- DAN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Dana (DAN) 8-KFinancial statements and exhibits

Filed: 21 Jul 04, 12:00am

Exhibit 99.1

| Dana Corporation Second-Quarter Conference Call July 21, 2004 (c) Dana Corporation, 2004 |

| Forward-Looking Statements Statements herein about our forecasts, beliefs, and expectations constitute "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on our current information and assumptions. Forward-looking statements are inherently subject to risks and uncertainties. Dana's actual results could differ materially from those that we anticipate or project due to a number of factors. These factors include the impact of national and international economic conditions; adverse effects from terrorism or hostilities; the strength of other currencies relative to the U.S. dollar; the cyclical nature of the global vehicular industry; the performance of the global aftermarket sector; changes in business relationships with our major customers and in the timing, size and continuation of their and our programs; the ability of our customers and suppliers to achieve their projected sales and production levels; competitive pressures on our sales and pricing; increases in production or material costs that cannot be recouped in product pricing; the impact of our collective bargaining negotiations; the continued success of our cost reduction and cash management programs and our long-term transformation strategy, and the success and timing of the divestiture of the automotive aftermarket business. Additional factors are contained in our public filings with the SEC. We do not undertake to update any forward-looking statements contained herein. (c) Dana Corporation, July 21, 2004 3 |

| Key Topics Solid Second-Quarter Performance Aftermarket Sale & Potential Use of Anticipated Proceeds New Business Growth New Global Purchasing Initiative Financial Review 5 |

| Financial Summary Q2 - 2004 Q2 - 2003 Sales $2.3 billion $2.0 billion Net Income Earnings per Share $108 million $0.72 $52 million $0.35 Net Income, excluding unusual items $75 million $47 million Earnings Per Share, excluding unusual items $0.50 $0.31 7 |

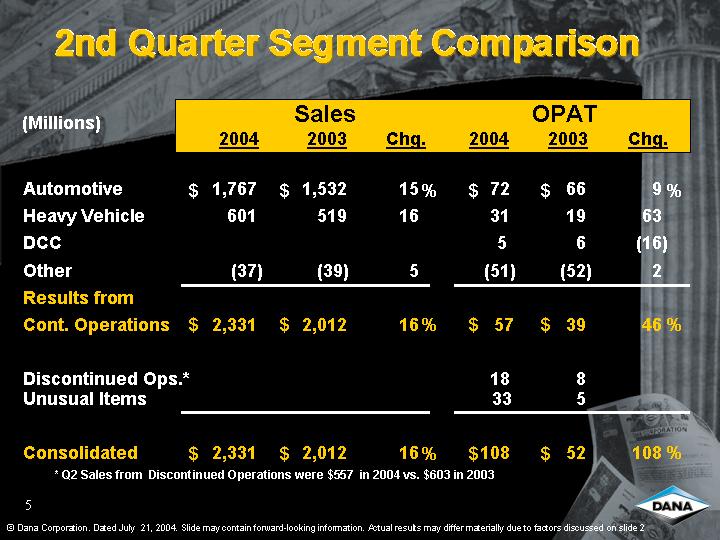

| 2nd Quarter Segment Comparison Sales OPAT 2004 2004 2003 2003 Chg. Chg. (Millions) 9 Automotive 1,767 1,532 15 72 66 9 Heavy Vehicle 601 519 16 31 19 63 DCC 5 6 (16) Other (37) (39) 5 (51) (52) 2 Results from Cont. Operations 2,331 2,012 16 57 39 46 Discontinued Ops.* 18 8 Unusual Items 33 5 Consolidated 2,331 2,012 16 108 52 108 % % % % % $ $ $ $ $ $ $ $ $ $ $ $ * Q2 Sales from Discontinued Operations were $557 in 2004 vs. $603 in 2003 % |

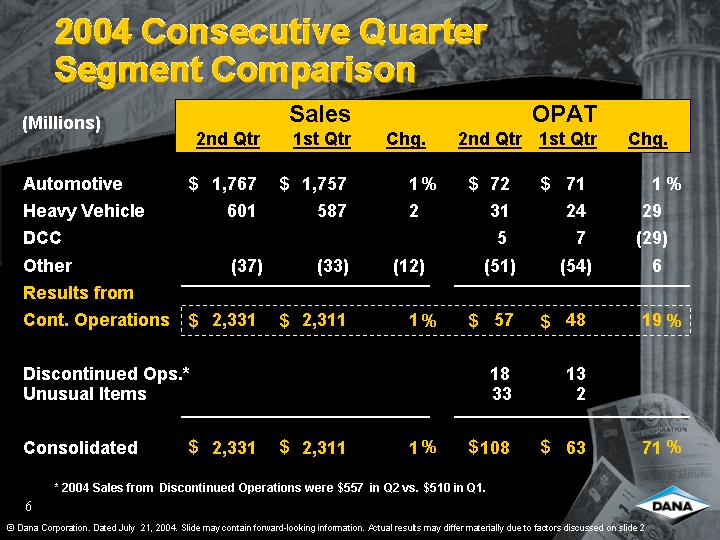

| 2004 Consecutive Quarter Segment Comparison Sales OPAT 2nd Qtr 2nd Qtr 1st Qtr 1st Qtr Chg. Chg. (Millions) 11 * 2004 Sales from Discontinued Operations were $557 in Q2 vs. $510 in Q1. Automotive 1,767 1,757 1 72 71 1 Heavy Vehicle 601 587 2 31 24 29 DCC 5 7 (29) Other (37) (33) (12) (51) (54) 6 Results from Cont. Operations 2,331 2,311 1 57 48 19 Discontinued Ops.* 18 13 Unusual Items 33 2 Consolidated 2,331 2,311 1 108 63 71 % % % % % $ $ $ $ $ $ $ $ $ $ $ $ % |

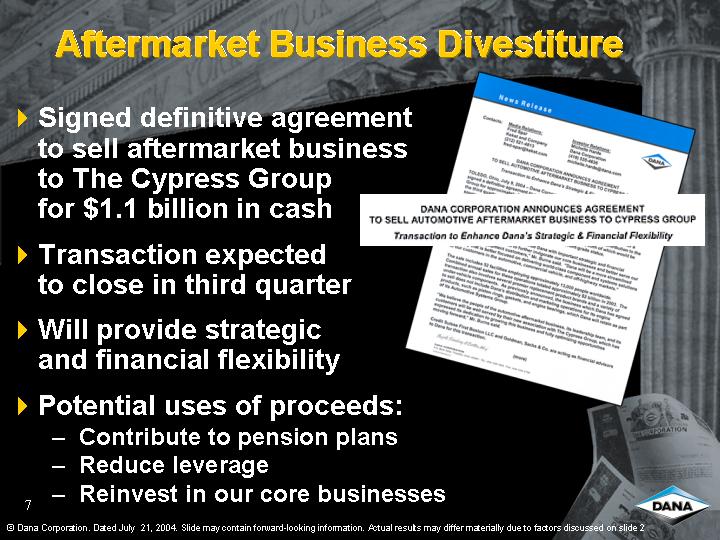

| Aftermarket Business Divestiture Signed definitive agreement to sell aftermarket business to The Cypress Group for $1.1 billion in cash Transaction expected to close in third quarter Will provide strategic and financial flexibility Potential uses of proceeds: Contribute to pension plans Reduce leverage Reinvest in our core businesses 13 |

| Dana Corporation Where We've Been Where We're Going Decentralized Company SBU Organization Disconnected Functions OE/Aftermarket Global Footprint w/NA Bias 2001 Restructuring Program Integrated Company Top-Line Growth & Continually Improving Cost Structure Market-Focused Organization Fully Leveraged Functions Strategic Focus - Vehicular OEM Truly Global Footprint w/Balance 15 What We've Done Combined ASG/EFMG; Integrating Operations Closed Remaining Plants; Focused on Improving Gross Margins Renewed Focus on Key Customers & Markets Established Global Purchasing Organization Agreed to Sell Automotive Aftermarket Business Negotiations with Dong Feng (China) |

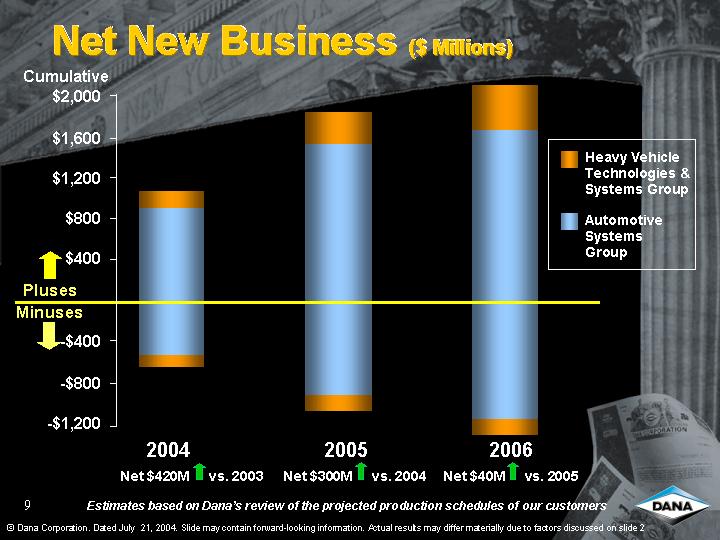

| Net New Business ($ Millions) Estimates based on Dana's review of the projected production schedules of our customers 17 Automotive Systems Group Heavy Vehicle Technologies & Systems Group Net $420M vs. 2003 2004 2005 2006 Pluses Minuses $2,000 $1,600 $1,200 $800 - -$400 - -$800 $400 - -$1,200 Cumulative Net $300M vs. 2004 Net $40M vs. 2005 |

| Exciting New Programs 19 (c) Dana Corporation. Dated July 21, 2004. Slide may contain forward-looking information. Actual results may differ materially due to factors discussed on slide 2 F-150 Tacoma Navistar X3/X5 Model 357 Colorado Titan Gator Blue Diamond |

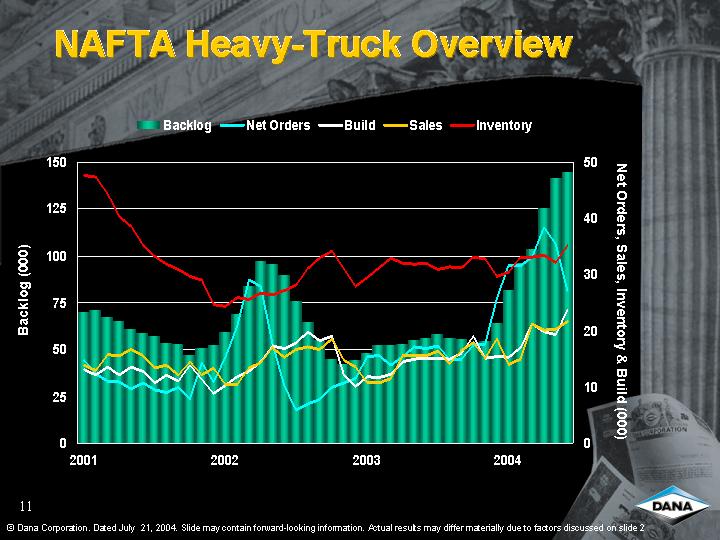

| 21 NAFTA Heavy-Truck Overview Backlog (000) Net Orders, Sales, Inventory & Build (000) Backlog Net Orders Build Sales Inventory 2001 69963 14785 13119 13888 47703 70726 12300 12184 13042 47415 67233 11085 13633 15836 44381 65214 10947 12199 15688 40345 60894 9656 13629 16679 38557 58728 10710 12863 15684 35290 57415 9541 10800 13446 33297 53620 9043 12128 13833 31908 52796 10042 11086 12110 30938 47005 7932 13924 14543 29642 50737 14453 11439 12133 29018 52665 10988 8845 13446 24667 2002 59201 15261 10281 10474 24389 68722 20705 11815 10528 25980 83944 29139 12814 13393 25602 97028 28004 14514 14350 26706 95689 17806 17282 16960 26381 89647 10388 16952 15390 27250 76166 5973 17831 16770 28195 64701 7071 19800 17197 31089 54739 7823 18331 16709 33022 44856 9961 19120 18545 34226 42417 10729 12207 14858 31160 44537 11584 10136 13647 27980 2003 48364 15466 11840 10821 29474 51826 15702 11644 10799 31241 52219 13928 12418 11551 33014 52787 15435 14524 15594 31966 54760 17261 14957 15597 31892 56123 16872 15233 15550 32057 58055 17357 15150 16402 30924 56383 14845 15049 14166 31412 55179 15026 16161 16622 31180 52787 17437 19022 17915 33108 54419 17628 15188 15117 32827 64356 25732 15432 18525 29743 2004 81413 31752 15382 14008 30398 |

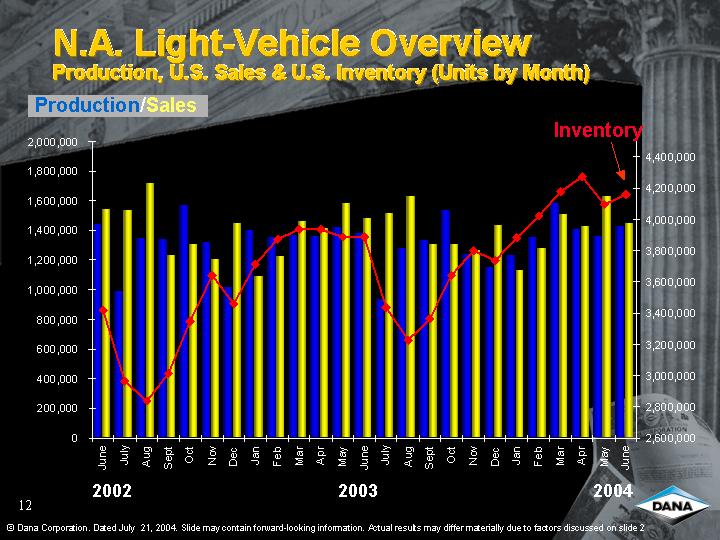

| N.A. Light-Vehicle Overview Production, U.S. Sales & U.S. Inventory (Units by Month) 2004 2002 Production/Sales 2003 Inventory 23 May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan Feb Mar Apr May June Production 1690059 1684636 857651 1555057 1444783 1560803 1347387 1058883 1221541 1229925 1467589 1312441 1531361 1406145 840382 1233702 1224142 1431725 1349914 1506078 1315223 1360385 1395887 1547157 1576133 1435876 987887 1341043 1337312 1559553 1312046 1010511 1397108 1344221 1363255 1356007 1412721 1371368 928292 1274961 1322997 1527000 1233235 1150379 1224080 1346490 1576554 1403556 1352941 1419456 Inventory 3742581 3795140 3345570 3386946 3436217 3634887 3817731 3803462 3837245 3734663 3732946 3634387 3558455 3459805 3032134 3081543 3117207 2865270 2992431 2953763 3128666 3238074 3243969 3298629 3383639 3416690 2963914 2838078 3013588 3345454 3641547 3457653 3713848 3874969 3938113 3934786 3888575 3888194 3437104 3227971 3362715 3640779 3797787 3737410 3883828 4021507 4176968 4270856 4096943 4159006 Sales 1619687 1613913 1432073 1539551 1474450 1333981 1232425 1240330 1167984 1353052 1593602 1346348 1599710 1619638 1346923 1448462 1289119 1722297 1324542 1310692 1108479 1307061 1514816 1441890 1506880 1536677 1524600 1705761 1223914 1301012 1203337 1441965 1088162 1218968 1453996 1408423 1576342 1473866 1509013 1628365 1300052 1302735 1258320 1424315 1122845 1274701 1504160 1419390 1625290 1443615 |

| Global Purchasing Initiative Goals: Transform decentralized structure Harmonize processes Drive "commonization" Achieve economies of scale Deliver savings Actions to Date: Appointed Paul Miller Global V.P. of Purchasing Established matrix organizational structure Two Supplier Week events - have met with 175 suppliers to date with very positive results 25 |

| 2003 2002 27 Excluding Unusual Items Tax Adjustment * NOTE: Comparable GAAP measures available at www.dana.com Transaction Costs As Reported Q2 Income Statement With DCC on an Equity Basis* Unusual Items Aftermarket DCC |

| 2003 2002 29 2004 2003 Second Quarter * NOTE: Comparable GAAP measures available at www.dana.com 2004 2003 Year-to-Date Income Statement With DCC on an Equity Basis* |

| Cash Flow Statement With DCC on an Equity Basis * (Millions) 31 2004 2003 Second Quarter 2004 2003 Year-to-Date * NOTE: Comparable GAAP measures available at www.dana.com |

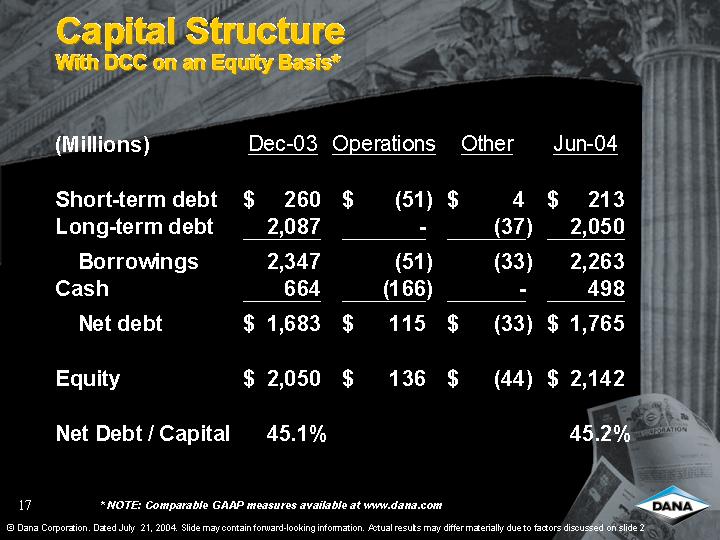

| 33 Capital Structure With DCC on an Equity Basis* * NOTE: Comparable GAAP measures available at www.dana.com |

| June 30, 2004 Debt Portfolio ($ Millions) 32 16 35 2004 2005 2006 2008 2009 2010 2011 2028 2029 A/R Sec'n 180 Revolver Sr Notes 150 350 250 819 165 268 Other 32.7 15.8 Maturities do not reflect swap valuation adjustments |

| 5-year bank facility $ 400 $ - $ 400 Accts receivable program* 300 180 120 Bridge facility* 100 - 100 Total short-term committed facilities $ 800 $ 180 $ 620 Plus: Cash 498 Total $1,118 Committed Drawn Available 37 (Millions) June 30, 2004 Liquidity Excluding DCC * Maximum size of Bridge facility is $200. In combination, draws against facilities cannot exceed $400. |

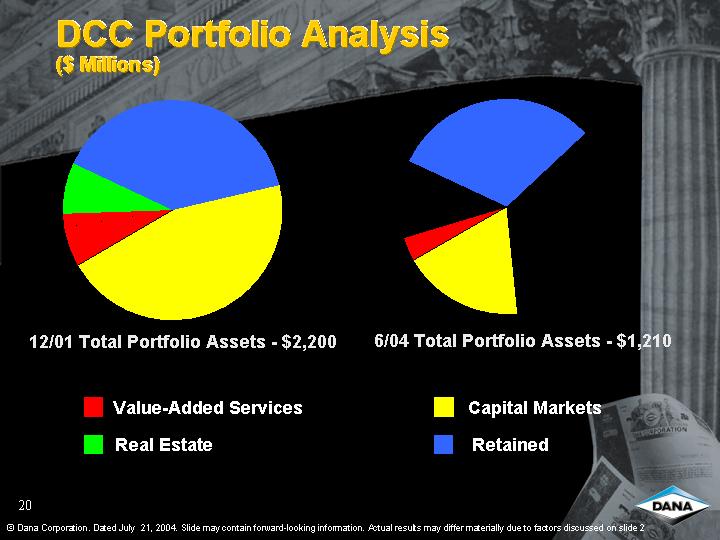

| 12/01 Total Portfolio Assets - $2,200 DCC Portfolio Analysis ($ Millions) VASG 85 50 45 RESG 170 705 195 CMG 610 Value-Added Services Retained Real Estate Capital Markets 6/04 Total Portfolio Assets - $1,210 VASG 120 10 50 RESG 170 900 0 CMG 410 39 |

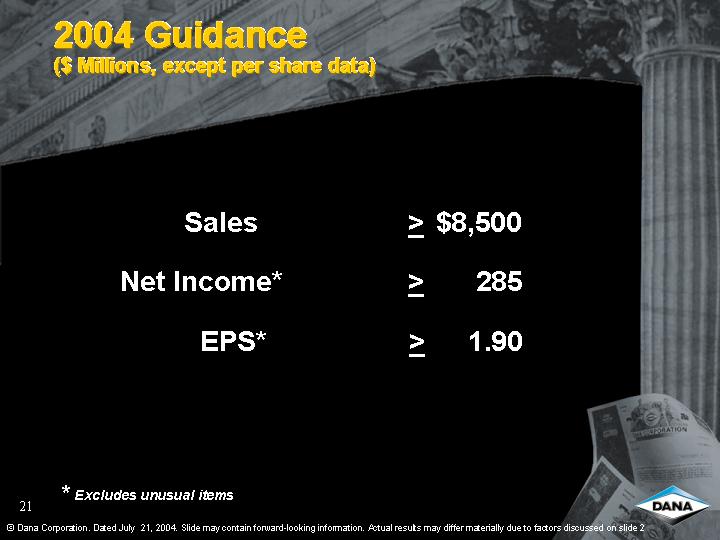

| 2004 Guidance ($ Millions, except per share data) Sales > $8,500 Net Income* > 285 EPS* > 1.90 41 * Excludes unusual items |

| 2004 Free Cash Flow Projection Excluding DCC * Excludes proceeds from aftermarket divestiture 43 (Millions) |

| Summary 45 Q2 performance: 16% Sales, 60% Profit* Pleased, but not satisfied We are taking action ... ASG Consolidation Better focus on markets we serve Improvement in Structures Purchasing Initiatives Help offset raw material costs Close AAG transaction Redeployment of proceeds Enhanced Customer Approach Improved revenue growth * Excludes Unusual items |

| 47 Questions |

| 49 Capital Structure Reconciliation as of December 31, 2003 |

| 51 Capital Structure Reconciliation as of June 30, 2004 |