OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2011

Estimated average burden hours per response: 18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2565

ING Money Market Portfolio

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | January 1, 2010 to December 31, 2010 |

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2010

Classes ADV, I, S and S2

ING Variable Product Funds

Domestic Equity and Income Portfolios

n ING Balanced Portfolio

n ING Growth and Income Portfolio

Domestic Equity Growth Portfolio

n ING Small Company Portfolio

Fixed-Income Portfolios

n ING Intermediate Bond Portfolio

n ING Money Market Portfolio

Global Equity Portfolio

n ING BlackRock Science and Technology Opportunities Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 2 | | |

|

| Portfolio Managers' Reports | | | 4 | | |

|

| Shareholder Expense Examples | | | 15 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 17 | | |

|

| Statements of Assets and Liabilities | | | 18 | | |

|

| Statements of Operations | | | 22 | | |

|

| Statements of Changes in Net Assets | | | 24 | | |

|

| Financial Highlights | | | 27 | | |

|

| Notes to Financial Statements | | | 30 | | |

|

| Summary Portfolios of Investments | | | 50 | | |

|

| Tax Information | | | 93 | | |

|

| Director/Trustee and Officer Information | | | 94 | | |

|

| Advisory Contract Approval Discussion | | | 99 | | |

|

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds' website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.ingfunds.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This report contains a summary portfolio of investments for certain Portfolios. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. The Portfolios' Forms N-Q, as well as a complete portfolio of investments, are available without charge upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT'S LETTER

Big Picture vs. Details

Dear Shareholder,

On January 25, 2011, President Obama delivered his second State of the Union address. He called on Americans to put aside partisan differences and harness the nation's creativity to adapt and thrive in a rapidly changing global economy. The president's challenge is timely: the United States is approaching a nexus of intermediate- and long-term concerns, and the choices we make over the next two years could determine the nation's competitiveness in the global economy for decades to come.

There are reasons to be optimistic — the International Monetary Fund ("IMF") predicts the U.S. economy will grow about 3% in 2011. China and India are expected to grow at about 9% and even the euro zone appears to be recovering from crisis; this growth, however, is being accompanied by mounting inflation pressures in certain regions, suggesting that many economies are expanding at unsustainable rates.

As I write this, the World Economic Forum is getting underway in Davos, Switzerland, and there are numerous concerns to deal with. Chief among them are the still-present risk of sovereign debt defaults in the euro zone; high unemployment and banking problems in the advanced economies; and inflationary pressures in emerging markets, especially with regard to food, fuel and commodities.

As we've noted before, uncertainty is a defining characteristic of our age and, in our opinion, is likely to remain so beyond this year. How should you respond within your investment portfolio? Remember that the most important consideration is your long-term goals, not the outlook for 2011. With investment hazards and opportunities everywhere, we believe it makes sense to cast as broad a net as possible around the globe. In our opinion, you want your portfolio to be well diversified so that it is not harmed too much by the trouble spots, and has some exposure to positive trends.

As always, we believe the best approach is a well-diversified portfolio and a well-defined investment plan. As we've noted many times before, it's important to discuss any proposed changes thoroughly with your advisor before taking any action. Thank you for your continued confidence in ING Funds. We look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President and Chief Executive Officer

ING Funds

January 26, 2011

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2010

In our semi-annual report we described how, after a 13-month advance through mid-April, a confluence of local and world issues sent global equities, in the form of the MSCI World IndexSM measured in local currencies, including net reinvested dividends ("MSCI" for regions discussed below), reeling to a loss for the first half of the fiscal year. In the second half of the year, the MSCI World IndexSM bounced back and for 2010 returned 10.01%. (The MSCI World IndexSM returned 11.76% for the one year ended December 31, 2010, measured in U.S. dollars.) By year end, investor sentiment had turned distinctly positive, despite the grave concerns that remained.

It was a bumpy ride. Markets from stocks to bonds to currencies were continually buffeted by news and events relating to three main themes: the stuttering U.S. economic recovery, the sovereign debt crisis in the Eurozone and growth dynamics in China.

In the U.S., quarterly gross domestic product ("GDP") growth decelerated from 2.7% (annualized) in the first quarter of 2010 to 1.7% in the second, before recovering to 2.6% in the third. But attention was focused more on employment and housing. The 18-month recession which ended in June of 2009 had cost some 8.7 million jobs. But since then, the unemployment rate had been stuck between 9.4% and 10.1%, barely dented by private sector new jobs averaging 107,000 per month as 2010 ended.

The other weakening link was housing. Sales of new and existing homes collapsed after the expiry in April of a program of tax credits for home buyers and languished thereafter. House prices (based on the S&P/Case-Shiller 20-City Composite Home Price Index), having shown annual increases from February, resumed a downward trend in October with the index still 30% below the peak recorded in April 2006.

To be sure, there were some grounds for optimism as 2010 drew to a close. Consumer spending had risen for five straight months. Investment in equipment and software was growing at double-digit annual percentage rates. On December 30, new unemployment claims were reported below 400,000 for the first time since July 2008. The Federal Reserve in November announced a second round of quantitative easing and would buy $600 billion in Treasury notes and bonds. The mixed mid-term election results forced a "compromise" stimulus package worth an estimated $858 billion for 2011. In combination, these two measures increased the attractiveness of riskier asset classes like equities at the expense of high grade bonds, which sold off.

In the Eurozone, after default was narrowly averted on Greece's maturing bonds, the creation in May of a European Financial Stabilization "mechanism", funded with up to €750 billion seemed to calm nerves for a while. But in October, attention turned to Ireland, where the Irish government had injected huge sums into local banks, rendering its own fiscal position untenable. The November 29, 2010 European Union/International Monetary Fund bail-out worth €67.5 billion left markets unimpressed. Suddenly it was May again with downgrades, soaring yields on peripheral Eurozone bonds, fears of contagion, falling stock markets and doubts about the viability of the euro itself. The European Central Bank aggressively bought sovereign bonds and the mood settled. But with Spain's banks needing to refinance €85 billion of debt in 2011, the issue remains unresolved.

Investors watched nervously as China, the source of much of the world's growth, wrestled with inflation, which reached 5.1% in November, and a housing bubble. The authorities tightened mortgage requirements, raised banks' reserve ratio requirements six times in 2010 and interest rates twice in the last quarter. More interest rate increases seem inevitable.

In U.S. fixed income markets, the Barclays Capital U.S. Aggregate Bond Index of investment grade bonds returned 6.54% in 2010. A slight balance towards risk aversion in the first half gave way to improved risk appetite in the second. For the whole year, the Barclays Capital U.S. Treasury index returned 5.87%, underperforming the Barclays Capital Corporate Investment Grade Bond Index with a return of 9.00%, but both fell well short of the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index which gained 14.94% for the one year period.

U.S. equities, represented by the S&P 500® Index including dividends, rose 15.06% in 2010, including its best September, a return of 8.92%, since 1939 and best December, a return of 6.68%, since 1991. Prices were supported by strong earnings reports, with operating earnings per share for S&P 500® companies recording four straight quarters of annual growth. Equities also benefited from improved risk appetite through the quantitative easing initiative and stimulus package referred to above.

In currencies, the worst of the gloom about the Eurozone in early June was replaced by renewed pessimism about the dollar in a stalling economy, before markets were seized by another bout of Eurozone angst. For the year, the dollar gained 8.15% against the euro and 2.95% against the pound, but lost 11.59% to the yen, which was sold in the market by the Bank of Japan after breaching 15-year high levels.

In international markets, the MSCI Japan® Index returned just 0.57% for the year after a strong last quarter, as quarterly GDP growth bounced back to 1.1% and the yen retreated from multi-year peaks. The tone of the market was generally poor with household spending fragile and consumer prices down for 21 months. The MSCI Europe ex UK® Index returned 4.84%, with Germany up 15.97% and Portugal, Italy, Ireland, Greece and Spain all falling. This broadly reflected the two-tier economy that has developed, with economic statistics favoring more soundly based countries at the expense of the peripherals. The MSCI UK® Index advanced 12.18%, despite the prospect of severe public spending cuts intended to eliminate an 11% budget deficit. Supporting sentiment was resilient, if perhaps temporary, quarterly GDP growth averaging 0.9% in the second half of the year.

Parentheses denote a negative number.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

2

BENCHMARK DESCRIPTIONS

| Index | | Description | |

| MSCI World IndexSM | | An unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. | |

|

| S&P/Case-Shiller 20-City Composite Home Price Index | | A composite index of the home price index for the top 20 Metropolitan Statistical Areas in the United States. The index is published monthly by Standard & Poor's. | |

|

| Barclays Capital U.S. Aggregate Bond Index | | An unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities. | |

|

| Barclays Capital U.S. Treasury Index | | An unmanaged index that includes public obligations of the U.S. Treasury. Treasury bills, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS and STRIPS, are excluded. | |

|

| Barclays Capital Corporate Investment Grade Bond Index | | The corporate component of the Barclays Capital U.S. Credit Index. The U.S. Credit Index includes publicly-issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. The index includes both corporate and non-corporate sectors. The corporate sectors are industrial, utility and finance, which includes both U.S. and non-U.S. corporations. | |

|

| Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index | | An unmanaged index that includes all fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity. | |

|

| S&P 500® Index | | An unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. | |

|

| MSCI Japan® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan. | |

|

| MSCI Europe ex UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK. | |

|

| MSCI UK® Index | | A free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK. | |

|

| S&P Target Risk Growth Index | | Seeks to provide increased exposure to equities, while also using some fixed-income exposure to dampen risk. | |

|

| Russell 2000® Index | | An unmanaged index that measures the performance of securities of small U.S. companies. | |

|

| iMoneyNet First Tier Retail Index | | An unmanaged index that includes the most broadly based money market funds. | |

|

| NYSE Arca Tech 100 Index | | A multi-industry technology index measuring the performance of companies using technology innovation across a broad spectrum of industries. It is comprised of 100 listed and over-the-counter stocks from 14 different subsectors including computer hardware, software, semiconductors, telecommunications, data storage and processing, electronics and biotechnology. | |

|

3

ING BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Balanced Portfolio (the "Portfolio") seeks total return consisting of capital appreciation (both realized and unrealized) and current income; the secondary investment objective is long-term capital appreciation. The Portfolio is managed by Christine Hurtsellers, Paul Zemsky, Heather Hackett and Christopher Corapi, Portfolio Managers, of ING Investment Management Co. — the Sub-Adviser.*

Performance: For the year ended December 31, 2010, the Portfolio's Class I shares provided a total return of 14.22% compared to the S&P Target Risk Growth Index and the ING Balanced Portfolio Composite Index (29% S&P 500 Index; 8% S&P MidCap 400 Index; 18% MSCI EAFE Index; 5% MSCI Emerging Markets Index; 40% Barclays Capital Global Aggregate Bond Index) which returned 11.18% and 11.37%, respectively, for the same period.

Portfolio Specifics(1): On April 30, 2010, the Portfolio changed its benchmark indices from the S&P 500® Index and the Barclays Capital U.S. Aggregate Bond Index to the S&P Target Risk Growth Index because the adviser considers the S&P Target Risk Growth Index to be a more appropriate benchmark index, as it reflects the types of securities in which the Portfolio invests.

From the beginning of the period through April 30, 2010, allocation and stock selection effects were both positive compared to the Composite Index. Our average underweight to fixed income contributed to performance. Strong stock selection helped performance in all asset classes including the large-, mid- and small-capitalization stocks; bonds also contributed to results.

When the Portfolio switched benchmarks as of May 1, 2010, we began to switch its investments as well. The Portfolio's investments in large- and mid-cap enhanced index funds were replaced by investments in fundamental equity funds in May. Small-cap exposure was eliminated and international exposure was added through developed international markets and emerging markets. From May 1, 2010 through the end of the year, allocation effect was slightly negative compared to the Composite Index. U.S. stock selection was favorable overall, especially within mid-cap equities. Stock selection within international equities detracted from performance. We added global bonds to the Portfolio's fixed income allocation in May; this strategic change had a neutral asset allocation effect compared to the Composite Index. On a total return basis, global bonds outperformed core bonds benefiting the Portfolio.

As we entered 2010, our assessment of the U.S. economy and financial markets suggested that equities were attractive. In particular, we believed that markets were too skeptical about the sustainability and magnitude of economic recovery in the Unites States and around the world. This skepticism meant that consensus earnings estimates for U.S. and global stocks were probably too low. In January, we moved to an overweight position in large-cap core U.S. stocks and an underweight in fixed income. On average, we remained tactically bullish and more optimistic than the consensus about cyclical economic prospects for the U.S. and world economies throughout the year.

While the capital markets activity, bank lending and other financial processes slowly and unevenly moved back to normal, they remained under pressure and sensitive to shifts in the outlook. Therefore, we made tactical moves back to a neutral asset allocation stance, reversing the equity overweight at different key points throughout the year. For example, in spring the heightened risk of a sovereign debt crisis affecting Greece, and other highly indebted European countries such as Portugal, seemed likely to offset positive economic and earnings news in the short term. Spreads on risky assets widened, inter-bank lending contracted and stock markets declined as this reappraisal of risk continued. Eventually, the Eurozone governments, the European Central Bank and the International Monetary Fund made an aggressive policy response stemming the nearly panic conditions that had emerged on global markets and providing near-term stability to European bond markets and to the euro exchange rate.

Current Strategy and Outlook: We continue to see the overall economic environment of the U.S. economy developing in the direction of a sustainable recovery through an expansion driven more broadly by final demand. U.S. economic data have turned relatively more positive with the Purchasing Managers' Index, initial jobless claims, and retail sales data suggesting that the economy is gaining momentum. U.S. monetary and fiscal policies remain stimulative. We believe the extension of the Bush tax cuts along with the large scale Treasury purchases by the U.S. Federal Reserve should provide additional stimulus via consumer spending and stable interest rates.

Investment Type Allocation

as of December 31, 2010

(as a percent of net assets)

| Common Stock | | | 56.1 | % | |

| Corporate Bonds/Notes | | | 13.6 | % | |

| U.S. Government Agency Obligations | | | 8.2 | % | |

| U.S. Treasury Obligations | | | 6.7 | % | |

| Exchange-Traded Funds | | | 5.1 | % | |

| Collateralized Mortgage Obligations | | | 4.9 | % | |

| Asset-Backed Securities | | | 3.5 | % | |

| Other Bonds | | | 3.2 | % | |

| Municipal Bonds | | | 0.1 | % | |

| Preferred Stock | | | 0.1 | % | |

| Real Estate Investment Trusts | | | 0.1 | % | |

| Positions in Purchased Options | | | 0.0 | % | |

| Other Assets and Liabilities — Net* | | | (1.6 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2010

(as a percent of net assets)

| Vanguard Emerging Markets ETF | | | 4.5 | % | |

| ExxonMobil Corp. | | | 1.5 | % | |

| Apple, Inc. | | | 1.3 | % | |

| U.S. Treasury Note, 0.625%, due 12/31/12 | | | 1.2 | % | |

| Microsoft Corp. | | | 1.2 | % | |

| U.S. Treasury Note, 3.875%, due 08/15/40 | | | 1.2 | % | |

| JPMorgan Chase & Co. | | | 1.0 | % | |

| Wells Fargo & Co. | | | 1.0 | % | |

| Qualcomm, Inc. | | | 0.9 | % | |

| Wal-Mart Stores, Inc. | | | 0.9 | % | |

* Excludes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

* Effective April 30, 2010, Vincent Costa and Michael Hyman were removed as portfolio managers to the Portfolio and Heather Hackett and Christopher Corapi were added as portfolio managers to the Portfolio.

(1) Effective April 30, 2010, the Portfolio changed from a quantitatively oriented allocation to a fundamental one.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

ING BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class S

May 29, 2003 | |

| Class I | | | 14.22 | % | | | 2.60 | % | | | 2.85 | % | | | — | | |

| Class S | | | 13.87 | % | | | 2.32 | % | | | — | | | | 4.58 | % | |

| S&P Target Risk Growth Index | | | 11.18 | % | | | — | | | | — | | | | — | | |

| ING Balanced Portfolio Composite Index | | | 11.37 | % | | | 5.37 | % | | | 5.53 | % | | | 7.85 | %(1) | |

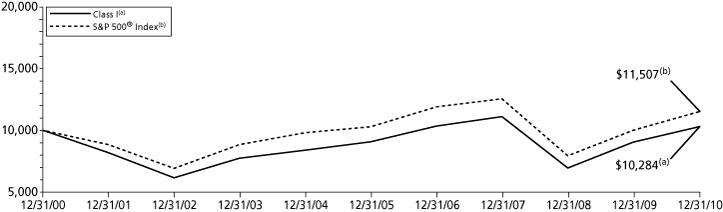

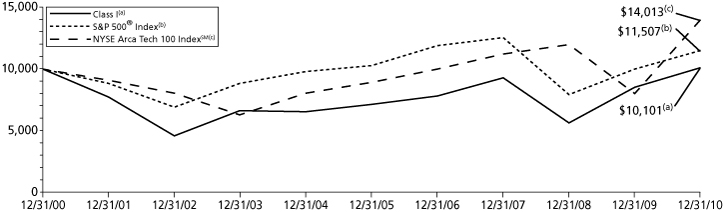

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Balanced Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance for the indices is shown from June 1, 2003.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

5

ING GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Growth and Income Portfolio (the "Portfolio") seeks to maximize total return through investments in a diversified portfolio of common stocks and securities convertible into common stocks. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Christopher F. Corapi and Michael Pytosh, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2010, the Portfolio's Class I shares provided a total return of 14.14% compared to the S&P 500® Index, which returned 15.06% for the same period.

Portfolio Specifics: The Portfolio lagged the benchmark for the one year period. Security selection in a handful of stocks, particularly in the financials, healthcare and consumer discretionary sectors, detracted from performance during the period. Selection among industrials and information technology, however, partially offset those losses.

Within financials our focus on what we believe are high quality companies was a headwind for the Portfolio as a number of high quality banks and lenders got tarnished due to the foreclosure issues towards the middle of the past year. The Portfolio's position in Bank of America Corp. was most unfavorable within the sector. We owned the stock as it was trading at a significantly discounted valuation, representing an attractive entry point for the stock of a dominant consumer bank with opportunities to better leverage its scale and more efficiently integrate its diverse business lines. The company had disappointing second quarter earnings and was mired in the mortgage foreclosure issues during the third quarter, which led to a drop in the stock price.

Within healthcare, the Portfolio's position in Zimmer Holdings, Inc. was negatively affected by some bad news at a competitor firm. In technology, our position in Cisco Systems, Inc. was unfavorable as the stock was down for the period. We owned the stock because we believed it had strong growth potential. The company has had some near term sales and earnings variability which hurt its stock price. We have exited all the above mentioned positions as of the end of the reporting period.

Among the Portfolio's favorable positions was Wabco Holdings, Inc. ("Wabco"), an industrials company. The company is a component supplier to trucks, trailers, buses and autos, predominantly in Western Europe. The Portfolio owns shares of Wabco as we believe it offers exposure to the cyclical recovery in European trucks, is a good play on secular growth and most importantly, it is a company that is not well covered by sell-side analysts. The position added returns to the portfolio as it reported strong third quarter numbers which were above analyst's estimates. We continue to hold this position as we believe it has further upside potential.

Apple, Inc. was among the top performers for the period. We believed in the company's growth prospects due to its strong product cycles despite the weak economy, and due to the success of the iPhone. We see further upside potential for the stock with the launch of the iPad and the iPhone4, which we believe will add value to the company's bottom line. We believe the market did not fully appreciate the strength of these products; the stock rose with the successful launches and better than anticipated sales of both the iPad and iPhone. We continue to hold the stock as we believe it has more upside potential.

Current Strategy and Outlook: Currently, the Portfolio is positioned in companies that we believe have strong or improving competitive positions, robust end markets or superior capital allocation opportunities. We believe each stock possesses an attractive valuation and a clear catalyst to improve it. We continue to be cautiously optimistic about the economy and believe that the Portfolio is well positioned to benefit from any uptick in the markets. We find plenty of companies that have strong financial characteristics, which we believe will benefit as the markets continue to invest in and differentiate among companies based on fundamentals. We continue to be constructive on U.S. and global economic prospects and are slightly biased towards companies that are leveraged to the global economic recovery. In light of this, we are currently overweight in technology, energy and early cycle industrials. We are cautious, however, about sectors that may confront significant policy changes or are defensively positioned in the business cycle, such as healthcare, utilities and consumer staples.

Industry Allocation

as of December 31, 2010

(as a percent of net assets)

| Information Technology | | | 19.5 | % | |

| Financials | | | 16.3 | % | |

| Energy | | | 13.4 | % | |

| Industrials | | | 10.8 | % | |

| Health Care | | | 10.2 | % | |

| Consumer Discretionary | | | 9.8 | % | |

| Consumer Staples | | | 9.7 | % | |

| Materials | | | 3.9 | % | |

| Telecommunication Services | | | 2.6 | % | |

| Utilities | | | 1.8 | % | |

| Other Assets and Liabilities — Net* | | | 2.0 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2010

(as a percent of net assets)

| ExxonMobil Corp. | | | 5.0 | % | |

| Apple, Inc. | | | 4.3 | % | |

| Microsoft Corp. | | | 3.7 | % | |

| JPMorgan Chase & Co. | | | 3.3 | % | |

| Wells Fargo & Co. | | | 3.1 | % | |

| Qualcomm, Inc. | | | 2.9 | % | |

| Wal-Mart Stores, Inc. | | | 2.9 | % | |

| PepsiCo, Inc. | | | 2.8 | % | |

| Google, Inc. — Class A | | | 2.5 | % | |

| Citigroup, Inc. | | | 2.5 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

6

ING GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

June 11, 2003 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 13.55 | % | | | — | | | | — | | | | (0.69 | )% | | | — | | | | — | | |

| Class I | | | 14.14 | % | | | 2.60 | % | | | 0.28 | % | | | — | | | | — | | | | — | | |

| Class S | | | 13.81 | % | | | 2.31 | % | | | — | | | | — | | | | 5.17 | % | | | — | | |

| Class S2 | | | 12.55 | % | | | — | | | | — | | | | — | | | | — | | | | 34.09 | % | |

| S&P 500® Index | | | 15.06 | % | | | 2.29 | % | | | 1.41 | % | | | (0.83 | )%(1) | | | 5.67 | %(2) | | | 36.89 | %(3) | |

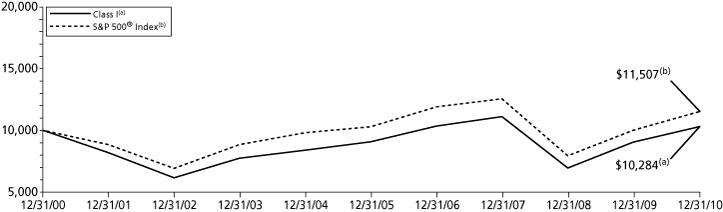

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Growth and Income Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance for the index is shown from January 1, 2007.

(2) Since inception performance for the index is shown from June 1, 2003.

(3) Since inception performance for the index is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

7

ING SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Small Company Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks of companies with smaller market capitalizations. The Portfolio is managed by Joseph Basset, CFA, and Steve Salopek, Portfolio Managers of ING Investment Management Co. — the Sub Adviser.

Performance: For the year ended December 31, 2010, the Portfolio's Class I shares provided a total return of 24.38% compared to the Russell 2000® Index, which returned 26.85% for the same period.

Portfolio Specifics: The Russell 2000® Index gained nearly 27% during 2010, outperforming both large- and mid-capitalization stocks for the reporting period. Small caps responded positively to the launch of a second round of quantitative easing by the U.S. Federal Reserve, coupled with improved economic data. Also helping to boost performance was greater merger and acquisition activity than in the past few years, due to cash on company balance sheets and easier access to capital. Cyclical sectors, e.g., information technology, materials, energy and consumer discretionary, led the benchmark's performance. All sectors produced double-digit returns, with technology leading the way.

The Portfolio's underperformance was due largely to negative security selection within the financials, information technology and materials sectors. In information technology, returns were held back by stock selection within semiconductors and semiconductor equipment and computers and peripherals. Within financials, stock selection within capital markets and commercial banks detracted from performance.

Positive stock selection within healthcare, energy and consumer staples partially offset those negative effects. Notable outperformance within healthcare was due to strong stock selection within biotechnology, healthcare providers and services and healthcare equipment and supplies. Energy benefited from stock selection within oil, gas and consumable fuels, while strong stock selection within food products benefited consumer staples.

McMoRan Exploration Co. ("McMoRan") and American Italian Pasta contributed significantly to performance over the period. McMoRan engages in the exploration and production of crude oil and natural gas offshore in the Gulf of Mexico and onshore in the Gulf Coast area. The company announced a very large natural gas discovery in the Gulf of Mexico in January. Also, energy companies with exposure to the Gulf of Mexico generally rebounded in the third quarter after the BP oil well was plugged. Specific to McMoRan, the market has begun to anticipate good results from its Blackbeard East project.

American Italian Pasta, which engages in the production of dry pasta, has agreed to be acquired by Ralcorp for $1.2 billion, a 27% premium. The acquisition will expand Ralcorp's private label business by entering into the pasta category.

QLogic Corp. ("QLogic") and FormFactor, Inc. ("FormFactor") were two of the largest detractors from performance over the period. QLogic engages in the design and supply of storage networking, high performance computing networking and converged networking infrastructure solutions. The company is a steady albeit slower growing company. We believe it underperformed other faster growing storage companies in 2010, which benefited from M&A speculation or by being acquired by larger technology companies. We continue to hold the stock for its attractive valuation, consistent cash flow generation and our belief that the business will show growth in 2011 supported by good IT spending.

FormFactor, which designs and sells semiconductor wafer probe cards, negatively pre-announced fourth quarter earnings at the beginning of 2010. The fact that they were one of the very few semiconductor companies that pre-announced negatively caused investor uncertainty regarding this stock. The company's earnings announcement and guidance for first quarter were also below expectations. Furthermore, FormFactor had a change in management which created uncertainty regarding its future business strategy. We continue to hold the position in the Portfolio as we believe that the company's technology is still good and that despite numerous missteps the intermediate term value of the company far exceeds the current stock price. As a result, we believe the company remains attractive from a risk/return perspective.

Current Strategy and Outlook: We continue to believe that the economy will improve slowly and that this environment will favor quality companies, as investors focus on fundamentals. The Portfolio's positioning has not changed significantly. We have slightly increased our exposure to commodities due to the attractiveness of individual stocks. We are cautious about possible inflationary pressures and the potential impact they may have on the performance of companies and valuations.

As the Portfolio has, in our opinion, a higher quality bias and we remain focused on companies that we believe have strong managements teams, strong balance sheets and good cash flow generation capabilities, we believe that we are well positioned for this market environment. Even among cyclicals our primary focus is on management quality, cash flows and the strength of the balance sheet. We continue to take advantage of the volatility in the market to invest in what we believe we are quality companies that are attractively valued.

Industry Allocation

as of December 31, 2010

(as a percent of net assets)

| Financials | | | 20.1 | % | |

| Information Technology | | | 17.1 | % | |

| Industrials | | | 16.4 | % | |

| Consumer Discretionary | | | 14.6 | % | |

| Health Care | | | 10.5 | % | |

| Materials | | | 6.0 | % | |

| Energy | | | 5.3 | % | |

| Utilities | | | 4.0 | % | |

| Consumer Staples | | | 2.0 | % | |

| Exchange-Traded Funds | | | 1.7 | % | |

| Telecommunication Services | | | 1.6 | % | |

| Other Assets and Liabilities — Net* | | | 0.7 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2010

(as a percent of net assets)

| iShares Russell 2000 Index Fund | | | 1.3 | % | |

| Jo-Ann Stores, Inc. | | | 1.2 | % | |

| Healthsouth Corp. | | | 1.1 | % | |

| Silgan Holdings, Inc. | | | 1.1 | % | |

| OfficeMax, Inc. | | | 1.1 | % | |

| Portland General Electric Co. | | | 1.1 | % | |

| DiamondRock Hospitality Co. | | | 1.1 | % | |

| Collective Brands, Inc. | | | 1.0 | % | |

| Life Time Fitness, Inc. | | | 1.0 | % | |

| Watsco, Inc. | | | 1.0 | % | |

* Excludes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

8

ING SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 16, 2008 | | Since Inception

of Class S

November 1, 2001 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 23.75 | % | | | — | | | | — | | | | 27.22 | % | | | — | | | | — | | |

| Class I | | | 24.38 | % | | | 6.23 | % | | | 6.47 | % | | | — | | | | — | | | | | | |

| Class S | | | 24.00 | % | | | 5.88 | % | | | — | | | | — | | | | 7.57 | % | | | — | | |

| Class S2 | | | 23.85 | % | | | — | | | | — | | | | — | | | | — | | | | 44.36 | % | |

| Russell 2000® Index | | | 26.85 | % | | | 4.47 | % | | | 6.33 | % | | | 27.01 | %(1) | | | 8.22 | % | | | 48.56 | %(2) | |

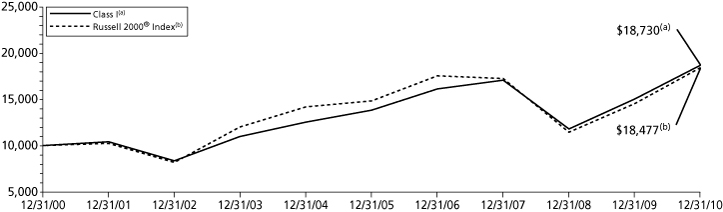

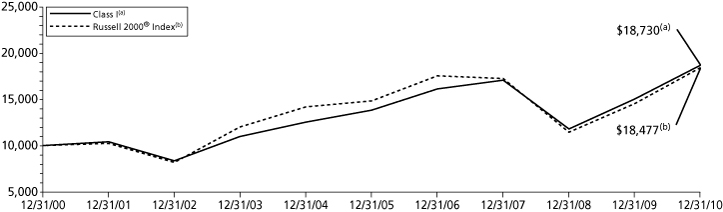

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Small Company Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance for the index is January 1, 2009.

(2) Since inception performance for the index is March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

9

ING INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Intermediate Bond Portfolio (the "Portfolio") seeks to maximize total return consistent with reasonable risk. The Portfolio seeks its objective through investments in a diversified portfolio consisting primarily of debt securities. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Christine Hurtsellers, Matthew Toms and Michael Mata, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.*

Performance: For the year ended December 31, 2010, the Portfolio's Class I shares provided a total return of 9.84% compared to the Barclays Capital U.S. Aggregate Bond Index, which returned 6.54% for the same period.

Portfolio Specifics: The Portfolio outperformed its benchmark for 2010. We saw dramatic shifts of interest rates throughout the year as the economy reacted to events such as the BP oil spill in the Gulf of Mexico, the European debt crisis, quantitative easing and tax policy changes. On balance the Portfolio stayed close to the benchmark duration for most of the year. Consequently, our yield curve and duration positioning slightly detracted from performance over the period.

The economy continued to heal and expand in 2010. Most non-Treasury or spread sectors within fixed income consequently outperformed. Our specific overweight positions to several spread sectors, e.g., corporate bonds, residential mortgage-backed securities ("RMBS") and commercial mortgage-backed securities ("CMBS") led our outperformance for the year. Additionally, allocations to non-index sectors like emerging market debt and high yield debt also helped contribute to the strong performance. Our underweighting of U.S. Treasuries and agency debentures to fund the spread sector overweight positions also benefited the performance of the Portfolio.

As economic data improved through the year and consumer confidence and spending returned, investment grade credit outperformed along with our security selection within investment grade corporate bonds. Our favoring of issuers in a variety of subsectors in the financial services sector, and several industrials subsectors, helped the portfolio outperform. Finally, our security selection decisions within mortgage-backed securities also had a very positive impact on Portfolio results for the year.

Our derivatives usage consisted of futures, swaps and options in the Portfolio. Futures and swaps were mostly used for duration management, which was a detractor over the period. Also, some swaps and options were used to hedge mortgage volatility towards the end of the year, due to our slight underweight in agency MBS. The net result and impact to relative performance over the period was negligible.

Current Outlook and Strategy: We begin 2011 with an economy that is absent any signs of inflation. We believe this allows the U.S. Federal Reserve (the "Fed") to remain accommodative, keeping short rates near zero and following its program of Treasury purchases out the yield curve. We believe interest rates will be somewhat contained given our tempered economic growth view and the Fed's commitment to a second round of quantitative easing. Consequently, we remain close to neutral in our duration positioning.

We believe this base case of slow continued economic growth with zero inflation will be supportive of risk assets and therefore remain overweight across most spread sectors. We continue to be positive on investment grade credit. Discussions about potentially more quantitative easing and the sovereign debt issues could keep investors seeking a safer trade for some time, which could be supportive for high-quality fixed income assets. Even if interest rates drift modestly higher, we believe corporate bonds still could perform well under our base economic forecast.

We believe MBS remain fundamentally sound, and if interest rate volatility remains contained they could outperform Treasuries in 2011. We continue to overweight CMBS and non-agency RMBS, as we believe the supply/demand factors will remain supportive and the underlying fundamentals are likely to continue to support current valuations.

In non-index sectors, we remain constructive but selective in high yield and see value in emerging market debt ("EMD"). We see the greatest value and opportunity in local currency EMD as further dollar depreciation could benefit investments denominated in local currencies.

Investment Type Allocation

as of December 31, 2010

(as a percent of net assets)

| Corporate Bonds/Notes | | | 39.1 | % | |

| U.S. Government Agency Obligations | | | 27.0 | % | |

| Collateralized Mortgage Obligations | | | 13.8 | % | |

| U.S. Treasury Obligations | | | 11.7 | % | |

| Asset-Backed Securities | | | 9.9 | % | |

| Foreign Government Bonds | | | 5.7 | % | |

| Preferred Stock | | | 0.2 | % | |

| Municipal Bonds | | | 0.1 | % | |

| Other Assets and Liabilities — Net* | | | (7.5 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2010

(as a percent of net assets)

| U.S. Treasury Note, 3.875%, due 08/15/40 | | | 3.8 | % | |

| Federal National Mortgage Association, | | | |

| 4.500%, due 01/25/39 | | | 3.2 | % | |

| Brazil Notas do Tesouro Nacional Series F, | | | |

| 10.000%, due 01/01/14 | | | 2.6 | % | |

| U.S. Treasury Note, 3.375%, due 11/15/19 | | | 2.0 | % | |

| Federal Home Loan Mortgage Corporation, | | | |

| 4.000%, due 08/15/40 | | | 1.8 | % | |

| U.S. Treasury Note, 2.250%, due 11/30/17 | | | 1.6 | % | |

| South Africa Government International Bond, | | | |

| 7.250%, due 01/15/20 | | | 1.6 | % | |

| U.S. Treasury Note, 2.625%, due 11/15/20 | | | 1.6 | % | |

| MBNA Credit Card Master Note Trust, | | | |

| 5.600%, due 07/17/14 | | | 1.5 | % | |

| Mexican Bonos, 8.000%, due 06/11/20 | | | 1.5 | % | |

* Excludes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I.

Portfolio holdings are subject to change daily.

* Effective August 2, 2010 Michael Hyman, Peter Guan and Christopher Diaz were removed as Portfolio Managers to the Portfolio and Matthew Toms and Michael Mata were added as Portfolio Managers to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

10

ING INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

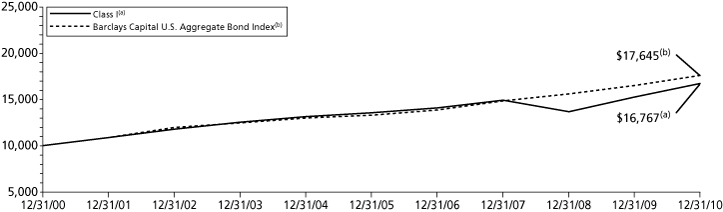

| Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

May 3, 2002 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 9.01 | % | | | — | | | | — | | | | 3.71 | % | | | — | | | | — | | |

| Class I | | | 9.84 | % | | | 4.35 | % | | | 5.30 | % | | | — | | | | — | | | | — | | |

| Class S | | | 9.51 | % | | | 4.07 | % | | | — | | | | — | | | | 4.77 | % | | | — | | |

| Class S2 | | | 9.29 | % | | | — | | | | — | | | | — | | | | — | | | | 13.01 | % | |

Barclays Capital U.S.

Aggregate Bond Index | | | 6.54 | % | | | 5.80 | % | | | 5.84 | % | | | 6.17 | %(1) | | | 5.52 | %(2) | | | 7.56 | %(3) | |

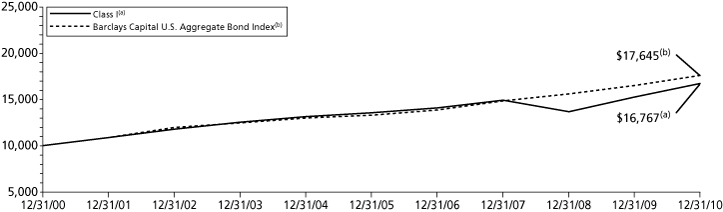

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Intermediate Bond Portfolio against the index indicated. An index has has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) Since inception performance for the the index is shown from January 1, 2007.

(2) Since inception performance for the index is shown from May 1, 2002.

(3) Since inception performance for the index is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

11

ING MONEY MARKET PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Money Market Portfolio (the "Portfolio") seeks to provide high current return, consistent with preservation of capital and liquidity, through investment in high-quality money market instruments, while maintaining a stable share price of $1.00 per share. The Portfolio is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2010, the Portfolio's shares provided a total return of 0.24% compared to the iMoneyNet First Tier Retail Index, which returned 0.03% for the same period.

Portfolio Specifics: For money market investors, 2010 was a year characterized by a low interest rate environment, continued government support and both the U.S. economy and global economy struggling in the first half of the year followed by stabilization and modest recovery in the second half of the year. Most money market funds were forced to waive a portion of their fees in order to maintain a yield at or above 0.00%.

Economic conditions improved modestly during the first quarter of 2010, building on the improvement seen in the second half of 2009, although portions of the economy such as housing continued to struggle. The unemployment rate remained elevated but declined to 9.7% at quarter-end, down from 10.0% as of December 31, 2009. The Federal Open Market Committee ("FOMC") kept short-term rates extremely low versus historical standards and indicated that rates would remain low for an extended period of time. Short-term money market rates changed little during the quarter. Revisions to SEC Rule 2a-7 were announced late in the quarter seeking to reduce risks for money market funds; but the revisions also reduce potential yields going forward.

During the second quarter of 2010, the public finance problems faced by the Greek government gradually evolved into a full-blown fiscal crisis for the euro zone. This weighed heavily on the short-term money markets here in the United States as most of the large European banks fund a portion of their liquidity needs in our market. In light of the deteriorating outlook for Europe and implications for global economic growth, the stubbornly high U.S. unemployment, continuing week housing market and below target inflation, the FOMC reiterated at both of the Federal Reserve (the "Fed") meetings during the quarter its intent to maintain an "exceptionally low levels of the federal funds rate for an extended period."

Economic reports during the third quarter of 2010 primarily painted a picture of a slowing recovery, continued high unemployment, below target inflation and continued difficulty in the housing sector. Market expectations for the Fed to start the next round of quantitative easing ("QE2") as early as November increased as the quarter progressed. Short-term yields declined during the quarter with the two-year Treasury going from 0.61% as of the end of June to 0.43% at the end of September. Yield for the various money market securities declined as well, led by the money market securities of high quality European banks on improving credit outlook.

The fourth quarter of 2010 saw the implementation of QE2 and on balance an improving economic picture, albeit only a modest recovery and not one expected to pull the economy out of the ditch in the near term. Housing and unemployment continued to recover in the U.S. Unemployment ended the year at 9.4%. Longer-term U.S. Treasury yields rose as the economic outlook improved but short-term money market rates remained anchored by expectations that the FOMC would keep the federal funds rate within the current range well into 2011 or beyond.

Our focus this past year was similar to 2009: not on maximizing yield and return but on preservation of capital, limiting credit risk and keeping an excess liquidity cushion against the still elevated risks in the market. We adjusted the overall makeup of the Portfolio to comply with SEC Rule 2a-7. The Portfolio performed in-line with its benchmark despite our risk reduction strategy, returning 0.02% for the year compared to the 0.03% return of the iMoneyNet First Tier Retail average return. The Portfolio took on interest rate risk throughout the year, maintaining a weighted average maturity ("WAM") at the longer end of its maturity range primarily by buying longer term Treasury and agency securities and selectively adding longer-term credit exposure later in the year. The Portfolio finished the year with a 54-day WAM, which is just shy of the new 60 day maximum WAM limit.

Current Strategy and Outlook: It is our opinion that the economy is positioned for a slow recovery in 2011 due to expected high continuing unemployment and the significant slack in the productive capacity. The lack of a sustained and significant housing recovery, constrained consumer spending and low inflation presents significant headwinds to a robust recovery. We believe the FOMC will be forced to keep the federal funds rate in the 0.00% to 0.25% range well into 2011 or beyond and that additional quantitative easing may be warranted. In our opinion, the potential for a significant increase in short-term money market yields and increase in the Portfolio's yield remain very low.

The Portfolio continues to focus on maintaining an extended weighted average maturity posture with limited credit risk, though current yields reduce the incentive to do so. Preservation of capital and liquidity remain our top objectives. We plan to maintain above normal liquidity to give the Portfolio the flexibility to take advantage of any periods of temporary yield increases.

Principal Risk Factors: Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

Investment Type Allocation

as of December 31, 2010

(as a percent of net assets)

| Commercial Paper | | | 49.3 | % | |

| Repurchase Agreement | | | 22.5 | % | |

| Corporate Bonds/Notes | | | 16.8 | % | |

| Certificates Of Deposit | | | 7.3 | % | |

| U.S. Government Agency Obligations | | | 3.7 | % | |

| U.S. Treasury Notes | | | 0.7 | % | |

| Securities Lending Collateral | | | 0.1 | % | |

| Other Assets and Liabilities — Net | | | (0.4 | )% | |

| Net Assets | | | 100.0 | % | |

Portfolio holdings are subject to change daily.

* Please see Note 5 for more information regarding the contractual waiver in place to reimburse certain expenses of the Portfolio to the extent necessary to assist the Portfolio in maintaining a net yield of not less than zero.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

12

ING BLACKROCK SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING BlackRock Science and Technology Opportunities Portfolio (the "Portfolio") seeks long-term capital appreciation. The Portfolio is managed by Thomas P. Callan, CFA, Managing Director and Senior Portfolio Manager, Erin Xie, PhD, Managing Director and Portfolio Manager and Jean M. Rosenbaum, CFA, Managing Director and Portfolio Manager of BlackRock Advisors, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2010, the Portfolio's Class I shares provided a total return of 18.56% compared to the S&P 500® Index and the NYSE Arca Tech 100 IndexSM, which returned 15.06% and 25.40%, respectively, for the same period.

Portfolio Specifics: Since the market lows in March of 2009, we have witnessed a robust, albeit choppy, recovery in equity markets. Similar to past recoveries, consumer-related stocks and other early-stage cyclicals were leaders of the rebound. Overall, emerging markets and small cap equities have led the recovery in financial markets. Despite the upward trend, equity markets have not been unidirectional, but rather characterized by pronounced reversals of range-bound trading patterns driven by massive swings in investor risk tolerance. These trading patterns suggest to us that the market is still searching for a consistent trend and one might argue that the late-stage 2010 rally was fueled more by market-friendly developments in Washington, DC and rampant energy and commodity prices rather than fundamentally solid signals of sustained economic recovery.

The Portfolio underperformed its reference benchmark, the NYSE Arca Tech 100 IndexSM, for the year. Disappointing stock selection across the semiconductors, communication equipment, and internet software & services sub-industries stood out as the primary cause of Portfolio underperformance, while cash was a notable drag and the effects of sector allocation were mixed. To start off the year, the software & services industry group was notably weak as the mix of Portfolio holdings within the internet software & services, systems software, and application software sub-industries returned poor relative results. In the second quarter, transaction timing hurt performance as additions to the Portfolio's semiconductors holdings suffered when the advancing market stalled out in mid-April as the European sovereign crisis took hold and fell steadily to close the first half of 2010. The underperformance of semiconductors was in part driven by fears of a global slowdown in economic growth coupled with investors' shifting opinions that forward earnings estimates were too high relative to current business conditions. Fears of a double dip recession were abruptly replaced with renewed optimism in the second half of 2010, causing equities to rebound sharply through year end. As investors turned toward higher-risk assets, information technology ("IT") stocks handily outperformed the health care sector, and as such, the Portfolio's large overweight in IT relative to the NYSE Arca Tech 100 IndexSM was a source of strength. In healthcare, the biggest detractor for the year was the decision to underweight the life sciences tools & services sub-industry. Industry consolidation and the advancement of research & development in the emerging markets were key drivers for these stocks.

From an individual holdings perspective, priceline.com, Inc., ARM Holdings PLC and Western Digital Corp. were the strongest relative contributors to returns, while Cisco Systems, Inc. and AsiaInfo-Linkage detracted from performance, as did underweight positions in Salesforce.com, Inc. and F5 Networks, Inc.

Current Strategy and Outlook: We are cautiously optimistic on financial markets in 2011. While we are alert to continuing signs of economic strength, particularly as it relates to employment figures in the U.S., we remain cognizant that the recent equity rally might not be long-sustained and a short-term retrenchment is possible. The robust government spending in the U.S. may prove successful in pulling the U.S. economy fully out of the doldrums, but an eventual need for austerity seems likely. The theme of austerity has already entered the lexicon in the Eurozone amidst the very real exogenous risks tied to the unresolved sovereign debt crisis. Given these environmental factors, we have constructively positioned the Portfolio with a bias toward companies that we believe have been demonstrating sustainable growth.

At year-end, 88% of the Portfolio was invested in IT, 4.5% in healthcare, and 2.5% in telecommunication services, with the remainder invested in industrials and consumer discretionary stocks. Within IT, the Portfolio's primary overweights relative to the benchmark were in semiconductors, internet software & services, and systems software, while it was underweight in application software, data processing & outsourced services, and communications equipment.

Industry Allocation

as of December 31, 2010

(as a percent of net assets)

| Information Technology | | | 87.1 | % | |

| Health Care | | | 4.4 | % | |

| Telecommunication Services | | | 2.4 | % | |

| Consumer Discretionary | | | 2.2 | % | |

| Industrials | | | 0.6 | % | |

| Other Assets and Liabilities — Net* | | | 3.3 | % | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2010

(as a percent of net assets)

| Apple, Inc. | | | 8.4 | % | |

| International Business Machines Corp. | | | 3.4 | % | |

| Google, Inc. — Class A | | | 3.0 | % | |

| F5 Networks, Inc. | | | 2.5 | % | |

| Qualcomm, Inc. | | | 2.4 | % | |

| Microsoft Corp. | | | 2.3 | % | |

| EMC Corp. | | | 2.2 | % | |

| Oracle Corp. | | | 2.1 | % | |

| Cisco Systems, Inc. | | | 1.9 | % | |

| Texas Instruments, Inc. | | | 1.8 | % | |

* Excludes short-term investments related to Blackrock Liquidity Funds TempFund Portfolio — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

13

ING BLACKROCK SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

PORTFOLIO MANAGERS' REPORT

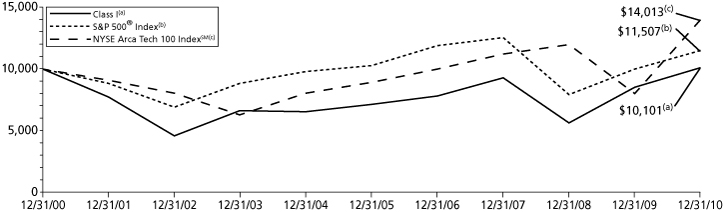

| Average Annual Total Returns for the Periods Ended December 31, 2010 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class S

November 1, 2001 | | Since Inception

of Class ADV

December 16, 2008 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 18.02 | % | | | — | | | | — | | | | — | | | | 32.35 | % | | | — | | |

| Class I | | | 18.56 | % | | | 6.82 | % | | | 0.10 | % | | | — | | | | — | | | | — | | |

| Class S(1) | | | 18.15 | % | | | 6.53 | % | | | — | | | | 2.18 | % | | | — | | | | — | | |

| Class S2 | | | 18.18 | % | | | — | | | | — | | | | — | | | | — | | | | 43.47 | % | |

| S&P 500® Index | | | 15.06 | % | | | 2.29 | % | | | 1.41 | % | | | 3.89 | % | | | 20.63 | %(2) | | | 36.89 | %(3) | |

| NYSE Arca Tech 100 IndexSM | | | 25.40 | % | | | 6.10 | % | | | 3.43 | % | | | 7.27 | % | | | 34.54 | %(2) | | | 44.43 | %(3) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING BlackRock Global Science and Technology Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) On December 16, 2003, all outstanding shares of Class S were fully redeemed. On July 20, 2005, Class S recommenced operations. The returns for Class S include the performance for Class I, adjusted to reflect the higher expenses of Class S, for the period December 17, 2003 to July 19, 2005.

(2) Since inception performance for the indices is shown from January 1, 2009.

(3) Since inception performance for the indices is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser. Formerly, ING Investment Management Co. served as the investment adviser. Prior to January 1, 2004, the Portfolio was sub-advised by a different sub-adviser.

14

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2010 to December 31, 2010. The Portfolios' expenses are shown without the imposition of any charges which are, or may be, imposed under your annuity contract. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, "Actual Portfolio Return," provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, "Hypothetical (5% return before expenses)," provides information about hypothetical account values and hypothetical expenses based on a Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

| ING Balanced Portfolio | | Beginning

Account

Value

July 1,

2010 | | Ending

Account

Value

December 31,

2010 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2010* | | Beginning

Account

Value

July 1,

2010 | | Ending

Account

Value

December 31,

2010 | | Annualized

Expense

Ratio | | Expenses Paid

During the

Period Ended

December 31,

2010* | |

| Class I | | $ | 1,000.00 | | | $ | 1,147.80 | | | | 0.62 | % | | $ | 3.36 | | | $ | 1,000.00 | | | $ | 1,022.08 | | | | 0.62 | % | | $ | 3.16 | | |

| Class S | | | 1,000.00 | | | | 1,146.60 | | | | 0.87 | | | | 4.71 | | | | 1,000.00 | | | | 1,020.82 | | | | 0.87 | | | | 4.43 | | |