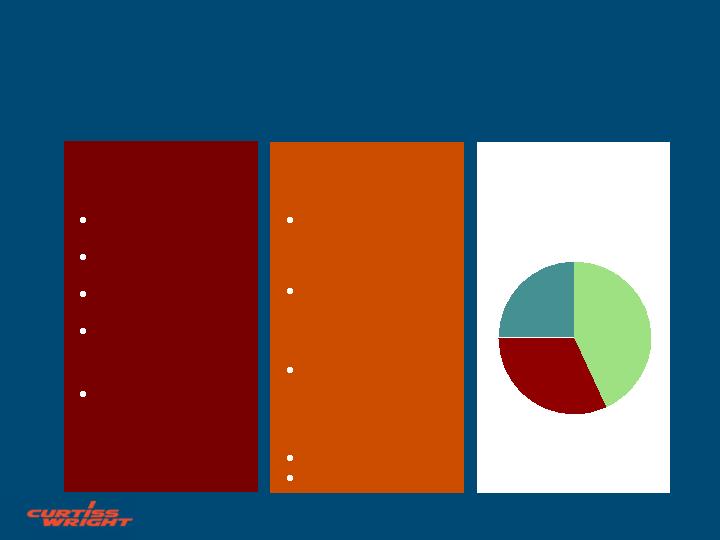

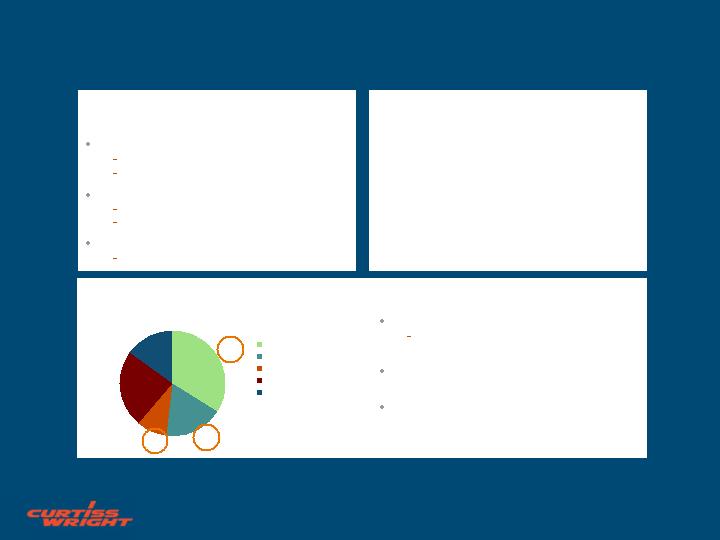

Curtiss-Wright Overview

Strategically focused, multinational provider of highly engineered

products and services

Strong positions in diversified, profitable niche markets built upon:

Engineering and technological leadership

Strong customer relationships

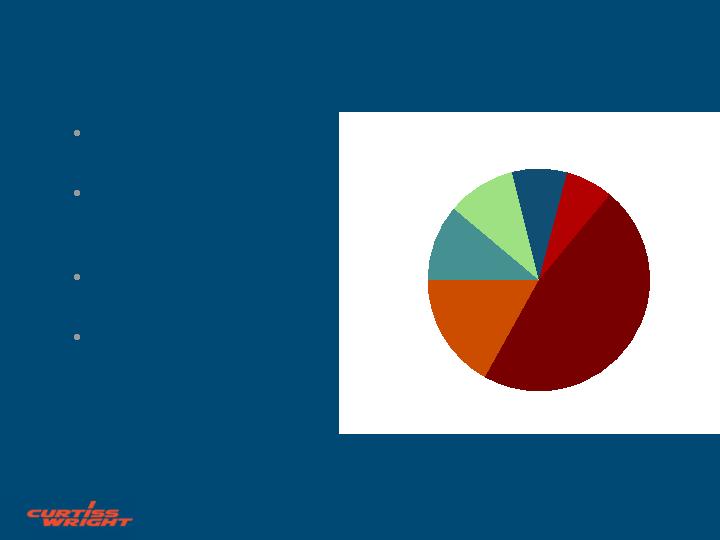

Strong base comprised of 3 business segments

Flow Control

41%

Motion Control

41%

Metal Treatment

18%

FEBRUARY 2005

3

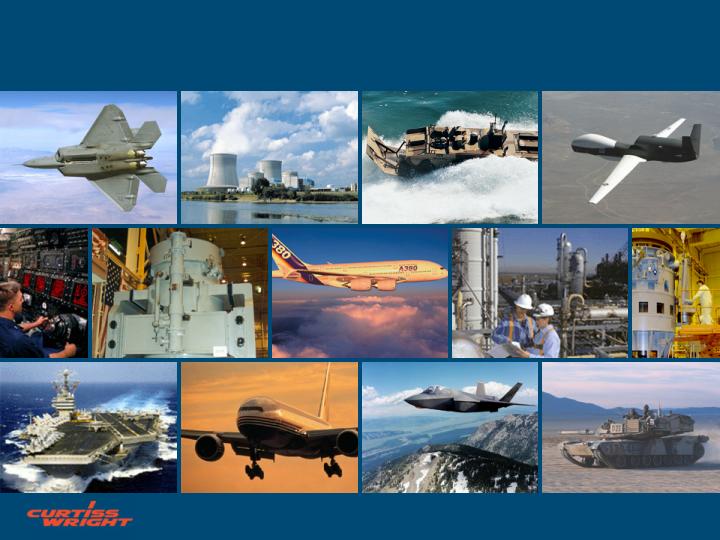

Highly Engineered Products

FEBRUARY 2005

4

Market Leader

FEBRUARY 2005

5

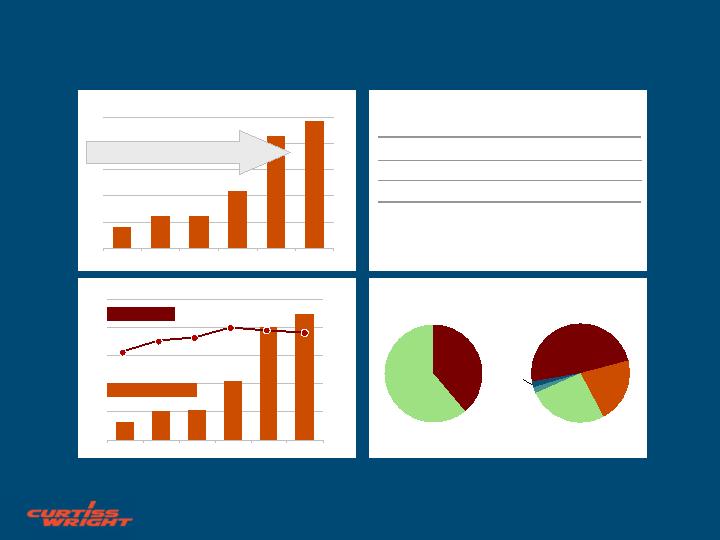

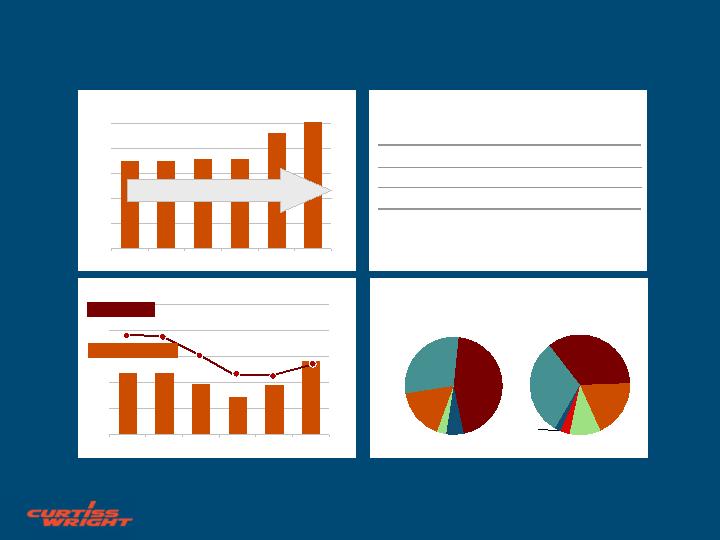

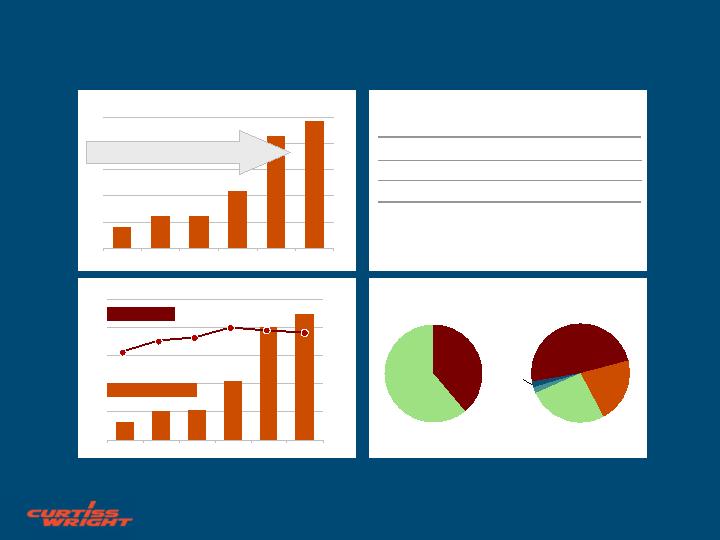

1999

2000

2001

2002

2003

2004

2005

Est

1999

2000

2001

2002

2003

2004

2005

Est

$293

$330

$343

$513

$746

$955

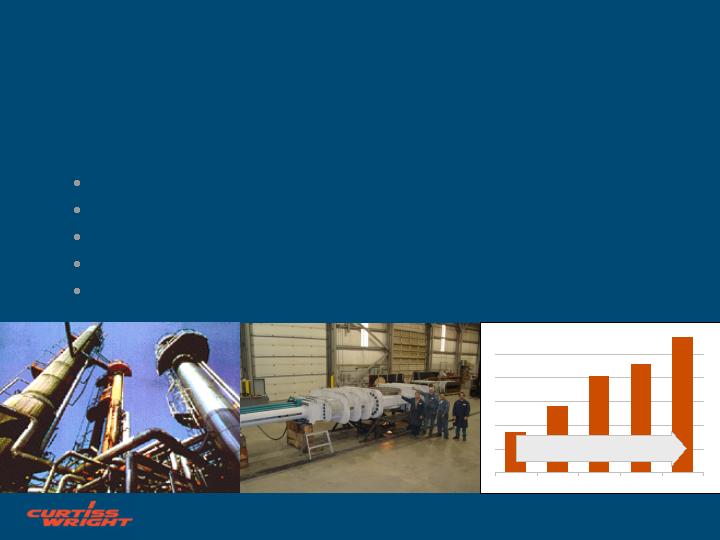

Growing Sales and Profits

SALES

OPERATING INCOME

One of America’s top 200 Small Companies – Forbes Magazine (1999-2002)

Top 100 Hot Growth Companies – Business Week (2002)

Top 30 Aerospace Businesses Ranked by Operating Margin – Flight International (2002)

+27% 5-Year CAGR

($ in millions)

($ in millions)

$43

$48

$47

$61

$89

$111

+21% 5-Year CAGR

$1,050-

1,100

$130-138

FEBRUARY 2005

6

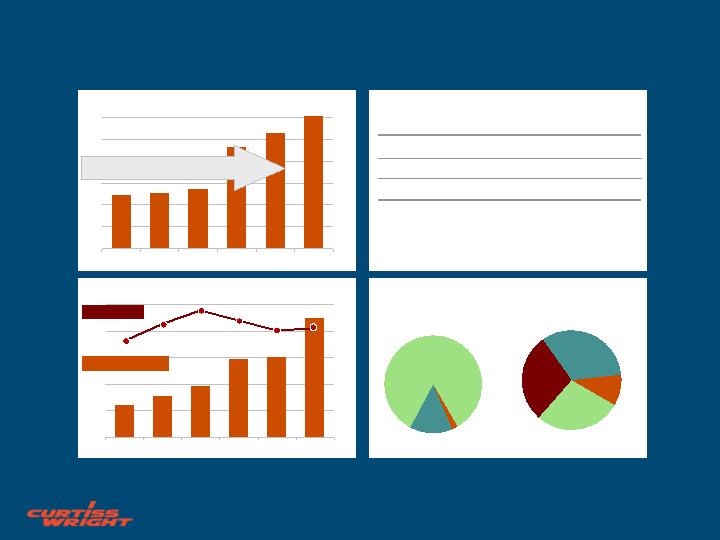

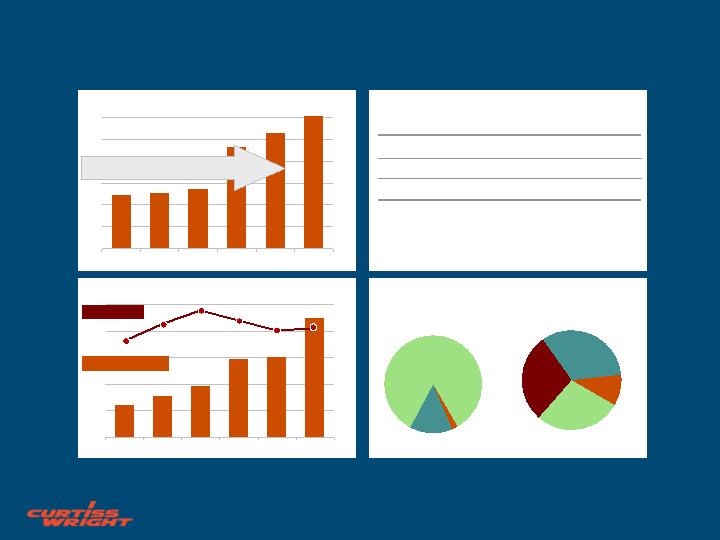

1999

2000

2001

2002

2003

2004

2005 Est

$1.67

$1.86

$1.99

$2.00

$2.50

$3.02

Earnings Per Share*

(Split Adjusted)

+13% 5-Year CAGR

* 2000-2002 Normalized to exclude the effects of environmental insurance

settlements, post-retirement costs, consolidation costs, gains related to

post- retirement medical benefits, recapitalization costs and gains on asset

sales.

$3.24 –

$3.45

FEBRUARY 2005

7

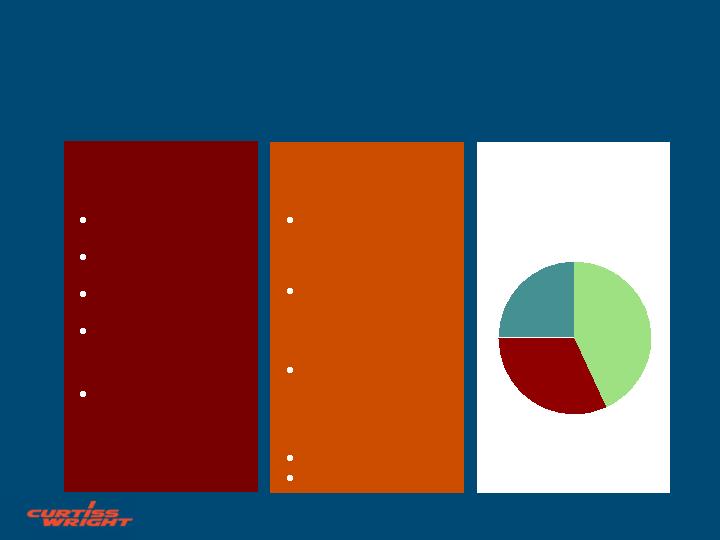

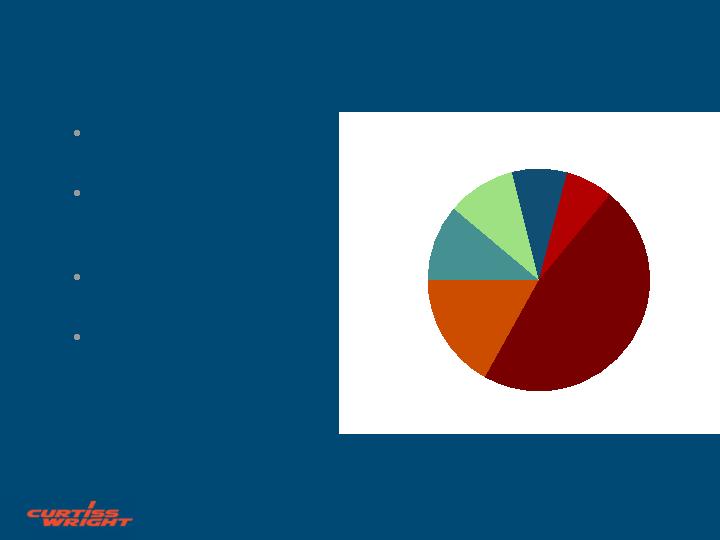

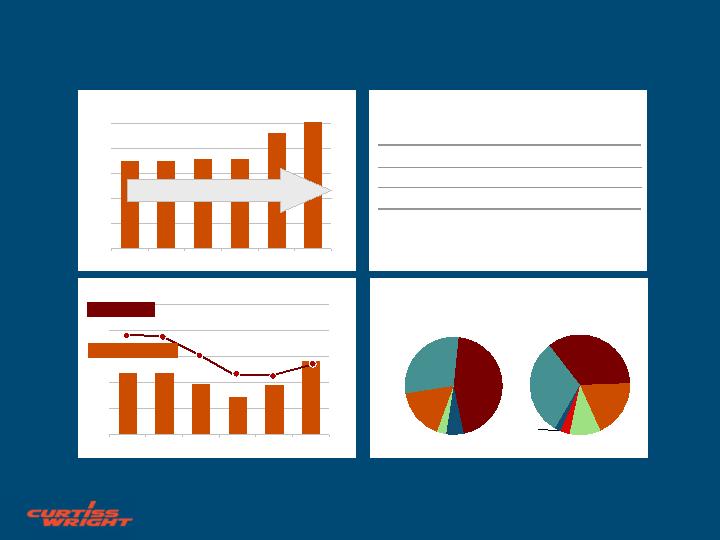

Diversification

Increased presence in

defense markets

Increased presence in

embedded computing

market

Leading position in

commercial aerospace

Global reach limits

exposure to domestic

markets

Defense

47%

Automobile

8%

Commercial

11%

Oil & Gas

10%

General

7%

Commercial

17%

Industrial

Power

Aerospace

FEBRUARY 2005

8

Business Segments

FEBRUARY 2005

9

1999

2000

2001

2002

2003

2004

1999

2000

2001

2002

2003

2004

$6,082

$10,276

$10,703

$20,693

$39,991

$64,965

$97,486

$98,257

$172,455

$388,139

Flow Control Segment

SALES

Business Units……

Employees…………

Sales / EE…………..

OPERATING INCOME

MARKETS SERVED

Operating Income ($000)

11.5%

9.4%

10.5%

10.9%

12.0%

11.7%

Operating Margin

+43% 5-year CAGR

2004

$341,271

$44,651

Commercial

Power

61%

Defense-

Navy

39%

1998

Defense-

Navy

49%

Oil &

Gas

21%

Commercial

Power

26%

Automotive

2%

Product Portfolio: Marine Propulsion Pumps &

Valves, Electronic Systems, Commercial Power,

Commercial Oil & Gas

General

Industrial

2%

266

2,070

2

14

1998

2004

$ 143,000

$ 216,000

FEBRUARY 2005

10

Flow Control - Products

Engineered control & relief valves

FCCU, coker, butterfly valves

Engineered pumps & drives

Nuclear/non-nuclear instrumentation & control

systems

Aircraft carrier flight critical components

Electromagnetic drive & propulsion system

Process Safety Management software

Nova - Nuclear power components

Trentec - Power equipment fabrication and

qualification

Groquip - Oil processing valves

GMBU - Naval propulsion pumps

1998

2003

2004

Engineered control and relief valves

FEBRUARY 2005

11

Expanded new markets

with related products

Expanded technical

content into electronic

controls

Expanded into the

process industry

Strategy

Flow Control

FEBRUARY 2005

12

$12,446

$15,463

$19,219

$29,579

$30,350

11.4%

12.7%

14.0%

12.2%

10.0%

11.6%

$124,155

$126,771

$137,103

$233,437

$265,905

Motion Control Segment

SALES

OPERATING INCOME

MARKETS SERVED

+26% 5-Year CAGR

Operating Income ($000)

Operating Margin

2004

$388,575

$44,903

Commercial

Aerospace

84%

1998

Commercial

Aerospace

28%

Defense-

Land

29%

Defense-

Aerospace

33%

General

Industrial

10%

Defense-

Aerospace

14%

General

Industrial

2%

Product Portfolio: Embedded Computing,

Integrated Sensing and Engineered Systems

1999

2000

2001

2002

2003

2004

1999

2000

2001

2002

2003

2004

FEBRUARY 2005

13

1998

2004

Business Units……

3

15

Employees…………

662

1,942

Sales / EE…………..

$

158,000

$

194,000

Motion Control - Products

Secondary flight control actuation systems

Component overhaul and logistics support

Secondary flight control actuation systems and

component overhaul & logistics support

Electro-mechanical aiming and stabilization

systems

Military fire control systems

Position sensors & control electronics

Power conversion products & embedded

computing

Dy 4 - Embedded Computing

Primagraphics – Embedded Computing

Synergy – Embedded Computing

1998

2003

2004

FEBRUARY 2005

14

Motion Control

Expand control technology

from mechanical to electro-

mechanical to electronics

Evolve from dependence on

commercial aerospace

market to service defense

and industrial markets

Strategy

FEBRUARY 2005

15

2004

$23,551

$23,502

$19,513

$14,403

$19,055

15.9%

22.6%

22.3%

18.1%

13.4%

13.7%

$104,143

$105,318

$107,807

$107,386

$138,895

Metal Treatment Segment

SALES

OPERATING INCOME

MARKETS SERVED

+11% 5-Year CAGR

Operating Income ($000)

Operating Margin

$178,324

$28,279

1998

General

Industrial

17%

Automotive

29%

Aerospace

45%

Power

3%

Process

6%

Product Portfolio: Shot Peening, Peen Forming,

Laser Peening, Specialty Coatings, Heat Treating

General

Industrial

19%

Automotive

31%

Aerospace

10%

Commercial

Aerospace

35%

Oil & Gas

3%

Power

2%

1999

2000

2001

2002

2003

2004

1999

2000

2001

2002

2003

2004

FEBRUARY 2005

16

1998

2004

Business Units……

36

56

Employees…………

1,075

1,603

Sales / EE…………..

$

98,000

$

112,000

Metal Treatment - Services

Shot peening

Peen forming

Heat treating

Special valves

Shot peening

Peen forming

Heat treating

Special valves

Laser peening

Coating applications

Anodizing / chemical milling

Evesham – Coatings

Everlube – Coatings

1998

2003

2004

FEBRUARY 2005

17

Strategy

Metal Treatment

Increase market share by

adding appropriate plant

sites

Add new coatings

services to business

portfolio

Introduce new laser

technology to shot

peening services

FEBRUARY 2005

18

Major Markets

FEBRUARY 2005

19

2005 Estimated Sales: $525M

Navy

Pumps, valves &

electronic systems

Submarine & aircraft

carrier

Jet fuel pumping

system retrofit

Advanced Naval

Propulsion technology

Army

Electromagnetic (EM)

Gun

Flow Control

DEFENSE SECTORS

Defense Market

Aerospace

32%

Ground

Vehicles

25%

Navy

43%

Aerospace

Embedded systems,

position sensors,

actuation and electronic

controls

F/A-22 Raptor, V-22

Osprey, Joint Strike

Fighter & Global Hawk

Ground Vehicles

Electronic controls,

aiming & stabilization

systems, embedded

systems and position

sensors

Abrams & Bradley tanks

Future Combat Systems

Motion Control

FEBRUARY 2005

20

Space Based

Rocket

Helicoptor

Aircraft

Bombers

UAV

Light Armoured

Armoured

Surface Ships

Submarines

Torpedoes & Decoys

Amphibious

M-5 Rocket

Hera

BA-2

Space Station

Shuttle

JEM

Seawolf

Collins

Los Angeles

NSSN

Mk-30

43X2

TP2000

LCAC

AAAV

Commanche

Sky Guardian 2000

Cobra

Apache

Sea King

ATIC

Global Hawk

Tier II+

Predator

LOROPS

UCAV

FCS

LAV-Recce

Warrior

HMMWV-ITAS

M1A2

Bradley-IBAS

FOX

Grizzly

Wolverine

B-2

B-52

JSF

F-22

F-16

F-15

F/A-18

Hawk

Tornado

U2R

AV-8B

EA-6B

C-130

P3C

Harrier

F-117

CTT

GBR

JORN

SMART-T

APX-100

UPZ-27

SeaVue

SLQ-32

Type 23 Frigate

MK45 Gun System

Typhoon

EOS-400

LPD-17

Communication

& Radar

Embedded Systems Markets

FEBRUARY 2005

21

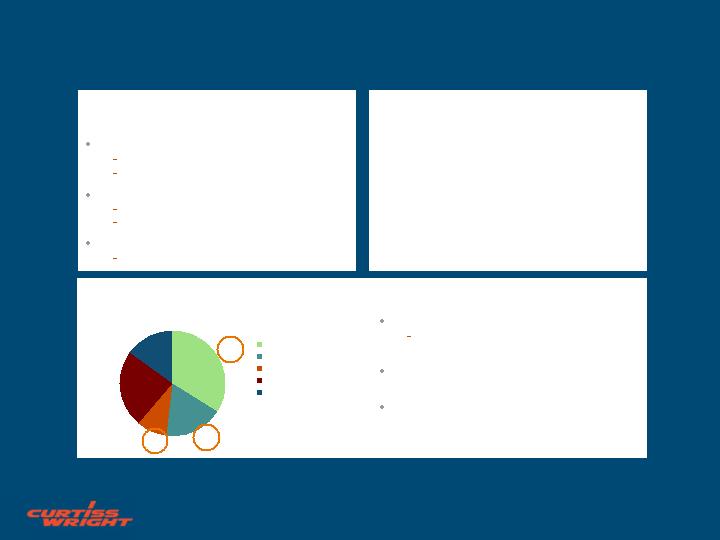

24%

15%

18%

9%

34%

Military

Medical

Industrial Control

Communications

Other

Embedded Computing Overview

Core market is the $1.5B Defense segment

Established leadership position with

outsourcing prime

Continued outsourcing by the primes

(US & Europe)

Leverage technology into high-end medical

and industrial control markets

C-W targets Military, Medical & Industrial segments

Worldwide Embedded Systems Market $4.5bn

Curtiss-Wright is Transforming the

Embedded Computing Landscape

Subsystems

Global Hawk UAV

mission computers and

sensor management

Bradley Tank gunner

control electronics

Stryker weapon autoloader

controls & turret electronics

Modular Solutions

F-22 - SBCs

F-15 - digital interrogation

system cards

Sentinel Radar

- DSP & SBCs

Six acquisitions since 2003

Revenue run rate $200M

90% military, 10% commercial markets

Accelerated strategic integration

Global presence leverages CW branding

Fully rebranded, single sales channel, R&D aligned

Diverse customer base ad platforms

5 largest programs generate <25% annual revenues

Fully Integrated, Interoperable Products

FEBRUARY 2005

22

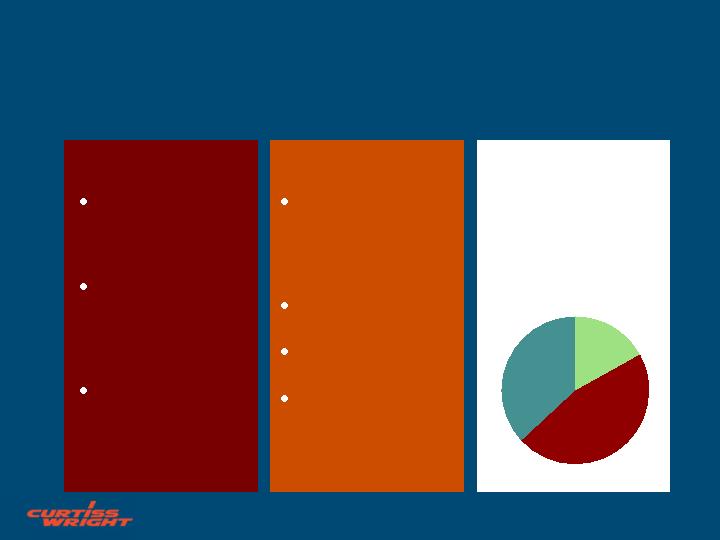

SALES SEGMENTATION

Commercial Aerospace Markets

Airbus:

A300, A318, A319, A320,

A321, A330, A340, A380

Boeing:

B727, B737, B747, B757,

B767, B777, B787

2005 Estimated Sales: 185M

Flight control and

utility actuation

components &

integrated systems

Position sensors,

flight recorders,

power supplies and

fire detection

systems

Component repair

& overhaul services

to the global airline

industry

Metal Treatment

Shot Peening –

structural

components, turbine

engines and fan

blades

Shot Peen Forming –

wing skins

Specialty Coatings –

structural components

Laser Peening –

turbine engines and

fan blades

Motion Control

OEM

46%

Metal

Treatment

37%

Repair &

Overhaul

17%

FEBRUARY 2005

23

Laser Peening

Uniquely positioned as the world-leader in laser peening

technology and commercial production

New market opportunities for laser peening services, such as

aerospace wing parts, highly stressed gears, medical implants,

and applications in oil & gas

FEBRUARY 2005

24

Metal Treatment

Automotive,

commercial power,

oil and gas, heavy

Industrial, medical

Motion Control

Stabilization

systems for high-

speed trains

Electronic sensors

for industrial

applications

Industrial Markets

SALES SEGMENTATION

Motion

Control

12%

Metal

Treatment

29%

Flow Control

59%

General

Industrial

19%

Oil & Gas

27%

Auto

22%

Commercial

Power

32%

Commercial power

pumps, valves and

electronic control

systems

Flow Control

2005 Estimated Sales: $370M

FEBRUARY 2005

25

SALES ($ millions)

2001

2002

2003

2004

2005E

$35

$47

$74

$122

Industrial Power Generation

2005 Estimated Sales: $122M

Plant life extensions: U.S.

New plant construction: Asia

Domestic plant restarts: Browns Ferry

Worldwide increase demand for power

Expanded product lines: valves, pumps, services

$105

37% 4-Year CAGR

FEBRUARY 2005

26

Industrial Oil & Gas

2005 Estimated Sales: $114M

New Products:

Coke drum deheading valve

Process Safety Management (PSM) software solutions

Pilot-operated valves

Expanded butterfly valve products

Plant upgrades

2001

2002

2003

2004

2005E

$34

$91

$114

35% 4-Year CAGR

SALES ($ millions)

$56

$81

FEBRUARY 2005

27

DeltaGuard® Coker Valve

Revolutionary valve technology for oil refining industry

Totally automated and sealed system dramatically improves

safety

Significantly reduces maintenance costs and increases

throughput

Enables processing of cheaper grades of crude oil

Intellectual property patent

Traditional Valves

Curtiss-Wright DeltaGuard® Coker Valve

FEBRUARY 2005

28

76 Years NYSE: CW, CW.B

Established Leader in Niche Markets

Technology

Market Position

Competitive Cost Structure

Diversified Business Plan

Proven Ability to Grow Profitably

Successful Integration of Acquisitions

Future Outlook

In Sum: A Solid Investment

FEBRUARY 2005

29

Safe Harbor Statement

Forward-looking statements in this document are made pursuant to the Safe

Harbor provisions of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ materially from those

expressed or implied. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date hereof.

Such risks and uncertainties include, but are not limited to: unanticipated

environmental remediation expenses or claims; a reduction in anticipated

orders; an economic downturn; changes in the need for additional machinery

and equipment and/or in the cost for the expansion of the Corporation’s

operations; changes in the competitive marketplace and/or customer

requirements; an inability to perform customer contracts at anticipated cost

levels; and other factors that generally affect the business of aerospace,

marine, and industrial companies. Please refer to the Company’s SEC filings

under the Securities and Exchange Act of 1934, as amended, for further

information.

FEBRUARY 2005

30

Thank you

For more information,

visit: www.curtisswright.com