- CW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Curtiss-Wright (CW) 8-KFinancial statements and exhibits

Filed: 2 Dec 03, 12:00am

Exhibit 99.1

First In Flight – 100 Years

Highly Engineered Products

A Market Leader

Company Profile

A Strategically Focused, Multinational Provider of

Highly Engineered Products and Services

Strong Positions in Diversified, Profitable Niche

Markets Built Upon:

Engineering and Technological Leadership

Strong Relationship with our Customers

Strong Base Comprised of 3 Business Segments:

Flow Control = 48%

Controls = 34%

Metal Treatment = 18%

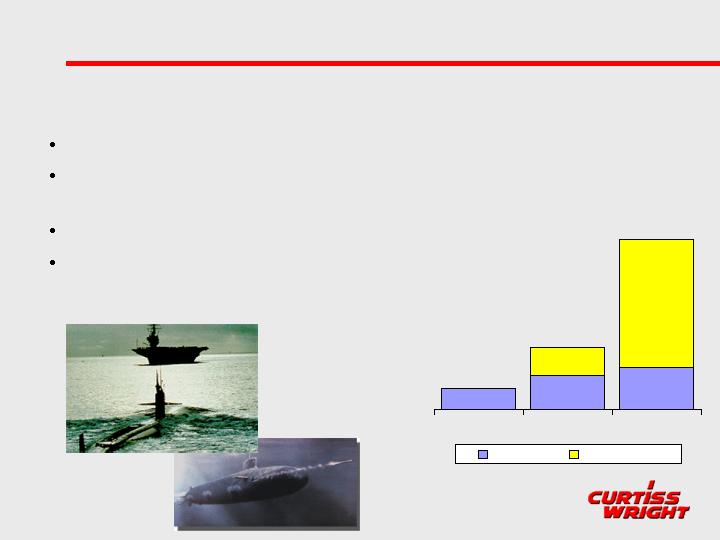

Growing Sales & Profits

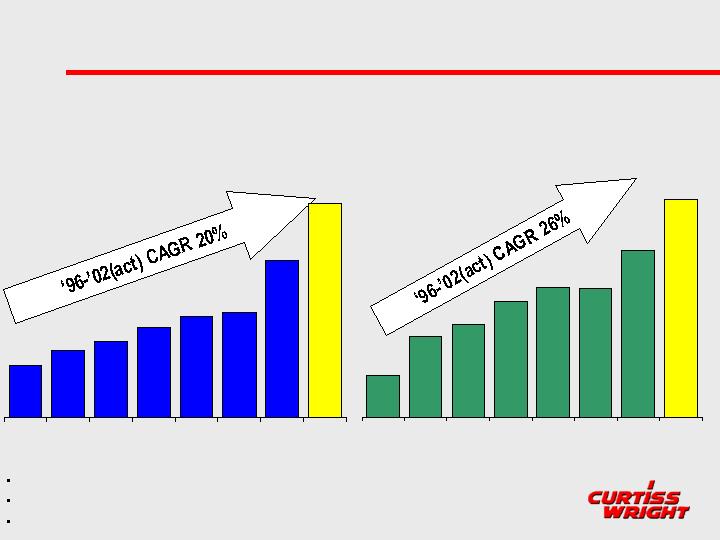

Sales

Normalized Operating

Income

15.5

30.0

34.3

42.6

48.0

47.4

61.3

80.0

1996

1997

1998

1999

2000

2001

2002

Forecast

2003

“One of America’s Top 200 Small Companies” ~ Forbes Magazine (1999 – 2002)

“Top 100 Hot Growth Companies” ~ Business Week (2002)

Top 30 Aerospace Businesses Ranked by Operating Margin ~ Flight International (2002)

170.5

219.4

249.4

293.3

329.6

343.2

513.3

700.0

1996

1997

1998

1999

2000

2001

2002

Forecast

2003

1996

1997

1998

1999

2000

2001

2002

2003

1996

1997

1998

1999

2000

2001

2002

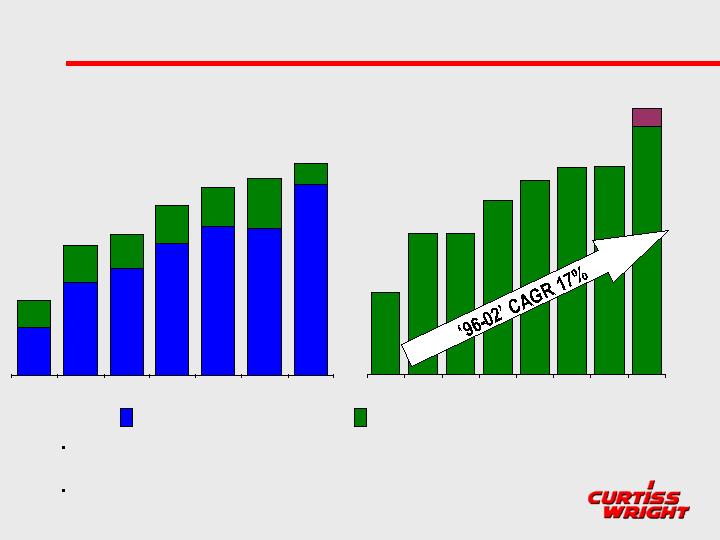

*Normalized to exclude the effects of environmental insurance settlements, post-retirement costs,

consolidation costs, gains related to post- retirement medical benefits, recapitalization costs and gains

on asset sales.

**Range of analysts expectations.

Earnings Components*

Operating Income

Non-Operating Income

15.5

30.0

34.3

48.0

47.4

61.3

8.6

11.9

11.2

12.2

12.4

16.2

7.0

42.6

In millions of dollars

$24.1

$41.9

$45.5

$54.8

$60.4

$63.6

$68.3

$1.58

$2.71

$2.70

$3.33

$3.72

$3.97

$3.99

$ 4.75-

$5.11

Earnings per share

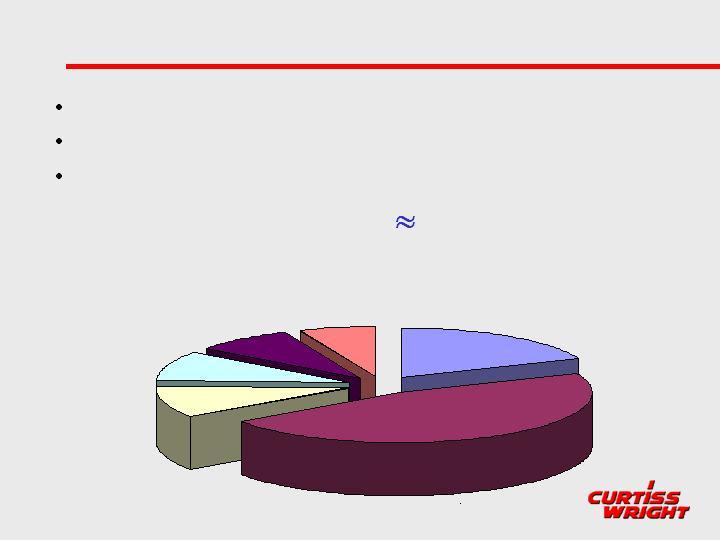

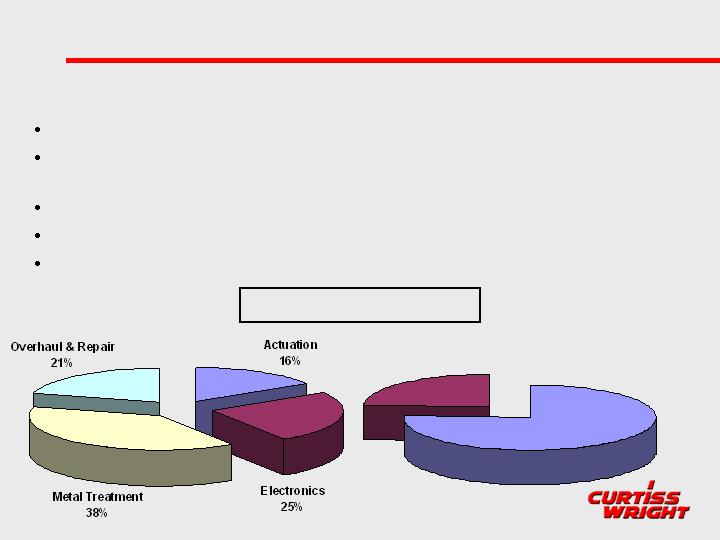

Commerical

Aerospace

19 %

Defense

47 %

Automotive/

Transportaton

6%

Process

Industry

(Oil / Gas)

10 %

Power

Generation

10 %

General

Industrial

8 %

Estimated 2003 Sales $700 Million

Decreased dependence on Commercial Aerospace

Increased presence in defense markets

Global reach limits exposure to domestic markets

Diversified Businesses

Major Markets

Aerospace

17%

Ground

Vehicles

23%

US Navy

60%

Defense Market

2003 Estimated Sales of $332M

Flow control products and electronic control systems for the

Nuclear and Surface Navy

Highly engineered Actuation & Electronic Devices & Control

Systems for Aerospace and Land-Based Armored Vehicles

Guidance Systems for Unmanned Aircraft

Antipersonnel Sensing Systems for Perimeter Security

Defenses

Defense Sectors

$23.7

$39.0

$48.4

$32.7

$148.3

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

2001

2002

2003 Est.

Base

Acquisitions

2003 Estimated Sales of $196M

Sales (million )

Organic Growth Rate 24%

Construction of New

Aircraft Carrier

Submarine Construction

Retrofit of Aviation Fuel

Pumping Valves

Naval Defense Market

Defense Growth Opportunities

Naval Programs

Increase in Submarine Build Rate

Retrofit of Valves for Aviation

Fuel Systems

Smart Valves

Aerospace

F-22 Raptor, F-35 Joint

Strike Fighter, Global

Hawk, V-22 Osprey

Land Based Defense

Expansion of Value Added

Cross Marketing

Commercial Aerospace

2003 Estimated Sales of $132M

Flight Control and Utility Actuation Components & Integrated Systems

Position Sensors, Flight Recorders, Power Supplies and Fire Detection

Systems

Metal Treatment of Aircraft and Jet Engine Structures & Components

Shot Peen Forming of Aircraft Wing Skins

Component Repair & Overhaul Services to the Global Airline Industry

Sales Segmentation

OEM

76%

Aftermarket

24%

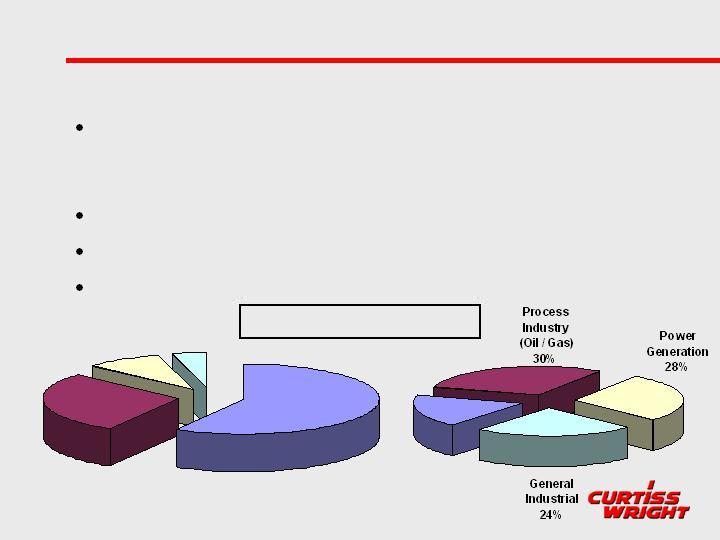

Industrial Markets

2003 Estimated Sales of $245M

Engineered Flow Control Products for the

Commercial Nuclear Power Generation and

Processing Industries

Metal Treatment Services

Electronic Sensors for Industrial Applications

Tilting Systems for High Speed Trains

Sales Segmentation

Auto

Transportation

18%

Other

4%

Electronics

9%

Metal Treatment

28%

Flow Control

59%

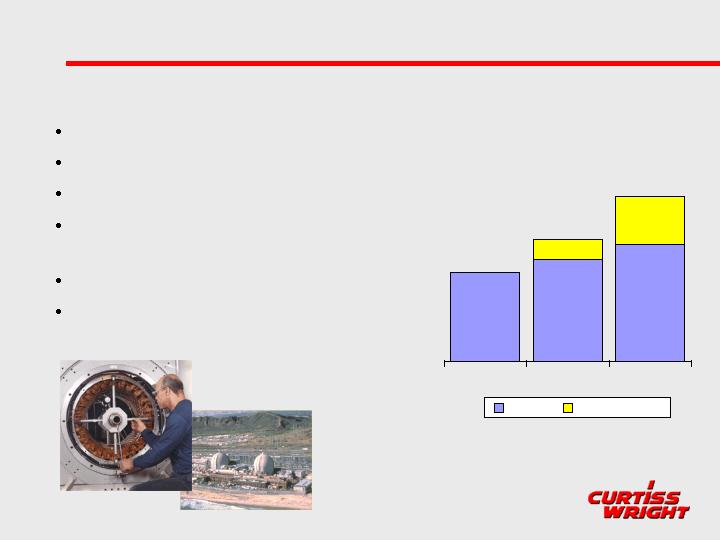

Industrial-Power Generation

Organic Growth Rate of 15%

Plant Life Extensions

New Plant Construction: Asia

Domestic Plant Restarts:

Browns Ferry

Worldwide Increase for Power

Expanded Product Lines:

Valves, Pumps, Services

Sales (million)

2003 Estimated Sales of $65M

$34.7

$39.7

$45.5

$19.0

$7.8

$0

$10

$20

$30

$40

$50

$60

$70

2001

2002

2003 Est.

Base

Acquisitions

Sales (million)

2003 Estimated Sales of $74M

Organic Growth Rate of 23%

New Products:

Coker De-heading Valves

Pilot Operated Valves

Expanded Butterfly Valve Products

Software Management Systems

Plant Upgrades

Industrial - Processing

$34.2

$40.4

$49.8

$15.8

$24.5

$0

$10

$20

$30

$40

$50

$60

$70

$80

2001

2002

2003 Est.

Base

Acquisitions

Strategic Directions

Strategic Directions

Geographical Market Expansion

Power Generation

Process Industry

Smart & Leakless Valves

Home Land Defense

Develop and Advance New Technologies

LasershotSM Peening

Significant fatigue lifetime improvements

Impacted safety/reliability on $14B Boeing 777 jets

Currently impacting Gulfstream V, A340-500 & 600 jets

Rolls Royce engines

U.S. DOE estimating laser-peening will save government

over $1B at Yucca Mountain Nuclear Waste facility

In Sum: A Solid Investment

Established Leader in Niche Markets

Technology

Market Position

Low Cost Manufacturer

Diversified Business Plan

Proven Ability to Grow Profitably

Successful Integration of Acquisitions

Future Outlook

Safe Harbor Statement

Forward-looking statements in this document are made pursuant

to the Safe Harbor provisions of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from those expressed or implied.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date

hereof. Such risks and uncertainties include, but are not limited

to: unanticipated environmental remediation expenses or claims;

a reduction in anticipated orders; an economic downturn;

changes in the need for additional machinery and equipment

and/or in the cost for the expansion of the Corporation’s

operations; changes in the competitive marketplace and/or

customer requirements; an inability to perform customer

contracts at anticipated cost levels; and other factors that

generally affect the business of aerospace, marine, and industrial

companies. Please refer to the Company’s SEC filings under the

Securities and Exchange Act of 1934, as amended, for further

information.

Thank you

For more information,visit:

www.curtisswright.com