- CW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Curtiss-Wright (CW) 8-KFinancial statements and exhibits

Filed: 4 Sep 03, 12:00am

Exhibit 99.1

First In Flight – 100 Years

Thank you for your introduction and the opportunity to talk about Curtiss-Wright at today’s event. We have a proven track record and are well positioned for future growth and we would like to tell you more about it today. Joining me today is our CFO, Glenn Tynan.

Curtiss-Wright is a corporation with a very rich history.

We are the actual corporate descendants of the Wright brothers and Glenn Curtiss. On December 17, 1903 Orville Wright made the First Flight and this milestone marked one of the greatest advancements of the 21st century. Glenn Curtiss was also an early aviator who actually competed with the Wright brothers both at air shows and commercially. Glenn Curtiss was also credited with building the first seaplane.

The companies founded by these three great aviation pioneers merged in 1929.

Since that time we have been listed on the NYSE, a period of 74 years.

1

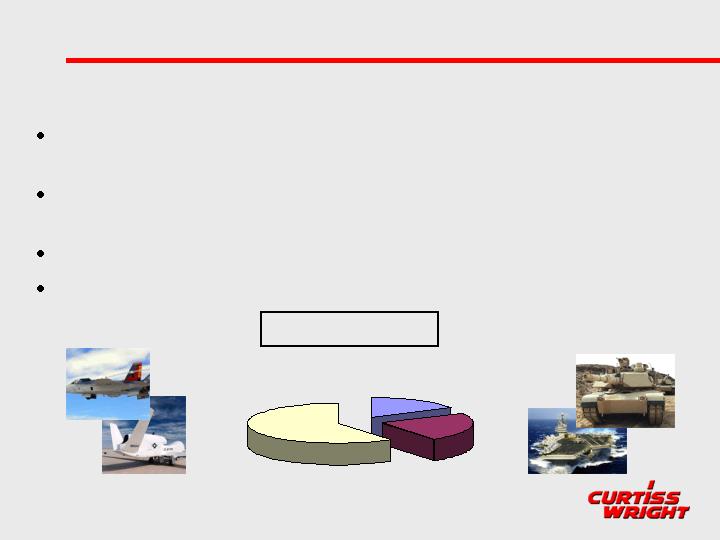

Company Profile

A Strategically Focused, Multinational Provider of

Highly Engineered Products and Services

Strong Positions in Diversified, Profitable Niche

Markets Built Upon:

Engineering and Technological Leadership

Strong Relationship with our Customers

Strong Base Comprised of 3 Business Segments:

Flow Control = 48%

Controls = 34%

Metal Treatment = 18%

Today Curtiss-Wright is a small cap multinational corporation with sales of over $700 million and provide highly engineered products to a variety of industries and markets.

Curtiss-Wright is the technological leader in the markets we serve and in many instances are also the low cost producer.

We enjoy strong customer relationships based on our ability to provide products and services that solve our customers’ problems.

Curtiss-Wright operates out of 3 business segments:

Our Flow Control segment provides flow control products and electronic control systems for a variety of markets. Our products go into the severest of service conditions, such as submarines, aircraft carriers, nuclear power plants, and chemical and petrochemical plants.

In Controls we are a leader in the design and manufacture of highly engineered Actuation and Electronic Devices and Control Systems for the commercial aerospace, military aerospace, land based defense and Industrial markets.

We are a leader in providing Metal Treatment services to a number of industries. We are the largest provider of shot peening and shot peen forming services in the world.

Each of our three business segments provide us with a high degree of diversification, profitability and cash flow

2

Highly Engineered Products

Pictured on this slide are just some of the products and services that we provide, which are high-end, highly engineered and are used in the most challenging environments.

Most of our products are specifically designed to our customer’s requirements. In most instances we are one of the few companies with the engineering expertise to provide these products, and in some instances we are the only company that possesses the required capabilities.

3

A Market Leader

We operate in a number of niche markets where we are positioned as the market leader. This position, combined with our engineering capabilities, allows us to obtain better than average profitability levels.

We benchmark our 3 business units against companies who are considered the best in the industry and in most cases we have the best operating statistics in the industry.

4

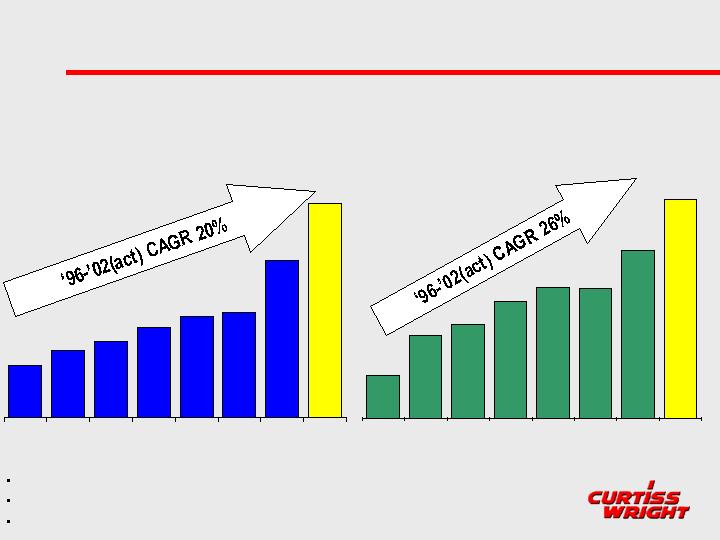

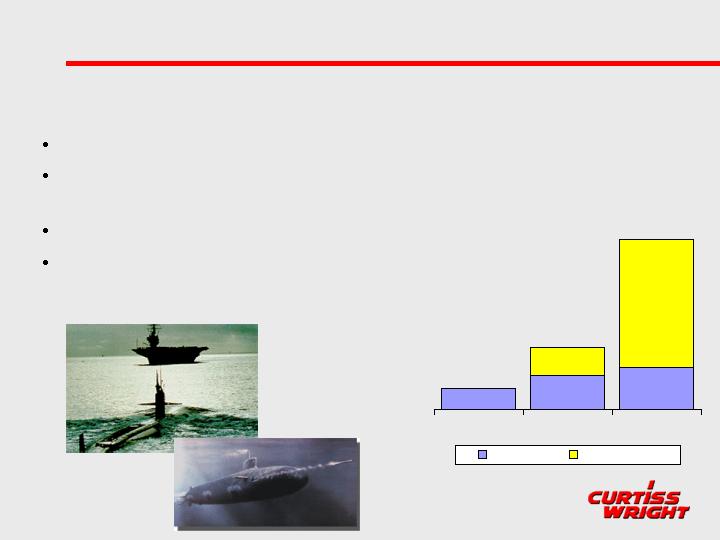

Growing Sales & Profits

Sales

Normalized Operating

Income

15.5

30.0

34.3

42.6

48.0

47.4

61.3

80.0

1996

1997

1998

1999

2000

2001

2002

Forecast

2003

170.5

219.4

249.4

293.3

329.6

343.2

513.3

700.0

1996

1997

1998

1999

2000

2001

2002

Forecast

2003

“One of America’s Top 200 Small Companies” ~ Forbes Magazine (1999 – 2002)

“Top 100 Hot Growth Companies” ~ Business Week (2002)

Top 30 Aerospace Businesses Ranked by Operating Margin ~ Flight International (2002)

In each of the last four years Forbes magazine recognized Curtiss-Wright as one of America’s top 200 small companies based upon sales and earnings growth.

As you see our sales have grown at a CAGR of 20% since 1996. Taking into account our projected sales for 2003, our compound annual growth rate would increase to 22%.

Our normalized operating income has grown at a CAGR of 26% over the same period. You will note that our operating income has grown faster than our sales during a period when we have made 20 acquisitions, which illustrates our proven ability to integrate these additions quickly while at the same time improving profitability.

Curtiss-Wright has also been recognized by Business Week magazine in 2002 as one of the Top 100 Growth Companies. And Flight International recognized Curtiss-Wright as one of the top 30 Aerospace companies in 2002 based upon profitability.

5

$1.58

$2.71

$2.70

$3.33

$3.72

$3.97

$3.99

$ 4.75-

$5.11

1996

1997

1998

1999

2000

2001

2002

2003

15.5

30.0

34.3

48.0

47.4

61.3

8.6

11.9

11.2

12.2

12.4

16.2

7.0

42.6

1996

1997

1998

1999

2000

2001

2002

*Normalized to exclude the effects of environmental insurance settlements, post-retirement costs,

consolidation costs, gains related to post- retirement medical benefits, recapitalization costs and gains on

asset sales.

**Range of analysts expectations.

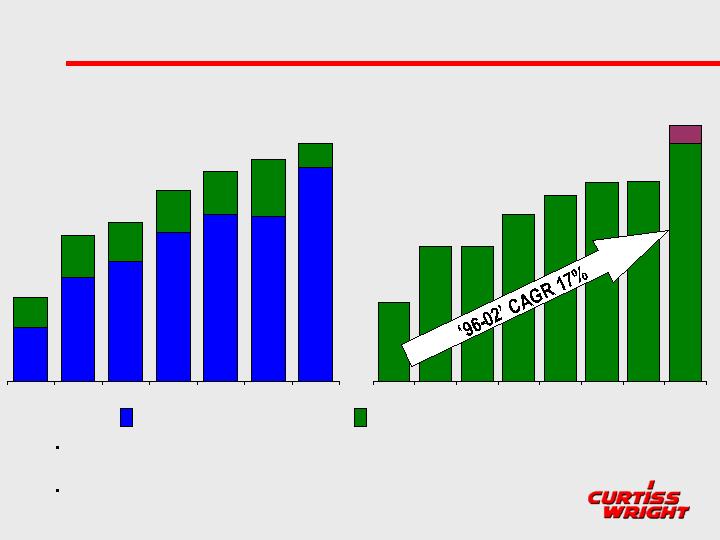

Earnings Components*

Operating Income

Non-Operating Income

In millions of dollars

Earnings per share

$24.1

$41.9

$45.5

$54.8

$60.4

$63.6

$68.3

The chart to the left reflects earnings before tax delineated between operating and nonoperating elements.

As you can see in prior years about 25% of our pre-tax earnings have come from non-operating sources, such as:

- Rental Income from Rental Properties which have been sold

- Investment income from our cash and marketable securities.

- Noncash pension income from our overfunded pension plan.

To the right is our normalized EPS which has grown at a CAGR of 17%. You will note that this growth rate is lower than that for our operating income due to the drag caused by our non-operating income, which has historically been a large component of our earnings and does not experience growth. We have since redeployed our resources from non-operating to operating elements and by doing so, we have not only strengthened our businesses but improved the quality of our earnings.

Analyst consensus earnings estimates for 2003 range from $4.75 to $5.10, which would represent an increase of somewhere between 19% and 28%. First half 2003 results of $363 million in sales and $41 million in operating income would put us well on our way to achieving these results.

|

|

|

Note: Actual EPS | 96 – 1.58 | 99 – 3.82 | 02 – 4.33 |

|

| 97 – 2.71 | 00 – 4.03 |

|

| 98 – 2.82 | 01 – 6.14 |

6

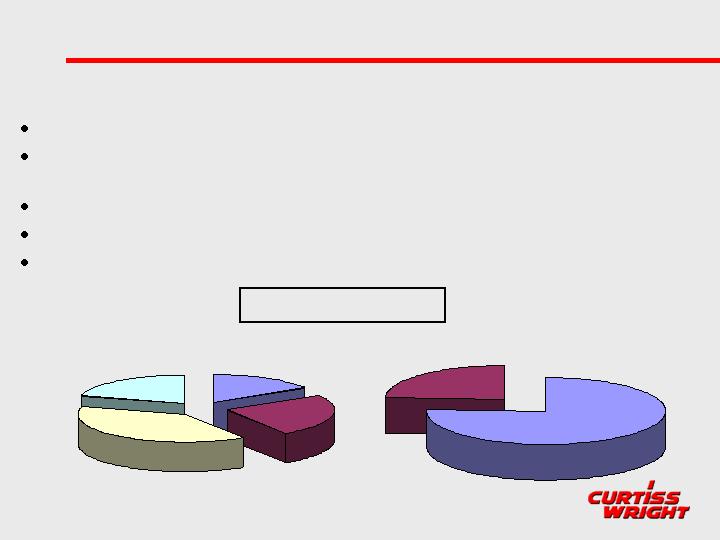

Commerical

Aerospace

19 %

Defense

47 %

Automotive/

Transportaton

6%

Process

Industry

(Oil / Gas)

10 %

Power

Generation

10 %

General

Industrial

8 %

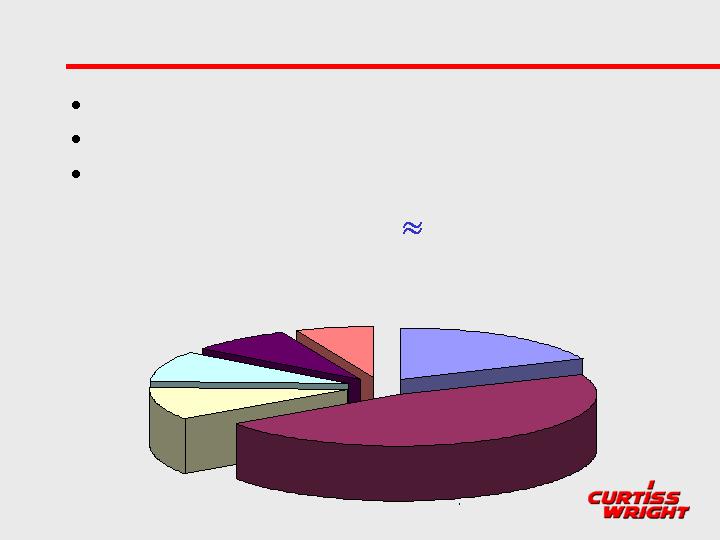

Diversified Businesses

Decreased dependence on Commercial Aerospace

Increased presence in defense markets

Global reach limits exposure to domestic markets

Estimated 2003 Sales $700 Million

Several years ago management initiated plans to diversify the company away from its dependence on Commercial Aerospace. Six years ago commercial aerospace represented approximately 50% of Curtiss-Wright, which was predominately Boeing and Airbus O.E.M. Today commercial aerospace less than 19% of our business, with Boeing at 5% and Airbus around 2%. The remainder of our commercial aerospace business is repair & overhaul services, regional and business jets. We have diversified away from commercial aerospace and, while the downturn in the commercial aerospace market has had its impact on the company, we are well positioned in other markets that have more than offset this decline.

At the same time, we have increased our position in the defense sector which is an area where we see significant opportunities. Prior to our recent acquisitions about 18% of our sales were defense-related. In 2003, we expect approximately 47% of our sales to come from defense. Our defense business has good diversification among all branches of service, with products for the navy, military aerospace and electronics, which are used on a variety of platforms such as ships, aircraft and land based vehicles.

7

Major Markets

8

Aerospace

17%

Ground

Vehicles

23%

US Navy

60%

Defense Market

2003 Estimated Sales of $332M

Flow control products and electronic control systems for the

Nuclear and Surface Navy

Highly engineered Actuation & Electronic Devices & Control

Systems for Aerospace and Land-Based Armored Vehicles

Guidance Systems for Unmanned Aircraft

Antipersonnel Sensing Systems for Perimeter Security

Defenses

Defense Sectors

Curtiss-Wright is the preferred provider of extremely sophisticated valves, pumps and electronic control systems for the nuclear navy. We also supply a variety of components and systems for the non-nuclear navy.

We are a leader in the design and manufacture of highly engineered components and Control Systems for military aircraft.

We are one of a few companies who can design and manufacture wing and bomb bay door actuation systems for military aircraft.

We provide fully digital aiming and stabilization systems and updated electronics for land-based military vehicles.

We also provide guidance, actuation and sensor systems for unmanned aircraft, such as the Global Hawk and UCAV programs.

For home land defense and anti-terrorist programs we are licensed to provide facial recognition systems and have an exclusive license to manufacture and distribute anti-personnel sensing systems which are currently used to protect foreign Air Force bases.

9

$23.7

$39.0

$48.4

$32.7

$148.3

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

2001

2002

2003 Est.

Base

Acquisitions

Naval Defense Market

Organic Growth Rate 24%

Construction of New Aircraft

Carrier

Submarine Construction

Retrofit of Aviation Fuel

Pumping Valves

Sales (million )

2003 Estimated Sales of $196M

During the past two years we have grown our Navy business primarily through acquiring EMD and Peerless Instruments. We are also expecting organic growth of 24% in 2003.

10

Defense Growth Opportunities

Naval Programs

Increase in Submarine Build Rate

Retrofit of Valves for Aviation

Fuel Systems

Smart Valves

Aerospace

F-22 Raptor, V-22 Osprey, F-35

Joint Strike Fighter, and Global

Hawk

Land Based Defense

Expansion of Value Added

Cross Marketing

Please see next page for comments.

11

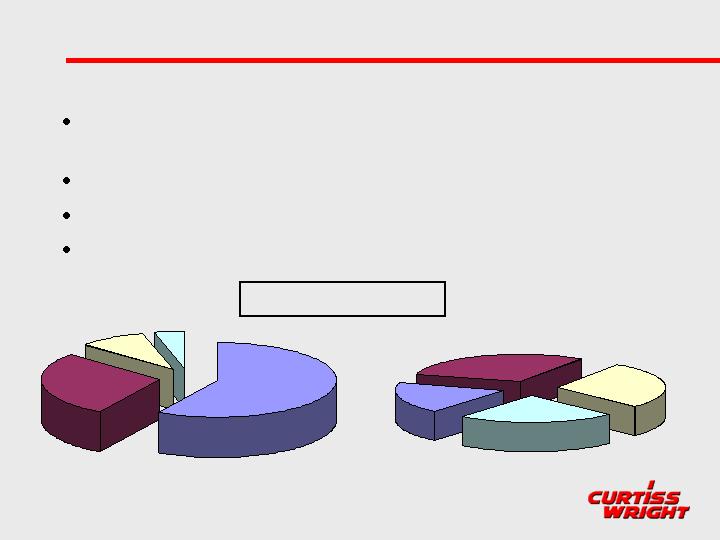

OEM

76%

Aftermarket

24%

Actuation

16%

Overhaul &

Repair 21%

Metal

Treatment

38%

Electronics

25%

Commercial Aerospace

2003 Estimated Sales of $132M

Flight Control and Utility Actuation Components & Integrated Systems

Position Sensors, Flight Recorders, Power Supplies and Fire Detection

Systems

Metal Treatment of Aircraft and Jet Engine Structures & Components

Shot Peen Forming of Aircraft Wing Skins

Component Repair & Overhaul Services to the Global Airline Industry

Sales Segmentation

In Motion Control we are a leader in the design and manufacture of highly engineered Actuation and Electronic Components and Control Systems for the commercial aerospace market. We are the number 1 supplier of actuators to Boeing.

Penny and Giles is considered the number 1 supplier of position sensors in Europe and supplies flight recorder products used to monitor an aircrafts’ operational performance. They also provide the latest technology in Quick Access recorders.

Autronics is the number 1 supplier of fire detection and suppression control systems to Boeing for which it has a proprietary and sole source position. They also provide customized power products.

We are a leader in providing metal treatment services on a global basis and are the largest provider of shot peening and shot peen forming services in the world. We currently form all of wings for Airbus. We have a 200,000 square foot plant in Chester, England adjacent to a BAE plant to form wing skins.

We also provide laser-peening. We are the only company in the world that provides laser-peening services commercially. Laser-peening increases the safety, life and reliability of a part on an order of magnitude over conventional shot-peening. We are currently laser-peening jet engine fan blades for Rolls Royce in both the US and England. Our laser-peening sales are anticipated to grow from $1 million last year to approximately $5 million this year. We expect revenues to double over the next two years.

12

Process

Industry (Oil

/ Gas) 30%

Auto

Transport-

ation 18%

General

Industrial

24%

Power

Generation

28%

Other

4%

Electronics

9%

Metal

Treatment

28%

Flow Control

59%

Industrial Markets

2003 Estimated Sales of $245M

Engineered Flow Control Products for the Commercial Nuclear

Power Generation and Processing Industries

Metal Treatment Services

Tilting Systems for High Speed Trains

Electronic Sensors for Industrial Applications

Sales Segmentation

We are forecasting sales to the industrial market in 2003 of $245 million. In this sector we sell highly engineered flow control products for the commercial nuclear power industry for both the aftermarket and construction of new facilities. We are the leading provider of severe service valves to the Asian nuclear program. As you can see in the chart we also provide flow control products to the processing industry which has been a market which we have been expanding our presence in and feel that, with our expanded product line and broadened distribution, this market will provide good opportunities for Curtiss-Wright in the future.

Our Metal Treatment business segment provides shot peening and heat treating services through its network of 51 facilities located in North America and Europe. We also provide coatings and a variety of other metal treatment applications. We will continue to look to expand the types of highly engineered metal treatment services that we provide.

Through our Controls business segment, we supply electronic sensors for industrial applications as well as tilting systems for high speed trains

13

$34.7

$39.7

$45.5

$19.0

$7.8

$0

$10

$20

$30

$40

$50

$60

$70

2001

2002

2003 Est.

Base

Acquisitions

Industrial-Power Generation

Organic Growth Rate of 15%

Plant Life Extensions

New Plant Construction: Asia

Domestic Plant Restarts:

Browns Ferry

Worldwide Increase for Power

Expanded Product Lines:

Valves, Pumps, Services

Sales (million)

2003 Estimated Sales of $65M

We supply valves, pumps and distribution products to the commercial nuclear industry in the United States and Asia.

The power generation market experienced a decline last year and is anticipated to experience a further decline this year.

Curtiss-Wright grew 14% organically and 37% overall in 2002. In 2003 we expect to grow an additional 15% organically and 36% overall when our recent acquisitions are included.

Our power generation market is impervious to economic conditions since the last thing a power company will do in response to a drop in demand is shut down its nuclear power plants.

Currently all 103 nuclear power plants in the United States are requesting plant life extensions which will provide Curtiss-Wright spares and engineering services business in the future.

14

Industrial - Processing

Organic Growth Rate of 23%

New Products:

Coker De-heading Valves

Pilot Operated Valves

Expanded Butterfly Valve Products

Software Management Systems

Plant Upgrades

Sales (million)

2003 Estimated Sales of $74M

$34.2

$40.4

$49.8

$15.8

$24.5

$0

$10

$20

$30

$40

$50

$60

$70

$80

2001

2002

2003 Est.

Base

Acquisitions

We provide the finest and most sophisticated severe service valves for the processing industry. We provide the latest state of the art leakless, smart, pilot operated, butterfly and coke de-heading valves.

Last year we grew 18% organically and 64% overall. This year we expect to grow 23% organically and 32% overall.

We are one of the few companies that have experienced double digit growth rates in both the power and processing markets which have been in a downturn for the last 2 years. This is an indication that our customers prefer our highly engineered products and services over their traditional suppliers.

15

Strategic Directions

16

Strategic Directions

Geographical Market Expansion

Power Generation

Smart & Leakless Valves

Home Front Defense

Develop and Advance New Technologies

Please see next page for comments.

17

LasershotSM Peening

Significant fatigue lifetime improvements

Impacted safety/reliability on $14B Boeing 777 jets

Currently impacting Gulfstream V, A340-500 & A600 jets

Rolls Royce engines

U.S. DOE estimating laser-peening will save government over

$1B at Yucca Mountain Nuclear Waste facility

Fatigue lifetime improvements of 20 times have been demonstrated in titanium, aluminum and other metals.

Laser-peening has already impacted the safety and reliability of over $14 billion worth of Boeing 777 jets (Rolls Royce Trent 800 engine) in the first year of production.

The laser-peening technology is currently also impacting Gulfstream V jets (Rolls Royce BR710 engine) and A340-500 and -600 jets (Rolls Royce Trent 500 engine), the largest Airbus jets currently flying.

The U.S Department of energy has estimated that laser-peening will save the government over $1 billion in deployment costs for the Yucca Mountain Nuclear Waste disposal project.

18

In Sum: A Solid Investment

Established Leader in Niche Markets

Technology

Market Position

Low Cost Manufacturer

Diversified Business Plan

Proven Ability to Grow Profitably

Successful Integration of Acquisitions

Future Outlook

Diversification — Our company is well balanced with 47% military and 53% commercial

Profitable Growth

Sales 20% CAGR since 1996

OI 26% CAGR since 1996

Integration — Our results prove that we are a successful integrator of new businesses

Our shareholders approved an increase in authorized shares to 45,650,000 shares.

We may use the increase for a stock split or acquisitions.

Outlook — Excellent!

19

Safe Harbor Statement

Forward-looking statements in this document are made pursuant

to the Safe Harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those expressed or implied.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

hereof. Such risks and uncertainties include, but are not limited

to: unanticipated environmental remediation expenses or claims;

a reduction in anticipated orders; an economic downturn;

changes in the need for additional machinery and equipment

and/or in the cost for the expansion of the Corporation’s

operations; changes in the competitive marketplace and/or

customer requirements; an inability to perform customer

contracts at anticipated cost levels; and other factors that

generally affect the business of aerospace, marine, and industrial

companies. Please refer to the Company’s SEC filings under the

Securities and Exchange Act of 1934, as amended, for further

information.

20

Thank you

For more information,visit:

www.curtisswright.com

21