Building the Premier Women’s Health Company Q1 2022 Earnings May 16, 2022 Exhibit 99.2

Forward-Looking Statements This presentation by TherapeuticsMD, Inc. may contain forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to TherapeuticsMD’s objectives, plans and strategies as well as statements, other than historical facts, that address activities, events or developments that the company intends, expects, projects, believes or anticipates will or may occur in the future. These statements are often characterized by terminology such as "believes," "hopes," "may," "anticipates," "should," "intends," "plans," "will," "expects," "estimates," "projects," "positioned," "strategy" and similar expressions and are based on assumptions and assessments made in light of management’s experience and perception of historical trends, current conditions, expected future developments and other factors believed to be appropriate. Forward-looking statements in this press release are made as of the date of this press release, and the company undertakes no duty to update or revise any such statements, whether as a result of new information, future events or otherwise. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which are outside of the company’s control. Important factors that could cause actual results, developments and business decisions to differ materially from forward-looking statements are described in the sections titled "Risk Factors" in the company’s filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, as well as reports on Form 8-K, and include the following: the effects of the COVID-19 pandemic; how the proceeds from the divestiture of the company’s vitaCare business will be utilized; the company’s ability to maintain or increase sales of its products; the company’s ability to develop and commercialize IMVEXXY®, ANNOVERA®, and BIJUVA® and obtain additional financing necessary therefor; whether the company will be able to comply with the covenants and conditions under its term loan facility and the company’s ability to refinance such facility; the effects of supply chain issues on the supply of the company’s products; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of the company’s current or future approved products or preclude the approval of the company’s future drug candidates; whether the FDA will approve the manufacturing supplement for ANNOVERA; the company’s ability to protect its intellectual property, including with respect to the Paragraph IV notice letters the company received regarding IMVEXXY; the length, cost and uncertain results of future clinical trials; the company’s reliance on third parties to conduct its manufacturing, research and development and clinical trials; the ability of the company’s licensees to commercialize and distribute the company’s products; the ability of the company’s marketing contractors to market ANNOVERA; the availability of reimbursement from government authorities and health insurance companies for the company’s products; the impact of product liability lawsuits; the influence of extensive and costly government regulation; the impact of leadership transitions; the volatility of the trading price of the company’s common stock and the concentration of power in its stock ownership. 2

3 Hugh O’Dowd CEO

4 Q1 2022 Financial Overview

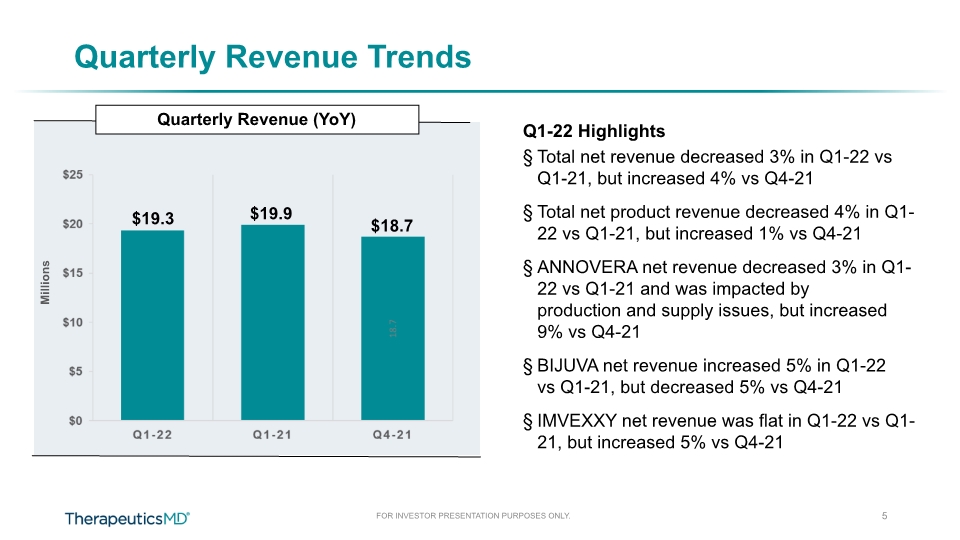

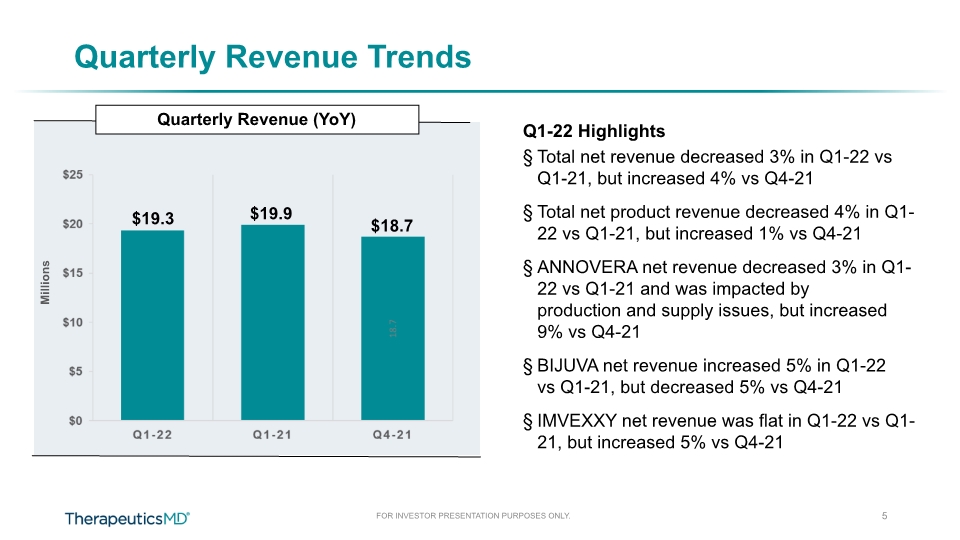

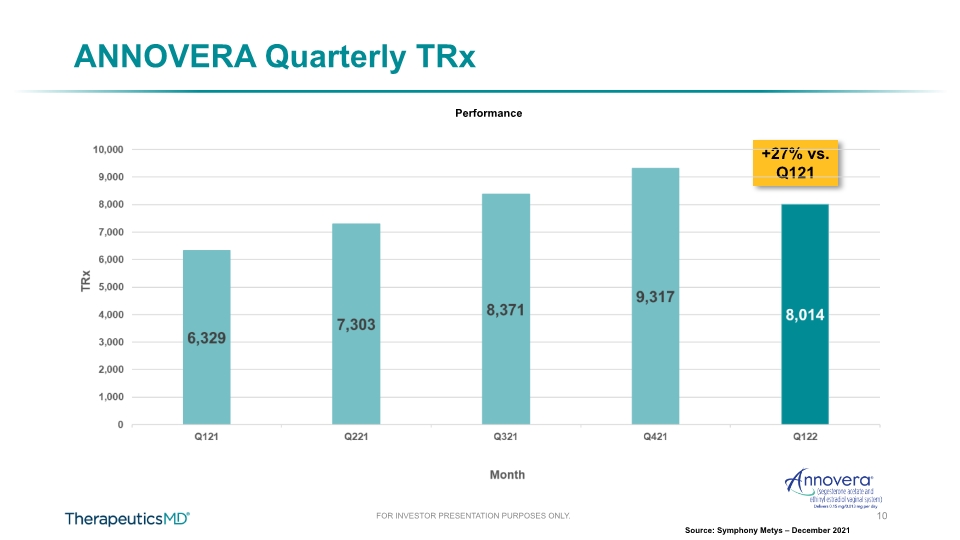

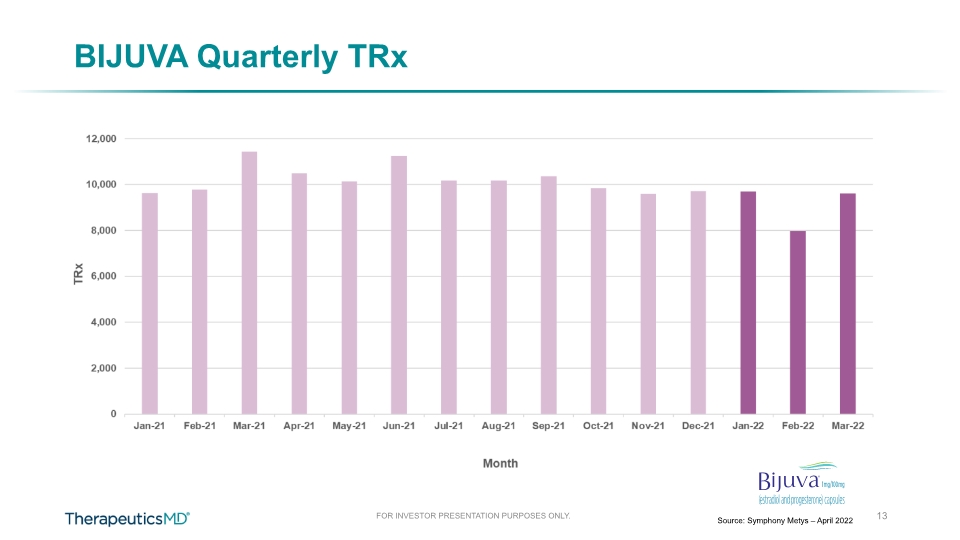

$18.7 Quarterly Revenue (YoY) Quarterly Revenue Trends Millions Q1-22 Highlights Total net revenue decreased 3% in Q1-22 vs Q1-21, but increased 4% vs Q4-21 Total net product revenue decreased 4% in Q1-22 vs Q1-21, but increased 1% vs Q4-21 ANNOVERA net revenue decreased 3% in Q1-22 vs Q1-21 and was impacted by production and supply issues, but increased 9% vs Q4-21 BIJUVA net revenue increased 5% in Q1-22 vs Q1-21, but decreased 5% vs Q4-21 IMVEXXY net revenue was flat in Q1-22 vs Q1-21, but increased 5% vs Q4-21 $19.3 5 $19.9

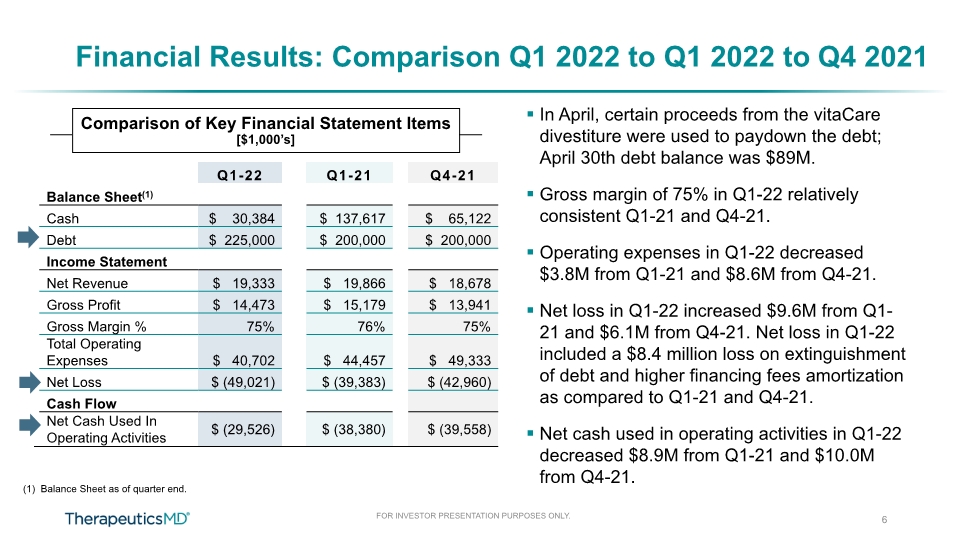

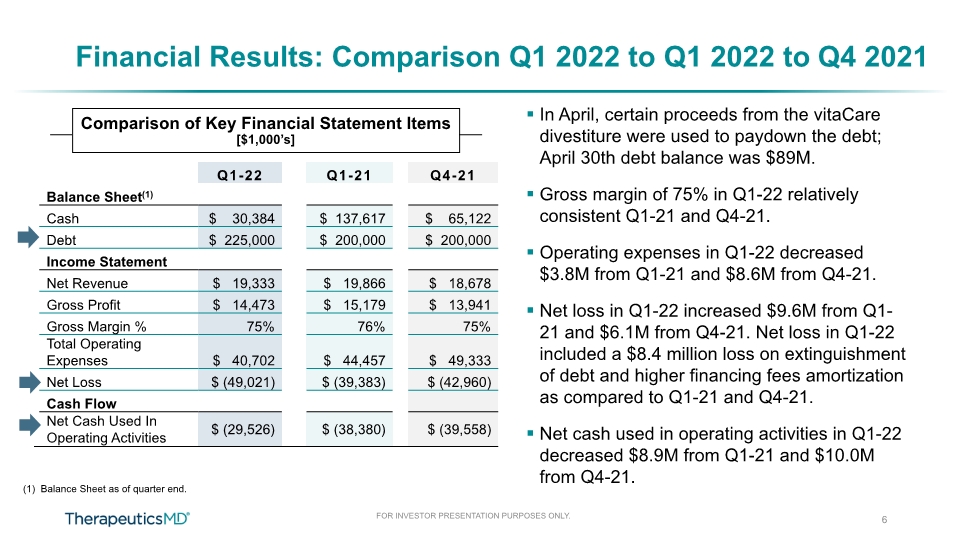

Financial Results: Comparison Q1 2022 to Q1 2022 to Q4 2021 In April, certain proceeds from the vitaCare divestiture were used to paydown the debt; April 30th debt balance was $89M. Gross margin of 75% in Q1-22 relatively consistent Q1-21 and Q4-21. Operating expenses in Q1-22 decreased $3.8M from Q1-21 and $8.6M from Q4-21. Net loss in Q1-22 increased $9.6M from Q1-21 and $6.1M from Q4-21. Net loss in Q1-22 included a $8.4 million loss on extinguishment of debt and higher financing fees amortization as compared to Q1-21 and Q4-21. Net cash used in operating activities in Q1-22 decreased $8.9M from Q1-21 and $10.0M from Q4-21. 6 (1) Balance Sheet as of quarter end. Comparison of Key Financial Statement Items [$1,000’s]

7 Q1 2022 Commercial Overview

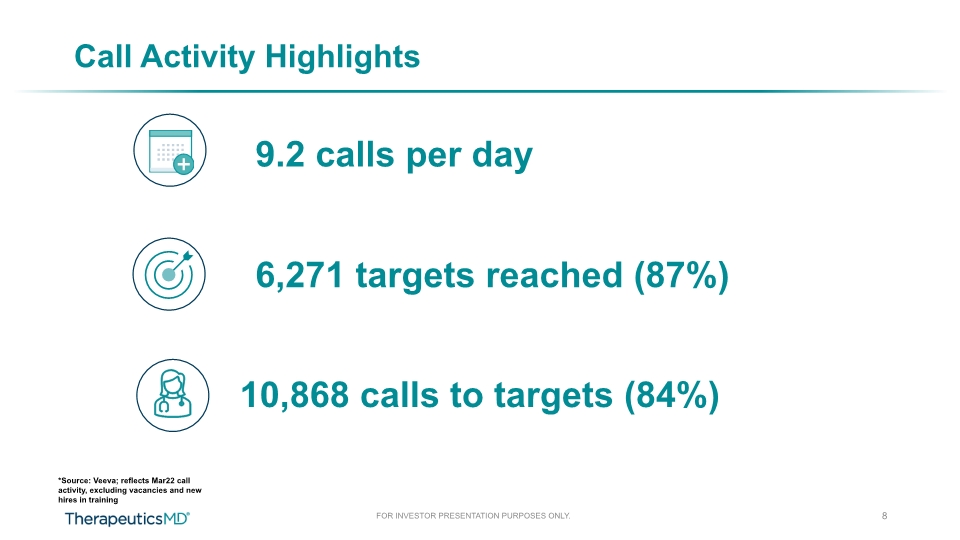

Call Activity Highlights 9.2 calls per day 6,271 targets reached (87%) 10,868 calls to targets (84%) *Source: Veeva; reflects Mar22 call activity, excluding vacancies and new hires in training 8

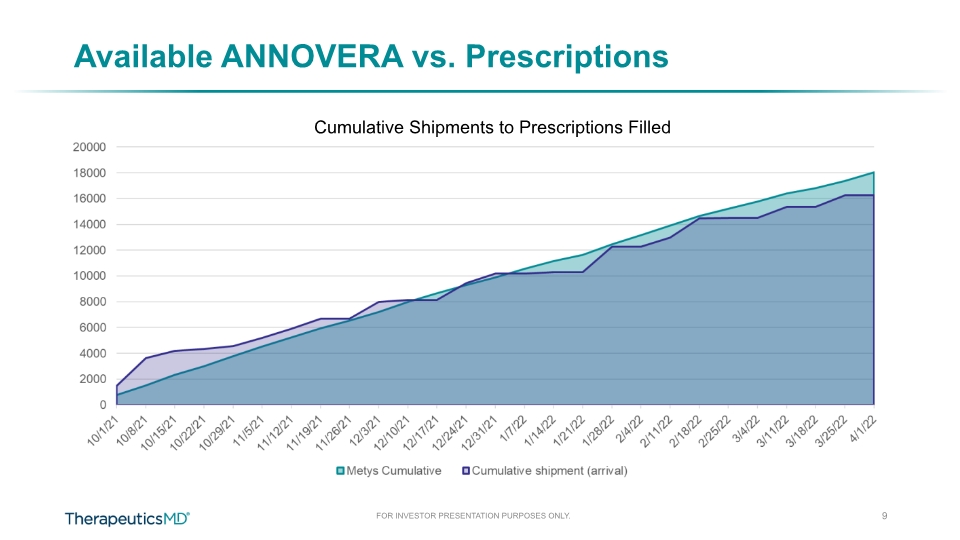

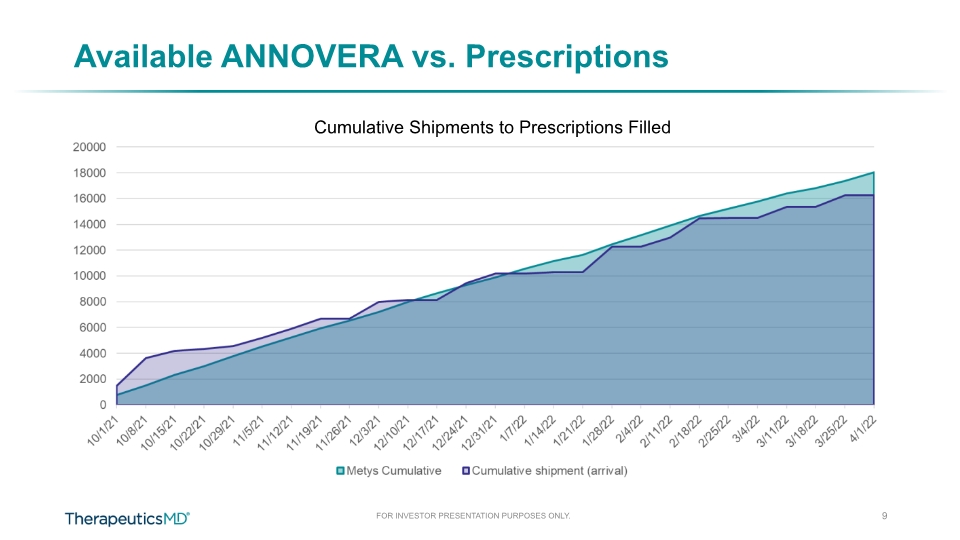

Available ANNOVERA vs. Prescriptions 9 Cumulative Shipments to Prescriptions Filled

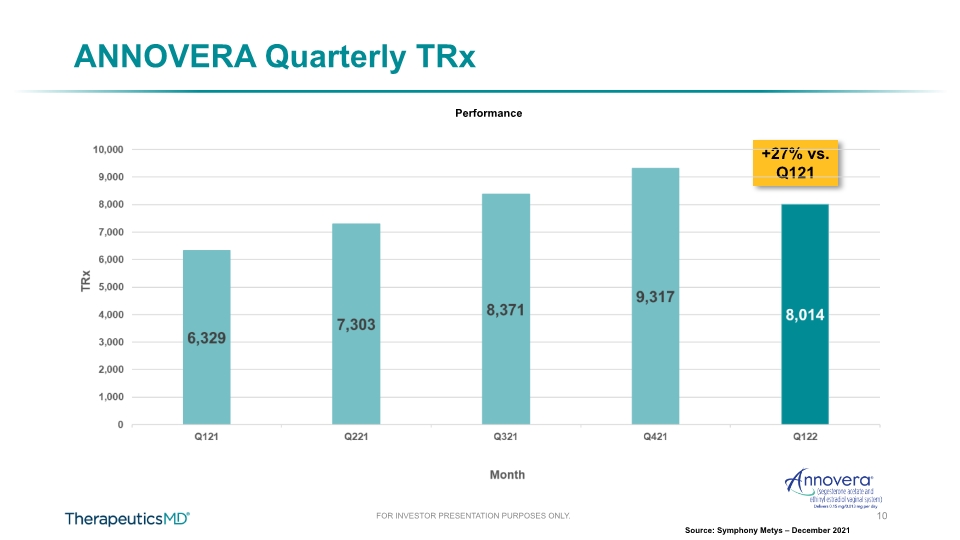

ANNOVERA Quarterly TRx +27% vs. Q121 Source: Symphony Metys – December 2021 Performance 10

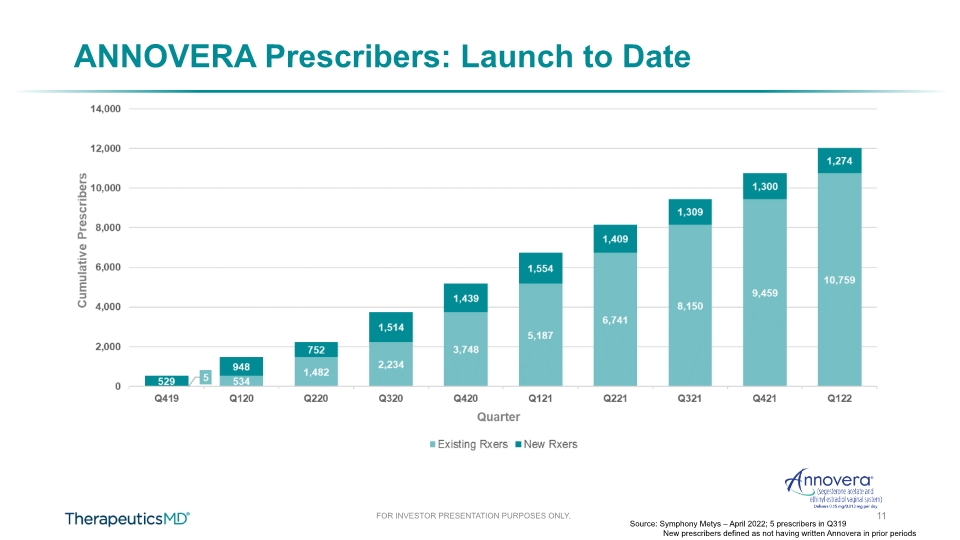

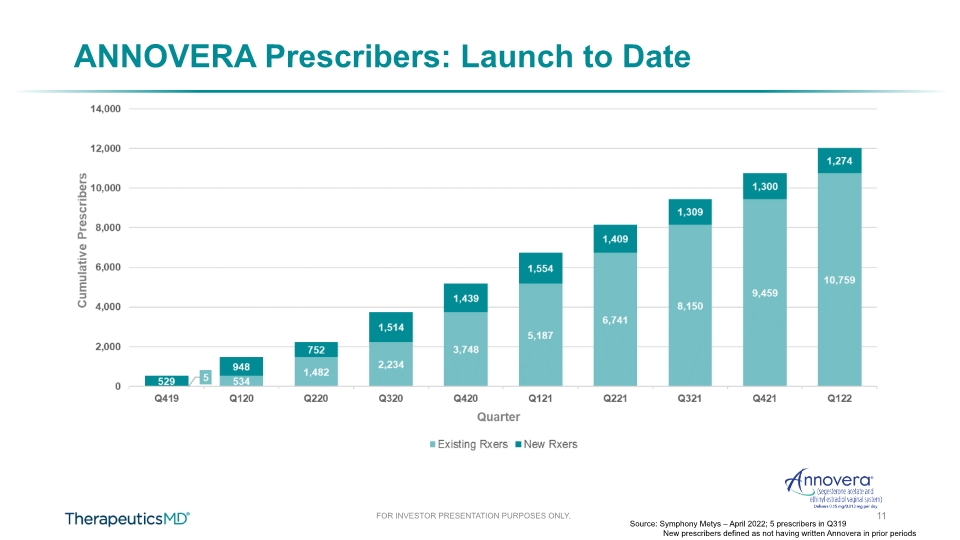

ANNOVERA Prescribers: Launch to Date Source: Symphony Metys – April 2022; 5 prescribers in Q319 New prescribers defined as not having written Annovera in prior periods 11

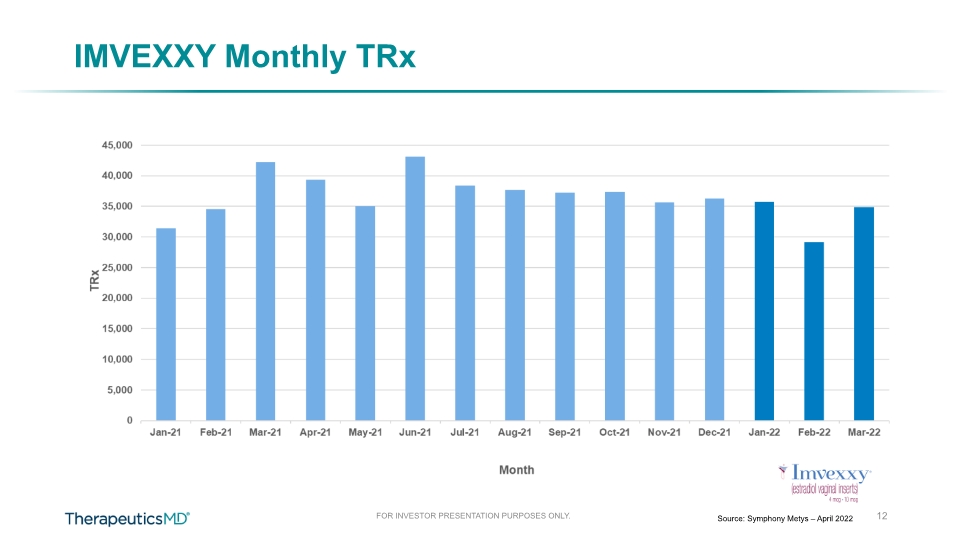

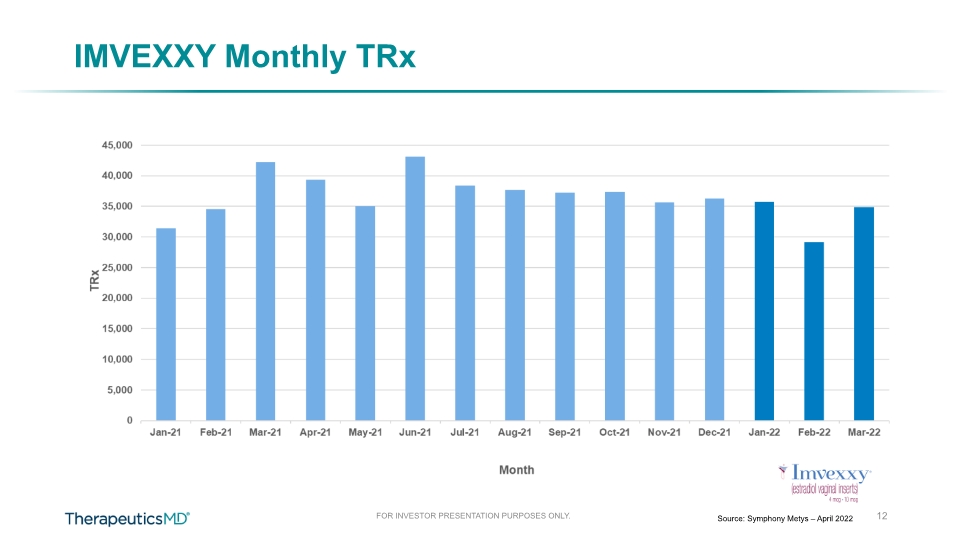

IMVEXXY Monthly TRx Source: Symphony Metys – April 2022 12

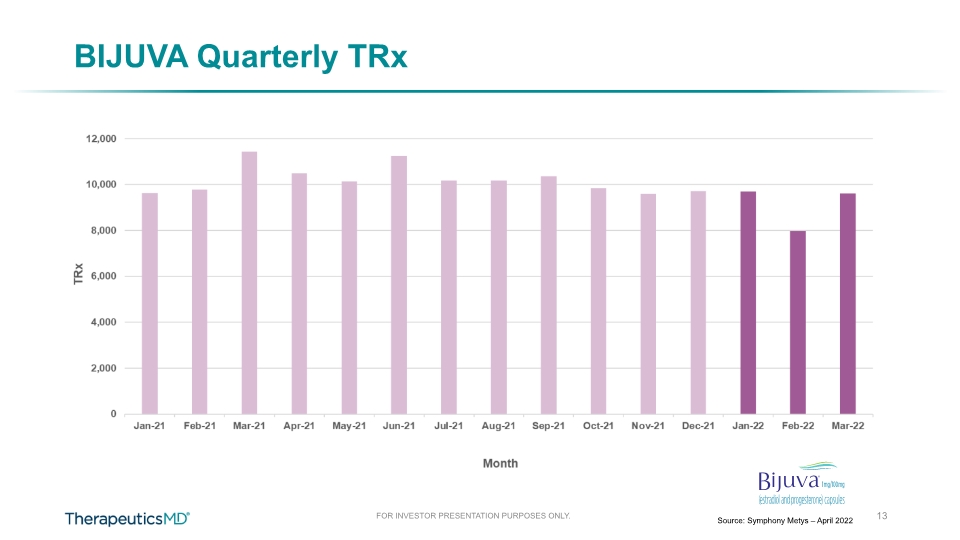

BIJUVA Quarterly TRx Source: Symphony Metys – April 2022 13