- USAU Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

U.S. Gold (USAU) DEF 14ADefinitive proxy

Filed: 23 Aug 12, 12:00am

| UNITED STATES | |||

| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

| SCHEDULE 14A | |||

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) | |||

| Filed by the Registrant ☒ | |||

| Filed by a Party other than the Registrant ☐ | |||

| Check the appropriate box: | |||

| ☐ | Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| ☒ | Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | ||

| ☐ | Soliciting Material under §240.14a-12 | ||

| Dataram Corporation | |||

| (Name of Registrant as Specified In Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| ☒ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ☐ | Fee paid previously with preliminary materials. | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

DATARAM CORPORATION

A NEW JERSEY CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on September 27, 2012 at 2:00 P.M.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder

Meeting to Be Held on September 27, 2012

The Proxy Statement and 2012 Annual Report are available atwww.dataram.com

TO THE SHAREHOLDERS OF DATARAM CORPORATION:

The Annual Meeting of the Shareholders of DATARAM CORPORATION (the “Company”) will be held at the Company’s corporate headquarters at 777 Alexander Road, Suite 100, Princeton, New Jersey, on Thursday, September 27, 2012 at 2:00 p.m., for the following purposes:

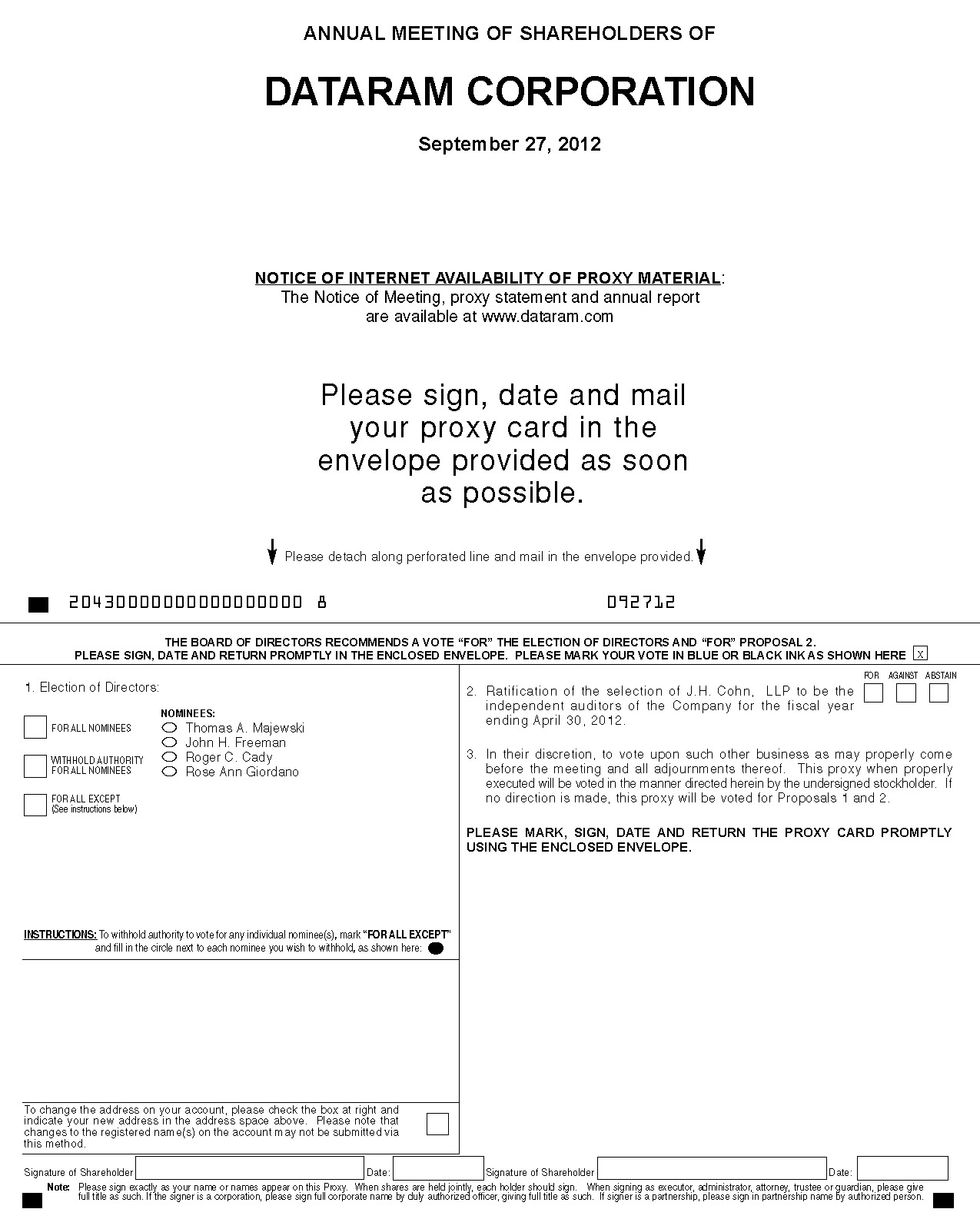

| (1) | To elect four (4) directors of the Company to serve until the next succeeding Annual Meeting of Shareholders and until their successors have been elected and have been qualified. |

| (2) | To ratify the selection of J.H. Cohn LLP as the independent certified public accountants of the Company for the fiscal year ending April 30, 2013. |

| (3) | To transact such other business as may properly come before the meeting or any adjournments. |

Only shareholders of record at the close of business on the 17th day of August 2012 are entitled to notice of and to vote at this meeting.

By order of the Board of Directors

Thomas J. Bitar,

Secretary

August 24, 2012

The Company’s 2012 Annual Report is enclosed.

PLEASE COMPLETE, DATE, SIGN AND RETURN THE ACCOMPANYING PROXY

IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED.

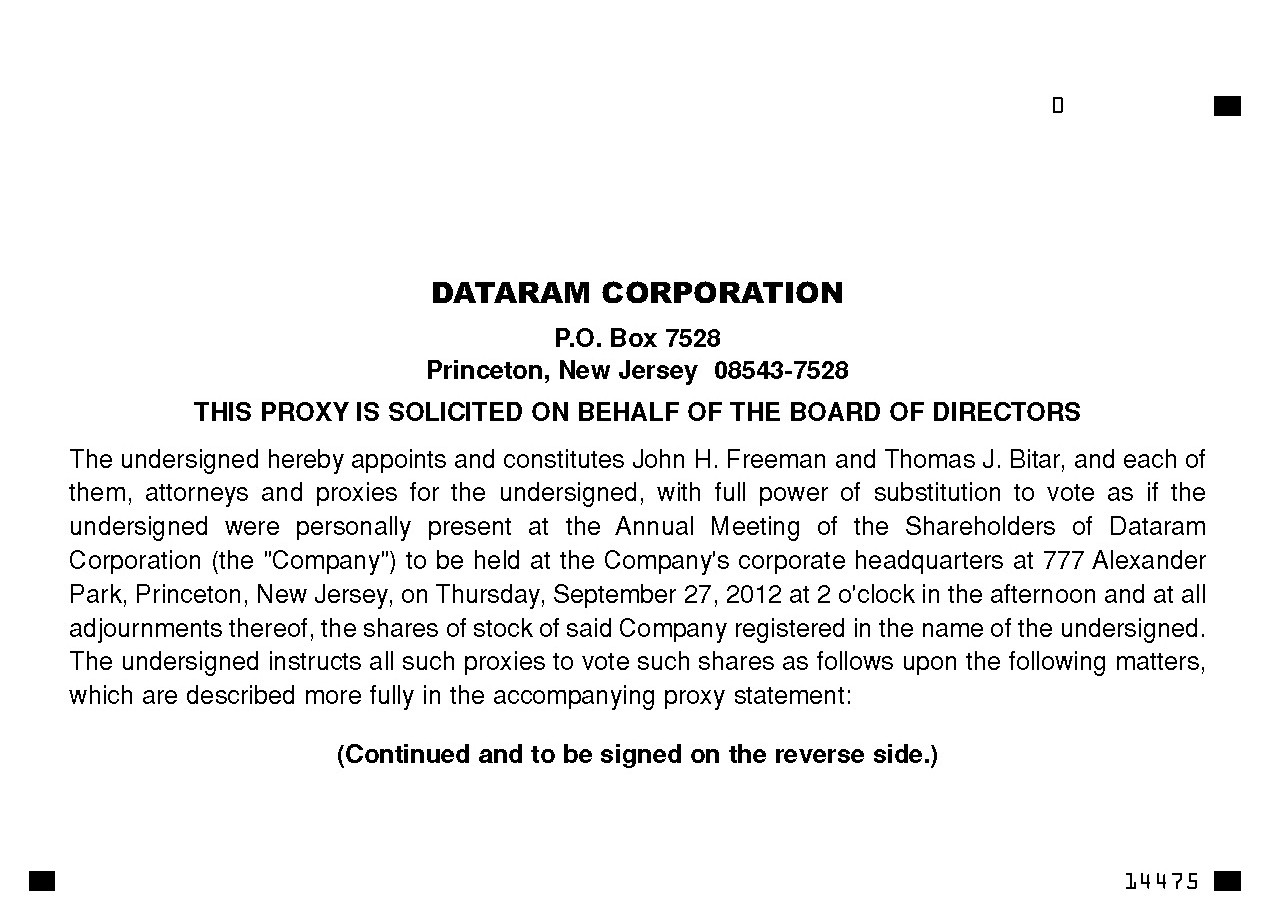

DATARAM CORPORATION

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

SEPTEMBER 27, 2012

This Proxy Statement is furnished by DATARAM CORPORATION (the “Company”), which has a mailing address for its principal executive offices at P.O. Box 7528, Princeton, New Jersey 08543-7528, in connection with the solicitation by the Board of Directors of proxies to be voted at the Annual Meeting of Shareholders of the Company to be held at the Company’s corporate headquarters at 777 Alexander Road, Suite 100, Princeton, New Jersey on Thursday, September 27, 2012 at 2:00 p.m. You may obtain directions to the Company’s corporate headquarters by contacting investor relations by telephone at (609) 799-0071 extension 2431 or athttp://corporate.dataram.com/contact-us-form/directions.The close of business on August 17, 2012 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. This Proxy Statement was mailed to shareholders on or about August 24, 2012.

You may own common shares in one or both of the following ways - either directly in your name as the shareholder of record, or indirectly through a broker, bank or other holder of record in “street name.” If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us. If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As a holder in street name, you have the right to direct your broker, bank or other holder of record how to vote by completing the voting instruction form that accompanies your proxy materials. Regardless of how you hold your shares, we invite you to attend the Meeting.

VOTING RIGHTS

On August 17, 2012 there were outstanding and entitled to vote 10,521,755 shares of the Company’s common stock, par value $1.00 per share (the “Common Stock”). Holders of the Common Stock are entitled to one vote for each share of Common Stock owned on the record date, exercisable in person or by proxy. Shareholders may revoke executed proxies at any time before they are voted by filing a written notice of revocation with the Secretary of the Company. Where a choice has been specified by the holder on the proxy, the shares will be voted as directed. Where no choice has been specified by the holder, the shares will be voted for the nominees described below and for the ratification of the selection of accountants.

Directors are elected by a plurality of the number of votes cast. With respect to each other matter to be voted upon, a vote of a majority of the number of shares voting is required for approval. Abstentions and proxies submitted by brokers with a “not voted” direction will not be counted as votes cast with respect to each matter.

| 1 |

EXECUTIVE OFFICERS OF THE COMPANY

The following table sets forth information concerning each of the Company’s executive officers:

| Name | Age | Positions with the Company |

| John H. Freeman | 63 | President and Chief Executive Officer |

| Marc P. Palker | 60 | Chief Financial Officer |

| Jeffrey H. Duncan | 62 | Vice President - Manufacturing and Engineering |

| Anthony M. Lougee | 51 | Controller |

| David S. Sheerr | 52 | General Manager, Micro Memory Bank (“MMB”) |

John H. Freeman has been employed by the Company since May 7, 2008 when he was named President and Chief Executive Officer. Mr. Freeman has been a Director since 2005. Additional information regarding Mr. Freeman is set forth under “Nominees for Director” below.

Marc P. Palker has served as the Company’s Interim Chief Financial Officer since January of 2012. He has been a director of CFO Consulting Partners, LLC since March 2010. During the performance of his duties as Interim Chief Financial Officer, Mr. Palker has continued as a director of CFO Consulting Partners and the Company compensates Mr. Palker as a consultant through CFO Consulting Partners. Mr. Palker is a Certified Management Accountant. Additional information regarding Mr. Palker’s compensation is set forth under “Related Party Transactions” and “Executive Compensation” below.

Jeffrey H. Duncan has been employed by the Company since 1974. In 1990, he became Vice President-Engineering. Since 1995, he served as Vice President-Manufacturing and Engineering.

Anthony M. Lougee has been employed by the Company since 1991, initially as Accounting Manager. In 2002 he was named an executive officer and currently serves as Controller, a position he has held since

1999.

David S. Sheerr has been employed by the Company since its acquisition of certain assets of Micro Memory Bank, Inc. from him on March 31, 2009. He previously served as President of Micro Memory Bank, Inc. from October 7, 1994 until the acquisition.

ELECTION OF DIRECTORS

Four (4) directors will be elected at the Annual Meeting of Shareholders by the vote of a plurality of the shares of Common Stock represented at such meeting. Unless otherwise indicated by the shareholder, the accompanying proxy will be voted for the election of the four (4) persons named under the heading “Nominees for Directors.” Although the Company knows of no reason why any nominee could not serve as a director, if any nominee shall be unable to serve, the accompanying proxy will be voted for a substitute nominee.

NOMINEES FOR DIRECTORS

The term of office for each director will expire at the next Annual Meeting of Shareholders and when the director’s successor shall have been elected and duly qualified. Each nominee is a member of the present Board of Directors and has been elected by shareholders at prior meetings.

| Name of Nominee | Age |

| Thomas A. Majewski | 60 |

| John H. Freeman | 63 |

| Roger C. Cady | 74 |

| Rose Ann Giordano | 73 |

Thomas A. Majewski is a real estate developer. He is also a principal in Walden, Inc., a computer consulting and technologies venture capital firm, which he joined in 1990. Prior to 1990, he had been Chief Financial Officer of Custom Living Homes & Communities, Inc., a developer of residential housing. Mr. Majewski has been a Director since 1990, and Chairman of the Board of Directors since July 2011. Mr. Majewski brings to the Board his business and financial expertise and extensive knowledge of Dataram’s history and operations.

| 2 |

John H. Freeman is President and Chief Executive Officer of the Company since May 2008. Prior to this Mr. Freeman was an independent consultant specializing in corporate sales, marketing and operations consulting since December, 2006. Prior to that and since September, 2004 he served as the Chief Operating Officer at Taratec Development Corporation, a life sciences consulting company. Prior to that, and for more than five years, he was responsible for leading IBM’s worldwide sales, marketing, and business planning for Pharmaceutical, Medical Device, and Life Sciences clients. This included IBM product sales of hardware, software, services and financing. Mr. Freeman has 30 years of executive sales and operations management experience with IBM. Mr. Freeman is a graduate of Pennsylvania State University with an M.S. in Computer Science and holds a B.A. in Mathematics from Syracuse University. Mr. Freeman has been a Director since 2005. Mr. Freeman brings to the Board extensive executive, marketing and technical experience, with a decades-long track record in the computer technology industry.

Roger C. Cady is a founder and principal of Arcadia Associates, a strategic consulting and mergers and acquisitions advisory firm. He was employed as Vice President of Business Development for Dynatech Corporation, a diversified communications equipment manufacturer, from 1993 to 1996. Before joining Dynatech he was a strategic management consultant for eight years. His business career has included 16 years in various engineering, marketing and management responsibilities as a Vice President of Digital Equipment Corporation, and President of two early stage startup companies. Mr. Cady has been a Director since 1996, and served as Chairman of the Board of Directors from September 2008 to July 2011. Mr. Cady brings to the Board extensive business and management experience focusing on the engineering and technology fields, and extensive knowledge of Dataram’s history and operations.

Rose Ann Giordano has been President of Thomis Partners, an investing and advisory services firm, since 2002. Prior to that, and for more than five years, Ms. Giordano served as Vice President of Worldwide Sales & Marketing for the Customer Services Division of Compaq Computer Corporation. Prior to that, Ms. Giordano held a number of executive positions with Digital Equipment Corporation. Ms. Giordano serves on the Board of Directors of Emerson Hospital. She formerly served on the Board of Directors of TimeTrade Inc., and The National Association of Corporate Director/New England. Ms. Giordano holds a B.A. in Mathematics from Marywood College and is a graduate of the Stanford University Business School Executive Program. Ms. Giordano has been a Director since 2005. Ms. Giordano brings to the Board extensive business, marketing and executive experience in the computer technology industry.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES PROPOSED BY THE BOARD OF DIRECTORS, AND, UNLESS A SHAREHOLDER GIVES INSTRUCTIONS ON THE PROXY CARD TO THE CONTRARY, THE PROXY AGENTS NAMED THEREON INTEND SO TO VOTE.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of Common Stock beneficially owned by certain owners known by the Company to beneficially own in excess of 5% of the Common Stock, each director of the Company, each named executive officer and seven directors and executive officers collectively, as of July 31, 2012. Unless otherwise indicated, stock ownership includes sole voting power and sole investment power. No other person or group is known to beneficially own in excess of five percent (5%) of the Common Stock.

| 3 |

| Name of Beneficial | Amount and Nature of | Percent of | |||

| Owner | Beneficial Ownership | Class (1) | |||

| Thomas A. Majewski | 129,250 | (2) | 1.2% | ||

| John H. Freeman | 338,000 | (3) | 3.1% | ||

| Roger C. Cady | 180,700 | (4) | 1.7% | ||

| Rose Ann Giordano | 69,361 | (5) | * | ||

| Marc P. Palker | - | * | |||

| Jeffrey H. Duncan | 106,080 | (6) | 1.0% | ||

| Anthony M. Lougee | 20,370 | (7) | * | ||

| David S. Sheerr | 270,000 | (8) | 2.5% | ||

| Directors and executive officers as a group (8 persons) | 1,113,761 | (9) | 9.8% | ||

| (1) | On August 19, 2012, 10,703,309 shares were outstanding. |

| (2) | Of this amount, 80,000 shares may be acquired by the exercise of options held. |

| (3) | Of this amount, 338,000 shares may be acquired by the exercise of options held. |

| (4) | Of this amount, 60,000 shares may be acquired by the exercise of options held. |

| (5) | Of this amount, 64,000 shares may be acquired by the exercise of options held. |

| (6) | Of this amount, 102,400 shares may be acquired by the exercise of options held and 3,680 shares are held by the Company’s 401(k) Plan. |

| (7) | Of this amount, 17,375 shares may be acquired upon the exercise of options held and 2,995 shares are held by the Company’s 401(k) Plan. |

| (8) | Of this amount, 270,000 shares may be acquired by the exercise of options held. |

| (9) | Of this amount, 931,775 shares may be acquired by the exercise of options held by executive officers, and 244,000 shares may be acquired by exercise of options held by outside directors. |

| * | Less than 1%. |

CORPORATE GOVERNANCE

Board Leadership Structure

The Company presently separates the roles of Chief Executive Officer and Chairman of the Board. This serves to align the Chairman’s role with the Company’s independent directors and to further enhance the independence of the Board from management. The Chairman works closely with the Chief Executive Officer to set the agenda for meetings and to facilitate information flow between the Board and management.

Board Role in Risk Oversight

The Company’s Board plays an active role in risk oversight of the Company. The Board does not have a formal risk management committee, but administers this oversight function through various standing committees of the Board, which are described below. The Audit Committee periodically reviews overall enterprise risk management, in addition to maintaining responsibility for oversight of financial reporting-related risks, including those related to the Company’s accounting, auditing and financial reporting practices. The Audit Committee also reviews reports and considers any material allegations regarding potential violations of the Company’s Code of Ethics. The Compensation Committee oversees risks arising from the Company’s compensation policies and programs. This Committee has responsibility for evaluating and approving the executive compensation and benefit plans, policies and programs of the Company. The Nominating Committee oversees corporate governance risks and oversees and advises the Board with respect to the Company’s policies and practices regarding significant issues of corporate responsibility.

RELATED PARTY TRANSACTIONS

All transactions by the Company with a director or executive officer must be approved by the Board of Directors if they exceed $120,000 in any fiscal year. Apart from any transactions disclosed herein, no such transaction was entered into with any director or executive officer during the last fiscal year. Such transactions will be entered into only if found to be in the best interest of the Company and approved in accordance with the Company’s Code of Ethics, which are available on the Company’s web site.

During fiscal 2012 and 2011, the Company purchased inventories for resale totaling approximately $5,400,000 and $2,600,000 respectively from Sheerr Memory, LLC (Sheerr Memory). Sheerr Memory’s owner is employed by the Company as the general manager of the acquired MMB business unit and is an executive officer of the Company. When the Company acquired certain assets of MMB, it did not acquire

| 4 |

any of its inventory. However, the Company informally agreed to purchase such inventory on an as needed basis, provided that the offering price was a fair market value price. The inventory acquired was purchased subsequent to the acquisition of MMB at varying times and consisted primarily of raw materials and finished goods used to produce products sold by the Company. Sheerr Memory offers the Company trade terms of net 30 days and all invoices are settled in the normal course of business. No interest is paid. The Company has made further purchases from Sheerr Memory subsequent to April 30, 2012 and management anticipates that the Company will continue to do so, although the Company has no obligation to do so.

On February 24, 2010, the Company entered into a Note and Security Agreement with Sheerr Memory’s owner. Under this agreement, the Company borrowed the principal sum of $1,000,000 for a period of six months, which the Company could extend for an additional three months without penalty. The loan bore interest at the rate of 5.25%, payable monthly. The entire principal amount was payable in the event of the employee’s termination of employment by the Company. The loan was secured by a security interest in all machinery, equipment and inventory of Dataram at its Montgomeryville, PA location. The loan was repaid in full on August 13, 2010. No further financing is available to the Company under this agreement.

On July 27, 2010, the Company entered into an agreement with a vendor Sheerr Memory, to consign a formula-based amount of up to $3,000,000 of certain inventory into the Company’s manufacturing facilities. As of April 30, 2011, the Company has received financing totaling $1.5 million under this agreement, of which $1,000,000 was used to repay in full a note payable to the employee arising from an agreement entered into with the employee in February, 2010 and which expired in August 2010. On December 14, 2011, the Company repaid the loan in full. No further financing is available to the Company under this agreement.

On December 14, 2011, the Company entered into a new Note and Security Agreement with Mr. Sheerr. The agreement provides for secured financing of up to $2,000,000. The Company is obligated to pay monthly, interest equal to 10% per annum calculated on a 360 day year of the outstanding loan balance. Principal is payable in sixty equal monthly installments, beginning on July 15, 2012. The Company may prepay any or all sums due under this agreement at any time without penalty. On closing, the Company borrowed $1,500,000 under the agreement and repaid in full the $1,500,000 due under the Consignment Agreement described in the proceeding paragraph. As of January 31, 2012, the Company has borrowed the full $2,000,000 available under this agreement. Principal amounts due under this obligation are $33,000 per month beginning on July 15, 2012. For the next fiscal year following April 30, 2012, the principal amount due under this obligation is $333,000. In each of four fiscal periods from May 1, 2013 thru April 30, 2017, the principal amounts due under this obligation are $400,000. In the fiscal period from May 1, 2017 thru June 30, 2017, the principal amount due on this obligation is $67,000.

The Company compensates its Interim Chief Financial Officer, Marc P. Palker, as a consultant through payment to CFO Consulting Partners, LLC, at the rate of $200 per hour. Mr. Palker has been director of CFO Consulting Partners, LLC since March 2010. Such payments totaled approximately $95,000 as of April 30, 2012. Mr. Palker does not receive any compensation for his services as Interim Chief Financial Officer directly from the Company and does not participate in any of the Company’s employee benefit plans. Additional information regarding Mr. Palker’s compensation is set forth under “Executive Compensation” below.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee of our Board of Directors is comprised of all members of our Board of Directors, except the Chief Executive Officer. The compensation committee’s basic responsibility is to review the performance of our management in achieving corporate goals and objectives and to ensure that our executive officers are compensated effectively in a manner consistent with our strategy and compensation practices. Toward that end, the compensation committee oversaw, reviewed and administered all of our compensation, equity and employee benefit plans and programs applicable to executive officers.

| 5 |

Compensation Philosophy and Objectives

We operate in an extremely competitive and rapidly changing industry. We believe that the skill, talent, judgment and dedication of our executive officers are critical factors affecting the long-term value of our company. Therefore, our goal is to maintain an executive compensation program that will fairly compensate our executives, attract and retain qualified executives who are able to contribute to our long-term success, induce performance consistent with clearly defined corporate goals and align our executives’ long-term interests with those of our shareholders. We did not identify specific metrics against which we measured the performance of our executive officers. Our decisions on compensation for our executive officers were based primarily upon our assessment of each individual’s performance. We relied upon judgment and not upon rigid guidelines or formulas in determining the amount and mix of compensation elements for each executive officer. Factors affecting our judgment include the nature and scope of the executive’s responsibilities and effectiveness in leading our initiatives to achieve corporate goals.

Mr. Freeman, our Chief Executive Officer, as the manager of the members of the executive team, assessed the individual contribution of each member of the executive team other than himself and, where applicable, made a recommendation to the compensation committee with respect to any merit increase in salary, cash bonus, and option awards. The compensation committee evaluated, discussed and modified or approved these recommendations and conducted a similar evaluation of Mr. Freeman’s contributions to the Company.

During 2012 and beyond, our objective will be to provide overall compensation that is appropriate given our business model and other criteria to be established by the compensation committee. Some of the elements of the overall compensation program are expected to include competitive base salaries, short-term cash incentives and long-term incentives in the form of options to purchase shares.

We expect that our Chief Executive Officer, as the manager of the members of the executive team, will continue to assess the individual contributions of the executive team and make a recommendation to the compensation committee with respect to any merit increase in salary, cash bonus pool allocations and the award of options to purchase shares. The compensation committee will then evaluate, discuss and modify or approve these recommendations and conduct a similar evaluation of the Chief Executive Officer’s contributions to corporate goals and achievement of individual goals.

Compensation Policies and Risk Management

The Compensation Committee and management periodically undertake a risk assessment of the Company’s compensation policies and practices, including a review of trends and developments in executive pay. The Compensation Committee does not believe that the Company’s compensation policies and practices motivate imprudent risk taking or are reasonably likely to cause a material adverse effect upon Dataram’s business and operations. In this regard, the Company notes, among other things, that the Company does not offer significant short-term incentives that might drive high-risk behavior at the expense of long-term Company value and that stock option awards to directors and management seek to align the interests of these individuals with the Company’s long-term growth goals.

Role of Executive Officers and Compensation Consultants

Our Chief Executive Officer supports the compensation committee in its work by providing information relating to our financial plans, performance assessments and recommendation for compensation of our executive officers. Mr. Freeman, while not a member of the compensation committee, is a member of the Board of Directors. The compensation committee has not in recent years engaged any third-party consultant to assist it in performing its duties, though it may elect to do so in the future.

Principal Elements of Executive Compensation

Our executive compensation program [currently consists] of the three components discussed below. There is no pre-established policy or target for the allocation between either cash and non-cash or short-term and long-term incentive compensation. Rather, the relevant factors associated with each executive are reviewed on a case-by-case basis to determine the appropriate level and mix of compensation.

| 6 |

Base Salaries. The salaries of our Chief Executive Officer and our other executive officers are established based on the scope of their responsibilities, taking into account competitive market compensation for similar positions based on information available to the compensation committee. We believe that our base salary levels are consistent with levels necessary to achieve our compensation objective, which is to maintain base salaries competitive with the market. We believe that below-market compensation could, in the long run, jeopardize our ability to retain our executive officers. Any base salary adjustments are expected to be based on competitive conditions, market increases in salaries, individual performance, our overall financial results and changes in job duties and responsibilities.

Annual Bonus Compensation. We maintain an annual bonus program. The award of bonuses to our executive officers is the responsibility of the compensation committee and is determined on the basis of individual performance. The annual bonus program is designed to reward performance in a way that furthers key corporate goals and aligns the interests of management with our annual financial performance.

Long-Term Incentive Compensation. In the past, the Company has awarded stock options to executive officers under various stock option plans. Currently the Company’s only option plan allows the award of options to purchase shares of common stock to employees (other than executive officers) of, and consultants to, the Company. The Company therefore does not currently anticipate awarding options to present executive officers in the near future.

Share Ownership Guidelines

We currently do not require our directors or executive officers to own a particular amount of our shares, although we do have a policy against directors or officers taking a short position in the Company’s stock. The compensation committee is satisfied that the equity holdings among our directors and executive officers are sufficient at this time to provide motivation and to align this group’s interests with our long-term performance.

Perquisites

Our executive officers participate in the same 401(k) plan and the same life and health group insurance plans, and are entitled to the same employee benefits, as our other salaried employees. In addition, some of our executive officers receive an automobile allowance as described in the Summary Compensation Table.

Post-Termination Protection and Change in Control

We have employment agreements with Messrs. Freeman, Duncan and Sheerr. The agreements with Messrs. Freeman and Duncan each provide for the payment of one year’s salary upon early termination in lieu of payments under the Company general severance policy; Mr. Sheerr’s agreement provides for the payment of six months’ salary.

Financial Restatements

The compensation committee has not adopted a policy with respect to whether we will make retroactive adjustments to any cash or equity-based incentive compensation paid to executive officers (or others) where the payment was predicated upon the achievement of financial results that were subsequently the subject of a restatement. Our compensation committee believes that this issue is best addressed when the need actually arises, when all of facts regarding the restatement are known.

Tax and Accounting Treatment of Compensation

Section 162(m) of the Internal Revenue Code places a limit, subject to certain exceptions, of $1 million on the amount of compensation that we may deduct from the U.S. source income in any one year with respect to our Chief Executive Officer, our Chief Financial Officer and each of our next three most highly paid executive officers.

We account for equity compensation paid to our employees, i.e. stock option awards, under the rules of FASB ASC, which requires us to estimate and record an expense for each award. Accounting rules also require us to record cash compensation as an expense at the time the obligation is accrued.

| 7 |

Summary

The compensation committee believes that our compensation philosophy and programs are designed to foster a performance-oriented culture that aligns our executive officers’ interests with those of our shareholders. The compensation committee also believes that the compensation of our executives is both appropriate and responsive to the goal of improving shareholder value.

Compensation Committee Report

The following report is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or the liabilities of Section 18 of the Exchange Act, and the report shall not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

The compensation committee has reviewed and discussed the Compensation Discussion and Analysis set forth above with our management. Based on its review and discussions, the committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and incorporated by reference into any Annual Report in Form 10-K filed with the SEC for the fiscal year ended April 30, 2012.

Thomas A. Majewski, Chairman

Roger C. Cady

Rose Ann Giordano

Summary Compensation

The following table sets forth the compensation paid for the fiscal years ended April 30, 2012, 2011 and 2010 to the Company’s Chief Executive Officer, the Chief Financial Officer and the Company’s other executive officers.

SUMMARY COMPENSATION TABLE (In Dollars)

| Name and Principal Position | Fiscal Year | Salary | Bonus | Other(1) | Option Awards(2) | Other Compensation(3) | Total |

| John H. Freeman | 2012 | $275,000 | $0 | $0 | $0 | $12,375 | $287,375 |

| President and Chief | 2011 | 275,000 | 10,000 | 0 | 0 | 12,375 | 297,375 |

| Executive Officer | 2010 | 275,000 | 68,640 | 0 | 247,500 | 12,375 | 603,515 |

| Mark E. Maddocks | 2012 | 143,321 | 4,000 | 5,850 | 0 | 7,431 | 153,171 |

| (Retired Jan. 13, 2012) | 2011 | 201,424 | 12,000 | 7,800 | 0 | 9,064 | 230,288 |

| Vice President-Finance, | 2010 | 201,424 | 25,000 | 7,800 | 140,100 | 9,060 | 383,388 |

| Chief Financial Officer | |||||||

| Marc P. Palker | 2012 | - | - | - | - | - | - |

| Chief Financial Officer(4) | |||||||

| Jeffrey H. Duncan | 2012 | 199,032 | 21,000 | 7,800 | 0 | 8,956 | 236,788 |

| Vice President- | 2011 | 199,032 | 23,000 | 7,800 | 0 | 8,956 | 238,788 |

| Manufacturing and Engineering | 2010 | 199,032 | 27,000 | 7,800 | 140,100 | 8,956 | 382,888 |

| Anthony M. Lougee | 2012 | 128,308 | 15,000 | 0 | 0 | 5,774 | 149,081 |

| Controller | 2011 | 125,000 | 11,000 | 0 | 0 | 5,624 | 141,624 |

| 2010 | 125,000 | 15,600 | 0 | 5,928 | 5,624 | 152,152 | |

| David S. Sheerr | 2012 | 200,000 | 20,000 | 0 | 53,100 | 9,000 | 282,100 |

| General Manager | 2011 | 200,000 | 68,105 | 0 | 90,000 | 9,000 | 367,105 |

| Micro Memory Bank | 2010 | 200,000 | 100,000 | 0 | 49,400 | 9,000 | 358,400 |

| 8 |

| (1) | Automobile allowances. |

| (2) | We measure the fair value of stock options using the Black-Scholes option pricing model based upon the market price of the underlying common stock as of the date of grant, reduced by the present value of estimated future dividends, using an expected quarterly dividend rate of nil in fiscal years 2012, 2011 and 2010. Risk-free interest rates ranging from 0.5% to 5.0% were used. For fiscal year 2012 option values were $0.53 for Mr. Sheerr’s option grant. For fiscal year 2011 option values were $0.90 for Mr. Sheerr’s option grant. For fiscal year 2010 option values were $1.375 for Mr. Freeman’s option grant, $1.401 for Mr. Duncan’s option grant, and $0.988 for Messrs. Lougee’s and Sheerr’s option grant. |

| (3) | Payments by the Company to a plan trustee under the Company’s Savings and Investment Retirement Plan, a 401(k) plan. The Company does not have a pension plan. |

| (4) | Mr. Palker has been director of CFO Consulting Partners, LLC since March 2010. During the performance of his duties as Interim Chief Financial Officer, Mr. Palker has continued as director of CFO Consulting Partners and the Company compensates Mr. Palker as a consultant through CFO Consulting Partners LLC. As a result, Mr. Palker does not receive any compensation directly from the Company and does not participate in any of the Company’s employee benefit plans. The Company compensates CFO Consulting Partners for Mr. Palker’s services at the rate of $200 per hour. Such payments totaled approximately $95,000 as of April 30, 2012. |

Grants of Plan-Based Awards (1)

There were no grants of plan-based awards to named executive officers of the Company in the Company’s fiscal year ended April 30, 2012.

The Company does not presently have any Equity Incentive Plan other than its 2011 Stock Option Plan and does not have a Non Equity Incentive Plan other than the bonus pool. The size of grants under the 2011 Stock Option Plan and the bonus pool are not predetermined in accordance with an incentive award.

| (1) | The following grant was made to Mr. David S. Sheerr pursuant to an employment agreement the Company entered into with him concurrent with the Company’s acquisition of certain assets of Micro Memory Bank, Inc. from Mr. Sheerr on March 31, 2009. |

| Grant | Option | Exercise | Grant Date |

| Date | Awards | Price (2) | Value (3) |

| 9/22/2011 | 100,000 | $1.06 | $90,000 |

| (2) | Closing market price on the date of grant. |

| (3) | Computed in accordance with the compensation-stock compensation of FASB ASC (see assumptions set forth under the Summary Compensation table). |

Narrative Description of Summary Compensation

Salary and bonus constituted approximately 91% of total compensation for the named executive officers in fiscal 2012. Options granted to Mr. Sheerr are five year options exercisable one year after the grant date. All options granted are at an exercise price equal to the closing market price of the Company’s common stock on the date of grant. No dividends are paid or accrued with respect to options for the benefit of employees prior to the date of option exercise.

| 9 |

Outstanding Options

The following table sets forth information concerning outstanding stock options at the fiscal year-end, April 30, 2012.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| Name | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable | Option Exercise Price($) | Option Expiration Date |

| John H. Freeman | ||||

| 2008(1) | 8,000 | 0 | 3.33 | 09/27/2012 |

| 2009 | 150,000 | 0 | 3.20 | 05/07/2018 |

| 2010 | 180,000 | 0 | 2.57 | 09/24/2019 |

| Jeffrey H. Duncan | ||||

| 2003 | 8,200 | 0 | 2.99 | 09/18/2012 |

| 2004 | 8,200 | 0 | 4.09 | 09/17/2013 |

| 2008 | 8,000 | 0 | 3.33 | 09/27/2012 |

| 2009 | 8,000 | 0 | 1.99 | 09/25/2018 |

| 2010(2) | 70,000 | 30,000 | 2.57 | 09/24/2019 |

| Anthony M. Lougee | ||||

| 2003 | 1,875 | 0 | 2.99 | 09/18/2012 |

| 2004 | 2,500 | 0 | 4.09 | 09/17/2013 |

| 2008 | 3,500 | 0 | 3.33 | 09/27/2012 |

| 2009 | 3,500 | 0 | 1.99 | 09/25/2013 |

| 2010 | 6,000 | 0 | 2.57 | 09/24/2014 |

| David Sheerr | ||||

| 2009 | 20,000 | 0 | 1.28 | 04/15/2014 |

| 2010 | 50,000 | 0 | 2.57 | 09/24/2014 |

| 2011 | 100,000 | 0 | 1.76 | 09/23/2015 |

| 2012(3) | 100,000 | 0 | 1.06 | 09/22/2016 |

| (1) | Option awards granted to Mr. Freeman when he was a non-employee director of the Company. |

| (2) | Options granted in fiscal 2010 to Mr. Duncan are ten year options, options to purchase 40,000 shares become exercisable one year after the date of grant, with options to purchase an additional 30,000 shares becoming exercisable on the second and third anniversaries of the date of grant. |

| (3) | Options granted to Mr. Sheerr are five year options exercisable one year after the grant date. |

All options granted are at an exercise price equal to the closing market price of the Company’s common stock on the date of grant.

Option Exercises

There were no stock option exercises by named executive officers during the fiscal year ended April 30, 2012.

| 10 |

EQUITY COMPENSATION PLAN INFORMATION AT APRIL 30, 2012

| Plan Category | Number of Securities to be issued upon exercise of outstanding options | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||

| (a) | (b) | (c) | ||||

| Equity compensation plans approved by security holders | 1,545,900 | $2.46 | 200,000 | |||

| Equity compensation plans not approved by security holders | 0 | - | 0 | |||

| Total | 1,545,900 | $2.46 | 200,000 |

EMPLOYMENT AGREEMENTS

On May 7, 2008, the Company’s Board of Directors appointed John H. Freeman to the position of President and Chief Executive Officer of the Company. The Board of Directors agreed to hire Mr. Freeman as President and Chief Executive Officer for a term of one year, with automatic renewal terms of one year each. Mr. Freeman’s base salary is $275,000 annually. He is eligible biannually for a bonus of up to 50% of his base salary, as determined by a review of the Company’s Compensation Committee, and also for a year-end bonus at the conclusion of the fiscal year if his performance exceeds expectations. Mr. Freeman receives three weeks paid vacation and is entitled to participate in any of the Company’s present and future life insurance, disability insurance, health insurance, pension retirement and similar plans as well.

The Board of Directors hired Mr. Freeman based on the agreement that he accepts certain non-solicitation, non-competition and non-disparagement restrictions.

Jeffrey H. Duncan entered into an Employment Agreement with the Company as of February 1, 2005. The agreement continues on a year to year basis until terminated by the Company on thirty (30) days notice before April 30th of each year. The current annual base compensation under the agreement is $199,032, which is subject to annual review by the Board of Directors. In addition, Mr. Duncan will receive a bonus based upon a formula which shall be reviewed and approved annually by the Board of Directors. The agreement may be terminated by the Company for cause and expire upon the death or six months after the onset of the disability of Mr. Duncan. In the event of termination or non-renewal, Mr. Duncan is entitled to one year’s base salary at the current rate plus a pro rata bonus for the current year. The agreement contains terms concerning confidentiality, post-employment restrictions on competition and non-solicitation of Company employees.

David Sheerr entered into an Employment Agreement with the Company as of March 31, 2009. The agreement has an initial term of four years and continues on a year to year basis thereafter until terminated by the Company on thirty (30) days notice before April 30th of each year. The current base compensation under the agreements for Mr. Sheerr is $200,000, which is subject to annual review by the Board of Directors. In addition the executive will receive a bonus based upon a formula based upon the operating performance of the Company’s Micro Memory Bank business unit. The Employment Agreement may be terminated by the Company for cause and expires upon the death or six months after the onset of the disability of the executive. In the event of termination or non-renewal, the executive is entitled to six months’ base salary at the current rate plus a pro rata bonus for the current year. The Employment Agreement contains terms concerning confidentiality, post-employment restrictions on competition and non-solicitation of Company employees.

| 11 |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Securities and Exchange Commission rules regarding disclosure of executive compensation require proxy statement disclosure of specified information regarding certain relationships of members of the Company’s Board of Directors with the Company or certain other entities. None of the members of the Corporation’s Board of Directors has a relationship requiring such disclosure.

RATIFICATION OF THE SELECTION OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has selected J.H. Cohn LLP as the independent certified public accountants to the Company for the fiscal year ending April 30, 2013. The holders of Common Stock are asked to ratify this selection. J.H. Cohn LLP has served the Company in this capacity since October of 2005. If the shareholders fail to ratify this selection of J.H. Cohn LLP, the Audit Committee will reconsider its action in light of the shareholder vote.

The Company has been advised by J.H. Cohn LLP that representatives of that firm are expected to be present at the Annual Meeting of Shareholders. These representatives will have the opportunity to make a statement, if they so desire, and will also be available to respond to appropriate questions from shareholders.

PRINCIPAL ACCOUNTANTS FEES AND SERVICES

The following table sets forth the aggregate fees billed to the Company for the last two fiscal years by the Company’s independent accounting firm J.H. Cohn LLP for professional services:

| 2012 | 2011 | |||||||

| Audit fees | $ | 154,190 | $ | 146,020 | ||||

| Audit related fees (1) | 15,500 | 15,000 | ||||||

| Tax fees (2) | 2,570 | 12,900 | ||||||

| Total fees | $ | 172,260 | $ | 173,920 | ||||

______________

| (1) | Consists principally of the audit of the financial statements of the Company’s employee benefit plan. |

| (2) | Consists principally of fees for tax consultation and tax compliance services, including foreign jurisdictions. |

All non-audit fees of an auditor must be pre-approved by the Audit Committee of the Board of Directors unless the amount is less than 5% of the amount of revenues to the auditor in the previous fiscal year or was not regarded as a non-audit fee at the time it was contracted for. In either event, the fee must be submitted to the Audit Committee for its approval before the completion of the audit. In the previous fiscal year, all Audit Related Fees, all Tax Fees and all Other Fees were pre-approved by the Audit Committee pursuant to this policy.

REPORT OF THE AUDIT COMMITTEE

Pre-approval by the Audit Committee of all non-audit services performed by the Company’s independent accountants is now required by law. Where urgent action is required, the Chairman of the Committee may give this approval subject to confirmation of this decision by the full Committee at its next meeting.

The Audit Committee has reviewed and discussed the Company’s audited financial statements for the fiscal year ended April 30, 2012 with management.

| 12 |

The Audit Committee has discussed with J.H. Cohn LLP the matters required to be discussed in Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol.1 AU Section 380, as adopted by the Public Company Accounting Oversight Board in Rule 3200T).

The Audit Committee has received the written disclosures and the letter from J.H. Cohn LLP required by Independence Standards Board Standard No. 1 (“Independence Standards Board Standard No 1.,Independence Discussion with Audit Committee, as adopted by the Public Company Accounting Oversight Board in Rule 3200T), as amended, and has discussed with J.H. Cohn LLP that firm’s independence from the Company.

Based on the review and discussions referred to above in this report, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2012 for filing with the Securities and Exchange Commission.

Thomas A. Majewski, Chairman

Roger C. Cady

Rose Ann Giordano

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” RATIFICATION OF THE SELECTION OF INDEPENDENT ACCOUNTANTS, AND, UNLESS A SHAREHOLDER GIVES INSTRUCTIONS ON THE PROXY CARD TO THE CONTRARY, THE APPOINTEES NAMED THEREON INTEND SO TO VOTE.

OTHER MATTERS

Should any other matter or business be brought before the meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the judgment of the proxy holder. The Company does not know of any such other matter or business.

PROPOSALS OF SECURITY HOLDERS AT 2013 ANNUAL MEETING

Any shareholder wishing to present a proposal which is intended to be presented at the 2013 Annual Meeting of Shareholders should submit such proposal to the Company at its principal executive offices no later than April 12, 2013. It is suggested that any proposals be sent by certified mail, return receipt requested.

BOARD OF DIRECTORS

The Board of Directors has a process for shareholders to communicate with directors. Shareholders should write to the President at the Company’s mailing address and specifically request that a copy of the letter be distributed to a particular board member or to all board members. Where no such specific request is made, the letter will be distributed to board members if material, in the judgment of the President, to matters on the Board’s agenda.

The Board of Directors of the Company met 10 times during the last fiscal year. It is the policy of the board that all members will attend the Annual Meeting of Shareholders and all members of the board attended last year’s meeting.

The Board of Directors has a standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended, whose members are Roger C. Cady, Thomas A. Majewski and Rose Ann Giordano. This Committee met 4 times during the last fiscal year. The principal functions of the Audit Committee are evaluation of work of the auditors, review of the accounting principles used in preparing the annual financial statements, review of internal controls and procedures and approval of all audit and non-audit services of the auditor. The Company’s Board of Directors has adopted a written charter for the Audit Committee which may be viewed at the Company’s website,www.dataram.com.Each member of the Audit Committee is “independent” within the meaning of the NASDAQ listing standards. The Board of Directors has determined that Mr. Majewski is a “financial expert” within the meaning of those standards and an “audit committee financial expert” within the meaning of Item 401(h) of SEC Regulation S-K and is “independent” as that term is used in Item 7(d)(3)(iv) of Schedule 14A of the Proxy Rules.

| 13 |

The Board of Directors has a standing Compensation Committee whose members are Roger C. Cady, Thomas A. Majewski and Rose Ann Giordano, all of whom are “independent” within the meaning of the NASDAQ listing standards. This committee relies upon the advice of the Company’s chief executive officer who makes recommendations both concerning director compensation and the compensation of other executive officers. This Committee meets as required. The principal functions of the Compensation Committee are to recommend to the Board of Directors the compensation of directors and the executive officers and to establish and administer various compensation plans, including the stock option plan. The Compensation Committee does not have a written charter.

The Board of Directors has a standing Nominating Committee whose members are Roger C. Cady, Thomas A. Majewski and Rose Ann Giordano, all of whom are “independent” within the meaning of the NASDAQ listing standards. This Committee meets as required. The principal function of this Committee is the recommendation to the Board of Directors of new members of the Board of Directors. The members of the Nominating Committee are “independent” within the meaning of the NASDAQ listing standards. The Board of Directors has adopted a charter for the Nominating Committee, which may be viewed at the Company’s website,www.dataram.com.In addition, the Nominating Committee also considers diversity with respect to viewpoint, skills and experience in determining the appropriate composition of the Board and identifying Director nominees. The Board is committed to following the Company’s policy of non-discrimination based on gender, race, age, religion or national origin. The Board believes that its policies are effective in identifying and enlisting candidates that will best fulfill the Board’s and the Company’s needs at the time of the search. In years in which the Board considers that the selection of a new director would be desirable, the Nominating Committee solicits recommendations from the directors and the executive officers. The Nominating Committee will also consider recommendations made by shareholders. From these recommendations, the committee selects a small group to be interviewed. The Nominating Committee then makes a recommendation to the full board. Shareholders desiring to make such recommendations should write directly to the Committee at the Company’s executive offices at P.O. Box 7528, Princeton, New Jersey 08543-7528.

DIRECTORS COMPENSATION

The following table sets forth information concerning non-employee director compensation during the fiscal year ended April 30, 2012:

| Fees | Option | All | |||

| Name | Earned(1) | Awards | Other | Total | |

| Thomas A. Majewski | $ 24,000 | 0 | 0 | $ 24,000 | |

| Roger C. Cady | $ 24,000 | 0 | 0 | $ 24,000 | |

| Rose Ann Giordano | $ 24,000 | 0 | 0 | $ 24,000 | |

(1) All directors’ fees, except for option awards, are paid in cash in the year earned. Directors who are not employees of the Company received a quarterly payment of $6,000. During fiscal 2012, no options were issued to directors of the Company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Securities and Exchange Commission requires that the Company report to shareholders the compliance of directors, executive officers and 10% beneficial owners with Section 16(a) of the Securities Exchange Act of 1934, as amended. This provision requires that such persons report on a current basis most acquisitions or dispositions of the Company’s securities. Based upon information submitted to the Company, all directors, executive officers and 10% beneficial owners have fully complied with such requirements during the past fiscal year, except that Form 3 for Marc P. Palker, Chief Financial Officer of the Company, was filed two days late.

| 14 |

MISCELLANEOUS

The accompanying proxy is being solicited on behalf of the Board of Directors of the Company. The expense of preparing, printing and mailing the form of proxy, including broker solicitation fees and accountants’ and attorneys’ fees in connection therewith, will be borne by the Company. The amount is expected to be the amount normally expended for a solicitation for an election of directors in the absence of a contest and costs represented by salaries and wages of regular employees and officers. Solicitation of proxies will be made by mail, but regular employees may solicit proxies by telephone or otherwise.

Please date, sign and return the accompanying proxy at your earliest convenience. No postage is required for mailing in the United States.

Financial information concerning the Company is set forth in the Company’s 2012 Annual Report to Security Holders, which is enclosed.

By Order of the Board of Directors

THOMAS J. BITAR,

Secretary

ANNUAL REPORT ON FORM 10-K

Upon the written request of a shareholder, the Company will provide, without charge, a copy of its Annual Report on Form 10-K for the year ended April 30, 2012, including the financial statements and schedules and documents incorporated by reference therein but without exhibits thereto, as filed with the Securities and Exchange Commission. The Company will furnish any exhibit to the Annual Report on Form 10-K to any shareholder upon request and upon payment of a fee equal to the Company’s reasonable expenses in furnishing such exhibit. All requests for the Annual Report on Form 10-K or its exhibits should be addressed to Chief Financial Officer, Dataram Corporation, P.O. Box 7528, Princeton, New Jersey 08543-7528.

| 15 |