TherapeuticsMD, Inc. 8-K

Exhibit 99.2

3Q 2018 Financial Results November 7, 2018

2 Forward - Looking Statements This presentation by TherapeuticsMD, Inc. (referred to as “we” and “our”) may contain forward - looking statements. Forward - lookin g statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as state men ts, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anti cip ate will or may occur in the future. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipat e,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are ba sed on assumptions and assessments made in light of our managerial experience and perception of historical trends, current condition s, expected future developments and other factors we believe to be appropriate. Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward - looking statements are n ot guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control. Imp ort ant factors that could cause actual results, developments and business decisions to differ materially from forward - looking statement s are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission, including our mos t r ecent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following: our ability to maintain or increase sales of our products; our ability to develop and commercialize IMVEXXY TM , ANNOVERA TM , BIJUVA TM and our hormone therapy drug candidates and obtain additional financing necessary therefor; whether we will be able to comply with the covenants and conditions under our term loan agreement; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of our current or future approved products or preclude t he approval of our future drug candidates; the length, cost and uncertain results of future clinical trials; the ability of our lic ensees to commercialize and distribute our product and product candidates; our reliance on third parties to conduct our manufacturing, research and development and clinical trials; the availability of reimbursement from government authorities and health insura nce companies for our products; the impact of product liability lawsuits; the influence of extensive and costly government regula tio n; the volatility of the trading price of our common stock and the concentration of power in our stock ownership. This non - promotional presentation is intended for investor audiences only.

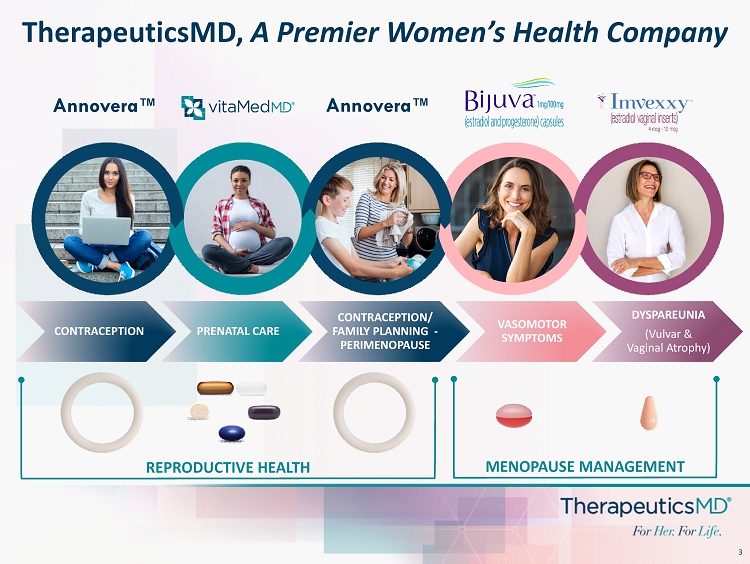

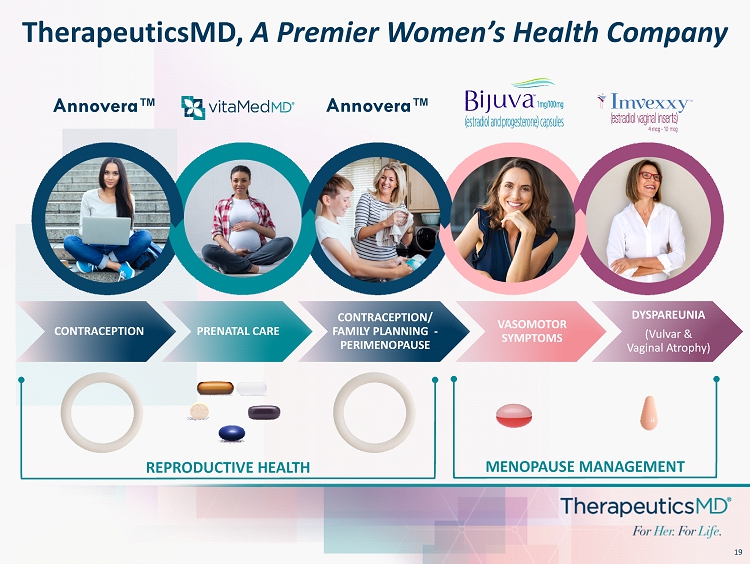

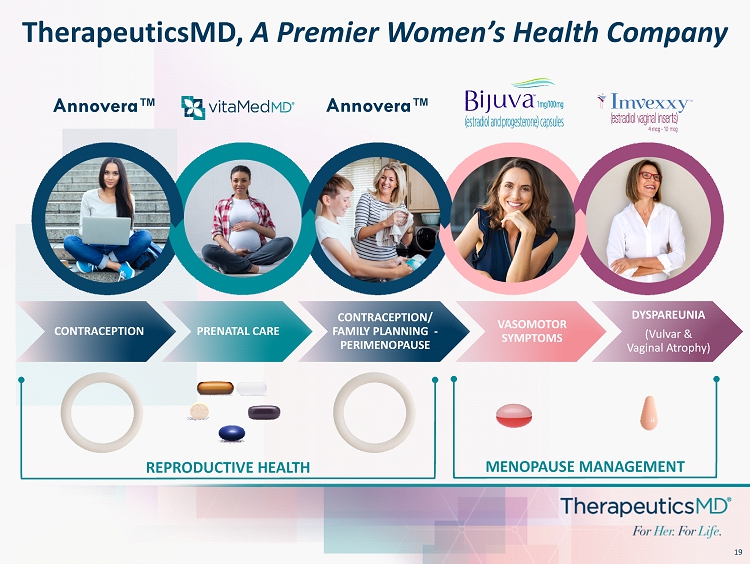

3 TherapeuticsMD, A Premier Women’s Health Company CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Annovera ™ Annovera ™

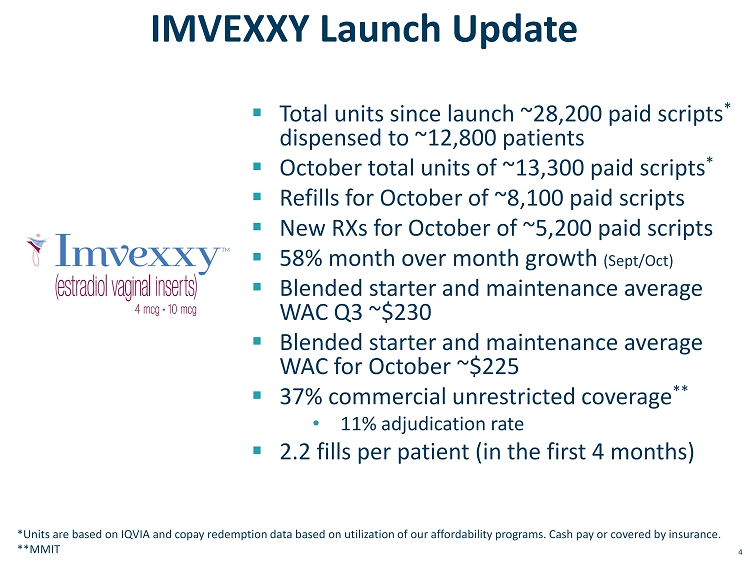

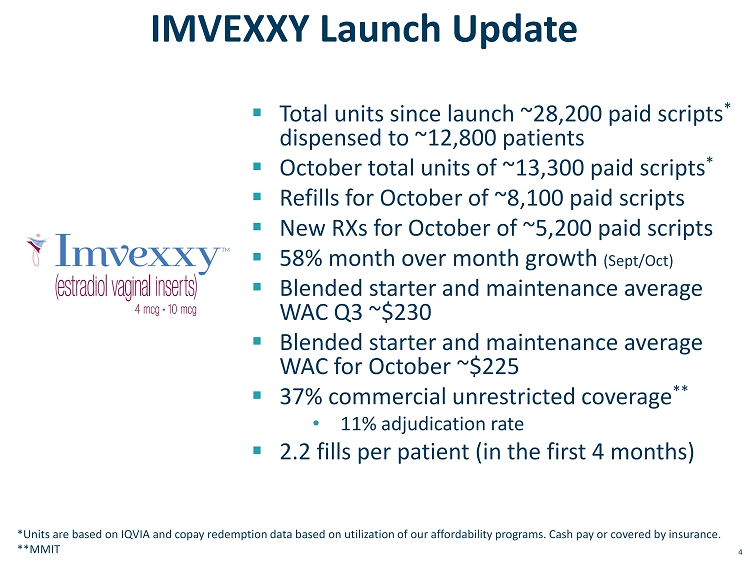

4 IMVEXXY Launch Update ▪ Total units since launch ~28,200 paid scripts * dispensed to ~12,800 patients ▪ October total units of ~13,300 paid scripts * ▪ Refills for October of ~8,100 paid scripts ▪ New RXs for October of ~5,200 paid scripts ▪ 58% month over month growth (Sept/Oct) ▪ Blended starter and maintenance average WAC Q3 ~$230 ▪ Blended starter and maintenance average WAC for October ~$225 ▪ 37% commercial unrestricted coverage ** • 11% adjudication rate ▪ 2.2 fills per patient (in the first 4 months) *Units are based on IQVIA and copay redemption data based on utilization of our affordability programs. Cash pay or covered b y i nsurance. **MMIT

5 VVA TRx Launch Comparison Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Month 13 Month 14 Month 15 Month 16 Month 17 Month 18 Imvexxy 154 6,276 8,443 13,300 Vagifem 25MG 301 3,480 8,849 12,601 17,764 21,036 23,981 26,719 28,700 36,186 37,160 43,208 45,882 47,882 52,603 48,674 57,675 56,485 Osphena 42 661 1,659 2,693 3,476 5,095 6,121 7,316 9,203 10,484 13,289 14,487 16,616 18,056 18,998 19,440 19,804 20,817 Intrarosa 128 1,390 2,363 3,945 5,118 6,251 6,875 7,631 9,675 10,633 12,579 13,782 14,669 16,508 16,119 8,443 13,300 8,849 12,601 43,208 56,485 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Imvexxy TRx Launch Comparison Imvexxy Vagifem 25MG Osphena Intrarosa IMVEXXY References: Imvexxy is QVIA and copay redemption data. Osphena and Intrarosa is SHA PHAST data. Vagifem is from IQVIA.

6 3Q 2018 Financial Update

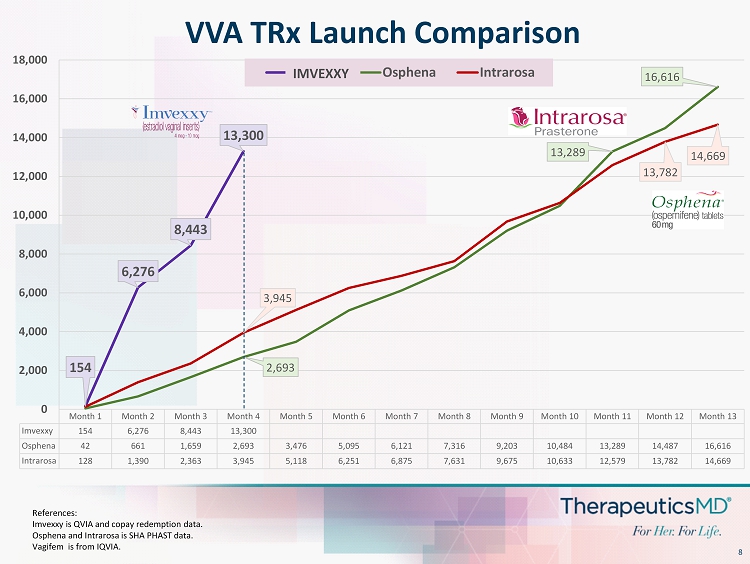

7 Commercial Update

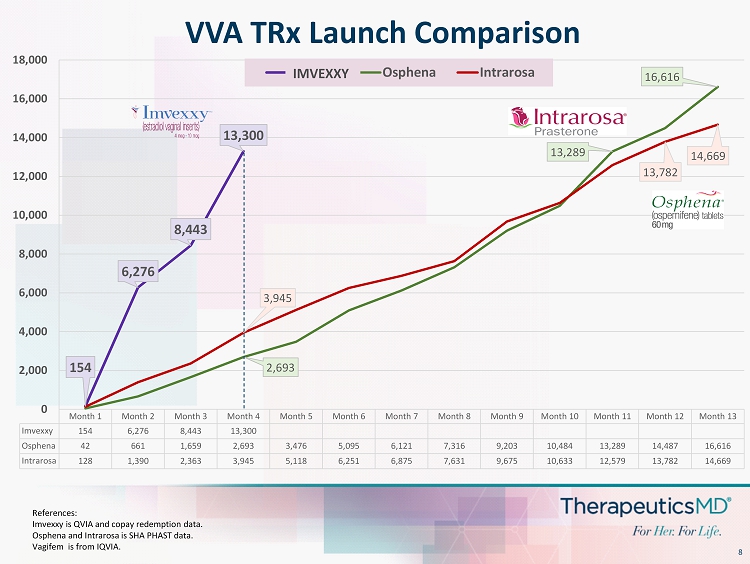

8 VVA TRx Launch Comparison Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Month 13 Imvexxy 154 6,276 8,443 13,300 Osphena 42 661 1,659 2,693 3,476 5,095 6,121 7,316 9,203 10,484 13,289 14,487 16,616 Intrarosa 128 1,390 2,363 3,945 5,118 6,251 6,875 7,631 9,675 10,633 12,579 13,782 14,669 154 6,276 8,443 13,300 2,693 13,289 16,616 3,945 13,782 14,669 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 Imvexxy Osphena Intrarosa IMVEXXY References: Imvexxy is QVIA and copay redemption data. Osphena and Intrarosa is SHA PHAST data. Vagifem is from IQVIA.

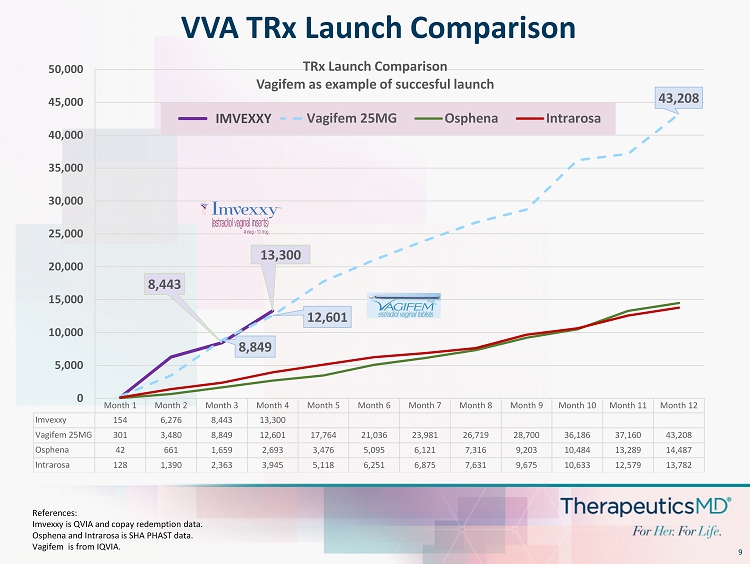

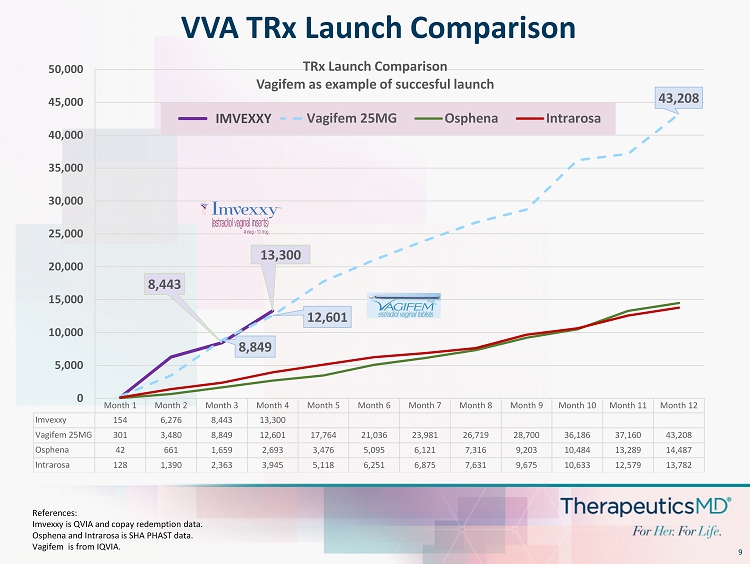

9 VVA TRx Launch Comparison Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Imvexxy 154 6,276 8,443 13,300 Vagifem 25MG 301 3,480 8,849 12,601 17,764 21,036 23,981 26,719 28,700 36,186 37,160 43,208 Osphena 42 661 1,659 2,693 3,476 5,095 6,121 7,316 9,203 10,484 13,289 14,487 Intrarosa 128 1,390 2,363 3,945 5,118 6,251 6,875 7,631 9,675 10,633 12,579 13,782 8,443 13,300 8,849 12,601 43,208 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 TRx Launch Comparison Vagifem as example of succesful launch Imvexxy Vagifem 25MG Osphena Intrarosa IMVEXXY References: Imvexxy is QVIA and copay redemption data. Osphena and Intrarosa is SHA PHAST data. Vagifem is from IQVIA.

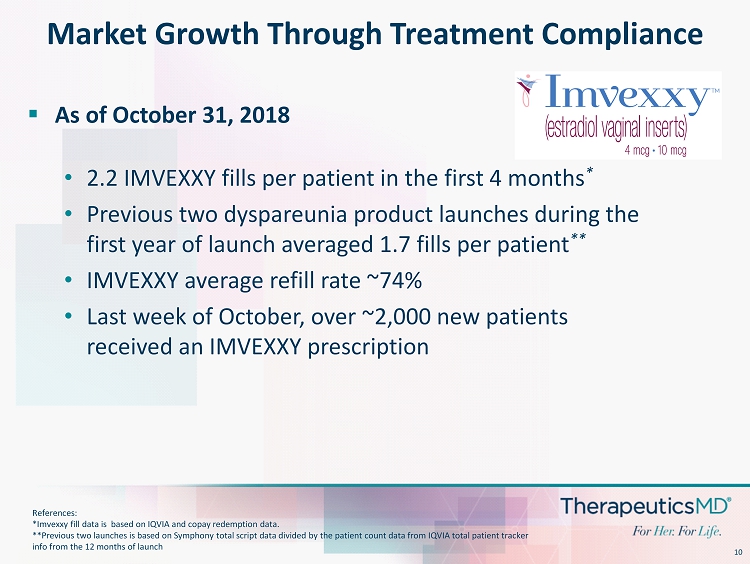

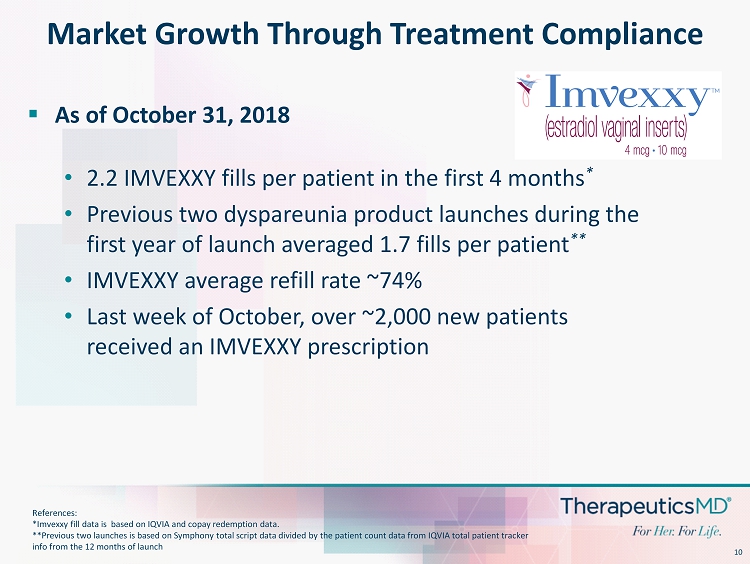

10 ▪ As of October 31, 2018 • 2.2 IMVEXXY fills per patient in the first 4 months * • Previous two dyspareunia product launches during the first year of launch averaged 1.7 fills per patient ** • IMVEXXY average refill rate ~74% • Last week of October, over ~2,000 new patients received an IMVEXXY prescription Market Growth Through Treatment Compliance References: *Imvexxy fill data is based on IQVIA and copay redemption data. **Previous two launches is based on Symphony total script data divided by the patient count data from IQVIA total patient tra cke r info from the 12 months of launch

11 ▪ Launched speaker programs across the US ▪ Adding additional sales reps to increase IMVEXXY market share and launch BIJUVA ▪ Launching consumer marketing effort Q1 of 2019 ▪ Increasing Bio - Ignite pharmacies with IMVEXXY ▪ Launch BIJUVA in the 2Q of 2019 ▪ Launch ANNOVERA as early as the 4Q of 2019 Next Phase of Growth

▪ Goal to close last remaining large commercial payers contracts in 2018 ▪ We are near the end of the expected 6 - month payer block ▪ Anticipate strong commercial adjudication will start in Q1 of 2019 IMVEXXY Payer Update

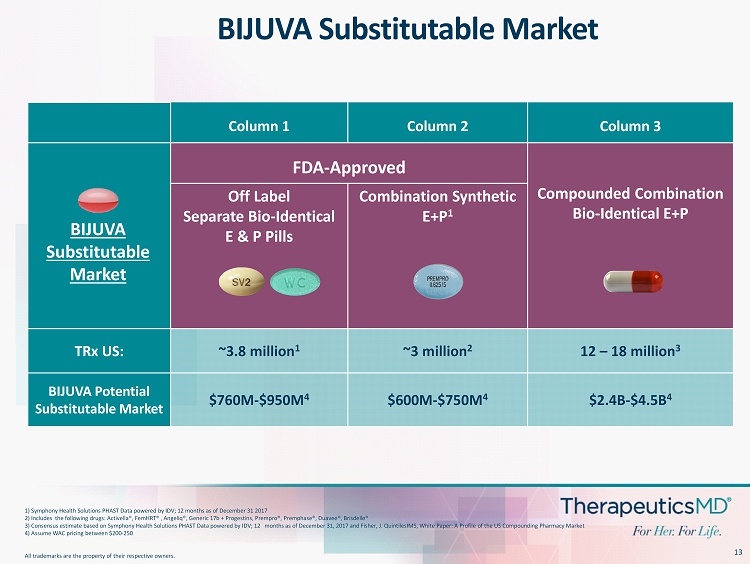

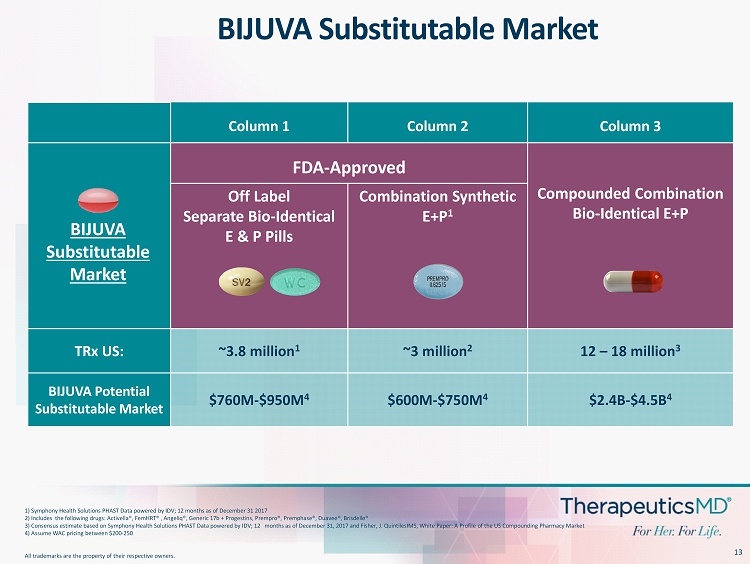

13 Column 1 Column 2 Column 3 FDA - Approved Compounded Combination Bio - Identical E+P Off Label Separate Bio - Identical E & P Pills Combination Synthetic E+P 1 TRx US: ~3.8 million 1 ~3 million 2 12 – 18 million 3 BIJUVA Potential Substitutable Market $760M - $950M 4 $600M - $750M 4 $2.4B - $4.5B 4 1) Symphony Health Solutions PHAST Data powered by IDV; 12 months as of December 31 2017 2) Includes the following drugs: Activella®, FemHRT ® , Angeliq ®, Generic 17b + Progestins, Prempro ®, Premphase ®, Duavee ®, Brisdelle® 3) Consensus estimate based on Symphony Health Solutions PHAST Data powered by IDV; 12 months as of December 31, 2017 and F ish er, J. QuintilesIMS, White Paper: A Profile of the US Compounding Pharmacy Market 4) Assume WAC pricing between $200 - 250 All trademarks are the property of their respective owners. BIJUVA Substitutable Market BIJUVA Substitutable Market

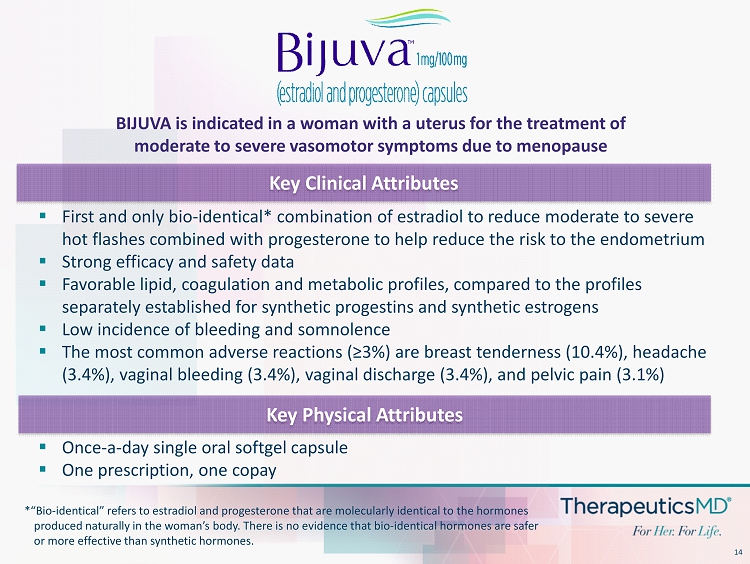

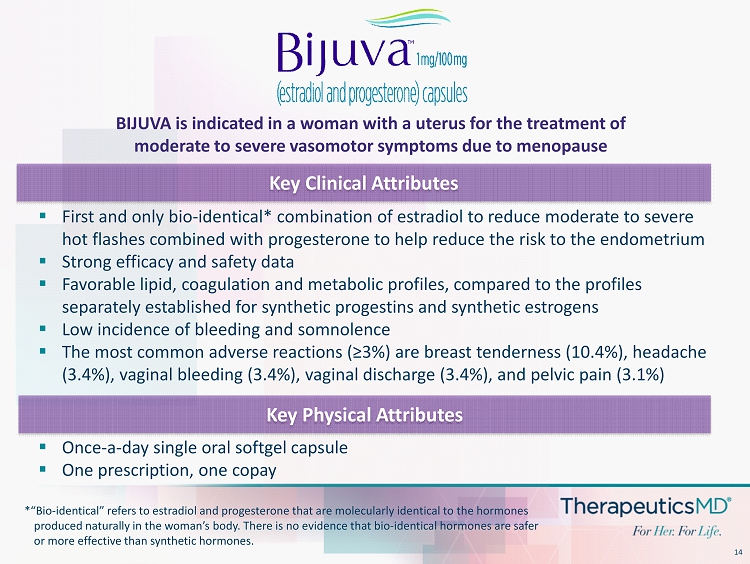

14 ▪ First and only bio - identical* combination of estradiol to reduce moderate to severe hot flashes combined with progesterone to help reduce the risk to the endometrium ▪ Strong efficacy and safety data ▪ Favorable lipid, coagulation and metabolic profiles, compared to the profiles separately established for synthetic progestins and synthetic estrogens ▪ Low incidence of bleeding and somnolence ▪ The most common adverse reactions (≥3%) are breast tenderness (10.4%), headache (3.4%), vaginal bleeding (3.4%), vaginal discharge (3.4%), and pelvic pain (3.1%) Key Physical Attributes Key Clinical Attributes ▪ Once - a - day single oral softgel capsule ▪ One prescription, one copay BIJUVA is indicated in a woman with a uterus for the treatment of moderate to severe vasomotor symptoms due to menopause *“Bio - identical” refers to estradiol and progesterone that are molecularly identical to the hormones produced naturally in the woman’s body. There is no evidence that bio - identical hormones are safer or more effective than synthetic hormones.

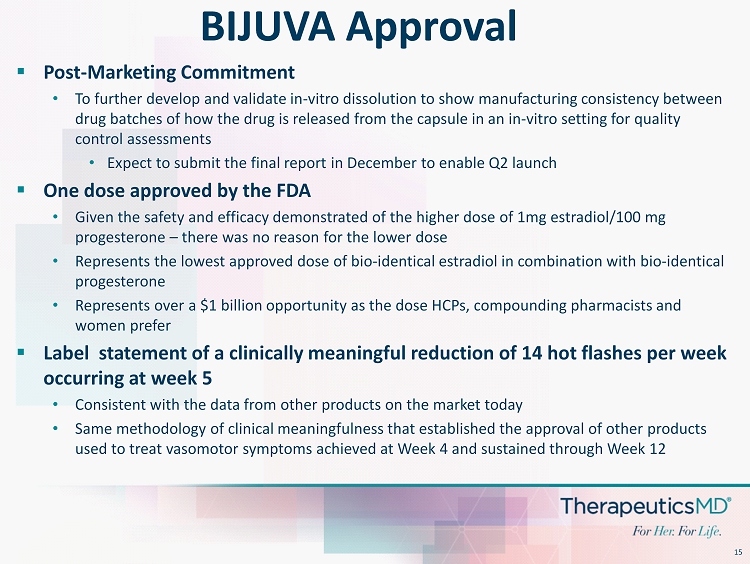

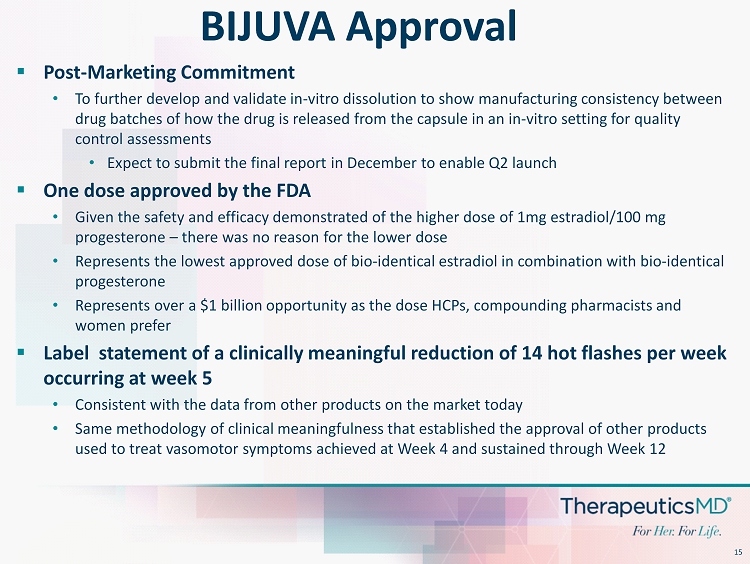

15 ▪ Post - Marketing Commitment • To further develop and validate in - vitro dissolution to show manufacturing consistency between drug batches of how the drug is released from the capsule in an in - vitro setting for quality control assessments • Expect to submit the final report in December to enable Q2 launch ▪ One dose approved by the FDA • Given the safety and efficacy demonstrated of the higher dose of 1mg estradiol/100 mg progesterone – there was no reason for the lower dose • Represents the lowest approved dose of bio - identical estradiol in combination with bio - identical progesterone • Represents over a $1 billion opportunity as the dose HCPs, compounding pharmacists and women prefer ▪ Label statement of a clinically meaningful reduction of 14 hot flashes per week occurring at week 5 • Consistent with the data from other products on the market today • Same methodology of clinical meaningfulness that established the approval of other products used to treat vasomotor symptoms achieved at Week 4 and sustained through Week 12 BIJUVA Approval

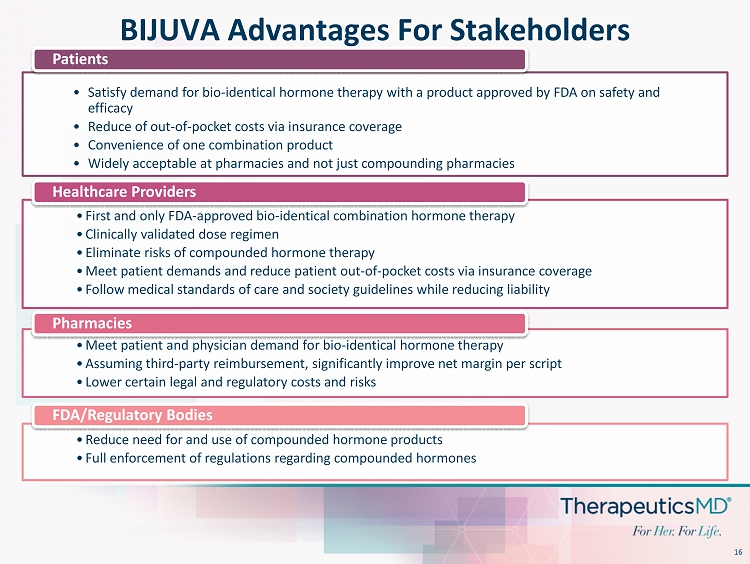

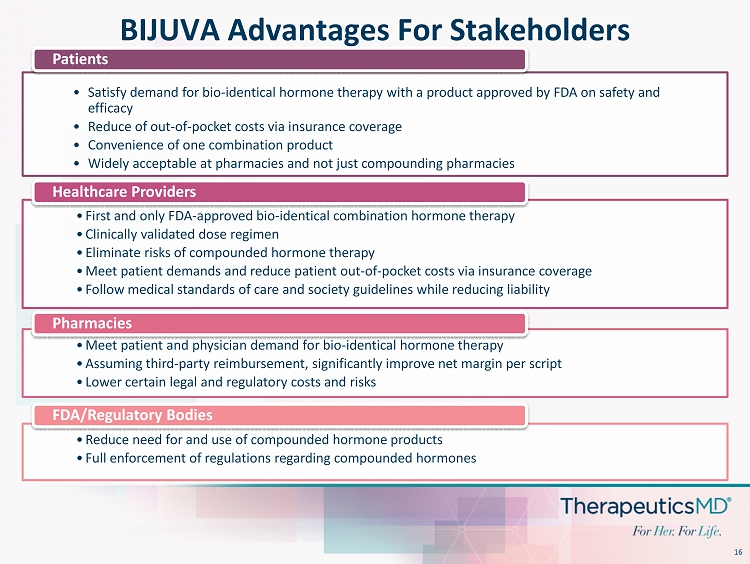

16 BIJUVA Advantages For Stakeholders • Satisfy demand for bio - identical hormone therapy with a product approved by FDA on safety and efficacy • Reduce of out - of - pocket costs via insurance coverage • Convenience of one combination product • Widely acceptable at pharmacies and not just compounding pharmacies Patients • First and only FDA - approved bio - identical combination hormone therapy • Clinically validated dose regimen • Eliminate risks of compounded hormone therapy • Meet patient demands and reduce patient out - of - pocket costs via insurance coverage • Follow medical standards of care and society guidelines while reducing liability Healthcare Providers • Meet patient and physician demand for bio - identical hormone therapy • Assuming third - party reimbursement, significantly improve net margin per script • Lower certain legal and regulatory costs and risks Pharmacies • Reduce need for and use of compounded hormone products • Full enforcement of regulations regarding compounded hormones FDA/Regulatory Bodies

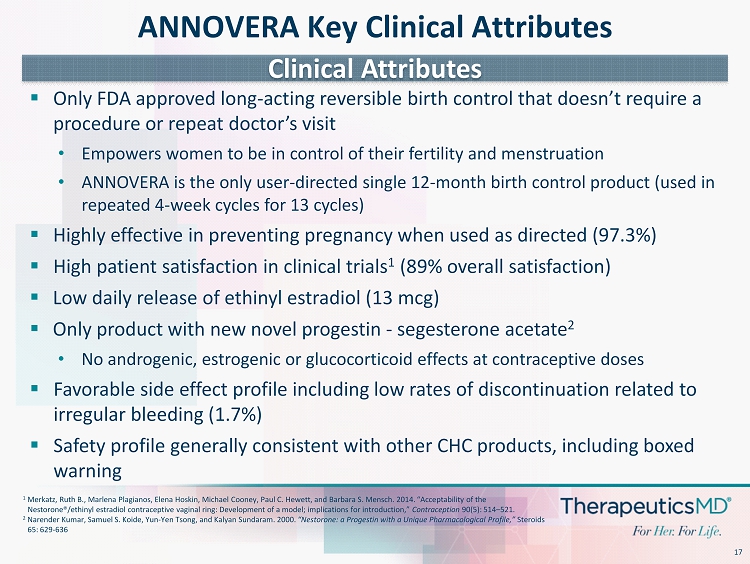

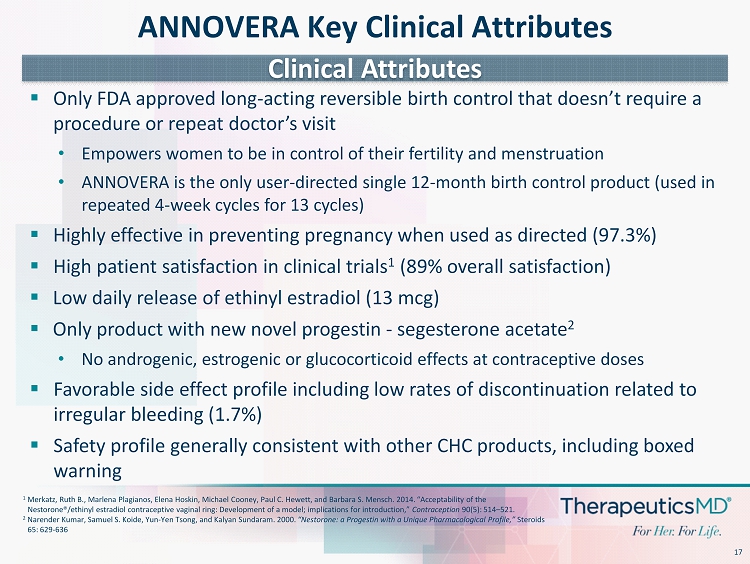

17 ▪ Only FDA approved long - acting reversible birth control that doesn’t require a procedure or repeat doctor’s visit • Empowers women to be in control of their fertility and menstruation • ANNOVERA is the only user - directed single 12 - month birth control product (used in repeated 4 - week cycles for 13 cycles) ▪ Highly effective in preventing pregnancy when used as directed (97.3%) ▪ High patient satisfaction in clinical trials 1 (89% overall satisfaction) ▪ Low daily release of ethinyl estradiol (13 mcg) ▪ Only product with new novel progestin - segesterone acetate 2 • No androgenic, estrogenic or glucocorticoid effects at contraceptive doses ▪ Favorable side effect profile including low rates of discontinuation related to irregular bleeding (1.7%) ▪ Safety profile generally consistent with other CHC products, including boxed warning 1 Merkatz , Ruth B., Marlena Plagianos , Elena Hoskin, Michael Cooney, Paul C. Hewett, and Barbara S. Mensch. 2014. “Acceptability of the Nestorone ®/ethinyl estradiol contraceptive vaginal ring: Development of a model; implications for introduction,” Contraception 90(5): 514 – 521. 2 Narender Kumar, Samuel S. Koide, Yun - Yen Tsong , and Kalyan Sundaram. 2000. “Nestorone: a Progestin with a Unique Pharmacological Profile,” Steroids 65: 629 - 636 ANNOVERA Key Clinical Attributes Clinical Attributes

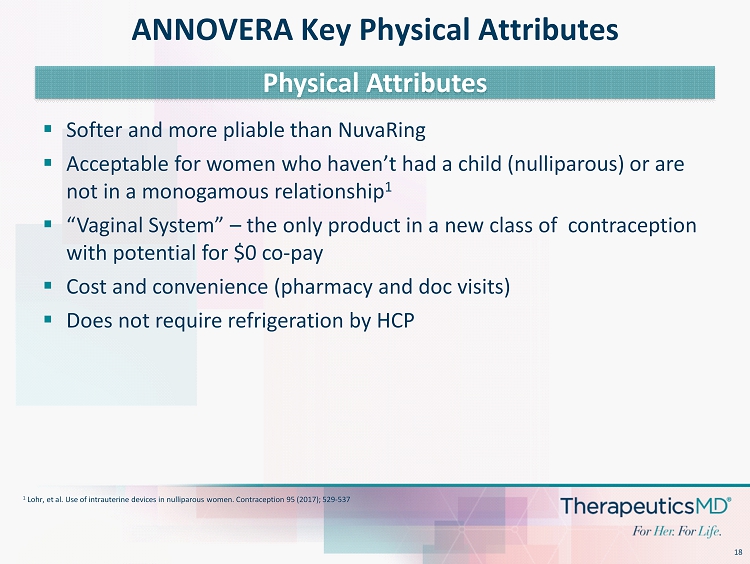

18 1 Lohr , et al. Use of intrauterine devices in nulliparous women. Contraception 95 (2017); 529 - 537 ANNOVERA Key Physical Attributes Physical Attributes ▪ Softer and more pliable than NuvaRing ▪ Acceptable for women who haven’t had a child (nulliparous) or are not in a monogamous relationship 1 ▪ “Vaginal System” – the only product in a new class of contraception with potential for $0 co - pay ▪ Cost and convenience (pharmacy and doc visits) ▪ Does not require refrigeration by HCP

19 TherapeuticsMD, A Premier Women’s Health Company CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Annovera ™ Annovera ™

20