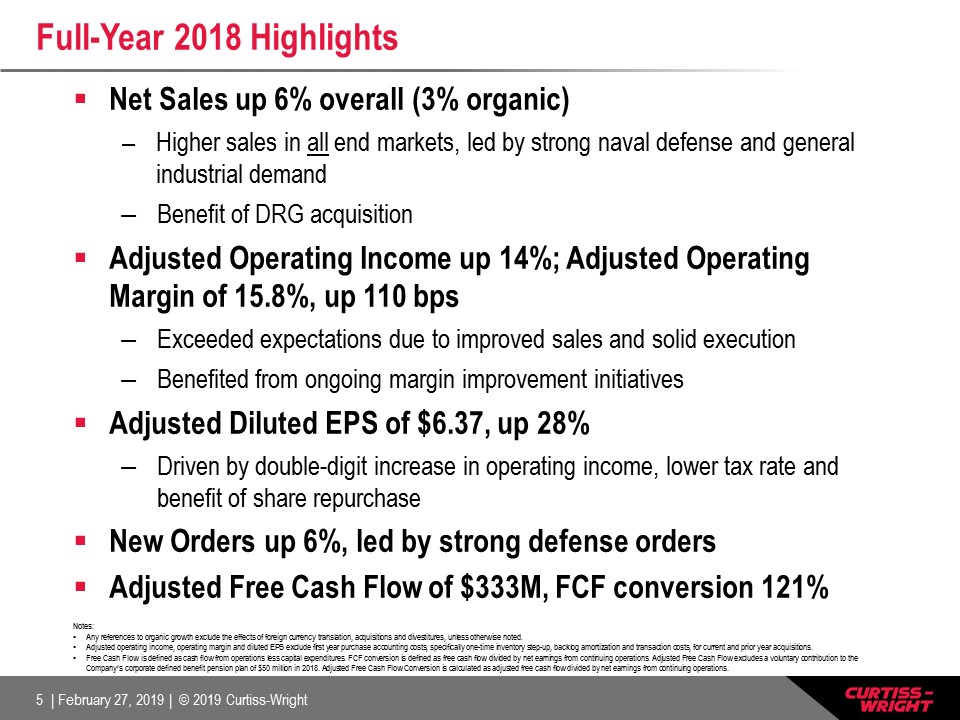

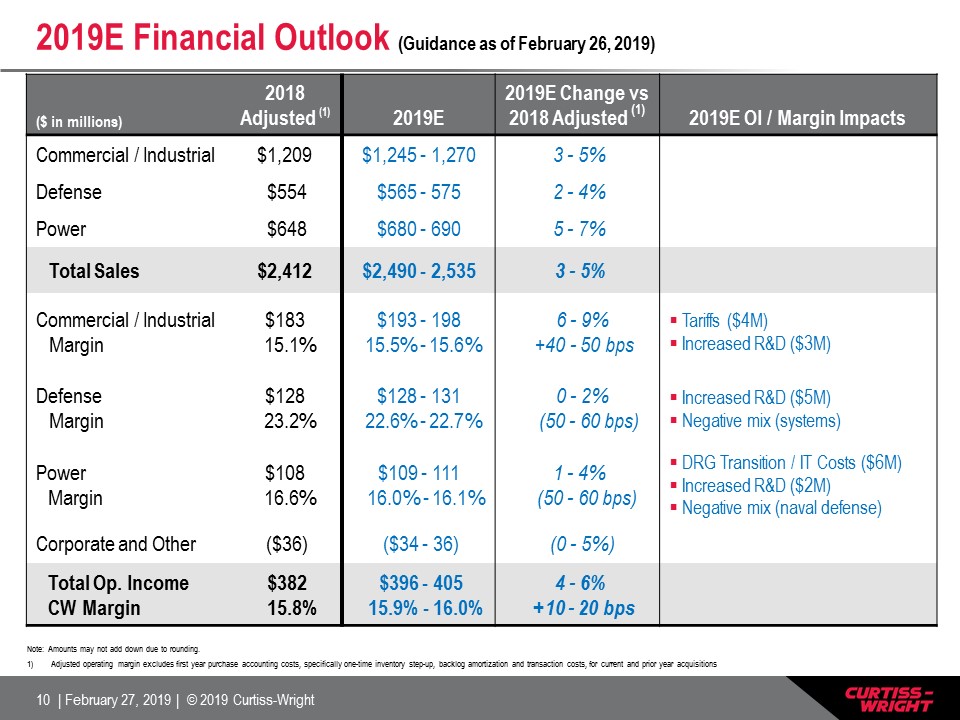

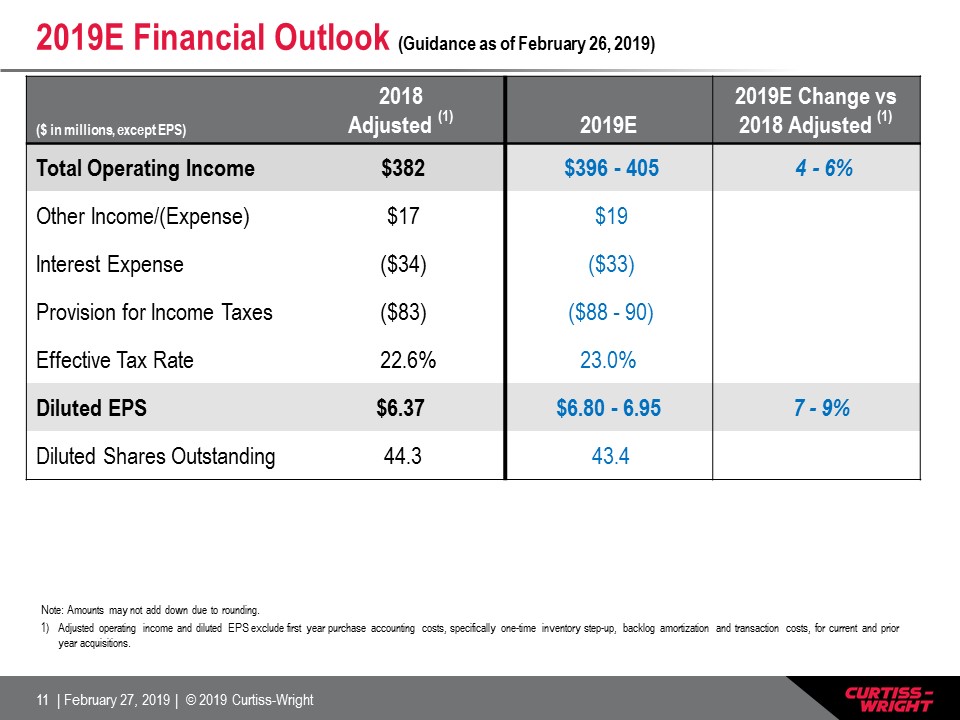

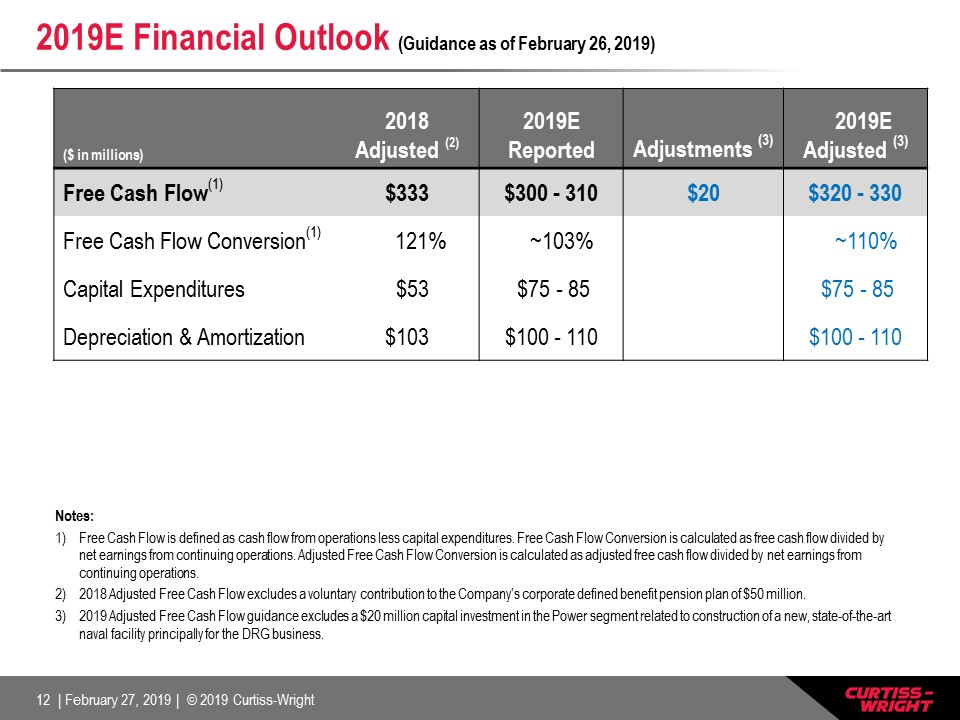

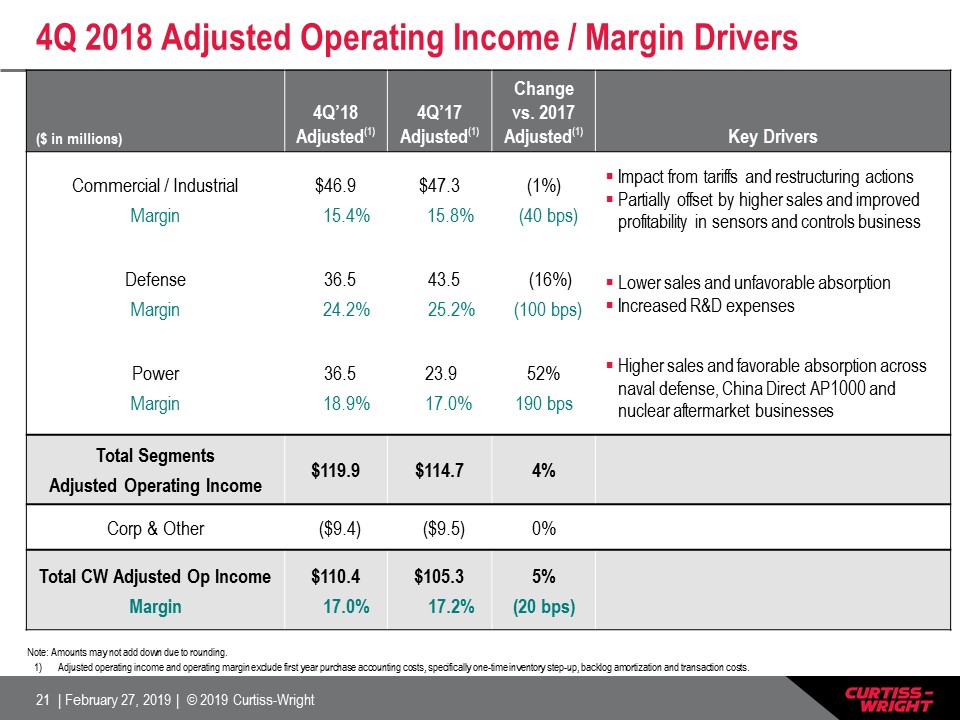

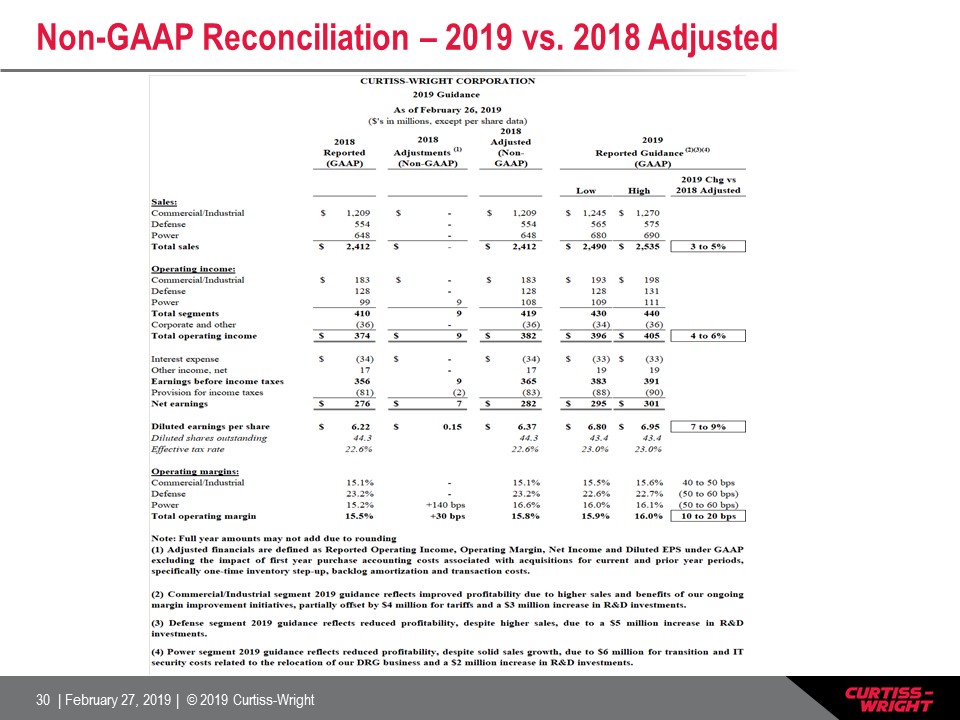

Appendix Non-GAAP Financial Results The company reports its financial performance in accordance with accounting principles generally accepted in the United States of America ("GAAP"). This press release refers to "Adjusted" amounts, which are Non-GAAP financial measures described below. We utilize a number of different financial measures in analyzing and assessing the overall performance of our business, and in making operating decisions, forecasting and planning for future periods. We consider the use of the non-GAAP measures to be helpful in assessing the performance of the ongoing operation of our business. We believe that disclosing non-GAAP financial measures provides useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. Beginning with the second quarter of 2018, coinciding with the initial reporting of the DRG acquisition, the Company elected to present its financials and guidance on an Adjusted, non-GAAP basis for operating income, operating margin, net earnings and diluted earnings per share to exclude first year purchase accounting costs associated with its acquisitions, specifically one-time inventory step-up, backlog amortization and transaction costs for current and prior year acquisitions. Management believes that this approach will provide improved transparency to the investment community in order to measure Curtiss-Wright’s core operating and financial performance, provide quarter-over-quarter comparisons excluding one-time items and show better comparisons among company peers. Reconciliations of non-GAAP to GAAP amounts are furnished with this presentation. All per share amounts are reported on a diluted basis. The following definitions are provided: Adjusted Operating Income, Operating Margin, Net Income and Diluted EPSThese Adjusted financials are defined as Reported Operating Income, Operating Margin, Net Income and Diluted EPS under GAAP excluding the impact of first year purchase accounting costs associated with acquisitions for current and prior year periods, specifically one-time inventory step-up, backlog amortization and transaction costs.