OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response: 18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-2514

ING Variable Funds

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | January 1, 2007 to December 31, 2007 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Funds

Annual Report

December 31, 2007

Classes ADV, I and S

ING Variable Product Funds

Domestic Equity and Income Portfolios

n ING VP Balanced Portfolio

n ING VP Growth and Income Portfolio

Fixed Income Portfolios

n ING VP Intermediate Bond Portfolio

n ING VP Money Market Portfolio

Domestic Equity Growth Portfolios

n ING VP Growth Portfolio

n ING VP Small Company Portfolio

Global and International Equity Portfolio

n ING VP Global Science and Technology Portfolio

Domestic Equity Value Portfolio

n ING VP Value Opportunity Portfolio

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 2 | | |

|

| Portfolio Managers' Reports | | | 4 | | |

|

| Shareholder Expense Examples | | | 19 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 22 | | |

|

| Statements of Assets and Liabilities | | | 23 | | |

|

| Statements of Operations | | | 26 | | |

|

| Statements of Changes in Net Assets | | | 29 | | |

|

| Financial Highlights | | | 33 | | |

|

| Notes to Financial Statements | | | 46 | | |

|

| Portfolios of Investments | | | 62 | | |

|

| Shareholder Meeting Information | | | 120 | | |

|

| Tax Information | | | 126 | | |

|

| Director/Trustee and Officer Information | | | 127 | | |

|

| Advisory Contract Approval Discussion | | | 131 | | |

|

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds' website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.ingfunds.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

PRESIDENT'S LETTER

Dear Shareholder,

It is impossible to discuss the current market climate without acknowledging the recent turmoil brought on by problems in the sub-prime mortgage market. Clearly the excesses in this sector of the market and other segments of collateralized debt have created challenges throughout credit markets worldwide.

Amidst the volatility, we at ING Funds remind our shareholders that the creditworthiness and quality of our funds' holdings is our ultimate priority — whether those holdings are part of our money market funds, fixed income funds or equity funds. Market volatility is an often present component of investing and we believe the best way to manage through turbulent environments is to build a well-balanced, fully-diversified portfolio, which aligns with your goals and risk tolerance.

ING Funds remains committed to developing and offering a diverse array of mutual funds designed to meet the goals of most investors. We urge you to work with your investment professional to make sure you are invested appropriately. Together, you can select the funds that will help you achieve your financial goals. We thank you for choosing ING Funds and look forward to continuing to serve you.

Sincerely,

Shaun Mathews

President

ING Funds

January 28, 2008

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2007

After recording a solid, if frequently nervous, 8.2% in the first half of the reporting period, global equities in the form of the Morgan Stanley Capital International World IndexSM(1) ("MSCI World IndexSM") measured in local currencies, including net reinvested dividends ("MSCI" for regions discussed below) succumbed to a 3.2% loss in the second half of the reporting period, as some important debt markets all but seized up, the crisis threatening the solvency of financial institutions and forcing central bankers to throw lifelines to stranded borrowers, while investors fled to the safe haven of short Treasuries. By year-end, confidence was wavering, oil was nudging $100 per barrel and markets seemed to be pricing in a recession. In currencies, the yen strengthened as "carry trades" were unwound in the flight from risk. The euro benefited from the European Central Bank's implacable refusal to match the Federal Reserve Board (the "Fed") and reduce interest rates. But the pound finally gave back some of its rece nt gains as the UK housing market started to sag. For the second six months, the dollar fell 8.5% and 8.9% against the euro and yen respectively, but rose 0.3% against the pound.

A relentlessly deteriorating housing market had caused alarm in the sub-prime mortgage loan sector, where lax lending standards in a low interest rate environment, had driven foreclosure rates inexorably higher. The problem had been exacerbated over the years by the business of securitizing the loans. They would be sliced, diced and repackaged for handsome fees into other securities, then sold on in their billions worldwide to financial institutions, which purchased them by issuing commercial paper, over the cost of which an effortless profit could apparently be made.

At one level this spreads the loan risk. But when the originator is removed from those taking the risk another is created. Like the banking business in its simplest form, everything depends on confidence. When it became obvious that these securities, many of them rated A or higher, were ultimately backed by sub-prime and not so sub-prime mortgages with questionable repayment prospects, confidence evaporated. The asset-backed commercial paper market contracted sharply. Banks stopped lending to each other. The structured investment vehicles, their investors and sponsoring banks would have to bear huge losses, but which ones and how much?

The Fed's first response to the liquidity and resulting economic threats was to reduce the discount rate, (the rate it will lend to banks), by 50 basis points (0.50%) on August 17, 2007 and another 100 basis points (1.00%) in three steps by year end, with matching cuts in the federal funds rate.

But it was no good. Using the discount window had a stigma attached to it while the liquidity problem was not an overnight one. The one-month London Interbank Offered Rate ("LIBOR") continued to rise even as the Fed eased. A procession of financial institutions announced heavy write- downs of mortgage-backed assets, along with various capital saving and raising initiatives, including the tapping of billions of dollars from sovereign wealth funds based in the Middle-East and Asia, surely a development of historic significance.

The spread between the one-month LIBOR and the federal funds rate only drifted down after the announcement of coordinated central bank action to add liquidity where it was needed including in the U.S., the use of a "term auction facility" where loans would be auctioned and broader forms of collateral would be accepted.

But by year end global economic conditions were still clearly weakening and many felt that the U.S. might already be in or on the cusp of recession.

In U.S. fixed income markets' the Treasury yield curve steepened in the first half and continued to do so in the second. The yield on the ten-year Treasury Note fell 100 basis points (1.00%) to 4.03%, while the yield on the three-month Bill fell 153 basis points (1.53%) to 3.14%. The broader Lehman Brothers® Aggregate Bond Index(2) ("LBAB") of investment grade bonds returned 5.93% for the first half of the reporting period and 6.97% for the year ended December 31, 2007.

U.S. equities, represented by the Standard & Poor's 500® Composite Stock Price Index(3) ("S&P 500® Index") including dividends, lost 1.4% in the second half, with the worst fourth quarter since 2000, after gaining 7% through June. For a while, as the events described above played out, investors seemed to believe that the Fed had the will and the tools to keep any down turn brief. The S&P 500® Index actually made a new high on October 9, 2007. For the year ended December 31, 2007, the S&P 500® Index returned 5.49%. But, the sense that a serious crisis was only just beginning to unfold and a succession of earnings disappointments especially among the financials sector, increasingly weighed on sentiment as the year wound down. Bizarrely, gross domestic product ("GDP") growth was being reported at a brisk 4.9%

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2007

for the third quarter, even as S&P 500 companies were reporting a decline in operating profits, the first fall in more than five years.

Internationally, the MSCI Japan® Index(4) slumped 15.8% in the second half of the reporting period on a resumption of falling consumer prices and fading global growth, while the strengthening yen threatened all-important exports. For the year ended December 31, 2007, the MSCI Japan® Index lost 4.23%. The MSCI Europe ex UK® Index(5) lost 4.8% in the second six months of the reporting period. A first half rally gave way to nervousness in mid-July after another rate increase and turned into a rout as the sub-prime debacle took shape. U.S. rate cuts were not reciprocated by the European Central Bank, which, with headline inflation up to 3.1%, confined its response to making liquidity available to the banking system, a staggering †500 billion on December 18, 2007. In the UK, stocks surged into the summer making the August 2007 slide ev en more violent than in continental Europe. But similar inflation worries limited the Bank of England to one 0.25% rate reduction despite a clearly weakening housing market. The MSCI UK® Index(5) fell 1.4% in the second half of the reporting period and returned 8.36% for the year ended December 31, 2007.

(1) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada Australia, New Zealand and the Far East.

(2) The LBAB Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the United States.

(4) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(5) The MSCI Europe ex UK® Index is a free float rising adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(6) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

ING VP BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Balanced Portfolio (the "Portfolio") seeks to maximize investment return consistent with reasonable safety of principal, by investing in a diversified portfolio of one or more of the following asset classes: stocks, bonds and cash equivalents, based on the judgment of the Portfolio's management, of which of those sectors or mix thereof offers the best investment prospects. The Portfolio is managed by Omar Aguilar, Ph.D., Paul Zemsky, and James B. Kauffmann, Portfolio Managers, of ING Investment Management Co. — the Sub-Adviser.

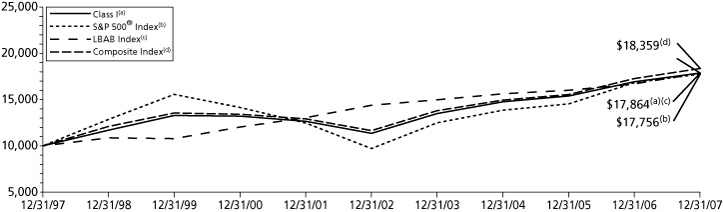

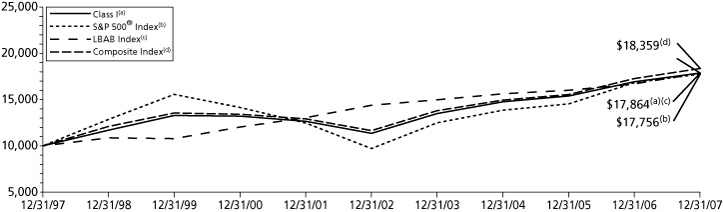

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 5.57% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), the Lehman Brothers® Aggregate Bond Index(2) ("LBAB Index") and the Composite Index(3) (60% S&P 500® Index/40% LBAB Index), which returned 5.49%, 6.97% and 6.22%, respectively, for the same period.

Portfolio Specifics: Asset allocation results contributed positively to performance of the Portfolio during 2007, mainly due to our neutralizing our equity position as equity markets deteriorated.

The performance of the domestic equity portion of the Portfolio was in line with its benchmark, the S&P 500® Index. Stock selection in the smaller-cap stocks was the largest detractor from performance during the year. Selection in the largest-cap stocks added value, particularly in the consumer discretionary and industrials sectors. Selection effect in information technology and the smaller-capitalization Industrial stocks acted as a major drag.

2007 was a difficult year for quantitatively managed equity strategies, as many underperformed. During the summer, a majority of our quantitative factors related to value, quality and momentum significantly underperformed. A systematic unwinding of highly leveraged positions by quantitative hedge funds, which focused on the same valuation factors, affected many of our holdings during August. A recalibration of factor weights during the second half of the year enabled us to recapture some of the losses, as our model was adjusted to a more growth-oriented market.

The fixed-income portion of the Portfolio underperformed its benchmark, the LBAB Index. The Portfolio's average credit quality was lower than that of the benchmark and detracted from results, as did the allocation to floating-rate notes and bonds issued by financial entities. While the Portfolios' overweight in mortgage-backed securities was not great, the sector experienced such losses that it hurt performance. An underweighting in corporate bonds for later periods of the year benefited performance. The Portfolio's generally long duration (higher interest-rate risk) stance helped performance for most but not all of the period.

The overall duration of the Portfolio was adjusted as investors fled from riskier bonds to purchase U.S. Treasuries or other sovereign debt. The Portfolio was underweight longer-dated Treasuries at various times, and so benefited form the relative underperformance of longer-dated Treasuries versus shorter as markets began to anticipate aggressive Federal Reserve Board (the "Fed") easing and the increasing risks for inflation. We also added Treasury inflation-protected securities positions as a counterweight to a re-inflationary Fed policy.

Current Strategy and Outlook: Economic growth in the United States slowed in the fourth quarter and we believe is likely to remain so into the first half of 2008. In our opinion, this is mainly due to tighter credit conditions, higher energy costs and continued weakness in housing. We do not anticipate any of these negative catalysts turning around in the first half of the year. If the U.S. economy avoids slipping into recession, we believe it may represent a buying opportunity in equities, but we do not see any catalyst at the moment to induce us to add to our stock holdings. We remain neutral in equities, with an overweight to large-cap, which we view as in better position than small- or mid-cap stocks to weather a period of slow growth or aftershocks from the credit crisis.

Allocations between equities and fixed-income are dependent on our quantitative asset allocation model not on a qualitative evaluation of the bond versus the equity markets.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2007

(as a percent of net assets)

| U.S. Treasury Note, 3.125%, due 11/30/09 | | | 6.2 | % | |

| ExxonMobil Corp. | | | 2.8 | % | |

| Chevron Corp. | | | 1.5 | % | |

| U.S. Treasury Note, 3.375%, due 11/30/12 | | | 1.4 | % | |

| Federal Home Loan Mortgage Corporation, | | | | | |

| 6.000%, due 02/01/34 | | | 1.4 | % | |

| Intel Corp. | | | 1.3 | % | |

| ConocoPhillips | | | 1.3 | % | |

| Goldman Sachs Group, Inc. | | | 1.1 | % | |

| Microsoft Corp. | | | 1.0 | % | |

| PepsiCo, Inc. | | | 1.0 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund and securities lending collateral.

Portfolio holdings are subject to change daily.

4

ING VP BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class S

May 29, 2003 | |

| Class ADV | | | 4.78 | % | | | — | | | | — | | | | 4.75 | % | | | — | | |

| Class I | | | 5.57 | % | | | 9.50 | % | | | 5.97 | % | | | — | | | | — | | |

| Class S | | | 5.31 | % | | | — | | | | — | | | | — | | | | 8.37 | % | |

| S&P 500® Index(1) | | | 5.49 | % | | | 12.83 | % | | | 5.91 | % | | | 5.49 | %(4) | | | 11.65 | %(5) | |

| LBAB Index(2) | | | 6.97 | % | | | 4.42 | % | | | 5.97 | % | | | 6.97 | %(4) | | | 3.91 | %(5) | |

| Composite Index(3) | | | 6.22 | % | | | 9.51 | % | | | 6.26 | % | | | 6.22 | %(4) | | | 8.60 | %(5) | |

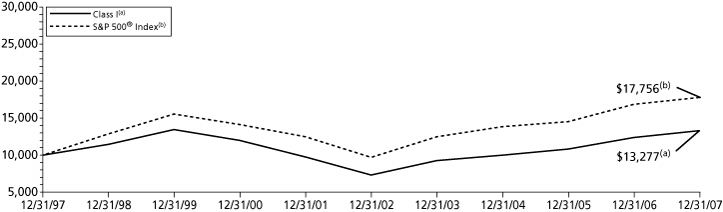

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Balanced Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) The LBAB Index is an unmanaged index composed of securities from the Lehman Brothers Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index.

(3) The Composite Index consists of 60% of return of (securities included in) the S&P 500® Index and 40% of the return of (securities included in) the LBAB Index.

(4) Since inception performance for the indices is shown from January 1, 2007.

(5) Since inception performance for the indices is shown from June 1, 2003.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

5

ING VP GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

VP Growth and Income Portfolio (the "Portfolio") seeks to maximize total return through investments in a diversified portfolio of common stocks and securities convertible into common stock. It is anticipated that capital appreciation and investment income will both be major factors in acheiving total return. The Portfolio is managed by Christopher F. Corapi*, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 7.40% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), which returned 5.49% for the same period.

Portfolio Specifics: The Portfolio outperformed its benchmark as a result of solid stock selection and sector allocation decisions. In particular, our stock picks within financials, industrials and health care contributed the most to performance. Underweighting the financials and consumer discretionary sectors throughout most of the year also aided relative returns. Stock selection in the consumer discretionary and energy sectors detracted from performance.

In the financial sector, Deutsche Boerse (sold), the European stock exchange and trading system provider, had a positive impact during the period. This stock was among the capital markets-oriented stocks whose earnings streams were viewed as more insulated from direct effects of the credit crisis. Precision Castparts Corp. and BE Aerospace, Inc. were two industrial names that have benefited from strength in the aerospace market. We believe this cycle could extend even further once the legacy carriers in the United States and Europe re-enter the market, and the next generation narrow body plane is introduced. In health care, our position in Covance, Inc. continues to benefit from the trend for pharmaceutical and biotech companies to outsource more early stage drug development and toxicology testing to contract research organizations.

Our investment in Omnicare, a geriatric pharmaceutical services company, was hurt during the quarter by rumors that the Department of Justice would launch an investigation into their business practices. We sold the position in December, as we believed that an investigation would overshadow management's turnaround efforts. Within consumer discretionary, Liz Claiborne, Inc. declined due to concerns over a continued housing crisis. We believe that lower guidance from the company going forward leaves room for a potential earnings surprise. The company has several strategic options, such as brand divestitures, that could enhance shareholder value. The biggest detractor from performance this year was bond guarantor MBIA, which declined due to exposure to collateralized debt obligations ("CDOs") and where fears of write downs prompted the company to seek additional outside capital and to shore up loss reserves.

Current Strategy and Outlook: Currently, the Portfolio is positioned in companies that we believe have strong or improving competitive positions, robust end markets or superior capital allocation opportunities. We believe each stock possesses an attractive valuation and a clear catalyst to improve it. Top holdings include Microsoft Corp., Google, Inc. and Johnson & Johnson ("JNJ"). We believe Microsoft Corp. will benefit from an upcoming product cycle in its main business. We believe that this is a major product cycle for Microsoft Corp. and while many are skeptical about the features, we believe that the new operating system and the Office application will be strong. Google, Inc. should be well positioned due to a secular trend toward online advertising, international expansion and growth opportunities in video and display advertising. We find JNJ attr active as a defensive play, given its diverse sources of revenue in terms of product mix and geographic breadth.

* Effective December 31, 2007, Scott Lewis is no longer a Portfolio Manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2007

(as a percent of net assets)

| ExxonMobil Corp. | | | 4.6 | % | |

| Microsoft Corp. | | | 4.1 | % | |

| Johnson & Johnson | | | 3.3 | % | |

| Google, Inc. - Class A | | | 3.1 | % | |

| Intel Corp. | | | 2.6 | % | |

| Altria Group, Inc. | | | 2.5 | % | |

| Procter & Gamble Co. | | | 2.4 | % | |

| Abbott Laboratories | | | 2.2 | % | |

| Merck & Co., Inc. | | | 2.1 | % | |

| General Electric Co. | | | 1.9 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund and securities lending collateral.

Portfolio holdings are subject to change daily.

6

ING VP GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

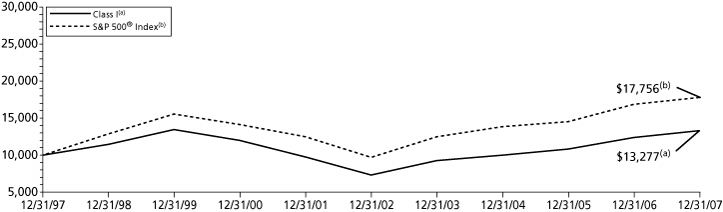

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

June 11, 2003 | |

| Class ADV | | | 6.66 | % | | | — | | | | — | | | | 6.22 | % | | | — | | |

| Class I | | | 7.40 | % | | | 12.62 | % | | | 2.87 | % | | | — | | | | — | | |

| Class S | | | 7.13 | % | | | — | | | | — | | | | — | | | | 10.72 | % | |

| S&P 500® Index(1) | | | 5.49 | % | | | 12.83 | % | | | 5.91 | % | | | 5.49 | %(2) | | | 11.65 | %(3) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Growth and Income Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) Since inception performance for the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from June 1, 2003.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

7

ING VP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Growth Portfolio (the "Portfolio") seeks growth of capital through investment in a diversified portfolio consisting primarily of common stock and securities convertible into common stocks believed to offer growth potential. The Portfolio is managed by Richard Welsh, CFA, Portfolio Manager and Jeff Bianchi, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 17.86% compared to the Russell 1000® Growth Index(1), which returned 11.81% for the same period.

Portfolio Specifics: Although real growth for fourth quarter 2007 is expected to weaken to about 1%, the nine-month average was in line with long-term gross domestic product ("GDP") potential at 3.1%. S&P 500® Index operating earnings surprised to the upside during this period as well. The market was further supported by attractive valuations, particularly relative to other asset categories. Bursting of the housing and credit market bubbles raised the level of both investment uncertainty and risk aversion. From a style perspective, however, growth stock performance relative to value improved dramatically, particularly during the second half. For the year, growth outperformed value by 12% in the Russell 1000® Index, thereby recouping practically all of 2006's relative underperformance. Growth stocks typically outperform in a period of high inflation and slowing economic and earnings growth.

The energy and materials sectors were the strongest performers with each rising 39%. Energy was spurred by the backdrop of a 43% increase in crude oil prices and 19% gain in natural gas. Equipment & services stocks led the advance in the sector. The materials sector benefited from a major contribution from the chemicals industry. The utilities sector also had a strong return of 27%.

The consumer discretionary sector had a negative return of 10.5% led by automobiles and leisure equipment & products. Consumer discretionary stocks started discounting deceleration in consumer spending as a consequence of tighter credit standards, lower confidence and energy prices. The telecommunication services sector fell 7% in large measure due to weakness in the diversified services segment. The financials sector declined less than 1% with particular weakness in the thrifts & mortgage finance industry.

The Portfolio's outperformance was due primarily to stock selection, with seven of ten sectors positive for the year. These sectors included health care, industrials, consumer discretionary, energy, materials, information technology and financials.

Agricultural company, Monsanto Co. made the strongest contribution to returns. Business trends improved throughout the year as evidenced by higher corn seed prices, increased corn acreage and market share gains reflecting superior technology. Market share outside the United States is expected to grow 2% annually through 2010. Shares of Gilead Science performed well as the company's HIV drug franchise continued to gain market share aided by its new triple combination drug, Atripla. Research In Motion Ltd. benefited from accelerated adoption of its BlackBerry phones. Mosaic Co. was another notable contributor.

Ambac Financial Group and American Express detracted equivalent amounts from returns. Ambac Financial Group's share weakness reflected investor nervousness that Ambac Financial Group would have to pay claims on instruments insured. Shares of American Express reflected signs that the sub-prime mortgage contagion was affecting the consumer credit area. Pactiv Corp. also detracted from relative returns as input prices continued to exceed expectations, and competition remained keen in the company's consumer products division. Other notable detractors were ITT Educational Services, Inc., Microsoft Corp. and Oracle Systems.

Current Strategy and Outlook: We expect the equity market to continue to feel the impact of housing and financial dislocations, thereby pressuring corporate profits. We anticipate increased volatility during the near-term as we attempt to quantify the damage associated with credit dislocations, real-estate losses and declining confidence. The Portfolio has been positioned more conservatively in anticipation of this backdrop.

From an investment perspective, sharply declining equity markets historically present opportunities. As unwelcome as market volatility and uncertainty are, we believe volatility can result in opportunistic stock purchases. We continuously seek companies that exhibit strong relative business momentum and market recognition at appropriate valuation levels.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Industry Allocation

as of December 31, 2007

(as a percent of net assets)

| Oil & Gas | | | 9.9 | % | |

| Healthcare - Services | | | 8.9 | % | |

| Chemicals | | | 7.7 | % | |

| Software | | | 7.1 | % | |

| Aerospace/Defense | | | 6.7 | % | |

| Semiconductors | | | 6.3 | % | |

| Telecommunications | | | 5.9 | % | |

| Beverages | | | 5.4 | % | |

| Internet | | | 5.4 | % | |

| Biotechnology | | | 5.3 | % | |

| Computers | | | 4.9 | % | |

| Miscellaneous Manufacturing | | | 4.4 | % | |

| Industries between 2.6% - 4.3%(1) | | | 12.1 | % | |

| Industries less than 2.6%(2) | | | 10.1 | % | |

| Other Assets and Liabilities - Net* | | | (0.1 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to ING Institutional Prime Money Market Fund and repurchase agreement.

(1) Includes four industries, which each represents 2.6% - 4.3% of net assets.

(2) Includes nine industries, which each represents less than 2.6% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings

as of December 31, 2007

(as a percent of net assets)

| Humana, Inc. | | | 3.9 | % | |

| Apple, Inc. | | | 3.6 | % | |

| Intel Corp. | | | 3.5 | % | |

| Aetna, Inc. | | | 3.5 | % | |

| Amazon.com, Inc. | | | 3.5 | % | |

| Lockheed Martin Corp. | | | 3.4 | % | |

| Express Scripts, Inc. | | | 3.3 | % | |

| Potash Corp. of Saskatchewan | | | 3.0 | % | |

| CA, Inc. | | | 3.0 | % | |

| Chevron Corp. | | | 2.9 | % | |

Portfolio holdings are subject to change daily.

8

ING VP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

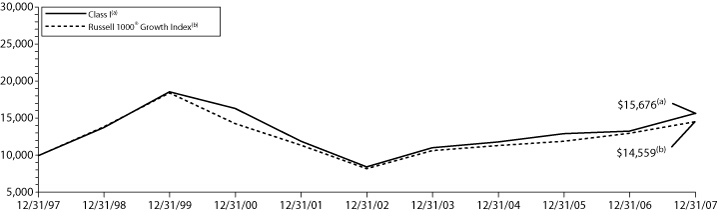

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class S

November 1, 2001 | |

| Class ADV | | | 17.21 | % | | | — | | | | — | | | | 17.11 | % | | | — | | |

| Class I | | | 17.86 | % | | | 13.08 | % | | | 4.60 | % | | | — | | | | — | | |

| Class S | | | 17.54 | % | | | 12.79 | % | | | — | | | | — | | | | 5.11 | % | |

| Russell 1000® Growth Index(1) | | | 11.81 | % | | | 12.11 | % | | | 3.83 | % | | | 11.81 | %(2) | | | 5.57 | % | |

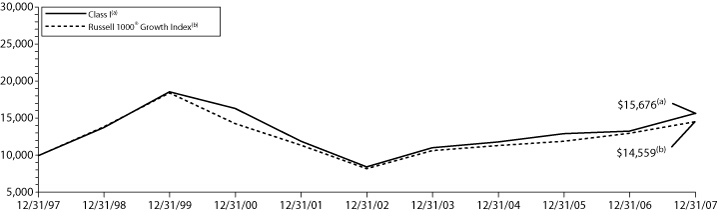

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Growth Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Growth Index measures the performance of the 1,000 largest companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth. The Russell 3000 Index is an unmanaged index that measures the performance of 3,000 U.S. companies based on total market capitalization.

(2) Since inception performance for the index is shown from January 1, 2007.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

9

ING VP SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Small Company Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks of companies with smaller market capitalizations. The Portfolio is managed by Joseph Basset, CFA, and Steve Salopek, Portfolio Managers of ING Investment Management Co. — the Sub Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 5.90% compared to the Russell 2000® Index(1), which returned (1.57)% for the same period.

Portfolio Specifics: Small-cap stocks, as measured by the Russell 2000® Index, lagged behind large- and mid-cap stocks for 2007. The Russell 2000® Index finished down 1.57% versus a rise of 5.77% for the Russell 1000® Index and a rise of 5.60% for the Russell Mid Cap Index. Small-cap stocks were hurt by concerns about the housing market and the credit crunch. Despite the federal rate cuts, the market faced considerable headwinds. Issues surrounding the credit markets heightened in July and August and then again in November, and concerns about credit availability affected financial firms and began to spread into the consumer discretionary sector, including retailers and retail real estate investment trust ("REITS"). However, 2007 proved to be positive for small-caps in that growth beat value for the first time since 2003 and active managers outperformed their benchmarks, due to size and quality biases in the market.

Stock selection within financials, energy, industrials and health care, coupled with our slight underweight in consumer discretionary, were the main performance drivers over the period. Stock selection in consumer discretionary and consumer staples detracted most from performance.

Ansys, Inc. BioMarin Pharmaceuticals Inc. and energy company Denbury Resources, Inc. contributed significantly to performance over the period. Ansys, Inc. develops engineering simulation software products. Throughout 2007, the company delivered revenue growth that was often ahead of Wall Street expectations, and expanded margins to near peak levels. The company's better than expected results and positive earnings revisions helped propel the stock higher during the year. BioMarin Pharmaceuticals develops and commercializes therapeutic enzyme products. The company received FDA approval in late 2007 for a drug called Kuvan for the treatment of Phenylketonuria, an inherited metabolic disorder. The company also announced pricing for the drug, which was at the higher end of investors' expectations.

Steven Madden Ltd. (sold) and Entercom Communications Corp. were two of the largest detractors from performance over the period. Steve Madden Ltd. designs and sells footwear brands for men, women and children. The stock's performance was negatively impacted by concerns surrounding earnings expectations and that the company's products were out of favor with the consumer. We no longer hold a position in this company. Entercom Communications Corp., which acquires and operates radio broadcast properties, underperformed in 2007 due to a slowdown in advertising spending. Also, the company's earnings were under pressure throughout the year, as the firm increased their expense and investment for future growth opportunities while revenues fell below expectations. We continue to hold this stock in the Portfolio, as we believe that the company's investments will pay off over the next year or two.

Current Strategy and Outlook: We continue to focus on companies that we believe have strong balance sheets and cash-flow generation capabilities. We believe we are defensively positioned within the financials sector, and have exposure to banks, diversified financials, and insurance. We are underweight real estate investment trusts, as we think that the real estate market is overextended. Within health care, the Portfolio continues to be positioned to gain from the strong demands and needs for behavioral health providers, health care equipment suppliers with niche franchises and disease management providers. We are underweight biotech stocks due to risk and valuation considerations, and we have no exposure to Medicaid managed care providers due to the deteriorating reimbursement environment. Our technology exposure is in software and services, hardware and e quipment and semiconductors.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2007

(as a percent of net assets)

| iShares Russell 2000 Index Fund | | | 2.0 | % | |

| Portland General Electric Co. | | | 1.1 | % | |

| Waste Connections, Inc. | | | 1.1 | % | |

| Carrizo Oil & Gas, Inc. | | | 1.1 | % | |

| UAP Holding Corp. | | | 1.0 | % | |

| Magellan Health Services, Inc. | | | 1.0 | % | |

| Westfield Financial, Inc. | | | 1.0 | % | |

| Human Genome Sciences, Inc. | | | 1.0 | % | |

| Vectren Corp. | | | 1.0 | % | |

| Alaska Communications Systems Group, Inc. | | | 1.0 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund and securities lending collateral.

Portfolio holdings are subject to change daily.

10

ING VP SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

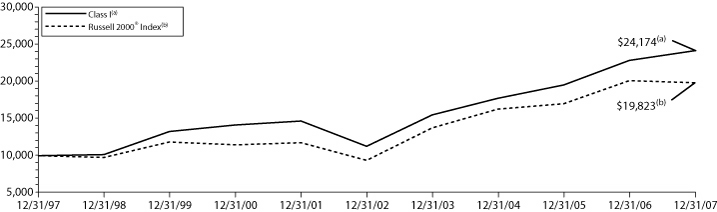

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class S

November 1, 2001 | |

| Class I | | | 5.90 | % | | | 16.48 | % | | | 9.22 | % | | | — | | |

| Class S | | | 5.68 | % | | | 16.22 | % | | | — | | | | 9.99 | % | |

| Russell 2000® Index(1) | | | (1.57 | )% | | | 16.25 | % | | | 7.08 | % | | | 11.26 | % | |

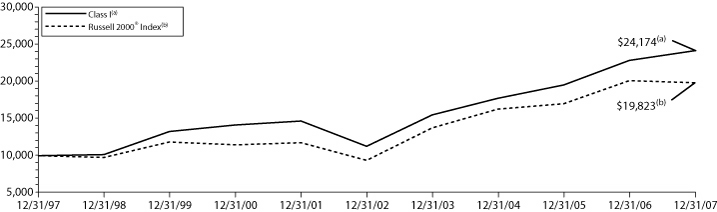

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Small Company Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index that measures the performance of 3,000 U.S. companies based on total market capitalization.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

11

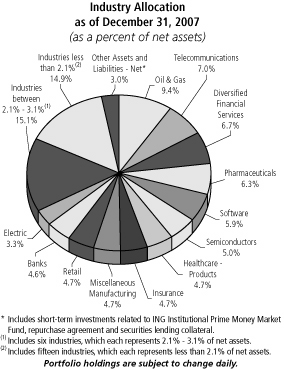

ING VP VALUE OPPORTUNITY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Value Opportunity Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks. The Portfolio is managed by Omar Aguilar, Ph.D. and Vincent Costa*, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 3.01% compared to the Russell 1000® Value Index(1) and the Russell 1000® Index(2), which returned (0.17)% and 5.77%, respectively, for the same period.

Portfolio Specifics: Relative to the Russell 1000® Value Index, the Portfolio benefited from favorable stock selection in consumer staples. Stock selection among consumer discretionary companies also helped relative performance. Stock selection and an underweight in financials also helped results.

Within consumer staples, two tobacco companies, Carolina Group and Altria Group, Inc., were top performers as tobacco litigation began easing. Strong international growth also enhanced Altria Group, Inc. (sold), Molson Coors Brewing Company, a consumer discretionary, was a turnaround story. Cost cutting, improving market share, and a strong brand boosted the stock price. The Portfolio's underweight in Time Warner, Inc. helped performance as the cable business slowed. Medco Health Solutions, Inc. and Mirant Corp. also contributed significantly.

Our underweight in energy detracted value during the period as higher oil prices aided energy stocks such as Chevron Corp. Growth in emerging countries outpaced the industry's ability to meet natural resources demand. Plains Exploration & Production Co. and Newfield Exploration Co. were two energy holdings that declined over the period. Two financial stocks were important detractors: E*Trade Financial Corp. and Bear Stearns.

Current Strategy and Outlook: Currently, the Portfolio is positioned in companies that we believe have strong or improving competitive positions, robust end markets and/or superior capital allocation opportunities. Furthermore, each stock possesses an attractive valuation and a clear catalyst to improve it.

* Effective November 12, 2007, Omar Aguilar, Ph.D. and Vincent Costa replaced Scott Lewis and Michael Leskinen as portfolio managers to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

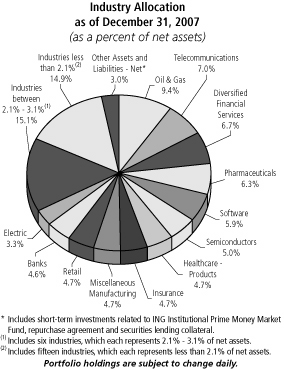

Industry Allocation

as of December 31, 2007

(as a percent of net assets)

| Oil & Gas | | | 16.2 | % | |

| Insurance | | | 16.0 | % | |

| Telecommunications | | | 9.8 | % | |

| Aerospace/Defense | | | 8.0 | % | |

| Healthcare - Services | | | 5.3 | % | |

| Banks | | | 4.9 | % | |

| Diversified Financial Services | | | 4.7 | % | |

| Miscellaneous Manufacturing | | | 4.5 | % | |

| Regional Malls | | | 3.3 | % | |

| Agriculture | | | 2.9 | % | |

| Electric | | | 2.8 | % | |

| Chemicals | | | 2.6 | % | |

| Industries between 1.7% - 2.5%(1) | | | 10.3 | % | |

| Industries less than 1.7%(2) | | | 8.8 | % | |

| Other Assets and Liabilities - Net* | | | (0.1 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to ING Institutional Prime Money Market Fund and securities lending collateral.

(1) Includes five industries, which each represents 1.7% - 2.5% of net assets.

(2) Includes nine industries, which each represents less than 1.7% of net assets.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2007

(as a percent of net assets)

| ExxonMobil Corp. | | | 6.0 | % | |

| General Dynamics Corp. | | | 4.2 | % | |

| Telefonica SA ADR | | | 4.2 | % | |

| AT&T, Inc. | | | 4.1 | % | |

| United Technologies Corp. | | | 3.8 | % | |

| ConocoPhillips | | | 3.4 | % | |

| Taubman Centers, Inc. | | | 3.2 | % | |

| Loews Corp. | | | 2.9 | % | |

| Chevron Corp. | | | 2.9 | % | |

| Axis Capital Holdings Ltd. | | | 2.5 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

12

ING VP VALUE OPPORTUNITY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

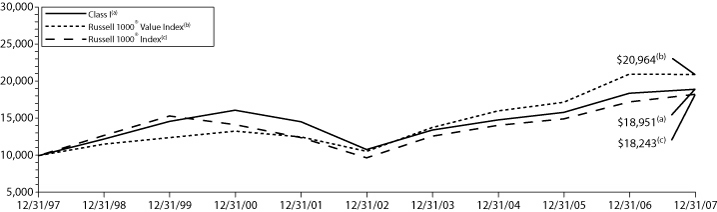

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class S

July 16, 2001 | |

| Class ADV | | | 2.33 | % | | | — | | | | — | | | | 2.31 | % | | | — | | |

| Class I | | | 3.01 | % | | | 11.91 | % | | | 6.59 | % | | | — | | | | — | | |

| Class S | | | 2.77 | % | | | 11.62 | % | | | — | | | | — | | | | 2.44 | % | |

| Russell 1000® Value Index(1) | | | (0.17 | )% | | | 14.63 | % | | | 7.68 | % | | | (0.17 | )%(3) | | | 7.62 | %(4) | |

| Russell 1000® Index(2) | | | 5.77 | % | | | 13.43 | % | | | 6.20 | % | | | 5.77 | %(3) | | | 5.44 | %(4) | |

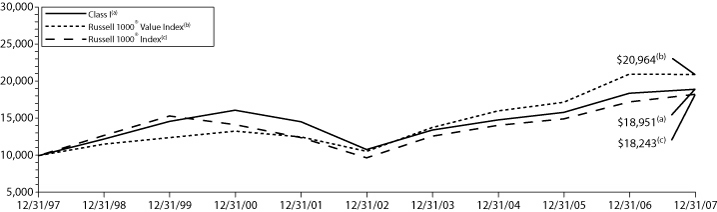

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Value Opportunity Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in the indices. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Value Index is an unmanaged index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values, which more closely tracks the types of securities in which the Portfolio invests than the S&P 500® Composite Stock Price Index.

(2) The Russell 1000® Index is a comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies.

(3) Since inception performance for the indices is shown from January 1, 2007.

(4) Since inception performance for the indices is shown from August 1, 2001.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

13

ING VP INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Intermediate Bond Portfolio (the "Portfolio") seeks to maximize total return consistent with reasonable risk. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by James B. Kauffmann, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 5.95% compared to the Lehman Brothers® Aggregate Bond Index(1) ("LBAB"), which returned 6.97% for the same period.

Portfolio Specifics: The dramatic sell-off in risk-based fixed-income assets following the summer of 2007 was the primary driver of performance for bond portfolio managers and sectors of the bond market. While the firestorm started with sub-prime mortgages, the unprecedented risk aversion spread quickly and resulted in massive losses at many mortgage companies, banks and brokerage firms. Sovereign wealth funds became major players in the re-capitalization of U.S. financial institutions. In general, markets made little distinction between the ultimate creditworthiness of individual bonds in the rush for perceived safety. Central banks around the globe were forced to inject liquidity as the inter-bank lending markets came to a near standstill.

The use of credit default swaps and related derivative indices enabled the Portfolio to mitigate some of the negative effects of the market disruption. Generally, the Portfolio's underweighting in corporate bonds for later periods of the year benefited performance. On the other hand, the Portfolio's allocation to floating-rate notes and bonds issued by financial entities acted as a drag. While our over weight in mortgage-backed securities ("MBS") was not great, the sector experienced such losses that it hurt our performance. The Portfolio's average credit quality was lower than benchmark and also detracted from results.

The Portfolio's generally long duration (higher interest-rate risk) stance helped performance for most but not all of the period. The overall duration of the Portfolio was adjusted as investors fled from riskier bonds to purchase U.S. Treasuries ("UST") or other sovereign debt. The Portfolio was underweight longer-dated Treasuries at various times, and so benefited from the relative underperformance of longer-dated UST versus shorter as markets began to anticipate aggressive Federal Reserve Board (the "Fed") easing and the increasing risks of inflation. We also added Treasury inflation-protected securities ("TIPS") positions as a counterweight to a re-inflationary Fed policy.

Current Outlook and Strategy: Our negative outlook for the U.S. economy remains intact. The pessimistic events in the U.S. residential real estate, amongst its credit enablers, and the systemic illiquidity these events have spawned will not soon abate. Extraordinary interventions by central banks across the world may have to continue into 2008. We believe that the troubles in the bond market will soon impact the real economy as lenders retreat and consumers become concerned about a softening labor market and the shrinking value of their homes.

We do not find solace in the global de-coupling theme advocated by others; and we are skeptical that the rest of the world can be untouched by a significant downturn in the U.S. economy. We maintain our long-term negative outlook for financials, construction and other industries afflicted by the residential real estate market; yet, unique tactical trades may arise near term. Our outlook for the U.S. dollar remains negative although it may be nearing a temporary oversold condition. Unease in the credit marketplace should persist, and we are comfortable with our current credit shorts or underweights. The heavy new issue calendar for corporate bonds may pressure spreads wider on existing paper, as new deals may come at discounts to outstanding paper, but opportunities may soon emerge.

The MBS team believes that their market has not yet priced in the risk of a slowing in prepayments as homeowners are less able to refinance or must stay in their homes longer. The commercial mortgage-backed securities ("CMBS") market could witness a rough patch in the near-term as it was not immune to the over-confident lending practices that have hobbled residential MBS.

The interest rates strategy team has positioned the Portfolio slightly long in duration with exposures to TIPS and the front end of the curve. Changing market perceptions of central bank actions may change quickly as could our duration postures.

We continue to hold some special situation high-yield bonds, despite our negative outlook for the sector as large new issues have yet to be digested. We will wait for more generalized price weakness or more compelling relative value before entering emerging market debt in a large way.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

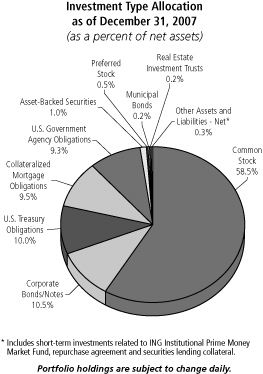

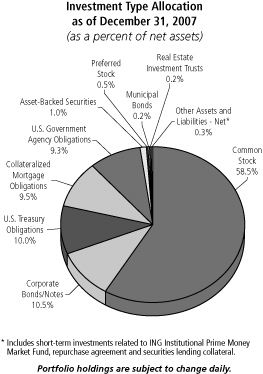

Investment Type Allocation

as of December 31, 2007

(as a percent of net assets)

| U.S. Treasury Obligations | | | 28.9 | % | |

| Collateralized Mortgage Obligations | | | 27.5 | % | |

| Corporate Bonds/Notes | | | 24.0 | % | |

| U.S. Government Agency Obligations | | | 18.5 | % | |

| Asset-Backed Securities | | | 2.4 | % | |

| Preferred Stock | | | 0.9 | % | |

| Municipal Bonds | | | 0.5 | % | |

| Other Assets and Liabilities - Net* | | | (2.7 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to ING Institutional Prime Money Market Fund, repurchase agreement and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Industries*

as of December 31, 2007

(as a percent of net assets)

| Collateralized Mortgage Obligations | | | 27.5 | % | |

| U.S. Treasury Notes | | | 24.3 | % | |

| Federal Home Loan Mortgage Corporation | | | 11.5 | % | |

| Diversified Financial Services | | | 6.8 | % | |

| Federal National Mortgage Corporation | | | 6.6 | % | |

| Banks | | | 6.2 | % | |

| Treasury Inflation Indexed Protected Securities | | | 2.3 | % | |

| U.S. Treasury Bonds | | | 2.3 | % | |

| Electric | | | 1.6 | % | |

| Retail | | | 1.4 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund and securities lending collateral.

Portfolio holdings are subject to change daily.

14

ING VP INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2007 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

May 3, 2002 | |

| Class ADV | | | 5.60 | % | | | — | | | | — | | | | 5.12 | % | | | — | | |

| Class I | | | 5.95 | % | | | 4.86 | % | | | 5.80 | % | | | — | | | | — | | |

| Class S | | | 5.70 | % | | | 4.60 | % | | | — | | | | — | | | | 5.38 | % | |

| LBAB Index(1) | | | 6.97 | % | | | 4.42 | % | | | 5.97 | % | | | 6.97 | %(2) | | | 5.32 | %(3) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Intermediate Bond Portfolio against the index indicated. An index has has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The LBAB Index is an unmanaged index composed of securities from the Lehman Brothers Government/Corporate Bond Index, Mortgage-Backed Securities Index and the Asset-Backed Securities Index.

(2) Since inception performance for the the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from May 1, 2002.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

15

ING VP MONEY MARKET PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Money Market Portfolio (the "Portfolio") seeks to provide high current return, consistent with preservation of capital and liquidity, through investment in high-quality money market instruments. The Portfolio is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 5.13% compared to the iMoneyNet First Tier Retail Index(1), which returned 4.57% for the same period.

Portfolio Specifics: 2007 was a challenging year for short-term fixed- income investors and in particular money market funds. Money market rates traded in a very narrow range for the first half of the year and into July as the Federal Open Markets Committees ("FOMC") kept the federal funds rate at 5.25%. There were limited opportunities for the Portfolio to differentiate itself from its competitors during this period.

In early August the sub-prime, hedge fund and collateralized debt obligations ("CDO") problems widened to affect most mortgage related markets, money market securities and interbank lending. Commercial paper rates and London Interbank Offered Rate ("LIBOR") skyrocketed as there was a flight to quality due to liquidity and counterparty concerns. The Federal Reserve Board (the "Fed") and other central banks were forced to take drastic measures to increase liquidity and market confidence. The Fed flooded the banking system with excess liquidity and cut the discount rate 0.50% in August. This was followed by an additional 0.50% cut in the discount rate and similar cut in the federal funds rate in September. Short-term liquidity and market confidence improved slowly following the moves by the central banks.

This improvement was only temporary forcing the Fed to cut rates another 0.25% on October 31. Liquidity concerns returned in December as the markets worried about financing over year-end and a deteriorating economic outlook. The Fed cut rates another 0.25%. The federal funds rate ended the year at 4.25%, a full percent below where it started the year. The central banks also added significant cash reserves over year-end to replace the financing normally provided by the large global banks.

The Portfolio used various strategies during the year as the market conditions changed. During the early stable period, the Portfolio took advantage of the trading range, increasing its weighted average maturity ("WAM") by buying longer-term fixed securities as rates moved to the higher end of the trading range. Our strategy of overweighting floating rate assets whose yields were tied to LIBOR worked well during the market dislocation and high LIBOR rates experienced during the later part of the year. We selectively bought asset-backed commercial paper of issuers that we determined to be well structured with excess credit enhancement and liquidity provided by highly rated strong financial institutions. We avoided issuers that had large exposure to sub-prime and CDO assets, including structured investment vehicles ("SIVs") which have been in the negative spotlight recently. This strategy allowed the Portfolio to outperform the majority of its peers during the second half of the year and for the year overall. That strategy remains in place.

Current Strategy and Outlook: We expect liquidity and money market securities to remain under stress in 2008 and require additional actions by the U.S. Treasury, the FOMC and other central banks. These will be determined by continued market stress on certain assets classes, interbank market liquidity and the state of the U.S and global economy. The market is expecting the Fed to ease at least 0.25% at its January 30 meeting, with additional cuts over the course of 2008. We see a risk that the effects of the deteriorating housing market and a slowing in the job market could spill over into the full economy. This is not now fully priced into the market. Our current strategy is to continue to take advantage of the high LIBOR rates by buying additional floating rate securities of highly rated issuers and selectively adding duration by buying longer-term fixed r ate securities.

(1) The iMoneyNet First Tier Retail Index is an unmanaged index that includes the most broadly based money market funds. This index is intended to be the comparative index for the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Investment Type Allocation

as of December 31, 2007

(as a percent of net assets) | |

| Corporate Bonds/Notes | | | 53.5 | % | |

| Commercial Paper | | | 41.3 | % | |

| Repurchase Agreement | | | 4.3 | % | |

| Certificates Of Deposit | | | 1.0 | % | |

| Securities Lending Collateral | | | 0.0 | % | |

| Other Assets and Liabilities - Net | | | (0.1 | )% | |

| Net Assets | | | 100.0 | % | |

Portfolio holdings are subject to change daily.

16

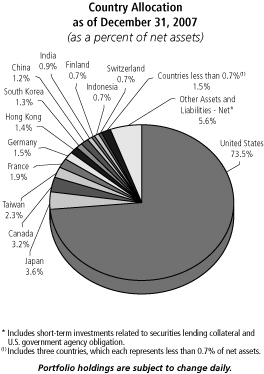

ING VP GLOBAL SCIENCE AND TECHNOLOGY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Global Science and Technology Portfolio (the "Portfolio") seeks long-term capital appreciation. The Portfolio is managed by Thomas P. Callan, CFA, Managing Director and Senior Portfolio Manager, Erin Xie, PhD, Managing Director and Portfolio Manager and Jean M. Rosenbaum, CFA, Managing Director and Portfolio Manager of BlackRock Advisors, LLC — the Sub-Adviser.

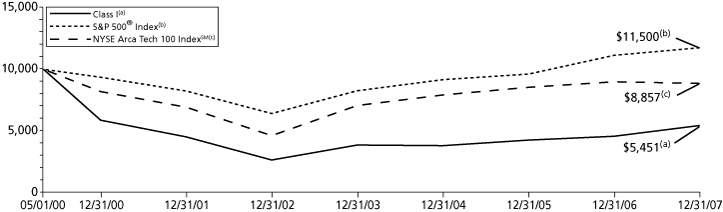

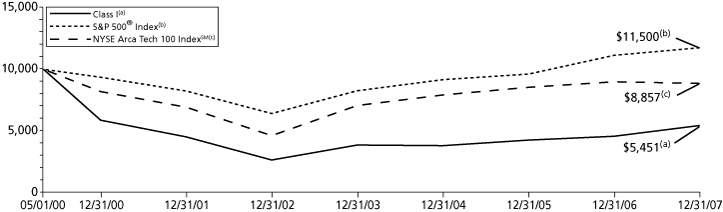

Performance: For the year ended December 31, 2007, the Portfolio's Class I shares provided a total return of 19.00% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index") and the NYSE Arca Tech 100 IndexSM(2),which returned 5.49% and 7.77%, respectively, for the same period.

Portfolio Specifics: Over the past year, global equity markets experienced gains, however increased volatility and meaningful market corrections made the period a much different one than in recent years. The Federal Reserve Board cut the federal funds target rate by 50 basis points (0.50%) on September 18, followed by an additional 25 basis points (0.25%) of easing on October 31 and December 11. These were the first rate cuts since July 2003. As financials and consumer discretionary stocks declined due to housing and credit related problems, technology shares faired relatively well amidst uncertain economic conditions.

Both stock selection and sector allocation decisions contributed positively to relative outperformance during the period. The most significant contributor was stock selection, which was positive across all economic sectors. In particular, selection gains were strongest in the information technology group. Allocation benefits were more moderate. The Portfolio's exposure to telecommunication services — a sector that is absent from the benchmark — produced the most favorable results.

Within information technology, selection gains were most pronounced in internet software & services, with Google, Inc. among the strongest contributors, and broadly across semiconductor equipment and software as performance within these groups were well above benchmark results. Stock selection within biotechnology benefited results over the year, as individual company performance varied significantly. Strong picks among wireless telecommunication services names also contributed to performance as several positions appreciated significantly, including Bharti Airtel Ltd. and China Mobile Ltd.

Conversely, hindering the Portfolio's relative return was an underweight to the strong-performing aerospace & defense and computer hardware sub-industry groups. Additionally, weaker stock selection within electronic manufacturing services and data processing & outsourced services partially offset otherwise strong performance across the information technology sector. The greatest drags on relative results from an individual stock perspective came from an underweight to Apple, Inc. and no exposure to Medimmune, Inc., both of which experienced significant price appreciation over the period.

Current Strategy and Outlook: While concerns grow about the U.S. economy and the extent of credit-related issues across the financial system, global growth expectations, in our opinion, remain relatively strong. However, forecasts are mixed across regions and we believe the risks are to the downside. We have been steadily building balance in the portfolio by adding more defensive positions and reducing our cyclical exposure. While valuations remain reasonable and world growth relatively robust, we are growing more wary of downside risks and believe caution is warranted. At year-end, the Portfolio was invested in information technology, health care, industrials, telecommunication services, and the remainder distributed among consumer discretionary, consumer staples, and materials sectors. Within information technology, the Portfolio's primary overweights ver sus the NYSE Arca Tech 100 IndexSM were in home entertainment software and internet software & services; significant underweights were in computer hardware, application software, and data processing & outsourced services. Inside the health care portion of the Portfolio, the Portfolio held an above-benchmark allocation to healthcare equipment and pharmaceuticals and a below-benchmark weighting in biotechnology and life science tools & services. Further, we maintained the Portfolio's allocation to telecommunication services, as strong global growth and rising revenue-per-user remain catalysts.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2007

(as a percent of net assets) | |

| Apple, Inc. | | | 4.6 | % | |

| Google, Inc. - Class A | | | 3.2 | % | |

| Intel Corp. | | | 2.1 | % | |

| DST Systems, Inc. | | | 2.1 | % | |

| Research In Motion Ltd. | | | 1.9 | % | |

| Cisco Systems, Inc. | | | 1.9 | % | |

| Microsoft Corp. | | | 1.9 | % | |

| Hewlett-Packard Co. | | | 1.8 | % | |

| Waters Corp. | | | 1.6 | % | |

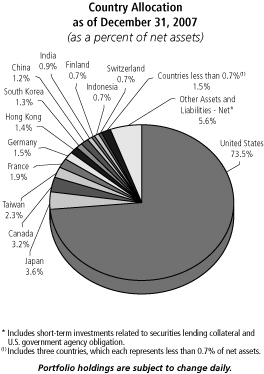

| Lockheed Martin Corp. | | | 1.6 | % | |