21st Annual NYSSA Insurance Industry Conference March 2017 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawfordandcompany.com. Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. Revenues Before Reimbursements ("Revenues") Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. Segment and Consolidated Operating Earnings Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its four operating segments. Segment operating earnings exclude income taxes, interest expense, amortization of customer-relationship intangible assets, goodwill impairment charges, restructuring and special charges, stock option expense, earnings or loss attributable to non-controlling interests, and certain unallocated corporate and shared costs and credits. Consolidated operating earnings is the total of segment operating earnings and certain unallocated and shared costs and credits. Earnings Per Share The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Non-GAAP Financial Information For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. Total Compensation ”Total Compensation" includes compensation, payroll taxes, and benefits provided to the employees of the Company, as well as payments to outsourced service providers that augment our staff. The difference between “Total Compensation” and the total of “Direct Compensation, Fringe Benefits & Non-Employee Labor” of our segments in our “Management’s Discussion and Analysis” in our Form 10-Q and Form 10-K represents the compensation, payroll taxes and benefits and payment to outsourced service providers that augment our staff for certain administrative functions performed by central headquarters staff that are included in “Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor” of our segments. FORWARD-LOOKING STATEMENTS AND ADDITIONAL INFORMATION

A GLOBAL BUSINESS SERVICES LEADER The world's largest publicly listed independent provider of global claims management solutions Multiple globally recognized brand names: Crawford®, Broadspire®, GCG® Clients include multinational insurance carriers, brokers and local insurance firms as well as 200 of the Fortune® 500

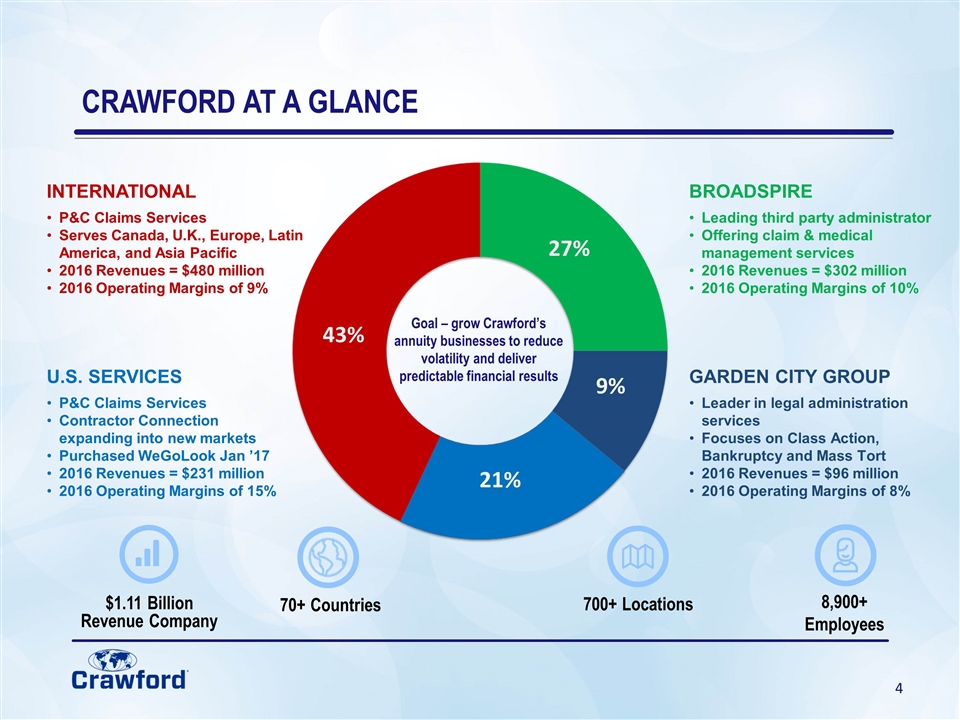

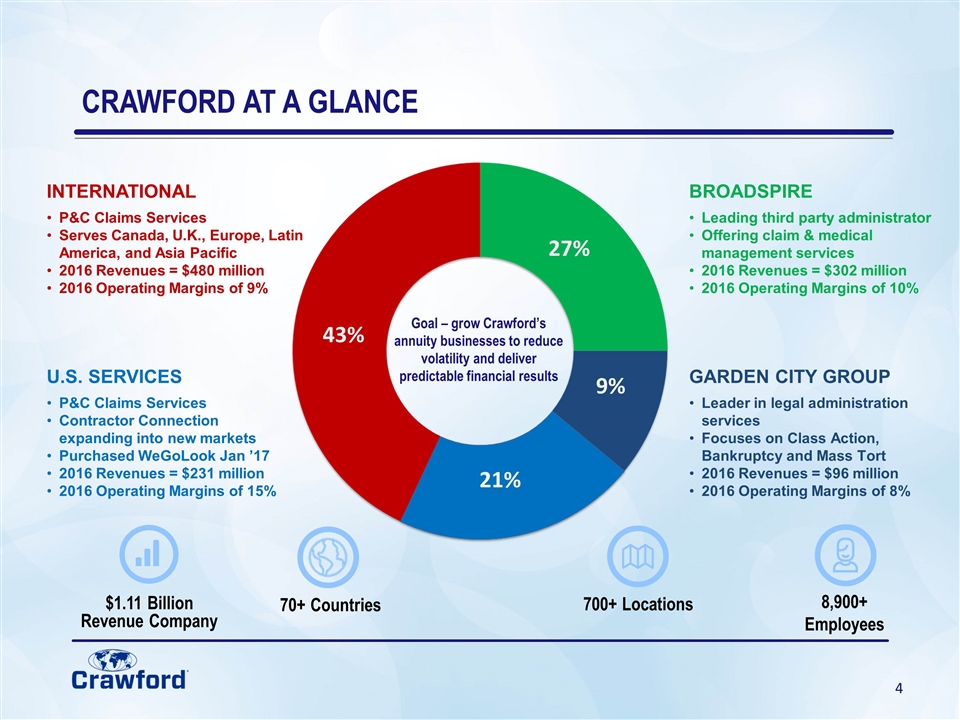

CRAWFORD AT A GLANCE GARDEN CITY GROUP Leader in legal administration services Focuses on Class Action, Bankruptcy and Mass Tort 2016 Revenues = $96 million 2016 Operating Margins of 8% INTERNATIONAL P&C Claims Services Serves Canada, U.K., Europe, Latin America, and Asia Pacific 2016 Revenues = $480 million 2016 Operating Margins of 9% BROADSPIRE Leading third party administrator Offering claim & medical management services 2016 Revenues = $302 million 2016 Operating Margins of 10% U.S. SERVICES P&C Claims Services Contractor Connection expanding into new markets Purchased WeGoLook Jan ’17 2016 Revenues = $231 million 2016 Operating Margins of 15% Goal – grow Crawford’s annuity businesses to reduce volatility and deliver predictable financial results 43% 27% 21% 9% $1.11 Billion Revenue Company 700+ Locations 8,900+ Employees 70+ Countries

INVESTMENT HIGHLIGHTS Experienced senior leadership team Repositioning the Global Claims Management business to deliver growth Expanding Crawford’s annuity businesses such as Broadspire and Contractor Connection to reduce volatility Positioning Garden City Group for a return to top line growth Crawford Innovative Ventures formed to explore strategic acquisitions Utilizing technology and strategic outsourcing to improve operations while reducing costs Instilling an entrepreneurial culture focused on growth and cross selling Crawford’s top strategic priority is to deliver more predictable financial results and ongoing revenue growth regardless of the market backdrop

EXECUTIVE MANAGEMENT Bruce Swain - EVP and Chief Financial Officer 30 years of experience in public and corporate accounting Held multiple positions during nearly 25 years at Crawford Has served as CFO since 2006 Harsha V. Agadi - President and Chief Executive Officer On June 21, 2016 Harsha Agadi was named President and CEO after serving as Interim President and CEO since August 2015 30 years of experience in leadership positions at both public and private companies, including several Fortune 500 companies Member of the Crawford Board of Directors since 2010 Andrew Robinson - Chief Operating Officer On January 9, 2017, Andrew Robinson was named Crawford’s first global COO Brings a strong 30-year track record of growth, financial improvement, and strategic and operational leadership 10 years of experience at Hanover Insurance Group, where he served as President of Specialty Insurance, EVP of Corporate Development and Chief Risk Officer

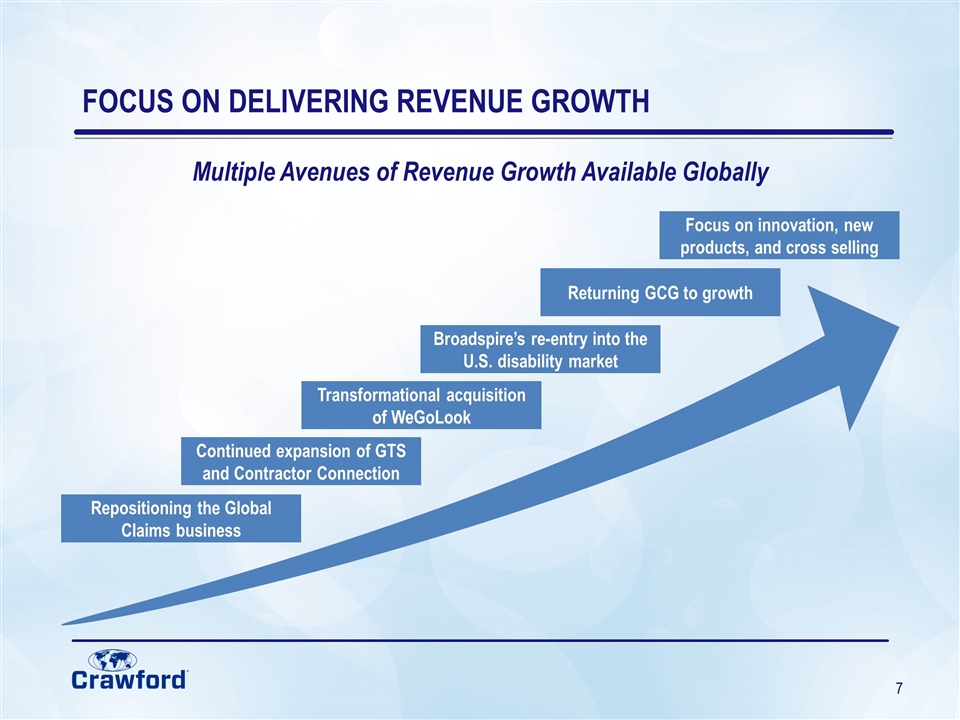

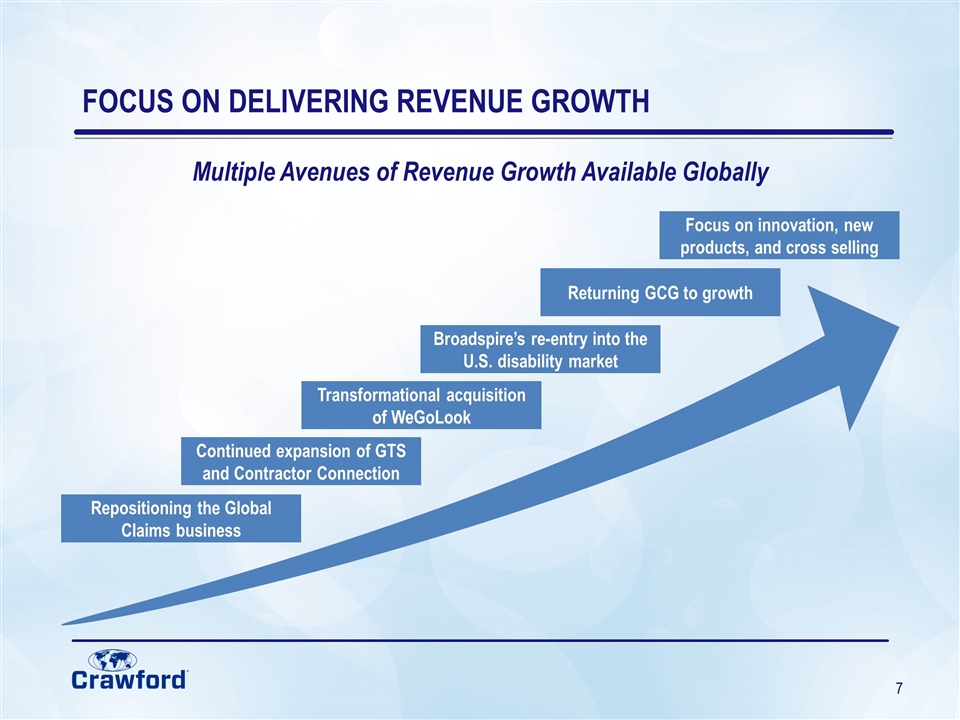

FOCUS ON DELIVERING REVENUE GROWTH Multiple Avenues of Revenue Growth Available Globally Repositioning the Global Claims business Continued expansion of GTS and Contractor Connection Transformational acquisition of WeGoLook Broadspire’s re-entry into the U.S. disability market Returning GCG to growth Focus on innovation, new products, and cross selling

One of the world’s largest independent providers of claims management solutions with an unparalleled competitive position and globally recognized portfolio of brands Delivering complex solutions to clients when speed of execution matters Integrated approach to managing national and multinational claims programs Strong client focus, leadership, consultation and guidance Provides services to approximately half of the Fortune 500 companies Strategic Focus – Drive top line growth and improved profitability: Expand Global Technical Services (GTS) Pursue runoff claims administration opportunities Continue to grow Contractor Connection WeGoLook acquisition to transform the high frequency, low severity claims market GLOBAL CLAIMS MANAGEMENT BUSINESS

GLOBAL TECHNICAL SERVICES (GTS) Crawford GTS has the largest, most experienced team of technical adjusters in the world Our Vision To be the world’s leading and most trusted provider of specialist loss management, forensic accounting and consulting solutions – powered by advanced analytics GTS has a global footprint comprising 500 executive general adjusters who are specialists in providing quality, end to end claims management Overview Client Need Carriers seek global, integrated end to end solutions for complex and major claims given a lack of complex claims experience, the need to control cost inflation, and inadequate customer outcomes Value Proposition Crawford GTS delivers clients reduced indemnity spend, friction costs and claims settlement time - resulting in improved policy holder and broker experiences Market Opportunity The total addressable market (TAM) is estimated at over $3.8 billion(1) annually - Crawford is well-equipped to take share (1) Based on Crawford & Company data and estimates

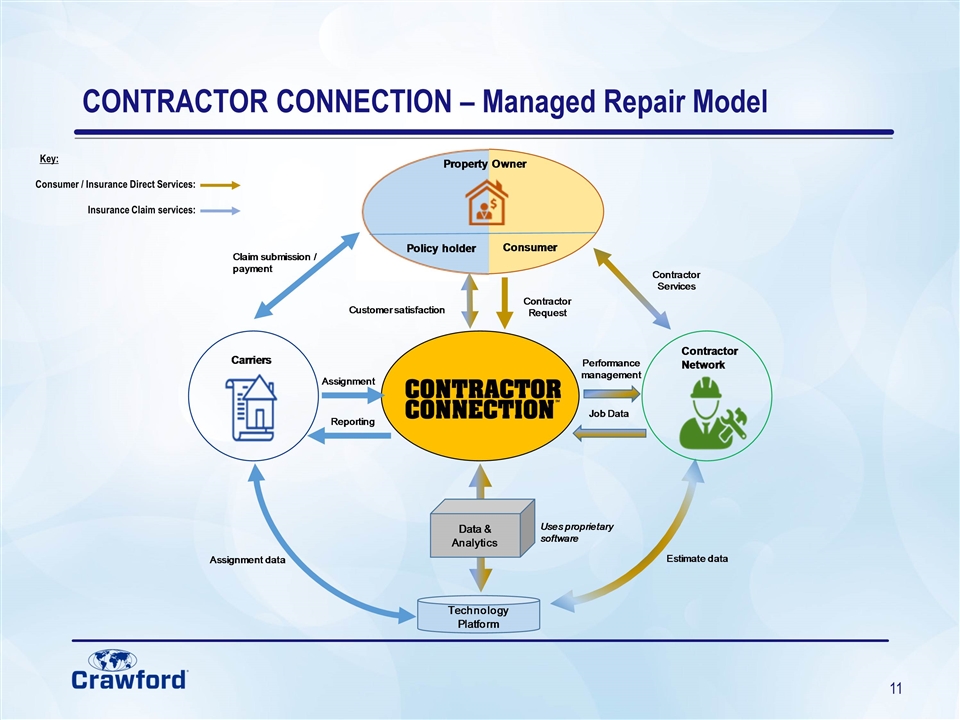

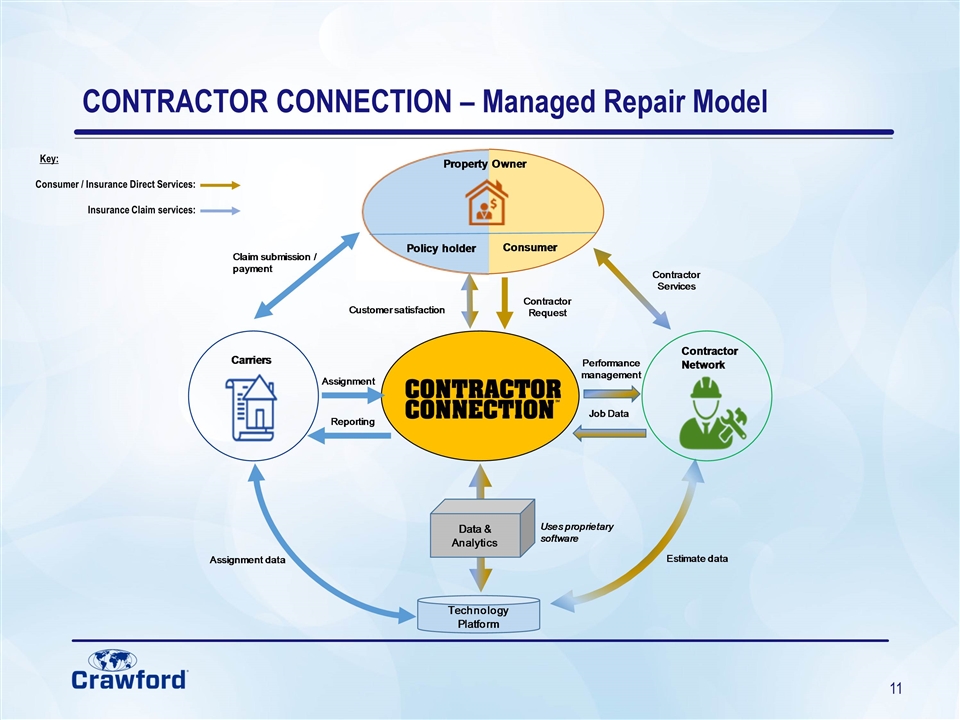

CONTRACTOR CONNECTION – A Significant Global Opportunity U.S. Contractor Managed Repair Market estimated to be $6 billion(1) U.S. Insurance Direct Market estimated to be $25 billion(1) U.S. Consumer Market estimated at ~$150 billion(1), highlighting the scale of the consumer opportunity International Contractor Managed Repair Market estimated to be $25 billion(1) across major markets Carriers seek to reduce indemnity, loss adjusting, and administrative expense while raising customer satisfaction Contractor Connection delivers improved policy holder satisfaction and renewal rates while reducing costs Contractors seek consistent volume of job opportunities and are willing to adapt to changes that bring rewards Contractor Connection delivers increased lead flow, higher job win rates, and lower marketing investment Consumers seek a hassle free remedy to finding reliable contractors capable of quality service at fair prices Contractor Connection delivers higher satisfaction for lower time investment at a fair price Network of over 5,300 general and specialty contractors Revenue Growth of 19% in 2016 compared to 2015 (Globally) Approximately 325,000 assignments with over $2.4 billion in repair estimates in 2016 Currently operational under the Contractor Connection brand name in the U.S., Canada, U.K. and Australia Overview Market Opportunity Meeting Key Stakeholder Needs (1) Based on Crawford & Company / Contractor Connection data and estimates

CONTRACTOR CONNECTION – Managed Repair Model Key: Consumer / Insurance Direct Services: Insurance Claim services:

WeGoLook – A Transformative Acquisition Acquisition closed on January 4, 2017 WeGoLook provides crowd sourced field services, leveraging the “gig” economy 100+ employees, headquartered in Oklahoma City 30,000+ on-demand “Looker” community Addressable market defined by nearly 200 million inspections with roughly $7 billion in value (1) 2016 revenues grew approximately 150% from 2015 and are expected to grow rapidly over the next three years Expected EPS accretion beginning in 2018 Disrupting the market for high frequency, low severity claims (1) Based on Crawford & Company data and estimates

WeGoLook – Expanding Crawford’s Reach

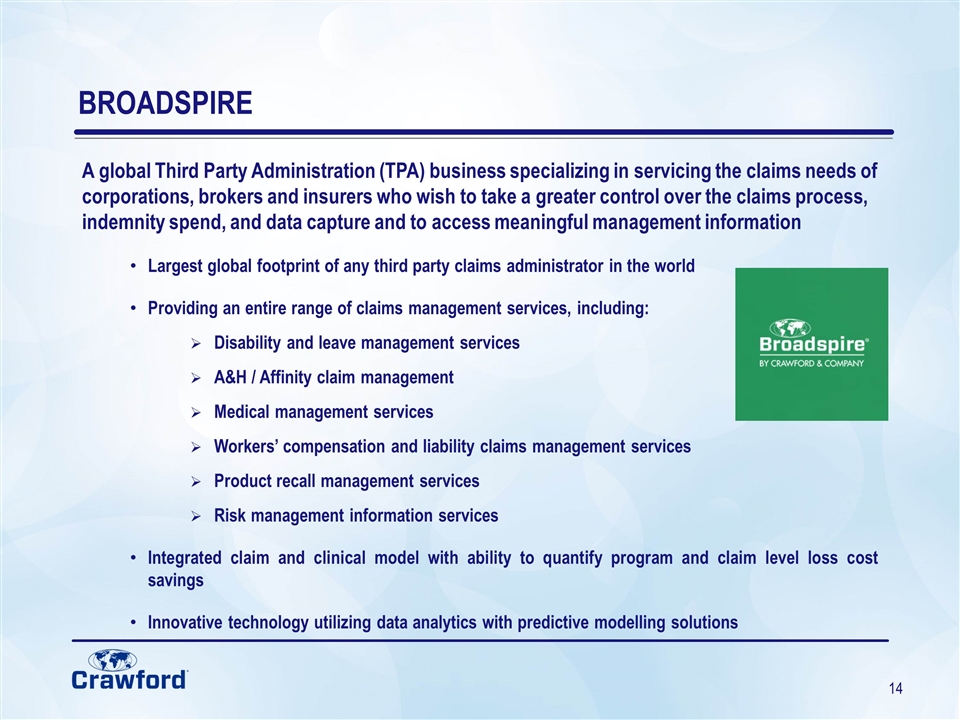

BROADSPIRE A global Third Party Administration (TPA) business specializing in servicing the claims needs of corporations, brokers and insurers who wish to take a greater control over the claims process, indemnity spend, and data capture and to access meaningful management information Largest global footprint of any third party claims administrator in the world Providing an entire range of claims management services, including: Disability and leave management services A&H / Affinity claim management Medical management services Workers’ compensation and liability claims management services Product recall management services Risk management information services Integrated claim and clinical model with ability to quantify program and claim level loss cost savings Innovative technology utilizing data analytics with predictive modelling solutions

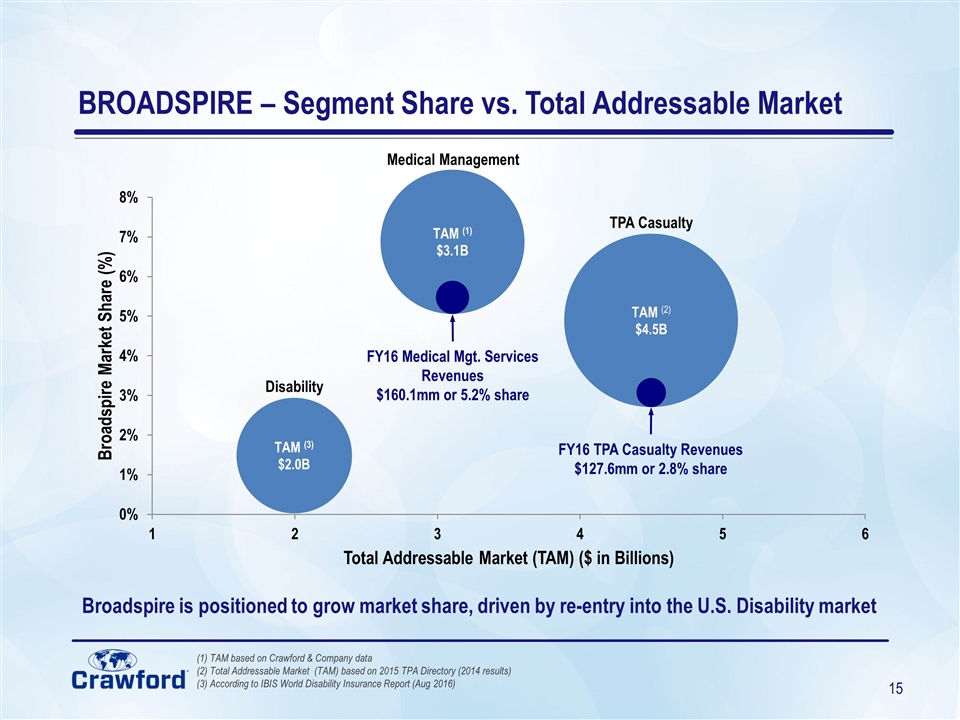

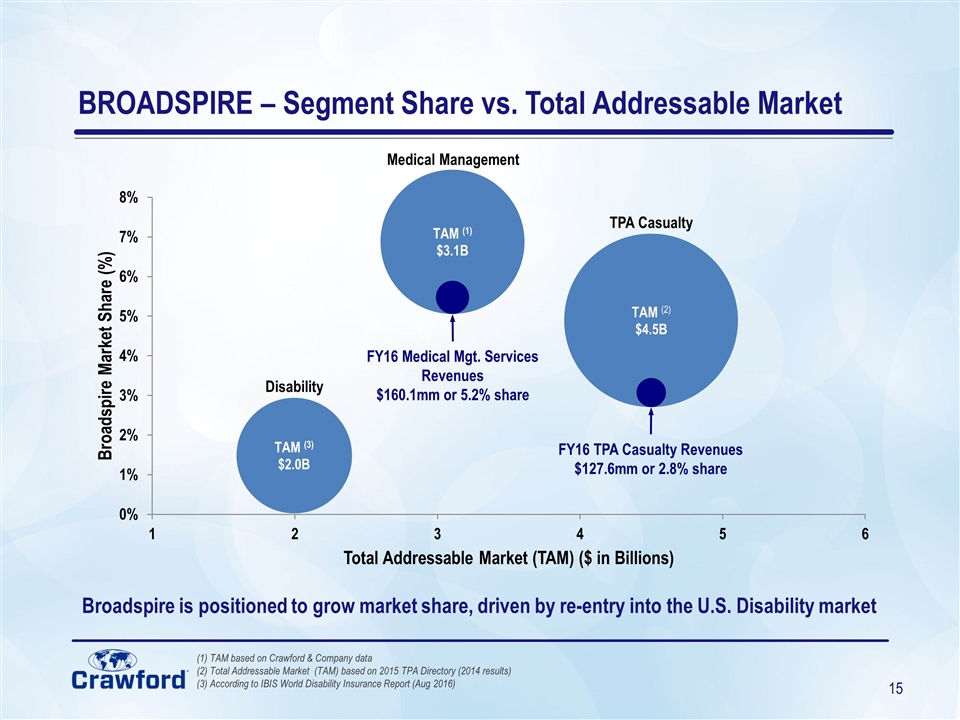

Broadspire is positioned to grow market share, driven by re-entry into the U.S. Disability market (1) TAM based on Crawford & Company data (2) Total Addressable Market (TAM) based on 2015 TPA Directory (2014 results) (3) According to IBIS World Disability Insurance Report (Aug 2016) Disability Medical Management TPA Casualty FY16 Medical Mgt. Services Revenues $160.1mm or 5.2% share FY16 TPA Casualty Revenues $127.6mm or 2.8% share BROADSPIRE – Segment Share vs. Total Addressable Market TAM (2) $4.5B TAM (1) $3.1B TAM (3) $2.0B

Recognized leader in providing legal administration services for class action settlements, bankruptcy cases, mass tort and legal noticing programs for over 30 years Strong senior leadership team Brand equity is significant – GCG is a top tier provider of claims administration across the globe, and has dominant market share among large class action cases Backlog remains robust, highlighted by key 2016 wins: Pfizer Securities Litigation Case Settlement Several Cases Related to LIBOR Settlements DOJ U.S. Victims of State Sponsored Terrorism Fund Harbor Freight Tools Sales Practice Case Settlement Opportunity for management to showcase further cost discipline and drive organic growth by capitalizing on an $81 million backlog Positioning Garden City Group for a return to growth GARDEN CITY GROUP

The insurance industry is experiencing rapid change, which requires innovative thinking and investment To ensure that Crawford stays at the forefront of this changing environment, Crawford has created Crawford Innovative Ventures, LLC (CIV) CIV has been created to invest in strategic acquisitions and partnerships that support Crawford’s broader strategic plan CIV’s primary focus is to bring new services to the insurance market and explore new markets for Crawford’s current and acquired expertise CIV will aim to be a catalyst for change across Crawford’s worldwide business and provide a new look to Crawford as the company begins an exciting transformation WeGoLook is CIV’s first acquisition CRAWFORD INNOVATIVE VENTURES

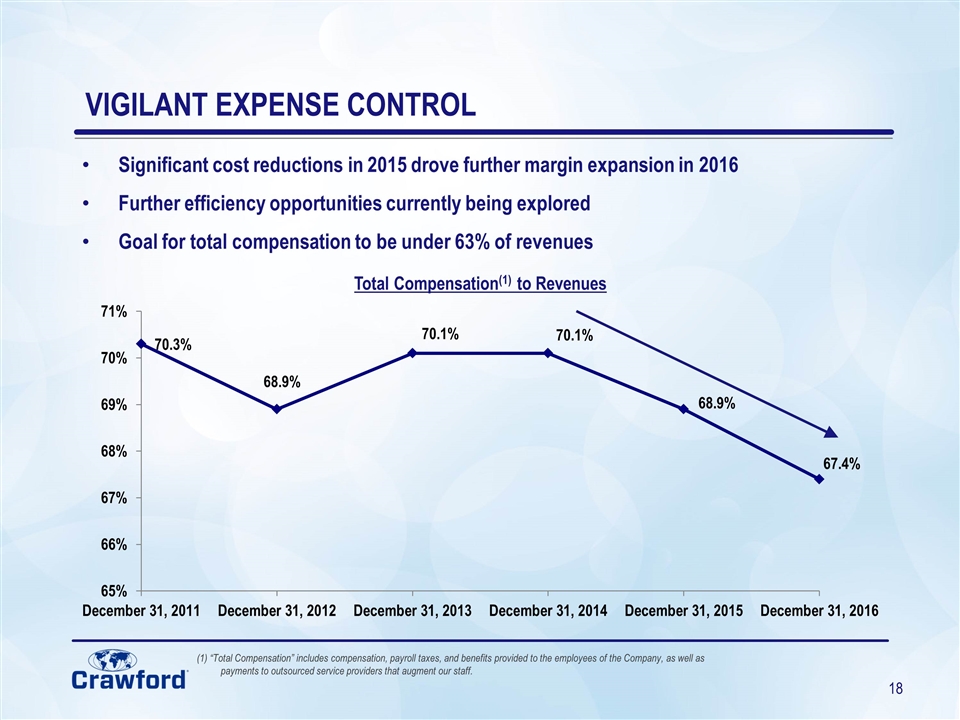

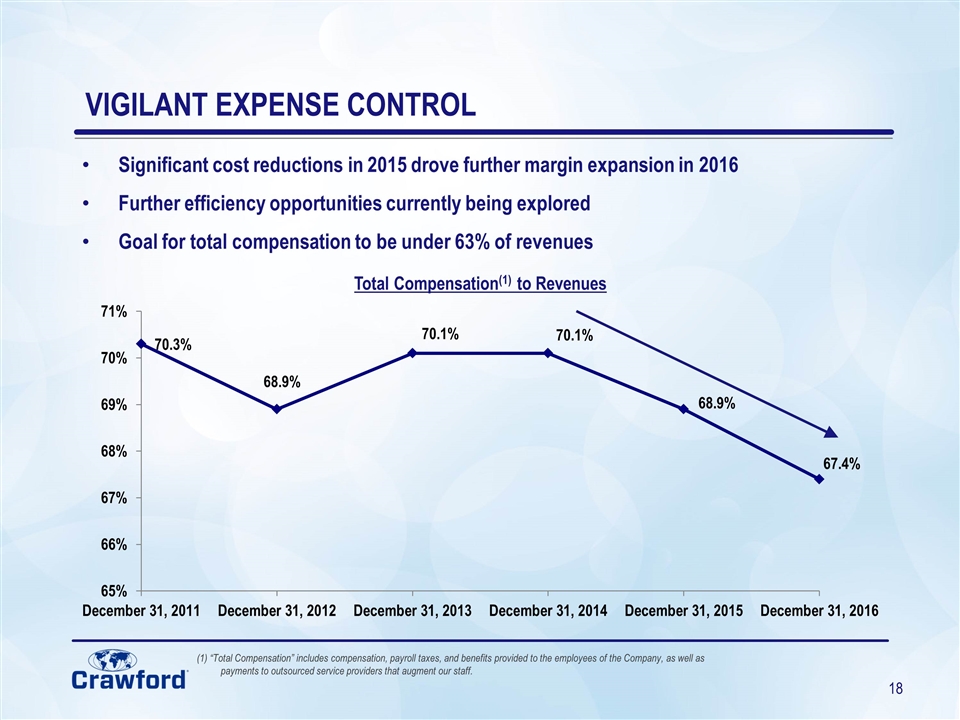

VIGILANT EXPENSE CONTROL Significant cost reductions in 2015 drove further margin expansion in 2016 Further efficiency opportunities currently being explored Goal for total compensation to be under 63% of revenues (1) “Total Compensation” includes compensation, payroll taxes, and benefits provided to the employees of the Company, as well as payments to outsourced service providers that augment our staff.

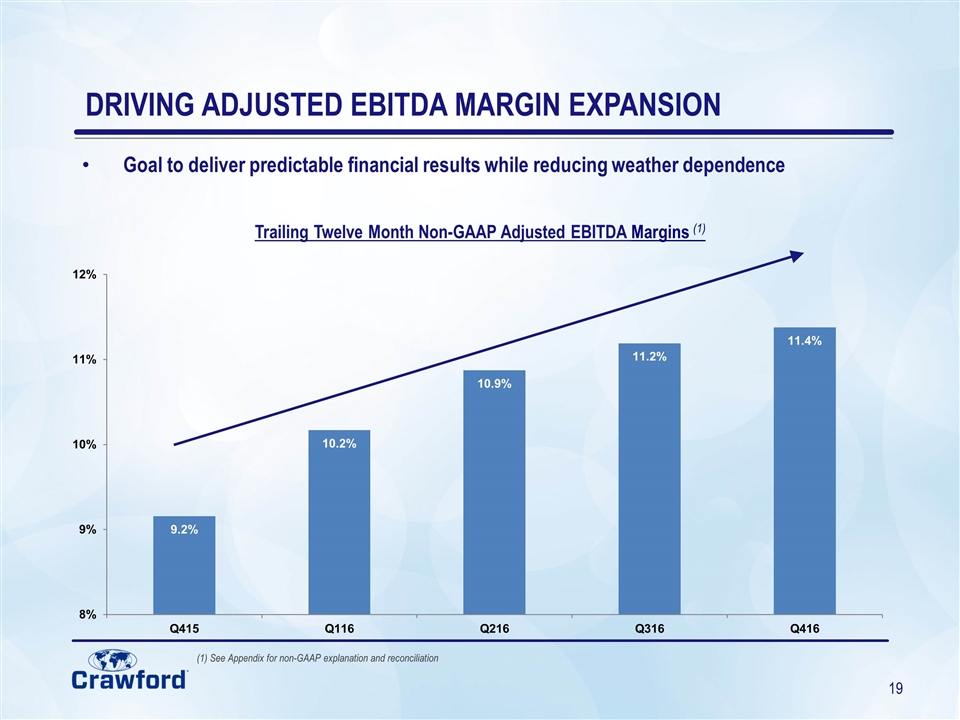

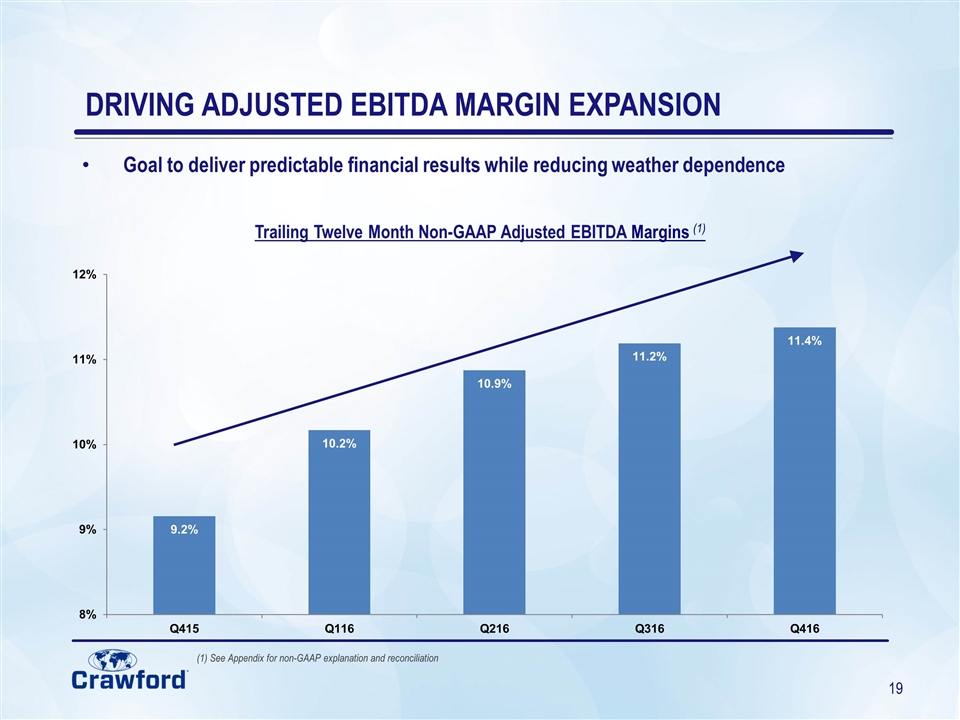

DRIVING ADJUSTED EBITDA MARGIN EXPANSION Goal to deliver predictable financial results while reducing weather dependence Trailing Twelve Month Non-GAAP Adjusted EBITDA Margins (1) (1) See Appendix for non-GAAP explanation and reconciliation

GLOBAL BUSINESS SERVICES AND TECHNOLOGY CENTERS SIMPLIFICATION Simplify how we do things today, both across and within divisions STANDARDIZATION Adopt the one best way of working globally and consolidate for scale in the right location OPERATIONAL EXCELLENCE Use our global scale to learn, innovate and continuously improve State of the art operational centers in the Philippines and India Philippine facility owned and operated by Crawford Consolidated global operations expected to drive improved customer service levels and lower costs $12 million of annual cost savings achieved as of year end 2016, which is expected to grow to $20 million in annual savings exiting year end 2019

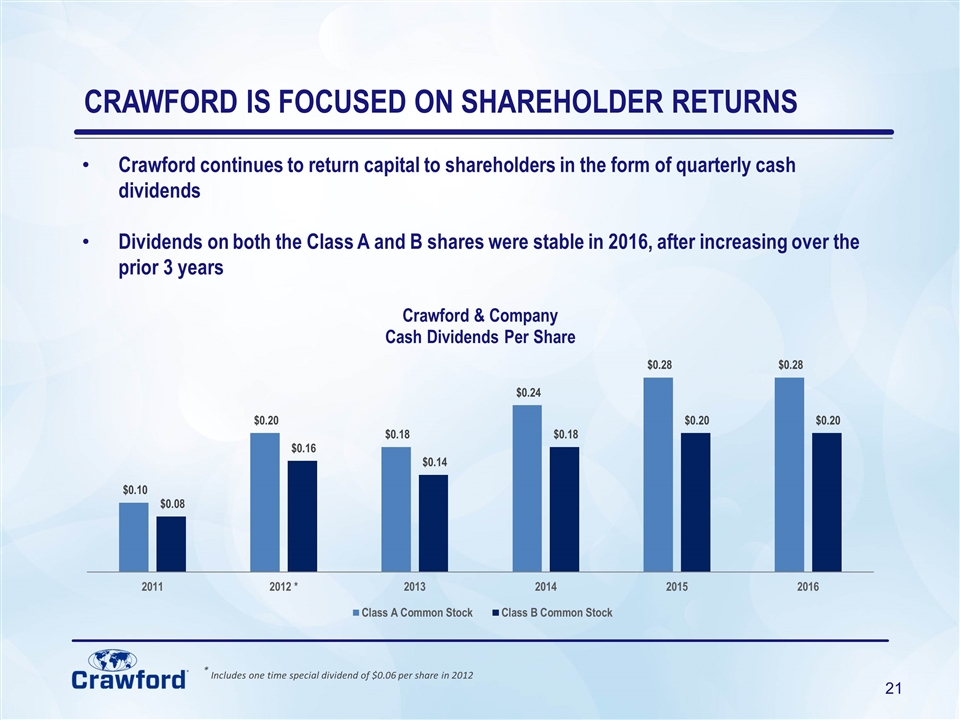

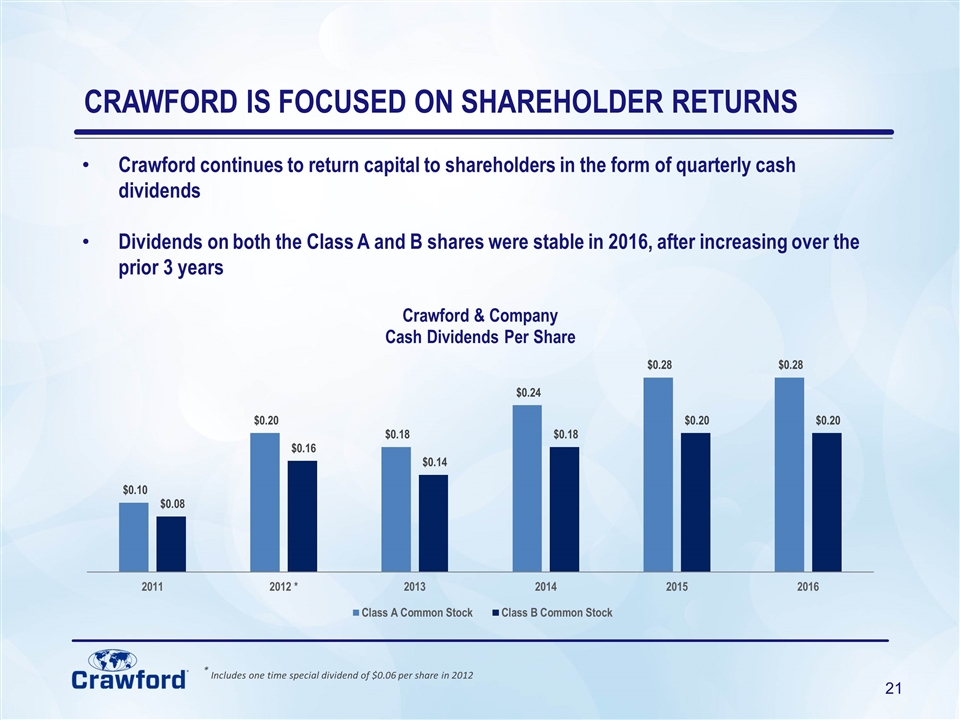

CRAWFORD IS FOCUSED ON SHAREHOLDER RETURNS * Includes one time special dividend of $0.06 per share in 2012 Crawford continues to return capital to shareholders in the form of quarterly cash dividends Dividends on both the Class A and B shares were stable in 2016, after increasing over the prior 3 years

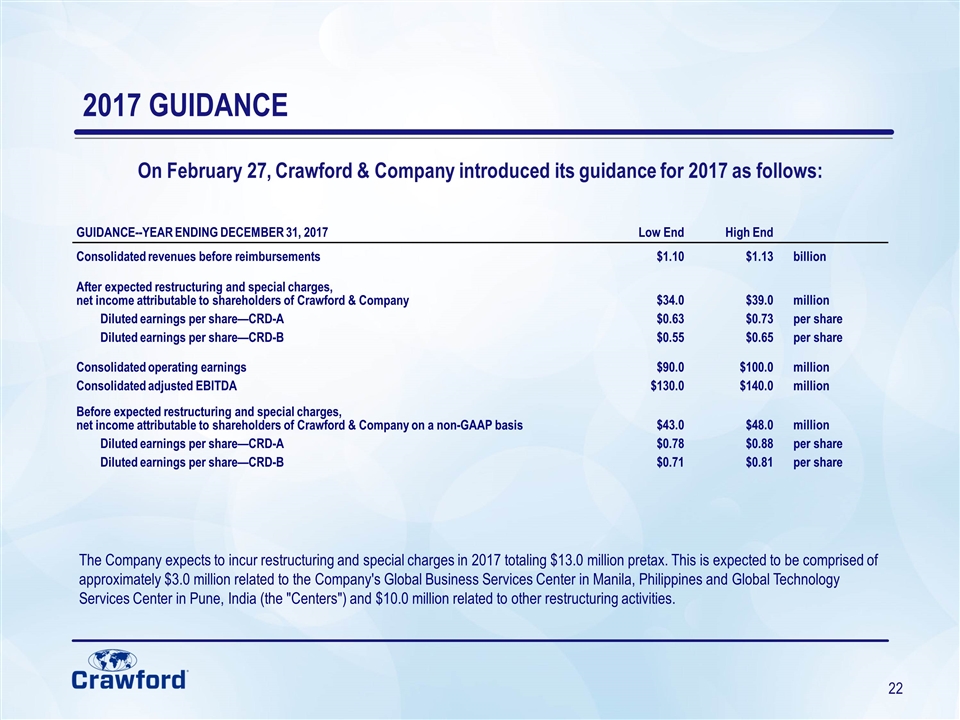

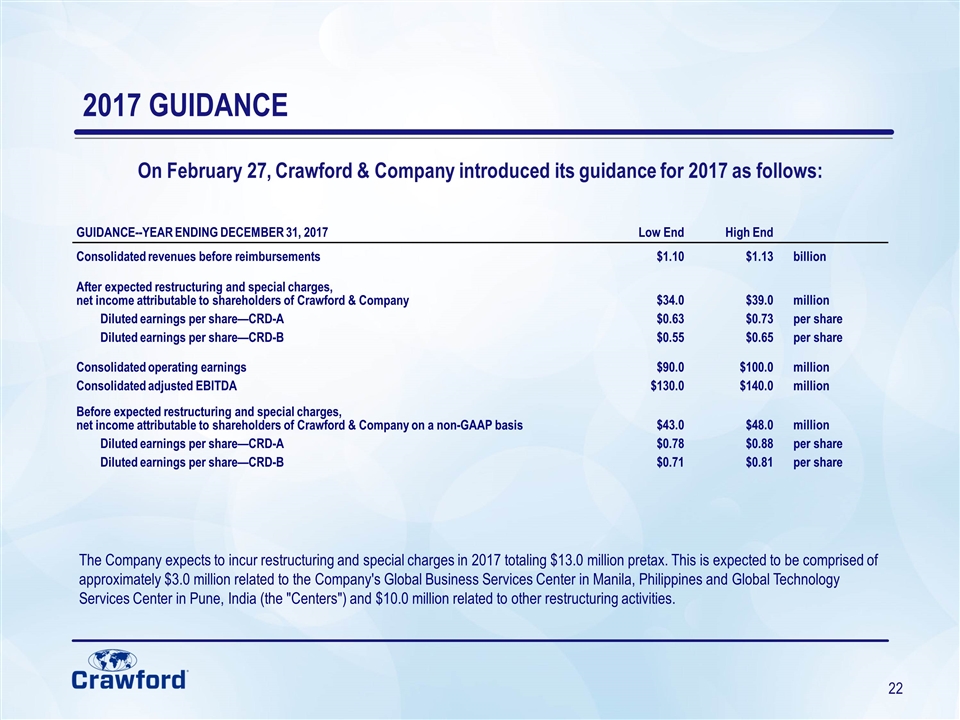

On February 27, Crawford & Company introduced its guidance for 2017 as follows: GUIDANCE--YEAR ENDING DECEMBER 31, 2017 Low End High End Consolidated revenues before reimbursements $1.10 $1.13 billion After expected restructuring and special charges, net income attributable to shareholders of Crawford & Company $34.0 $39.0 million Diluted earnings per share—CRD-A $0.63 $0.73 per share Diluted earnings per share—CRD-B $0.55 $0.65 per share Consolidated operating earnings $90.0 $100.0 million Consolidated adjusted EBITDA $130.0 $140.0 million Before expected restructuring and special charges, net income attributable to shareholders of Crawford & Company on a non-GAAP basis $43.0 $48.0 million Diluted earnings per share—CRD-A $0.78 $0.88 per share Diluted earnings per share—CRD-B $0.71 $0.81 per share 2017 GUIDANCE The Company expects to incur restructuring and special charges in 2017 totaling $13.0 million pretax. This is expected to be comprised of approximately $3.0 million related to the Company's Global Business Services Center in Manila, Philippines and Global Technology Services Center in Pune, India (the "Centers") and $10.0 million related to other restructuring activities.

LOOKING TO 2017 Reposition the Global Claims Management business to deliver revenue growth and improved profitability Expand Global Technical Services (GTS) Grow Contactor Connection globally WeGoLook to transform the market for high frequency, low severity claims Continue to deliver consistent growth and margin expansion at Broadspire in the U.S. and explore global TPA opportunities Positioning Garden City Group for a return to growth Crawford Innovation Ventures to deliver new services to the insurance industry and open new markets to Crawford Strategic review underway to identify further expense reduction opportunities Positioning Crawford to deliver more predictable financial results and ongoing revenue growth

Questions & Answers

Appendix A: Consolidated Financial Information for the Year Ended December 31, 2016

2016 BUSINESS HIGHLIGHTS Crawford generated record cash flow from operations during 2016 Vigilant cost control delivered year-over-year margin expansion of 230 basis points Andrew Robinson joined in January as the Company’s first Chief Operating Officer Primary focus on optimizing Crawford’s operations, sales and marketing Additional mandate to expand Crawford’s product offerings globally Strategic review underway to further reduce expenses and realign sales objectives Goal to deliver Crawford’s medium term target of 10% operating margins Additional objective is to refocus sales teams on solution selling and cross sale opportunities Acquired a majority stake in WeGoLook in January 2017 – positions Crawford to better serve the high-frequency, low-severity claims market Contractor Connection advertising campaign launched across seven markets in January, designed to penetrate the $25 billion Insurance Direct market

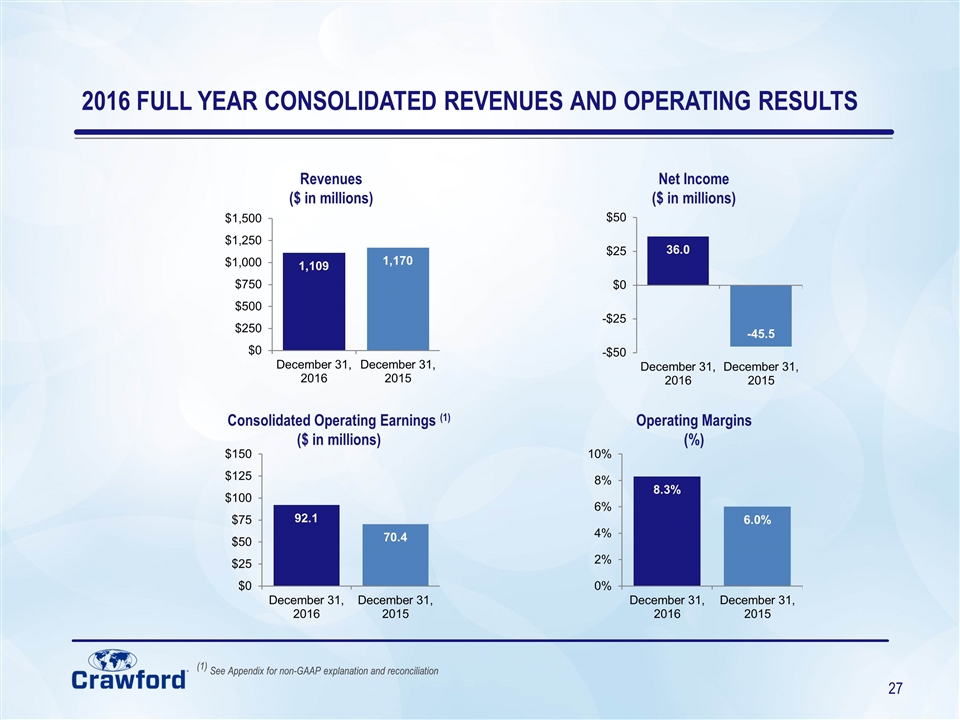

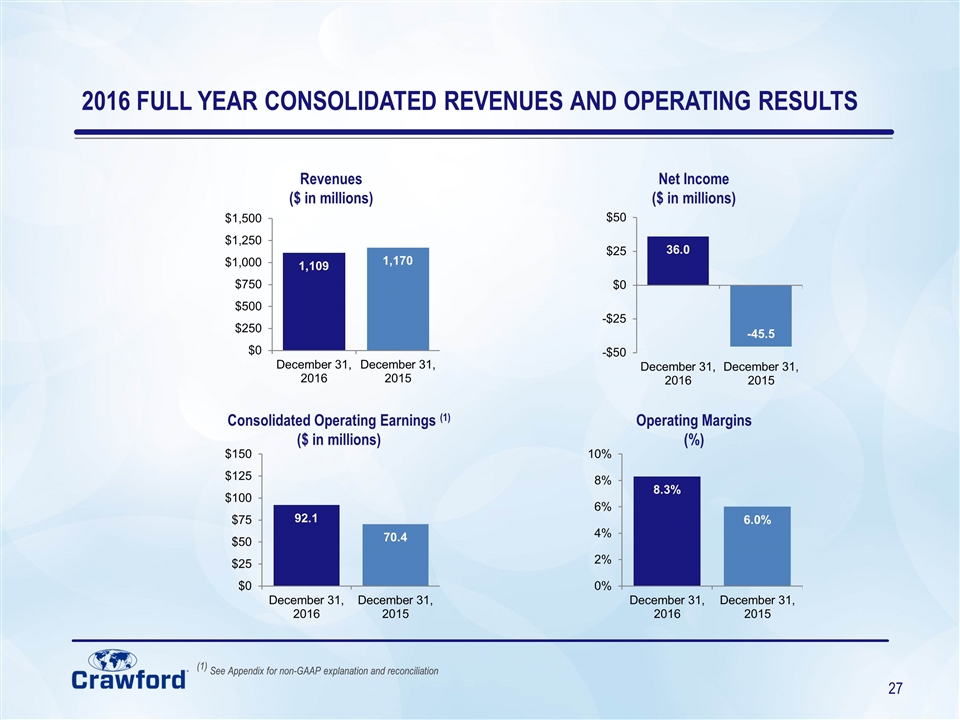

2016 FULL YEAR CONSOLIDATED REVENUES AND OPERATING RESULTS (1) See Appendix for non-GAAP explanation and reconciliation Operating Margins (%) Revenues ($ in millions) Consolidated Operating Earnings (1) ($ in millions) Net Income ($ in millions)

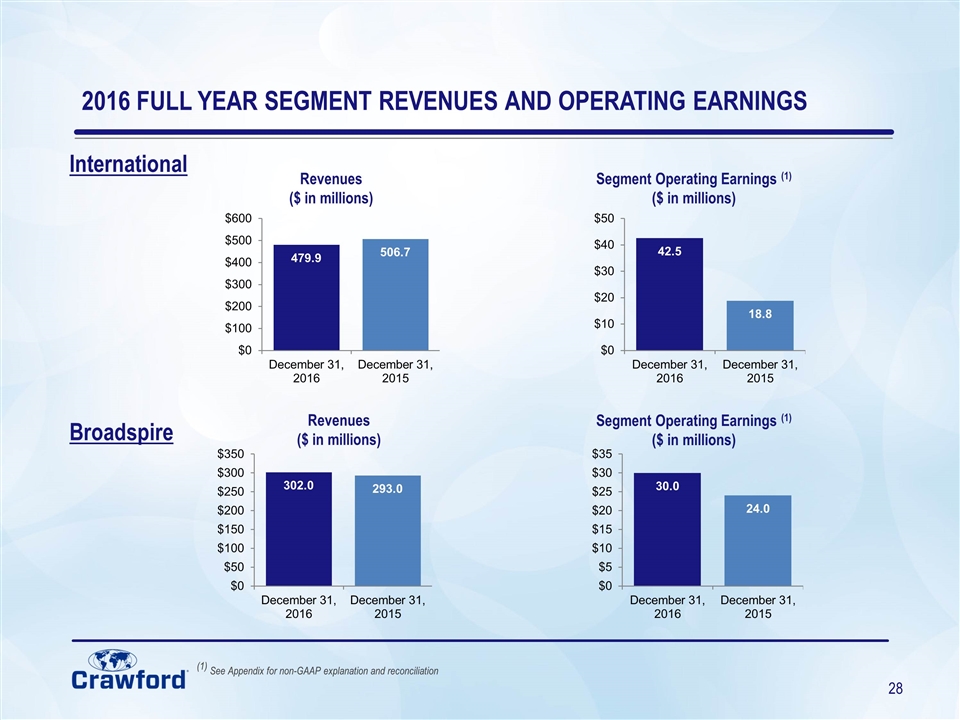

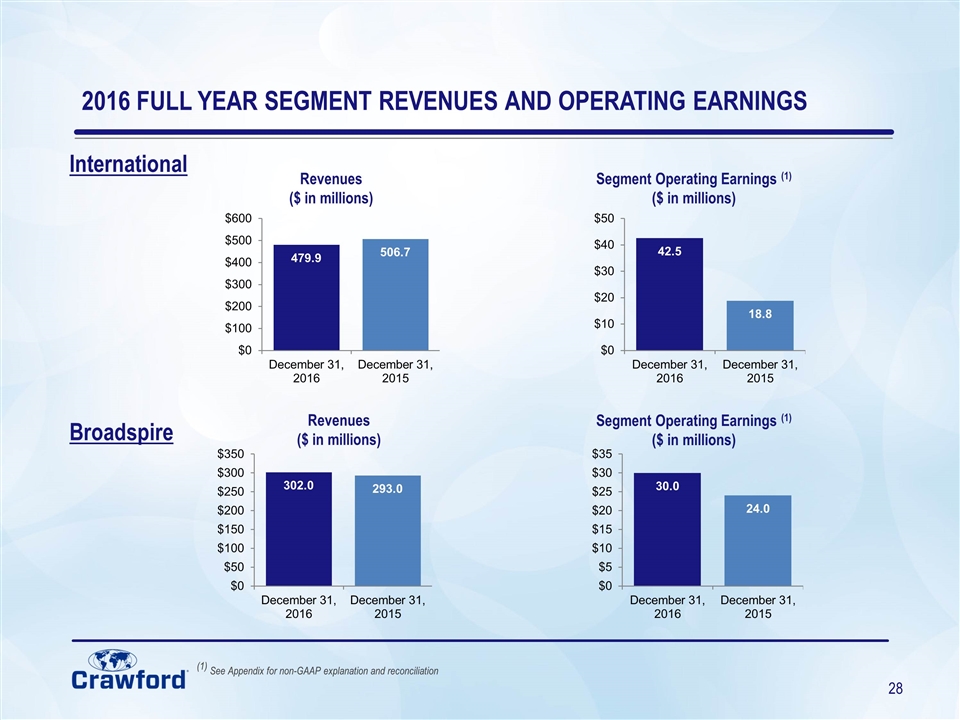

2016 FULL YEAR SEGMENT REVENUES AND OPERATING EARNINGS International (1) See Appendix for non-GAAP explanation and reconciliation Broadspire Revenues ($ in millions) Revenues ($ in millions) Segment Operating Earnings (1) ($ in millions) Segment Operating Earnings (1) ($ in millions)

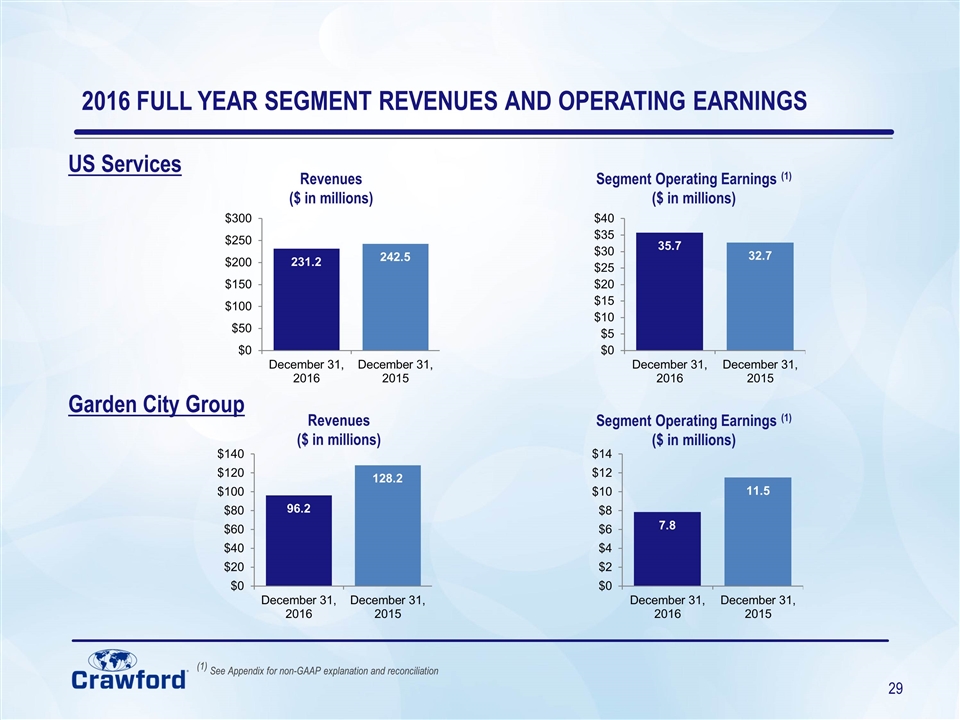

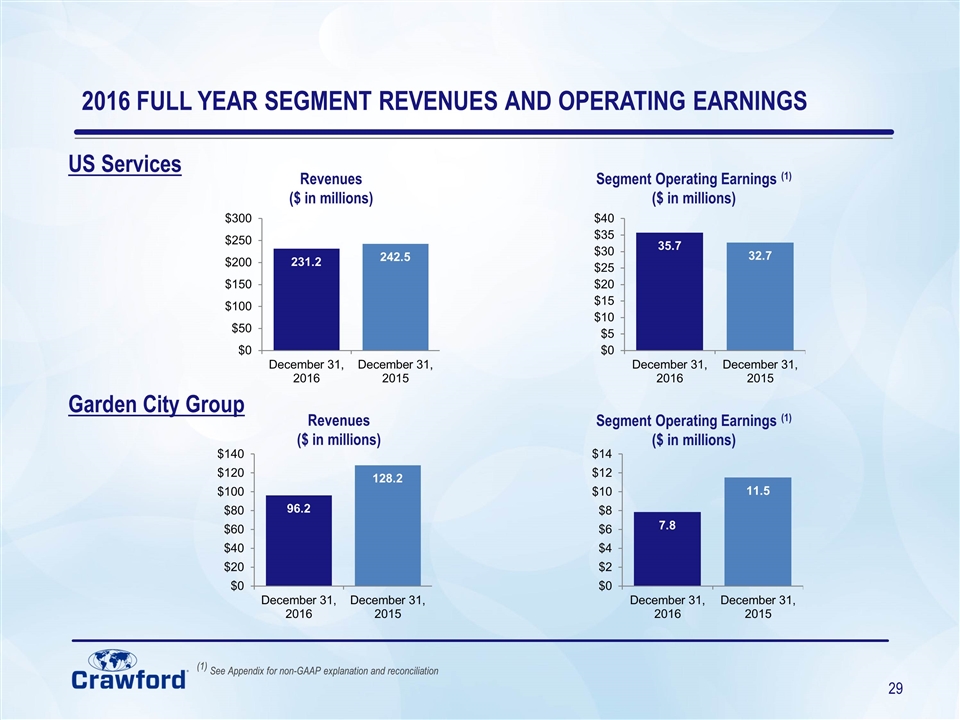

2016 FULL YEAR SEGMENT REVENUES AND OPERATING EARNINGS US Services (1) See Appendix for non-GAAP explanation and reconciliation Garden City Group Revenues ($ in millions) Revenues ($ in millions) Segment Operating Earnings (1) ($ in millions) Segment Operating Earnings (1) ($ in millions)

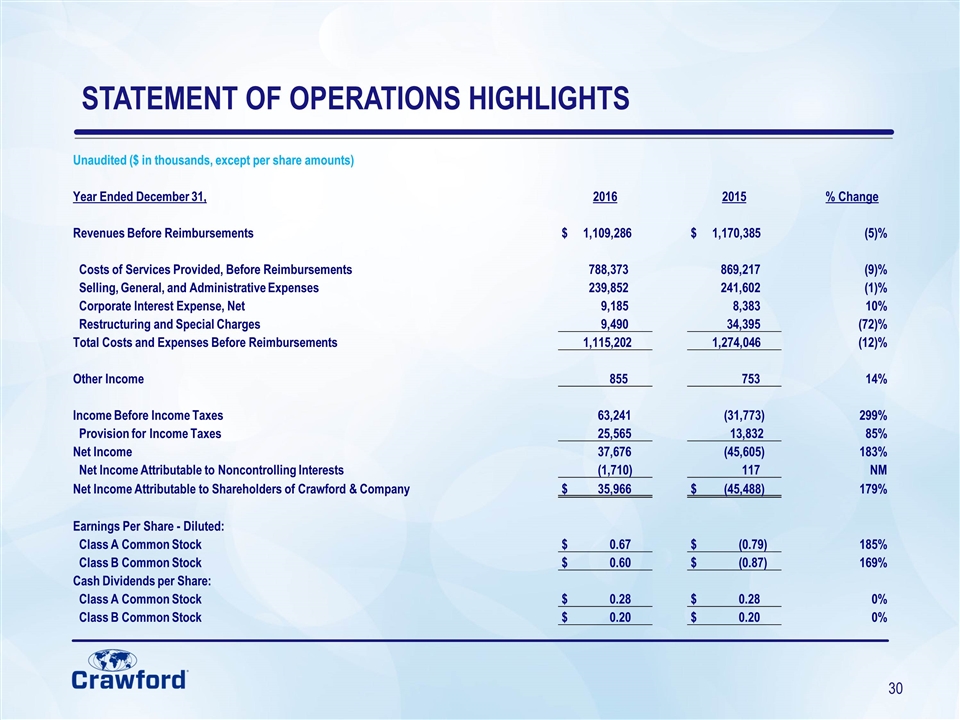

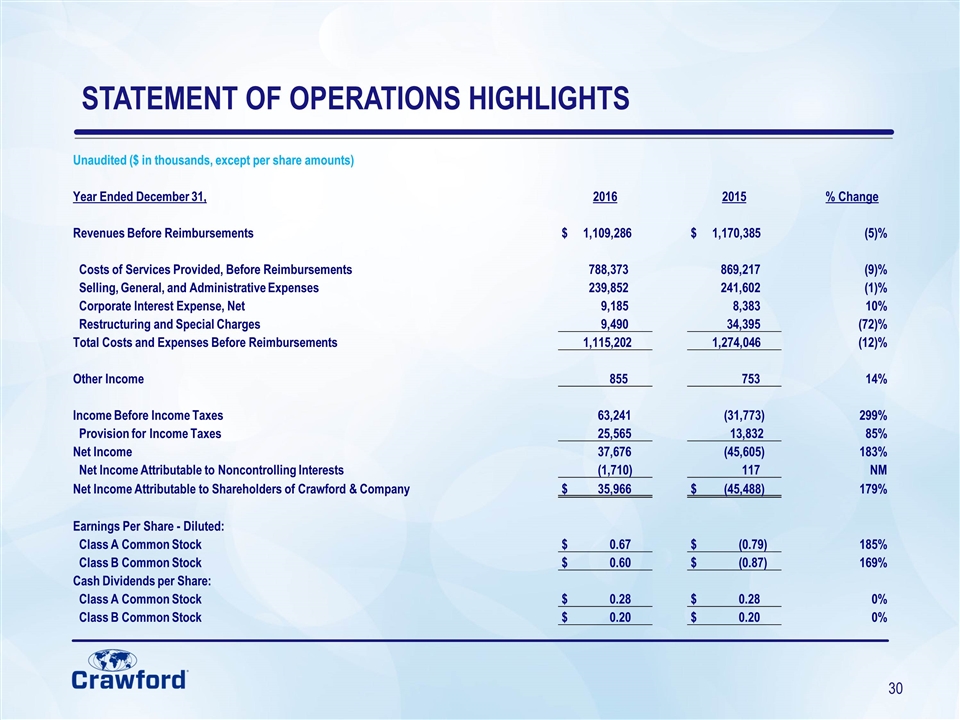

STATEMENT OF OPERATIONS HIGHLIGHTS Unaudited ($ in thousands, except per share amounts) Year Ended December 31, 2016 2015 % Change Revenues Before Reimbursements $ 1,109,286 $ 1,170,385 (5)% Costs of Services Provided, Before Reimbursements 788,373 869,217 (9)% Selling, General, and Administrative Expenses 239,852 241,602 (1)% Corporate Interest Expense, Net 9,185 8,383 10% Restructuring and Special Charges 9,490 34,395 (72)% Total Costs and Expenses Before Reimbursements 1,115,202 1,274,046 (12)% Other Income 855 753 14% Income Before Income Taxes 63,241 (31,773) 299% Provision for Income Taxes 25,565 13,832 85% Net Income 37,676 (45,605) 183% Net Income Attributable to Noncontrolling Interests (1,710) 117 NM Net Income Attributable to Shareholders of Crawford & Company $ 35,966 $ (45,488) 179% Earnings Per Share - Diluted: Class A Common Stock $ 0.67 $ (0.79) 185% Class B Common Stock $ 0.60 $ (0.87) 169% Cash Dividends per Share: Class A Common Stock $ 0.28 $ 0.28 0% Class B Common Stock $ 0.20 $ 0.20 0%

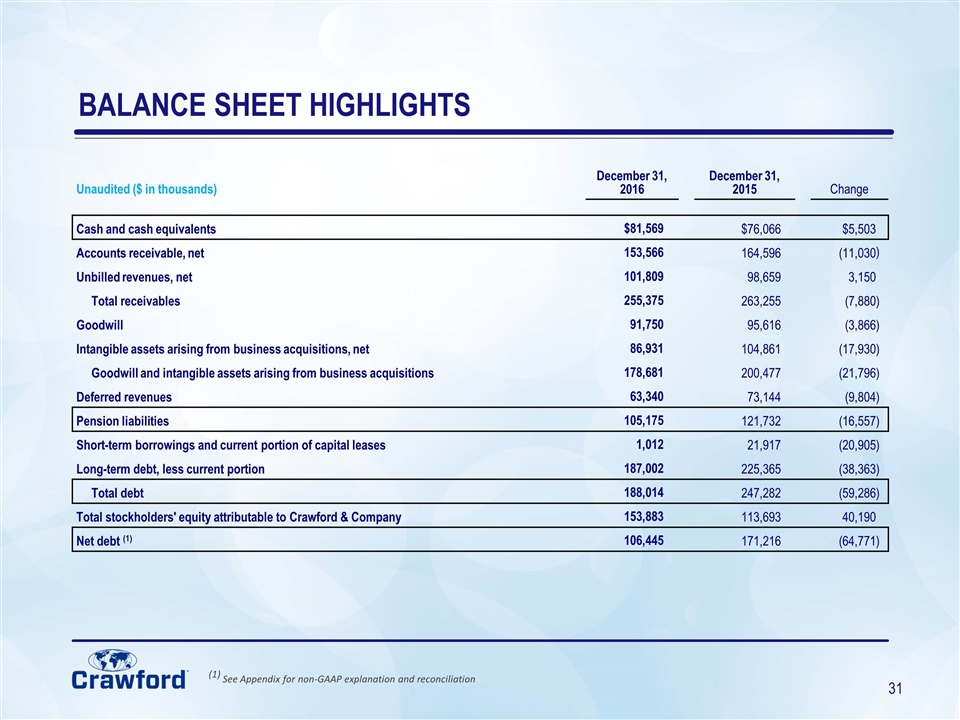

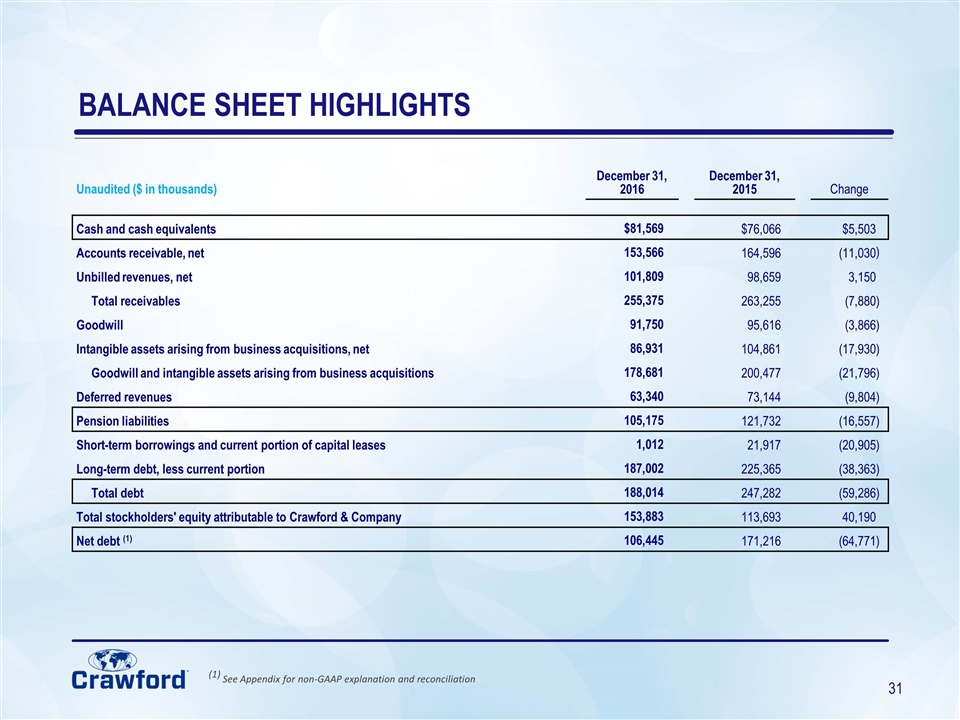

Unaudited ($ in thousands) December 31, 2016 December 31, 2015 Change Cash and cash equivalents $81,569 $76,066 $5,503 Accounts receivable, net 153,566 164,596 (11,030 ) Unbilled revenues, net 101,809 98,659 3,150 Total receivables 255,375 263,255 (7,880 ) Goodwill 91,750 95,616 (3,866 ) Intangible assets arising from business acquisitions, net 86,931 104,861 (17,930 ) Goodwill and intangible assets arising from business acquisitions 178,681 200,477 (21,796 ) Deferred revenues 63,340 73,144 (9,804 ) Pension liabilities 105,175 121,732 (16,557 ) Short-term borrowings and current portion of capital leases 1,012 21,917 (20,905 ) Long-term debt, less current portion 187,002 225,365 (38,363 ) Total debt 188,014 247,282 (59,286 ) Total stockholders' equity attributable to Crawford & Company 153,883 113,693 40,190 Net debt (1) 106,445 171,216 (64,771 ) (1) See Appendix for non-GAAP explanation and reconciliation BALANCE SHEET HIGHLIGHTS

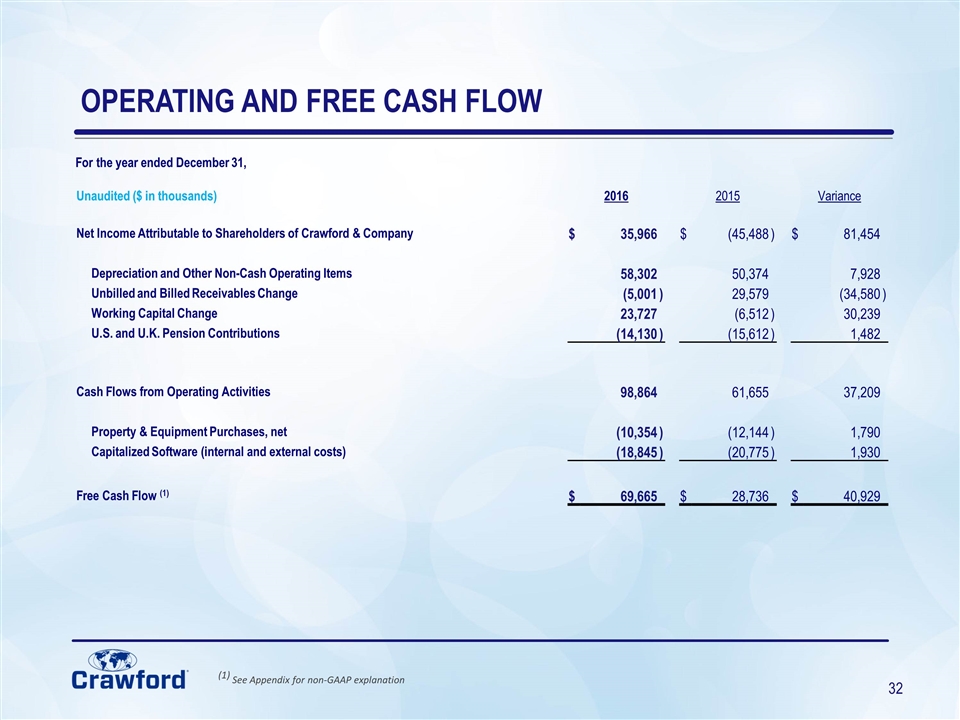

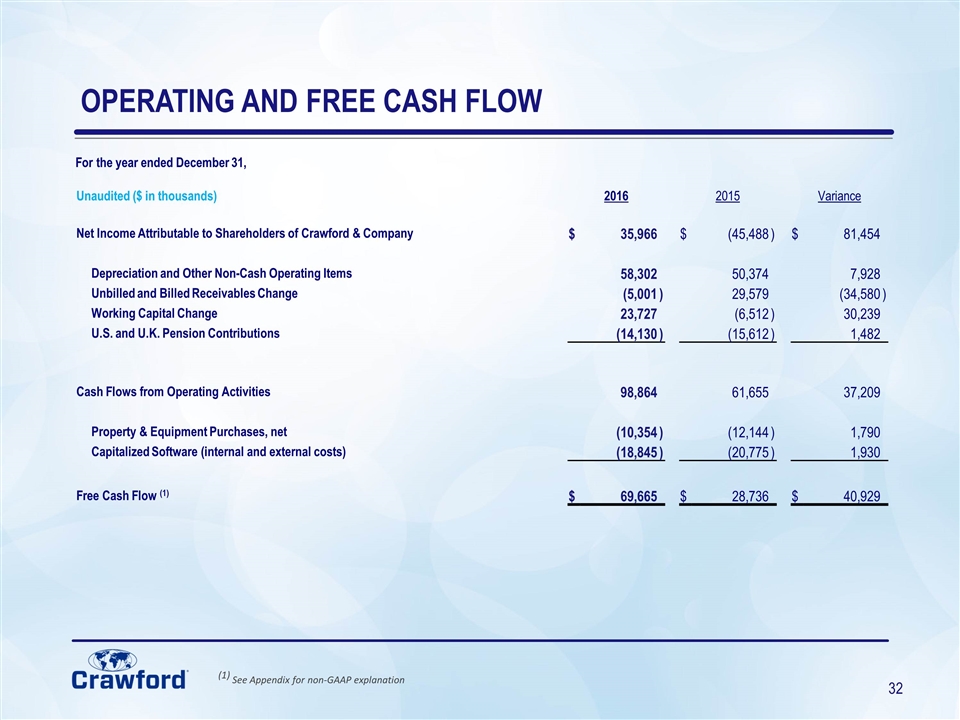

Unaudited ($ in thousands) 2016 2016 2015 2015 Variance Variance Net Income Attributable to Shareholders of Crawford & Company $ 35,966 $ (45,488 ) $ 81,454 Depreciation and Other Non-Cash Operating Items 58,302 50,374 7,928 Unbilled and Billed Receivables Change (5,001 ) 29,579 (34,580 ) Working Capital Change 23,727 (6,512 ) 30,239 U.S. and U.K. Pension Contributions (14,130 ) (15,612 ) 1,482 Cash Flows from Operating Activities 98,864 61,655 37,209 Property & Equipment Purchases, net (10,354 ) (12,144 ) 1,790 Capitalized Software (internal and external costs) (18,845 ) (20,775 ) 1,930 Free Cash Flow (1) $ 69,665 $ 28,736 $ 40,929 For the year ended December 31, OPERATING AND FREE CASH FLOW (1) See Appendix for non-GAAP explanation

Appendix B: Non-GAAP Financial Information

Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings (loss). As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 32. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill impairment charges, restructuring and special charges, income taxes, and net income or loss attributable to noncontrolling interests. APPENDIX: NON-GAAP FINANCIAL INFORMATION

Adjusted EBITDA Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income with adjustments for depreciation and amortization, interest expense-net, income tax provision, goodwill impairment charges, restructuring and special charges, and non-cash stock-based compensation expense. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. Non-GAAP Adjusted Net Income and Diluted Earnings per Share Excluded from non-GAAP adjusted net income and diluted earnings per share are goodwill impairment, restructuring and special charges, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations. APPENDIX: NON-GAAP FINANCIAL INFORMATION (continued)

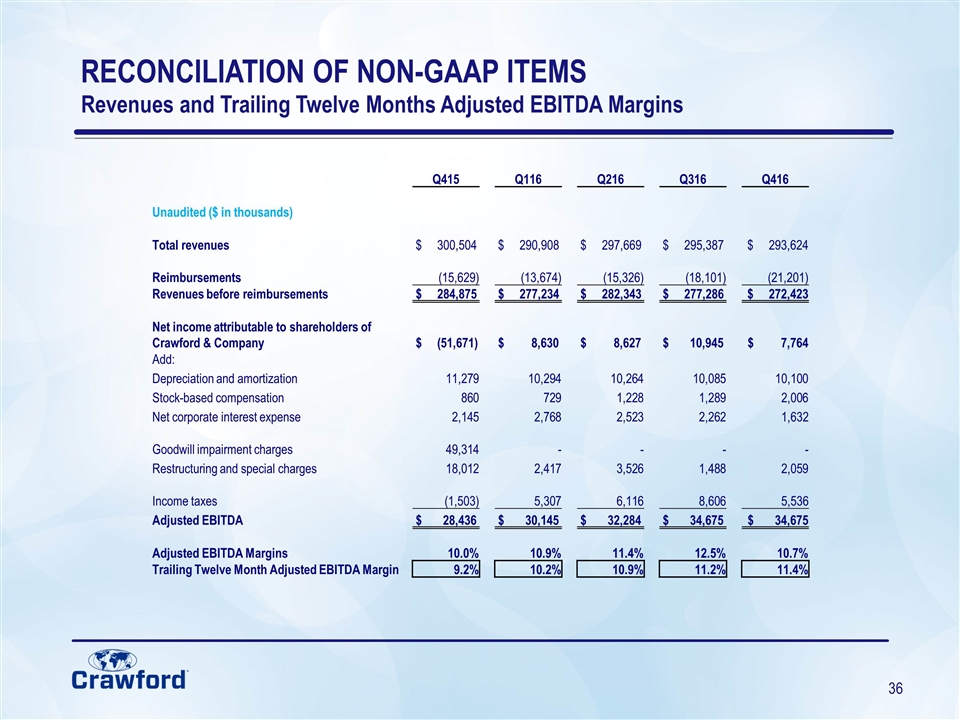

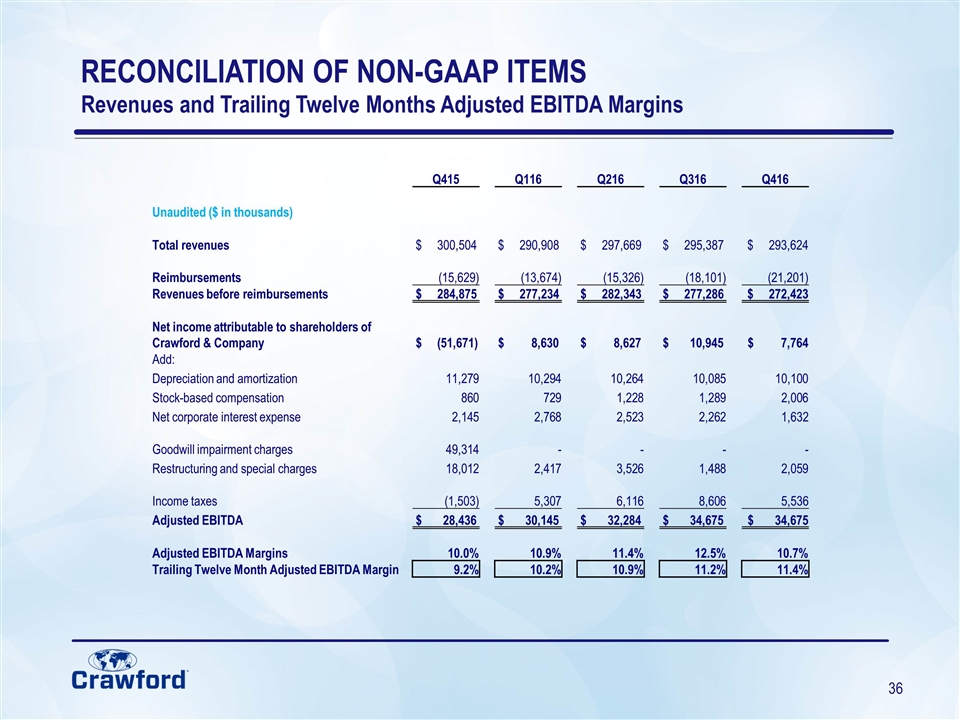

RECONCILIATION OF NON-GAAP ITEMS Revenues and Trailing Twelve Months Adjusted EBITDA Margins Q415 Q116 Q216 Q316 Q416 Unaudited ($ in thousands) Total revenues $ 300,504 $ 290,908 $ 297,669 $ 295,387 $ 293,624 Reimbursements (15,629) (13,674) (15,326) (18,101) (21,201) Revenues before reimbursements $ 284,875 $ 277,234 $ 282,343 $ 277,286 $ 272,423 Net income attributable to shareholders of Crawford & Company $ (51,671) $ 8,630 $ 8,627 $ 10,945 $ 7,764 Add: Depreciation and amortization 11,279 10,294 10,264 10,085 10,100 Stock-based compensation 860 729 1,228 1,289 2,006 Net corporate interest expense 2,145 2,768 2,523 2,262 1,632 Goodwill impairment charges 49,314 - - - - Restructuring and special charges 18,012 2,417 3,526 1,488 2,059 Income taxes (1,503) 5,307 6,116 8,606 5,536 Adjusted EBITDA $ 28,436 $ 30,145 $ 32,284 $ 34,675 $ 34,675 Adjusted EBITDA Margins 10.0% 10.9% 11.4% 12.5% 10.7% Trailing Twelve Month Adjusted EBITDA Margin 9.2% 10.2% 10.9% 11.2% 11.4%

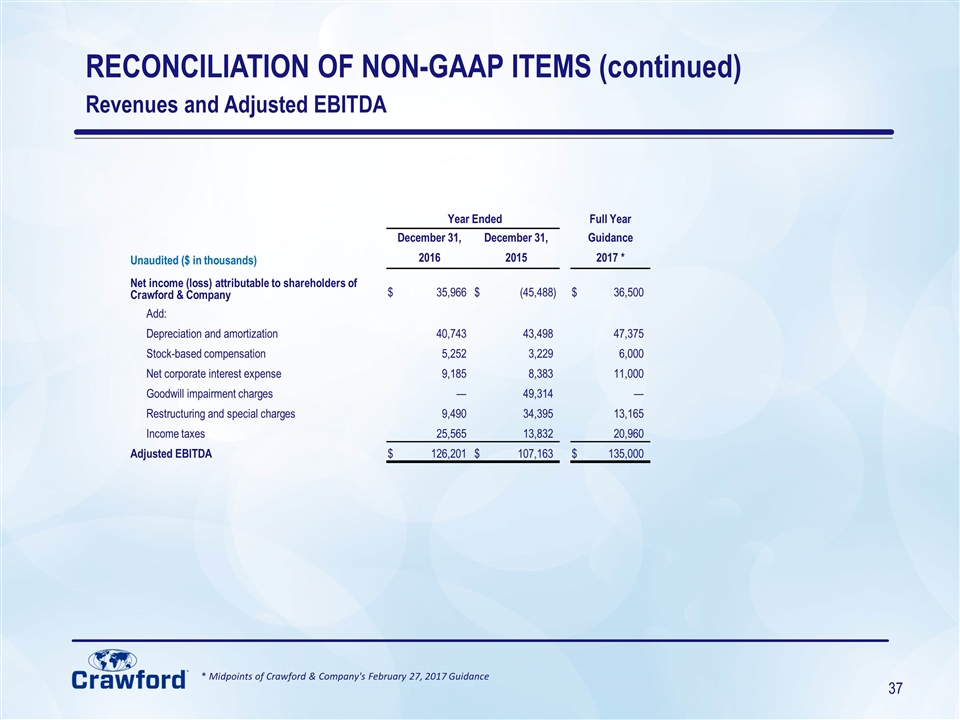

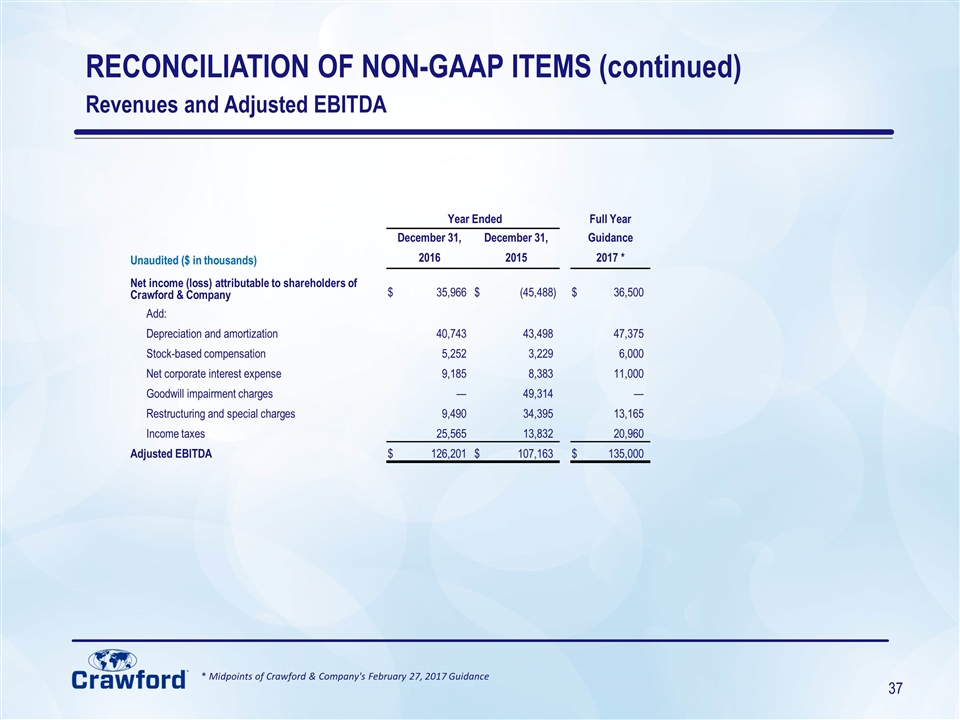

RECONCILIATION OF NON-GAAP ITEMS (continued) Revenues and Adjusted EBITDA Year Ended Year Ended Full Year Full Year December 31, December 31, December 31, December 31, Guidance Guidance Unaudited ($ in thousands) 2016 2016 2015 2015 2017 * 2017 * Net income (loss) attributable to shareholders of Crawford & Company $ 35,966 $ (45,488 ) $ 36,500 Add: Depreciation and amortization 40,743 43,498 47,375 Stock-based compensation 5,252 3,229 6,000 Net corporate interest expense 9,185 8,383 11,000 Goodwill impairment charges — 49,314 — Restructuring and special charges 9,490 34,395 13,165 Income taxes 25,565 13,832 20,960 Adjusted EBITDA $ 126,201 $ 107,163 $ 135,000 * Midpoints of Crawford & Company's February 27, 2017 Guidance

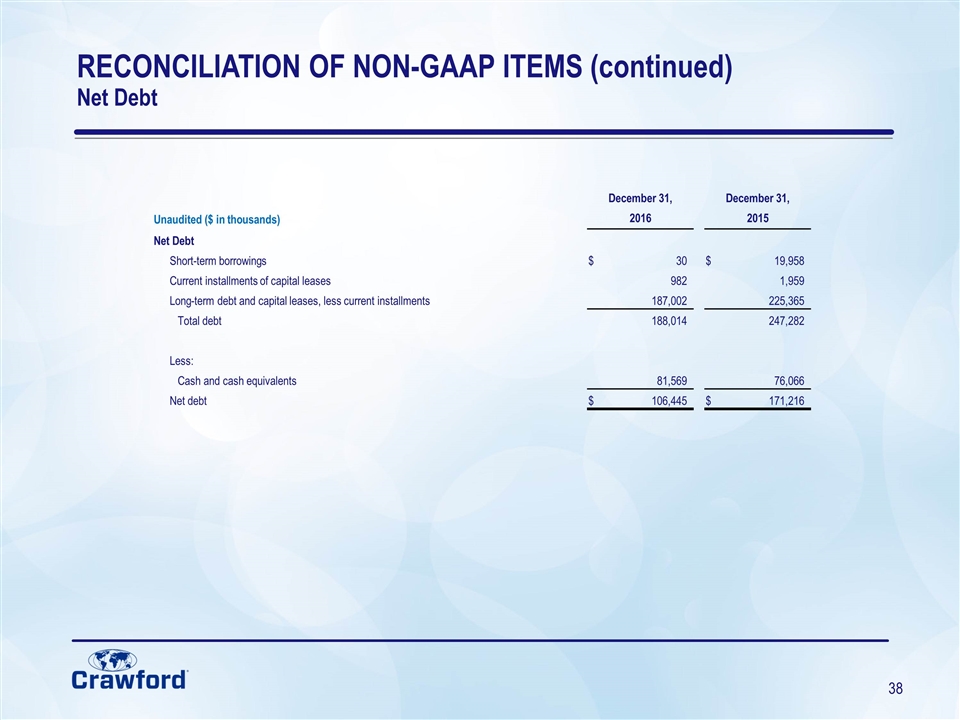

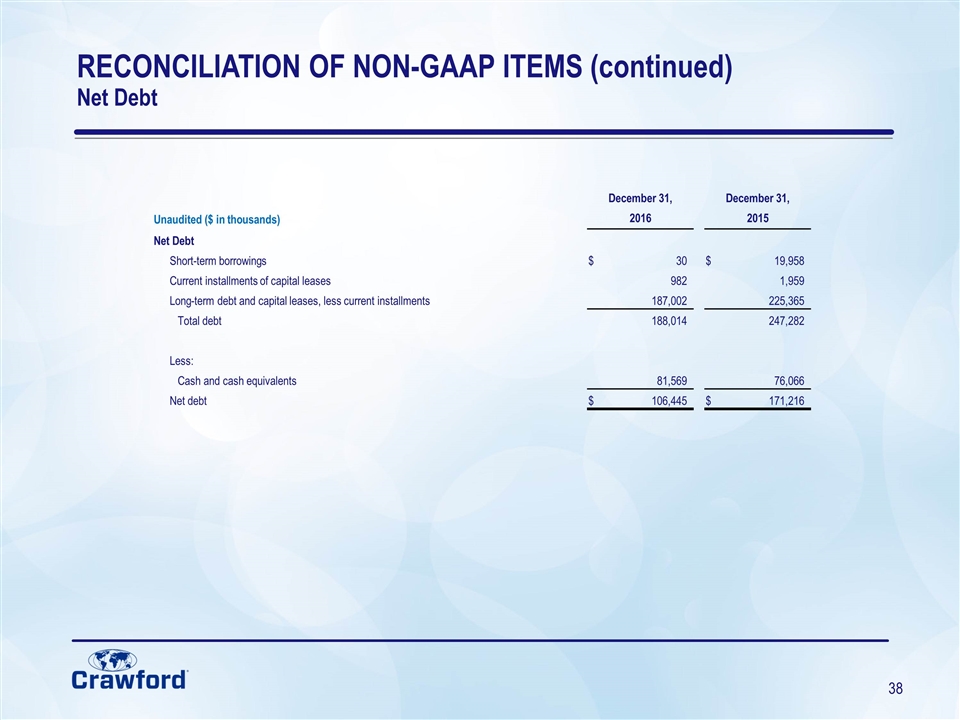

RECONCILIATION OF NON-GAAP ITEMS (continued) Net Debt December 31, December 31, December 31, December 31, Unaudited ($ in thousands) 2016 2016 2015 2015 Net Debt Short-term borrowings $ 30 $ 19,958 Current installments of capital leases 982 1,959 Long-term debt and capital leases, less current installments 187,002 225,365 Total debt 188,014 247,282 Less: Cash and cash equivalents 81,569 76,066 Net debt $ 106,445 $ 171,216

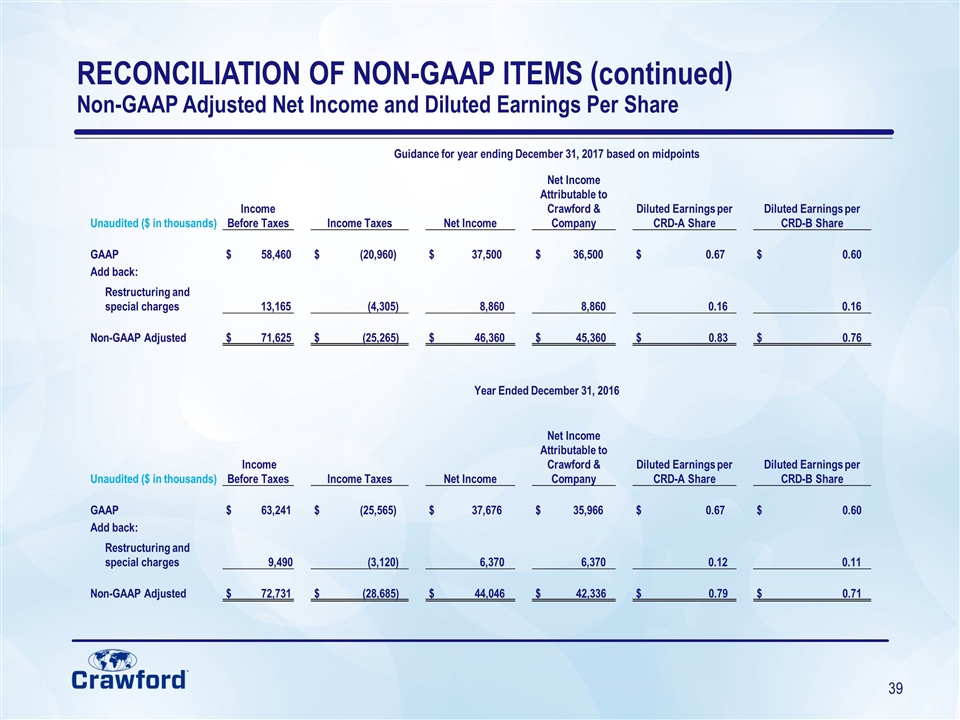

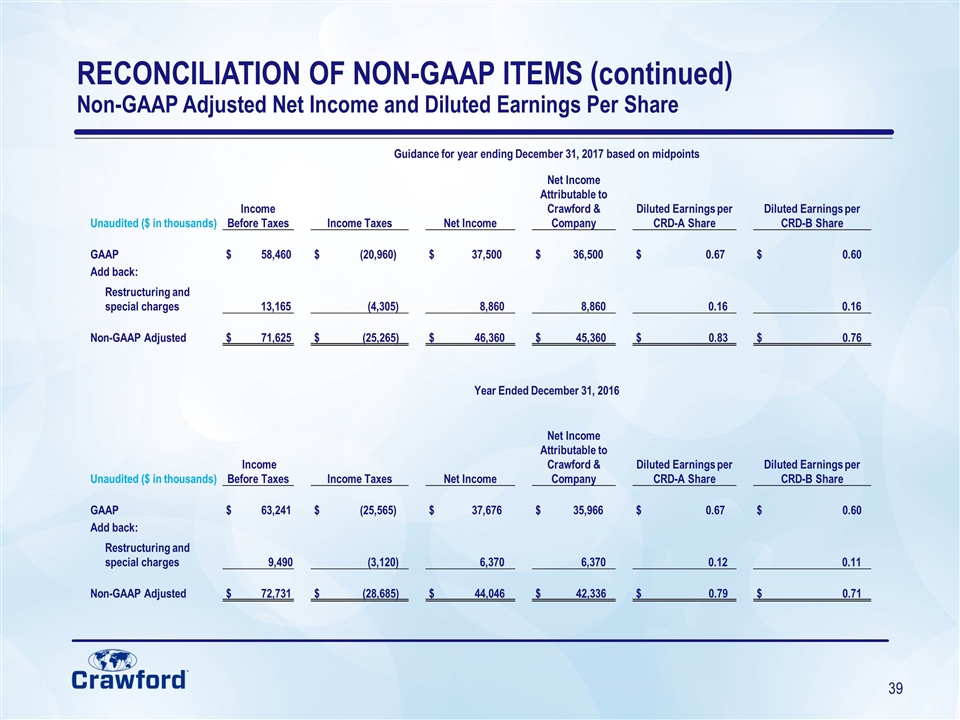

RECONCILIATION OF NON-GAAP ITEMS (continued) Non-GAAP Adjusted Net Income and Diluted Earnings Per Share Guidance for year ending December 31, 2017 based on midpoints Unaudited ($ in thousands) Income Before Taxes Income Taxes Net Income Net Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share Diluted Earnings per CRD-B Share GAAP $ 58,460 $ (20,960) $ 37,500 $ 36,500 $ 0.67 $ 0.60 Add back: Restructuring and special charges 13,165 (4,305) 8,860 8,860 0.16 0.16 Non-GAAP Adjusted $ 71,625 $ (25,265) $ 46,360 $ 45,360 $ 0.83 $ 0.76 Year Ended December 31, 2016 Unaudited ($ in thousands) Income Before Taxes Income Taxes Net Income Net Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share Diluted Earnings per CRD-B Share GAAP $ 63,241 $ (25,565) $ 37,676 $ 35,966 $ 0.67 $ 0.60 Add back: Restructuring and special charges 9,490 (3,120) 6,370 6,370 0.12 0.11 Non-GAAP Adjusted $ 72,731 $ (28,685) $ 44,046 $ 42,336 $ 0.79 $ 0.71