First Quarter 2015 Earnings Conference Call May 7, 2015 Crawford & Company

PAGE 2 • Forward-Looking Statements —This presentation contains forward-looking statements, including statements about the future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the United States Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. —Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. —In recent periods the Company has derived a material portion of its revenues and operating earnings from a limited number of client engagements and special projects within its Legal Settlement Administration segment, specifically its work on the gulf-related class action settlement. Although the Company continued to earn revenues from the Legal Settlement Administration projects in 2015, these revenues, and related operating earnings, were at a reduced rate as compared to 2014. The projects continue to wind down, and the Company expects these revenues, and related operating earnings, to be at a reduced rate in all future periods, as compared to 2014. No assurances of timing of the project end dates and, therefore, continued revenues or operating earnings, can be provided. In the event the Company is unable to replace revenues and related operating earnings from these projects as they wind down, or upon the termination or other expiration thereof, with revenues and operating earnings from new projects and customers within this or other segments, there could be a material adverse effect on the Company's results of operations. • Revenues Before Reimbursements ("Revenues") —Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. • Segment and Consolidated Operating Earnings —Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, special charges, stock option expense, earnings or loss attributable to non-controlling interests, and certain unallocated corporate and shared costs and credits. Consolidated operating earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. • Earnings Per Share —The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock (CRDA) than on the voting Class B Common Stock (CRDB), subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of CRDA must receive the same type and amount of consideration as holders of CRDB, unless different consideration is approved by the holders of 75% of CRDA, voting as a class. —In certain periods, the Company has paid a higher dividend on CRDA than on CRDB. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two- class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. • Non-GAAP Financial Information —For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

PAGE 3 • The world's largest independent provider of global claims management solutions • Multiple globally recognized brand names: Crawford, Broadspire, GCG • Clients include multinational insurance carriers, brokers and local insurance firms as well as 200 of the Fortune 500 GLOBAL BUSINESS SERVICES LEADER EMEA-A/P 1 Serves the U.K., European, Middle Eastern, African and Asia Pacific markets BROADSPIRE 3 Serves large national accounts, carriers and self-insured entities AMERICAS 2 Serves the U.S., Canadian and Latin American markets LEGAL SETTLEMENT ADMINISTRATION 4 Provides administration for class action settlements and bankruptcy matters

TODAY'S AGENDA --- Welcome and Opening Comments --- First Quarter 2015 Financial Review --- Updated Guidance

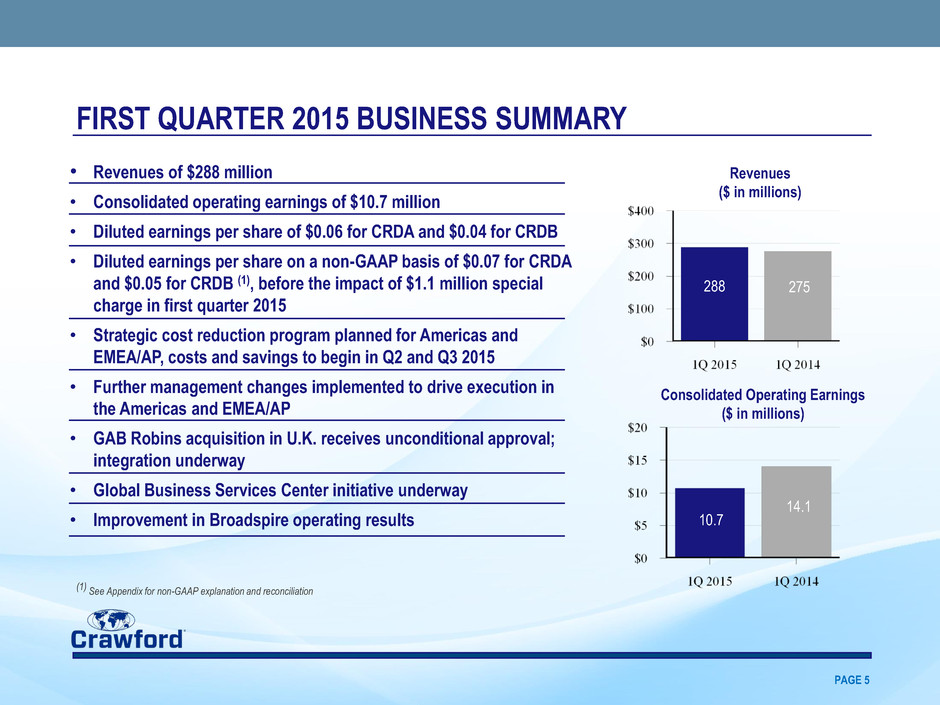

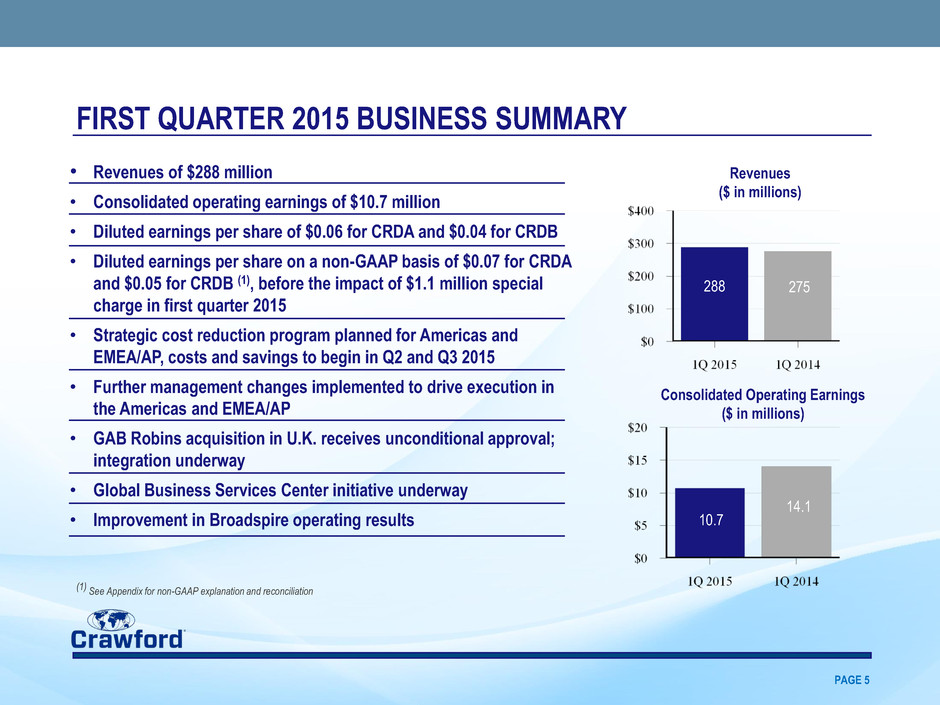

PAGE 5 14.1 288 275 Revenues ($ in millions) Consolidated Operating Earnings ($ in millions) • Revenues of $288 million • Consolidated operating earnings of $10.7 million • Diluted earnings per share of $0.06 for CRDA and $0.04 for CRDB • Diluted earnings per share on a non-GAAP basis of $0.07 for CRDA and $0.05 for CRDB (1), before the impact of $1.1 million special charge in first quarter 2015 • Strategic cost reduction program planned for Americas and EMEA/AP, costs and savings to begin in Q2 and Q3 2015 • Further management changes implemented to drive execution in the Americas and EMEA/AP • GAB Robins acquisition in U.K. receives unconditional approval; integration underway • Global Business Services Center initiative underway • Improvement in Broadspire operating results FIRST QUARTER 2015 BUSINESS SUMMARY 10.7 (1) See Appendix for non-GAAP explanation and reconciliation

FIRST QUARTER 2015 Financial Review

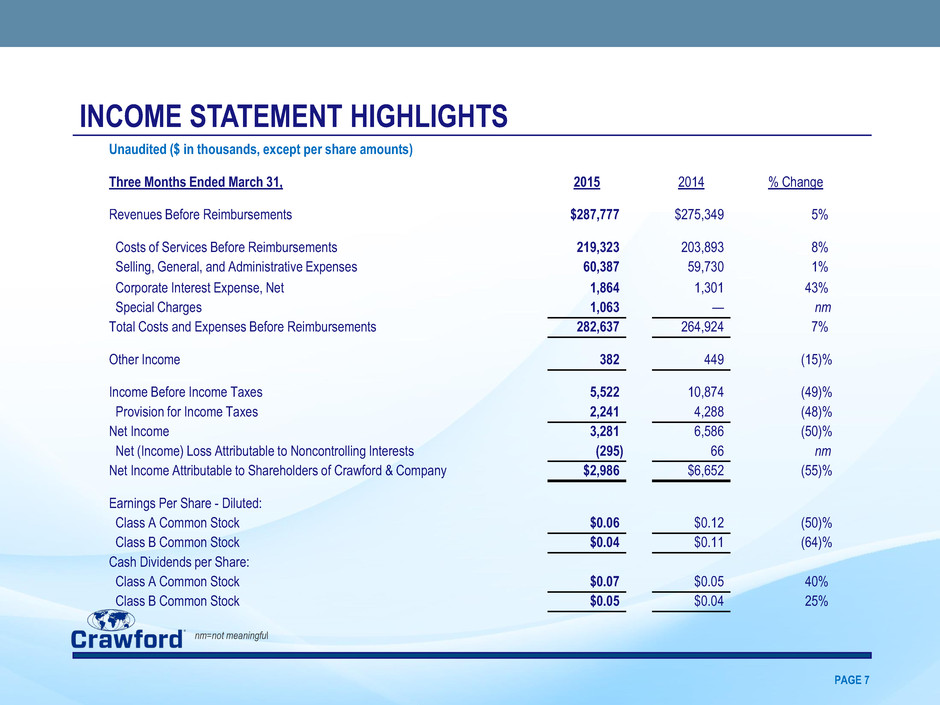

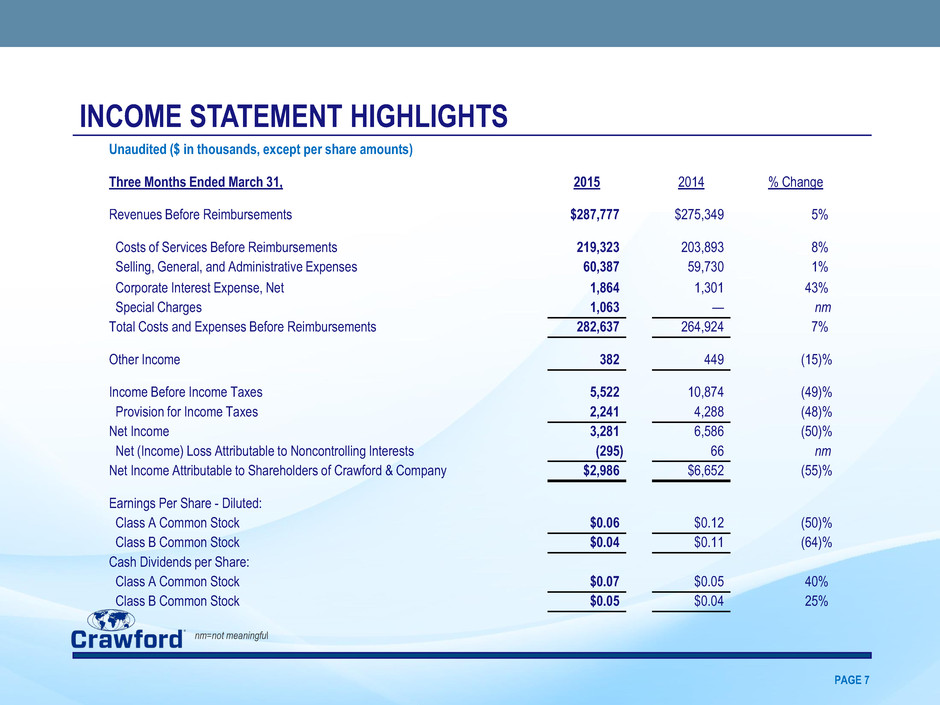

PAGE 7 Unaudited ($ in thousands, except per share amounts) Three Months Ended March 31, 2015 2014 % Change Revenues Before Reimbursements $287,777 $275,349 5 % Costs of Services Before Reimbursements 219,323 203,893 8 % Selling, General, and Administrative Expenses 60,387 59,730 1 % Corporate Interest Expense, Net 1,864 1,301 43 % Special Charges 1,063 — nm Total Costs and Expenses Before Reimbursements 282,637 264,924 7 % Other Income 382 449 (15 )% Income Before Income Taxes 5,522 10,874 (49 )% Provision for Income Taxes 2,241 4,288 (48 )% Net Income 3,281 6,586 (50 )% Net (Income) Loss Attributable to Noncontrolling Interests (295 ) 66 nm Net Income Attributable to Shareholders of Crawford & Company $2,986 $6,652 (55 )% Earnings Per Share - Diluted: Class A Common Stock $0.06 $0.12 (50 )% Class B Common Stock $0.04 $0.11 (64 )% Cash Dividends per Share: Class A Common Stock $0.07 $0.05 40 % Class B Common Stock $0.05 $0.04 25 % INCOME STATEMENT HIGHLIGHTS nm=not meaningful

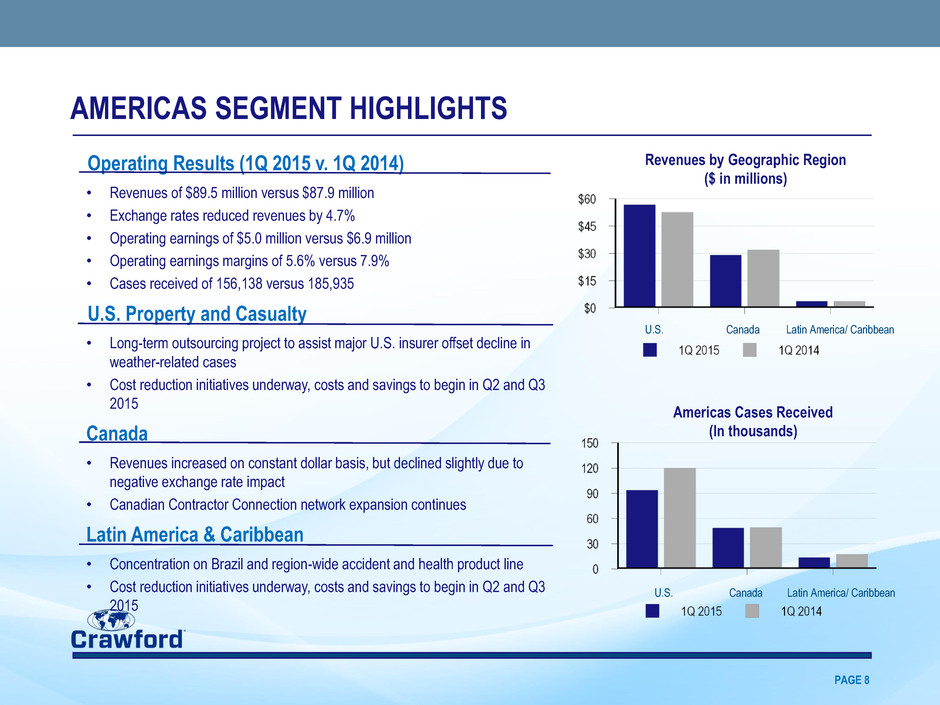

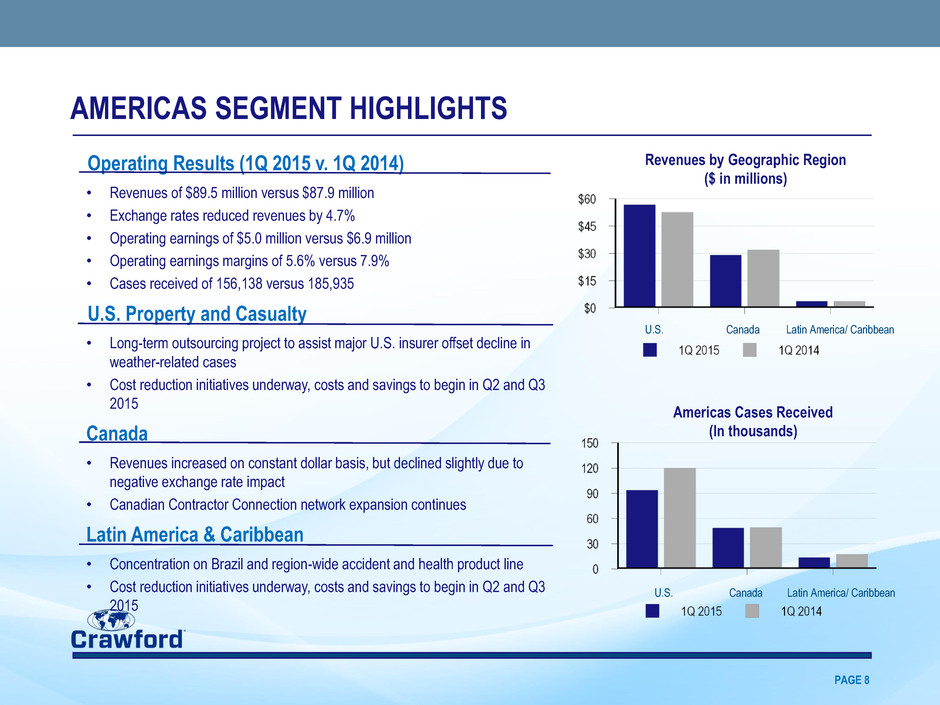

PAGE 8 U.S. Canada Latin America/ Caribbean Revenues by Geographic Region ($ in millions) Americas Cases Received (In thousands) U.S. Canada Latin America/ Caribbean Operating Results (1Q 2015 v. 1Q 2014) • Revenues of $89.5 million versus $87.9 million • Exchange rates reduced revenues by 4.7% • Operating earnings of $5.0 million versus $6.9 million • Operating earnings margins of 5.6% versus 7.9% • Cases received of 156,138 versus 185,935 U.S. Property and Casualty • Long-term outsourcing project to assist major U.S. insurer offset decline in weather-related cases • Cost reduction initiatives underway, costs and savings to begin in Q2 and Q3 2015 Canada • Revenues increased on constant dollar basis, but declined slightly due to negative exchange rate impact • Canadian Contractor Connection network expansion continues Latin America & Caribbean • Concentration on Brazil and region-wide accident and health product line • Cost reduction initiatives underway, costs and savings to begin in Q2 and Q3 2015 AMERICAS SEGMENT HIGHLIGHTS

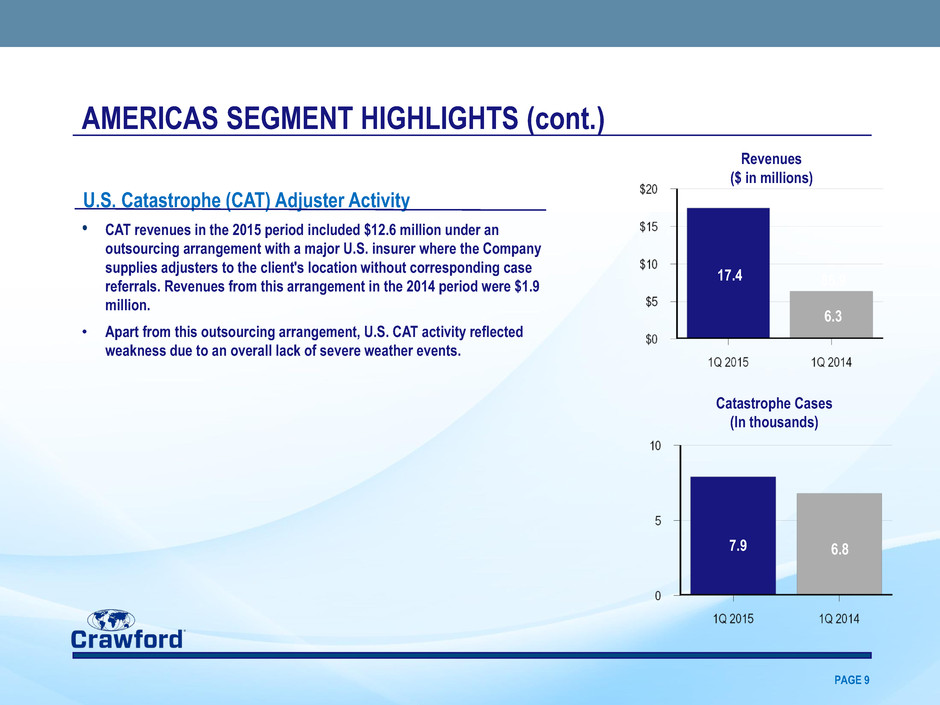

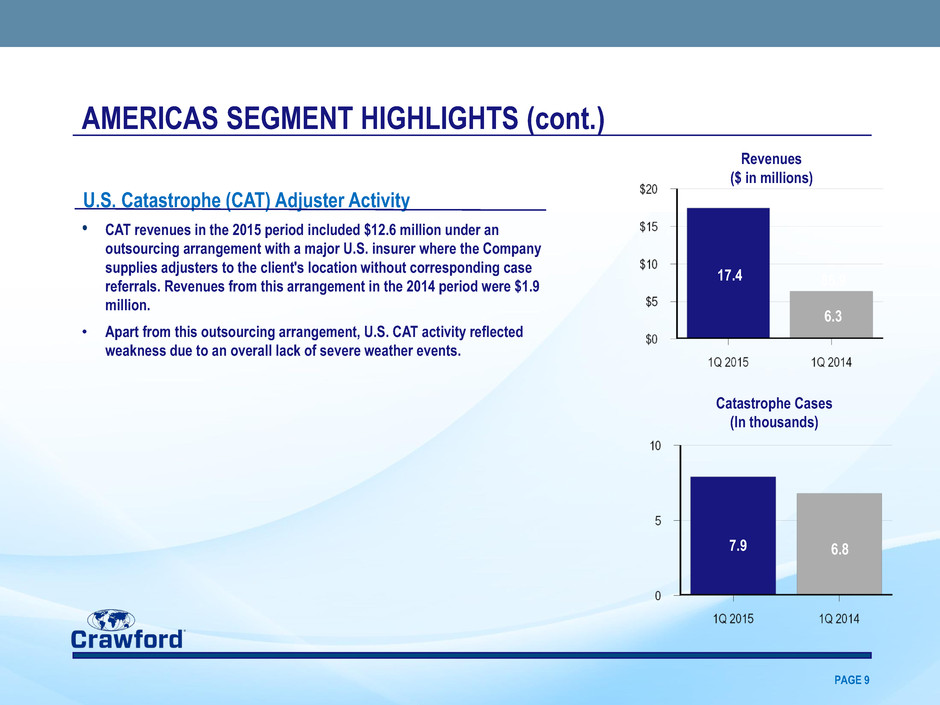

PAGE 9 9.1 85.9 6.5 17.4 6.3 6.8 Revenues ($ in millions) Catastrophe Cases (In thousands) U.S. Catastrophe (CAT) Adjuster Activity • CAT revenues in the 2015 period included $12.6 million under an outsourcing arrangement with a major U.S. insurer where the Company supplies adjusters to the client's location without corresponding case referrals. Revenues from this arrangement in the 2014 period were $1.9 million. • Apart from this outsourcing arrangement, U.S. CAT activity reflected weakness due to an overall lack of severe weather events. AMERICAS SEGMENT HIGHLIGHTS (cont.) 7.9

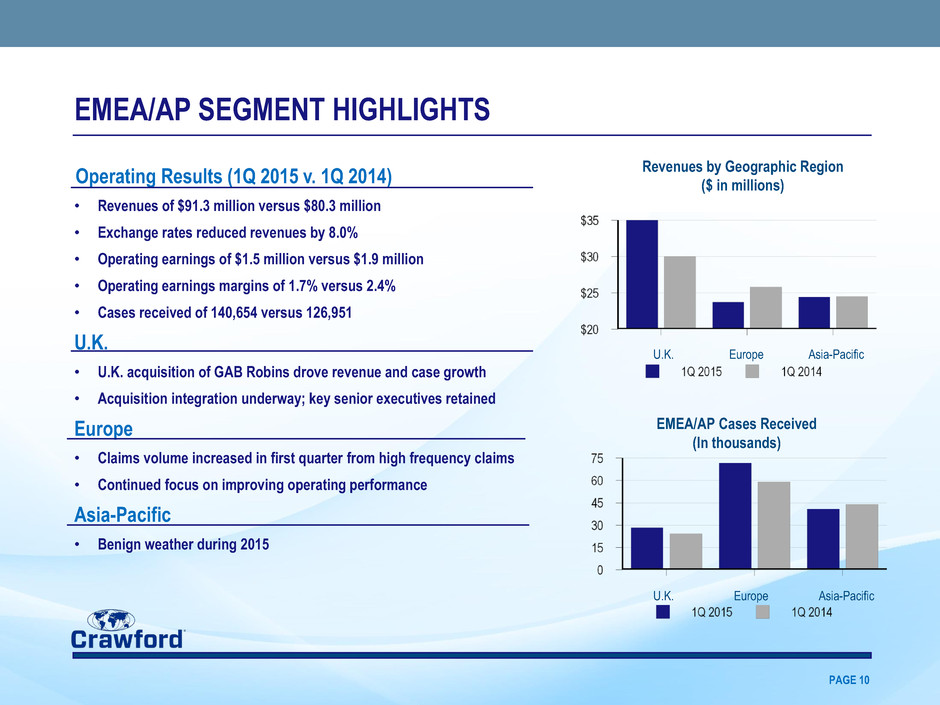

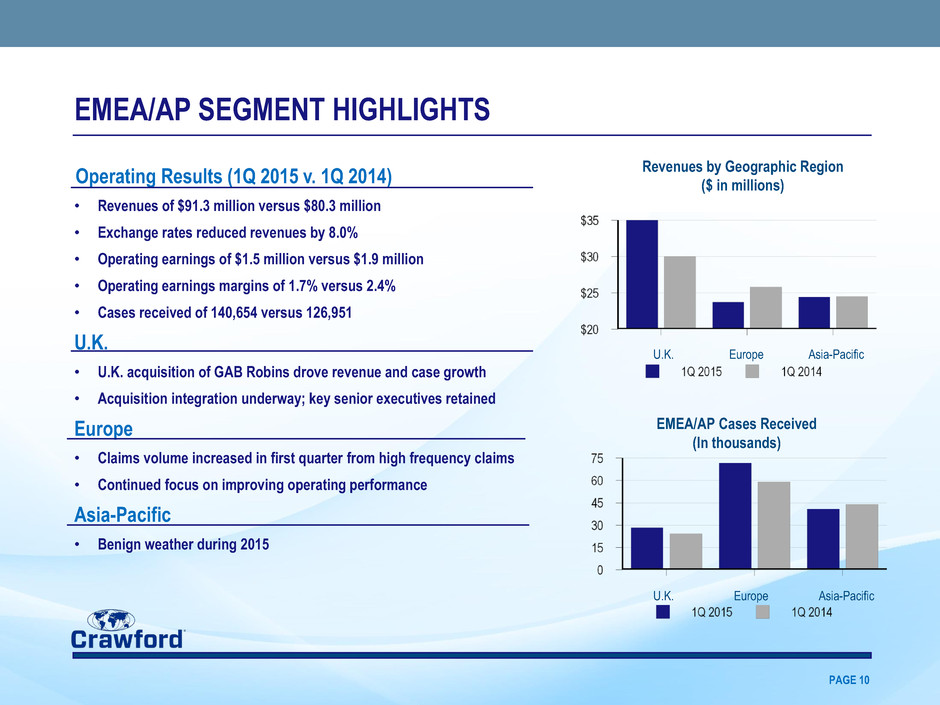

PAGE 10 U.K. Europe U.K. Asia-Pacific Asia-Pacific Europe Revenues by Geographic Region ($ in millions) EMEA/AP Cases Received (In thousands) Operating Results (1Q 2015 v. 1Q 2014) • Revenues of $91.3 million versus $80.3 million • Exchange rates reduced revenues by 8.0% • Operating earnings of $1.5 million versus $1.9 million • Operating earnings margins of 1.7% versus 2.4% • Cases received of 140,654 versus 126,951 U.K. • U.K. acquisition of GAB Robins drove revenue and case growth • Acquisition integration underway; key senior executives retained Europe • Claims volume increased in first quarter from high frequency claims • Continued focus on improving operating performance Asia-Pacific • Benign weather during 2015 EMEA/AP SEGMENT HIGHLIGHTS

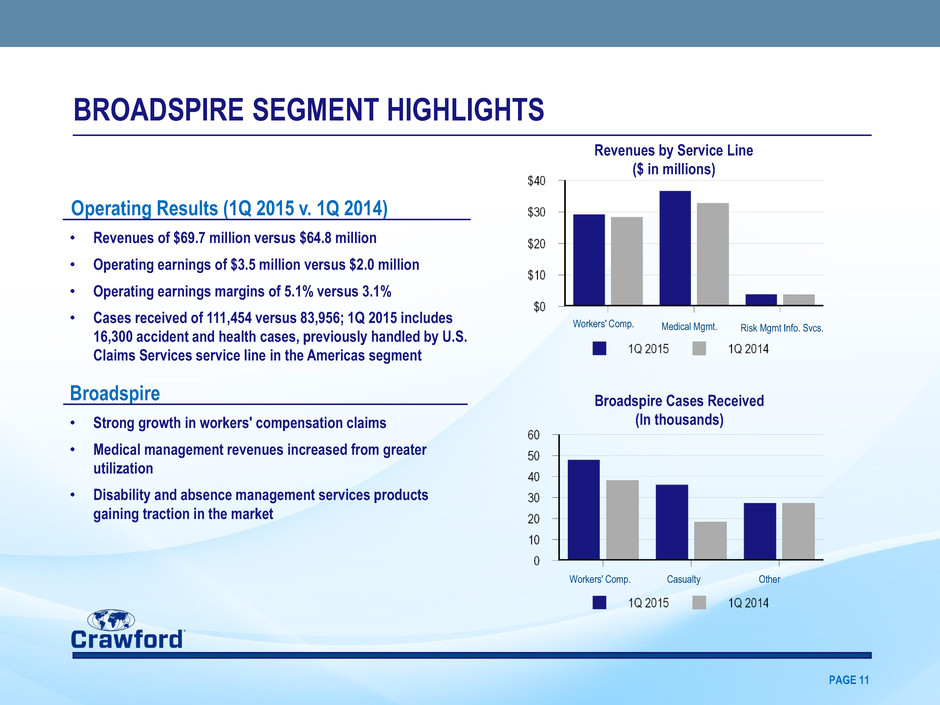

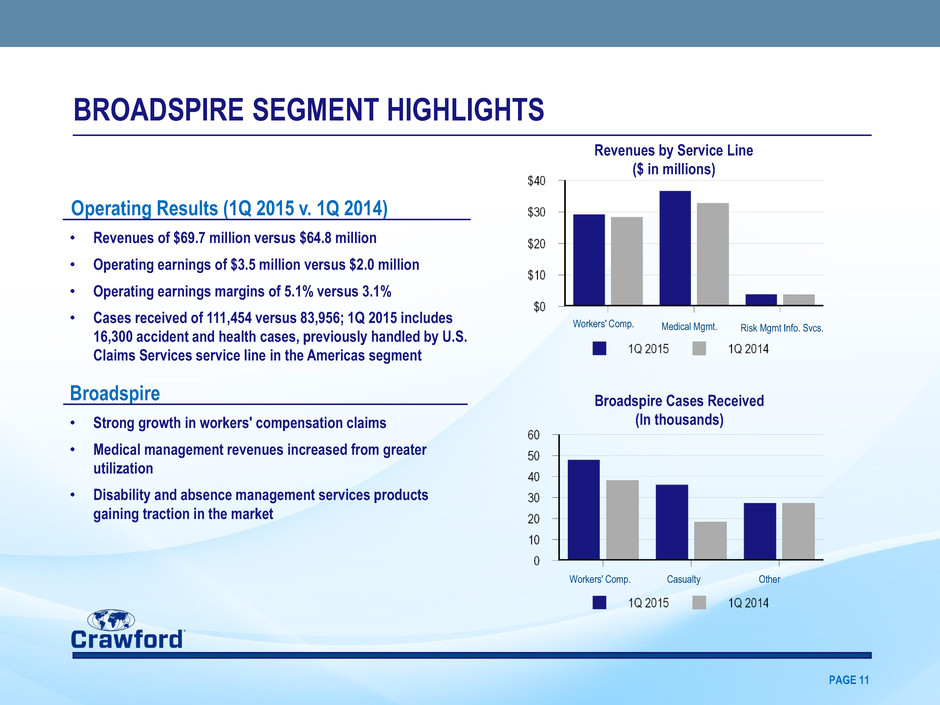

PAGE 11 Revenues by Service Line ($ in millions) Broadspire Cases Received (In thousands) Risk Mgmt Info. Svcs. Other Medical Mgmt. Casualty Workers' Comp. Workers' Comp. Operating Results (1Q 2015 v. 1Q 2014) • Revenues of $69.7 million versus $64.8 million • Operating earnings of $3.5 million versus $2.0 million • Operating earnings margins of 5.1% versus 3.1% • Cases received of 111,454 versus 83,956; 1Q 2015 includes 16,300 accident and health cases, previously handled by U.S. Claims Services service line in the Americas segment Broadspire • Strong growth in workers' compensation claims • Medical management revenues increased from greater utilization • Disability and absence management services products gaining traction in the market First BROADSPIRE SEGMENT HIGHLIGHTS

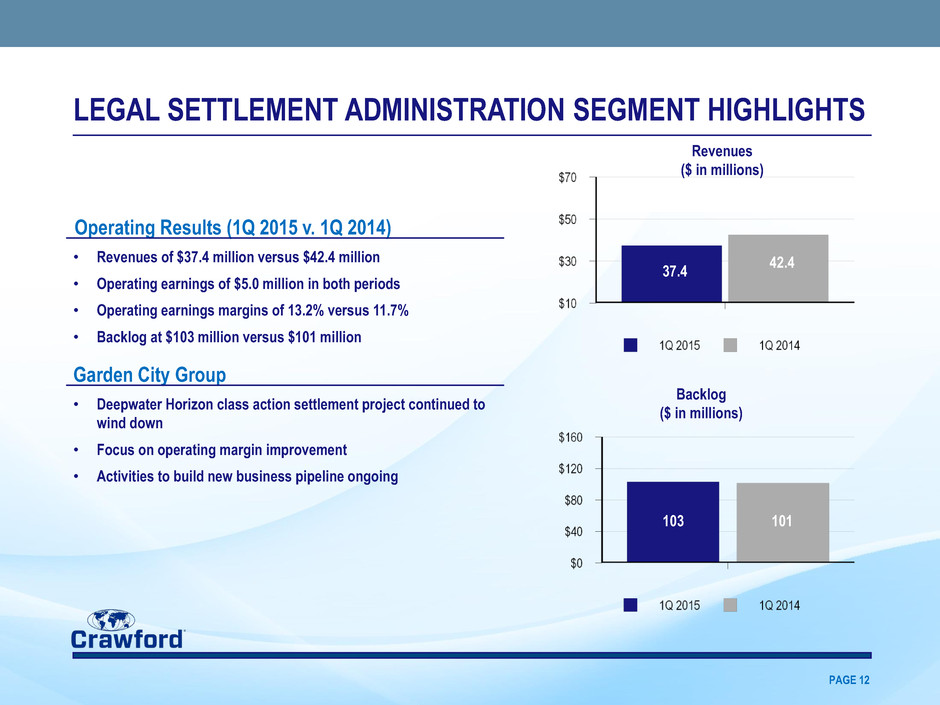

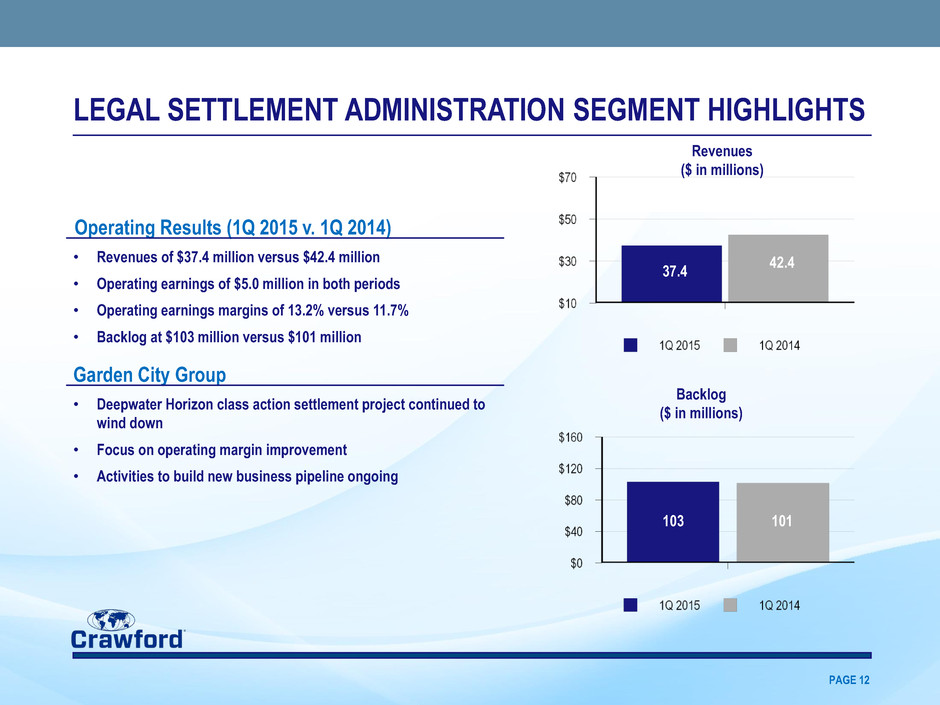

PAGE 12 Backlog ($ in millions) Operating Results (1Q 2015 v. 1Q 2014) • Revenues of $37.4 million versus $42.4 million • Operating earnings of $5.0 million in both periods • Operating earnings margins of 13.2% versus 11.7% • Backlog at $103 million versus $101 million Garden City Group • Deepwater Horizon class action settlement project continued to wind down • Focus on operating margin improvement • Activities to build new business pipeline ongoing LEGAL SETTLEMENT ADMINISTRATION SEGMENT HIGHLIGHTS Revenues ($ in millions) 42.4 37.4 103 101

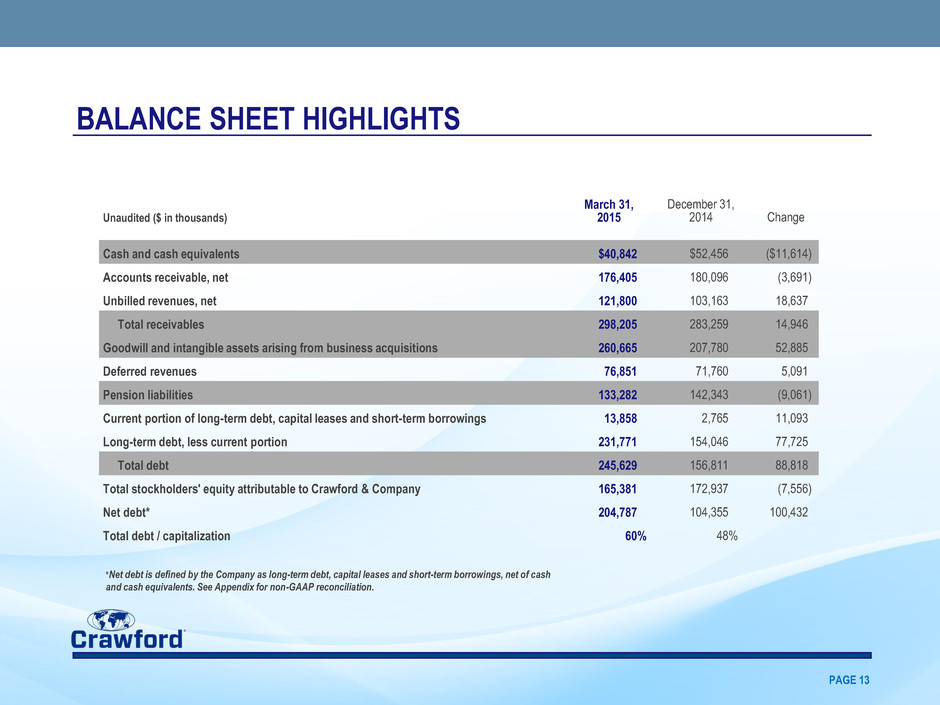

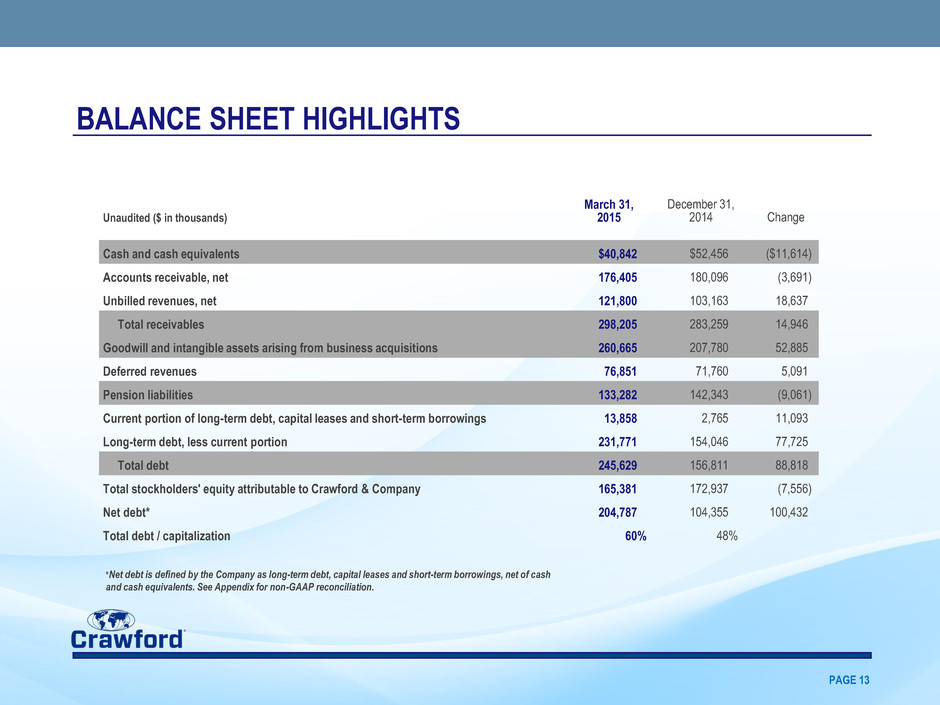

PAGE 13 Unaudited ($ in thousands) March 31, 2015 December 31, 2014 Change Cash and cash equivalents $40,842 $52,456 ($11,614 ) Accounts receivable, net 176,405 180,096 (3,691 ) Unbilled revenues, net 121,800 103,163 18,637 Total receivables 298,205 283,259 14,946 Goodwill and intangible assets arising from business acquisitions 260,665 207,780 52,885 Deferred revenues 76,851 71,760 5,091 Pension liabilities 133,282 142,343 (9,061 ) Current portion of long-term debt, capital leases and short-term borrowings 13,858 2,765 11,093 Long-term debt, less current portion 231,771 154,046 77,725 Total debt 245,629 156,811 88,818 Total stockholders' equity attributable to Crawford & Company 165,381 172,937 (7,556 ) Net debt* 204,787 104,355 100,432 Total debt / capitalization 60 % 48 % *Net debt is defined by the Company as long-term debt, capital leases and short-term borrowings, net of cash and cash equivalents. See Appendix for non-GAAP reconciliation. BALANCE SHEET HIGHLIGHTS

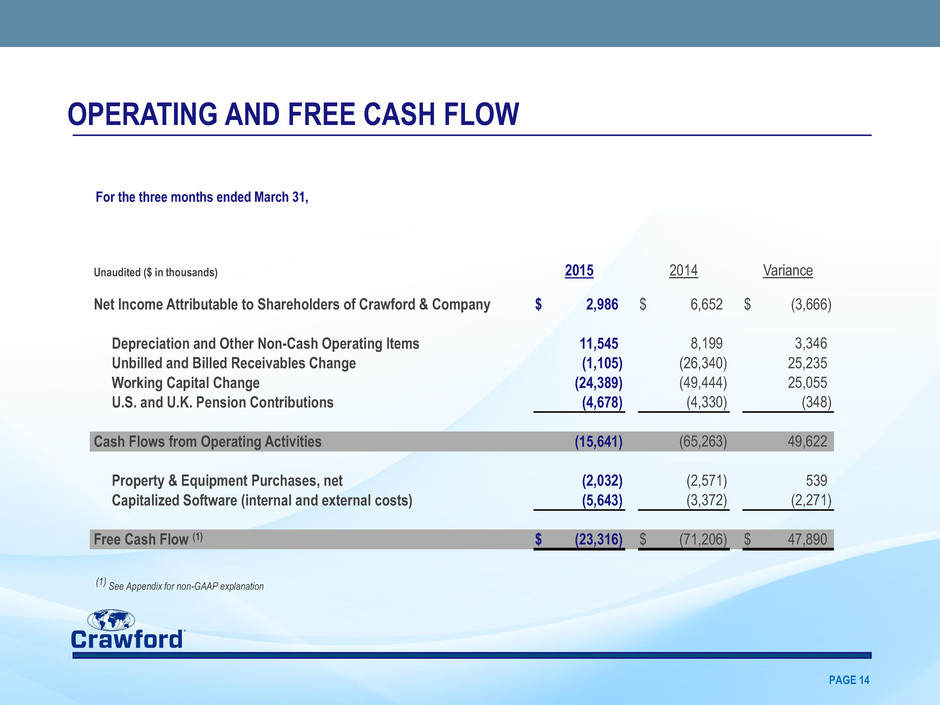

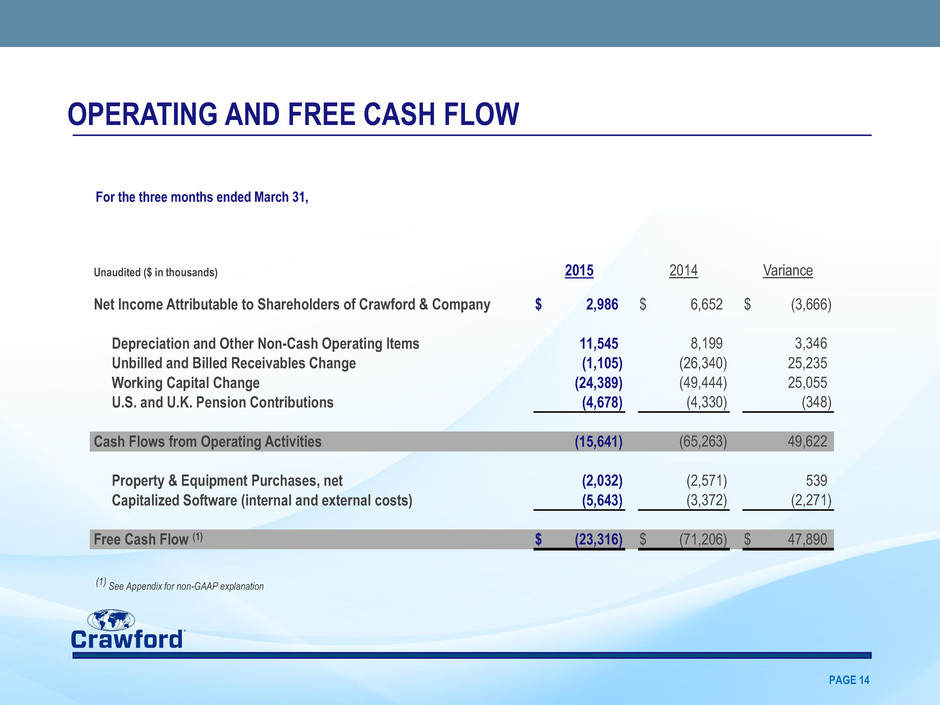

PAGE 14 Unaudited ($ in thousands) 2015 2014 Variance Net Income Attributable to Shareholders of Crawford & Company $ 2,986 $ 6,652 $ (3,666 ) Depreciation and Other Non-Cash Operating Items 11,545 8,199 3,346 Unbilled and Billed Receivables Change (1,105 ) (26,340 ) 25,235 Working Capital Change (24,389 ) (49,444 ) 25,055 U.S. and U.K. Pension Contributions (4,678 ) (4,330 ) (348 ) Cash Flows from Operating Activities (15,641 ) (65,263 ) 49,622 Property & Equipment Purchases, net (2,032 ) (2,571 ) 539 Capitalized Software (internal and external costs) (5,643 ) (3,372 ) (2,271 ) Free Cash Flow (1) $ (23,316 ) $ (71,206 ) $ 47,890 For the three months ended March 31, OPERATING AND FREE CASH FLOW (1) See Appendix for non-GAAP explanation

PAGE 15 Share Repurchases: • During the 2015 first quarter, Crawford repurchased 17,700 shares of CRDA at an average cost of $7.79 per share • From inception of share repurchase programs authorized in May 2012 through March 31, 2015, Crawford has repurchased 1,589,227 shares of CRDA at an average cost of $6.28 per share and 7,000 shares of CRDB at an average cost of $3.83 per share Dividends: • During the 2015 first quarter, Crawford paid a dividend of $0.07 on CRDA and $0.05 on CRDB OTHER FINANCIAL HIGHLIGHTS

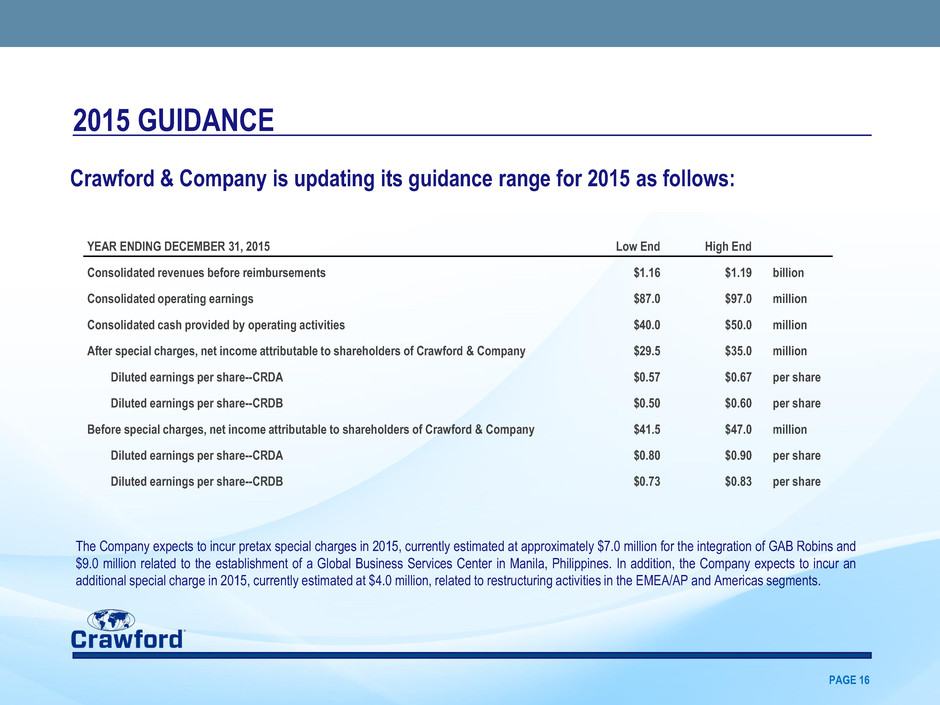

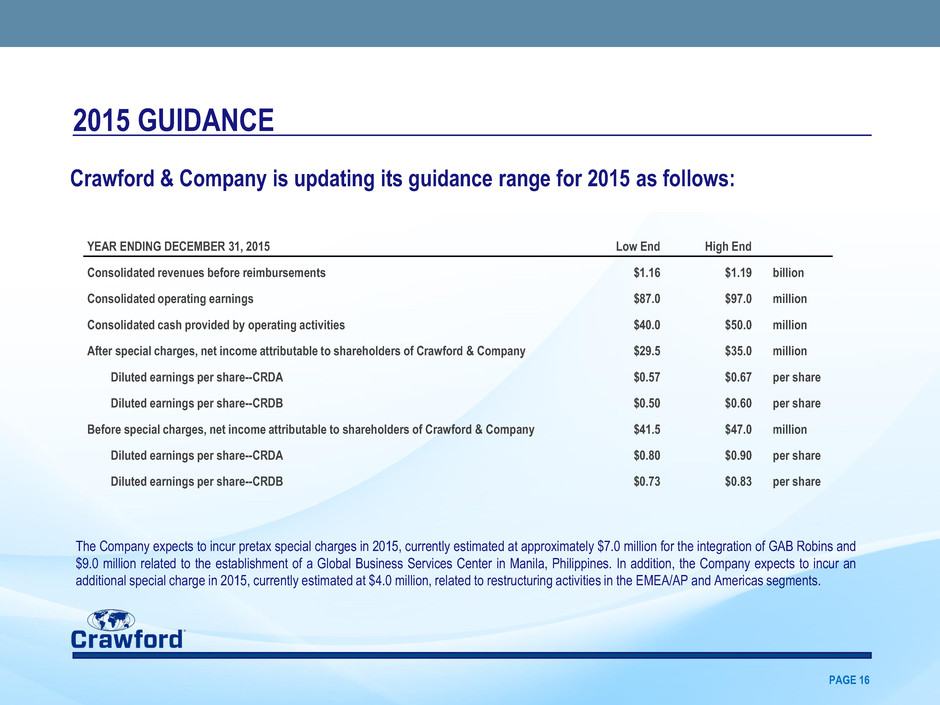

PAGE 16 Crawford & Company is updating its guidance range for 2015 as follows: YEAR ENDING DECEMBER 31, 2015 Low End High End Consolidated revenues before reimbursements $1.16 $1.19 billion Consolidated operating earnings $87.0 $97.0 million Consolidated cash provided by operating activities $40.0 $50.0 million After special charges, net income attributable to shareholders of Crawford & Company $29.5 $35.0 million Diluted earnings per share--CRDA $0.57 $0.67 per share Diluted earnings per share--CRDB $0.50 $0.60 per share Before special charges, net income attributable to shareholders of Crawford & Company $41.5 $47.0 million Diluted earnings per share--CRDA $0.80 $0.90 per share Diluted earnings per share--CRDB $0.73 $0.83 per share 2015 GUIDANCE The Company expects to incur pretax special charges in 2015, currently estimated at approximately $7.0 million for the integration of GAB Robins and $9.0 million related to the establishment of a Global Business Services Center in Manila, Philippines. In addition, the Company expects to incur an additional special charge in 2015, currently estimated at $4.0 million, related to restructuring activities in the EMEA/AP and Americas segments.

Appendix FIRST QUARTER 2015

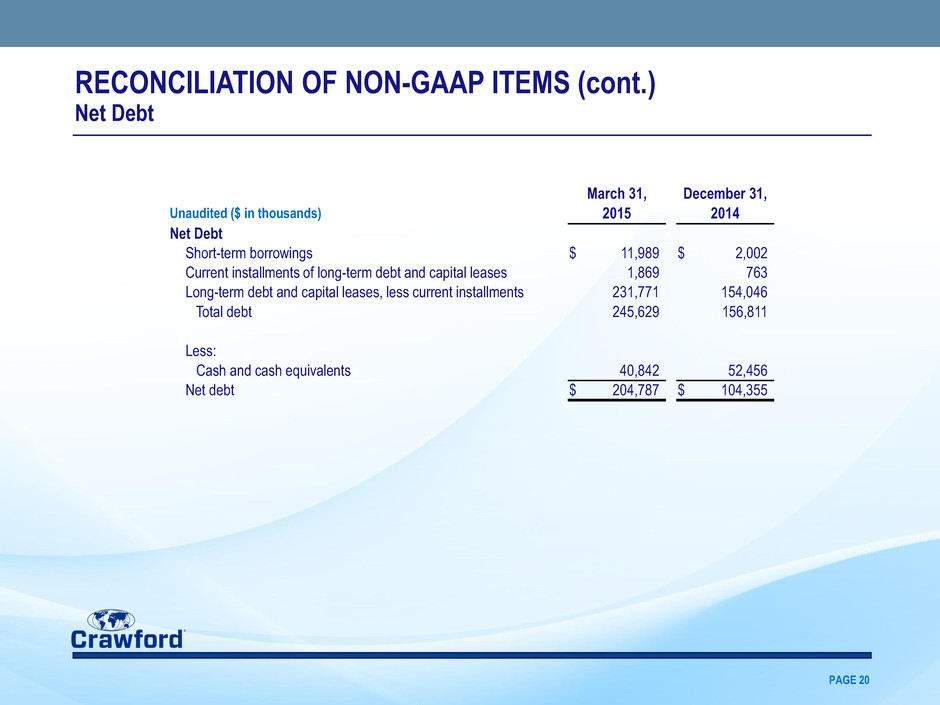

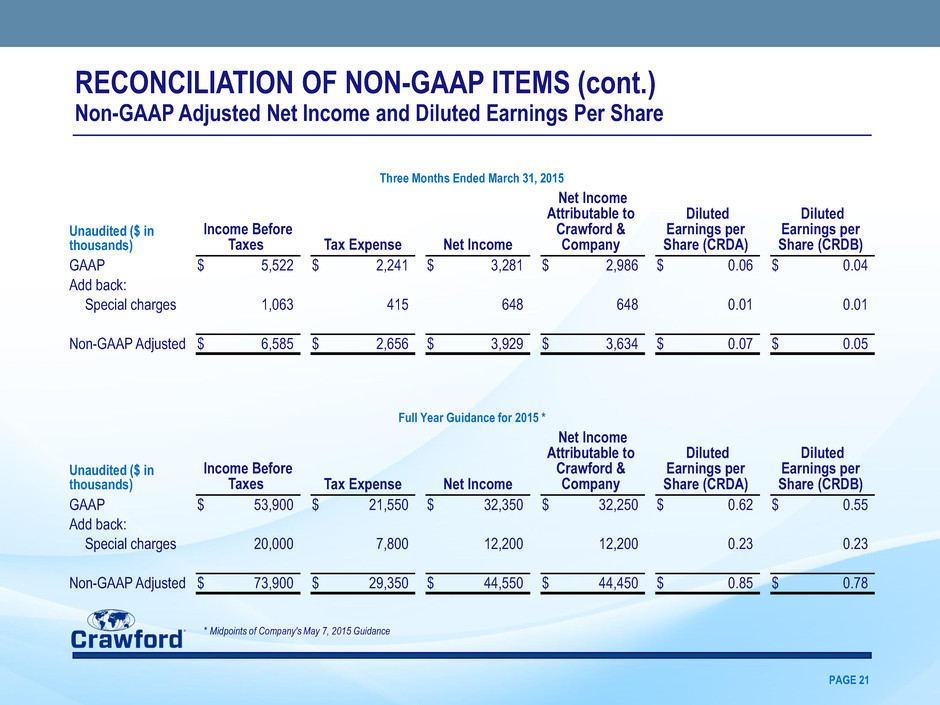

PAGE 18 Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues,respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. The GAAP-required gross up of our revenues including these pass-through reimbursed expenses is self-evident in the accompanying reconciliation. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 14. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, special charges, income taxes, and net income or loss attributable to noncontrolling interests. Non-GAAP adjusted Net Income and Diluted Earnings per Share Included in net income and earnings per share are special charges, which arise from non-core items not expected to impact our future performance on a regular recurring basis. Management believes it is useful to others to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations. APPENDIX: NON-GAAP FINANCIAL INFORMATION

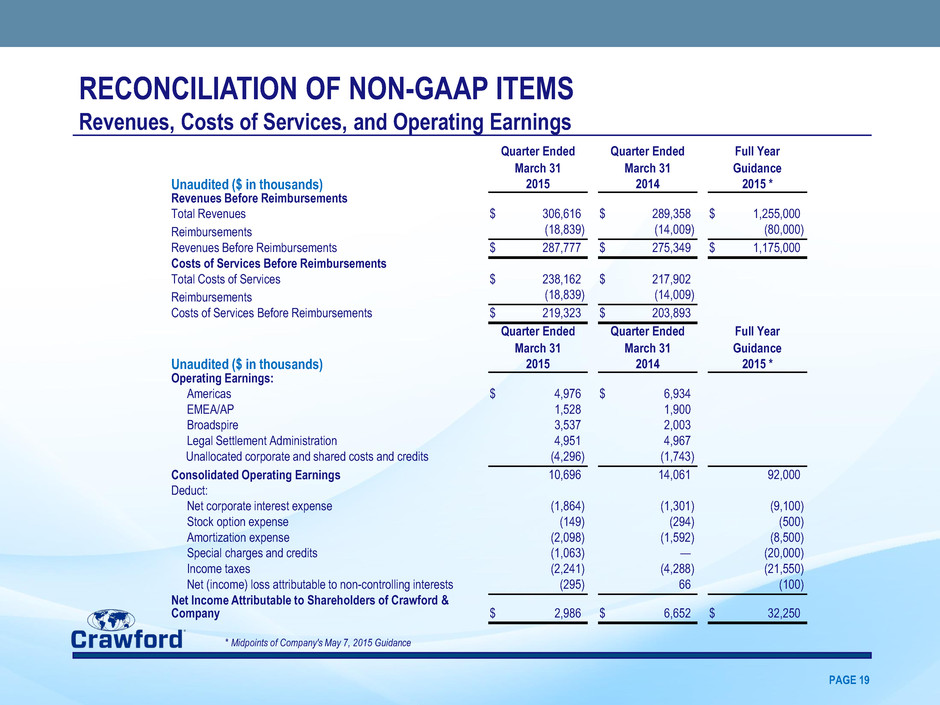

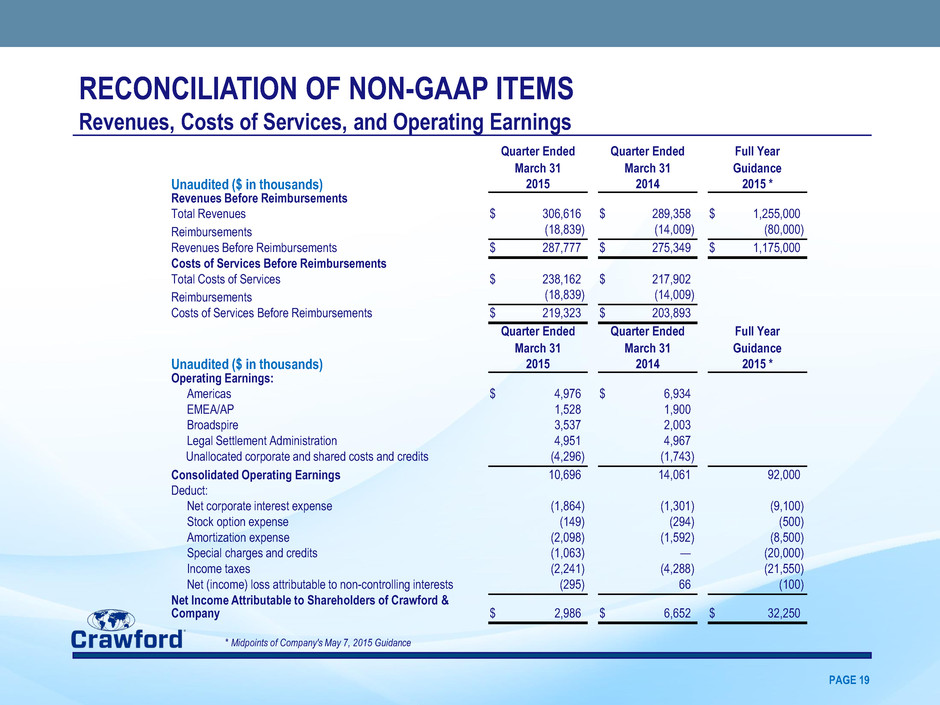

PAGE 19 Quarter Ended Quarter Ended Full Year March 31 March 31 Guidance Unaudited ($ in thousands) 2015 2014 2015 * Revenues Before Reimbursements Total Revenues $ 306,616 $ 289,358 $ 1,255,000 Reimbursements (18,839 ) (14,009 ) (80,000 ) Revenues Before Reimbursements $ 287,777 $ 275,349 $ 1,175,000 Costs of Services Before Reimbursements Total Costs of Services $ 238,162 $ 217,902 Reimbursements (18,839 ) (14,009 ) Costs of Services Before Reimbursements $ 219,323 $ 203,893 Revenues, Costs of Services, and Operating Earnings Quarter Ended Quarter Ended Full Year March 31 March 31 Guidance Unaudited ($ in thousands) 2015 2014 2015 * Operating Earnings: Americas $ 4,976 $ 6,934 EMEA/AP 1,528 1,900 Broadspire 3,537 2,003 Legal Settlement Administration 4,951 4,967 Unallocated corporate and shared costs and credits (4,296 ) (1,743 ) Consolidated Operating Earnings 10,696 14,061 92,000 Deduct: Net corporate interest expense (1,864 ) (1,301 ) (9,100 ) Stock option expense (149 ) (294 ) (500 ) Amortization expense (2,098 ) (1,592 ) (8,500 ) Special charges and credits (1,063 ) — (20,000 ) Income taxes (2,241 ) (4,288 ) (21,550 ) Net (income) loss attributable to non-controlling interests (295 ) 66 (100 ) Net Income Attributable to Shareholders of Crawford & Company $ 2,986 $ 6,652 $ 32,250 RECONCILIATION OF NON-GAAP ITEMS * Midpoints of Company's May 7, 2015 Guidance

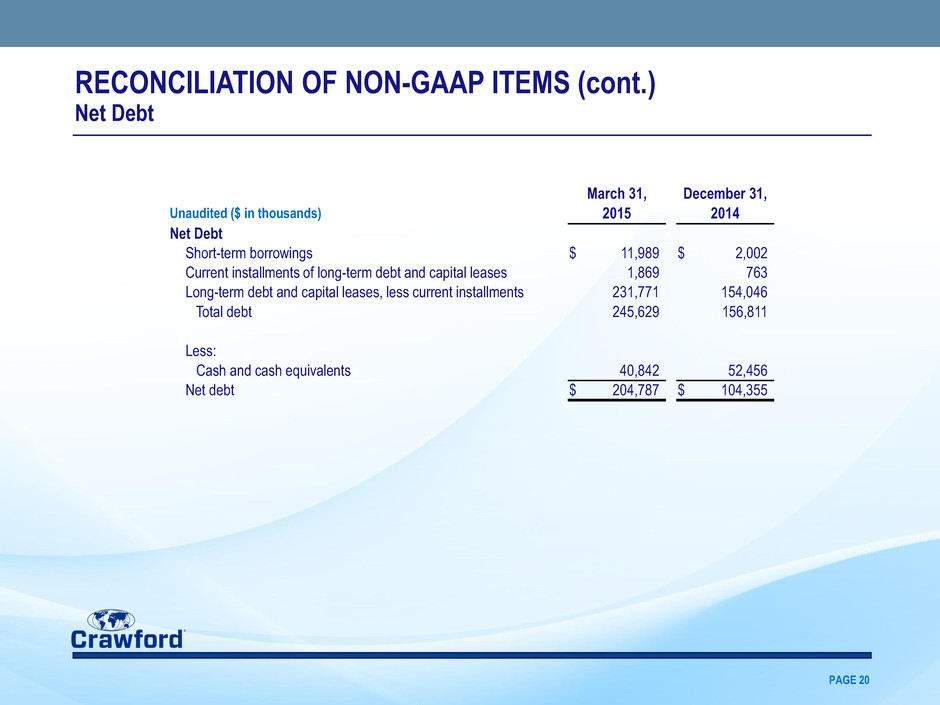

PAGE 20 RECONCILIATION OF NON-GAAP ITEMS (cont.) Net Debt March 31, December 31, Unaudited ($ in thousands) 2015 2014 Net Debt Short-term borrowings $ 11,989 $ 2,002 Current installments of long-term debt and capital leases 1,869 763 Long-term debt and capital leases, less current installments 231,771 154,046 Total debt 245,629 156,811 Less: Cash and cash equivalents 40,842 52,456 Net debt $ 204,787 $ 104,355

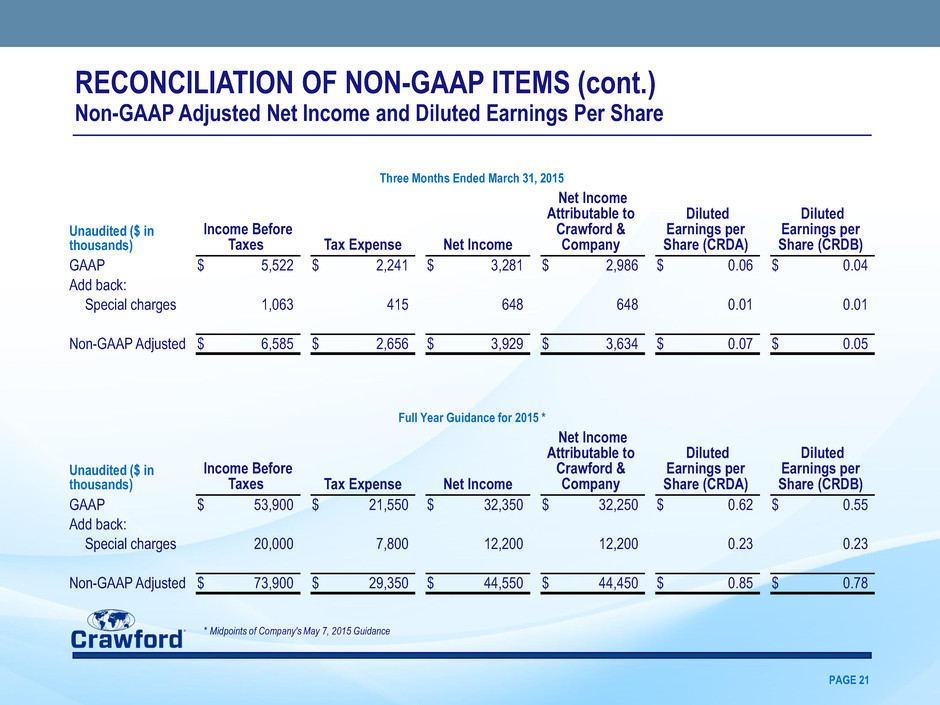

PAGE 21 RECONCILIATION OF NON-GAAP ITEMS (cont.) Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Three Months Ended March 31, 2015 Unaudited ($ in thousands) Income Before Taxes Tax Expense Net Income Net Income Attributable to Crawford & Company Diluted Earnings per Share (CRDA) Diluted Earnings per Share (CRDB) GAAP $ 5,522 $ 2,241 $ 3,281 $ 2,986 $ 0.06 $ 0.04 Add back: Special charges 1,063 415 648 648 0.01 0.01 Non-GAAP Adjusted $ 6,585 $ 2,656 $ 3,929 $ 3,634 $ 0.07 $ 0.05 Full Year Guidance for 2015 * Unaudited ($ in thousands) Income Before Taxes Tax Expense Net Income Net Income Attributable to Crawford & Company Diluted Earnings per Share (CRDA) Diluted Earnings per Share (CRDB) GAAP $ 53,900 $ 21,550 $ 32,350 $ 32,250 $ 0.62 $ 0.55 Add back: Special charges 20,000 7,800 12,200 12,200 0.23 0.23 Non-GAAP Adjusted $ 73,900 $ 29,350 $ 44,550 $ 44,450 $ 0.85 $ 0.78 * Midpoints of Company's May 7, 2015 Guidance