As filed with the Securities and Exchange Commission on August 15, 2011

Securities Act File No.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. o

Post-Effective Amendment No. o

ING VARIABLE FUNDS

(Exact Name of Registrant as Specified in Charter)

7337 East Doubletree Ranch Road, Scottsdale, Suite 100, Arizona 85258-2034

(Address of Principal Executive Offices) (Zip Code)

1-800-262-3862

(Registrant’s Area Code and Telephone Number)

Huey P. Falgout. Jr.

ING U.S. Legal Services

7337 East Doubletree Ranch Road

Scottsdale, AZ 85258

(Name and Address of Agent for Service)

With copies to:

Philip H. Newman, Esq.

Goodwin Procter LLP

Exchange Place

53 State Street

Boston, MA 02109

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

ING CORE GROWTH AND INCOME PORTFOLIO

(Formerly, ING Janus Contrarian Portfolio)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-366-0066

September 28, 2011

Dear Shareholder:

We are pleased to invite you to a special meeting of shareholders (the “Special Meeting”) of ING Core Growth and Income Portfolio, (“Core Portfolio”). The Special Meeting is scheduled for 10:00 A.M., Local time, on November 4, 2011, at 7337 Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.

At the Special Meeting shareholders of Core Portfolio will be asked to vote on the proposed reorganization (the “Reorganization”) of Core Portfolio with and into ING Growth and Income Portfolio (“Growth and Income Portfolio”) (together with Core Portfolio, the “Portfolios”, each a “Portfolio”). Each Portfolio is a member of the mutual fund group called the “ING Funds.”

In addition shareholders will be asked to approve a new sub-advisory agreement for Core Portfolio with ING Investment Management Co. (“ING IM”). ING IM currently serves as the sub-adviser to Core Portfolio under an interim sub-advisory agreement between Directed Services LLC, Core Portfolio’s investment adviser, and ING IM. This interim sub-advisory agreement will not terminate until after the anticipated closing date for the proposed Reorganization. Shareholders are being asked to approve this “permanent” sub-advisory agreement for ING IM to serve beyond the interim period in the event shareholders do not approve the Reorganization.

Shares of Core Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (collectively, “Qualified Plans”) or, at your direction by your insurance company, through its separate accounts to serve as investment opinions under your variable annuity contract or variable life insurance policy. If the Reorganization is approved by shareholders the separate account in which you have an interest or the Qualified Plan in which you are a participant will own shares of Growth and Income Portfolio instead of shares of Core Portfolio beginning on the date of Reorganization. The Reorganization would provide the separate account in which you have an interest or the Qualified Plan in which you are a participant with an opportunity to participate in a significantly larger portfolio with the same investment objective.

Formal notice of the Special Meeting appears on the next page, followed by the Proxy Statement/Prospectus. The Proposals are discussed in detail in the enclosed Proxy Statement/Prospectus, which you should read carefully. After careful consideration, the Board has concluded that the Proposals are in the best interests of Core Portfolio and its shareholders and recommends that you vote “FOR” the Proposals.

Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than November 3, 2011.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

| Sincerely, |

| |

|

|

| |

| Shaun P. Mathews |

| President and Chief Executive Officer |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

OF

ING CORE GROWTH AND INCOME PORTFOLIO

(Formerly, ING Janus Contrarian Portfolio)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-366-0066

Scheduled for November 4, 2011

To the Shareholders:

NOTICE IS HEREBY GIVEN that a special meeting of the shareholders (the “Special Meeting”) of ING Core Growth and Income Portfolio (“Core Portfolio”) is scheduled for 10:00 A.M., Local time on November 4, 2011 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. Core Portfolio is a series of ING Investors Trust.

At the Special Meeting, Core Portfolio’s shareholders will be asked:

1. To approve an Agreement and Plan of Reorganization by and between Core Portfolio and ING Growth and Income Portfolio (“Growth and Income Portfolio”), providing for the reorganization of Core Portfolio with and into Growth and Income Portfolio;

2. To approve a new sub-advisory agreement between Directed Services LLC (“DSL”), the investment adviser to Core Portfolio and ING IM, Core Portfolio’s proposed sub-adviser; and

3. To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes.

Please read the enclosed Proxy Statement/Prospectus carefully for information concerning the Proposals to be placed before the Special Meeting.

The Board has concluded that the Proposals are in the best interests of Core Portfolio and its shareholders and recommends that you vote “FOR” the Proposals.

Shareholders of record as of the close of business on August 12, 2011, are entitled to notice of, and to vote at, the Special Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement/Prospectus. Regardless of whether you plan to attend the Special Meeting, please complete, sign, and return promptly, but in no event later than November 3, 2011, the enclosed Voting Instruction Card so that a maximum number of shares may be voted. Proxies may be revoked at any time before there are exercised by submitting a revised proxy, by giving written notice of revocation to Core Portfolio or by voting in person at the Special Meeting.

| By Order of the Board of Trustees

Huey P. Falgout, Jr. Secretary September 28, 2011 |

PROXY STATEMENT/PROSPECTUS

September 28, 2011

PROXY STATEMENT FOR:

ING CORE GROWTH AND INCOME PORTFOLIO

(Formerly, ING Janus Contrarian Portfolio)

(A series of ING Investors Trust)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-366-0066

Special Meeting of Shareholders

of ING Core Growth and Income Portfolio

Scheduled for November 4, 2011

PROSPECTUS FOR:

ING GROWTH AND INCOME PORTFOLIO

(A series of ING Variable Funds)

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034

1-800-992-0180

The U.S. Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities nor has the SEC judged whether the information in this Proxy Statement/Prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

ING CORE GROWTH AND INCOME PORTFOLIO

PROXY STATEMENT/PROSPECTUS

September 28, 2011

TABLE OF CONTENTS

INTRODUCTION

Why is the Special Meeting Being Held?

A special meeting of shareholders (the “Special Meeting”) of ING Core Growth and Income Portfolio (“Core Portfolio”) is scheduled for 10:00 A.M. Local time on November 4, 2011 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034 for the following purposes:

1. To approve an Agreement and Plan of Reorganization by and between Core Portfolio and ING Growth and Income Portfolio (“Growth and Income Portfolio”), providing for the reorganization of Core Portfolio with and into Growth and Income Portfolio (the “Reorganization”);

2. To approve a new sub-advisory agreement between Directed Services LLC (“DSL”), the investment adviser to Core Portfolio and ING IM, Core Portfolio’s proposed sub-adviser (“Proposal Two”, together with the Reorganization, the “Proposals”); and

3. To transact such other business, not currently contemplated, that may properly come before the Special Meeting, or any adjournment(s) or postponement(s) thereof, in the discretion of the proxies or their substitutes.

Why did you send me this booklet?

Shares of Core Portfolio have been purchased by you or at your direction through your qualified pension or retirement plan (“Qualified Plans”) or, at your direction by your insurance company, through its separate accounts, to serve as investment options under your variable annuity contract or variable life insurance policy (“Variable Contract”). This booklet includes a combined proxy statement and prospectus (“Proxy Statement/Prospectus”) and a Voting Instruction Card for Core Portfolio. It provides you with information you should review before providing voting instructions on the matters listed above and in the Notice of Special Meeting.

The insurance company and Qualified Plans or their trustees, as record owners of Core Portfolio’s shares are, in most cases, the true “shareholders” of Core Portfolio; however, participants in Qualified Plans (“Plan Participants”) or holders of Variable Contracts (“Variable Contracts Holders”) may be asked to instruct their Qualified Plan trustee or insurance company, as applicable, as to how they would like the shares attributed to their Qualified Plan or Variable Contract to be voted. For clarity and ease of reading, references to “shareholder” or “you” throughout this Proxy Statement/Prospectus do not usually refer to the technical shareholder but rather refer to the persons who are being asked to provide voting instructions on the Proposals.

Because you, as a shareholder of Core Portfolio, are being asked to approve a Reorganization Agreement that will result in a transaction in which you will ultimately hold shares of Growth and Income Portfolio, this Proxy Statement also serves as a prospectus for Growth and Income Portfolio. Growth and Income Portfolio is an open-end management investment company that seeks to maximize total return through investments in a diversified portfolio of common stock and securities convertible into common stocks. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return.

Who is eligible to vote?

Shareholders holding an investment in shares of Core Portfolio as of the close of business on August 12, 2011 (the “Record Date”), are eligible to vote or instruct their insurance company or plan trustee as to how to vote their shares. (See “General Information” for a more detailed discussion of voting procedures).

How do I vote?

If a shareholder wishes to participate in the Special Meeting, he or she may submit the Voting Instructions Card originally sent with the Proxy Statement or attend the Special Meeting in person. Shareholders can vote by completing, signing and returning the enclosed Voting Instructions Card promptly in the enclosed envelope, through telephone touch-tone voting, via Internet voting, or by attending the Special Meeting in person and voting. To vote by telephone or Internet, follow the voting instructions as outlined on your Voting Instructions Card. These options require shareholders to input a control number, which is located on your Voting Instructions Card. After entering this number, shareholders will be prompted to provide their voting instructions on the Proposals, as applicable. Shareholders will have the opportunity to review their voting instructions and make any necessary changes before submitting their voting instructions and terminating their telephone call or Internet link. Shareholders who vote on the Internet, in addition to confirming their voting instructions prior to submission, may also request an e-mail confirming their instructions. Joint owners must each sign the Voting Instructions Card.

If a shareholder wishes to participate in the Special Meeting, but does not wish to give a proxy by telephone or Internet, the shareholder may still submit by mail the Voting Instructions Card originally sent with this Proxy Statement or attend the Special Meeting in person.

How does the Board recommend that I vote?

The Board recommends that shareholders vote “FOR” the Proposals.

1

When and where will the Special Meeting be held?

The Special Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034, on November 4, 2011, at 10:00 A.M., Local time, and, if the Special Meeting is adjourned or postponed, any adjournment(s) or postponement(s) of the Special Meeting will also be held at the above location. If you expect to attend the Special Meeting in person, please call Shareholder Services toll-free at (800) 992-0180.

How can I obtain more information about the Portfolios?

Should you have any questions about the Portfolios, please do not hesitate to contact Shareholder Services toll free at (800) 992-0180. The prospectuses and other information regarding the Portfolios are available on the Internet at http://www.ingfunds.com/vp/literature.

Each Portfolio is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and files reports, proxy materials and other information with the SEC. You can copy and review information about each Portfolio, including the SAI, reports, proxy materials and other information at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the Public Reference Room by calling the SEC at 1-202-551-8090. Such materials are also available in the EDGAR Database on the SEC’s internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing to the SEC’s Public Reference Section, Office of Consumer Affairs and Information, U.S. Securities and Exchange Commission, 100 F. Street N.E., Washington, D.C. 20549.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to Be Held on November 4, 2011.

The Proxy Statement/Prospectus is available on the Internet at http://www.proxyweb.com/ing. Additional information about each Portfolio is available in its Prospectuses, Statement of Additional Information, Semi-Annual Report, and Annual Report to shareholders. Copies of the Portfolios’ Annual and unaudited Semi-Annual Reports have previously been mailed to shareholders. This Proxy Statement should be read in conjunction with the Annual and unaudited Semi-Annual Reports. You can obtain copies of the Prospectuses, Statement of Additional Information, Annual and unaudited Semi-Annual Reports of each Portfolio upon request, without charge, by writing to Core Portfolio at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona, 85258-2034, by calling (800) 366-0066, or by visiting http://www.ingfunds.com/vp/literature.

2

SUMMARY OF THE PROPOSALS

The Proposed Reorganization

You should read this entire Proxy Statement/Prospectus carefully. You should also review the Reorganization Agreement, which is attached hereto as Appendix A. You should consult Core Portfolio Prospectuses dated April 28, 2011, for more information about Core Portfolio.

On June 23-24, 2011, the Board approved the Reorganization Agreement. Subject to shareholder approval, the Reorganization Agreement provides for:

· the transfer of all of the assets of Core Portfolio to Growth and Income Portfolio in exchange for shares of beneficial interest of Growth and Income Portfolio;

· the assumption by Growth and Income Portfolio of the liabilities of Core Portfolio known as of the Closing Date (as described below);

· the distribution of shares of Growth and Income Portfolio to the shareholders of Core Portfolio; and

· the complete liquidation of Core Portfolio.

If shareholders approve the Reorganization, each owner of ADV Class, Class I, Class S, and Class S2 shares of Core Portfolio would become a shareholder of the corresponding share class of Growth and Income Portfolio. The Reorganization is expected to be effective on December 2, 2011, or such other date as the parties may agree (the “Closing Date”). Each shareholder of Core Portfolio will hold, immediately after the Closing Date, shares of Growth and Income Portfolio having an aggregate value equal to the aggregate value of the shares of Core Portfolio held by that shareholder as of the close of business on the Closing Date.

In considering whether to approve the Reorganization, you should note that:

· Currently, both Core Portfolio and Growth and Income Portfolio have identical investment objectives and principal investment strategies and are managed by the same sub-adviser, ING IM (as noted above, ING IM serves as the interim sub-adviser to Core Portfolio);

· DSL is the adviser to Core Portfolio, while ING Investments, LLC (“ING Investments”) is the adviser to Growth and Income Portfolio;

· In anticipation of the proposed Reorganization and in connection with the appointment of ING IM as sub-adviser under an interim sub-advisory agreement, DSL has contractually agreed to waive all or a portion of its investment management fee and/or reimburse expenses in amounts necessary to limit the expenses of each class of Core Portfolio so that they align with Growth and Income Portfolio’s net expense ratios;

· The purchase and redemption of shares of each Portfolio may be made by Separate Accounts and by participants in Qualified Plans; consequently, Variable Contract Holders and Plan Participants should consult the underlying product prospectus or Qualified Plan documents, respectively, with respect to purchases, exchanges, redemption of shares and related fees;

· Each Portfolio is distributed by ING Investments Distributor, LLC (“IID” or “Distributor”); and

· The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization pursuant to Section 368(a) of Internal Revenue Code of 1986, as amended (the “Code”); accordingly, pursuant to this treatment, neither Core Portfolio nor its shareholders, nor Growth and Income Portfolio nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement.

The Proposed Sub-Advisory Agreement

From October 2, 2000 until June 30, 2011, Core Portfolio was sub-advised by Janus Capital Management LLC (“Janus”) and Core Portfolio’s name was ING Janus Contrarian Portfolio. During a meeting held June 23-24, 2011, the Board, including a majority of the trustees who are not “interested persons” of Core Portfolio, as defined in the 1940 Act (“Independent Trustees”), determined to terminate the investment sub-advisory agreement with Janus and approved an interim sub-advisory agreement between DSL and ING IM (“Interim Agreement”) pursuant to which ING IM currently serves as sub-adviser to Core Portfolio. The Interim Agreement will expire on December 18, 2011 or earlier, if shareholders approve the Proposals. On July 15, 2011, the Board, including all of the Independent Trustees approved a permanent sub-advisory agreement between DSL and ING IM (“Proposed Sub-Advisory Agreement”), subject to shareholder approval. Shareholders of Core Portfolio must approve the Proposed Sub-Advisory Agreement for it to become effective.

· On June 24, 2011, the Board approved the Reorganization of Core Portfolio with and into Growth and Income Portfolio, as described above;

3

· The terms of the Interim Agreement and the Proposed Sub-Advisory Agreement are substantially similar to the those of the prior sub-advisory agreement with Janus;

· In connection with the appointment of ING IM as sub-adviser pursuant to the Interim Agreement, Core Portfolio also adopted a new investment objective and new principal investment strategies which are identical to those of Growth and Income Portfolio. For more information on the principal investment strategies and principal risks of Core Portfolio prior to June 30, 2011, see Appendix B. As a result, ING IM is currently managing Core Portfolio in a manner similar to the way it manages Growth and Income Portfolio; and

· DSL, as the adviser to Core Portfolio, continues to be responsible for monitoring the investment program and performance of ING IM, which is an affiliate of DSL.

4

PROPOSAL ONE — APPROVAL OF THE PROPOSED REORGANIZATION

What is the proposed Reorganization?

Shareholders of Core Portfolio are being asked to approve an Agreement and Plan of Reorganization, providing for the reorganization of Core Portfolio with and into Growth and Income Portfolio. If the Reorganization is approved, shareholders in Core Portfolio will become shareholders in Growth and Income Portfolio as of the close of business on the Closing Date.

Why is a Reorganization proposed?

On May 12, 2011, Janus announced that David Decker, the lead portfolio manager to Core Portfolio, was leaving Janus and would cease to be the portfolio manager for Core Portfolio effective June 30, 2011. Following the announcement, the Board directed DSL to explore options to address the Board’s concern regarding the change in portfolio manager. After analyzing the alternatives, DSL recommended reorganizing Core Portfolio with and into Growth and Income Portfolio.

During the June 23-24, 2011 Board Meeting, the Reorganization was presented for consideration to the Board. The Board, including a majority of the Independent Trustees, determined that the interests of the shareholders of Core Portfolio would not be diluted as a result of the Reorganization and that the Reorganization would be in the best interests of Core Portfolio and its shareholders.

In anticipation of the Reorganization, the Board terminated the Portfolio Management Agreement between Janus and DSL and approved the Interim Agreement with ING IM. For more information on the Interim Agreement, please see Proposal Two. In addition, the Board approved changes to the investment objective and principal investment strategies to align Core Portfolio with Growth and Income Portfolio. As result both Portfolios’ have identical investment objectives, principal investment strategies, and principal risks. A Supplement describing these changes was mailed to shareholders on June 30, 2011.

On August 3, 2011, the Reorganization was presented for consideration to the Board of Trustees for Growth and Income Portfolio (the “Growth and Income Board”). The Growth and Income Board, including all of the Independent Trustees, determined that the interests of the shareholders of Growth and Income Portfolio will not be diluted as a result of the Reorganization and that the Reorganization is in the best interests of Growth and Income Portfolio and its shareholders.

The Reorganization will allow Core Portfolio’s shareholders to remain invested in a professionally managed portfolio that seeks to maximize total return through investments in a diversified portfolio of common stock and securities convertible into common stocks.

How do the Investment Objectives compare?

As discussed above, in anticipation of the merger, the Board approved a change in the investment objective of Core Portfolio to align it with the investment objective of Growth and Income Portfolio. Consequently, both portfolios have identical investment objectives. Prior to September 15, 2011, the investment objective of the Core Portfolio was to seek capital appreciation.

| | Core Portfolio and Growth and Income Portfolio |

Investment Objective | | Seeks to maximize total return through investments in a diversified portfolio of common stock and securities convertible into common stocks. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. |

5

How do the Annual Portfolio Operating Expenses compare?

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Portfolios. The table does not reflect fees or expenses that are, or may be, imposed under an insurance company separate account serving as an investment option under Variable Contracts or Qualified Plans. For more information on these charges, please refer to the documents governing your Variable Contract or consult your plan administrator. The Advisory Agreement between DSL and Core Portfolio provides for a “bundled fee” arrangement under which DSL provides (in addition to advisory services), custodial, administrative, transfer agency, portfolio accounting, auditing and ordinary legal services in return for a single management fee.

Annual Portfolio Operating Expenses(1)

Expenses you pay each year as a % of the value of your investment

| | Core Portfolio | | Growth and Income Portfolio | |

Class ADV | | | | | |

Management Fee | | 0.79 | % | 0.50 | % |

Distribution and/or Shareholder Services (12b-1) Fees | | 0.75 | % | 0.50 | % |

Other Expenses | | 0.00 | % | 0.10 | % |

Total Annual Portfolio Operating Expenses | | 1.54 | % | 1.10 | % |

Waivers and Reimbursements(2) | | (0.49 | )% | (0.05 | )% |

Net Expenses | | 1.05 | % | 1.05 | % |

| | | | | |

Class I | | | | | |

Management Fee | | 0.79 | % | 0.50 | % |

Distribution and/or Shareholder Services (12b-1) Fees | | 0.00 | % | — | |

Other Expenses | | 0.00 | % | 0.10 | % |

Total Annual Portfolio Operating Expenses | | 0.79 | % | 0.60 | % |

Waivers and Reimbursements(2) | | (0.19 | )% | — | |

Net Expenses | | 0.60 | % | 0.60 | % |

| | | | | |

Class S | | | | | |

Management Fee | | 0.79 | % | 0.50 | % |

Distribution and/or Shareholder Services (12b-1) Fees | | 0.25 | % | 0.25 | % |

Other Expenses | | 0.00 | % | 0.10 | % |

Total Annual Portfolio Operating Expenses | | 1.04 | % | 0.85 | % |

Waivers and Reimbursements(2) | | (0.19 | )% | — | |

Net Expenses | | 0.85 | % | 0.85 | % |

| | | | | |

Class S2 | | | | | |

Management Fee | | 0.79 | % | 0.50 | % |

Distribution and/or Shareholder Services (12b-1) Fees | | 0.50 | % | 0.50 | % |

Other Expenses | | 0.00 | % | 0.10 | % |

Total Annual Portfolio Operating Expenses | | 1.29 | % | 1.10 | % |

Waivers and Reimbursements(2) | | (0.29 | )% | (0.10 | )% |

Net Expenses | | 1.00 | % | 1.00 | % |

(1) Expense ratios have been adjusted to reflect current expense rates

(2) For Core Portfolio DSL is contractually obligated to limit expenses to 1.20%, 0.60%, 0.85%, and 1.00% for Class ADV, Class I, Class S, and Class S2, respectively, through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses and Acquired Fund Fees and Expenses. This obligation will automatically renew for one-year terms unless it is terminated by Core Portfolio or DSL upon written notice within 90 days of the end of the current term or upon termination of the management agreement and is subject to possible recoupment by the DSL within three years. In addition, the distributor to Core Portfolio is contractually obligated to waive 0.15% and 0.10% for Class ADV and Class S2, respectively, of the distribution fee through May 1, 2012. There is no guarantee that the distribution fee waiver will continue after May 1, 2012. The distributor to Growth and Income Portfolio is contractually obligated to waive 0.05% and 0.10% for Class ADV and Class S2, respectively, of the distribution fee through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. Last, the distributor to Core Portfolio is contractually obligated to waive an additional 0.15% for Class ADV of the distribution fee through May 1, 2013. There is no guarantee that the distribution fee waiver will continue after May 1, 2013. The distribution fee waivers will only renew if the distributor elects to renew them.

6

Expense Example $

Expenses you pay each year as a % of the value of your investment

The Example is intended to help you compare the cost of investing in shares of the Portfolios with the costs of investing in other mutual funds. The Example does not reflect expenses and charges which are, or may be, imposed under your Variable Contract or Qualified Plan. The Example assumes that you invest $10,000 in the Portfolios for the time periods indicated. The Example also assumes that your investment had a 5% return each year and that the Portfolios’ operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | Core Portfolio | | Growth and Income Portfolio | |

Class | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | |

ADV | $ | 107 | | 407 | | 728 | | 1,639 | | 107 | | 345 | | 601 | | 1,336 | |

I | $ | 61 | | 233 | | 420 | | 960 | | 61 | | 192 | | 335 | | 750 | |

S | $ | 87 | | 312 | | 556 | | 1,254 | | 87 | | 271 | | 471 | | 1,049 | |

S2 | $ | 102 | | 359 | | 636 | | 1,426 | | 102 | | 340 | | 597 | | 1,331 | |

How do the Principal Investment Strategies compare?

As discussed above, in anticipation of the merger, the Board approved a change in the principal investment strategies of Core Portfolio to align them with those of Growth and Income Portfolio. Consequently, both portfolios have identical principal investment strategies. Prior to June 30, 2011, Core Portfolio pursued its investment objective through different investment strategies. For more information on the principal investment strategies and principal risks of Core Portfolio prior to June 30, 2011, see Appendix B.

| | Core Portfolio and Growth and Income Portfolio |

Principal Investment Strategies | | Under normal market conditions, the Portfolio invests at least 65% of its total assets in common stocks that the sub-adviser (“Sub-Adviser”) believes have significant potential for capital appreciation or income growth or both. The Sub-Adviser may invest principally in common stocks and securities convertible into common stocks having significant potential for capital appreciation, may purchase common stock principally for their income potential through dividends or may acquire securities having a mix of these characteristics. The Portfolio may also engage in option writing. The Portfolio may invest in certain higher risk investments such as derivative instruments, including, but not limited to, put and call options. The Portfolio typically used derivatives to seek to reduce exposure to volatility and to substitute for taking a position in the underlying asset. The Portfolio may also invest in other investment companies, including exchange-traded funds, to the extent permitted under the Investment Company Act of 1940, as amended and the rules, regulations, and exemptive orders thereunder (“1940 Act”). In managing the Portfolio, the Sub-Adviser: emphasizes stocks of larger companies; looks to strategically invest the Portfolio’s assets in stocks of mid-sized companies and up to 25% of its total assets in stock of foreign issuers, depending upon market conditions; and utilizes an intensive, fundamentally driven research process to evaluate company financial characteristics (for example, price-to-earnings ratios, growth rates and earnings estimates) to select securities within each class. In analyzing these characteristics, the Sub-Adviser attempts to identify positive earnings momentum and positive valuation characteristics in selecting securities whose perceived value is not reflected in their price. The Sub-Adviser may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into opportunities believed to be more promising, among others. The Portfolio may lend portfolio securities on a short-term or long-term basis, up to 33 1/3 % of its total assets. |

How do the Principal Risks of Investing in the Portfolios compare?

As discussed above, in anticipation of the merger, the Board approved a change in the investment objective and principal investment strategies of Core Portfolio to align them with those of Growth and Income Portfolio. Consequently, both portfolios have identical principal investment strategies and principal risks. Prior to June 30, 2011, Core Portfolio had different principal risks. For more information on the principal investment strategies and principal risks of Core Portfolio prior to June 30, 2011, see Appendix B.

Company The price of a given company’s stock could decline or underperform for many reasons including, among others, poor management, financial problems, or business challenges. If a company declares bankruptcy or becomes insolvent, its stocks could become worthless.

Convertible Securities Convertible securities are securities that are convertible into or exercisable for common stocks at a stated price or rate. Convertible securities are subject to the usual risks associated with debt securities, such as interest rate

7

and credit risk. In addition, because convertible securities react to changes in the value of the stocks into which they convert, they are subject to market risk.

Currency To the extent that the Portfolios invest directly in foreign currencies or in securities denominated in, or that trade in, foreign (non-U.S.) currencies, it is subject to the risk that those currencies will decline in value relative to the U.S. dollar or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged.

Derivative Instruments Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The use of certain derivatives may also have a leveraging effect which may increase the volatility of the Portfolios and reduce its returns.

Foreign Investments Investing in foreign (non-U.S.) securities may result in the Portfolios experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to smaller markets, differing reporting, accounting and auditing standards, and nationalization, expropriation or confiscatory taxation, foreign currency fluctuations, currency blockage, or political changes or diplomatic developments.

Liquidity If a security is illiquid, the Portfolios might be unable to sell the security at a time when the Portfolio’s manager might wish to sell, and the security could have the effect of decreasing the overall level of the Portfolio’s liquidity. Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Portfolios could realize upon disposition. The Portfolio may make investments that become less liquid in response to market developments or adverse investor perception. The Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the Portfolio.

Market Stock prices are volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. From time to time, the stock market may not favor the growth- or value-oriented securities in which the Portfolios invest. Rather, the market could favor securities to which the Portfolios are not exposed or may not favor equities at all.

Market Capitalization Stocks fall into three broad market capitalization categories - large, mid and small. Investing primarily in one category carries the risk that, due to current market conditions, that category may be out of favor with investors. If valuations of large-capitalization companies appear to be greatly out of proportion to the valuations of mid- or small-capitalization companies, investors may migrate to the stocks of mid- and small-sized companies causing the Portfolios that invest in these companies to increase in value more rapidly than a fund that invests in larger, fully-valued companies. Investing in mid- and small-capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, and a more limited trading market for their stocks as compared with larger companies. As a result, stocks of mid- and small-capitalization companies may decline significantly in market downturns.

Other Investment Companies The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because the Portfolios may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company (including management fees, administration fees and custodial fees) in addition to the expenses of the Portfolio.

Securities Lending Securities lending involves two primary risks: “investment risk” and “borrower default risk.” Investment risk is the risk that the Portfolios will lose money from the investment of the cash collateral received from the borrower. Borrower default risk is the risk that the Portfolios will lose money due to the failure of a borrower to return a borrowed security in a timely manner.

8

How does Core Portfolio Performance compare to Growth and Income Portfolio?

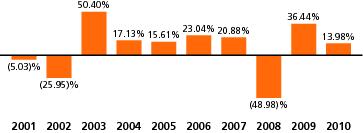

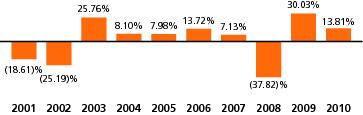

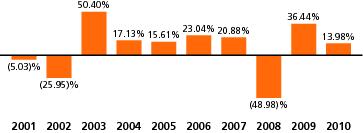

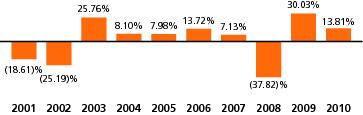

The following information is intended to help you understand the risks of investing in the Portfolios. The following bar charts show the changes in Core Portfolio’s Class S shares’ performance from year to year and Growth and Income Portfolio’s adjusted Class I shares’ performance (2001-2003) and Class S shares’ performance (2004-2010), and the table compares the Portfolios’ performance to the performance of a broad-based securities market index/indices for the same period. Growth and Income Portfolio’s Class I shares’ performance has been adjusted to reflect the higher expenses of Class S shares. During the periods reflected in both the bar chart and the table, Core Portfolio was sub-advised by Janus pursuant to different strategies than those currently in place for Core Portfolio. The Portfolios’ performance information reflects applicable fee waivers and/or expense limitations in effect during the period presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. Other class shares’ performance would differ from Class S shares’ performance to the extent of any differences in the expenses paid. Performance in the Average Annual Total Returns table does not include insurance-related charges imposed under a Variable Contract or expenses related to a Qualified Plan. If these charges or expenses were included, performance would be lower. Thus, you should not compare the Portfolios’ performance directly with the performance information of other investment products without taking into account all insurance-related charges and expenses payable under your Variable Contract or Qualified Plan. The Portfolios’ past performance is no guarantee of future results.

ING Core Growth and Income Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd, 2009, 31.18% and Worst quarter: 4th, 2008, (28.61)%

ING Growth and Income Portfolio - Calendar Year Total Returns

(as of December 31 of each year)

Best quarter: 2nd, 2009, 17.25% and Worst quarter: 4th, 2008, (21.74)%

9

Average Annual Total Returns%

(for the periods ended December 31, 2010)

| | 1 Year | | 5 Years

(or life of the class) | | 10 Years

(or life of the class) | | Inception Date | |

Core Portfolio | | | | | | | | | |

Class ADV | | 13.56 | % | (1.31 | )% | N/A | | 12/29/06 | |

S&P 500 ® Index(1) | | 15.06 | % | (0.83 | )%(2) | N/A | | | |

MSCI ACW IndexSM(3) | | 12.67 | % | (0.53 | )%(2) | N/A | | | |

Class I | | 14.34 | % | 1.92 | % | N/A | | 4/28/06 | |

S&P 500 ® Index(1) | | 15.06 | % | 1.27 | %(2) | N/A | | | |

MSCI ACW IndexSM(3) | | 12.67 | % | 1.49 | %(2) | N/A | | | |

Class S | | 13.98 | % | 3.36 | % | 5.39 | % | 10/02/00 | |

S&P 500 ® Index(1) | | 15.06 | % | 2.29 | % | 1.41 | % | | |

MSCI ACW IndexSM(3) | | 12.67 | % | 3.44 | % | 3.20 | % | | |

Class S2 | | 13.78 | % | 3.21 | % | 10.60 | % | 09/09/02 | |

S&P 500 ® Index(1) | | 15.06 | % | 2.29 | % | 5.96 | %(2) | | |

MSCI ACW IndexSM(3) | | 12.67 | % | 3.44 | % | 8.30 | %(2) | | |

Growth and Income Portfolio | | | | | | | | | |

Class ADV | | 13.55 | % | (0.69 | )% | N/A | | 12/20/06 | |

S&P 500 ® Index(1) | | 15.06 | % | (0.83 | )%(2) | N/A | | | |

Class I | | 14.14 | % | 2.60 | % | 0.28 | % | 12/31/79 | |

S&P 500 ® Index(1) | | 15.06 | % | 2.29 | % | 1.41 | %(2) | | |

Class I (adjusted for Class S) | | 13.89 | % | 2.36 | % | 0.04 | % | 12/31/79 | |

S&P 500® Index(1) | | 15.06 | | 2.29 | % | 1.41 | %(2) | | |

Class S | | 13.81 | % | 2.31 | % | 5.17 | % | 6/11/03 | |

S&P 500 ® Index(1) | | 15.06 | % | 2.29 | % | 5.67 | %(2) | | |

Class S2 | | 12.55 | % | 34.09 | % | N/A | | 2/27/09 | |

S&P 500 ® Index(1) | | 15.06 | % | 36.89 | %(2) | N/A | | | |

(1) The Index returns do not reflect deductions for fees, expenses, or taxes.

(2) Reflects index performance since the date closest to the class’ inception for which data is available.

(3) The index returns include the reinvestment of dividends and distributions net of withholding taxes, but do not reflect fees, brokerage commissions, or other expenses.

How does the Management of the Portfolios compare?

The following table describes the management of the Portfolios.

| | Core Portfolio | | Growth and Income Portfolio |

Investment Adviser | | Directed Services LLC (“DSL”) | | ING Investments, LLC (“ING Investments”) |

Investment Advisory Fee (as a percentage of average daily net assets) | | 0.810% on the first $250 million; 0.770% on the next $400 million; 0.730% on the next $450 million; and 0.670% of assets in excess of $1.1 billion. | | 0.50% on the first $10 billion; 0.45% on the next $5 billion; and 0.425% of assets in excess of $15 billion. |

Sub-Adviser | | ING Investment Management Co. (“ING IM”) (on an interim basis) | | ING IM |

Sub-Advisory Fee (as a percentage of average daily net assets) | | 0.450% on the first $100 million; 0.400% on the next $100 million; 0.350% on the next $200 million; 0.325% on the next $500 million; and 0.300% of assets in excess of $900 million. | | 0.225% on the first $10 billion; 0.203% on the next $5 billion; and 0.191% of assets in excess of $15 billion. |

Portfolio Manager(s) | | Chris Corapi Michael Pytosh | | Chris Corapi Michael Pytosh |

Advisers to the Portfolios

DSL, a Delaware limited liability company, serves as the investment adviser to Core Portfolio. ING Investments, an Arizona limited liability company, serves as the investment adviser to Growth and Income Portfolio (DSL, together with ING Investments, the “Advisers”). The Advisers have overall responsibility for the management and oversee all investment advisory and portfolio management services for their respective Portfolio. In addition, DSL assists in managing and supervising all

10

aspects of the general day-to-day business activities and operations of Core Portfolio, including custodial, transfer agency, dividend disbursing, accounting, auditing, compliance and related services.

DSL and ING Investments are each registered with the SEC as an investment adviser. DSL is registered with Financial Industry Regulatory Authority (“FINRA”) as a broker-dealer. The Advisers are indirect, wholly-owned subsidiaries of ING Groep N.V. (“ING Groep”) (NYSE:ING). ING Groep is a global financial institution of Dutch origin offering banking, investments, life insurance and retirement services to over 85 million private, corporate and institutional clients in more than 40 countries. With a diverse workforce of about 105,000 people, ING Groep is dedicated to setting the standard in helping its clients manage their financial future.

ING Groep has adopted a formal restructuring plan that was approved by the European Commission in November 2009 under which the ING life insurance businesses, including the retirement services and investment management businesses, which include the Advisers and their affiliates, would be separated from ING Groep by the end of 2013. To achieve this goal, ING Groep announced in November 2010 that it plans to pursue two separate initial public offerings: one a U.S. focused offering that would include U.S. based insurance, retirement services, and investment management operations: and the other a European based offering for European and Asian based insurance and investment management operations. There can be no assurance that the restructuring plan will be carried out through two offerings or at all.

The restructuring plan and the uncertainty about its implementation, whether implemented through the planned initial public offerings or through other means, in whole or in part, may be disruptive to the businesses of ING entities, including the ING entities that service the Portfolios, and may cause, among other things, interruption or reduction of business and services, diversion of management’s attention from day-to-day operations, and loss of key employees or customers. A failure to complete the offerings or other means of implementation on favorable terms could have a material adverse impact on the operations of the businesses subject to the restructuring plan. The restructuring plan may result in the Advisers’ loss of access to services and resources of ING Groep, which could adversely affect its businesses and profitability. In addition, the divestment of ING businesses, including the Advisers, may potentially be deemed a “change of control” of the entity. A change of control would result in the termination of the Portfolios’ advisory and sub-advisory agreements, which would trigger the necessity for new agreements that would require approval of the Portfolios’ Boards, and may trigger the need for shareholder approval. Currently, the Advisers do not anticipate that the restructuring will have a material adverse impact on the Portfolios or their operations and administration.

DSL’s and ING Investments’ principal office is located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258. As of December 31, 2010, DSL and ING Investments managed approximately $41.5 billion and $47.5 billion in assets, respectively.

Sub-Advisers to the Portfolios

The Adviser to each of Core Portfolio and Growth and Income Portfolio has engaged ING IM as a sub-adviser to provide the day-to-day management of each Portfolio’s portfolio. Each Adviser acts as a ‘‘manager-of-managers’’ for their respective Portfolios. The Advisers delegate to ING IM the responsibility for investment management, subject to the Advisers’ oversight. The Advisers are responsible for monitoring the investment program and performance of ING IM to the Portfolios.

ING IM, a Connecticut corporation, is registered with the SEC as an investment adviser. ING IM is an indirect, wholly-owned subsidiary of ING Groep and is an affiliate of DSL and ING Investments. The principal office of ING IM is located at 230 Park Avenue, New York, New York 10169. As of December 31, 2010, ING IM managed approximately $59.04 billion in assets.

11

What are the Key Differences in the Rights of Core Portfolio’s Shareholders and Growth and Income Portfolio’s Shareholders?

Core Portfolio is a series of ING Investors Trust (“IIT”), a Massachusetts business trust. Growth and Income Portfolio is a series of ING Variable Funds (“IVF”), which is also a Massachusetts business trust. The Amended and Restated Agreement and Declaration of Trust for IIT and the Amended and Restated Declaration of Trust for IVF provide shareholders with differing rights. The key differences are described in the table below.

| | Core Portfolio | | Growth and Income Portfolio |

Reorganization or Redomiciliation | | Majority shareholder approval is necessary for organizing a corporation or corporations under the laws of any jurisdiction or any other trust, partnership, association or other organization to take over all of the Trust Property or to carry on any business in which the Trust shall directly or indirectly have any interest, and to sell, convey and transfer the Trust Property to any such corporation, trust, association or organization in exchange for the shares or securities thereof or otherwise, and to lend money to, subscribe for the Shares or securities of, and enter into any contracts with any such corporation, trust, partnership, association or organization, or any corporation, trust, partnership, association or organization in which the Trust holds or is about to acquire shares or any other interest. Shareholder approval is not required for the Trustees to organize or assist in organizing one or more corporations, trusts, partnerships, associations or other organizations and selling, conveying or transferring a portion of the Trust Property to such organizations or entities. Reorganization of the assets belonging to the series may be made by the Trustees with the transfer either (1) being made subject to, or with the assumption by the transferee of, the liabilities belonging to each series of assets of which are being so transferred, or (2) no being made subject to, or not with the assumption of, any or all such liabilities; provided that majority shareholder approval is provided. | | Shareholder approval is not necessary for the Trustees to cause to be organized or assist in organizing a corporation or corporations under the laws of any jurisdiction or any other trust, partnership, limited liability company, association or other organization, or a series or class of any of them, to acquire all or a portion of the Trust Property or the property of any Series or Class or to carry on any business in which the Trust or the Series or Class shall directly or indirectly have any interest, and to sell, convey and transfer the Trust Property or the property of any Series or Class to any such corporation, trust, partnership, limited liability company, association or organization, or series or class thereof, in exchange for the shares or securities thereof or otherwise, and to lend money to, subscribe for the shares or securities of, and enter into any contracts with any such corporation, trust, partnership, limited liability company, association or organization, or series or class thereof, in which the Trust or the Series or Class holds or is about to acquire shares or any other interest. No shareholder approval is necessary for recapitalization or reclassification of any series or class, whether deemed in merger, consolidation, reorganization or exchange of shares or otherwise whereby the Trust issues Shares of one or more Series or Classes in connection with the acquisition of assets (including those subject to liabilities) from any other investment company or similar entity, including another Series or Class of the Trust. |

Consolidation or Merger | | Consolidation or merger requires the approval of a majority shareholder vote of each Series affected thereby. The terms “merge” or “merger” as used therein shall not include the purchase or acquisition of any assets of any other trust, partnership, association or corporation which is an investment company organized under the laws of the Commonwealth of Massachusetts or any other state of the United States. | | Merger or consolidation between the Trust or any Series or any successor thereto does not require the vote or consent of Shareholders. |

Additional Information about the Reorganization

The Reorganization Agreement

The terms and conditions under which the proposed transaction may be consummated are set forth in the Reorganization Agreement. Significant provisions of the Reorganization Agreement are summarized below; however, this

12

summary is qualified in its entirety by reference to the Reorganization Agreement, a copy of which is attached to this Proxy Statement/Prospectus as Appendix A.

The Reorganization Agreement provides for: (i) the transfer, as of the Closing Date, of all of the assets of Core Portfolio in exchange for shares of beneficial interest of Growth and Income Portfolio and the assumption by Growth and Income Portfolio of all of Core Portfolio’s liabilities; and (ii) the distribution of shares of Growth and Income Portfolio to shareholders of Core Portfolio, as provided for in the Reorganization Agreement. Core Portfolio will then be liquidated.

Each shareholder of ADV Class, Class I, Class S, and Class S2 shares of Core Portfolio will hold, immediately after the Closing Date, the corresponding share class of Growth and Income Portfolio having an aggregate value equal to the aggregate value of the shares of Core Portfolio held by that shareholder as of the close of business on the Closing Date. In the interest of economy and convenience, shares of Growth and Income Portfolio generally will not be represented by physical certificates, unless you request the certificates in writing.

The obligations of the Portfolios under the Reorganization Agreement are subject to various conditions, including approval of the shareholders of Core Portfolio. The Reorganization Agreement also requires that each of the Portfolios take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or advisable to consummate and make effective the transactions contemplated by the Reorganization Agreement. The Reorganization Agreement may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Appendix A to review the terms and conditions of the Reorganization Agreement. Potential liabilities of Core Portfolio that are not known as of the Closing Date are not assumed by Growth and Income Portfolio under the terms of the Reorganization Agreement.

Expenses of the Reorganization

The expenses of the Reorganization will be borne by DSL (or an affiliate). The expenses of the Reorganization shall include, but not be limited to, the costs associated with the preparation of necessary filings with the SEC, printing and distribution the Proxy Statement/Prospectus and proxy materials, legal fees, accounting fees, securities registration fees, and expenses of holding the Special Meeting. The expenses of the Reorganization do not include the transition costs described in “Portfolio Transitioning,” which are expected to be minimal.

Tax Considerations

The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Code. Accordingly, pursuant to this treatment, neither Core Portfolio nor its shareholders, nor Growth and Income Portfolio nor its shareholders, are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Agreement. As a condition to the Closing of the Reorganization, the Portfolios will receive an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Portfolios.

Prior to the Closing Date, Core Portfolio will pay to the Separate Accounts of Participating Insurance Companies and Qualified Plans that own its shares, a cash distribution consisting of any undistributed investment company taxable income and/or any undistributed realized net capital gains, including any net gains realized from any sales of assets prior to the Closing Date. Variable Contract owners and Plan Participants are not expected to recognize any income or gains for federal income tax purposes from this cash distribution.

Portfolio Transitioning

As discussed above, in anticipation of the Reorganization the Board approved changes to the investment objective and investment strategies of Core Portfolio to align them with those of Growth and Income Portfolio. Since the Portfolios now have identical investment objectives and investment strategies, ING IM does not anticipate needing to sell a significant portion of Core Portfolio’s holdings shortly prior to the Closing Date if the Reorganization is approved. If any of Core Portfolio’s holdings are sold prior to the Closing Date the proceeds of such sales are expected to be invested in securities that ING IM wishes for Growth and Income Portfolio to hold and temporary investments, which will be delivered to Growth and Income Portfolio at the Closing Date. During the transition period, Core Portfolio may not be pursuing its investment objective and strategies, and limitations on permissible investments and investment restrictions will not apply. After the Closing Date of the Reorganization, ING IM, as the sub-adviser to Growth and Income Portfolio, may also sell portfolio holdings that it acquired from Core Portfolio, and Growth and Income Portfolio may not be immediately fully invested in accordance with its stated investment strategies. In addition, each Portfolio may engage in a variety of transition management techniques to facilitate the portfolio transition process. Such sales and purchases by the Portfolios during the transition period may be made at a disadvantageous time and would result in increased transaction costs that are borne by shareholders.

Future Allocation of Premiums

Shares of Core Portfolio have been purchased at the direction of Variable Contract owners by Participating Insurance Companies through Separate Accounts to fund benefits payable under a Variable Contract. If the Reorganization is approved, Participating Insurance Companies have advised us that all premiums or transfers to Core Portfolio will be allocated to Growth and Income Portfolio.

13

What is the Board’s recommendation?

Based upon its review, the Board has determined that the Reorganization is in the best interest of Core Portfolio and its shareholders. Accordingly, after consideration of such factors and information it considered relevant, the Board, including the Independent Trustees, approved the Reorganization and voted to recommend to shareholders that they approve the Reorganization. The Board is therefore recommending that Core Portfolio’s shareholders vote “FOR” the Reorganization.

What factors did the Board consider?

The Board, in approving the Reorganization, considered a number of factors, including, but not limited to, the following (1) the announced departure of the former lead portfolio manager from Janus; (2) an analysis of potential unaffiliated sub-advisers that could replace Janus; (3) DSL’s analysis of potential alternative portfolios that could have served as a merger partner for Core Portfolio other than Growth and Income Portfolio; (4) the lower gross and net expense ratios that current shareholders of Core Portfolio are expected to experience as a result of the Reorganization; (5) the comparative fee structure of the Portfolios; (6) the relatively high volatility of Core Portfolio when it was sub-advised by Janus; (7) the investment performance of Growth and Income Portfolio as compared to Core Portfolio for the one-, three-, and five-year periods ended May 31, 2011 as well as the comparative investment performance for prior calendar years; (8) the similarity and differences in investment styles between Core Portfolio, when sub-advised by Janus, and Growth and Income Portfolio sub-advised by ING IM; (9) the changes approved by the Board in the investment objective, policies, restrictions, management and portfolio holdings of Core Portfolio to align them with Growth and Income Portfolio; (10) the fact that Growth and Income Portfolio has a significantly larger asset size than Core Portfolio, which is likely to result in economies of scale for the benefit of current shareholders of Core Portfolio; (11) the net revenue benefits for DSL and its affiliates, including the net revenue benefits accrued as the result of ING IM replacing Janus, a sub-adviser unaffiliated with DSL, as the sub-adviser to Core Portfolio; (12) the other potential benefits of the Reorganization to Core Portfolio’s shareholders; (13) the direct or indirect costs to be incurred by each Portfolio and its shareholders in connection with the Reorganization, including the cost of transitioning Core Portfolio; (14) the expected tax consequences of the Reorganization to Core Portfolio and its shareholders, including that the Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization; and (15) the Board’s determination that the Reorganization will not dilute the interests of the shareholders of either of the Portfolios.

The Board of Core Portfolio recommends that shareholders approve the Reorganization with and into Growth and Income Portfolio.

What is the required vote?

Approval of the Reorganization Agreement requires the affirmative vote of the lesser of (i) 67% or more of the voting securities present at the meeting, provided that more than 50% of the voting securities are present in person or represented by proxy at the Special Meeting, or (ii) a majority of the shares entitled to vote. The holders of a majority of the outstanding shares present in person or by proxy shall constitute a quorum at any meeting of the shareholders.

What happens if shareholders do not approve the Reorganization?

If shareholders of Core Portfolio do not approve the Reorganization, Core Portfolio will continue to be managed by DSL as described in the prospectus, and the Board will determine what additional action should be taken.

14

PROPOSAL TWO — APPROVAL OF THE PROPOSED SUB-ADVISORY AGREEMENT

What is Proposal Two?

Core Portfolio and DSL wish to retain the services of ING IM as the sub-adviser to Core Portfolio. At a meeting held on June 23-24, 2011, the Board terminated Core Portfolio’s prior sub-advisory agreement with Janus, effective June 30, 2011. As discussed above, in anticipation of the Reorganization described in Proposal One, the Board also approved changes in the investment objective and principal investment strategies to align them with those of Growth and Income Portfolio. After a transition period during which Core Portfolio was managed by a transition manager, the Board appointed ING IM as the sub-adviser to Core Portfolio pursuant to the Interim Agreement between DSL and ING IM, effective July 21, 2011. On July 15, 2011, the Board approved the Proposed Sub-Advisory Agreement subject to shareholder approval. The Interim Agreement expires on December 18, 2011. In the event the Reorganization is not approved, shareholders must approve the Proposed Sub-Advisory Agreement, if ING IM is to serve beyond the interim period.

If Proposal Two is approved by shareholders, the Proposed Sub-Advisory Agreement is expected to become effective on or about November 4, 2011 and will remain in full force and effect, unless otherwise terminated, through November 30, 2013 and can be continued from year-to-year thereafter in accordance with its terms as described below. A copy of the Proposed Sub-Advisory Agreement between DSL and ING IM is included as Appendix D.

Who is Core Portfolio’s investment adviser?

DSL, a Delaware limited liability company, serves as the investment adviser to Core Portfolio. For more information on DSL, please see “How does the Management of the Portfolios compare?” in Proposal One. See Appendix E for a listing of the names, addresses, and the principal occupations of the principal executive officers of DSL.

Who was the Sub-Adviser?

Janus, together with its predecessors, has served as an investment adviser since 1969 and currently serves as investment adviser or sub-adviser to Separately Managed Accounts, Mutual Funds, as well as Commingled Pools or private funds, and Wrap Fee Accounts. Janus Capital is a direct subsidiary of Janus Capital Group Inc. (“JCG”) which owns approximately 95% of Janus Capital, with the remaining 5% held by Janus Management Holdings Corporation. JCG is a publicly traded company with principal operations in the financial asset management businesses. The principal address of Janus Capital is 151 Detroit Street, Denver, Colorado 80206. As of December 31, 2010, JCG assets under management were approximately $169.5 billion.

On May 12, 2011, Janus announced that David Decker, the lead portfolio manager to Core Portfolio, was leaving Janus and would cease to be the portfolio manager to Core Portfolio, effective June 30, 2011. Following the announcement, the Board directed DSL to explore options to address the Board’s concern regarding the change in portfolio manager. After analyzing the alternatives, DSL recommended merging Core Portfolio into Growth and Income Portfolio.

Who is the proposed Sub-Adviser?

Founded in 1972, ING IM is a Connecticut corporation registered as an investment adviser. For more information on ING IM, please see “How does the Management of the Portfolios compare?” in Proposal One.

See Appendix E for a listing of the names, addresses, and the principal occupations of the directors and principal executive officers of ING IM, including a Director and Officer of Core Portfolio who is also an officer of ING IM. Growth and Income Portfolio is the only other investment company with investment objectives similar to that of Core Portfolio for which ING IM acts as a sub-adviser, for more information on the annual rate of compensation paid by and the net assets of Growth and Income Portfolio, please see Proposal One.

How will Proposal Two, if approved, affect the management of Core Portfolio?

As discussed above, the day-to-day management of Core Portfolio is currently provided by ING IM pursuant to the Interim Agreement. If the Proposed Sub-Advisory Agreement is approved, ING IM would continue to serve as sub-adviser to Core Portfolio and provide the day-to-day management of Core Portfolio. DSL would be responsible for monitoring the investment program and performance of ING IM with respect to Core Portfolio.

The following investment professionals with ING IM are primarily responsible for the day-to-day management of the Portfolio:

Christopher F. Corapi, Portfolio Manager and Chief Investment Officer of Equities, joined ING IM in February 2004. Prior to joining ING IM, Mr. Corapi served as Global Head of Equity Research at Federated Investors since 2002. He served as Head of U.S. Equities and portfolio manager at Credit Suisse Asset Management beginning in 2000 and Head of Emerging Markets Research at JPMorgan Investment Management beginning in 1998.

Michael Pytosh, Portfolio Manager, joined ING Investment Management in 2004 as a senior sector analyst covering the technology sector. Prior to 2004, Mr. Pytosh was with Lincoln Equity Management, LLC, since 1996, where he started as a technology analyst and ultimately took on the role of the firm’s president. Prior to that, Mr. Pytosh was a technology analyst at JPMorgan Investment Management and an analyst at Lehman Brothers.

15

Were there changes to the name of the Portfolio, its investment objective, and principal investment strategies?

Yes, changes were already made to the name of Core Portfolio, its investment objective, and principal investment strategies in connection with the termination of Janus and the appointment of ING IM pursuant to the Interim Agreement. As described in Proposal One, on June 23-24, 2011, the Board approved changes to the Portfolio’s name, investment objective, and principal investment strategies.

These changes are detailed in a supplement to Core Portfolio’s current prospectus dated June 30, 2011, which was mailed to shareholders. For more information on the investment objective and principal investment strategies of Core Portfolio prior to June 30, 2011, see Appendix B. No additional changes to Core Portfolio, its name, investment objectives, or principal investment strategies are anticipated in connection with Proposal Two.

What are the terms of the Advisory Agreement?

The Investment Advisory Agreement between Core Portfolio and DSL (“Advisory Agreement”) requires DSL to oversee the provision of all investment advisory and portfolio management services for the Portfolio. The Advisory Agreement requires DSL to provide, subject to the supervision of the Board, investment advice and investment services to Core Portfolio and to furnish advice and recommendations with respect to the investment of Core Portfolio’s assets and the purchase or sale of its portfolio securities. The Advisory Agreement also permits DSL to delegate certain management responsibilities, pursuant to a sub-advisory agreement, to other investment advisers. DSL oversees the investment management services of Core Portfolio’s sub-adviser.

The Advisory Agreement provides for a unified or “bundled fee” arrangement, under which DSL provides, in addition to advisory services, administrative services and other services necessary for the ordinary operation of Core Portfolio. DSL procures and pays for the services and information necessary to the proper conduct of Core Portfolio’s business, including custodial, administrative, transfer agency, portfolio accounting, dividend disbursing, auditing and ordinary legal services. DSL also acts as liaison among the various service providers to Core Portfolio, including the custodian, portfolio accounting agent, sub-adviser and the insurance company or companies to which Core Portfolio offers its shares, among others. DSL also reviews Core Portfolio for compliance with applicable legal requirements and monitors the sub-adviser for compliance with requirements under applicable law and with the investment policies and restrictions of Core Portfolio. DSL does not bear the expense of brokerage fees and other transactional expenses for securities or other assets (which are generally considered part of the cost for the assets), taxes (if any) paid by Core Portfolio, interest on borrowing, fees and expenses of the Independent Trustees, including the cost of the Trustees and Officers Errors and Omissions Liability Insurance coverage and the cost of counsel to the Independent Trustees, and extraordinary expenses, such as litigation or indemnification expenses.

From time to time, DSL may recommend the appointment of additional sub-advisers or replacement of non-affiliated sub-advisers to the Board. It is not expected that DSL would normally recommend replacement of an affiliated sub-adviser as part of its oversight responsibilities. Core Portfolio and DSL have received exemptive relief from the SEC to permit DSL, with the approval of the Board, to appoint an additional non-affiliated sub-adviser or to replace an existing sub-adviser with a non-affiliated sub-adviser, as well as change the terms of a contract with a non-affiliated sub-adviser, without submitting the contract to a vote of Core Portfolio’s shareholders. Core Portfolio will notify shareholders of any change in the identity of a sub-adviser of Core Portfolio, the addition of a sub-adviser to Core Portfolio, or any change in the terms of a contract with a non-affiliated sub-adviser. In this event, the name of Core Portfolio and its investment strategies may also change.

The Advisory Agreement provides that DSL is not subject to liability to Core Portfolio for any act or omission in the course of, or connected with, rendering services under the Advisory Agreement, except by reason of willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties under the Advisory Agreement.

After an initial two-year term, the Advisory Agreement continues in effect from year to year so long as such continuance is specifically approved at least annually by (1) the Board or (2) the vote of a “majority” (as defined in the 1940 Act) of Core Portfolio’s outstanding shares voting as a single class; provided that, in either event, the continuance is also approved by at least a majority of those Trustees who are neither parties to the Advisory Agreement nor “interested persons” (as defined in the 1940 Act) of any such party nor have any interest in the Agreement, by vote cast in person at a meeting called for the purpose of voting on such approval.

For the services it provides to Core Portfolio under the Advisory Agreement, DSL currently receives an advisory fee, payable monthly, at the annual rate of Core Portfolio’s average daily net assets shown in the table below. The table below also indicates the annual fees (advisory fees) paid by Core Portfolio to DSL for the fiscal year ended December 31, 2010.

| | Annual Advisory Fee

(as a percentage of average daily net assets) | | Advisory Fees Paid for

Fiscal Year Ended

December 31, 2010 | |

Core Portfolio | | 0.810% on the first $250 million; 0.770% on the next $400 million; 0.730% on the next $450 million; and 0.670% of assets in excess of $1.1 billion. | | $ | 4,307,784 | |

| | | | | | |

16

In anticipation of the proposed Reorganization and in connection with the appointment of ING IM as sub-adviser under the Interim Agreement, DSL has contractually agreed to waive all or a portion of its investment management fee and/or reimburse expenses in amounts necessary to limit the expenses of each class of Core Portfolio so that they align with Growth and Income Portfolio’s net expense ratios. Effective July 1, 2011, DSL is contractually obligated to limit expenses to 1.20%, 0.60%, 0.85%, and 1.00% for Class ADV, Class I, Class S, and Class S2, respectively, through May 1, 2013; the obligation does not extend to interest, taxes, brokerage commissions, extraordinary expenses and Acquired Fund Fees and Expenses. This obligation will automatically renew for one-year terms unless it is terminated by Core Portfolio or DSL upon written notice within 90 days of the end of the current term or upon termination of the management agreement and is subject to possible recoupment by the DSL within three years.

What are the terms of the Proposed Sub-Advisory Agreement?

A copy of the Proposed Sub-Advisory Agreement between DSL and ING IM is included as Appendix D. The description of the Proposed Sub-Advisory Agreement that follows is qualified in its entirety by reference to Appendix D.

The Proposed Sub-Advisory Agreement is materially identical to the Interim Agreement. As compared to the prior sub-advisory agreement with Janus, the key terms of the Proposed Sub-Advisory Agreement are substantially similar with the exception of the effective dates and the indemnification provisions. Under the Proposed Sub-Advisory Agreement, the fees payable to ING IM would be paid by DSL, and not by Core Portfolio. Pursuant to the Proposed Sub-Advisory Agreement, ING IM would act as Core Portfolio’s sub-adviser. In this capacity, ING IM would furnish Core Portfolio with investment advisory services in connection with a continuous investment program and manage Core Portfolio’s investments in accordance with its investment objective, investment policies, and restrictions, as set forth in Core Portfolio’s prospectus and statement of additional information. Subject to the supervision and control of DSL, which in turn is subject to the supervision and control of the Board, ING IM, in its discretion, would determine and select the securities to be purchased for and sold from Core Portfolio and place orders with and gives instructions to brokers, dealers, and others to cause such transactions to be executed.

In the absence of willful misfeasance, bad faith, or gross negligence in the performance of its duties or reckless disregard of its obligations and duties under the Proposed Sub-Advisory Agreement, ING IM would not be liable to the Company, its shareholders or to DSL for any act or omission resulting in any loss suffered by the Company, Core Portfolio or Core Portfolio’s shareholders in connection with any service provided under the Proposed Sub-Advisory Agreement.

The sub-advisory fee payable under the Proposed Sub-Advisory Agreement would be pursuant to the following fee schedule (as a percentage of the Portfolio’s average daily net assets). The sub-advisory fee paid by DSL for fiscal year ended December 31, 2010 was paid to the former sub-adviser, Janus.

| | Annual Sub-Advisory Fee

(as a percentage of average daily net assets) | | Sub-Advisory Fees Paid for Fiscal

Year Ended December 31, 2010 | |

Core Portfolio | | 0.450% on the first $100 million; 0.400% on the next $100 million; 0.350% on the next $200 million; 0.325% on the next $500 million; and 0.300% of assets in excess of $900 million. | | $ | 2,026,013 | |

| | | | | | |