UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811- 2485

John Hancock Current Interest

(Exact name of registrant as specified in charter)

200 Berkeley Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Salvatore Schiavone

Treasurer

200 Berkeley Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant's telephone number, including area code:617-663-4497

| Date of fiscal year end: | March 31 |

| Date of reporting period: | March 31, 2020 |

ITEM 1. REPORTS TO STOCKHOLDERS.

John Hancock

Money Market Fund

Annual report 3/31/2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change, and you do not need to take any action. You may elect to receive shareholder reports and other communications electronically by calling John Hancock Investment Management at 800-225-5291 (Class A, Class B and Class C shares) or by contacting your financial intermediary.

You may elect to receive all reports in paper, free of charge, at any time. You can inform John Hancock Investment Management or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by following the instructions listed above. Your election to receive reports in paper will apply to all funds held with John Hancock Investment Management or your financial intermediary.

A message to shareholders

Dear shareholder,

Global financial markets were on pace to deliver strong returns during the 12 months ended March 31, 2020, until heightened fears over the coronavirus (COVID-19) sent markets tumbling during the last five weeks of the period.Investors reacted by exiting higher-risk assets and moving into cash, leading to a liquidity crunch in the fixed-income markets. After the longest bull market in U.S. history, we're now in bear market territory.

In response to the sell-off, the U.S. Federal Reserve acted quickly, lowering interest rates to zero and reinstating quantitative easing, as well as announcing its plans to shore up short-term debt. These steps, along with the passage of an estimated $2 trillion federal economic stimulus bill, helped lift the markets in the final two weeks of March, while credit spreads rebounded off their highs as liquidity concerns eased.

The continued spread of COVID-19, trade disputes, rising unemployment, and other geopolitical tensions may continue to create uncertainty among businesses and investors. Your financial professional can helpposition your portfolio so that it's sufficiently diversified to seek to meet your long-term objectives and to withstand the inevitable bouts of market volatility along the way.

On behalf of everyone at John Hancock Investment Management, I'd like to take this opportunity to welcome new shareholders and thank existing shareholders for the continued trust you've placed in us.

Sincerely,

Andrew G. Arnott

President and CEO,

John Hancock Investment Management

Head of Wealth and Asset Management,

United States and Europe

This commentary reflects the CEO's views as of this report's period end and are subject to change at any time. Diversification does not guarantee investment returns and does not eliminate risk of loss. All investments entail risks, including the possible loss of principal. For more up-to-date information, you can visit our website at jhinvestments.com.

John Hancock

Money Market Fund

Table of contents

| 2 | Your fund at a glance | |

| 5 | Manager's discussion of fund performance | |

| 7 | Your expenses | |

| 9 | Fund's investments | |

| 13 | Financial statements | |

| 16 | Financial highlights | |

| 19 | Notes to financial statements | |

| 25 | Report of independent registered public accounting firm | |

| 26 | Tax information | |

| 27 | Statement regarding liquidity risk management | |

| 30 | Trustees and Officers | |

| 34 | More information |

PERFORMANCE HIGHLIGHTS OVER THE LAST TWELVE MONTHS

The U.S. Federal Reserve (Fed) enacted significant interest-rate cuts over the course of the period

The federal funds rate, which stood at a target range of 2.25% to 2.50% when the period began, was cut to a range of 0.00% to 0.25% by the end of March 2020.

The spread of COVID-19 was the primary factor in the dramatic policy shift

The shutdowns associated with the coronavirus led to sharp reductions in the economic growth outlook, prompting the Fed to act quickly to head off a potential crisis.

The fund maintained a steady approach

The portfolio was positioned with above-average interest-rate sensitivity throughout the year, with an ongoing focus on liquidity and diversification.

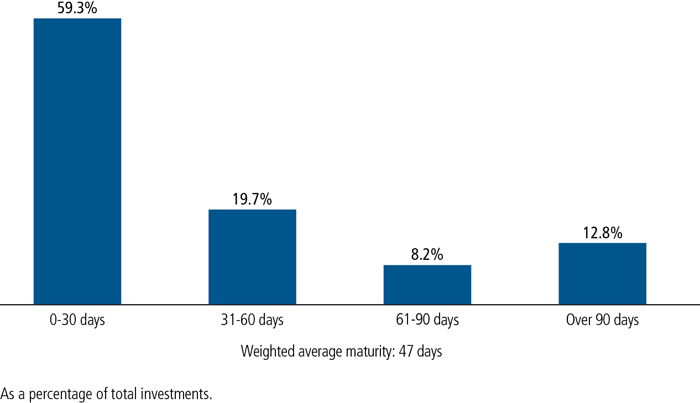

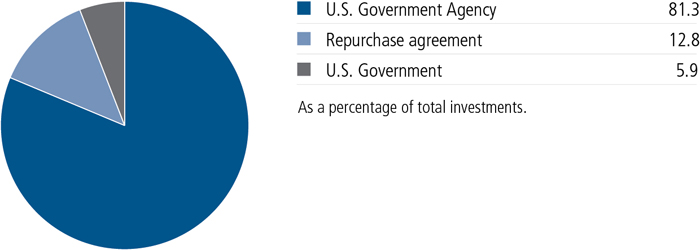

PORTFOLIO COMPOSITION AS OF 3/31/2020 (%)

A note about risks

The fund may be subject to various risks as described in the fund's prospectus. A widespread health crisis such as a global pandemic could cause substantial market volatility, exchange-trading suspensions and closures, impact the ability to complete redemptions, and affect fund performance. For example, the novel coronavirus disease (COVID-19) has resulted in significant disruptions to global business activity. The impact of a health crisis and other epidemics and pandemics that may arise in the future could affect the global economy in ways that cannot necessarily be foreseen at the present time. A health crisis may exacerbate other pre-existing political, social, and economic risks. Any such impact could adversely affect the fund's performance, resulting in losses to your investment. For more information, please refer to the "Principal risks" section of the prospectus.

Can you describe some of the key events during the 12 months ended March 31, 2020?

Money market yields fell dramatically over the course of the year. When the annual period began, the U.S. Federal Reserve (Fed) was in the midst of a pivot from a long cycle of interest-rate increases to a series of rate cuts. The Fed lowered interest rates three times in 2019, with quarter-point reductions at its July, September, and October meetings, and it ended the calendar year with a target range of 1.50% to 1.75%. These cuts reflected the backdrop of slow economic growth and low inflation that was in place at this time.

In mid-September, the Fed also started carrying out open market operations to inject liquidity into the banking system and keep short-term interest rates within its target range. While investors generally viewed this move as being purely technical in nature, it was the first time the Fed had to conduct open market operations since the 2008 global financial crisis.

Market conditions changed dramatically in the final three months of the period. As the spread of COVID-19 accelerated and economic activity ground to a halt, investors became increasingly concerned about the potential long-term fallout of the pandemic. The Fed responded by cutting its target range by 50 basis points (one half of a percentage point) on March 3, 2020, followed by another 100 basis points on March 15. The target range stood at a range of 0.00% to 0.25% at the end of March, and the consensus expectation called for the Fed to hold at this level for the immediate future given the likelihood of a sharp downturn in economic growth.

In addition to slashing interest rates, the Fed introduced several programs intended to maintain liquidity in the money markets, including the Money Market Mutual Fund Liquidity Facility, the Commercial Paper Funding Facility, and the Primary Dealer Credit Facility. These facilities were designed to help the market continue to function during the crisis. While market conditions seemed to stabilize somewhat in late March, it was not yet known what the full extent of the pandemic would be or how much economic pain would be required to defeat it.

In this environment, the one-month London Interbank Offered Rate (LIBOR)—a key basis for money market rates—fell from 2.49% on March 31, 2019, to 0.99% at the

close of the period. The three-month LIBOR declined from 2.60% to 1.45% in the same span.

Given the uncertain backdrop for financial markets and the flat-to-inverted yield curve (i.e., higher yields for shorter-dated securities), cash flooded into money market funds throughout the annual period. Money market assets increased over $1.4 trillion in the 12-month interval, bringing the total invested in the category to $4.6 trillion.

How would you characterize the fund's positioning?

We kept the portfolio's duration (interest-rate sensitivity) on the higher end of the possible range throughout the course of the period based on our expectation that the Fed would continue to cut rates. The fund maintained a longer duration at the end of the period, as we sought to lock in higher yields for as long as possible. As always, we continued to emphasize liquidity and diversification.

MANAGED BY

| Team of U.S. research analysts and portfolio managers |

| Your expenses |

| ANNUAL REPORT | JOHN HANCOCK MONEY MARKET FUND | 7 |

| Account value on 10-1-2019 | Ending value on 3-31-2020 | Expenses paid during period ended 3-31-20201 | Annualized expense ratio | ||

| Class A | Actual expenses/actual returns | $1,000.00 | $1,005.40 | $2.81 | 0.56% |

| Hypothetical example | 1,000.00 | 1,022.20 | 2.83 | 0.56% | |

| Class B | Actual expenses/actual returns | 1,000.00 | 1,005.40 | 2.81 | 0.56% |

| Hypothetical example | 1,000.00 | 1,022.20 | 2.83 | 0.56% | |

| Class C | Actual expenses/actual returns | 1,000.00 | 1,005.40 | 2.81 | 0.56% |

| Hypothetical example | 1,000.00 | 1,022.20 | 2.83 | 0.56% |

| 1 | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

| 8 | JOHN HANCOCK MONEY MARKET FUND | ANNUAL REPORT |

| Fund’s investments |

| Maturity date | Yield (%) | Par value^ | Value | ||

| U.S. Government Agency 80.7% | $686,085,371 | ||||

| (Cost $686,085,371) | |||||

| Federal Agricultural Mortgage Corp. (SOFR + 0.100%) (A) | 04-01-21 to 08-23-21 | 0.112 | 7,000,000 | 7,000,000 | |

| Federal Agricultural Mortgage Corp. (Prime rate - 3.020%) (A) | 09-01-20 | 0.233 | 2,474,000 | 2,474,000 | |

| Federal Agricultural Mortgage Corp. (Prime rate - 3.010%) (A) | 05-20-20 | 0.243 | 6,134,000 | 6,134,000 | |

| Federal Agricultural Mortgage Corp. (1 month LIBOR + 0.030%) (A) | 11-20-20 | 0.814 | 5,192,000 | 5,192,000 | |

| Federal Agricultural Mortgage Corp. (1 month LIBOR + 0.040%) (A) | 07-24-20 | 1.039 | 4,349,000 | 4,348,231 | |

| Federal Agricultural Mortgage Corp. (1 month LIBOR + 0.140%) (A) | 06-02-20 | 1.535 | 2,042,000 | 2,042,728 | |

| Federal Agricultural Mortgage Corp. (1 month LIBOR + 0.060%) (A) | 10-01-20 to 04-01-21 | 1.021 to 1.690 | 8,898,000 | 8,897,184 | |

| Federal Agricultural Mortgage Corp. | 04-01-20 to 03-18-21 | 0.010 to 1.421 | 54,508,000 | 54,385,792 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.060%) (A) | 04-09-20 | 0.152 | 2,188,000 | 2,188,000 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.085%) (A) | 03-10-21 | 0.177 | 6,287,000 | 6,287,000 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.095%) (A) | 07-26-21 | 0.188 | 4,907,000 | 4,907,000 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.100%) (A) | 12-16-20 | 0.198 | 4,000,000 | 3,999,851 | |

| Federal Farm Credit Bank (Prime rate - 3.050%) (A) | 12-11-20 | 0.208 | 3,899,000 | 3,898,864 | |

| Federal Farm Credit Bank (U.S. Federal Funds Effective Rate + 0.120%) (A) | 02-09-21 | 0.218 | 3,186,000 | 3,185,865 | |

| Federal Farm Credit Bank (Prime rate - 3.010%) (A) | 06-07-21 | 0.243 | 3,606,000 | 3,606,000 | |

| Federal Farm Credit Bank (3 month USBMMY + 0.160%) (A) | 01-19-21 | 0.248 | 2,217,000 | 2,217,000 | |

| Federal Farm Credit Bank (Prime rate - 2.950%) (A) | 07-20-20 | 0.253 | 2,059,000 | 2,059,317 | |

| Federal Farm Credit Bank (Prime rate - 2.960%) (A) | 07-09-20 | 0.305 | 10,526,000 | 10,525,673 | |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK MONEY MARKET FUND | 9 |

| Maturity date | Yield (%) | Par value^ | Value | ||

| Federal Farm Credit Bank (3 month USBMMY + 0.140%) (A) | 05-28-21 | 0.309 | 2,662,000 | $2,659,522 | |

| Federal Farm Credit Bank (Prime rate - 2.980%) (A) | 11-12-20 | 0.313 | 224,000 | 223,945 | |

| Federal Farm Credit Bank (SOFR + 0.120%) (A) | 03-18-21 | 0.335 | 350,000 | 349,317 | |

| Federal Farm Credit Bank (Prime rate - 2.915%) (A) | 12-17-20 | 0.345 | 3,500,000 | 3,499,877 | |

| Federal Farm Credit Bank (Prime rate - 2.930%) (A) | 08-27-20 to 09-24-20 | 0.223 to 0.330 | 3,394,000 | 3,394,548 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.015%) (A) | 03-17-21 | 0.810 | 826,000 | 826,130 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.090%) (A) | 12-13-21 | 0.928 | 300,000 | 299,852 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.270%) (A) | 05-25-21 | 1.027 | 1,298,000 | 1,301,041 | |

| Federal Farm Credit Bank (3 month LIBOR + 0.010%) (A) | 09-20-21 | 1.081 | 1,230,000 | 1,231,074 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.030%) (A) | 05-03-21 | 1.567 | 3,897,000 | 3,897,000 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.035%) (A) | 01-19-21 to 05-13-21 | 0.796 to 0.843 | 5,821,000 | 5,821,000 | |

| Federal Farm Credit Bank (3 month LIBOR) (A) | 11-16-21 | 1.674 | 328,000 | 328,216 | |

| Federal Farm Credit Bank (3 month LIBOR - 0.135%) (A) | 10-29-20 | 1.676 | 5,456,000 | 5,455,558 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.025%) (A) | 08-25-20 to 01-22-21 | 0.967 to 0.990 | 3,632,000 | 3,631,903 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.080%) (A) | 07-26-21 to 08-25-21 | 1.018 to 1.041 | 3,943,000 | 3,943,001 | |

| Federal Farm Credit Bank (1 month LIBOR - 0.080%) (A) | 05-11-20 to 06-01-20 | 0.728 to 1.600 | 3,270,000 | 3,269,606 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.110%) (A) | 03-25-21 to 12-10-21 | 0.986 to 1.071 | 6,556,000 | 6,556,038 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.010%) (A) | 07-30-20 to 04-19-21 | 0.849 to 0.933 | 9,152,000 | 9,152,527 | |

| Federal Farm Credit Bank (1 month LIBOR + 0.160%) (A) | 01-25-21 to 10-04-21 | 1.031 to 1.682 | 1,896,000 | 1,896,314 | |

| Federal Farm Credit Bank (1 month LIBOR) (A) | 04-27-20 to 12-22-21 | 0.714 to 1.040 | 19,795,000 | 19,794,303 | |

| Federal Farm Credit Bank | 04-13-20 to 03-11-21 | 0.101 to 1.871 | 75,258,000 | 75,022,251 | |

| Federal Home Loan Bank (SOFR + 0.025%) (A) | 04-22-20 | 0.025 | 9,235,000 | 9,235,056 | |

| Federal Home Loan Bank (SOFR + 0.040%) (A) | 08-25-20 | 0.031 | 3,415,000 | 3,415,271 | |

| Federal Home Loan Bank (SOFR + 0.045%) (A) | 08-14-20 | 0.056 | 6,770,000 | 6,770,000 | |

| Federal Home Loan Bank (SOFR + 0.080%) (A) | 05-11-20 | 0.072 | 240,000 | 240,005 |

| 10 | JOHN HANCOCK MONEY MARKET FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Maturity date | Yield (%) | Par value^ | Value | ||

| Federal Home Loan Bank (SOFR + 0.020%) (A) | 05-14-20 to 08-19-20 | 0.030 to 0.072 | 4,275,000 | $4,274,993 | |

| Federal Home Loan Bank (SOFR + 0.030%) (A) | 08-05-20 to 09-04-20 | 0.041 to 0.061 | 13,195,000 | 13,194,550 | |

| Federal Home Loan Bank (SOFR + 0.050%) (A) | 01-22-21 | 0.104 | 10,255,000 | 10,251,419 | |

| Federal Home Loan Bank (SOFR + 0.105%) (A) | 10-01-20 | 0.117 | 2,170,000 | 2,170,000 | |

| Federal Home Loan Bank (SOFR + 0.100%) (A) | 12-23-20 | 0.129 | 8,095,000 | 8,093,980 | |

| Federal Home Loan Bank (1 month LIBOR - 0.123%) (A) | 04-24-20 | 0.254 | 4,405,000 | 4,406,564 | |

| Federal Home Loan Bank (3 month LIBOR - 0.095%) (A) | 09-13-21 | 0.741 | 2,735,000 | 2,732,914 | |

| Federal Home Loan Bank (3 month LIBOR - 0.135%) (A) | 12-18-20 | 0.762 | 6,745,000 | 6,745,136 | |

| Federal Home Loan Bank (1 month LIBOR - 0.025%) (A) | 04-20-20 | 0.773 | 480,000 | 479,996 | |

| Federal Home Loan Bank (1 month LIBOR - 0.040%) (A) | 04-17-20 | 0.780 | 280,000 | 279,999 | |

| Federal Home Loan Bank (1 month LIBOR + 0.050%) (A) | 05-20-21 | 0.832 | 1,400,000 | 1,400,036 | |

| Federal Home Loan Bank (3 month LIBOR - 0.175%) (A) | 05-08-20 | 1.506 | 12,405,000 | 12,405,932 | |

| Federal Home Loan Bank | 04-01-20 to 03-08-21 | 0.030 to 1.796 | 269,123,000 | 268,978,156 | |

| Federal Home Loan Mortgage Corp. (SOFR + 0.150%) (A) | 03-04-22 | 0.162 | 2,574,000 | 2,574,000 | |

| Federal Home Loan Mortgage Corp. | 04-20-20 to 02-16-21 | 0.408 to 1.726 | 9,718,000 | 9,744,392 | |

| Federal National Mortgage Association (SOFR + 0.060%) (A) | 07-30-20 | 0.011 | 1,387,000 | 1,387,274 | |

| Federal National Mortgage Association (SOFR + 0.070%) (A) | 12-11-20 | 0.081 | 1,000,000 | 1,000,000 | |

| Federal National Mortgage Association | 04-08-20 to 02-26-21 | 0.010 to 1.672 | 30,401,000 | 30,404,170 | |

| U.S. Government 5.8% | $49,709,034 | ||||

| (Cost $49,709,034) | |||||

| U.S. Treasury Bill | 04-28-20 to 05-26-20 | 0.000 to 0.015 | 33,596,100 | 33,595,692 | |

| U.S. Treasury Inflation Indexed Note | 04-15-20 | (3.198) | 1,250,036 | 1,251,631 | |

| U.S. Treasury Note (3 month USBMMY + 0.139%) (A) | 04-30-21 | 0.198 | 2,729,300 | 2,730,154 | |

| U.S. Treasury Note (3 month USBMMY + 0.300%) (A) | 10-31-21 | 0.260 | 2,747,200 | 2,752,837 | |

| U.S. Treasury Note | 09-30-20 to 11-30-20 | 1.612 to 1.625 | 9,355,600 | 9,378,720 | |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK MONEY MARKET FUND | 11 |

| Par value^ | Value | ||||

| Repurchase agreement 12.7% | $107,937,000 | ||||

| (Cost $107,937,000) | |||||

| Barclays Tri-Party Repurchase Agreement dated 3-31-20 at 0.010% to be repurchased at $20,000,006 on 4-1-20, collateralized by $20,534,075 U.S. Treasury Inflation Indexed Notes, 1.250% due 7-15-20 (valued at $20,400,067) | 20,000,000 | 20,000,000 | |||

| Repurchase Agreement with State Street Corp. dated 3-31-20 at 0.000% to be repurchased at $87,937,000 on 4-1-20, collateralized by $86,080,000 U.S. Treasury Notes, 1.875% due 4-30-22 (valued at $89,696,996) | 87,937,000 | 87,937,000 | |||

| Total investments (Cost $843,731,405) 99.2% | $843,731,405 | ||||

| Other assets and liabilities, net 0.8% | 6,590,957 | ||||

| Total net assets 100.0% | $850,322,362 | ||||

| The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the fund. Maturity date represents the final legal maturity date on the security. | |

| ^All par values are denominated in U.S. dollars unless otherwise indicated. | |

| Security Abbreviations and Legend | |

| LIBOR | London Interbank Offered Rate |

| SOFR | Secured Overnight Financing Rate |

| USBMMY | U.S. Treasury Bill Money Market Yield |

| (A) | Variable rate obligation. |

| 12 | JOHN HANCOCK MONEY MARKET FUND | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Financial statements |

| Assets | |

| Unaffiliated investments, at value (Cost $735,794,405) | $735,794,405 |

| Repurchase agreements, at value (Cost $107,937,000) | 107,937,000 |

| Total investments, at value (Cost $843,731,405) | 843,731,405 |

| Cash | 611 |

| Interest receivable | 617,458 |

| Receivable for fund shares sold | 8,195,412 |

| Receivable from affiliates | 10,073 |

| Other assets | 69,683 |

| Total assets | 852,624,642 |

| Liabilities | |

| Distributions payable | 2,755 |

| Payable for fund shares repurchased | 2,054,289 |

| Payable to affiliates | |

| Accounting and legal services fees | 36,721 |

| Transfer agent fees | 79,617 |

| Distribution and service fees | 10,073 |

| Trustees' fees | 521 |

| Other liabilities and accrued expenses | 118,304 |

| Total liabilities | 2,302,280 |

| Net assets | $850,322,362 |

| Net assets consist of | |

| Paid-in capital | $850,321,635 |

| Total distributable earnings (loss) | 727 |

| Net assets | $850,322,362 |

| Net asset value per share | |

| Based on net asset value and shares outstanding - the fund has an unlimited number of shares authorized with no par value | |

| Class A ($834,953,922 ÷ 834,953,112 shares) | $1.00 |

| Class B ($865,217 ÷ 865,264 shares)1 | $1.00 |

| Class C ($14,503,223 ÷ 14,503,265 shares)1 | $1.00 |

| 1 | Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 13 |

| Investment income | |

| Interest | $13,431,545 |

| Expenses | |

| Investment management fees | 2,504,367 |

| Distribution and service fees | 1,786,086 |

| Accounting and legal services fees | 128,905 |

| Transfer agent fees | 825,586 |

| Trustees' fees | 12,596 |

| Custodian fees | 108,716 |

| State registration fees | 130,291 |

| Printing and postage | 100,163 |

| Professional fees | 36,546 |

| Other | 21,547 |

| Total expenses | 5,654,803 |

| Less expense reductions | (1,835,954) |

| Net expenses | 3,818,849 |

| Net investment income | 9,612,696 |

| Realized and unrealized gain (loss) | |

| Net realized gain (loss) on | |

| Unaffiliated investments | 8,720 |

| 8,720 | |

| Increase in net assets from operations | $9,621,416 |

| 14 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Year ended 3-31-20 | Year ended 3-31-19 | |

| Increase (decrease) in net assets | ||

| From operations | ||

| Net investment income | $9,612,696 | $8,809,473 |

| Net realized gain | 8,720 | 330 |

| Increase in net assets resulting from operations | 9,621,416 | 8,809,803 |

| Distributions to shareholders | ||

| From earnings | ||

| Class A | (9,445,136) | (8,584,928) |

| Class B | (18,704) | (32,931) |

| Class C | (154,778) | (191,434) |

| Total distributions | (9,618,618) | (8,809,293) |

| From fund share transactions | 223,600,320 | 108,786,883 |

| Total increase | 223,603,118 | 108,787,393 |

| Net assets | ||

| Beginning of year | 626,719,244 | 517,931,851 |

| End of year | $850,322,362 | $626,719,244 |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 15 |

| Financial highlights |

| CLASS A SHARES Period ended | 3-31-20 | 3-31-19 | 3-31-18 | 3-31-17 | 3-31-16 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Net investment income1 | 0.014 | 0.016 | 0.006 | —2 | —2 |

| Net realized and unrealized gain (loss) on investments | —2 | —2 | —2 | —2 | —2 |

| Total from investment operations | 0.014 | 0.016 | 0.006 | —2 | —2 |

| Less distributions | |||||

| From net investment income | (0.014) | (0.016) | (0.006) | —2 | —2 |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total return (%)3 | 1.45 | 1.56 | 0.594 | 0.024 | 0.014 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $835 | $613 | $500 | $490 | $417 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 0.82 | 0.83 | 0.81 | 0.86 | 1.00 |

| Expenses including reductions | 0.56 | 0.57 | 0.554 | 0.474 | 0.304 |

| Net investment income | 1.42 | 1.57 | 0.574 | 0.044 | 0.014 |

| 1 | Based on average daily shares outstanding. |

| 2 | Less than $0.0005 per share. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Includes the impact of waivers and/or reimbursements in order to maintain a zero or positive yield. See Note 4. |

| 16 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| CLASS B SHARES Period ended | 3-31-20 | 3-31-19 | 3-31-18 | 3-31-17 | 3-31-16 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Net investment income1 | 0.015 | 0.015 | 0.004 | —2 | —2 |

| Net realized and unrealized gain (loss) on investments | (0.001)3 | 0.001 | 0.001 | —2 | —2 |

| Total from investment operations | 0.014 | 0.016 | 0.005 | —2 | —2 |

| Less distributions | |||||

| From net investment income | (0.014) | (0.016) | (0.005) | —2 | —2 |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total return (%)4,5 | 1.45 | 1.57 | 0.466 | 0.016 | 0.016 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $1 | $2 | $3 | $4 | $7 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.57 | 1.58 | 1.56 | 1.62 | 1.75 |

| Expenses including reductions | 0.56 | 0.57 | 0.676 | 0.486 | 0.306 |

| Net investment income | 1.51 | 1.51 | 0.426 | 0.016 | 0.016 |

| 1 | Based on average daily shares outstanding. |

| 2 | Less than $0.0005 per share. |

| 3 | The amount shown for a share outstanding does not correspond with the aggregate net gain (loss) on investments for the period due to the timing of the sales and repurchases of shares in relation to fluctuating market values of the investments of the fund. |

| 4 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 5 | Does not reflect the effect of sales charges, if any. |

| 6 | Includes the impact of waivers and/or reimbursements in order to maintain a zero or positive yield. See Note 4. |

| SEE NOTES TO FINANCIAL STATEMENTS | ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 17 |

| CLASS C SHARES Period ended | 3-31-20 | 3-31-19 | 3-31-18 | 3-31-17 | 3-31-16 |

| Per share operating performance | |||||

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Net investment income1 | 0.014 | 0.016 | 0.006 | —2 | —2 |

| Net realized and unrealized gain (loss) on investments | —2 | —2 | —2 | —2 | —2 |

| Total from investment operations | 0.014 | 0.016 | 0.006 | —2 | —2 |

| Less distributions | |||||

| From net investment income | (0.014) | (0.016) | (0.006) | —2 | —2 |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total return (%)3,4 | 1.45 | 1.56 | 0.605 | 0.025 | 0.015 |

| Ratios and supplemental data | |||||

| Net assets, end of period (in millions) | $15 | $12 | $15 | $20 | $25 |

| Ratios (as a percentage of average net assets): | |||||

| Expenses before reductions | 1.57 | 1.58 | 1.56 | 1.62 | 1.75 |

| Expenses including reductions | 0.56 | 0.57 | 0.555 | 0.475 | 0.315 |

| Net investment income | 1.45 | 1.55 | 0.555 | 0.035 | 0.015 |

| 1 | Based on average daily shares outstanding. |

| 2 | Less than $0.0005 per share. |

| 3 | Total returns would have been lower had certain expenses not been reduced during the applicable periods. |

| 4 | Does not reflect the effect of sales charges, if any. |

| 5 | Includes the impact of waivers and/or reimbursements in order to maintain a zero or positive yield. See Note 4. |

| 18 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS |

| Notes to financial statements |

| ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 19 |

| 20 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT |

| March 31, 2020 | March 31, 2019 | |

| Ordinary income | $9,618,618 | $8,809,293 |

| ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 21 |

| Class | Expense reduction |

| Class A | $48,994 |

| Class B | 91 |

| Class | Expense reduction |

| Class C | $783 |

| Total | $49,868 |

| Class | Rule 12b-1 Fee |

| Class A | 0.25% |

| Class B | 1.00% |

| Class C | 1.00% |

| 22 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT |

| Class | Distribution and service fees | Transfer agent fees |

| Class A | $1,667,001 | $811,157 |

| Class B | 12,386 | 1,495 |

| Class C | 106,699 | 12,934 |

| Total | $1,786,086 | $825,586 |

| Year Ended 3-31-20 | Year Ended 3-31-19 | |||

| Shares | Amount | Shares | Amount | |

| Class A shares | ||||

| Sold | 576,881,810 | $576,881,810 | 378,388,879 | $378,388,879 |

| Distributions reinvested | 9,323,926 | 9,323,926 | 8,486,577 | 8,486,577 |

| Repurchased | (364,050,959) | (364,050,959) | (274,220,549) | (274,220,549) |

| Net increase | 222,154,777 | $222,154,777 | 112,654,907 | $112,654,907 |

| Class B shares | ||||

| Sold | 435,746 | $435,746 | 726,323 | $726,323 |

| Distributions reinvested | 17,101 | 17,101 | 30,122 | 30,122 |

| Repurchased | (1,344,998) | (1,344,998) | (1,812,130) | (1,812,130) |

| Net decrease | (892,151) | $(892,151) | (1,055,685) | $(1,055,685) |

| ANNUAL REPORT | JOHN HANCOCK Money Market Fund | 23 |

| Year Ended 3-31-20 | Year Ended 3-31-19 | |||

| Shares | Amount | Shares | Amount | |

| Class C shares | ||||

| Sold | 10,358,817 | $10,358,817 | 11,188,006 | $11,188,006 |

| Distributions reinvested | 148,615 | 148,615 | 181,039 | 181,039 |

| Repurchased | (8,169,738) | (8,169,738) | (14,181,384) | (14,181,384) |

| Net increase (decrease) | 2,337,694 | $2,337,694 | (2,812,339) | $(2,812,339) |

| Total net increase | 223,600,320 | $223,600,320 | 108,786,883 | $108,786,883 |

| 24 | JOHN HANCOCK Money Market Fund | ANNUAL REPORT |

| ANNUAL REPORT | JOHN HANCOCK MONEY MARKET FUND | 25 |

| Tax information (Unaudited) |

| 26 | JOHN HANCOCK MONEY MARKET FUND | ANNUAL REPORT |

STATEMENT REGARDING LIQUIDITY RISK MANAGEMENT

Operation of the Liquidity Risk Management Program

This section describes operation and effectiveness of the Liquidity Risk Management Program (LRMP) established in accordance with Rule 22e-4 under the Investment Company Act of 1940, as amended (the Liquidity Rule). The Board of Trustees (the Board) of each Fund in the John Hancock Group of Funds (each a Fund and collectively, the Funds) that is subject to the requirements of the Liquidity Rule has appointed John Hancock Investment Management, LLC and John Hancock Variable Trust Advisers, LLC (together, the Advisor) to serve as Administrator of the LRMP with respect to each of the Funds, including John Hancock Money Market Fund, subject to the oversight of the Board. In order to provide a mechanism and process to perform the functions necessary to administer the LRMP, the Advisor established the Liquidity Risk Management Committee (the Committee). The Fund's subadvisor, Manulife Investment Management (the Subadvisor) executes the day-to-day investment management and security-level activities of the Fund in accordance with the requirements of the LRMP, subject to the supervision of the Advisor and the Board.

The Committee holds monthly meetings to: (1) review the day-to-day operations of the LRMP; (2) review and approve month end liquidity classifications; (3) review quarterly testing and determinations, as applicable; and (4) review other LRMP related material. The Committee also conducts daily, monthly, quarterly, and annual quantitative and qualitative assessments of each subadvisor to a Fund that is subject to the requirements of the Liquidity Rule and is a part of the LRMP to monitor investment performance issues, risks and trends. In addition, the Committee may conduct ad-hoc reviews and meetings with subadvisors as issues and trends are identified, including potential liquidity and valuation issues.

The Committee provided the Board at an in-person meeting held on March 15-18, 2020 with a written report which addressed the Committee's assessment of the adequacy and effectiveness of the implementation and operation of the LRMP and any material changes to the LRMP. The report, which covered the period December 1, 2018 through December 31, 2019, included an assessment of important aspects of the LRMP including, but not limited to:

• Operation of the Fund's Redemption-In-Kind Procedures;

• Highly Liquid Investment Minimum (HLIM) determination;

• Compliance with the 15% limit on illiquid investments;

• Reasonably Anticipated Trade Size (RATS) determination;

• Security-level liquidity classifications; and

• Liquidity risk assessment.

The report also covered material liquidity matters which occurred or were reported during this period applicable to the Fund, if any, and the Committee's actions to address such matters.

Redemption-In-Kind Procedures

Rule 22e-4 requires any fund that engages in or reserves the right to engage in in-kind redemptions to adopt and implement written policies and procedures regarding in-kind redemptions as part of the management of its liquidity risk. These procedures address the process for redeeming in kind, as well as the circumstances under which the Fund would consider redeeming in kind. Anticipated large redemption activity will be evaluated to identify situations where redeeming in securities instead of cash may be appropriate.

As part of its annual assessment of the LRMP, the Committee reviewed the implementation and operation of the Redemption-In-Kind Procedures and determined they are operating in a manner that such procedures are adequate and effective to manage in-kind redemptions on behalf of the Fund as part of the LRMP.

Highly Liquid Investment Minimum determination

The Committee uses an HLIM model to determine a Fund's HLIM. This process incorporates the Fund's investment strategy, historical redemptions, liquidity classification rollup percentages and cash balances, redemption policy, access to funding sources, distribution channels and client concentrations. If the Fund falls below its established HLIM for a period greater than 7 consecutive calendar days, the Committee prepares a report to the Board within one business day following the seventh consecutive calendar day with an explanation of how the Fund plans to restore its HLIM within a reasonable period of time.

Based on the HLIM model, the Committee has determined that the Fund qualifies as a Primarily Highly Liquid Fund (PHLF). It is therefore not required to establish a HLIM. The Fund is tested quarterly to confirm its PHLF status.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to HLIM and PHLF determinations, and determined that such policies and procedures are operating in a manner that is adequate and effective as part of the LRMP.

Compliance with the 15% limit on illiquid investments

Rule 22e-4 sets an aggregate illiquid investment limit of 15% for a fund. Funds are prohibited from acquiring an illiquid investment if this results in greater than 15% of its net assets being classified as illiquid. When applying this limit, the Committee defines "illiquid investment" to mean any investment that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. If a 15% illiquid investment limit breach occurs for longer than 1 business day, the Fund is required to notify the Board and provide a plan on how to bring illiquid investments within the 15% threshold, and after 7 days confidentially notify the Securities and Exchange Commission (the SEC).

In February 2019, as a result of extended security markets closures in connection with the Chinese New Year in certain countries, the SEC released guidance, and the Committee approved and adopted an Extended Market Holiday Policy to plan for and monitor known Extended Market Holidays (defined as all expected market holiday closures spanning four or more calendar days).

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to the 15% illiquid investment limit and determined such policies and procedures are operating in a manner that is adequate and effective as part of the LMRP.

Reasonably Anticipated Trade Size determination

In order to assess the liquidity risk of a Fund, the Committee considers the impact on the Fund that redemptions of a RATS would have under both normal and reasonably foreseeable stressed conditions. Modelling the Fund's RATS requires quantifying cash flow volatility and analyzing distribution channel concentration and redemption risk. The model is designed to estimate the amount of assets that the Fund could reasonably anticipate trading on a given day, during both normal and reasonably foreseeable stressed conditions, to satisfy redemption requests.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to RATS determinations and determined that such policies and procedures are operating in a manner that is adequate and effective at making RATS determinations as part of the LRMP.

Security-level liquidity classifications

When classifying the liquidity of portfolio securities, the Fund adheres to the liquidity classification procedures established by the Advisor. In assigning a liquidity classification to Fund portfolio holdings, the following key inputs, among others, are considered: the Fund's RATS, feedback from the applicable Subadvisor on market-, trading- and investment-specific considerations, an assessment of current market conditions and fund portfolio holdings, and a value impact standard. The Subadvisor also provides position-level data to the Committee for use in monthly classification reconciliation in order to identify any classifications that may need to be changed as a result of the above considerations.

As part of its annual assessment of the LRMP, the Committee reviewed the policies and procedures in place with respect to security-level liquidity classifications and determined that such policies and procedures are operating in a manner that is adequate and effective as part of the LRMP.

Liquidity risk assessment

The Committee periodically reviews and assesses, the Fund's liquidity risk, including its investment strategy and liquidity of portfolio investments during both normal and reasonably foreseeable stressed conditions (including whether the investment strategy is appropriate for an open-end fund, the extent to which the strategy involves a relatively concentrated portfolio or large positions in particular issuers, and the use of borrowings for investment purposes and derivatives), cash flow analysis during both normal and reasonably foreseeable stressed conditions, and holdings of cash and cash equivalents, as well as borrowing arrangements and other funding sources.

The Committee also monitors global events, such as the COVID-19 Coronavirus, that could impact the markets and liquidity of portfolio investments and their classifications.

As part of its annual assessment of the LRMP, the Committee reviewed Fund-Level Liquidity Risk Assessment Reports for each of the Funds and determined that the investment strategy for each Fund continues to be appropriate for an open-ended structure.

Adequacy and Effectiveness

Based on the review and assessment conducted by the Committee, the Committee has determined that the LRMP has been implemented, and is operating in a manner that is adequate and effective at assessing and managing the liquidity risk of each Fund.

This chart provides information about the Trustees and Officers who oversee your John Hancock fund. Officers elected by the Trustees manage the day-to-day operations of the fund and execute policies formulated by the Trustees.

Independent Trustees

| Name, year of birth Position(s) held with Trust Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| Hassell H. McClellan, Born: 1945 | 2012 | 204 |

| Trustee and Chairperson of the Board Director/Trustee, Virtus Funds (since 2008); Director, The Barnes Group (since 2010); Associate Professor, The Wallace E. Carroll School of Management, Boston College (retired 2013). Trustee (since 2005) and Chairperson of the Board (since 2017) of various trusts within the John Hancock Fund Complex. | ||

| Charles L. Bardelis,2 Born: 1941 | 2012 | 204 |

| Trustee Director, Island Commuter Corp. (marine transport). Trustee of various trusts within the John Hancock Fund Complex (since 1988). | ||

| James R. Boyle,Born: 1959 | 2015 | 204 |

| Trustee Chief Executive Officer, Foresters Financial (since 2018); Chairman and Chief Executive Officer, Zillion Group, Inc. (formerly HealthFleet, Inc.) (healthcare) (2014-2018); Executive Vice President and Chief Executive Officer, U.S. Life Insurance Division of Genworth Financial, Inc. (insurance) (January 2014-July 2014); Senior Executive Vice President, Manulife Financial, President and Chief Executive Officer, John Hancock (1999-2012); Chairman and Director, John Hancock Investment Management LLC, John Hancock Investment Management Distributors LLC, and John Hancock Variable Trust Advisers LLC (2005-2010). Trustee of various trusts within the John Hancock Fund Complex (2005-2014 and since 2015). | ||

| Peter S. Burgess,2 Born: 1942 | 2012 | 204 |

| Trustee Consultant (financial, accounting, and auditing matters) (since 1999); Certified Public Accountant; Partner, Arthur Andersen (independent public accounting firm) (prior to 1999); Director, Lincoln Educational Services Corporation (since 2004); Director, Symetra Financial Corporation (2010-2016); Director, PMA Capital Corporation (2004-2010). Trustee of various trusts within the John Hancock Fund Complex (since 2005). | ||

| William H. Cunningham, Born: 1944 | 2006 | 204 |

| Trustee Professor, University of Texas, Austin, Texas (since 1971); former Chancellor, University of Texas System and former President of the University of Texas, Austin, Texas; Chairman (since 2009) and Director (since 2006), Lincoln National Corporation (insurance); Director, Southwest Airlines (since 2000); former Director, LIN Television (2009-2014). Trustee of various trusts within the John Hancock Fund Complex (since 1986). | ||

| Grace K. Fey, Born: 1946 | 2012 | 204 |

| Trustee Chief Executive Officer, Grace Fey Advisors (since 2007); Director and Executive Vice President, Frontier Capital Management Company (1988-2007); Director, Fiduciary Trust (since 2009). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | ||

Independent Trustees (continued)

| Name, year of birth Position(s) held with Trust Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| Deborah C. Jackson, Born: 1952 | 2008 | 204 |

| Trustee President, Cambridge College, Cambridge, Massachusetts (since 2011); Board of Directors, Massachusetts Women's Forum (since 2018); Board of Directors, National Association of Corporate Directors/New England (since 2015); Board of Directors, Association of Independent Colleges and Universities of Massachusetts (2014-2017); Chief Executive Officer, American Red Cross of Massachusetts Bay (2002-2011); Board of Directors of Eastern Bank Corporation (since 2001); Board of Directors of Eastern Bank Charitable Foundation (since 2001); Board of Directors of American Student Assistance Corporation (1996-2009); Board of Directors of Boston Stock Exchange (2002-2008); Board of Directors of Harvard Pilgrim Healthcare (health benefits company) (2007-2011). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | ||

| James M. Oates,2Born: 1946 | 2012 | 204 |

| Trustee Managing Director, Wydown Group (financial consulting firm) (since 1994); Chairman and Director, Emerson Investment Management, Inc. (2000-2015); Independent Chairman, Hudson Castle Group, Inc. (formerly IBEX Capital Markets, Inc.) (financial services company) (1997-2011); Director, Stifel Financial (since 1996); Director, Investor Financial Services Corporation (1995-2007); Director, Connecticut River Bancorp (1998-2014); Director/Trustee, Virtus Funds (since 1988). Trustee (since 2004) and Chairperson of the Board (2005-2016) of various trusts within the John Hancock Fund Complex. | ||

| Steven R. Pruchansky, Born: 1944 | 2006 | 204 |

| Trustee and Vice Chairperson of the Board Managing Director, Pru Realty (since 2017); Chairman and Chief Executive Officer, Greenscapes of Southwest Florida, Inc. (since 2014); Director and President, Greenscapes of Southwest Florida, Inc. (until 2000); Member, Board of Advisors, First American Bank (until 2010); Managing Director, Jon James, LLC (real estate) (since 2000); Partner, Right Funding, LLC (2014-2017); Director, First Signature Bank & Trust Company (until 1991); Director, Mast Realty Trust (until 1994); President, Maxwell Building Corp. (until 1991). Trustee (since 1992), Chairperson of the Board (2011-2012), and Vice Chairperson of the Board (since 2012) of various trusts within the John Hancock Fund Complex. | ||

| Gregory A. Russo, Born: 1949 | 2008 | 204 |

| Trustee Director and Audit Committee Chairman (since 2012), and Member, Audit Committee and Finance Committee (since 2011), NCH Healthcare System, Inc. (holding company for multi-entity healthcare system); Director and Member (2012-2018) and Finance Committee Chairman (2014-2018), The Moorings, Inc. (nonprofit continuing care community); Vice Chairman, Risk & Regulatory Matters, KPMG LLP (KPMG) (2002-2006); Vice Chairman, Industrial Markets, KPMG (1998-2002); Chairman and Treasurer, Westchester County, New York, Chamber of Commerce (1986-1992); Director, Treasurer, and Chairman of Audit and Finance Committees, Putnam Hospital Center (1989-1995); Director and Chairman of Fundraising Campaign, United Way of Westchester and Putnam Counties, New York (1990-1995). Trustee of various trusts within the John Hancock Fund Complex (since 2008). | ||

Non-Independent Trustees3

| Name, year of birth Position(s) held with Trust Principal occupation(s) and other directorships during past 5 years | Trustee of the Trust since1 | Number of John Hancock funds overseen by Trustee |

| Andrew G. Arnott, Born: 1971 | 2017 | 204 |

| President and Non-Independent Trustee Head of Wealth and Asset Management, United States and Europe, for John Hancock and Manulife (since 2018); Executive Vice President, John Hancock Financial Services (since 2009, including prior positions); Director and Executive Vice President, John Hancock Investment Management LLC (since 2005, including prior positions); Director and Executive Vice President, John Hancock Variable Trust Advisers LLC (since 2006, including prior positions); President, John Hancock Investment Management Distributors LLC (since 2004, including prior positions); President of various trusts within the John Hancock Fund Complex (since 2007, including prior positions). Trustee of various trusts within the John Hancock Fund Complex (since 2017). | ||

| Marianne Harrison, Born: 1963 | 2018 | 204 |

| Non-Independent Trustee President and CEO, John Hancock (since 2017); President and CEO, Manulife Canadian Division (2013-2017); Member, Board of Directors, CAE Inc. (since 2019); Member, Board of Directors, MA Competitive Partnership Board (since 2018); Member, Board of Directors, American Council of Life Insurers (ACLI) (since 2018); Member, Board of Directors, Communitech, an industry-led innovation center that fosters technology companies in Canada (2017-2019); Member, Board of Directors, Manulife Assurance Canada (2015-2017); Board Member, St. Mary's General Hospital Foundation (2014-2017); Member, Board of Directors, Manulife Bank of Canada (2013-2017); Member, Standing Committee of the Canadian Life & Health Assurance Association (2013-2017); Member, Board of Directors, John Hancock USA, John Hancock Life & Health, John Hancock New York (2012-2013). Trustee of various trusts within the John Hancock Fund Complex (since 2018). | ||

Principal officers who are not Trustees

| Name, year of birth Position(s) held with Trust Principal occupation(s) during past 5 years | Officer of the Trust since |

| Francis V. Knox, Jr.,Born: 1947 | 2006 |

| Chief Compliance Officer Vice President, John Hancock Financial Services (since 2005); Chief Compliance Officer, various trusts within the John Hancock Fund Complex, John Hancock Investment Management LLC, and John Hancock Variable Trust Advisers LLC (since 2005). | |

| Charles A. Rizzo, Born: 1957 | 2007 |

| Chief Financial Officer Vice President, John Hancock Financial Services (since 2008); Senior Vice President, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2008); Chief Financial Officer of various trusts within the John Hancock Fund Complex (since 2007). | |

| Salvatore Schiavone, Born: 1965 | 2010 |

| Treasurer Assistant Vice President, John Hancock Financial Services (since 2007); Vice President, John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2007); Treasurer of various trusts within the John Hancock Fund Complex (since 2007, including prior positions). | |

Principal officers who are notTrustees (continued)

| Name, year of birth Position(s) held with Trust Principal occupation(s) during past 5 years | Officer of the Trust since |

| Christopher (Kit) Sechler,Born: 1973 | 2018 |

| Chief Legal Officer and Secretary Vice President and Deputy Chief Counsel, John Hancock Investments (since 2015); Assistant Vice President and Senior Counsel (2009-2015), John Hancock Investment Management; Chief Legal Officer and Secretary of various trusts within the John Hancock Fund Complex (since 2018); Assistant Secretary of John Hancock Investment Management LLC and John Hancock Variable Trust Advisers LLC (since 2009). | |

The business address for all Trustees and Officers is 200 Berkeley Street, Boston, Massachusetts 02116-5023.

The Statement of Additional Information of the fund includes additional information about members of the Board of Trustees of the Trust and is available without charge, upon request, by calling 800-225-5291.

| 1 | Each Trustee holds office until his or her successor is elected and qualified, or until the Trustee's death, retirement, resignation, or removal. Mr. Boyle has served as Trustee at various times prior to the date listed in the table. |

| 2 | Member of the Audit Committee. |

| 3 | The Trustee is a Non-Independent Trustee due to current or former positions with the Advisor and certain affiliates. |

Trustees Hassell H. McClellan,Chairperson Officers Andrew G. Arnott Francis V. Knox, Jr. Charles A. Rizzo Salvatore Schiavone Christopher (Kit) Sechler | Investment advisor John Hancock Investment Management LLC Subadvisor Manulife Investment Management (US) LLC Principal distributor John Hancock Investment Management Distributors LLC Custodian State Street Bank and Trust Company Transfer agent John Hancock Signature Services, Inc. Legal counsel K&L Gates LLP Independent registered public accounting firm PricewaterhouseCoopers LLP |

* Member of the Audit Committee

† Non-Independent Trustee

The fund's proxy voting policies and procedures, as well as the fund proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) website at sec.gov or on our website.

All of the fund's holdings as of the end of each month are filed with the SEC on Form N-MFP. The fund's Form N-MFP filings are available on our website and the SEC's website, sec.gov.

We make this information on your fund and other fund details available on our website at jhinvestments.com or by calling 800-225-5291.

| You can also contact us: | |||

| 800-225-5291 jhinvestments.com | Regular mail: John Hancock Signature Services, Inc. | Express mail: John Hancock Signature Services, Inc. | |

John Hancock family of funds

DOMESTIC EQUITY FUNDS Blue Chip Growth Classic Value Disciplined Value Disciplined Value Mid Cap Equity Income Financial Industries Fundamental All Cap Core Fundamental Large Cap Core New Opportunities Regional Bank Small Cap Core Small Cap Growth Small Cap Value U.S. Global Leaders Growth U.S. Quality Growth GLOBAL AND INTERNATIONAL EQUITY FUNDS Disciplined Value International Emerging Markets Emerging Markets Equity Fundamental Global Franchise Global Equity Global Shareholder Yield Global Thematic Opportunities International Dynamic Growth International Growth International Small Company | INCOME FUNDS Bond California Tax-Free Income Emerging Markets Debt Floating Rate Income Government Income High Yield High Yield Municipal Bond Income Investment Grade Bond Money Market Short Duration Bond Short Duration Credit Opportunities Strategic Income Opportunities Tax-Free Bond ALTERNATIVE AND SPECIALTY FUNDS Absolute Return Currency Alternative Asset Allocation Alternative Risk Premia Diversified Macro Infrastructure Multi-Asset Absolute Return Seaport Long/Short |

A fund's investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus contains this and other important information about the fund. To obtain a prospectus, contact your financial professional, call John Hancock Investment Management at 800-225-5291, or visit our website at jhinvestments.com. Please read the prospectus carefully before investing or sending money.

ASSET ALLOCATION Balanced Multi-Asset High Income Multi-Index Lifetime Portfolios Multi-Index Preservation Portfolios Multimanager Lifestyle Portfolios Multimanager Lifetime Portfolios Retirement Income 2040 EXCHANGE-TRADED FUNDS John Hancock Multifactor Consumer Discretionary ETF John Hancock Multifactor Consumer Staples ETF John Hancock Multifactor Developed International ETF John Hancock Multifactor Emerging Markets ETF John Hancock Multifactor Energy ETF John Hancock Multifactor Financials ETF John Hancock Multifactor Healthcare ETF John Hancock Multifactor Industrials ETF John Hancock Multifactor Large Cap ETF John Hancock Multifactor Materials ETF John Hancock Multifactor Media and John Hancock Multifactor Mid Cap ETF John Hancock Multifactor Small Cap ETF John Hancock Multifactor Technology ETF John Hancock Multifactor Utilities ETF | ENVIRONMENTAL, SOCIAL, AND ESG All Cap Core ESG Core Bond ESG International Equity ESG Large Cap Core CLOSED-END FUNDS Financial Opportunities Hedged Equity & Income Income Securities Trust Investors Trust Preferred Income Preferred Income II Preferred Income III Premium Dividend Tax-Advantaged Dividend Income Tax-Advantaged Global Shareholder Yield |

John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed

from the fund. Brokerage commissions will reduce returns.

John Hancock ETFs are distributed by Foreside Fund Services, LLC, and are subadvised by Dimensional Fund Advisors LP.

Foreside is not affiliated with John Hancock Investment Management Distributors LLC or Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP receives compensation from John Hancock in connection with licensing rights to the

John Hancock Dimensional indexes. Dimensional Fund Advisors LP does not sponsor, endorse, or sell, and makes no

representation as to the advisability of investing in, John Hancock Multifactor ETFs.

John Hancock Investment Management

A trusted brand

John Hancock Investment Management is a premier asset manager

representing one of America's most trusted brands, with a heritage of

financial stewardship dating back to 1862. Helping our shareholders

pursue their financial goals is at the core of everything we do. It's why

we support the role of professional financial advice and operate with

the highest standards of conduct and integrity.

A better way to invest

We serve investors globally through a unique multimanager approach:

We search the world to find proven portfolio teams with specialized

expertise for every strategy we offer, then we apply robust investment

oversight to ensure they continue to meet our uncompromising

standards and serve the best interests of our shareholders.

Results for investors

Our unique approach to asset management enables us to provide

a diverse set of investments backed by some of the world's best

managers, along with strong risk-adjusted returns across asset classes.

John Hancock Investment Management Distributors LLC n Member FINRA, SIPC

200 Berkeley Street n Boston, MA 02116-5010 n 800-225-5291 n jhinvestments.com

This report is for the information of the shareholders of John Hancock Money Market Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus.

| MF1149223 | 44A 3/20 5/2020 |

ITEM 2. CODE OF ETHICS.

As of the end of the year, March 31, 2020, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its Chief Executive Officer, Chief Financial Officer and Treasurer (respectively, the principal executive officer, the principal financial officer and the principal accounting officer, the “Covered Officers”). A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Peter S. Burgess is the audit committee financial expert and is “independent”, pursuant to general instructions on Form N-CSR Item 3.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements amounted to $31,586 for the fiscal year ended March 31, 2020 and $30,238 for the fiscal year ended March 31, 2019 for John Hancock Money Market Fund. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(b) Audit-Related Services

Audit-related fees for assurance and related services by the principal accountant are billed to the registrant or to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser ("control affiliates") that provides ongoing services to the registrant. The nature of the services provided was affiliated service provider internal controls reviews. Amounts billed to the registrant amounted to $616 for the fiscal year ended March 31, 2020 and $571 for the fiscal year ended March 31, 2019. Amounts billed to control affiliates were $116,467 and $113,000 for the fiscal years ended March 31, 2020 and 2019, respectively.

(c) Tax Fees

The aggregate fees billed for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning (“tax fees”) amounted to $2,858 for the fiscal year ended March 31, 2020 and $2,775 for the fiscal year ended March 31, 2019. The nature of the services comprising the tax fees was the review of the registrant’s tax returns and tax distribution requirements. These fees were billed to the registrant and were approved by the registrant’s audit committee.

(d) All Other Fees

The nature of the services comprising all other fees is advisory services provided to the investment manager. Other fees amounted to $91 for the fiscal year ended March 31, 2020 and $102 for the fiscal year ended March 31, 2019 and were billed to the registrant or to the control affiliates.

(e)(1) Audit Committee Pre-Approval Policies and Procedures:

The trust’s Audit Committee must pre-approve all audit and non-audit services provided by the independent registered public accounting firm (the “Auditor”) relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to a fund, the Audit Committee reviews the services to determine whether they are appropriate and permissible under applicable law.

The trust’s Audit Committee has adopted policies and procedures to, among other purposes, provide a framework for the Committee’s consideration of audit-related and non-audit services by the Auditor. The policies and procedures require that any audit-related and non-audit service provided by the Auditor and any non-audit service provided by the Auditor to a fund service provider that relates directly to the operations and financial reporting of a fund are subject to approval by the Audit Committee before such service is provided. Audit-related services provided by the Auditor that are expected to exceed $25,000 per year/per fund are subject to specific pre-approval by the Audit Committee. Tax services provided by the Auditor that are expected to exceed $30,000 per year/per fund are subject to specific pre-approval by the Audit Committee.

All audit services, as well as the audit-related and non-audit services that are expected to exceed the amounts stated above, must be approved in advance of provision of the service by formal resolution of the Audit Committee. At the regularly scheduled Audit Committee meetings, the Committee reviews a report summarizing the services, including fees, provided by the Auditor.

(e)(2) Services approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

Audit-Related Fees, Tax Fees and All Other Fees:

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

(f) According to the registrant’s principal accountant for the fiscal year ended March 31, 2020, the percentage of hours spent on the audit of the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons who were not full-time, permanent employees of principal accountant was less than 50%.

(g) The aggregate non-audit fees billed by the registrant’s principal accountant for non-audit services rendered to the registrant and rendered to the registrant's control affiliates were $1,084,932 for the fiscal year ended March 31, 2020 and $889,301 for the fiscal year ended March 31, 2019.

(h) The audit committee of the registrant has considered the non-audit services provided by the registrant’s principal accountant to the control affiliates and has determined that the services that were not pre-approved are compatible with maintaining the principal accountant’s independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The registrant has a separately-designated standing audit committee comprised of independent trustees. The members of the audit committee are as follows:

Peter S. Burgess - Chairman

Charles L. Bardelis

Theron S. Hoffman

ITEM 6. SCHEDULE OF INVESTMENTS.

| (a) | Not applicable. |

| (b) | Not applicable. |

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The registrant has adopted procedures by which shareholders may recommend nominees to the registrant's Board of Trustees. A copy of the procedures is filed as an exhibit to this Form N-CSR. See attached “John Hancock Funds – Nominating, Governance and Administration Committee Charter”.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 13. EXHIBITS.

(a)(1) Code of Ethics for Covered Officers is attached.

(a)(2) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b)(1) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c)(1) Submission of Matters to a Vote of Security Holders is attached. See attached “John Hancock Funds – Nominating, Governance and Administration Committee Charter”.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Current Interest

By:

/s/ Andrew Arnott

______________________________

Andrew Arnott

President

Date: May 12, 2020

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:

/s/ Andrew Arnott

______________________________

Andrew Arnott

President

Date: May 12, 2020

By:

/s/ Charles A. Rizzo

______________________________

Charles A. Rizzo

Chief Financial Officer

Date: May 12, 2020