- CMI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Cummins (CMI) PRE 14APreliminary proxy

Filed: 17 Mar 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

ý | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

o | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| CUMMINS INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

500 JACKSON STREET, BOX 3005, COLUMBUS, INDIANA 47202-3005

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

To Our Shareholders:

NOTICE IS HEREBY GIVEN that the 2017 Annual Meeting of the Shareholders of Cummins Inc. will be held at our Columbus Engine Plant located at 500 Central Avenue, Columbus, Indiana, on Tuesday, May 9, 2017, at 11:00 a.m. Eastern Daylight Saving Time, for the following purposes:

Only shareholders of our Common Stock of record at the close of business on March 7, 2017 are entitled to notice of and to vote at the meeting.

If you do not expect to be present in person at the meeting, you are urged to vote your shares by telephone, via the Internet, or by completing, signing and dating the enclosed proxy card and returning it promptly in the envelope provided.

You may revoke your proxy card at any time before the voting. Except with respect to shares attributable to accounts held in the Cummins Retirement and Savings Plans, any shareholders entitled to vote at the annual meeting who attend the meeting will be entitled to cast their votes in person.

| MARK J. SIFFERLEN, Secretary |

March 27, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2017

ANNUAL SHAREHOLDER MEETING TO BE HELD ON MAY 9, 2017:

the Annual Report and Proxy Statement are available at www.proxyvote.com

PROXY STATEMENT FOR 2017 ANNUAL SHAREHOLDERS MEETING

We are furnishing this proxy statement in connection with the solicitation by our Board of Directors of proxies to be voted at our 2017 Annual Meeting of Shareholders to be held on Tuesday, May 9, 2017, and at any adjournment thereof, which we refer to as our "Annual Meeting." This proxy statement, together with the enclosed proxy card, is first being made available to our shareholders on or about March 27, 2017.

Holders of our Common Stock of record at the close of business on March 7, 2017 are entitled to vote at the Annual Meeting. On that date there were issued and outstanding 167,971,264 shares of Common Stock, each of which is entitled to one vote on each matter submitted to a shareholder vote at the Annual Meeting.

Each share of Common Stock represented by a properly executed and delivered proxy card will be voted at the Annual Meeting in accordance with the instructions indicated on that proxy card, unless such proxy card has been previously revoked. If no instructions are indicated on a signed proxy card, the shares represented by such proxy card will be voted as recommended by our Board.

A shareholder may revoke his or her proxy card at any time before the Annual Meeting by delivering to our Secretary written notice of such revocation. This notice must include the number of shares for which the proxy card had been given and the name of the shareholder of such shares as it appears on the stock certificate(s), or in book entry form on the records of our stock transfer agent and registrar, Wells Fargo Shareowner Services, evidencing ownership of such shares. In addition, except with respect to shares attributable to accounts held in the Cummins Retirement and Savings Plans (the "Cummins RSPs"), any shareholder who has executed a proxy card but is present at the Annual Meeting will be entitled to cast his or her vote in person instead of by proxy card, thereby canceling the previously executed proxy card.

Participants in a Cummins RSP who hold shares of Common Stock in their account and provide voting instructions to the trustee with respect to such shares will have their shares voted by the trustee as instructed. Such participants will be considered named fiduciaries with respect to the shares allocated to their accounts solely for purposes of this proxy solicitation. If no voting instructions are provided, shares held in the accounts will be voted in the same manner and proportion as shares with respect to which valid voting instructions were received. Any instructions received by the trustee from participants regarding their vote shall be confidential. Cummins RSP participants may attend the Annual Meeting but cannot vote the shares in their Cummins RSP accounts in person at the Annual Meeting.

IMPORTANT: If you hold your shares in a brokerage account, you should be aware that, due to New York Stock Exchange, or NYSE, rules, if you do not affirmatively instruct your broker how to vote within 10 days prior to our Annual Meeting, your broker willnot be permitted to vote your shares (i) for the election of directors; (ii) on the advisory vote on the compensation of our named executive officers; (iii) on the advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; (iv) on our amended and restated 2012 Omnibus Incentive Plan; (v) on the amendments to our by-laws to implement proxy access; or (vi) on the shareholder proposal regarding proxy access. Therefore, you must affirmatively take action to vote your shares at our Annual Meeting. If you do not affirmatively vote your shares, your shares will not be voted (i) for the election of directors; (ii) on the advisory vote on the compensation of our named executive officers; (iii) on the advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; (iv) on our amended and restated 2012 Omnibus Incentive Plan; (v) on the amendments to our by-laws to implement proxy access; or (vi) on the shareholder proposal regarding proxy access.

1

We long have believed that good corporate governance is important in ensuring that we are managed for the long-term benefit of our shareholders. We continuously review our Board's structure, policies and practices and compare them to those suggested by various authorities in corporate governance and to the practices of other public companies. Our corporate governance principles, charters for each of our Board's Audit, Compensation, and Governance and Nominating Committees, our code of business conduct and our by-laws, along with certain other corporate governance documents, are available on our website,www.cummins.com, and are otherwise available in print to any shareholder who requests them from our Secretary.

Corporate Governance Highlights

| | | | | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Director Independence | • 9 of 10 director nominees are independent • 5 fully independent Board Committees: Audit; Compensation; Governance & Nominating; Finance; and Safety, Environment & Technology | |||||||

| | | | | | | | | |

| | Board Accountability | | • All directors are elected annually • Simple majority voting standard for all uncontested director elections • Shareholder right to call special meetings | | ||||

| | | | | | | | | |

| Proxy Access | • Proactive adoption in 2016 of proxy access for director nominees, subject to approval at 2017 Annual Meeting of Shareholders • Available to a shareholder, or group of up to 20 shareholders, holding 3% of our common stock for at least 3 years | |||||||

| | | | | | | | | |

| | Board Leadership | | • Annual assessment and determination of Board leadership structure • Annual election of independent Lead Director whenever Chairman/CEO roles are combined or when the Chairman is not independent • Lead Director has strong role and significant governance duties, including chair of Governance & Nominating Committee and of all Executive Sessions of independent directors | | ||||

| | | | | | | | | |

| Board Evaluation and Effectiveness | • Annual Board and Committee self-assessments • Annual independent director evaluation of Chairman and CEO | |||||||

| | | | | | | | | |

| | Board Refreshment | | • Average tenure of current directors is 9 years • 2 new directors added to Board in last 2 years; 7 new directors since 2008 • Mandatory director retirement age • Board members represent diverse perspectives; current Board includes 2 female directors, 1 African-American director and 2 directors from Latin America | | ||||

| | | | | | | | | |

| Director Engagement | • All of the directors attended 75% or more of the aggregate number of meetings of our Board and the committees on which they served during 2016 • Limits on director/CEO membership on other public company boards | |||||||

| | | | | | | | | |

| | Director Access | | • Significant interaction with senior business leaders through regular business reviews and site visits • Directors have ability to hire outside experts and consultants and to conduct independent investigations | | ||||

| | | | | | | | | |

| Clawback and Anti-Hedging Policies | • Clawback policy permits us to recoup certain compensation payments in the event any of our financial statements are required to be materially restated resulting from the fraudulent actions of any officer • Directors and officers prohibited from engaging in any pledging, short sales or hedging investments involving our common stock | |||||||

| | | | | | | | | |

| | Director/Officer Share Ownership Guidelines | | • CEO required to hold shares equivalent to 5x base salary • Members of the Cummins Leadership Team (including all of the Named Executive Officers other than the CEO) required to hold shares equivalent to 3x base salary • All other officers required to hold shares equivalent to 1x base salary • Directors required to hold shares equivalent to 3x his or her total annual retainer | | ||||

| | | | | | | | | |

2

Independence

Nine out of our ten directors qualify as independent directors within the meaning of the rules adopted by the Securities and Exchange Commission, or SEC, and the corporate governance standards for companies listed on the NYSE. Pursuant to the requirements of the NYSE, our Board has adopted independence standards that meet or exceed the independence standards of the NYSE, including categorical standards to assist the Governance and Nominating Committee and our Board in evaluating the independence of each director. The categorical standards are included in our corporate governance principles, which are available on our website atwww.cummins.com. A copy also may be obtained upon written request.

Following a discussion and applying the standards referenced above, the Governance and Nominating Committee of our Board determined that all directors standing for election, except N. Thomas Linebarger, our Chief Executive Officer, qualified as independent. Based on the recommendation of the Committee, our full Board approved this conclusion.

Leadership Structure and Risk Oversight

Our corporate governance principles describe in detail how our Board must conduct its oversight responsibilities in representing and protecting our company's stakeholders. As stated in the principles, our Board has the freedom to decide whom our Chairman and Chief Executive Officer should be based solely on what it believes is in the best interests of our company and its shareholders. Currently, our Board believes it is in the best interests of our company for the roles of our Chairman and Chief Executive Officer to be combined and to appoint a Lead Director from among our independent directors. Our Board believes that this leadership structure currently assists our Board in creating a unified vision for our company, streamlines accountability for our performance and facilitates our Board's efficient and effective functioning.

Our Board evaluates its policy on whether the roles of our Chairman and Chief Executive Officer should be combined on an annual basis. In doing so, our Board considers the skills, experiences and qualifications of our then-serving directors (including any newly elected directors), the evolving needs of our company, how well our leadership structure is functioning, and the views of our shareholders.

Based on its review of our leadership structure in 2016, our Board continues to believe that Mr. Linebarger, our Chief Executive Officer, is the person best qualified to serve as our Chairman given his history in executive positions with our company and his skills and experience in the industries in which we operate. Alexis M. Herman is our Lead Director. Ms. Herman was selected for this position because of her service on our Board since 2001, her experience as the U.S. Secretary of Labor and her other experiences in leadership positions in the private and public sectors. Ms. Herman is actively involved in setting and approving the Board's agendas and focus. She works to create a collaborative atmosphere that leverages the strengths of our diverse Board and encourages directors to actively question management when necessary and seeks to ensure that our Board is receiving the information necessary to complete its duties. Ms. Herman meets with other directors and members of senior management outside of the regularly scheduled Board meetings to seek to ensure that our Board is functioning effectively and identifying areas of potential improvement.

Our Lead Director's responsibilities include:

3

Our Board and its committees are involved on an ongoing basis in the oversight of our material enterprise-related risks. Our senior management, led by our Chief Executive Officer in conjunction with other appropriate officers and our enterprise risk management team, undertakes a process that identifies, categorizes and analyzes the relative severity and likelihood of the various different types of risks to which we are or may be subject. Depending upon the type of the material identified risks, our Board, Audit Committee, Finance Committee, Compensation Committee, Governance and Nominating Committee and/or Safety, Environment and Technology Committee then receive periodic reports and information directly from our senior management members who have functional responsibility for the management of such risks. These reports identify and assess the different types of enterprise-related risks and address mitigation strategies and plans implemented or proposed for each key risk. Based on the further input of our senior management as necessary or appropriate, our Board and/or its respective appropriate committee then reviews such information, proposed mitigation strategies and plans, and monitors our progress on mitigating such risks. Our Board's and its committees' roles in the oversight process of our identified material risks have not impacted our Board's leadership structure.

Board of Directors and Committees

Our Board held six meetings during 2016. All of the directors attended 75% or more of the aggregate number of meetings of our Board and the committees on which they served that were held during the periods in which they served. The non-employee members of our Board also met in executive session without management present as part of each regular meeting. Alexis M. Herman, our Lead Director, presided over these sessions.

Under our corporate governance principles, our Board has established six standing committees. Certain of the principal functions performed by these committees and the members of our Board currently serving on these committees are as follows:

Audit Committee. The current members of our Audit Committee are R. K. Herdman (Chairman), A. M. Herman, T. J. Lynch and G. R. Nelson. All members are independent directors as defined under our independence criteria, SEC rules and NYSE listing standards, including those specifically applicable to audit committee members. The Audit Committee met nine times during 2016. Our Board has determined that Mr. Herdman and Mr. Lynch are "audit committee financial experts" for purposes of the SEC's rules. The Audit Committee reviews our accounting principles and procedures. The Audit Committee also reviews the scope, timing and fees for our annual external audit, the planning and resources for internal audit activities, and the results of audit examinations performed by our internal auditors and independent public accountants, including any recommendations to further improve our system of accounting and internal controls. It also monitors the independence and performance of our external and internal auditors.

4

Compensation Committee. The current members of our Compensation Committee are G. R. Nelson (Chairman), R. K. Herdman, A. M. Herman and T. J. Lynch. All members are independent directors as defined under our independence criteria, SEC rules and NYSE listing standards, including those specifically applicable to compensation committee members. The Compensation Committee met six times during 2016. The Compensation Committee administers and determines eligibility for, and makes awards under, our incentive plans. The Committee also reviews and evaluates our executive compensation standards and practices, including salaries, bonus distributions, deferred compensation practices and participation in stock purchase plans. It annually establishes and approves the compensation of our Chief Executive Officer following a review of his performance, including input from all of the other independent directors.

For 2016, the Compensation Committee engaged Farient Advisors LLC, or Farient, as its independent compensation consultant to provide input and advice to the Committee. Farient was engaged to provide analysis and recommendations on compensation strategy issues; assess our peer group used for comparing performance and pay; benchmark our total compensation levels and mix (by pay component), plan design and policies; test the alignment between performance and pay; benchmark our equity levels; monitor the impact and success of any program changes; provide regular updates on changes impacting compensation and guidance on how to respond; assess any management proposals on the foregoing issues; review our compensation-related disclosures; assist with our annual compensation risk assessment; annually assess and provide advice regarding the views of proxy advisory services and major institutional shareholders on our executive compensation practices; provide analysis and advice relating to say on pay votes; and assist in setting the compensation of our Board.

Farient provided advice and guidance to the Committee on several matters in 2016, including:

Other than the services described above, Farient does not provide any other services to our company. Farient's role in establishing the compensation of our Named Executive Officers, to the extent material, is addressed under "Executive Compensation—Compensation Discussion and Analysis."

Our Compensation Committee maintains a formal process to ensure the independence of any executive compensation advisor engaged by the Committee, including consideration of all factors relevant to the advisor's independence from management. The factors considered by the Committee include:

The Compensation Committee assessed the independence of Farient in light of the foregoing factors and concluded that Farient is an independent compensation advisor and that its work for the Committee did not raise any conflict of interest.

5

The Committee also:

Governance and Nominating Committee. The current members of our Governance and Nominating Committee are A. M. Herman (Chairman), R. J. Bernhard, F. R. Chang Diaz, B. V. Di Leo, S. B. Dobbs, R. K. Herdman, T. J. Lynch, W. I. Miller and G. R. Nelson. All members are independent directors as defined under our independence criteria, SEC rules and NYSE listing standards. The Governance and Nominating Committee met five times during 2016. The Governance and Nominating Committee reviews and makes recommendations to our Board with respect to its membership, size, composition, procedures and organization. The Committee uses its network of contacts to identify potential director candidates, and it engaged a professional search firm to identify potential director candidates based on criteria selected by the Committee, interview identified candidates and conduct background checks. This Committee will also consider properly submitted shareholder recommendations of nominees for election to our Board. Shareholder recommendations, including biographical information as to the proposed candidate and a statement from the shareholder as to the qualifications and willingness of such person to serve on our Board, must be submitted in writing to our Secretary.

Director Selection and Board Refreshment. It is a top priority of our Board and our Governance and Nominating Committee that our directors have the skills, background and values to effectively represent the long term interest of our shareholders. Throughout the year, our Board reviews a matrix of the qualifications, skills and experience that we believe our Board needs to have and discusses whether there are any gaps that need to be filled that will improve our Board's performance. We assess potential new director candidates in light of the matrix and whether they possess qualifications, skills and experience needed by our Board. When we identify potential new director candidates, we review extensive background information compiled by our professional search firm, evaluate their references, consider their prior board experience and conduct in-person interviews.

We also believe that new perspectives and ideas are essential for an innovative and strategic board. The average tenure of our directors is approximately nine years. Since 2008, we have added seven new directors to our Board, including the two new directors we added in 2015, Mr. Di Leo and Mr. Lynch, to address our commitment to have a sitting chief executive officer of a publicly traded company on our Board (Mr. Lynch) and more international experience (Mr. Di Leo and Mr. Lynch). In addition, the Committee routinely reviews the Board's committee assignments with a goal of rotating membership on committees every three to five years. Based on this review, the Board will be rotating the committee assignments of several directors at the May 2017 meeting. Our Board will continue to review and refresh the skills, qualifications and experiences that our Board needs to have to serve the long term interests of our shareholders.

As required by our corporate governance principles, our Governance and Nominating Committee must recommend director nominees such that our Board is comprised of a substantial majority of

6

independent directors and possesses a variety of experience and background, including those who have substantial experience in the business community, those who have substantial experience outside the business community (such as public, academic or scientific experience), and those who will represent our stakeholders as a whole rather than special interest groups or individual constituencies.

Each candidate should have sufficient time available to devote to our affairs and be free of any conflict of interest that would violate any applicable law or regulation or interfere with the proper performance of his or her responsibilities including being able to represent the best long-term interests of all of our shareholders. Each candidate also should possess substantial and significant experience that would be of particular importance to us in the performance of his or her duties as a director. The Committee does not intend to alter the manner in which it evaluates candidates, including the foregoing criteria, based on whether or not the candidate was recommended by a shareholder.

Importance of Diversity. One of our core values is diversity. In evaluating candidates for our Board, our Governance and Nominating Committee considers only potential directors who demonstrate the attributes of diversity as well as our other core values of integrity, corporate responsibility, global involvement, innovation and delivering superior results. As reflected in our corporate governance principles, we are committed to equal employment opportunity in assembling our Board. We believe that directors with different backgrounds and experiences makes our boardroom and our company stronger. As our Committee considers possible directors, it seeks out candidates who represent the diverse perspectives of all people. We believe our Board has been effective in assembling a highly qualified, diverse group of directors. We currently have two female directors, one African-American director and two directors from Latin America. We will continue to identify opportunities to enhance our Board diversity as we consider future candidates.

Shareholder Nominations. Any shareholder entitled to vote for the election of directors at a meeting may nominate a person or persons for election as directors only if written notice of such shareholder's intent to make such nominations is given, either by personal delivery or by mail, postage prepaid, to the Secretary of our company not later than 160 days in advance of the originally scheduled date of such meeting (provided, however, that if the originally scheduled date of such meeting is earlier than the anniversary of the date of the previous year's annual meeting, such written notice may be so given and received not later than the close of business on the 10th day following the date of the first public disclosure, which may include any public filing by us with the SEC, of the originally scheduled date of such meeting).

Each notice required by our by-laws must be signed manually or by facsimile by the shareholder of record and must set forth the information required by our by-laws, including (i) the name and address, as they appear on our books, of the shareholder who intends to make the nomination and of any beneficial owner or owners on whose behalf the nomination is made; (ii) a representation that the shareholder is a holder of record of shares of our Common Stock entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (iii) certain other information regarding the shareholder and its interests in our company; (iv) the name, age, business address and residential address of each nominee proposed in such notice; (v) the principal occupation or employment of each such nominee; (vi) the number of shares of our capital stock that are owned of record or beneficially by each such nominee; (vii) with respect to each nominee for election or reelection to our Board, a completed and signed questionnaire, representation and agreement described in our by-laws; (viii) such other information regarding each nominee proposed by such shareholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had each nominee been nominated, or intended to be nominated, by our Board; (ix) a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, including all arrangements or understandings pursuant to which the nominations are being made, between or among such shareholder and beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the

7

one hand, and each proposed nominee, and his or her respective affiliates and associates, or any other person or persons (naming such person or persons), on the other hand; and (x) the written consent of each nominee to serve as a director if so elected.

The deadline for written notice of a shareholder's intent to make a nomination with respect to the Annual Meeting was the close of business on November 30, 2016, which was 160 days in advance of the Annual Meeting (which is typically held on the second Tuesday of each May). We received no such qualifying nominations before this deadline with respect to the Annual Meeting.

Executive Committee. The members of our Executive Committee are N. T. Linebarger (Chairman), W. I. Miller and A.M. Herman. Our Executive Committee is authorized to exercise the powers of our Board in the management and direction of our business and affairs during the intervals between meetings of our Board. It also acts upon matters specifically delegated to it by the full Board of Directors. Our Executive Committee did not meet during 2016.

Finance Committee. The members of our Finance Committee are W. I. Miller (Chairman), R. J. Bernhard, F. R. Chang Diaz, B. V. Di Leo and S. B. Dobbs. Our Finance Committee is authorized to review and advise our management and our Board on our financial strategy pertaining to capital structure, creditworthiness, dividend policy, share repurchase policy, and financing requirements. Our Finance Committee met three times during 2016.

Safety, Environment and Technology Committee. The members of our Safety, Environment and Technology Committee are R. J. Bernhard (Chairman), F. R. Chang Diaz, B. V. Di Leo, S. B. Dobbs and W. I. Miller. This Committee is authorized to assist the Board of Directors in its oversight of safety policies, review environmental and technological strategies, compliance programs and major projects and review public policy developments, strategies and positions taken by us with respect to safety, environmental and technological matters that significantly impact us or our products. It met four times in 2016.

Communication with the Board of Directors. Shareholders and other interested parties may communicate with our Board, including our Lead Director and other non-management directors, by sending written communication to the directors c/o our Secretary, 301 East Market Street, Indianapolis, Indiana 46204. All such communications will be reviewed by the Secretary or his designee to determine which communications are appropriate to be forwarded to the directors. All communications will be forwarded except those that are related to our products and services, are solicitations or otherwise relate to improper or irrelevant topics as determined in the sole discretion of the Secretary or his designee.

Our Secretary maintains and provides copies of all such communications received and determined appropriate to be forwarded to the Governance and Nominating Committee in advance of each of its meetings and reports to the Committee on the number and nature of communications that were not determined appropriate to be forwarded.

We require all of our director nominees standing for election at an annual meeting of shareholders to attend such meeting. All director nominees standing for election at our 2016 Annual Meeting of Shareholders were present in person. We currently expect all director nominees standing for election at the Annual Meeting to be present in person.

8

ELECTION OF DIRECTORS

(Items 1 Through 10 on the Proxy Card)

General

All ten of our directors are nominated for reelection at the Annual Meeting to hold office until our 2018 annual meeting of shareholders and until their successors are elected and qualified. Any submitted proxy will be voted in favor of the nominees named below to serve as directors unless the shareholder indicates to the contrary on his or her proxy. All nominees have been previously elected to our Board by our shareholders and have served continuously since the date indicated below.

Majority Vote Required for Director Elections

To be elected, each director nominee must receive a majority of the votes cast by shareholders at the Annual Meeting. Receipt by a nominee of the majority of votes cast means that the number of shares voted "for" exceeds the number of votes "against" that nominee. Abstentions and broker non-votes are not counted as a vote either "for" or "against" a nominee.

On October 11, 2016, our Board approved an amendment to our by-laws to further clarify that the term of any incumbent director who receives more "against" votes than "for" votes in an uncontested election will automatically terminate at the shareholder meeting at which the votes were cast. Previously, the by-laws provided that the term of an incumbent director who did not receive a majority "for" vote in an uncontested election would automatically terminate on the earlier of 90 days after the shareholder meeting or the date on which our Board selected a replacement director. Accordingly, under the amended by-laws, the term of any director nominee who receives less than a majority of the votes cast by shareholders at the Annual Meeting will automatically terminate at the Annual Meeting. The by-laws as amended continue to provide that, in the case of a contested election, directors will be elected by a plurality of the votes represented in person or by proxy and entitled to vote in the election.

Our Board expects that each of the nominees will be able to serve as a director if elected at the Annual Meeting, but if any of them is unable to serve at the time the election occurs, proxies received that have been voted either for such nominee or for all nominees or which contain no voting instructions will be voted for the election of another nominee to be designated by our Board, unless our Board decides to reduce the number of our directors.

9

NOMINEES FOR BOARD OF DIRECTORS

The names of the nominees for directors, together with biographical sketches, including their business experience during the past five years, directorships of other public corporations and their qualifications to serve on our Board are set forth below. Our nominees are listed below, beginning with our Chairman and Chief Executive Officer and followed by our independent directors in alphabetical order.

OUR BOARD RECOMMENDS THAT SHAREHOLDERS VOTEFOR EACH OF THE NOMINEES SET FORTH BELOW.

|

Director Since: 2009 Age: 54 Board Committees: Executive Mr. Linebarger became the Chairman of the Board and Chief Executive Officer of our company on January 1, 2012. Mr. Linebarger was our President and Chief Operating Officer from 2008-2011 after serving as Executive Vice President and President, Power Generation Business from 2003 to 2008 and as Vice President, Chief Financial Officer from 2000 to 2003. From 1998 to 2000, he was our Vice President, Supply Chain Management, after holding various other positions with us. Mr. Linebarger received a B.S. from Stanford University and a B.A. from Claremont McKenna College in 1986 and M.S. and M.B.A. degrees from Stanford in 1993. He has been a director of Harley-Davidson, Inc. since 2008. Summary of Qualifications and Experience: • Automotive & Transportation Experience • Financial Expertise • International Experience • Manufacturing Background • Sales and Marketing Background • Technology Background Key Contributions to the Board: • Strategic leadership with decades of experience with our global business • Seeks to ensure directors are informed of significant issues impacting our company and receive necessary information • Works collaboratively with our Lead Director to set agendas for Board meetings and assess the engagement and effectiveness of our Board, its committees, and individual directors |

10

|

Director Since: 2008 Age: 64 Board Committees: Finance; Governance and Nominating; Safety, Environment and Technology Mr. Bernhard joined the University of Notre Dame in 2007 and prior to that was Associate Vice President for Research at Purdue University since 2004. He also held Assistant, Associate and full Professor positions at Purdue University. He was Director of the Ray W. Herrick Laboratories at Purdue's School of Mechanical Engineering from 1994 to 2005. Mr. Bernhard is also a Professional Engineer and earned a B.S.M.E. and Ph.D., E.M. from Iowa State University in 1973 and 1982, and an M.S.M.E. from the University of Maryland in 1976. He was the Secretary General of the International Institute of Noise Control Engineering (I-INCE) from 2000 to 2015, and the Institute of Noise Control Engineering. Summary of Qualifications and Experience: • Academic Leader • Automotive and Transportation Experience • Manufacturing Background • Technology Background Key Contributions to the Board: • Chair of Safety, Environment and Technology Committee • Leverages technical background to offer valuable insight • Pushes for improvement in safety and technology planning • Mentors our technical leaders |

11

|

Director Since: 2009 Age: 66 Board Committees: Finance; Governance and Nominating; Safety, Environment and Technology Dr. Chang Diaz is Chairman and Chief Executive Officer of Ad Astra Rocket Company, a U.S. spaceflight engineering company based in Houston, Texas and dedicated to the development of advanced in-space electric propulsion technology. Ad Astra also develops space-derived Earth applications in clean renewable energy and electric transportation. Dr. Chang Diaz founded Ad Astra in 2005 following his retirement from NASA after a 25-year career during which he flew seven space missions and logged over 1,600 hours in space. In 1994, Dr. Chang Diaz founded and directed NASA's Advanced Space Propulsion Laboratory at the Johnson Space Center where he managed a multicenter research team developing new plasma rocket technology. Dr. Chang Diaz is a dual citizen of Costa Rica and the United States. As part of his involvement in Costa Rica's development, Dr. Chang Diaz currently leads the implementation of the "Strategy for the XXI Century," a plan to transform Costa Rica into a fully developed nation by the year 2050. Dr. Chang Diaz received the Liberty Medal in 1986 from President Ronald Reagan and is a four-time recipient of NASA's Distinguished Service Medal, the agency's highest honor. Dr. Chang Diaz also serves as an Adjunct Professor of Physics at Rice University and the University of Houston. Summary of Qualifications and Experience: • International Experience • Manufacturing Background • Technology Background Key Contributions to the Board: • Brings an expansive view of technology matters • Pushes our Board to think long-term in technology planning • Well-versed in international business issues • Strong engagement in the development of our Latin America business |

12

|

Director Since: 2015 Age: 60 Board Committees: Finance; Governance and Nominating; Safety, Environment and Technology Mr. Di Leo has served as Senior Vice President, Global Markets, for International Business Machines Corporation, or IBM, a globally integrated technology and consulting company, since 2012. In this position, he is accountable for revenue, profit, and client satisfaction in Japan, Asia Pacific, Latin America, Greater China and the Middle East and Africa. He also oversees IBM's Enterprise and Commercial client segments globally. From 2008 to 2011, he was General Manager for IBM's Growth Markets Unit based in Shanghai. Mr. Di Leo has more than 40 years of business leadership experience in multinational environments, having lived and held executive positions on four continents. Mr. Di Leo is a member of the international advisory board of Instituto de Estudios Superiores de la Empresa (IESE Business School) as well as a member of the Deming Center Advisory Board of Columbia Business School. He holds a business administration degree from Ricardo Palma University and a postgraduate degree from Escuela Superior de Administracion de Negocios, both in his native Peru. He is fluent in Spanish, Portuguese, English and Italian. Summary of Qualifications and Experience: • International Experience • IT Experience • Sales and Marketing Background • Technology Background Key Contributions to the Board: • Brings perspective on international business issues having lived and held executive positions on four continents • Offers insight regarding technology and sales and marketing issues • Works to ensure customer-focused approach in addressing product and service-related issues |

13

|

Director Since: 2010 Age: 60 Board Committees: Finance; Governance and Nominating; Safety, Environment and Technology Mr. Dobbs is a former executive of Fluor Corporation, a publicly traded professional services firm providing engineering, procurement, construction, fabrication and modularization, commissioning and maintenance, as well as project management services on a global basis. Mr. Dobbs served as Senior Group President over Fluor's Industrial and Infrastructure Group until his retirement in 2014. In that role, Mr. Dobbs was responsible for a wide diversity of the markets served by Fluor, including infrastructure, telecommunications, mining, operations and maintenance, transportation, life sciences, heavy manufacturing, advanced technology, microelectronics, commercial, institutional, health care, water, and alternative power. Mr. Dobbs served Fluor in numerous U.S. and international locations including Southern Africa, Europe, and China. He is an industry recognized expert in project finance in Europe and the United States, particularly public private partnerships and private finance initiatives. Since 2015, Mr. Dobbs has been a member of the Board of Directors of Lend Lease Corporation Limited, an international property and infrastructure group that is publicly traded in Australia. Mr. Dobbs earned his doctorate in engineering from Texas A&M University and holds two undergraduate degrees in nuclear engineering, also from Texas A&M. Until his retirement from Fluor, he served on the World Economic Forum's Global Agenda Council on Geopolitical Risk as well as the Governor's Business Council for the State of Texas. He also served as a director of the U.S. China Business Council. Summary of Qualifications and Experience: • Automotive and Transportation Experience • Financial Expertise • International Experience • Manufacturing Background • Technology Background Key Contributions to the Board: • Possesses emerging market/international experience from his Fluor career • Adds perspective gained from leading business operations in U.S, Southern Africa, Europe and China • Leverages technical background to provide insight regarding technology matters • Experience in project finance |

14

|

Director Since: 2008 Age: 68 Board Committees: Audit; Compensation; Governance and Nominating Mr. Herdman has been Managing Director of Kalorama Partners LLC, a Washington, D.C. consulting firm specializing in providing advice regarding corporate governance, risk assessment, crisis management and related matters since 2004. He was the Chief Accountant of the SEC from October 2001 to November 2002 prior to joining Kalorama. Prior to joining the SEC, he was Ernst & Young's Vice Chairman of Professional Practice for its Assurance and Advisory Business Services (AABS) practice in the Americas and the Global Director of AABS Professional Practice for Ernst & Young International. He was the senior Ernst & Young partner responsible for the firm's relationships with the SEC, FASB and AICPA. Since 2011, he has been a member of the Board of Directors and has chaired the Audit Committee of WPX Energy, Inc. In April 2015, he retired from the Board of Directors of HSBC Finance Corporation and HSBC USA Inc. Mr. Herdman had served on the Audit Committees of both companies through April 2013. Mr. Herdman also retired from the Board of Directors of HSBC North America Holdings, Inc. in April 2015 and was past Chairman of both its Audit and Risk Committees. Summary of Qualifications and Experience: • Financial Expertise • Government/Regulatory Affairs Background • International Experience • Manufacturing Background Key Contributions to the Board: • Chair of Audit Committee • Provides insight concerning financial and risk management matters • Mentors finance leaders and helps our finance function enhance skills and talent • Actively engaged in our Enterprise Risk Management program |

15

|

Director Since: 2001 Age: 69 Board Committees: Audit; Compensation; Executive; Governance and Nominating Ms. Herman serves as Chair and Chief Executive Officer of New Ventures LLC, a corporate consulting company, and has held these positions since 2001. She serves as Chair of Toyota Motor Corporation's North American Diversity Advisory Board and is a member of Toyota's Global Advisory Board. From 1997 to 2001, she served as U.S. Secretary of Labor. She has also served as a director of The Coca Cola Company since 2007, Entergy Corporation since 2003, and MGM Resorts International since 2002. In addition, Ms. Herman is Co-Chair for the Bush Clinton Presidential Leadership Scholars Program and the Senior Vice Chair of the National Urban League. In 2014, Ms. Herman was named to the 2014 National Association of Corporate Directors (NACD) Directorship 100 in recognition of exemplary leadership in the boardroom and promoting the highest standards of corporate governance. Summary of Qualifications and Experience: • Diversity Initiatives Experience • International Experience • Government/Regulatory Affairs Background • Manufacturing Background Key Contributions to the Board: • Lead Director and Chair of the Governance and Nominating Committee • Brings knowledge of the U.S. government and regulatory process • Offers strategic worldview due to her work with global corporations • Works with management on diversity and talent development initiatives • Creates a culture that fosters open discussion and full board participation |

16

|

Director Since: 2015 Age: 62 Board Committees: Audit; Compensation; Governance and Nominating Mr. Lynch is the Executive Chairman of TE Connectivity Ltd. (formerly Tyco Electronics Ltd.), a global provider of connectivity and sensor solutions, harsh environment applications, and undersea telecommunication systems. Mr. Lynch served as the Chief Executive Officer of TE Connectivity Ltd. from January 2006 to March 2017, and has served as a member of its board of directors since 2007 and as Chairman of the Board since January 2013. From September 2004 to January 2006, Mr. Lynch was at Tyco International as the President of Tyco Engineered Products & Services, a global manufacturer of industrial valves and controls. Mr. Lynch joined Tyco from Motorola, where he served as Executive Vice President of Motorola, and President and Chief Executive Officer of Motorola's Personal Communications sector, a leading supplier of cellular handsets. Mr. Lynch has served as a director of Thermo Fisher Scientific Inc. since 2009. Mr. Lynch serves on the President's National Security Telecommunications Advisory Committee, and on the Boards of The Franklin Institute and the U.S. China Business Council (USCBC). Summary of Qualifications and Experience: • CEO of Public Company from 2006 to 2017 • Financial Expertise • International Experience • Manufacturing Background • Technology Background Key Contributions to the Board: • Brings perspective of a sitting Chairman and former CEO of a publicly traded global company • Leverages business and financial background in rendering advice and insight • Identifies and raises strategic considerations for Board consideration |

17

|

Director Since: 1989 Age: 60 Board Committees: Executive; Finance; Governance and Nominating; Safety, Environment and Technology Mr. Miller has served as President of the Wallace Foundation, a knowledge-focused national philanthropy with a mission of improving learning and enrichment for disadvantaged children and the vitality of the arts for everyone, since 2011. Mr. Miller was the Chairman of Irwin Management Company, a Columbus, Indiana private investment firm, from 1990 to 2011. Mr. Miller has also served as Chairman of the Board of Tipton Lakes Company, a real estate development firm, since 1985. Mr. Miller has been a director or trustee of the New Perspective Fund, Inc. and the New World Fund, Inc. since 1992 and of the EuroPacific Growth Fund, Inc. since 1999. All three of the funds are in the same mutual fund family. Summary of Qualifications and Experience: • Deep Historical Knowledge of the Company • Financial Expertise • Manufacturing Background Key Contributions to the Board: • Chair of Finance Committee • Professional experience in the banking and investment industries • Extensive knowledge of our company, its values and its global operations • Advises and oversees our cash management strategy and management of the balance sheet |

18

|

Director Since: 2004 Age: 67 Board Committees: Audit; Compensation; Governance and Nominating Ms. Nelson became President and CEO of PTI Resources, LLC, an independent consulting firm, in 2005. Prior to this role, Ms. Nelson retired in 2005 from Edison International, where she had been President of Midwest Generation EME, LLC since 1999 and General Manager of Edison Mission Energy Americas since 2002. Her business responsibilities have included management of regulated and unregulated power operations and a large energy trading subsidiary as well as the construction and operation of power generation projects worldwide. She has had extensive experience in business negotiations, environmental policy matters and human resources. She has served as a director of Ball Corporation since 2006, TransAlta Corporation since 2014 and Sims Metal Management Limited since 2014. Since 2010, she has been a director of CH2M Hill Companies Ltd., a privately-held company. She serves on the advisory committee of the Center for Executive Women at Northwestern University. In November 2012, Ms. Nelson was named to the 2012 National Association of Corporate Directors (NACD) Directorship 100 in recognition of exemplary leadership in the boardroom and promoting the highest standards of corporate governance. Ms. Nelson is an NACD Board Fellow. Summary of Qualifications and Experience: • Automotive and Transportation Experience • Diversity Initiatives Experience • International Experience • Manufacturing Background • Technology Background Key Contributions to the Board: • Chair of Compensation Committee • Provides perspective based on background in power generation and business • Utilizes expertise in compensation and governance matters to oversee best practices in executive compensation • Possesses human resources and environmental experience • Works outside of regular meetings to support the development of women in leadership roles |

19

In December 2016, our Compensation Committee conducted its annual risk assessment of our compensation policies and practices covering all employees. After a thorough review and assessment of potential risks, our Compensation Committee evaluated the levels of risk-taking that potentially could be encouraged by our compensation arrangements, taking into account the arrangements' risk-mitigation features, to determine whether they are appropriate in the context of our strategic plan and annual budget, our overall compensation arrangements, our compensation objectives and our company's overall risk profile. Risk-mitigation features identified by our Compensation Committee included the following:

20

unanticipated matters. We believe that allowing these exclusions lessens the risk that our executives would otherwise be encouraged to take actions or inactions with respect to such items based on the effect the actions might have on incentive compensation, rather than based on the actions' merits and impact on achieving our long-term goals and objectives.

As a result of its review, our Compensation Committee concluded that we have a balanced pay and performance executive compensation program that does not drive excessive financial risk-taking. We believe that risks arising from our compensation policies and practices are not reasonably likely to have a material adverse effect on our company.

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Our Compensation Discussion and Analysis, or CD&A, provides detailed information about our executive compensation programs as well as the principles and processes utilized by the Compensation Committee in making executive compensation decisions. This CD&A focuses on the compensation of the following five executive officers, whom we refer to as our "Named Executive Officers" for 2016:

Named Executive Officer | Title | |

N. Thomas Linebarger | Chairman of the Board of Directors and Chief Executive Officer | |

Patrick J. Ward | Vice President—Chief Financial Officer | |

Richard J. Freeland | President and Chief Operating Officer | |

Livingston L. Satterthwaite | Vice President—President, Distribution Business | |

Marya M. Rose | Vice President—Chief Administrative Officer |

Executive Summary

Our long-term success depends on our ability to attract, motivate, focus and retain highly talented individuals who are committed to our vision and strategy. A key objective of our executive compensation program is to link our executives' pay to their performance and their advancement of our overall annual and long-term performance and business strategies. Other objectives include encouraging high-performing executives to remain with us over the course of their careers.

We believe that the amount of compensation for each Named Executive Officer reflects extensive management experience, continued high performance and exceptional service to Cummins. We also believe that our compensation strategies have been effective in attracting executive talent and promoting performance and retention.

Principles of our Executive Compensation Program

The primary focus of our executive compensation program is the principle of pay for performance, as we define it, both in program design and in specific awards. We believe that the level of compensation received by executives should be closely tied to our corporate financial and stock price performance.

Our executive compensation program also is designed to attract, motivate, focus and retain employees with the skills required to achieve our performance goals in a competitive global business environment. Therefore, our program is designed to reflect each individual's contribution to our corporate performance, while striking an appropriate balance between short-term and long-term corporate results.

In addition to our focus on pay for performance, we also consider the following principles when designing and implementing our executive compensation program:

21

Link between Financial Performance and Executive Compensation

We have a long-standing commitment to pay for performance that we implement by providing a majority of compensation through arrangements designed to hold our executive officers accountable for business results and reward them for consistently strong corporate performance and the creation of value for our shareholders. The Compensation Committee has carefully structured the key elements of our executive compensation program to support this objective. Specifically:

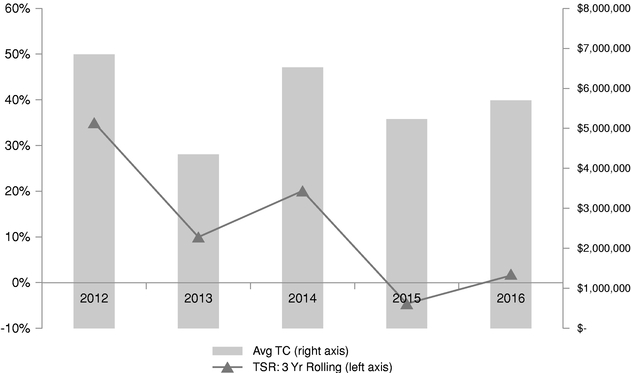

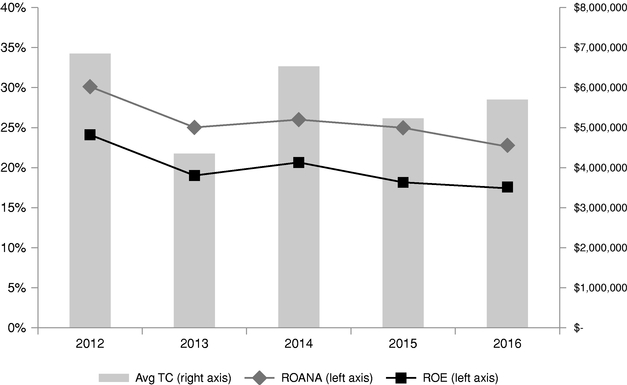

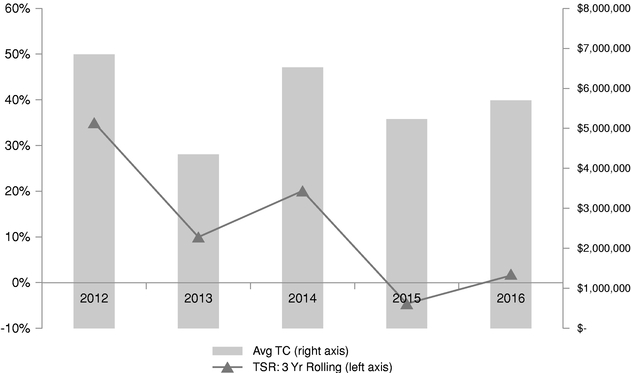

Our Compensation Committee annually requests that Farient Advisors LLC, or Farient, evaluate the relationship between our executive compensation and our financial and shareholder return performance. As in prior years, Farient conducted quantitative analyses to test the alignment of our Chief Executive Officer's pay and corporate performance by simulating the pay for performance tests relied upon by proxy voting advisory firms and by using its own pay for performance alignment model which tests 3-year average performance-adjusted compensation relative to 3-year average Total Shareholder Return, or TSR. Our Compensation Committee considers these analyses in evaluating whether our Chief Executive Officer's compensation has corresponded with the performance delivered.

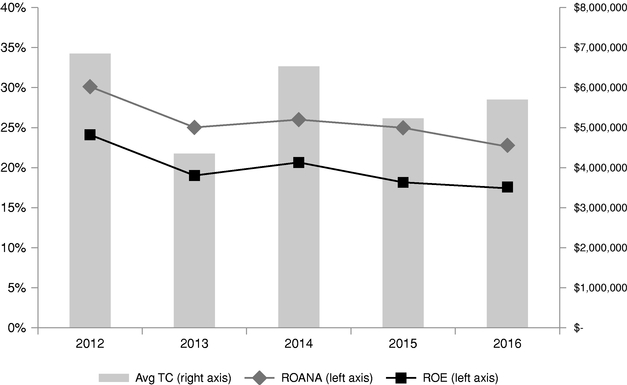

In addition, as a further test, the following graphs show the relationship between our corporate financial and TSR performance and our executive compensation levels over the past five years as measured by our: (i) average TSR (three-year rolling average, on a dividend reinvested basis); (ii) ROANA;

22

(iii) ROE; and (iv) average annual total compensation for our Named Executive Officers, or Avg TC, as reported in our Summary Compensation Table:

NEO Pay Relative to Performance

Note: The "Avg TC" values in these graphs reflect the averages of the total compensation values for our Named Executive Officers as reported in the Summary Compensation Tables of our proxy statements for the respective years shown in the graphs.

23

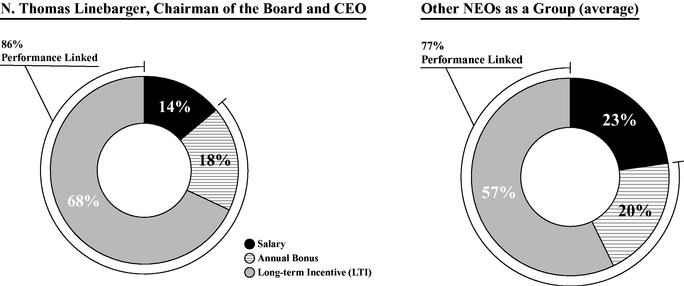

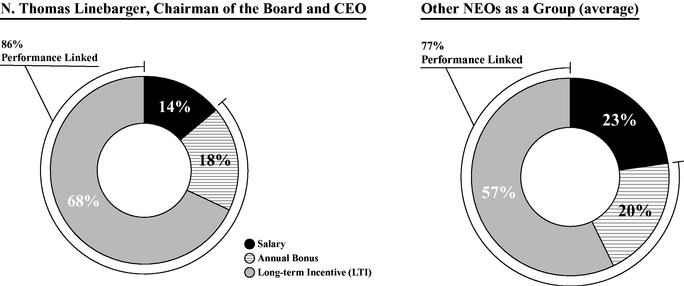

To illustrate how our executive compensation program achieves our pay at risk principle, set forth below are the percentages for each of the three elements that make up the target total direct compensation opportunity provided in 2016 to our Chief Executive Officer and our other Named Executive Officers as a group.

Target Total Direct Compensation Mix—Fiscal Year 2016

(Consists of base salary, annual bonus award target and 2016 long-term incentive grant value)

The targets for performance-linked components for 2016 were 86% and 77% for the CEO and Named Executive Officers, respectively.

How We Performed in 2016 and How Our Executive Compensation Aligned with Our Performance

In 2016, we continued to face challenging economic conditions, resulting in a decrease in year over year revenue and earnings. Despite these decreases, we returned value to our shareholders through increased dividends and share repurchases. We believe that our financial performance is closely correlated with the compensation of our Named Executive Officers. The average compensation increase for our NEOs reflected in the NEO Pay Relative to Performance graphs is primarily due to stock price appreciation in 2016, resulting in higher valuation of the equity issued in our compensation programs.

2016 Business Highlights. Our revenues decreased by 8 percent in 2016 compared to 2015, as a result of declines in North American commercial truck production and the lowest levels of demand for high horsepower engines in industrial and power generation markets in more than a decade. International sales declined 2 percent as strong sales growth in China and India were more than offset by weak demand in Latin America, the Middle East and Africa. Cash flow from operations generated in 2016 was strong which allowed us to reinvest in our business and return cash to shareholders. Key business highlights for 2016 include:

24

Market Alignment of our Executive Compensation Program Elements

Throughout our CD&A, each reference to the "market" and to our market positioning practices is intended to incorporate the market positioning approach outlined below.

We review our executive compensation program on a regular basis, and generally target the median of the market in positioning each element of our compensation: base salary, target annual bonus and target long-term incentives. These elements together equate to target total direct compensation. We consider target compensation to be at the median of the market if it is within +/– 10% of the median level indicated by the benchmarking data.

For 2016, our primary reference in aligning executives' compensation to the market was a consolidation and integration of market data from the Aon Hewitt Total Compensation Management Executive Survey and Mercer Benchmark Database Survey of companies in the manufacturing industry. Data also were referenced from our Custom Peer Group, defined below. The data we obtained from our Custom Peer Group for comparison purposes pertained to pay levels for the Chief Executive Officer position (although these data were consulted for reference only and were not blended with the survey data to determine pay positioning), pay program design, dilution, and performance. We believe this approach provides an appropriate representation of the market, as applicable to our executives, and reduces the impact of fluctuations in market data over time.

Our Custom Peer Group is made up of the following 17 companies. The companies were selected based on industry, reputation, revenue size, investor comparisons and competition for customers and talent. Our Custom Peer Group includes both U.S. and internationally listed publicly traded major participants in the end markets we serve and includes: (i) customers with a strong presence in one or more of our major markets, (ii) competitors that compete directly or indirectly with one or more of the company's businesses, and (iii) key suppliers of related products. It also includes diversified industrial companies that compete for investor capital within the Industrial market segment. We have been consistent in how our Custom Peer Group is selected, and, as a result, the group has remained the same for the past several years.

• Borg Warner Incorporated | • Caterpillar Incorporated | |

• Daimler AG | • Danaher Corporation | |

• Deere and Company | • Donaldson Company Incorporated | |

• Eaton Corporation | • Emerson Electric Company | |

• Honeywell International Incorporated | • Illinois Tool Works | |

• Ingersoll-Rand PLC | • Navistar International Corporation | |

• Paccar Incorporated | • Parker-Hannifin Corporation | |

• Textron Incorporated | • Volvo AB | |

• W. W. Grainger, Inc. |

Advisory Shareholder Vote on our Executive Compensation in 2016

In May 2016, after the 2016 executive compensation actions described in this CD&A had taken place, we held our sixth advisory shareholder vote to approve the compensation of our Named Executive Officers at our annual shareholders' meeting. Consistent with the recommendation of our Board, our shareholders voted 95.6% in favor of our executive compensation. In response to this strong vote of shareholder

25

approval and considering our belief that our programs support our business strategies and our objectives, we have not undertaken any material changes to our executive compensation programs for 2017.

How our Executive Compensation is Determined

Our Compensation Committee regularly reviews all elements of our executive compensation program and makes changes it deems appropriate from time to time. Each review includes general comparisons against market data and analysis prepared by the Compensation Committee's independent executive compensation consultant, Farient, including data on market practices, analysis, and decision support in the following areas:

The Compensation Committee has the flexibility to establish performance measures and goals annually that are deemed appropriate to help achieve our business strategy and objectives. In setting the performance goals for the annual bonus, performance shares, and performance cash plan, the Compensation Committee benchmarks historical performance of the Custom Peer Group and regularly evaluates whether the goals are sufficiently demanding relative to short-term and long-term performance trends of these peers. Additionally, the Committee solicits Farient's assessment regarding the degree of difficulty associated with the incentive plan performance targets in the context of both external analyst expectations for our annual and long-term performance as well as relative peer performance expectations. Using this process, the Committee believes that the payouts associated with various levels of our performance under the incentive plans are aligned with our objective of creating long-term value for our shareholders within an appropriate external performance context.

The Compensation Committee may also decide to include or exclude the effects of certain operating performance measures which result from decisions made at the corporate level, such as acquisitions, divestitures, or joint venture formations in the initial year, if such events were not anticipated at the time targets were initially established, pension plan contributions above required levels and certain other unanticipated matters.

26

Best Practices Adopted in Determining Executive Compensation

We continually review best practices in the area of executive compensation. Our executive compensation arrangements include features considered to be best practices, such as the following:

| | | | ||

|---|---|---|---|---|

| What We Do | ||||

| | | | | |

| Performance Measurement | • We set clear financial goals that we believe are challenging but achievable, meet or exceed competitive standards, and enhance shareholder value over time. • We use different performance measures in our short- and long-term incentive compensation plans to correlate with our financial performance on both an annual and longer-term basis, as well as our returns to shareholders. In addition, we believe that our performance measures correlate to shareholder value creation over the long term. | |||

| | | | | |

| Compensation Program Design / Pay For Performance Alignment | • Our annual bonus plan is designed to strengthen the tie between individual employee performance and corporate performance. • Our annual bonus plan uses a "One Cummins" structure in which all eligible employees participate. Our unified annual bonus plan reinforces the overall success of our company; encourages collaboration across our organization; and promotes "One Cummins" by encouraging our employees to collectively share in the success of our company. • We use multiple components under our long-term incentive compensation program (performance cash, performance shares and stock options) to address the motivational concerns associated with a singular focus on any one form of long-term incentive compensation. • To further encourage focus on the sustained growth of our company over the long term and to aid in retention, our performance shares, performance cash and stock option awards to our executive officers cliff vest after three years. • We cap payouts under our short-and long-term performance compensation plans at 200% of the target awards. • Perquisites do not comprise a major element in our executive compensation program. | |||

| | | | | |

| Risk Mitigation | • We maintain a compensation recoupment, or "clawback," policy in our corporate governance principles providing that, if any of our financial statements are required to be materially restated resulting from the fraudulent actions of any officer, our Compensation Committee may direct that we recover all or a portion of any award or any past or future compensation other than base salary from any such officer with respect to any year for which our financial results are adversely affected by such restatement. | |||

| | | | | |

| Governance | • We monitor our pay practices to help confirm that they do not encourage excessive risk taking. • Our Compensation Committee benefits from the use of an outside, independent compensation consultant. | |||

| | | | | |

| Other | • We require executive officers to maintain certain stock ownership levels and prohibit them from engaging in forms of hedging or similar types of transactions with respect to our stock. • We prohibit officers from entering into any arrangement that, directly or indirectly, involves the pledge of our securities or other use of our securities as collateral for a loan. • Benefits under our change in control arrangements with our executive officers are subject to a "double trigger" rather than a "single trigger" (i.e., in addition to the change in control occurring, the executive officer's employment must be terminated by us without cause or by the executive officer with good reason in order for him or her to receive any benefits under the arrangement). | |||

| | | | | |

| What We Don't Do |

| |

• We do not permit backdating or repricing of stock options. |

• We do not have separate employment contracts with our executive officers. |

• We do not guarantee salary increases, bonuses or equity grants for our executive officers and we do not provide discretionary bonuses to our Named Executive Officers. |

• We will not gross-up excise taxes that may be imposed on payments to our executive officers in connection with a change in control. |

27

Determination of Our Chief Executive Officer's Compensation

On an annual basis, our Chief Executive Officer discusses his priorities and objectives with respect to our company's and our management team's goals with the full Board. Our independent directors formally review our Chief Executive Officer's performance annually. This review is based on our Chief Executive Officer's performance against specific objectives, which include the progress made by our company in implementing its business strategy and achieving its business objectives, both short-term and long-term. This review, which is reported in detail to the Compensation Committee, considers both quantitative and qualitative performance matters and is a key factor used by the Compensation Committee in setting our Chief Executive Officer's compensation for the coming year. Specific business objectives and goals that were part of our Chief Executive Officer's performance review for 2016 included the financial performance of our company, progress towards achieving our company's long-term strategic objectives and the development of key leadership talent.

After receiving the reports described above from both our Chief Executive Officer and the independent directors, the Compensation Committee meets in executive session to determine the compensation of our Chief Executive Officer. In this discussion, the Compensation Committee has access to data and advice from its compensation consultant, Farient. Members of management do not make recommendations regarding the compensation of our Chief Executive Officer. The Compensation Committee Chair then presents the Compensation Committee's decisions on the compensation for our Chief Executive Officer to the Board for its information.

Role of Our Officers in Setting Compensation for Other Officers

Members of our senior management, including our Named Executive Officers, recommend compensation to our Chief Executive Officer for officers in the areas for which they are responsible (but not with respect to their own compensation). Taking these recommendations into consideration, our Chief Executive Officer then makes recommendations to our Compensation Committee regarding each officer. Our senior management and our Chief Executive Officer base these recommendations on assessments of individual performance and potential to assume greater responsibility, as well as market survey data for similar executive positions. Our Chief Executive Officer discusses the recommendations and performance of the officers with the Compensation Committee. The Compensation Committee reviews our Chief Executive Officer's recommendations, may make modifications based on the market data and a discussion of individual and corporate performance, and then makes the final decisions regarding each officer's total targeted compensation, and its respective elements. Our officer compensation review occurs annually, at the February Compensation Committee meeting. This is the first Compensation Committee meeting after our prior year-end and provides the earliest opportunity to review and assess individual and corporate performance for the previous year. As part of its review process, the Compensation Committee has access to the advice and input of its independent compensation consultant, Farient.

Tax Considerations in Determining Officer Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended, or Code, limits the corporate tax deduction to $1 million for compensation paid annually to any one of our Named Executive Officers (other than our Chief Financial Officer), unless the compensation meets certain requirements to qualify as performance based compensation. It is generally our intention to qualify compensation payments for tax deductibility under Section 162(m). Notwithstanding our intentions, because of ambiguities and uncertainties as to the application and interpretation of Section 162(m) and the regulations issued thereunder, no assurance can be given that compensation intended to satisfy the requirements for deductibility under Section 162(m) will so qualify.

The Compensation Committee reserves the right to provide compensation that does not qualify as performance based compensation under Section 162(m) to the extent it believes such compensation is

28

necessary to continue to provide competitive arrangements intended to attract and retain, and provide appropriate incentives to, qualified officers and other key employees.

As explained in this CD&A, we have historically targeted the base salaries of our Named Executive Officers at the median range of base salaries in the market. The Compensation Committee intends to continue this policy notwithstanding the provisions of Section 162(m). As a result of the foregoing, the portion of our Chief Executive Officer's base salary that exceeded $1 million in 2016, as well as any other compensation paid to our Named Executive Officers (other than our Chief Financial Officer) in excess of $1 million that was not performance based within the meaning of Section 162(m), will not qualify for tax deductibility under Section 162(m).

Compensation Program Elements

Our executive compensation program consists of three principal elements: base salary, annual bonus opportunities and long-term incentive compensation opportunities. When considered together, these elements are total direct compensation. In total, all elements of our executive compensation program are designed to fulfill our basic goals of linking pay to performance and to pay competitively. All officers participate in each element of the program, but in varying degrees.

All elements of compensation are reviewed annually for each officer, including our Named Executive Officers. Our annual review of executive compensation includes an evaluation of each officer's compensation as it compares to the median of the market for each officer's position. Our annual review also includes consideration of internal equity and the experience, tenure, potential and performance of each officer. Our Compensation Committee bases its final decisions about officers' compensation on a subjective consideration of all of these factors. As a result, the Compensation Committee believes that the 2016 total direct compensation for each of the Named Executive Officers is placed at the appropriate level relative to the competitive market median.

Base Salary

In our annual review of base salaries for our officers, we target base salary at the median of the market for similar executive positions. Because we also subjectively consider other factors, including experience, tenure, potential, performance and internal equity, some officers' base salaries may be set above or below the median range. The Compensation Committee believes that all of the Named Executive Officers' salaries for 2016, after adjustment as described below, are placed at the appropriate level of the external market.

2016 Adjustments to Base Salary

In determining the base salaries for the Named Executive Officers, the Compensation Committee reviewed each executive's job responsibilities, management experience, individual contributions, number of years in his or her position, and then-current salary relative to market pay levels.

Following a comprehensive review of Mr. Linebarger's base salary relative to the calculated median market value, the Compensation Committee determined that Mr. Linebarger's base salary should be maintained at $1,375,000.

After considering input from Mr. Linebarger and reviewing the competitive pay positioning of each Named Executive Officer relative to his or her calculated median market value, the Compensation

29

Committee decided to maintain 2016 base salaries at the same level as that in 2015 for each Named Executive Officer:

| | 2016 Base Salary Increases | |||||||||||

| | | | | | | | | | | | | | |

Named Executive Officer | | 2015 Base Salary | | $ Increase | | % Increase | | 2016 Base Salary | |||||

N. Thomas Linebarger | $ | 1,375,000 | $ | 0 | 0 | % | $ | 1,375,000 | |||||

Patrick J. Ward | $ | 726,000 | $ | 0 | | 0 | % | $ | 726,000 | ||||

Richard J. Freeland | $ | 848,000 | $ | 0 | 0 | % | $ | 848,000 | |||||

Livingston L. Satterthwaite | $ | 570,000 | $ | 0 | | 0 | % | $ | 570,000 | ||||

Marya M. Rose | $ | 634,000 | $ | 0 | 0 | % | $ | 634,000 | |||||

Annual Bonus

We design annual bonus opportunities for our executives to link executive pay to our annual financial performance. Annual bonus payouts are equal to the executive's participation rate multiplied by the executive's base salary and then further multiplied by a payout factor based on our company's actual financial performance against our ROANA goal for that year. There is no discretionary element to computing annual bonuses.

For example:

| $726,000 | Annual Base Salary | |

| × 60% | Participation Rate | |