Crawford & Company Investor Presentation May 2019 ® Exhibit 99.1

Forward-Looking Statements and Additional Information Forward-Looking Statements This presentation contains forward-looking statements, including statements about the expected future financial condition, results of operations and earnings outlook of Crawford & Company. Statements, both qualitative and quantitative, that are not statements of historical fact may be "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. Forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from historical experience or Crawford & Company's present expectations. Accordingly, no one should place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Crawford & Company does not undertake to update forward-looking statements to reflect the impact of circumstances or events that may arise or not arise after the date the forward-looking statements are made. Results for any interim period presented herein are not necessarily indicative of results to be expected for the full year or for any other future period. For further information regarding Crawford & Company, and the risks and uncertainties involved in forward-looking statements, please read Crawford & Company's reports filed with the Securities and Exchange Commission and available at www.sec.gov or in the Investor Relations section of Crawford & Company's website at www.crawco.com. Crawford's business is dependent, to a significant extent, on case volumes. The Company cannot predict the future trend of case volumes for a number of reasons, including the fact that the frequency and severity of weather-related claims and the occurrence of natural and man-made disasters, which are a significant source of cases and revenue for the Company, are generally not subject to accurate forecasting. Revenues Before Reimbursements ("Revenues") Revenues Before Reimbursements are referred to as "Revenues" in both consolidated and segment charts, bullets and tables throughout this presentation. Segment and Consolidated Operating Earnings Under the Financial Accounting Standards Board's Accounting Standards Codification ("ASC") Topic 280, "Segment Reporting," the Company has defined segment operating earnings as the primary measure used by the Company to evaluate the results of each of its three operating segments. Segment operating earnings represent segment earnings, including the direct and indirect costs of certain administrative functions required to operate our business, but excludes unallocated corporate and shared costs and credits, net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, income taxes, and net income or loss attributable to noncontrolling interests and redeemable noncontrolling interests. Earnings Per Share The Company's two classes of stock are substantially identical, except with respect to voting rights and the Company's ability to pay greater cash dividends on the non-voting Class A Common Stock than on the voting Class B Common Stock, subject to certain limitations. In addition, with respect to mergers or similar transactions, holders of Class A Common Stock must receive the same type and amount of consideration as holders of Class B Common Stock, unless different consideration is approved by the holders of 75% of the Class A Common Stock, voting as a class. In certain periods, the Company has paid a higher dividend on CRD-A than on CRD-B. This may result in a different earnings per share ("EPS") for each class of stock due to the two-class method of computing EPS as required by ASC Topic 260 - "Earnings Per Share". The two-class method is an earnings allocation method under which EPS is calculated for each class of common stock considering both dividends declared and participation rights in undistributed earnings as if all such earnings had been distributed during the period. Non-GAAP Financial Information For additional information about certain non-GAAP financial information presented herein, see the Appendix following this presentation. Total Compensation ”Total Compensation" includes compensation, payroll taxes, and benefits provided to the employees of the Company, as well as payments to outsourced service providers that augment our staff. The difference between “Total Compensation” and the total of “Direct Compensation, Fringe Benefits & Non-Employee Labor” of our segments in our “Management’s Discussion and Analysis” in our Form 10-Q and Form 10-K represents the compensation, payroll taxes and benefits and payment to outsourced service providers that augment our staff for certain administrative functions performed by central headquarters staff that are included in “Expenses Other Than Direct Compensation, Fringe Benefits & Non-Employee Labor” of our segments.

Crawford & Company Crawford Claims Solutions (P&C adjusting solutions) Crawford TPA Solutions (Broadspire) Crawford Specialty Solutions (Global Technical Services & Contractor Connection) The world’s largest publicly listed independent provider of global outsourced claims management solutions 1.7 Million Claims handled worldwide $14 Billion Claims payments annually CRD-A & CRD-B Listed on NYSE 9,000 Total employees Organized across global service lines:

Crawford & Company Loss resolution for carriers, brokers and corporates Our Mission Restoring and enhancing lives, businesses and communities. Our Vision To be the leading provider and most trusted source for expert assistance, serving those who insure and self-insure the risks of businesses and communities anywhere in the world.

We bring together thoughtful experts from around the world to offer comprehensive, intelligent outsourced solutions to our customers Loss Adjusting Third Party Administration Managed Repair Medical Management On-Demand Services Catastrophe Response

Crawford & Company Value Proposition and Value Delivery System Customer-focused solutions driven by data and executed by experts globally to mitigate risk for carriers, brokers and corporates Value Proposition High-performing, caring and capable employees globally Flexible workforce with vast experience, delivering expertise and data-driven innovations Technology-led, end-to-end outsourced claims management solutions Service breadth and depth, backed by financial strength Global outsourced solutions for global risk bearers Value Delivery System

End-to-End Outsourced Solutions Multi-channel FNOL Pre & Post Loss Inspections Liability, Auto, WC & Disability Claims Property Claims Desk Adjusting CAT, Property & Auto Field Adjusting Business Interruption & Forensic Accounting Managed Repair ANALYTICS & REPORTING

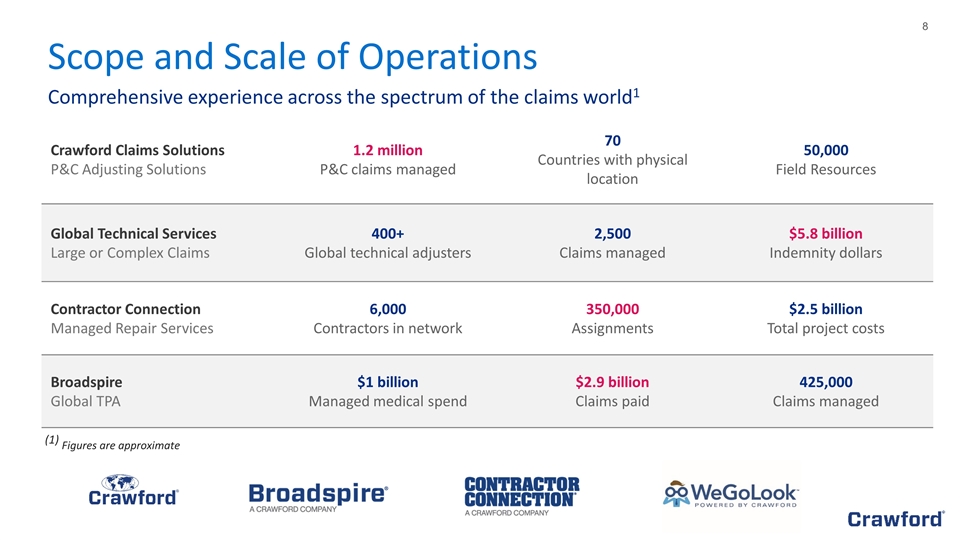

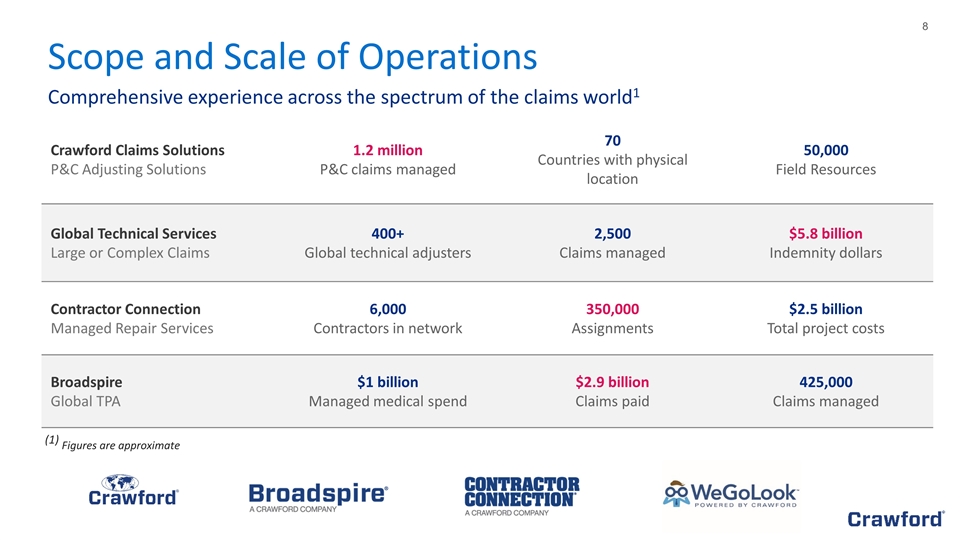

Scope and Scale of Operations Comprehensive experience across the spectrum of the claims world1 Crawford Claims Solutions P&C Adjusting Solutions 1.2 million P&C claims managed 70 Countries with physical location 50,000 Field Resources Global Technical Services Large or Complex Claims 400+ Global technical adjusters 2,500 Claims managed $5.8 billion Indemnity dollars Contractor Connection Managed Repair Services 6,000 Contractors in network 350,000 Assignments $2.5 billion Total project costs Broadspire Global TPA $1 billion Managed medical spend $2.9 billion Claims paid 425,000 Claims managed (1) Figures are approximate

Crawford—Attractive Business Model Experienced Management Team Aligned with Shareholders Global Product and Geographic Diversification Recurring Fee For Service Revenue Model Strong Cash Flow Generation Technology Enabled BPO Platform Blue Chip Global Client Base with Long-Term Relationships Solid Balance Sheet and Low Debt Profile Healthy Dividend Yield Celebrated 50 Years as a Public Company

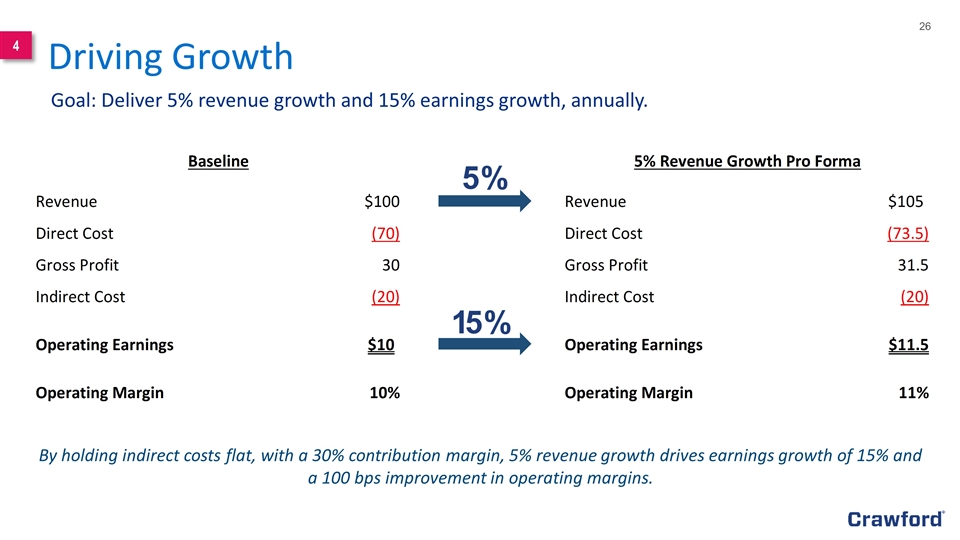

4 Management’s primary goal is to translate innovation and investment spending into sustained 5% revenue growth and 15% earnings growth, annually Deliver 5% Revenue and 15% Earnings Growth, Annually Goal: Deliver Sustained Revenue and Earnings Growth 5 Strong Balance Sheet & Cash Flow Characteristics Strong cash generation used to de-lever. Total Company debt at the lowest level in three years, at 2018 year-end 1 Experienced Management Team Crawford’s management team has extensive knowledge and experience in creating value at large service organizations, and brings best-in-class leadership skills to bear for all of Crawford’s stakeholders 6 Favorable Capital Return Profile Crawford continues to return capital to shareholders via both quarterly cash dividends and ongoing share repurchases Investment Thesis 3 Crawford is investing in our people, technology and new product development to solve the challenges of Carriers, Brokers and Corporates which will lead to accelerated revenue and earnings growth Investing to Drive Innovation & Accelerate Growth 2 The P&C Industry Is Experiencing Rapid Change As the severity and frequency of global P&C claims rise, carriers are increasingly turning to third party adjusters as a cost effective solution as compared to large in-house adjusting teams

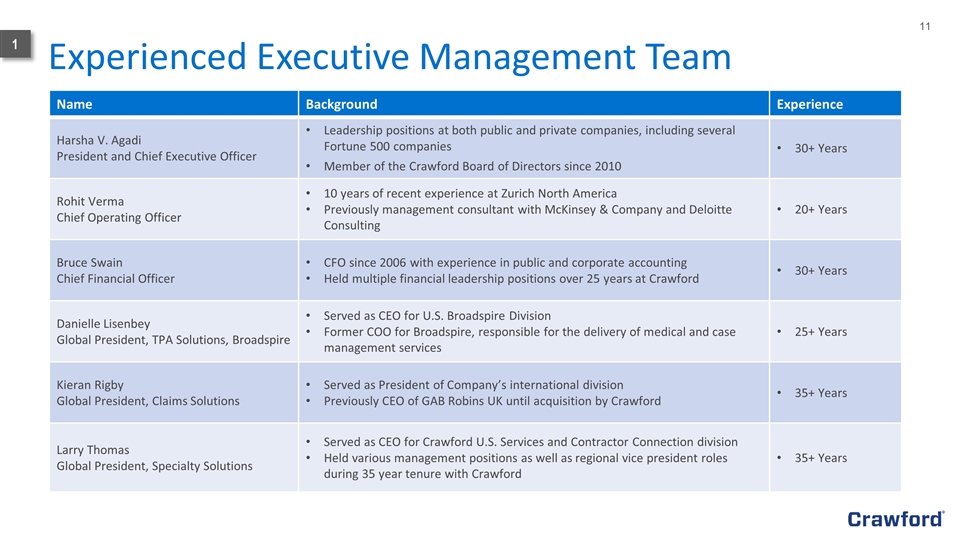

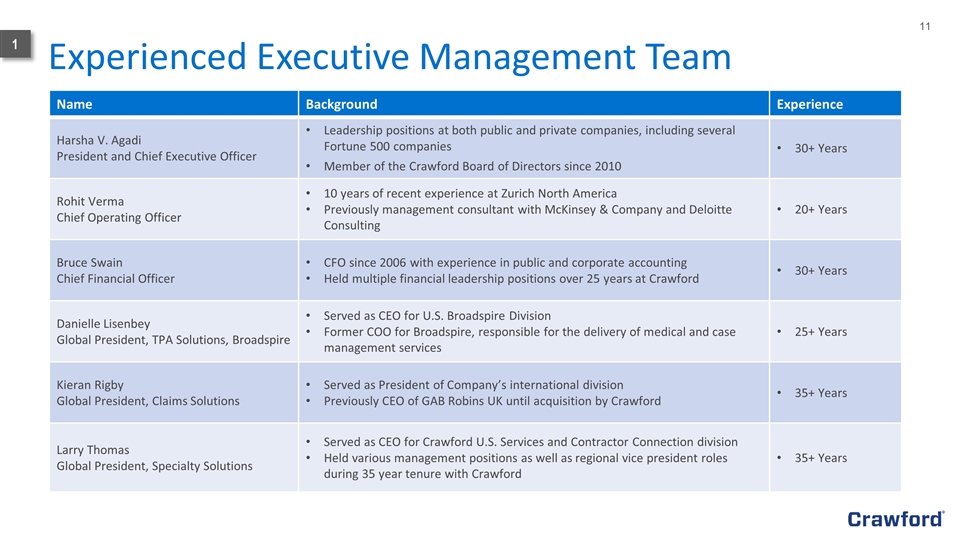

Experienced Executive Management Team 1 Name Background Experience Harsha V. Agadi President and Chief Executive Officer Leadership positions at both public and private companies, including several Fortune 500 companies Member of the Crawford Board of Directors since 2010 30+ Years Rohit Verma Chief Operating Officer 10 years of recent experience at Zurich North America Previously management consultant with McKinsey & Company and Deloitte Consulting 20+ Years Bruce Swain Chief Financial Officer CFO since 2006 with experience in public and corporate accounting Held multiple financial leadership positions over 25 years at Crawford 30+ Years Danielle Lisenbey Global President, TPA Solutions, Broadspire Served as CEO for U.S. Broadspire Division Former COO for Broadspire, responsible for the delivery of medical and case management services 25+ Years Kieran Rigby Global President, Claims Solutions Served as President of Company’s international division Previously CEO of GAB Robins UK until acquisition by Crawford 35+ Years Larry Thomas Global President, Specialty Solutions Served as CEO for Crawford U.S. Services and Contractor Connection division Held various management positions as well as regional vice president roles during 35 year tenure with Crawford 35+ Years

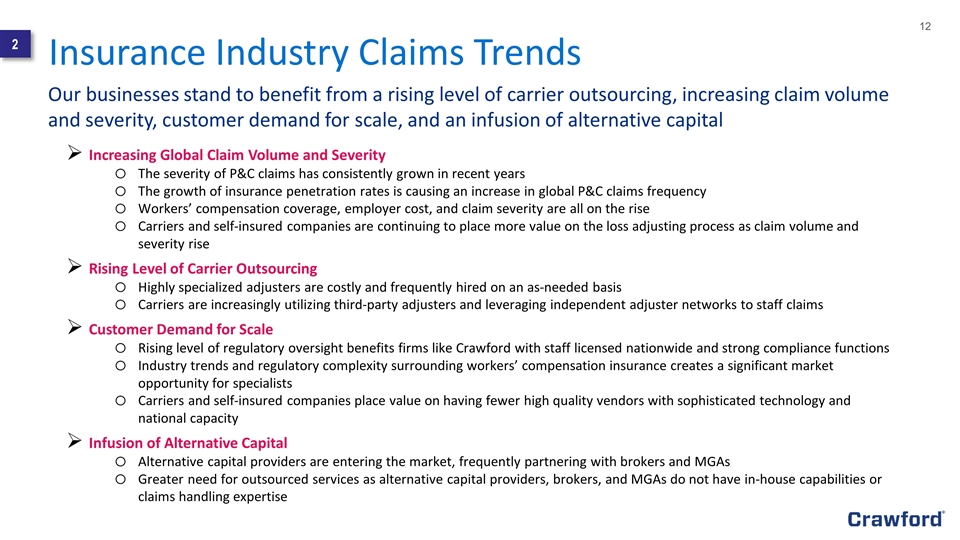

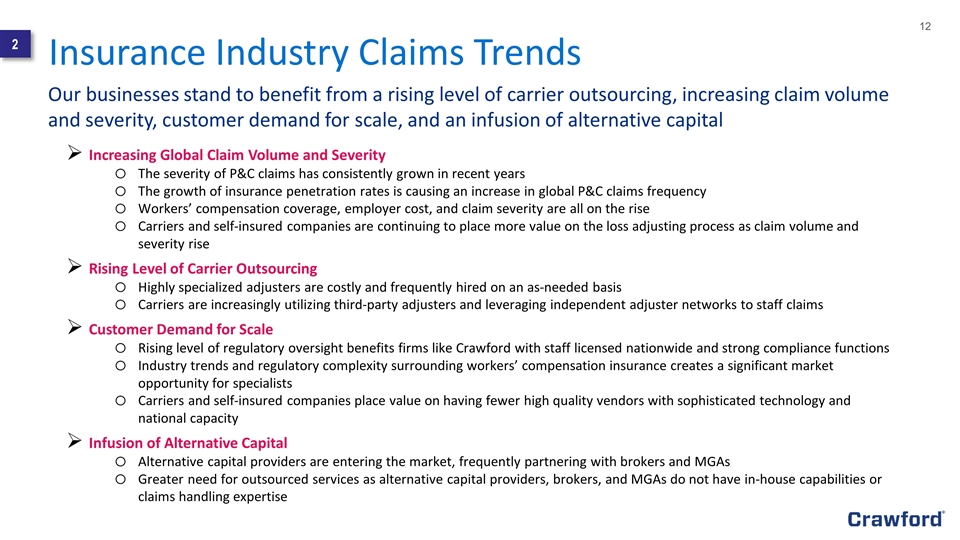

Insurance Industry Claims Trends Our businesses stand to benefit from a rising level of carrier outsourcing, increasing claim volume and severity, customer demand for scale, and an infusion of alternative capital Increasing Global Claim Volume and Severity The severity of P&C claims has consistently grown in recent years The growth of insurance penetration rates is causing an increase in global P&C claims frequency Workers’ compensation coverage, employer cost, and claim severity are all on the rise Carriers and self-insured companies are continuing to place more value on the loss adjusting process as claim volume and severity rise Rising Level of Carrier Outsourcing Highly specialized adjusters are costly and frequently hired on an as-needed basis Carriers are increasingly utilizing third-party adjusters and leveraging independent adjuster networks to staff claims Customer Demand for Scale Rising level of regulatory oversight benefits firms like Crawford with staff licensed nationwide and strong compliance functions Industry trends and regulatory complexity surrounding workers’ compensation insurance creates a significant market opportunity for specialists Carriers and self-insured companies place value on having fewer high quality vendors with sophisticated technology and national capacity Infusion of Alternative Capital Alternative capital providers are entering the market, frequently partnering with brokers and MGAs Greater need for outsourced services as alternative capital providers, brokers, and MGAs do not have in-house capabilities or claims handling expertise 2

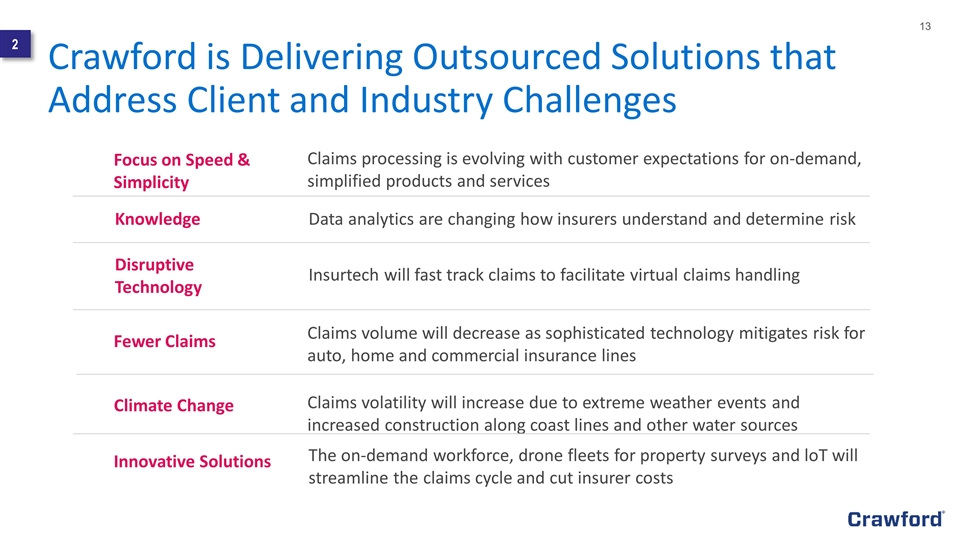

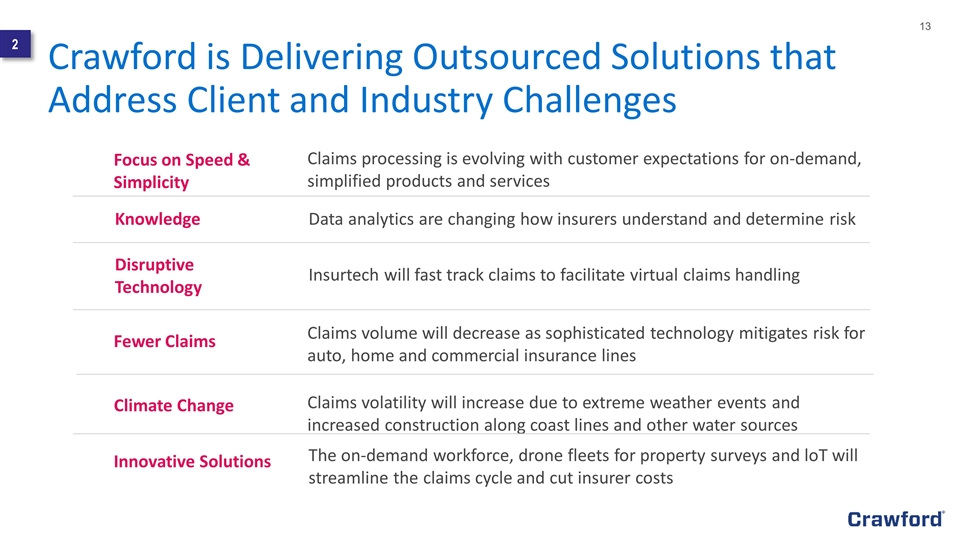

Crawford is Delivering Outsourced Solutions that Address Client and Industry Challenges Knowledge Insurtech will fast track claims to facilitate virtual claims handling Claims volatility will increase due to extreme weather events and increased construction along coast lines and other water sources Fewer Claims Focus on Speed & Simplicity Disruptive Technology Climate Change Claims processing is evolving with customer expectations for on-demand, simplified products and services Data analytics are changing how insurers understand and determine risk Claims volume will decrease as sophisticated technology mitigates risk for auto, home and commercial insurance lines The on-demand workforce, drone fleets for property surveys and loT will streamline the claims cycle and cut insurer costs Innovative Solutions 2

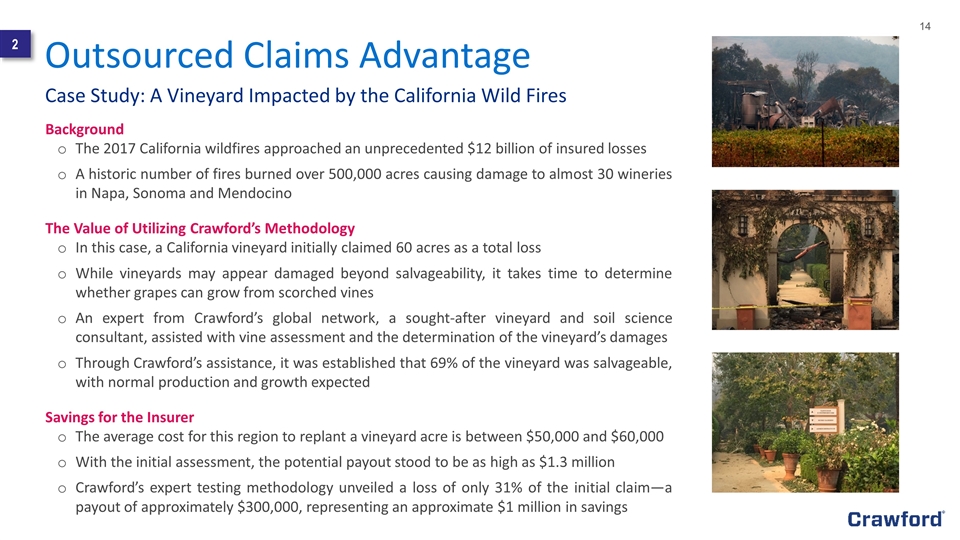

Outsourced Claims Advantage Case Study: A Vineyard Impacted by the California Wild Fires Background The 2017 California wildfires approached an unprecedented $12 billion of insured losses A historic number of fires burned over 500,000 acres causing damage to almost 30 wineries in Napa, Sonoma and Mendocino The Value of Utilizing Crawford’s Methodology In this case, a California vineyard initially claimed 60 acres as a total loss While vineyards may appear damaged beyond salvageability, it takes time to determine whether grapes can grow from scorched vines An expert from Crawford’s global network, a sought-after vineyard and soil science consultant, assisted with vine assessment and the determination of the vineyard’s damages Through Crawford’s assistance, it was established that 69% of the vineyard was salvageable, with normal production and growth expected Savings for the Insurer The average cost for this region to replant a vineyard acre is between $50,000 and $60,000 With the initial assessment, the potential payout stood to be as high as $1.3 million Crawford’s expert testing methodology unveiled a loss of only 31% of the initial claim—a payout of approximately $300,000, representing an approximate $1 million in savings 2

Terminix Terminix is one of the largest pest control companies in the world, operating in 47 states and 22 countries With an internal third-party liability model, they faced two challenges: The significant time commitment required for local branch managers to inspect alleged termite damage Managing third-party contractors who perform necessary repairs The Value of Making the Transition to an Outsourced TPA Model Integrating our field, TPA and property repair network capabilities, we delivered a TPA model for Terminix which achieved remarkable success, demonstrated by: Reduced time needed for claim resolution A decreased cost per claim and litigation rate Terminix: A case study in the value of transitioning to an outsourced TPA model TPA Outsourcing 2

Background 99 Cents Only Stores is a deep-discount retailer with more than 350 stores in four states As a retailer with over 17,000 employees, 99 Cents Only Stores struggled to manage the large number of employee injuries caused by overexertion, repetitive strain, slips and falls, and cuts or breaks Utilizing Real World Experience Backed by Data and Analytics Crawford’s Broadspire brand partnered with broker Beecher Carlson, implementing a series of programs that helped: Mitigate the frequency and severity of claims Reduce claim duration Lower costs 99 Cents Only Stores not only leveraged Broadspire’s retail claims expertise, but their capabilities in medical management, enabling them to treat many of the injuries before they became open claims Improved Efficiency and Cost Reduction Broadspire partnered with broker Beecher Carlson to revamp and enhance the retailer’s safety and workers compensation programs resulting in: Total cost reduction of over $18 million A reduction of 52% in lost time days and 44% drop in total incurred since 2016 46% drop in the number of open claims 42% drop in outstanding reserves 99 Cents Only Stores 2

Belmont (UK) Limited Leveraging Crawford’s integrated solutions Background Belmond La Samanna and Belmond Cap Juluca were left devastated by the powerful hurricanes of 2017 Strong winds and sea surges caused significant property damage and interrupted business As major employers in the local community, the resorts needed to be restored as soon as possible Identifying and Implementing a Solution With a deep expertise in helping the hospitality industry and handling large-scale complex claims following weather-related catastrophes, Crawford Global Technical Services™ introduced the specialist skills of Crawford Forensic Accounting Services and WeGoLook® During a time when communication was difficult, the drone capabilities of WeGoLook® captured footage of the resort properties the day after they were struck by the hurricanes Crawford’s findings made Belmond immediately aware of the scale of the losses and the resources needed to restore the properties Return to Business Crawford’s Global Technical Services adjuster managed all the parties involved to provide support and guidance throughout the claim With Crawford’s support, Belmond received a swift settlement of insurance claims Both luxury resorts were able to re-open in 2018 2

Investments in Market Leading Technology At Crawford, we’re not just embracing change, we’re leading it. Some of the significant investments we have made to develop solutions to meet clients’ needs and drive growth: Drone capabilities - WeGoLook has a network of over 2,000 licensed drone operators Intuitive Looker interface - Data collection integrated with Crawford claims systems Internet of Things (loT) - Working with partners on leak detection sensors that will significantly reduce claim costs Virtual Reality (VR) - Supports our clients’ pre-and post-loss needs for accurate, detailed image capture RENOVO - Crawford’s new U.S. catastrophe adjuster portal Robotic Process Automation (RPA) - Driving efficiency and quality in the claims process Variance Analytics - Developed tools to understand risk variance within metrics Job Track tool - Interactive web accessed tool providing unprecedented transparency into the property repair process 3

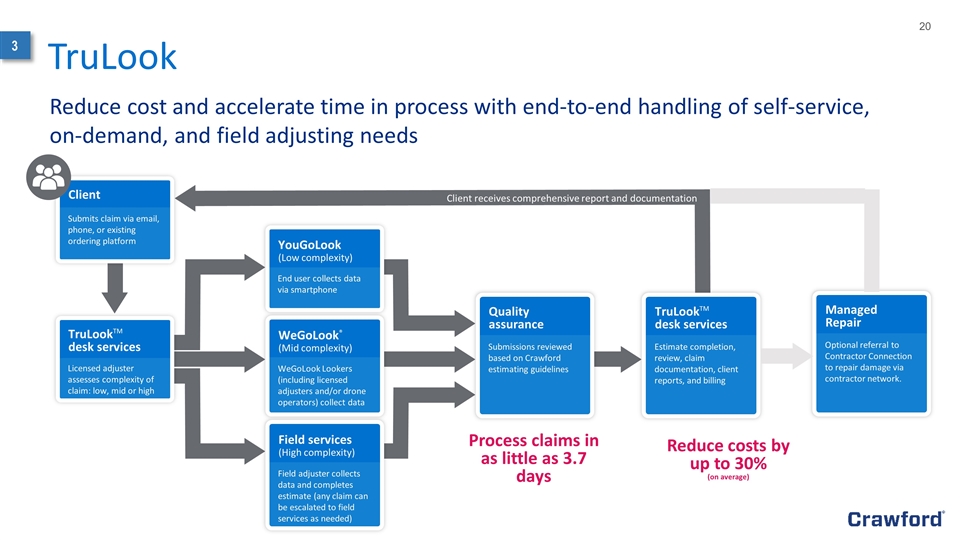

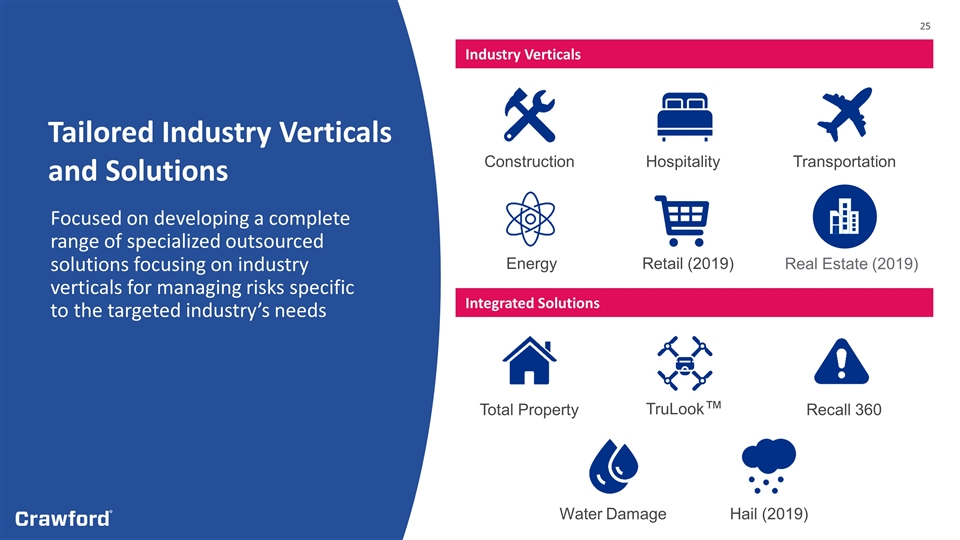

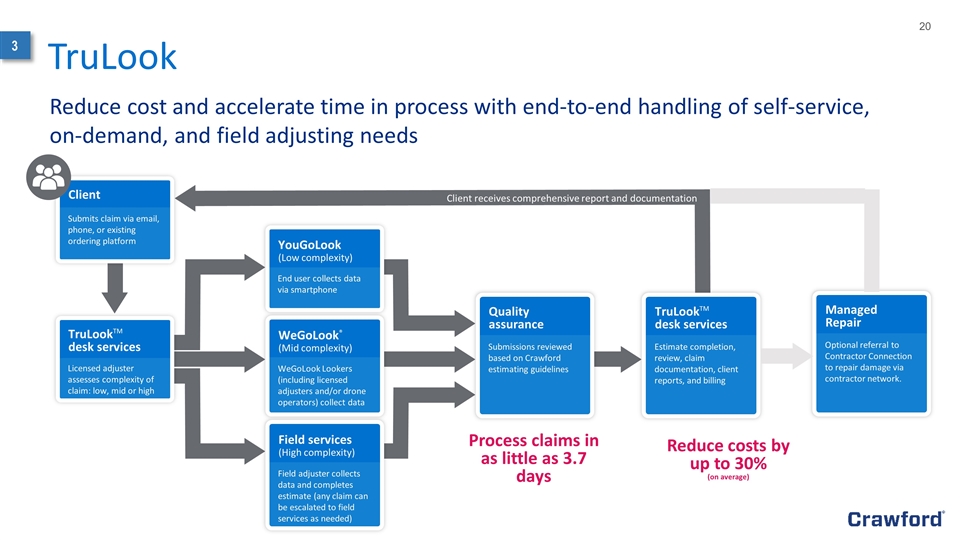

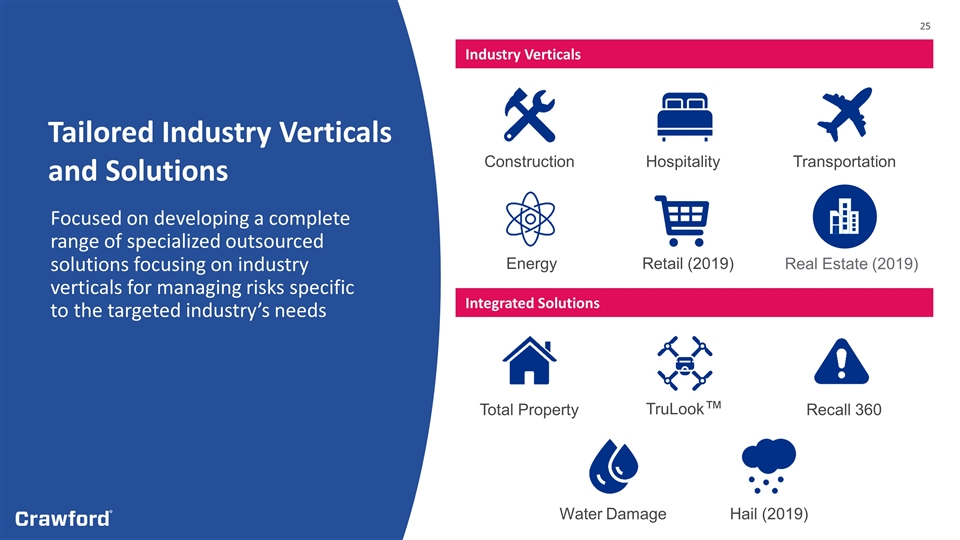

Innovating to Accelerate Growth, Improve Client Experience and Reduce Costs TruLook Claims triage process leverages self-service app, WeGoLook Lookers and traditional field adjusters to reduce costs and improve cycle times. Industry Solutions Focus on developing a complete range of specialized solutions designed to manage the specific risks of the targeted industry verticals, including construction, hospitality, retail, real estate and transportation. Investing in Technology Technology is driving the management of risk in new directions and Crawford has chosen to be a change leader which requires investing in technology focused on driving innovation. Contractor Connection The industry’s largest contractor managed repair network of general and specialty contractors providing service in the U.S., U.K., Canada, Australia, and Germany. 3

TruLook Client receives comprehensive report and documentation Client Submits claim via email, phone, or existing ordering platform TruLookTM desk services Licensed adjuster assesses complexity of claim: low, mid or high YouGoLook (Low complexity) End user collects data via smartphone WeGoLook® (Mid complexity) WeGoLook Lookers (including licensed adjusters and/or drone operators) collect data Field services (High complexity) Field adjuster collects data and completes estimate (any claim can be escalated to field services as needed) Quality assurance Submissions reviewed based on Crawford estimating guidelines TruLookTM desk services Estimate completion, review, claim documentation, client reports, and billing Process claims in as little as 3.7 days Reduce costs by up to 30% (on average) Reduce cost and accelerate time in process with end-to-end handling of self-service, on-demand, and field adjusting needs Managed Repair Optional referral to Contractor Connection to repair damage via contractor network. 3

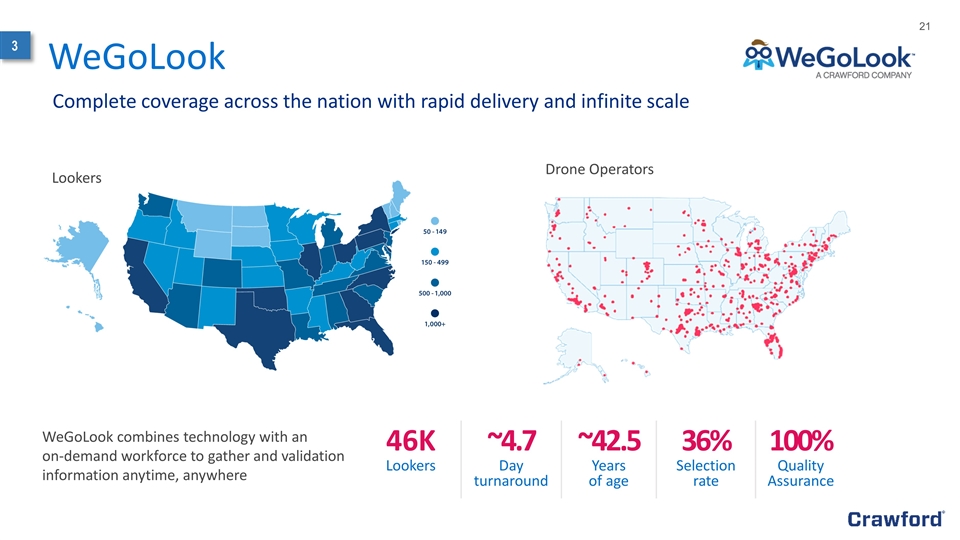

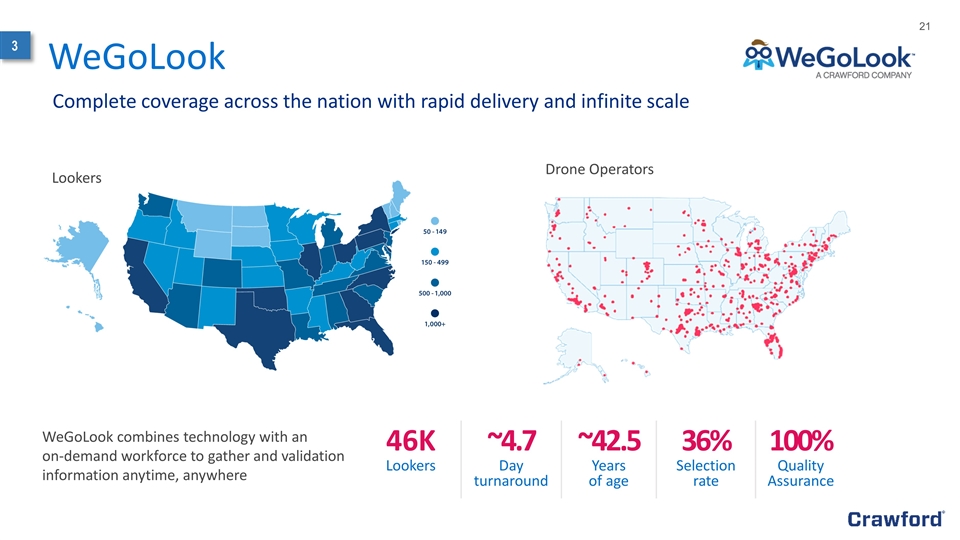

WeGoLook 46K ~4.7 ~42.5 36% 100% Lookers Day turnaround Years of age Selection rate Quality Assurance Complete coverage across the nation with rapid delivery and infinite scale 3 Lookers Drone Operators WeGoLook combines technology with an on-demand workforce to gather and validation information anytime, anywhere

Managed Repair Reduce time-in-process and support your customers all the way to restoration Faster service Through rigorous performance management and consistent application of expectations, we improve cycle times and increase customer satisfaction. Accurate estimates Leveraging technology, people processes, and industry best practices, we deliver accurate estimates tailored to each client's estimating guidelines. Improved efficiency By assessing damage and estimating repair in a single step, our trusted process supports our clients’ claim segmentation strategies and leads to better management of loss adjustment expenses. Unmatched quality Our contractors deliver world-class quality and stand behind their work with a five-year workmanship warranty on all completed repairs. $2.5B project costs processed annually 350k+ annual assignments 6,000+ contractors in network 3

3 Scale to support Service depth to deliver Results that matter Presence in 22 countries 550+ clients globally $11B+ total incurred on open claims (as of 11/30/18) 248K claims managed in 2017 Fully integrated medical management program Data-driven approach with predictive components Artificial intelligence/robotic process automation 15% reduction in average paid when using full clinical & analytical claim model Outperform inflation as measured by NCCI 9.6% reduction in opioid MED per claim in 2018 vs 5.9% industry average TPA Solutions Consistent and predictable reductions in clients total cost of risk enhanced by comprehensive service teams

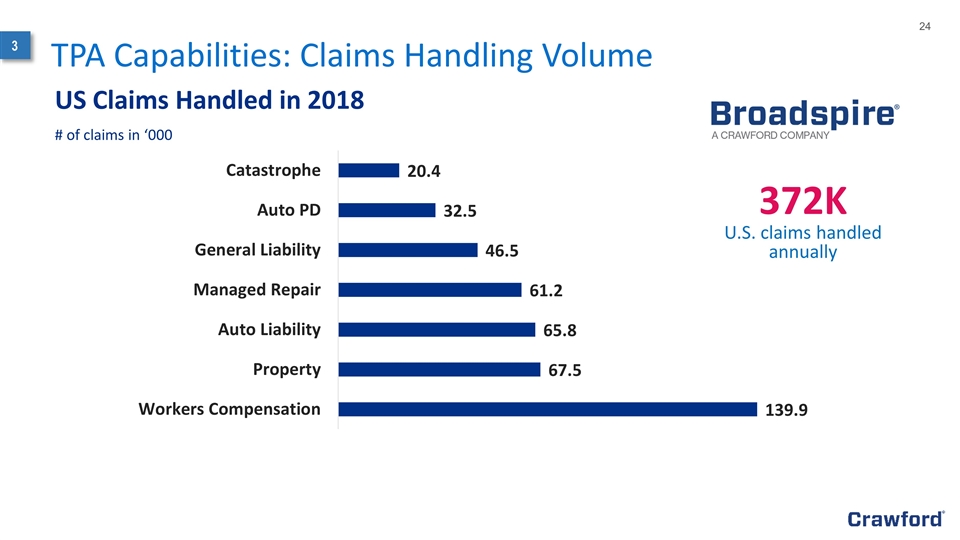

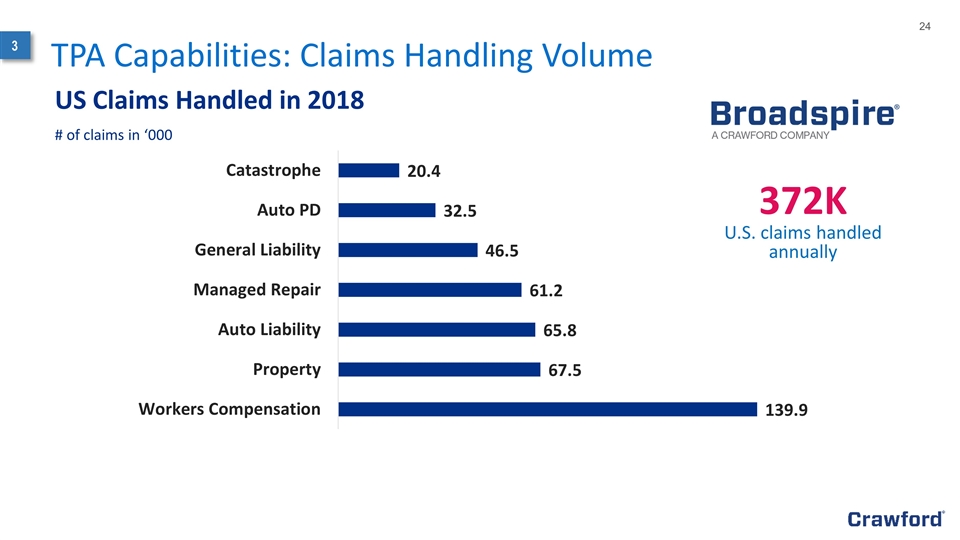

3 TPA Capabilities: Claims Handling Volume US Claims Handled in 2018 # of claims in ‘000 372K U.S. claims handled annually

Focused on developing a complete range of specialized outsourced solutions focusing on industry verticals for managing risks specific to the targeted industry’s needs Tailored Industry Verticals and Solutions Industry Verticals Integrated Solutions Construction Hospitality Transportation Total Property TruLook™ Recall 360 Energy Retail (2019) Hail (2019) Water Damage Real Estate (2019)

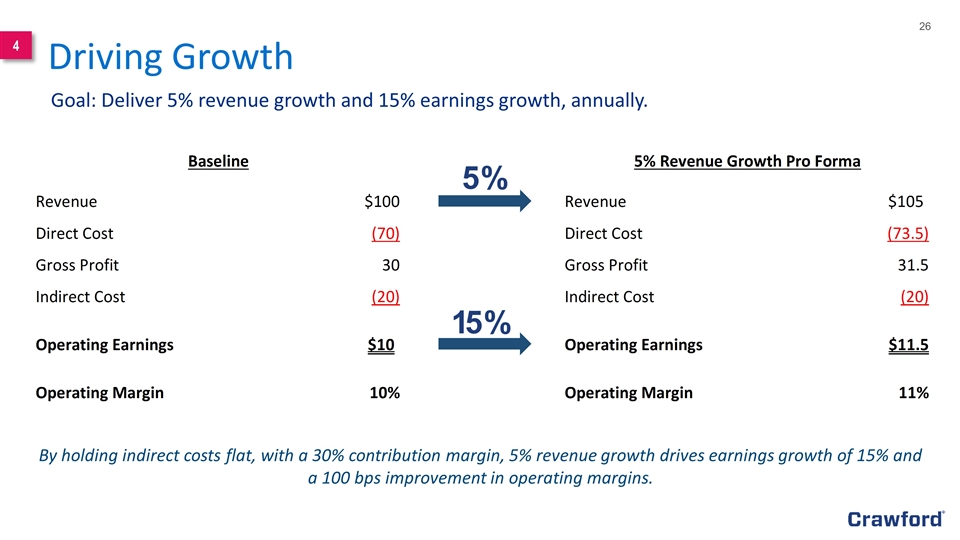

Driving Growth 5 % 15 % 4 Goal: Deliver 5% revenue growth and 15% earnings growth, annually. By holding indirect costs flat, with a 30% contribution margin, 5% revenue growth drives earnings growth of 15% and a 100 bps improvement in operating margins.

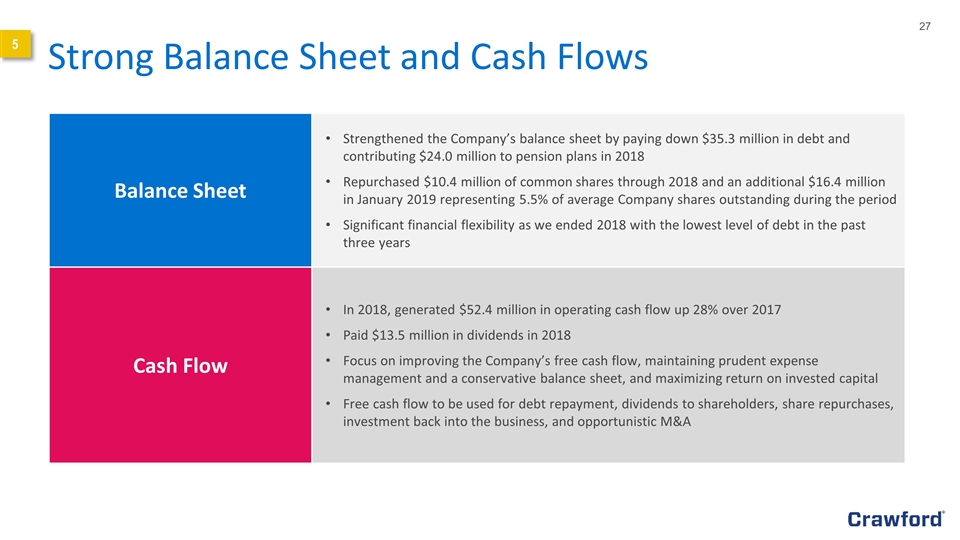

Strong Balance Sheet and Cash Flows 5 Balance Sheet Strengthened the Company’s balance sheet by paying down $35.3 million in debt and contributing $24.0 million to pension plans in 2018 Repurchased $10.4 million of common shares through 2018 and an additional $16.4 million in January 2019 representing 5.5% of average Company shares outstanding during the period Significant financial flexibility as we ended 2018 with the lowest level of debt in the past three years Cash Flow In 2018, generated $52.4 million in operating cash flow up 28% over 2017 Paid $13.5 million in dividends in 2018 Focus on improving the Company’s free cash flow, maintaining prudent expense management and a conservative balance sheet, and maximizing return on invested capital Free cash flow to be used for debt repayment, dividends to shareholders, share repurchases, investment back into the business, and opportunistic M&A

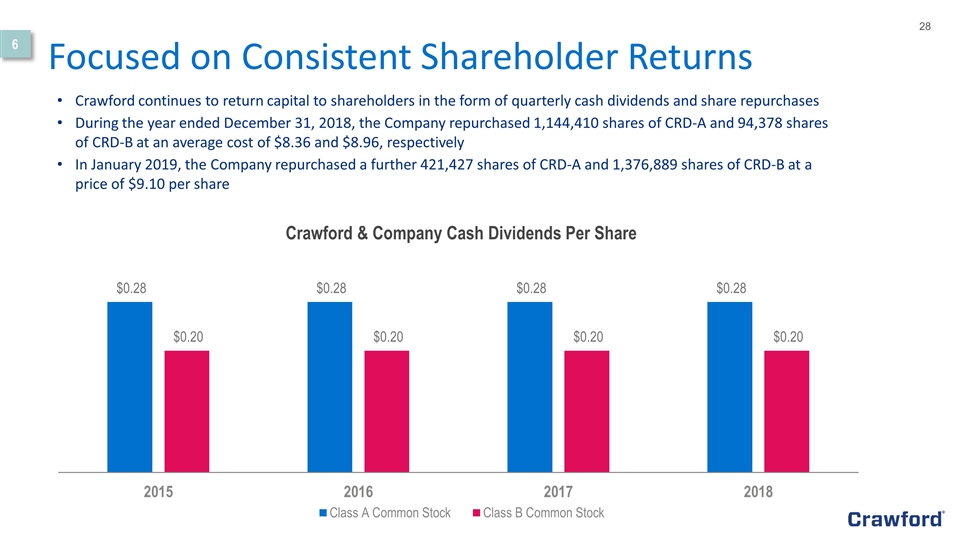

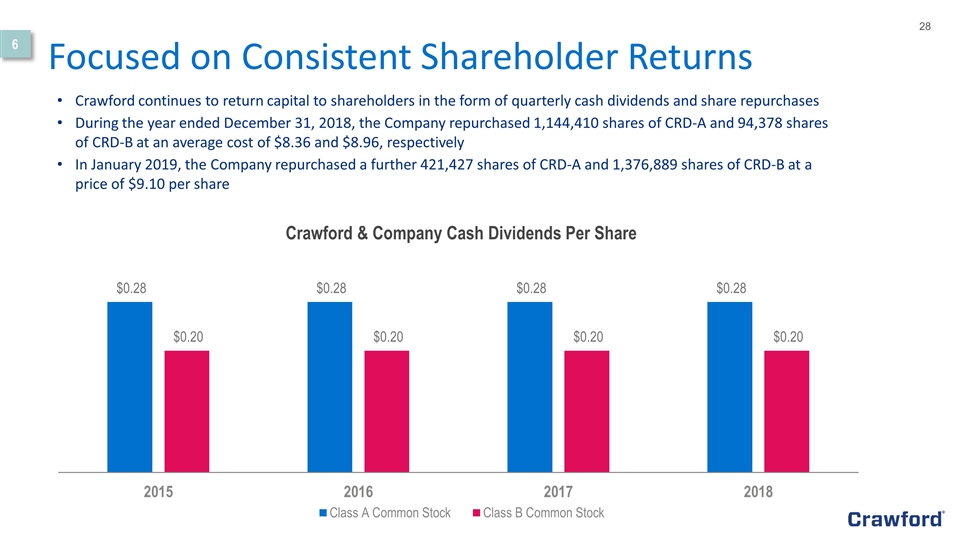

Focused on Consistent Shareholder Returns Crawford continues to return capital to shareholders in the form of quarterly cash dividends and share repurchases During the year ended December 31, 2018, the Company repurchased 1,144,410 shares of CRD-A and 94,378 shares of CRD-B at an average cost of $8.36 and $8.96, respectively In January 2019, the Company repurchased a further 421,427 shares of CRD-A and 1,376,889 shares of CRD-B at a price of $9.10 per share 6

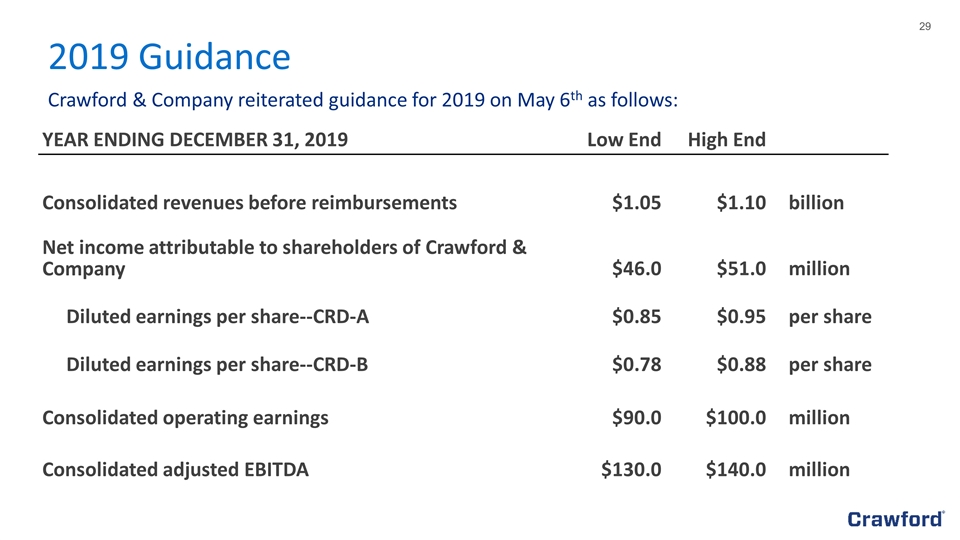

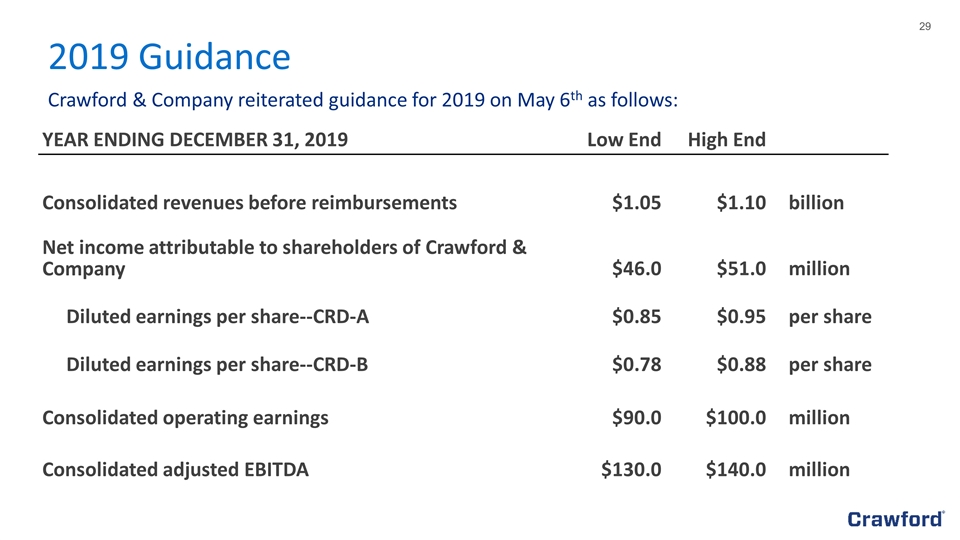

YEAR ENDING DECEMBER 31, 2019 Low End High End Consolidated revenues before reimbursements $1.05 $1.10 billion Net income attributable to shareholders of Crawford & Company $46.0 $51.0 million Diluted earnings per share--CRD-A $0.85 $0.95 per share Diluted earnings per share--CRD-B $0.78 $0.88 per share Consolidated operating earnings $90.0 $100.0 million Consolidated adjusted EBITDA $130.0 $140.0 million 2019 Guidance Crawford & Company reiterated guidance for 2019 on May 6th as follows:

Positioned For A Return To Growth Growth: Increasing the velocity of revenue growth through continuous innovation as we work to deliver our goal of achieving 5% revenue growth and 15% earnings growth annually Looking forward, Crawford has four primary objectives for 2019: 1 2 3 4 System Readiness: Prioritizing IT investments across the globe to be at the forefront of innovation and disruption People Readiness: Attract, develop, engage and retain the caring and capable people who deliver the Company’s mission. Continue to advance employee training and leadership development Fiscal Responsibility: Focusing on cash generation capabilities and improving the Company’s free cash flow. Maintain prudent expense management and a conservative balance sheet while maximizing our return on capital investment and providing a meaningful return to shareholders

Appendix A: Global Service Lines

Crawford Claims Solutions Value Proposition Enhancing the policy holder experience through scalable field adjusting solutions and optimizing claim expense for clients Value Delivery System Most extensive network of field services in the world Widest range of innovative, end-to-end outsourced claims management solutions Scalable and mobile workforce can respond to catastrophes anywhere in the world Globally deployed field assets supported by technical and specialist expertise Leveraging crowd sourcing and mobile apps, data analytics, robotics and AI applications with key partners Comprehensive Suite of Services Loss Adjusting Catastrophe Response Temporary Staffing On-Demand Services Drones Vehicle & Heavy Equipment Inspections Surveying for Underwriting Centralized Intake/FNOL* Global Administration FNOL* to Final Payment Summary Value Delivery System Current engagements in over 70 countries Nearly 9,000 claims professionals + network of 46,000 Lookers Cutting-edge Capabilities Multiple outsourced solutions for field and inspection services Reduced claims handling costs and expedited service through WeGoLook Catastrophe response, including disruptive technologies Building consultancy and legal services * First Notice of Loss

Third Party Administration Solutions: Broadspire Value Proposition Consistent and predictable reductions in clients’ total cost of risk delivered by comprehensive service teams Value Delivery System Client-centric integrated outsourced solutions powered by innovation and data science Analytically infused integration between claims and clinical offerings Innovative technologies driving quality and consistency Credentialed claims and clinical industry experts Interchangeable enterprise solutions driving automated processes Comprehensive Suite of Services Workers Compensation Disability and Leave Management Auto/Motor General Liability Product Liability and Recall Medical Management Accident & Health Employers Liability Affinity Warranty Summary Global Presence Only TPA with global presence – servicing customers in 16 countries Global account management, treasury and IT infrastructure Cutting-edge Capabilities Data-driven approaches with predictive components driving claim and clinical cost savings Artificial intelligence/robotic process automation in development to further streamline processes

Crawford Specialty Solutions Value Proposition Financial savings powered by analytics-driven insights delivered by world leading experts Value Delivery System Integrated end-to-end and project managed outsourced claims solutions Specialty practice groups Vast experience delivering expertise globally Data analytics and management information systems Comprehensive Suite of Services Casualty Property Specialty Loss Adjusting Forensic Accounting Cyber Summary Global Presence Global network operating in 144 locations worldwide 400+ executive general adjusters with an average of 25 yrs of experience Global Technical Services Cutting-edge Capabilities Complex claims • Large loss claims • Specialty claims Aviation, oil & gas, construction, hospitality, real estate, manufacturing, mining, forensic accounting and building consultancy Value Proposition The most prompt, vast, managed repair network driving policy holder and consumer satisfaction and indemnity management, backed by a five-year workmanship warranty Technology–led integrated outsourced solutions leveraging service breadth Deep roster of professional and highly credentialed contractors Analytics-based performance management Continuous innovation and global expansion Comprehensive Suite of Services Summary Global Presence Servicing customers in five countries, with an eye for expansion Contractor Connection Cutting-edge Capabilities Leveraging people, process and technology to drive performance Managed repair network to perform all scopes of work, any repair anywhere Value Delivery System Managed Repair Adjuster Referral Emergency Services Direct to Consumer Affinity

Appendix B: First Quarter 2019 Segment Results

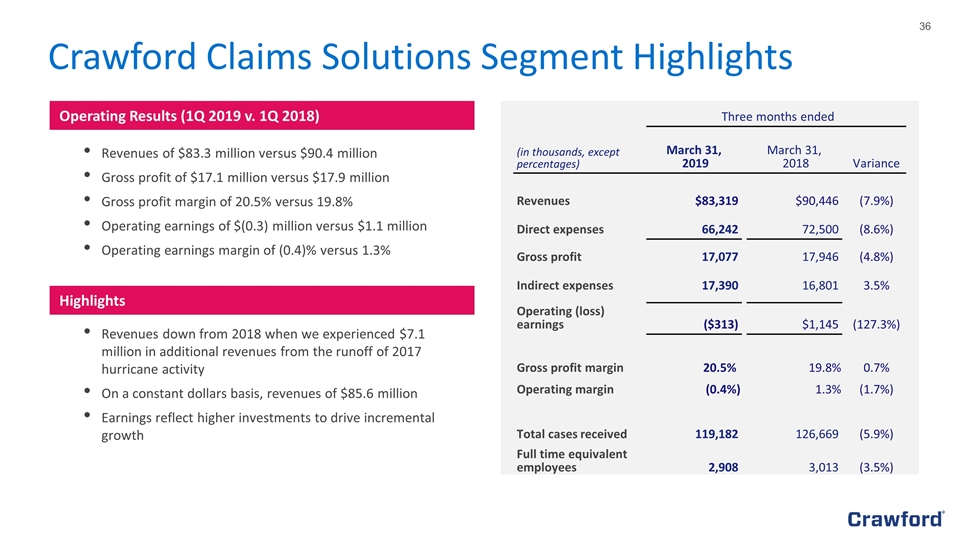

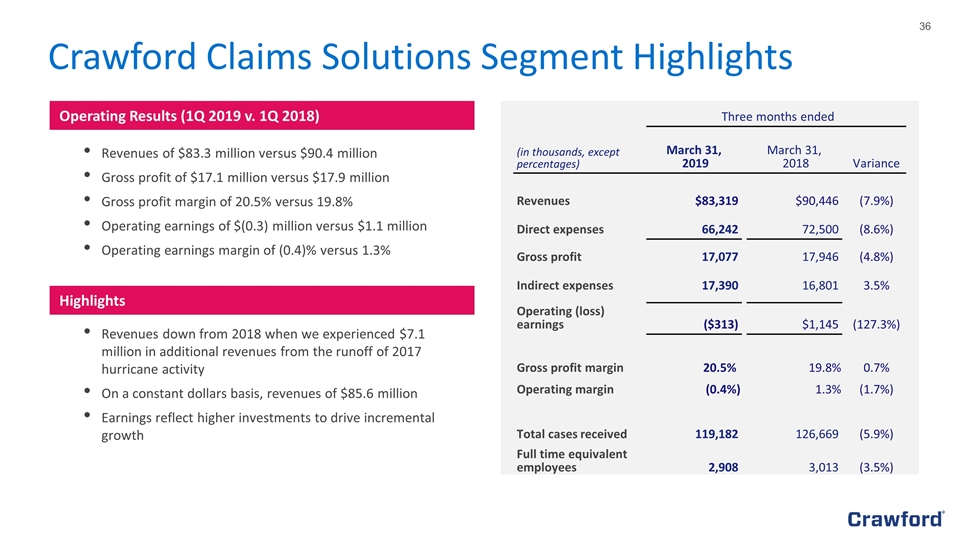

Crawford Claims Solutions Segment Highlights Revenues of $83.3 million versus $90.4 million Gross profit of $17.1 million versus $17.9 million Gross profit margin of 20.5% versus 19.8% Operating earnings of $(0.3) million versus $1.1 million Operating earnings margin of (0.4)% versus 1.3% Revenues down from 2018 when we experienced $7.1 million in additional revenues from the runoff of 2017 hurricane activity On a constant dollars basis, revenues of $85.6 million Earnings reflect higher investments to drive incremental growth Operating Results (1Q 2019 v. 1Q 2018) Highlights Three months ended (in thousands, except percentages) March 31, 2019 March 31, 2018 Variance Revenues $83,319 $90,446 (7.9%) Direct expenses 66,242 72,500 (8.6%) Gross profit 17,077 17,946 (4.8%) Indirect expenses 17,390 16,801 3.5% Operating (loss) earnings ($313) $1,145 (127.3%) Gross profit margin 20.5 % 19.8 % 0.7% Operating margin (0.4 %) 1.3 % (1.7%) Total cases received 119,182 126,669 (5.9%) Full time equivalent employees 2,908 3,013 (3.5%)

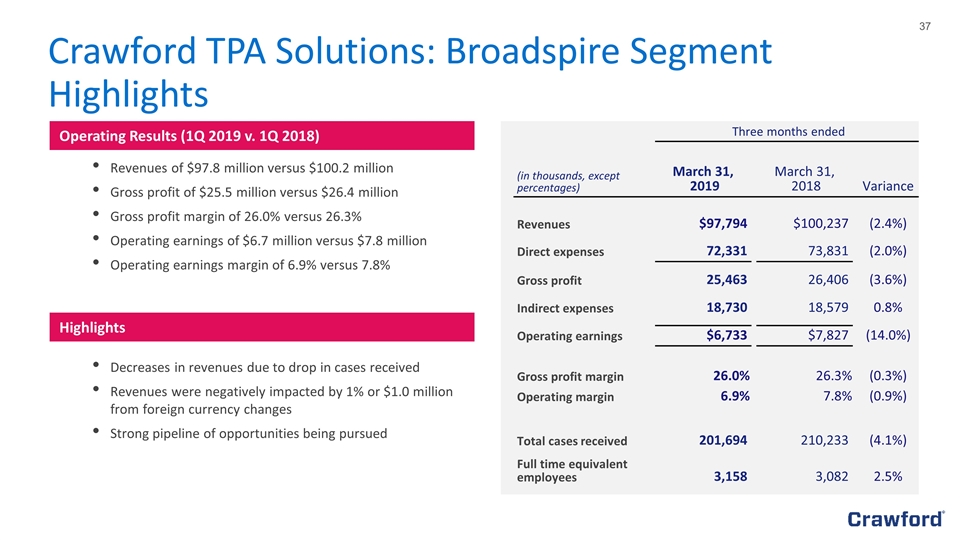

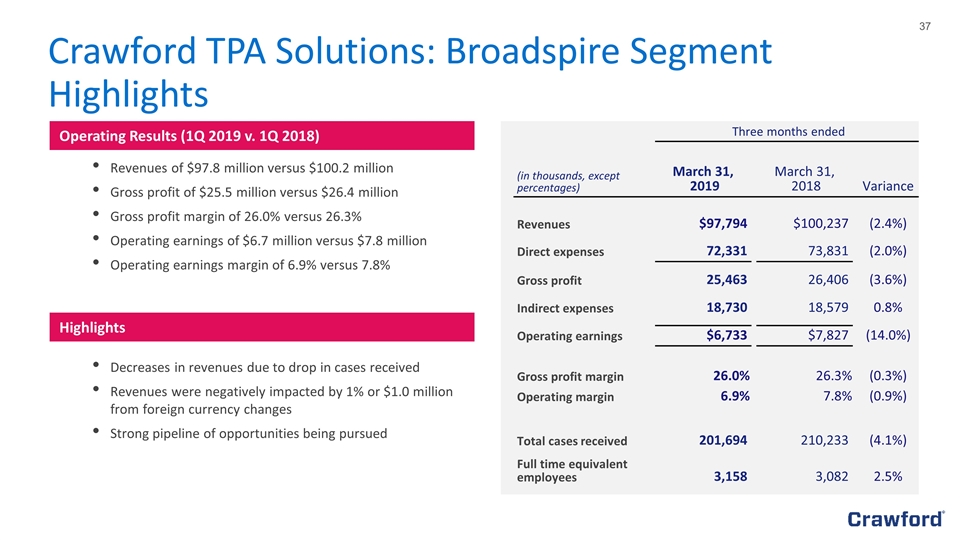

Crawford TPA Solutions: Broadspire Segment Highlights Revenues of $97.8 million versus $100.2 million Gross profit of $25.5 million versus $26.4 million Gross profit margin of 26.0% versus 26.3% Operating earnings of $6.7 million versus $7.8 million Operating earnings margin of 6.9% versus 7.8% Decreases in revenues due to drop in cases received Revenues were negatively impacted by 1% or $1.0 million from foreign currency changes Strong pipeline of opportunities being pursued Operating Results (1Q 2019 v. 1Q 2018) Highlights Three months ended (in thousands, except percentages) March 31, 2019 March 31, 2018 Variance Revenues $97,794 $100,237 (2.4%) Direct expenses 72,331 73,831 (2.0%) Gross profit 25,463 26,406 (3.6%) Indirect expenses 18,730 18,579 0.8% Operating earnings $6,733 $7,827 (14.0%) Gross profit margin 26.0 % 26.3 % (0.3%) Operating margin 6.9 % 7.8 % (0.9%) Total cases received 201,694 210,233 (4.1%) Full time equivalent employees 3,158 3,082 2.5%

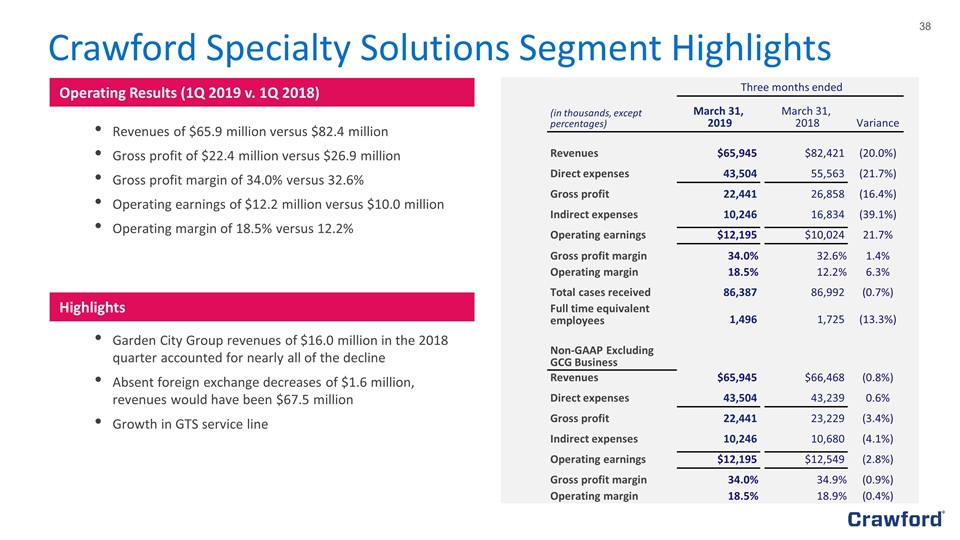

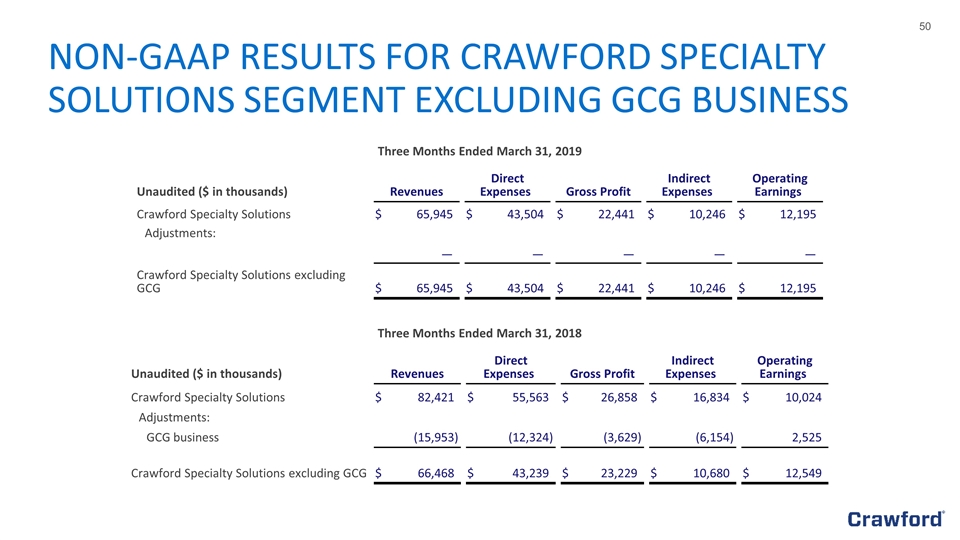

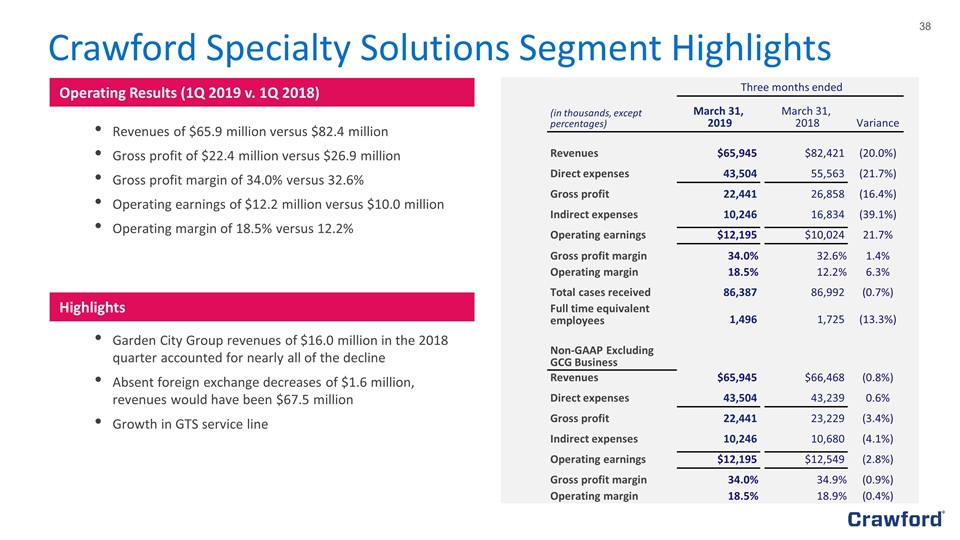

Crawford Specialty Solutions Segment Highlights Revenues of $65.9 million versus $82.4 million Gross profit of $22.4 million versus $26.9 million Gross profit margin of 34.0% versus 32.6% Operating earnings of $12.2 million versus $10.0 million Operating margin of 18.5% versus 12.2% Garden City Group revenues of $16.0 million in the 2018 quarter accounted for nearly all of the decline Absent foreign exchange decreases of $1.6 million, revenues would have been $67.5 million Growth in GTS service line Operating Results (1Q 2019 v. 1Q 2018) Highlights Three months ended (in thousands, except percentages) March 31, 2019 March 31, 2018 Variance Revenues $65,945 $82,421 (20.0%) Direct expenses 43,504 55,563 (21.7%) Gross profit 22,441 26,858 (16.4%) Indirect expenses 10,246 16,834 (39.1%) Operating earnings $12,195 $10,024 21.7% Gross profit margin 34.0 % 32.6 % 1.4% Operating margin 18.5 % 12.2 % 6.3% Total cases received 86,387 86,992 (0.7%) Full time equivalent employees 1,496 1,725 (13.3%) Non-GAAP Excluding GCG Business Revenues $65,945 $66,468 (0.8%) Direct expenses 43,504 43,239 0.6% Gross profit 22,441 23,229 (3.4%) Indirect expenses 10,246 10,680 (4.1%) Operating earnings $12,195 $12,549 (2.8%) Gross profit margin 34.0 % 34.9 % (0.9%) Operating margin 18.5 % 18.9 % (0.4%)

Appendix C: First Quarter 2019 Consolidated Financial Results

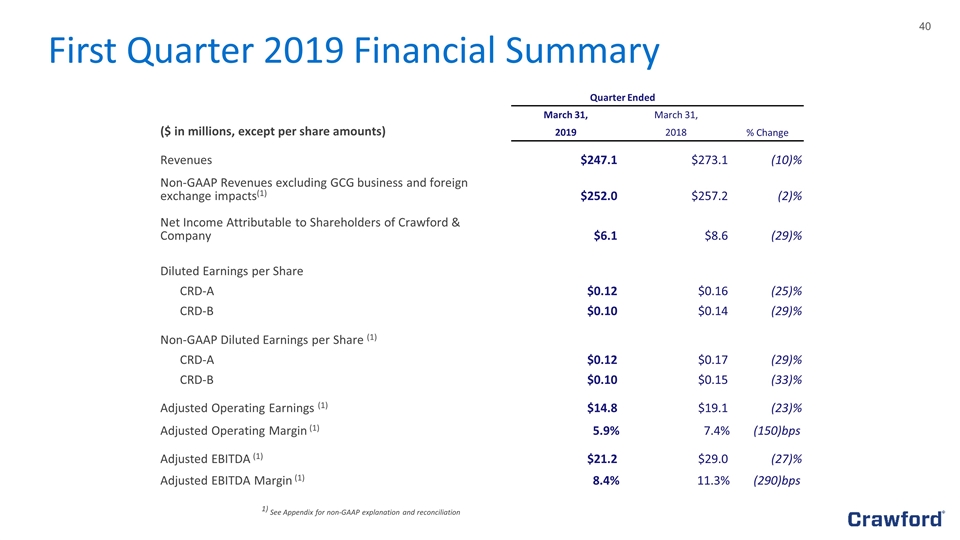

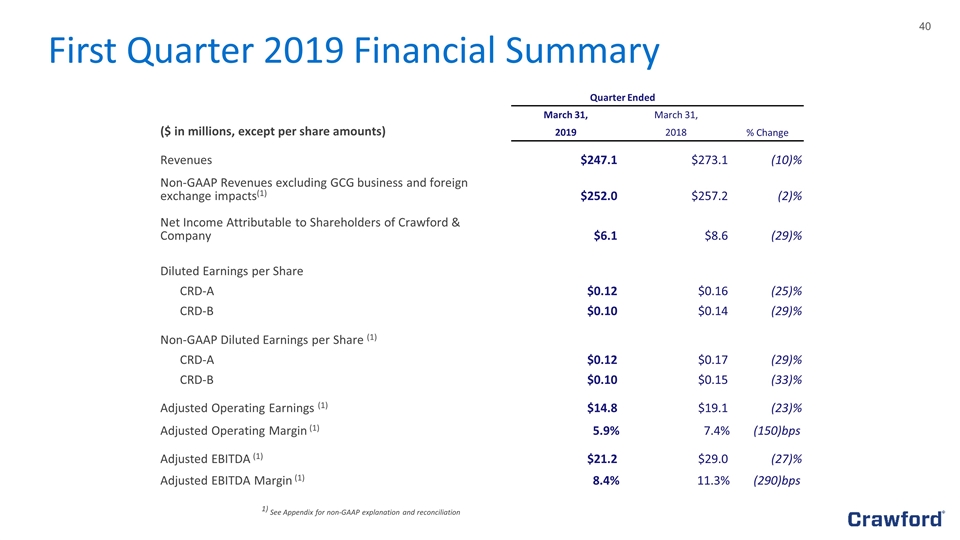

1) See Appendix for non-GAAP explanation and reconciliation First Quarter 2019 Financial Summary Quarter Ended March 31, March 31, ($ in millions, except per share amounts) 2019 2018 % Change Revenues $247.1 $273.1 (10 )% Non-GAAP Revenues excluding GCG business and foreign exchange impacts(1) $252.0 $257.2 (2 )% Net Income Attributable to Shareholders of Crawford & Company $6.1 $8.6 (29 )% Diluted Earnings per Share CRD-A $0.12 $0.16 (25 )% CRD-B $0.10 $0.14 (29 )% Non-GAAP Diluted Earnings per Share (1) CRD-A $0.12 $0.17 (29 )% CRD-B $0.10 $0.15 (33 )% Adjusted Operating Earnings (1) $14.8 $19.1 (23 )% Adjusted Operating Margin (1) 5.9 % 7.4 % (150)bps Adjusted EBITDA (1) $21.2 $29.0 (27 )% Adjusted EBITDA Margin (1) 8.4 % 11.3 % (290)bps

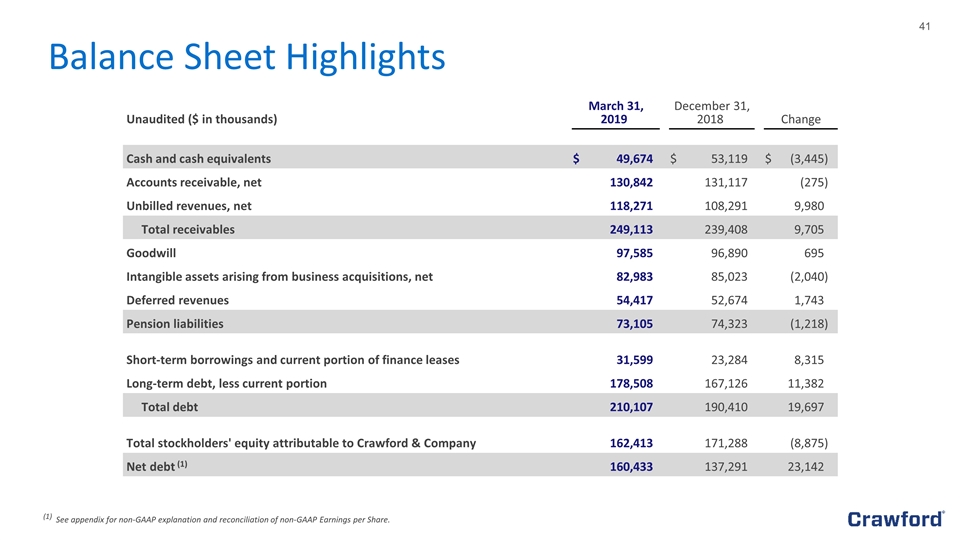

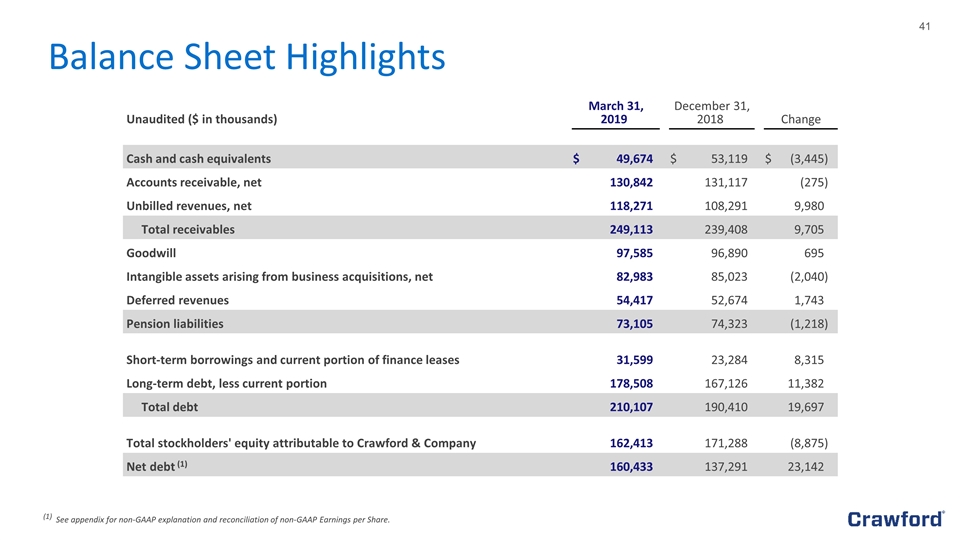

Balance Sheet Highlights (1) See appendix for non-GAAP explanation and reconciliation of non-GAAP Earnings per Share. Unaudited ($ in thousands) March 31, 2019 March 31, 2019 December 31, 2018 December 31, 2018 Change Change Cash and cash equivalents $ 49,674 $ 53,119 $ (3,445 ) Accounts receivable, net 130,842 131,117 (275 ) Unbilled revenues, net 118,271 108,291 9,980 Total receivables 249,113 239,408 9,705 Goodwill 97,585 96,890 695 Intangible assets arising from business acquisitions, net 82,983 85,023 (2,040 ) Deferred revenues 54,417 52,674 1,743 Pension liabilities 73,105 74,323 (1,218 ) Short-term borrowings and current portion of finance leases 31,599 23,284 8,315 Long-term debt, less current portion 178,508 167,126 11,382 Total debt 210,107 190,410 19,697 Total stockholders' equity attributable to Crawford & Company 162,413 171,288 (8,875 ) Net debt (1) 160,433 137,291 23,142

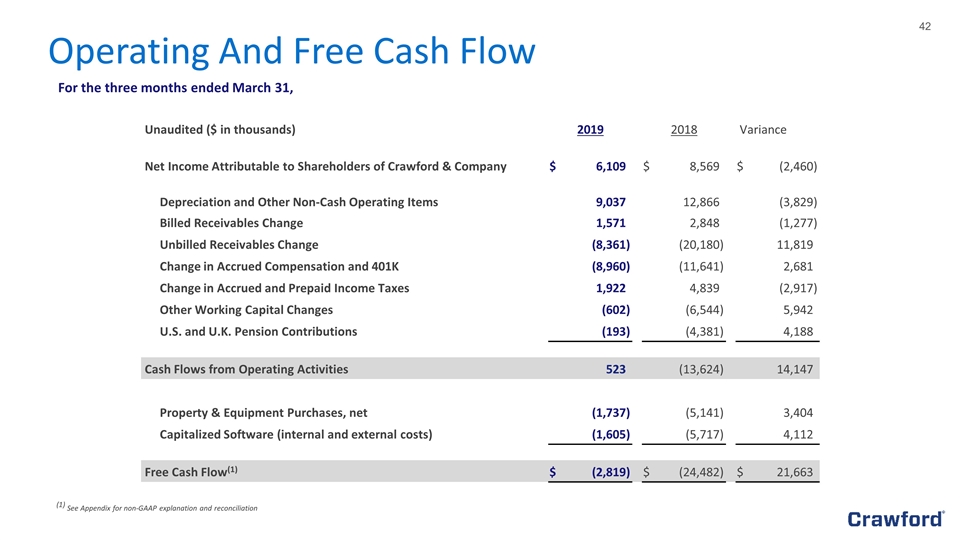

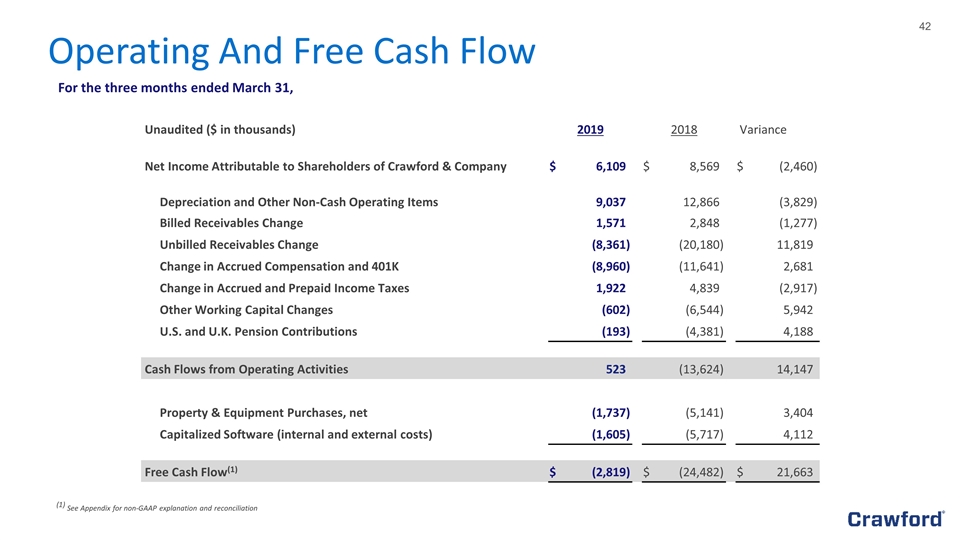

Operating And Free Cash Flow (1) See Appendix for non-GAAP explanation and reconciliation Unaudited ($ in thousands) 2019 2019 2018 2018 Variance Variance Net Income Attributable to Shareholders of Crawford & Company $ 6,109 $ 8,569 $ (2,460 ) Depreciation and Other Non-Cash Operating Items 9,037 12,866 (3,829 ) Billed Receivables Change 1,571 2,848 (1,277 ) Unbilled Receivables Change (8,361 ) (20,180 ) 11,819 Change in Accrued Compensation and 401K (8,960 ) (11,641 ) 2,681 Change in Accrued and Prepaid Income Taxes 1,922 4,839 (2,917 ) Other Working Capital Changes (602 ) (6,544 ) 5,942 U.S. and U.K. Pension Contributions (193 ) (4,381 ) 4,188 Cash Flows from Operating Activities 523 (13,624 ) 14,147 Property & Equipment Purchases, net (1,737 ) (5,141 ) 3,404 Capitalized Software (internal and external costs) (1,605 ) (5,717 ) 4,112 Free Cash Flow(1) $ (2,819 ) $ (24,482 ) $ 21,663 For the three months ended March 31,

Appendix D: Non-GAAP Financial Information

Appendix: Non-GAAP Financial Information Measurements of financial performance not calculated in accordance with GAAP should be considered as supplements to, and not substitutes for, performance measurements calculated or derived in accordance with GAAP. Any such measures are not necessarily comparable to other similarly-titled measurements employed by other companies. Reimbursements for Out-of-Pocket Expenses In the normal course of our business, our operating segments incur certain out-of-pocket expenses that are thereafter reimbursed by our clients. Under GAAP, these out-of-pocket expenses and associated reimbursements are required to be included when reporting expenses and revenues, respectively, in our consolidated results of operations. In this presentation, we do not believe it is informative to include in reported revenues the amounts of reimbursed expenses and related revenues, as they offset each other in our consolidated results of operations with no impact to our net income or operating earnings. As a result, unless noted in this presentation, revenue and expense amounts exclude reimbursements for out-of-pocket expenses. Net Debt Net debt is computed as the sum of long-term debt, capital leases and short-term borrowings less cash and cash equivalents. Management believes that net debt is useful because it provides investors with an estimate of what the Company's debt would be if all available cash was used to pay down the debt of the Company. The measure is not meant to imply that management plans to use all available cash to pay down debt. Free Cash Flow Management believes free cash flow is useful to investors as it presents the amount of cash the Company has generated that can be used for other purposes, including additional contributions to the Company's defined benefit pension plans, discretionary prepayments of outstanding borrowings under our credit agreement, and return of capital to shareholders, among other purposes. It does not represent the residual cash flow of the Company available for discretionary expenditures. The reconciliation from Cash Flows from Operating Activities is provided on slide 41. Segment and Consolidated Operating Earnings Operating earnings is the primary financial performance measure used by our senior management and chief operating decision maker to evaluate the financial performance of our Company and operating segments, and make resource allocation and certain compensation decisions. Management believes operating earnings is useful to others in that it allows them to evaluate segment and consolidated operating performance using the same criteria our management and chief operating decision maker use. Consolidated operating earnings represent segment earnings including certain unallocated corporate and shared costs and credits, but before net corporate interest expense, stock option expense, amortization of customer-relationship intangible assets, goodwill and intangible asset impairment charges, restructuring and special charges, loss on disposition of business lines, income taxes, and net income or loss attributable to noncontrolling interests.

Appendix: Non-GAAP Financial Information (continued) Segment and Consolidated Gross Profit Gross profit is defined as revenues less direct expenses which exclude indirect overhead expenses allocated to the business. Indirect expenses consist of centralized administrative support costs, regional and local shared services that are allocated to each segment based on usage. Adjusted EBITDA Adjusted EBITDA is used by management to evaluate, assess and benchmark our operational results and the Company believes that adjusted EBITDA is relevant and useful information widely used by analysts, investors and other interested parties. Adjusted EBITDA is defined as net income with adjustments for depreciation and amortization, interest expense-net, income tax provision, restructuring and special charges, loss on disposition of business line, goodwill and intangible asset impairment charges and non-cash stock-based compensation expense and excluding the impacts of the GCG business. Adjusted EBITDA is not a term defined by GAAP and as a result our measure of adjusted EBITDA might not be comparable to similarly titled measures used by other companies. Adjusted Revenue, Operating Earnings, Pretax Earnings, Net Income, Diluted Earnings per Share and EBITDA Excluding the GCG Business Included in non-GAAP adjusted measurements as an add back or subtraction to GAAP measurements, are impacts of the disposed of GCG business, restructuring and special charges net of tax, and loss on disposition of business line net of tax, which arise from non-core items not directly related to our normal business or operations, or our future performance. Management believes it is useful to exclude these charges when comparing net income and diluted earnings per share across periods, as these charges are not from ordinary operations.

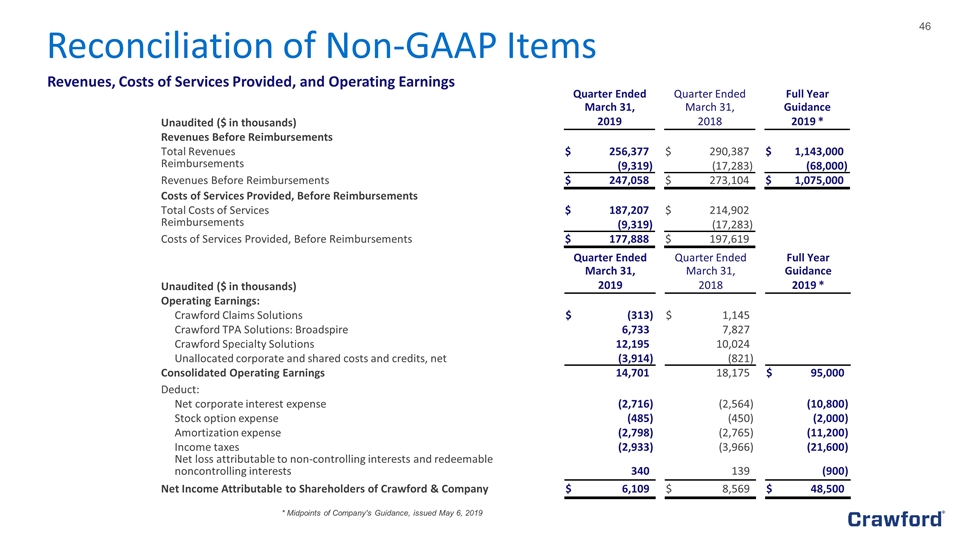

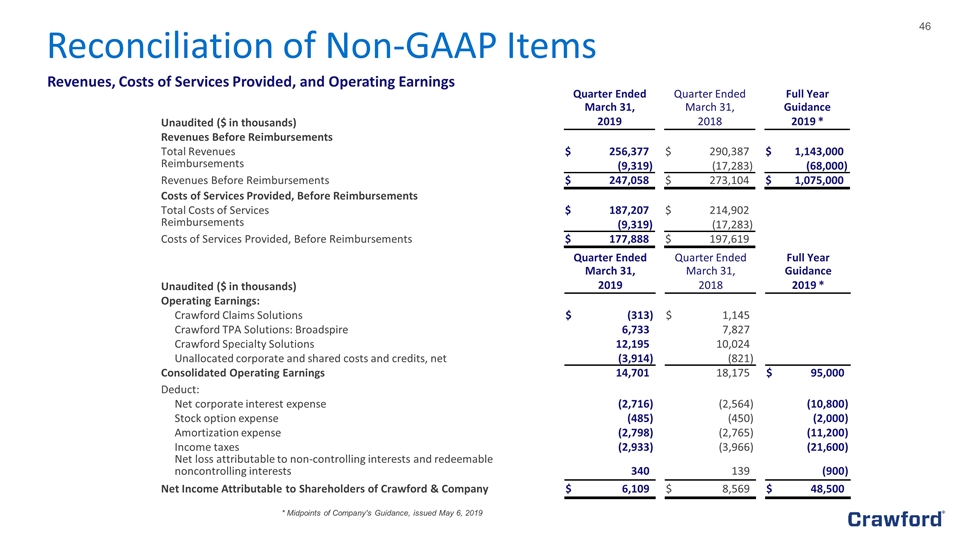

Revenues, Costs of Services Provided, and Operating Earnings * Midpoints of Company's Guidance, issued May 6, 2019 Reconciliation of Non-GAAP Items Quarter Ended Quarter Ended Quarter Ended Quarter Ended Full Year Full Year March 31, March 31, March 31, March 31, Guidance Guidance Unaudited ($ in thousands) 2019 2019 2018 2018 2019 * 2019 * Revenues Before Reimbursements Total Revenues $ 256,377 $ 290,387 $ 1,143,000 Reimbursements (9,319 ) (17,283 ) (68,000 ) Revenues Before Reimbursements $ 247,058 $ 273,104 $ 1,075,000 Costs of Services Provided, Before Reimbursements Total Costs of Services $ 187,207 $ 214,902 Reimbursements (9,319 ) (17,283 ) Costs of Services Provided, Before Reimbursements $ 177,888 $ 197,619 Quarter Ended Quarter Ended Quarter Ended Quarter Ended Full Year Full Year March 31, March 31, March 31, March 31, Guidance Guidance Unaudited ($ in thousands) 2019 2019 2018 2018 2019 * 2019 * Operating Earnings: Crawford Claims Solutions $ (313 ) $ 1,145 Crawford TPA Solutions: Broadspire 6,733 7,827 Crawford Specialty Solutions 12,195 10,024 Unallocated corporate and shared costs and credits, net (3,914 ) (821 ) Consolidated Operating Earnings 14,701 18,175 $ 95,000 Deduct: Net corporate interest expense (2,716 ) (2,564 ) (10,800 ) Stock option expense (485 ) (450 ) (2,000 ) Amortization expense (2,798 ) (2,765 ) (11,200 ) Income taxes (2,933 ) (3,966 ) (21,600 ) Net loss attributable to non-controlling interests and redeemable noncontrolling interests 340 139 (900 ) Net Income Attributable to Shareholders of Crawford & Company $ 6,109 $ 8,569 $ 48,500

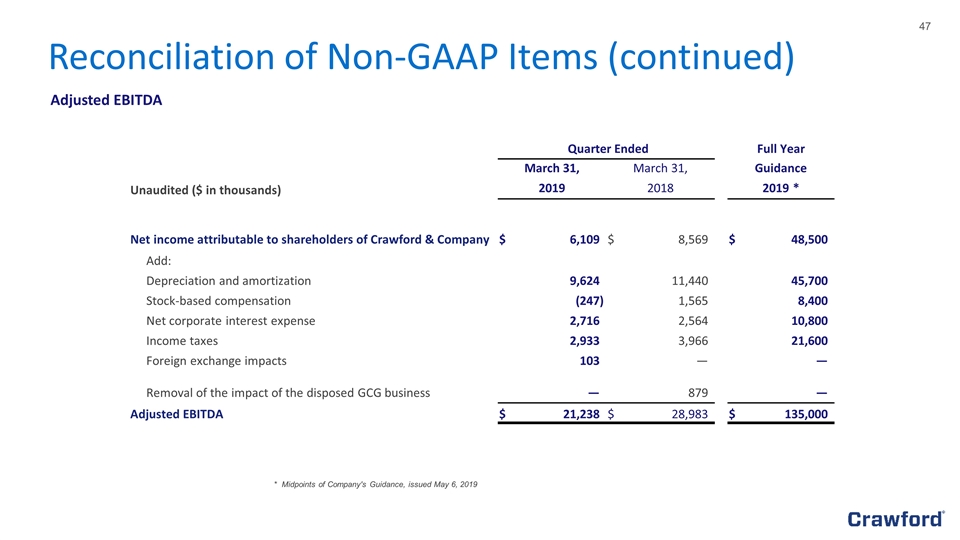

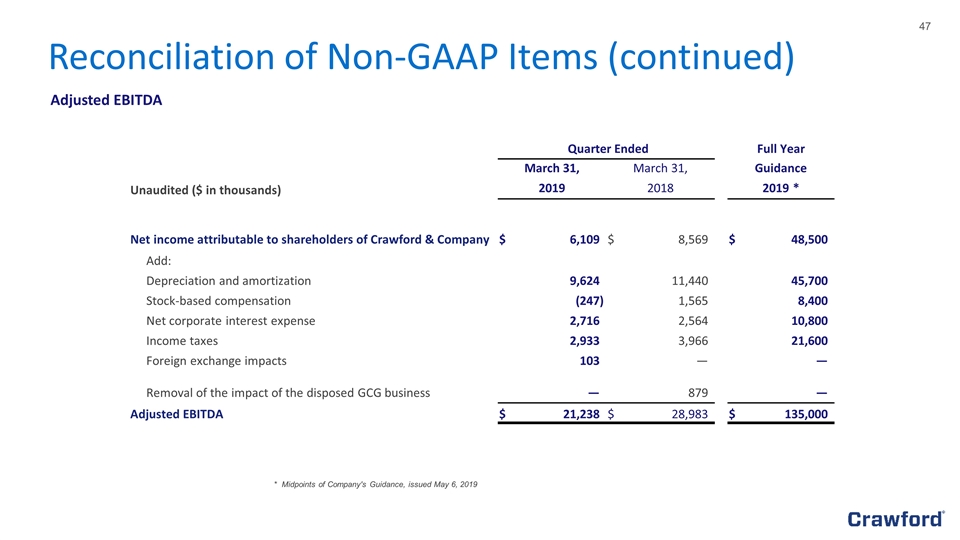

Adjusted EBITDA * Midpoints of Company's Guidance, issued May 6, 2019 Reconciliation of Non-GAAP Items (continued) Quarter Ended Quarter Ended Full Year Full Year March 31, March 31, March 31, March 31, Guidance Guidance Unaudited ($ in thousands) 2019 2019 2018 2018 2019 * 2019 * Net income attributable to shareholders of Crawford & Company $ 6,109 $ 8,569 $ 48,500 Add: Depreciation and amortization 9,624 11,440 45,700 Stock-based compensation (247 ) 1,565 8,400 Net corporate interest expense 2,716 2,564 10,800 Income taxes 2,933 3,966 21,600 Foreign exchange impacts 103 — — Removal of the impact of the disposed GCG business — 879 — Adjusted EBITDA $ 21,238 $ 28,983 $ 135,000

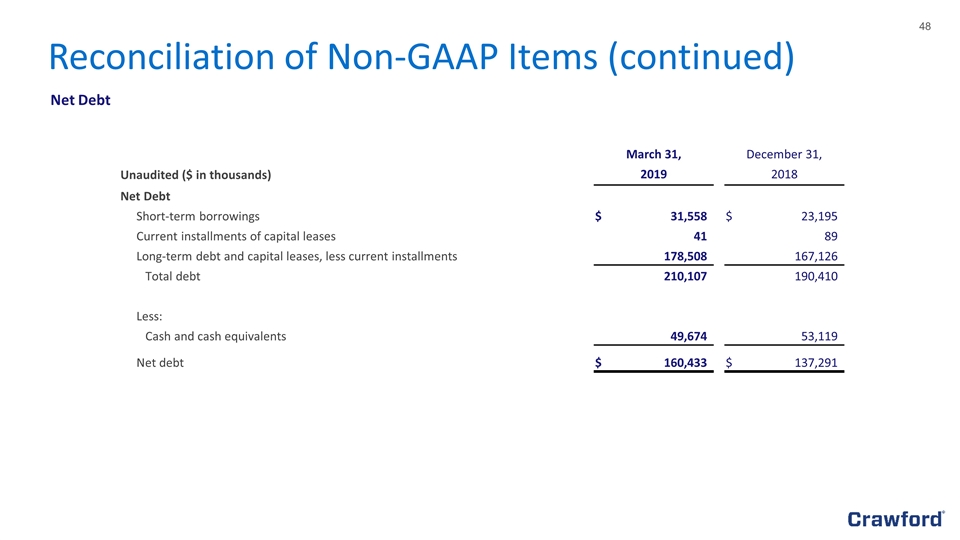

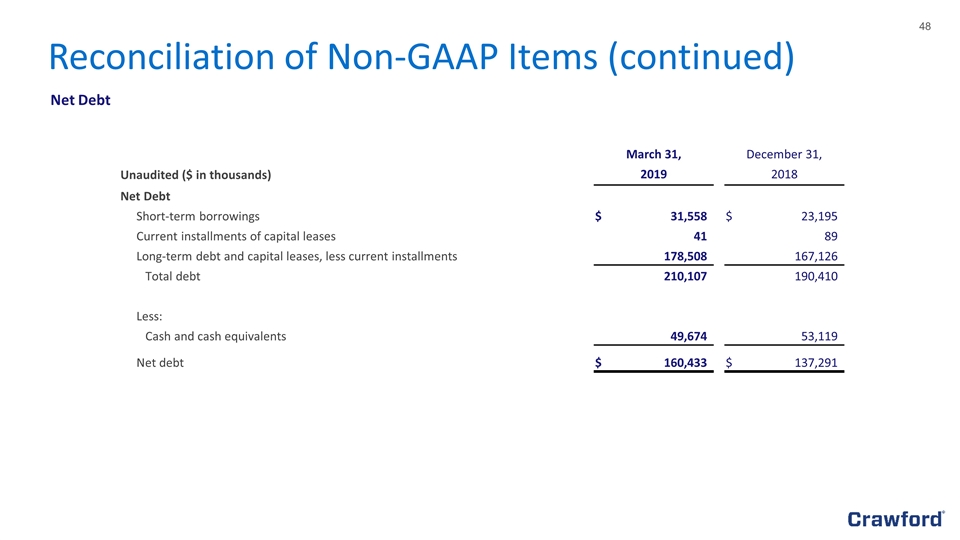

Net Debt Reconciliation of Non-GAAP Items (continued) March 31, March 31, December 31, December 31, Unaudited ($ in thousands) 2019 2019 2018 2018 Net Debt Short-term borrowings $ 31,558 $ 23,195 Current installments of capital leases 41 89 Long-term debt and capital leases, less current installments 178,508 167,126 Total debt 210,107 190,410 Less: Cash and cash equivalents 49,674 53,119 Net debt $ 160,433 $ 137,291

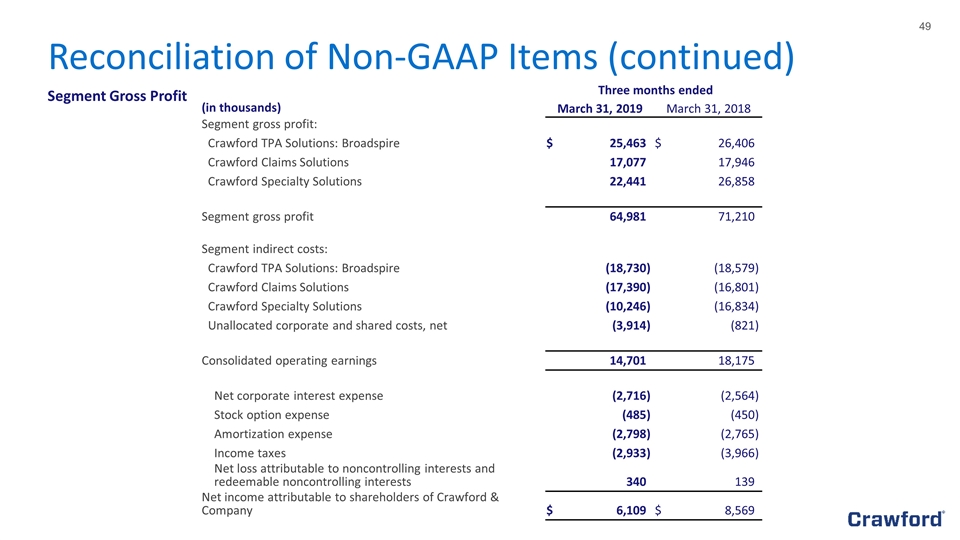

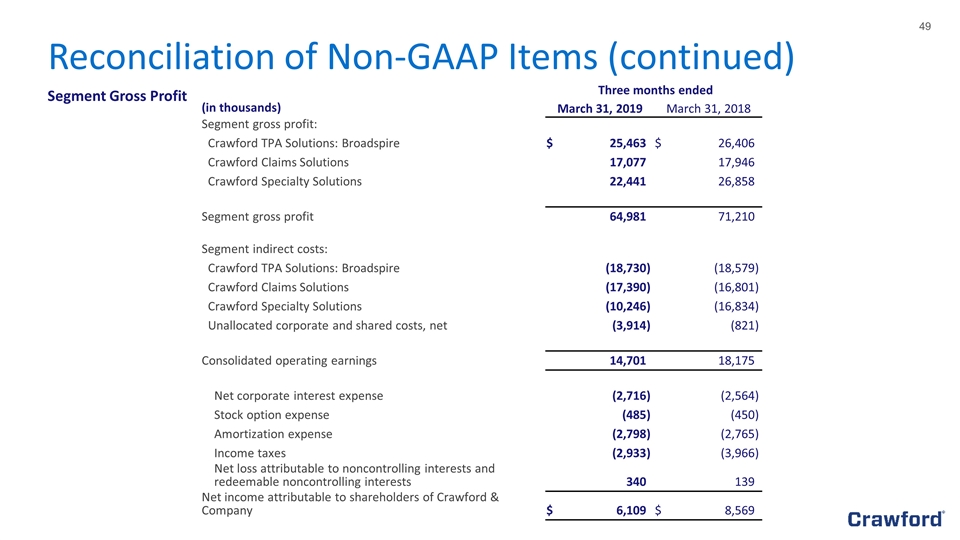

Segment Gross Profit Reconciliation of Non-GAAP Items (continued) Three months ended Three months ended (in thousands) March 31, 2019 March 31, 2019 March 31, 2018 March 31, 2018 Segment gross profit: Crawford TPA Solutions: Broadspire $ 25,463 $ 26,406 Crawford Claims Solutions 17,077 17,946 Crawford Specialty Solutions 22,441 26,858 Segment gross profit 64,981 71,210 Segment indirect costs: Crawford TPA Solutions: Broadspire (18,730 ) (18,579 ) Crawford Claims Solutions (17,390 ) (16,801 ) Crawford Specialty Solutions (10,246 ) (16,834 ) Unallocated corporate and shared costs, net (3,914 ) (821 ) Consolidated operating earnings 14,701 18,175 Net corporate interest expense (2,716 ) (2,564 ) Stock option expense (485 ) (450 ) Amortization expense (2,798 ) (2,765 ) Income taxes (2,933 ) (3,966 ) Net loss attributable to noncontrolling interests and redeemable noncontrolling interests 340 139 Net income attributable to shareholders of Crawford & Company $ 6,109 $ 8,569

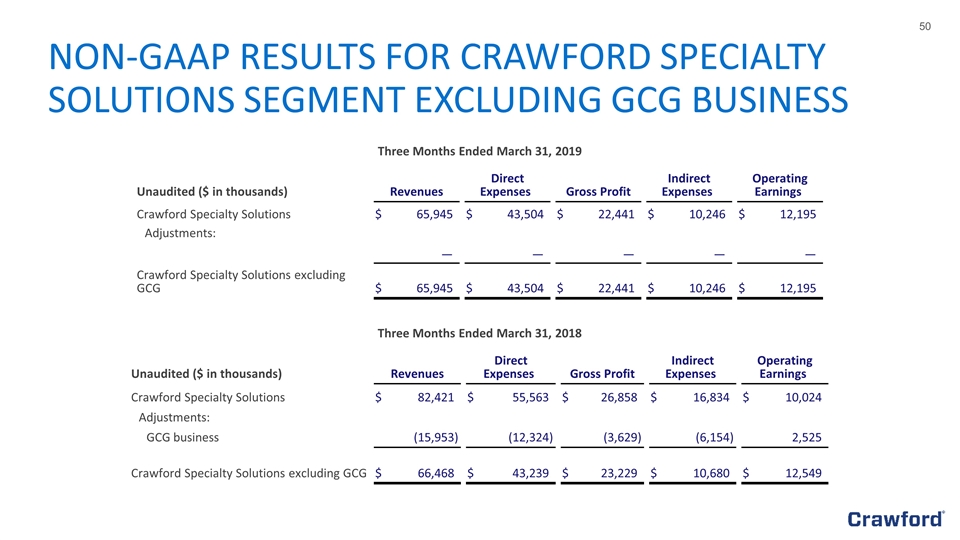

NON-GAAP RESULTS FOR CRAWFORD SPECIALTY SOLUTIONS SEGMENT EXCLUDING GCG BUSINESS Three Months Ended March 31, 2019 Unaudited ($ in thousands) Revenues Revenues Direct Expenses Direct Expenses Gross Profit Gross Profit Indirect Expenses Indirect Expenses Operating Earnings Operating Earnings Crawford Specialty Solutions $ 65,945 $ 43,504 $ 22,441 $ 10,246 $ 12,195 Adjustments: — — — — — Crawford Specialty Solutions excluding GCG $ 65,945 $ 43,504 $ 22,441 $ 10,246 $ 12,195 Three Months Ended March 31, 2018 Unaudited ($ in thousands) Revenues Revenues Direct Expenses Direct Expenses Gross Profit Gross Profit Indirect Expenses Indirect Expenses Operating Earnings Operating Earnings Crawford Specialty Solutions $ 82,421 $ 55,563 $ 26,858 $ 16,834 $ 10,024 Adjustments: GCG business (15,953 ) (12,324 ) (3,629 ) (6,154 ) 2,525 Crawford Specialty Solutions excluding GCG $ 66,468 $ 43,239 $ 23,229 $ 10,680 $ 12,549

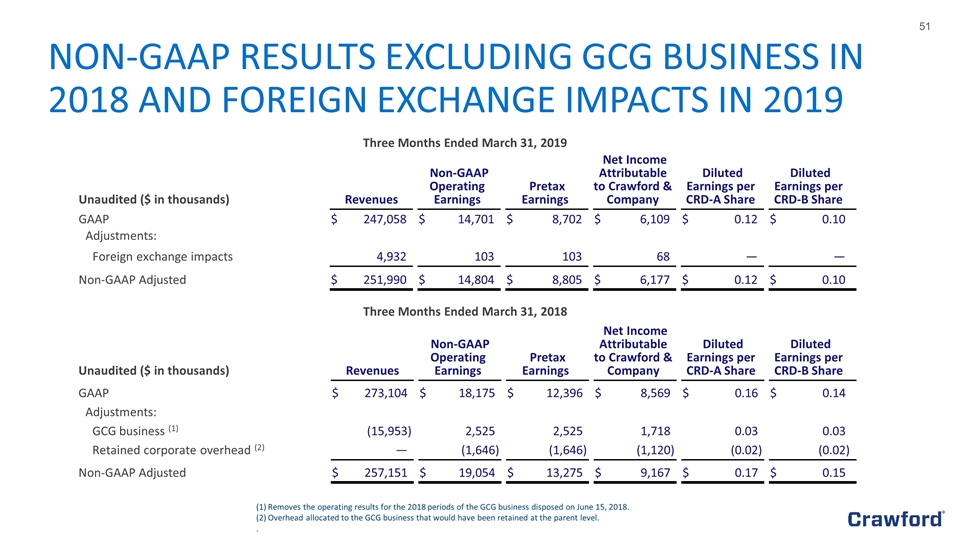

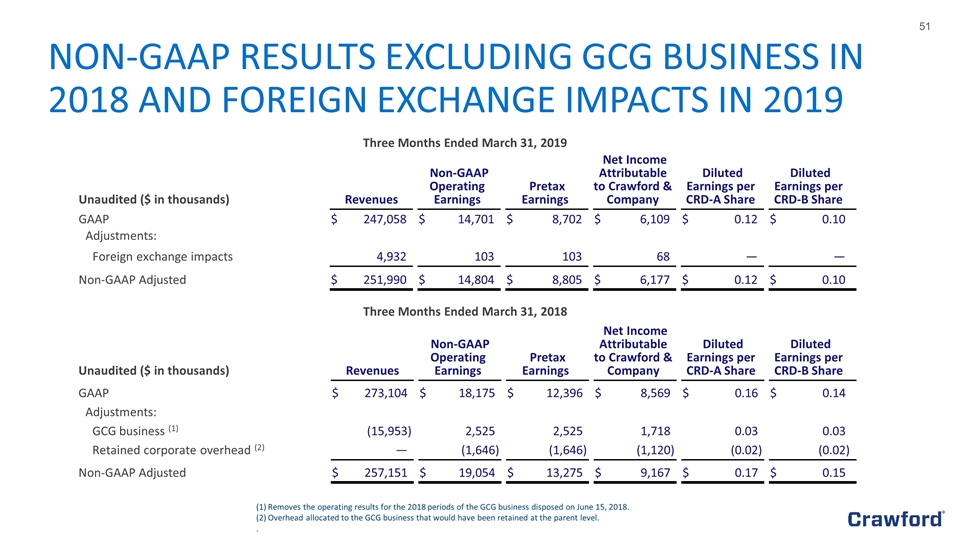

(1) Removes the operating results for the 2018 periods of the GCG business disposed on June 15, 2018. (2) Overhead allocated to the GCG business that would have been retained at the parent level. . NON-GAAP RESULTS EXCLUDING GCG BUSINESS IN 2018 AND FOREIGN EXCHANGE IMPACTS IN 2019 Three Months Ended March 31, 2019 Unaudited ($ in thousands) Revenues Revenues Non-GAAP Operating Earnings Non-GAAP Operating Earnings Pretax Earnings Pretax Earnings Net Income Attributable to Crawford & Company Net Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share Diluted Earnings per CRD-A Share Diluted Earnings per CRD-B Share Diluted Earnings per CRD-B Share GAAP $ 247,058 $ 14,701 $ 8,702 $ 6,109 $ 0.12 $ 0.10 Adjustments: Foreign exchange impacts 4,932 103 103 68 — — Non-GAAP Adjusted $ 251,990 $ 14,804 $ 8,805 $ 6,177 $ 0.12 $ 0.10 Three Months Ended March 31, 2018 Unaudited ($ in thousands) Revenues Revenues Non-GAAP Operating Earnings Non-GAAP Operating Earnings Pretax Earnings Pretax Earnings Net Income Attributable to Crawford & Company Net Income Attributable to Crawford & Company Diluted Earnings per CRD-A Share Diluted Earnings per CRD-A Share Diluted Earnings per CRD-B Share Diluted Earnings per CRD-B Share GAAP $ 273,104 $ 18,175 $ 12,396 $ 8,569 $ 0.16 $ 0.14 Adjustments: GCG business (1) (15,953 ) 2,525 2,525 1,718 0.03 0.03 Retained corporate overhead (2) — (1,646 ) (1,646 ) (1,120 ) (0.02 ) (0.02 ) Non-GAAP Adjusted $ 257,151 $ 19,054 $ 13,275 $ 9,167 $ 0.17 $ 0.15

Crawford & Company ®