- DAN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Dana (DAN) 8-KDana Corporation 3rd Quarter Conference Call

Filed: 24 Oct 03, 12:00am

Dana Corporation

3rd Quarter Conference Call

October 24, 2003

Forward-Looking Statements

Statements herein about our forecasts, beliefs, and expectations constitute

“forward-looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are based on our current

information and assumptions. Forward-looking statements are inherently

subject to risks and uncertainties. Dana’s actual results could differ materially

from those that we anticipate or project due to a number of factors. These

factors include the impact of national and international economic conditions;

adverse effects from terrorism or hostilities; the strength of other currencies

relative to the U.S. dollar; the cyclical nature of the global vehicular industry;

the performance of the global aftermarket sector; changes in business

relationships with our major customers and in the timing, size and continuation

of their and our programs; the ability of our customers and suppliers to

achieve their projected sales and production levels; competitive pressures on

our sales and pricing; increases in production or material costs that cannot be

recouped in product pricing; the impact of our collective bargaining

negotiations and those of our customers in the North American light vehicle

sector; the continued success of our cost reduction and cash management

programs and our long-term transformation strategy; and costs associated

with ArvinMeritor’s tender offer for our common stock. Additional factors are

contained in our public filings with the SEC. We do not undertake to update

any forward-looking statements contained herein.

© Dana Corporation, 2003

Agenda

Operational Review

Third-Quarter Performance

Increased Dividend

Future Outlook

Wrap-Up

Q & A Session

Sales

Financial Summary

Q3 -2003

$ 0.02

$ 2.4 billion

$ 2.4 billion

Net Income

$ 61 million

$ 4 million

Earnings Per Share

$ 0.41

Q3 -2002

Segment Comparison – 3rd Qtr

Sales

OPAT

2003

2003

2002

2002

Chg.

Chg.

%

%

%

%

%

N/M

N/M

N/M: Not Meaningful

N/M

$

$

$

$

$

$

$

$

$

$

$

$4

Automotive

928

859

8

35

28

25

Aftermarket

574

562

2

26

26

0

Engine & Fluid

482

498

(3)

18

18

0

Heavy Vehicle

488

494

(1)

23

20

15

DCC

6

7

(14)

Other

(62)

(57)

9

(65)

(61)

7

Results from Cont.

Operations

2,410

2,356

2

43

38

13

Discontinued Ops.

6

Unusual Items

18

(40)

Total

2,410

2,356

2

61

Projected Net Incremental Business

($ Millions)

SBU

2004

2003

2006

2005

2007

ASG

AAG

EFMG

HVTSG

TOTAL

195

20

85

195

495

545

30

125

190

890

720

35

170

175

1,100

685

35

215

240

1,175

635

35

235

250

1,155

Prior Qtr.

905

495

1,230

1,100

1,270

Estimates based on Dana’s review of the projected production schedules of our customers

($ Millions)

2003

2002

Income Statement

With DCC on an Equity Basis

2003

2002

YTD

Third Quarter

Net sales

2,410

$

2,356

$

7,393

$

7,253

$

Other income

33

20

71

47

2,443

2,376

7,464

7,300

Cost of sales

2,176

2,118

6,658

6,457

SG&A expense

156

174

529

558

Restructuring

34

122

Interest expense

40

42

123

131

2,372

2,368

7,310

7,268

Income before taxes

71

8

154

32

Income taxes

(25)

(12)

(58)

(46)

Minority interest

(2)

(4)

(6)

(13)

Equity in affiliate earnings

17

7

72

71

Discontinued operations

5

(8)

3

Accounting change effect

(220)

Net income (loss)

61

4

154

(173)

$

$

$

$

Cash Flow Statement

With DCC on an Equity Basis

2003

2002

YTD

($ Millions)

Sources

Net income (loss)

154

(173)

$

Accounting change effect

220

Depreciation

249

291

Asset sales

7

12

Divestitures

145

41

Working capital increase

(219)

(15)

336

376

Uses

Capital spend

(209)

(186)

Dividends

(5)

(5)

Acquisitions

(31)

Net change in other accounts

(19)

55

(233)

(167)

Restructuring plan

After-tax charges

119

Cash payments

(92)

(108)

Proceeds from asset sales

37

23

(55)

34

Cash decrease in net debt

48

243

$

$

$

Working Capital Comparison

With DCC on an Equity Basis

($ Millions)

2003

2002

YTD

Increase through Sept. 30

(219)

(15)

Q1 2002 tax refund

-

(152)

Adjusted increase through Sept. 30

(219)

(167)

Capital Structure

With DCC on an Equity Basis

12/31/02

Operations

9/30/03

Other

($ Millions)

Short-term debt

53

52

254

359

Long-term debt

2,462

(102)

(270)

2,090

Borrowings

2,515

(50)

(16)

2,449

Cash

551

(2)

1

550

Net debt

1,964

(48)

(17)

1,899

Equity

1,482

150

218

1,850

Net debt/capital

57.0%

50.7%

$

$

$

$

$

$

$

$

$

$

$

$

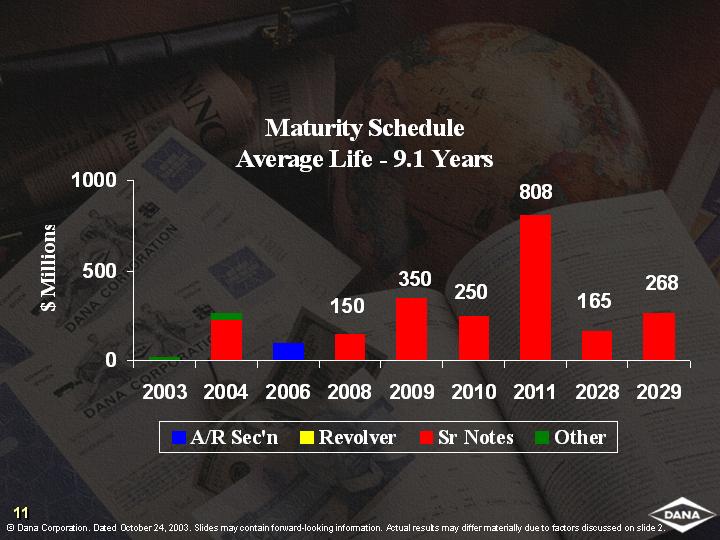

September 30, 2003 Debt Portfolio

With DCC on an Equity Basis

Maturities do not reflect swap valuation adjustments

23

262

100

Committed Drawn Available

September 30, 2003 Liquidity

With DCC on an Equity Basis

5-year bank facility

$400

$

-

$

400

Accts receivable program

400

100

300

Total short-term

committed facilities

$800

$ 100

$

700

Plus: Cash

550

Total

$1,250

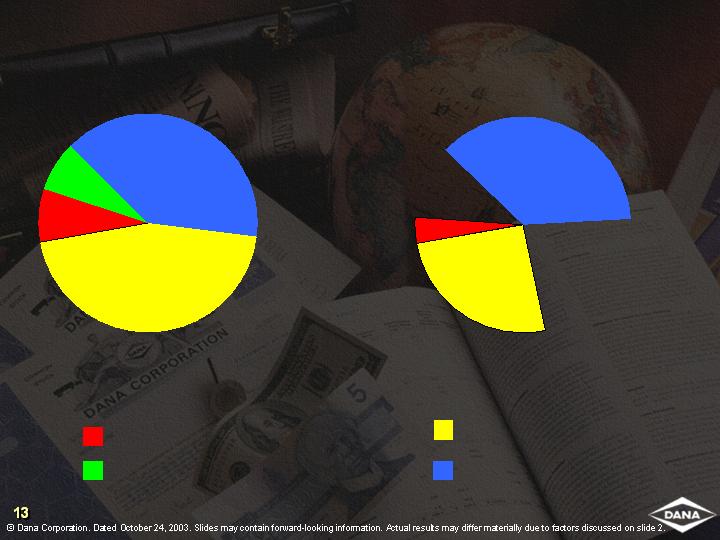

12/01 Total Portfolio Assets - $2,200

DCC Portfolio Analysis

($ Millions)

Value-Added Services

Retained

Real Estate

Capital Markets

9/03 Total Portfolio Assets - $1,420

Net of certain non-recourse debt

2003 Full-Year Guidance

Net Income

In

Millions

January

$ 180-200

February

$ 185-205

April

$ 195-215

$ 1.41-1.48

October

$ 210-220

($ Millions, except per-share amounts)

Date

Provided

EPS

$ 1.21-1.34

$ 1.24-1.38

$ 1.31-1.44

2003 Cash Projection

With DCC on an Equity Basis

($ Millions)

Sources:

Net income

210

Depreciation

330

Working capital

150

Divestiture proceeds

145

835

Less:

Capital spend

(315)

Dividends

(15)

505

Cash payments for restructuring

$

$

$

$

100-130

Net Income $300 Million

EPS $2.00

Re-affirming 2004 Guidance

Dana Consolidated

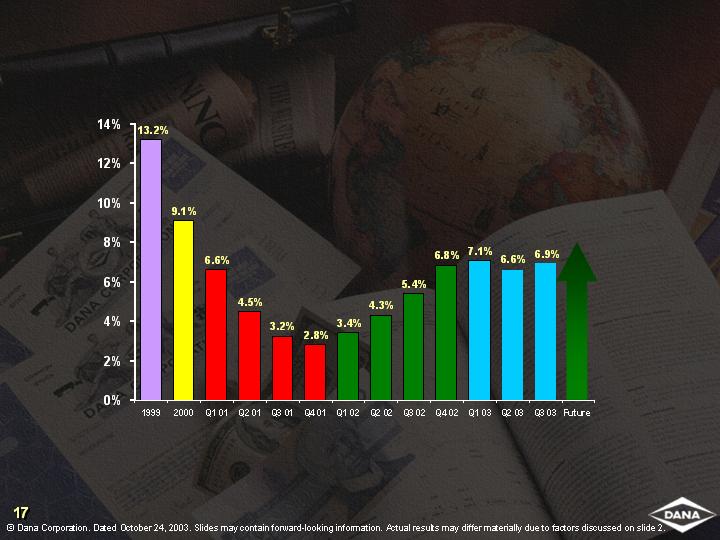

Return On Invested Capital (ROIC)

(Last 12 Months Total Income/ 5-Quarter Rolling Average Invested Capital)

Return excludes unusual items. Invested capital reflects DCC on an equity basis.

A Word on ArvinMeritor

Greater Shareholder Value Created Under Dana’s Strategic Plan

Offer is inadequate

Offer is opportunistic

Macro environment improving every month

Our business momentum is substantial and

accelerating

Reflected in earnings and dividend increase

Offer is highly conditional

No announced progress on financing

Serious antitrust concerns: FTC has issued a

“second request”

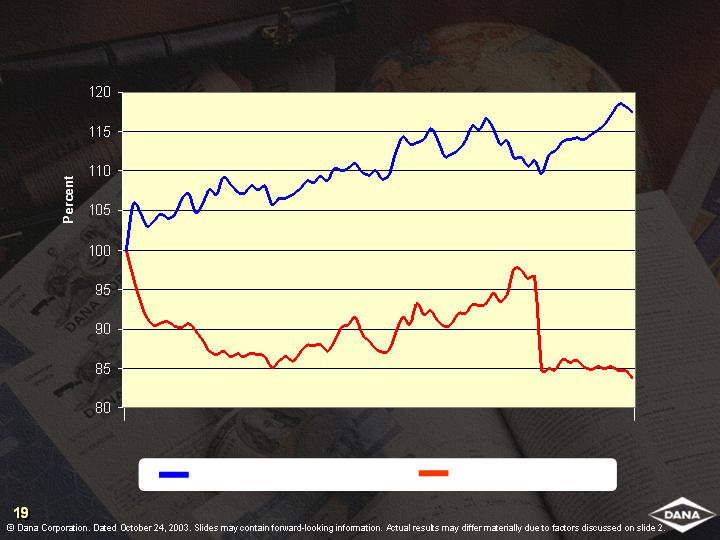

Market Reaction Since July 7, 2003

07/07/03

10/23/03

S&P Auto Parts Index ArvinMeritor

ARM: -20%

S&P Auto Parts: +14%

Performance Flywheel

Core

Content

Capital

Efficiency

Innovation

ROIC

Gross Margin

Customer

Shareholder

Value

Shareholder

Value

Shareholder

Value

Shareholder

Value

Increased Dividend Declared

Dividend of 6 cents per share payable

Dec. 15, 2003 announced on October 21

Confidence in company’s performance

and direction

Continued success in executing restructuring plan

Approaching what could be considered

“investment-grade” performance

Expectation of continued improvement in earnings

and cash flow

Dividends are an important component of total return to shareholders

2004 Outlook

Improved top-line

performance

Heavy duty volumes

New business wins

Bottom-line and cash flow

improvements

Restructuring complete

Substantial operating

leverage

Leverage off of start-up

costs incurred in 2003

Long-Term Objectives

Key Drivers in 2004 Earnings

Annual top-line growth

6% to 7%

Continued margin

improvement

Balance sheet

Return to investment

grade credit rating

Net Income guidance of $300 million (~ $2.00 per share) for 2004

In Summary …

Strong third-quarter results

Earnings significantly improved over 2002

2003 full-year net income forecast raised

to range of $210 to $220 million

Net debt-to-capital ratio reduced to 50.7%

Increased fourth-quarter dividend to

6 cents per share

Reaffirming 2004 EPS guidance of $2.00

We are far from finished

Quickening the pace

Eliminating waste

Committed to growing our company

Questions?

Final Thoughts

Third-quarter earnings significantly

improved over 2002

2003 full-year net income forecast raised

to range of $210 to $220 million

Net debt-to-capital ratio reduced to 50.7%

Increased fourth-quarter dividend to

6 cents per share

Reaffirming 2004 EPS guidance of $2.00

Supplemental Data

Details of Restructuring Charges & Credits by SBU

Nine Months Ended September 30, 2003

Three Months Ended September 30, 2003

Restructuring

Restructuring

Reversals of

Disposition

Provisions

Accruals

Gain (Loss)

Automotive

3

-

-

Aftermarket

5

-

-

Engine & Fluid

1

1

-

Heavy Vehicle

6

16

1

Other

3

-

-

18

17

1

Restructuring

Restructuring

Reversals of

Disposition

Provisions

Accruals

Gain (Loss)

Automotive

10

9

1

Aftermarket

6

-

-

Engine & Fluid

4

1

1

Heavy Vehicle

7

17

2

Other

3

-

-

30

27

4

$

$

$

$

$

$

$

$

$

$

$

$

2003

2002

2003

2002

YTD

Third Quarter

Supplemental Data

Change in Working Capital - DCC on an Equity Basis

($Millions)

Balance at beginning of period

1,101

1,091

830

1,116

Cash from operations:

Incr (decr) in accts rec.

(21)

(98)

203

298

Incr (decr) in inventory

12

52

(10)

17

Incr (decr) in other assets

(11)

(3)

33

13

Decr (incr) in curr liabs

17

88

(7)

(313)

Net from operations

(3)

39

219

15

Restructuring

28

(10)

92

(11)

Divestitures

6

(71)

Exchange & other non-cash

(49)

(29)

7

(23)

Balance at end of period

1,077

1,097

1,077

1,097

$

$

$

$

$

$

$

$

Dana w/DCC

on Equity Basis

December 31, 2002

Capital Structure

DCC

Elimination

Entries

Dana

Consolidated

Debt

53

2,462

2,515

551

1,964

1,482

57.0

234

753

987

20

967

271

78.1

-

-

-

-

-

287

3,215

3,502

571

2,931

1,482

66.4

Short-term debt

Long-term debt

Borrowings

Cash

Net debt

Equity

Net debt/capital

(271)

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

($ in Millions)

Dana w/DCC

on Equity Basis

September 30, 2003

Capital Structure

DCC

Elimination

Entries

Dana

Consolidated

Debt

359

2,090

2,449

550

1,899

1,850

50.7

225

563

788

86

702

323

68.5

-

-

-

-

-

(323)

584

2,653

3,237

636

2,601

1,850

58.4

Short-term debt

Long-term debt

Borrowings

Cash

Net debt

Equity

Net debt/capital

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

($ in Millions)

Dana w/DCC

on Equity Basis

Three Months Ended September 30, 2003

Change in Working Capital

DCC

Elimination

Entries

Dana

Consolidated

1,101

(21)

12

(11)

17

(3)

190

3

-

(8)

9

4

-

4

-

-

-

4

1,291

(14)

12

(19)

26

5

Balance at beginning of period

Cash from operations:

Increase (decrease) in receivables

Increase (decrease) in inventory

Net from operations

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

Increase (decrease) in other assets

Decrease (increase) in current liabilities

Restructuring

Divestitures

Exchange and other non-cash

Balance at end of period

28

-

(49)

1,077

-

-

(2)

192

-

-

(4)

-

28

-

(55)

1,269

($ in Millions)

Dana w/DCC

on Equity Basis

Nine Months Ended September 30, 2003

Change in Working Capital

DCC

Elimination

Entries

Dana

Consolidated

830

203

(10)

33

(7)

219

179

(104)

-

106

6

8

1

-

-

-

(2)

(2)

1,010

99

(10)

139

(3)

225

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

92

(71)

7

1,077

-

-

5

192

-

-

1

-

92

(71)

13

1,269

($ in Millions)

Balance at beginning of period

Cash from operations:

Increase (decrease) in receivables

Increase (decrease) in inventory

Net from operations

Increase (decrease) in other assets

Decrease (increase) in current liabilities

Restructuring

Divestitures

Exchange and other non-cash

Balance at end of period

Dana w/DCC

on Equity Basis

Three Months Ended September 30, 2002

Change in Working Capital

DCC

Elimination

Entries

Dana

Consolidated

1,091

(98)

52

(3)

88

39

106

1

-

(4)

5

2

1

4

-

-

-

4

1,198

(93)

52

(7)

93

45

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

(10)

6

(29)

1,097

-

-

12

120

-

-

(12)

(7)

(10)

6

(29)

1,210

($ in Millions)

Balance at beginning of period

Cash from operations:

Increase (decrease) in receivables

Increase (decrease) in inventory

Net from operations

Increase (decrease) in other assets

Decrease (increase) in current liabilities

Restructuring

Divestitures

Exchange and other non-cash

Balance at end of period

Dana w/DCC

on Equity Basis

Nine Months Ended September 30, 2002

Change in Working Capital

DCC

Elimination

Entries

Dana

Consolidated

1,116

298

17

13

(313)

15

109

(18)

-

22

10

14

4

(7)

-

-

-

(7)

1,229

273

17

35

(303)

22

This consolidating statement provides a reconciliation of the amounts presented for Dana with Dana Credit Corporation

(DCC) on an equity basis to amounts presented for Dana Corporation on a fully consolidated basis.

(11)

-

(23)

1,097

-

-

(3)

120

-

-

(4)

(7)

(11)

-

(30)

1,210

($ in Millions)

Balance at beginning of period

Cash from operations:

Increase (decrease) in receivables

Increase (decrease) in inventory

Net from operations

Increase (decrease) in other assets

Decrease (increase) in current liabilities

Restructuring

Divestitures

Exchange and other non-cash

Balance at end of period