TherapeuticsMD, Inc. 8-K

Exhibit 99.2

4 Q and Full - Year 2018 Financial Results February 21, 2019

2 Forward - Looking Statements This presentation by TherapeuticsMD, Inc. (referred to as “we” and “our”) may contain forward - looking statements. Forward - lookin g statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as state men ts, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anti cip ate will or may occur in the future. These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipat e,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are ba sed on assumptions and assessments made in light of our managerial experience and perception of historical trends, current condition s, expected future developments and other factors we believe to be appropriate. Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward - looking statements are n ot guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control. Imp ort ant factors that could cause actual results, developments and business decisions to differ materially from forward - looking statement s are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission, including our mos t r ecent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following: our ability to maintain or increase sales of our products; our ability to develop and commercialize IMVEXXY®, ANNOVERA TM , BIJUVA TM and our hormone therapy drug candidates and obtain additional financing necessary therefor; whether we will be able to comply with the covenants and conditions under our term loan agreement; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of our current or future approved products or preclude t he approval of our future drug candidates; the length, cost and uncertain results of future clinical trials; the ability of our lic ensees to commercialize and distribute our product and product candidates; our reliance on third parties to conduct our manufacturing, research and development and clinical trials; the availability of reimbursement from government authorities and health insura nce companies for our products; the impact of product liability lawsuits; the influence of extensive and costly government regula tio n; the volatility of the trading price of our common stock and the concentration of power in our stock ownership. This non - promotional presentation is intended for investor audiences only.

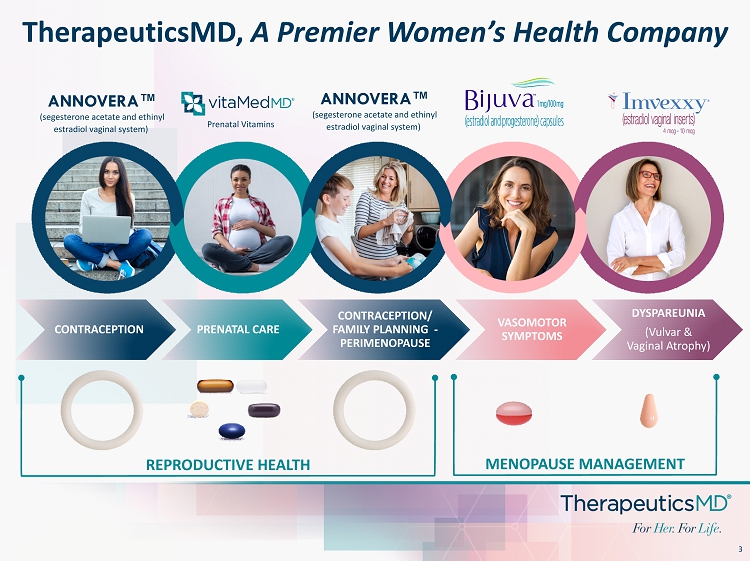

3 TherapeuticsMD, A Premier Women’s Health Company CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT ANNOVERA™ ( segesterone acetate and ethinyl estradiol vaginal system) ANNOVERA™ ( segesterone acetate and ethinyl estradiol vaginal system) Prenatal Vitamins

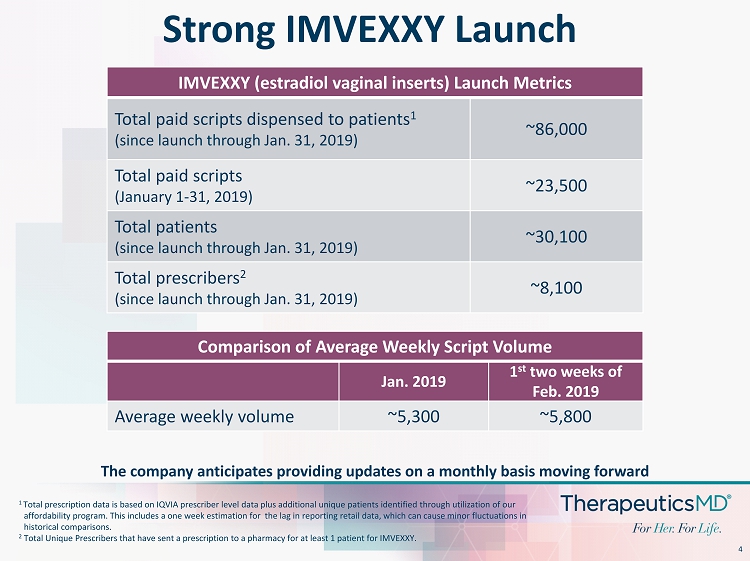

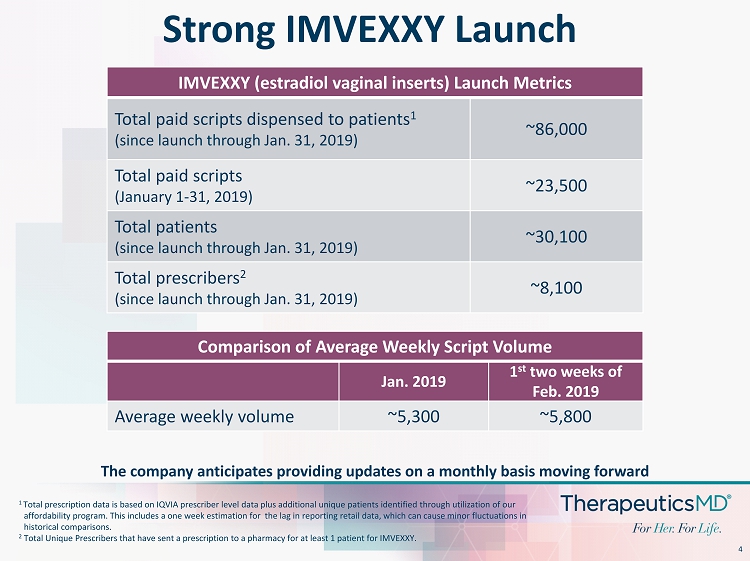

4 Strong IMVEXXY Launch 1 Total prescription data is based on IQVIA prescriber level data plus additional unique patients identified through utilizatio n o f our affordability program . This includes a one week estimation for the lag in reporting retail data, which can cause minor fluctuations in historical comparisons. 2 Total Unique Prescribers that have sent a prescription to a pharmacy for at least 1 patient for IMVEXXY. IMVEXXY (estradiol vaginal inserts) Launch Metrics Total paid scripts dispensed to patients 1 (since launch through Jan. 31, 2019) ~86,000 Total paid scripts (January 1 - 31, 2019) ~23,500 Total patients (since launch through Jan. 31, 2019) ~30,100 Total prescribers 2 (since launch through Jan. 31, 2019) ~8,100 The company anticipates providing updates on a monthly basis moving forward Comparison of Average Weekly Script Volume Jan. 2019 1 st two weeks of Feb. 2019 Average weekly volume ~5,300 ~5,800

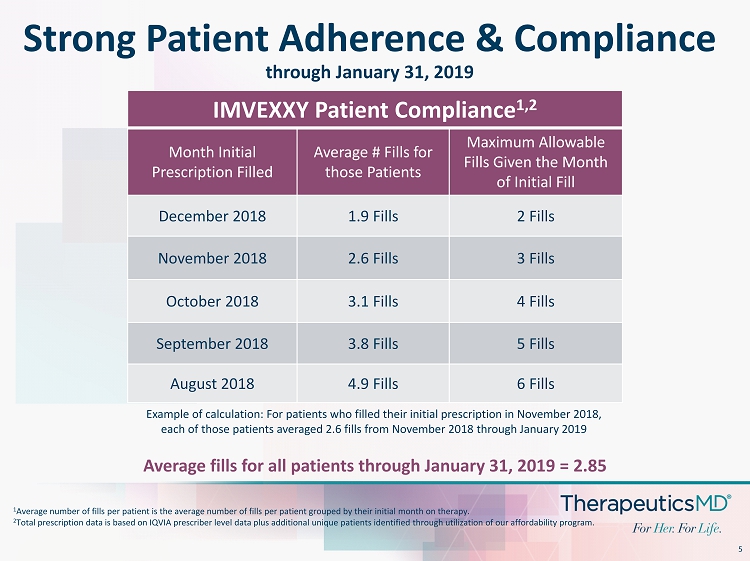

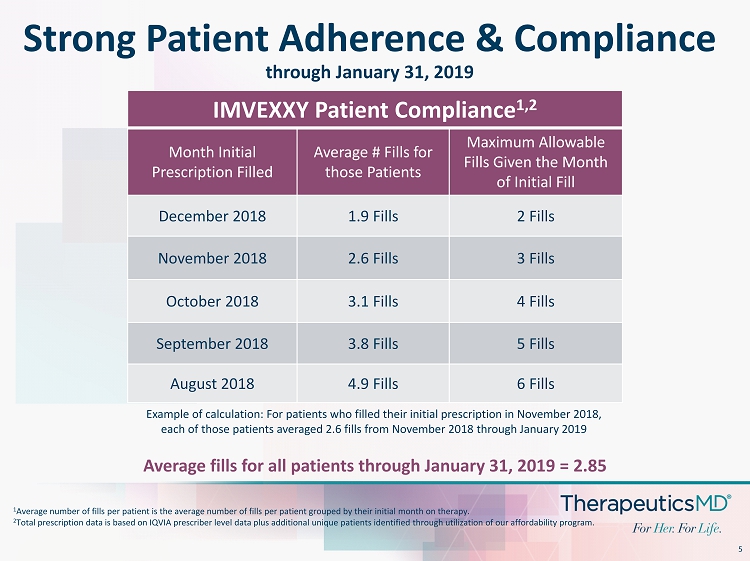

5 Strong Patient Adherence & Compliance through January 31, 2019 Average fills for all patients through January 31, 2019 = 2.85 IMVEXXY Patient Compliance 1,2 Month Initial Prescription Filled Average # Fills for those Patients Maximum Allowable Fills Given the Month of Initial Fill December 2018 1.9 Fills 2 Fills November 2018 2.6 Fills 3 Fills October 2018 3.1 Fills 4 Fills September 2018 3.8 Fills 5 Fills August 2018 4.9 Fills 6 Fills 1 Average number of fills per patient is the average number of fills per patient grouped by their initial month on therapy. 2 Total prescription data is based on IQVIA prescriber level data plus additional unique patients identified through utilizatio n o f our affordability program. Example of calculation: For patients who filled their initial prescription in November 2018, each of those patients averaged 2.6 fills from November 2018 through January 2019

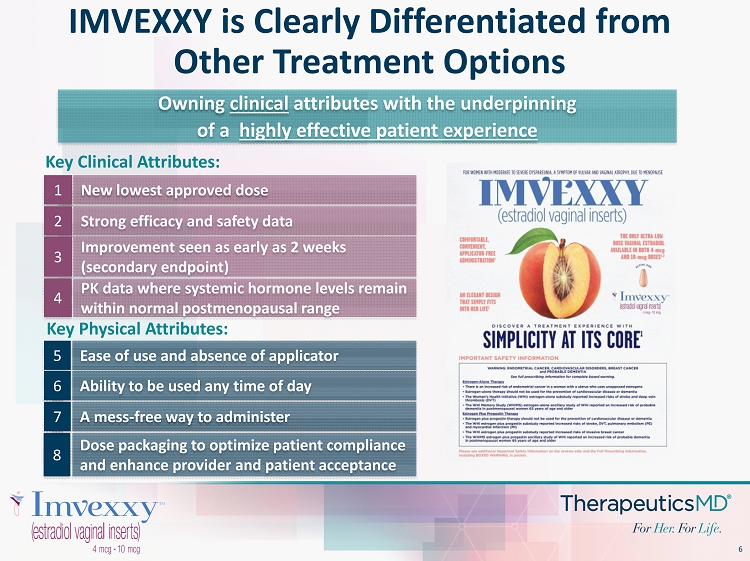

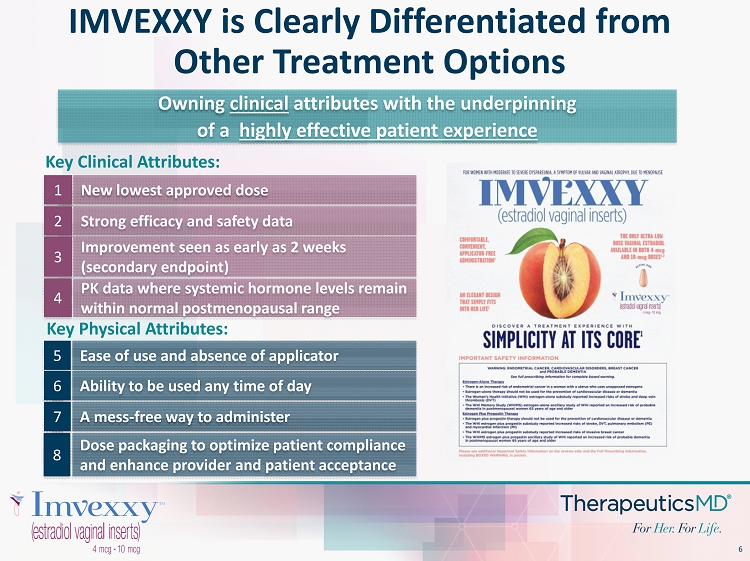

6 Improvement seen as early as 2 weeks (secondary endpoint) Key Clinical Attributes: New lowest approved dose 1 Strong efficacy and safety data 2 3 Owning clinical attributes with the underpinning of a highly effective patient experience Ease of use and absence of applicator 5 Ability to be used any time of day 6 A mess - free way to administer 7 PK data where systemic hormone levels remain within normal postmenopausal range 4 Dose packaging to optimize patient compliance and enhance provider and patient acceptance 8 Key Physical Attributes: IMVEXXY is Clearly Differentiated from Other Treatment Options

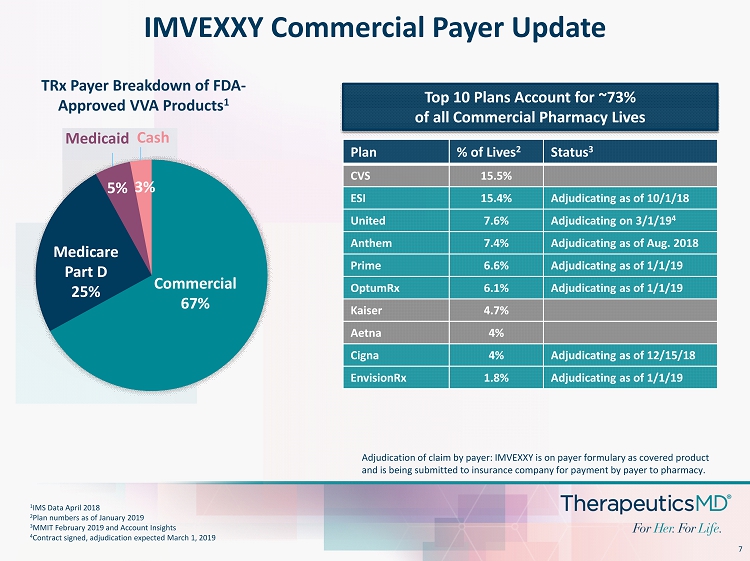

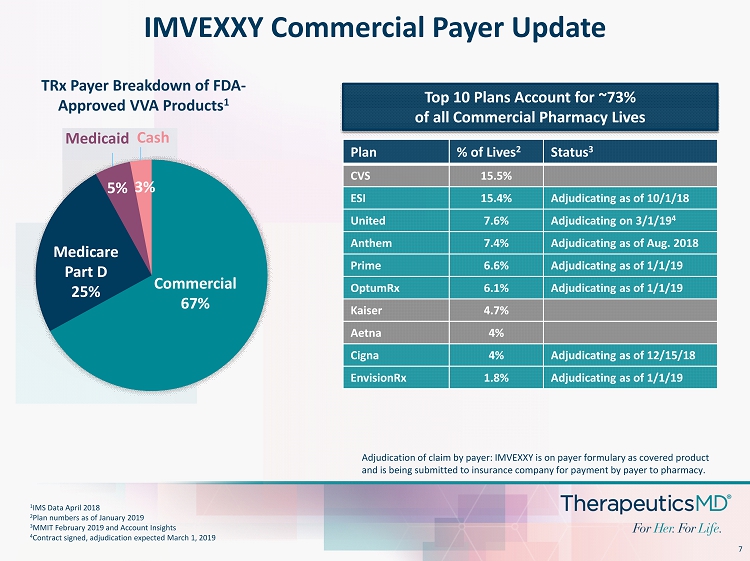

7 IMVEXXY Commercial Payer Update Plan % of Lives 2 Status 3 CVS 15.5% ESI 15.4% Adjudicating as of 10/1/18 United 7.6% Adjudicating on 3/1/19 4 Anthem 7.4% Adjudicating as of Aug. 2018 Prime 6.6% Adjudicating as of 1/1/19 OptumRx 6.1% Adjudicating as of 1/1/19 Kaiser 4.7% Aetna 4% Cigna 4% Adjudicating as of 12/15/18 EnvisionRx 1.8% Adjudicating as of 1/1/19 1 IMS Data April 2018 2 Plan numbers as of January 2019 3 MMIT February 2019 and Account Insights 4 Contract signed, adjudication expected March 1, 2019 Top 10 Plans Account for ~73% of all Commercial Pharmacy Lives Medicaid Cash Commercial 67% Medicare Part D 25% 5% 3% TRx Payer Breakdown of FDA - Approved VVA Products 1 Adjudication of claim by payer: IMVEXXY is on payer formulary as covered product and is being submitted to insurance company for payment by payer to pharmacy.

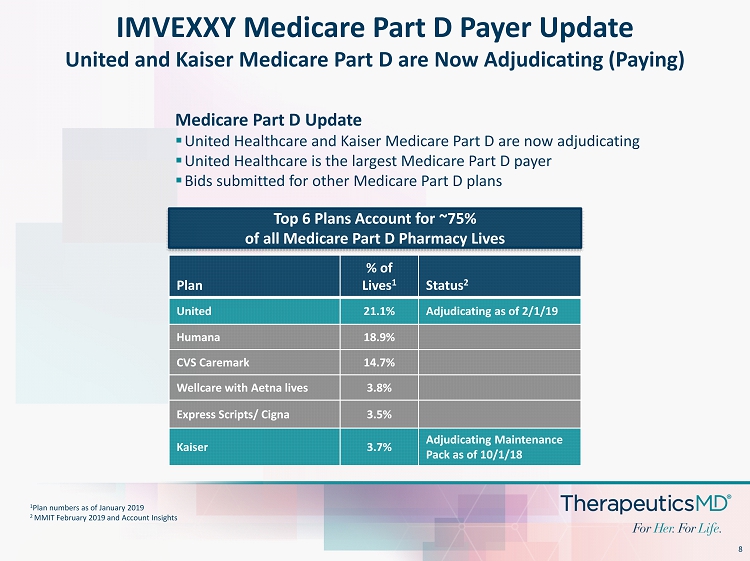

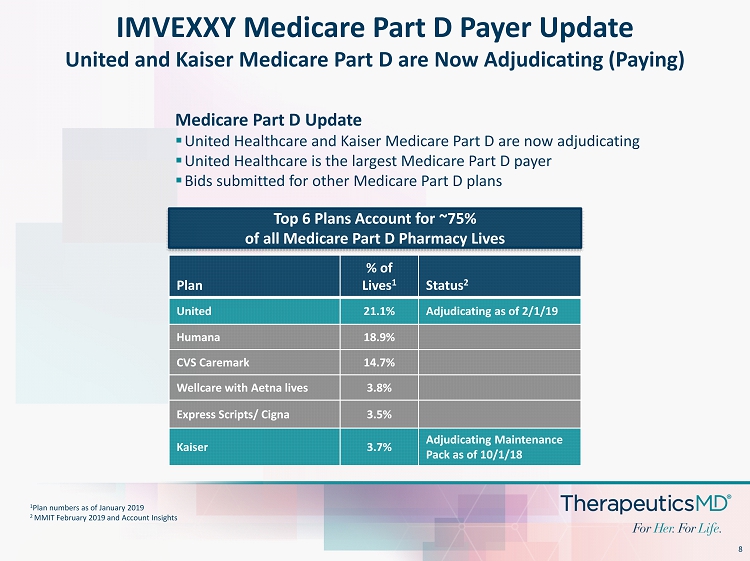

8 IMVEXXY Medicare Part D Payer Update United and Kaiser Medicare Part D are Now Adjudicating (Paying) Plan % of Lives 1 Status 2 United 21.1% Adjudicating as of 2/1/19 Humana 18.9% CVS Caremark 14.7% Wellcare with Aetna lives 3.8% Express Scripts/ Cigna 3.5% Kaiser 3.7% Adjudicating Maintenance Pack as of 10/1/18 1 Plan numbers as of January 2019 2 MMIT February 2019 and Account Insights Top 6 Plans Account for ~75% of all Medicare Part D Pharmacy Lives Medicare Part D Update ▪ United Healthcare and Kaiser Medicare Part D are now adjudicating ▪ United Healthcare is the largest Medicare Part D payer ▪ Bids submitted for other Medicare Part D plans

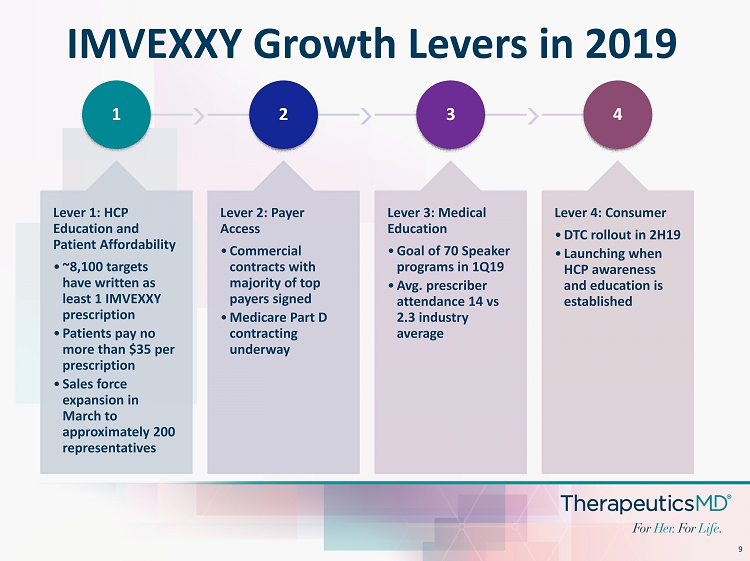

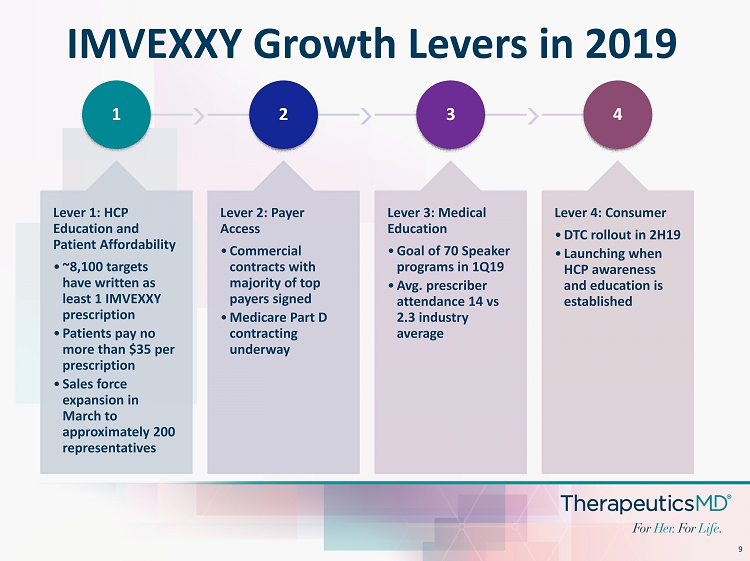

9 IMVEXXY Growth Levers in 2019 1 Lever 1: HCP Education and Patient Affordability • ~8,100 targets have written as least 1 IMVEXXY prescription • Patients pay no more than $35 per prescription • Sales force expansion in March to approximately 200 representatives 2 Lever 2: Payer Access • Commercial contracts with majority of top payers signed • Medicare Part D contracting underway 3 Lever 3: Medical Education • Goal of 70 Speaker programs in 1Q19 • Avg. prescriber attendance 14 vs 2.3 industry average 4 Lever 4: Consumer • DTC rollout in 2H19 • Launching when HCP awareness and education is established

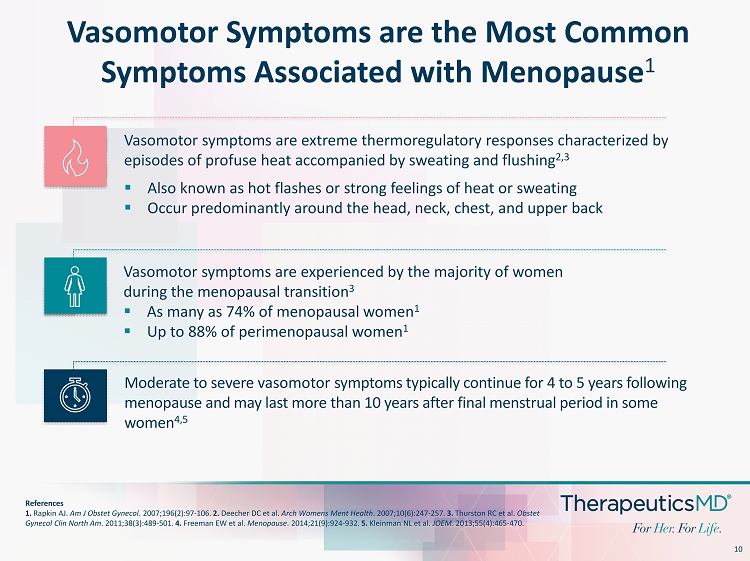

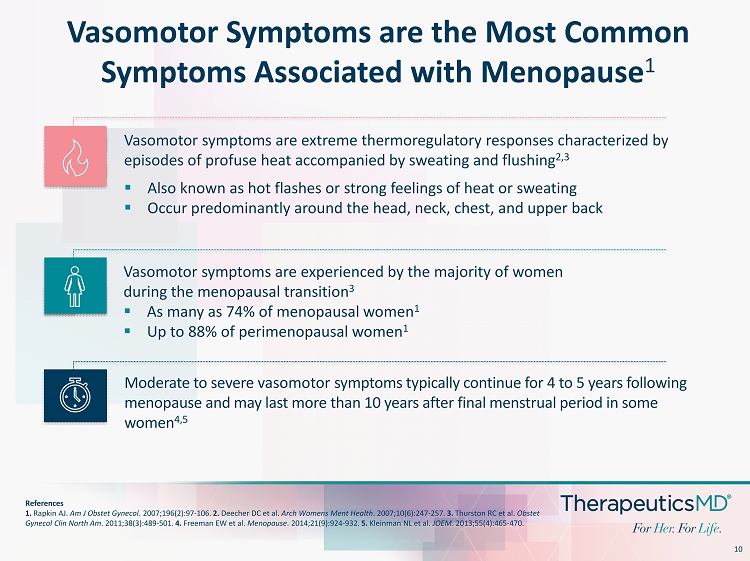

10 Vasomotor Symptoms are the Most Common Symptoms Associated with Menopause 1 References 1. Rapkin AJ. Am J Obstet Gynecol . 2007;196(2):97 - 106. 2. Deecher DC et al. Arch Womens Ment Health . 2007;10(6):247 - 257. 3. Thurston RC et al. Obstet Gynecol Clin North Am . 2011;38(3):489 - 501. 4. Freeman EW et al. Menopause . 2014;21(9):924 - 932. 5. Kleinman NL et al. JOEM . 2013;55(4):465 - 470. Vasomotor symptoms are extreme thermoregulatory responses characterized by episodes of profuse heat accompanied by sweating and flushing 2,3 Vasomotor symptoms are experienced by the majority of women during the menopausal transition 3 ▪ As many as 74% of menopausal women 1 ▪ Up to 88% of perimenopausal women 1 Moderate to severe vasomotor symptoms typically continue for 4 to 5 years following menopause and may last more than 10 years after final menstrual period in some women 4,5 ▪ Also known as hot flashes or strong feelings of heat or sweating ▪ Occur predominantly around the head, neck, chest, and upper back

11 WHI Impact on FDA Approved Hormone Therapy 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1998 2000 2002 2004 2006 2008 2010 2012 2013 2014 2016 2018 % of Market - FDA Approved Synthetic HRT % of Market - FDA Approved Bio-Identical HRT 2000 88.7 Million TRx 2018 7.7 Million TRx 2018 16.9 Million TRx 2000 18.8 Million TRx Market Share of Synthetic vs Bio - Identical Symphony Health PHAST Data Excludes products for VVA category of products

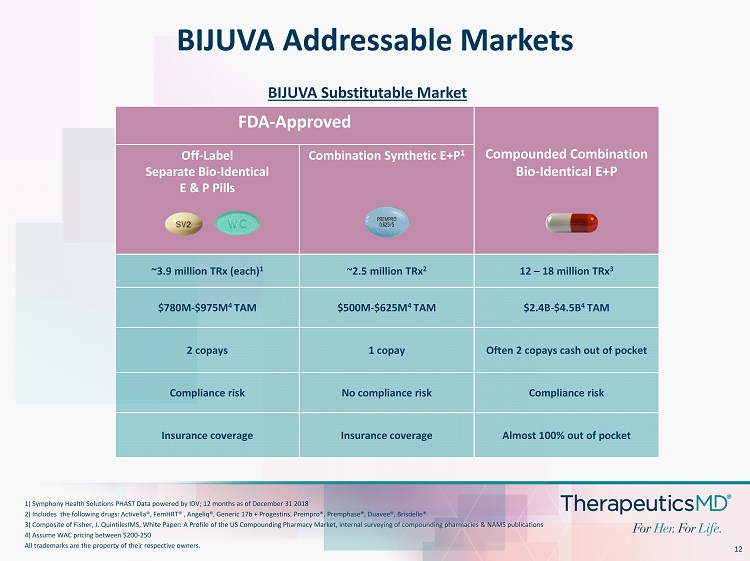

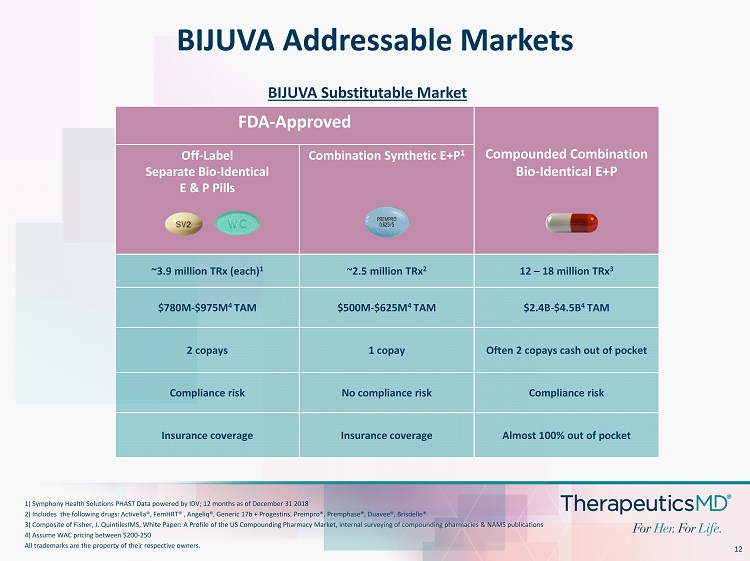

12 BIJUVA Addressable Markets 1) Symphony Health Solutions PHAST Data powered by IDV; 12 months as of December 31 2018 2) Includes the following drugs: Activella ®, FemHRT ® , Angeliq ®, Generic 17b + Progestins, Prempro ®, Premphase ®, Duavee ®, Brisdelle ® 3) Composite of Fisher, J. QuintilesIMS, White Paper: A Profile of the US Compounding Pharmacy Market, internal surveying of com pounding pharmacies & NAMS publications 4) Assume WAC pricing between $200 - 250 All trademarks are the property of their respective owners. FDA - Approved Compounded Combination Bio - Identical E+P Off - Label Separate Bio - Identical E & P Pills Combination Synthetic E+P 1 ~3.9 million TRx (each) 1 ~2.5 million TRx 2 12 – 18 million TRx 3 $780M - $975M 4 TAM $500M - $625M 4 TAM $2.4B - $4.5B 4 TAM 2 copays 1 copay Often 2 copays cash out of pocket Compliance risk No compliance risk Compliance risk Insurance coverage Insurance coverage Almost 100% out of pocket BIJUVA Substitutable Market

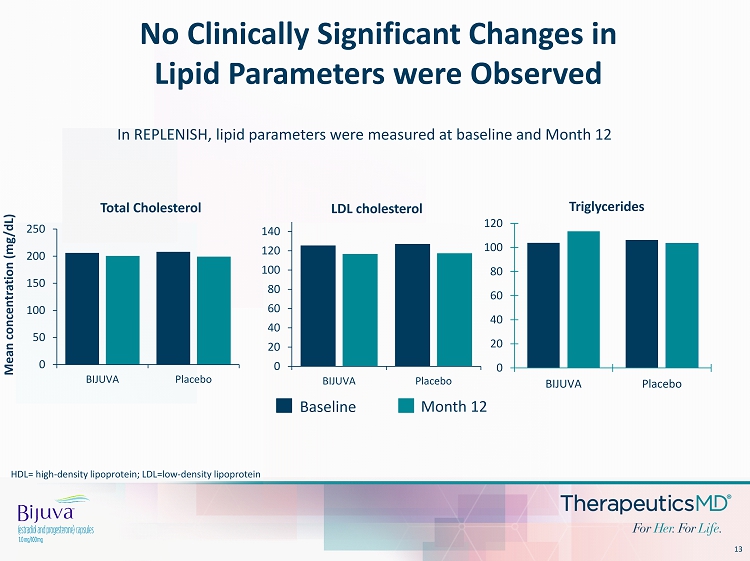

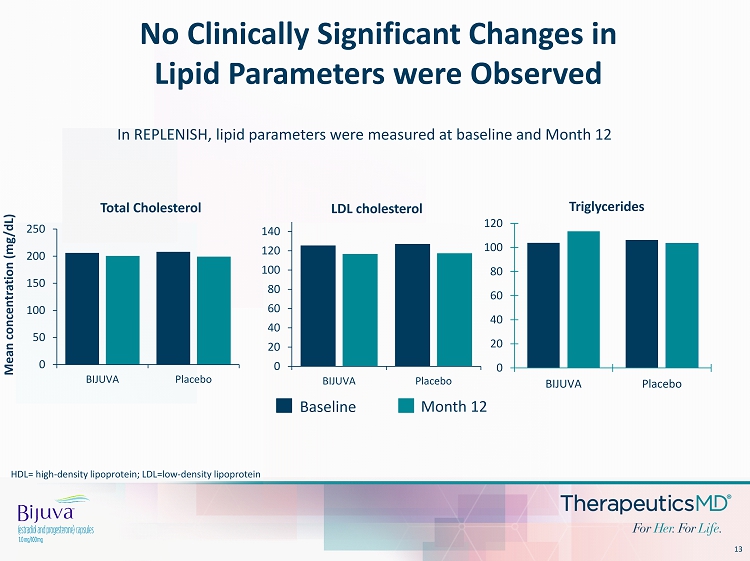

13 No Clinically Significant Changes in Lipid Parameters were Observed 0 50 100 150 200 250 BIJUVA Placebo Mean concentration (mg/dL) Total Cholesterol 0 20 40 60 80 100 120 140 BIJUVA Placebo LDL cholesterol Baseline Month 12 In REPLENISH, lipid parameters were measured at baseline and Month 12 HDL= high - density lipoprotein; LDL=low - density lipoprotein 0 20 40 60 80 100 120 BIJUVA Placebo Triglycerides

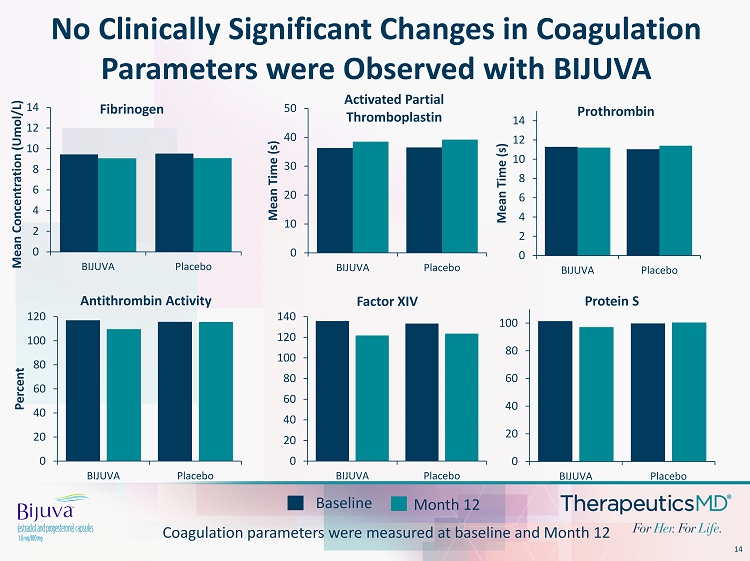

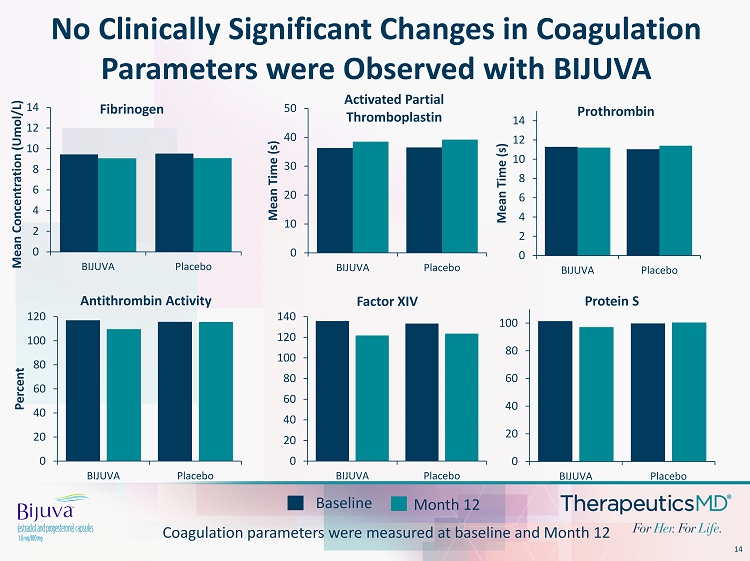

14 No Clinically Significant Changes in Coagulation Parameters were Observed with BIJUVA 0 20 40 60 80 100 120 140 BIJUVA Placebo Factor XIV 0 20 40 60 80 100 BIJUVA Placebo Protein S Baseline Month 12 Coagulation parameters were measured at baseline and Month 12 0 2 4 6 8 10 12 14 BIJUVA Placebo Mean Concentration ( Umol /L) Fibrinogen 0 10 20 30 40 50 BIJUVA Placebo Mean Time (s) Activated Partial Thromboplastin 0 2 4 6 8 10 12 14 BIJUVA Placebo Mean Time (s) Prothrombin 0 20 40 60 80 100 120 BIJUVA Placebo Percent Antithrombin Activity

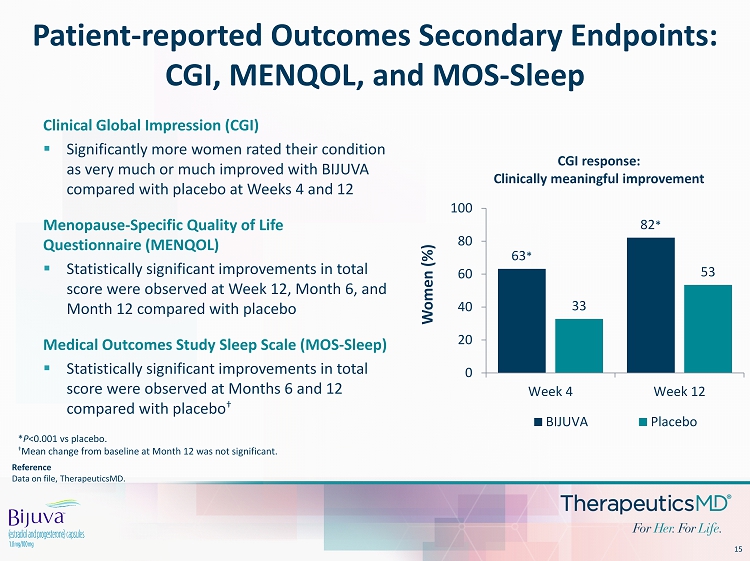

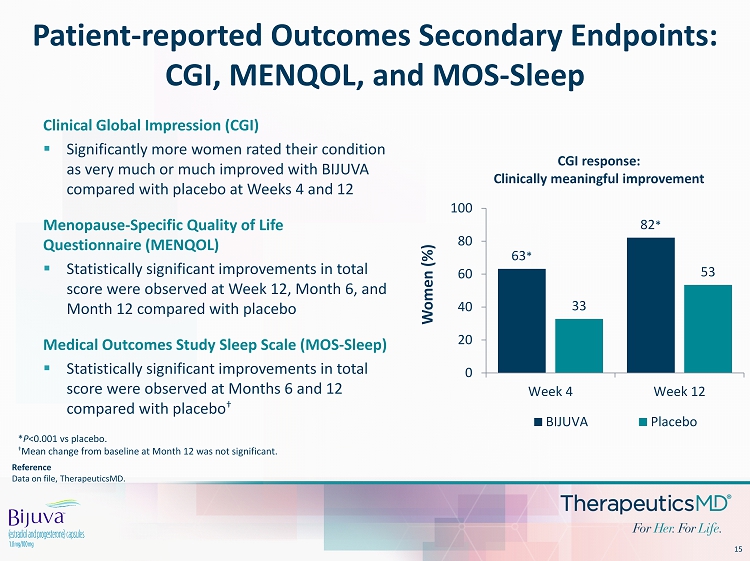

15 Reference Data on file, TherapeuticsMD . Patient - reported Outcomes Secondary Endpoints: CGI, MENQOL, and MOS - Sleep Clinical Global Impression (CGI) ▪ Significantly more women rated their condition as very much or much improved with BIJUVA compared with placebo at Weeks 4 and 12 Menopause - Specific Quality of Life Questionnaire (MENQOL) ▪ Statistically significant improvements in total score were observed at Week 12, Month 6, and Month 12 compared with placebo Medical Outcomes Study Sleep Scale (MOS - Sleep) ▪ Statistically significant improvements in total score were observed at Months 6 and 12 compared with placebo † * P <0.001 vs placebo. † Mean change from baseline at Month 12 was not significant. 63 * 82 * 33 53 0 20 40 60 80 100 Week 4 Week 12 Women (%) CGI response: Clinically meaningful improvement BIJUVA Placebo

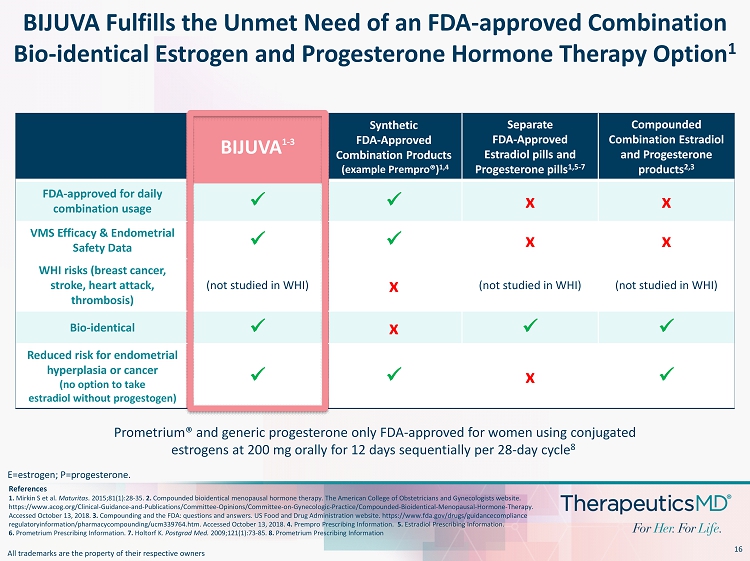

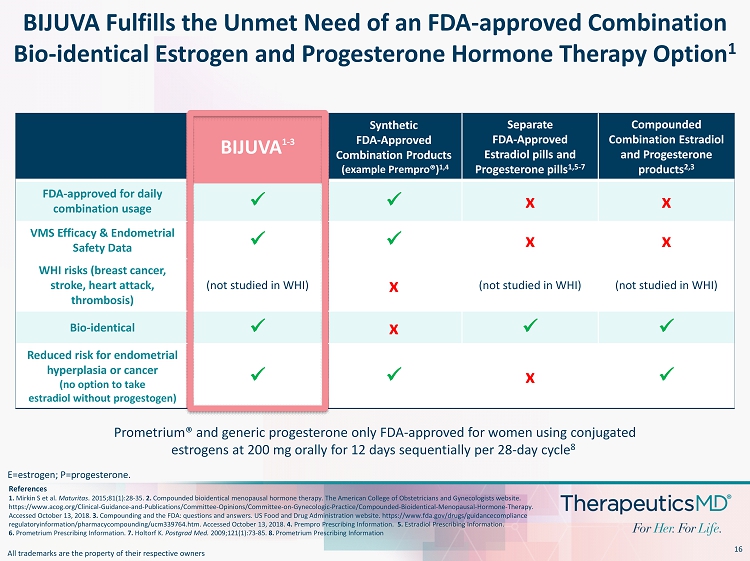

16 BIJUVA Fulfills the Unmet Need of an FDA - approved Combination Bio - identical Estrogen and Progesterone Hormone Therapy Option 1 References 1. Mirkin S et al. Maturitas . 2015;81(1):28 - 35. 2. Compounded bioidentical menopausal hormone therapy. The American College of Obstetricians and Gynecologists website. https://www.acog.org/Clinical - Guidance - and - Publications/Committee - Opinions/Committee - on - Gynecologic - Practice/Compounded - Bioident ical - Menopausal - Hormone - Therapy. Accessed October 13, 2018. 3. Compounding and the FDA: questions and answers. US Food and Drug Administration website. https:// www.fda.gov /drugs/ guidancecompliance regulatoryinformation / pharmacycompounding /ucm339764.htm. Accessed October 13, 2018. 4. Prempro Prescribing Information. 5. Estradiol Prescribing Information. 6. Prometrium Prescribing Information. 7. Holtorf K. Postgrad Med. 2009;121(1):73 - 85. 8 . Prometrium Prescribing Information Prometrium ® and generic progesterone only FDA - approved for women using conjugated estrogens at 200 mg orally for 12 days sequentially per 28 - day cycle 8 E=estrogen; P=progesterone. BIJUVA 1 - 3 Synthetic FDA - Approved Combination Products (example Prempro ®) 1,4 Separate FDA - Approved Estradiol pills and Progesterone pills 1,5 - 7 Compounded Combination Estradiol and Progesterone products 2,3 FDA - approved for daily combination usage x x x x VMS Efficacy & Endometrial Safety Data x x x x WHI risks (breast cancer, stroke, heart attack, thrombosis) (not studied in WHI) x (not studied in WHI) (not studied in WHI) Bio - identical x x x x Reduced risk for endometrial hyperplasia or cancer (no option to take estradiol without progestogen) x x x x All trademarks are the property of their respective owners

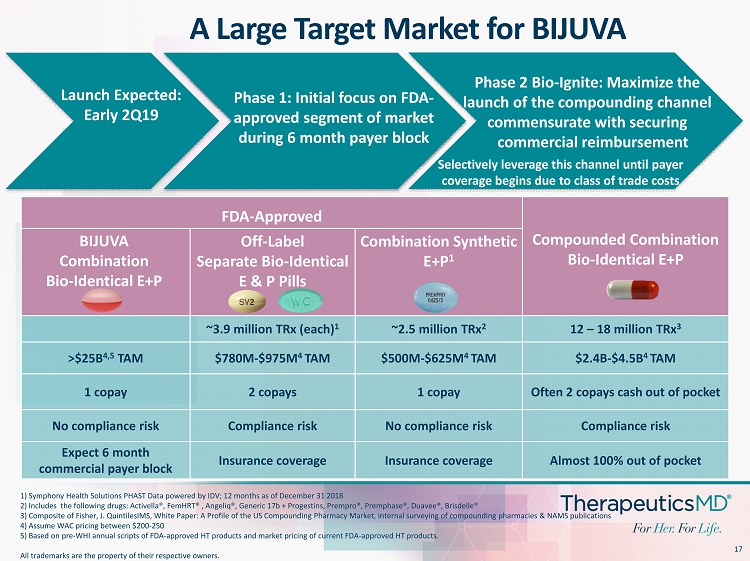

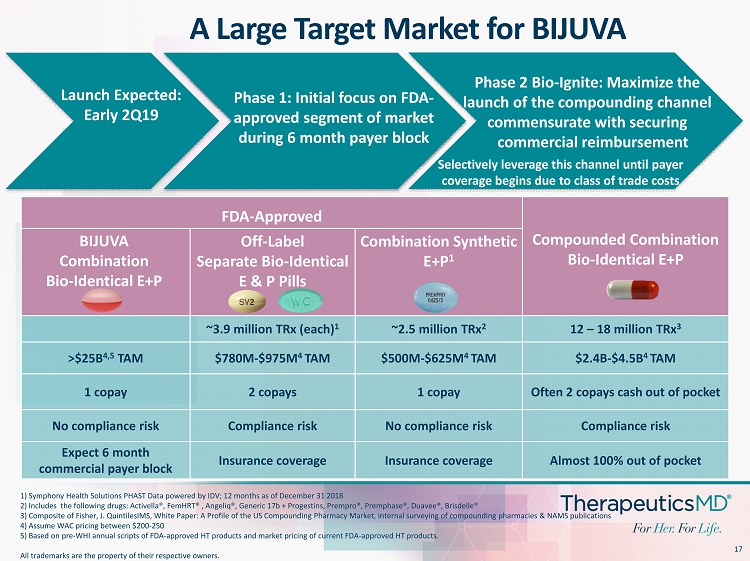

17 FDA - Approved Compounded Combination Bio - Identical E+P Off - Label Separate Bio - Identical E & P Pills Combination Synthetic E+P 1 ~3.9 million TRx (each) 1 ~2.5 million TRx 2 12 – 18 million TRx 3 >$25B 4,5 TAM $780M - $975M 4 TAM $500M - $625M 4 TAM $2.4B - $4.5B 4 TAM 1 copay 2 copays 1 copay Often 2 copays cash out of pocket No compliance risk Compliance risk No compliance risk Compliance risk Expect 6 month commercial payer block Insurance coverage Insurance coverage Almost 100% out of pocket 1) Symphony Health Solutions PHAST Data powered by IDV; 12 months as of December 31 2018 2) Includes the following drugs: Activella®, FemHRT ® , Angeliq ®, Generic 17b + Progestins, Prempro ®, Premphase ®, Duavee ®, Brisdelle® 3) Composite of Fisher, J. QuintilesIMS, White Paper: A Profile of the US Compounding Pharmacy Market, internal surveying of com pounding pharmacies & NAMS publications 4) Assume WAC pricing between $200 - 250 5) Based on pre - WHI annual scripts of FDA - approved HT products and market pricing of current FDA - approved HT products. All trademarks are the property of their respective owners. A Large Target Market for BIJUVA BIJUVA Combination Bio - Identical E+P Phase 2 Bio - Ignite: Maximize the launch of the compounding channel commensurate with securing commercial reimbursement Selectively leverage this channel until payer coverage begins due to class of trade costs Launch Expected: Early 2Q19 Phase 1: Initial focus on FDA - approved segment of market during 6 month payer block

18 Product TRx Count Osphena ® 217,000 Estrace ® & Generic 1,902,000 Premarin® 1,220,000 Vagifem ® & Generic 1,500,000 Estring ® 262,000 Compounded Vaginal E 200,000+* Grand Total 5,301,000 Independent Community Pharmacy IMVEXXY and BIJUVA Addressable Markets * Estimated number of vaginal scripts. Assumption based on consultant feedback and extrapolation of survey response data. IMVEXXY Substitutable Market 1) Symphony Health Solutions PHAST Data powered by IDV; 12 months as of December 31 2018 2) Includes the following drugs: Activella ®, FemHRT ® , Angeliq ®, Generic 17b + Progestins, Prempro ®, Premphase ®, Duavee ®, Brisdelle ® 3) Composite of Fisher, J. QuintilesIMS, White Paper: A Profile of the US Compounding Pharmacy Market, internal surveying of com pounding pharmacies & NAMS publications 4) Assume WAC pricing between $200 - 250 All trademarks are the property of their respective owners. FDA - Approved Compounded Combination Bio - Identical E+P Off - Label Separate Bio - Identical E & P Pills Combination Synthetic E+P 1 ~3.9 million TRx (each) 1 ~2.5 million TRx 2 12 – 18 million TRx 3 $780M - $975M 4 TAM $500M - $625M 4 TAM $2.4B - $4.5B 4 TAM 2 copays 1 copay Often 2 copays cash out of pocket Compliance risk No compliance risk Compliance risk Insurance coverage Insurance coverage Almost 100% out of pocket BIJUVA Substitutable Market

19 Pharmacy Targeting: - 700+ are high tier targets (T1 - T4 based on byte data) - These locations produce the highest potential volume of compounded bio - identical hormone replacement therapy (CBHRT) scripts Program Stats (5 Months of Launch): Live Accounts: 22 States Reached: MA, OH, TX, VA, TN, AL, NH, PA, FL, SC, NY, OK, NJ, GA In Vetting Process: 25 Unique CBHRT Prescribers Identified - 2,787 (Jan. 22, 2019) Recently Partnered (has not yet started Vetting Process): Second largest network of ~100 pharmacies

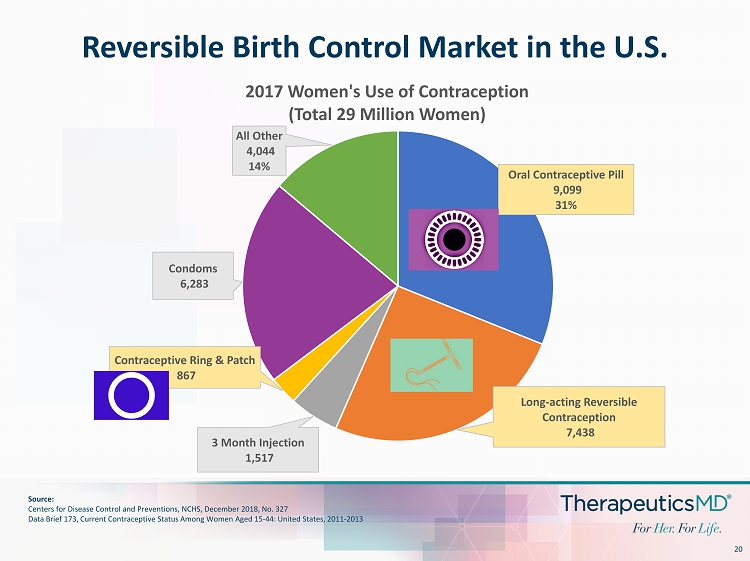

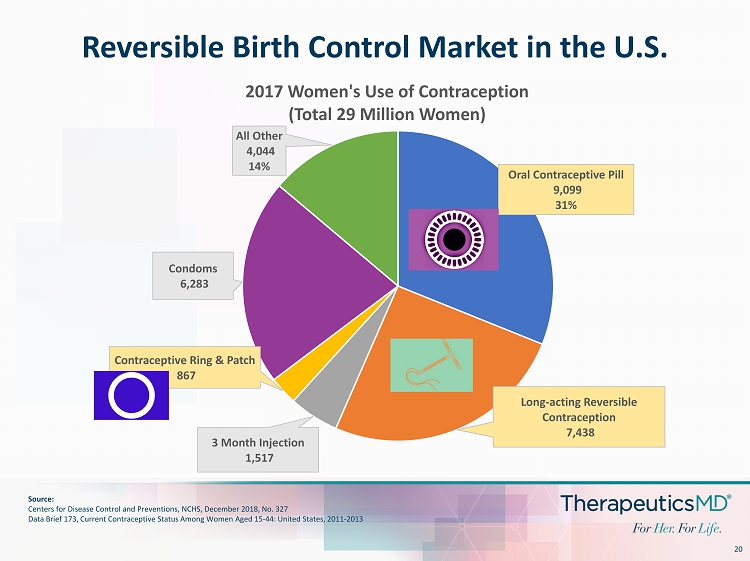

20 Reversible Birth Control Market in the U.S. Oral Contraceptive Pill 9,099 31% Long - acting Reversible Contraception 7,438 3 Month Injection 1,517 Contraceptive Ring & Patch 867 Condoms 6,283 All Other 4,044 14% 2017 Women's Use of Contraception (Total 29 Million Women) Source: Centers for Disease Control and Preventions, NCHS, December 2018, No. 327 Data Brief 173, Current Contraceptive Status Among Women Aged 15 - 44: United States, 2011 - 2013

21 ▪ Only FDA approved long - acting reversible birth control that doesn’t require a procedure or repeat doctor’s visit • Empowers women to be in control of their fertility and menstruation • Annovera is the only user - directed single 12 - month birth control product (used in repeated 4 - week cycles for 13 cycles) ▪ Highly effective in preventing pregnancy when used as directed (97.3%) ▪ High patient satisfaction in clinical trials 1 (89% overall satisfaction) ▪ Low daily release of ethinyl estradiol (13 mcg) ▪ Only product with new novel progestin - segesterone acetate 2 • No androgenic, estrogenic or glucocorticoid effects at contraceptive doses ▪ Favorable side effect profile including low rates of discontinuation related to irregular bleeding (1.7%) ▪ Safety profile generally consistent with other CHC products, including boxed warning 1 Merkatz , Ruth B., Marlena Plagianos , Elena Hoskin, Michael Cooney, Paul C. Hewett, and Barbara S. Mensch. 2014. “Acceptability of the Nestorone ®/ethinyl estradiol contraceptive vaginal ring: Development of a model; implications for introduction,” Contraception 90(5): 514 – 521. 2 Narender Kumar, Samuel S. Koide, Yun - Yen Tsong , and Kalyan Sundaram. 2000. “Nestorone: a Progestin with a Unique Pharmacological Profile,” Steroids 65: 629 - 636 ANNOVERA ( Segesterone Acetate and Ethinyl Estradiol Vaginal System) Clinical Attributes

22 1 Lohr , et al. Use of intrauterine devices in nulliparous women. Contraception 95 (2017); 529 - 537 ANNOVERA Physical Attributes Physical Attributes ▪ Softer and more pliable than NuvaRing ▪ Acceptable for women who haven’t had a child (nulliparous) or are not in a monogamous relationship 1 ▪ “Vaginal System” – the only product in a new class of contraception with potential for $0 co - pay ▪ Cost and convenience (pharmacy and doc visits) ▪ Does not require refrigeration by HCP

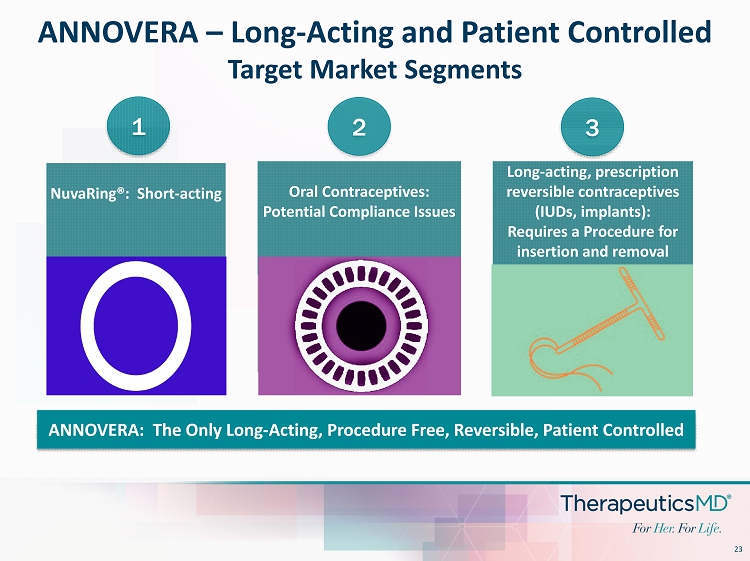

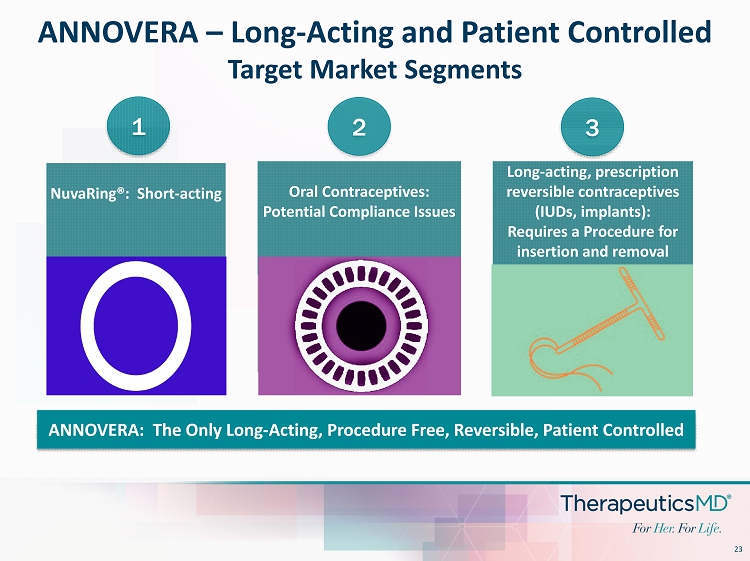

23 ANNOVERA – Long - Acting and Patient Controlled Target Market Segments Oral Contraceptives: Potential Compliance Issues Long - acting, prescription reversible contraceptives (IUDs, implants): Requires a Procedure for insertion and removal NuvaRing®: Short - acting 1 2 3 ANNOVERA: The Only Long - Acting, Procedure Free, Reversible, Patient Controlled

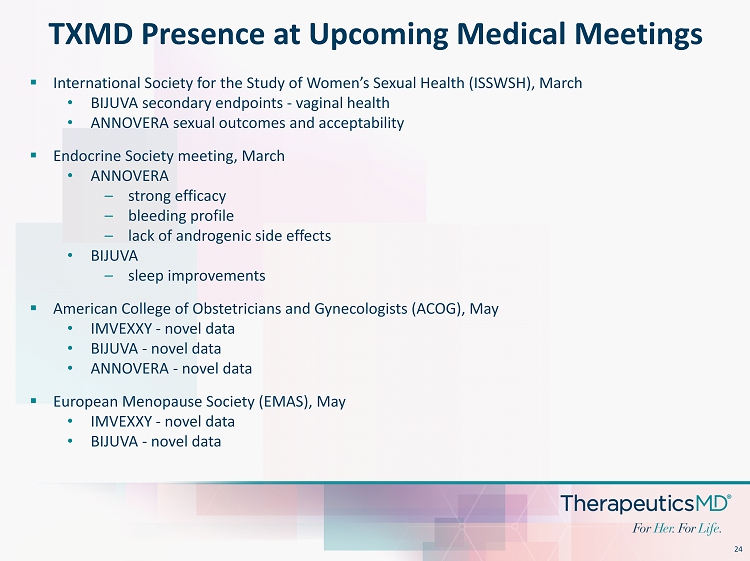

24 TXMD Presence at Upcoming Medical Meetings ▪ International Society for the Study of Women’s Sexual Health (ISSWSH), March • BIJUVA secondary endpoints - vaginal health • ANNOVERA sexual outcomes and acceptability ▪ Endocrine Society meeting, March • ANNOVERA – strong efficacy – bleeding profile – lack of androgenic side effects • BIJUVA – sleep improvements ▪ American College of Obstetricians and Gynecologists (ACOG), May • IMVEXXY - novel data • BIJUVA - novel data • ANNOVERA - novel data ▪ European Menopause Society (EMAS), May • IMVEXXY - novel data • BIJUVA - novel data

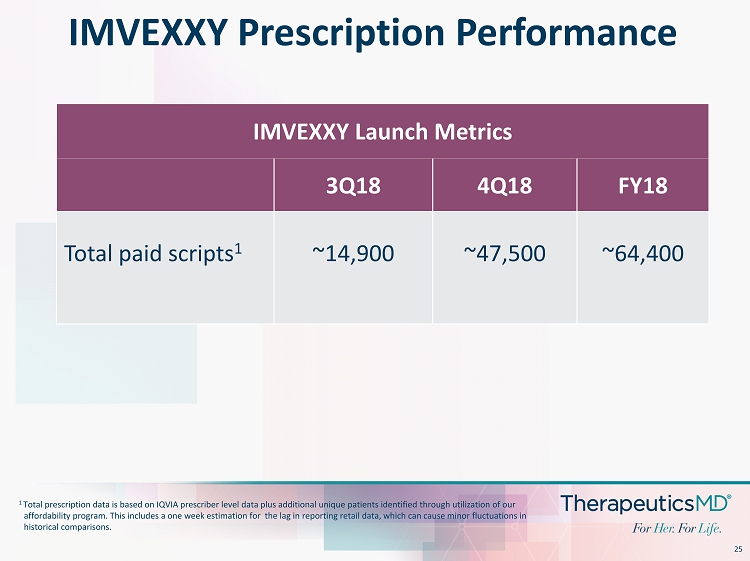

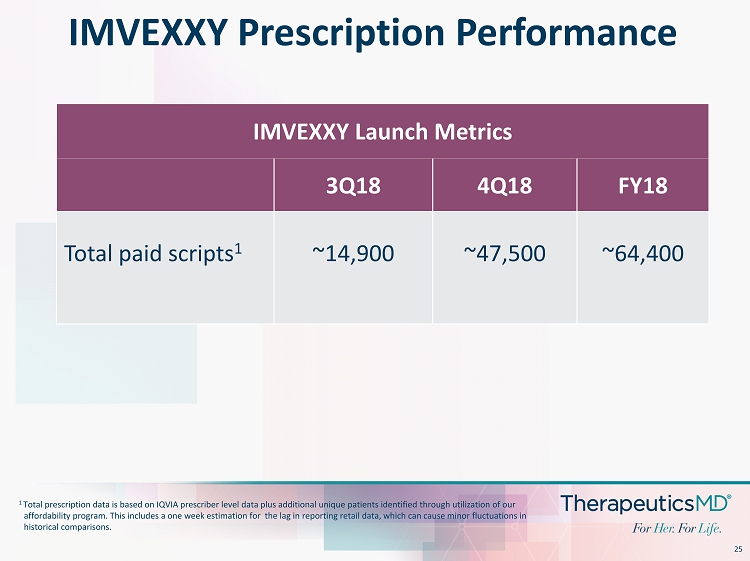

25 IMVEXXY Prescription Performance 1 Total prescription data is based on IQVIA prescriber level data plus additional unique patients identified through utilizatio n o f our affordability program . This includes a one week estimation for the lag in reporting retail data, which can cause minor fluctuations in historical comparisons. IMVEXXY Launch Metrics 3Q18 4Q18 FY18 Total paid scripts 1 ~14,900 ~47,500 ~64,400

26 Looking Ahead: Key Expected Events in 2019 ▪ 1Q 2019 - Speaker programs throughout the U.S. highlighting the clinical and physical attributes of IMVEXXY ▪ 1Q 2019 - through 3Q 2019 – Expand IMVEXXY Part D coverage ▪ 2H 2019 - Begin direct - to - consumer marketing for IMVEXXY ▪ 2Q 2019 – U.S. commercial launch of BIJUVA and draw second $75 million debt tranche with MidCap Financial Trust ▪ 2H (targeting 3Q) 2019 - U.S. commercial launch of ANNOVERA ▪ 2H 2019 - Debt funding for ANNOVERA launch ▪ Summer 2019 - Company to hold Analyst Day ▪ Late 4Q 2019 - BIJUVA 6 - month “new to market” payer block expected to end ▪ Full - Year 2019 - Oral presentations and posters related to clinical benefits of IMVEXXY, BIJUVA and ANNOVERA at medical meetings ▪ Throughout 2019 - Continue to expand BIO - IGNITE with a fuller expansion towards the end of 2019 when the six - month payer block for BIJUVA is expected to end

27