As filed with the Securities and Exchange Commission on December 6, 2013

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. o

Post-Effective Amendment No. o

ING Intermediate Bond Portfolio

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Suite 100, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-262-3862

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout, Jr.

ING U.S. Legal Services

7337 East Doubletree Ranch Road

Scottsdale, AZ 85258

(Name and Address of Agent for Service)

With copies to:

Philip H. Newman, Esq.

Goodwin Procter, LLP

Exchange Place

53 State Street

Boston, MA 02109

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on January 13, 2014, pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Title of Securities Being Registered: Class S of ING Intermediate Bond Portfolio

ING BOND PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 366-0066

January 24, 2014

Dear Shareholder:

On behalf of the Board of Trustees (the “Board”) of ING Bond Portfolio (“Bond Portfolio”), we are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of Bond Portfolio. The Special Meeting is scheduled for 1:00 P.M., Local time, on February 27, 2014, at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting shareholders of Bond Portfolio will be asked to vote on the proposed reorganization (the “Reorganization”) of Bond Portfolio with and into ING Intermediate Bond Portfolio (“Intermediate Bond Portfolio”) (together with Bond Portfolio, the “Portfolios,” each a “Portfolio”). Each Portfolio is a member of the mutual fund group called the “ING Funds.”

Shares of Bond Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (collectively, “Qualified Plans”) or, at your direction by your insurance company, through its separate accounts to serve as an investment option under your variable annuity contract or variable life insurance policy. If the Reorganization is approved by shareholders, the separate account in which you have an interest or the Qualified Plan in which you are a participant will own shares of Intermediate Bond Portfolio instead of shares of Bond Portfolio beginning on the date the Reorganization occurs. The Reorganization would provide the separate account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a larger combined Portfolio that seeks to maximize total return consistent with reasonable risk.

Formal notice of the Special Meeting appears on the next page, followed by a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”). The Reorganization is discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. After careful consideration, the Board recommends that you vote “FOR” the Reorganization.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please take the time to read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than February 26, 2014.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| Sincerely, |

| |

|

|

| Shaun P. Mathews |

| President and Chief Executive Officer |

(This page intentionally left blank)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

ING BOND PORTFOLIO

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 366-0066

Scheduled for February 27, 2014

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of ING Bond Portfolio (“Bond Portfolio”) is scheduled for 1:00 P.M., Local time on February 27, 2014 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting, Bond Portfolio’s shareholders will be asked:

1. To approve an Agreement and Plan of Reorganization by and between Bond Portfolio and ING Intermediate Bond Portfolio (“Intermediate Bond Portfolio”), providing for the reorganization of Bond Portfolio with and into Intermediate Bond Portfolio (the “Reorganization”); and

2. To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes.

Please read the enclosed combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) carefully for information concerning the Reorganization to be placed before the Special Meeting.

The Board of Trustees recommends that you vote “FOR” the Reorganization.

Shareholders of record as of the close of business on December 13, 2013 are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return promptly, but in no event later than February 26, 2014, the enclosed Proxy Ballot or Voting Instruction Card so that a quorum will be present and a maximum number of shares may be voted. Proxies or voting instructions may be revoked at any time before they are exercised by submitting a revised Proxy Ballot or Voting Instruction Card, by giving written notice of revocation to Bond Portfolio, or by voting in person at the Special Meeting.

| By Order of the Board of Trustees |

| |

|

|

| Huey P. Falgout, Jr. |

| Secretary |

January 24, 2014

(This page intentionally left blank)

PROXY STATEMENT/PROSPECTUS

January 24, 2014

Special Meeting of Shareholders

of ING Bond Portfolio

Scheduled for February 27, 2014

ACQUISITION OF THE ASSETS OF: | | BY AND IN EXCHANGE FOR SHARES OF: |

| | |

ING Bond Portfolio

(A series of ING Investors Trust)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 366-0066 | | ING Intermediate Bond Portfolio

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

(800) 992-0180 |

(each an open-end management investment company)

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on February 27, 2014

This Proxy Statement/Prospectus and Notice of Special Meeting are available at:www.proxyvote.com/ing

The Prospectus/Proxy Statement explains concisely what you should know before voting on the matter described herein or investing in ING Intermediate Bond Portfolio. Please read it carefully and keep it for future reference.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS PROXY STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TO OBTAIN MORE INFORMATION

To obtain more information about ING Bond Portfolio (“Bond Portfolio”) and ING Intermediate Bond Portfolio (“Intermediate Bond Portfolio,” and together with Bond Portfolio, the “Portfolios”), please write, call, or visit our website for a free copy of the current prospectus, statement of additional information, annual/semi-annual shareholder reports, or other information.

By Phone: | | (800) 992-0180 |

| | |

By Mail: | | ING Funds

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034 |

| | |

By Internet: | | www.ingfunds.com/vp/literature |

The following documents containing additional information about the Portfolios, each having been filed with the U.S. Securities and Exchange Commission (“SEC”), are incorporated by reference into this Proxy Statement/Prospectus:

1. The Statement of Additional Information dated January 24, 2014 relating to this Proxy Statement/Prospectus;

2. The Prospectus and Statement of Additional Information dated April 30, 2013 for Bond Portfolio; and

3. The Prospectus for Class S and Statement of Additional Information dated April 30, 2013 for Intermediate Bond Portfolio.

The Portfolios are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, and in accordance therewith, file reports and other information including proxy materials with the SEC.

You also may view or obtain these documents from the SEC:

In Person: | | Public Reference Section

100 F Street, N.E.

Washington, D.C. 20549

(202) 551-8090 |

| | |

By Mail: | | U.S. Securities and Exchange Commission

Public Reference Section

100 F Street, N.E.

Washington, D.C. 20549

(Duplication Fee Required) |

| | |

By Email: | | publicinfo@sec.gov

(Duplication Fee Required) |

| | |

By Internet: | | www.sec.gov |

When contacting the SEC, you will want to refer to the Portfolios’ SEC file numbers. The file number for the document listed above as (1) is [File No. generated with N-14 filing]. The file numbers for the documents listed above as (2) and (3) are 811-05629 and 811-02361, respectively.

TABLE OF CONTENTS

Introduction | 1 |

What is happening? | 1 |

Why did you send me this booklet? | 1 |

Who is eligible to vote? | 1 |

How do I vote? | 1 |

How does the Board recommend that I vote? | 1 |

When and where will the Special Meeting be held? | 1 |

Summary of the Proposed Reoranization | 2 |

Proposal One — Approval of the Reorganization | 3 |

What is the proposed Reorganization? | 3 |

Why is a Reorganization proposed? | 3 |

How do the Investment Objectives compare? | 3 |

How do the Annual Portfolio Operating Expenses compare? | 3 |

How do the Principal Investment Strategies compare? | 4 |

How do the Principal Risks compare? | 5 |

How does Bond Portfolio’s performance compare to Intermediate Bond Portfolio? | 8 |

How does the management of the Portfolios compare? | 9 |

What are the key differences in the rights of shareholders of Bond Portfolio and Intermediate Bond Portfolio? | 11 |

Additional Information about the Portfolios | 11 |

Additional Information about the Reorganization | 11 |

What is the Board’s recommendation? | 13 |

What factors did the Board consider? | 13 |

What is the required vote? | 13 |

What happens if shareholders do not approve the Reorganization? | 13 |

General Information about the Proxy Statement/Prospectus | 14 |

Who is asking for my vote? | 14 |

How is my proxy being solicited? | 14 |

What happens to my proxy once I submit it? | 14 |

Can I revoke my proxy after I submit it? | 14 |

How will my shares be voted? | 14 |

How many shares are outstanding? | 15 |

Can shareholders submit proposals for a future shareholder meeting? | 15 |

Why did my household only receive one copy of this Proxy Statement/Prospectus? | 15 |

Appendix A: Form of Agreement and Plan of Reorganization | 16 |

Appendix B: Additional Information Regarding ING Intermediate Bond Portfolio | 25 |

Portfolio Holdings Information | 25 |

How Shares Are Priced | 25 |

How to Buy and Sell Shares | 25 |

Frequent Trading - Market Timing | 26 |

Payments to Financial Intermediaries | 27 |

Dividends, Distributions, and Taxes | 27 |

FINANCIAL HIGHLIGHTS | 29 |

Appendix C: Security Ownership of Certain Beneficial and Record Owners | 30 |

INTRODUCTION

What is happening?

On September 13, 2013 the investment adviser to the ING Bond Portfolio (“Bond Portfolio”) and ING Intermediate Bond Portfolio (“Intermediate Bond Portfolio,” together with Bond Portfolio, the “Portfolios) proposed and the Board of Trustees (the “Board”) approved an Agreement and Plan of Reorganization (the “Reorganization Agreement”). The Reorganization Agreement provides for the reorganization of Bond Portfolio with and into Intermediate Bond Portfolio (the “Reorganization”). The Reorganization Agreement requires shareholder approval, and, if approved, is expected to be effective on March 14, 2014, or such other date as the parties may agree (the “Closing Date”).

Why did you send me this booklet?

Shares of Bond Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (“Qualified Plans”) or, at your direction, by your insurance company through its separate accounts (“Separate Accounts”) to serve as an investment option under your variable annuity and/or variable life contract (“Variable Contract”).

This booklet includes a combined proxy statement and prospectus (the “Proxy Statement/Prospectus”) and a Proxy Ballot or Voting Instruction Card for Bond Portfolio. It provides you with information you should review before providing voting instructions on the matters listed in the Notice of Special Meeting.

The Separate Accounts and Qualified Plans or their trustees, as record owners of Bond Portfolio shares are, in most cases, the true “shareholders” of Bond Portfolio; however, participants in Qualified Plans (“Plan Participants”) or holders of Variable Contracts (“Variable Contracts Holders”) may be asked to instruct their Qualified Plan trustee or Separate Accounts, as applicable, as to how they would like the shares attributed to their Qualified Plan or Variable Contract to be voted. For clarity and ease of reading, references to “shareholder” or “you” throughout this Proxy Statement/Prospectus do not refer to the technical shareholder but rather refer to the persons who are being asked to provide voting instructions with respect to the proposals, unless the context indicates otherwise. Similarly, for ease of reading, references to “voting” or “vote” do not refer to the technical vote but rather to the voting instructions provided by Variable Contracts Holders or Plan Participants.

Because you are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of Intermediate Bond Portfolio, this Proxy Statement also serves as a prospectus for Intermediate Bond Portfolio. Intermediate Bond Portfolio is an open-end management investment company, which seeks to maximize total return consistent with reasonable risk, as described more fully below.

Who is eligible to vote?

Shareholders holding an investment in shares of Bond Portfolio as of the close of business on December 13, 2013 (the “Record Date”) are eligible to vote at the Special Meeting or any adjournments or postponements thereof.

How do I vote?

You may submit your Proxy Ballot or Voting Instruction Card in one of four ways:

· By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card.

· By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot or Voting Instruction Card. You will be required to provide your control number located on the Proxy Ballot or Voting Instruction Card.

· By Mail. Mark the enclosed Proxy Ballot or Voting Instruction Card, sign and date it, and return it in the postage-paid envelope we provided. Joint owners must each sign the Proxy Ballot or Voting Instruction Card.

· In Person at the Special Meeting. You can vote your shares in person at the Special Meeting. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

To be certain your vote will be counted, a properly executed Proxy Ballot or Voting Instruction Card must be received no later than 5:00 P.M., Local time, on February 26, 2014.

How does the Board recommend that I vote?

The Board recommends that shareholders vote “FOR” the Reorganization.

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on February 27, 2014, at 1:00 P.M., Local time, and, if the Special Meeting is adjourned or postponed, any adjournments or postponements of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

1

SUMMARY OF THE PROPOSED REORANIZATION

You should read this entire Proxy Statement/Prospectus carefully. You should also review the Reorganization Agreement, which is attached hereto as Appendix A. For more information about Intermediate Bond Portfolio, please consult Appendix B and the Prospectus dated April 30, 2013.

Subject to shareholder approval, the Reorganization Agreement provides for:

· the transfer of all of the assets of Bond Portfolio to Intermediate Bond Portfolio in exchange for shares of beneficial interest of Intermediate Bond Portfolio;

· the assumption by Intermediate Bond Portfolio of all the liabilities of Bond Portfolio;

· the distribution of shares of Intermediate Bond Portfolio to the shareholders of Bond Portfolio; and

· the complete liquidation of Bond Portfolio.

If shareholders approve the Reorganization, each owner of shares of Bond Portfolio would become a shareholder of Class S shares of Intermediate Bond Portfolio. The Reorganization is expected to be effective on the Closing Date. Each shareholder of Bond Portfolio will hold, immediately after the Closing Date, shares of Intermediate Bond Portfolio having an aggregate value equal to the aggregate value of the shares of Bond Portfolio held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

· Bond Portfolio and Intermediate Bond Portfolio have substantially similar investment objectives and investment strategies.

· ING Investments, LLC (“ING Investments” or the “Adviser”) serves as adviser to both Portfolios. ING Investment Management Co. LLC (“ING IM”) serves as sub-adviser to both Portfolios.

· The gross and net expense ratios experienced by shareholders of Bond Portfolio are expected to decrease as a result of the Reorganization.

· As of June 30, 2013, Bond Portfolio had approximately $415 million in net assets and Intermediate Bond Portfolio had approximately $2.1 billion in net assets.

· The Reorganization will not affect a shareholder’s right to purchase, redeem, or exchange shares of the Portfolios. In addition, the Reorganization will not affect how shareholders purchase and sell their shares.

· Each Portfolio is distributed by ING Investments Distributor, LLC (the “Distributor”).

· The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither Bond Portfolio nor its shareholders, nor Intermediate Bond Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

2

PROPOSAL ONE — APPROVAL OF THE REORGANIZATION

What is the proposed Reorganization?

Shareholders of Bond Portfolio are being asked to approve a Reorganization Agreement, providing for the reorganization of Bond Portfolio with and into Intermediate Bond Portfolio. If the Reorganization is approved, shareholders in Bond Portfolio will become shareholders in Intermediate Bond Portfolio as of the close of business on the Closing Date.

Why is a Reorganization proposed?

The Adviser and its affiliates are in the process of conducting a comprehensive review of the mutual funds offered within the ING Funds Complex. At the September 2013 Board Meeting, the Adviser presented to the Board a series of proposals, including the Reorganization, which were intended to, among other things, enhance the efficiency and reduce the complexity of the ING Funds Complex. In support of its proposal, ING Investments noted that both Bond Portfolio and Intermediate Bond Portfolio have the same portfolio managers and are managed pursuant to substantially similar investment strategies. In addition, the Adviser noted that Intermediate Bond Portfolio had lower gross and net expenses.

How do the Investment Objectives compare?

As described in the chart that follows, the Portfolios have substantially similar investment objectives.

| | Bond Portfolio | | Intermediate Bond Portfolio | |

Investment Objective | | The Portfolio seeks to provide maximum total return through income and capital appreciation. | | The Portfolio seeks to maximize total return consistent with reasonable risk. The Portfolio seeks its objective through investments in a diversified portfolio consisting primarily of debt securities. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. | |

How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. Pro forma fees and expenses, which are the estimated fees and expenses of Intermediate Bond Portfolio after giving effect to the Reorganization, assume that the Reorganization occurred on June 30, 2013. Both the gross and net expenses of Intermediate Bond Portfolio are lower than the gross and net expenses of Bond Portfolio. This table does not reflect fees or expenses that are, or may be, imposed under your Variable Contract or a Qualified Plan. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator.

Annual Portfolio Operating Expenses

Expenses you pay each year as a % of the value of your investment

| | Bond

Portfolio | | Intermediate

Bond Portfolio

Class S | | Intermediate

Bond Portfolio

Class S

Pro Forma(1) | |

Management Fee | | 0.48 | %(2) | 0.40 | % | 0.40 | % |

Distribution and/or Shareholder Services (12b-1) Fees | | 0.60 | % | 0.25 | % | 0.25 | % |

Administrative Services Fee | | 0.10 | %(3) | 0.06 | % | 0.06 | % |

Other Expenses | | 0.06 | % | 0.04 | % | 0.04 | % |

Acquired Fund Fees and Expenses. | | 0.01 | % | None | | None | |

Total Annual Portfolio Operating Expenses | | 1.25 | %(4) | 0.75 | % | 0.75 | % |

Waivers and Reimbursements | | (0.49 | )%(5) | None | | 0.00 | %(6) |

Total Annual Portfolio Operating Expenses after Waivers and Reimbursements | | 0.76 | % | 0.75 | % | 0.75 | % |

(1) Expense ratios have been adjusted to reflect current expense rates.

(2) Prior to July 20, 2012, the Portfolio operated as a feeder fund and invested all of its assets in Class 1 shares of a master fund, the American Funds Insurance Series® Bond Fund (“Master Fund”), and the management fee previously paid by the Portfolio was that of the Master Fund. This management fee was not paid to the Adviser.

(3) Prior to July 20, 2012, the Portfolio did not pay an administrative services fee.

(4) Total Annual Portfolio Operating Expenses may be higher than the Portfolio’s ratio of expenses to average net assets shown in the Portfolio’s Financial Highlights, which reflects the operating expenses of the Portfolio and does not include Acquired Fund Fees and Expenses.

(5) The adviser is contractually obligated to limit expenses to 0.99% through May 1, 2015; the obligation does not extend to interest, taxes, brokerage commissions, Acquired Fund Fees and Expenses, and extraordinary expenses. The obligation will automatically renew for one-year terms unless: (i) the adviser provides 90 days written notice of its termination; and (ii) such termination is approved by the Board; or (iii) the Investment Advisory Agreement has been terminated. The obligation is subject to possible recoupment by the adviser within three years. In addition, the distributor is contractually obligated to waive a portion of its distribution fee such that the Portfolio’s Total Annual Portfolio Operating Expenses after Waivers and Reimbursements do not exceed 0.75% through May 1, 2015. There is no guarantee that the distribution fee waiver will continue after May 1, 2015. The distribution fee waiver will renew if the distributor elects to renew it. Any fees waived pursuant to the distribution fee waiver shall not be eligible for recoupment. Notwithstanding the foregoing, termination or modification of this distribution fee waiver requires approval by the Portfolio’s Board.

3

(6) If shareholders approve the Reorganization, the Adviser is contractually obligated to limit expenses to 0.80% for Class S through May 1, 2015. The obligation does not extend to interest, taxes, brokerage commissions, Acquired Fund Fees and Expenses, and extraordinary expenses. The obligation will automatically renew for one-year terms unless: (i) the adviser provides 90 days written notice of its termination; and (ii) such termination is approved by the Board; or (iii) the Investment Advisory Agreement has been terminated. The obligation is subject to possible recoupment by the adviser within three years.

Expense Examples

The Examples are intended to help you compare the costs of investing in shares of the Portfolios with the costs of investing in other mutual funds. The Examples do not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Examples assume that you invest $10,000 in the Portfolios for the time periods indicated. The Examples also assume that your investment had a 5% return during each year and that the Portfolios’ operating expenses remain the same. Although your actual costs may be higher or lower based on these assumptions your costs would be:

Bond Portfolio | | Intermediate Bond Portfolio | | Intermediate Bond Portfolio

Pro Forma | |

1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | |

$ | 78 | | 348 | | 639 | | 1,468 | | 77 | | 240 | | 417 | | 930 | | 77 | | 240 | | 417 | | 930 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

The Examples reflect applicable expense limitation agreements, and/or waivers in effect, if any, for the one-year period, and the first of the three-, five-, and ten-year periods.

How do the Principal Investment Strategies compare?

As described in more detail in the table that follows, the Portfolios have substantially similar investment strategies. Both Portfolios invest primarily in a portfolio of bonds and seek to maintain an average portfolio quality rating of at least investment grade. Both Portfolios may invest a portion of their assets in high-yield debt instruments (commonly referred to as “junk bonds”), foreign securities, and derivatives.

| | Bond Portfolio | | Intermediate Bond Portfolio |

Investment Strategies | | Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in a portfolio of bonds. The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in the investment policy. Bonds include, but are not limited to, corporate, government, and mortgage bonds, which, at the time of purchase, are rated investment-grade. Investment-grade bonds are rated at least BBB- by Standard & Poor’s Rating Services or BBaa3 by Moody’s Investors Service, Inc., have an equivalent rating by a nationally recognized statistical rating organization, or, if unrated, are determined by the sub-adviser (“Sub-Adviser”) to be of comparable quality. The Portfolio may also invest in: preferred stocks; high quality money market instruments; municipal bonds; debt instruments of foreign issues (including those located in emerging market countries); securities denominated in foreign currencies; foreign currencies; mortgage-backed and asset-backed securities; bank loans and floating rate secured loans (“Senior Loans”); and derivatives including futures, options and swaps involving securities, securities indices and interest rates, which may be denominated in the U.S. dollar or foreign currencies. Although the Portfolio may invest a portion of its assets in high-yield (high risk) debt instruments, commonly referred to as “junk bonds,” rated below investment grade, the Portfolio will seek to maintain a minimum average portfolio quality rating of at least investment-grade. Generally, the Sub-Adviser maintains a dollar-weighted average duration between three and ten years. Duration is the most commonly used measure of risk in debt instruments as it incorporates multiple features of the debt instruments (e.g., yield, coupon, maturity, etc.) into one number. Duration is a measure of sensitivity to the price of a debt security to a change in interest rates. Duration is weighted average of the times that interest payments and the final return of principal are received. The weights are the amounts of the instrument. Duration is expressed as a number of | | Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in a portfolio of bonds, including but not limited to corporate, government and mortgage bonds, which, at the time of purchase, are rated investment-grade (e.g., rated at least BBB- by Standard & Poor’s Rating Services or Baa3 by Moody’s Investors Services, Inc.) or have an equivalent rating by a nationally recognized statistical rating organization, or are of comparable quality if unrated. The Portfolio will provide shareholders with at least 60 days’ prior notice of any change in this investment policy. Although the Portfolio may invest a portion of its assets in high-yield (high risk) debt instruments, commonly referred to as “junk bonds,” rated below investment grade, the Portfolio will seek to maintain a minimum average portfolio quality rating of at least investment-grade. Generally, the sub-adviser (“Sub-Adviser”) maintains a dollar-weighted average duration between three and ten years. Duration is the most commonly used measure of risk in debt instruments as it incorporates multiple features of the debt instruments (e.g., yield, coupon, maturity, etc.) into one number. Duration is a measure of sensitivity to the price of a debt security to a change in interest rates. Duration is weighted average of the times that interest payments and the final return of principal are received. The weights are the amounts of the instrument. Duration is expressed as a number of years. The bigger the duration number, the greater the interest-rate risk or reward for the debt instrument prices. For example, the price of a bond with an average duration of five years would be expected to fall approximately 5% if interest rates rose by one percentage point. Conversely, the price of a bond with an average duration of five years would be expected to rise approximately 5% if interest rates drop by one percentage point. The Portfolio may also invest in: preferred stocks; high quality money market instruments; municipal bonds; debt instruments of foreign issues (including those located in emerging market countries); securities |

4

| | Bond Portfolio | | Intermediate Bond Portfolio |

| | years. The bigger the duration number, the greater the interest-rate risk or reward for the debt instrument prices. For example, the price of a bond with an average duration of five years would be expected to fall approximately 5% if interest rates rose by one percentage point. Conversely, the price of a bond with an average duration of five years would be expected to rise approximately 5% if interest rates drop by one percentage point. The Portfolio typically uses derivatives to reduce exposure to other risks, such as interest rate or currency risk, to substitute for taking a position in the underlying assets, and/or to enhance returns in the Portfolio. The Portfolio may seek to obtain exposure to the securities in which it invests by entering into a series of purchase and sale contracts or through other investment techniques such as buy backs and dollar rolls. The Portfolio may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations and exemptive orders thereunder (the “1940 Act”). The investment process focuses on buy bonds at a discount to their intrinsic value. The Sub-Adviser utilizes proprietary quantitative techniques to identify bonds or sectors that are inexpensive relative to other bonds or sectors that are inexpensive relative to other bonds or sectors based on their historical price relationships. Teams of asset specialists use this relative value analysis to guide them in the security selection process. The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 331/3% of its total assets. | | denominated in foreign currencies; foreign currencies; mortgage-backed and asset-backed securities; bank loans and floating rate secured loans (“Senior Loans”); and derivatives including futures, options and swaps involving securities, securities indices and interest rates, which may be denominated in the U.S. dollar or foreign currencies. The Portfolio typically uses derivatives to reduce exposure to other risks, such as interest rate or currency risk, to substitute for taking a position in the underlying assets, and/or to enhance returns in the Portfolio. The Portfolio may seek to obtain exposure to the securities in which it invests by entering into a series of purchase and sale contracts or through other investment techniques such as buy backs and dollar rolls. The Portfolio may invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended, and the rules, regulations and exemptive orders thereunder (the “1940 Act”). The Sub-Adviser believes that the relationship between the drivers of debt instrument returns change over time and that recognizing this is key to managing debt instrument assets. Therefore, the Sub-Adviser employs a dynamic investment process that balances top-down macroeconomic considerations and fundamental bottom-up analysis during the steps of its investment process — sector allocation, security selection, duration and yield curve management. This includes leveraging proprietary qualitative analysis along with quantitative tools throughout the portfolio construction process. The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 331/3% of its total assets. |

How do the Principal Risks compare?

Because the Portfolios have similar investment objectives, many of the risks of investing in Intermediate Bond Portfolio are the same as the risks of investing in Bond Portfolio. The following summarizes and compares the principal risks of investing in the Portfolios.

Risks | | Bond Portfolio | | Intermediate

Bond Portfolio |

Call During periods of falling interest rates, a bond issuer may “call” or repay its high-yielding bond before the bond’s maturity date. If forced to invest the unanticipated proceeds at lower interest rates, the Portfolio would experience a decline in income. | | ü | | ü |

| | | | |

Company The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. | | ü | | ü |

5

Risks | | Bond Portfolio | | Intermediate

Bond Portfolio |

Credit Prices of bonds and other debt instruments can fall if the issuer’s actual or perceived financial health deteriorates, whether because of broad economic or issuer-specific reasons. In certain cases, the issuer could be late in paying interest or principal, or could fail to pay altogether. | | ü | | ü |

| | | | |

Currency To the extent that the Portfolio invests directly in foreign (non-U.S.) currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those foreign (non-U.S.) currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. | | ü | | ü |

| | | | |

Derivative Instruments Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The use of certain derivatives may also have a leveraging effect which may increase the volatility of the Portfolio and reduce its returns. Derivatives may not perform as expected, so the Portfolio may not realize the intended benefits. When used for hedging, the change in value of a derivative may not correlate as expected with the currency, security, or other risk being hedged. In addition, given their complexity, derivatives expose the Portfolio to the risk of improper valuation. | | ü | | ü |

| | | | |

Foreign Investments/Developing and Emerging Markets Investing in foreign (non-U.S.) securities may result in the Portfolio experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to: smaller markets; differing reporting, accounting, and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage, or replacement; potential for default on sovereign debt; or political changes or diplomatic developments. Markets and economies throughout the world are becoming increasingly interconnected, and conditions or events in one market, country or region may adversely impact investments or issuers in another market, country or region. Foreign investment risks may be greater in developing and emerging markets than in developed markets. | | ü | | ü |

| | | | |

High-Yield Securities Investments rated below investment-grade (or of similar quality if unrated) are known as “high-yield securities” or “junk bonds.” High-yielding securities are subject to greater levels of credit and liquidity risks. High-yielding securities are considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments. | | ü | | ü |

| | | | |

Interest in Loans The value and income streams of interests in loans (including participation interests in lease financings and assignments in secured variable or floating rate loans) will decline if borrowers delay payments or fail to pay altogether. A large rise in interest rates could increase this risk. Although loans are generally fully collateralized when purchased, the collateral may become illiquid or decline in value. Many loans themselves carry liquidity and valuation risks. | | ü | | ü |

| | | | |

Interest Rate With bonds and other fixed rate debt instruments, a rise in interest rates generally causes values to fall; conversely, values generally rise as interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk. In the case of inverse securities, the interest rate generally will decrease when the market rate of interest to which the inverse security is indexed decreases. As of the date of this Prospectus/Proxy Statement, interest rates in the United States are at or near historic lows, which may increase the Portfolio’s exposure to risks associated with rising interest rates. | | ü | | ü |

| | | | |

Investment Model The manager’s proprietary model may not adequately allow for existing or unforeseen market factors or the interplay between such factors. | | ü | | ü |

| | | | |

Liquidity If a security is illiquid, the Portfolio might be unable to sell the security at a time when the Portfolio’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the Portfolio’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Portfolio could realize upon disposition. The Portfolio may make investments that become less liquid in response to market developments or adverse investor perception. The Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the Portfolio. | | ü | | ü |

6

Risks | | Bond Portfolio | | Intermediate

Bond Portfolio |

Market Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. Stock markets tend to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. Additionally, legislative, regulatory or tax policies or developments in these areas may adversely impact the investment techniques available to a manager, add to Portfolio costs and impair the ability of the Portfolio to achieve its investment objectives. | | ü | | ü |

| | | | |

Mortgage- and/or Asset-Backed Securities Defaults on or the low credit quality or liquidity of the underlying assets of the asset-backed (including mortgage-backed) securities held by the Portfolio may impair the value of the securities. There may be limitations on the enforceability of any security interest granted with respect to those underlying assets. These securities also present a higher degree of prepayment and extension risk and interest rate risk than do other types of fixed-income securities. | | ü | | ü |

| | | | |

Municipal Obligations The municipal market in which the Portfolio invests is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities. | | ü | | ü |

| | | | |

Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because the Portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of the Portfolio. | | ü | | ü |

| | | | |

Prepayment and Extension Prepayment risk is the risk that principal on mortgages or other loan obligations underlying a security may be repaid prior to the stated maturity date, which may reduce the market value of the security and the anticipated yield-to-maturity. Extension risk is the risk that an issuer will exercise its right to repay principal on an obligation held by the Portfolio later than expected, which may decrease the value of the obligation and prevent the Portfolio from investing expected repayment proceeds in securities paying yields higher than the yields paid by the securities that were expected to be repaid. | | ü | | ü |

| | | | |

Securities Lending Securities lending involves two primary risks: “investment risk” and “borrower default risk.” Investment risk is the risk that the Portfolio will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that the Portfolio will lose money due to the failure of a borrower to return a borrowed security in a timely manner. | | ü | | ü |

| | | | |

Sovereign Debt These securities are issued or guaranteed by foreign government entities. Investments in sovereign debt are subject to the risk that a government entity may delay payment, restructure its debt, or refuse to pay interest or repay principal on its sovereign debt. Some of these reasons may include cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of its debt position to its economy or its failure to put in place economic reforms required by the International Monetary Fund or other multilateral agencies. If a government entity defaults, it may ask for more time in which to pay or for further loans. There is no legal process for collecting sovereign debts that a government does not pay or a bankruptcy proceeding by which all or a part of the sovereign debt that a government entity has not repaid may be collected. | | ü | | |

| | | | |

U.S. Government Securities and Obligations U.S. government securities are obligations of, or guaranteed by, the U.S. government, its agencies or government-sponsored enterprises. U.S. government securities are subject to market and interest rate risk, and may be subject to varying degrees of credit risk. | | ü | | ü |

7

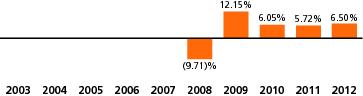

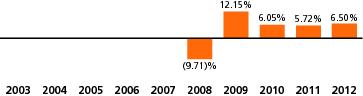

How does Bond Portfolio’s performance compare to that of Intermediate Bond Portfolio?

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar chart shows the changes in Bond Portfolio’s performance and Intermediate Bond Portfolio’s Class S shares’ performance from year to year, and the table compares each Portfolio’s performance to the performance of a broad-based securities market index for the same period. Each Portfolio’s performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolio’s performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolios’ past performance is no guarantee of future results.

ING Bond Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd, 2009, 5.88% and Worst quarter: 3rd, 2008, (5.64)%

ING Intermediate Bond Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 3rd, 2009, 7.10% and Worst quarter: 3rd, 2008, (4.42)%

Average Annual Total Returns%

(for the periods ended December 31, 2012)

| | | | 1 Year | | 3 Years | | 5 Years | | 10 Years

(or life of the class) | | Inception

Date | |

Bond Portfolio(1) | | % | | 6.50 | | 6.09 | | 3.87 | | 3.75 | | 11/12/07 | |

BCAB Index(2) | | % | | 4.21 | | 6.19 | | 5.95 | | 6.17 | (4) | — | |

| | | | | | | | | | | | | |

Intermediate Bond Portfolio (Class S)(3) | | % | | 9.08 | | 8.63 | | 5.44 | | 5.02 | | 05/03/02 | |

BCAB Index(2) | | % | | 4.21 | | 6.19 | | 5.95 | | 5.18 | | — | |

(1) Prior to July 2012, Bond Portfolio operated as a “master-feeder” structure, wherein it invested all of its assets in Class 1 shares of the American Funds Insurance Series® Bond Fund (the “Master Fund”). Performance prior to that date is attributable to the Master Fund.

(2) The index returns do not reflect deductions for fees, expenses, or taxes.

(3) Christine Hurtsellers began serving as a portfolio manager to Intermediate Bond Portfolio in January 2009. Matthew Toms began serving as a portfolio manager in August 2010. Performance prior to that period is attributable to a different portfolio management team.

(4) Reflects index performance since the date closest to the Portfolio’s inception for which data is available.

8

How does the management of the Portfolios compare?

The following table describes the management of the Portfolios.

| | Bond Portfolio | | Intermediate Bond Portfolio |

Investment Adviser | | ING Investments, LLC

(“ING Investments” or the “Adviser”) | | ING Investments |

| | | | |

Investment Advisory Fee

(as a percentage of average daily net assets) | | 0.480% of the first $600 million of assets;

0.440% on the next $400 million of assets;

0.400% on the next $1 billion of assets;

0.380% on the next $1 billion of assets

0.360% on assets in excess of $3 billion. | | Currently:

0.400% on all assets If the Reorganization is approved by shareholders;

0.400% on the 1st $4 billion;

0.380% on the next $3 billion; and

0.360% on all assets thereafter(1) |

| | | | |

Sub-Adviser | | ING Investment Management Co. LLC

(“ING IM”) | | ING IM |

| | | | |

Sub-Advisory Fee

(as a percentage of average daily net assets) | | 0.216% on the first $600 million;

0.198% on the next $400 million;

0.180% on the next $1 billion;

0.171% on the next $1 billion;

0.162% on all assets thereafter | | 0.180% on all assets |

| | | | |

Portfolio Managers | | Christine Hurtsellers, CFA

Matthew Toms | | Christine Hurtsellers, CFA

Matthew Toms |

| | | | |

Administrator | | ING Funds Services, LLC

(the “Administrator”) | | Administrator |

| | | | |

Administrative Fee

(as a percentage of average daily net assets) | | 0.100% on all assets | | 0.055% on the first $5 billion;

0.030% on all assets thereafter |

| | | | |

Distributor | | ING Investment Distributor, LLC

(the “Distributor”) | | Distributor |

(1) At the October 2013 Board Meeting, the Board also approved the reorganization of ING PIMCO Total Return Bond Portfolio, a separate series of ING Investors Trust, with and into Intermediate Bond Portfolio. If approved by shareholders of ING PIMCO Total Return Bond Portfolio, this reorganization is also expected to occur in March 2014. This advisory fee is contingent upon shareholder approval of the reorganization of either Bond Portfolio or ING PIMCO Total Return Bond Portfolio into Intermediate Bond Portfolio.

Advisers to the Portfolios

ING Investments, an Arizona limited liability company, serves as the investment adviser to the Portfolios. ING Investments has overall responsibility for the management of the Portfolios. ING Investments oversees all investment advisory and portfolio management services for the Portfolios. ING Investments is registered with the SEC as an investment adviser.

The Adviser is an indirect, wholly-owned subsidiary of ING U.S., Inc. (“ING U.S.”). ING U.S. is a U.S.-based financial institution whose subsidiaries operate in the retirement, investment, and insurance industries. As of the date of this Prospectus, ING U.S. is a majority-owned subsidiary of ING Groep N.V. (“ING Groep”). ING Groep is a global financial institution of Dutch origin, with operations in more than 40 countries.

In October 2009, ING Groep submitted a restructuring plan (the “Restructuring Plan”) to the European Commission in order to receive approval for state aid granted to ING Groep by the Kingdom of the Netherlands in November 2008 and March 2009. To receive approval for this state aid, ING Groep was required to divest its insurance and investment management businesses, including ING U.S., before the end of 2013. In November 2012, the Restructuring Plan was amended to permit ING Groep additional time to complete the divestment. Pursuant to the amended Restructuring Plan, ING Groep must divest at least 25% of ING U.S. by the end of 2013, more than 50% by the end of 2014, and the remaining interest by the end of 2016 (such divestment, the “Separation Plan”).

In May 2013, ING U.S. conducted an initial public offering of ING U.S. common stock (the “IPO”). On September 13, 2013, ING U.S. filed a new Registration Statement on Form S-1 with the U.S. Securities and Exchange Commission (the “SEC”) in connection with another potential public offering of ING U.S. common stock held by ING Groep. ING U.S. will did not issue or sell common stock in the offering. On October 23, 2013, ING U.S. announced the pricing of 33 million shares of its common stock being offered by ING Groep in this offering. Closing of the offering occurred on October 29, 2013. ING Groep also granted the underwriters in the offering an option exercisable within 30 days, to acquire up to approximately an additional 5 million shares from ING Groep. This option was exercised in full. ING U.S. did not receive any proceeds from the offering.

ING Groep continues to own a majority of the common stock of ING U.S. ING Groep has stated that it intends to sell its remaining controlling ownership interest in ING U.S. over time. While the base case for the remainder of the Separation Plan is the

9

divestment of ING Groep’s remaining interest in one or more broadly distributed offerings, all options remain open and it is possible that ING Groep’s divestment of its remaining interest in ING U.S. may take place by means of a sale to a single buyer or group of buyers.

It is anticipated that one or more of the transactions contemplated by the Separation Plan would result in the automatic termination of the existing advisory and sub-advisory agreements under which the Adviser and sub-adviser provide services to each Portfolio. In order to ensure that the existing investment advisory and sub-advisory services can continue uninterrupted, the Board approved new advisory and sub-advisory agreements for the Portfolios in connection with the IPO. Shareholders of the Portfolios approved new investment advisory and sub-advisory agreements prompted by the IPO, as well as any future advisory and sub-advisory agreements prompted by the Separation that are approved by the Board and whose terms are not materially different from the current agreements. This means that shareholders may not have another opportunity to vote on a new agreement with the Adviser or an affiliated sub-adviser even if they undergo a change of control, as long as no single person or group of persons acting together gains “control” (as defined in the 1940 Act) of ING U.S.

The Separation Plan, whether implemented through public offerings or other means, may be disruptive to the businesses of ING U.S. and its subsidiaries, including the Adviser and affiliated entities that provide services to the Portfolios, and may cause, among other things, interruption of business operations or services, diversion of management’s attention from day-to-day operations, reduced access to capital, and loss of key employees or customers. The completion of the Separation Plan is expected to result in the Adviser’s loss of access to the resources of ING Groep, which could adversely affect its business. It is anticipated that ING U.S., as a stand-alone entity, may be a publicly held U.S. company subject to the reporting requirements of the Securities Exchange Act of 1934 as well as other U.S. government and state regulations, and subject to the risk of changing regulation.

During the time that ING Groep retains a majority interest in ING U.S., circumstances affecting ING Groep, including restrictions or requirements imposed on ING Groep by European and other authorities, may also affect ING U.S. A failure to complete the Separation Plan could create uncertainty about the nature of the relationship between ING U.S. and ING Groep, and could adversely affect ING U.S. and the Adviser and its affiliates. Currently, the Adviser and its affiliates do not anticipate that the Separation Plan will have a material adverse impact on their operations or the Portfolios and their operations.

ING Investments’ principal office is located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. As of December 31, 2012, ING Investments managed approximately $46.2 billion in assets.

Sub-Adviser to the Portfolios

ING IM serves as sub-adviser to the Portfolios. ING IM is a Delaware limited liability company, was founded in 1972 and is registered with the SEC as an investment adviser. ING IM is an indirect, wholly-owned subsidiary of ING U.S. and is an affiliate of ING Investments. ING IM has acted as adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. The principal office of ING IM is located at 230 Park Avenue, New York, New York 10169. As of December 31, 2012, ING IM managed approximately $66.3 billion in assets.

The following individuals are jointly responsible for the day-to-day management of Portfolios.

Christine Hurtsellers, CFA, Portfolio Manager, has been with ING IM since 2005 and leads the fixed-income business for ING IM. From 1999 to 2005, Ms. Hurtsellers worked at Freddie Mac® where she managed adjustable-rate mortgages, mortgage-backed securities, collateralized mortgage obligations, and mortgage derivatives portfolios. Ms. Hurtsellers also managed portfolios for Alliance Capital Management and Banc One.

Matthew Toms, CFA, Portfolio Manager, joined ING IM in September, 2009 as Senior Vice President and Head of U.S. Public Fixed-Income Investments. In this role, Mr. Toms directly oversees the investment teams responsible for investment-grade corporate, high-yield corporate, structured product, and money market strategies for the general account as well as external client business; as well as ensures coordination of credit strategies across developed and emerging markets. Prior to joining ING IM, Mr. Toms was employed by Calamos Investments from March, 2007 to September, 2009, where he established and grew their fixed-income business. From May 2000 to March 2007, Mr. Toms was employed by Northern Trust and Lincoln National in various different roles.

Administrator

The Administrator serves as administrator to each Portfolio. With respect to Intermediate Bond Portfolio, the Administrator receives an annual administrative services fee equal to 0.055% on the first $5 billion of daily net assets and 0.03% thereafter of the Portfolio’s average daily net assets. With respect to Bond Portfolio, the Administrator receives an annual administrative services fee equal to 0.10% of the Portfolio’s average daily net assets.

The administrative services provided to each Portfolio includes acting as a liaison among the various service providers to the Portfolio, including the custodian, portfolio accounting agent, the Sub-Adviser, and the insurance companies to which a Portfolio offers its shares. The Administrator also reviews the Portfolios for compliance with applicable legal requirements and monitors the Sub-Adviser for compliance with requirements under applicable law and with the investment policies and restrictions of the Portfolios.

Distributor

The Distributor is the principal underwriter and distributor of each Portfolio. It is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

10

The Distributor is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

What are the key differences in the rights of shareholders of Bond Portfolio and Intermediate Bond Portfolio?

Bond Portfolio is a separate series of ING Investors Trust, an open-end management investment company organized as a Massachusetts business trust. Intermediate Bond Portfolio is an open-end management investment company organized as a Massachusetts business trust. Both Portfolios are governed by a board of trustees consisting of the same 12 members. For more information on the history of ING Investors Trust or Intermediate Bond Portfolio, see each Portfolio’s SAI dated April 30, 2013.

Each Portfolio is organized as a Massachusetts business trust or series thereof, which is governed by a Declaration of Trust and Bylaws. Under Massachusetts law, shareholders of a Massachusetts business trust, under certain circumstances, could be held personally liable for the obligations of the business trust. However, both Bond Portfolio and Intermediate Bond Portfolio operate under a Declaration of Trust that disclaims shareholder liability for acts or obligations of the Portfolio. As such, shareholders have no personal liability for the Portfolio’s acts or obligations.

The key differences are described in the table below.

| | Bond Portfolio | | Intermediate Bond Portfolio |

Quorum | | Except as otherwise provided by law, the holders of thirty percent of the outstanding Shares of each Series or Class present in person or by proxy shall constitute a quorum for the transactions of any business at any meeting of Shareholders. | | At Any Shareholder meeting, unless otherwise provided by law, this Declaration, or the by-laws, the presence in person or by proxy of a majority of the votes entitled to be cast constitutes a quorum. |

| | | | |

Termination | | The Trust, or any Series or Class thereof, may be terminated by the affirmative vote of a majority of the Trustees. | | The Trust or any Series thereof may be terminated by (i) the affirmative vote of the holders of a majority of the Shares entitled to vote at any meeting of Shareholders or (ii) by an instrument in writing signed by a majority of the Trustees. |

Additional Information about the Portfolios

Dividends and Other Distributions

Each Portfolio declares and pays dividends from net investment income at least annually. Each Portfolio will also pay distributions from net realized capital gains, reduced by available capital losses, at least annually. All dividend and capital gains distributions will be automatically reinvested in additional shares of the Portfolios at the net asset value (“NAV”) of such shares on the payment date unless a participating insurance company’s Separate Account is permitted to hold cash and elects to receive payment in cash. From time to time, a portion of a Portfolio’s distributions may constitute a return of capital.

To comply with federal tax regulations, the Portfolios may also pay an additional capital gains distribution.

Capitalization

The following table shows on an unaudited basis the capitalization of each of the Portfolios as of June 30, 2013 and on a pro forma basis as of June 30, 2013, giving effect to the reorganization.

| | Bond Portfolio | | Intermediate Bond

Portfolio | | Adjustments | | Intermediate Bond

Portfolio

Pro Forma | |

Net Assets | | $ | 415,078,591 | | $ | 1,143,399,409 | | — | | $ | 1,558,478,000 | |

Net Asset Value Per Share | | $ | 10.19 | | $ | 12.65 | | — | | $ | 12.65 | |

Shares Outstanding | | 40,725,530 | | 90,395,947 | | (7,912,993 | )(1) | 123,208,484 | |

(1) Reflects new shares issued, net of retired shares of ING Bond Portfolio. (Calculation: Net Assets ÷ NAV per share.)

Additional Information about the Reorganization

The Reorganization Agreement

The terms and conditions under which the proposed transaction may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below; however, this summary is qualified in its entirety by reference to the Reorganization Agreement, a copy of which is attached to this Proxy Statement/Prospectus as Appendix A.

11

The Reorganization Agreement provides for: (i) the transfer, as of the Closing Date, of all of the assets of Bond Portfolio in exchange for shares of beneficial interest of Intermediate Bond Portfolio and the assumption by Intermediate Bond Portfolio of all of Bond Portfolio’s liabilities; and (ii) the distribution of shares of Intermediate Bond Portfolio to shareholders of Bond Portfolio, as provided for in the Reorganization Agreement. Bond Portfolio will then be liquidated.

Each shareholder of shares of Bond Portfolio will hold, immediately after the Closing Date, Class S shares of Intermediate Bond Portfolio having an aggregate value equal to the aggregate value of the shares of Bond Portfolio held by that shareholder as of the close of business on the Closing Date. In the interest of economy and convenience, shares of Intermediate Bond Portfolio generally will not be represented by physical certificates, unless you request the certificates in writing.

The obligations of the Portfolios under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of Bond Portfolio and that each Portfolio receives an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. The Reorganization Agreement also requires that each of the Portfolios take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement.

Expenses of the Reorganization

The expenses of the Reorganization will be borne by the Adviser (or an affiliate). The expenses of the Reorganization shall include, but not be limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution the Proxy Statement/Prospectus and proxy materials, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganization do not include the transition costs described in “Portfolio Transitioning” below.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Code. Accordingly, pursuant to this treatment, neither Bond Portfolio nor its shareholders, nor Intermediate Bond Portfolio nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. As a condition to the Closing of the Reorganization, the Portfolios will receive an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Portfolios.

Prior to the Closing Date, Bond Portfolio will pay to the Separate Accounts of Participating Insurance Companies and Qualified Plans that own its shares, a cash distribution consisting of any undistributed investment company taxable income and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date. Variable Contract owners and Plan Participants are not expected to recognize any income or gains for federal income tax purposes from this cash distribution.

As of June 30, 2013, Bond Portfolio has estimated capital loss carryforwards of $4,738,775; none of which will expire as a result of the Reorganization. Intermediate Bond Portfolio has estimated capital loss carryforwards of $217,644,730, although a portion of the amount of these losses that may offset Intermediate Bond Portfolio’s capital gains in any given year is expected to be limited as a result of other reorganizations entered into by Intermediate Bond Portfolio. Variable Contract Owners and Plan Participants are not expected to be affected by any limitations on the utilization of capital losses by the Portfolios. After the Reorganization, the losses of Bond Portfolio generally may be available to Intermediate Bond Portfolio, to offset its capital gains, although a portion of the amount of these losses that may offset Intermediate Bond Portfolio’s capital gains in any given year may be limited due to this Reorganization. The ability of Intermediate Bond Portfolio to absorb losses in the future depends on a variety of factors that cannot be known in advance, including the existence of capital gains against which these losses may be offset. In addition, the benefits of any of these various capital loss carryforwards and built-in losses currently are available only to pre-Reorganization shareholders of each Portfolio. After Reorganization, however, these benefits will inure to the benefit of all post-Reorganization shareholders of Intermediate Bond Portfolio.

Portfolio Transitioning

As discussed above, the Portfolios have substantially similar investment strategies. As a result, ING IM is not expected to sell a significant portion of Bond Portfolio’s holdings prior to the Closing Date to prepare for the Reorganization. If in connection with the Reorganization any of Bond Portfolio’s holdings are sold prior to the Closing Date, the proceeds of such sales are expected to be invested in securities that ING IM wishes for Intermediate Bond Portfolio to hold and temporary investments, which will be delivered to Intermediate Bond Portfolio at the Closing Date. During the transition period, Bond Portfolio may not be pursuing its investment objective and strategies, and limitations on permissible investments and investment restrictions will not apply. After the Closing Date of the Reorganization, ING IM, as the sub-adviser to Intermediate Bond Portfolio, may also sell portfolio holdings that it acquired from Bond Portfolio, and Intermediate Bond Portfolio may not be immediately fully invested in accordance with its stated investment strategies. In addition, each Portfolio may engage in a variety of transition management techniques to facilitate the portfolio transition process, including without limitation, the purchase and sale of baskets of securities and exchange-traded funds, and enter into and close futures contracts or other derivative transactions. Such sales and purchases by the Portfolios during the transition period may be made at a disadvantageous time and could result in potential losses for the Portfolios. No transition costs are expected to be incurred in connection with the Reorganization; however, the Adviser will be responsible for paying any transition costs that are incurred.

12

Future Allocation of Premiums

Shares of Bond Portfolio have been purchased at the direction of Variable Contract owners by Participating Insurance Companies through Separate Accounts to fund benefits payable under a Variable Contract. If the Reorganization is approved, Participating Insurance Companies have advised us that all premiums or transfers to Bond Portfolio will be allocated to Intermediate Bond Portfolio.

What is the Board’s recommendation?

Based upon its review, the Board, including a majority of the Trustees who are not “interested persons,” as defined by the 1940 Act (the “Independent Trustees”), determined that the interests of the shareholders of the Portfolios would not be diluted as a result of the Reorganization and that the Reorganization would be in the best interests of the Portfolios and their shareholders. Accordingly, after consideration of such factors and information it considered relevant, the Board, including a majority of the Independent Trustees, approved the Reorganization Agreement and voted to recommend to shareholders that they approve the Reorganization Agreement. The Board is therefore recommending that Total Return Bond’s shareholders vote “FOR” the Reorganization Agreement.

What factors did the Board consider?

The Board considered the Reorganization as part of its overall consideration of what would be in the best interest of Bond Portfolio and its shareholders. The Board determined that Bond Portfolio would benefit from being combined into Intermediate Bond Portfolio under the day-to-day management of ING IM.

The Board, in approving the Reorganization, considered a number of factors, including, but not limited to, the following: (1) the similarities and differences in the investment objectives and investment strategies of each Portfolio; (2) an analysis of ING IM as the sub-adviser of each Portfolio; (3) a presentation from ING Investments regarding proposals, including the Reorganization, intending to, among other things, enhance the efficiency and reduce the complexity of the ING Funds Complex; (4) the similarity in fee structures of each of the Portfolios; (5) the superior performance of Intermediate Bond Portfolio as compared to the performance of Bond Portfolio for the year-to-date, one-year, three-year and five-year time periods; (6) the performance of Bond Portfolio as compared to its Morningstar, Inc. (“Morningstar”) peer group and the performance of Intermediate Bond Portfolio as compared to its Morningstar peer group; (7) the lower gross and net expense ratio that current shareholders of Bond Portfolio are expected to experience as a result of the Reorganization; (8) consideration that Bond Portfolio has no designated share classes and Intermediate Bond Portfolio has classes ADV, I, S and S2 and ING Investments’ analysis and proposal regarding merging Bond Portfolio into Class S of Intermediate Bond Portfolio; (9) proposed advisory fee break points for Intermediate Bond Portfolio to be implemented in connection with the Reorganization to provide further benefits to the shareholders of the Portfolios; (10) proposed expense limits for Intermediate Bond Portfolio to be implemented in connection with the Reorganization which will provide the Portfolios’ shareholders with the added benefit of protection against rising expense ratios should Intermediate Bond Portfolio’s net assets ever decrease, subject to Board approval, these expense limits will expire on May 1, 2015; (11) the larger combined asset size of the two Portfolios, which would be likely to provide greater scale and superior potential to maintain long-term scale benefits for the shareholders of both Portfolios; (12) the fact that direct or indirect costs relating to the Reorganization will not be borne by either Portfolio or their shareholders; (13) the expected tax consequences of the Reorganization to Bond Portfolio and its shareholders, including that the Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization; and (14) the Board’s determination that the Reorganization will not dilute the interests of the shareholders of Bond Portfolio.

In addition, the Board considered the net revenue benefits for ING Investments and its affiliates that would result from the Reorganization.

What is the required vote?

Approval of the Reorganization Agreement requires the affirmative vote of the lesser of: (i) 67% or more of the voting securities present at the meeting, provided that more than 50% of the voting securities are present in person or represented by proxy at the Special Meeting; or (ii) a majority of the shares entitled to vote.

What happens if shareholders do not approve the Reorganization?

If shareholders of Bond Portfolio do not approve the Reorganization, Bond Portfolio will continue to be managed by ING Investments as described in its prospectus, and the Board will determine what additional action should be taken.

13

GENERAL INFORMATION ABOUT THE PROXY STATEMENT/PROSPECTUS

Who is asking for my vote?

The Board is soliciting your vote for a special meeting of Bond Portfolio’s shareholders.

How is my proxy being solicited?

Solicitation of proxies or voting instructions is being made primarily by the mailing of the Notice of Special Meeting, this Proxy Statement/Prospectus, and the Proxy Ballot or Voting Instruction Card on or about January 24, 2014. In addition to the solicitation of proxies by mail, employees of the Adviser and its affiliates, without additional compensation, may solicit proxies in person or by telephone, telegraph, facsimile, or oral communications.

What happens to my proxy once I submit it?

The Board has named Huey P. Falgout, Jr., Secretary, Theresa K. Kelety, Assistant Secretary, and Todd Modic, Assistant Secretary, or one or more substitutes designated by them, as proxies who are authorized to vote Portfolio shares as directed by shareholders.

Can I revoke my proxy after I submit it?

A shareholder may revoke the accompanying proxy at any time prior to its use by filing with ING Investors Trust a written revocation or a duly executed proxy bearing a later date. In addition, any shareholder who attends the Special Meeting in person may vote by ballot at the Special Meeting, thereby canceling any proxy or voting instruction previously given.

How will my shares be voted?