UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02565

Voya Government Money Market Portfolio

(Exact name of registrant as specified in charter)

| 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, AZ | 85258 |

| (Address of principal executive offices) | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2023

Classes ADV, I, R6, S, S2 and T

Voya Variable Product Funds

■ Voya Balanced Portfolio

■ Voya Global High Dividend Low Volatility Portfolio

■ Voya Government Money Market Portfolio

■ Voya Growth and Income Portfolio

■ Voya Intermediate Bond Portfolio

■ Voya Small Company Portfolio

Effective January 24, 2023, the U.S. Securities and Exchange Commission adopted rule and form amendments to require mutual funds to transmit concise and visually engaging streamlined annual and semi-annual reports to shareholders that highlight key information deemed important for investors to assess and monitor their fund investments. Other information, including financial statements, will no longer appear in the funds’ streamlined shareholder reports but must be available online, delivered free of charge upon request, and filed on a semi-annual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024.

This report is submitted for general information to shareholders of the Voya mutual funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully.

|  | E-Delivery Sign-up – details inside |

INVESTMENT MANAGEMENT voyainvestments.com | |  |

TABLE OF CONTENTS

| Go Paperless with E-Delivery! |  |

| Sign up now for on-line prospectuses, fund reports, and proxy statements. |

| Just go to individuals.voya.com/page/e-delivery, follow the directions and complete the quick 5 Steps to Enroll. |

| You will be notified by e-mail when these communications become available on the internet. |

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the Portfolios’ website at www.voyainvestments.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC’s”) website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended December 31 is available without charge on the Portfolios’ website at www.voyainvestments.com and on the SEC’s website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form NPORT-P. The Portfolios’ Forms NPORT-P are available on the SEC’s website at www.sec.gov. Each Portfolio’s complete schedule of portfolio holdings is available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180. Voya Government Money Market Portfolio does not file on Form N-PORT.

The Voya Government Money Market Portfolio files its complete schedule of portfolio holdings with the SEC monthly on Form N-MFP. The Portfolio’s Form N-MFP is available on the SEC’s website at www.sec.gov or the monthly schedule of portfolio holdings are also available at: www.voyainvestments.com and without charge upon request from the Portfolio by calling Shareholder Services toll-free at (800) 992-0180.

Benchmark Descriptions

| Index | Description |

| Bloomberg U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”) | An index of publicly issued investment grade U.S. government, mortgage-backed, asset- backed and corporate debt securities. |

| iMoneyNet Government Institutional Index | The average return for a category of money market funds that includes all government institutional funds: Treasury Institutional, Treasury and Repo Institutional and Government and Agencies Institutional. |

| MSCI Europe, Australasia and Far East®(“MSCI EAFE®”) Index | An index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. It includes the reinvestment of dividends net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing. |

| MSCI World Value IndexSM (“MSCI World Value”) | The index captures large and mid cap securities exhibiting overall value style characteristics across 23 Developed Markets countries. |

| Russell 2000® Index | An index that measures the performance of securities of small U.S. companies. |

| Russell 3000® Index | An index that measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. |

| S&P 500® Index* | An index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets. |

| S&P Target Risk® Growth Index | Seeks to measure the performance of an asset allocation strategy targeted to a growth focused risk profile. |

| * | The S&P 500® Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by Voya Financial. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Voya Financial Product(s) is/are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® Index. |

| Voya Balanced Portfolio | | Portfolio Managers’ Report |

Voya Balanced Portfolio (the “Portfolio”) seeks total return consisting of capital appreciation (both realized and unrealized) and current income; the secondary investment objective is long-term capital appreciation. The Portfolio uses an asset allocation strategy (“Target Asset Allocation”) to invest in a diversified portfolio of various asset classes and investment strategies. The Portfolio is managed by Lanyon Blair, CFA, and Barbara Reinhard, CFA, Portfolio Managers* of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class I shares provided a total return of 15.92% compared to the S&P Target Risk® Growth Index, Bloomberg U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”), MSCI EAFE® Index (“MSCI EAFE®”) and Russell 3000® Index, which returned 15.38%, 5.53%, 18.24% and 25.96%, respectively, for the same period.

Portfolio Specifics: At the beginning of the period, the Portfolio was underweight in equity and overweight to fixed income relative to its strategic allocation benchmark. Equity sub-asset class allocations were overweight to U.S. small cap equities and U.S. core fixed income and underweight in U.S. large cap and international developed equites. Within fixed income, the Portfolio was underweight in U.S. high yield and overweight to U.S. long duration government bonds.

Investment Type Allocation

as of December 31, 2023 (as a percentage of net assets) |

| | Common Stock | 36.0% | |

| | Mutual Funds | 29.6% | |

| | Corporate Bonds/Notes | 7.6% | |

| | U.S. Government Agency Obligations | 7.1% | |

| | Exchange-Traded Funds | 6.9% | |

| | U.S. Treasury Obligations | 3.8% | |

| | Collateralized Mortgage Obligations | 3.2% | |

| | Asset-Backed Securities | 2.5% | |

| | Commercial Mortgage-Backed Securities | 2.3% | |

| | Sovereign Bonds | 0.1% | |

| | Preferred Stock | 0.0% | |

| | Assets in Excess of Other Liabilities* | 0.9% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. Portfolio holdings are subject to change daily. | |

In early January, the Portfolio added to U.S. mid cap and emerging markets equity by reducing core fixed income. Risk appetite was overly depressed, which gave a contrarian signal that in our opinion equities could still rally. China’s re-opening and favorable relative valuations offered a good adding point for emerging market equities and allocating to U.S. mid caps helped diversify away from U.S. large cap technology. In early February, prior to a big run-up in yields before the emergence of banking sector stress, the Portfolio reduced duration. Inflation appeared hotter than expected at the time, yields were approaching a resistance level and a more neutral duration posture was the prudent positioning, in our view.

As part of its annual review in early April, the Portfolio’s strategic asset allocations were reset, resulting in reduced strategic allocations to stocks. Target allocations to U.S. large cap, international developed equities and core U.S. bonds were reduced, while U.S. mid cap and short-term bonds were increased. Later in the period, we cut some of the Portfolio’s underweights in international developed equities as a risk management trade, despite the region’s still unfavorable risk- reward profile. Finally, at the end of April, we reduced U.S. small cap equities and increased U.S. large cap equities. At the time, U.S. small caps remained oversold and traded at attractive relative valuations, but concerns over regional banking issues were expected to weigh on the asset class in the near-term.

There were no other fundamental asset allocation trades during the remainder of the period. The Portfolio continues to favor U.S. assets and maintain modestly defensive posture overall with a preference for U.S. large cap equities and core investment grade fixed income.

Top Ten Holdings as of December 31, 2023 (as a percentage of net assets) |

| | Voya U.S. Stock Index Portfolio - Class I | 18.2% |

| | Voya Short Term Bond Fund - Class R6 | 7.0% |

| | Vanguard FTSE Emerging Markets ETF | 2.9% |

| | Voya Small Company Fund - Class R6 | 2.0% |

| | iShares Core U.S. Aggregate Bond ETF | 1.9% |

| | Vanguard Long-Term Treasury ETF | 1.9% |

| | Federal Home Loan Bank Discount Notes, 10.550%, 01/02/24 | 1.6% |

| | Microsoft Corp. | 1.6% |

| | Apple, Inc. | 1.6% |

| | Voya VACS Series HYB Fund | 1.4% |

| Portfolio holdings are subject to change daily. |

Overall, tactical asset allocation positioning relative to the strategic asset allocation was a challenge to performance.Holding underlying funds contributed to the Portfolio’s performance for the year. The U.S. large cap equity sleeve was the main contributor to excess returns. The U.S. core fixed income sleeve also added value.

Current Strategy and Outlook: After unexpectedly strong performance from the U.S. economy and capital markets last year, investors enter 2024 more upbeat. While we are encouraged about the progress of inflation and the resiliency of consumers and corporations, we think noticeably slower economic growth, fair to modestly extended valuations and very optimistic forecasts around U.S. Federal Reserve rate cuts could limit upside potential for stocks. We see rates markets are providing little room for yields to decline outside a meaningful slowing of economic growth. Despite high expectations, we think global stocks and bonds can produce respectable

| Portfolio Managers’ Report | | Voya Balanced Portfolio |

returns throughout the year. The current setting presents opportunities for allocators to benefit from divergences in global policy, business cycles and pricing of risk. In this macro environment, we emphasize balance in the Portfolios, but believe U.S. exceptionalism is set to persist.

The disinflationary process continues as decongested supply chain issues and slowing demand forces have accounted for most of the recent relief. We see more downside from factors such as shelter, and weaker wage growth as the lagged impact of tighter monetary policy further filters into the labor market, where there are early signs of weakness — such as declining job openings and quits. However, we do not expect significant deterioration in the labor market. We believe limited private sector overreach and rising real incomes from falling inflation should keep the growth downturn mild.

In our opinion, U.S. equities may continue to outperform other countries and regions, driven by their higher growth potential, proactive corporate rightsizing and robust earnings from unrivaled software innovation. We continue to be cautious on Europe as we believe the region’s cyclical gearing and relatively high interest rate sensitivity has made the sting from tighter policy more broadly felt. Europe is also more exposed to energy supply shocks and external demand from China, which is struggling. Exports have plunged, due in part to U.S. companies’ efforts to re-shore or move offshore manufacturing elsewhere. Furthermore, China’s real estate sector, their main growth engine, is in our opinion, in freefall. We are mindful that sentiment is beaten down and look for signs that the Chinese authorities will implement coordinated policy action before shifting stances.

* Effective May 1, 2023, Lanyon Blair, CFA was added as a portfolio manager to the Portfolios and Matthew Toms, CFA was removed as a portfolio manager. In addition, effective December 31, 2023, Paul Zemsky retired from Voya Investment Management Co. LLC and is no longer a portfolio manager to the Portfolios.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| Voya Balanced Portfolio | | Portfolio Managers’ Report |

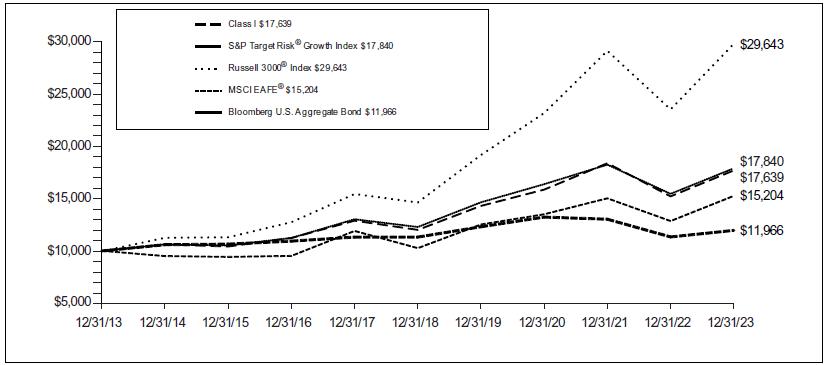

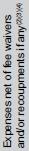

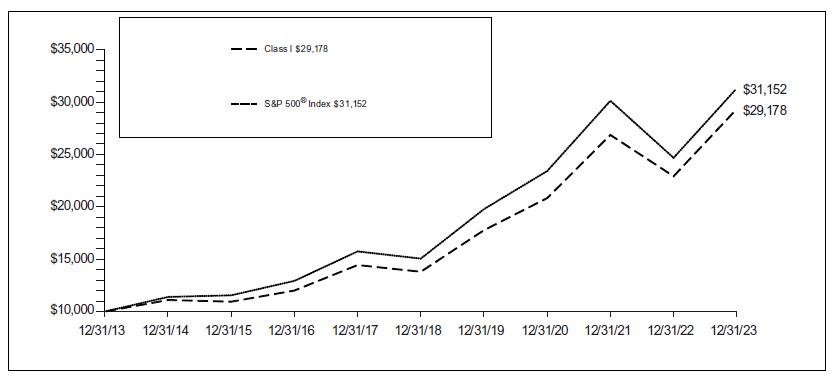

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| 1 Year | 5 Year | 10 Year |

| Class I | 15.92% | 7.98% | 5.84% |

| Class S | 15.71% | 7.72% | 5.58% |

| S&P Target Risk® Growth Index | 15.38% | 7.73% | 5.96% |

| Russell 3000® Index | 25.96% | 15.16% | 11.48% |

| MSCI EAFE® | 18.24% | 8.16% | 4.28% |

| Bloomberg U.S. Aggregate Bond | 5.53% | 1.10% | 1.81% |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Balanced Portfolio against the indices indicated. An index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which

have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| Portfolio Managers’ Report | | Voya Global High Dividend Low Volatility Portfolio |

Voya Global High Dividend Low Volatility Portfolio (the “Portfolio”) seeks long-term capital growth and current income. The Portfolio is managed by Steve Wetter, Kai Yee Wong, Peg DiOrio, CFA, and Vincent Costa, CFA, Portfolio Managers(1) of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class S shares provided a total return of 6.43% compared to the MSCI World Value IndexSM (the “Index” or “MSCI World Value”) which returned 11.51% for the same period.

Portfolio Specifics: For the reporting period, the Portfolio underperformed the Index. In terms of the Portfolio’s performance, the Portfolio’s lower beta positioning detracted, while the core model contributed.

On the regional level, stock selection was weakest in North America. On the sector level, stock selection was strong in the energy sector. At the individual stock level, not owning Exxon Mobil Corp., the underweight in Chevron Corp. and exposure to non-benchmark stock Sage Group PLC contributed.

Geographic Diversification

as of December 31, 2023 (as a percentage of net assets) |

| | United States | 67.1% | |

| | Japan | 7.0% | |

| | United Kingdom | 4.2% | |

| | Australia | 2.4% | |

| | Canada | 2.2% | |

| | France | 2.2% | |

| | Spain | 2.0% | |

| | Hong Kong | 1.7% | |

| | Netherlands | 1.7% | |

| | Switzerland | 1.4% | |

| | Countries between 0.1% - 1.2%^ | 6.7% | |

| | Assets in Excess of Other Liabilities* | 1.4% | |

| | Net Assets | 100.0% | |

| * Includes short-term investments and exchange-traded funds. ^ Includes 12 countries, which each 0.1% - 1.2% of net n assets. | |

| Portfolio holdings are subject to change daily. |

Top Ten Holdings as of December 31, 2023 (as a percentage of net assets) |

| | Johnson & Johnson | 1.8% |

| | Merck & Co., Inc. | 1.6% |

| | AbbVie, Inc. | 1.5% |

| | Chevron Corp. | 1.5% |

| | PepsiCo, Inc. | 1.3% |

| | Cisco Systems, Inc. | 1.2% |

| | Procter & Gamble Co. | 1.2% |

| | Verizon Communications, Inc. | 1.1% |

| | Amgen, Inc. | 1.1% |

| | Philip Morris International, Inc. | 1.0% |

| Portfolio holdings are subject to change daily. |

By contrast, at the sector level stock selection was weakest in the information technology and financials sectors. At the individual stock level, not owning Broadcom Inc. and Intel Corporation and the overweight to Bristol-Myers Squibb Co. detracted from relative returns.

Current Strategy and Outlook: This is an actively-managed global quantitative equity strategy that seeks to generate higher dividend income and total returns, with lower volatility and better downside capture, than the Index. The investment process seeks to create a universe of sustainable dividend-paying stocks and utilizes fundamentally driven sector-specific alpha models to identify the most attractive stocks within each region- sector. The Portfolio is then optimized to achieve its dividend, alpha and volatility objectives.

(1) Effective on or about March 1, 2024, Peg DiOrio will be removed as portfolio manager for the Portfolio.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

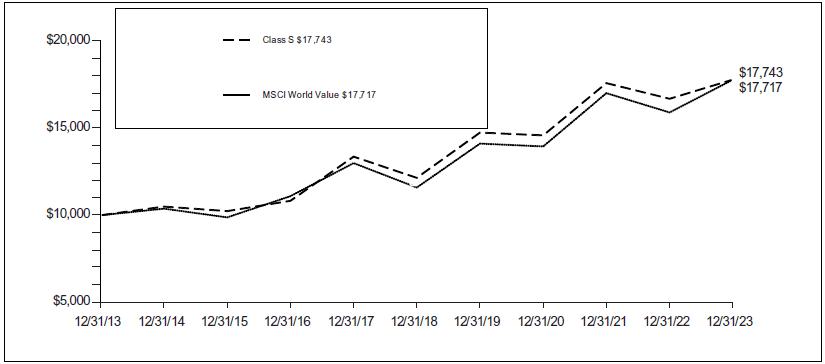

| Voya Global High Dividend Low Volatility Portfolio | | Portfolio Managers’ Report |

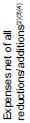

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | | | Since |

| 1 Year | 5 Year | 10 Year | Inception |

| Class ADV | 6.18% | 7.62% | 5.64% | — |

| Class I(1) | 6.74% | 8.17% | 6.14% | — |

| Class S | 6.43% | 7.89% | 5.90% | — |

| Class S2 | 6.37% | 7.75% | — | 5.44%(2) |

| Class T | 6.15% | 7.53% | — | 5.24%(2) |

| MSCI World Value | 11.51% | 8.87% | 5.89% | 6.07% |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Global High Dividend Low Volatility Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| (1) | Class I incepted on March 5, 2015. The Class I shares performance shown for the period prior to their inception date is the performance of Class S shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

| (2) | Class S2 and T inception date was March 5, 2015. |

| Portfolio Managers’ Report | Voya Government Money Market Portfolio |

| | |

Voya Government Money Market Portfolio* (the “Portfolio”) seeks to provide high current return, consistent with preservation of capital and liquidity, through investment in high-quality money market instruments, while maintaining a stable share price of $1.00 per share. The Portfolio is managed by David S. Yealy, Portfolio Manager of Voya Investment Management Co. LLC (“Voya IM”) — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class I shares provided a total return of 4.77% compared to the iMoneyNet Government Institutional Index, which returned 4.83% for the same period.

Portfolio Specifics: For the reporting period ended December 31, 2023, preservation of capital and keeping an excess liquidity cushion were our primary objectives for the Portfolio during the period. Maximizing the yield and the total return of the fund remained a secondary objective.

| Investment Type Allocation |

| as of December 31, 2023 |

| (as a percentage of net assets) |

| | U.S. Treasury Debt | 41.8% | |

| | U.S. Government Agency Debt | 32.2% | |

| | U.S. Treasury Repurchase Agreements | 21.2% | |

| | Investment Companies | 4.1% | |

| | Assets in Excess of Other Liabilities | 0.7% | |

| | Net Assets | 100.0% | |

Portfolio holdings are subject to change daily. |

2023 was a year of uncertainty, from the banking crisis early in the year to the U.S. Federal Reserve’s unexpected pivot on interest rates in December. The U.S. economy remained surprisingly resilient, driven by low unemployment, rising wages, robust consumer spending and increased investment in manufacturing. Volatility persisted in the U.S. bond market but ended the year on a strong note.

The yield on the U.S. Treasury 10-year note remained in a tight range for the first seven months of the year before spiking in August following news of a red-hot jobs market and then, ultimately falling in December to near where it began the year as inflation and employment both moderated. Credit-sensitive bond sectors, such as high yield and bank loans, provided investors with equity-like returns for the year. Emerging market debt staged a comeback from a difficult 2022 thanks to waning inflation and a weakening U.S. dollar.

The Portfolio maintained a shorter than normal weighted average maturity (“WAM”) for the majority of the reporting period. Early in the year, we anticipated further hikes after 2022’s aggressive moves. The Fed raised rates four out of its first five meetings for a total of 100 basis points, before pausing and ending the year in the range of 5.25–5.50%.

In addition to the Portfolio’s shorter WAM, it held floating rate Treasuries tied to the three-month Treasury bill, which added yield early in the year. The Portfolio then shifted to floating rate agencies tied to the secured overnight funding rate (“SOFR”). At the time, we believed the SOFR would be higher than the three-month Treasury bill as the market priced in rate cuts. This belief persists for 2024.

Outlook and Current Strategy: As the market focus shifts from inflation to growth concerns, in our view duration will become an effective offset to risky asset drawdowns. It is our opinion that rate volatility, though receding from recent peaks, will remain above pre-pandemic levels due to uncertainty about the timing of rate cuts and concerns about government debt levels. Elevated real rates will incent investors to increase allocations to fixed income, creating opportunities during bouts of volatility.

That said, we believe many corners of the market appear to be priced for a soft landing. While this has become a more likely outcome, we believe the risks to this outcome materializing are being ignored. Labor markets are coming into better balance which, while good news for inflation, could cause concern among workers that a turn in the cycle is approaching. This in turn could compel workers to boost savings rates which would limit consumption and act as a challenge to growth.

As such, we think the Fed will cut rates in 2024, although not as soon as or by as much as the market is currently pricing in. We will look for opportunities to extend WAM if the market moves in line with our view. We expect ample openings over the year to make that shift as inflation and labor data trend smoothly. Until then, we will keep a shorter WAM and continue to buy floating-rate agencies.

| Voya Government Money Market Portfolio | Portfolio Managers’ Report |

| | |

* Please see Note 5 for more information regarding the contractual waiver in place to reimburse certain expenses of the Portfolio to the extent necessary to assist the Portfolio in maintaining a net yield of not less than 0.00%.

You could lose money by investing in the Portfolio. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Portfolio’s sponsor has no legal obligation to provide financial support to the Portfolio, and you should not expect that the sponsor will provide financial support to the Portfolio at any time.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| Portfolio Managers’ Report | Voya Growth and IncomE Portfolio |

| | |

Voya Growth and Income Portfolio (the “Portfolio”) seeks to maximize total return through investments in a diversified portfolio of common stock and securities convertible into common stocks. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Vincent Costa, CFA, James Dorment, CFA, and Gregory Wachsman, CFA, Portfolio Managers of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class I shares provided a total return of 27.39% compared to the S&P 500® Index (the “Index”), which returned 26.29% for the same period.

Portfolio Specifics: For the reporting period, the Portfolio outperformed the Index, due to strong stock selection. Stock selection within the health care, financials and consumer discretionary sectors had the greatest positive impact on performance. At the individual stock level, overweight positions in Amazon.com, Inc. and NVIDIA Corp. and an underweight position in Apple Inc. contributed the most to performance. By contrast, on the sector level, stock selection in communication services had the largest negative impact on relative performance. Key detractors included an underweight position in Meta Platforms Inc., not owning Tesla, Inc. and an overweight position in AT&T Inc.

Sector Diversification

as of December 31, 2023

(as a percentage of net assets) |

| | Information Technology | 26.4% | |

| | Health Care | 14.8% | |

| | Financials | 11.4% | |

| | Consumer Discretionary | 10.2% | |

| | Industrials | 9.0% | |

| | Communication Services | 7.5% | |

| | Consumer Staples | 6.8% | |

| | Energy | 4.7% | |

| | Materials | 3.1% | |

| | Utilities | 3.0% | |

| | Real Estate | 2.9% | |

| | Assets in Excess of Other Liabilities* | 0.2% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. | | |

Portfolio holdings are subject to change daily. |

| | Top Ten Holdings

as of December 31, 2023

(as a percentage of net assets) |

| | Microsoft Corp. | 8.9% |

| | Amazon.com, Inc. | 5.7% |

| | Meta Platforms, Inc. - Class A | 4.0% |

| | NVIDIA Corp. | 3.8% |

| | Philip Morris International, Inc. | 2.4% |

| | Bank of America Corp. | 2.2% |

| | AT&T, Inc. | 2.1% |

| | Roper Technologies, Inc. | 2.1% |

| | Micron Technology, Inc. | 2.1% |

| | Intercontinental Exchange, Inc. | 2.1% |

Portfolio holdings are subject to change daily. |

Current Strategy and Outlook: The recent “Fed Pivot” appears to be signalling that the period of interest rate increases is over and that rate cuts in 2024 will be forthcoming. We believe this will continue to drive a broadening out of the equity market. From a positioning standpoint, more economically sensitive companies and sectors should see a benefit relative to more defensive or stable growth companies and sectors, in our opinion. While we always seek to have balance in the Portfolio, we’ve increased our exposure modestly to companies that we believe are more economically sensitive given the soft-landing narrative in place currently and potentially for some time going forward.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

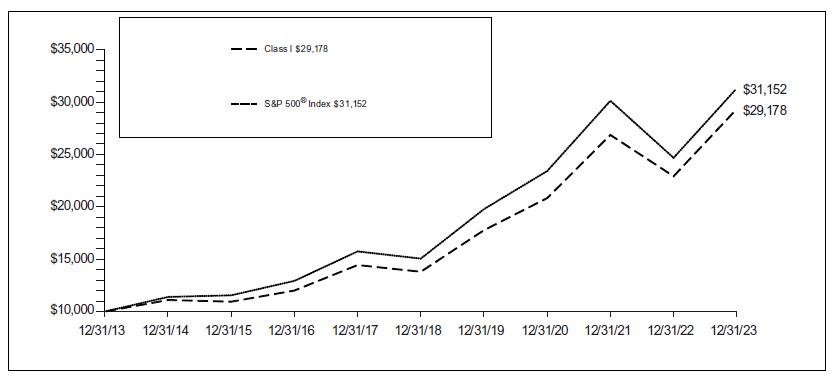

| Voya Growth and IncomE Portfolio | Portfolio Managers’ Report |

| | |

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year |

| Class ADV | 26.78% | 15.67% | 10.80% |

| Class I | 27.39% | 16.20% | 11.30% |

| Class S | 27.06% | 15.90% | 11.02% |

| Class S2 | 26.90% | 15.73% | 10.86% |

| S&P 500® Index | 26.29% | 15.69% | 12.03% |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Growth and Income Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which

have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| Portfolio Managers’ Report | Voya Intermediate BonD Portfolio |

| | |

Voya Intermediate Bond Portfolio (the “Portfolio”) seeks to maximize total return consistent with reasonable risk. The Portfolio seeks its objective through investments in a diversified portfolio consisting primarily of debt securities. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by David Goodson, Randall Parrish, CFA, Matthew Toms, CFA, and Sean Banai, CFA, Portfolio Managers* of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class I shares provided a total return of 7.28% compared to the Bloomberg

U.S. Aggregate Bond Index (“Bloomberg U.S. Aggregate Bond”), which returned 5.53% for the same period.

Portfolio Specifics: After experiencing the worst bout of inflation in 40 years in 2022, inflation continued to remain elevated in 2023. That said, significant progress was made over the course of the year, with core Personal Consumption Expenditures Price Index (“PCE”) ending November at 3.2%. This was accomplished in part by the U.S. Federal Reserve continuing to hike rates and reduce the size of their balance sheet. At the start of the year, many were expecting a recession however this clearly did not play out. In fact, economic data came in relatively strong, and gross domestic product (GDP) growth came in above trend.

| | Investment Type Allocation | |

| | as of December 31, 2023 | |

| | (as a percentage of net assets) | |

| | Corporate Bonds/Notes | 25.9% | |

| | U.S. Government Agency Obligations | 21.5% | |

| | Mutual Funds | 14.6% | |

| | Collateralized Mortgage Obligations | 14.1% | |

| | Asset-Backed Securities | 7.8% | |

| | U.S. Treasury Obligations | 7.8% | |

| | Commercial Mortgage-Backed Securities | 5.1% | |

| | Municipal Bonds | 0.1% | |

| | Assets in Excess of Other Liabilities* | 3.1% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. | | |

| Portfolio holdings are subject to change daily. | |

Over the course of the year, longer term rates ebbed and flowed with economic data. Overall, rates spent a majority of the year moving higher as the timeline for recession continued to get pushed out. By October, the 10-year treasury had hit 5%. Shortly thereafter, many began to speculate that the Fed was at the end of their hiking cycle due to the meaningful decline in the level of inflation. At their final meeting of the year, Jerome Powell's post meeting press conference all but confirmed this was the case. As a result, rates staged a significant rally through the end of the year, ending only marginally higher than where they started.

Credit markets broadly moved in line with rates. Spreads widened in response to better-than-expected economic data or higher than expected inflation and tightened when the reverse occurred. The key difference is that credit spreads ended of the year inside of where they started.

The Portfolio outperformed its benchmark. Sector allocation decisions contributed to relative performance. Our allocation to high yield was the top contributor, followed by non-agency residential mortgage-backed securities (“RMBS”) and credit risk transfer (“CRT”). Security selection also contributed albeit to a lesser extent. Off benchmark selections within agency mortgage-backed securities (“MBS”) and asset backed securities (“ABS”) contributed strongly, as did selections within investment grade (“IG”) corporate. Offsetting some of these results were selections within commercial mortgage- backed securities (“CMBS”), with a handful of subordinate conduit credit positions being responsible for a majority of the underperformance. Duration and yield curve positioning detracted slightly from relative performance.

| |

Top Ten Holdings |

| | as of December 31, 2023* |

| | (as a percentage of net assets) |

| | Voya VACS Series SC Fund | 5.2% |

| | Voya VACS Series EMHCD Fund | 4.1% |

| | Voya VACS Series HYB Fund | 3.1% |

| | United States Treasury Bonds, 4.750%, 11/15/43 | 2.8% |

| | Voya VACS Series EMCD Fund | 2.2% |

| | United States Treasury Notes, 4.500%, 11/15/33 | 1.9% |

| | Uniform Mortgage-Backed Securities, 5.000%, 10/01/52 | 1.4% |

| | Uniform Mortgage-Backed Securities, 2.000%, 02/01/52 | 1.3% |

| | Uniform Mortgage-Backed Securities, 2.500%, 02/01/52 | 1.1% |

| | Ginnie Mae, 2.500%, 05/20/52 | 0.9% |

| | * Excludes short-term investments. | |

| Portfolio holdings are subject to change daily. |

The Portfolio used derivatives such as futures, swaps options and forward contracts for hedging and overall risk management. The use of derivatives detracted from performance for the period.

Current Strategy & Outlook: Looking forward, the outlook has improved marginally, however we still expect growth to slow below trend. The increased cost of capital will likely curb consumption and investment, however ongoing government support measures at a global level are expected to partially offset these effects. In particular, China's growth focused investment and advanced economies efforts to enhance supply chain security are anticipated to bolster growth in the short term.

| Voya Intermediate BonD Portfolio | Portfolio Managers’ Report |

| | |

As the market focus shifts from inflation to growth concerns, we believe duration will become an effective offset to risky asset drawdowns. Rate volatility, though receding from recent peaks, will remain above pre-pandemic levels due to uncertainty about the timing of rate cuts and concerns about government debt levels. We believe elevated real rates will incent investors to increase allocations to fixed income, creating opportunities during bouts of volatility.

That said, many corners of the market appear to be priced for a soft landing. While this has become a more likely outcome, we believe the risks to this outcome materializing are being ignored. Labor markets are coming into better balance which, while good news for inflation, could cause concern among workers that a turn in the cycle is approaching. This in turn could compel workers to boost savings rates which would limit consumption and act as a challenge to growth.

With this dynamic in place, the Portfolio has a moderate level of risk with focus on higher quality credit , and allocations are skewed towards sectors with better relative value. For example, securitized credit markets are currently trading with wider spreads relative to comparably rated corporates bonds.

Meanwhile, the dark clouds facing the sector due to concerns over CMBS appear to be fading as lower rates make refinancing existing loans less challenging. Within corporate credit, we prefer IG, however to the extent we are willing to drift into lower quality, we prefer high yield over senior loans given the latter is most directly impacted by higher financing costs. Outside of credit, agency MBS remain attractive relative to treasuries due to historically wide spreads despite minimal prepayment risk.

* Effective May 1, 2024, Matt Toms will no longer be one of the portfolio managers to the Portfolio. Additionally, effective May 1, 2024, Eric Stein will be added as one of the portfolio managers to the Portfolio.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

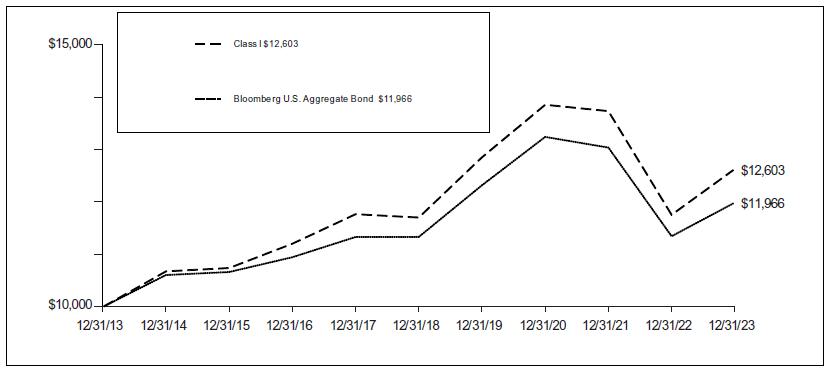

| Portfolio Managers’ Report | Voya Intermediate BonD Portfolio |

| | |

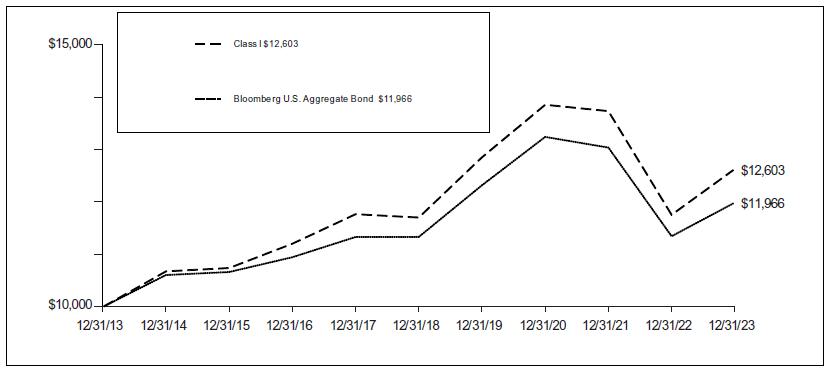

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year |

| Class ADV | 6.78% | 1.00% | 1.83% |

| Class I | 7.28% | 1.50% | 2.34% |

| Class S | 7.03% | 1.26% | 2.09% |

| Class S2 | 6.89% | 1.10% | 1.93% |

| Bloomberg U.S. Aggregate Bond | 5.53% | 1.10% | 1.81% |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Intermediate Bond Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which

have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| Voya Small Company Portfolio | Portfolio Managers’ Report |

| | |

Voya Small Company Portfolio (the “Portfolio”) seeks growth of capital primarily through investment in a diversified portfolio of common stock of companies with smaller market capitalizations. The Portfolio is managed by Vincent Costa, CFA, Gareth Shepherd, PhD, CFA, and Russell Shtern, CFA, Portfolio Managers of Voya Investment Management Co. LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2023, the Portfolio’s Class I shares provided a total return of 18.00% compared to the Russell 2000® Index, which returned 16.93% for the same period.

Portfolio Specifics: For the reporting period, the Portfolio outperformed its benchmark, driven by both positive stock selection and a positive allocation impact. Stock selection in the financials and real estate sectors drove performance, followed by the overweight and selection in the information technology sector. Conversely, selection in the industrials and energy sectors detracted.

| | Sector Diversification | |

| | as of December 31, 2023 | |

| | (as a percentage of net assets) | |

| | Industrials | 18.6% | |

| | Information Technology | 17.7% | |

| | Financials | 15.9% | |

| | Health Care | 13.9% | |

| | Consumer Discretionary | 7.8% | |

| | Materials | 7.2% | |

| | Real Estate | 5.5% | |

| | Energy | 4.3% | |

| | Communication Services | 2.8% | |

| | Consumer Staples | 2.4% | |

| | Exchange-Traded Funds | 1.9% | |

| | Utilities | 1.7% | |

| | Assets in Excess of Other Liabilities* | 0.3% | |

| | Net Assets | 100.0% | |

| | * Includes short-term investments. | | |

| Portfolio holdings are subject to change daily. |

| | Top Ten Holdings |

| | as of December 31, 2023 |

| | (as a percentage of net assets) |

| | iShares Russell 2000 ETF | 1.9% |

| | Watts Water Technologies, Inc. - Class A | 1.4% |

| | Mueller Water Products, Inc. - Class A | 1.3% |

| | Hillenbrand, Inc. | 1.2% |

| | Element Solutions, Inc. | 1.2% |

| | Dropbox, Inc. - Class A | 1.1% |

| | AAON, Inc. | 1.1% |

| | ExlService Holdings, Inc. | 1.1% |

| | Atlantic Union Bankshares Corp. | 1.0% |

| | Excelerate Energy, Inc. - Class A | 1.0% |

| Portfolio holdings are subject to change daily. |

Individual contributors included overweight positions in ImmunoGen, Inc., Tri Pointe Homes, Inc. and Altair Engineering Inc. Key detractors from performance for the period included overweight positions in Excelerate Energy, Inc., Shyft Group, Inc. and BioCryst Pharmaceuticals, Inc.

Current Strategy and Outlook: In our view, the side effects of the pandemic shock have mostly subsided, and inflation is the final piece of the puzzle. We view the recovery not as a classic business cycle, but as an economy trying to normalize following a natural disaster. First, came the government- mandated lockdowns and the bust. Then, came the re-openings and the effects of mega-policy stimulus. Lastly, came the 180-degree reversal in monetary policy. Inflation peaked in June 2022 at 9.1%, which means that most of the disinflation we have seen since then has had little to do with Fed policy. We believe that disinflation could continue (and may intensify) over the next 18 months. Corporate earnings are accelerating as the U.S. consumer, in our view, remains healthy and in our opinion, corporate fundamental factors are sound.

The views expressed in this commentary are informed opinions. They should not be considered promises or advice. The views expressed reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. Portfolio holdings are subject to change daily. The outlook for this Portfolio may differ from that presented for other Voya mutual funds. This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements. The Portfolio’s performance returns shown reflect applicable fee waivers and/or expense limits in effect during this period. Absent such fee waivers/expense limitations, if any, performance would have been lower. Performance for the different classes of shares will vary based on differences in fees associated with each class. An index has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

| Portfolio Managers’ Report | Voya Small Company Portfolio |

| | |

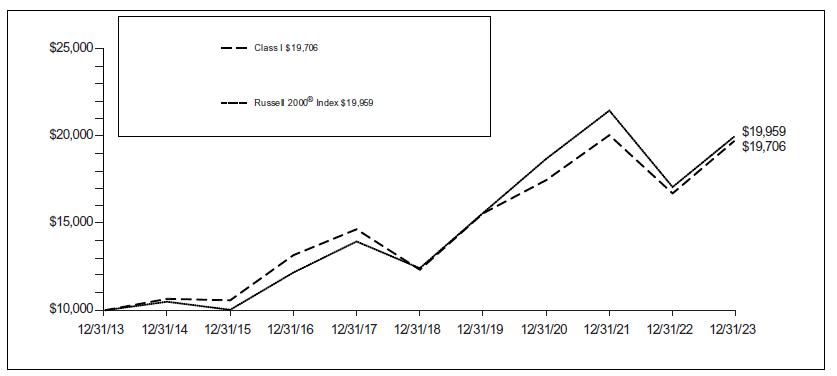

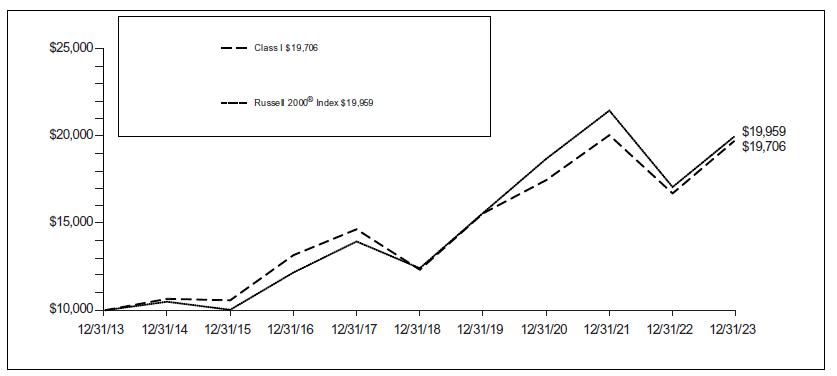

| Average Annual Total Returns for the Periods Ended December 31, 2023 |

| | 1 Year | 5 Year | 10 Year |

| Class ADV | 17.37% | 9.30% | 6.49% |

| Class I | 18.00% | 9.84% | 7.02% |

| Class R6(1) | 18.05% | 9.88% | 7.46% |

| Class S | 17.68% | 9.57% | 6.75% |

| Russell 2000® Index | 16.93% | 9.97% | 7.16% |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of Voya Small Company Portfolio against the index indicated. The index is unmanaged and has no cash in its portfolio and imposes no sales charges. An investor cannot invest directly in an index.

The Portfolio’s performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your variable annuity contract or variable life insurance policy. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Portfolio distributions or the redemption of Portfolio shares.

The performance shown includes, if applicable, the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which

have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract or a variable life insurance policy. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please log on to www.voyainvestments.com or call (800) 992-0180 to get performance through the most recent month end.

Portfolio holdings are subject to change daily.

| (1) | Class R6 incepted on November 24, 2015. The Class R6 shares performance shown for the period prior to their inception date is the performance of Class I shares without adjustment for any differences in the expenses between the two classes. If adjusted for such differences, returns would be different. |

SHAREHOLDER EXPENSE EXAMPLES (UnaUdited)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2023 to December 31, 2023. The Portfolios’ expenses are shown without the imposition of any charges which are, or may be, imposed under your variable annuity contract, variable life insurance policy, qualified pension, or retirement plan. Expenses would have been higher if such charges were included.

Actual Expenses

The left section of the table shown below, “Actual Portfolio Return,” provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The right section of the table shown below, “Hypothetical (5% return before expenses),” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not a Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the hypothetical section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Actual Portfolio Return | | Hypothetical (5% return before expenses) | |

| | | Beginning | | Ending | | | | Expenses Paid | | Beginning | | Ending | | | | Expenses Paid | |

| | | Account | | Account | | | | During the | | Account | | Account | | | | During the | |

| | | Value | | Value | | Annualized | | Period Ended | | Value | | Value | | Annualized | | Period Ended | |

| | | July 1, | | December 31, | | Expense | | December 31, | | July 1, | | December 31, | | Expense | | December 31, | |

| | | 2023 | | 2023 | | Ratio | | 2023* | | 2023 | 2023 | | Ratio | | 2023* | |

| | Voya Balanced Portfolio | | | | | | | | | | | | | | | |

| | Class I | $1,000.00 | $1,058.70 | | 0.69% | $3.58 | $1,000.00 | $1,021.73 | 0.69% | $3.52 | |

| | Class S | 1,000.00 | 1,058.20 | | 0.94 | 4.88 | 1,000.00 | 1,020.47 | 0.94 | 4.79 | |

| | ... | | | | | | | | | | | | | | | | |

| | Voya Global High Dividend Low Volatility Portfolio | | | | | | | | | | | |

| | Class ADV | $1,000.00 | $1,053.60 | | 1.10% | $5.69 | $1,000.00 | $1,019.66 | 1.10% | $5.60 | |

| | Class I | 1,000.00 | 1,056.80 | | 0.60 | 3.11 | 1,000.00 | 1,022.18 | 0.60 | 3.06 | |

| | Class S | 1,000.00 | 1,055.40 | | 0.85 | 4.40 | 1,000.00 | 1,020.92 | 0.85 | 4.33 | |

| | Class S2 | 1,000.00 | 1,055.20 | | 1.00 | 5.18 | 1,000.00 | 1,020.16 | 1.00 | 5.09 | |

| | Class T | 1,000.00 | 1,053.70 | | 1.20 | 6.21 | 1,000.00 | 1,019.16 | 1.20 | 6.11 | |

| | ... | | | | | | | | | | | | | | | | |

| | Voya Government Money Market Portfolio | | | | | | | | | | | | |

| | Class I | $1,000.00 | $1,025.30 | | 0.43% | $2.20 | $1,000.00 | $1,023.04 | 0.43% | $2.19 | |

| | Class S | 1,000.00 | 1,024.50 | | 0.58 | 2.96 | 1,000.00 | 1,022.28 | 0.58 | 2.96 | |

| | ... | | | | | | | | | | | | | | | | |

| | Voya Growth and Income Portfolio | | | | | | | | | | | | |

| | Class ADV | $1,000.00 | $1,082.20 | | 1.12% | $5.88 | $1,000.00 | $1,019.56 | 1.12% | $5.70 | |

| | Class I | 1,000.00 | 1,084.90 | | 0.67 | 3.52 | 1,000.00 | 1,021.83 | 0.67 | 3.41 | |

| | Class S | 1,000.00 | 1,083.10 | | 0.92 | 4.83 | 1,000.00 | 1,020.57 | 0.92 | 4.69 | |

| | Class S2 | 1,000.00 | 1,083.10 | | 1.07 | 5.62 | 1,000.00 | 1,019.81 | 1.07 | 5.45 | |

| | | | | | | | | | | | | | | | | | |

SHAREHOLDER EXPENSE EXAMPLES (UnaUdited) (CONTINUED)

| | | | Actual Portfolio Return | | | | Hypothetical (5% return before expenses) | |

| | | Beginning | | Ending | | | | Expenses Paid | | Beginning | | Ending | | | | Expenses Paid | |

| | | Account | | Account | | | | During the | | Account | | Account | | | | During the | |

| | | Value | | Value | | Annualized | | Period Ended | | Value | | Value | | Annualized | | Period Ended | |

| | | July 1, | | December 31, | | Expense | | December 31, | | July 1, | | December 31, | | Expense | | December 31, | |

| | | 2023 | | 2023 | | Ratio | | 2023* | | 2023 | 2023 | | Ratio | | 2023* | |

| | Voya Intermediate Bond Portfolio | | | | | | | | | | | | | |

| | Class ADV | $1,000.00 | | $1,041.80 | | 1.03% | $5.30 | $1,000.00 | $1,020.01 | 1.03% | $5.24 | |

| | Class I | 1,000.00 | | 1,045.10 | | 0.53 | 2.73 | 1,000.00 | 1,022.53 | 0.53 | 2.70 | |

| | Class S | 1,000.00 | | 1,044.00 | | 0.78 | 4.02 | 1,000.00 | 1,021.27 | 0.78 | 3.97 | |

| | Class S2 | 1,000.00 | | 1,042.30 | | 0.93 | 4.79 | 1,000.00 | 1,020.52 | 0.93 | 4.74 | |

| | ... | | | | | | | | | | | | | | | | |

| | Voya Small Company Portfolio | | | | | | | | | | | | | |

| | Class ADV | $1,000.00 | | $1,091.80 | | 1.36% | $7.17 | $1,000.00 | $1,018.35 | 1.36% | $6.92 | |

| | Class I | 1,000.00 | | 1,094.30 | | 0.86 | 4.54 | 1,000.00 | 1,020.87 | 0.86 | 4.38 | |

| | Class R6 | 1,000.00 | | 1,094.10 | | 0.80 | 4.22 | 1,000.00 | 1,021.17 | 0.80 | 4.08 | |

| | Class S | 1,000.00 | | 1,092.90 | | 1.11 | 5.86 | 1,000.00 | 1,019.61 | 1.11 | 5.65 | |

| | | | | | | | | | | | | | | | | |

| * | Expenses are equal to each Portfolio’s respective annualized expense ratios multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half-year. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Voya Balanced Portfolio, Voya Global High Dividend Low Volatility Portfolio, Voya Government Money Market Portfolio, Voya Growth and Income Portfolio, Voya Intermediate Bond Portfolio and Voya Small Company Portfolio and the Boards of Directors/Trustees of Voya Balanced Portfolio, Inc., Voya Variable Portfolios, Inc., Voya Government Money Market Portfolio, Voya Variable Funds and Voya Intermediate Bond Portfolio

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Voya Balanced Portfolio, Voya Global High Dividend Low Volatility Portfolio, Voya Government Money Market Portfolio, Voya Growth and Income Portfolio, Voya Intermediate Bond Portfolio and Voya Small Company Portfolio (collectively referred to as the “Portfolios”) (each a portfolio of Voya Balanced Portfolio, Inc., Voya Variable Portfolios, Inc., Voya Government Money Market Portfolio, Voya Variable Funds, Voya Intermediate Bond Portfolio and Voya Variable Portfolios, Inc., respectively (collectively referred to as the “Registrants”)), including the portfolios of investments, as of December 31, 2023, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the four years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Portfolios at December 31, 2023, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended and their financial highlights for each of the four years in the period then ended, in conformity with U.S. generally accepted accounting principles.

The financial highlights for the period ended December 31, 2019, were audited by another independent registered public accounting firm whose report, dated February 26, 2020, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Registrants’ management. Our responsibility is to express an opinion on each of the Portfolios’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Registrants in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Registrants are not required to have, nor were we engaged to perform, an audit of the Registrants’ internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Registrants’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2023, by correspondence with the custodian, brokers and others; when replies were not received from brokers and others, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Voya investment companies since 2019.

Boston, Massachusetts

February 28, 2024

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2023

| | | Voya | | | Voya

Global

High Dividend | | | Voya

Government

Money | |

| | | Balanced

Portfolio | | | Low Volatility

Portfolio | | | Market

Portfolio | |

| ASSETS: | | | | | | | | | | | | |

| Investments in securities at fair value+* | | $ | 212,281,599 | | | $ | 483,840,327 | | | $ | – | |

| Investments in affiliates at fair value** | | | 90,118,920 | | | | – | | | | – | |

| Short-term investments at fair value† | | | 5,333,273 | | | | 4,716,913 | | | | – | |

| Short-term investments at amortized cost | | | – | | | | – | | | | 617,762,728 | |

| Repurchase agreements | | | – | | | | – | | | | 167,237,000 | |

| Cash | | | 193,404 | | | | 84,014 | | | | 30,128 | |

| Cash collateral for futures contracts | | | 340,223 | | | | – | | | | – | |

| Cash pledged for centrally cleared swaps (Note 2) | | | 300,000 | | | | – | | | | – | |

| Foreign currencies at value‡ | | | 4,900 | | | | 1,271 | | | | – | |

| Receivables: | | | | | | | | | | | | |

| Investment securities sold | | | 19,466 | | | | 4,810 | | | | – | |

| Fund shares sold | | | 10,749 | | | | 117,074 | | | | 2,186,948 | |

| Dividends | | | 135,202 | | | | 1,076,581 | | | | 6,557 | |

| Interest | | | 503,440 | | | | – | | | | 3,791,818 | |

| Foreign tax reclaims | | | 107,019 | | | | 1,234,962 | | | | – | |

| Unrealized appreciation on forward foreign currency contracts | | | 343 | | | | – | | | | – | |

| Unrealized appreciation on forward premium swaptions | | | 2,699 | | | | – | | | | – | |

| Prepaid expenses | | | 2,566 | | | | 4,391 | | | | 4,513 | |

| Reimbursement due from Investment Adviser | | | 39,116 | | | | 9,625 | | | | – | |

| Other assets | | | 43,569 | | | | 51,833 | �� | | | 105,180 | |

| Total assets | | | 309,436,488 | | | | 491,141,801 | | | | 791,124,872 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for investment securities purchased | | | 840,304 | | | | 4,798 | | | | – | |

| Payable for investment securities purchased on a delayed-delivery or when- issued basis | | | 1,106,994 | | | | – | | | | – | |

| Payable for fund shares redeemed | | | 165,016 | | | | 272,428 | | | | 12,410 | |

| Payable upon receipt of securities loaned | | | 1,892,414 | | | | 3,913,913 | | | | – | |

| Unrealized depreciation on forward premium swaptions | | | 680 | | | | – | | | | – | |

| Variation margin payable on centrally cleared swaps | | | 152 | | | | – | | | | – | |

| Variation margin payable on futures contracts | | | 6,831 | | | | – | | | | – | |

| Payable for investment management fees | | | 152,938 | | | | 228,041 | | | | 202,863 | |

| Payable for distribution and shareholder service fees | | | 390 | | | | 79,185 | | | | 39 | |

| Payable to directors/ trustees under the deferred compensation plan (Note 6) | | | 43,569 | | | | 51,833 | | | | 105,180 | |

| Payable for directors/ trustees fees | | | 740 | | | | 1,235 | | | | 1,540 | |

| Other accrued expenses and liabilities | | | 121,069 | | | | 107,807 | | | | 178,622 | |

| Written options, at fair value^ | | | 79,778 | | | | – | | | | – | |

| Total liabilities | | | 4,410,875 | | | | 4,659,240 | | | | 500,654 | |

| NET ASSETS | | $ | 305,025,613 | | | $ | 486,482,561 | | | $ | 790,624,218 | |

| | | | | | | | | | | | | |

| NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 270,176,614 | | | $ | 441,763,080 | | | $ | 790,706,617 | |

| Total distributable earnings (loss) | | | 34,848,999 | | | | 44,719,481 | | | | (82,399 | ) |

| NET ASSETS | | $ | 305,025,613 | | | $ | 486,482,561 | | | $ | 790,624,218 | |

| | | | | | | | | | | | | |

| + | Including securities loaned at value | | $ | 1,819,620 | | | $ | 3,697,235 | | | $ | — | |

| * | Cost of investments in securities | | $ | 196,745,223 | | | $ | 447,191,903 | | | $ | — | |

| ** | Cost of investments in affiliates | | $ | 84,566,583 | | | $ | — | | | $ | — | |

| † | Cost of short-term investments | | $ | 5,334,659 | | | $ | 4,716,913 | | | $ | — | |

| ‡ | Cost of foreign currencies | | $ | 6,146 | | | $ | 1,238 | | | $ | — | |

| ^ | Premiums received on written options | | $ | 72,188 | | | $ | — | | | $ | — | |

See Accompanying Notes to Financial Statements

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2023 (CONTINUED)

| | | | Voya

Balanced

Portfolio | | | | Voya

Global

High Dividend

Low Volatility

Portfolio | | | | Voya

Government

Money

Market

Portfolio | |

| Class ADV | | | | | | | | | | | | |

| Net assets | | | n/a | | | $ | 10,354,332 | | | | n/a | |

| Shares authorized | | | n/a | | | | 100,000,000 | | | | n/a | |

| Par value | | | n/a | | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | n/a | | | | 940,232 | | | | n/a | |

| Net asset value and redemption price per share | | | n/a | | | $ | 11.01 | | | | n/a | |

| | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | |

| Net assets | | $ | 303,165,862 | | | $ | 122,201,627 | | | $ | 789,249,318 | |

| Shares authorized | | | 500,000,000 | | | | 100,000,000 | | | | unlimited | |

| Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 1.000 | |

| Shares outstanding | | | 20,497,067 | | | | 11,121,157 | | | | 789,231,704 | |

| Net asset value and redemption price per share | | $ | 14.79 | | | $ | 10.99 | | | $ | 1.00 | |

| | | | | | | | | | | | | |

| Class S | | | | | | | | | | | | |

| Net assets | | $ | 1,859,751 | | | $ | 351,455,873 | | | $ | 1,374,900 | |

| Shares authorized | | | 500,000,000 | | | | 300,000,000 | | | | unlimited | |

| Par value | | $ | 0.001 | | | $ | 0.001 | | | $ | 1.000 | |

| Shares outstanding | | | 126,384 | | | | 31,803,743 | | | | 1,374,869 | |

| Net asset value and redemption price per share | | $ | 14.72 | | | $ | 11.05 | | | $ | 1.00 | |

| | | | | | | | | | | | | |

| Class S2 | | | | | | | | | | | | |

| Net assets | | | n/a | | | $ | 229,196 | | | | n/a | |

| Shares authorized | | | n/a | | | | 100,000,000 | | | | n/a | |

| Par value | | | n/a | | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | n/a | | | | 21,054 | | | | n/a | |

| Net asset value and redemption price per share | | | n/a | | | $ | 10.89 | | | | n/a | |

| | | | | | | | | | | | | |

| Class T | | | | | | | | | | | | |

| Net assets | | | n/a | | | $ | 2,241,533 | | | | n/a | |

| Shares authorized | | | n/a | | | | 100,000,000 | | | | n/a | |

| Par value | | | n/a | | | $ | 0.001 | | | | n/a | |

| Shares outstanding | | | n/a | | | | 203,249 | | | | n/a | |

| Net asset value and redemption price per share | | | n/a | | | $ | 11.03 | | | | n/a | |

See Accompanying Notes to Financial Statements

STATEMENTS OF ASSETS AND LIABILITIES AS OF DECEMBER 31, 2023

| | | Voya

Growth and

Income

Portfolio | | | Voya

Intermediate

Bond

Portfolio | | | Voya

Small

Company

Portfolio | |

| ASSETS: | | | | | | | | | |

| Investments in securities at fair value+* | | $ | 2,002,417,073 | | | $ | 1,905,945,121 | | | $ | 302,647,105 | |

| Investments in affiliates at fair value** | | | – | | | | 339,274,750 | | | | – | |

| Short-term investments at fair value† | | | 1,014,000 | | | | 166,097,861 | | | | 2,997,798 | |

| Cash | | | 1,126,614 | | | | 1,778,217 | | | | 72,578 | |

| Cash collateral for futures contracts | | | – | | | | 6,051,061 | | | | – | |

| Cash pledged for centrally cleared swaps (Note 2) | | | – | | | | 6,266,000 | | | | – | |

| Cash pledged as collateral for OTC derivatives (Note 2) | | | – | | | | 2,210,000 | | | | – | |

| Cash pledged as collateral for delayed-delivery or when-issued securities (Note 2) | | | – | | | | 567,000 | | | | – | |

| Receivables: | | | | | | | | | | | | |

| Investment securities sold | | | – | | | | 595,526 | | | | – | |

| Fund shares sold | | | 382,075 | | | | 1,191,384 | | | | 1,158 | |

| Dividends | | | 1,604,443 | | | | 28,875 | | | | 385,353 | |

| Interest | | | 736 | | | | 13,869,732 | | | | – | |

| Foreign tax reclaims | | | 38,637 | | | | – | | | | 10,338 | |

| Unrealized appreciation on forward foreign currency contracts | | | – | | | | 9,795 | | | | – | |

| Unrealized appreciation on forward premium swaptions | | | – | | | | 76,459 | | | | – | |

| Prepaid expenses | | | 15,666 | | | | 21,044 | | | | 2,608 | |

| Reimbursement due from Investment Adviser | | | – | | | | 390,244 | | | | 5,273 | |

| Other assets | | | 231,158 | | | | 323,773 | | | | 41,558 | |

| Total assets | | | 2,006,830,402 | | | | 2,444,696,842 | | | | 306,163,769 | |

| | | | | | | | | | | | | |

| LIABILITIES: | | | | | | | | | | | | |

| Income distribution payable | | | – | | | | 330 | | | | – | |

| Payable for investment securities purchased | | | – | | | | 16,811,561 | | | | 11,078 | |

| Payable for investment securities purchased on a delayed-delivery or when- issued basis | | | – | | | | 24,029,870 | | | | – | |

| Payable for fund shares redeemed | | | 270,606 | | | | 856,635 | | | | 146,786 | |

| Payable upon receipt of securities loaned | | | – | | | | 82,375,714 | | | | 2,052,798 | |

| Unrealized depreciation on forward premium swaptions | | | – | | | | 14,316 | | | | – | |

| Variation margin payable on centrally cleared swaps | | | – | | | | 7,178 | | | | – | |

| Variation margin payable on futures contracts | | | – | | | | 366,509 | | | | – | |

| Payable for investment management fees | | | 999,607 | | | | 967,452 | | | | 185,361 | |

| Payable for distribution and shareholder service fees | | | 37,838 | | | | 377,062 | | | | 16,762 | |

| Payable to directors/ trustees under the deferred compensation plan (Note 6) | | | 231,158 | | | | 323,773 | | | | 41,558 | |

| Payable for directors/ trustees fees | | | 4,688 | | | | 5,833 | | | | 730 | |

| Other accrued expenses and liabilities | | | 539,494 | | | | 433,361 | | | | 94,184 | |

| Written options, at fair value^ | | | – | | | | 2,329,357 | | | | – | |

| Total liabilities | | | 2,083,391 | | | | 128,898,951 | | | | 2,549,257 | |

| NET ASSETS | | $ | 2,004,747,011 | | | | $2,315,797,891 | | | $ | 303,614,512 | |

| | | | | | | | | | | | | |

| NET ASSETS WERE COMPRISED OF: | | | | | | | | | | | | |

| Paid-in capital | | $ | 1,591,858,011 | | | $ | 2,758,195,713 | | | $ | 293,922,764 | |

| Total distributable earnings (loss) | | | 412,889,000 | | | | (442,397,822 | ) | | | 9,691,748 | |

| NET ASSETS | | $ | 2,004,747,011 | | | $ | 2,315,797,891 | | | $ | 303,614,512 | |

| | | | | | | | | | | | | |

| + | Including securities loaned at value | | $ | — | | | $ | 80,471,011 | | | $ | 1,978,440 | |

| * | Cost of investments in securities | | $ | 1,605,791,814 | | | $ | 1,972,182,146 | | | $ | 282,064,304 | |

| ** | Cost of investments in affiliates | | $ | — | | | $ | 336,366,410 | | | $ | — | |