31, 2013, Crawford has repurchased 1,162,335 shares of CRDA at an average cost of $5.55 per share and 7,000 shares of CRDB at an average cost of $3.83 per share, under the 2.0 million share repurchase program authorized in May 2012 Other Financial Highlights

Fourth Quarter and Full Year 2013 Operational Review

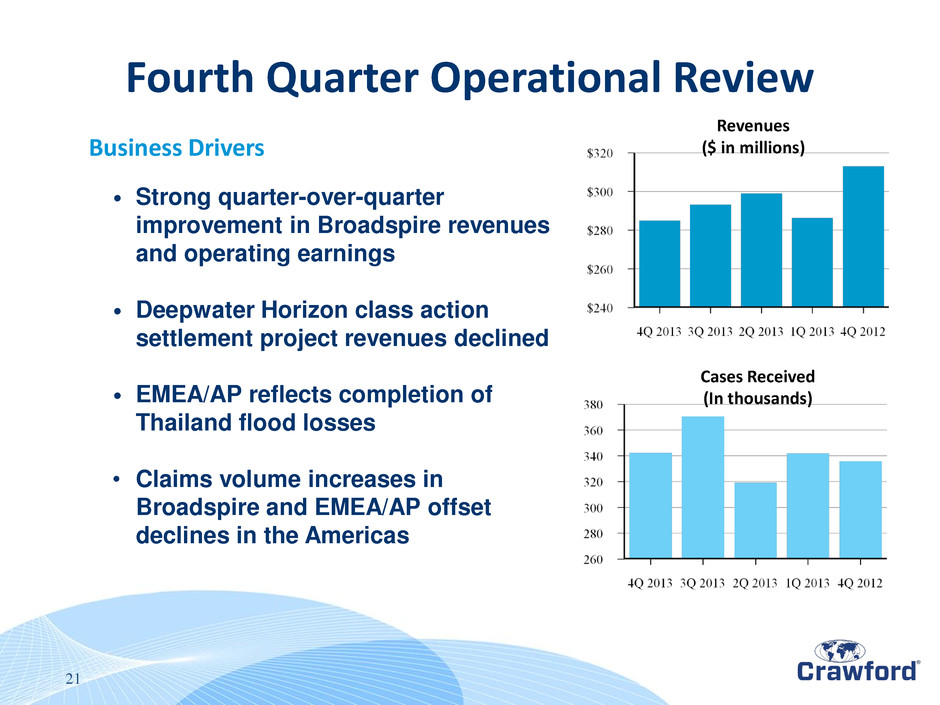

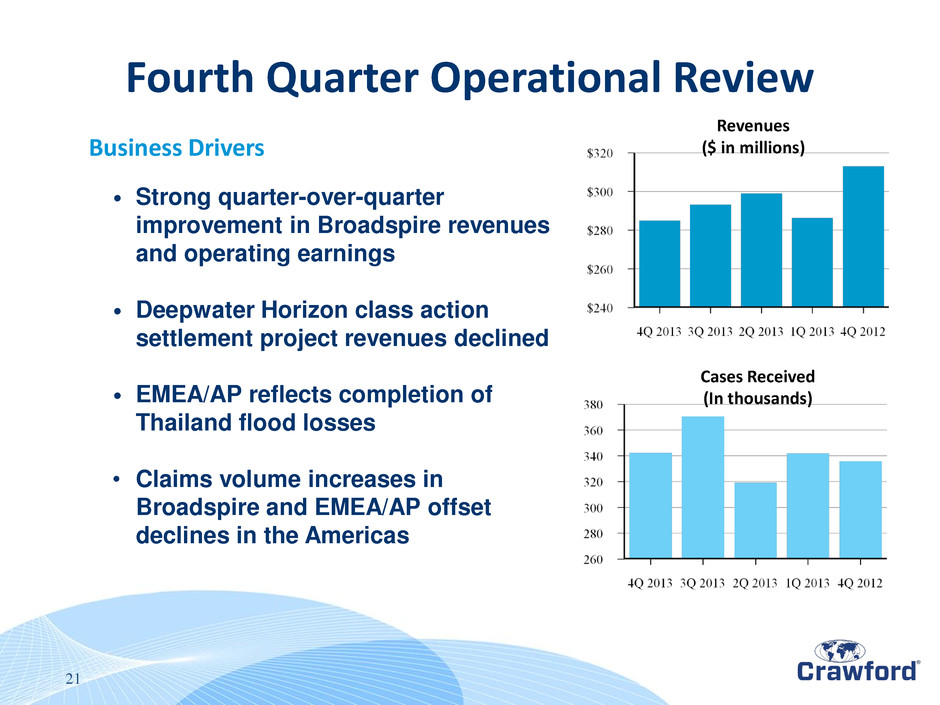

21 Revenues ($ in millions) Cases Received (In thousands) • Strong quarter-over-quarter improvement in Broadspire revenues and operating earnings • Deepwater Horizon class action settlement project revenues declined • EMEA/AP reflects completion of Thailand flood losses • Claims volume increases in Broadspire and EMEA/AP offset declines in the Americas Business Drivers Fourth Quarter Operational Review

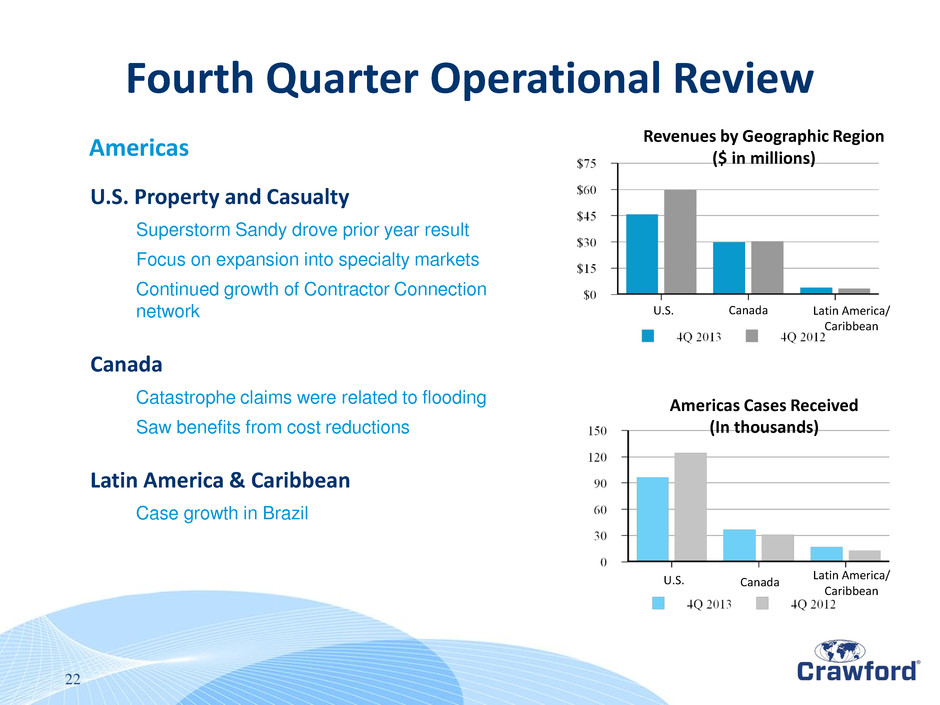

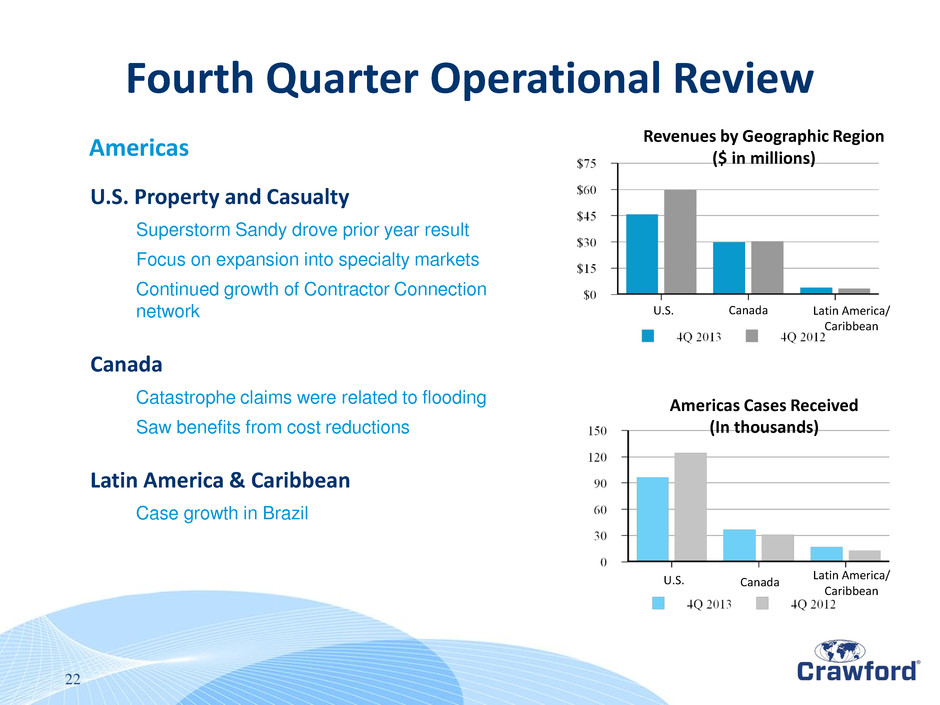

22 U.S. Canada Latin America/ Caribbean Revenues by Geographic Region ($ in millions) Americas Cases Received (In thousands) U.S. Canada Latin America/ Caribbean U.S. Property and Casualty Superstorm Sandy drove prior year result Focus on expansion into specialty markets Continued growth of Contractor Connection network Canada Catastrophe claims were related to flooding Saw benefits from cost reductions Latin America & Caribbean Case growth in Brazil Americas Fourth Quarter Operational Review

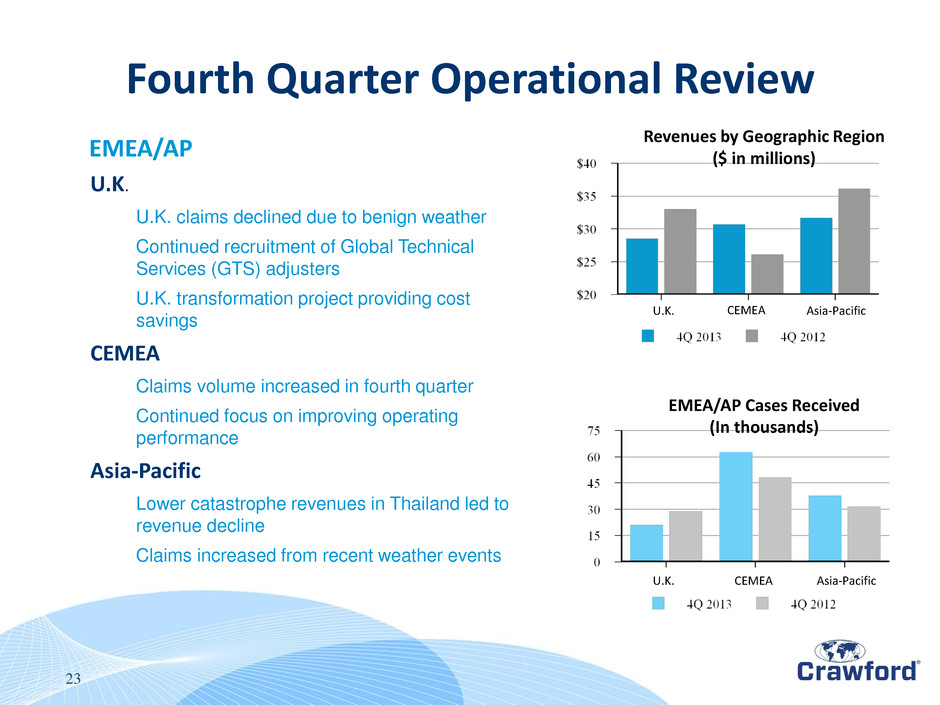

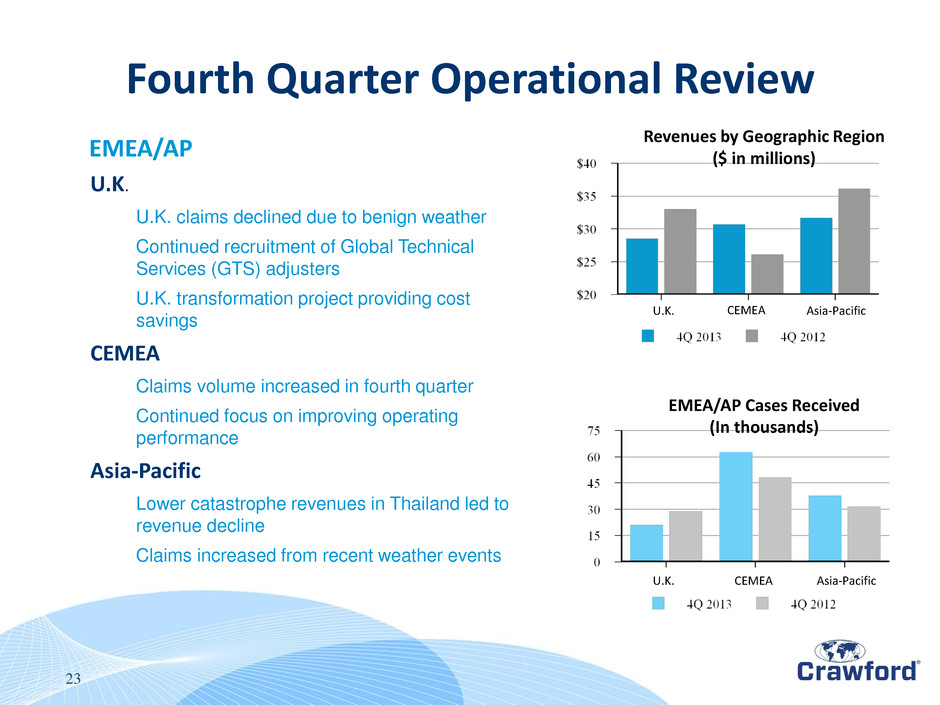

23 U.K. CEMEA U.K. Asia-Pacific Asia-Pacific CEMEA Revenues by Geographic Region ($ in millions) EMEA/AP Cases Received (In thousands) EMEA/AP U.K. U.K. claims declined due to benign weather Continued recruitment of Global Technical Services (GTS) adjusters U.K. transformation project providing cost savings CEMEA Claims volume increased in fourth quarter Continued focus on improving operating performance Asia-Pacific Lower catastrophe revenues in Thailand led to revenue decline Claims increased from recent weather events Fourth Quarter Operational Review

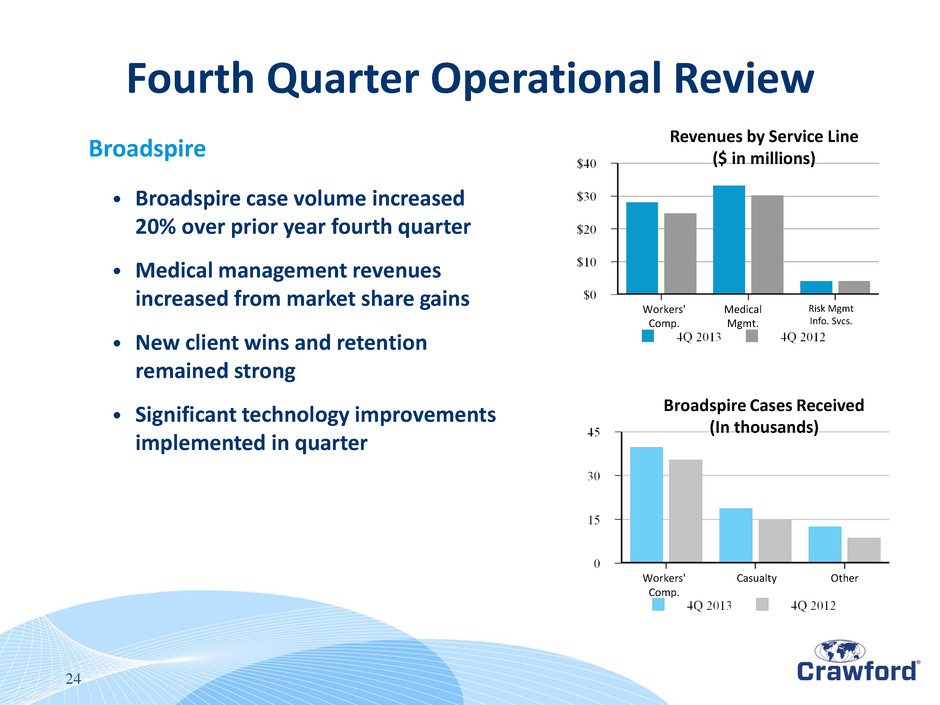

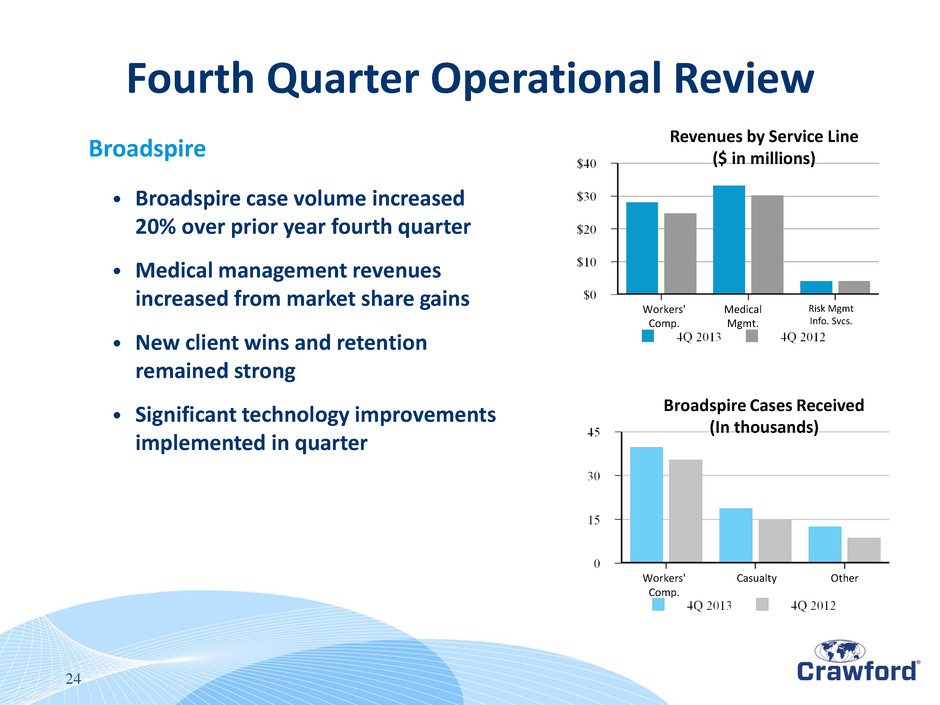

24 Revenues by Service Line ($ in millions) Broadspire Cases Received (In thousands) Risk Mgmt Info. Svcs. Other Medical Mgmt. Casualty Workers' Comp. Workers' Comp. Broadspire • Broadspire case volume increased 20% over prior year fourth quarter • Medical management revenues increased from market share gains • New client wins and retention remained strong • Significant technology improvements implemented in quarter Fourth Quarter Operational Review

9. 1 25 Backlog ($ in millions) Legal Settlement Administration • Deepwater Horizon class action project continued to wind down • New business wins continued in both class action and bankruptcy space • Backlog at $108 million Fourth Quarter Operational Review Revenues ($ in millions) 65.4 49.1 108 152

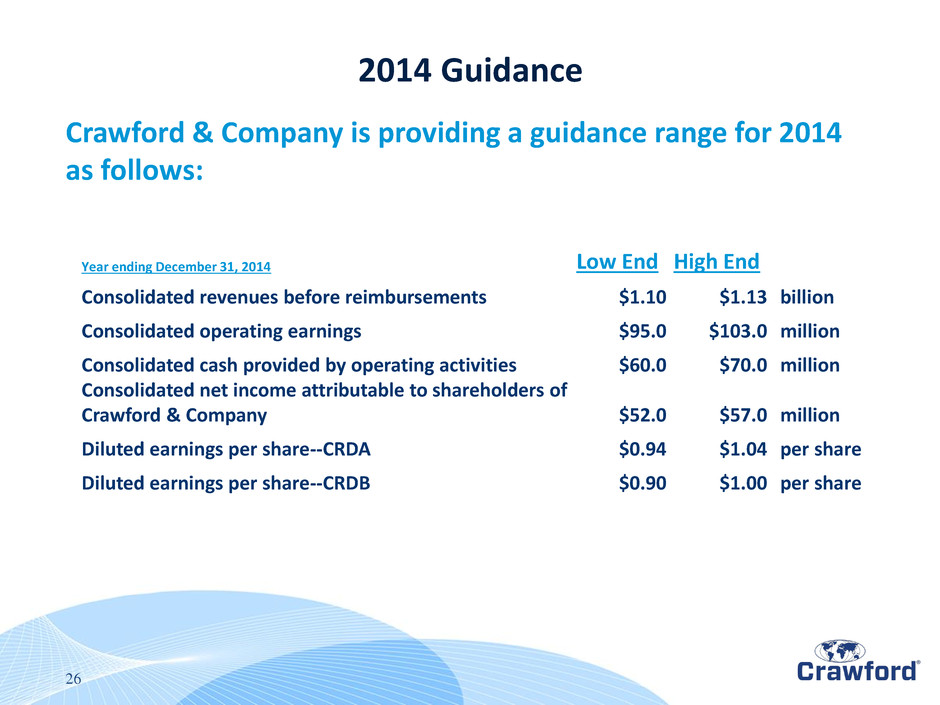

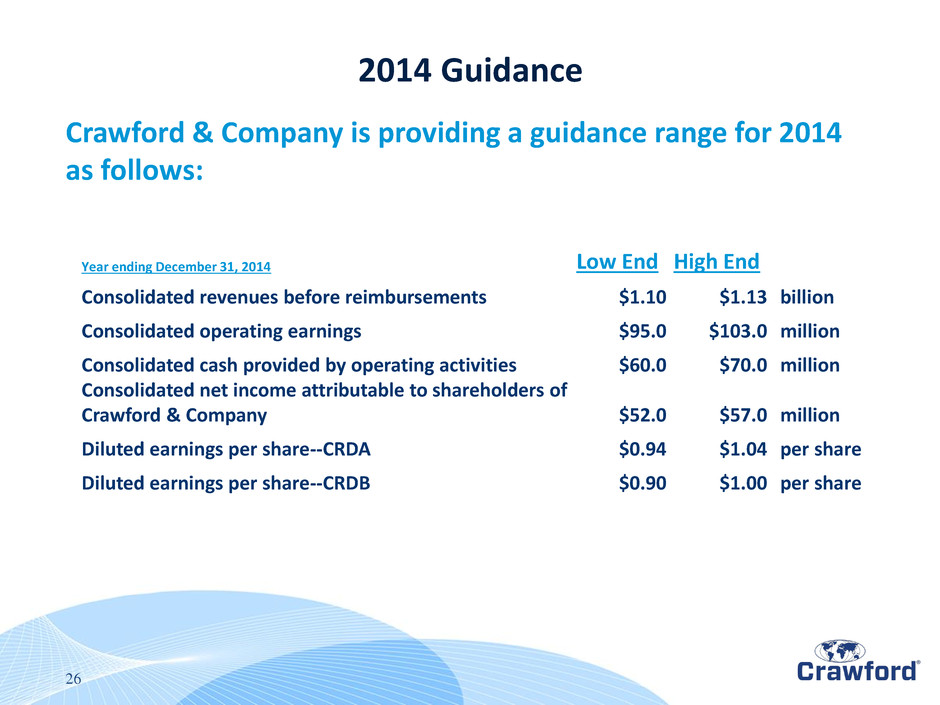

26 Crawford & Company is providing a guidance range for 2014 as follows: Year ending December 31, 2014 Low End High End Consolidated revenues before reimbursements $1.10 $1.13 billion Consolidated operating earnings $95.0 $103.0 million Consolidated cash provided by operating activities $60.0 $70.0 million Consolidated net income attributable to shareholders of Crawford & Company $52.0 $57.0 million Diluted earnings per share--CRDA $0.94 $1.04 per share Diluted earnings per share--CRDB $0.90 $1.00 per share 2014 Guidance

27 • Grow business and increase revenues through broader market coverage, investment in future business platforms, and launch of new products • Create a global GTS powerhouse by adding world-class adjusters and further expanding our industry-leading breadth of services • Develop significant cost advantages by further increasing our operating efficiencies across the globe • Enhance our data management and analytics capabilities by leveraging the Risk Sciences Group and developing our data analytics consulting business • Remain a great place to work by continuing to attract, engage and retain the best talent and by improving their productivity with innovative technology solutions • Further expand our environmental sustainability initiatives through eco- friendly purchasing policies and solutions 2014 - 2016 Strategic Initiatives

Fourth Quarter and Full Year 2013 Appendix

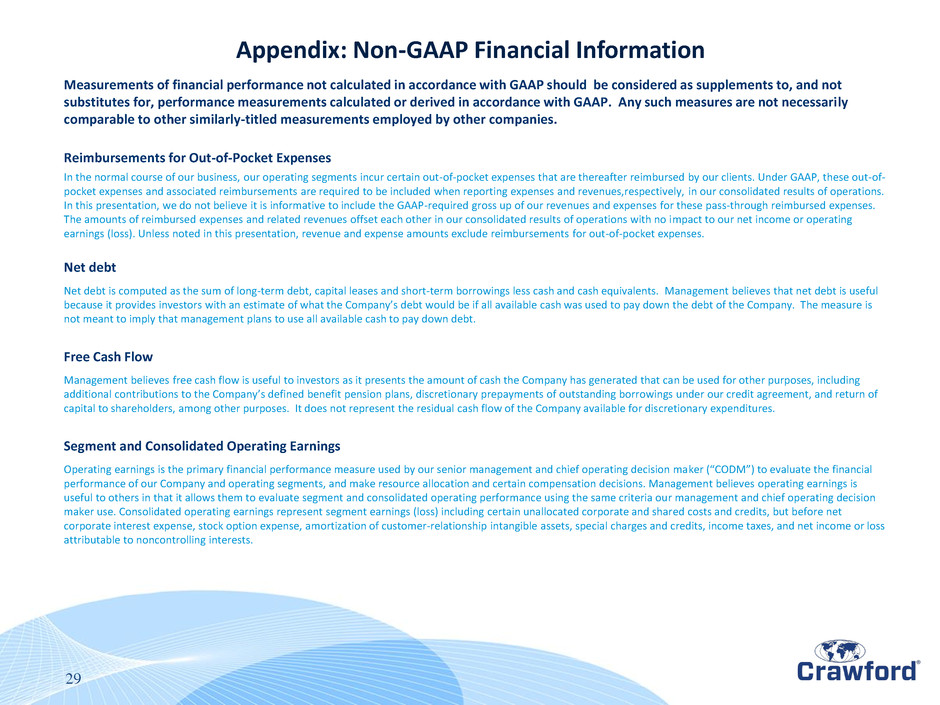

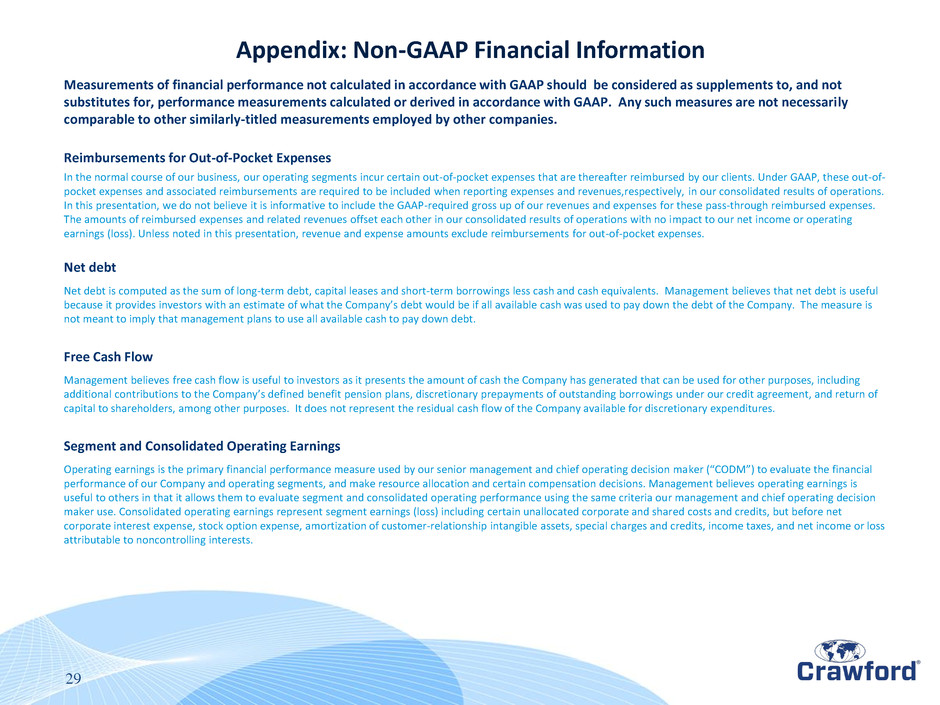

29 Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of- pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues,respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include the GAAP-required gross up of our revenues and expenses for these pass-through reimbursed expenses. The amounts of reimbursed expenses and related revenues offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). Unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company’s debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company’s defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker (“CODM”) to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings (loss) including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, special charges and credits, income taxes, and net income or loss attributable to noncontrolling interests. Appendix: Non-GAAP Financial Information

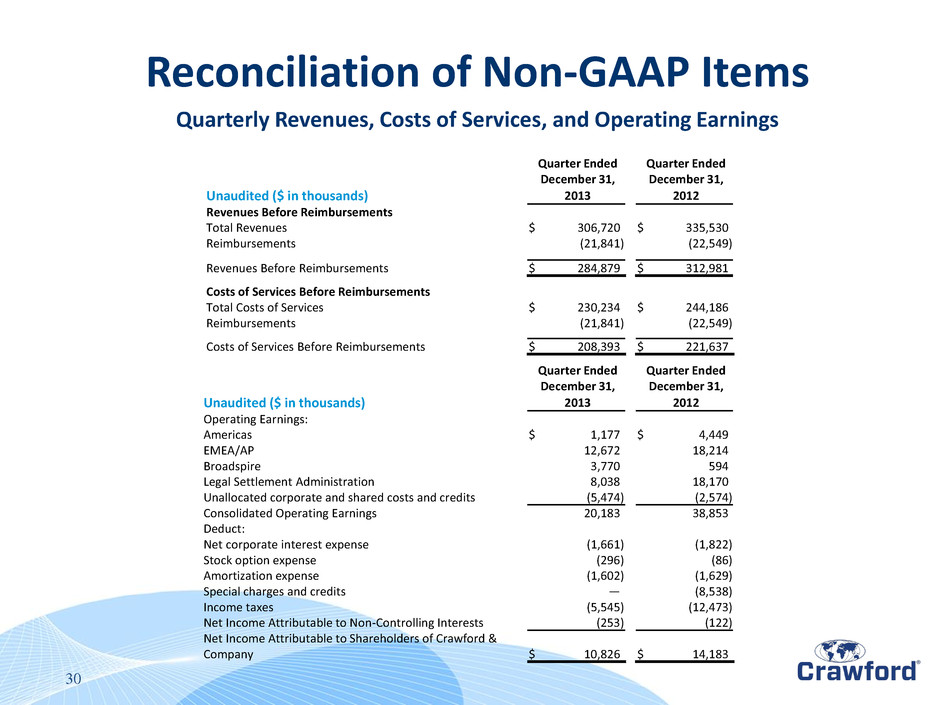

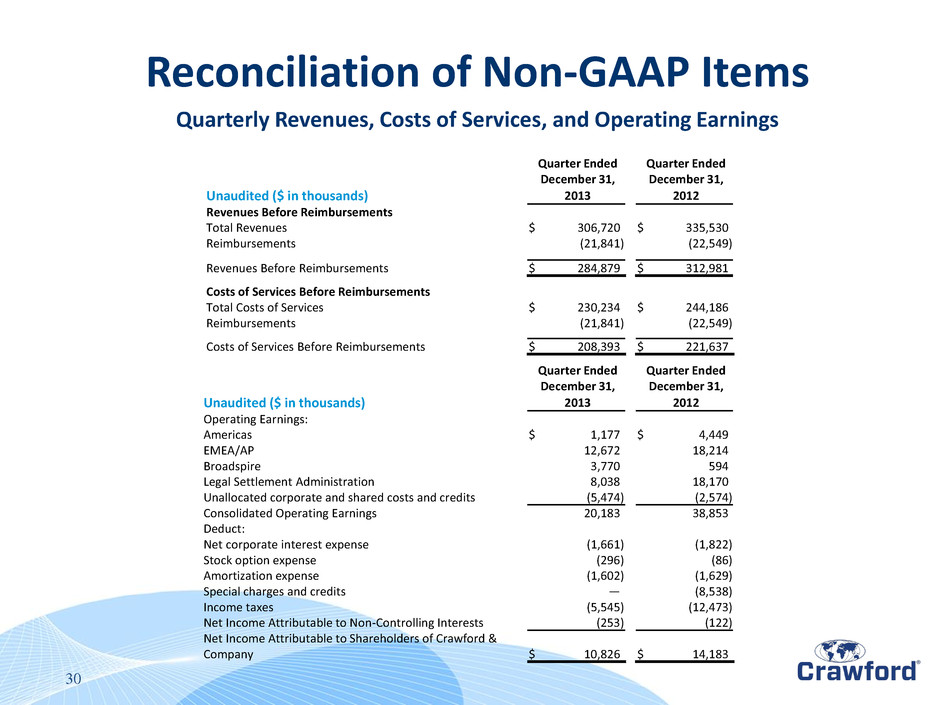

Quarter Ended Quarter Ended December 31, December 31, Unaudited ($ in thousands) 2013 2012 Revenues Before Reimbursements Total Revenues $ 306,720 $ 335,530 Reimbursements (21,841 ) (22,549 ) Revenues Before Reimbursements $ 284,879 $ 312,981 Costs of Services Before Reimbursements Total Costs of Services $ 230,234 $ 244,186 Reimbursements (21,841 ) (22,549 ) Costs of Services Before Reimbursements $ 208,393 $ 221,637 30 Quarterly Revenues, Costs of Services, and Operating Earnings Quarter Ended Quarter Ended December 31, December 31, Unaudited ($ in thousands) 2013 2012 Operating Earnings: Americas $ 1,177 $ 4,449 EMEA/AP 12,672 18,214 Broadspire 3,770 594 Legal Settlement Administration 8,038 18,170 Unallocated corporate and shared costs and credits (5,474 ) (2,574 ) Consolidated Operating Earnings 20,183 38,853 Deduct: Net corporate interest expense (1,661 ) (1,822 ) Stock option expense (296 ) (86 ) Amortization expense (1,602 ) (1,629 ) Special charges and credits — (8,538 ) Income taxes (5,545 ) (12,473 ) Net Income Attributable to Non-Controlling Interests (253 ) (122 ) Net Income Attributable to Shareholders of Crawford & Company $ 10,826 $ 14,183 Reconciliation of Non-GAAP Items

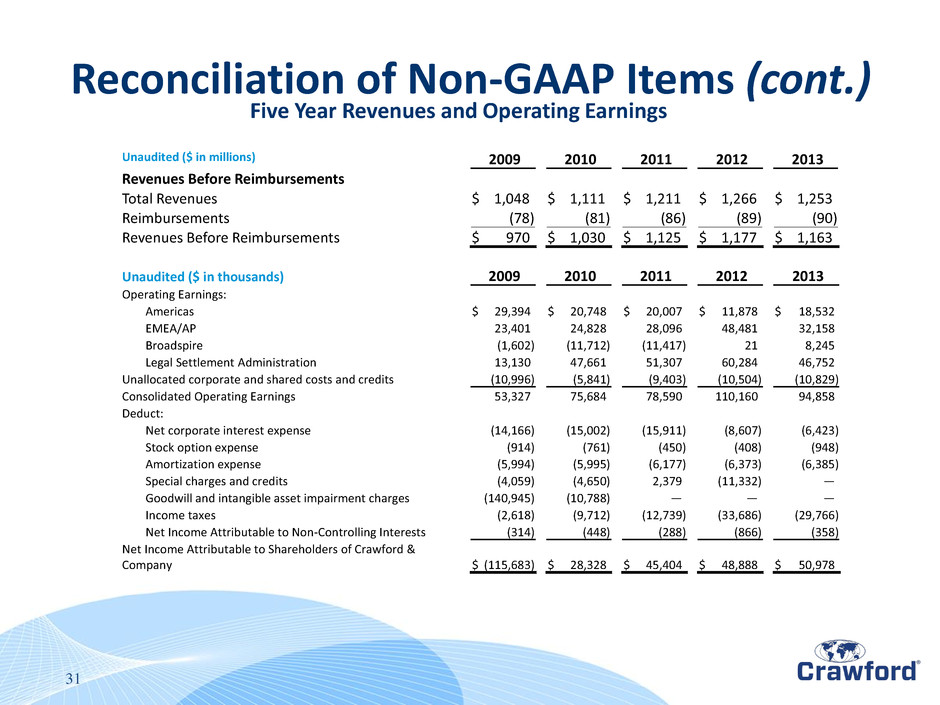

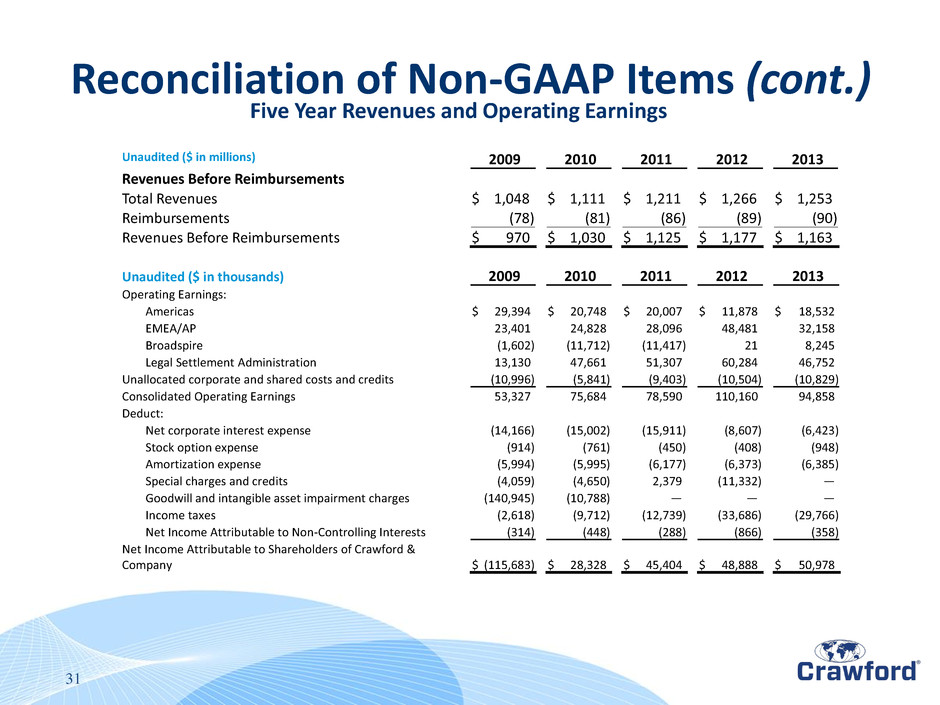

Reconciliation of Non-GAAP Items (cont.) Unaudited ($ in thousands) 2009 2010 2011 2012 2013 Operating Earnings: Americas $ 29,394 $ 20,748 $ 20,007 $ 11,878 $ 18,532 EMEA/AP 23,401 24,828 28,096 48,481 32,158 Broadspire (1,602 ) (11,712 ) (11,417 ) 21 8,245 Legal Settlement Administration 13,130 47,661 51,307 60,284 46,752 Unallocated corporate and shared costs and credits (10,996 ) (5,841 ) (9,403 ) (10,504 ) (10,829 ) Consolidated Operating Earnings 53,327 75,684 78,590 110,160 94,858 Deduct: Net corporate interest expense (14,166 ) (15,002 ) (15,911 ) (8,607 ) (6,423 ) Stock option expense (914 ) (761 ) (450 ) (408 ) (948 ) Amortization expense (5,994 ) (5,995 ) (6,177 ) (6,373 ) (6,385 ) Special charges and credits (4,059 ) (4,650 ) 2,379 (11,332 ) — Goodwill and intangible asset impairment charges (140,945 ) (10,788 ) — — — Income taxes (2,618 ) (9,712 ) (12,739 ) (33,686 ) (29,766 ) Net Income Attributable to Non-Controlling Interests (314 ) (448 ) (288 ) (866 ) (358 ) Net Income Attributable to Shareholders of Crawford & Company $ (115,683 ) $ 28,328 $ 45,404 $ 48,888 $ 50,978 31 Five Year Revenues and Operating Earnings Unaudited ($ in millions) 2009 2010 2011 2012 2013 Revenues Before Reimbursements Total Revenues $ 1,048 $ 1,111 $ 1,211 $ 1,266 $ 1,253 Reimbursements (78 ) (81 ) (86 ) (89 ) (90 ) Revenues Before Reimbursements $ 970 $ 1,030 $ 1,125 $ 1,177 $ 1,163

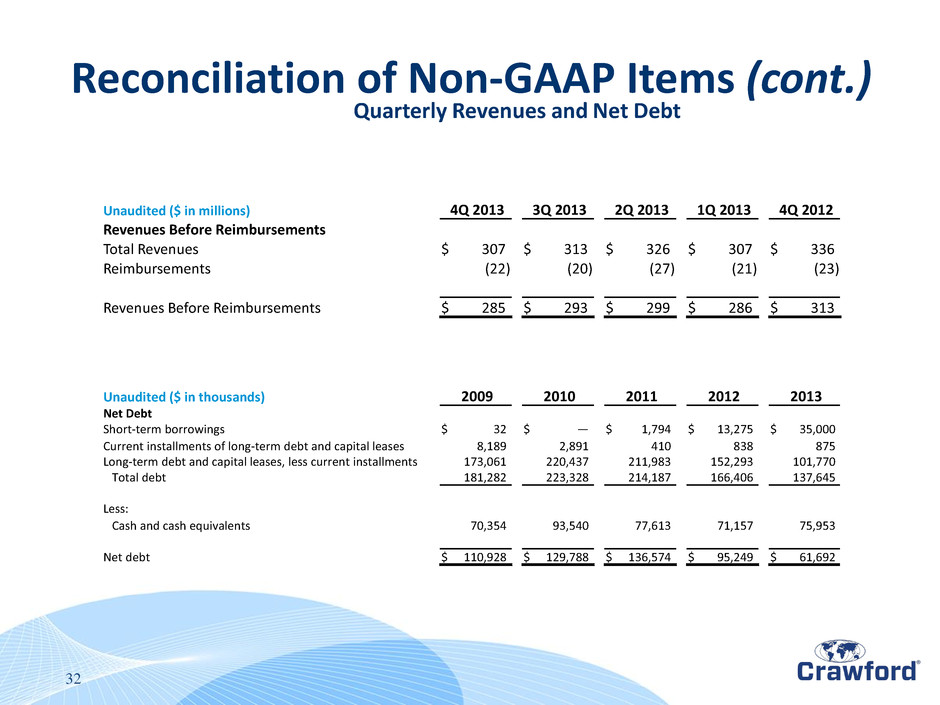

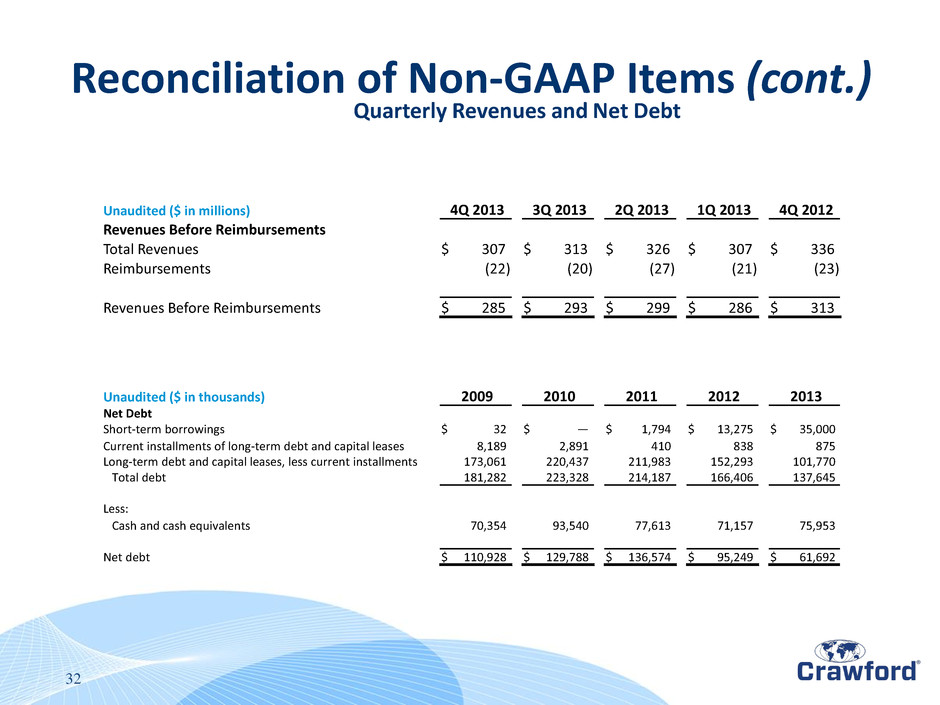

Reconciliation of Non-GAAP Items (cont.) 32 Quarterly Revenues and Net Debt Unaudited ($ in millions) 4Q 2013 3Q 2013 2Q 2013 1Q 2013 4Q 2012 Revenues Before Reimbursements Total Revenues $ 307 $ 313 $ 326 $ 307 $ 336 Reimbursements (22 ) (20 ) (27 ) (21 ) (23 ) Revenues Before Reimbursements $ 285 $ 293 $ 299 $ 286 $ 313 Unaudited ($ in thousands) 2009 2010 2011 2012 2013 Net Debt Short-term borrowings $ 32 $ — $ 1,794 $ 13,275 $ 35,000 Current installments of long-term debt and capital leases 8,189 2,891 410 838 875 Long-term debt and capital leases, less current installments 173,061 220,437 211,983 152,293 101,770 Total debt 181,282 223,328 214,187 166,406 137,645 Less: Cash and cash equivalents 70,354 93,540 77,613 71,157 75,953 Net debt $ 110,928 $ 129,788 $ 136,574 $ 95,249 $ 61,692