TherapeuticsMD, Inc. 8-K

Exhibit 99.2

FOR INVESTOR PRESENTATION PURPOSES ONLY. 2Q 2020 Earnings August 6, 2020

FOR INVESTOR PRESENTATION PURPOSES ONLY. Forward - Looking Statements This presentation by TherapeuticsMD, Inc . (referred to as “we,” “our,” or “the Company”) may contain forward - looking statements . Forward - looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as statements, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future . These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are based on assumptions and assessments made in light of our managerial experience and perception of historical trends, current conditions, expected future developments and other factors we believe to be appropriate . Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control . Important factors that could cause actual results, developments and business decisions to differ materially from forward - looking statements are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), including our most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following : the company’s ability to protect the intellectual property related to its products ; the effects of the COVID - 19 pandemic ; the company’s ability to maintain or increase sales of its products ; the company’s ability to develop and commercialize IMVEXXY®, ANNOVERA®, and BIJUVA® and obtain additional financing necessary therefor ; whether the company will be able to comply with the covenants and conditions under its term loan facility ; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of the company’s current or future approved products or preclude the approval of the company’s future drug candidates ; whether the FDA will approve the efficacy supplement for the lower dose of BIJUVA ; the company’s ability to protect its intellectual property, including with respect to the Paragraph IV notice letters the company received regarding IMVEXXY and BIJUVA ; the length, cost and uncertain results of future clinical trials ; the company’s reliance on third parties to conduct its manufacturing, research and development and clinical trials ; the ability of the company’s licensees to commercialize and distribute the company’s products ; the ability of the company’s marketing contractors to market ANNOVERA ; the availability of reimbursement from government authorities and health insurance companies for the company’s products ; the impact of product liability lawsuits ; the influence of extensive and costly government regulation ; the volatility of the trading price of the company’s common stock and the concentration of power in its stock ownership . This non - promotional presentation is intended for investor audiences only . 2

FOR INVESTOR PRESENTATION PURPOSES ONLY. Strategic Overview 3

FOR INVESTOR PRESENTATION PURPOSES ONLY. Strategic Overview ▪ 2Q20 total net revenue was resilient despite COVID - 19 ▪ Set Sixth Street revenue covenants to reflect the impact of COVID - 19 ▪ Executed a strategic and multifaceted plan to adapt to the new reality of a global pandemic and drive long - term shareholder value ⎯ Swift action to right - size our company, reduction of total operating expenses expected to trend to ~$40M by 4Q20 ⎯ Remain laser focused on reaching goal of EBITDA breakeven on a quarterly basis in 2021 ⎯ Pivoted sales force to operate in a “hybrid” model and support healthcare providers virtually ⎯ Launched into new channels of distribution including telehealth, public health and Department of Defense to accelerate growth ⎯ Reshaped Board of Directors and Management Team ▪ Despite COVID - 19, the Company returned product portfolio to growth which is expected to continue throughout 2020 4

FOR INVESTOR PRESENTATION PURPOSES ONLY. Sixth Street Update 5

FOR INVESTOR PRESENTATION PURPOSES ONLY. Sixth Street Loan Update ▪ Revised total minimum net revenue covenants for ANNOVERA, IMVEXXY and BIJUVA ▪ While not formal guidance, covenants are based on the Company’s post - COVID - 19 revised forecast ▪ The Company and Sixth Street are not moving forward with the undrawn $50 million tranche under the financing agreement, which was designed to be drawn following the successful full commercial launch of ANNOVERA in the second quarter, due to the pause in the launch timing caused by the COVID - 19 pandemic ▪ There continues to be an active dialogue with Sixth Street regarding potential additional financing 4Q 2020 1Q 2021 2Q 2021 3Q 2021 4Q 2021 $20M $25M $37.5M $47.5M $57.5M 6

FOR INVESTOR PRESENTATION PURPOSES ONLY. Financial Update 7

FOR INVESTOR PRESENTATION PURPOSES ONLY. Quarterly Net Revenue Trends Quarterly Net Revenue ▪ 2Q20 total net revenue of $10.7M ▪ Early in the quarter, due to COVID - 19 there was a reduction in patient visits to healthcare providers that negatively impacted volumes ▪ L ater in the quarter, we saw patient demand for ANNOVERA outpace wholesaler orders resulting in a drawdown of inventory in the channel ▪ More recently, we are pleased to see early momentum building through commercial execution of our plans and expect this to continue throughout the rest of 2020 8

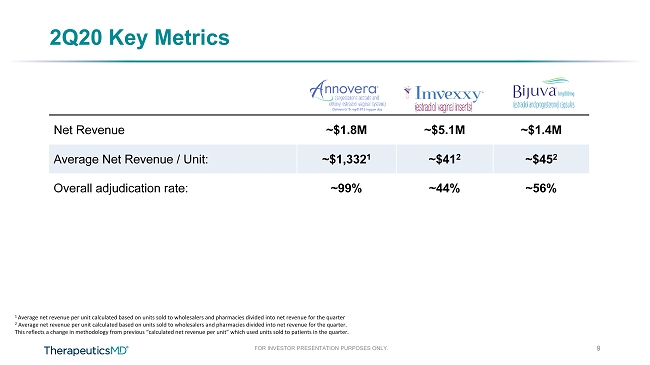

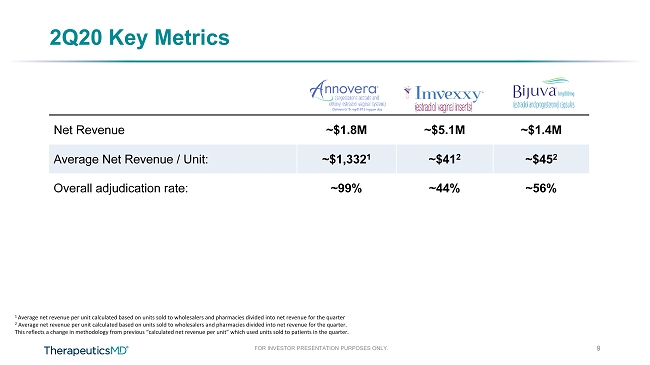

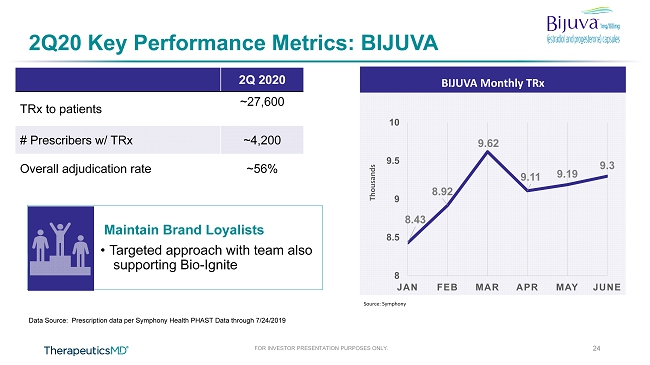

FOR INVESTOR PRESENTATION PURPOSES ONLY. 2Q20 Key Metrics 1 Average net revenue per unit calculated based on units sold to wholesalers and pharmacies divided into net revenue for the qu art er 2 Average net revenue per unit calculated based on units sold to wholesalers and pharmacies divided into net revenue for the qu art er. This reflects a change in methodology from previous “calculated net revenue per unit” which used units sold to patients in the quarter. ANNOVERA IMVEXXY BIJUVA Net Revenue ~$1.8M ~$5.1M ~$1.4M Average Net Revenue / Unit : ~$1,332 1 ~$41 2 ~$45 2 Overall adjudication rate : ~99% ~44% ~56% 9

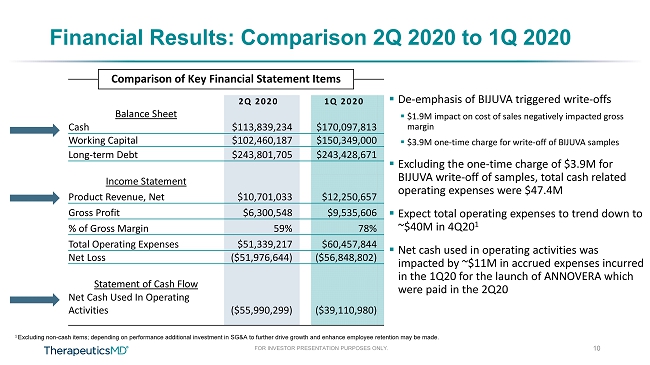

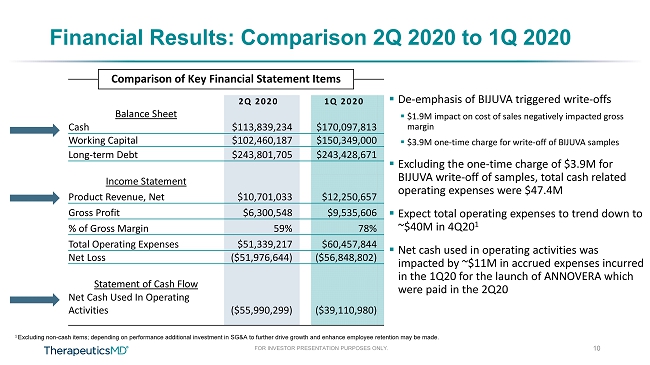

FOR INVESTOR PRESENTATION PURPOSES ONLY. Financial Results: Comparison 2Q 2020 to 1Q 2020 1 E xcluding non - cash items; depending on performance additional investment in SG&A to further drive growth and enhance employee ret ention may be made. ▪ D e - emphasis of BIJUVA triggered write - offs ▪ $1.9M impact on cost of sales negatively impacted gross margin ▪ $3.9M one - time charge for write - off of BIJUVA samples ▪ Excluding the one - time charge of $3.9M for BIJUVA write - off of samples, total cash related operating expenses were $47.4M ▪ Expect total operating expenses to trend down to ~$40M in 4Q20 1 ▪ Net cash used in operating activities was impacted by ~$11M in accrued expenses incurred in the 1Q20 for the launch of ANNOVERA which were paid in the 2Q20 2Q 2020 1Q 2020 Balance Sheet Cash $113,839,234 $170,097,813 Working Capital $102,460,187 $150,349,000 Long - term Debt $243,801,705 $243,428,671 Income Statement Product Revenue, Net $10,701,033 $12,250,657 Gross Profit $6,300,548 $9,535,606 % of Gross Margin 59% 78% Total Operating Expenses $51,339,217 $60,457,844 Net Loss ($51,976,644) ($56,848,802) Statement of Cash Flow Net Cash Used In Operating Activities ($55,990,299) ($39,110,980) Comparison of Key Financial Statement Items 10

FOR INVESTOR PRESENTATION PURPOSES ONLY. Commercial Updates 11

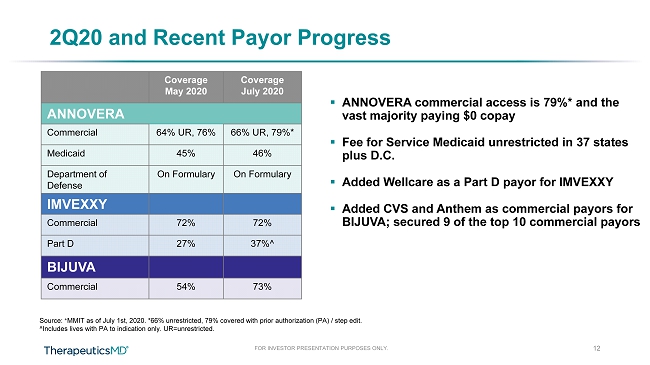

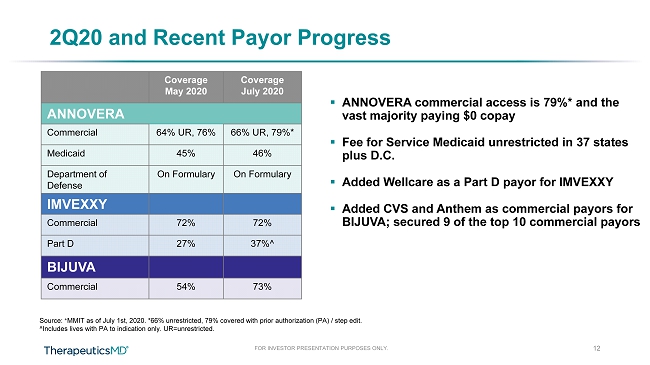

FOR INVESTOR PRESENTATION PURPOSES ONLY. ▪ ANNOVERA commercial access is 79%* and the vast majority paying $0 copay ▪ Fee for Service Medicaid unrestricted in 37 states plus D.C. ▪ Added Wellcare as a Part D payor for IMVEXXY ▪ Added CVS and Anthem as commercial payors for BIJUVA; secured 9 of the top 10 commercial payors 2Q20 and Recent Payor Progress Coverage May 2020 Coverage July 2020 ANNOVERA Commercial 64% UR, 76% 66% UR, 79%* Medicaid 45% 46% Department of Defense On Formulary On Formulary IMVEXXY Commercial 72% 72% Part D 27% 37%^ BIJUVA Commercial 54% 73% 12 Source: + MMIT as of July 1st , 2020. *66% unrestricted, 79% covered with prior authorization (PA) / step edit. ^Includes lives with PA to indication only. UR=unrestricted.

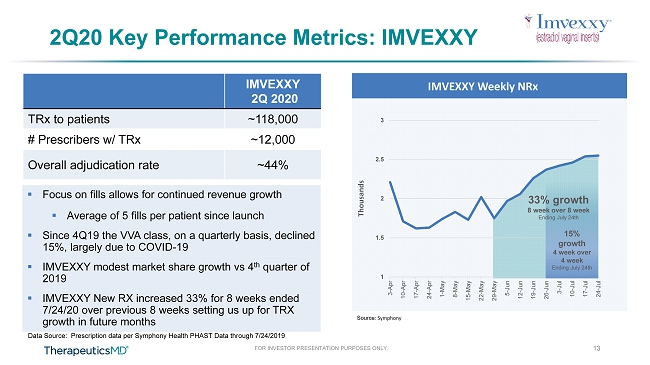

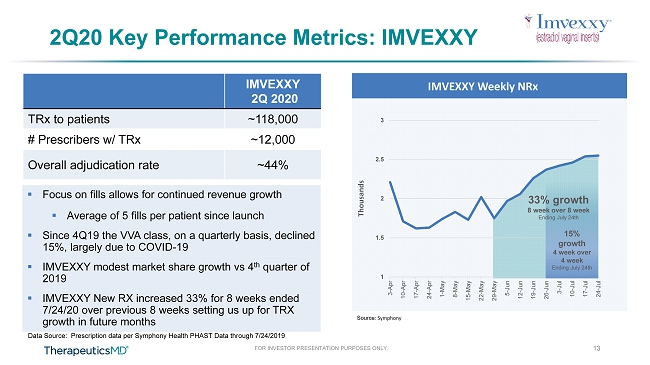

FOR INVESTOR PRESENTATION PURPOSES ONLY. 2Q20 Key Performance Metrics: IMVEXXY Source : Symphony IMVEXXY 2Q 2020 TRx to patients ~118,000 # Prescribers w/ TRx ~12,000 Overall adjudication rate ~44% ▪ Focus on fills allows for continued revenue growth ▪ Average of 5 fills per patient since launch ▪ Since 4Q19 the VVA class, on a quarterly basis, declined 15%, largely due to COVID - 19 ▪ IMVEXXY modest market share growth vs 4 th quarter of 2019 ▪ IMVEXXY New RX increased 33% for 8 weeks ended 7/24/20 over previous 8 weeks setting us up for TRX growth in future months Data Source: Prescription data per Symphony Health PHAST Data through 7/24/2019 IMVEXXY Weekly NRx Thousands 1 1.5 2 2.5 3 3-Apr 10-Apr 17-Apr 24-Apr 1-May 8-May 15-May 22-May 29-May 5-Jun 12-Jun 19-Jun 26-Jun 3-Jul 10-Jul 17-Jul 24-Jul 13 33% growth 8 week over 8 week Ending July 24th 15% growth 4 week over 4 week Ending July 24th

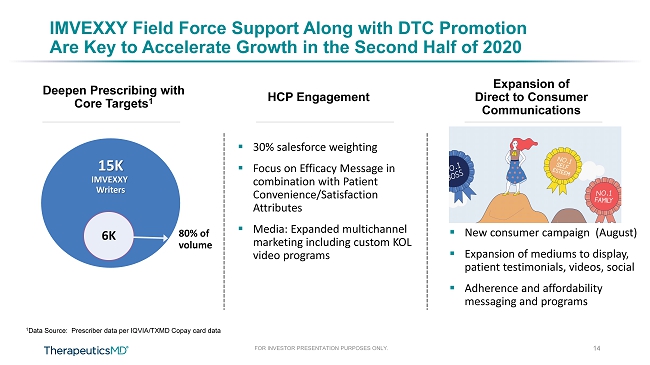

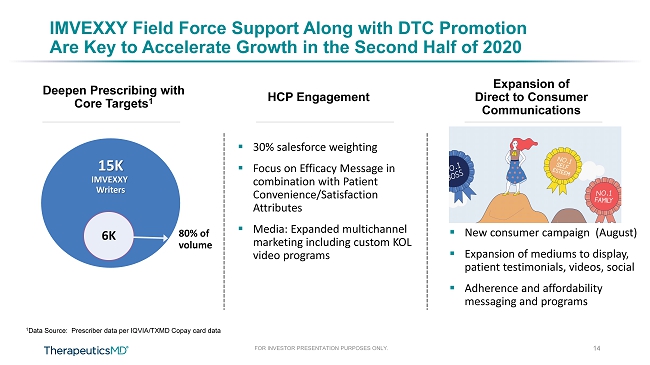

FOR INVESTOR PRESENTATION PURPOSES ONLY. Deepen Prescribing with Core Targets 1 HCP Engagement Expansion of Direct to Consumer Communications IMVEXXY Field Force Support Along with DTC Promotion Are Key to Accelerate Growth in the Second Half of 2020 15K IMVEXXY Writers 6 K 80% of volume ▪ 30% salesforce weighting ▪ Focus on Efficacy Message in combination with Patient Convenience/Satisfaction Attributes ▪ Media: Expanded multichannel marketing including custom KOL video programs ▪ New consumer campaign (August) ▪ Expansion of mediums to display, patient testimonials, videos, social ▪ Adherence and affordability messaging and programs 14 1 Data Source: Prescriber data per IQVIA/TXMD Copay card data

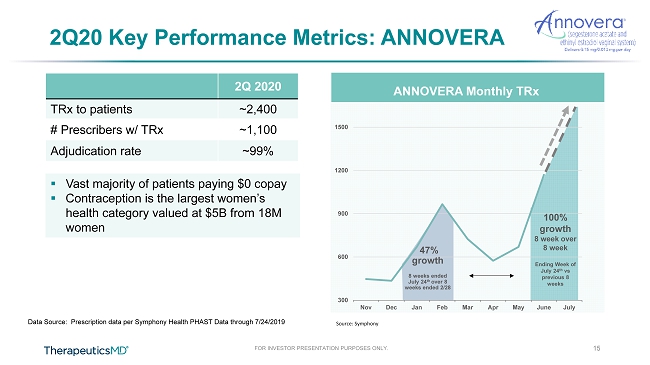

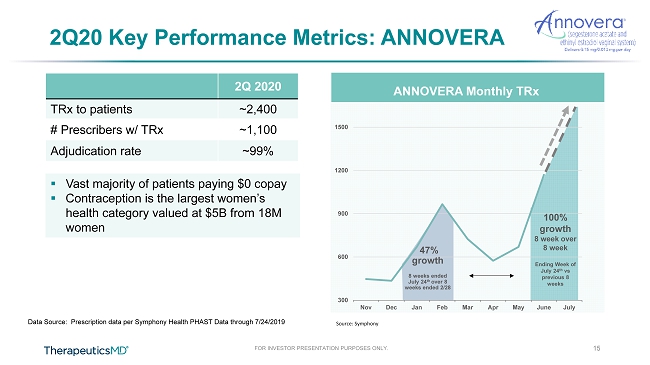

FOR INVESTOR PRESENTATION PURPOSES ONLY. 300 600 900 1200 1500 July June May Apr Mar Feb Jan Dec Nov ANNOVERA Monthly TRx 2Q20 Key Performance Metrics: ANNOVERA 47% growth 8 weeks ended July 24 th over 8 weeks ended 2/28 2Q 2020 TRx to patients ~2,400 # Prescribers w/ TRx ~1,100 Adjudication rate ~99% 15 ▪ Vast majority of patients paying $0 copay ▪ Contraception is the largest women’s health category valued at $5B from 18M women Source: Symphony 100% growth 8 week over 8 week Ending Week of July 24 th vs previous 8 weeks Data Source: Prescription data per Symphony Health PHAST Data through 7/24/2019

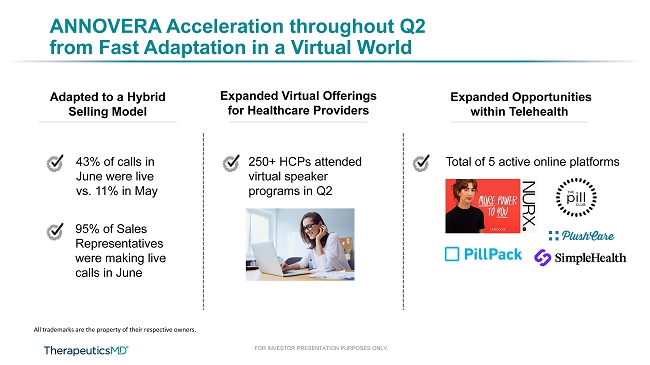

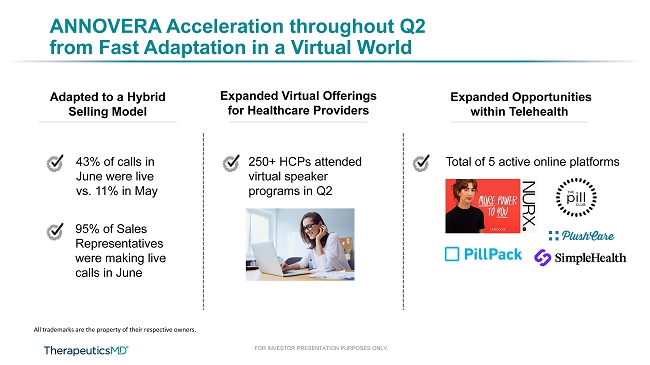

FOR INVESTOR PRESENTATION PURPOSES ONLY. ANNOVERA Acceleration throughout Q2 from Fast Adaptation in a Virtual World 250+ HCPs attended virtual speaker programs in Q2 43% of calls in June were live vs. 11% in May 95% of Sales Representatives were making live calls in June Adapted to a Hybrid Selling Model Expanded Virtual Offerings for Healthcare Providers Expanded Opportunities within Telehealth Total of 5 active online platforms All trademarks are the property of their respective owners.

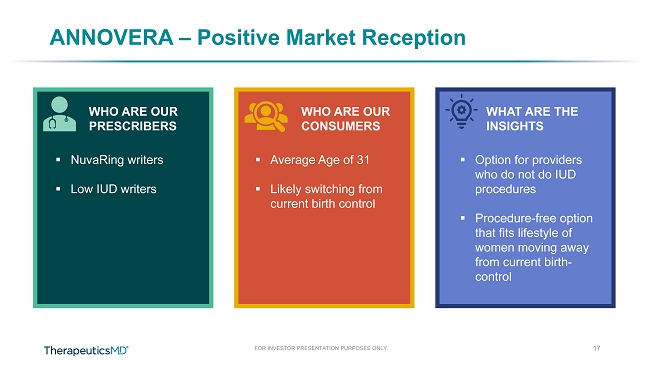

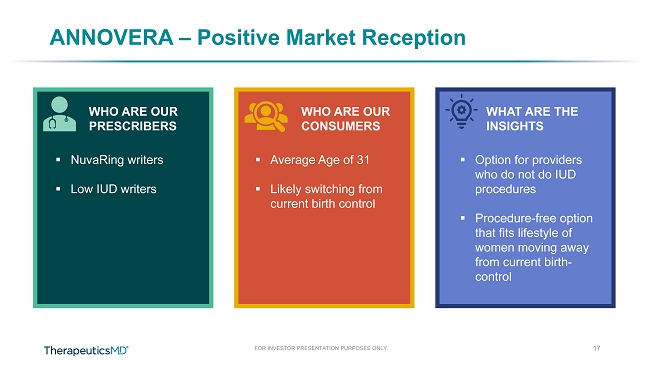

FOR INVESTOR PRESENTATION PURPOSES ONLY. ANNOVERA – Positive Market Reception ▪ NuvaRing writers ▪ Low IUD writers ▪ Average Age of 31 ▪ Likely switching from current birth control ▪ Option for providers who do not do IUD procedures ▪ Procedure - free option that fits lifestyle of women moving away from current birth - control WHO ARE OUR PRESCRIBERS WHO ARE OUR CONSUMERS WHAT ARE THE INSIGHTS 17

FOR INVESTOR PRESENTATION PURPOSES ONLY. Expectations for a Successful Brand Data Source : Symphony Health PHAST Data 18 Contraception Market Size ANNOVERA Revenue at Different S hares Time to Achieve 4 - 5% Market Share $5 billion market size 28 million new prescriptions annually 18 million women Lo - Loestrin - ~4 years NuvaRing - ~5 years 1%: 180K Rx, ~$360M 2%: 360K Rx, ~$720M 3%: 540K Rx, ~$1.1B 4%: 720K Rx, ~$1.4B 5%: 900K Rx, ~$1.8B All trademarks are the property of their respective owners.

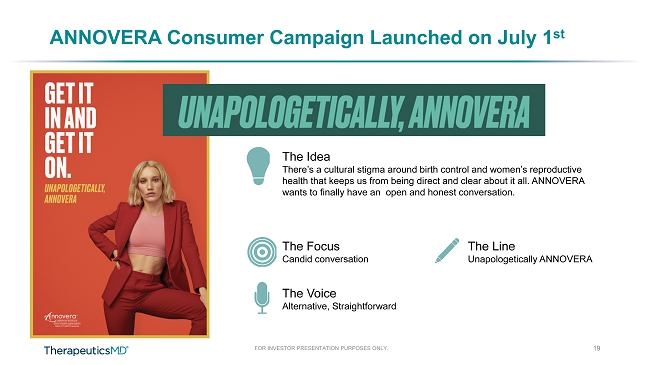

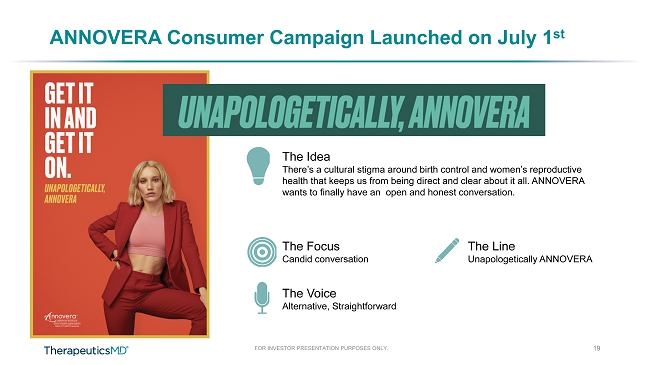

FOR INVESTOR PRESENTATION PURPOSES ONLY. ANNOVERA Consumer Campaign Launched on July 1 st The Idea There’s a cultural stigma around birth control and women’s reproductive health that keeps us from being direct and clear about it all. ANNOVERA wants to finally have an open and honest conversation. The Focus Candid conversation The Voice Alternative, Straightforward The Line Unapologetically ANNOVERA 19

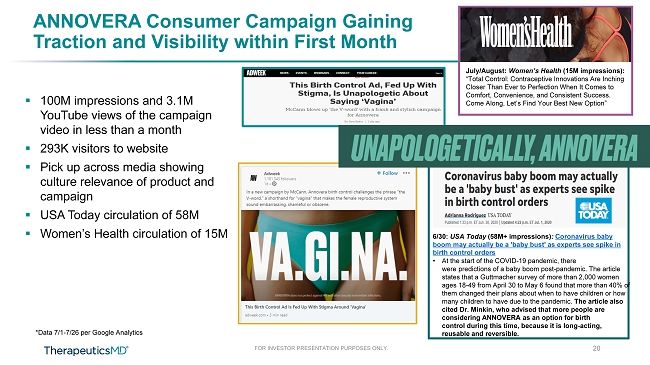

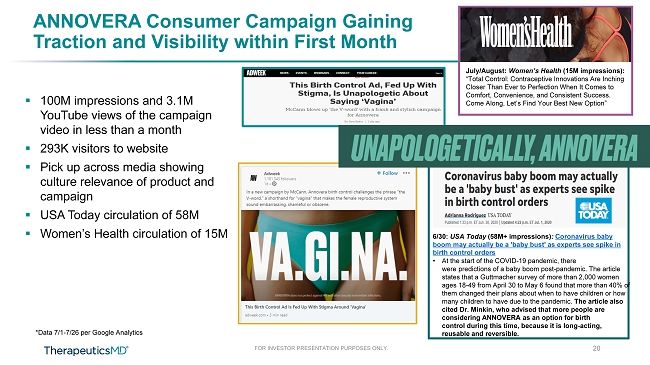

FOR INVESTOR PRESENTATION PURPOSES ONLY. ANNOVERA Consumer Campaign Gaining Traction and Visibility within First Month ▪ 100M impressions and 3.1M YouTube views of the campaign video in less than a month ▪ 293K visitors to website ▪ Pick up across media showing culture relevance of product and campaign ▪ USA Today circulation of 58M ▪ Women’s Health circulation of 15M 6/30: USA Today (58M+ impressions) : Coronavirus baby boom may actually be a 'baby bust' as experts see spike in birth control orders • At the start of the COVID - 19 pandemic, there were predictions of a baby boom post - pandemic. The article states that a Guttmacher survey of more than 2,000 women ages 18 - 49 from April 30 to May 6 found that more than 40% of them changed their plans about when to have children or how many children to have due to the pandemic. The article also cited Dr. Minkin , who advised that more people are considering ANNOVERA as an option for birth control during this time, because it is long - acting, reusable and reversible. July/August: Women’s Health (15M impressions): “Total Control: Contraceptive Innovations Are Inching Closer Than Ever to Perfection When It Comes to Comfort, Convenience, and Consistent Success. Come Along, Let’s Find Your Best New Option” *Data 7/1 - 7/26 per Google Analytics 20

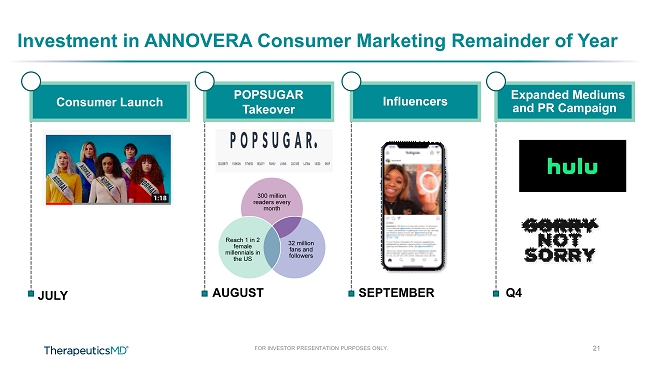

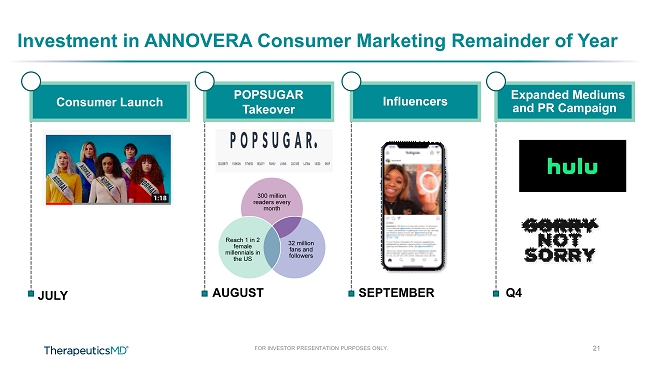

FOR INVESTOR PRESENTATION PURPOSES ONLY. Investment in ANNOVERA Consumer Marketing Remainder of Year 300 million readers every month 32 million fans and followers Reach 1 in 2 female millennials in the US Consumer Launch JULY POPSUGAR Takeover AUGUST Influencers SEPTEMBER Expanded Mediums and PR Campaign Q4 21

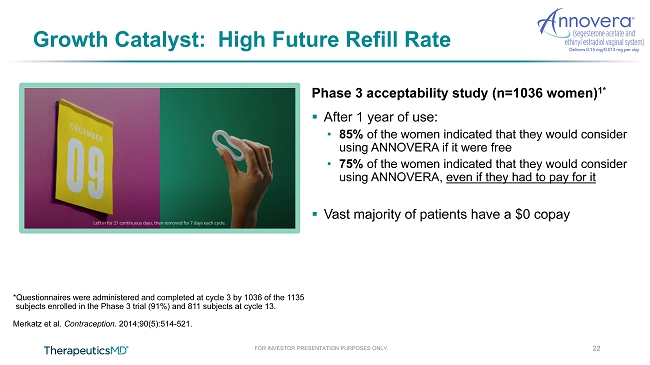

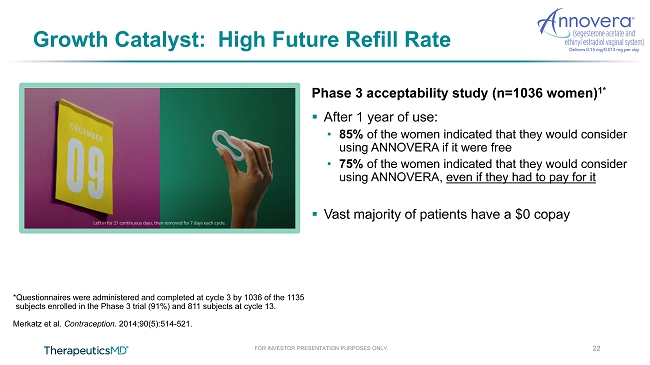

FOR INVESTOR PRESENTATION PURPOSES ONLY. Growth Catalyst: High Future Refill Rate *Questionnaires were administered and completed at cycle 3 by 1036 of the 1135 subjects enrolled in the Phase 3 trial (91%) and 811 subjects at cycle 13. Merkatz et al. Contraception . 2014;90(5):514 - 521 . 22 ▪ After 1 year of use: • 85% of the women indicated that they would consider using ANNOVERA if it were free • 75% of the women indicated that they would consider using ANNOVERA, even if they had to pay for it ▪ Vast majority of patients have a $0 copay Phase 3 acceptability study (n=1036 women) 1*

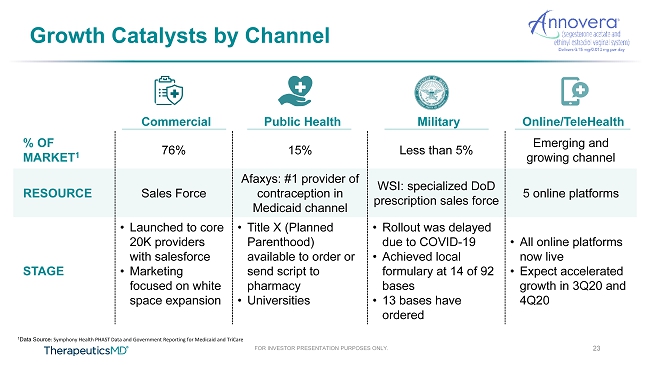

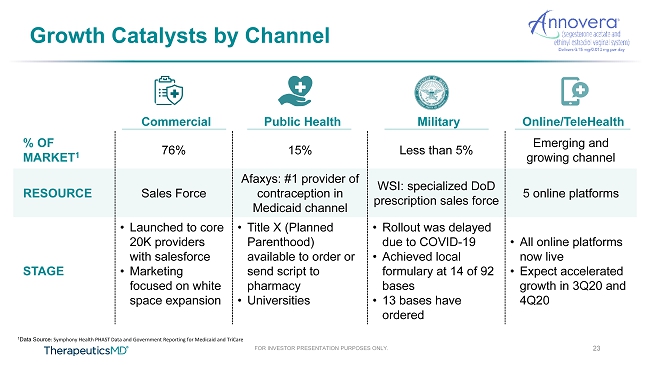

FOR INVESTOR PRESENTATION PURPOSES ONLY. Growth Catalysts by Channel 23 Commercial Public Health Military Online/TeleHealth % OF MARKET 1 76% 15% Less than 5% Emerging and growing channel RESOURCE Sales Force Afaxys : #1 provider of contraception in Medicaid channel WSI: specialized DoD prescription sales force 5 online platforms STAGE • Launched to core 20K providers with salesforce • Marketing focused on white space expansion • Title X (Planned Parenthood) available to order or send script to pharmacy • Universities • Rollout was delayed due to COVID - 19 • Achieved local formulary at 14 of 92 bases • 13 bases have ordered • All online platforms now live • Expect accelerated growth in 3Q20 and 4Q20 1 Data Source : Symphony Health PHAST Data and Government Reporting for Medicaid and TriCare

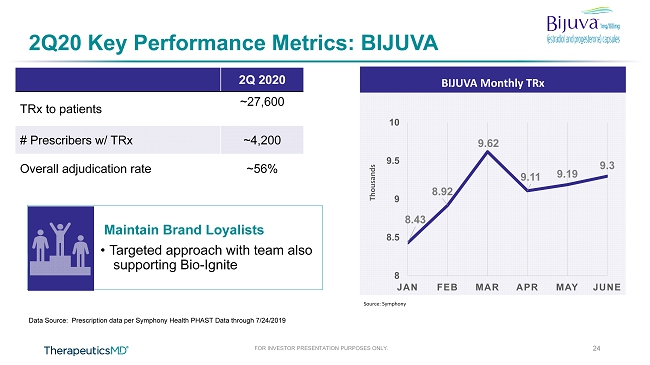

FOR INVESTOR PRESENTATION PURPOSES ONLY. BIJUVA Monthly TRx 8.43 8.92 9.62 9.11 9.19 9.3 8 8.5 9 9.5 10 JAN FEB MAR APR MAY JUNE Thousands Source: Symphony 2Q 2020 TRx to patients ~27,600 # Prescribers w/ TRx ~4,200 Overall adjudication rate ~56% 2Q20 Key Performance Metrics: BIJUVA 24 Data Source: Prescription data per Symphony Health PHAST Data through 7/24/2019 Maintain Brand Loyalists • Targeted approach with team also supporting Bio - Ignite

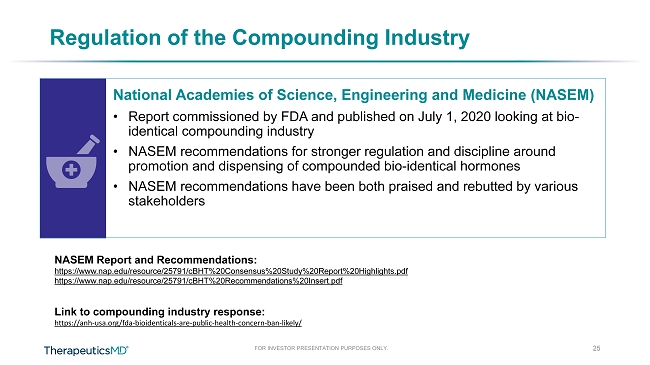

FOR INVESTOR PRESENTATION PURPOSES ONLY. Regulation of the Compounding Industry 25 NASEM Report and Recommendations: https://www.nap.edu/resource/25791/cBHT%20Consensus%20Study%20Report%20Highlights.pdf https://www.nap.edu/resource/25791/cBHT%20Recommendations%20Insert.pdf Link to c ompound ing industry response: https://anh - usa.org/fda - bioidenticals - are - public - health - concern - ban - likely/ National Academies of Science, Engineering and Medicine ( NASEM ) • Report commissioned by FDA and published on July 1, 2020 looking at bio - identical compounding industry • NASEM recommendations for stronger regulation and discipline around promotion and dispensing of compounded bio - identical hormones • NASEM recommendations have been both praised and rebutted by various stakeholders

FOR INVESTOR PRESENTATION PURPOSES ONLY. Key Takeaways ▪ 2Q20 total net revenue was resilient despite COVID - 19 ▪ Set Sixth Street revenue covenants to reflect the impact of COVID - 19 ▪ Executed a strategic and multifaceted plan to adapt to the new reality of a global pandemic and drive long - term shareholder value ⎯ Swift action to right - size our company, reduction of total operating expenses expected to trend to ~$40M by 4Q20 ⎯ Remain laser focused on reaching goal of EBITDA breakeven on a quarterly basis in 2021 ⎯ Pivoted sales force to operate in a “hybrid” model and support healthcare providers virtually ⎯ Launched into new channels of distribution including telehealth, public health and Department of Defense to accelerate growth ⎯ Reshaped Board of Directors and Management Team ▪ Despite COVID - 19, the Company returned product portfolio to growth which is expected to continue throughout 2020 26

FOR INVESTOR PRESENTATION PURPOSES ONLY. CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Prenatal Vitamins Q&A 27

FOR INVESTOR PRESENTATION PURPOSES ONLY. Appendix 28

FOR INVESTOR PRESENTATION PURPOSES ONLY. The Commercial Plan supports the Portfolio 120 - 130 Sales Reps Afaxys (Public Health) and WSI (VA/Military) ▪ ANNOVERA is our lead product ▪ IMVEXXY is positioned as a second detail ▪ BIJUVA focus on maintaining the brand to leverage the opportunity at the right time Distribution Channels All trademarks are the property of their respective owners. VA/Military Public Health 1 2 Online Platforms Retail Product Focus: National and Regional retail chains Consumer Marketing Plans Across ANNOVERA and IMVEXXY 29